Make Your Financial Plans Shine with Bank Templates from Template.net

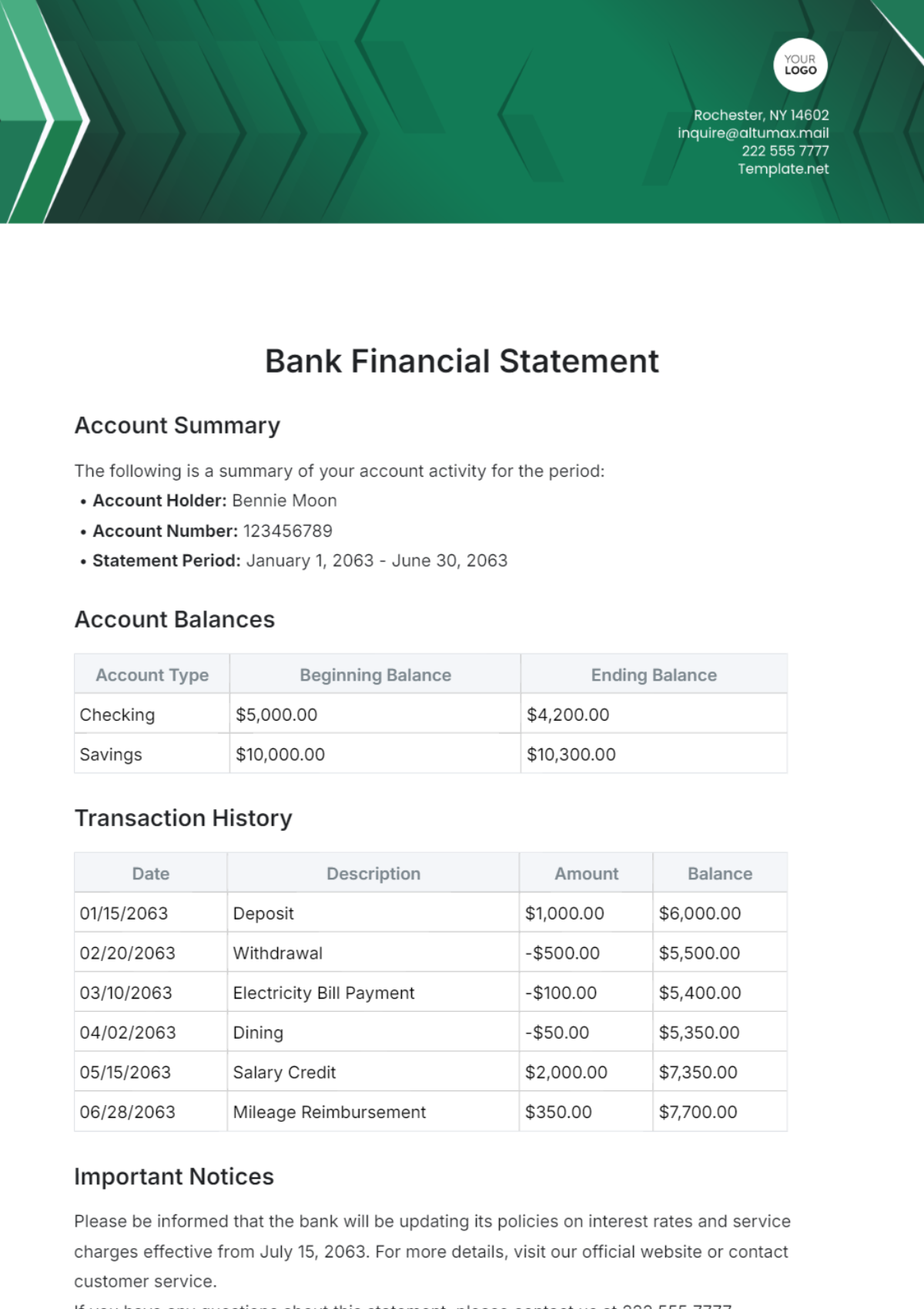

Bring your financial strategies to life with Bank Templates from Template.net. Designed specifically for businesses and financial professionals, these templates help you keep your audience engaged, streamline your reporting process, and enhance your presentations with professional-grade designs. Whether you’re looking to promote a new financial service or send out an annual financial report, these templates have you covered. Every template includes essential details like key financial metrics, dates, and contact information to ensure that nothing is left out. No design skills are required, thanks to the user-friendly interface and professional-grade designs, making it easy for anyone to create and customize their documents for both print and digital distribution.

Discover the many Bank Templates we have on hand, each crafted to meet various banking and financial needs. Start by selecting a suitable template, then easily swap in your financial data and tweak colors and fonts to match your brand. Take it a step further by dragging-and-dropping icons or graphics, or adding animated effects to enhance the presentation of your data. With AI-powered text tools, the possibilities for customization are endless, and you can achieve this all without any design skills. Our template library is regularly updated with new designs, ensuring that you always have fresh options to choose from. When you’re finished, download your documents or share them instantly via link, print, or export across multiple channels, making collaboration and distribution a breeze.