Bring Your Construction Projects to Life with Construction Templates from Template.net

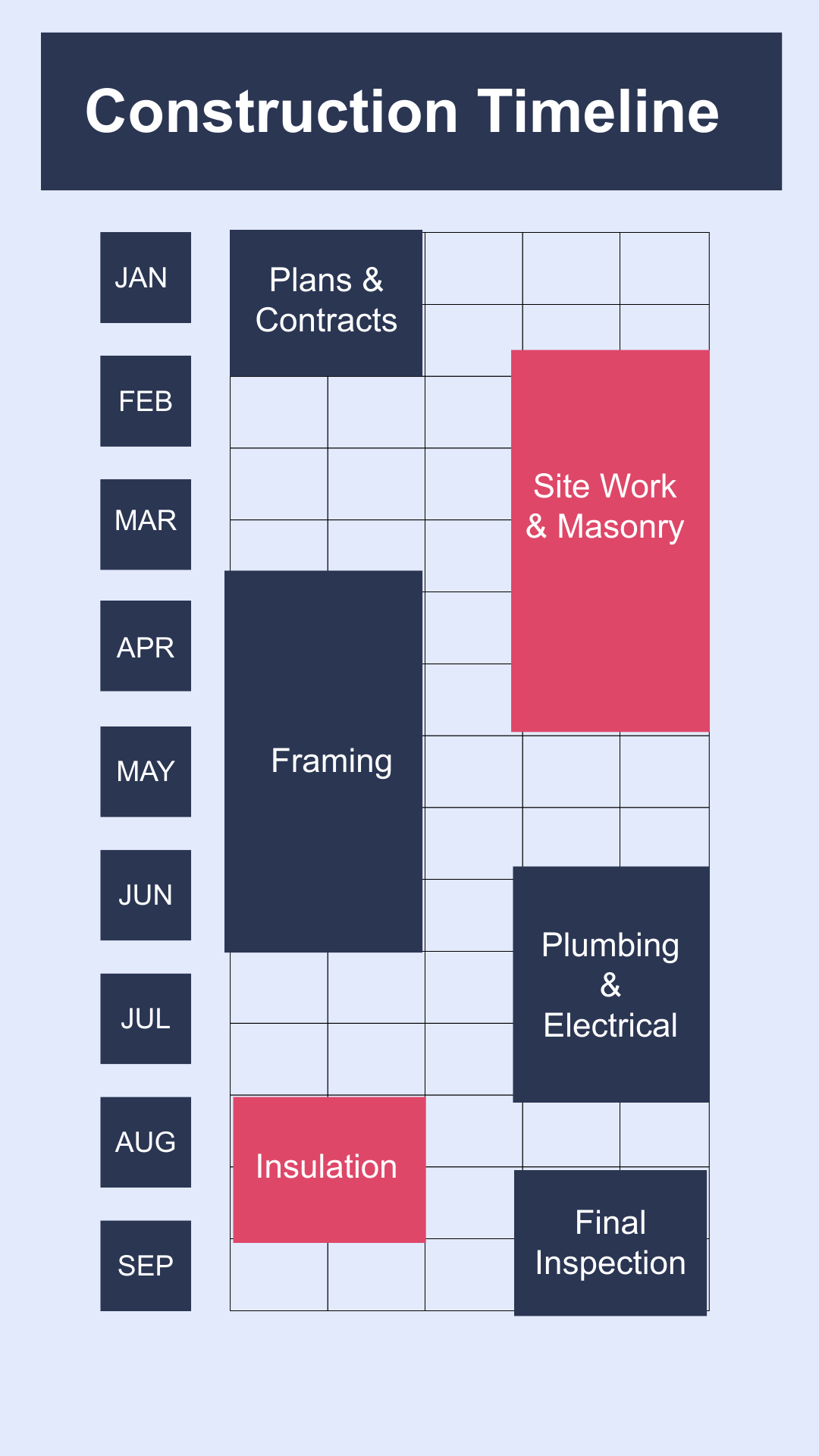

Keep your construction team engaged, organized, and on schedule with Construction Templates from Template.net. Perfect for project managers, contractors, and architects, this comprehensive resource allows you to streamline your operations and enhance productivity. Whether you're promoting a new project launch or organizing team schedules, these templates cater to all your professional needs. Featuring key elements like timeline integration and location markers, these professional-grade templates require no design skills, saving you precious time and effort. Customize layouts for digital presentations or printable project briefs with ease.

Discover the many construction templates we have on hand tailored to your specific needs. Start by selecting a template, seamlessly swap in your assets, and fine-tune colors and fonts to match your brand. Add advanced touches such as drag-and-drop icons, graphic elements, and even animated effects for a more dynamic presentation. With AI-powered text tools, the possibilities are endless and completely skill-free. Our library is consistently updated with fresh designs, ensuring you always have the most up-to-date resources at your fingertips. When you’re finished, download or share your creations via link, print, email, or export to multiple channels.