Free Checklist for Accounting Standards

Ensuring compliance with accounting standards is crucial for maintaining financial accuracy and transparency within an organization. This checklist provides a structured approach to reviewing adherence to accounting standards, covering key areas essential for financial reporting.

Instructions: Tick the checkboxes next to each checklist item upon completion. Review and update this checklist regularly to maintain adherence to accounting standards.

I. Financial Statement Preparation

A. Income Statement

Verify that all revenue and expenses are accurately recorded according to the accrual basis of accounting.

Confirm that proper classification and presentation of items adhere to relevant accounting frameworks such as GAAP or IFRS.

Ensure consistency in the treatment of extraordinary items or unusual transactions, disclosing them appropriately.

B. Balance Sheet

Validate the completeness and accuracy of assets, liabilities, and equity items.

Check for compliance with valuation principles, including historical cost, fair value, and impairment assessments.

Review the disclosure of significant accounting policies and estimates affecting the balance sheet amounts.

II. Internal Controls and Compliance

A. Segregation of Duties

Assess the segregation of duties to prevent fraud and errors, ensuring no single individual has control over all stages of a transaction.

Review authorization levels and limits for financial transactions to prevent unauthorized activities.

B. Documentation and Record-Keeping

Ensure all financial transactions are supported by adequate documentation, including invoices, contracts, and receipts.

Verify the completeness and accuracy of financial records, such as ledgers, journals, and reconciliations.

III. Regulatory Reporting

A. Tax Compliance

Verify the accuracy and timeliness of tax filings, including income tax, sales tax, and payroll tax returns.

Confirm compliance with tax laws and regulations, including any changes in tax rates or deductions.

B. External Reporting

Review financial statements and disclosures for compliance with regulatory requirements and industry standards.

Ensure timely submission of financial reports to regulatory authorities and stakeholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Stay compliant and organized through this ultimate Checklist for Accounting Standards Template. This indispensable tool is fully customizable and editable in our Ai Editor Tool, ensuring that you adhere to all accounting protocols efficiently. Embrace clarity and accuracy in your financial reporting with this editable template, exclusively available at Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

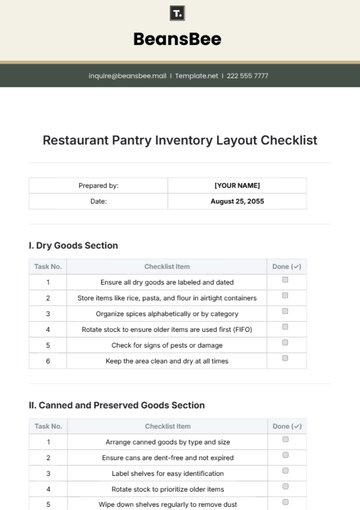

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

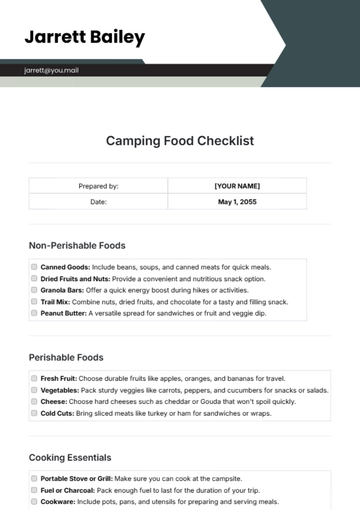

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

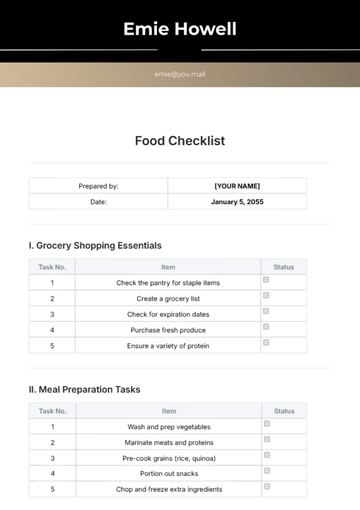

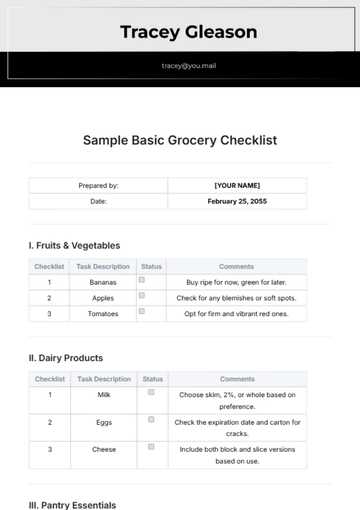

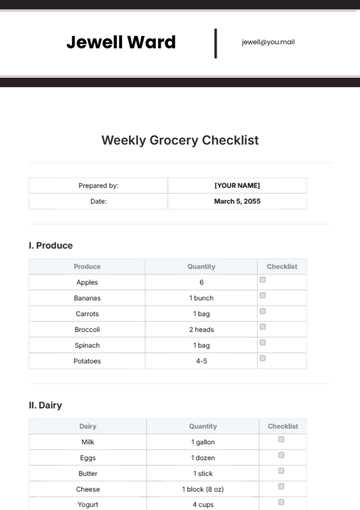

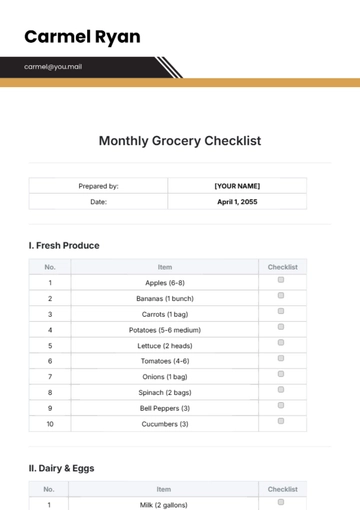

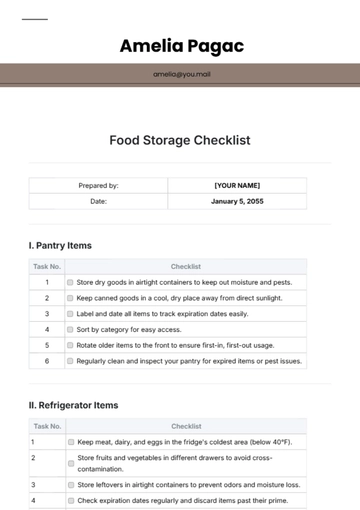

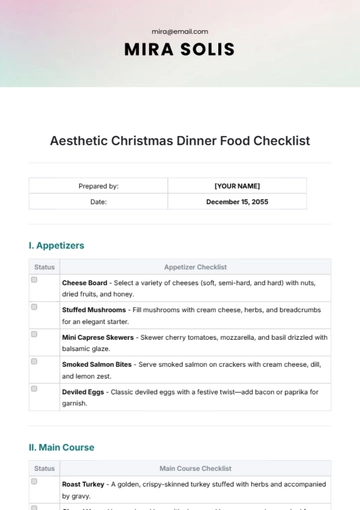

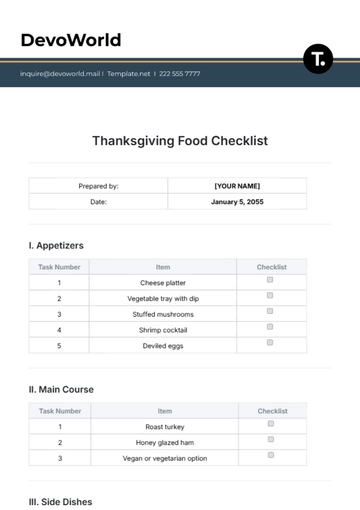

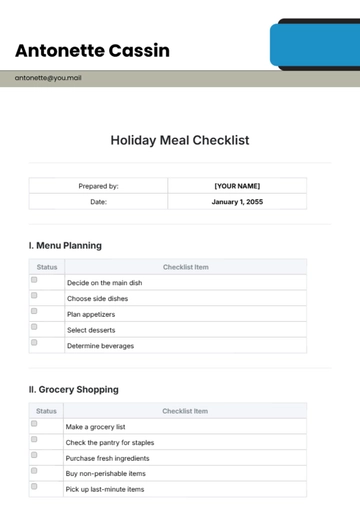

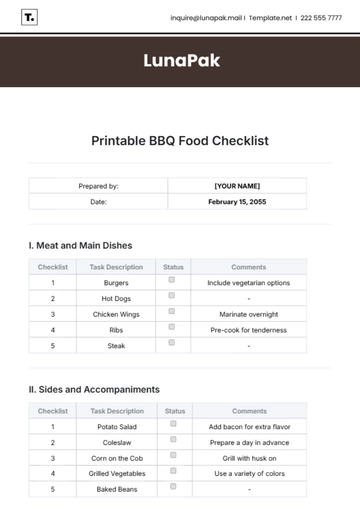

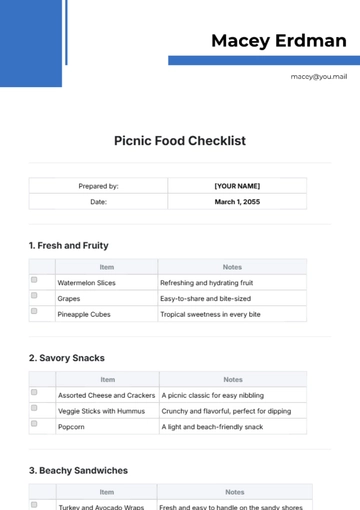

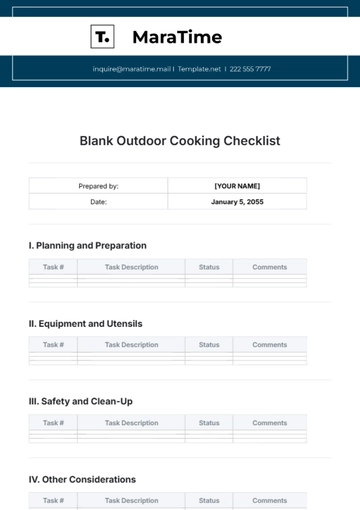

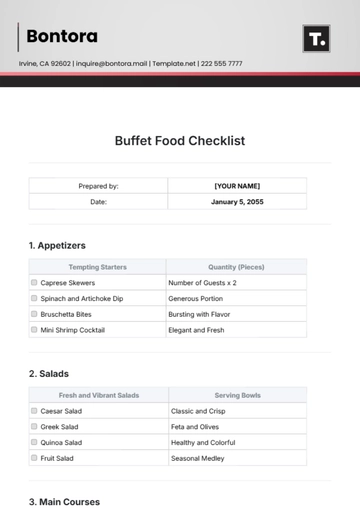

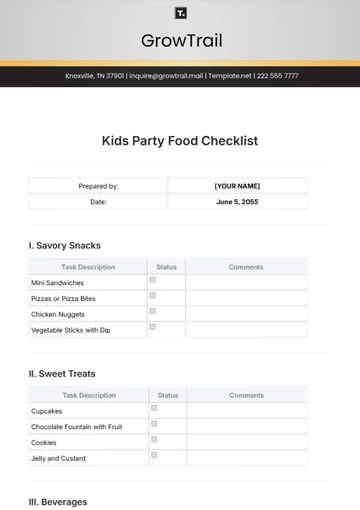

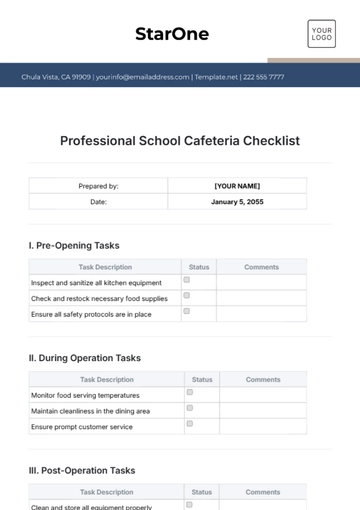

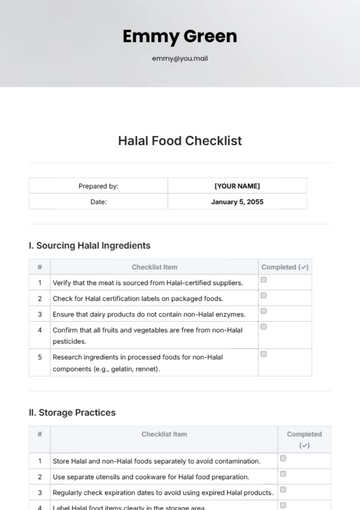

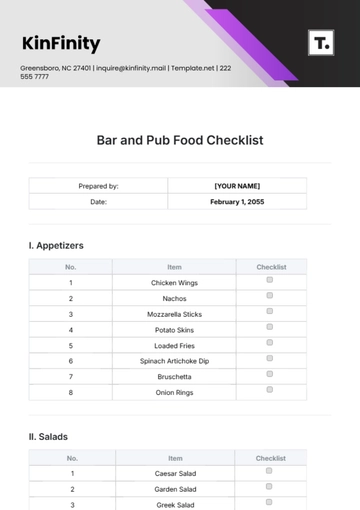

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

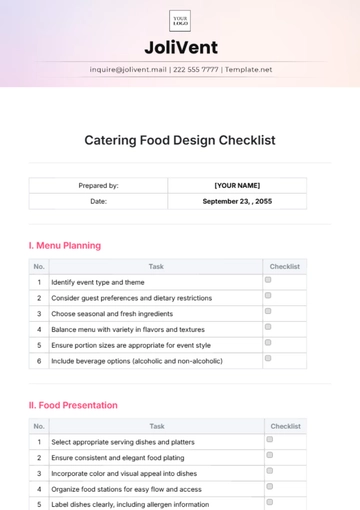

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

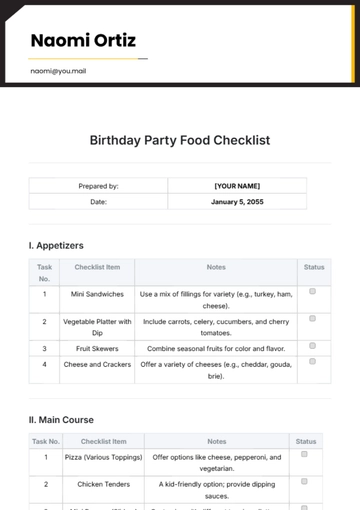

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist