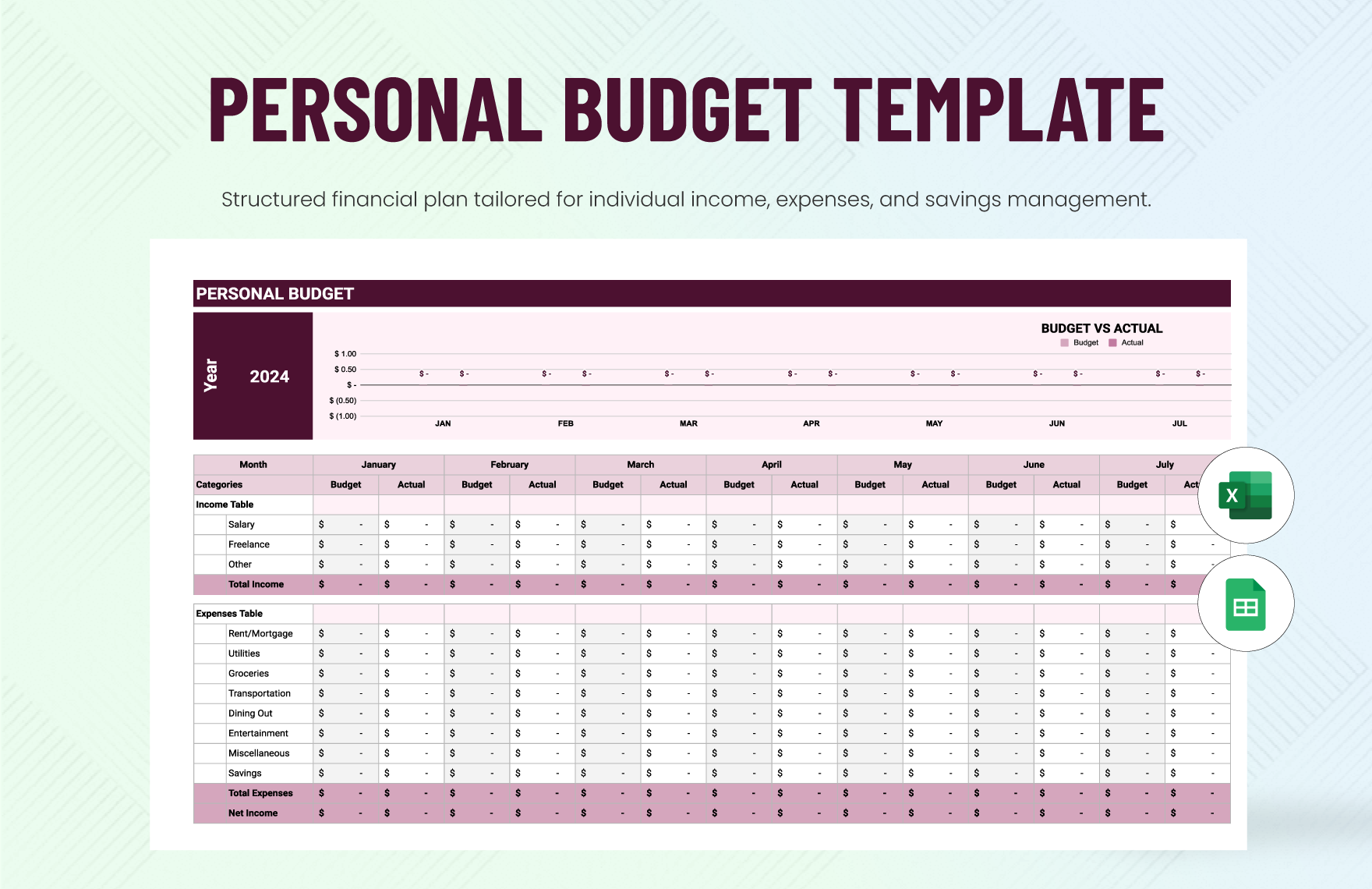

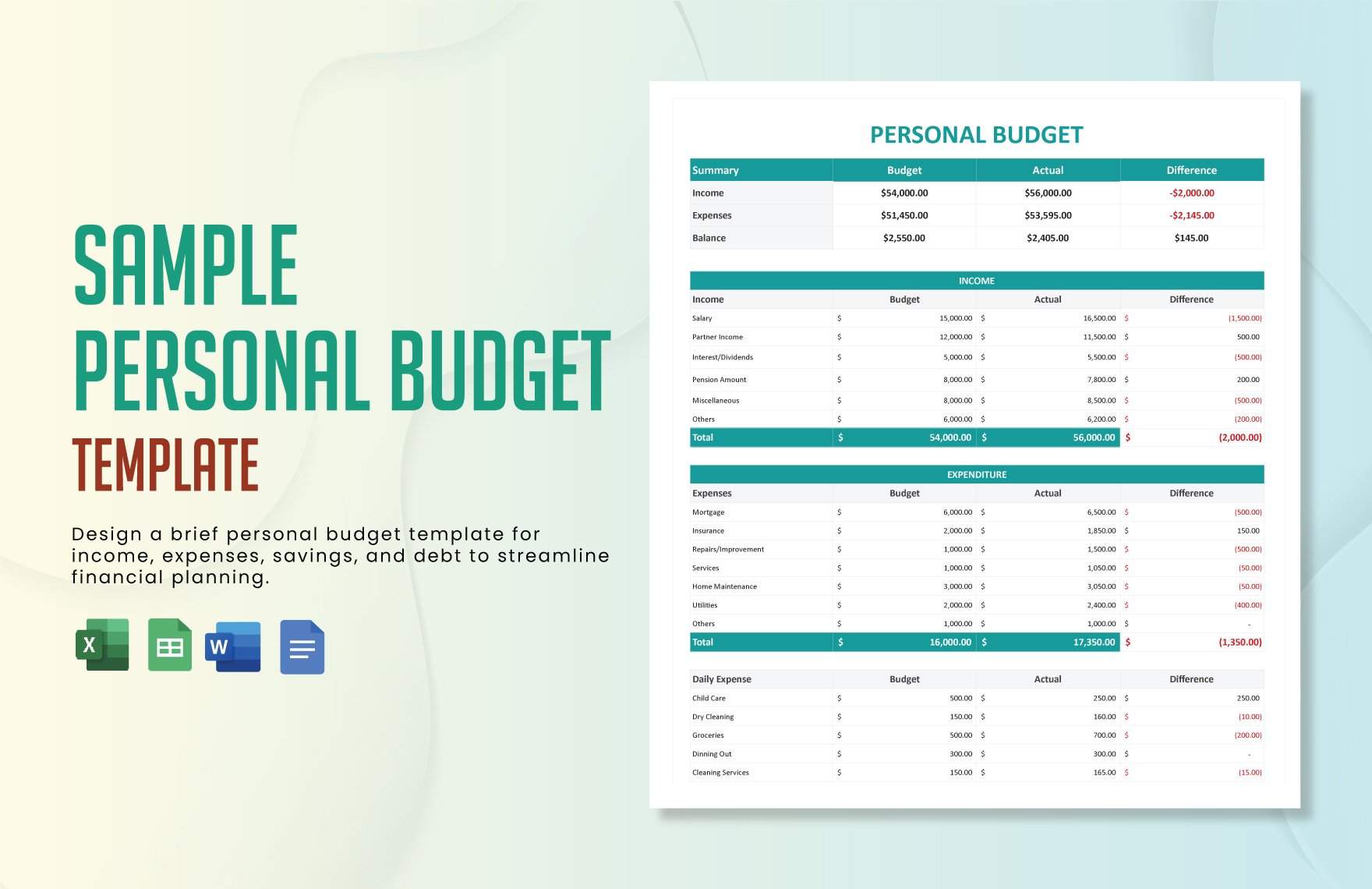

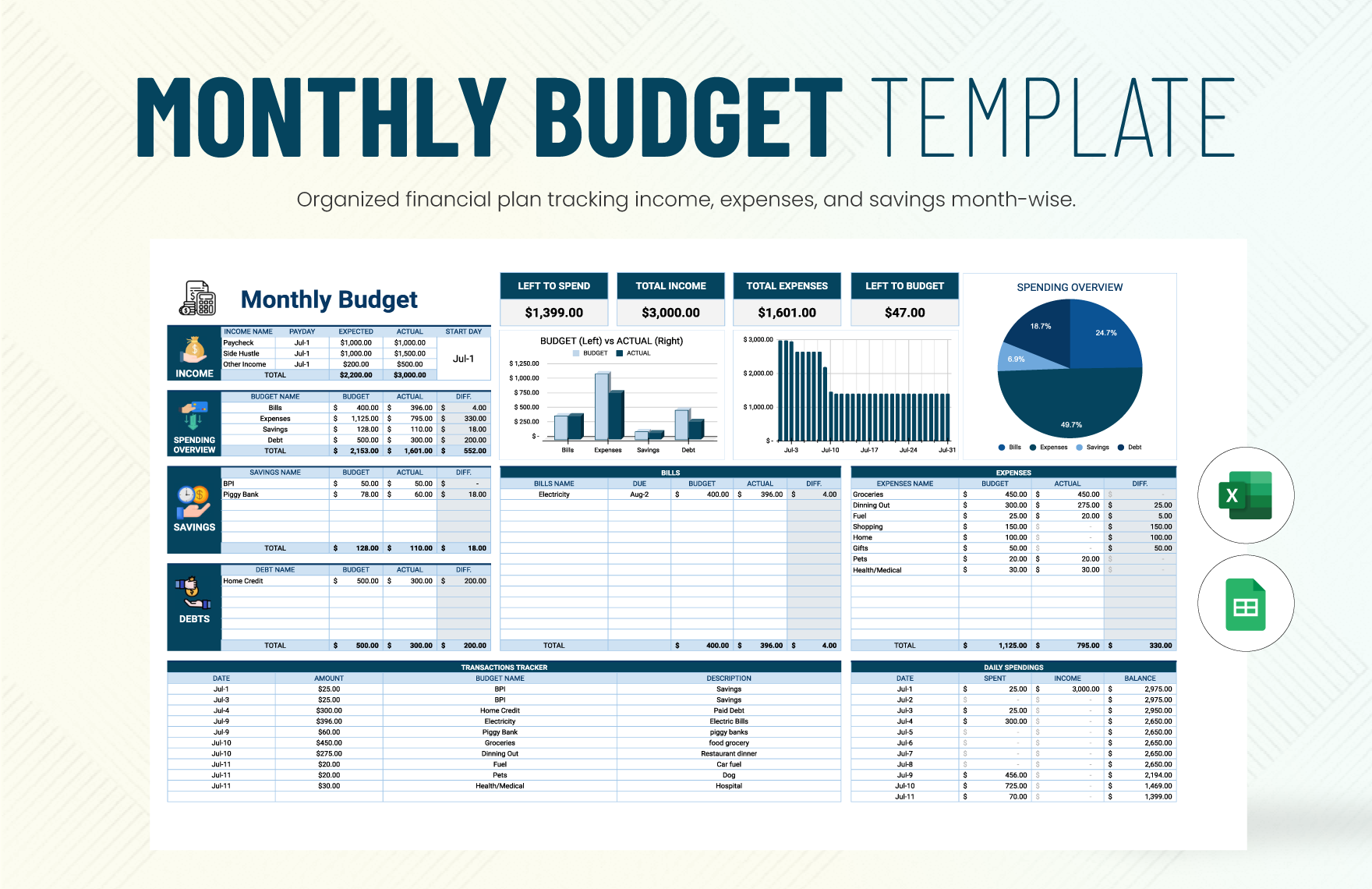

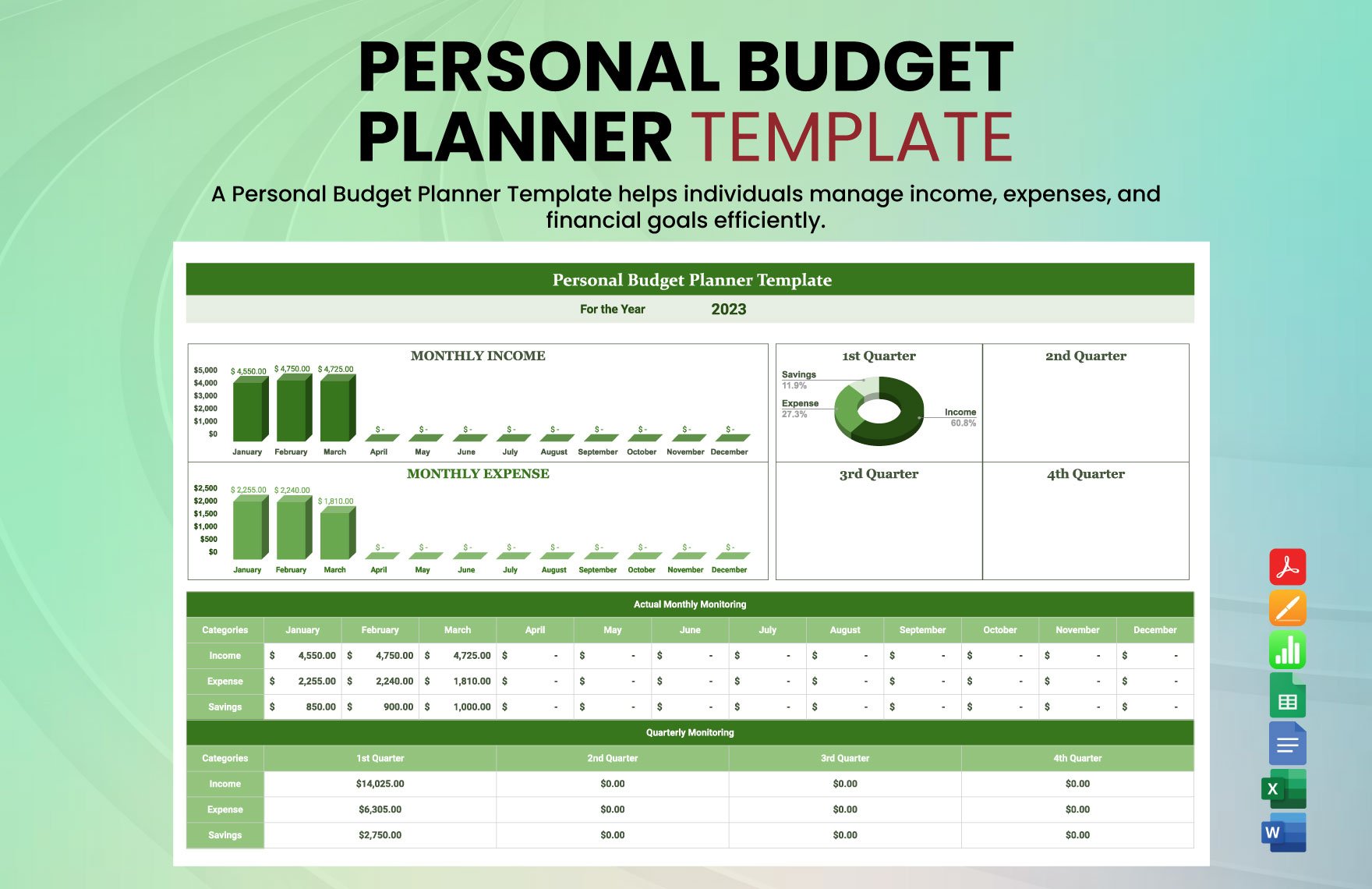

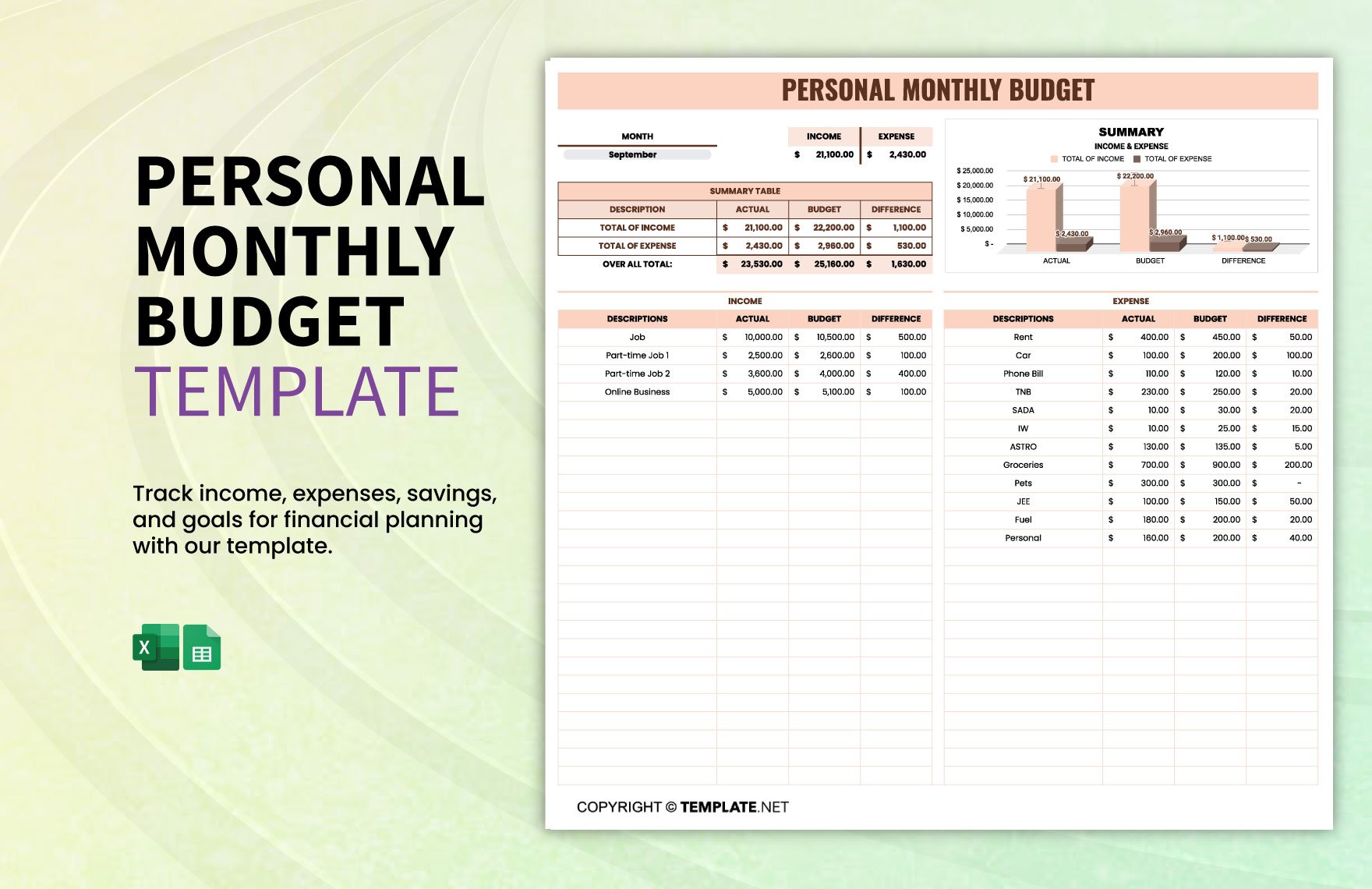

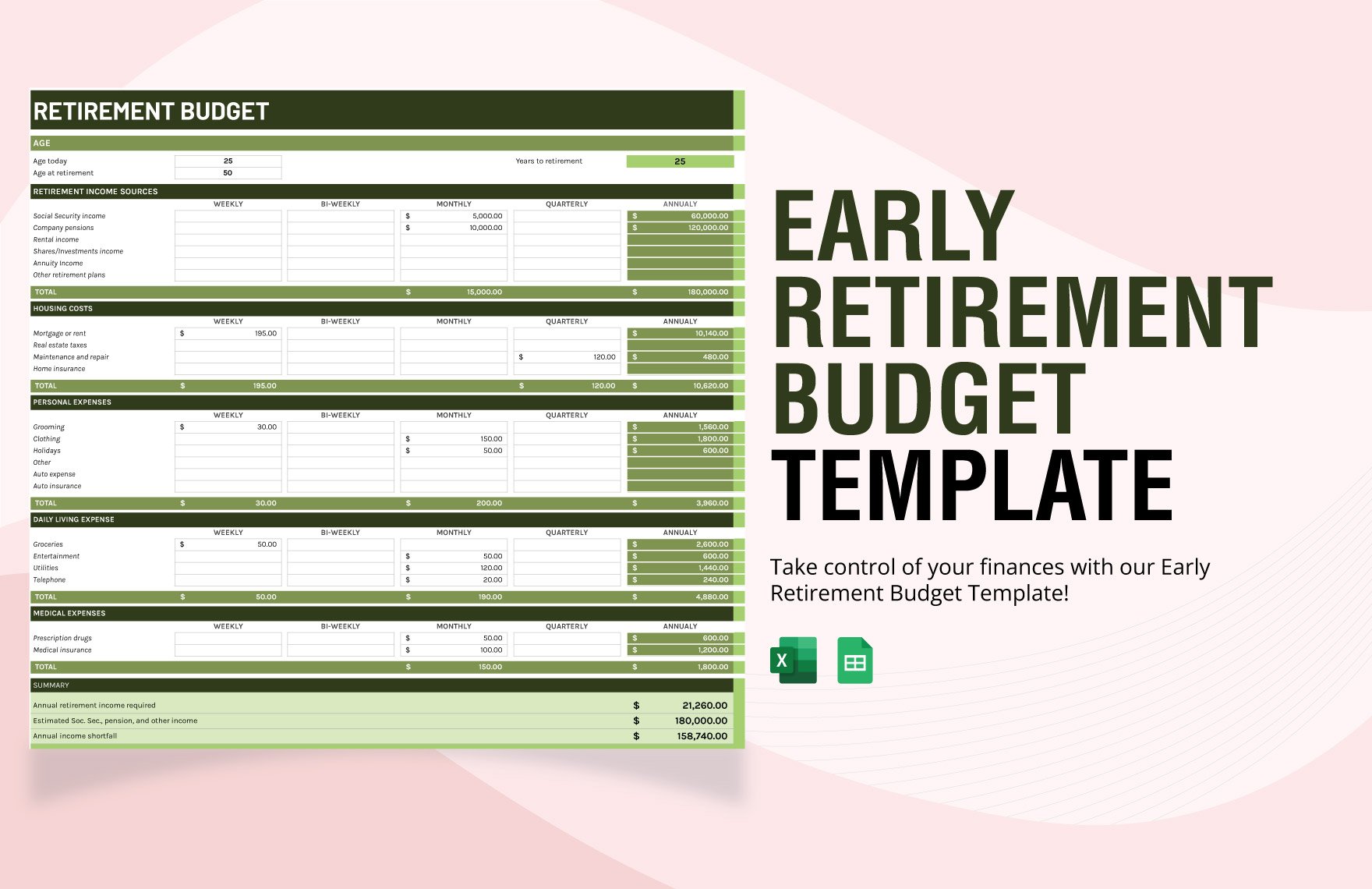

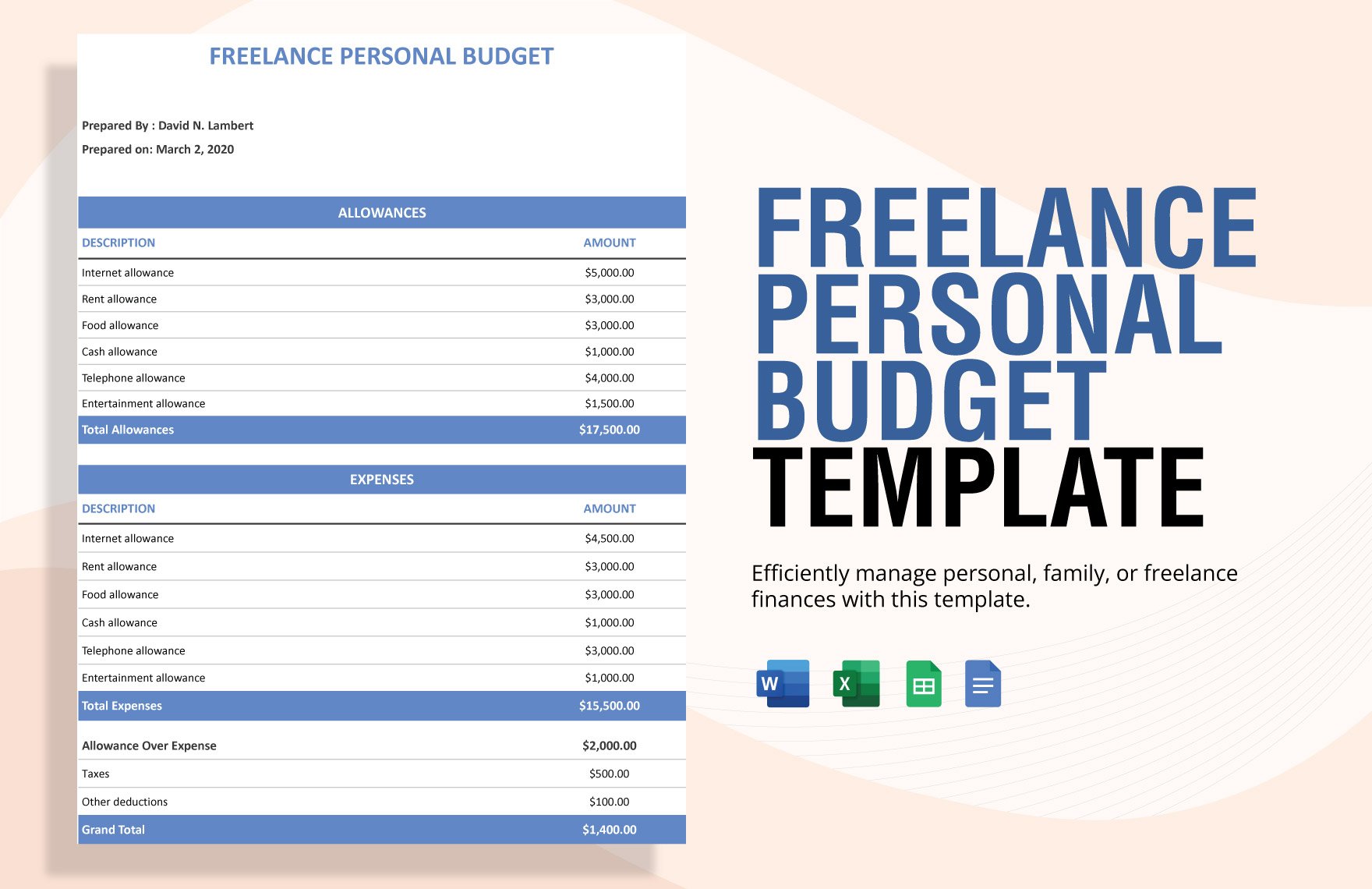

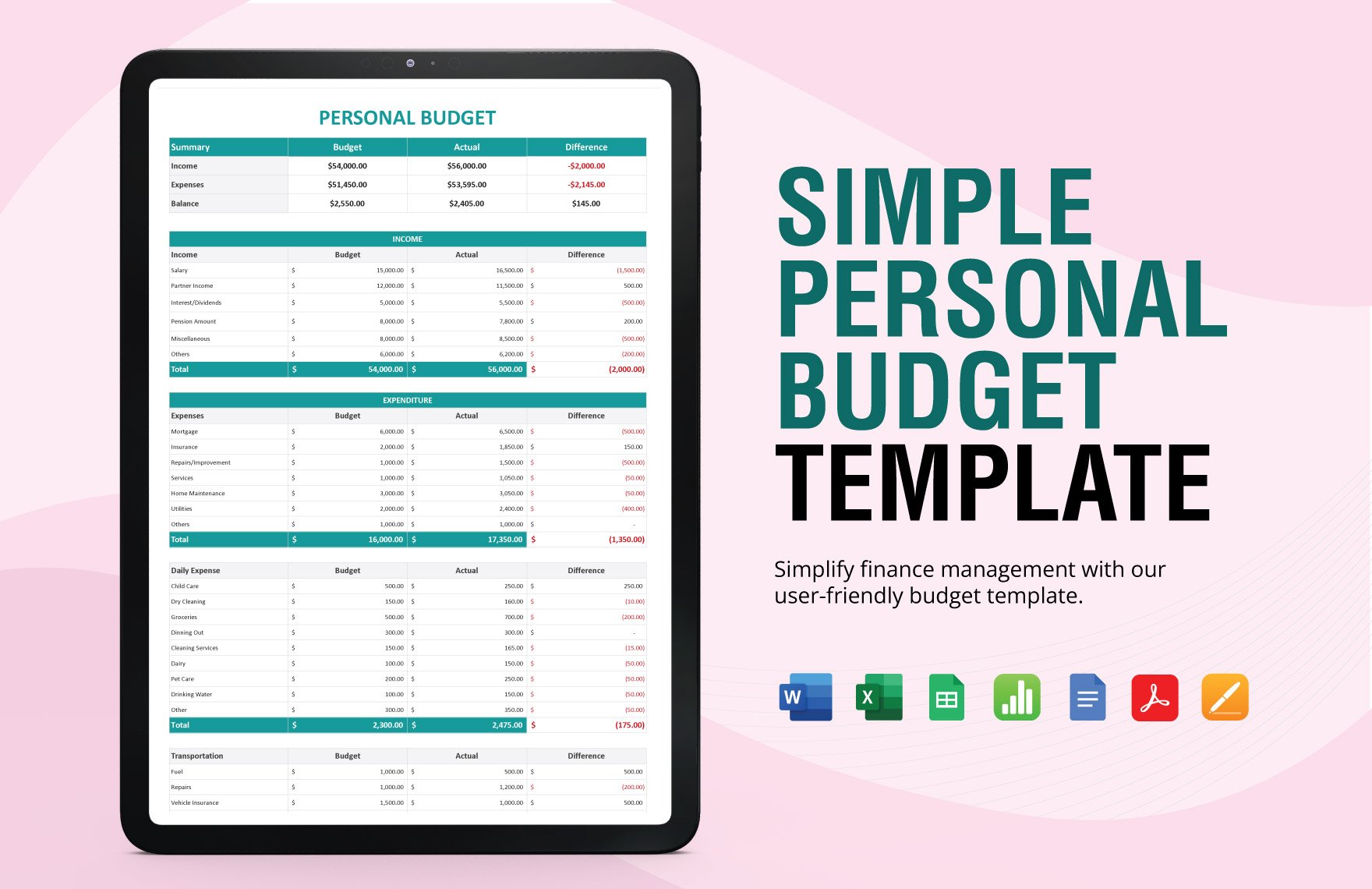

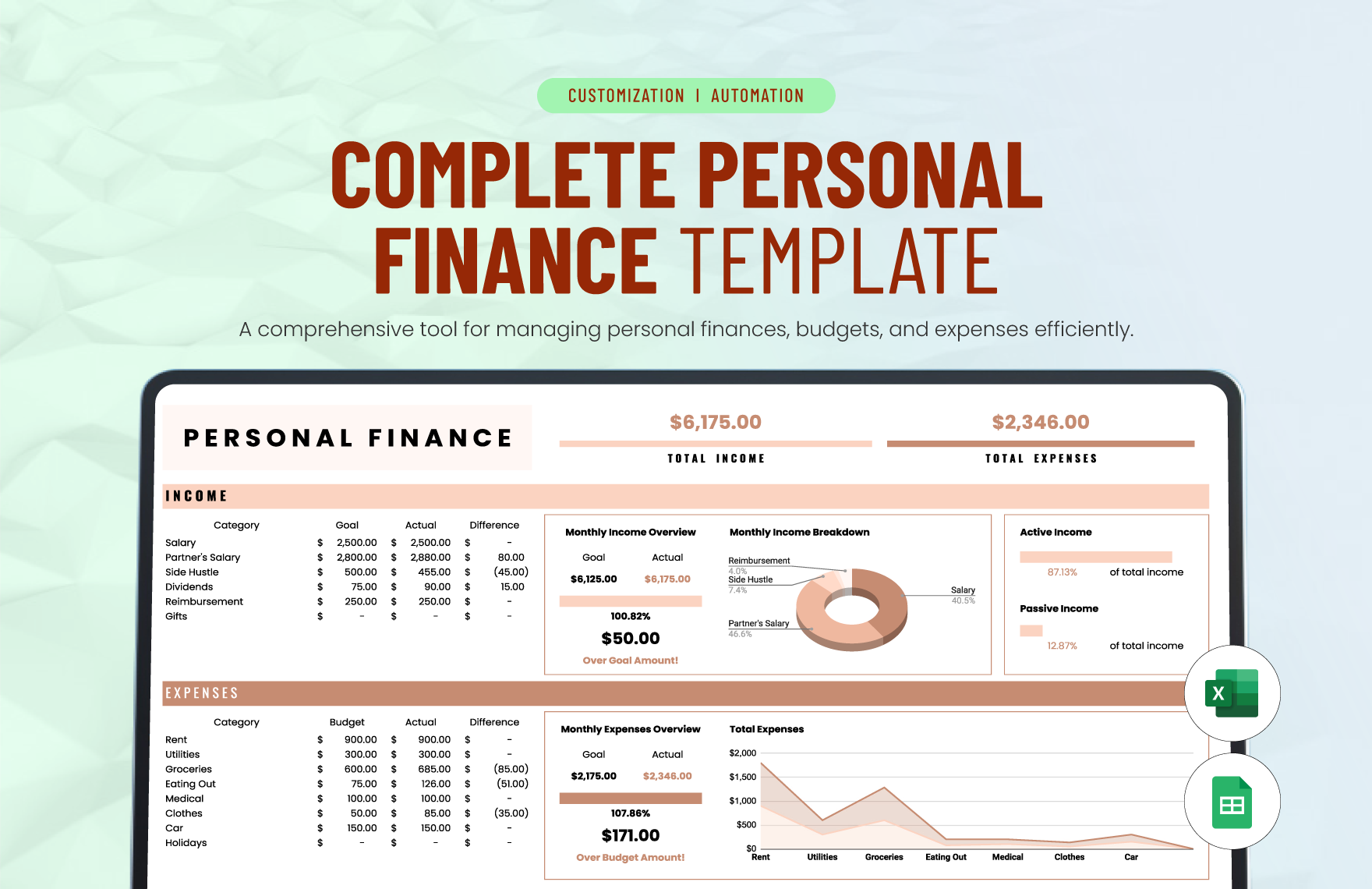

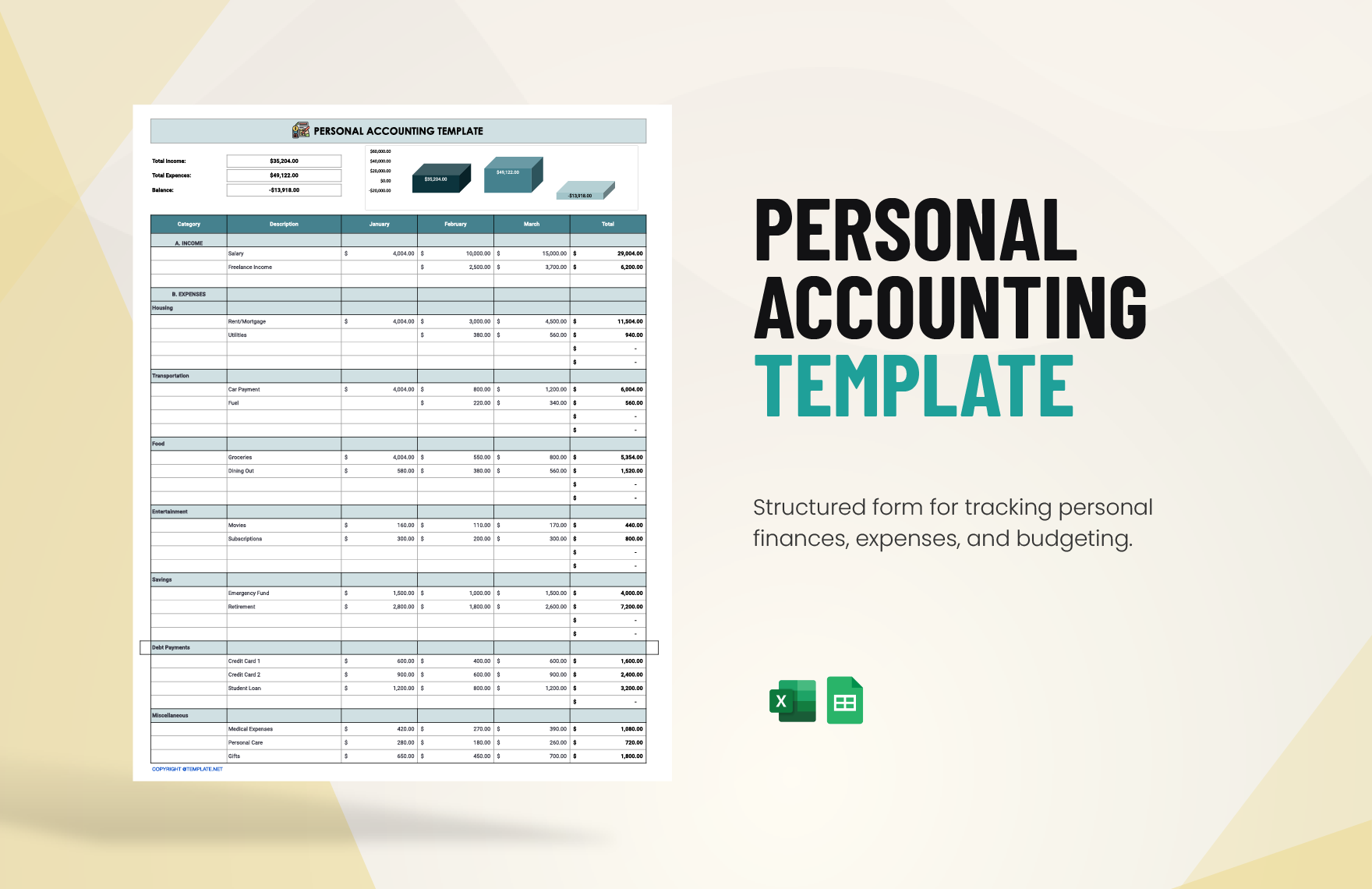

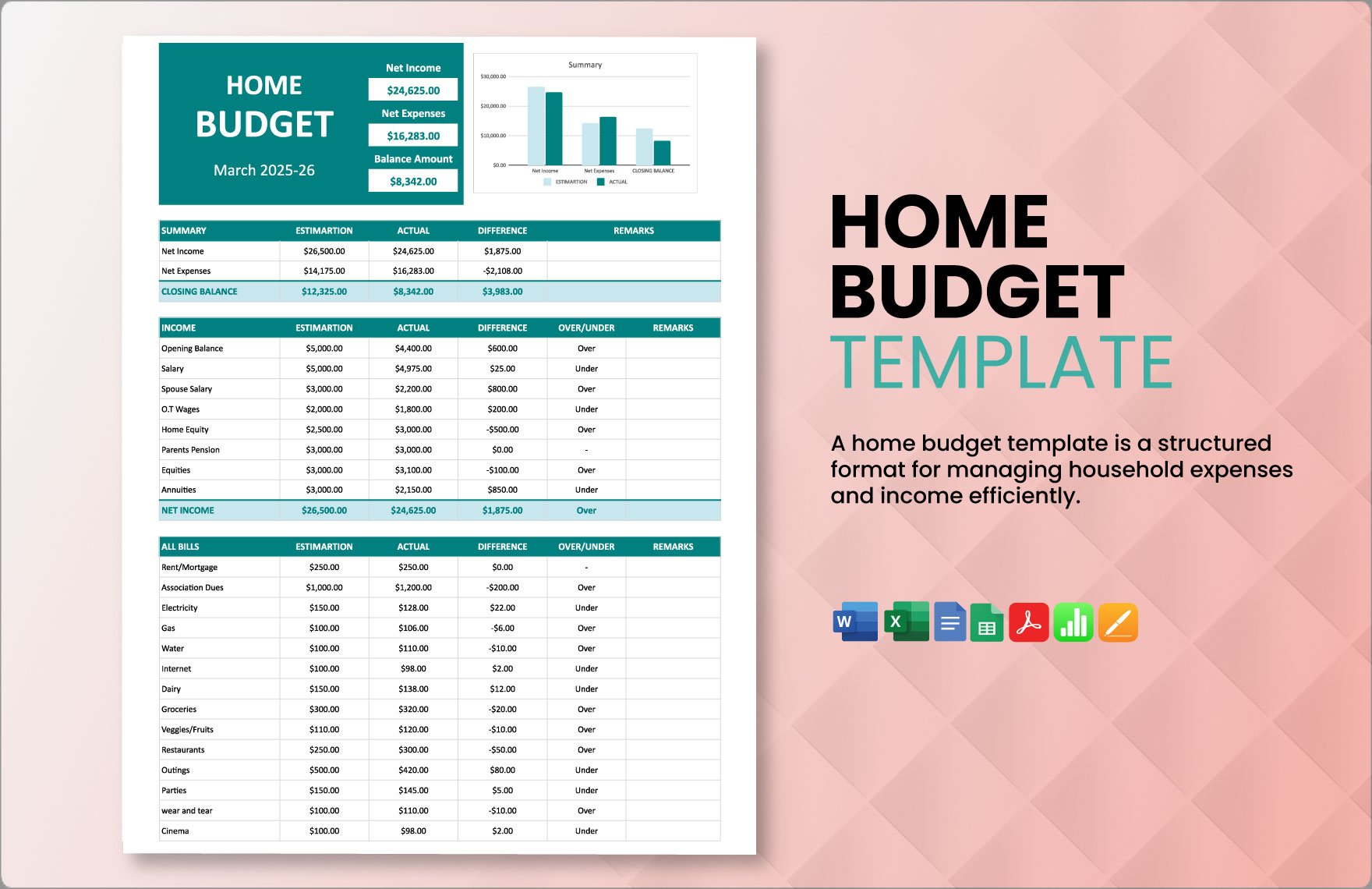

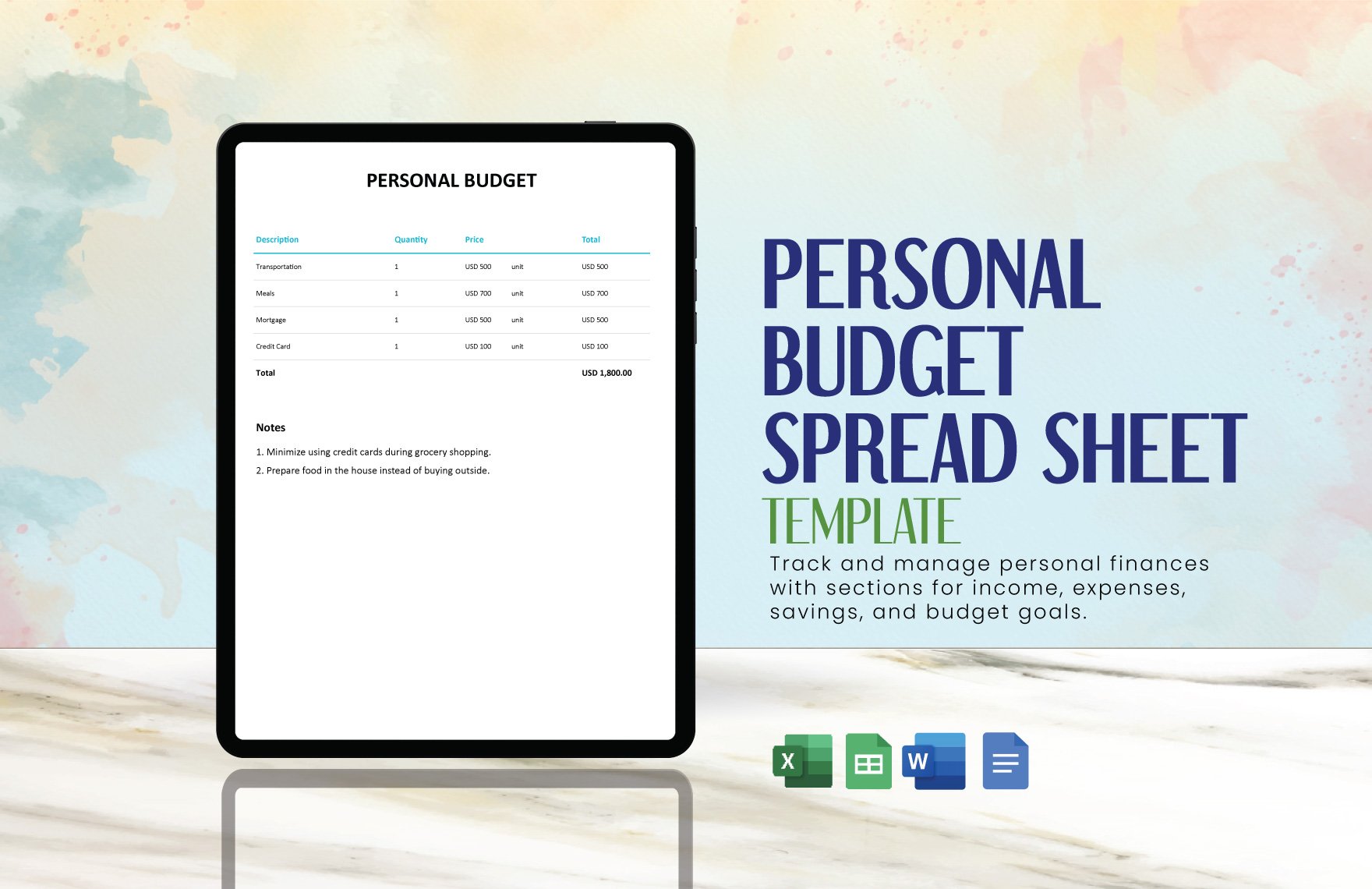

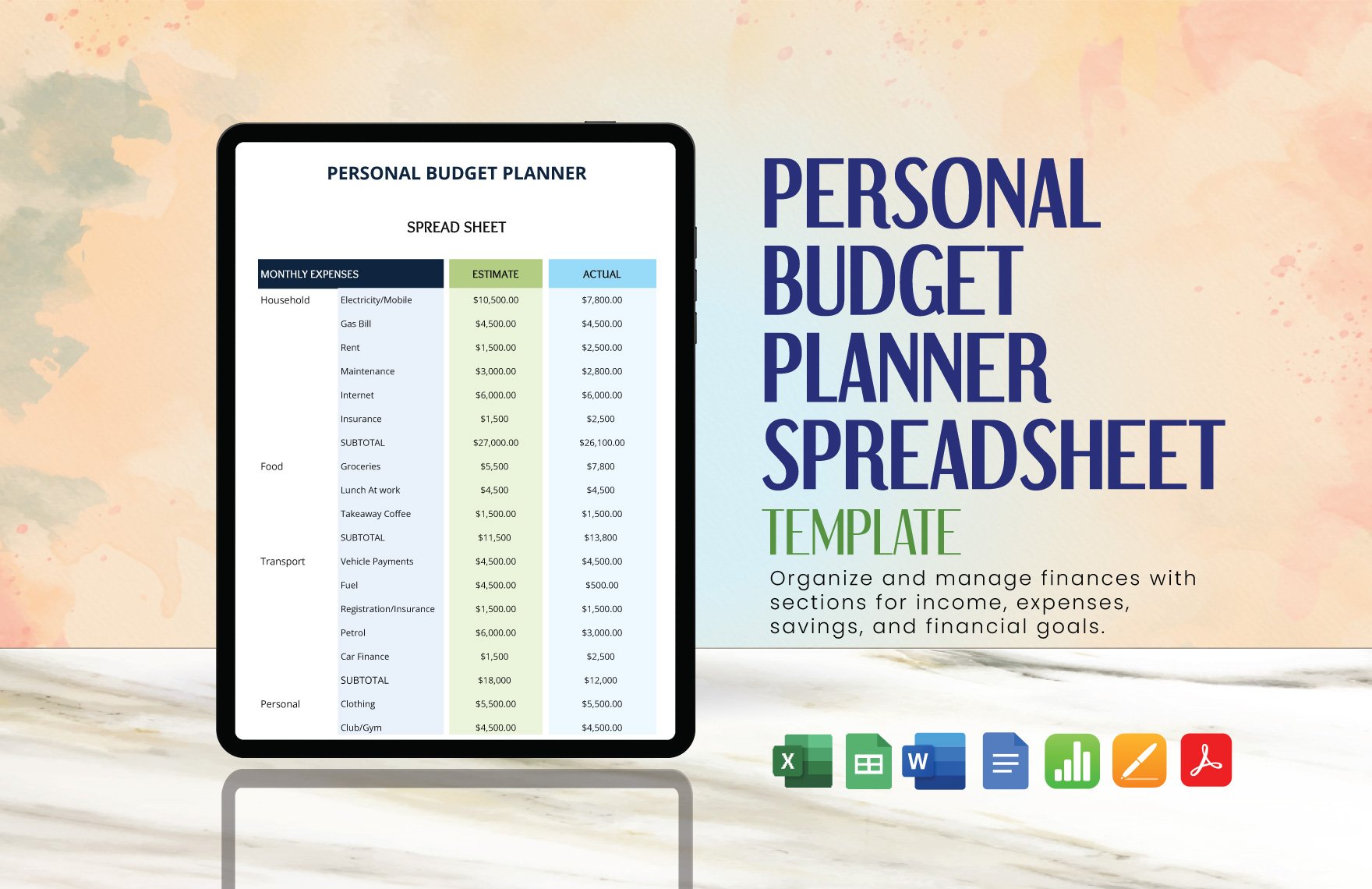

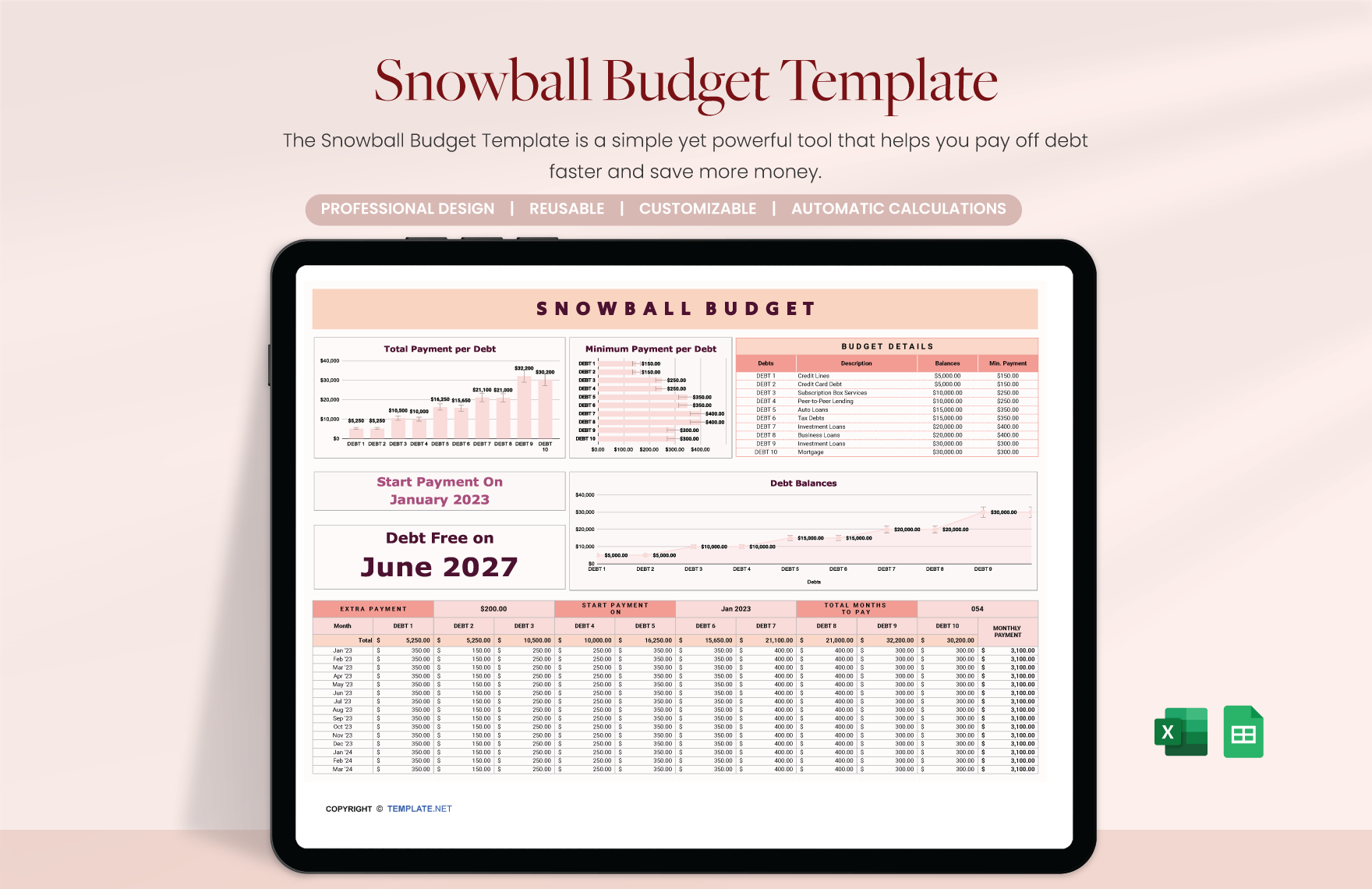

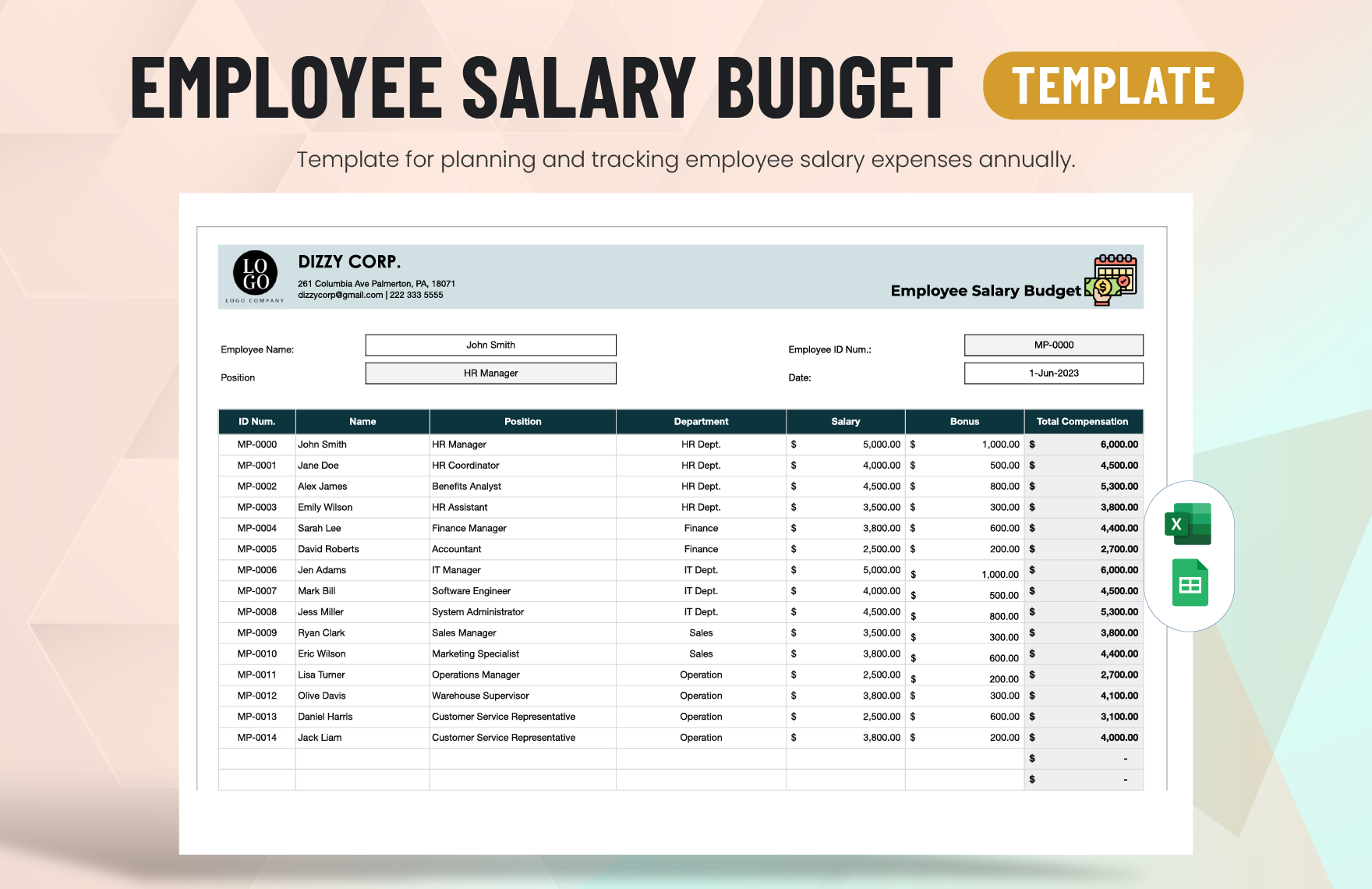

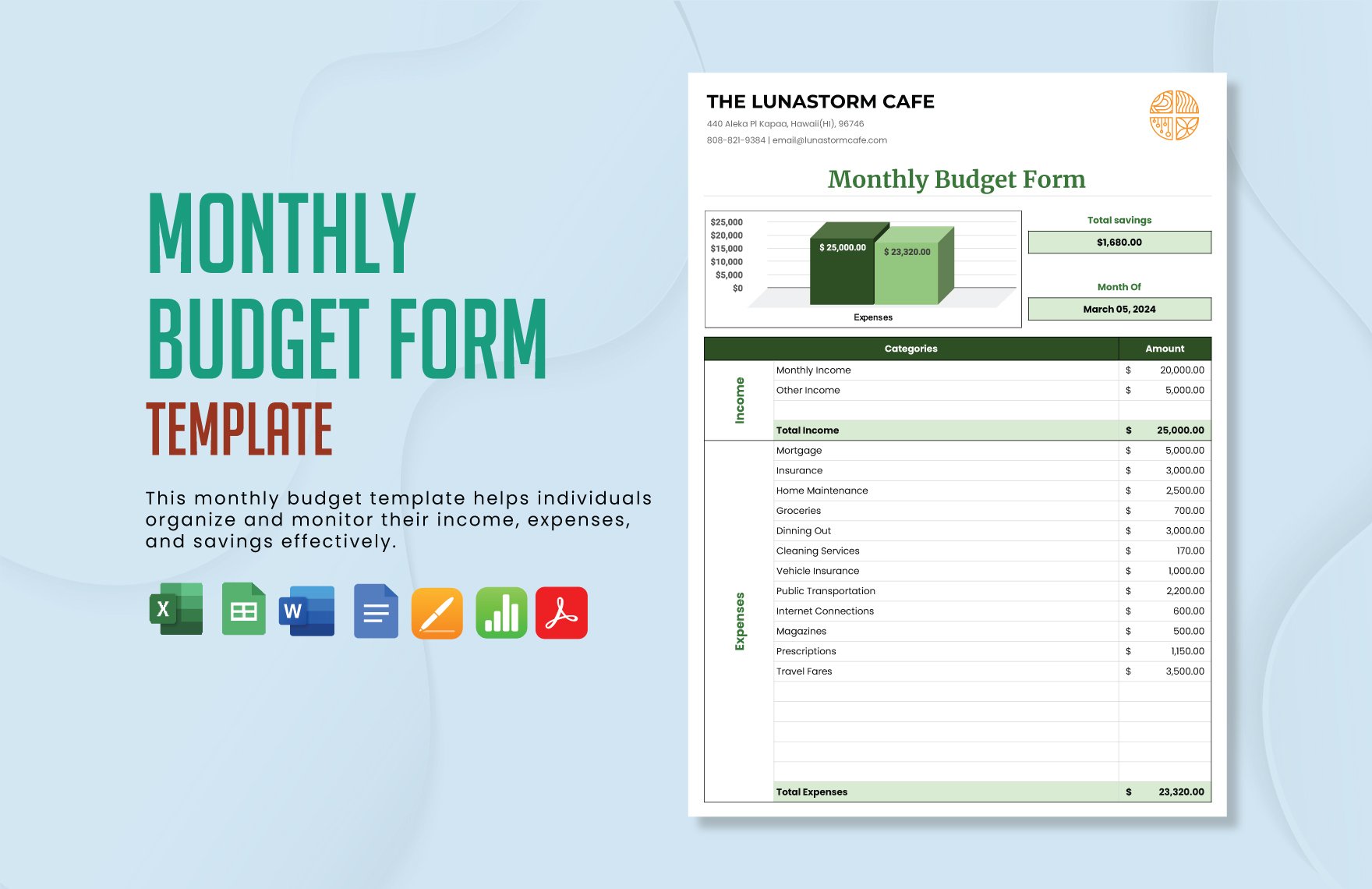

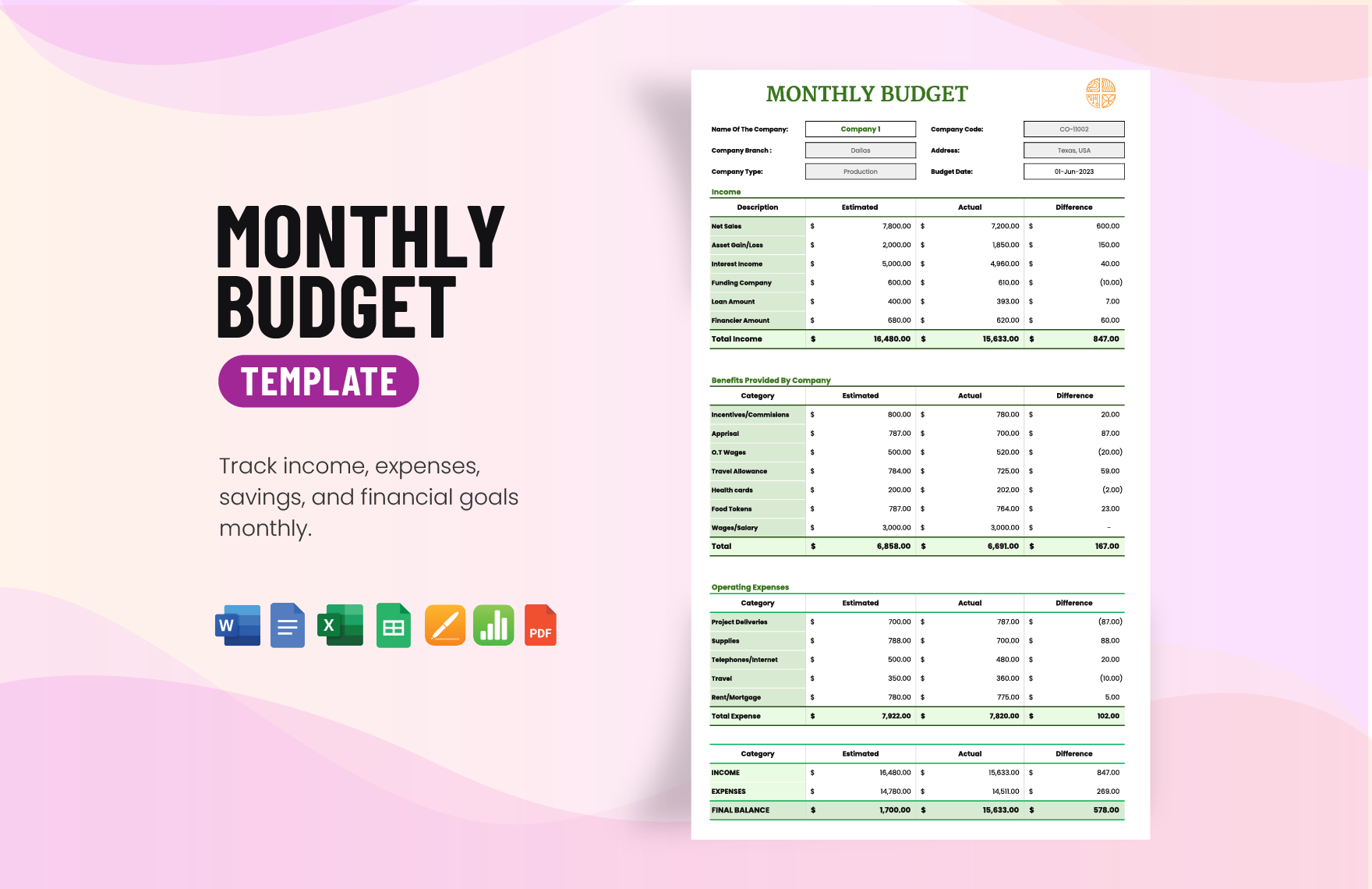

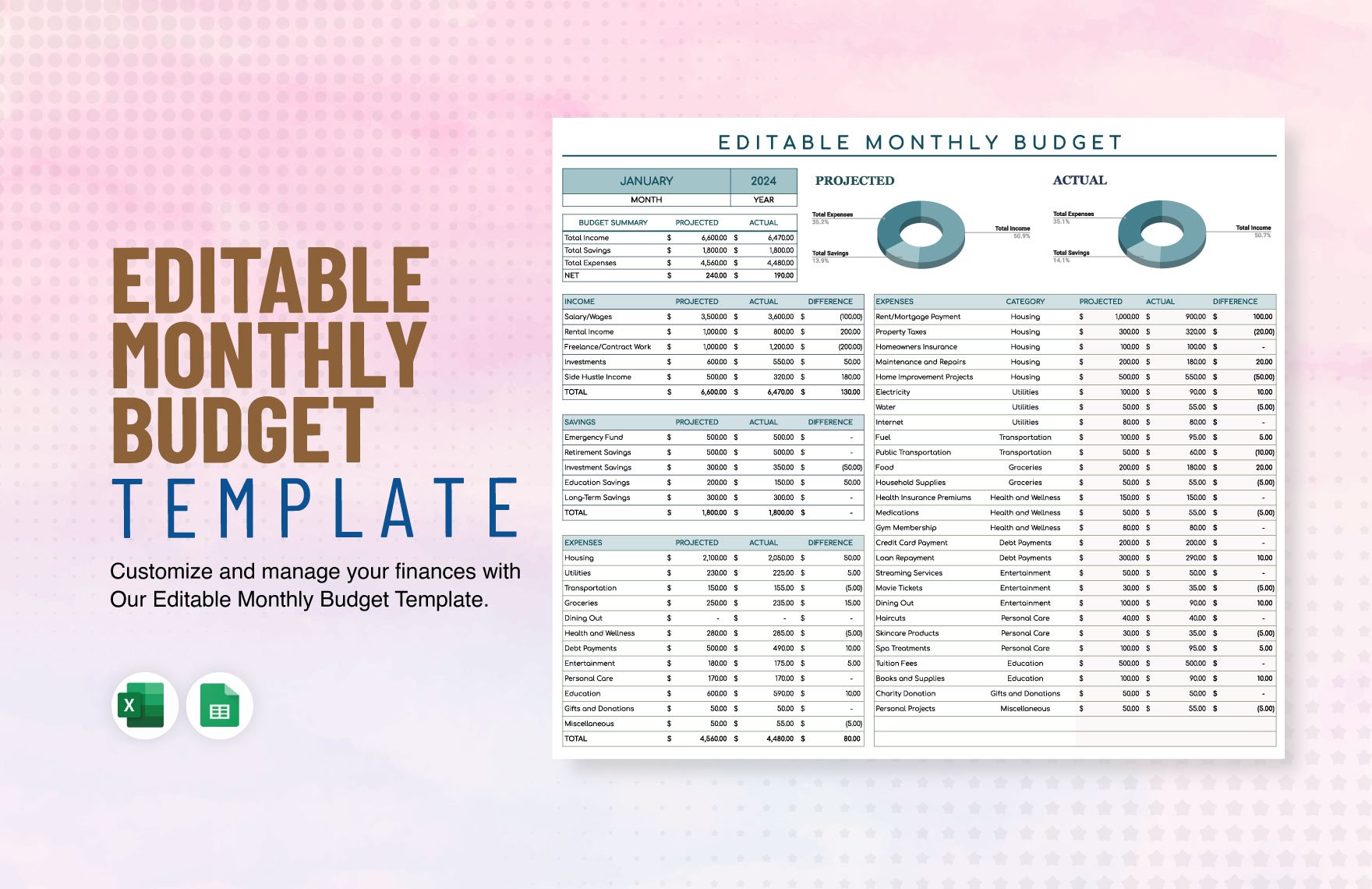

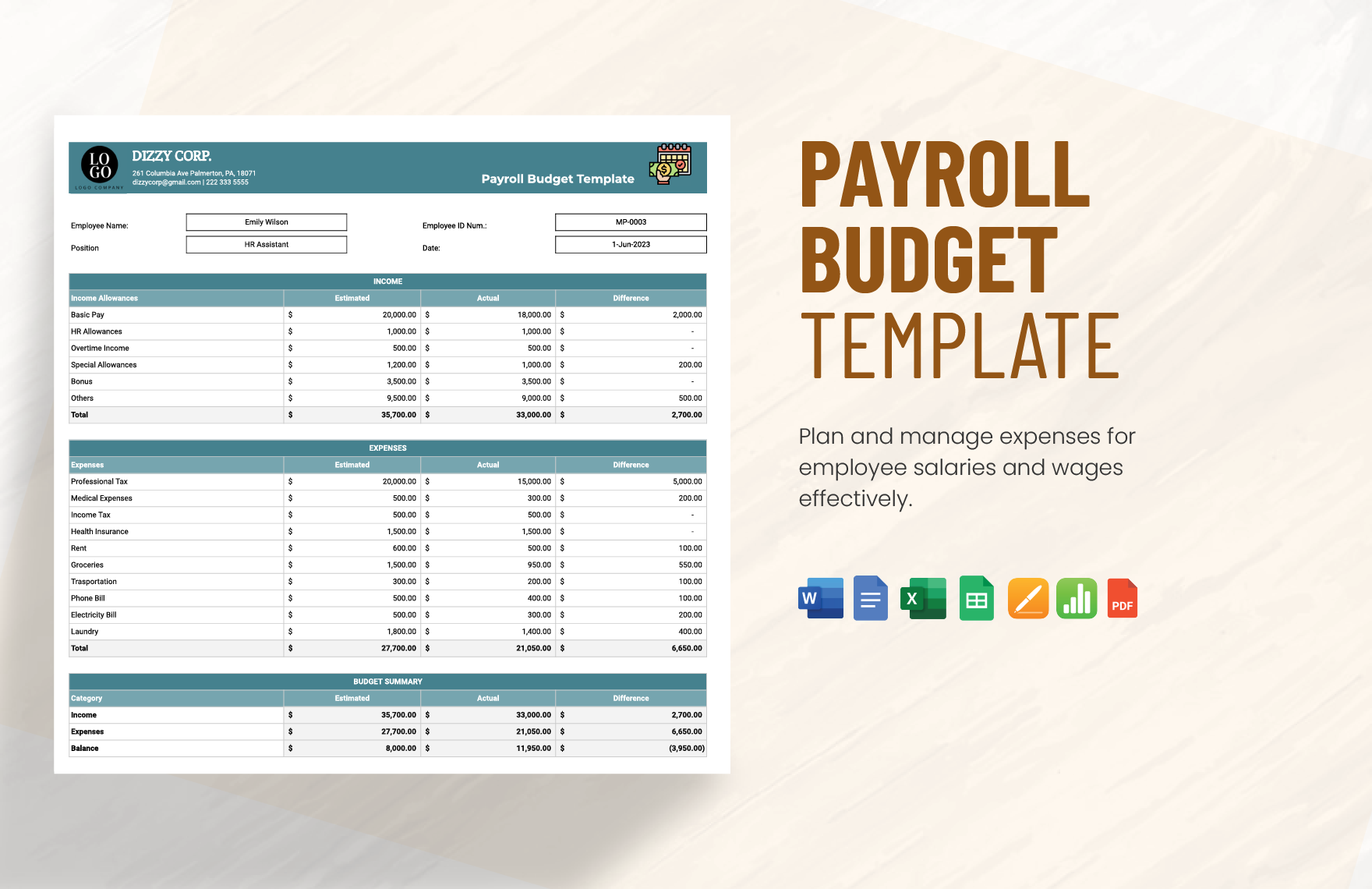

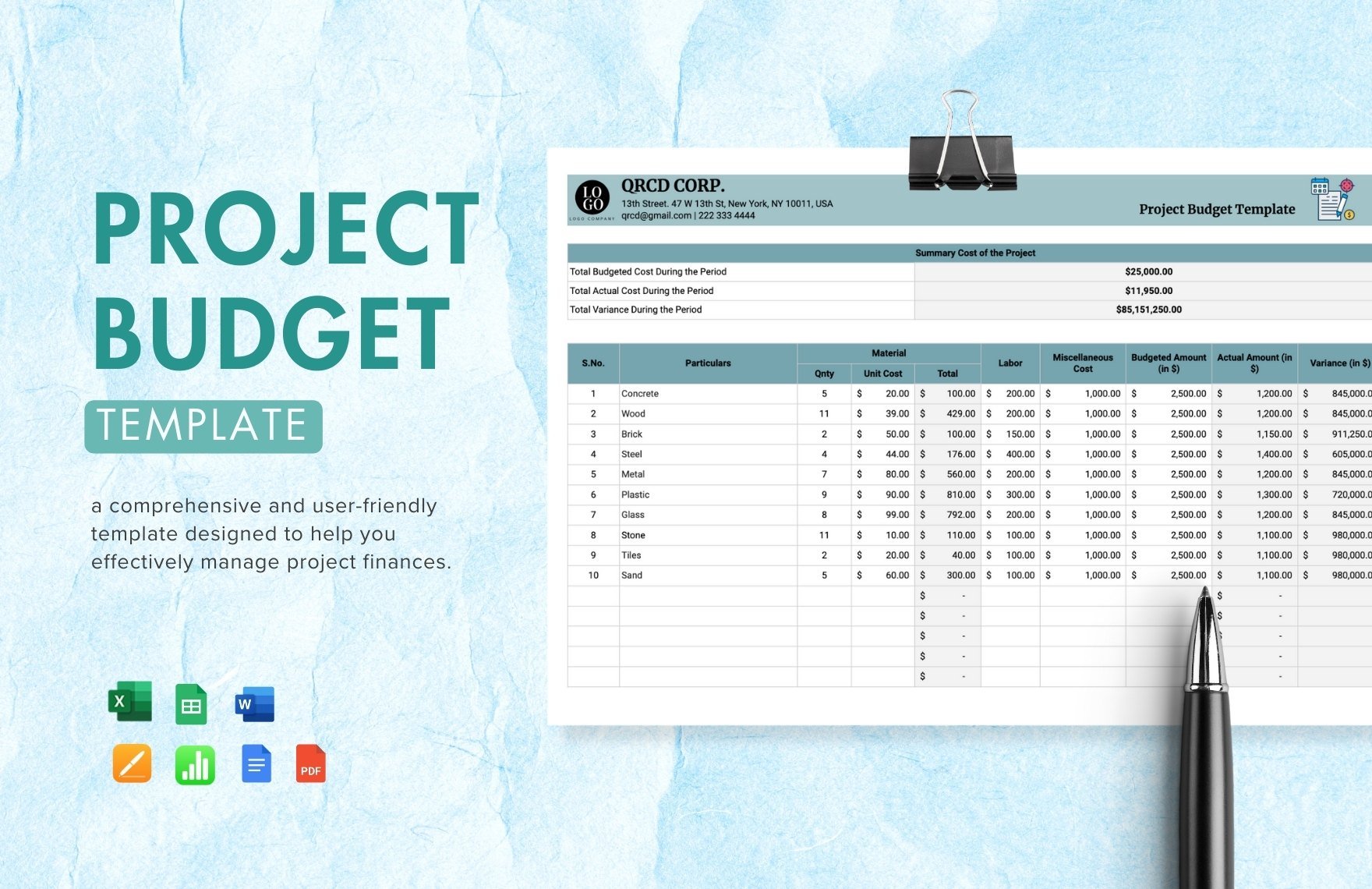

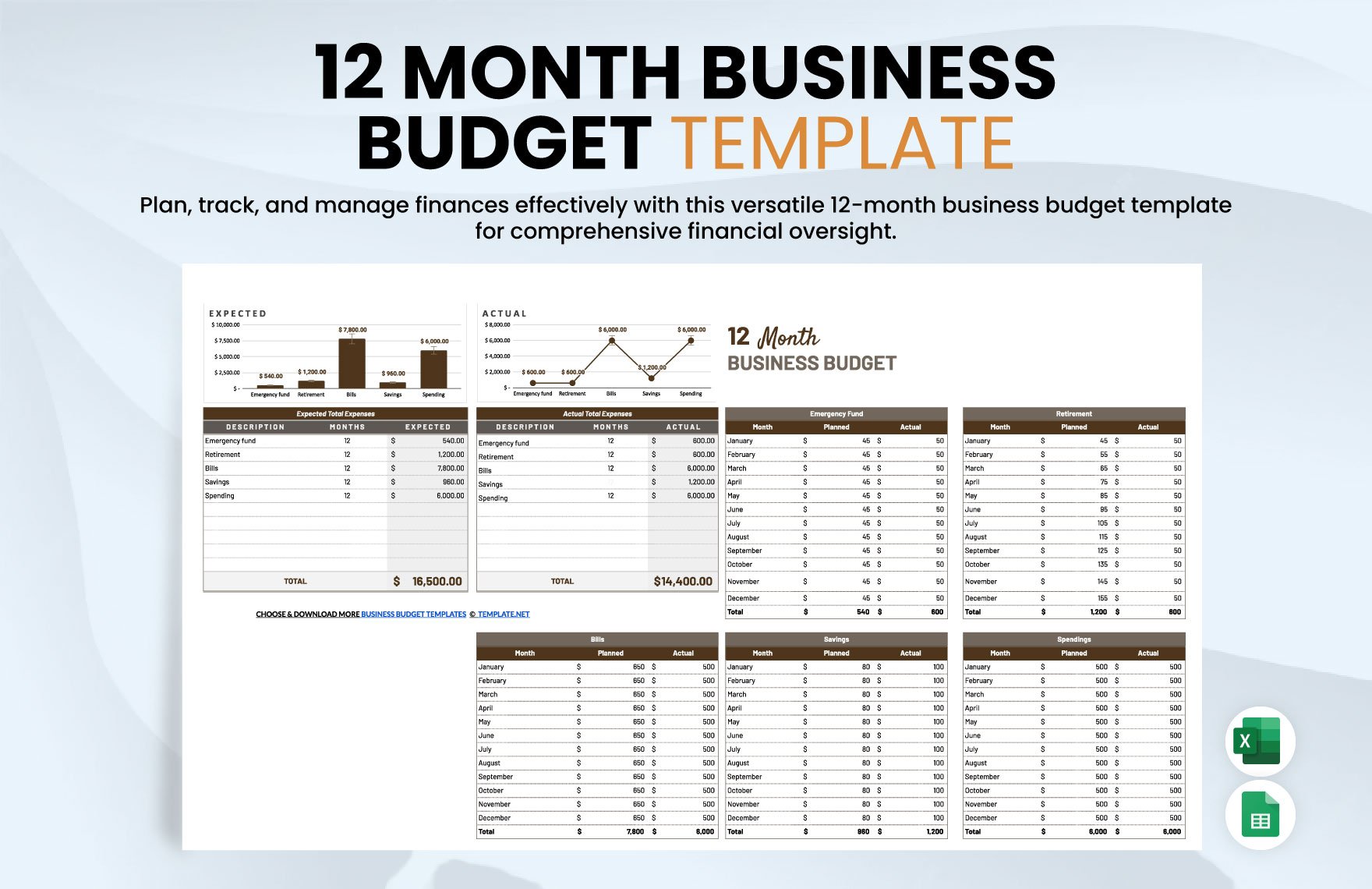

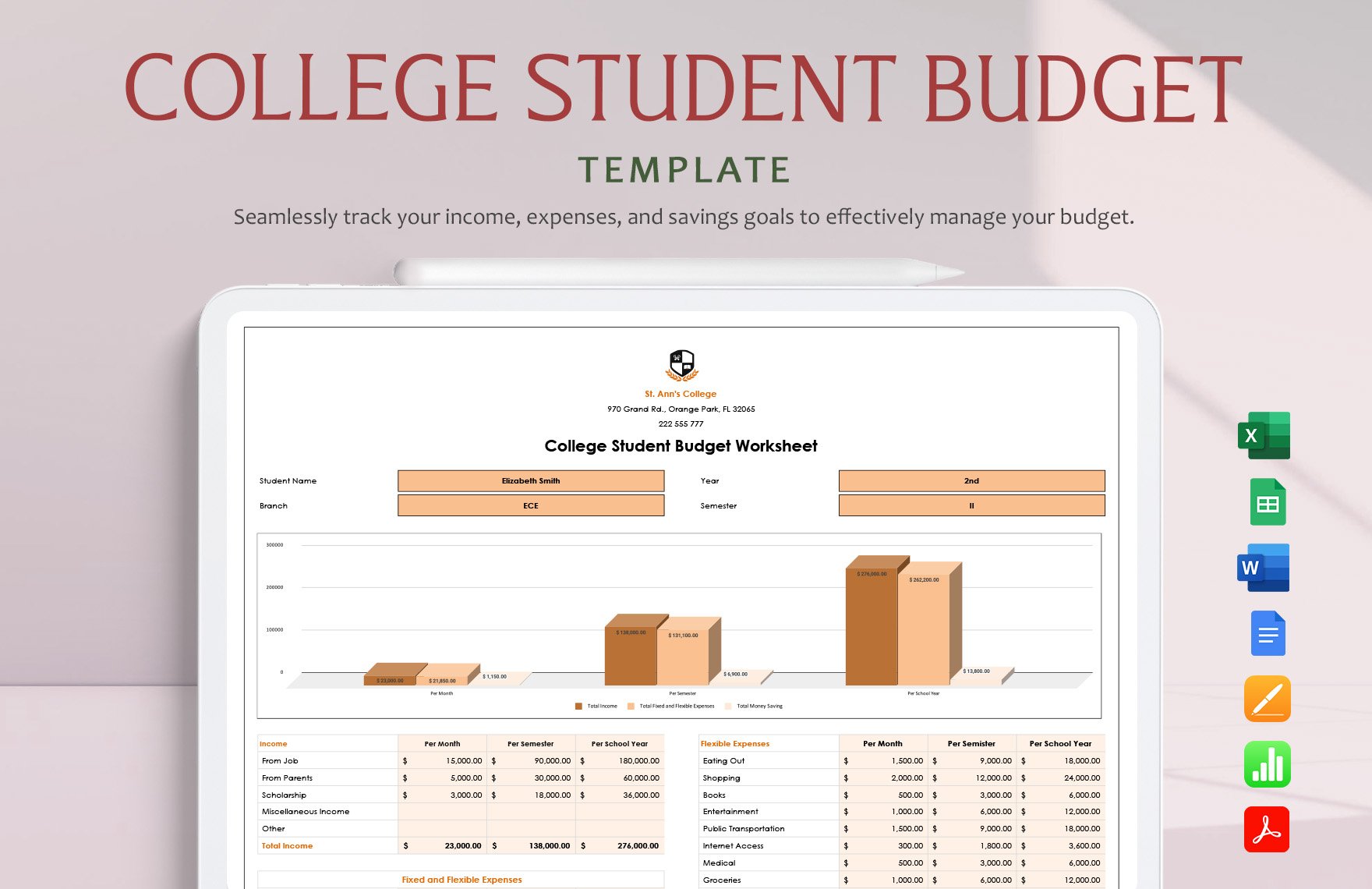

Take control of your finances with free pre-designed Personal Budget Templates in Microsoft Excel by Template.net

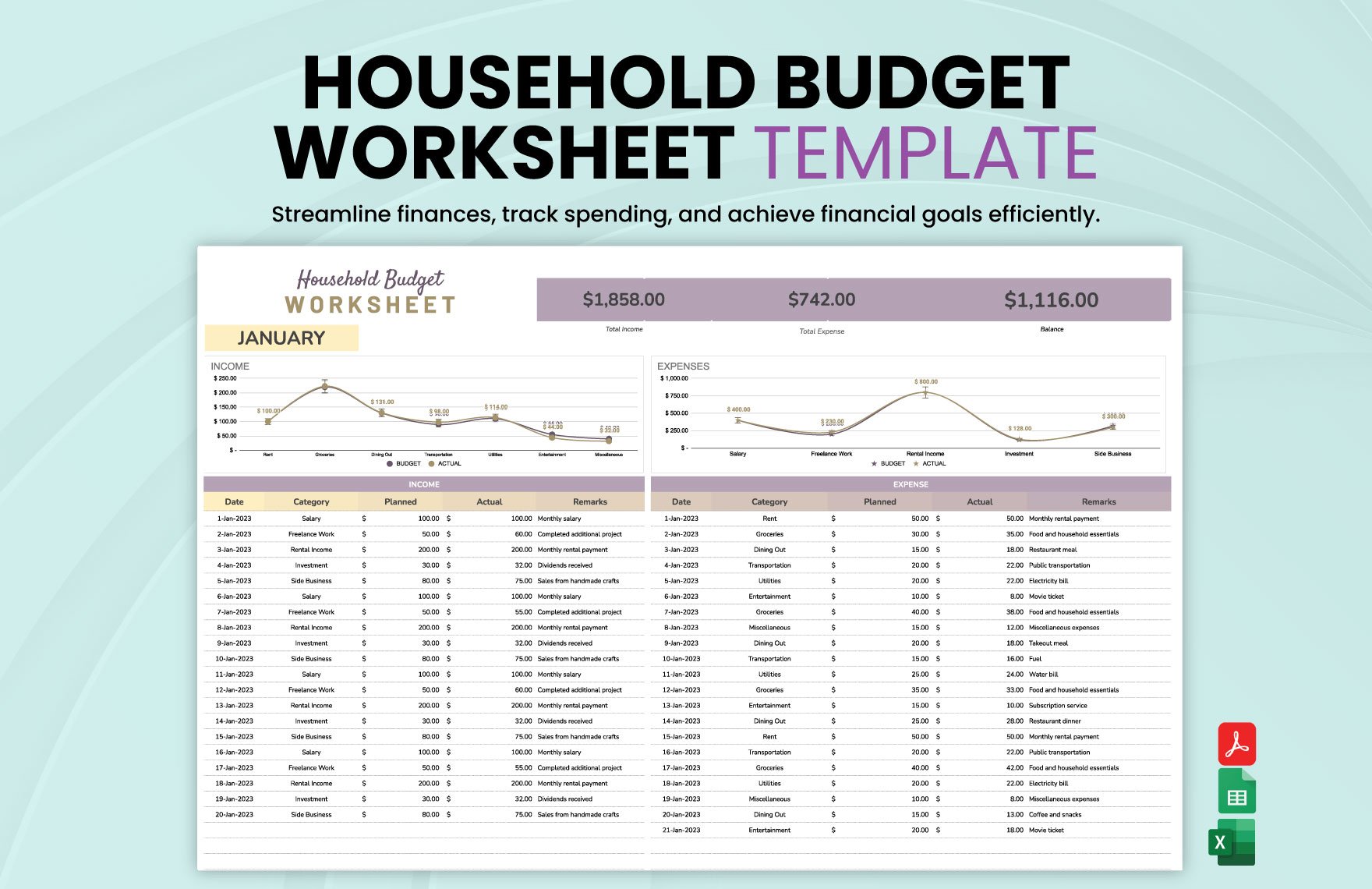

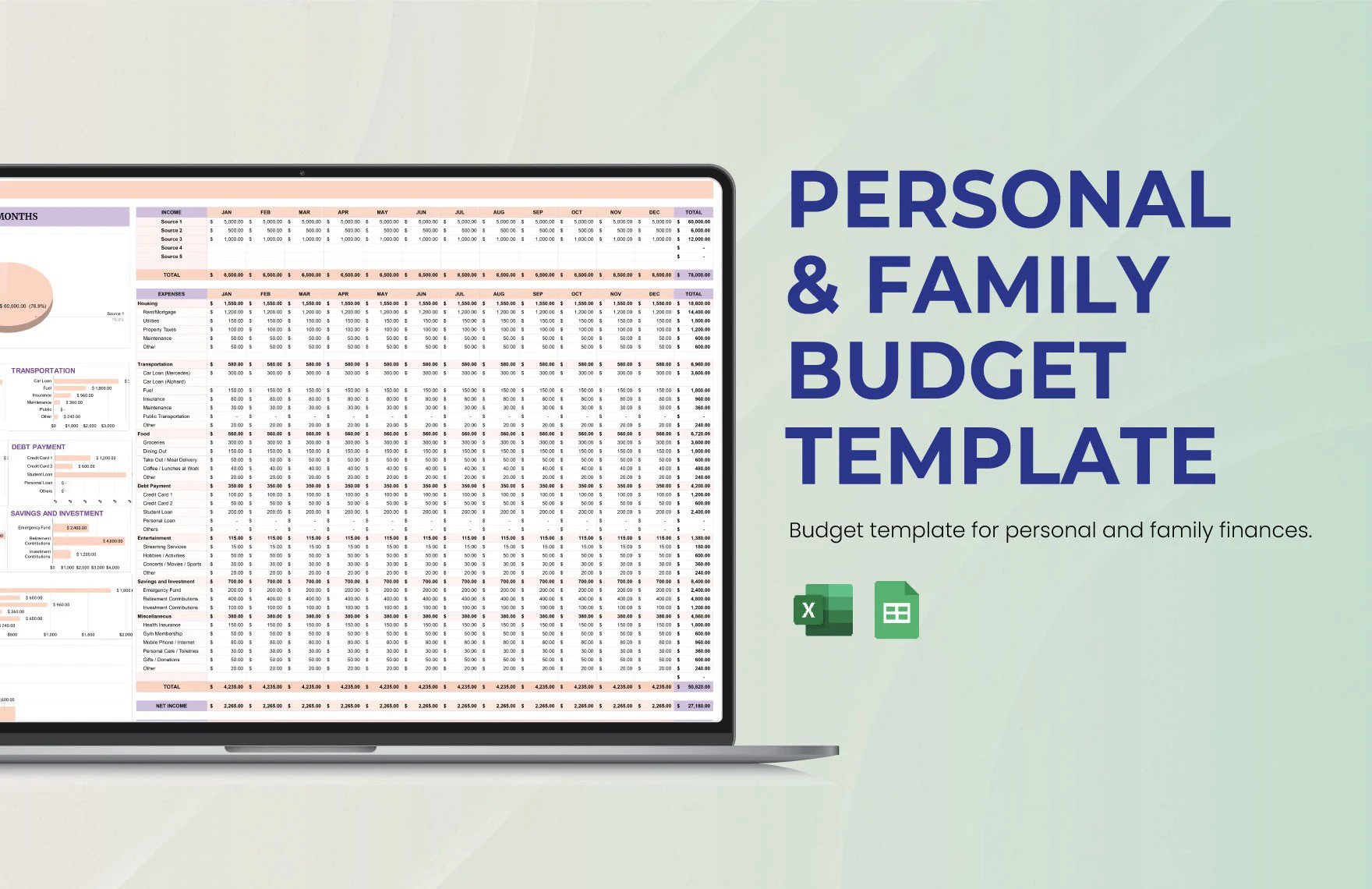

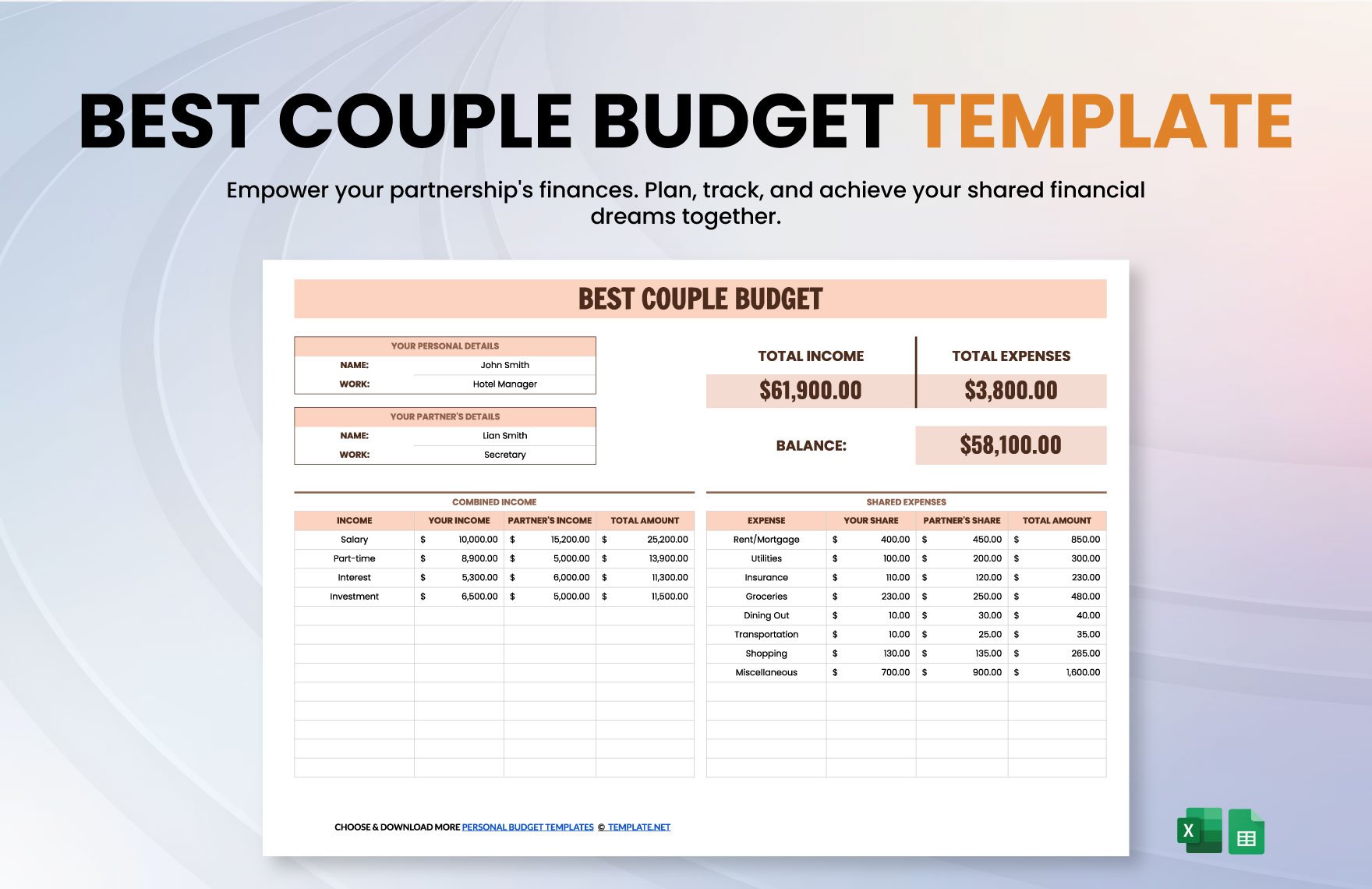

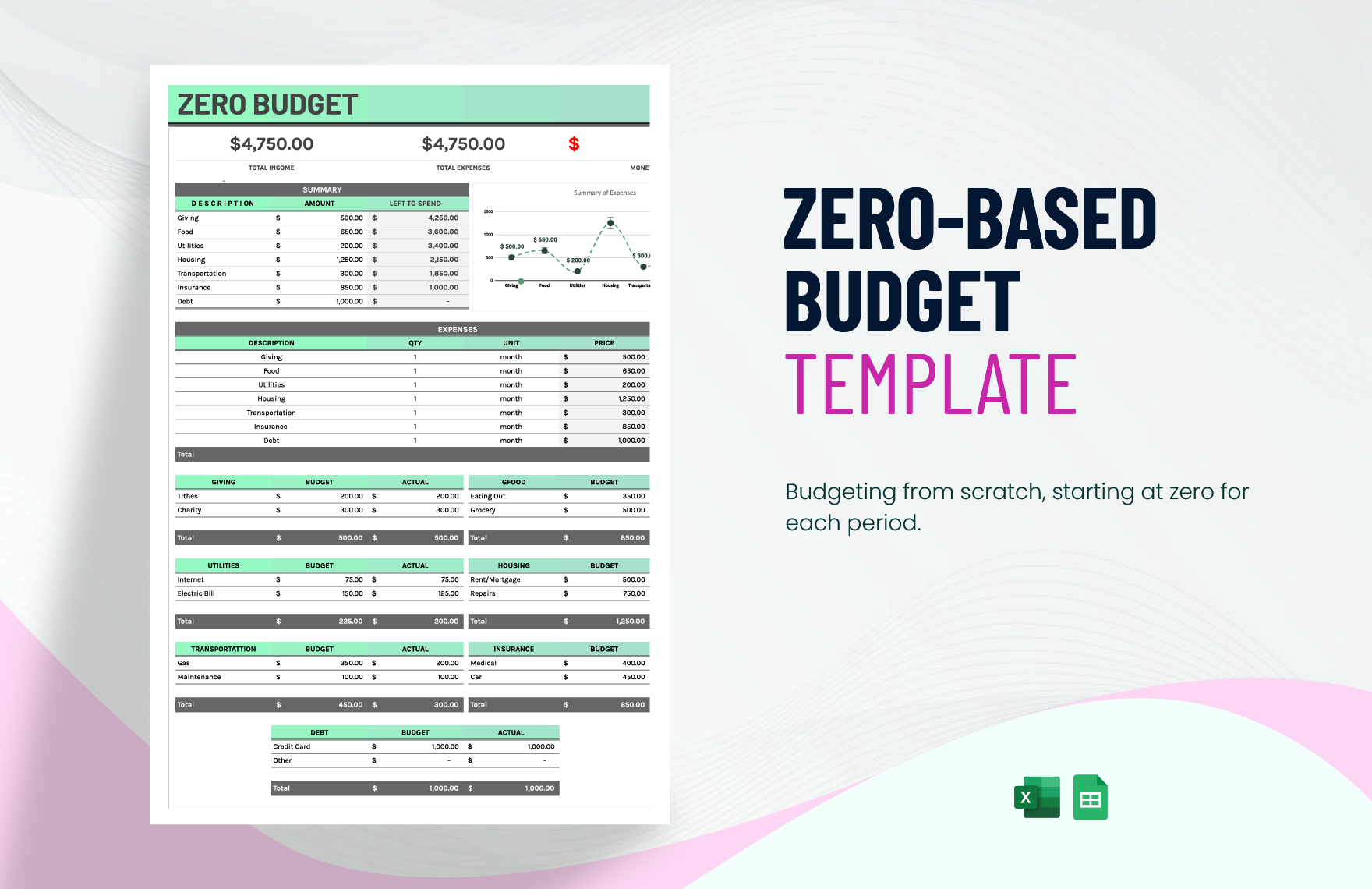

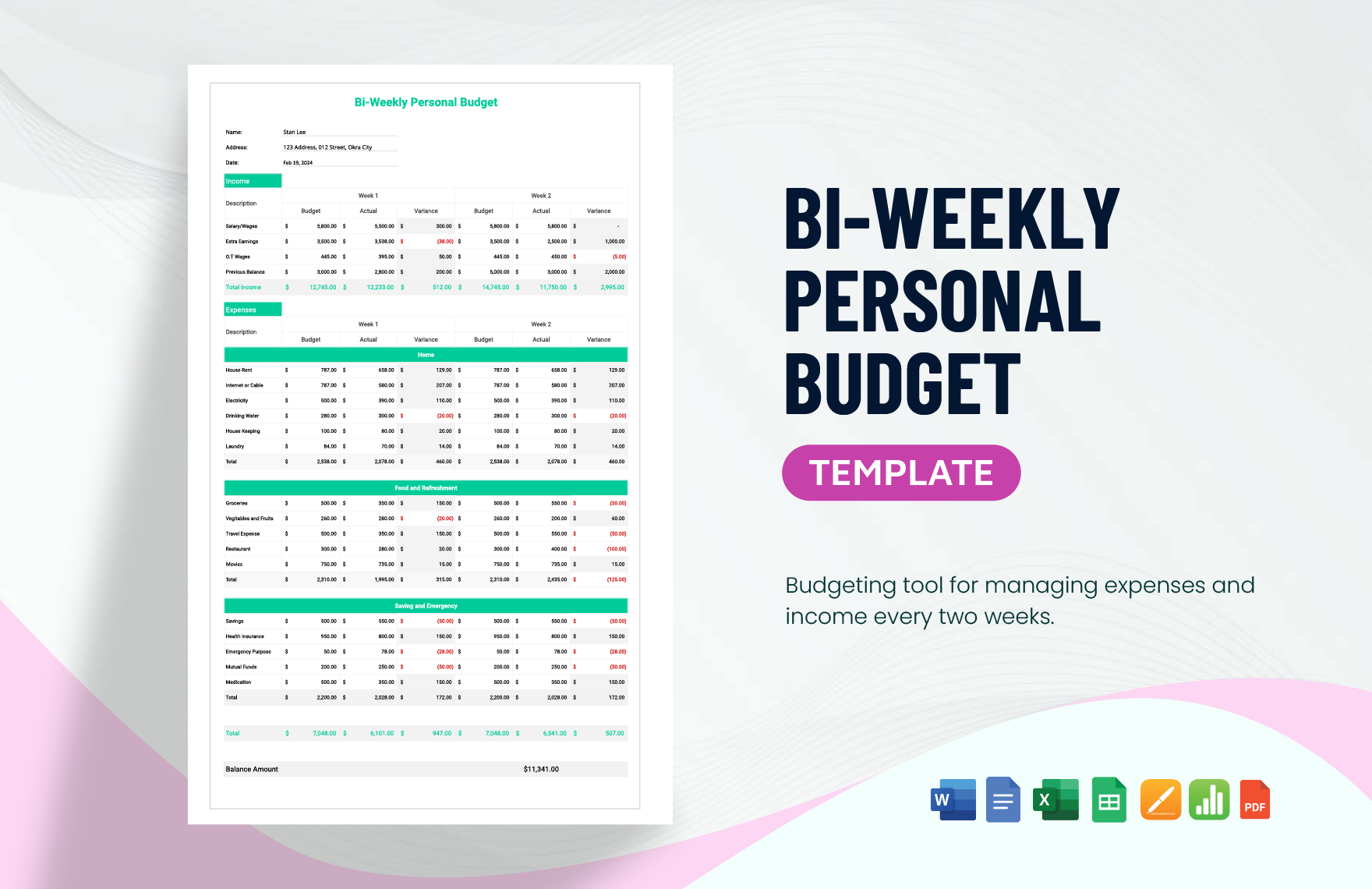

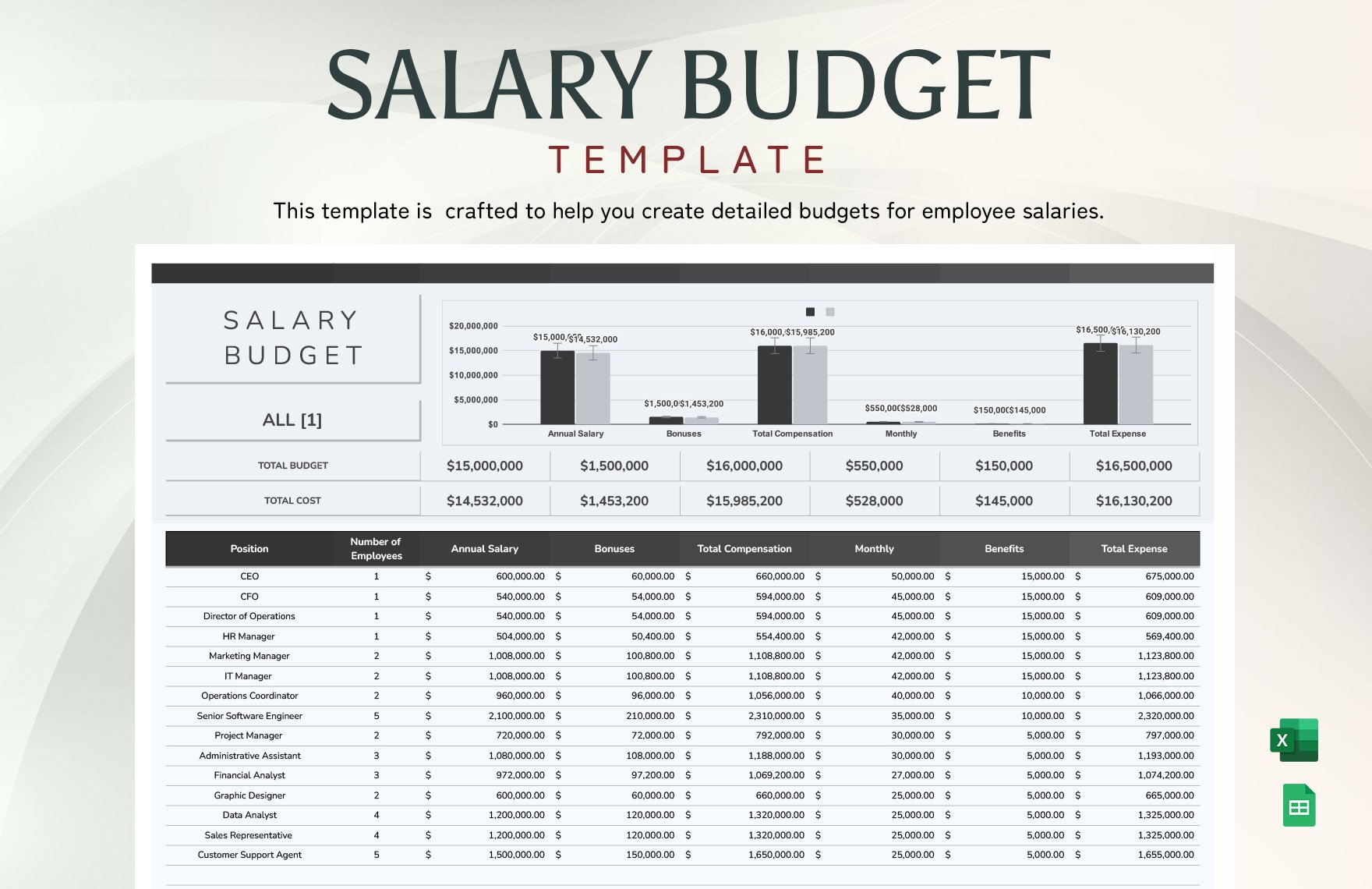

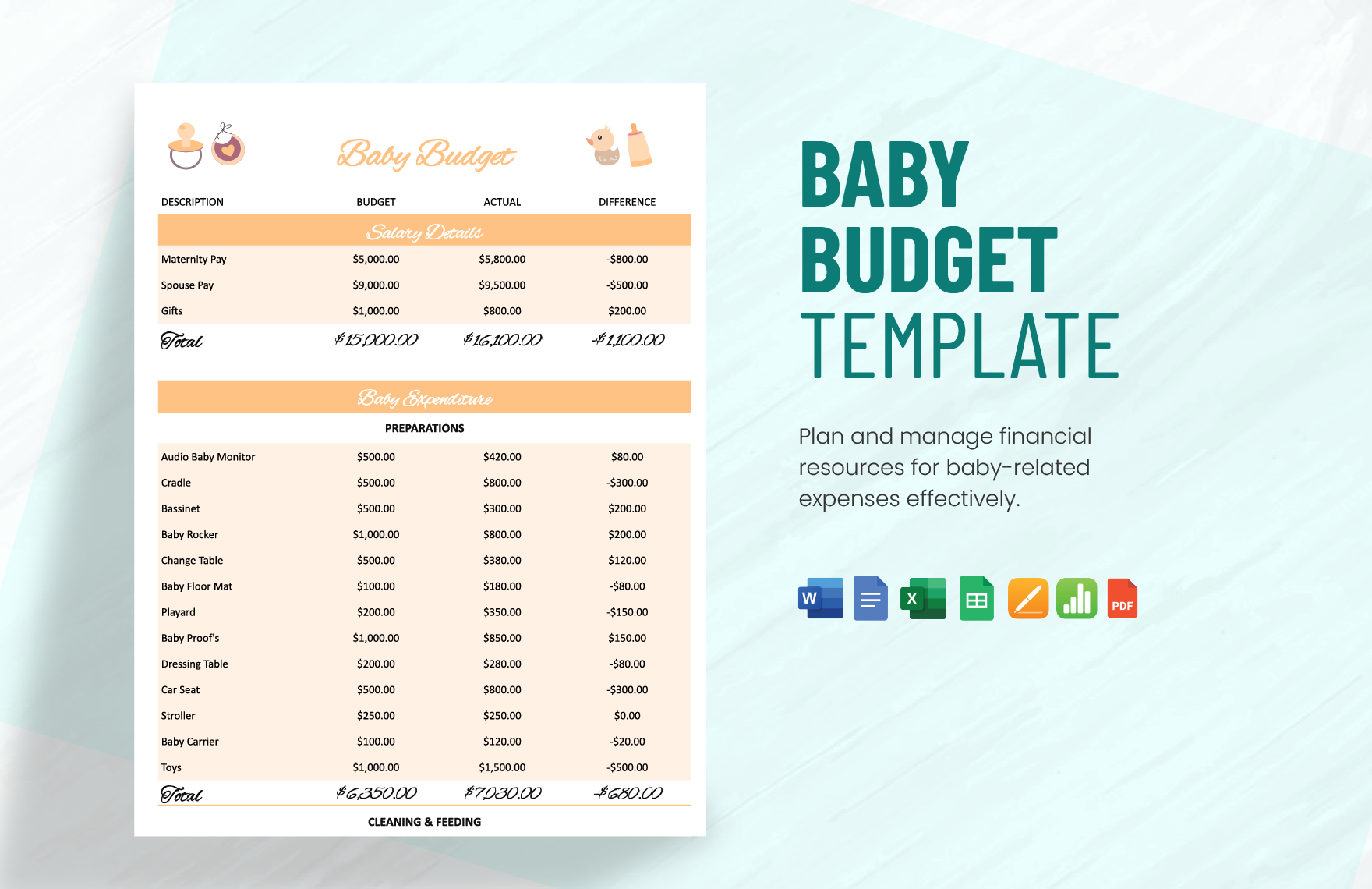

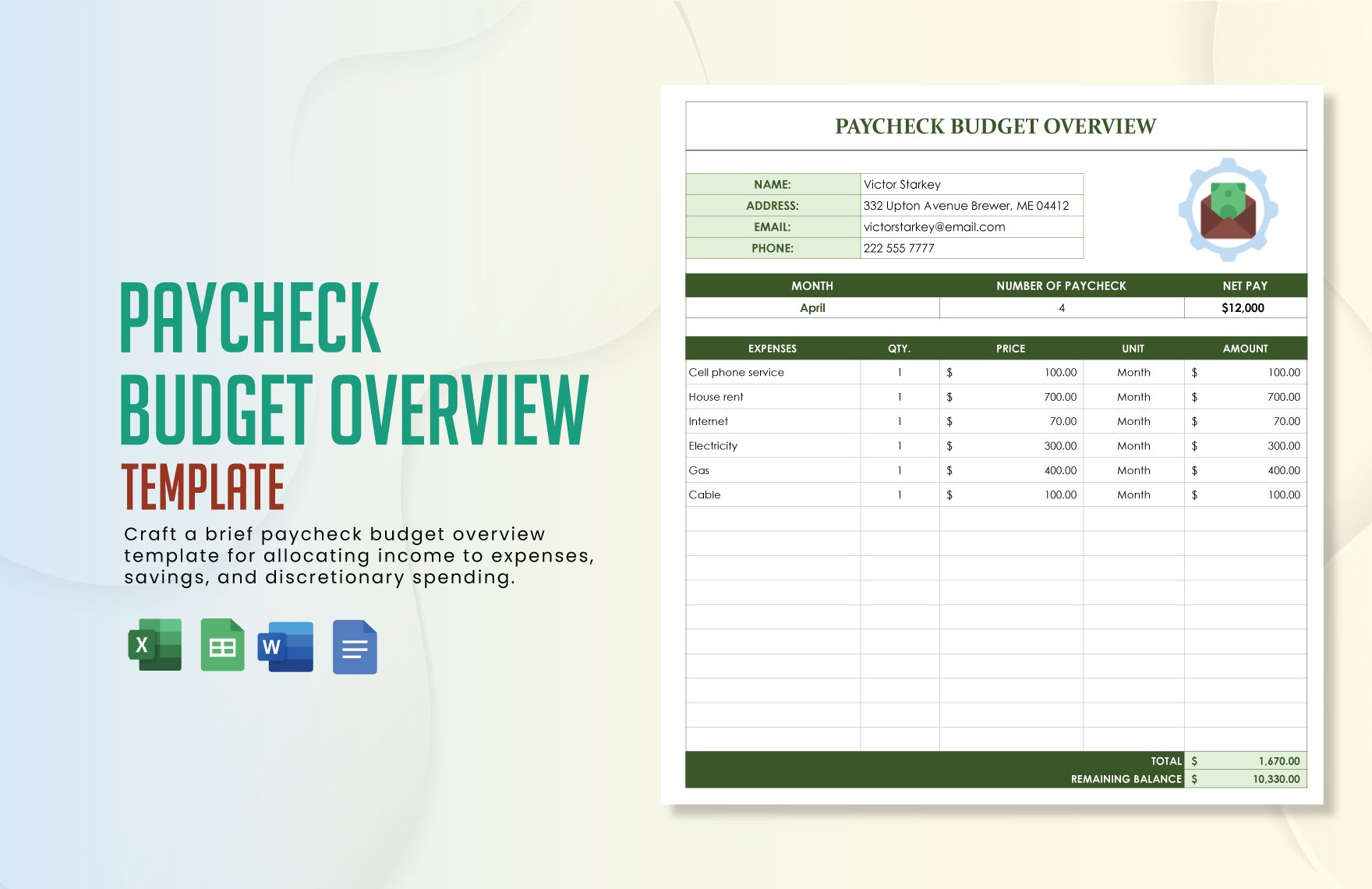

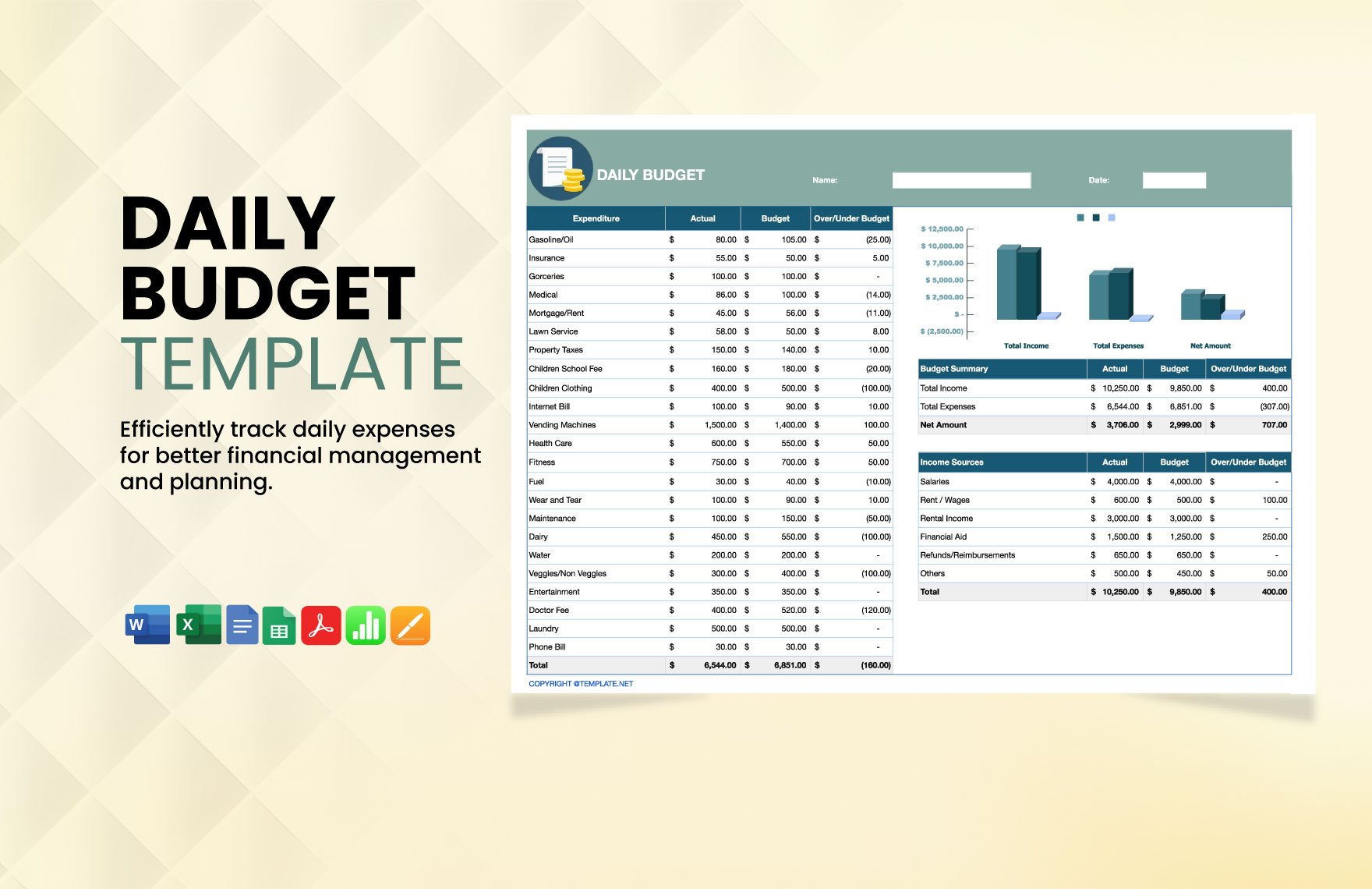

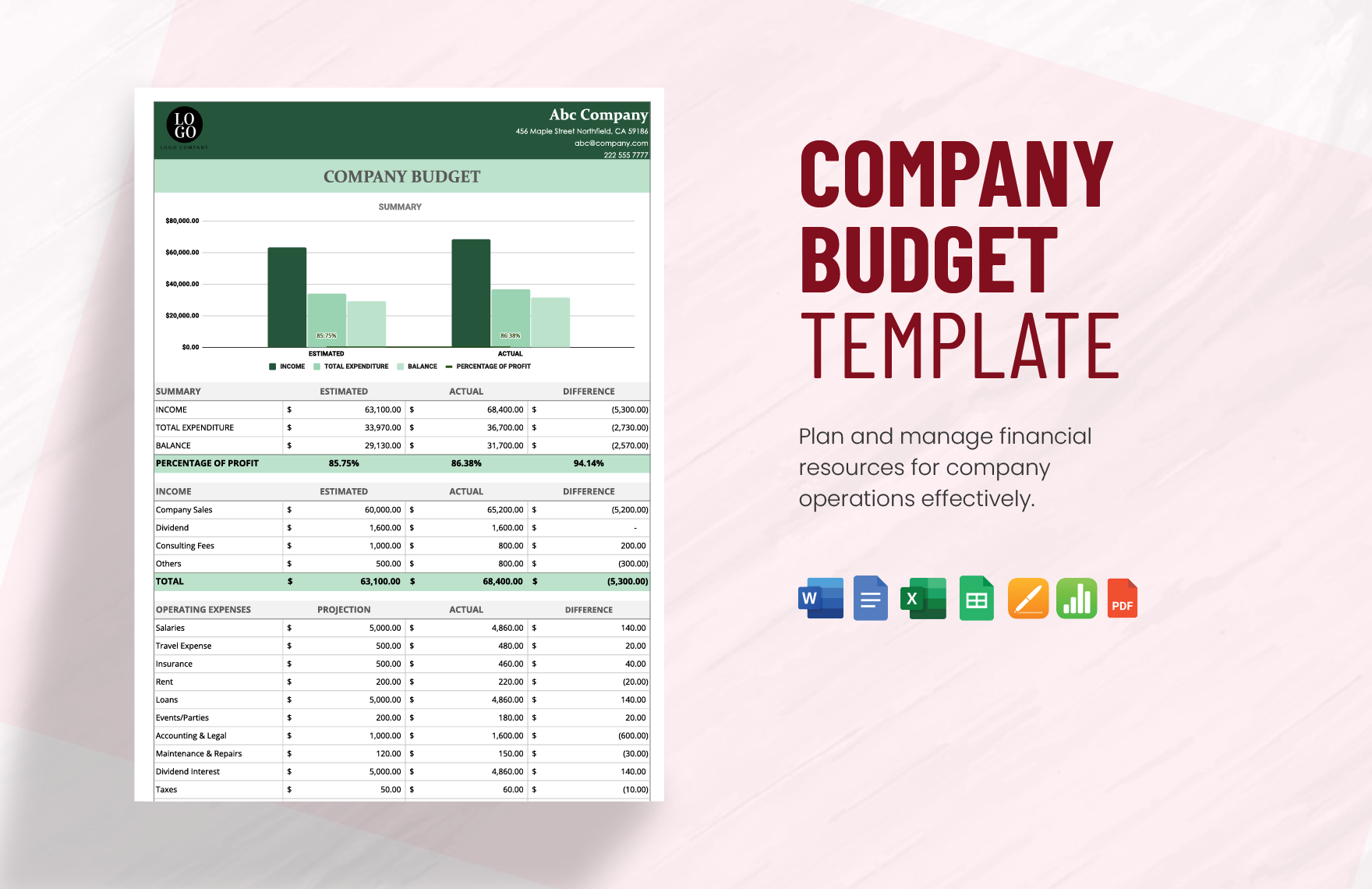

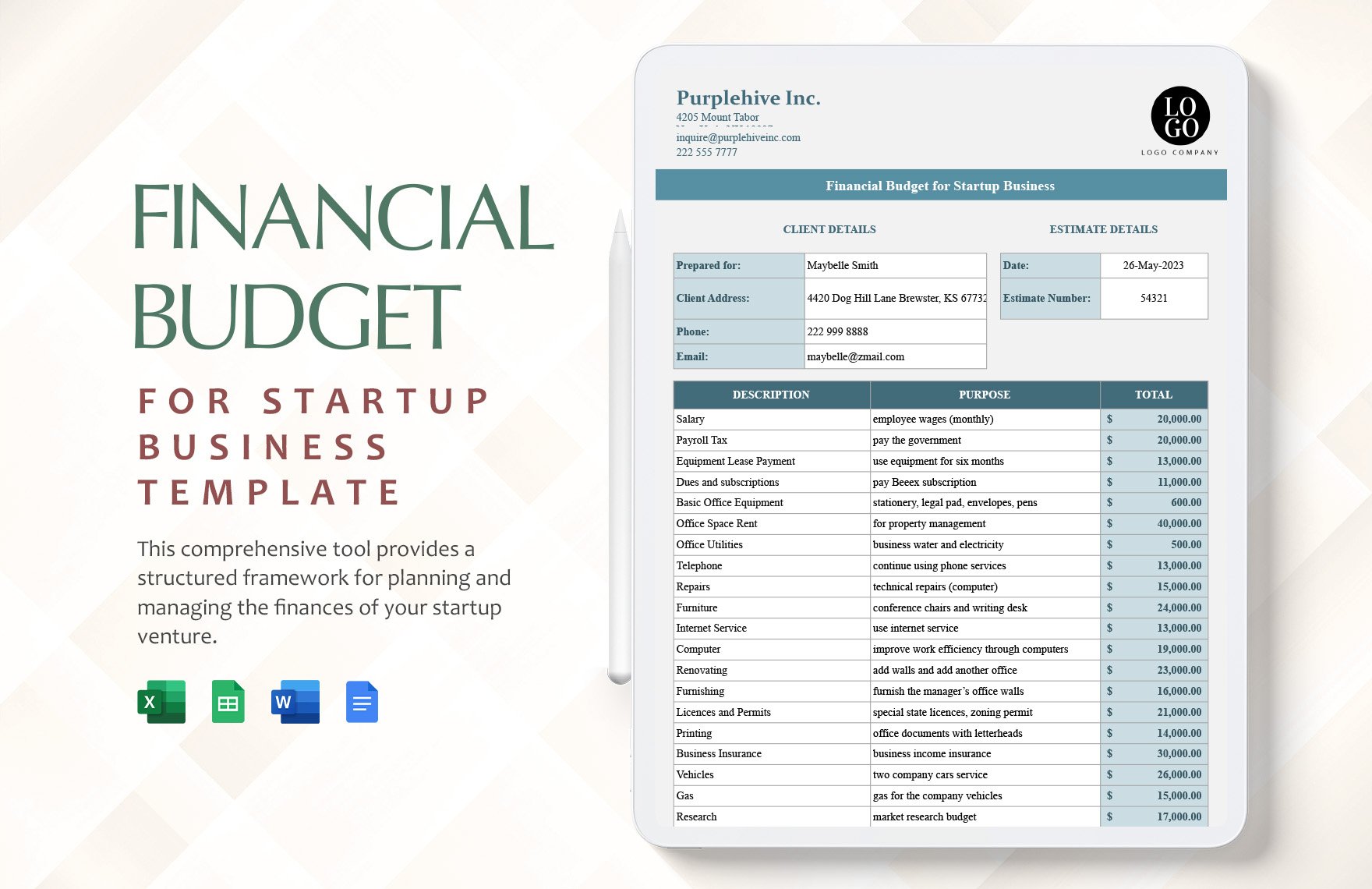

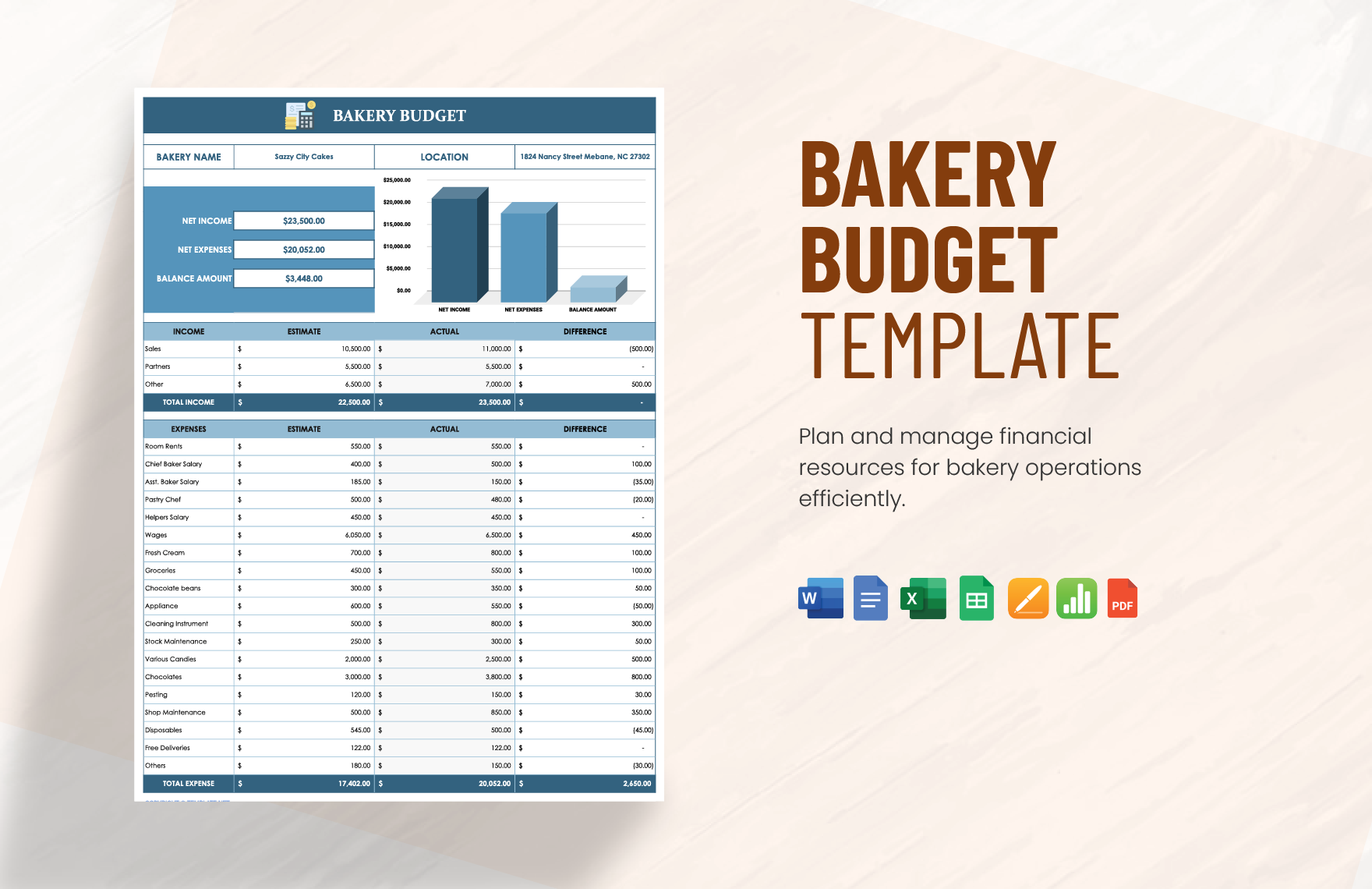

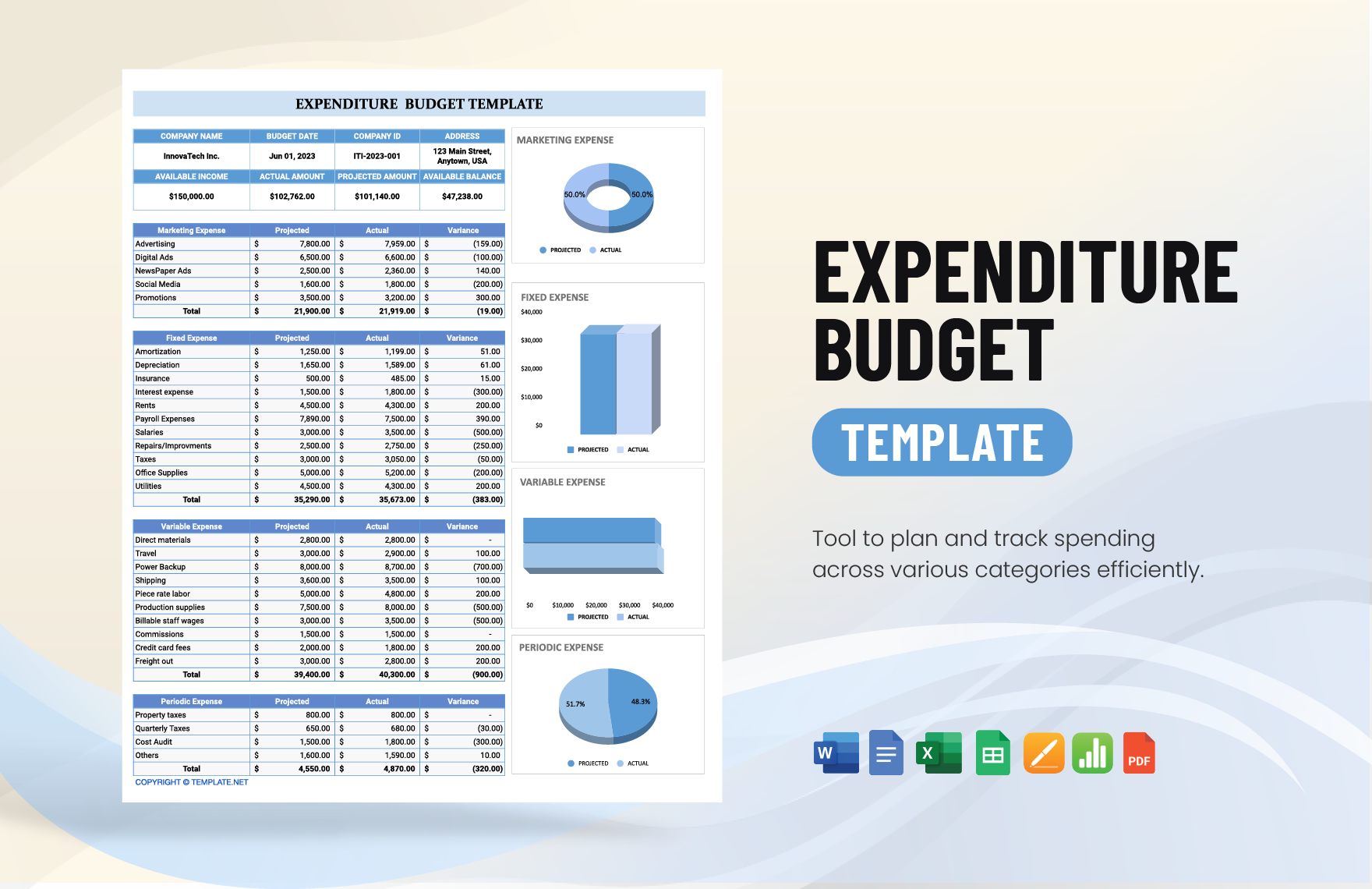

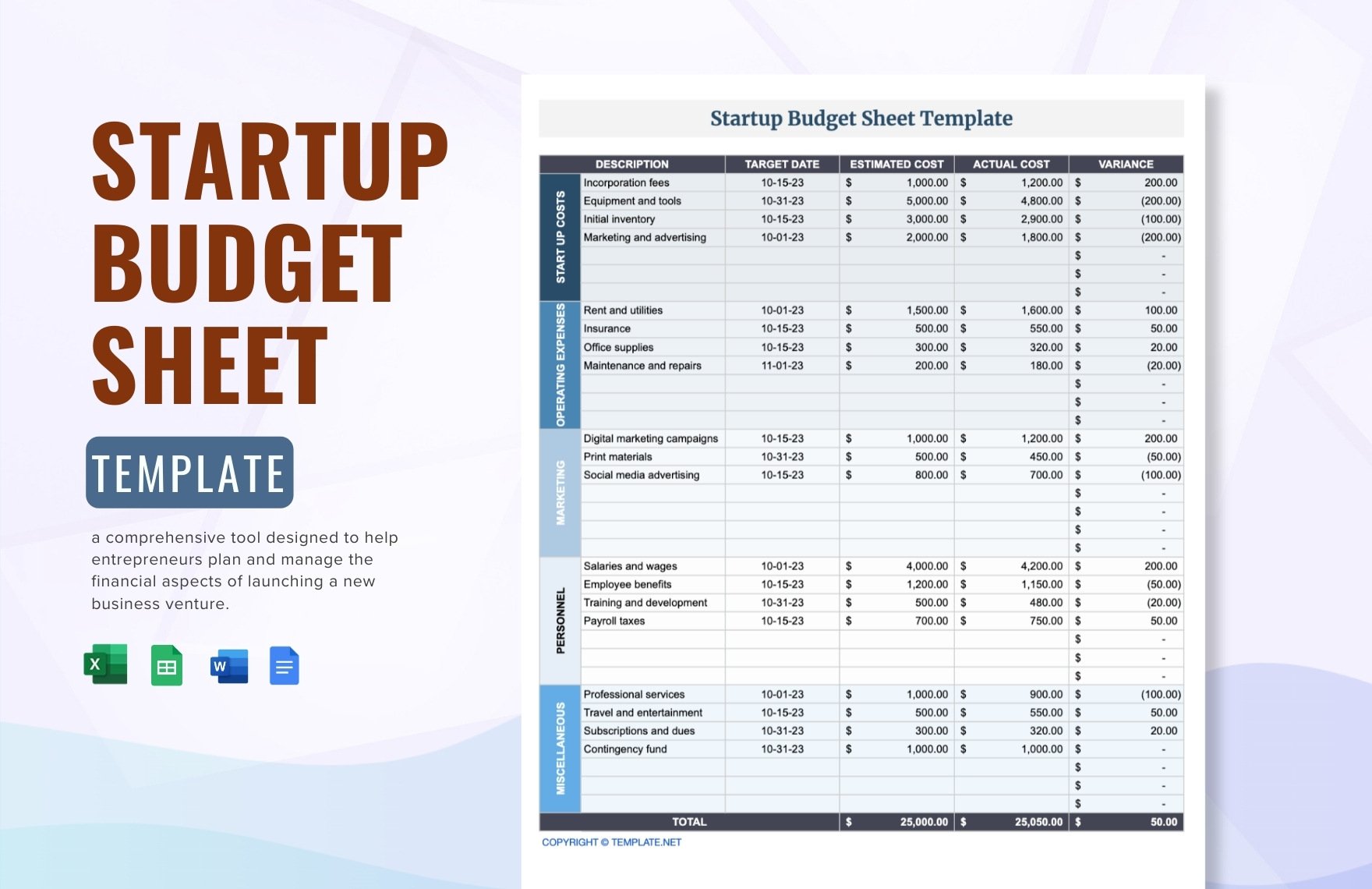

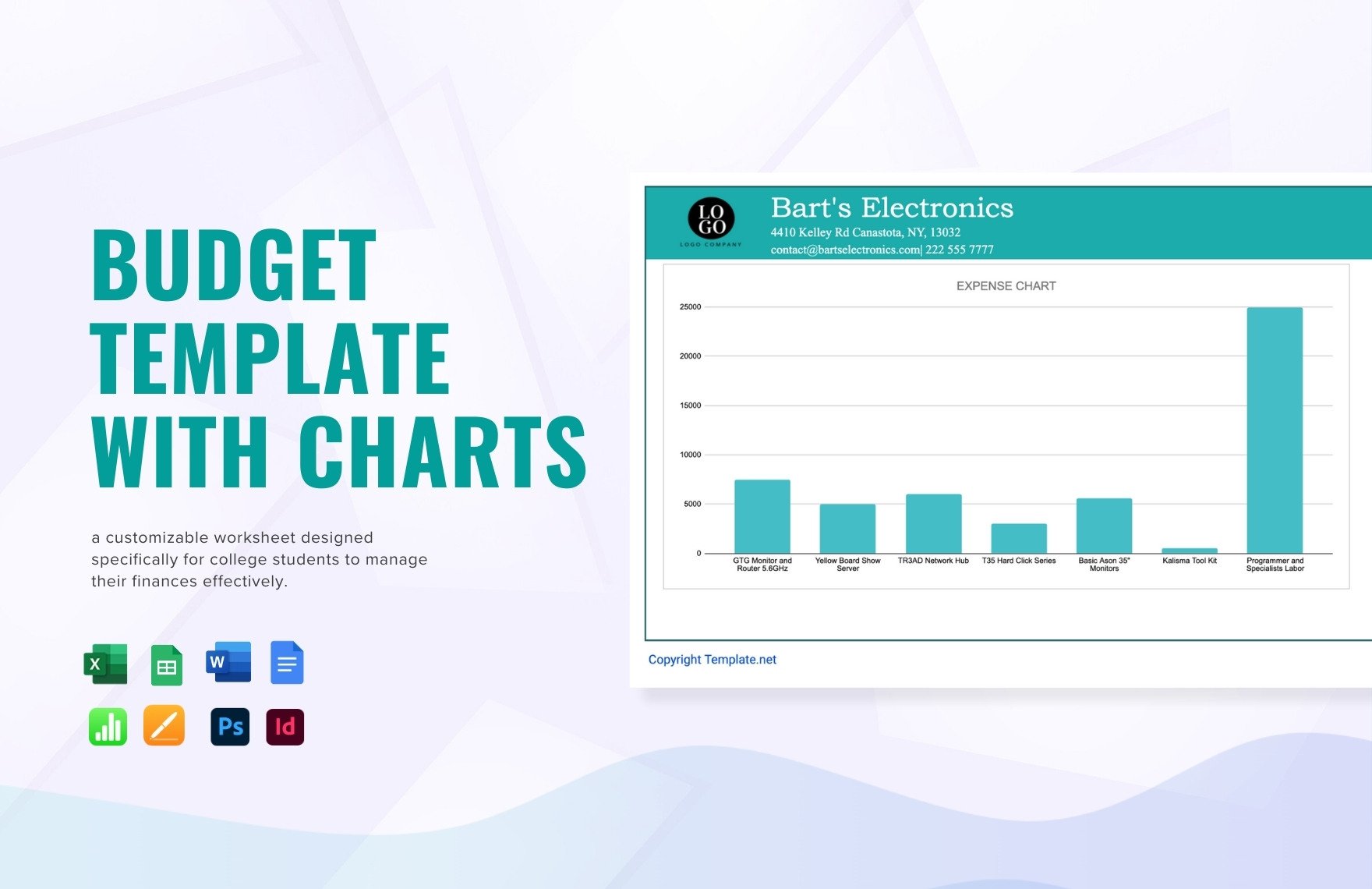

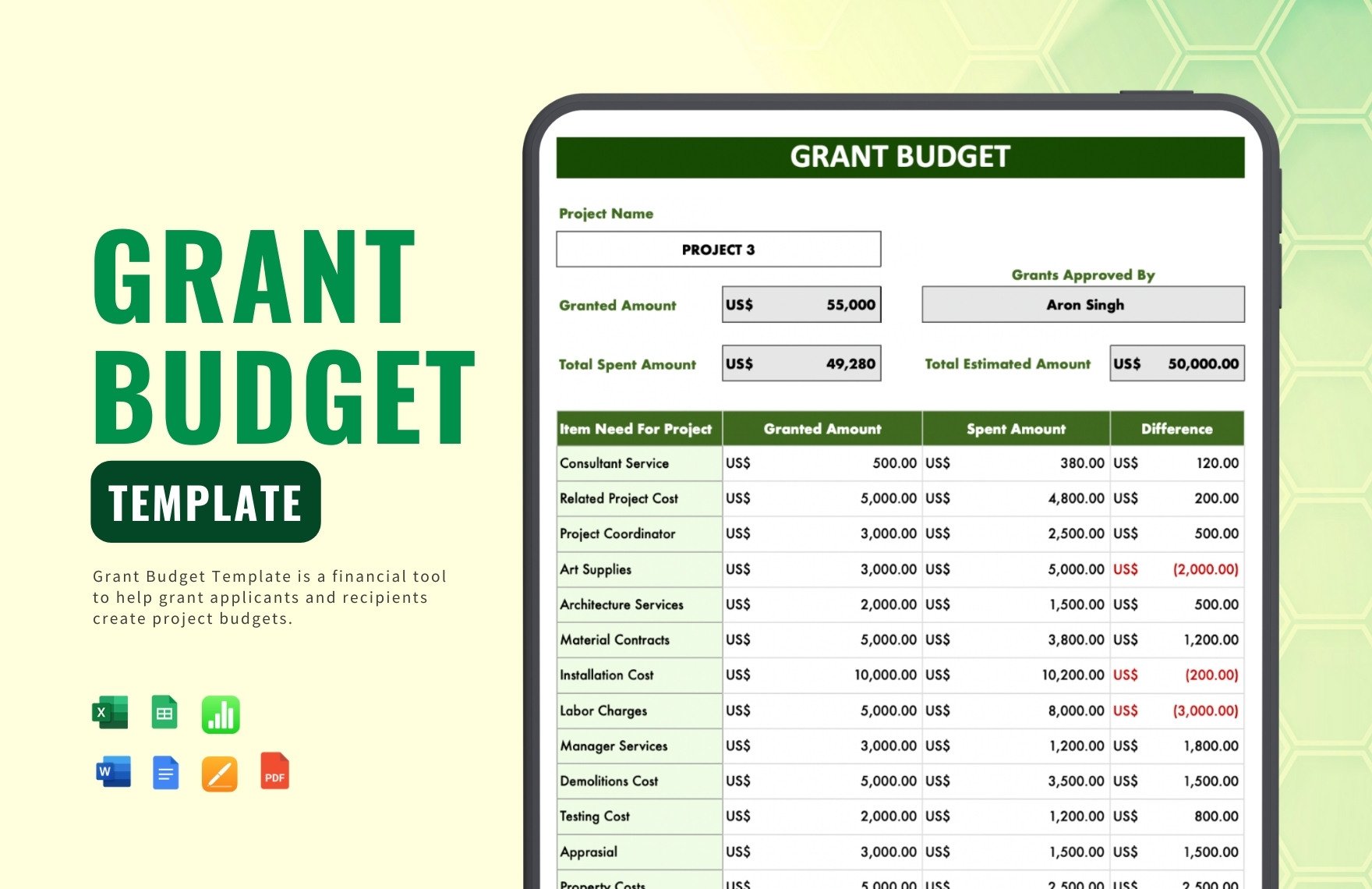

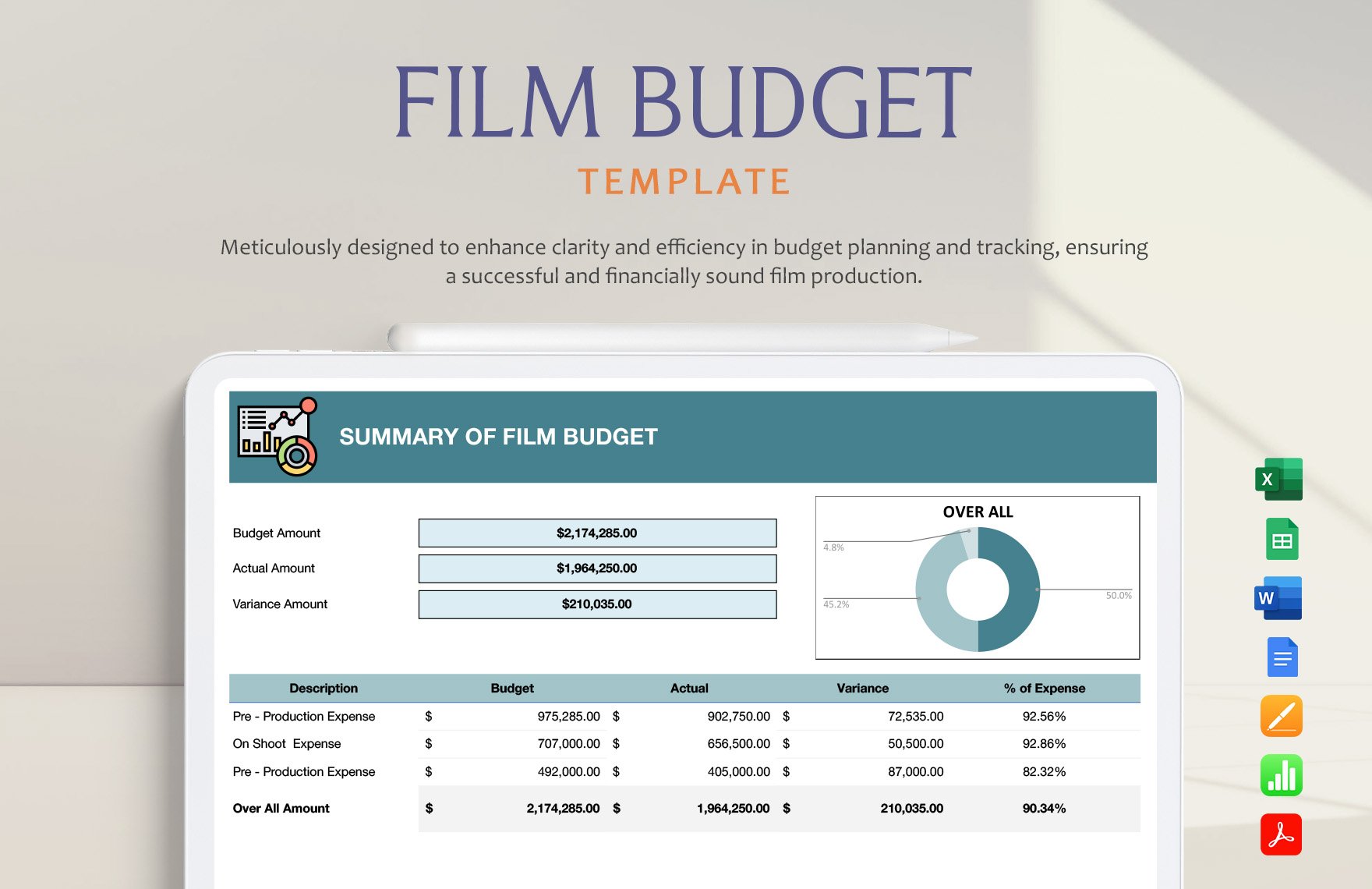

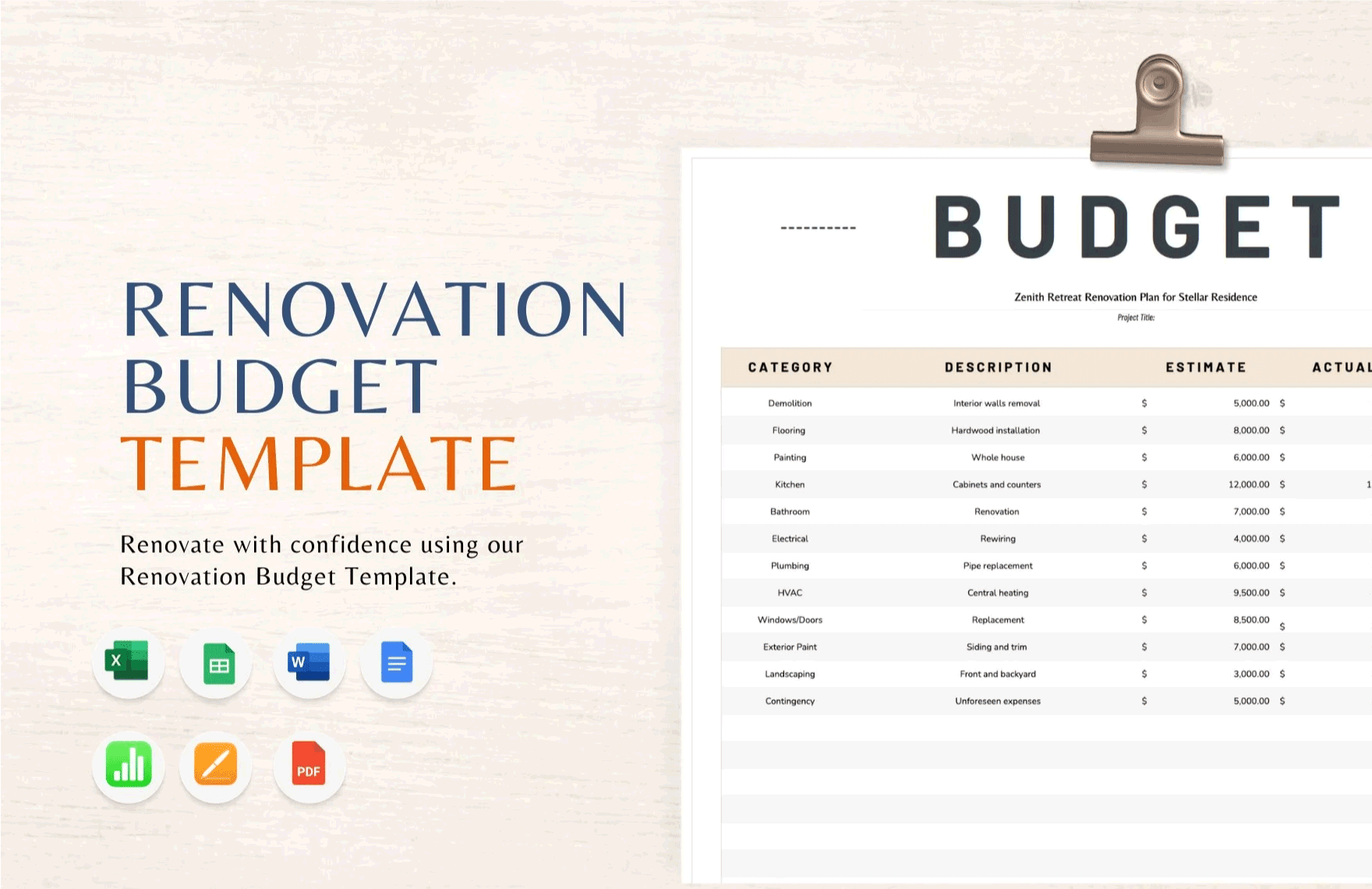

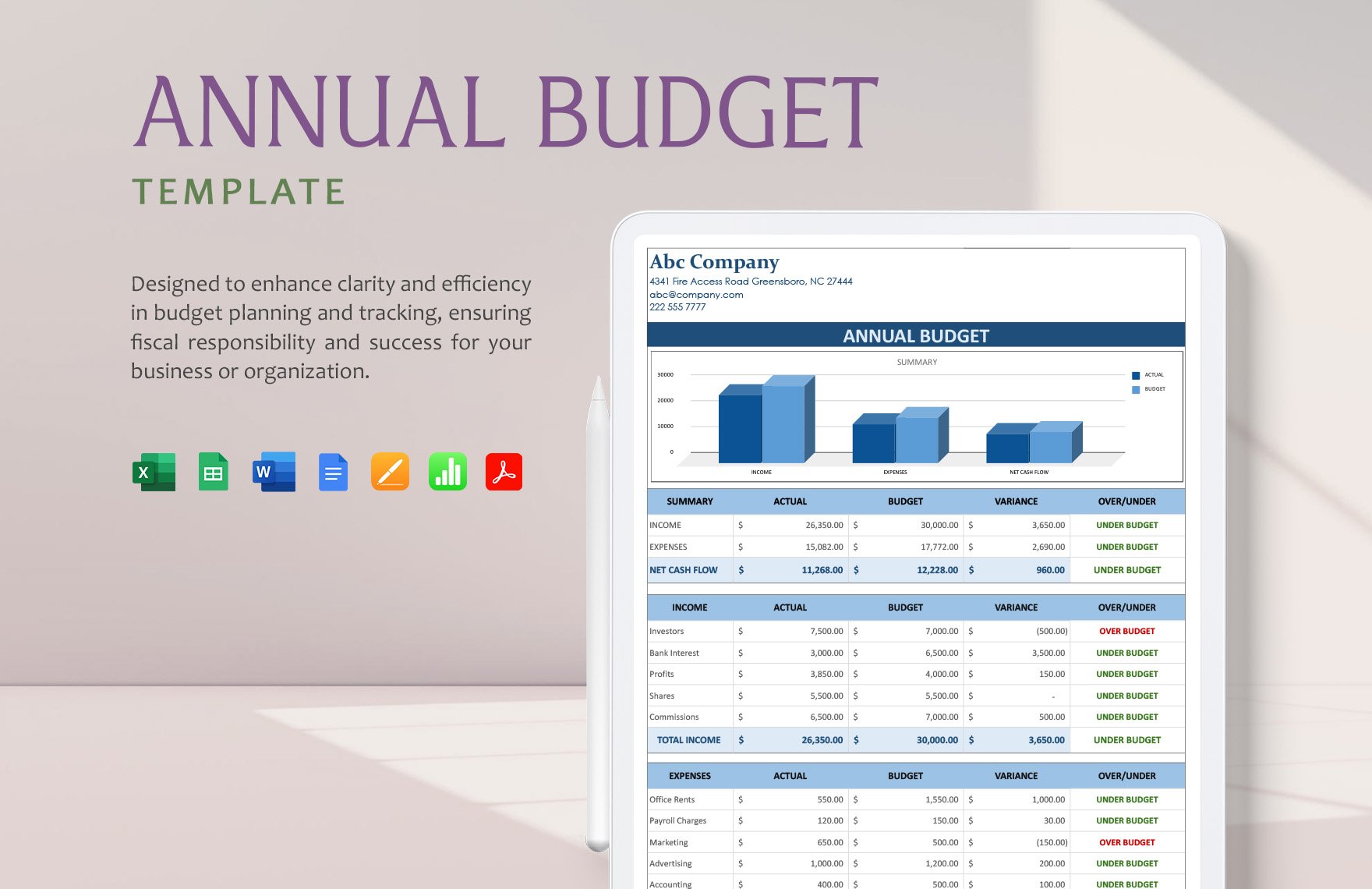

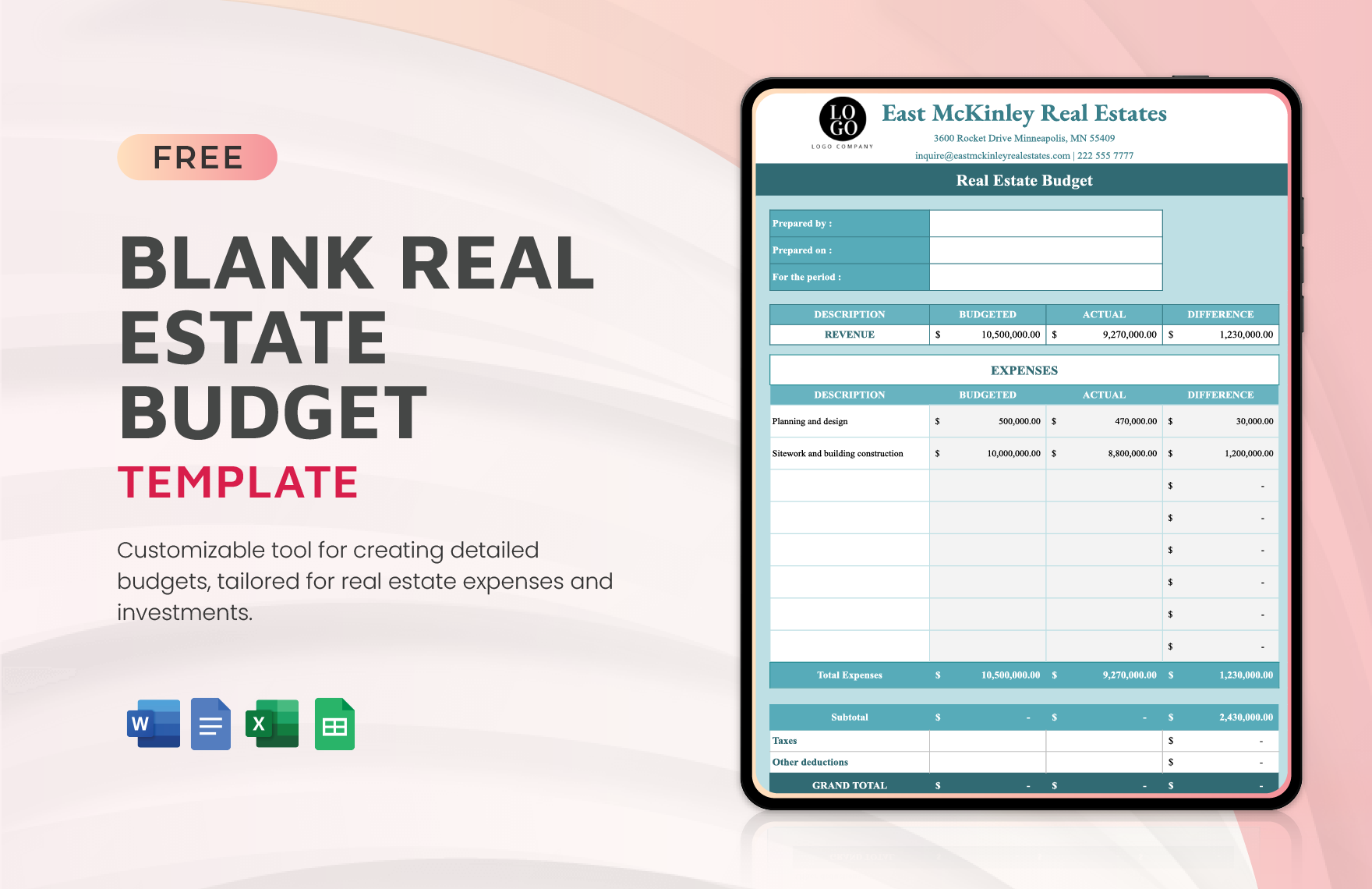

Whether you're a student, professional, or entrepreneur, managing your finances has never been easier. With personal budget templates by Template.net, create detailed, professional-grade budget plans quickly and easily, even with no prior financial planning experience. Use these templates to organize monthly expenses or plan for upcoming vacations, enabling you to make informed financial decisions. Every template comes in a Microsoft Excel format, allowing you to seamlessly download, print, and personalize to fit your unique financial needs. Thanks to free pre-designed templates, you don't need any design skills to produce stunning, effective budget layouts for both personal and professional use. Optimize your finances today with customizable layouts for both digital distribution and print.

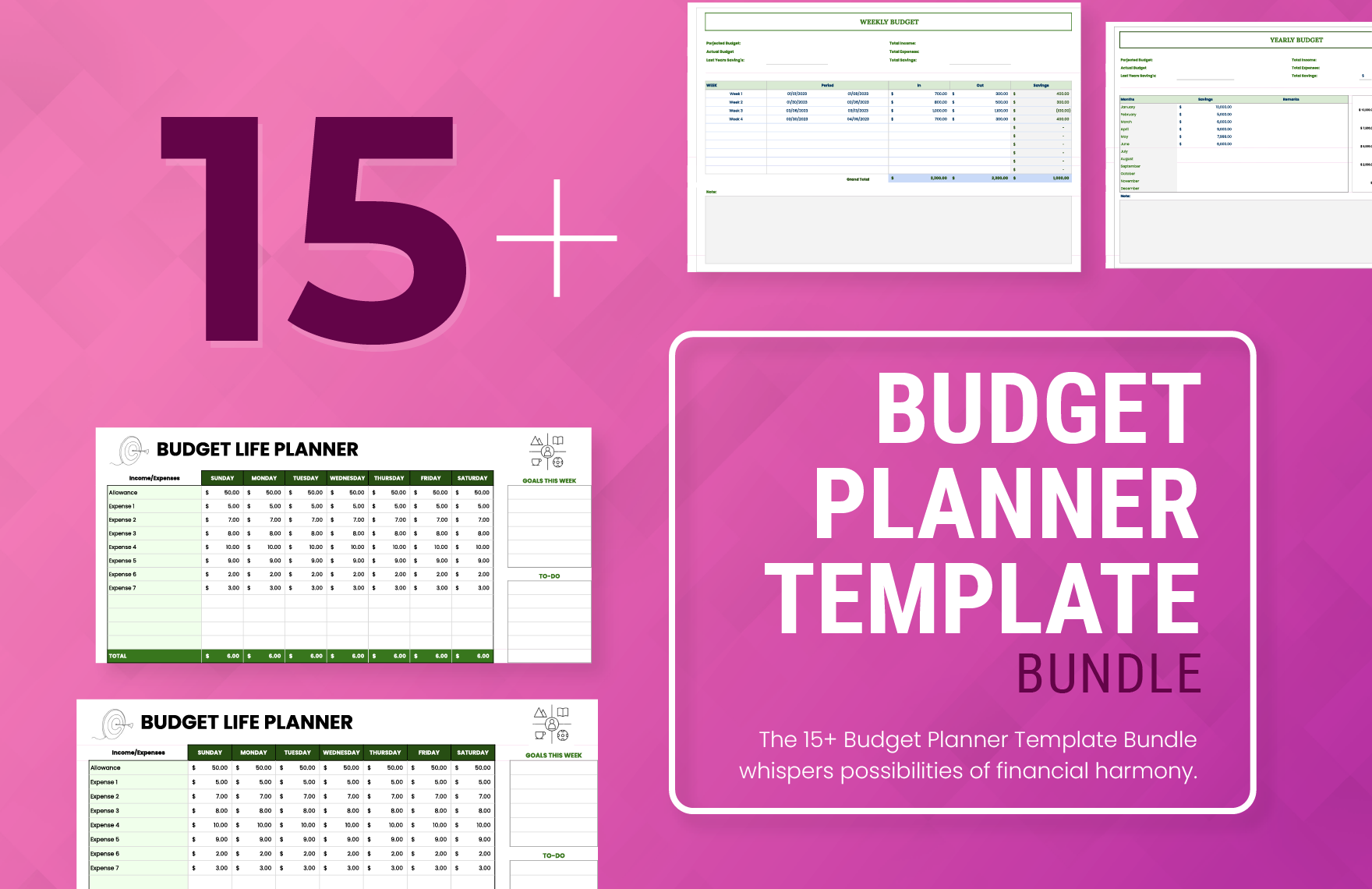

Discover a plethora of stunning pre-designed Personal Budget Templates ready to cater to your every need. Template.net keeps your financial planning at the forefront with their regularly updated collections of free and premium designs, accommodating both beginners and seasoned financial planners alike. You can effortlessly download each template, share them through print and email, and enjoy increased reach and functionality. For the ultimate flexibility, employ a mix of free and premium templates to tailor your budget planning solutions. With these invaluable resources at your fingertips, maintaining financial stability has never been more within your grasp.