Bring Your Financial Strategies to Life with Finance Templates from Template.net

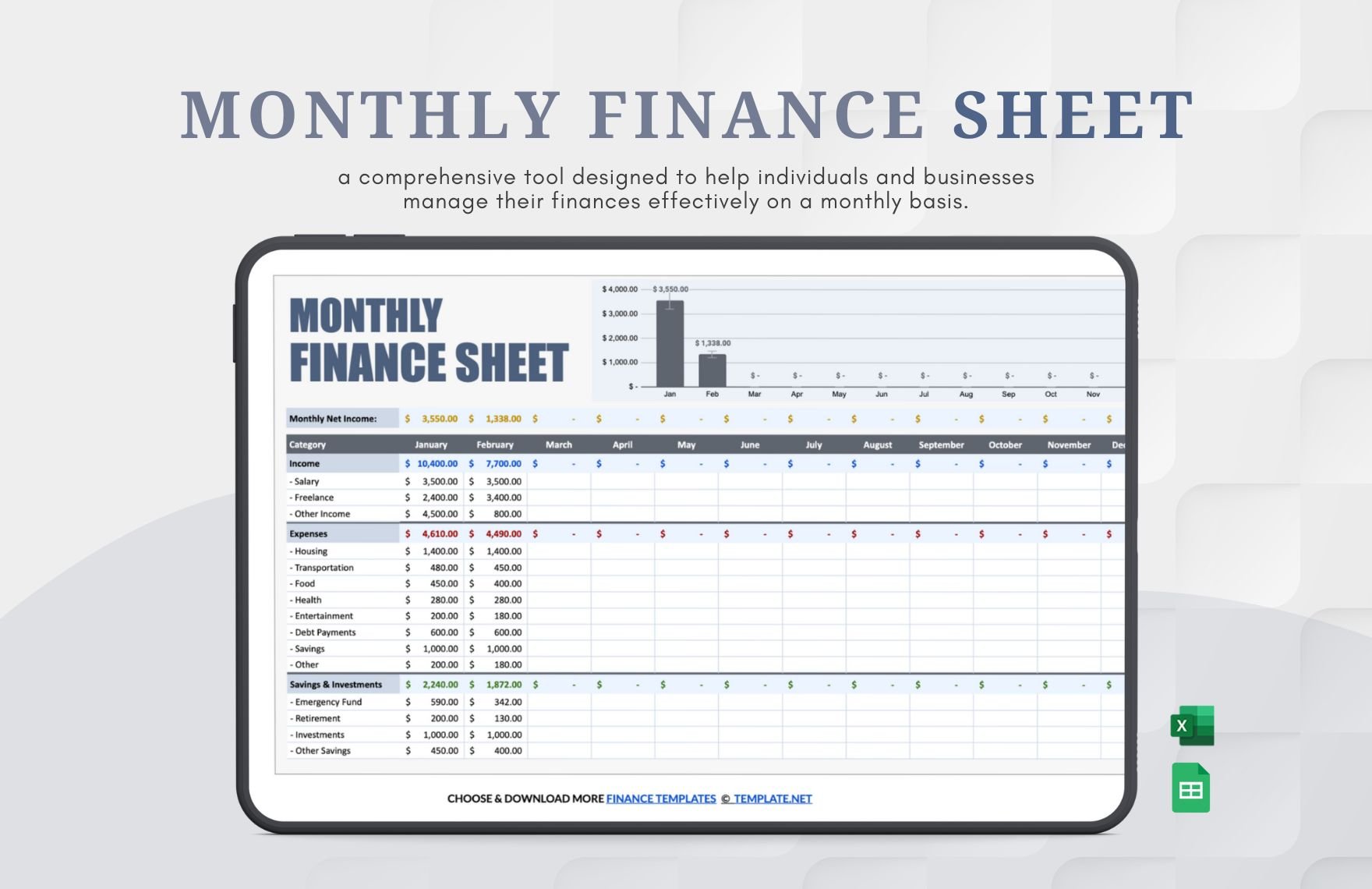

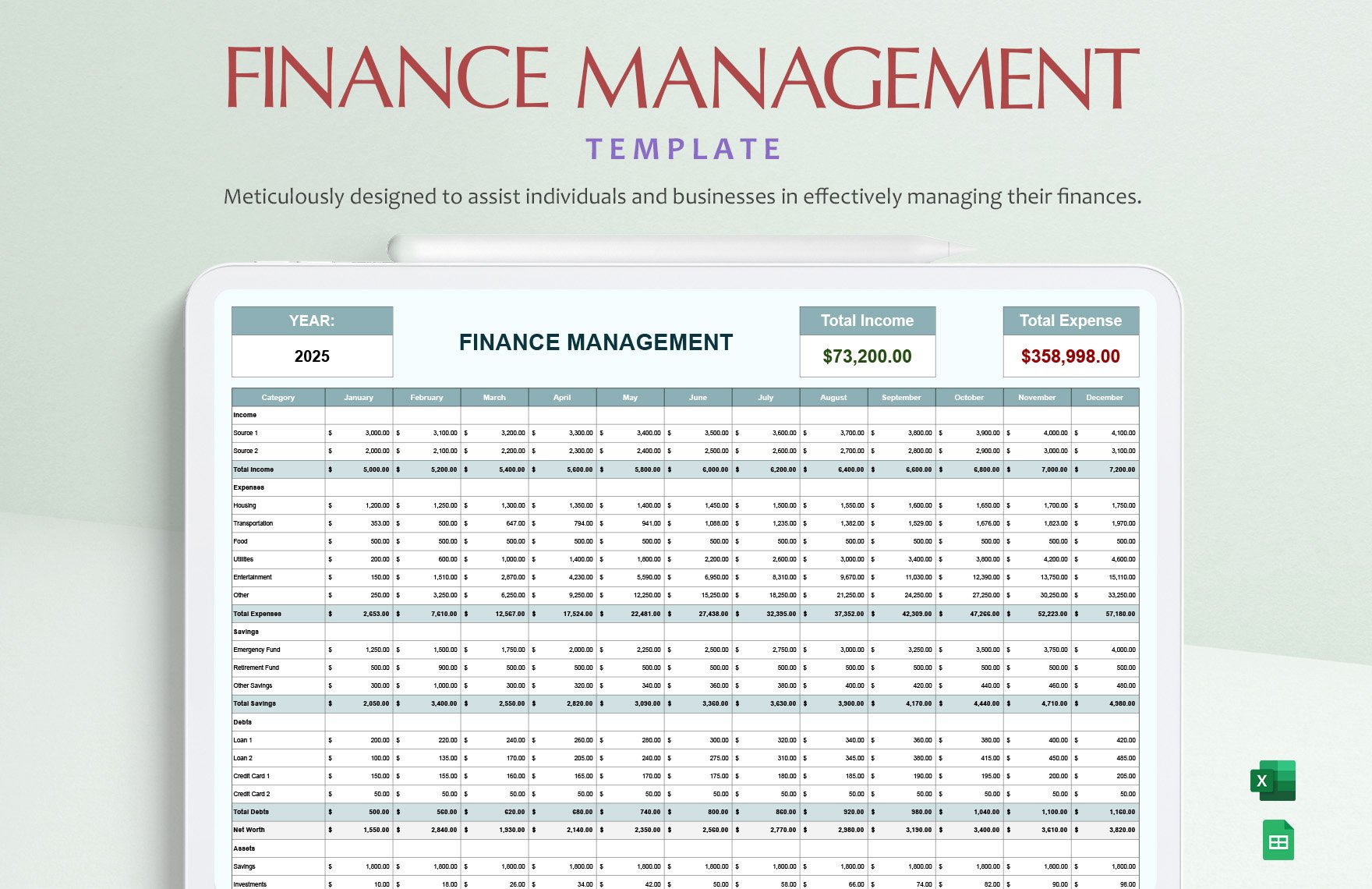

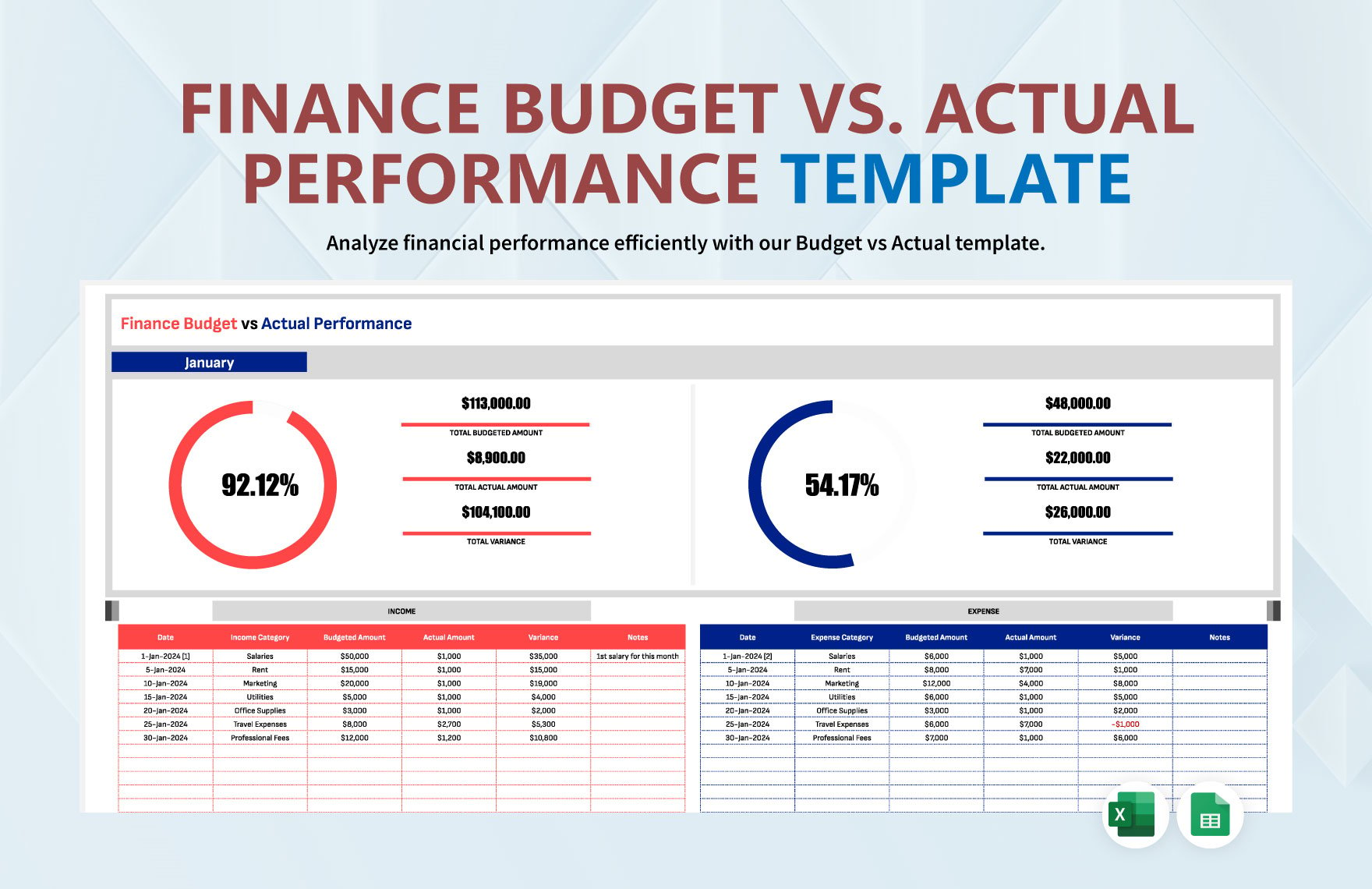

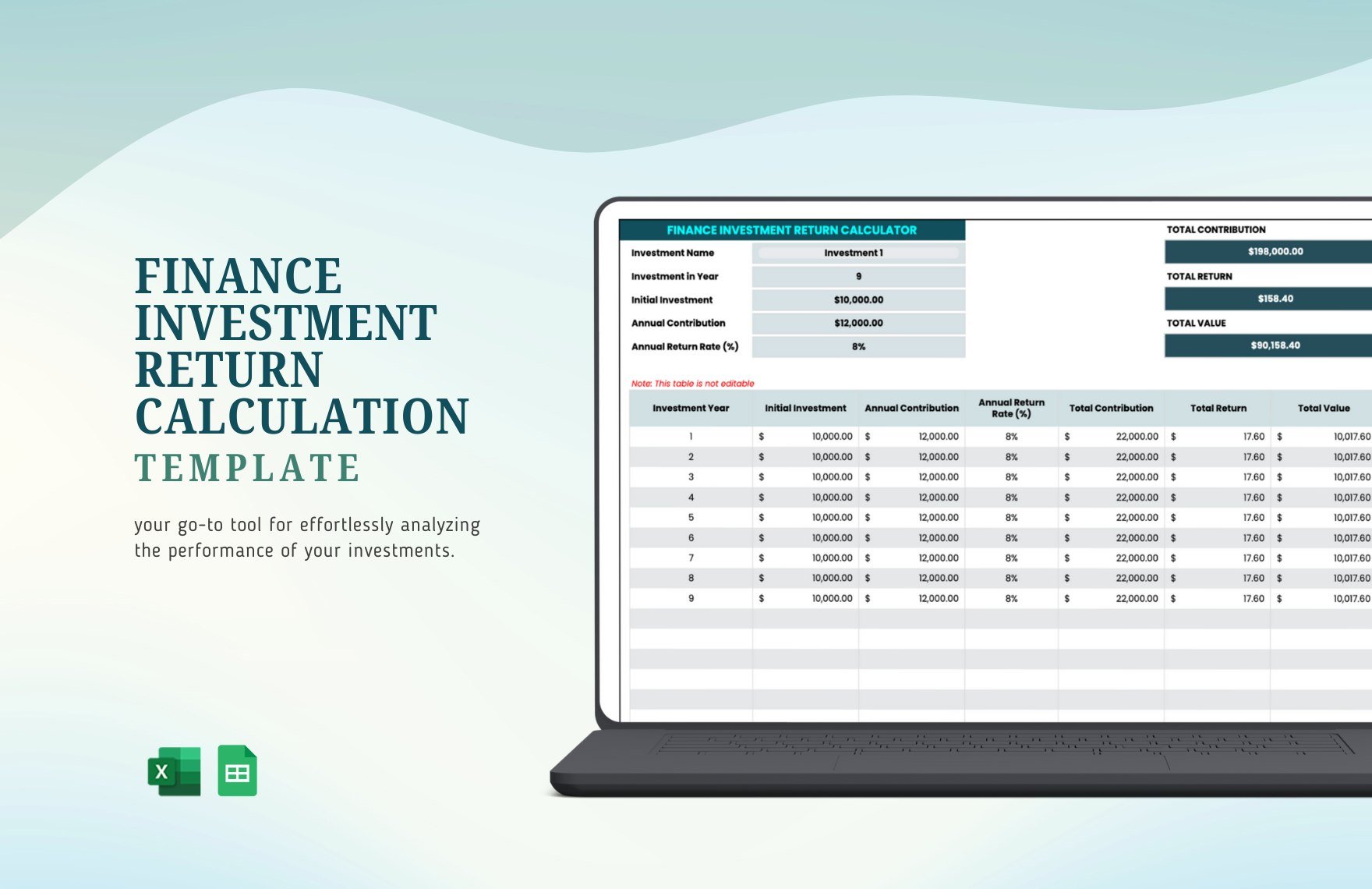

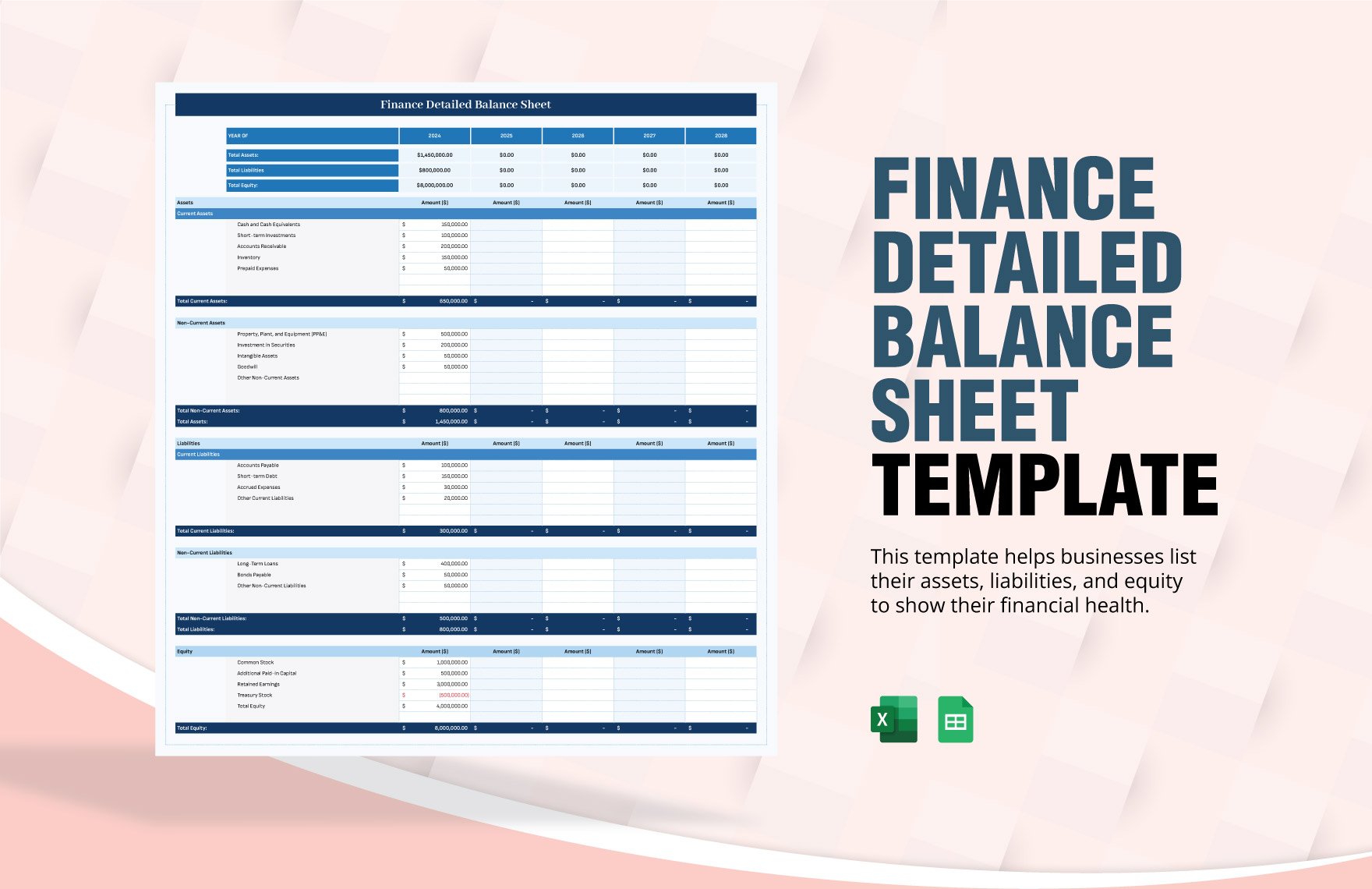

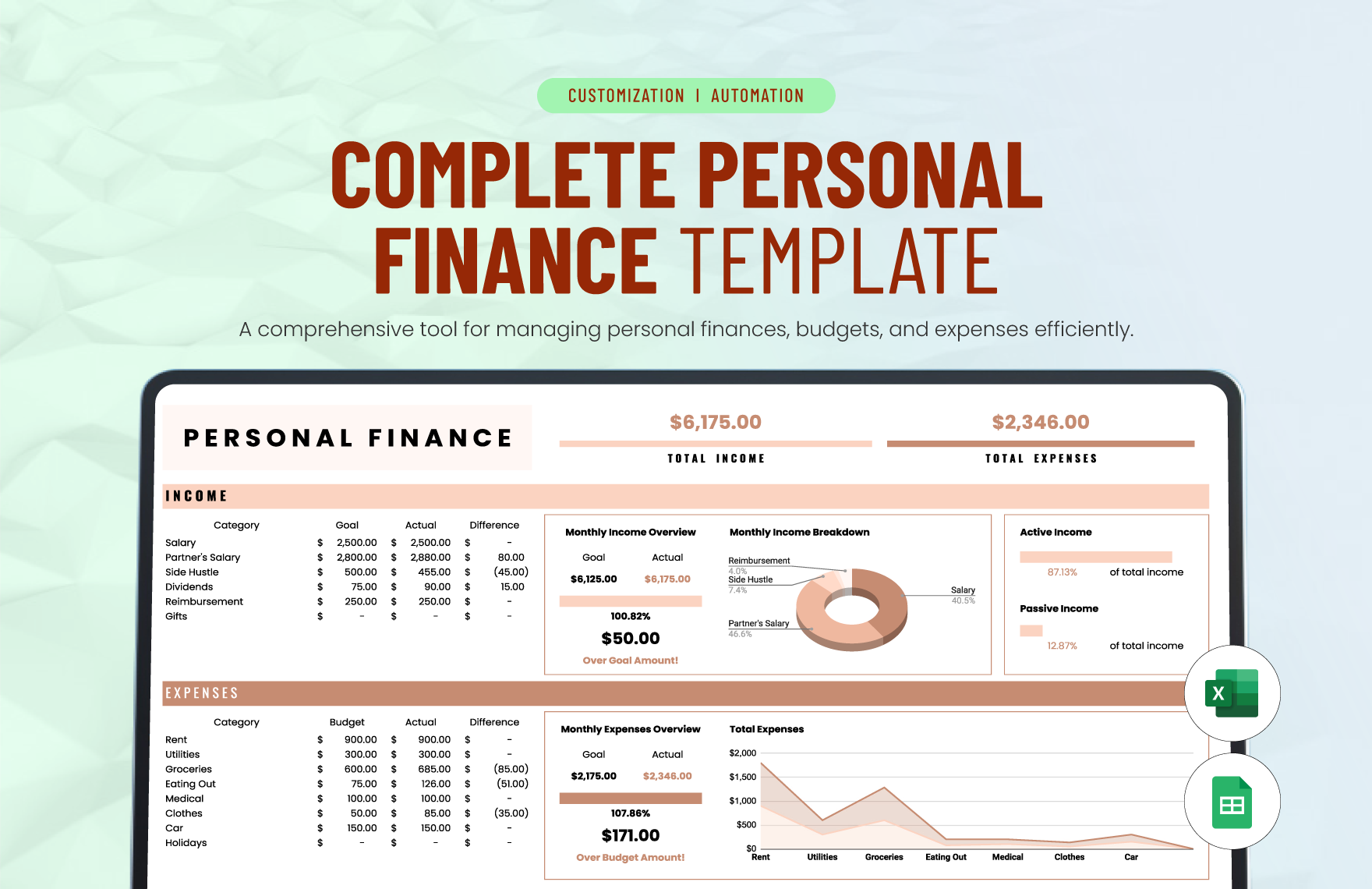

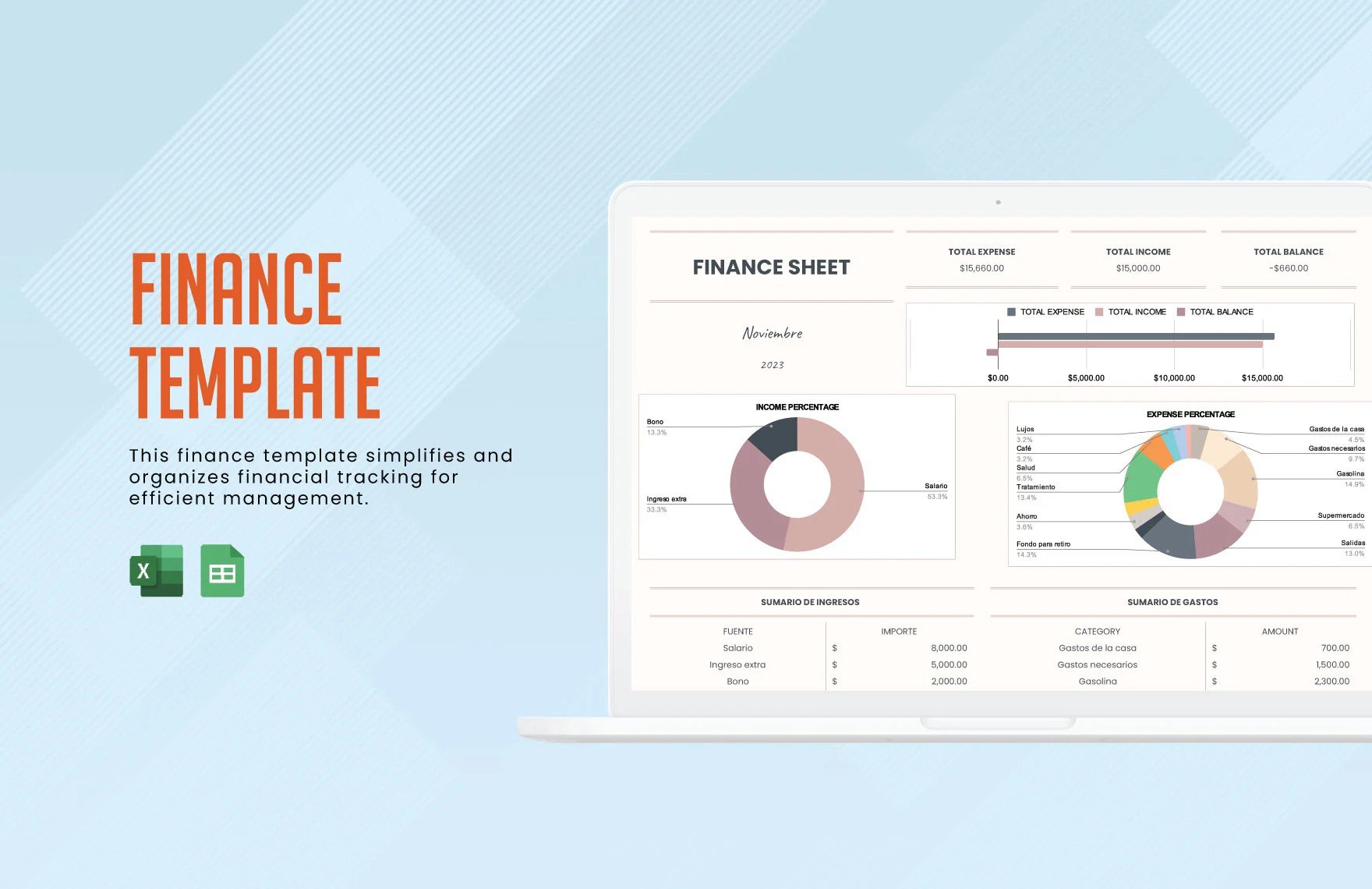

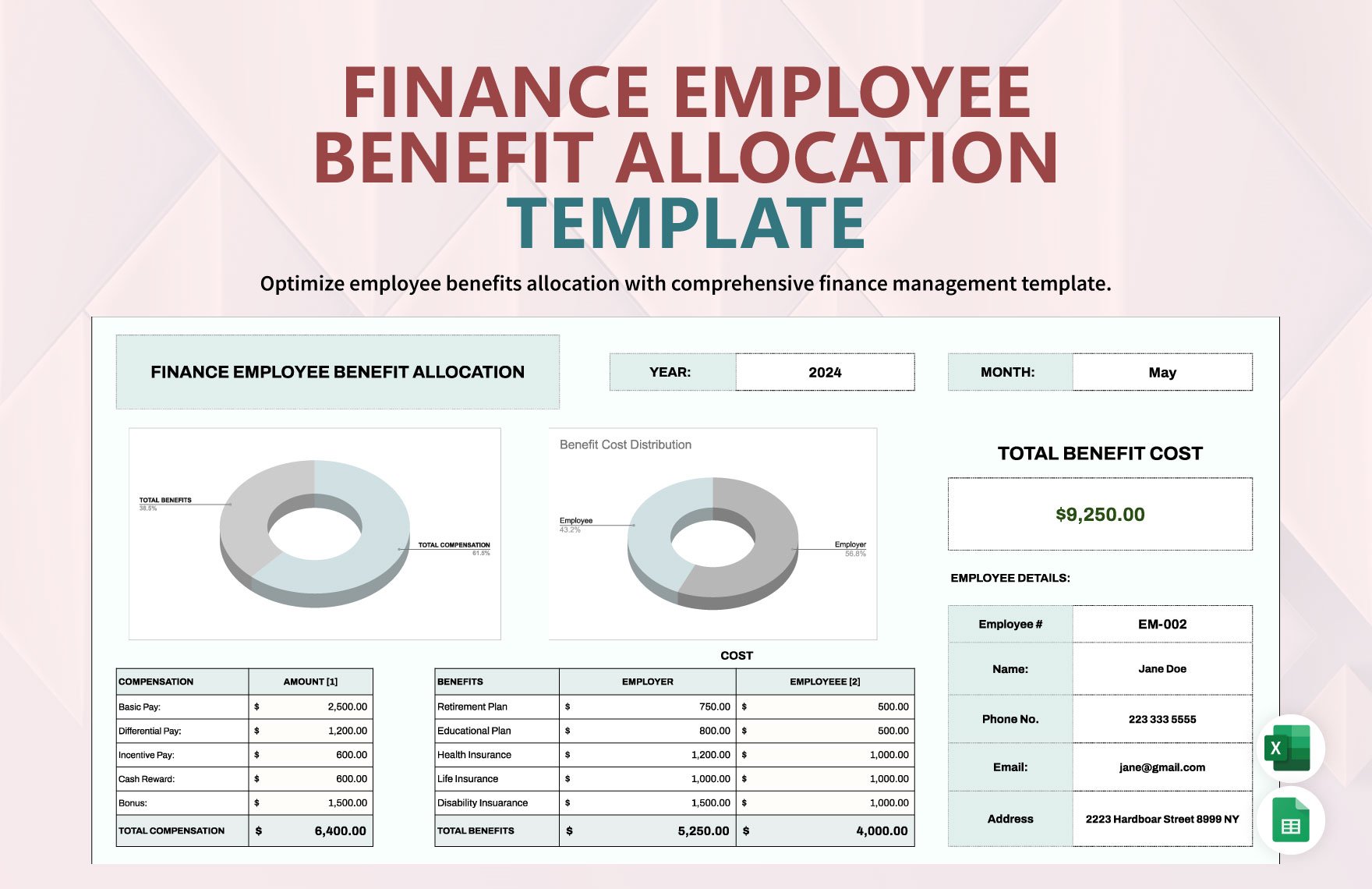

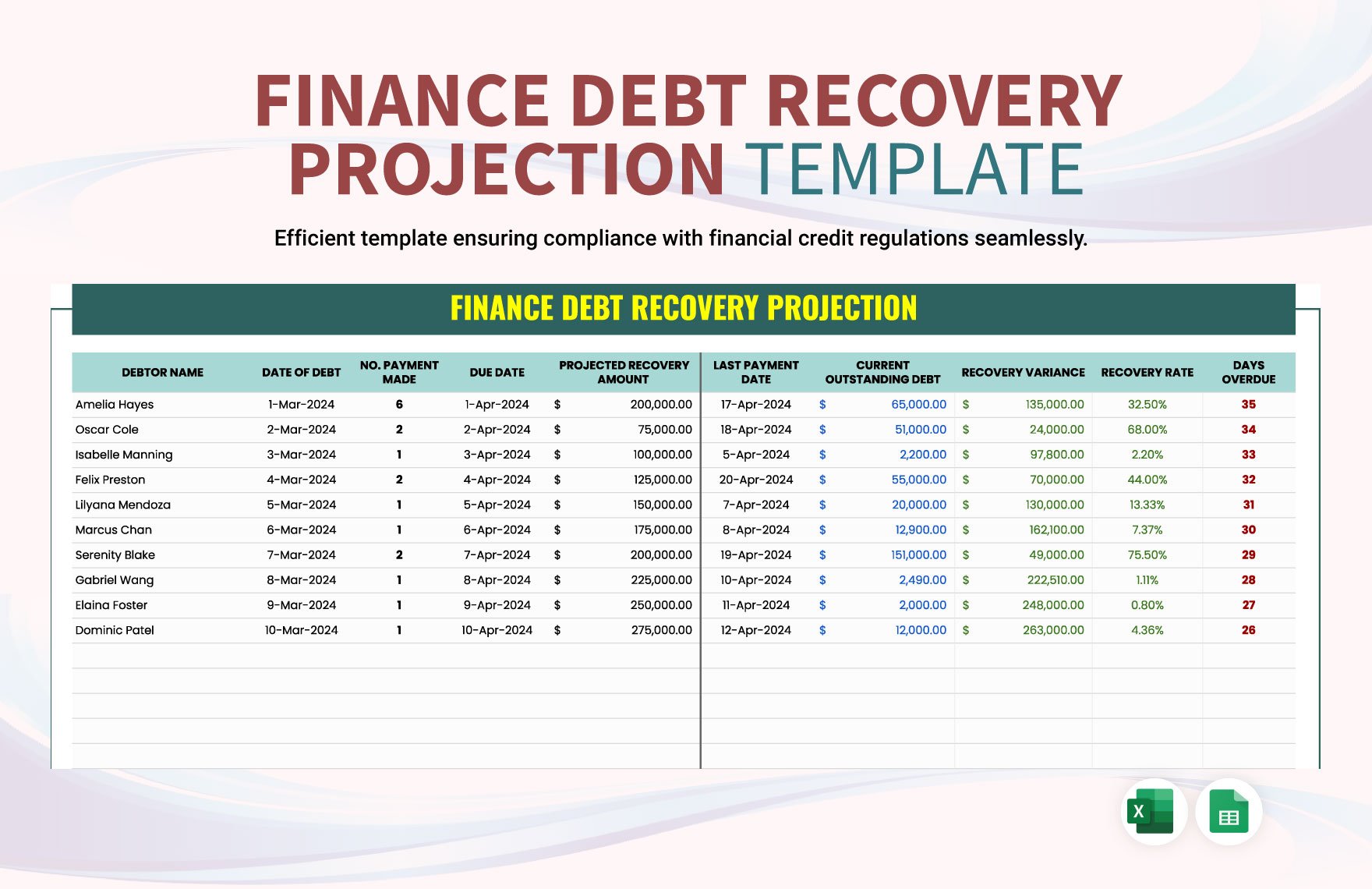

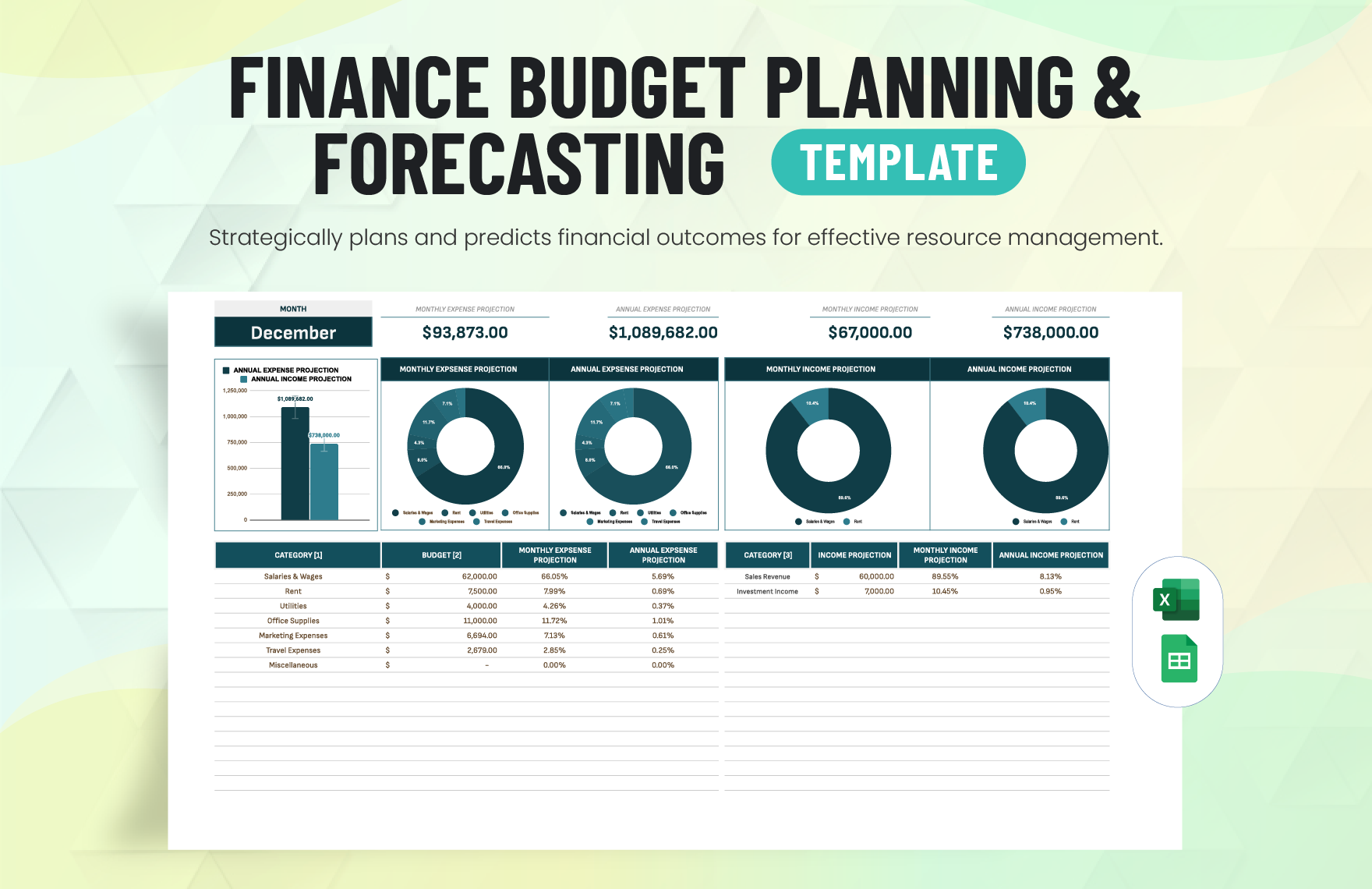

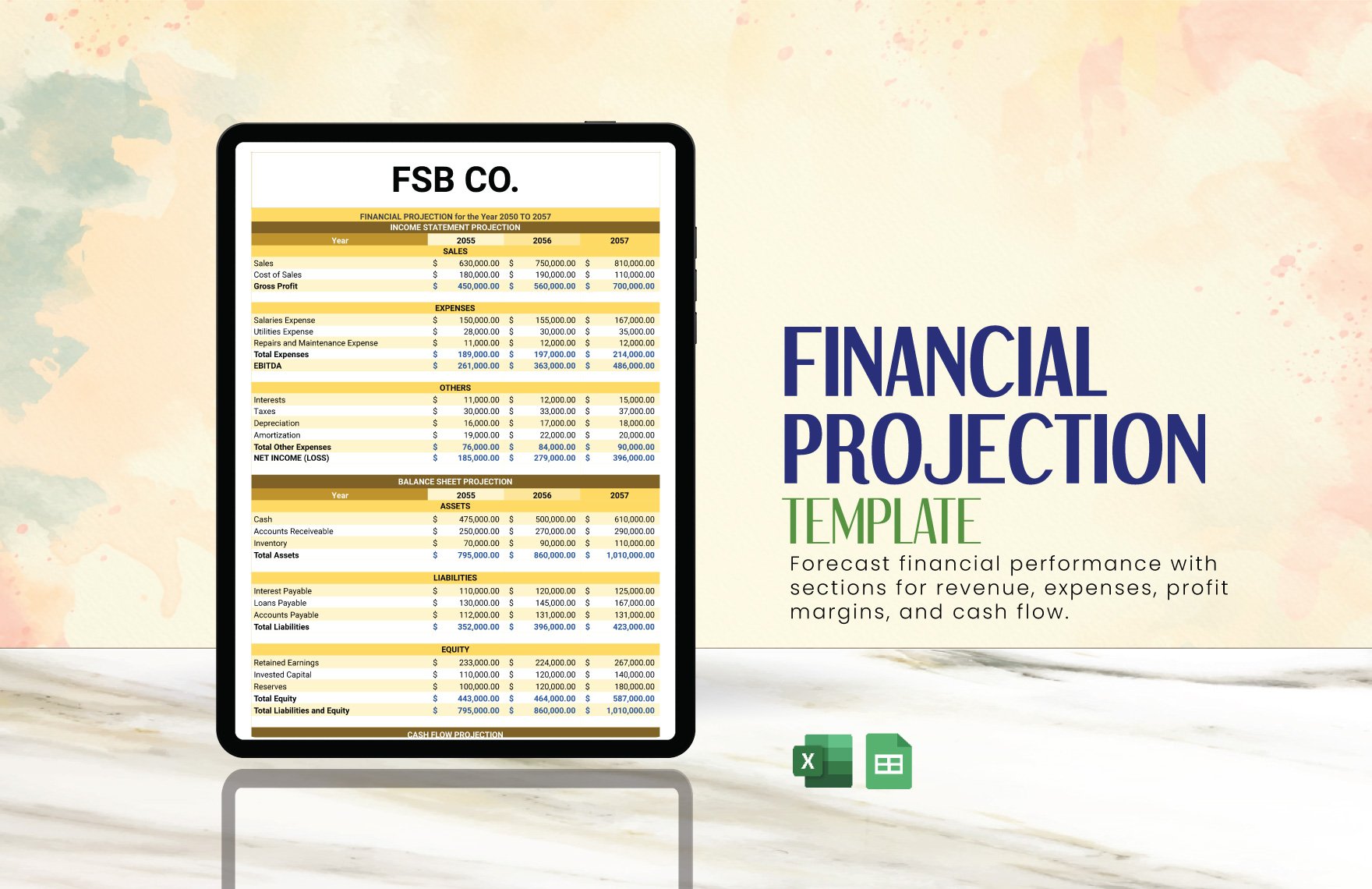

Keep your business thriving with our Finance Templates from Template.net. Designed specifically for financial professionals and business owners, these templates empower you to streamline budgeting processes, enhance financial reporting, and manage transactions effortlessly. Whether you're preparing to launch a new product campaign or optimize your company's yearly financial plan, our templates provide the perfect solution. Each template contains essential details such as currency formats, calculation rows, and contact information fields to ensure precision and professionalism. No extensive financial knowledge is required, and setup is seamless — just plug in your data with our easy-to-use, professional-grade designs and watch your plans come alive.

Discover the many Finance Templates we have on hand to meet your varied business needs. Simply select a template from our diverse library and effortlessly swap in your company’s financial data, tweak colors and fonts to align with your branding, and make it uniquely yours. Add finishing touches with drag-and-drop graphics or include animated visuals for dynamic presentations — no technical skills needed. The possibilities are endless with our regularly updated templates, infusing fun and flexibility into your financial planning. When you're finished, download your document for print, share it via email, or export it to your preferred platform, making it perfect for multiple channels of distribution. Collaborate in real time, ensuring everyone on your team is aligned and informed.