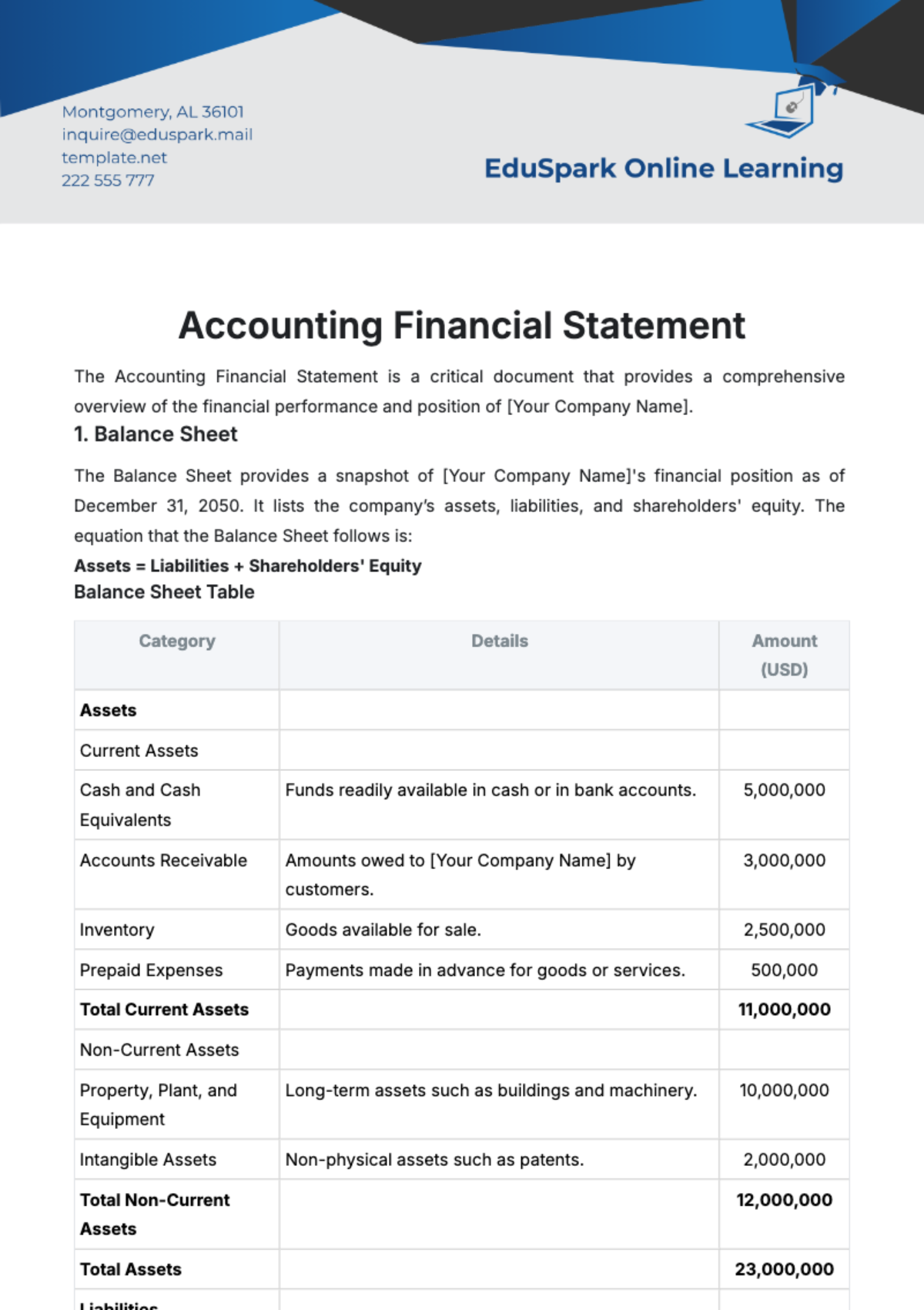

Get Your Financial Management to Life with Accounting Templates from Template.net

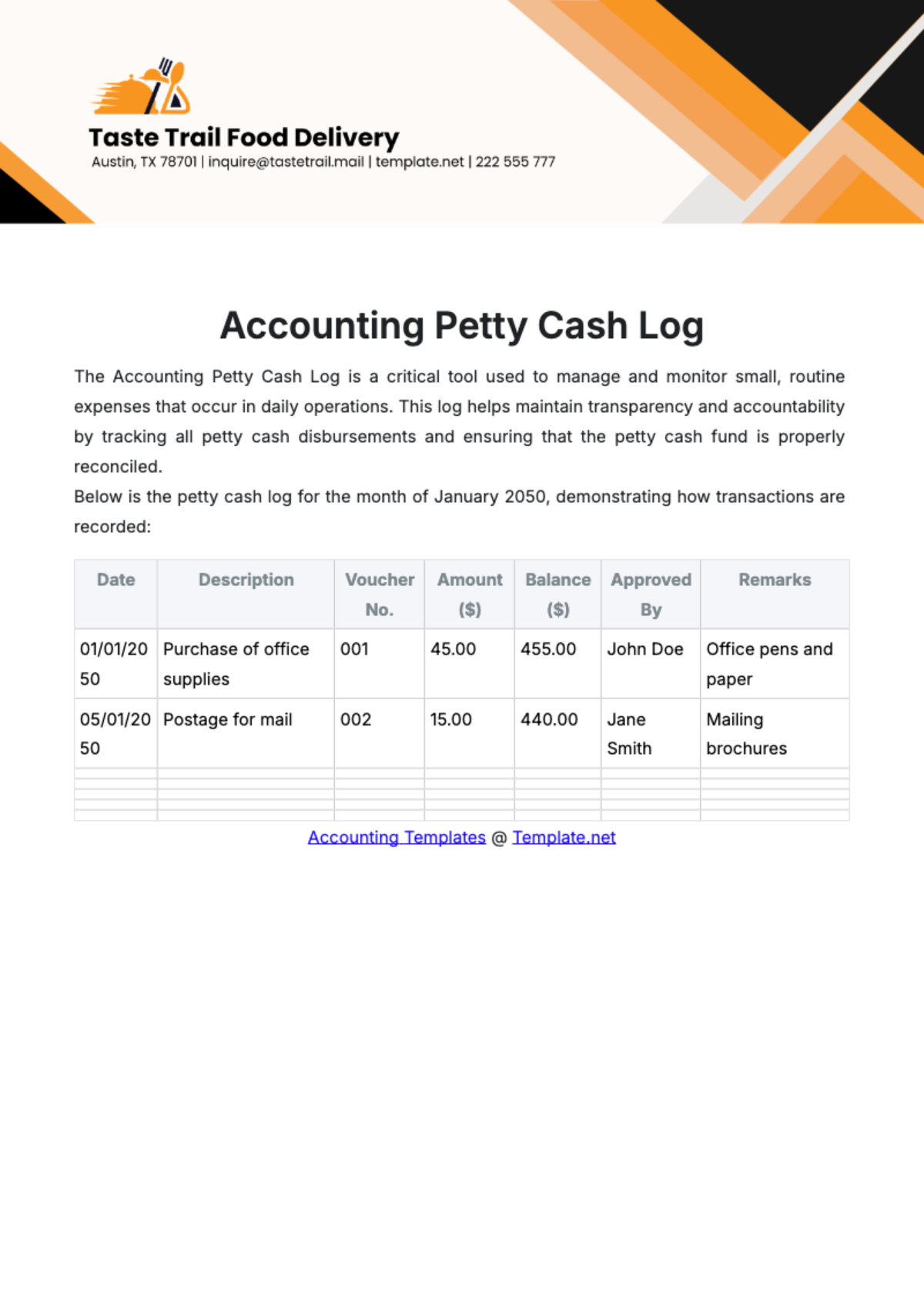

Keep your business organized, enhance productivity, and streamline financial processes with Accounting Templates from Template.net. These templates are perfect for business owners and accountants who aim to manage their financial records efficiently without the hassle of starting from scratch. Use them to create professional-looking invoices or compile detailed expense reports with ease. Our templates come equipped with fields for dates, amounts, customer details, and more, ensuring that crucial information is included. With no extensive accounting knowledge required, you can enjoy the benefits of professional-grade designs and customizable formats, making your accounting tasks less time-consuming and more accurate.

Discover the many Accounting Templates we have on hand, designed to suit various financial needs. Select a template that fits your requirements, then simply swap in your own data and tweak colors and fonts to align with your branding. For those looking to add an extra touch of professionalism, you can drag-and-drop icons or graphics, as well as incorporate animated effects to emphasize key information. The possibilities are endless, and best of all, no advanced design skills are needed. Stay ahead with our regularly updated templates featuring new designs added weekly. When you're finished, download or share via link or print, ideal for multiple channels and collaboration in real time.