Free Accounting Disclosure Checklist

This checklist aims to assist accounting professionals in ensuring thorough and accurate financial disclosures. It is essential for maintaining transparency, compliance, and trust among stakeholders.

Instructions: Tick the checkboxes to track progress as you review each item. Ensure compliance with relevant accounting standards and regulatory requirements.

1. Financial Statements Disclosure:

Balance Sheet: Verify that all assets, liabilities, and equity items are accurately disclosed.

Income Statement: Ensure comprehensive reporting of revenues, expenses, gains, and losses.

Statement of Cash Flows: Confirm proper classification and disclosure of cash inflows and outflows.

Notes to Financial Statements: Review disclosures regarding accounting policies, contingencies, and significant transactions.

Segment Reporting: Evaluate disclosures related to operating segments and geographical areas.

2. Accounting Policies and Estimates:

Consistency: Check for consistency in the application of accounting policies across reporting periods.

Disclosure of Changes: Ensure adequate disclosure of changes in accounting policies and estimates and their impact.

Judgment and Estimates: Assess the reasonableness and adequacy of management's judgments and estimates.

Fair Value Measurements: Verify disclosures related to fair value measurements and the methods used.

Sensitivity Analysis: Evaluate sensitivity analysis disclosures for significant accounting estimates.

3. Related Party Transactions and Contingencies:

Related Party Transactions: Review disclosures of transactions with related parties, including nature and terms.

Contingencies: Assess the adequacy of disclosure regarding legal, tax, and environmental contingencies.

Commitments: Ensure comprehensive disclosure of contractual obligations, including lease commitments and purchase obligations.

Litigation: Verify disclosure of pending litigation, claims, and assessments, including potential financial impacts.

Subsequent Events: Evaluate disclosures of significant events occurring after the reporting period.

4. Regulatory Compliance and Other Disclosures:

Compliance with Laws and Regulations: Confirm disclosures related to compliance with applicable laws and regulations.

Non-GAAP Measures: Assess the appropriateness and transparency of disclosures regarding non-GAAP financial measures.

Risk Factors: Review disclosures of key risks and uncertainties affecting the organization's financial condition and performance.

Corporate Governance: Evaluate disclosures related to corporate governance practices, including board composition and compensation.

Environmental, Social, and Governance (ESG) Disclosures: Ensure comprehensive disclosure of ESG-related matters, reflecting the organization's commitment to sustainability and responsible business practices.

Company: [Your Company Name]

Conducted by: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This dynamic Accounting Disclosure Checklist Template from Template.net is your ticket to seamless navigation through the intricate world of financial disclosures. Fully customizable and editable using our Ai Editor Tool, it guarantees that every disclosure is not just accurate, but also comprehensive. What are you waiting for, access it now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

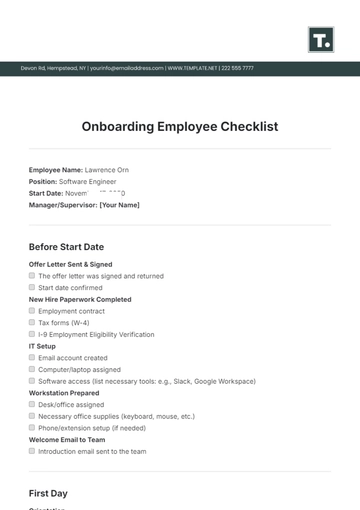

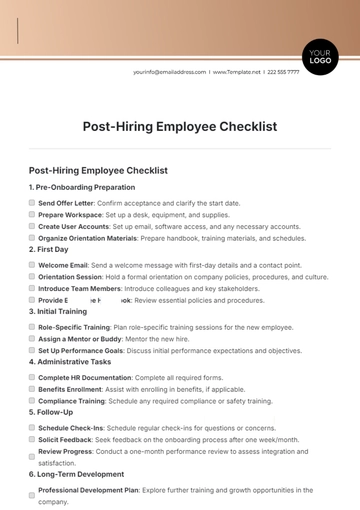

- Onboarding Checklist

- Quality Checklist

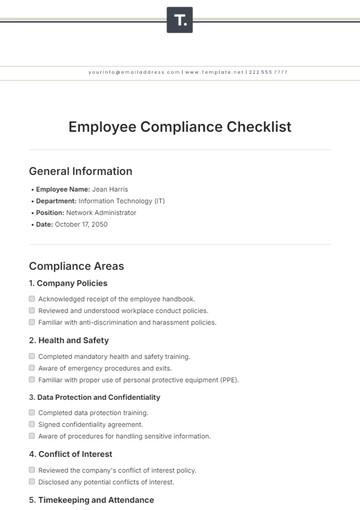

- Compliance Checklist

- Audit Checklist

- Registry Checklist

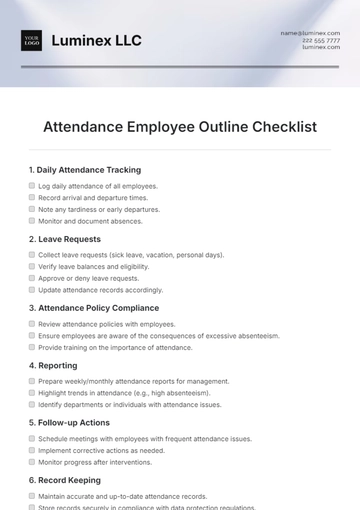

- HR Checklist

- Restaurant Checklist

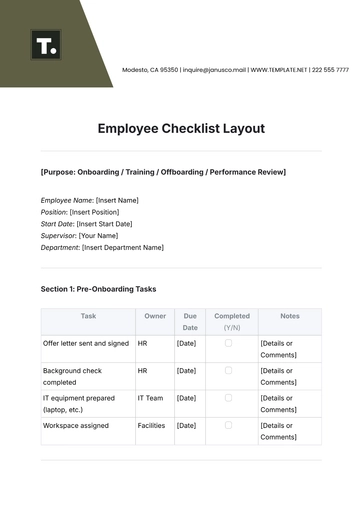

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

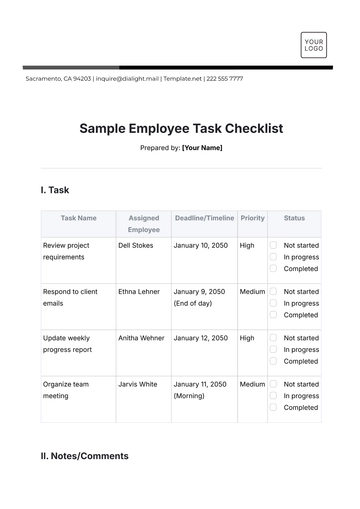

- Task Checklist

- Professional Checklist

- Hotel Checklist

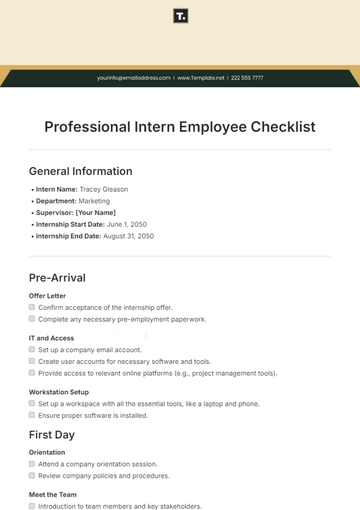

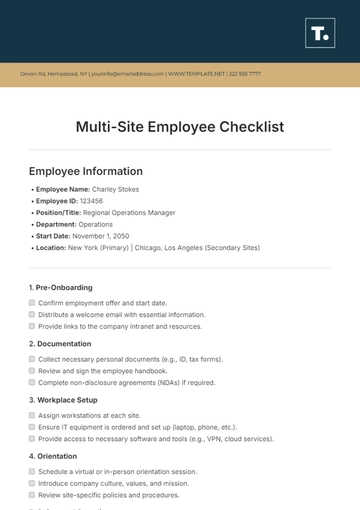

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

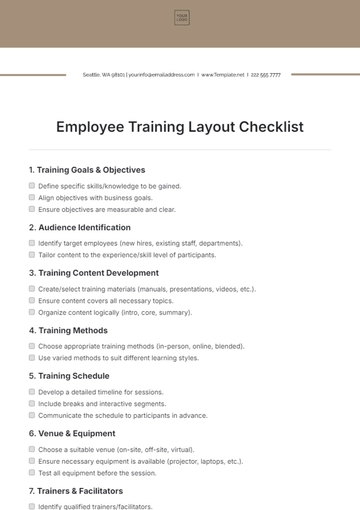

- Employee Training Checklist

- Medical Checklist

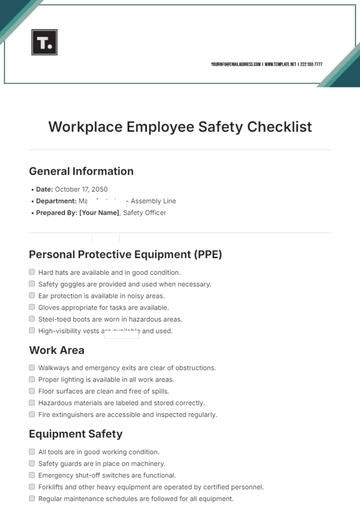

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

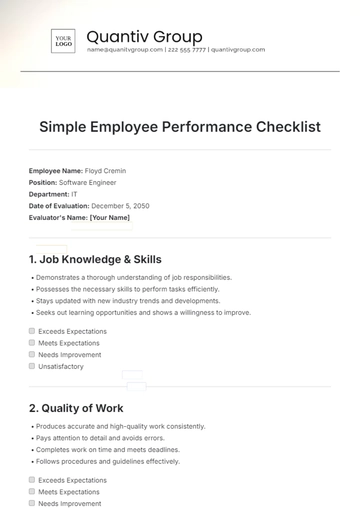

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

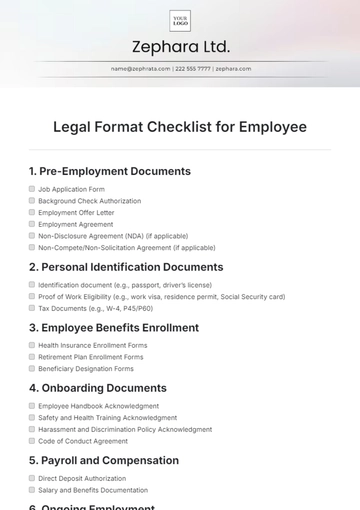

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist