Free Internal Audit Accounting Checklist

Internal audit is a crucial component of financial management, ensuring compliance, accuracy, and transparency in accounting practices. This checklist outlines key areas that internal auditors should focus on to maintain financial integrity.

Instructions:

Simply check off each item upon completion, facilitating easy tracking and evaluation. This intuitive system ensures a comprehensive overview of your tasks.

Objectives :

To establish a regular review of financial documents and reports.

To ensure accurate recording and reporting of financial transactions.

To maintain compliance with accounting standards and laws.

1. Financial Reporting and Compliance:

Ensure accurate and transparent financial reporting, complying with regulatory standards.

Verify adherence to Generally Accepted Accounting Principles (GAAP).

Confirm compliance with applicable laws and regulations.

Assess the accuracy and completeness of financial statements.

Verify proper disclosure of significant accounting policies.

Confirm consistency in financial reporting across periods.

Review the classification and presentation of financial information.

Assess the adequacy of internal controls over financial reporting.

Evaluate the effectiveness of internal audit procedures.

Confirm the independence and objectivity of the internal audit function.

2. Controls and Risk Management:

Evaluate the effectiveness of internal controls and risk management systems.

Assess the design and implementation of internal controls.

Evaluate the segregation of duties to prevent fraud.

Review the effectiveness of risk identification and mitigation strategies.

Confirm the existence of a robust whistleblower mechanism.

Assess the adequacy of disaster recovery and business continuity plans.

Evaluate the reliability of information systems and data security measures.

Confirm compliance with industry-specific regulatory requirements.

Review management's response to previous audit findings.

Assess the effectiveness of fraud detection and prevention measures.

3. Asset Management:

Ensure efficient and accountable management of organizational assets.

Confirm accurate recording and tracking of fixed assets.

Assess the adequacy of inventory control systems.

Verify compliance with depreciation policies.

Evaluate the security measures for safeguarding physical assets.

Confirm reconciliation of financial records with physical assets periodically.

Review the management of intangible assets, such as intellectual property.

Assess the adequacy of insurance coverage for key assets.

Confirm compliance with lease accounting standards.

Evaluate the disposal process for assets reaching the end of their useful life.

Conducted by: [Your Name]

Company: [Your Company Name]

Date: [Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Strengthen your internal audit processes with this Internal Audit Accounting Checklist Template, available at Template.net. This editable and customizable template facilitates a thorough and systematic audit. Leverage our accessible Ai Editor Tool to tailor the checklist to your organization's unique audit requirements, ensuring comprehensive and effective internal controls. Download today!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

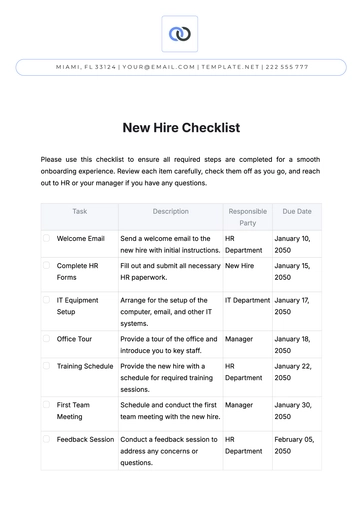

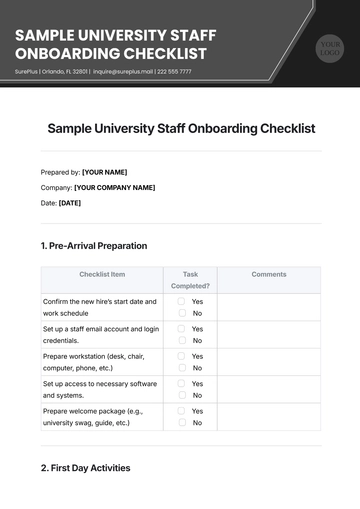

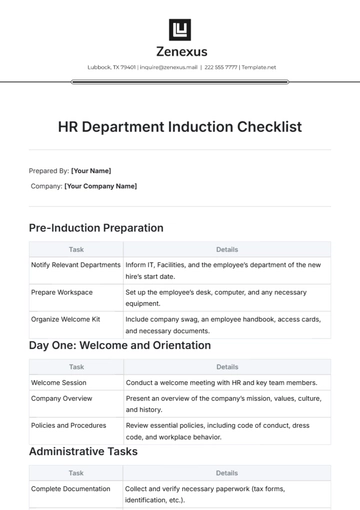

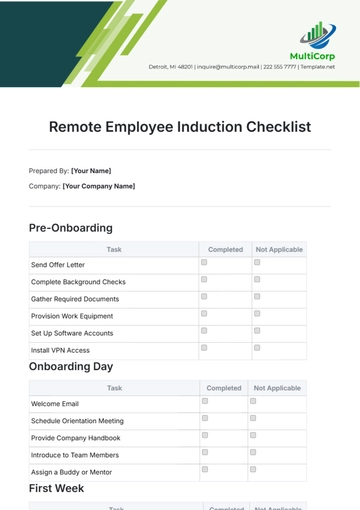

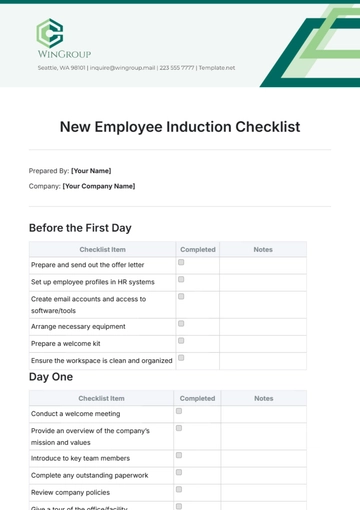

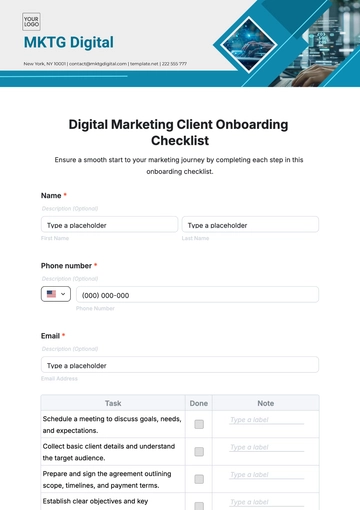

- Onboarding Checklist

- Quality Checklist

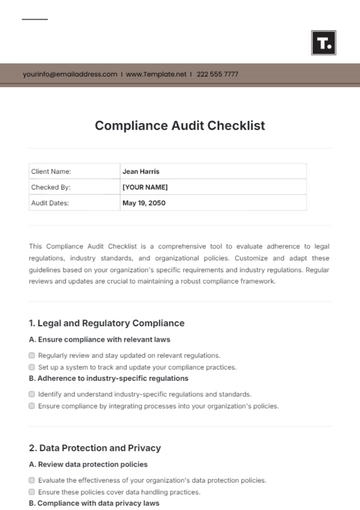

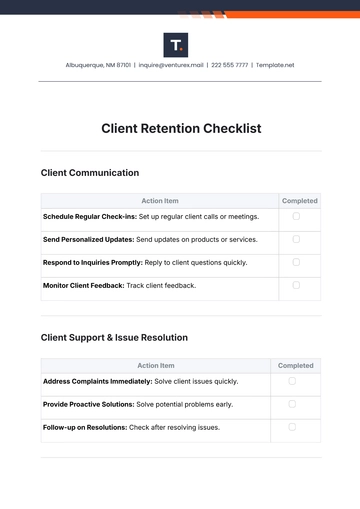

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

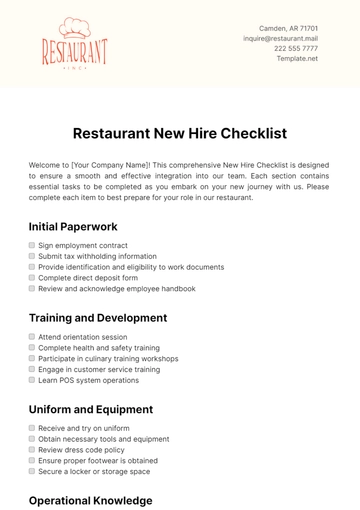

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

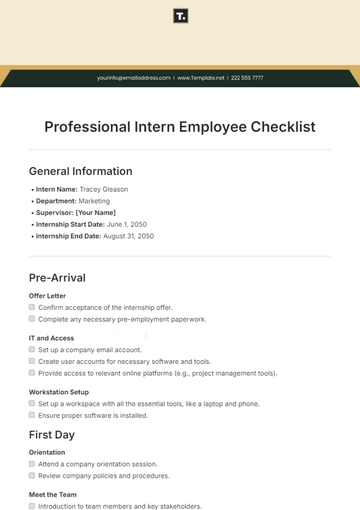

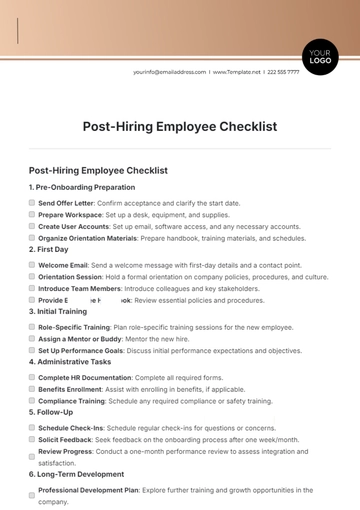

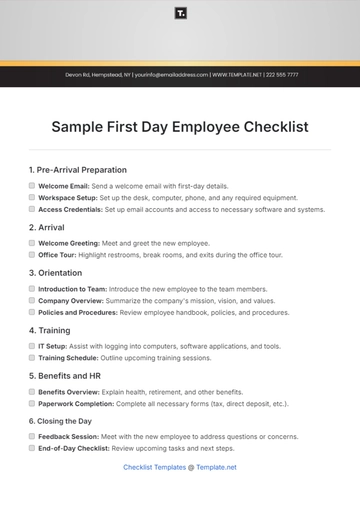

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

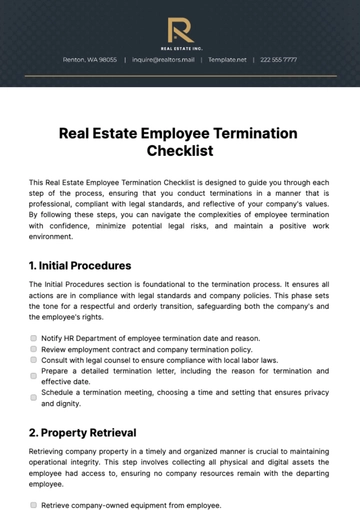

- Real Estate Checklist

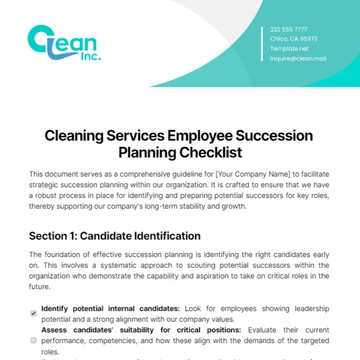

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

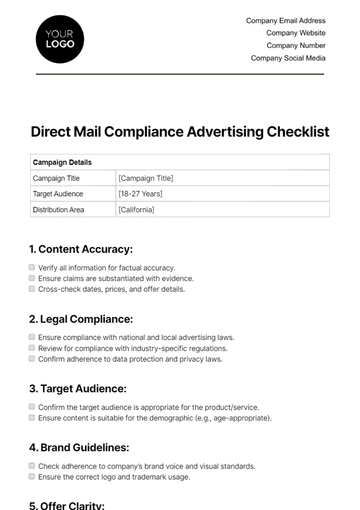

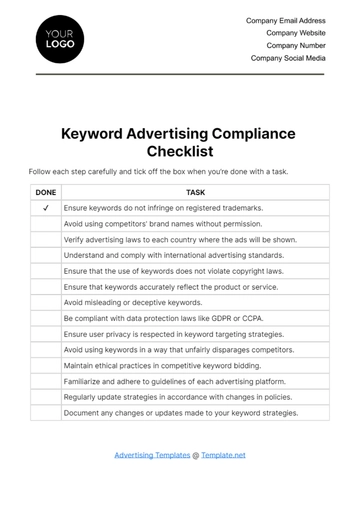

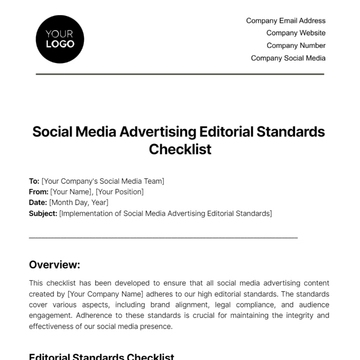

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

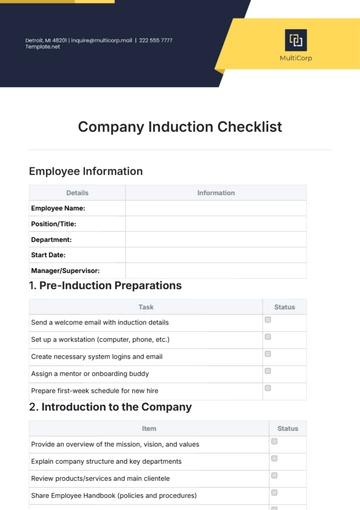

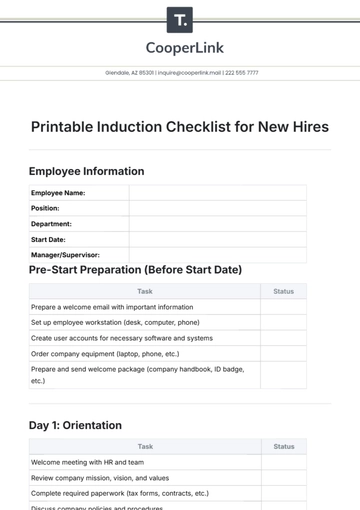

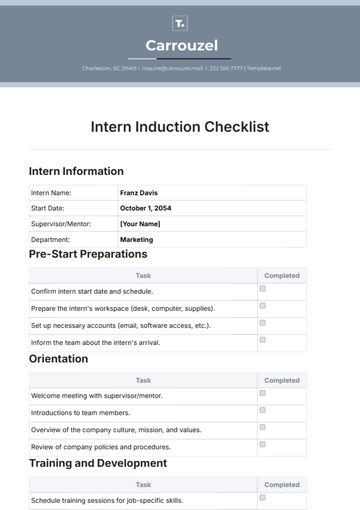

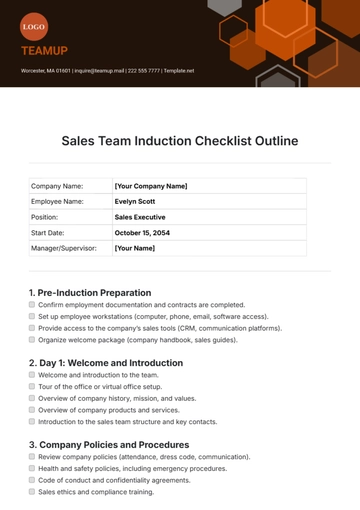

- Induction Checklist

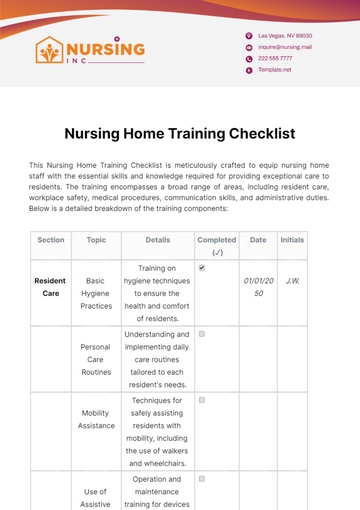

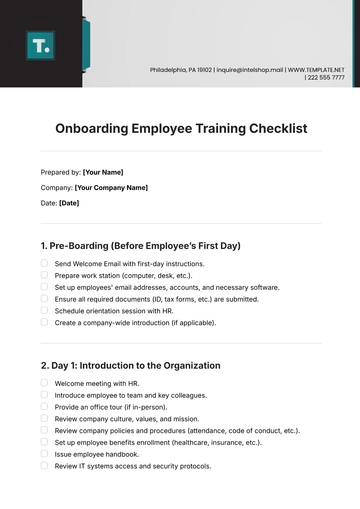

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

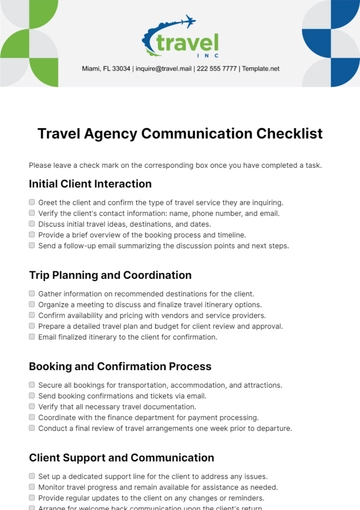

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

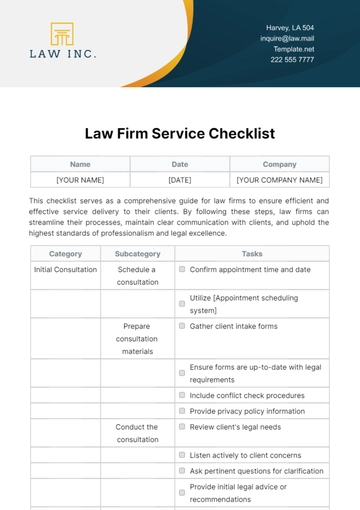

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

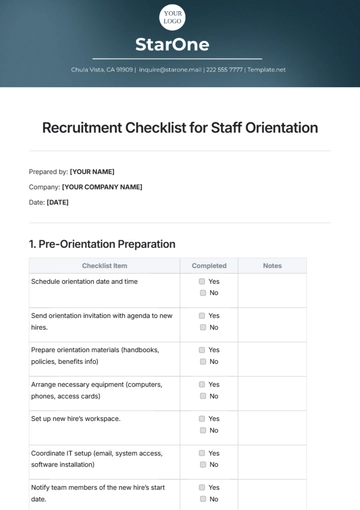

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

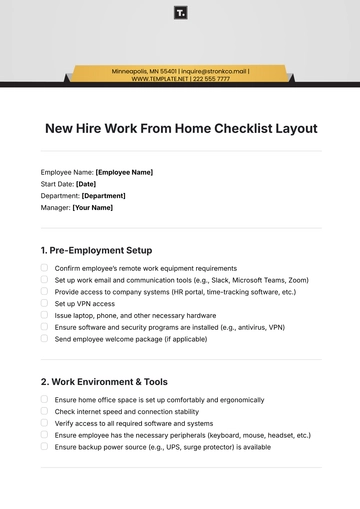

- Work From Home Checklist

- Student Checklist

- Application Checklist