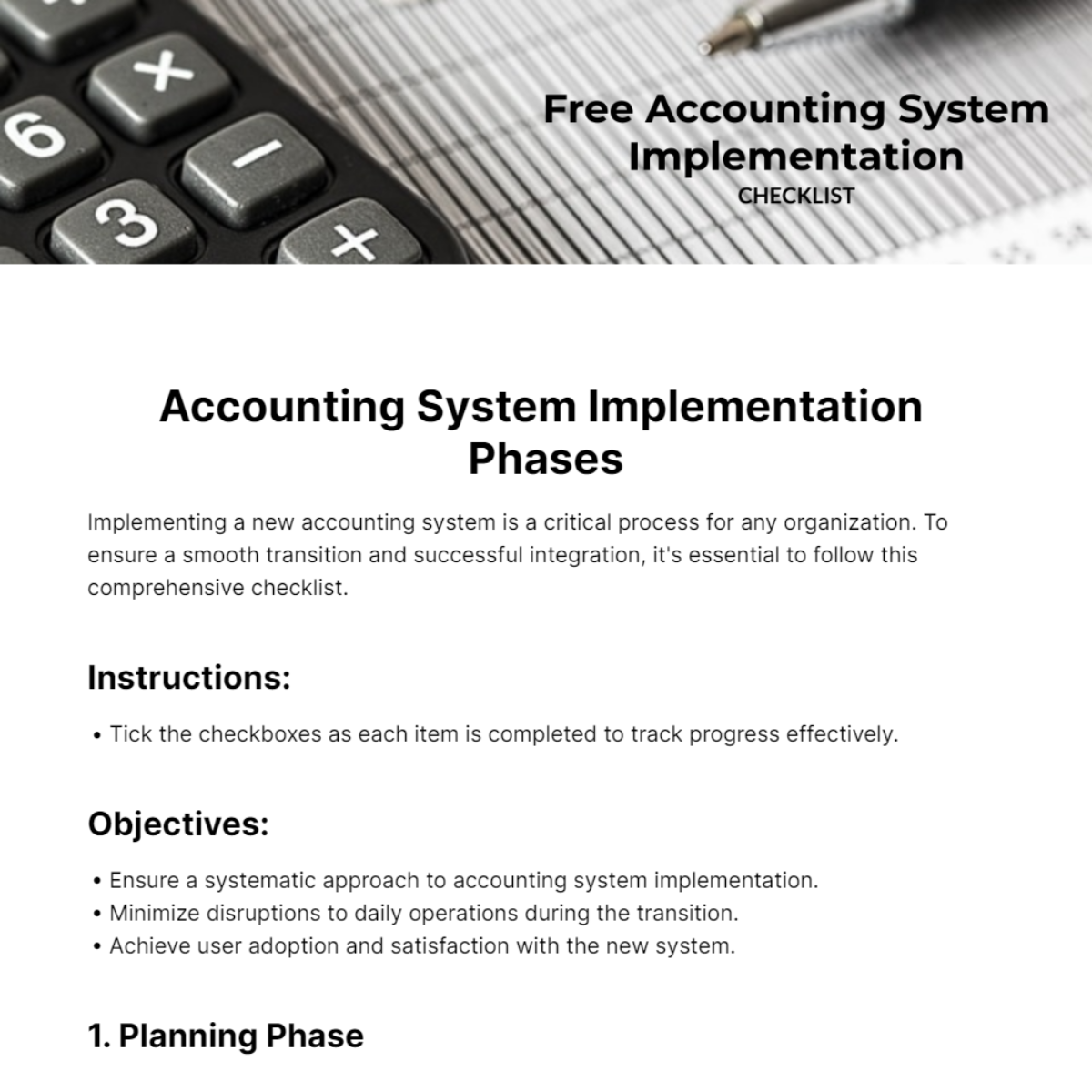

Free Accounting System Implementation Checklist

Implementing a new accounting system is a critical process for any organization. To ensure a smooth transition and successful integration, it's essential to follow this comprehensive checklist.

Instructions:

Tick the checkboxes as each item is completed to track progress effectively.

Objectives:

Ensure a systematic approach to accounting system implementation.

Minimize disruptions to daily operations during the transition.

Achieve user adoption and satisfaction with the new system.

1. Planning Phase

Initial Assessment

Evaluate current accounting processes and software.

Identify key stakeholders and their requirements.

Determine the budget and timeline for implementation.

Assess the need for customization or integration with other systems.

Set clear goals and objectives for the new accounting system.

Selection of Accounting Software

Research and compare different accounting software options.

Evaluate features such as scalability, user-friendliness, and reporting capabilities.

Request demos and trials to test usability and functionality.

Consider compatibility with existing hardware and software.

Obtain feedback from end-users and IT department.

2. Pre-Implementation Preparation

Data Migration Planning

Conduct a thorough data audit to identify what needs to be migrated.

Cleanse and standardize data to ensure accuracy and consistency.

Develop a data migration plan, including mapping data fields and formats.

Allocate resources for data extraction, transformation, and loading.

Test data migration processes in a sandbox environment.

Training and Change Management

Develop a training program for end-users and administrators.

Provide training materials, manuals, and online resources.

Assign roles and responsibilities for system administration and support.

Communicate the benefits of the new system and address concerns.

Establish a feedback mechanism for ongoing training and support.

3. Implementation Phase

System Configuration and Customization

Configure the accounting software settings to align with business requirements.

Customize templates for invoices, reports, and financial statements.

Set up user permissions and access controls based on roles.

Integrate third-party applications or modules as needed.

Conduct thorough testing of configurations and customizations.

Go-Live Preparation

Develop a contingency plan for potential issues or disruptions.

Schedule a final data backup before transitioning to the new system.

Communicate the go-live date and any downtime or service interruptions.

Conduct a pilot run or soft launch to identify any last-minute issues.

Ensure adequate support resources are available during the go-live period.

Conducted by: [Your Name]

Company: [Your Company Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Embark on a journey of seamless financial management with this professionally created Accounting System Implementation Checklist Template that’s offered by Template.net! Crafted with adaptability in mind, this customizable template offers a dynamic solution to your accounting needs. It's fully editable in our Ai Editor Tool to fit your unique requirements.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

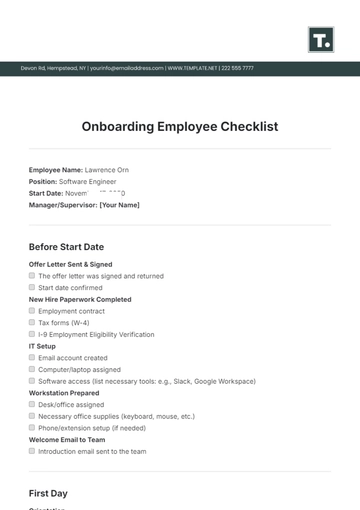

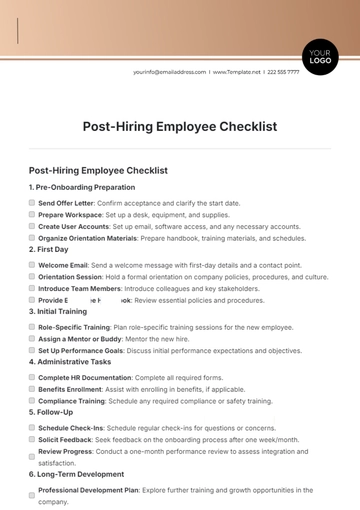

- Onboarding Checklist

- Quality Checklist

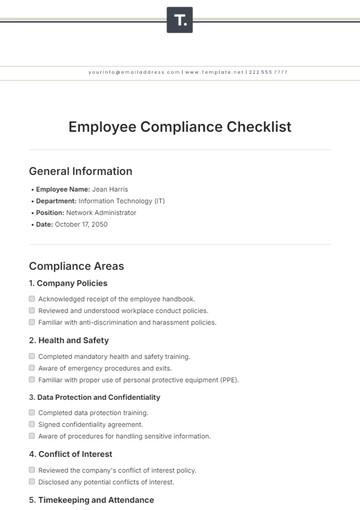

- Compliance Checklist

- Audit Checklist

- Registry Checklist

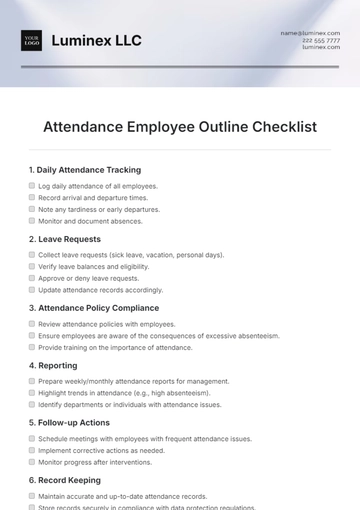

- HR Checklist

- Restaurant Checklist

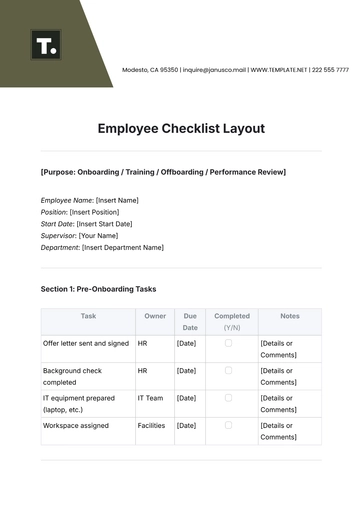

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

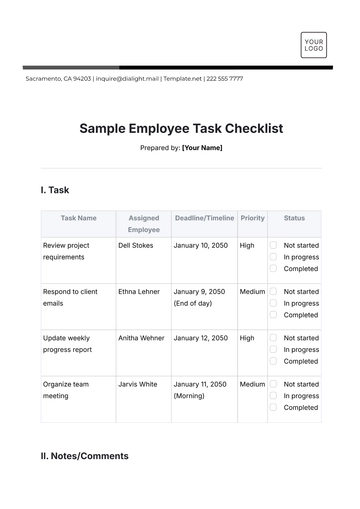

- Task Checklist

- Professional Checklist

- Hotel Checklist

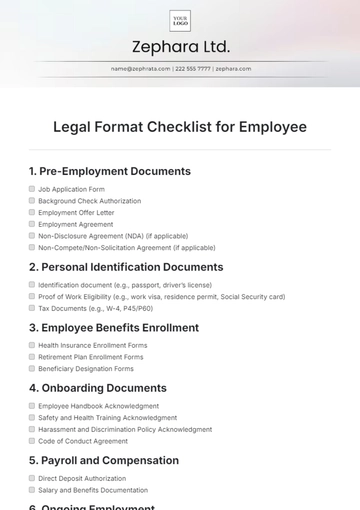

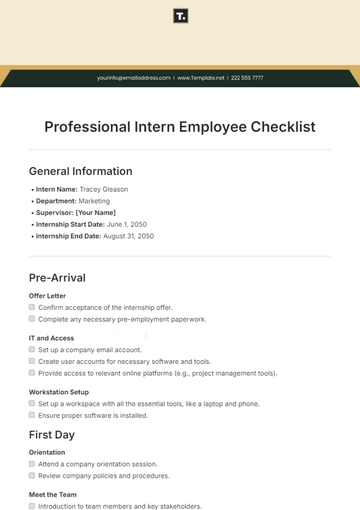

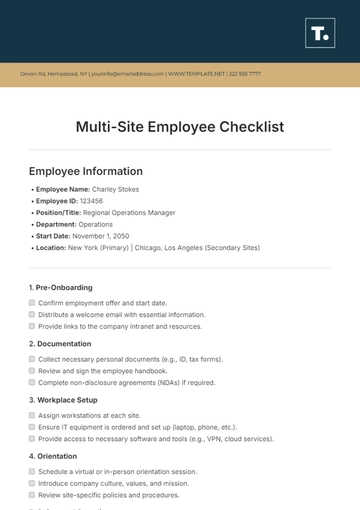

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

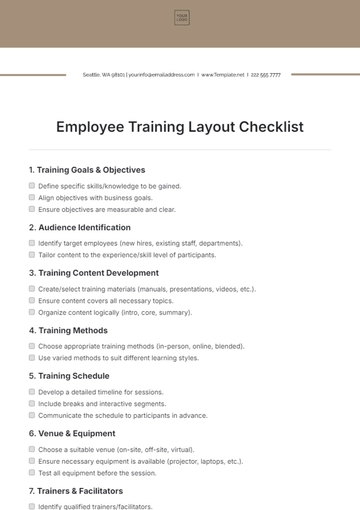

- Employee Training Checklist

- Medical Checklist

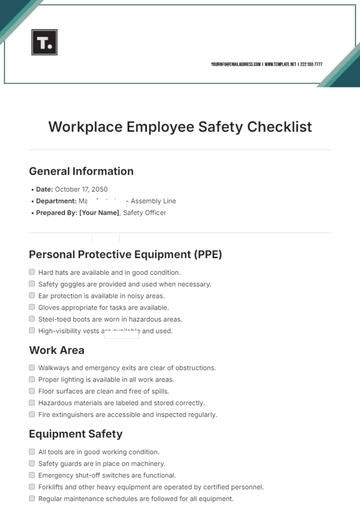

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

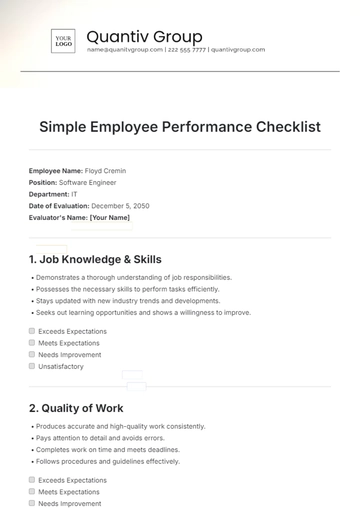

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist