Free Nonprofit Accounting Checklist

Sound financial management is critical for nonprofit organizations to fulfill their mission effectively. This checklist provides a comprehensive guide to key accounting tasks to maintain transparency, compliance, and financial health.

Instructions:

Tick the checkboxes as you complete each task to track progress.

Objectives:

Ensure financial transparency and accountability.

Maintain compliance with regulatory requirements.

Enhance donor trust and confidence in financial management.

Financial Records Management

Regularly update financial records, including income, expenses, donations, and grants.

Record all financial transactions with clear documentation to support expenditures and revenues.

Reconcile bank statements monthly to ensure accuracy between recorded transactions and bank balances.

Keep track of all assets owned by the organization, including equipment, property, and investments.

Adhere to record retention policies to ensure compliance with legal and regulatory requirements.

Budgeting and Reporting

Develop an annual budget that aligns with the organization's strategic goals and programs.

Regularly monitor budget versus actual performance to identify variances and adjust spending as needed.

Produce accurate and timely financial reports for board members, donors, and stakeholders.

Comply with grant requirements by submitting detailed financial reports on time.

Maintain transparency by publishing financial reports on the organization's website or providing them upon request.

Compliance and Governance

File required tax forms accurately and on time to maintain tax-exempt status.

Prepare for annual audits by organizing financial records and documentation.

Implement internal controls to prevent fraud and ensure financial integrity.

Provide regular financial updates to the board of directors and engage them in financial decision-making.

Adhere to ethical standards in financial management, ensuring honesty, integrity, and accountability.

Fundraising and Donor Management

Maintain a system to track and acknowledge donations promptly, including donor information and contribution details.

Ensure compliance with regulations governing fundraising activities, including solicitation registrations.

Manage grants effectively, tracking funds received, expenditures, and reporting requirements.

Cultivate relationships with donors through personalized communications and stewardship efforts.

Properly record and report non-monetary donations according to accounting standards.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure the highest standards of financial record-keeping with Template.net’s Nonprofit Accounting Checklist Template. This template offers customizable features and is seamlessly editable in our Ai Editor Tool. Whether you're a seasoned financial professional or new to nonprofit accounting, this checklist provides a reliable framework to streamline your organization's financial operations.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

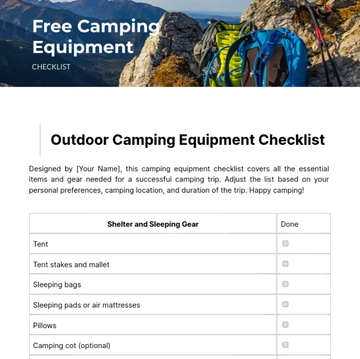

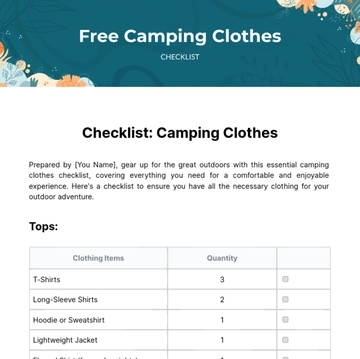

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

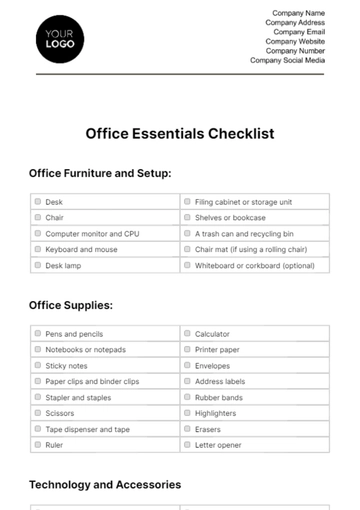

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

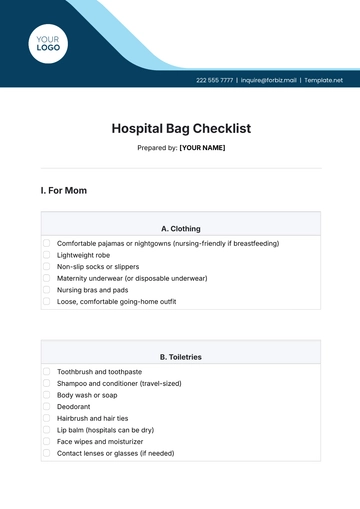

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

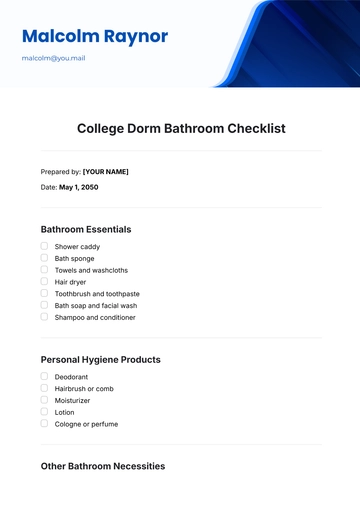

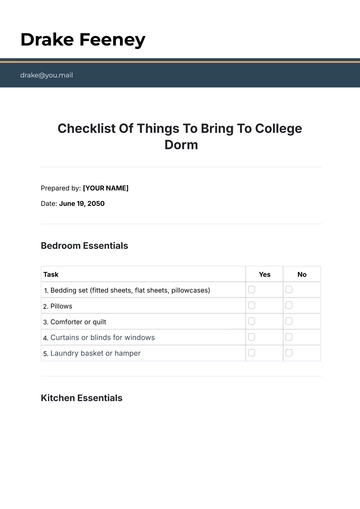

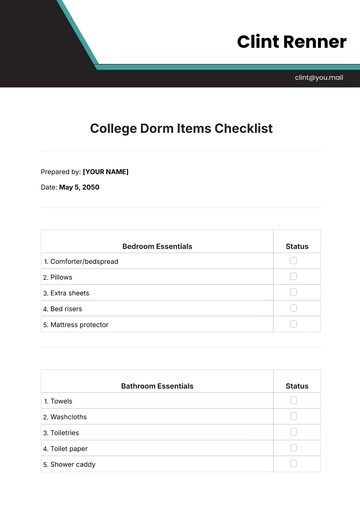

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist