Free Month End Close Accounting Checklist

This Accounting Checklist serves as a systematic tool to review and complete crucial financial tasks. This structure ensures accuracy and compliance with the accounting process, fully embodying the company’s unique approach towards liabilities. Mark each task as finished to streamline monitoring and assessment.

Objectives:

Streamline the financial tasks within [Your Company Name].

Promote accuracy and regulatory compliance in the accounting process.

Incorporate an integrated approach towards liabilities management.

Financial Reporting and Analysis

Verify all journal entries are properly recorded and classified in accordance with GAAP.

Reconcile balance sheet accounts, including cash, accounts receivable, and accounts payable, to ensure accuracy and completeness.

Review income statement variances against budgeted or forecasted amounts to identify any discrepancies or unusual trends.

Analyze key performance indicators (KPIs) such as profitability ratios, liquidity ratios, and efficiency ratios to assess the company's financial health.

Prepare financial statements, including the income statement, balance sheet, and cash flow statement, in compliance with regulatory requirements.

Accruals and Prepayments

Accrue expenses for goods or services received but not yet invoiced, such as utilities, rent, and salaries.

Record prepayments for expenses paid in advance but not yet incurred, such as insurance premiums or rent.

Review accruals and prepayments schedules to ensure completeness and accuracy.

Adjust accruals and prepayments based on actual usage or consumption during the period.

Reconcile accruals and prepayments to supporting documentation and vendor invoices.

Compliance and Regulatory Requirements

Review compliance with tax obligations, including sales tax, payroll tax, and income tax filings.

Verify compliance with regulatory requirements, such as SEC reporting (for publicly traded companies) or industry-specific regulations.

Assess compliance with accounting standards, such as GAAP or IFRS.

Document any changes in accounting policies or procedures and ensure proper disclosure in financial statements.

Conduct internal controls testing to identify and mitigate any weaknesses or deficiencies.

Closing Procedures and Documentation

Perform a final review of all financial transactions and adjustments made during the month.

Close sub-ledgers and ensure proper reconciliation to the general ledger.

Archive supporting documentation, including invoices, bank statements, and reconciliations, in a secure and organized manner.

Document any significant accounting judgments or estimates made during the month-end close process.

Prepare a month-end close checklist outlining tasks completed, outstanding issues, and deadlines for next month's close.

Prepared by: [Your Name]

Date: [Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your month-end closing procedures with the Month End Close Accounting Checklist Template that’s found right at Template.net. This editable and customizable template ensures a systematic and error-free closing process. Personalize the checklist effortlessly using our Ai Editor Tool, optimizing your month-end procedures for enhanced financial control. Access it now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

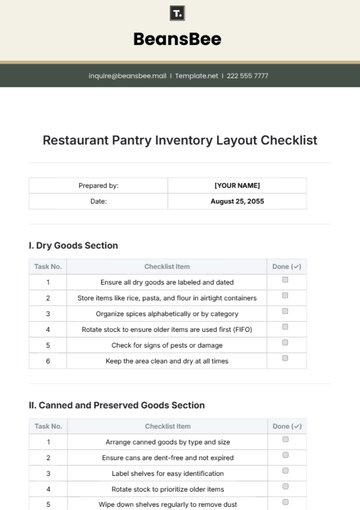

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

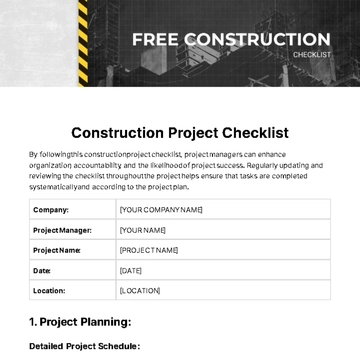

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

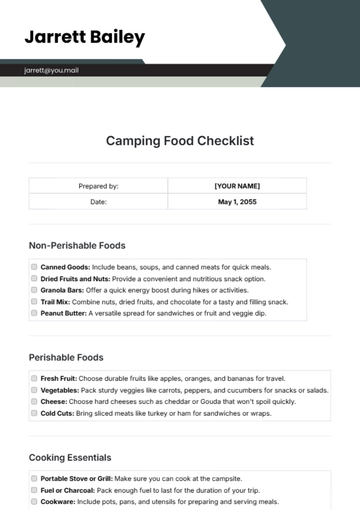

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

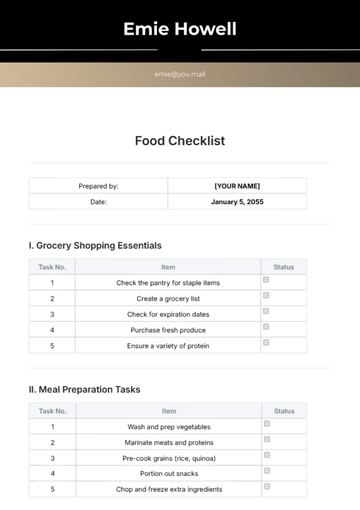

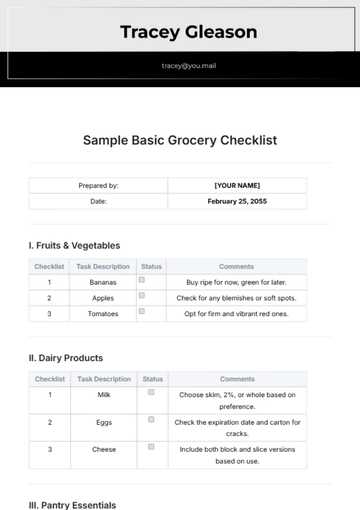

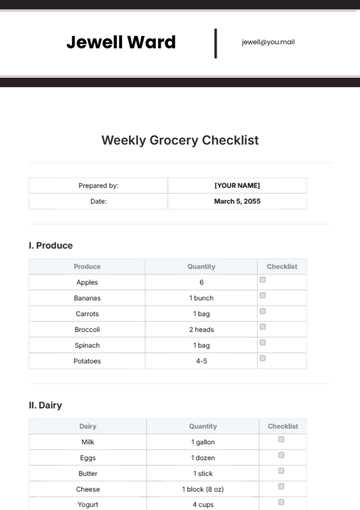

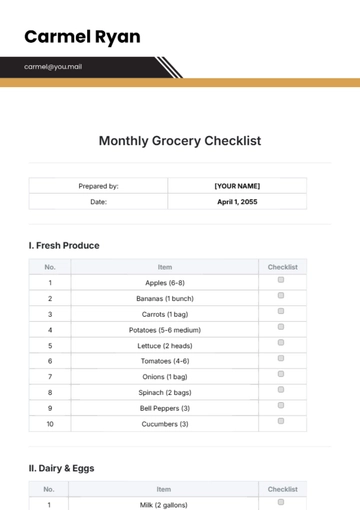

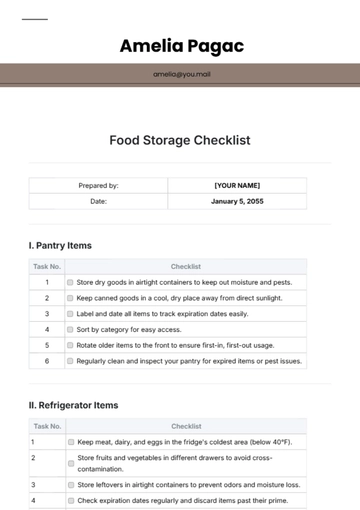

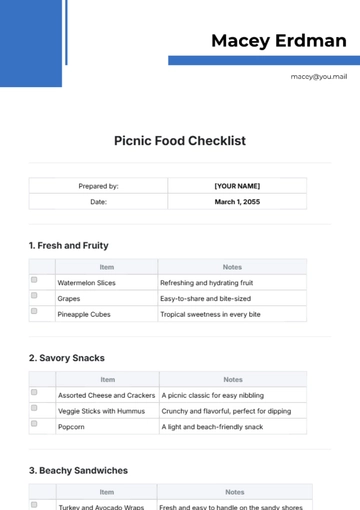

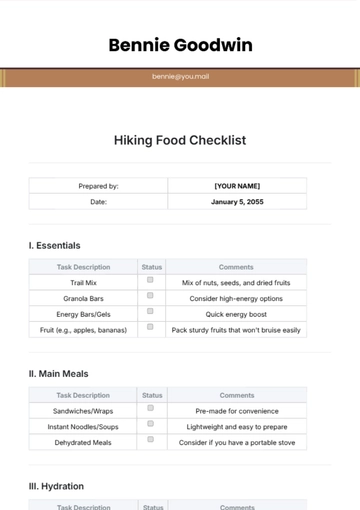

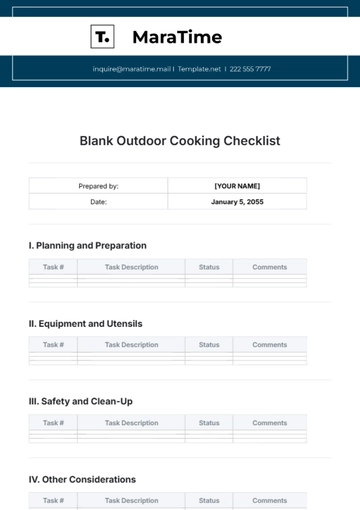

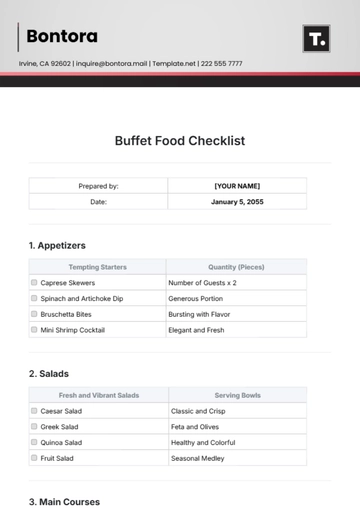

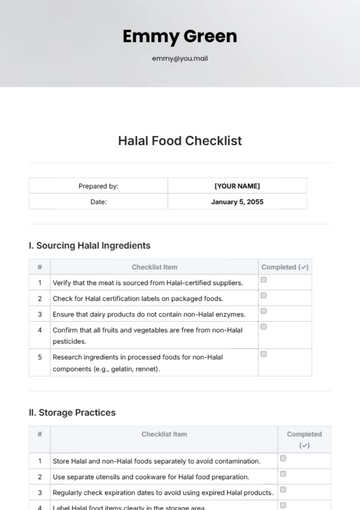

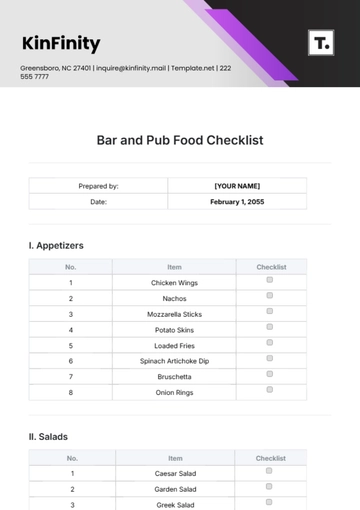

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

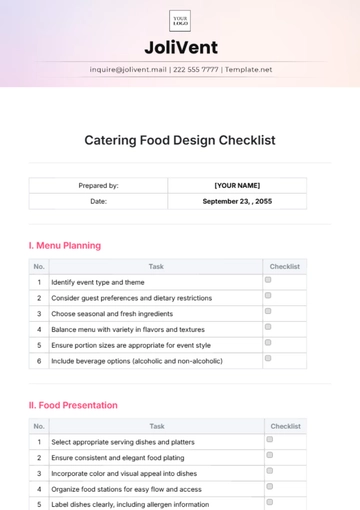

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

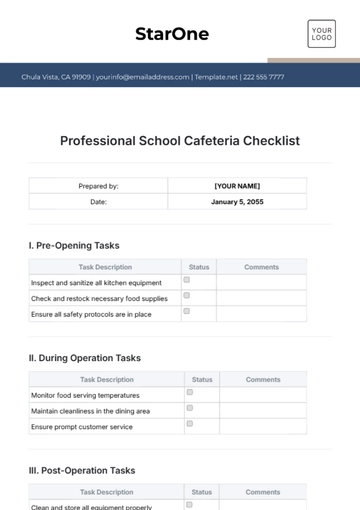

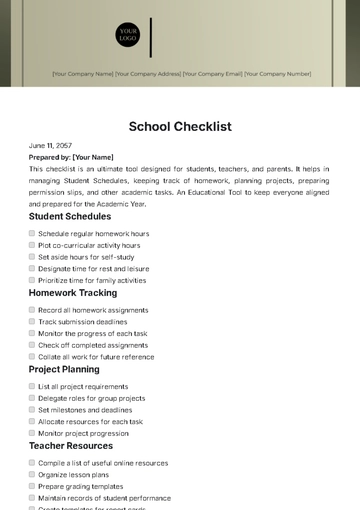

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

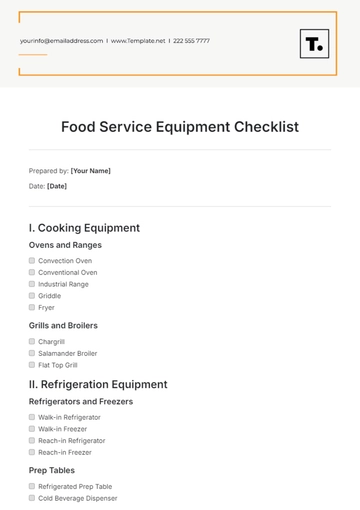

- Equipment Checklist

- Trade Show Checklist

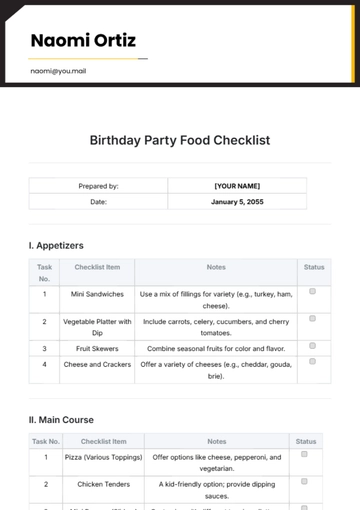

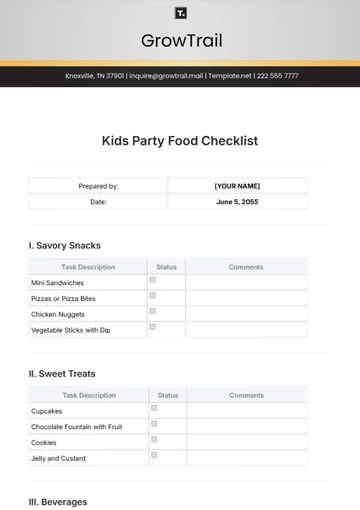

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist