Bring your business reporting to life with pre-designed Call Report Templates in Adobe PDF by Template.net

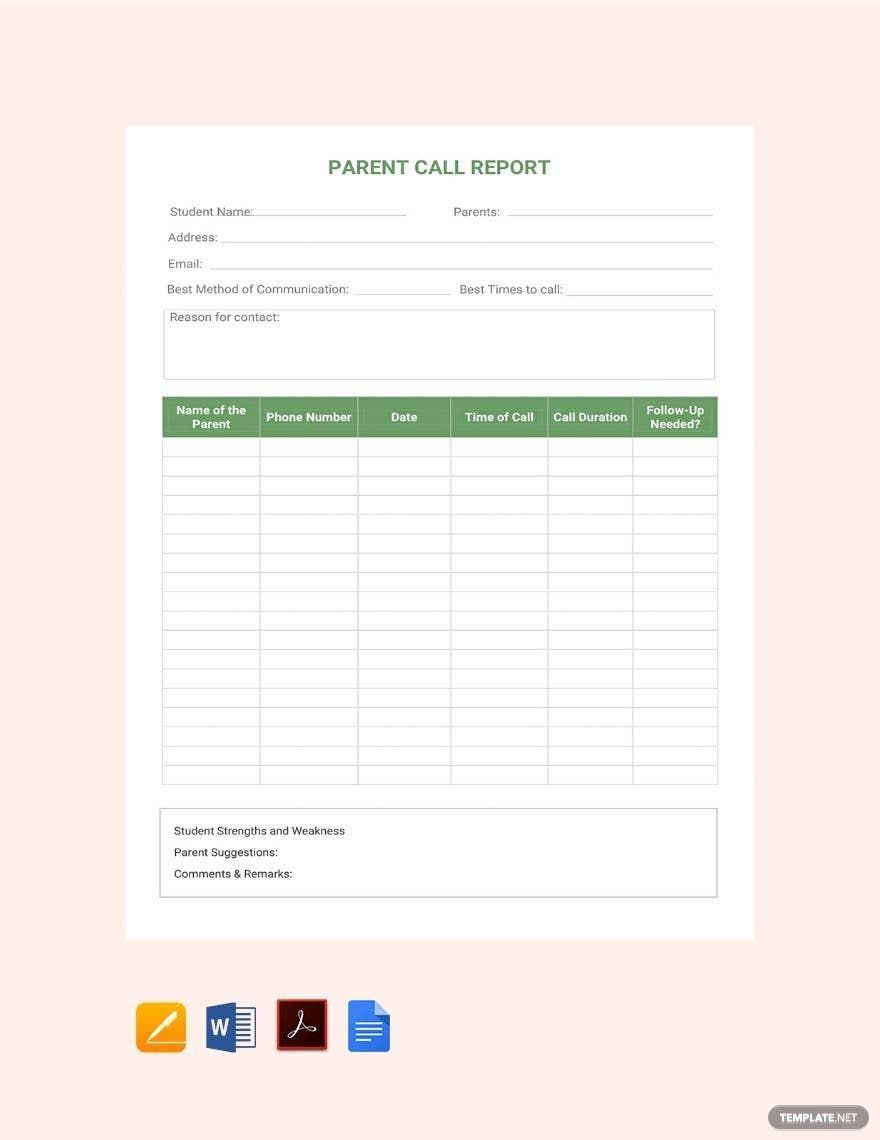

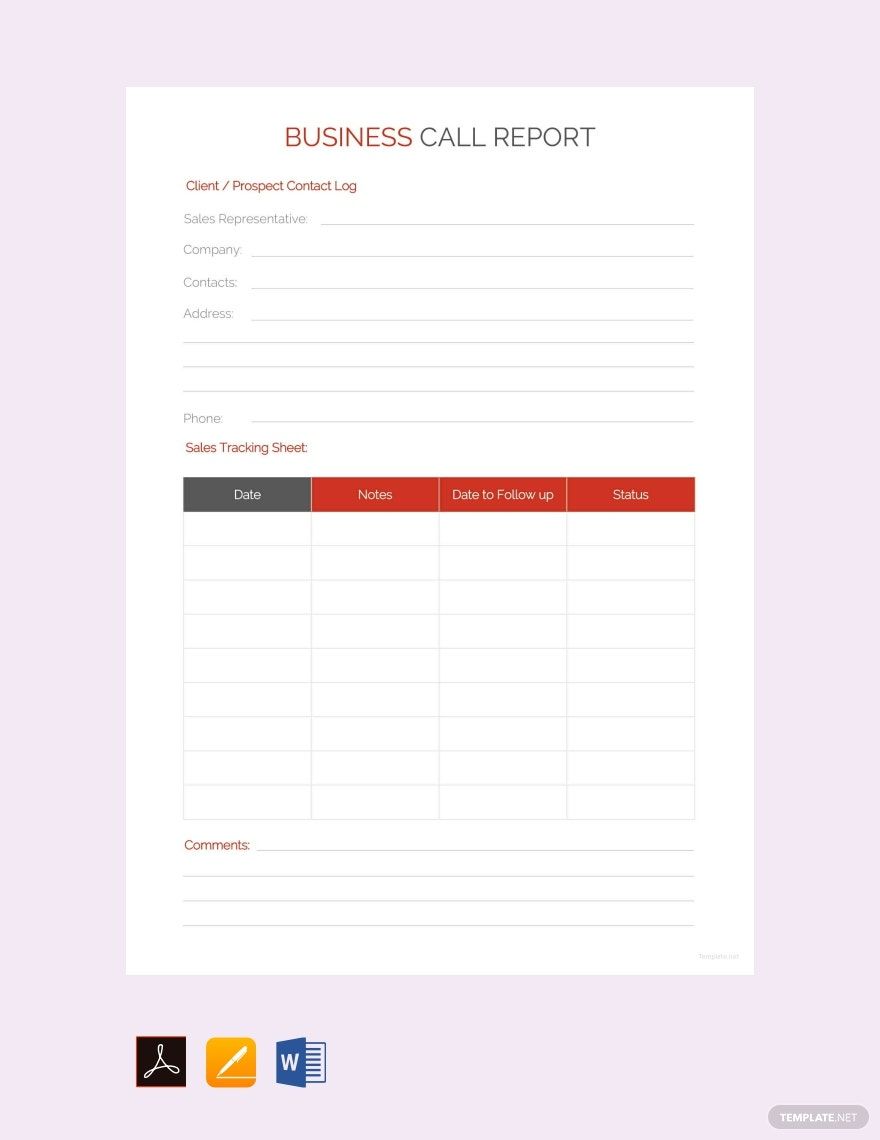

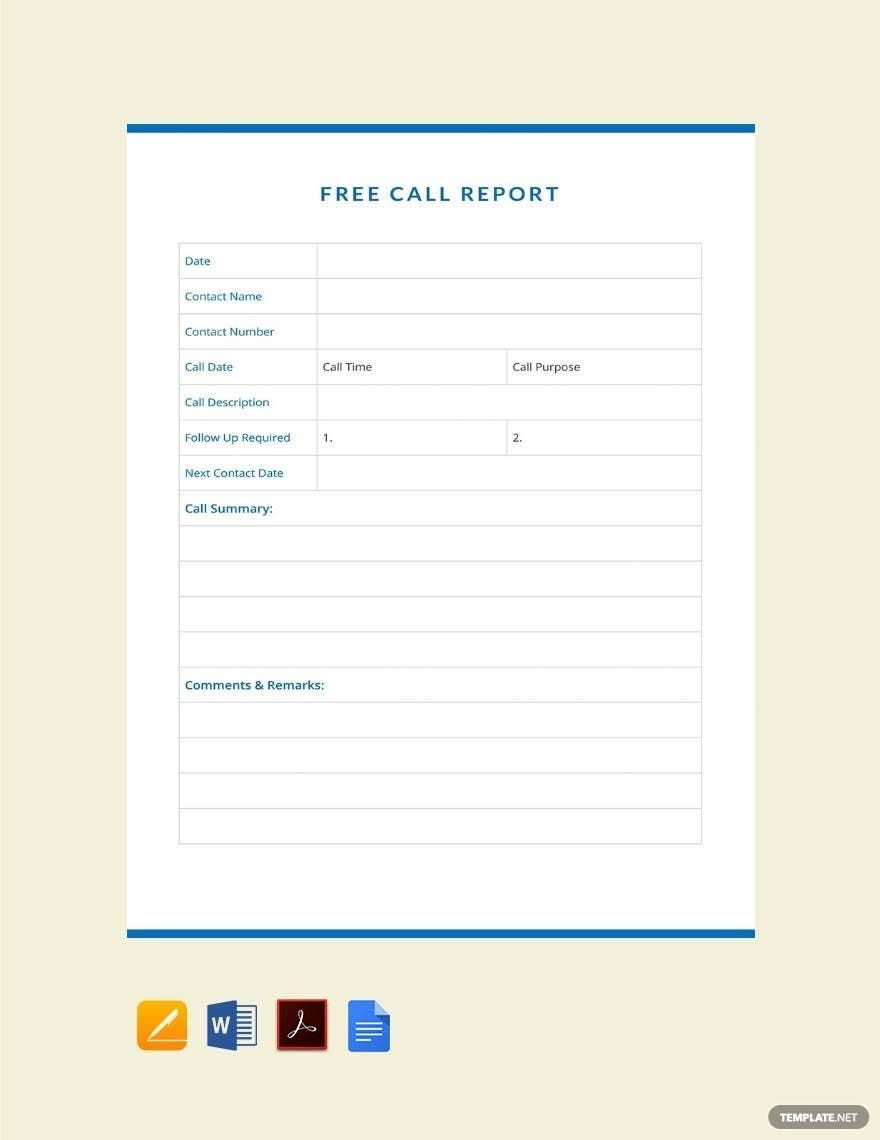

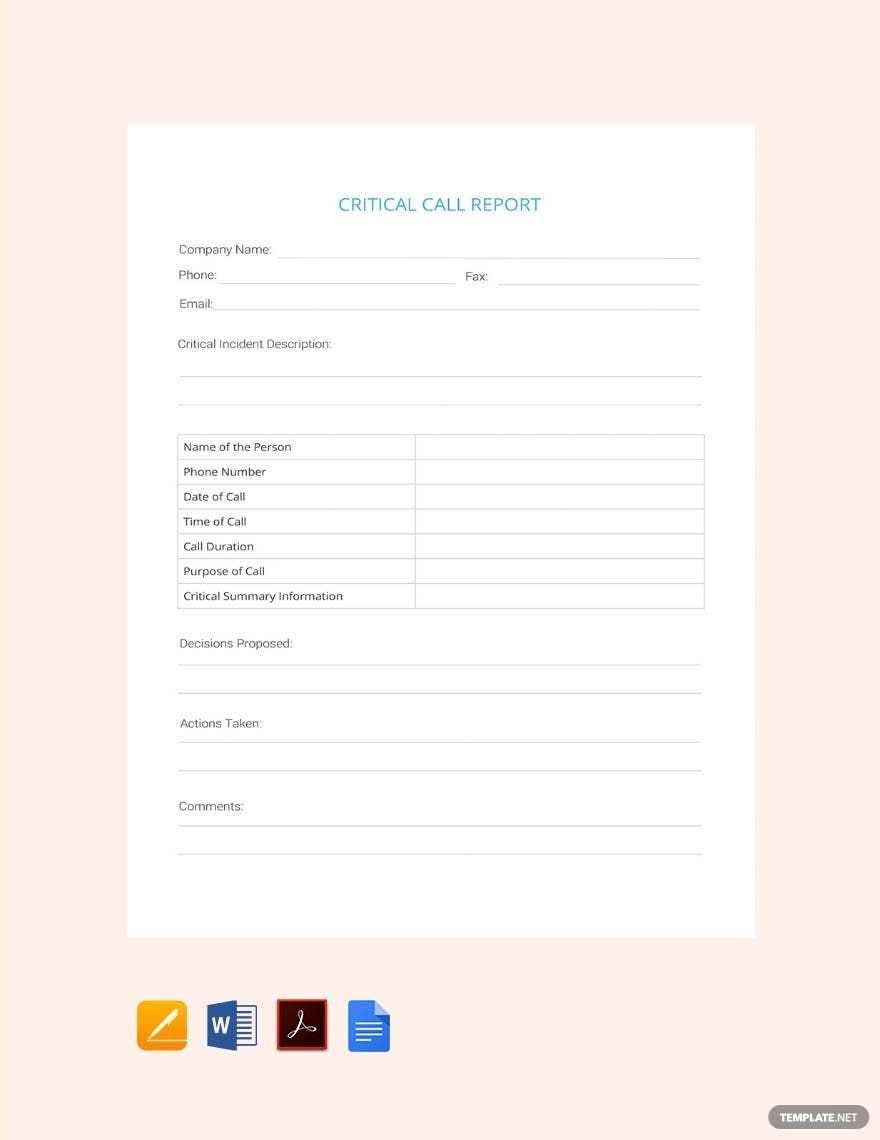

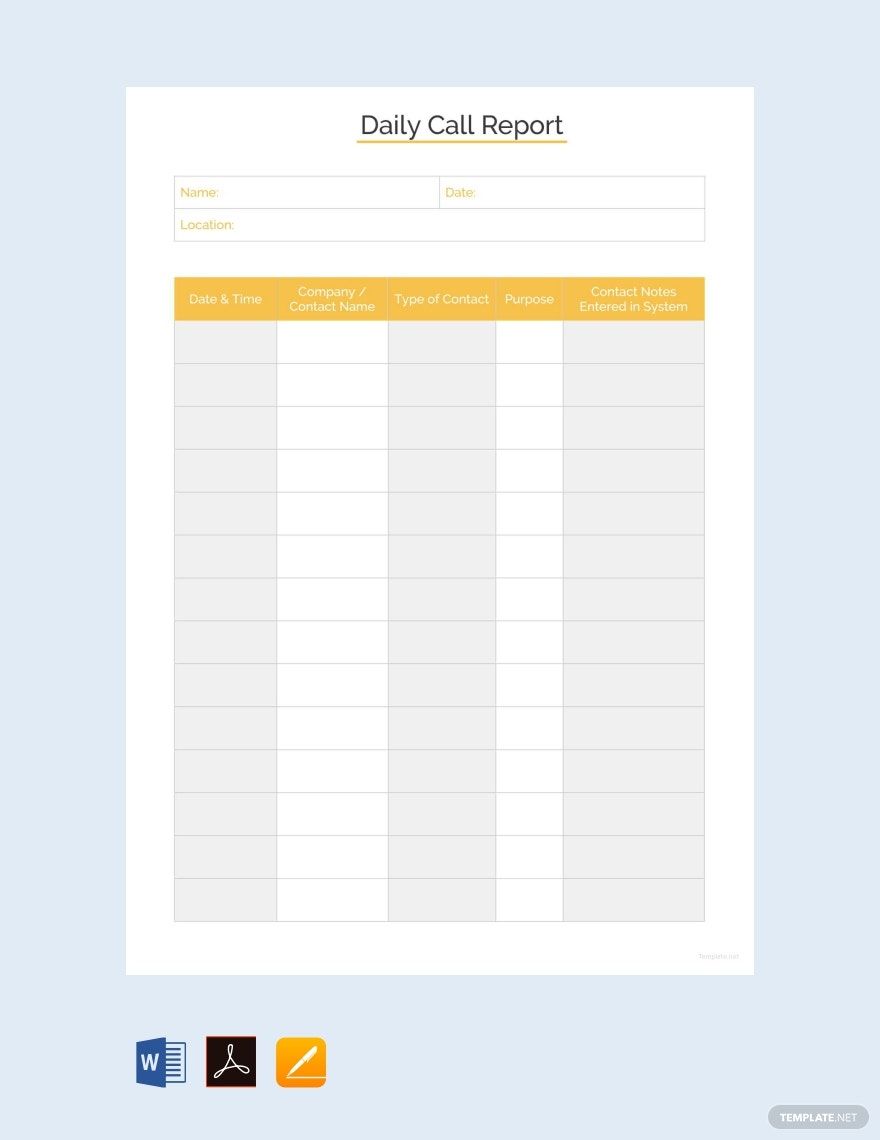

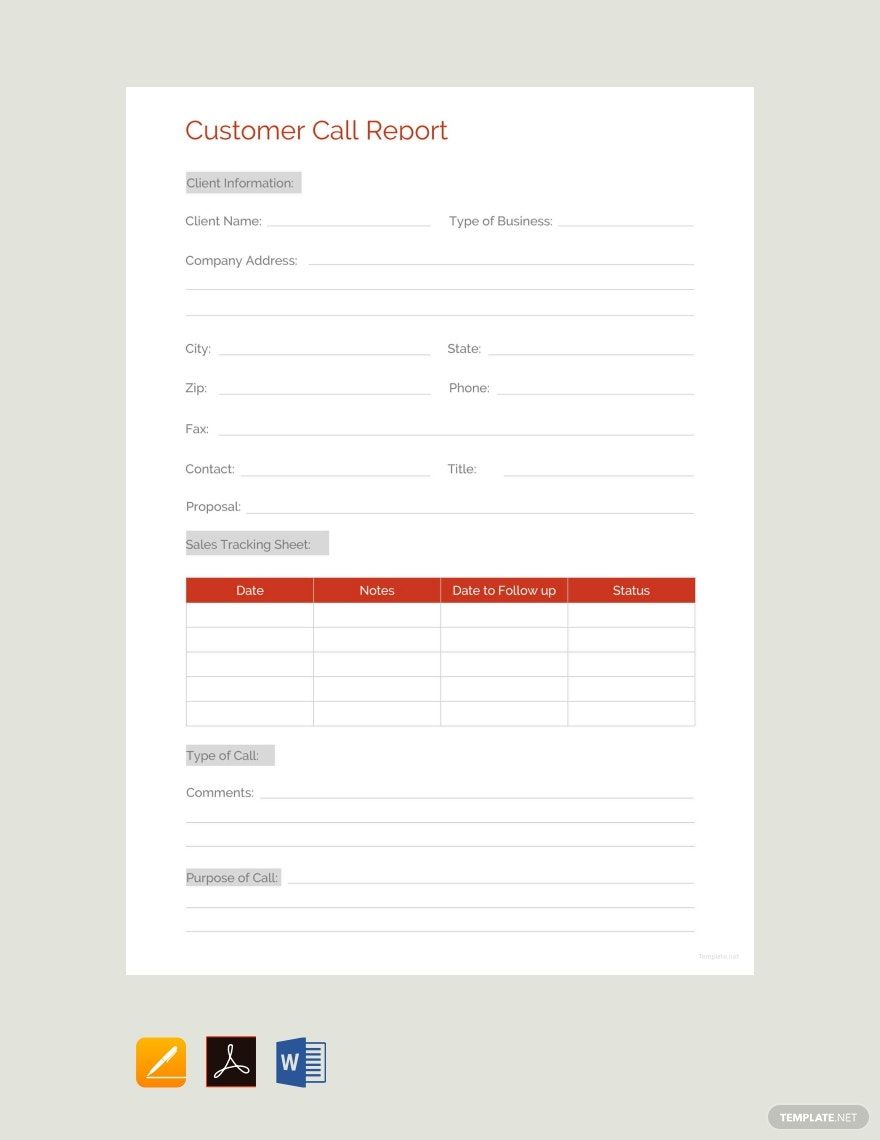

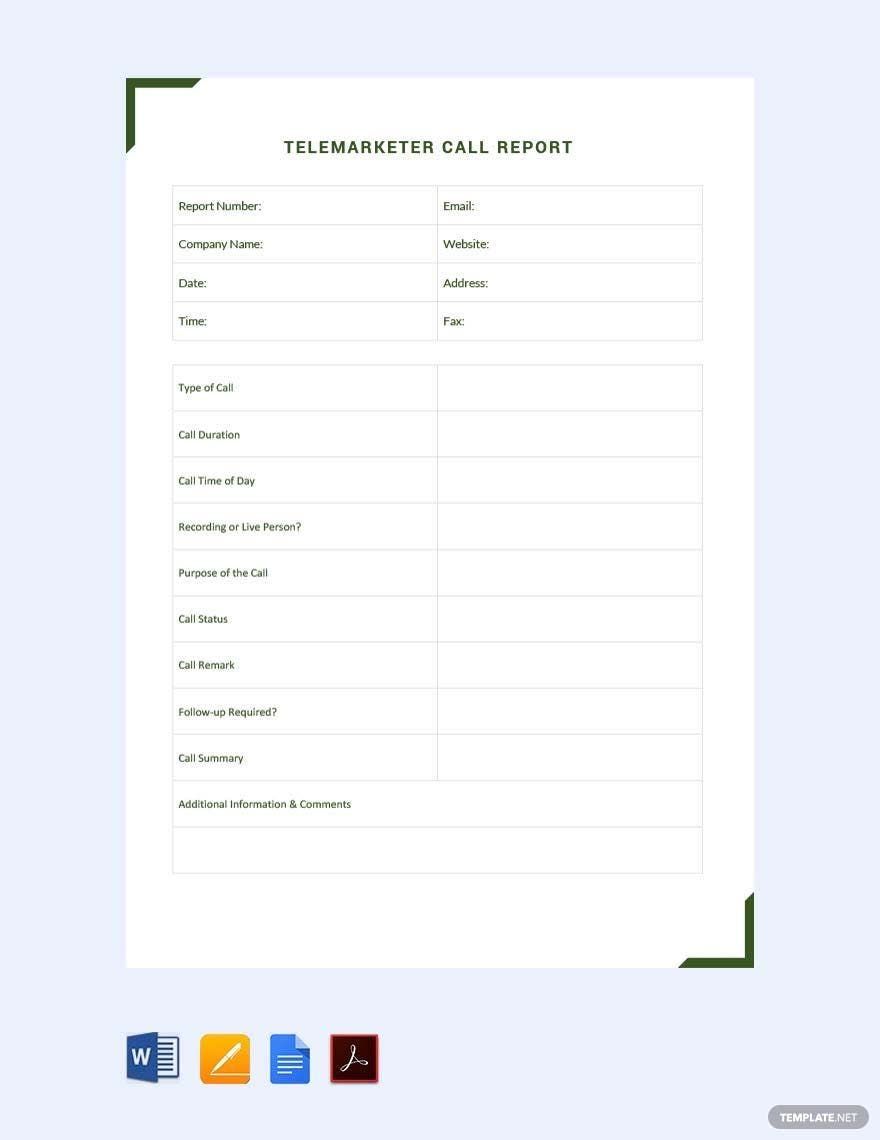

Create professional-grade reports quickly and easily with no design experience using pre-designed Call Report Templates by Template.net. These templates are perfect for business professionals looking to streamline data presentation and ensure that every detail is covered in an organized manner. Whether you need to summarize sales meetings or compile insights from client interactions, Call Report Templates are the ideal solution. Each template is available as free and completely pre-designed, offering downloadable and printable files in Adobe PDF format. Our free templates are not only easy to use with no design skills needed, but also provide customizable layouts for enhanced digital distribution or traditional print.

Explore more beautiful premium pre-designed templates in Adobe PDF format on Template.net. With our regularly updated library, you'll always find fresh designs tailored to current trends and industry needs. You have the option to download these templates for offline use or share them effortlessly via link, print, or email for increased reach. By blending the flexibility of free and premium templates, you can ensure maximum impact and engagement in your business communications. Visit Template.net today to discover the full suite of tools designed to make your reporting tasks seamless and efficient.