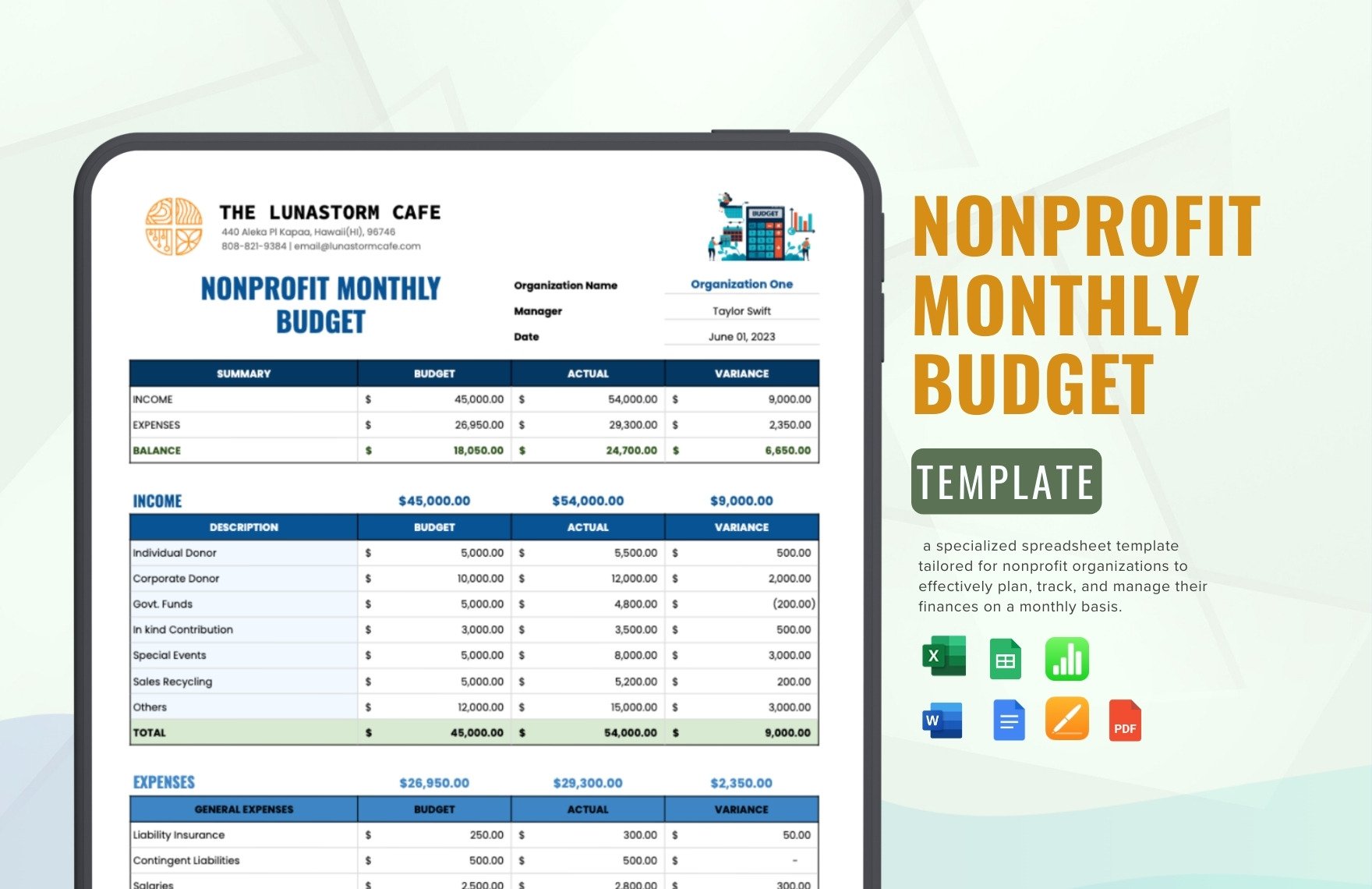

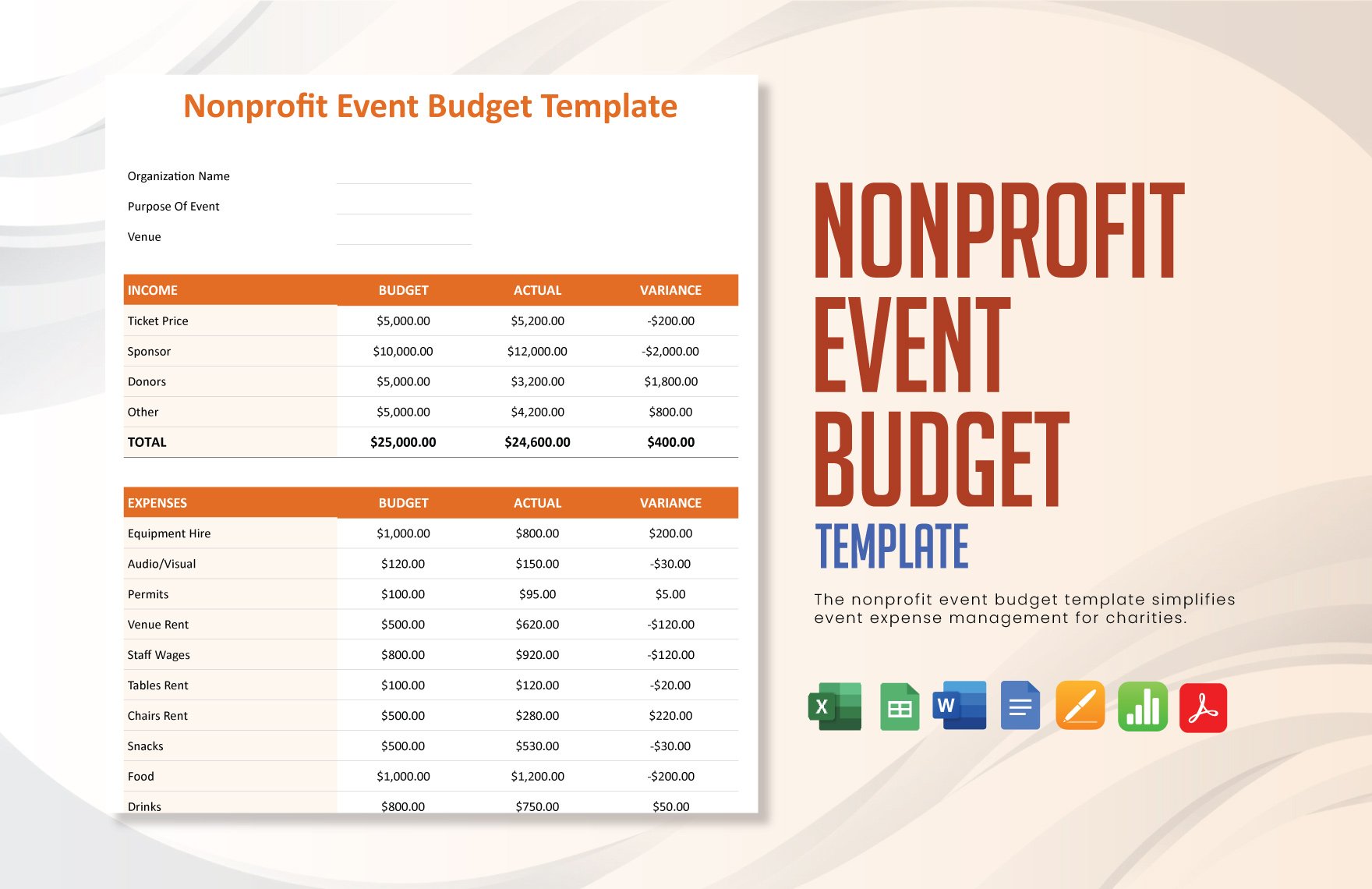

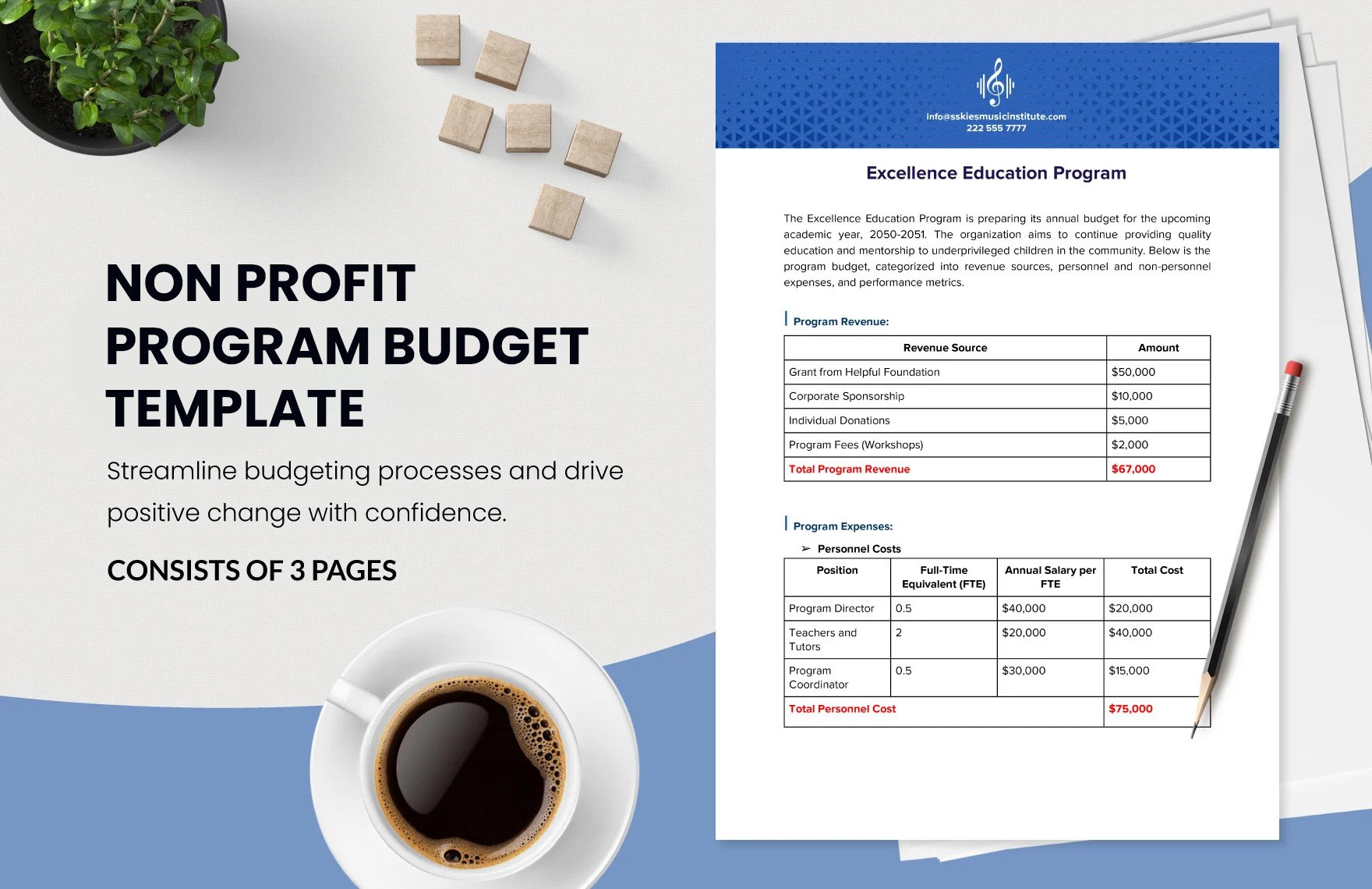

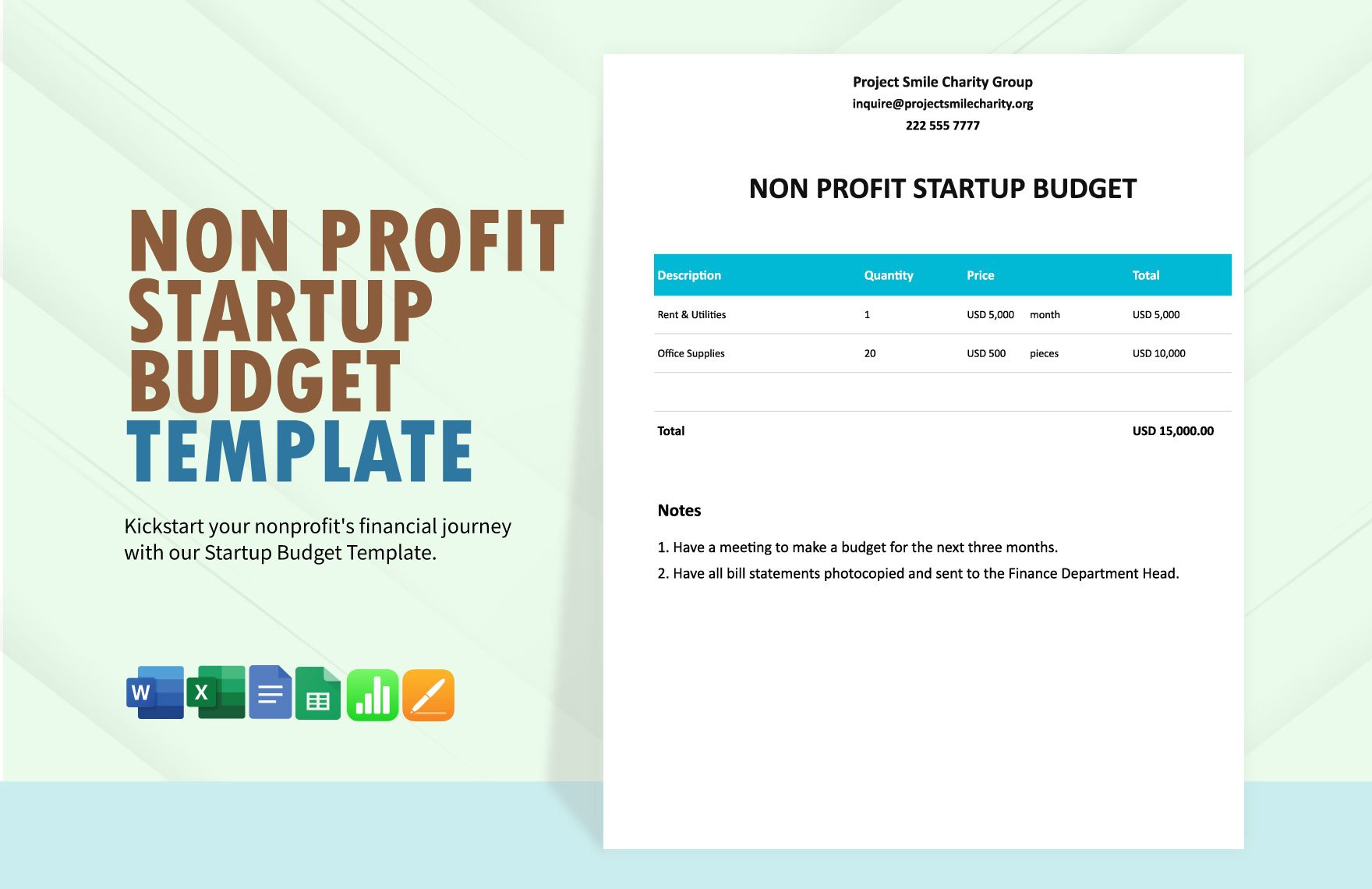

If you are considering giving something to society, it would be an excellent match for you to begin a non-profit organization. Once you start finding a way to support the community or start organizing a charitable event, you will have to build a financial plan that will be enough for all these projects. This is the part where the tension and the difficulty come in that's why we prepared these easily editable Non-Profit Budget Templates in Apple (MAC) Pages. With these collections of 100% customizable sample templates, it will be easy for you to create revenue reports for daily, weekly, monthly, or even annual basis. So, if you got a nonprofit organization, these high-quality and ready-made templates will save you from the hassle. Download now!

How to Create a Non-Profit Budget in Apple Mac Pages

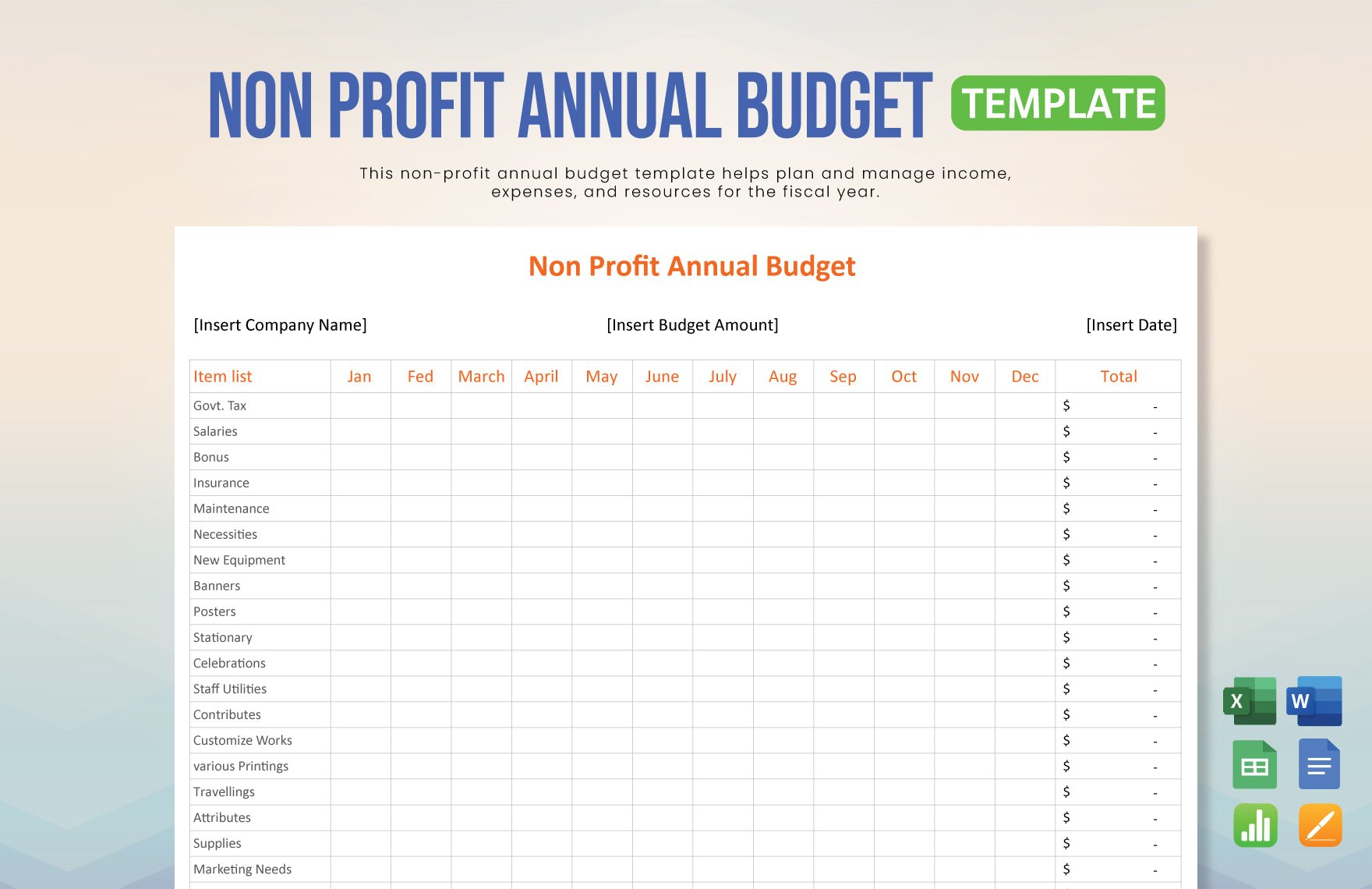

Budgeting is the method wherein you lay the groundwork for your money and invest it to achieve the financial goals. Many non-profit organizations (66.3 percent) have annual budgets below $1 million, as mentioned by Guidestar. Identifying the organization's needs and desires and tackling your financial state is a significant initial step before you build your operating budget.

If you are wondering how to organize and format your budget for your non-profit organization, here's how:

1. Specify Your Purpose

Jot down all of the expenditures that you must pay and consider them a priority on your checklist. Ensure your budget are adequate for your expenses. Build a gap to your budget and reserve it for unexpected costs, such as repairs, maintenance, and so on. It is necessary to consider the monthly expenses to build a reasonable budget.

2. Focus on Your Budget

Evaluate if your budget is more significant than what you are going to expend. This will allow you to save cash and make obligations paid off. You will have to find out where and when to start specifying the expenditures.

3. Take Note of Your Spending

Excessive expenditures that are not part of the actual plan will significantly impact the budget management output. This can lead to transaction delays or project delays. Always collect the receipts every time you purchase something. Eventually, having copies of all receipts can come in very handy in case.

4. Always Record Everything

Investigating all the money that your organization controls will keep you from getting on the edge of your budget. This record will encourage you to calculate an estimation of your total expenditure and earnings on a specific period. It will also indicate whether you meet your financial goal or whether you get through your budget.

5. Evaluate

Review and start comparing the organization's financial reports, and make a note of their peaks and their lowest points. If you consider more of those as mentioned earlier, make adjustments and modifications to enhance these areas, if possible. Having such a modification will help you reach the goals you want.