Build Professional Documents Quickly with Pre-designed Construction Templates in Microsoft Word by Template.net

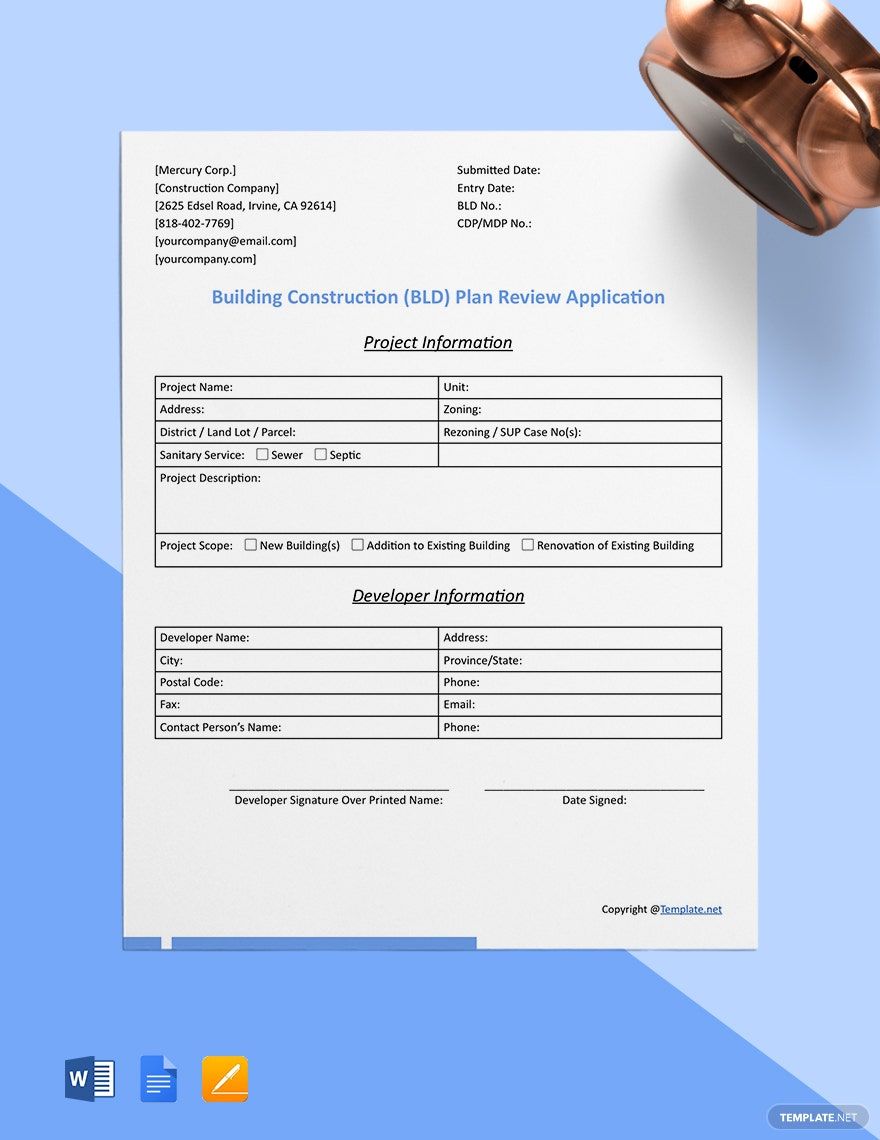

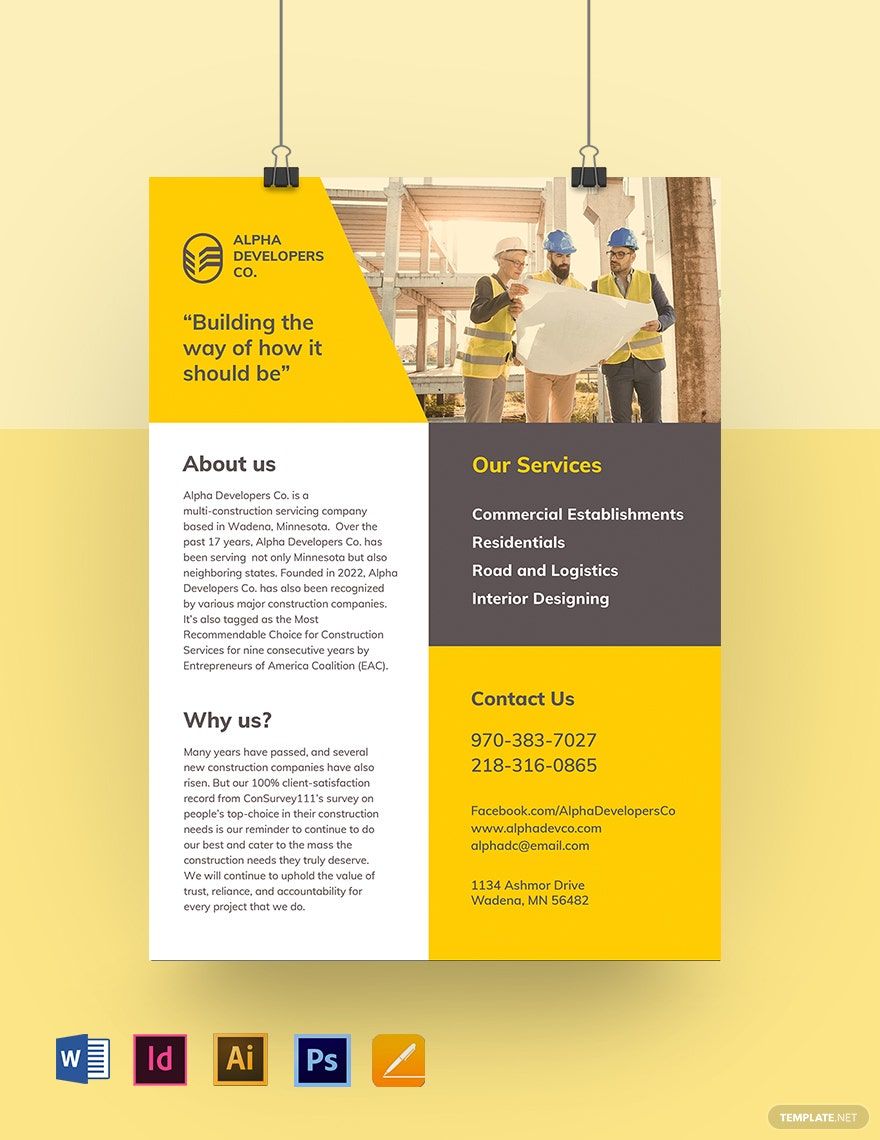

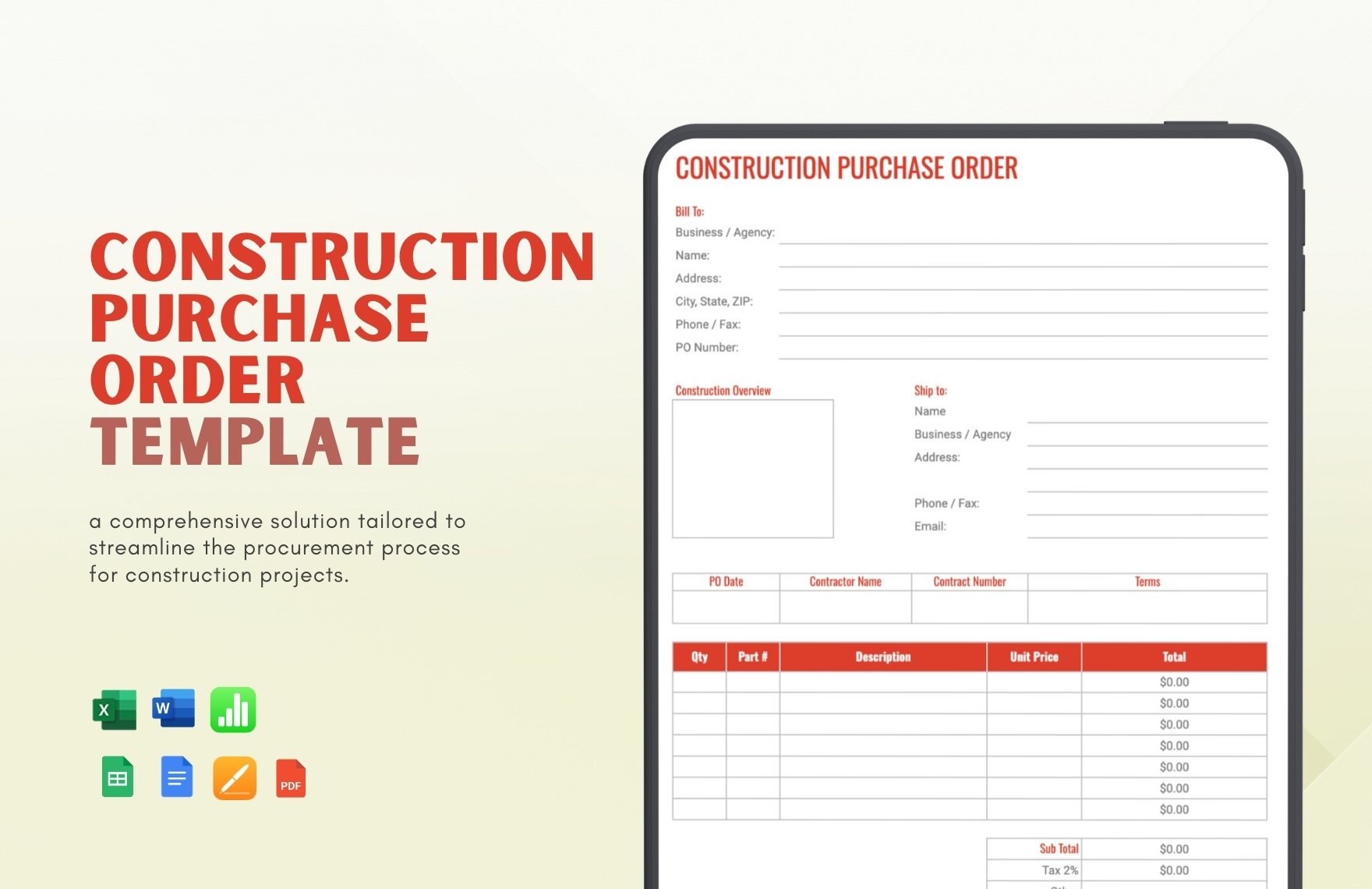

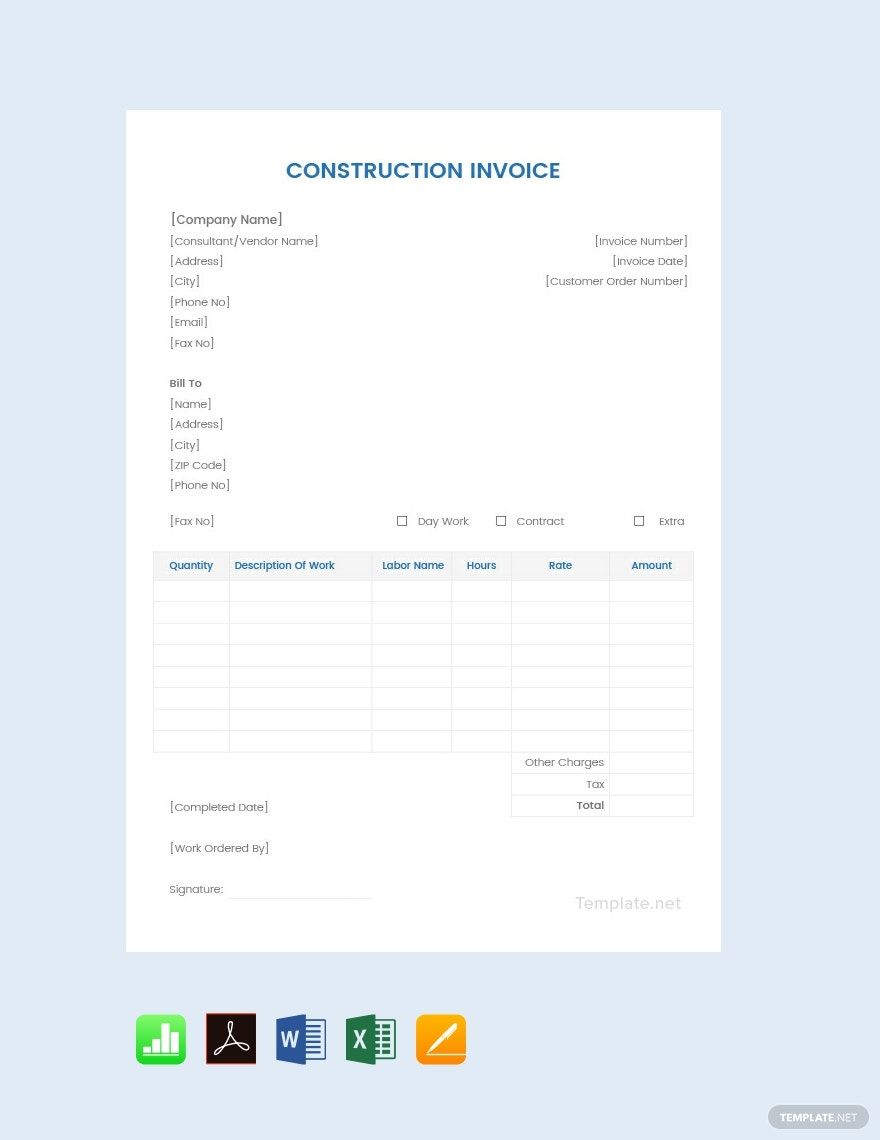

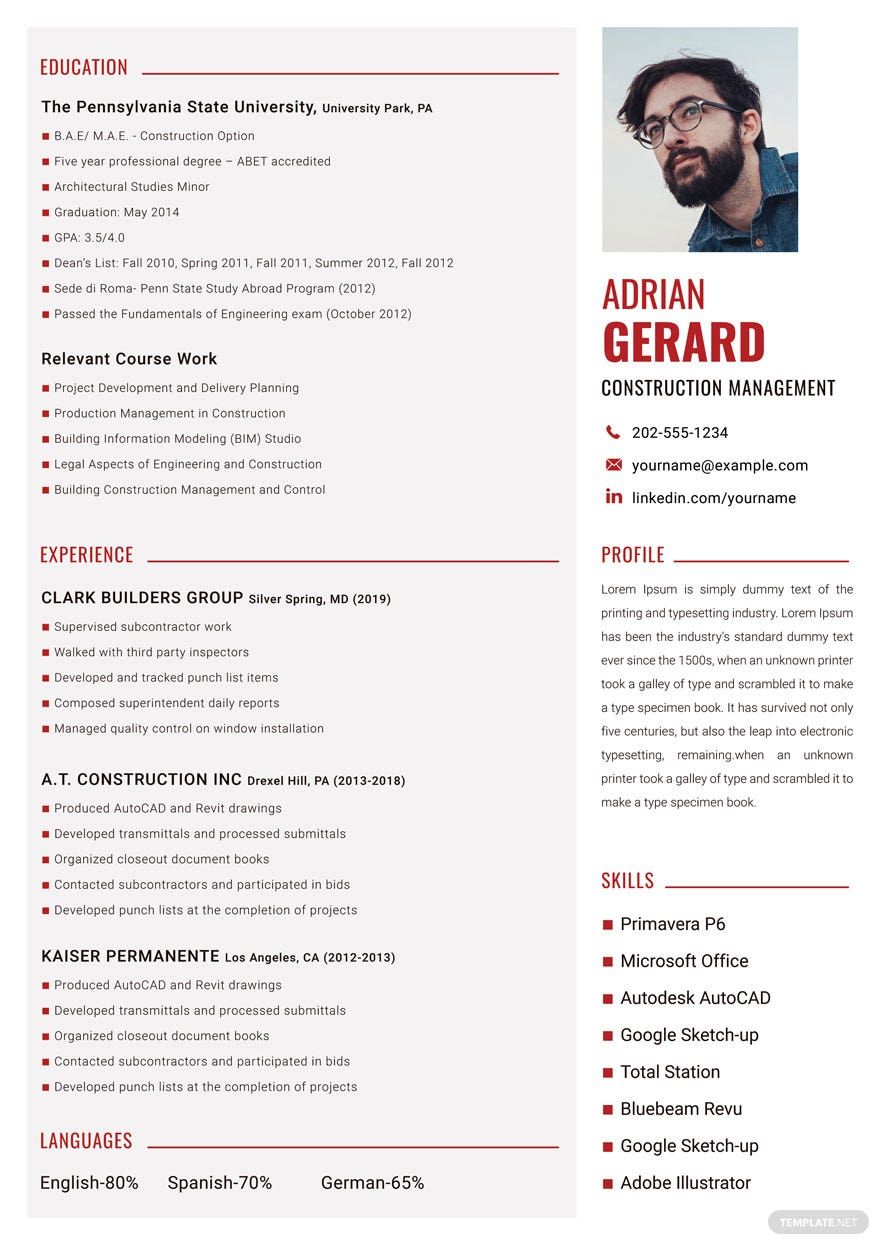

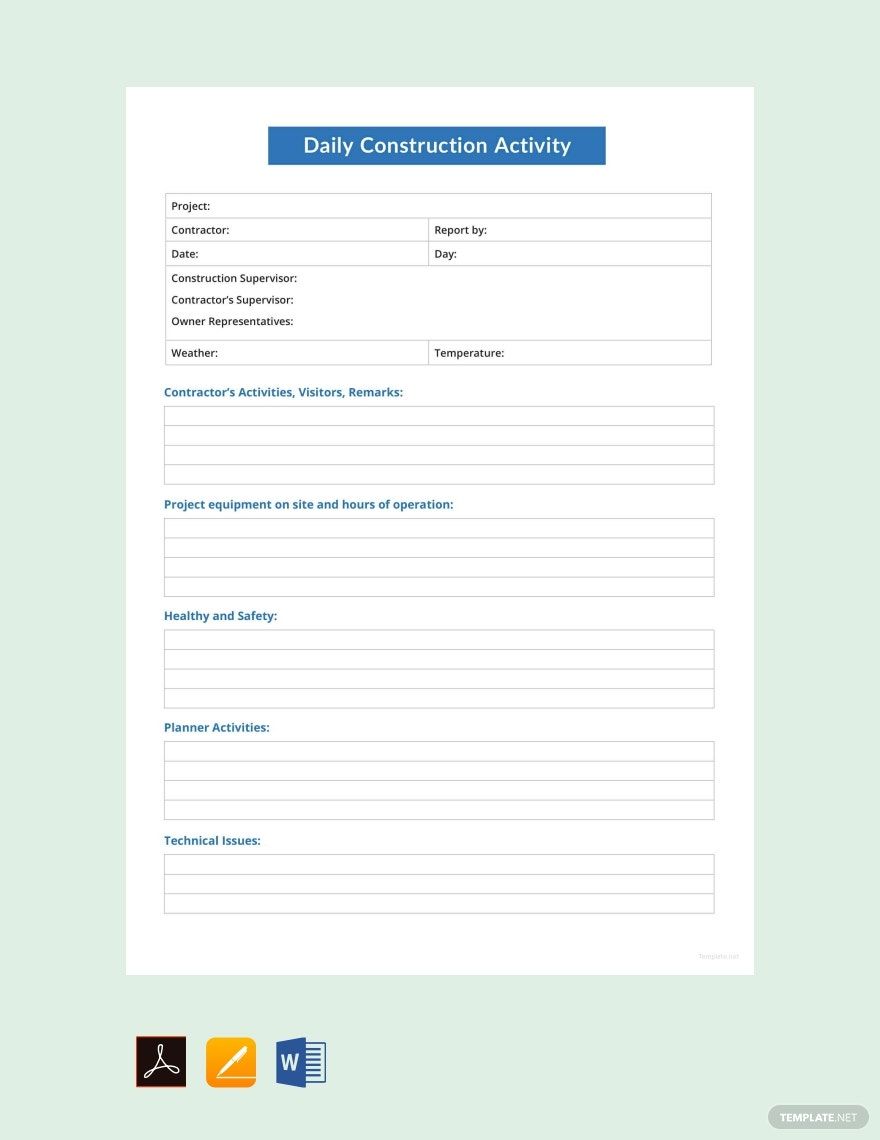

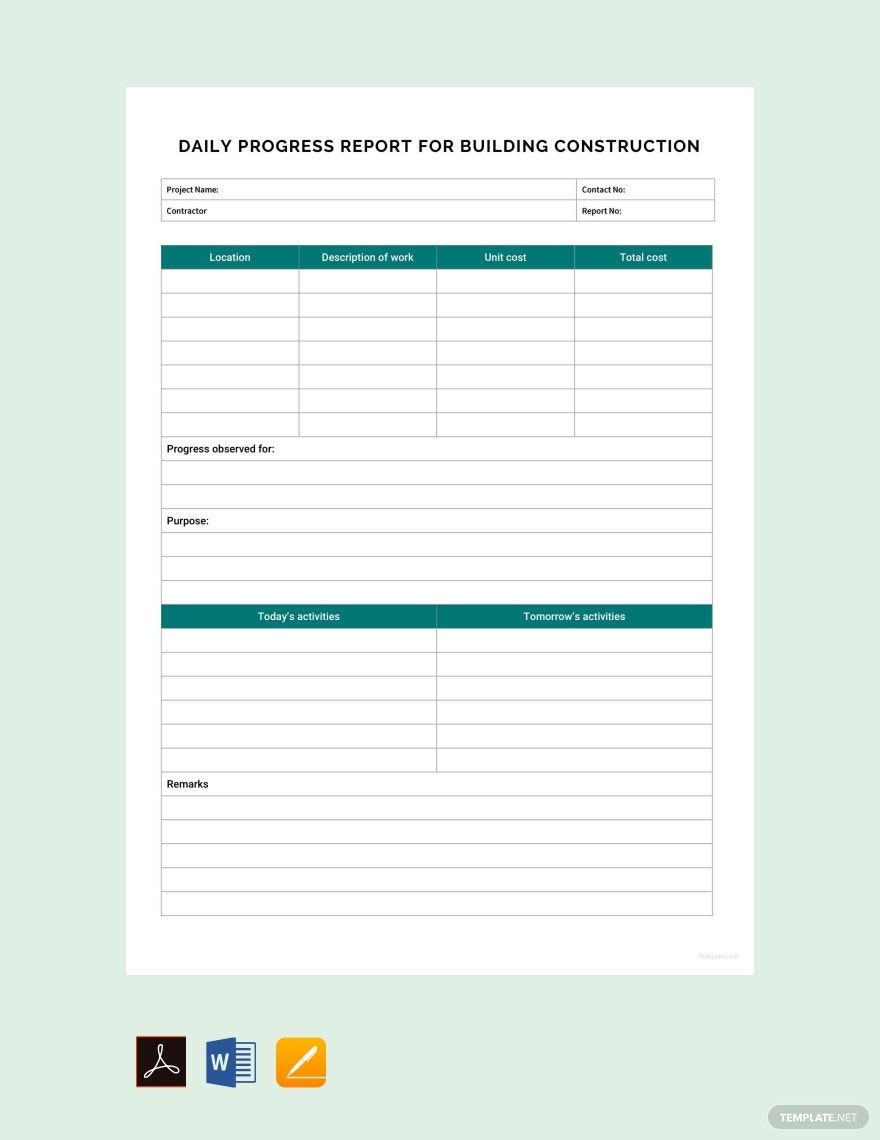

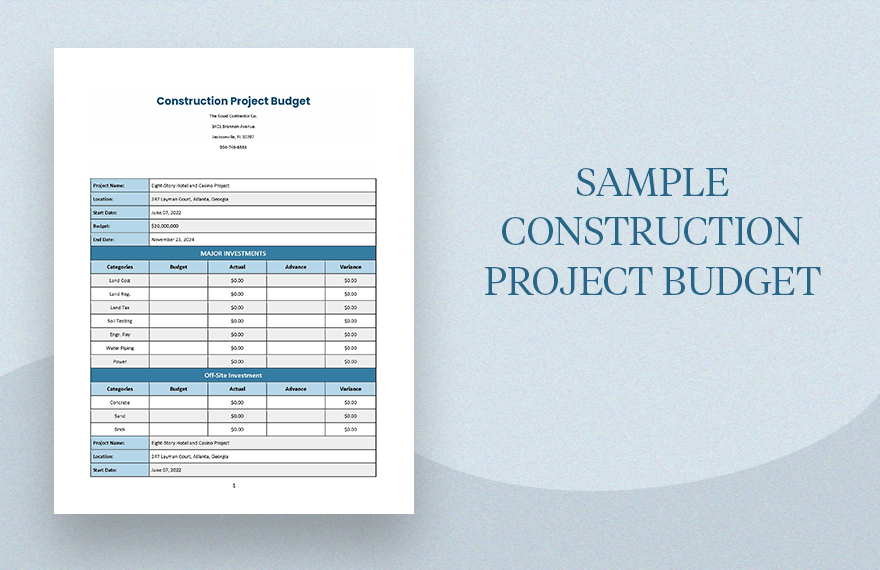

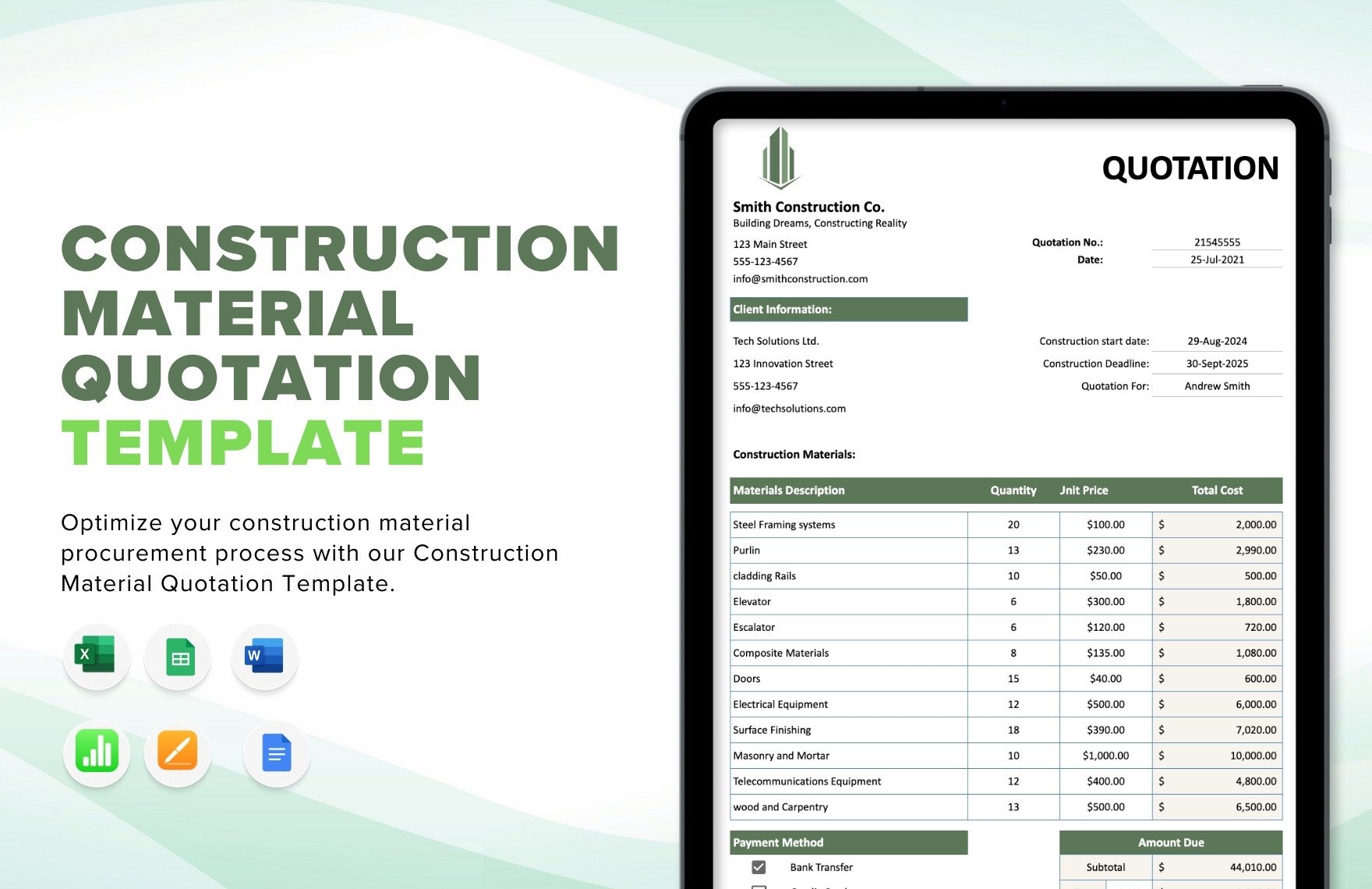

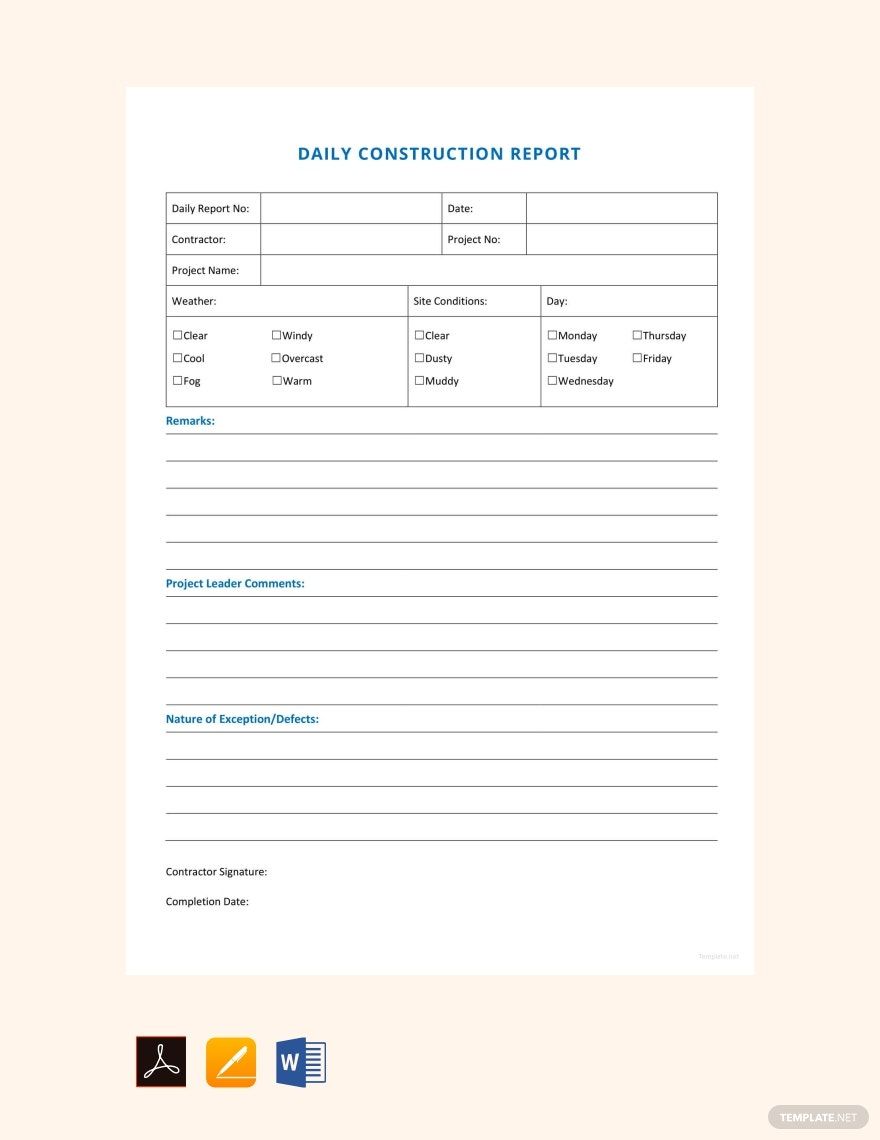

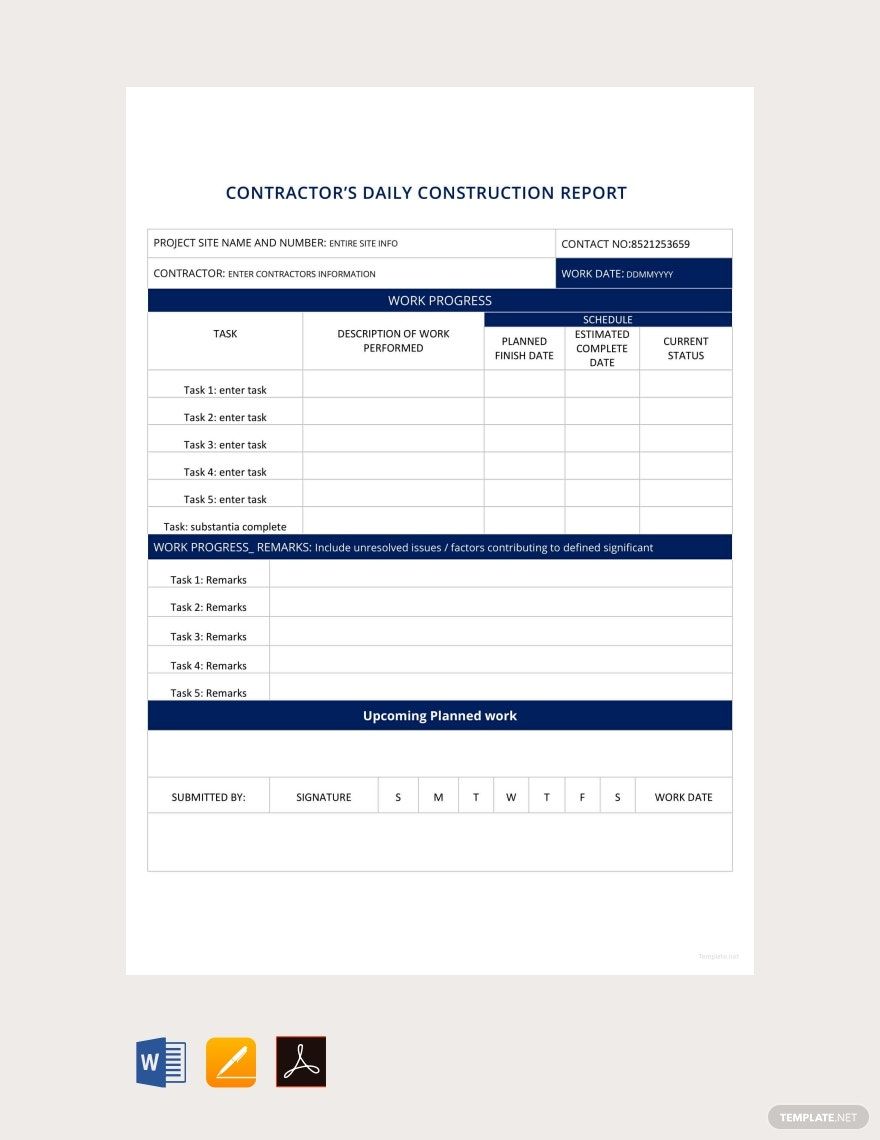

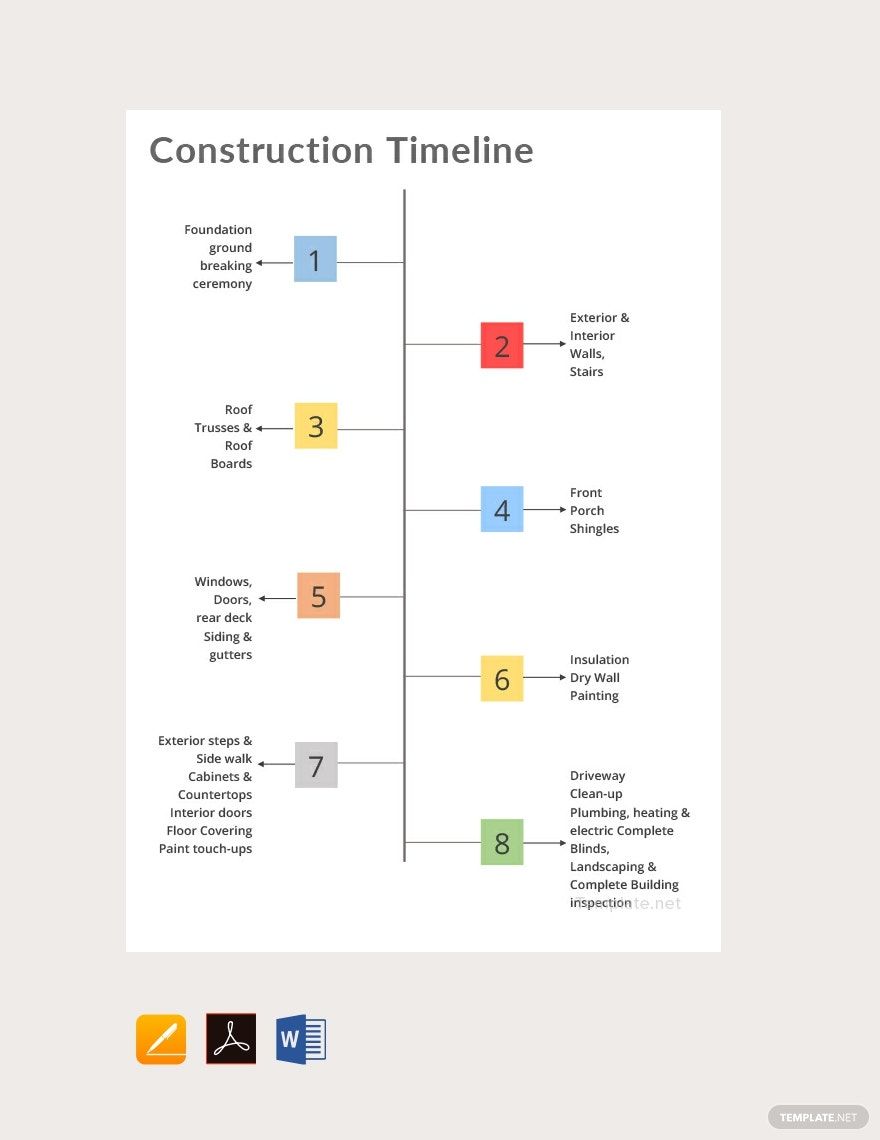

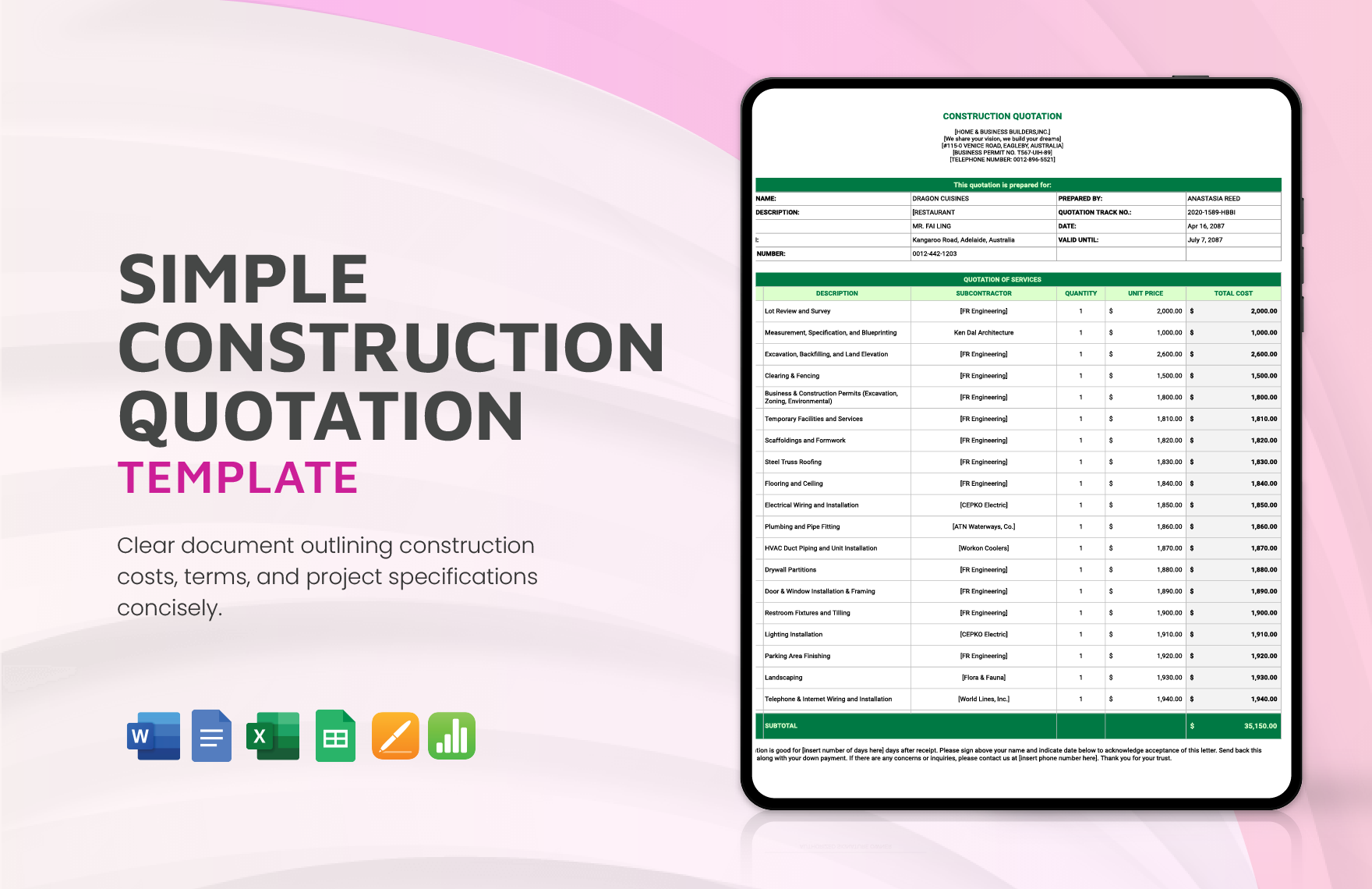

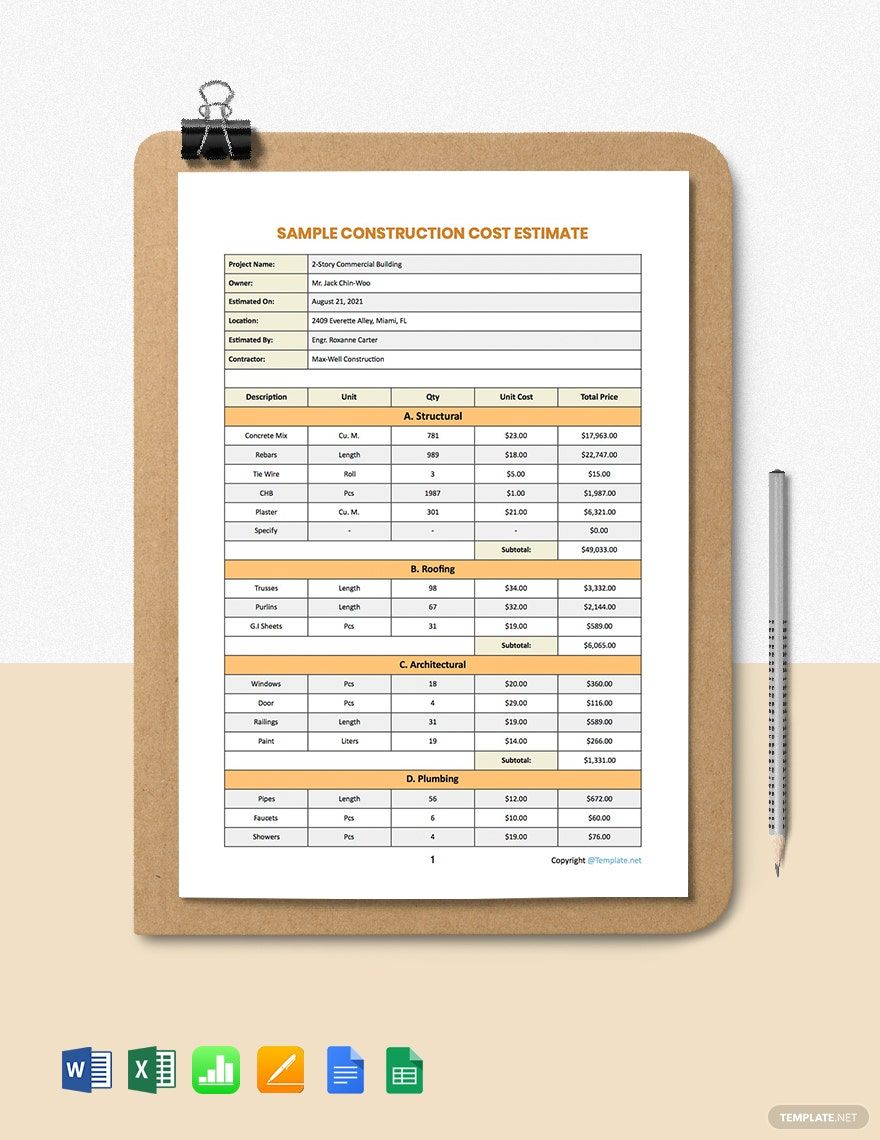

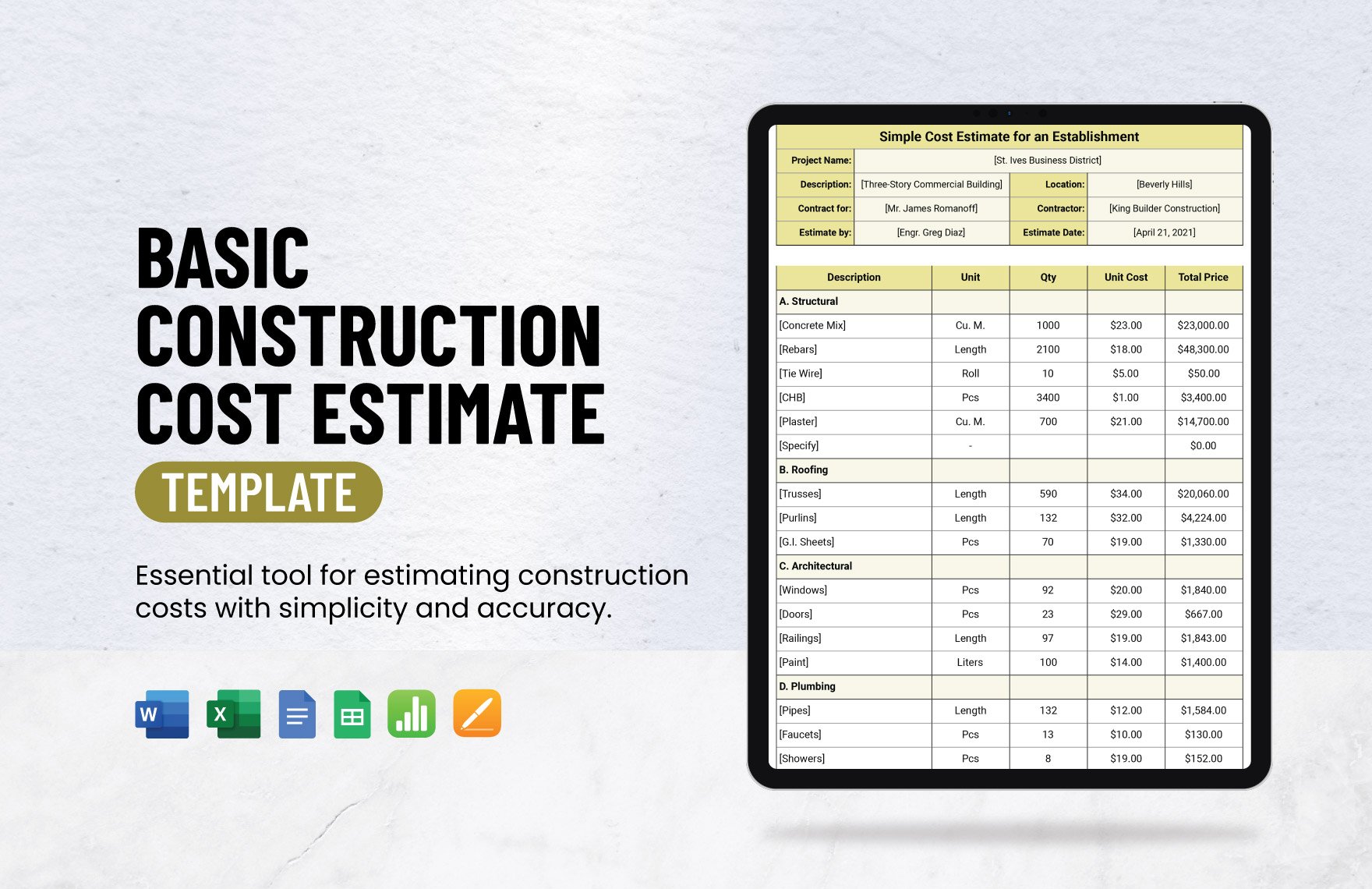

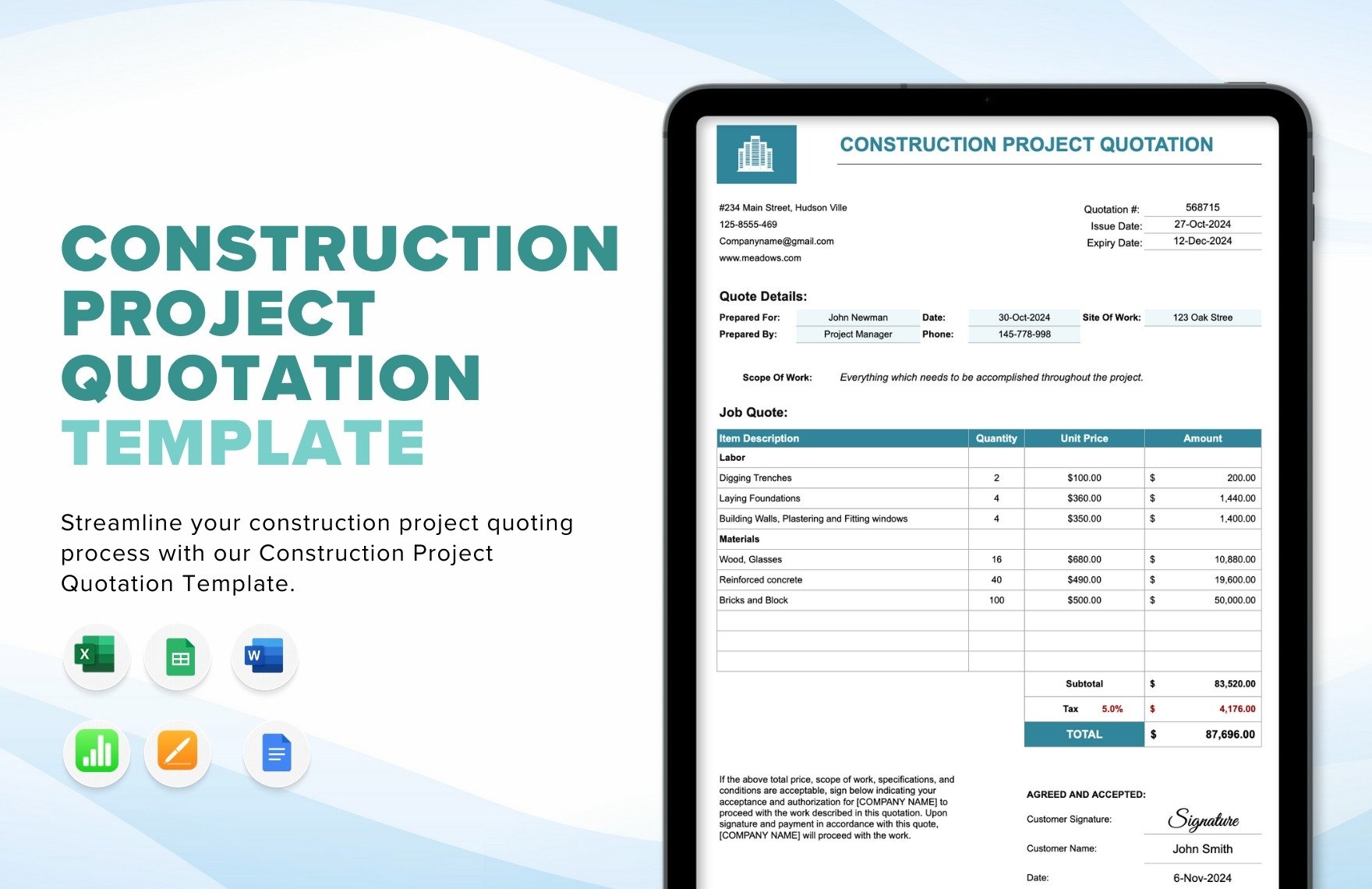

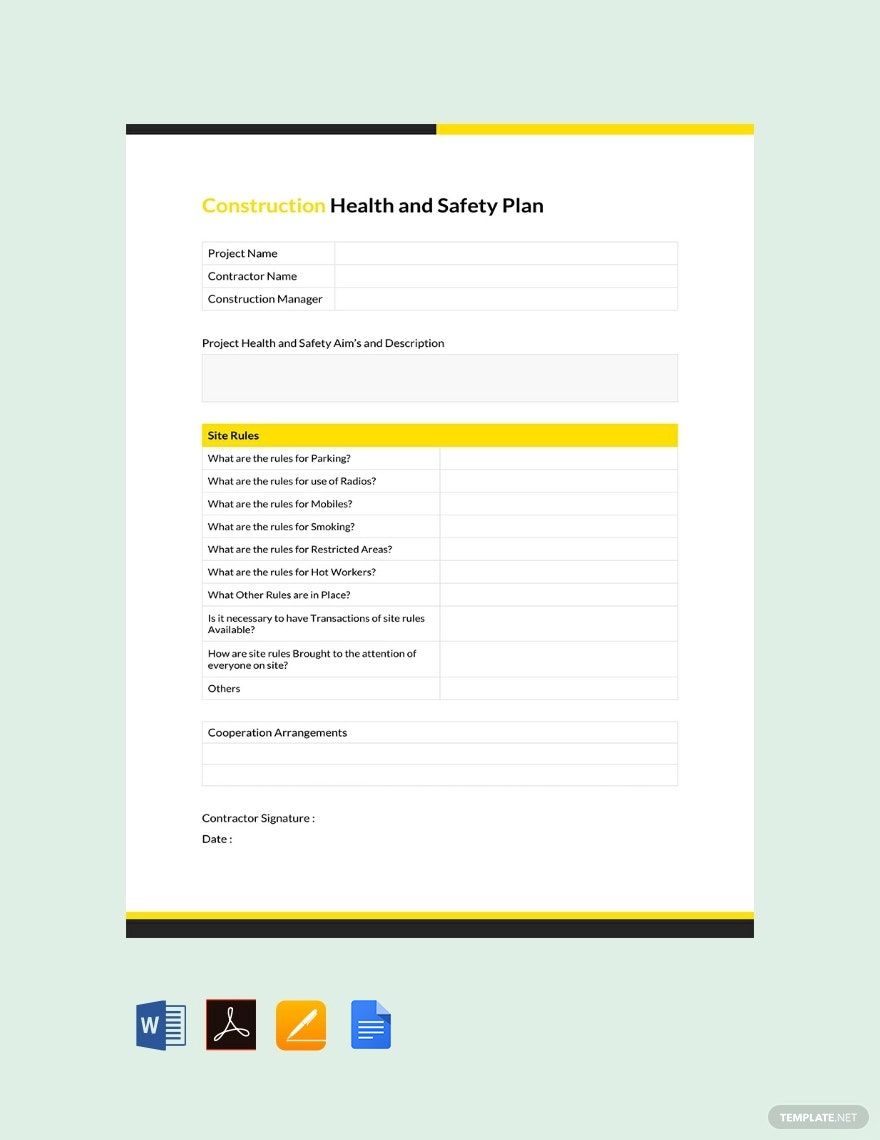

Bring your event promotions to life with these expertly crafted Construction Templates by Template.net. Designed for professionals and businesses involved in the construction industry, these templates allow you to create professional-grade documents, reports, and promotional materials efficiently and stylishly—no design experience needed. Whether you're looking to promote a construction event or showcase your latest project features, these pre-designed templates will serve your needs. You'll find an array of templates that are downloadable and printable in Microsoft Word, allowing you to produce high-quality physical and digital copies. Enjoy the ease of use and valuable savings with beautiful pre-designed templates and take advantage of Template.net's broad selection of free templates to get started immediately.

Explore more beautiful premium pre-designed templates in Microsoft Word to further enhance your projects with Template.net. Discover an ever-growing library of templates that cater to all aspects of construction documentation and marketing. With premium templates refreshed regularly, you'll always find fresh designs to keep your materials up-to-date with modern aesthetics. Download or share your documents via link, print, email, or export to increase your reach and impact. Maximize your flexibility by using both free and premium templates; take full advantage of the multiple options available to ensure your creation stands out.