Free Financial Statement

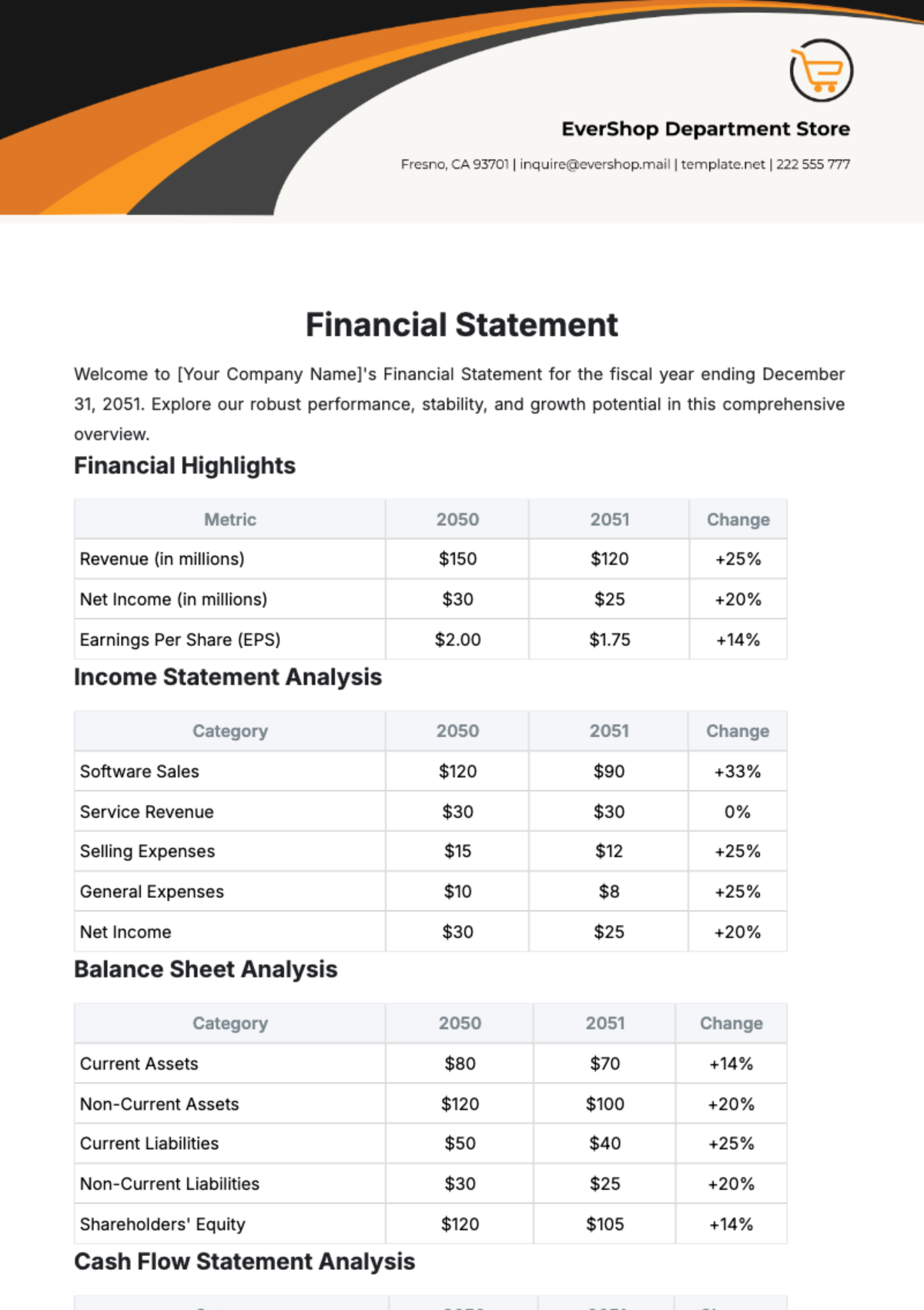

Welcome to [Your Company Name]'s Financial Statement for the fiscal year ending December 31, 2051. Explore our robust performance, stability, and growth potential in this comprehensive overview.

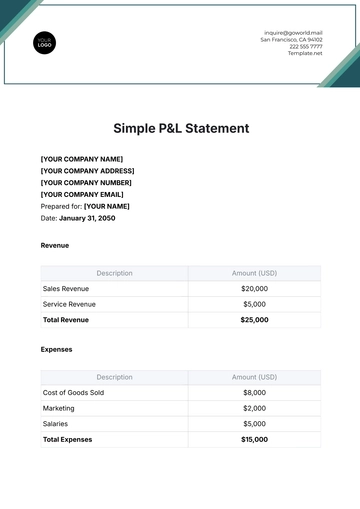

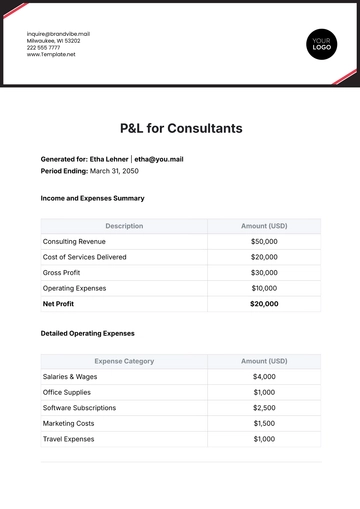

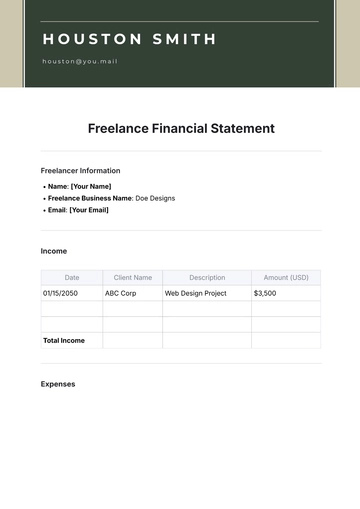

Financial Highlights

Metric | 2050 | 2051 | Change |

|---|---|---|---|

Revenue (in millions) | $150 | $120 | +25% |

Net Income (in millions) | $30 | $25 | +20% |

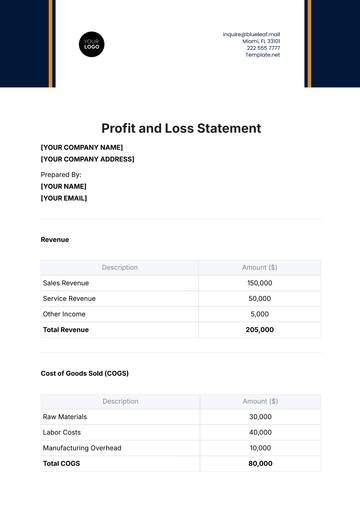

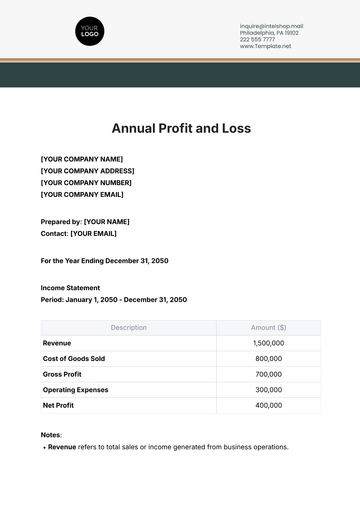

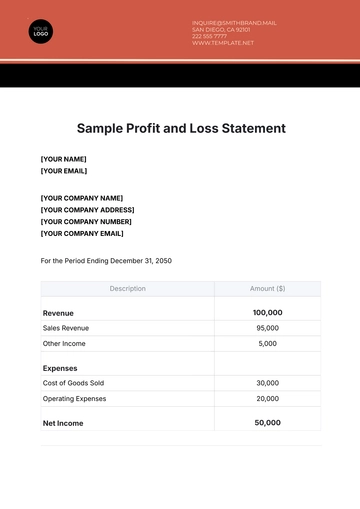

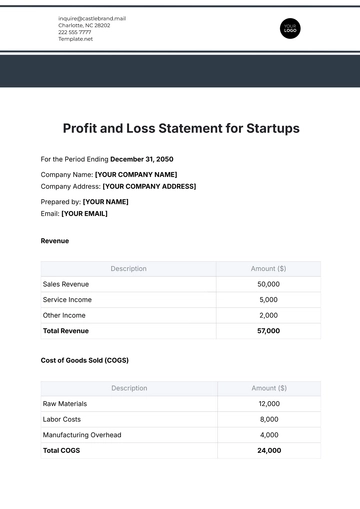

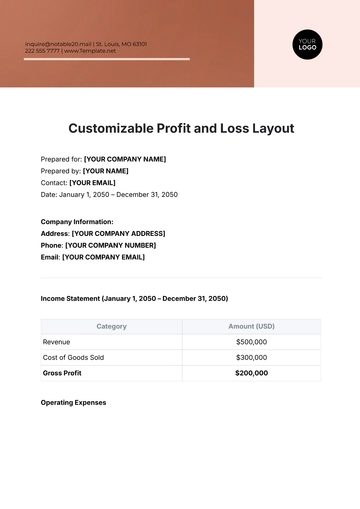

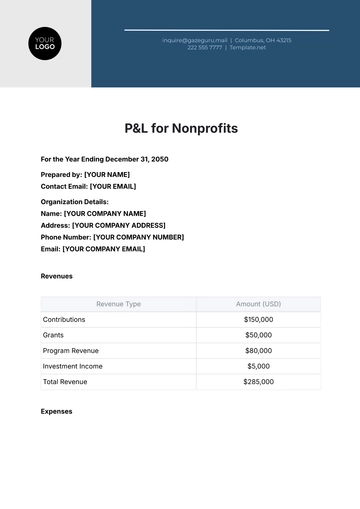

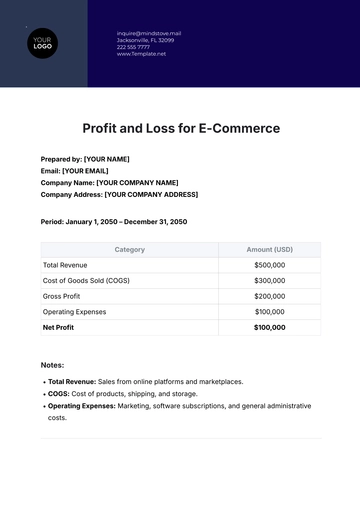

Income Statement Analysis

Category | 2050 | 2051 | Change |

|---|---|---|---|

Software Sales | $120 | $90 | +33% |

Service Revenue | $30 | $30 | 0% |

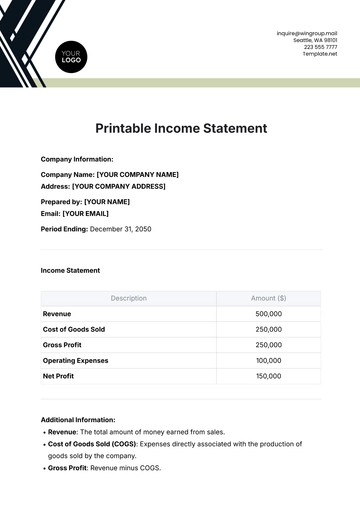

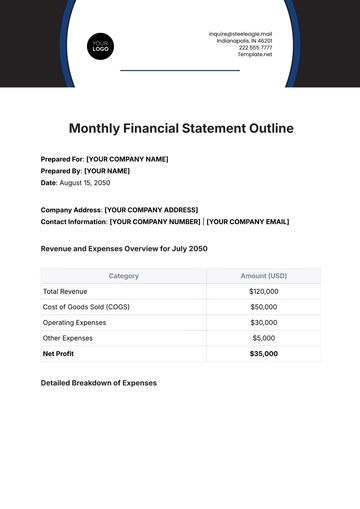

Balance Sheet Analysis

Category | 2050 | 2051 | Change |

|---|---|---|---|

Current Assets | $80 | $70 | +14% |

Non-Current Assets | $120 | $100 | +20% |

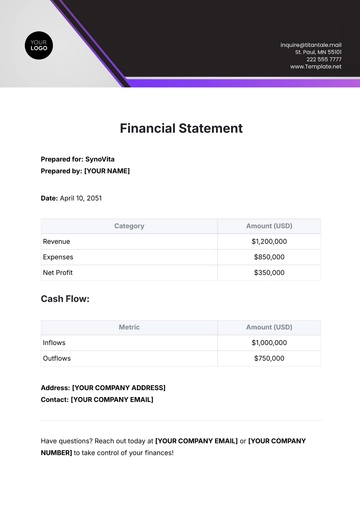

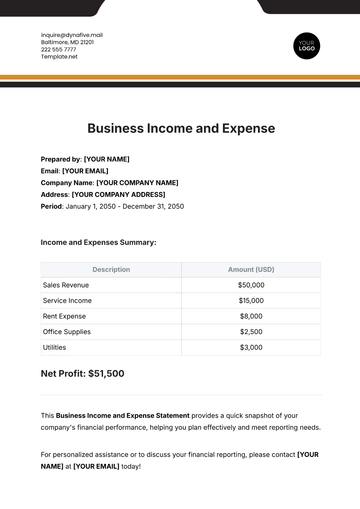

Cash Flow Statement Analysis

Category | 2050 | 2051 | Change |

|---|---|---|---|

Operating Cash Flow | $40 | $35 | +14% |

Investing Activities | -$20 | -$15 | -33% |

Conclusion and Recommendations

[Your Company Name] has demonstrated strong financial performance in 2051, with notable growth in revenue, profitability, and positive liquidity indicators. The company's focus on innovation, strategic partnerships, and prudent financial management positions it well for future growth. Recommendations include continued investment in R&D and monitoring market trends for sustained success.

Prepared by: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial clarity with our exclusive Financial Statement Template from Template.net. Crafted for precision, this editable and customizable template streamlines your reporting. Effortlessly navigate through figures with our AI Editor Tool, ensuring your financial insights are not just comprehensive but also a breeze to present. Elevate your reporting experience today!