Free Acquisition Accounting Checklist

Acquisition accounting is a critical process that ensures the accurate recording and reporting of acquired assets, liabilities, and equity. This checklist provides a structured approach to effectively manage the acquisition accounting process. Simply tick the checkboxes next to each item as you complete the corresponding task.

Objectives:

Ensure compliance with accounting standards and regulatory requirements.

Facilitate a seamless transition and integration of acquired entities into the acquiring company.

Enhance transparency and accuracy in financial reporting following the acquisition.

1. Pre-Acquisition Preparation

Legal Due Diligence

Review legal documents, such as contracts, agreements, and licenses to identify any potential risks or liabilities.

Verify the ownership and validity of intellectual property rights associated with the acquired entity.

Financial Due Diligence

Examine historical financial statements, tax returns, and audit reports to assess the financial health and performance of the target company.

Analyze the quality of earnings, cash flow trends, and potential contingent liabilities.

2. Acquisition Execution

Valuation Assessment

Engage with valuation experts to determine the fair value of identifiable assets, liabilities, and contingent liabilities.

Assess the fair value of intangible assets such as goodwill, trademarks, and customer relationships.

Purchase Price Allocation

Allocate the purchase price to tangible and intangible assets based on their fair values determined during the valuation process.

Ensure compliance with accounting standards, such as ASC 805 (IFRS 3) regarding the allocation of purchase consideration.

3. Post-Acquisition Integration

Accounting System Integration

Integrate the financial reporting systems of the acquired entity with those of the acquiring company to streamline reporting processes.

Establish controls and procedures to ensure the accurate recording and consolidation of financial data.

Employee Integration

Assess the impact of the acquisition on the workforce and implement strategies for integrating employees into the organizational structure.

Provide training and support to employees to facilitate a smooth transition and alignment with company culture.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This dynamic Acquisition Accounting Checklist Template, exclusively available at Template.net, is your compass for navigating through the complexities of acquisitions with ease. Tailored for meticulous due diligence, it offers fully customizable and editable capabilities, directly tailored in our user-friendly Ai Editor Tool. What are you waiting for, make it yours today!

You may also like

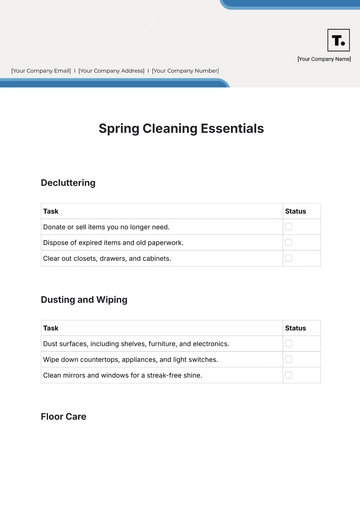

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

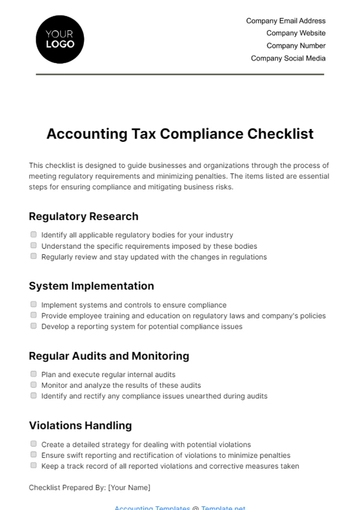

- Compliance Checklist

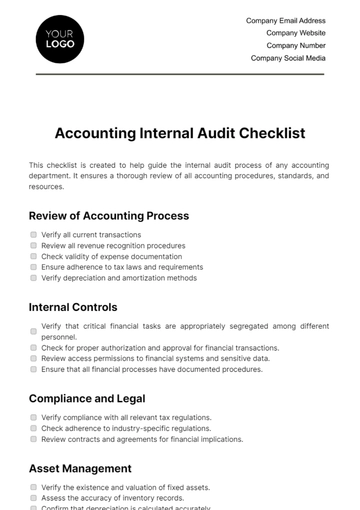

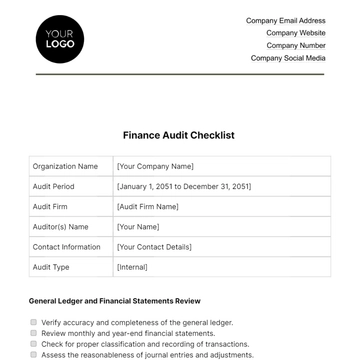

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

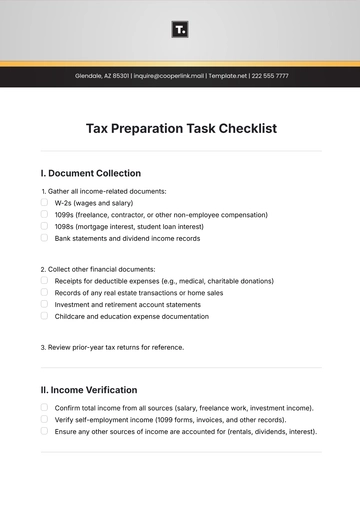

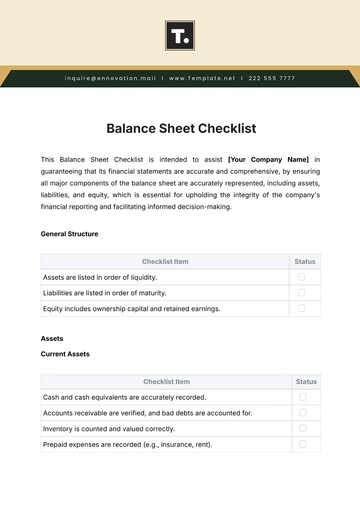

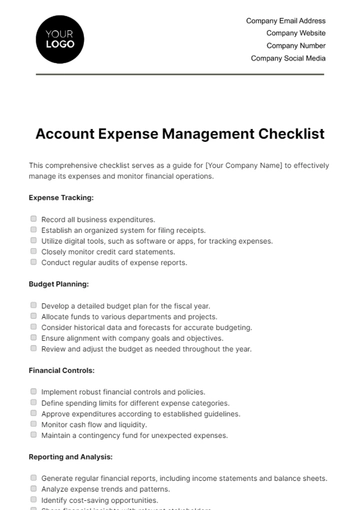

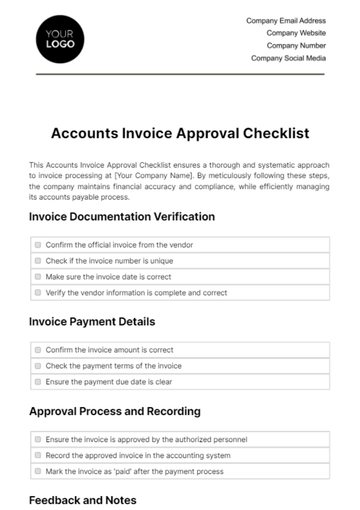

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

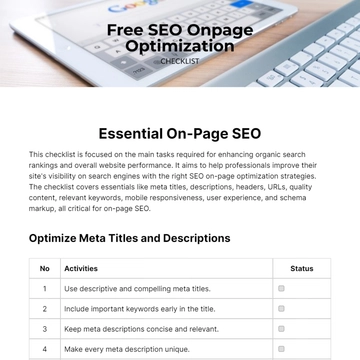

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

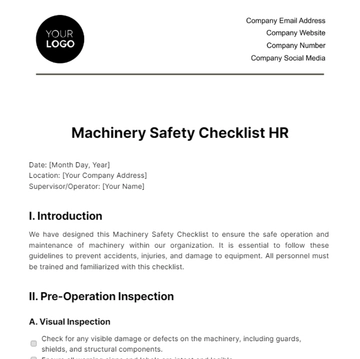

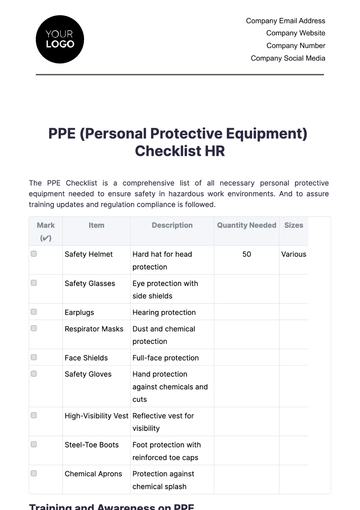

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist