Transform Your Creative Projects with Free Pre-Designed Apple Page Templates by Template.net

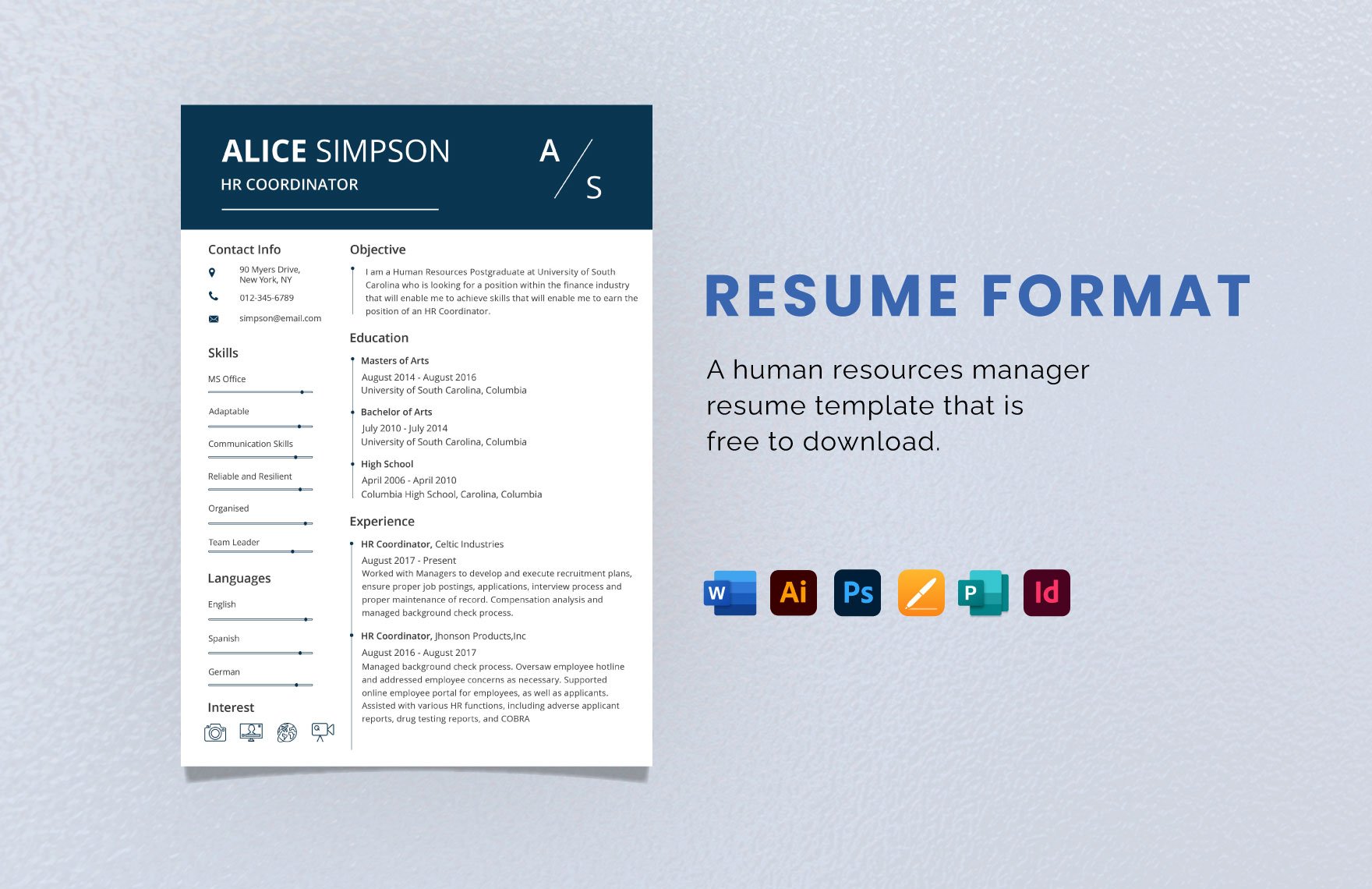

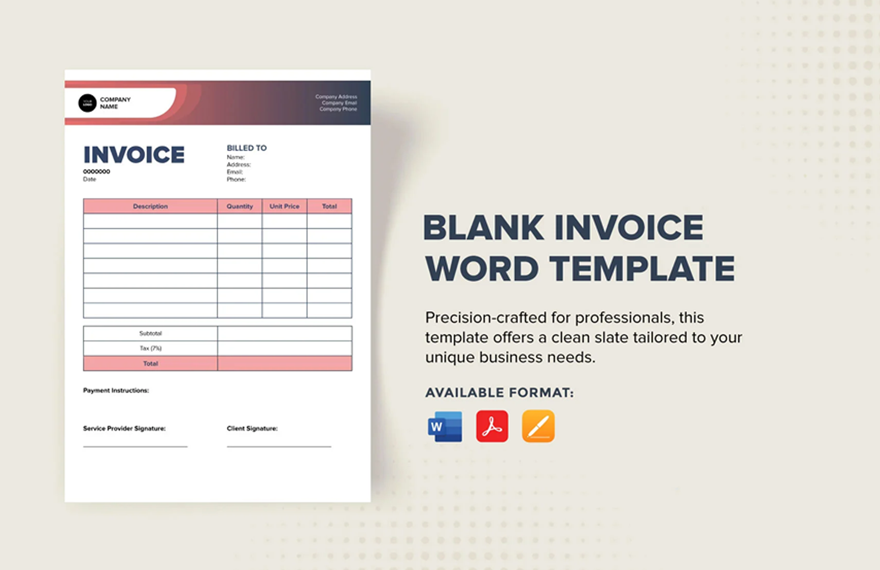

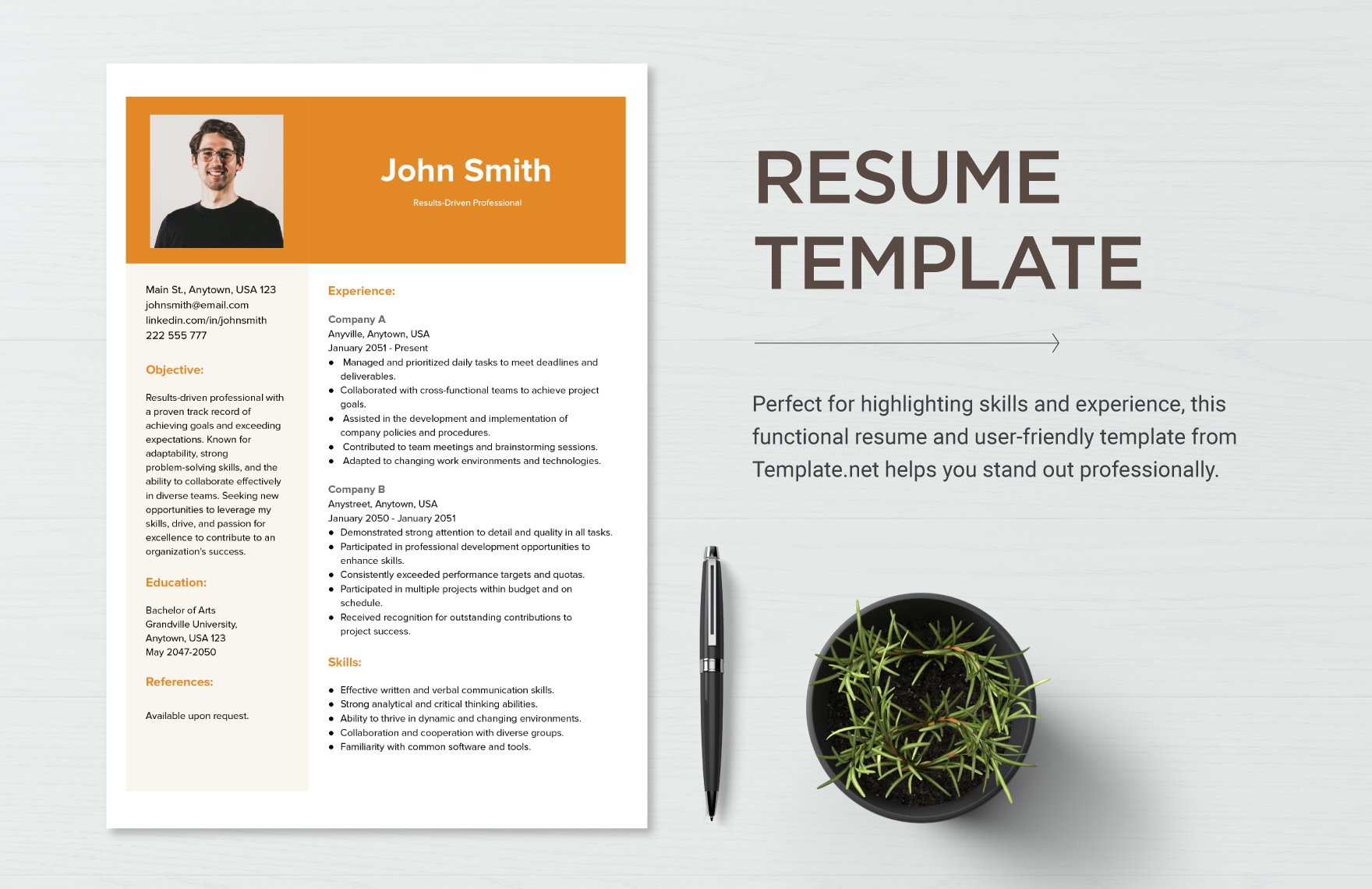

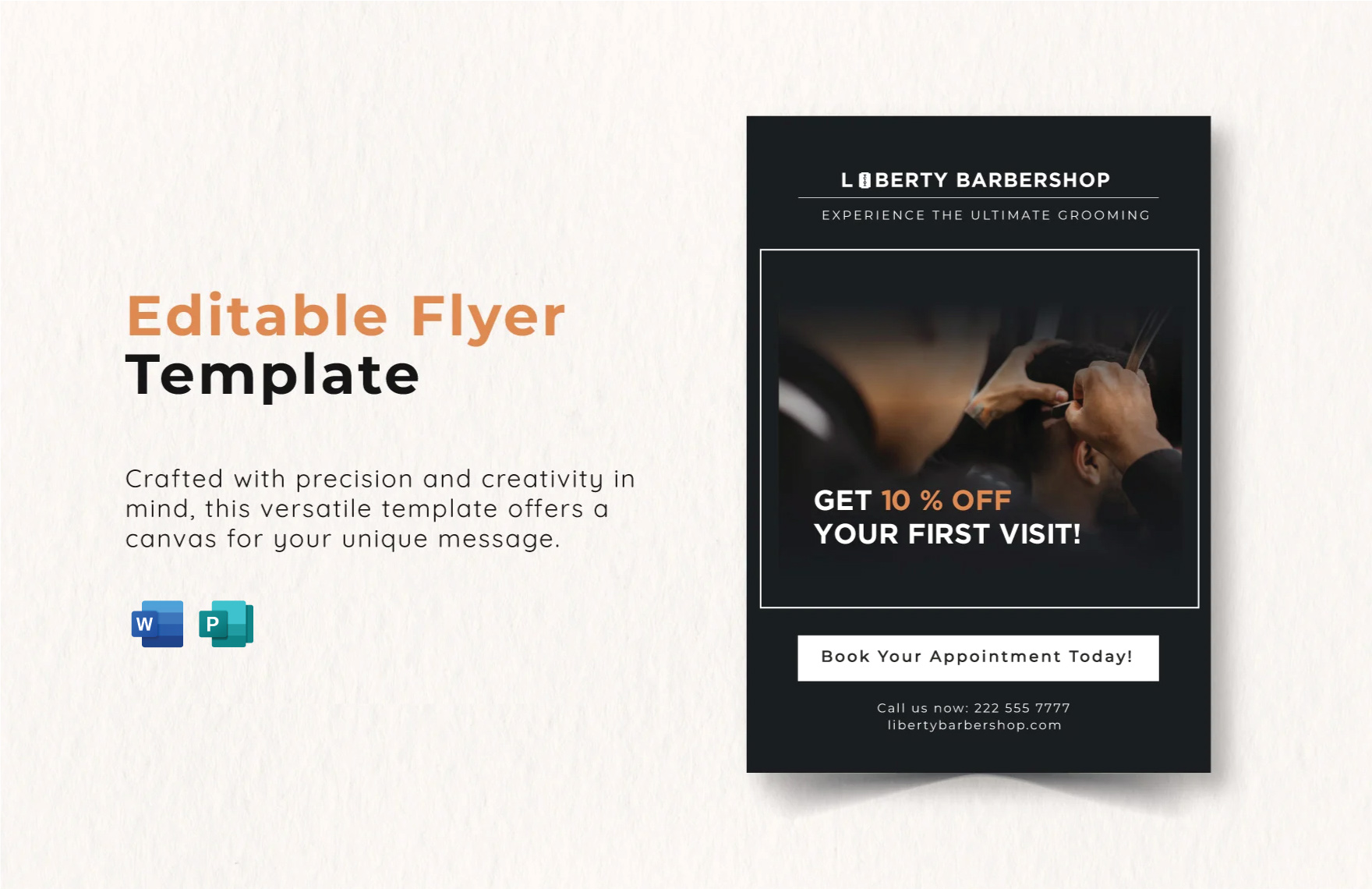

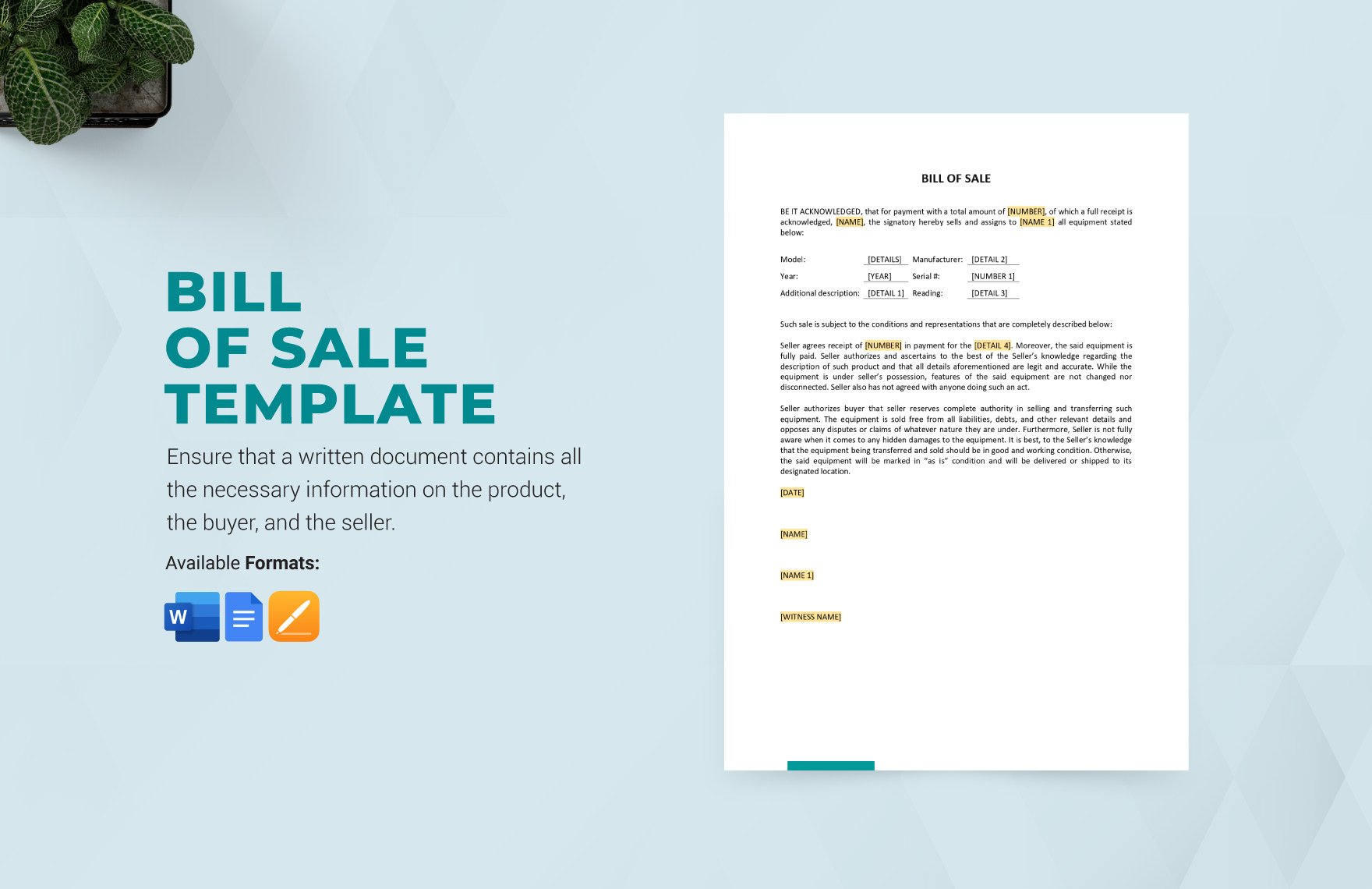

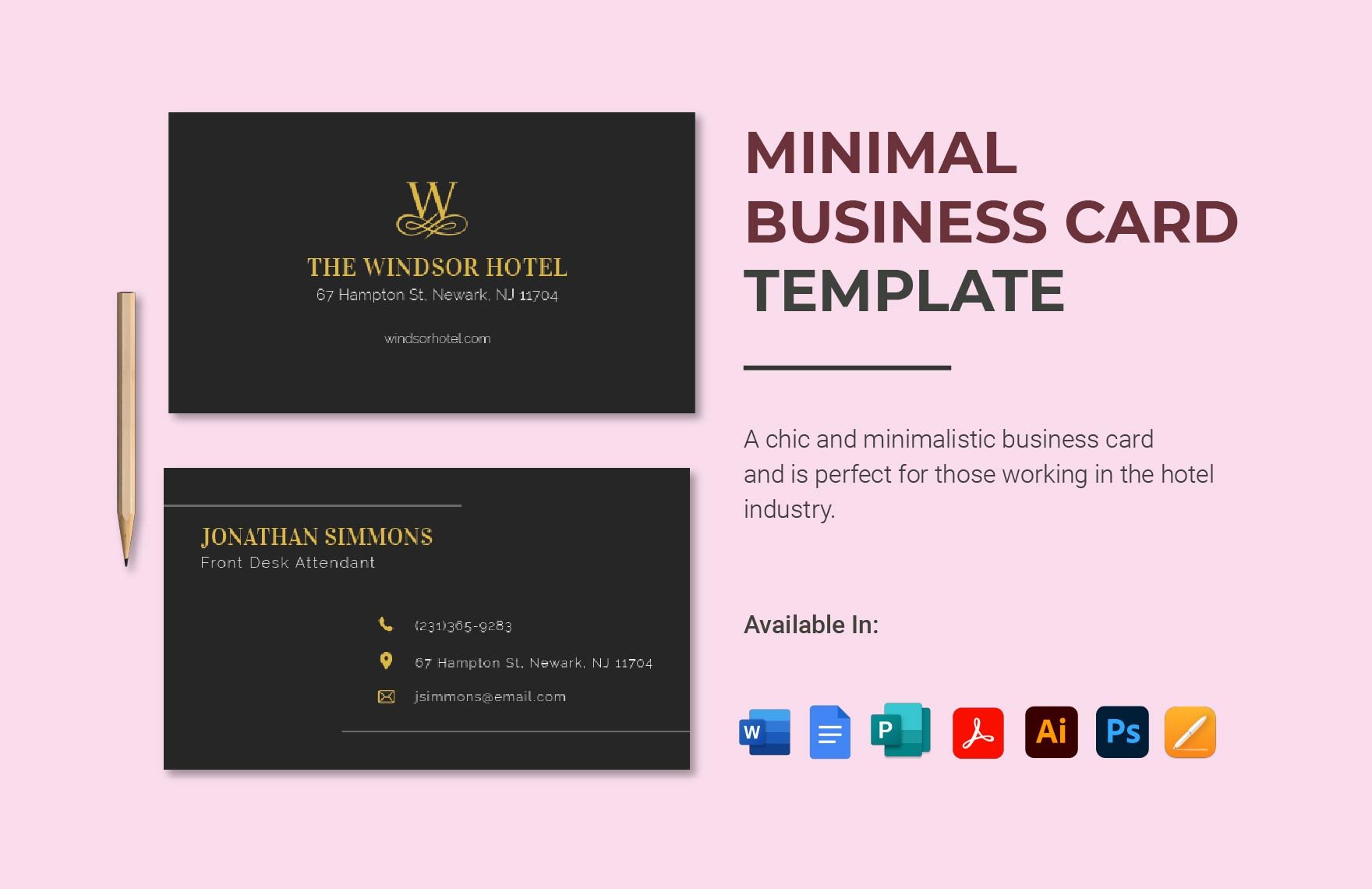

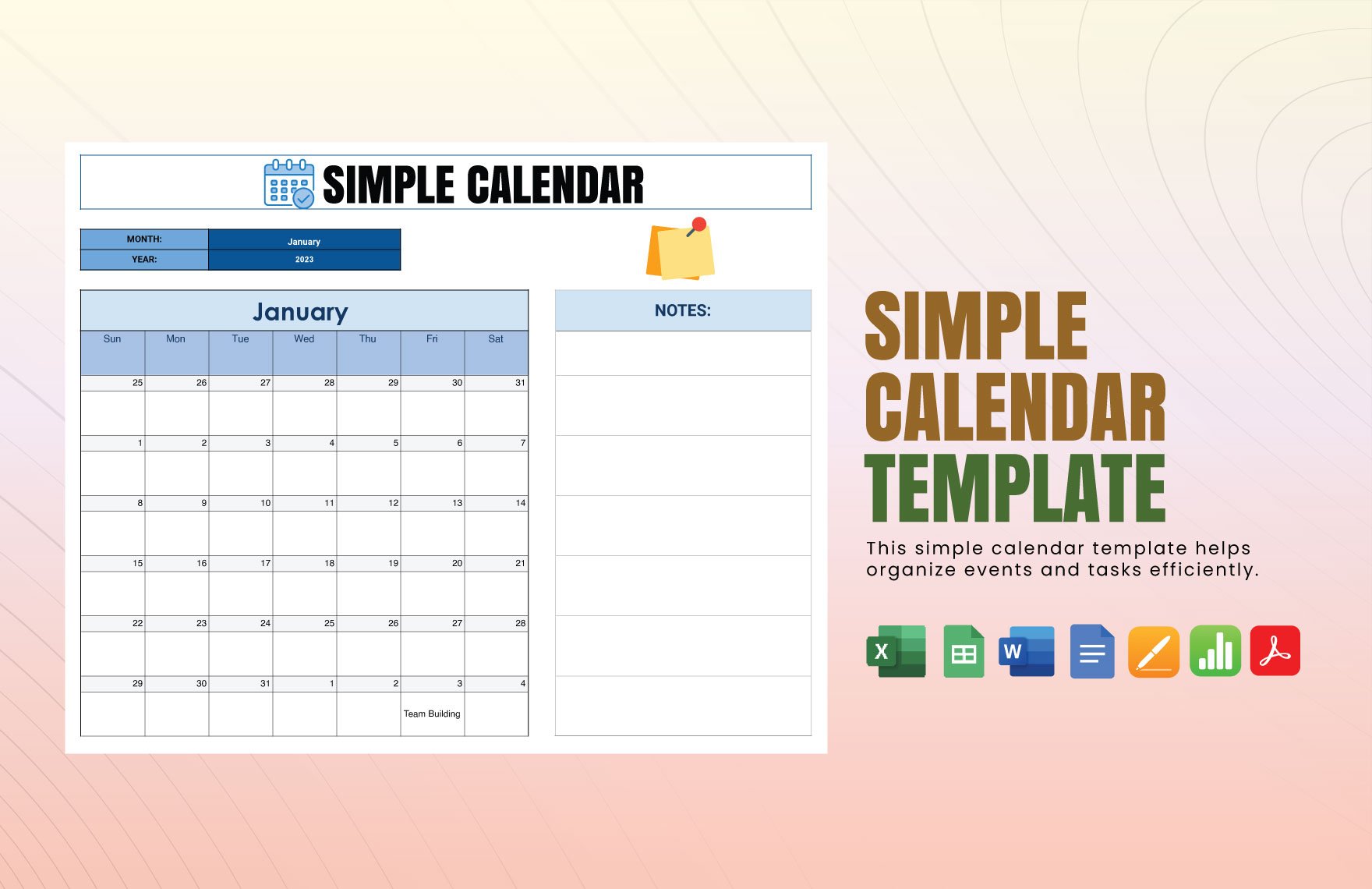

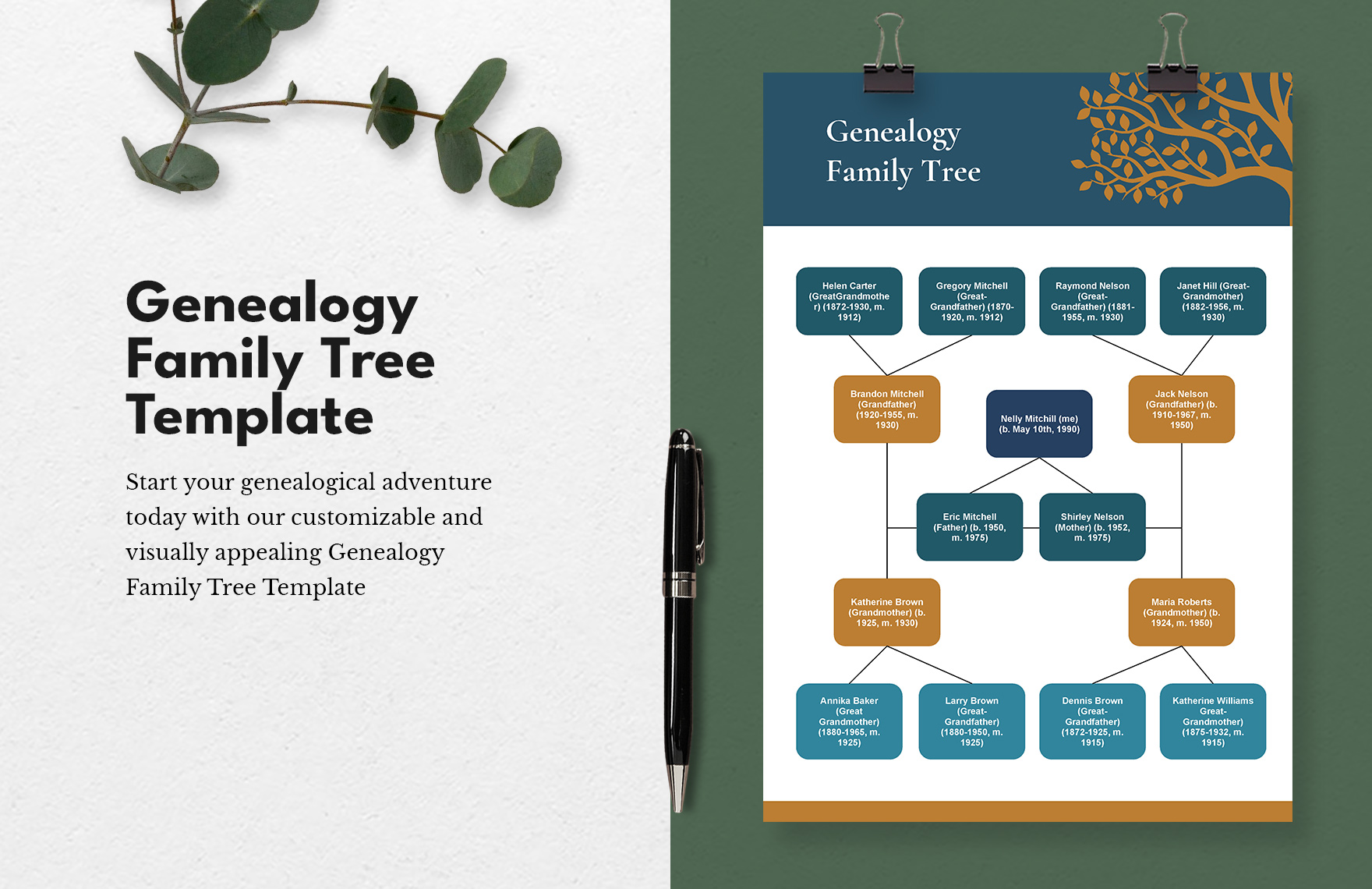

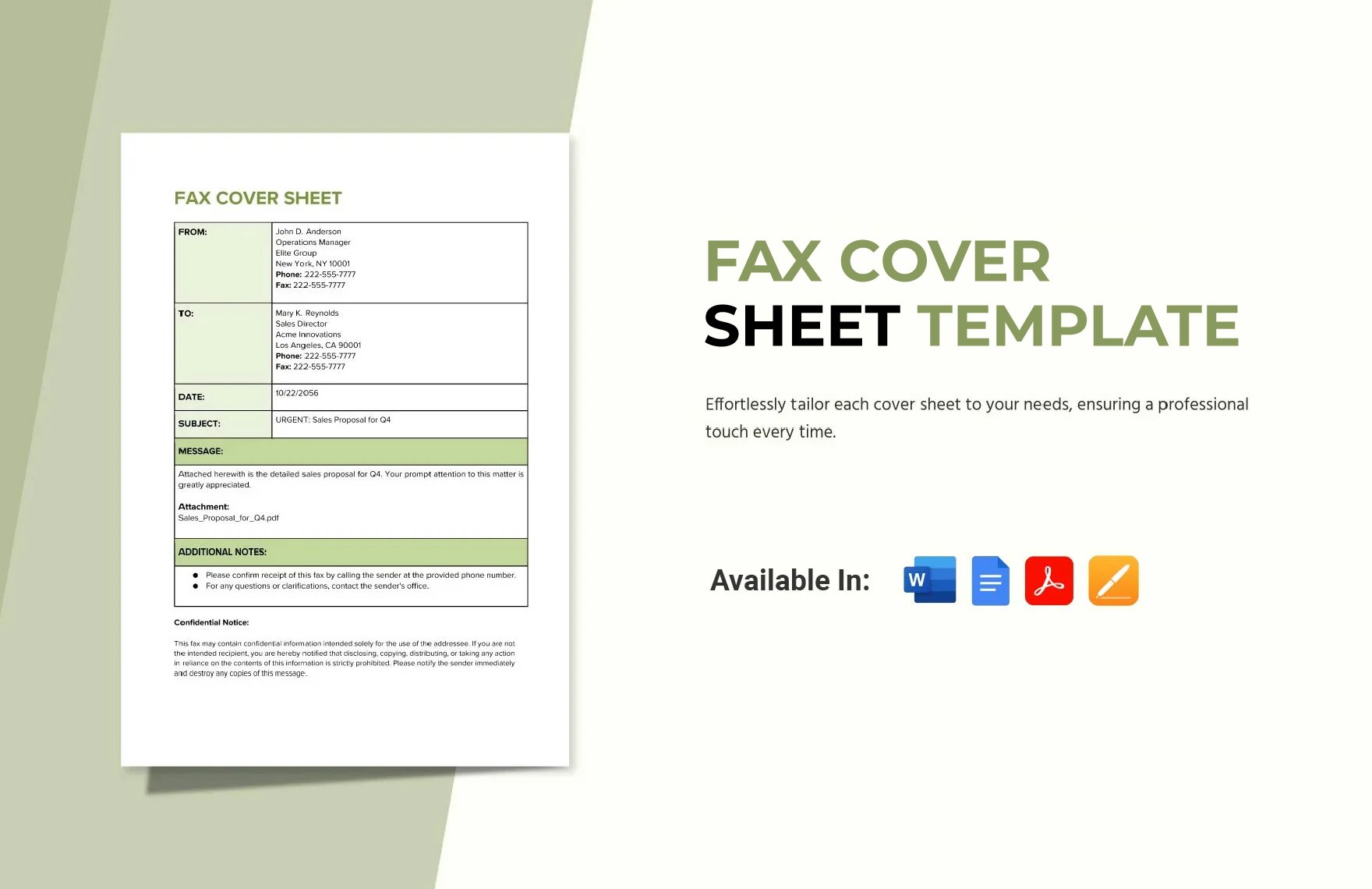

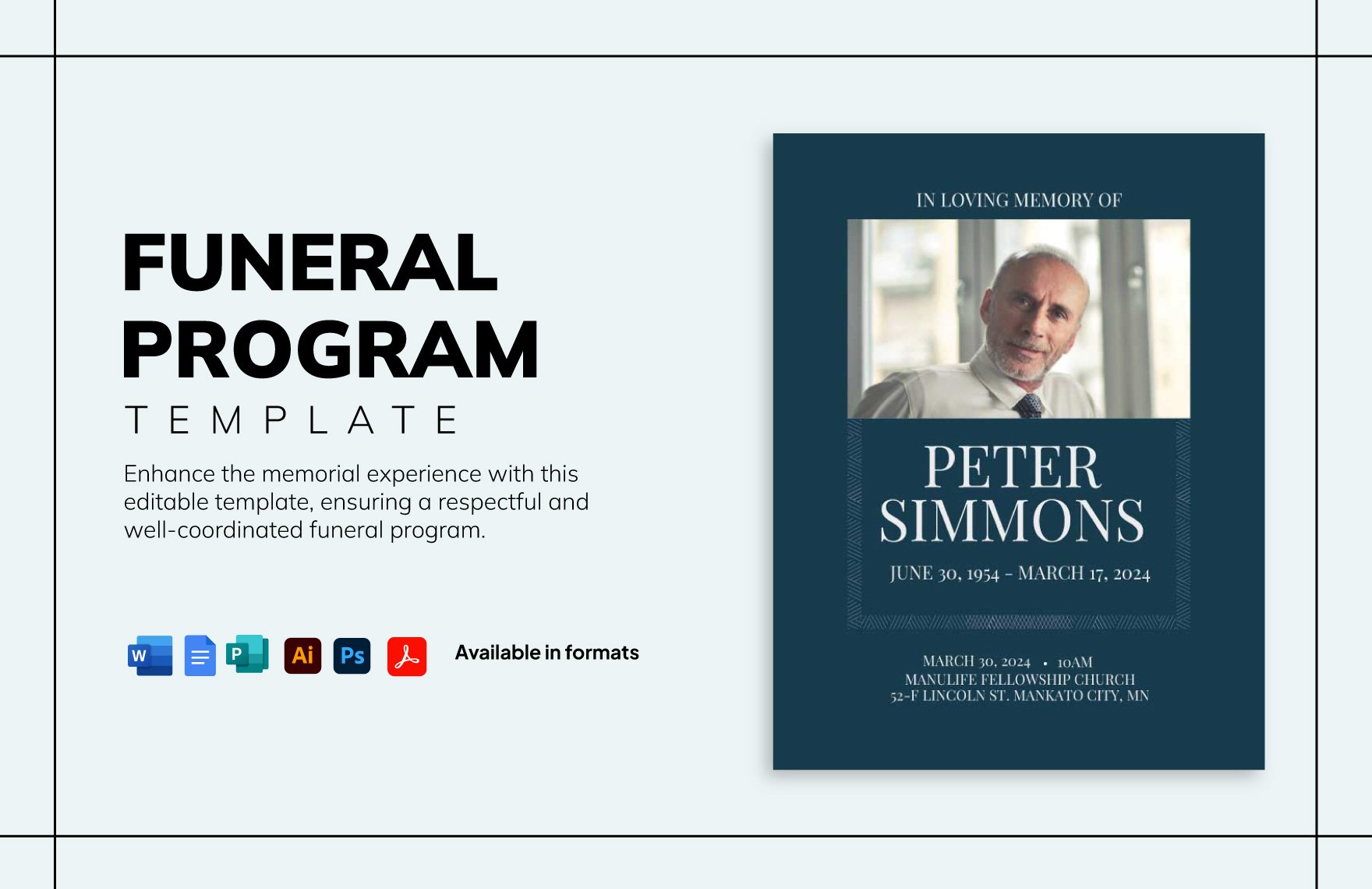

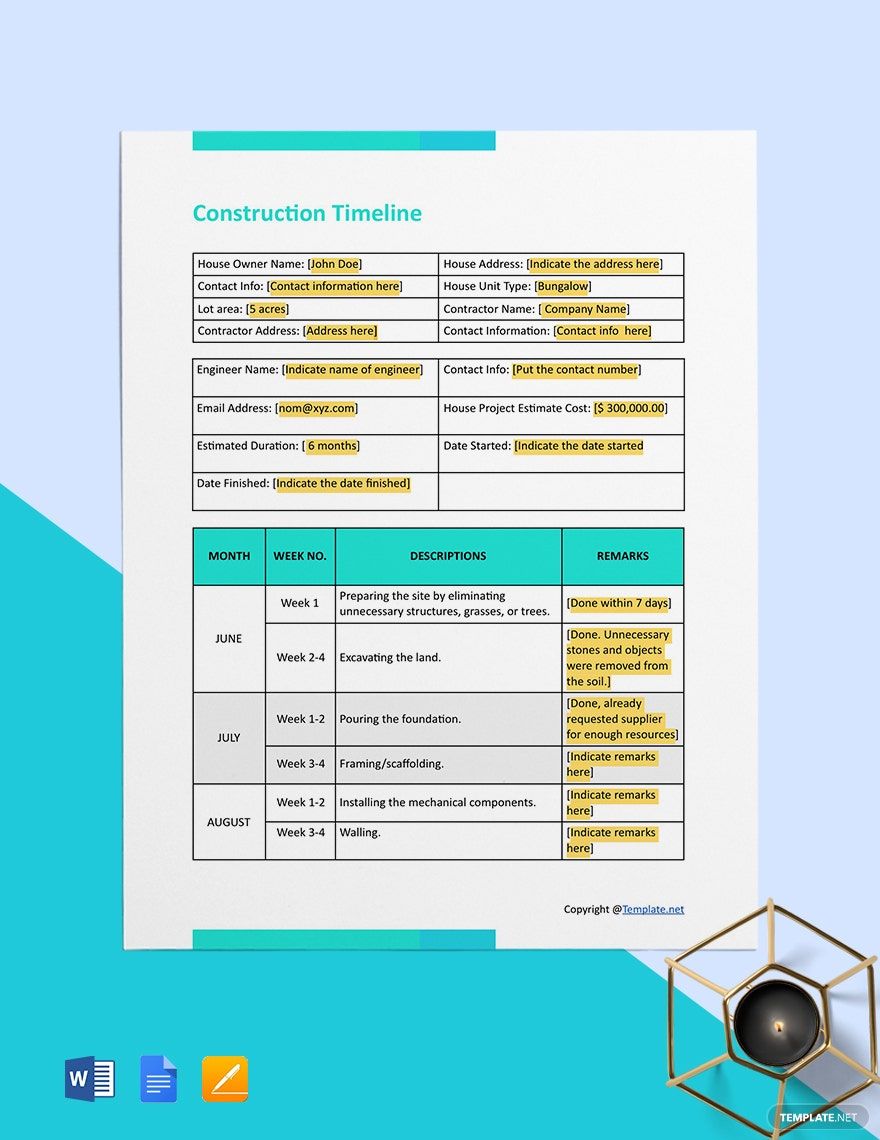

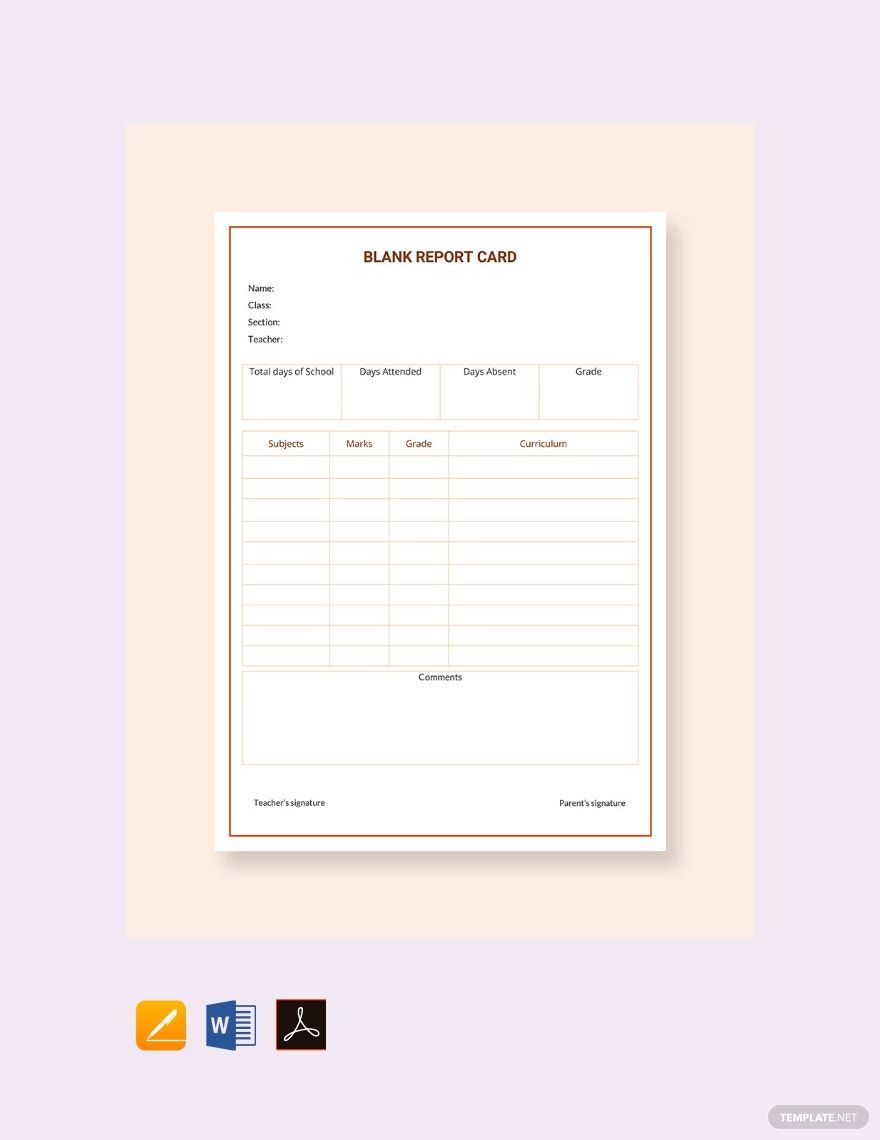

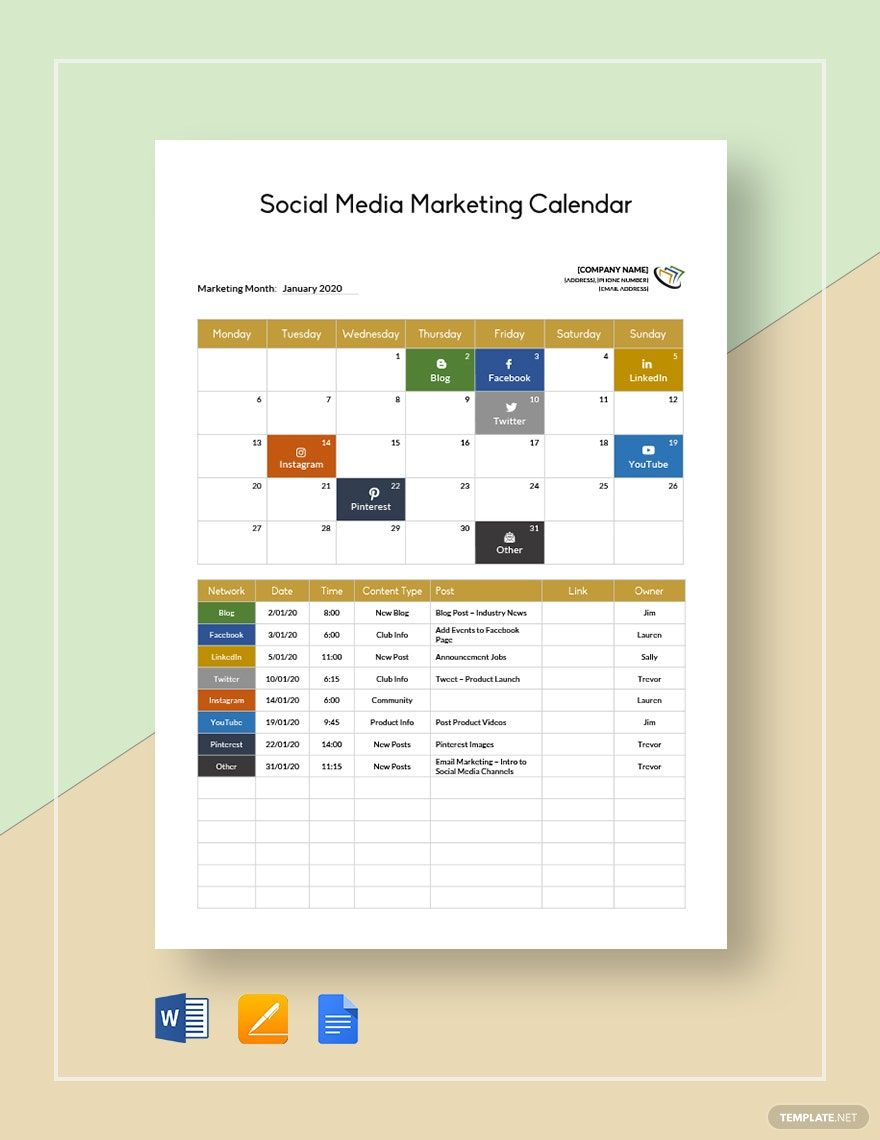

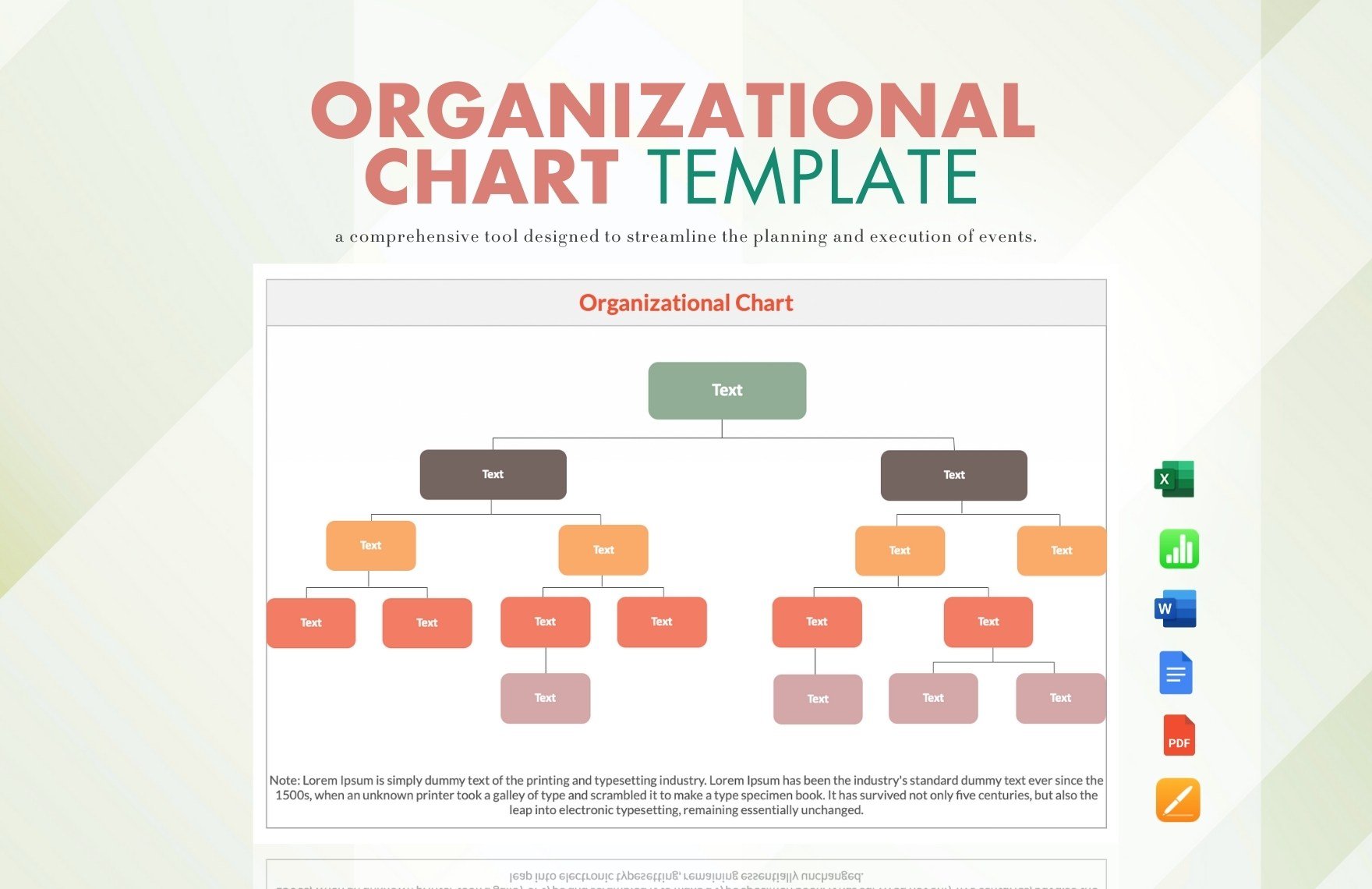

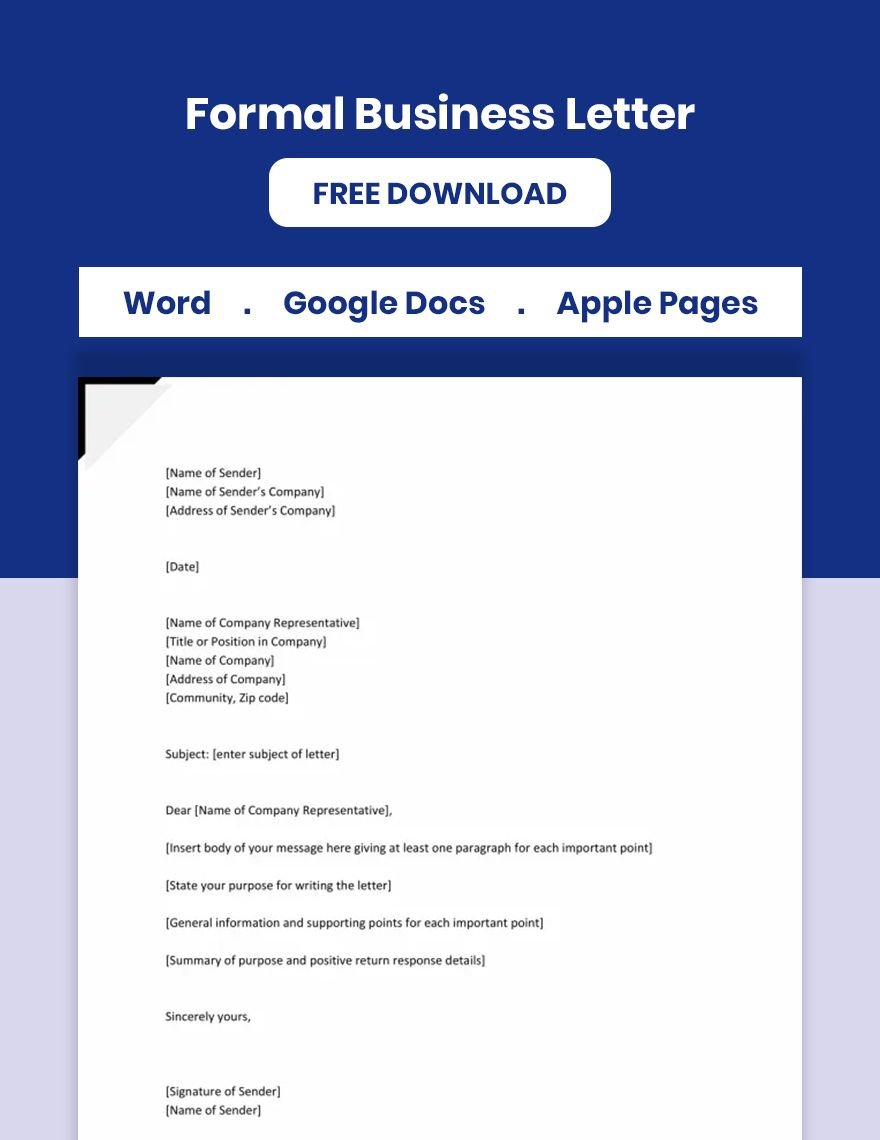

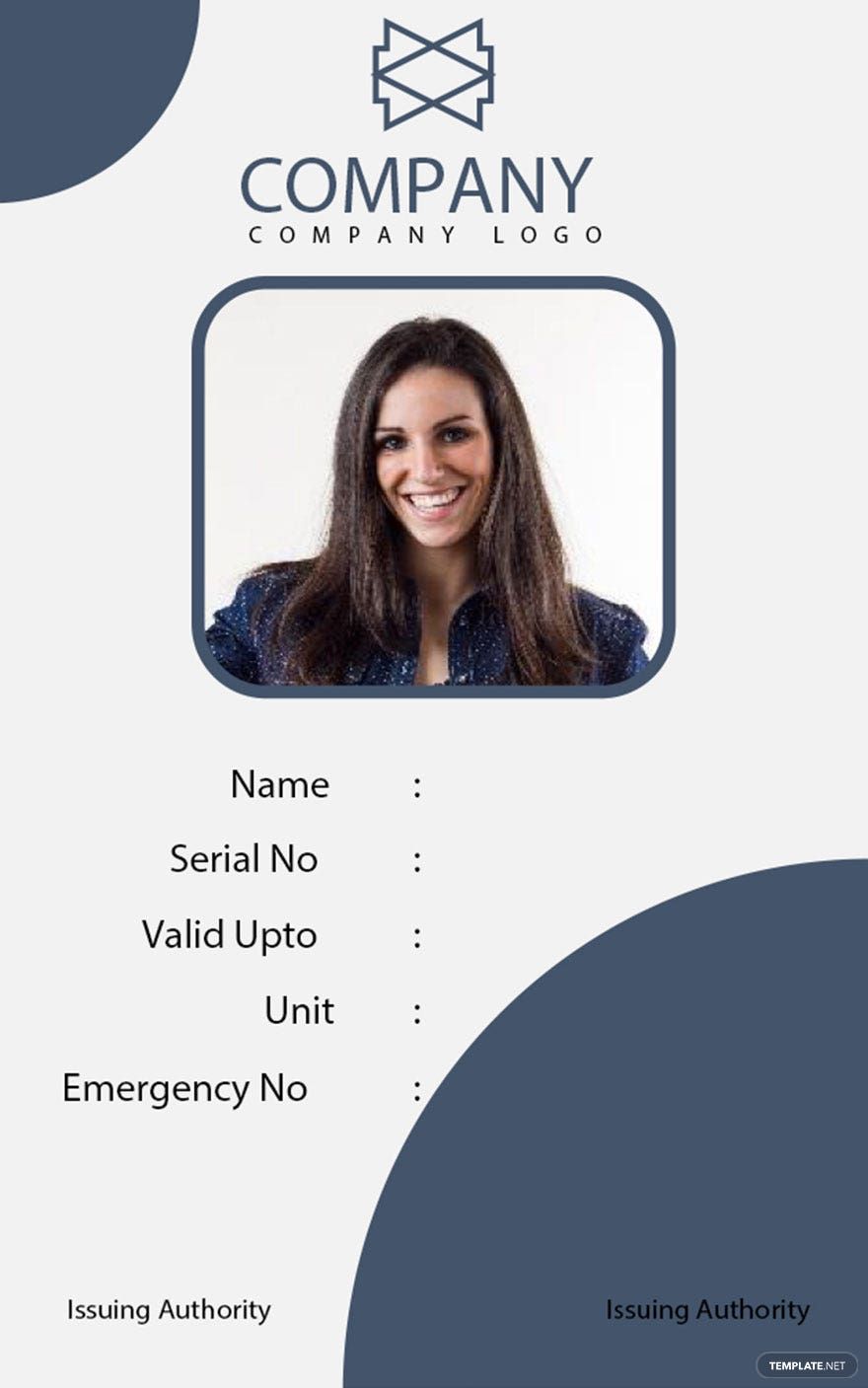

Unleash your creative potential without the hassle of starting from scratch using our Free and pre-designed Apple Page Templates by Template.net. Perfect for those with any level of design expertise, you can achieve professional-grade results effortlessly. Whether you're looking to enhance an important presentation or craft a visually stunning newsletter, our templates are your go-to resource. With a myriad of options available, all downloadable and printable in Apple Pages format, these templates guarantee a hassle-free experience. Say goodbye to long hours of designing, as our beautiful pre-designed templates mean no design skills are needed, fostering ease and incredible time savings. Customize layouts for social media, professional documents, or engaging promotional material to suit both print and digital distribution seamlessly.

Discover a wealth of creativity through the wide array of pre-designed Apple Page Templates available at Template.net. Continuously updated with the freshest styles and designs, our library makes it possible for your projects to remain relevant and cutting-edge. Choose from an extensive selection of templates to elevate your work, with options to download or share via link, email, or direct print for maximum reach. To get the most out of your design journey, we encourage you to explore a mix of Free and Premium templates, providing both flexibility and sophistication in your projects. Dive into our collection today and reinvent the way you create with Apple Pages.