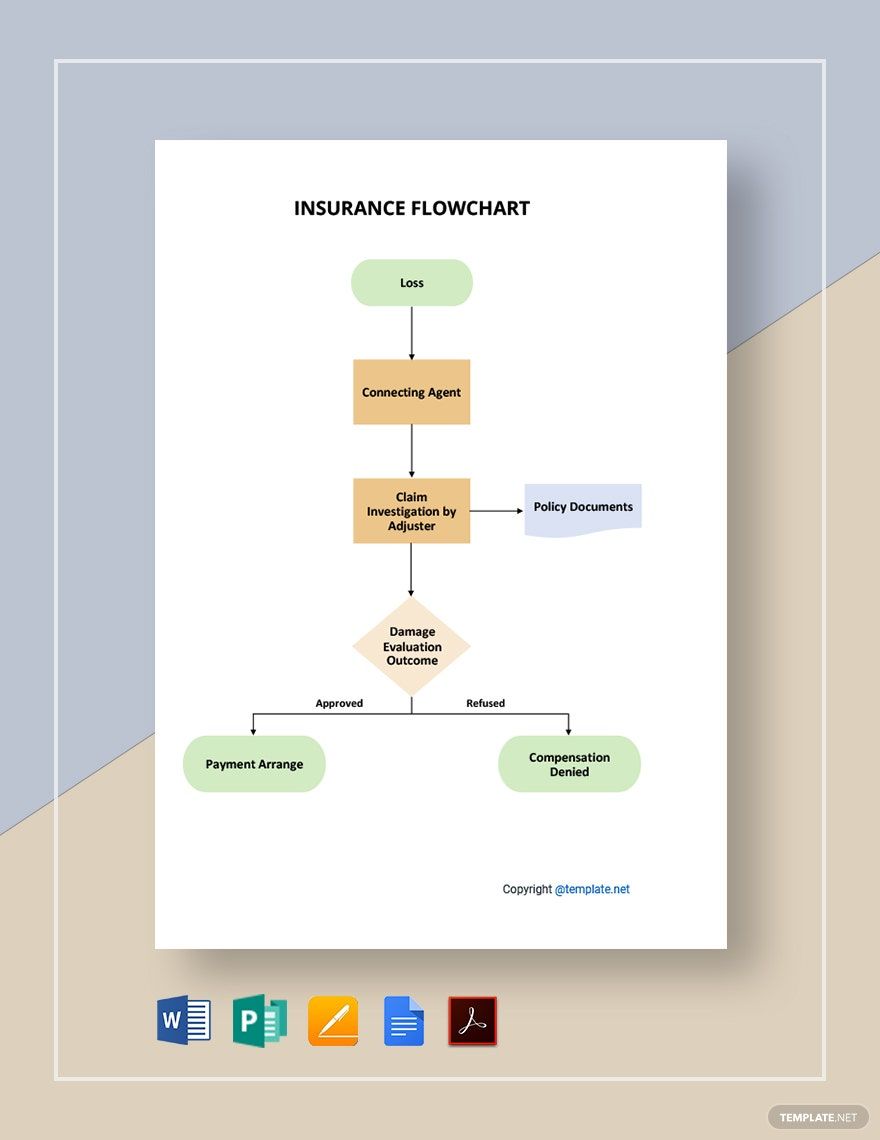

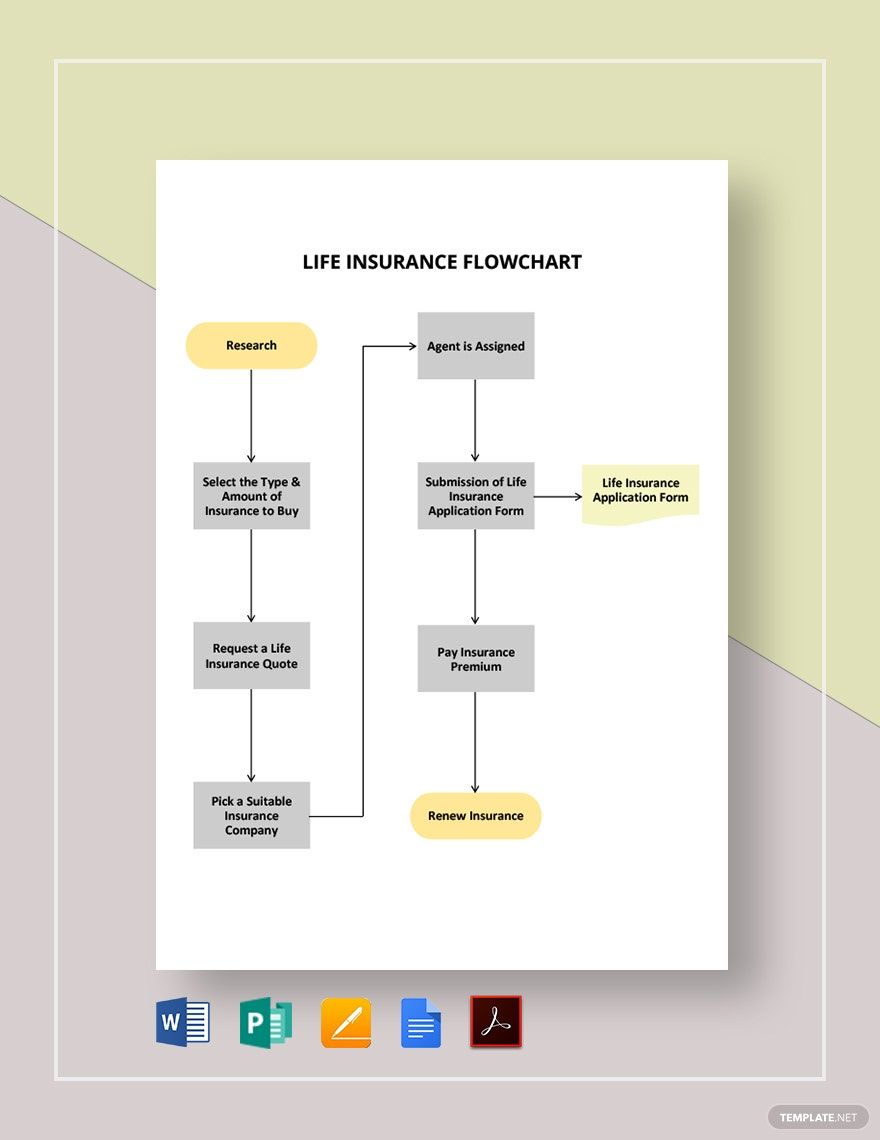

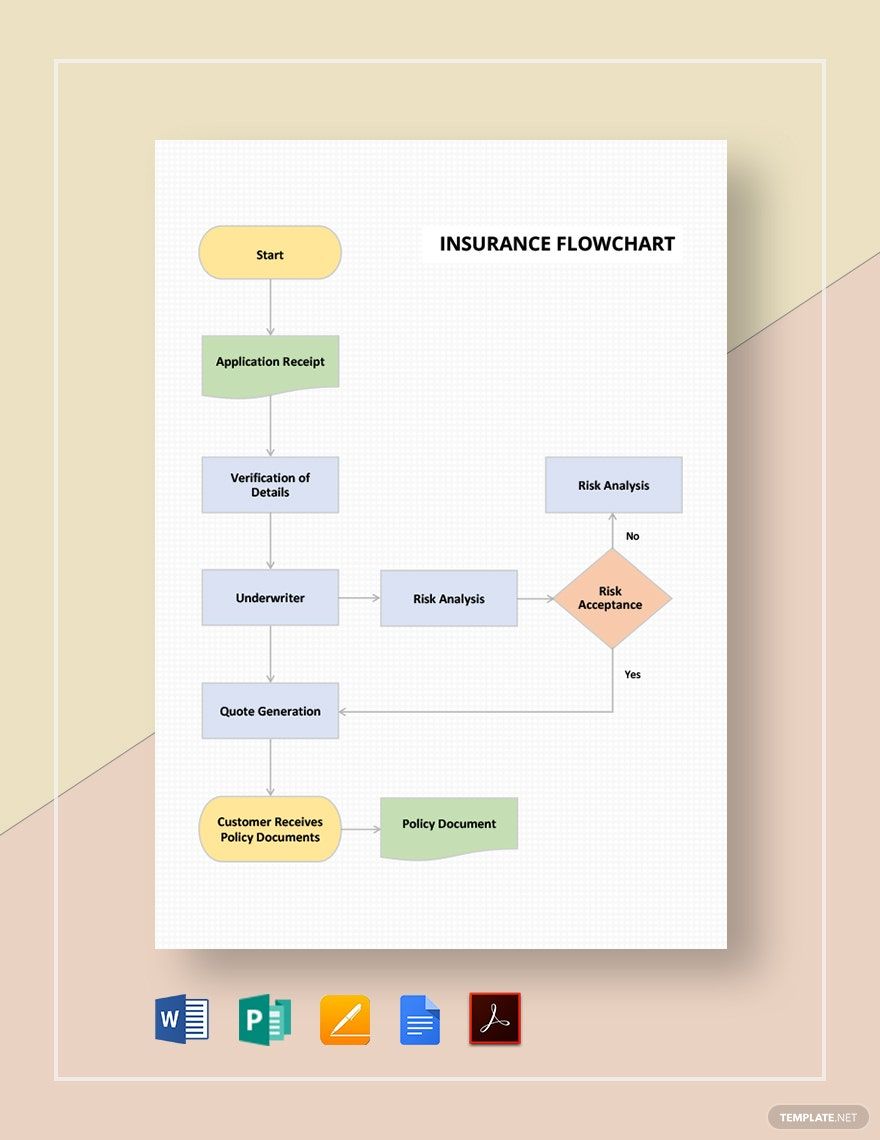

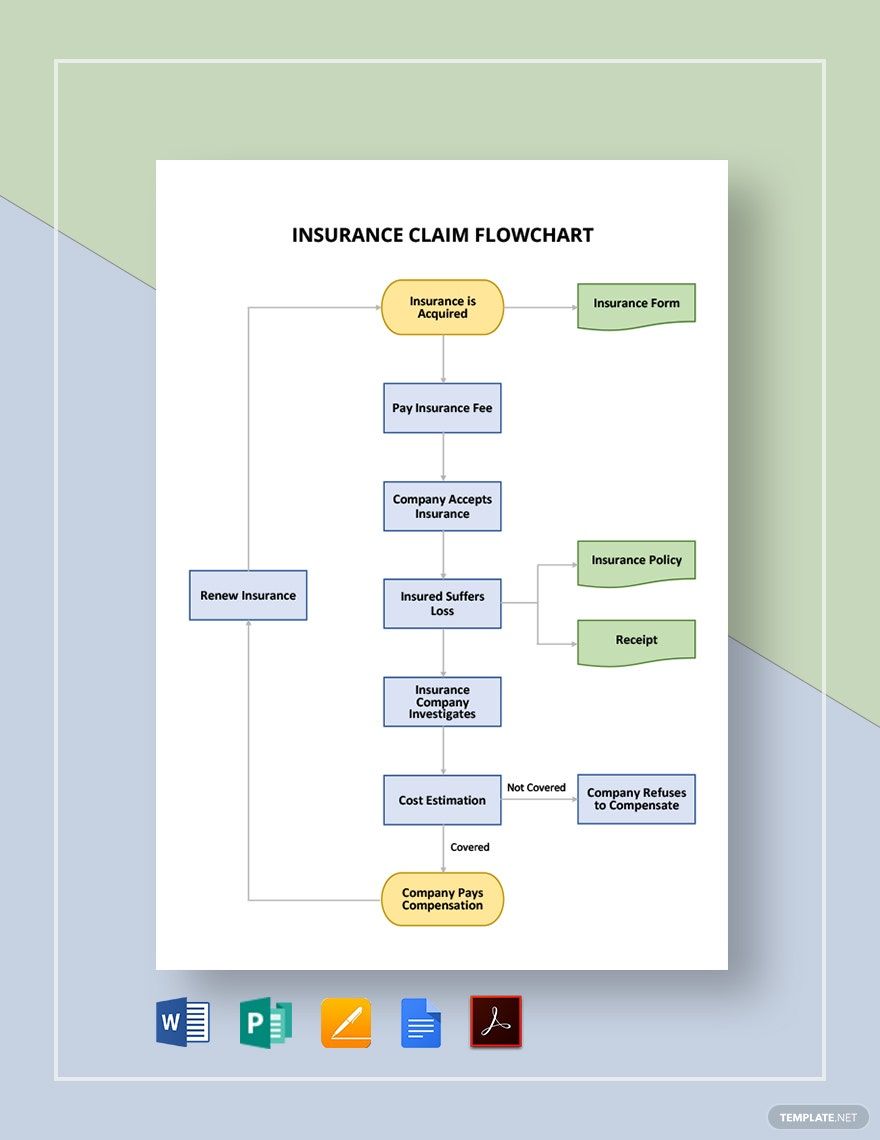

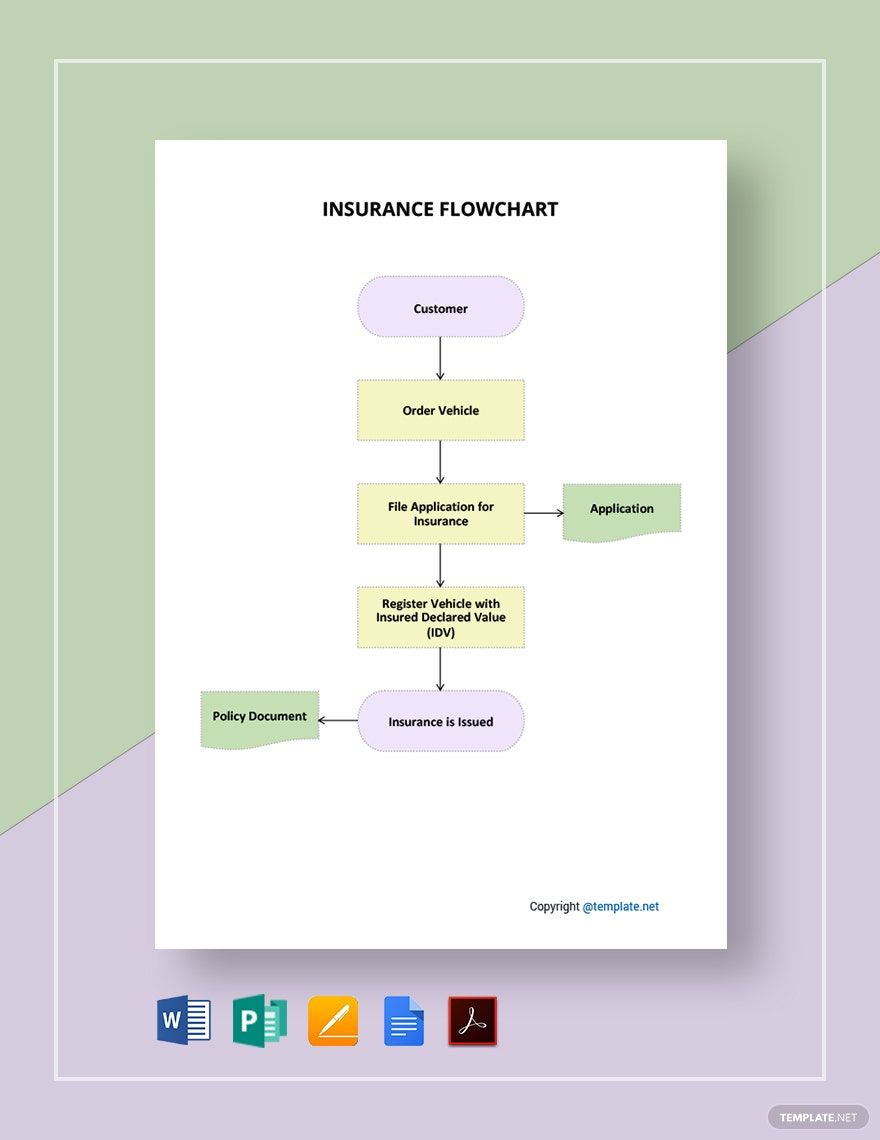

Whether medical insurance or car insurance company, sure they face various types of workflow challenges. A lot of employees often face mistakes that are very much avoidable after all. That is why, when there is a more organized activity diagram and communication diagram, it can build better client and company relationships. Therefore a Flow Chart must be ready and updated all the time. A flowchart, like organizational charts, is a visual representation of the structure necessary for your company to function properly. It must highlight the step-by-step process or activity for a specific task to achieve a goal.

Like infographics, preparing medical, health, or property insurance can get taxing because it needs to be doable, realistic, and achievable. But good news because you land in the right place! Get started with Template.net’s free and premium Insurance Flowchart Templates in Apple Pages! All of our Agency Flowcharts are designed to clarify the application, billing, or claims processing. Each document contains diagrams, connectors, and workflow details. With the variety of ready-made templates to choose from, your task remains to choose what works for your team.

Remember, a Business Flowchart must contain the sequence of actions beneficial for both employees and clients. Add, delete, or replace actions with the help of our very responsive editing workspace. Having an editing tool that does not require installation showcases efficiency. Save, download in Apple Pages, or print it instantly without worries. If you need more flowcharts or insurance templates, Template.net is the place to be. Feel free to subscribe for more!