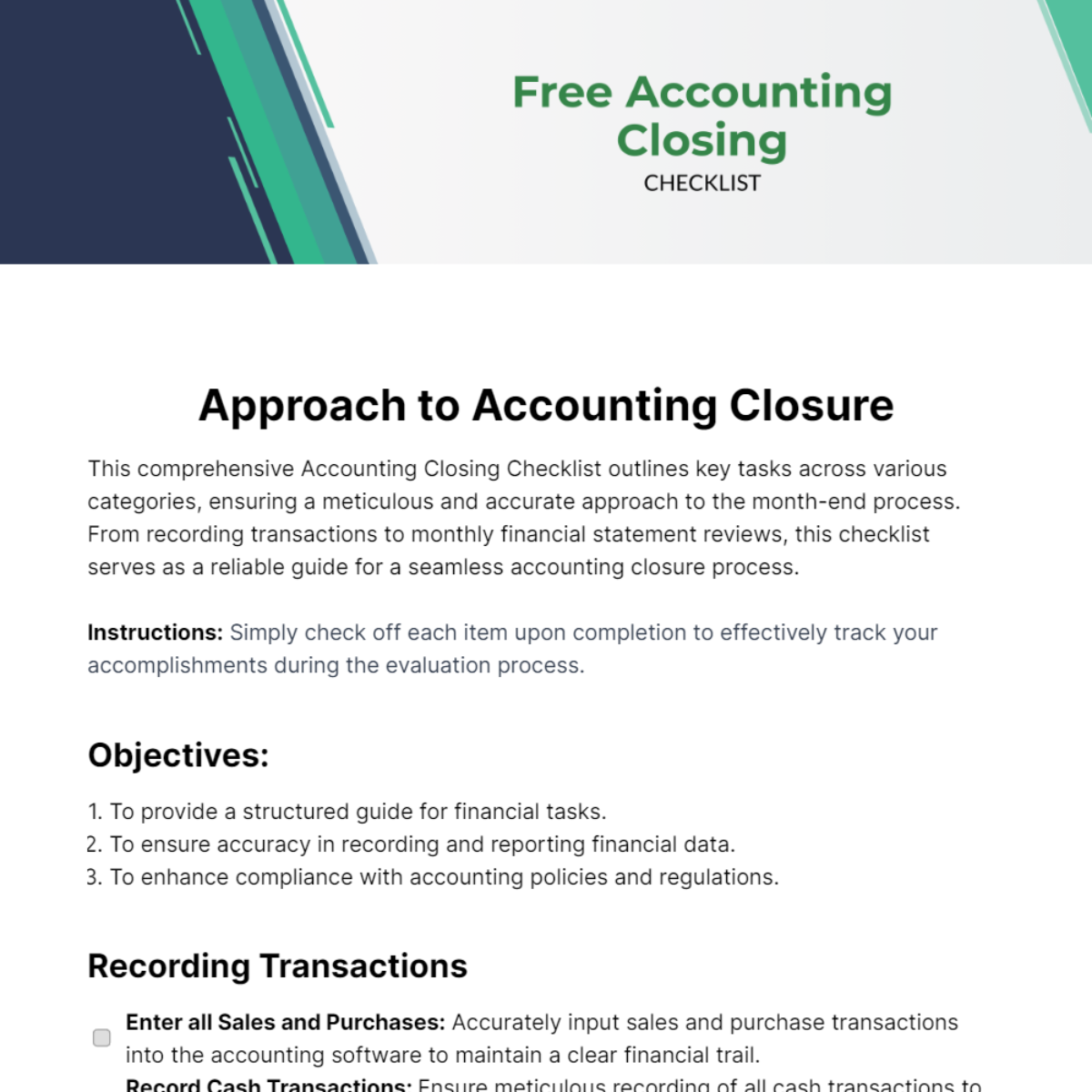

Free Accounting Closing Checklist

This comprehensive Accounting Closing Checklist outlines key tasks across various categories, ensuring a meticulous and accurate approach to the month-end process. From recording transactions to monthly financial statement reviews, this checklist serves as a reliable guide for a seamless accounting closure process.

Instructions: Simply check off each item upon completion to effectively track your accomplishments during the evaluation process.

Objectives:

To provide a structured guide for financial tasks.

To ensure accuracy in recording and reporting financial data.

To enhance compliance with accounting policies and regulations.

Recording Transactions

Enter all Sales and Purchases: Accurately input sales and purchase transactions into the accounting software to maintain a clear financial trail.

Record Cash Transactions: Ensure meticulous recording of all cash transactions to reflect the actual financial position.

Enter Payroll Transactions: Record payroll transactions accurately, accounting for salaries, taxes, and any deductions.

Record Business Expense Receipts: Capture and categorize all business expense receipts to track and manage expenditures effectively.

Input Depreciation/Amortization: Include depreciation and amortization amounts to accurately reflect the diminishing value of assets over time.

Invoice Management

Send out Invoices to Clients: Timely issuance of invoices to clients for services or products rendered.

Monitor Client Payments: Regularly track and send reminders for overdue invoices, ensuring consistent cash flow.

Process Refunds or Adjustments: Handle client refunds or adjustments as needed, maintaining transparency in financial dealings.

Record Client Deposits: Accurately record client deposits or prepayments to reflect current liabilities.

Perform Client Invoicing Audit: Regularly review and audit client invoices to identify any discrepancies or errors.

Accounting Reconciliation

Perform Bank Reconciliation: Ensure a meticulous comparison between the company's bank statement and accounting records.

Perform Inter-company Account Reconciliation: Reconcile accounts with inter-company transactions to maintain accurate financial records.

Verify Expense Reimbursements: Validate all expense reimbursements to ensure compliance with company policies.

Validate Credit Notes and Adjustments: Verify and record credit notes and adjustments accurately.

Verify Transaction Classification: Confirm the correct classification of all transactions to maintain accuracy in financial reporting.

Monthly Closing Process

Review Balance Sheet Accounts: Thoroughly review and reconcile balance sheet accounts for accuracy.

Review and Adjust Income Statement Accounts: Evaluate income statement accounts, making necessary adjustments for precision.

Review and Approve Monthly Financial Statements: Scrutinize and approve monthly financial statements for accuracy and completeness.

Prepare Monthly Management Reporting Package: Compile a comprehensive management reporting package for stakeholders.

Review Variance Analyses: Analyze variances from budget forecasts, identifying and addressing any significant discrepancies.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Close your books with confidence using this Accounting Closing Checklist Template that’s exclusively offered by Template.net. This expertly designed and highly customizable checklist, editable in our easy-to-use Ai Editor Tool, ensures nothing is overlooked in your accounting process. Enhance accuracy and efficiency in your financial closing with this user-friendly template.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

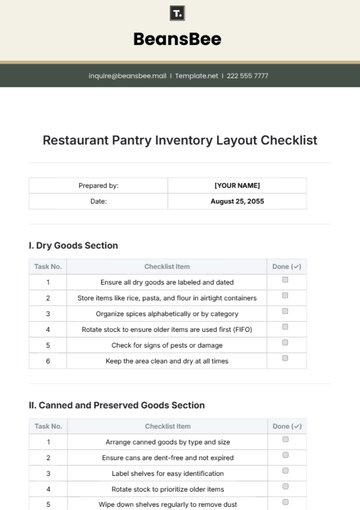

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

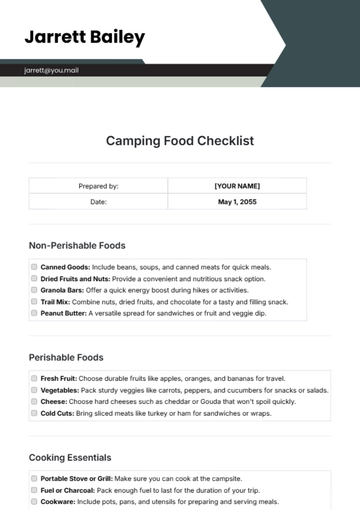

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

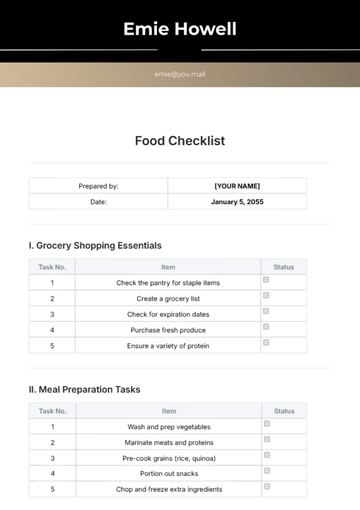

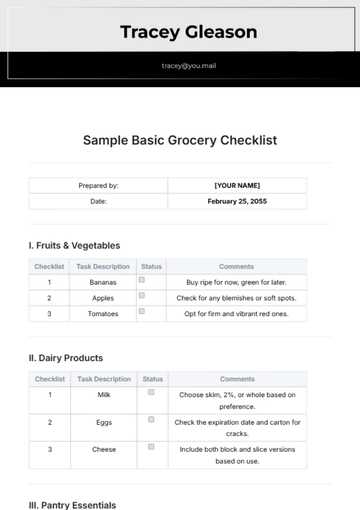

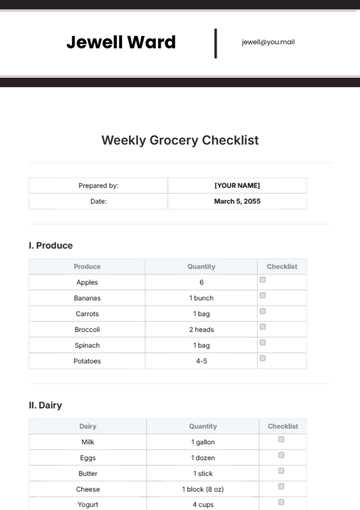

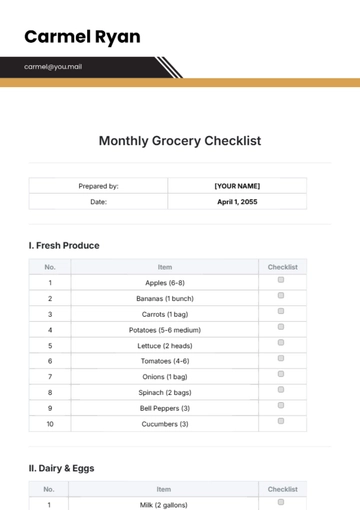

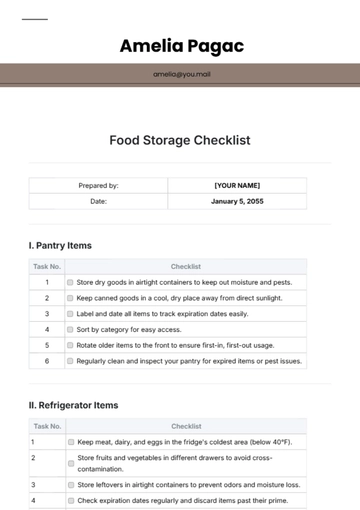

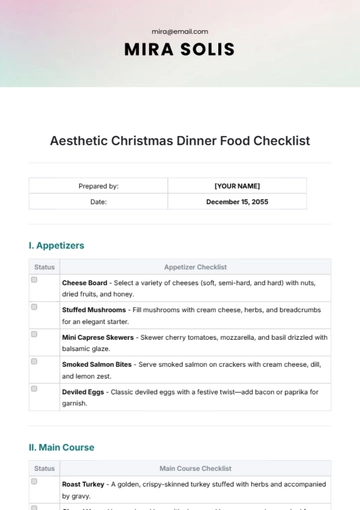

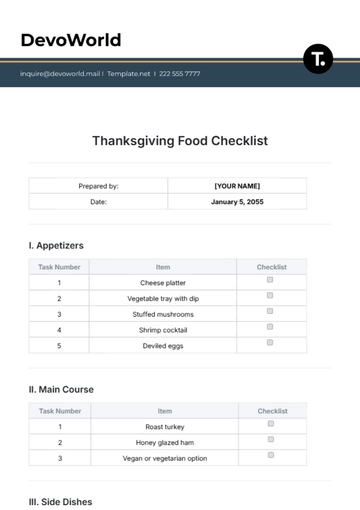

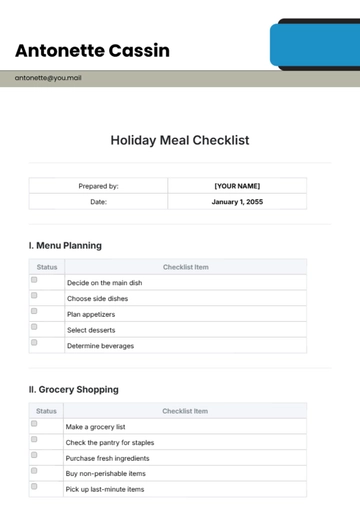

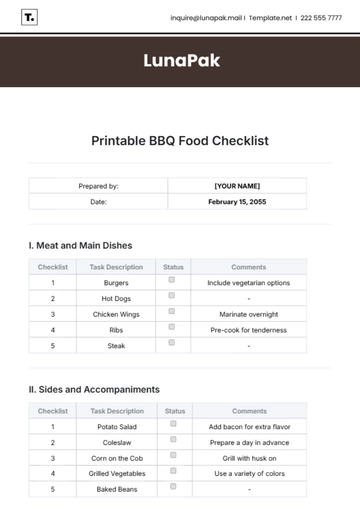

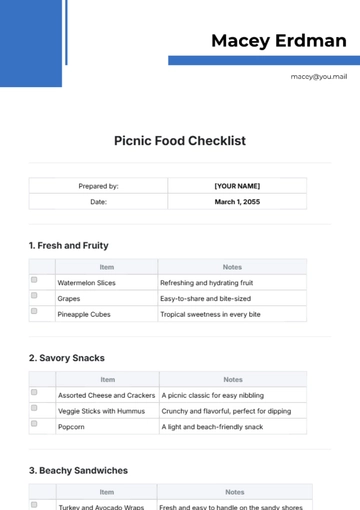

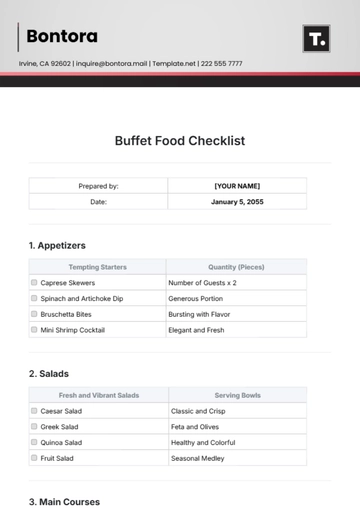

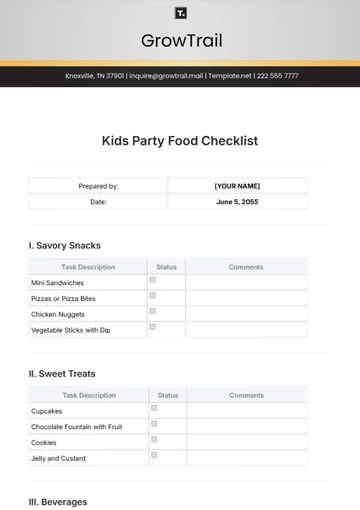

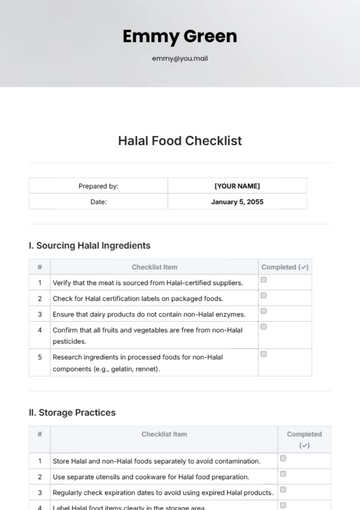

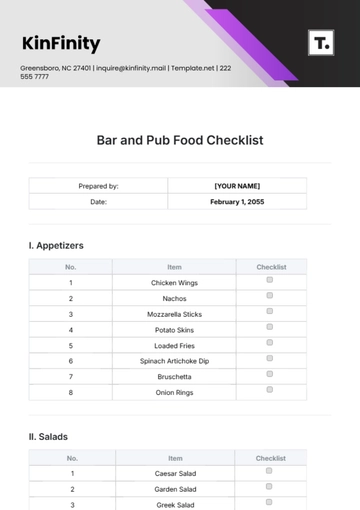

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

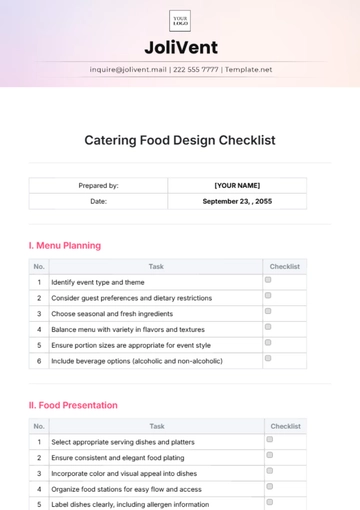

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

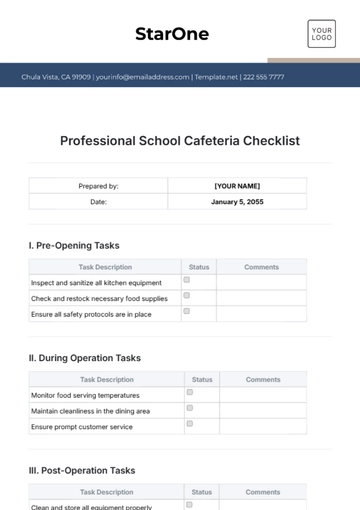

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

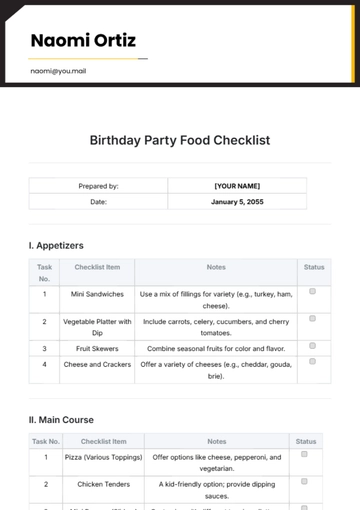

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist