Free Daily Accounting Checklist

This checklist serves to streamline daily accounting processes, promote accuracy and compliance, and support informed decision-making based on real-time financial insights. By diligently following this checklist, businesses can maintain financial integrity and optimize their operational performance.

Instructions: Tick the checkboxes next to each checklist item upon completion. Review the checklist at the end of the day to ensure all tasks are completed.

Daily Transactions Review

Sales Transactions:

Verify all sales transactions are recorded accurately in the system.

Reconcile sales receipts with POS or online payment platforms.

Confirm sales tax calculations are correct for each transaction.

Check for any unusual or suspicious transactions that may require further investigation.

Ensure all discounts, refunds, and returns are properly accounted for.

Expense Transactions:

Review and categorize all expense transactions.

Validate vendor invoices against purchase orders or contracts.

Check for duplicate or unauthorized expenses.

Reconcile credit card statements with receipts.

Verify that all recurring expenses are accounted for and appropriately documented.

Bank Reconciliation

Compare Bank Statements:

Match bank statement transactions with the accounting records.

Investigate any discrepancies or missing transactions.

Reconcile differences between the ending balance in the bank statement and the company's records.

Confirm the accuracy of bank charges and interest earned.

Ensure all outstanding checks and deposits are properly recorded.

Cash Flow Analysis:

Analyze cash inflows and outflows for the day.

Assess liquidity and identify any potential cash flow issues.

Monitor outstanding receivables and payables.

Evaluate the adequacy of cash reserves for upcoming expenses.

Adjust cash management strategies as needed to optimize liquidity.

Financial Reporting

Generate Financial Reports:

Compile daily financial data to generate reports, such as income statements and balance sheets.

Review reports for accuracy and completeness.

Compare current performance with previous periods and budgeted projections.

Analyze key financial metrics to assess business performance.

Distribute reports to relevant stakeholders in a timely manner.

Documentation and Filing:

Ensure all supporting documents are properly filed and organized.

Archive electronic copies of financial records for future reference.

Maintain compliance with regulatory requirements regarding record retention.

Implement backup procedures to safeguard financial data.

Update documentation protocols to reflect any process changes or improvements.

Prepared by: [Your Name]

Date: [Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Stay on top of your finances with this Daily Accounting Checklist Template, exclusively available at Template.net. This customizable and user-friendly tool, designed specifically for daily use, is perfect for maintaining accurate records. Ensure financial diligence and streamline your accounting routine with this essential checklist, editable in our Ai Editor Tool.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

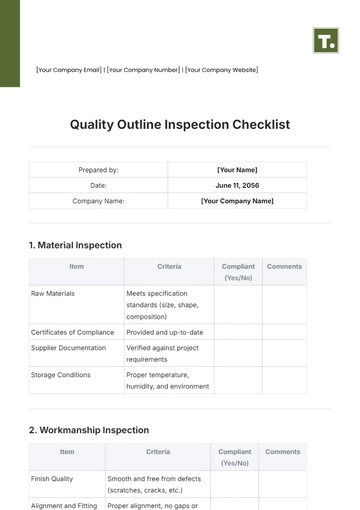

- Quality Checklist

- Compliance Checklist

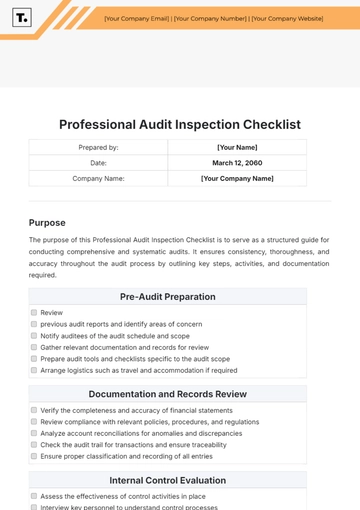

- Audit Checklist

- Registry Checklist

- HR Checklist

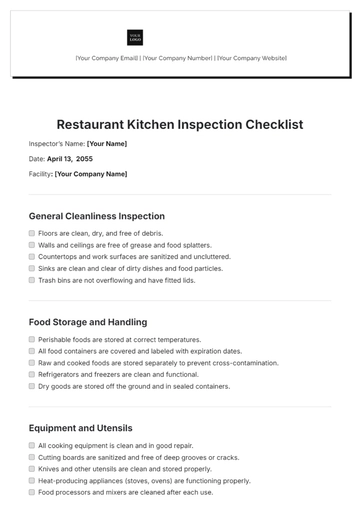

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

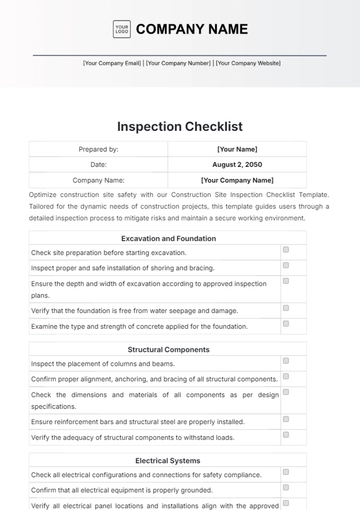

- Construction Checklist

- Task Checklist

- Professional Checklist

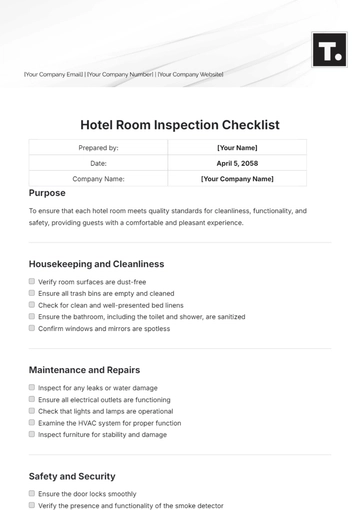

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

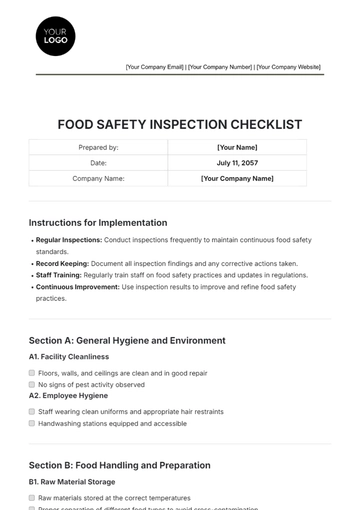

- Food Checklist

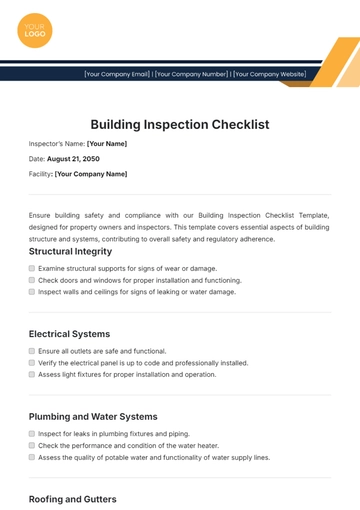

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

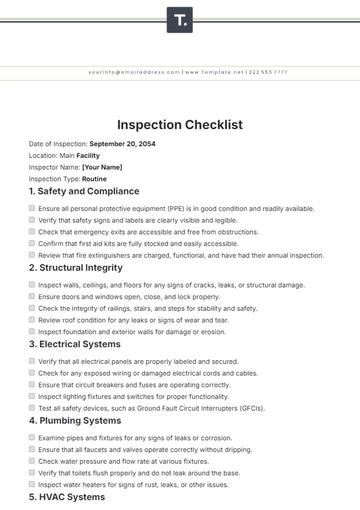

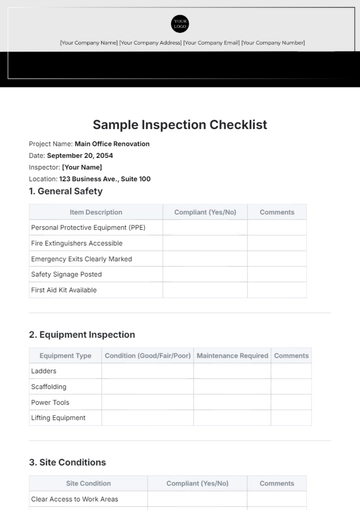

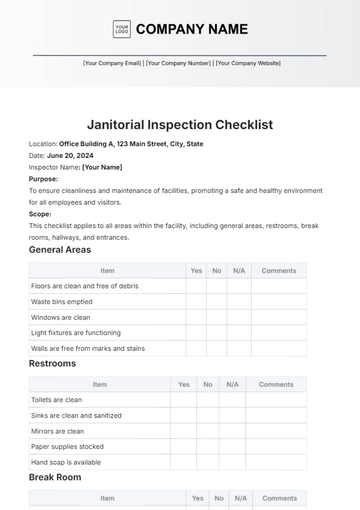

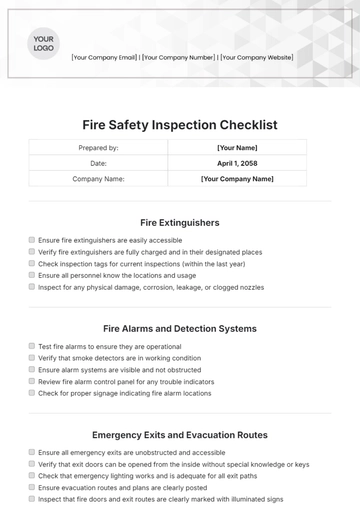

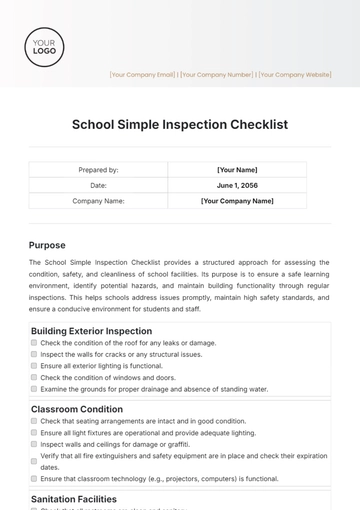

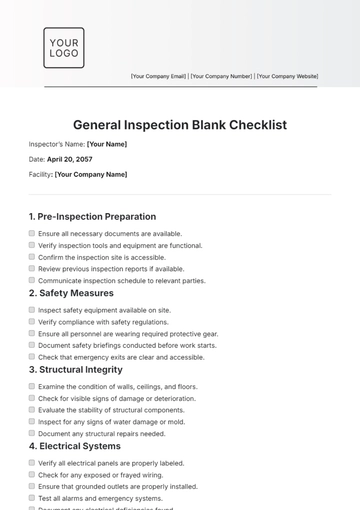

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

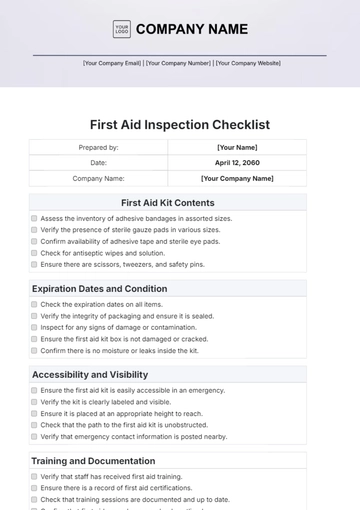

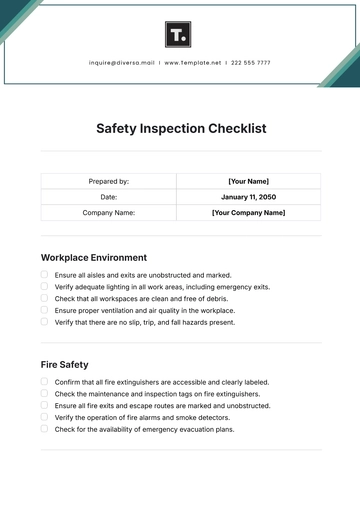

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

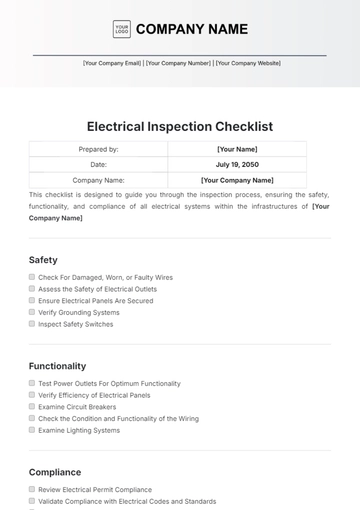

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

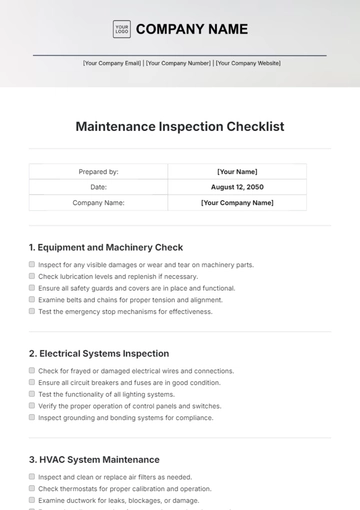

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

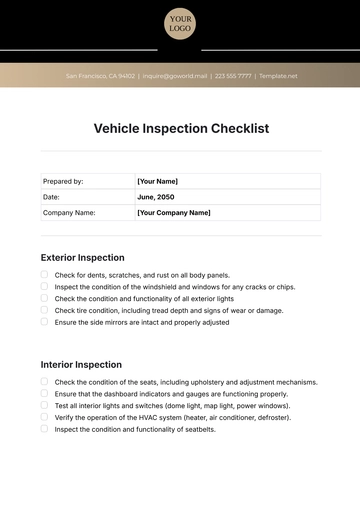

- Vehicle Checklist

- Travel Agency Checklist

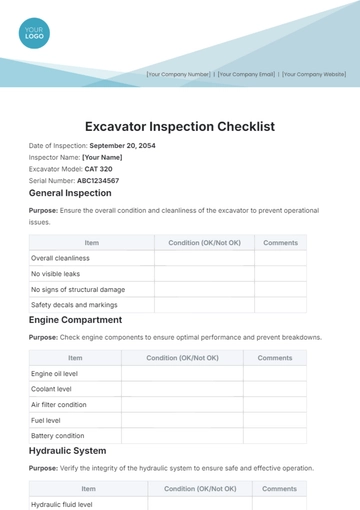

- Vehicle Inspection Checklist

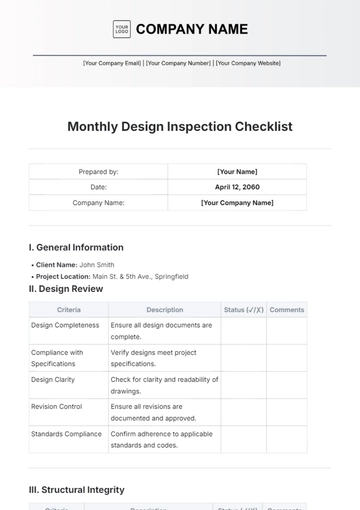

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist