Make Your Document Management Effortless with Construction Receipt Templates from Template.net

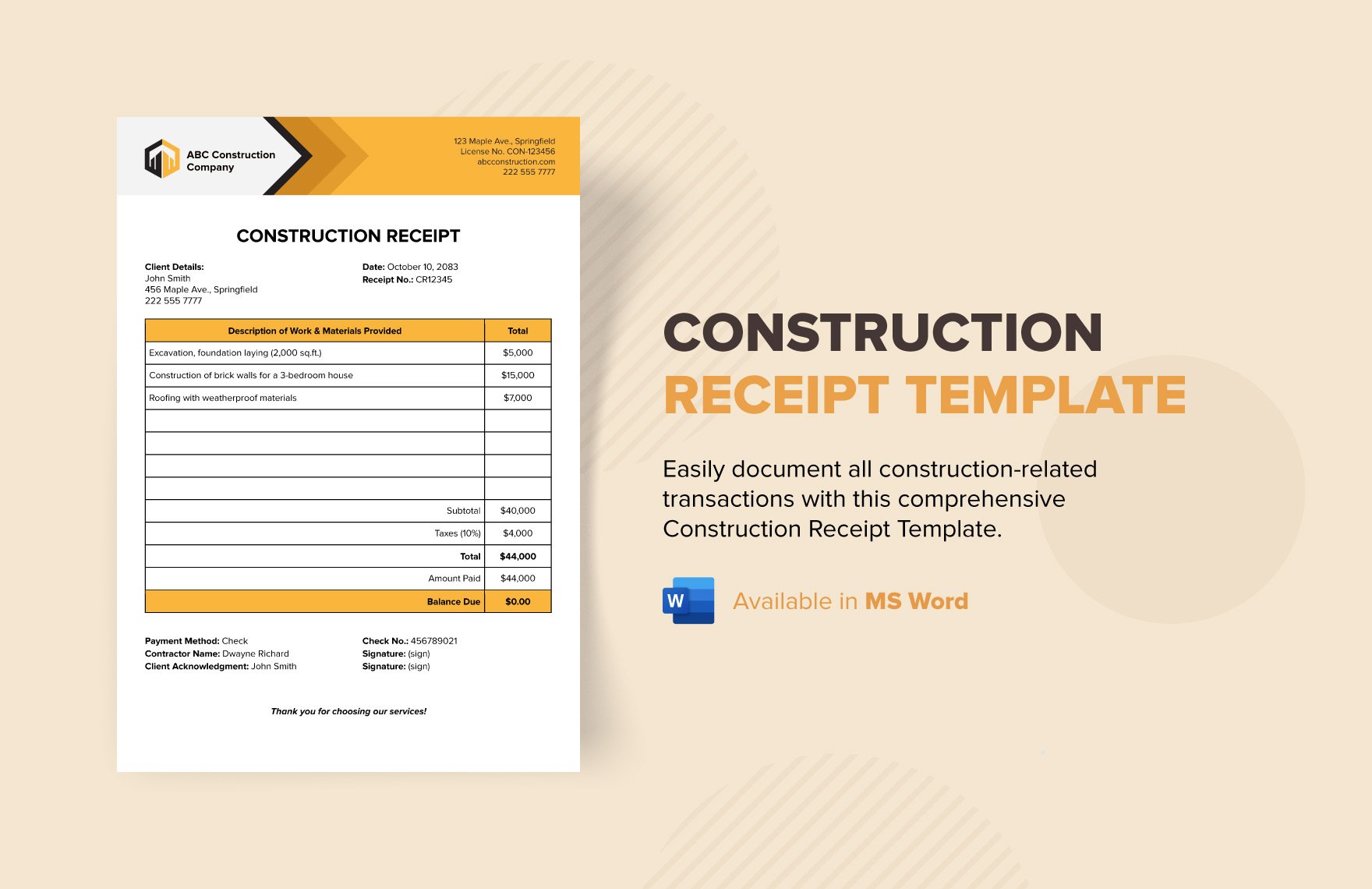

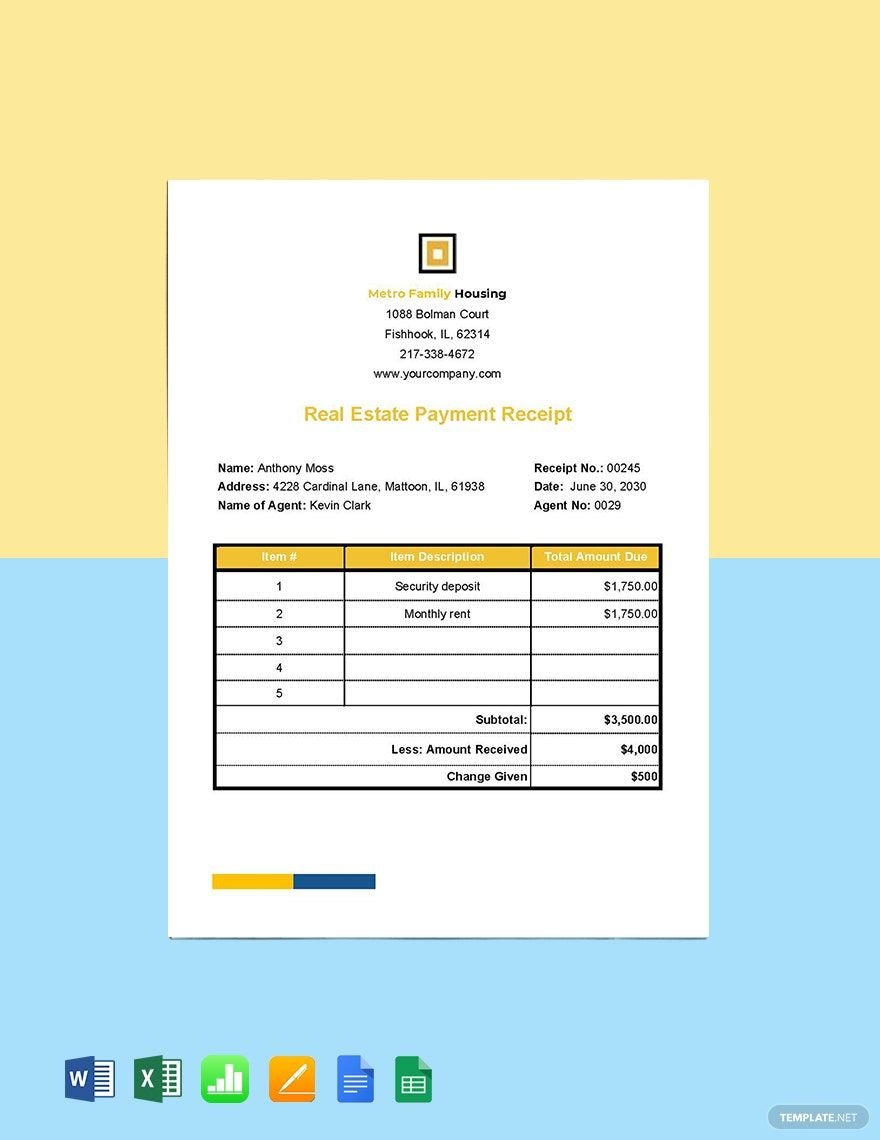

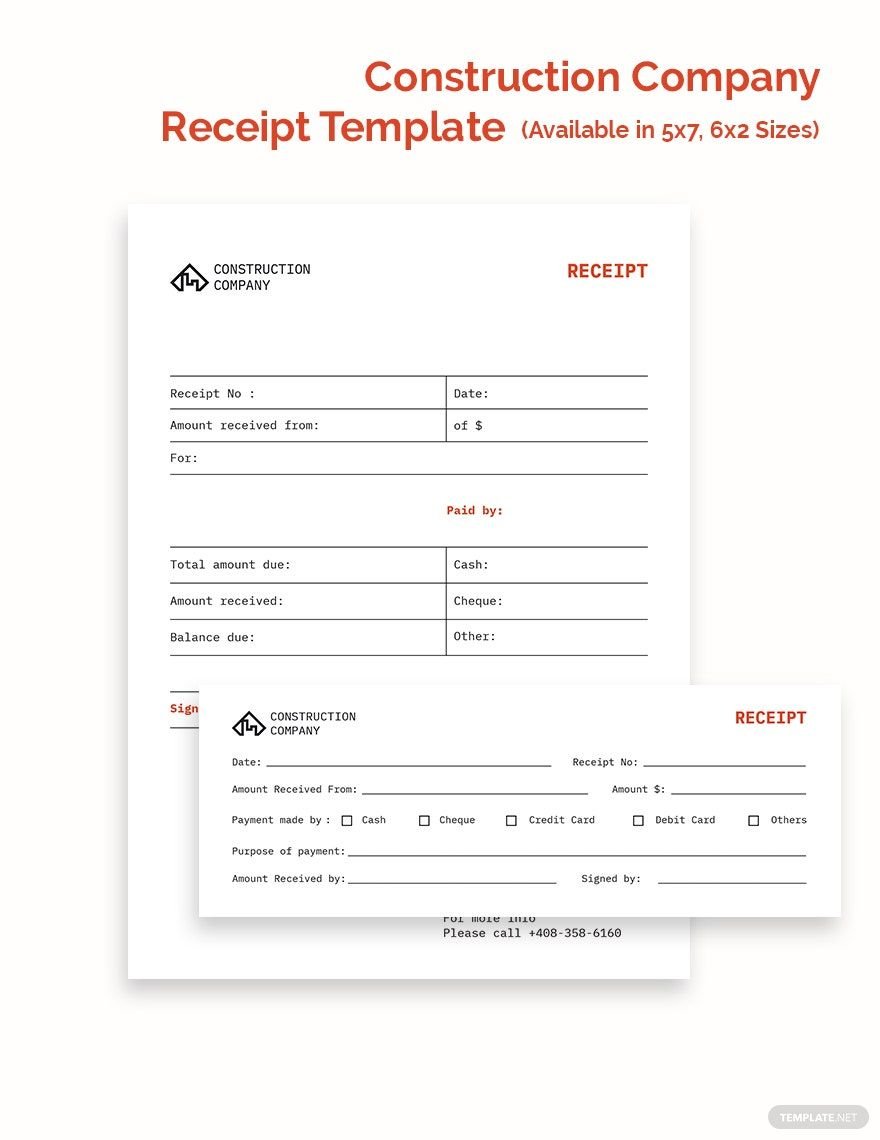

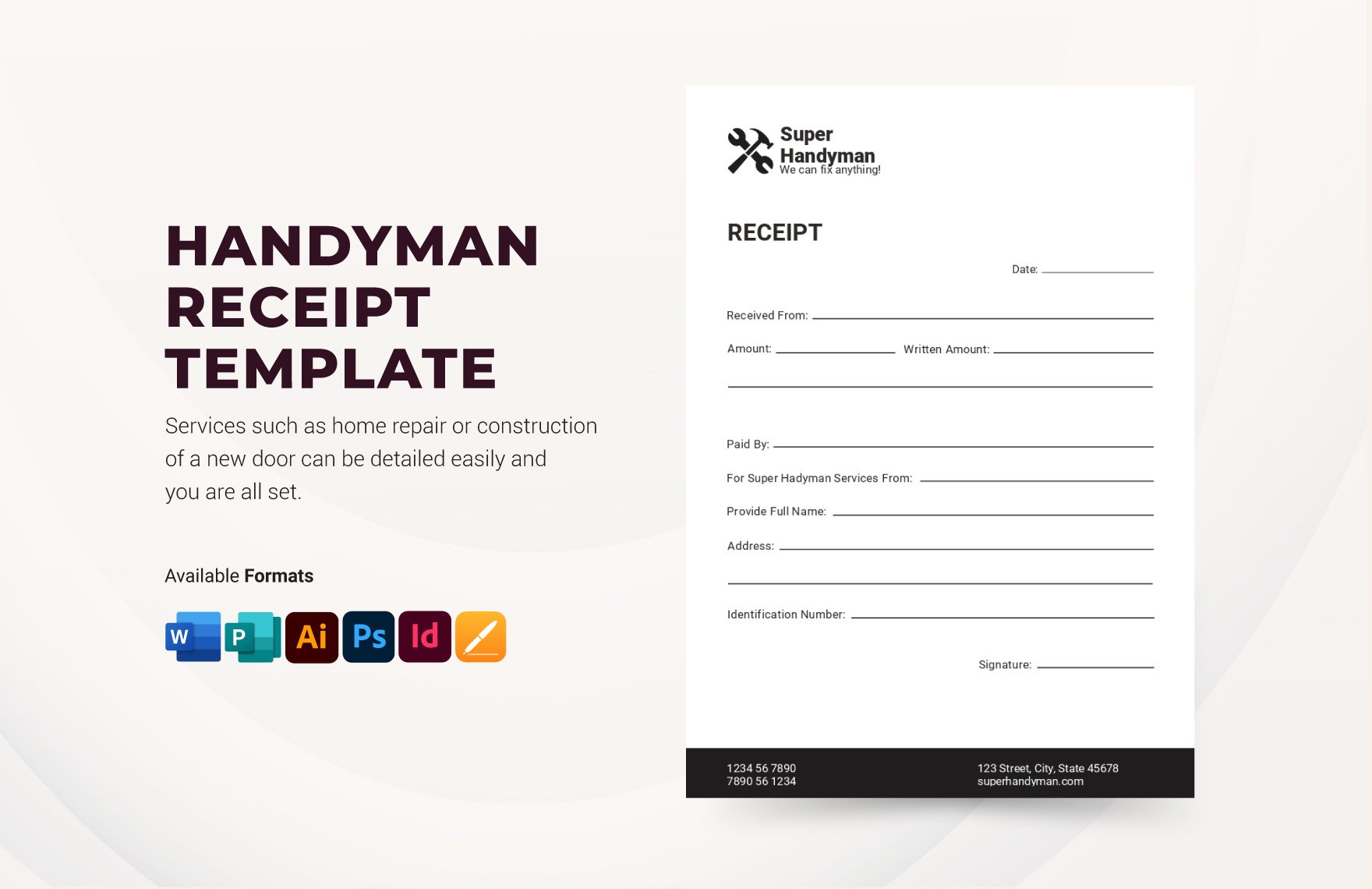

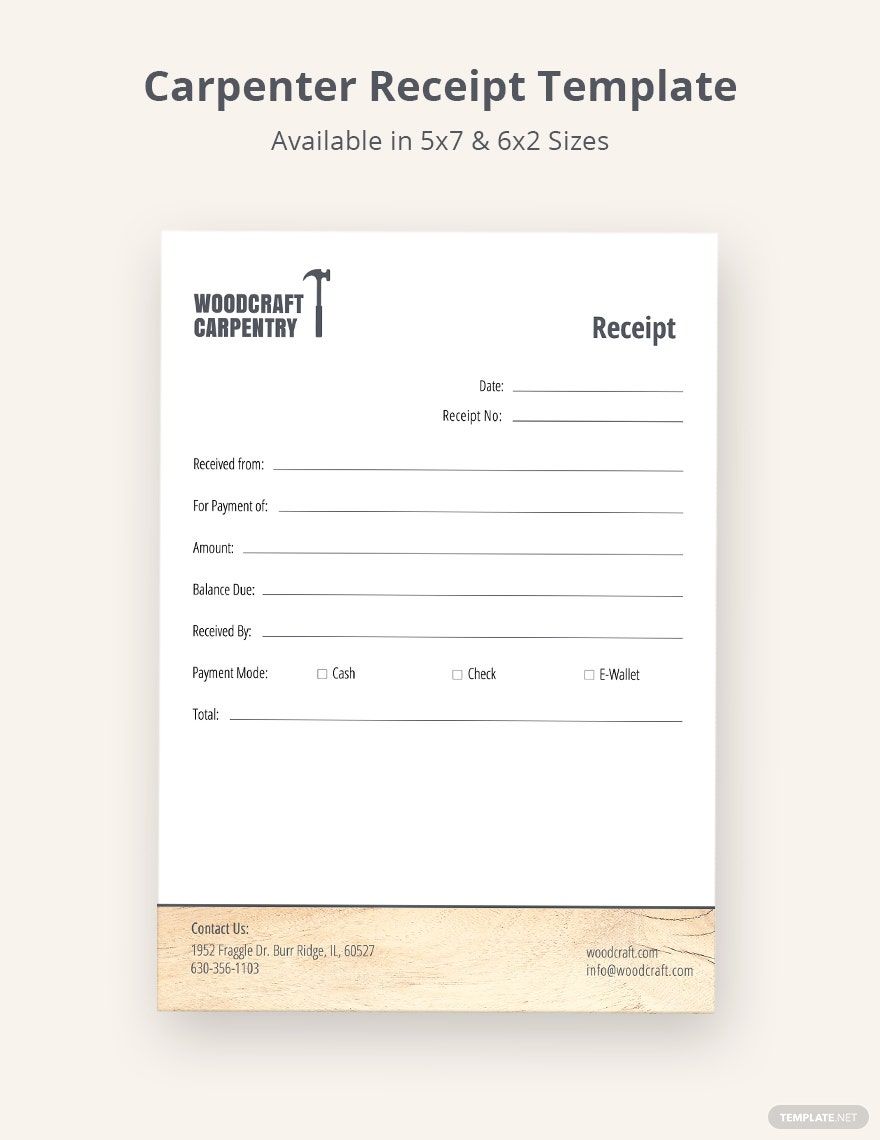

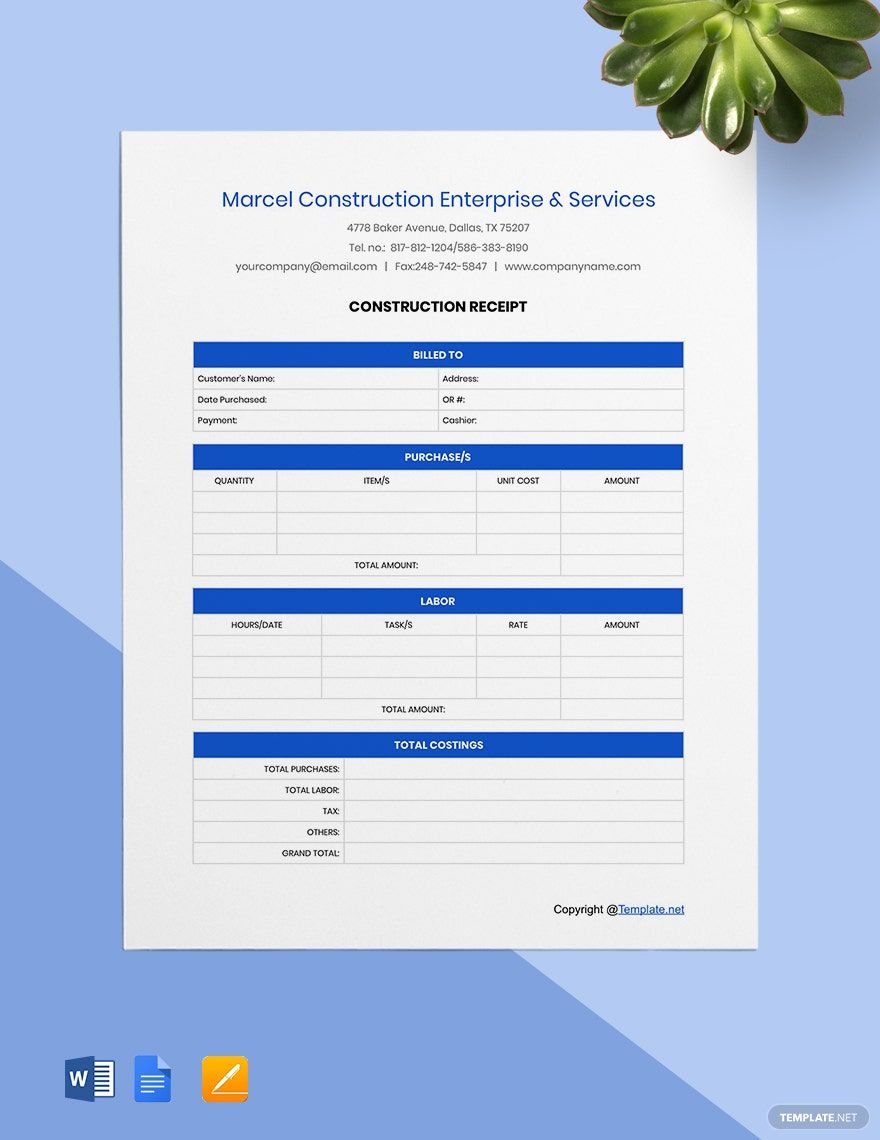

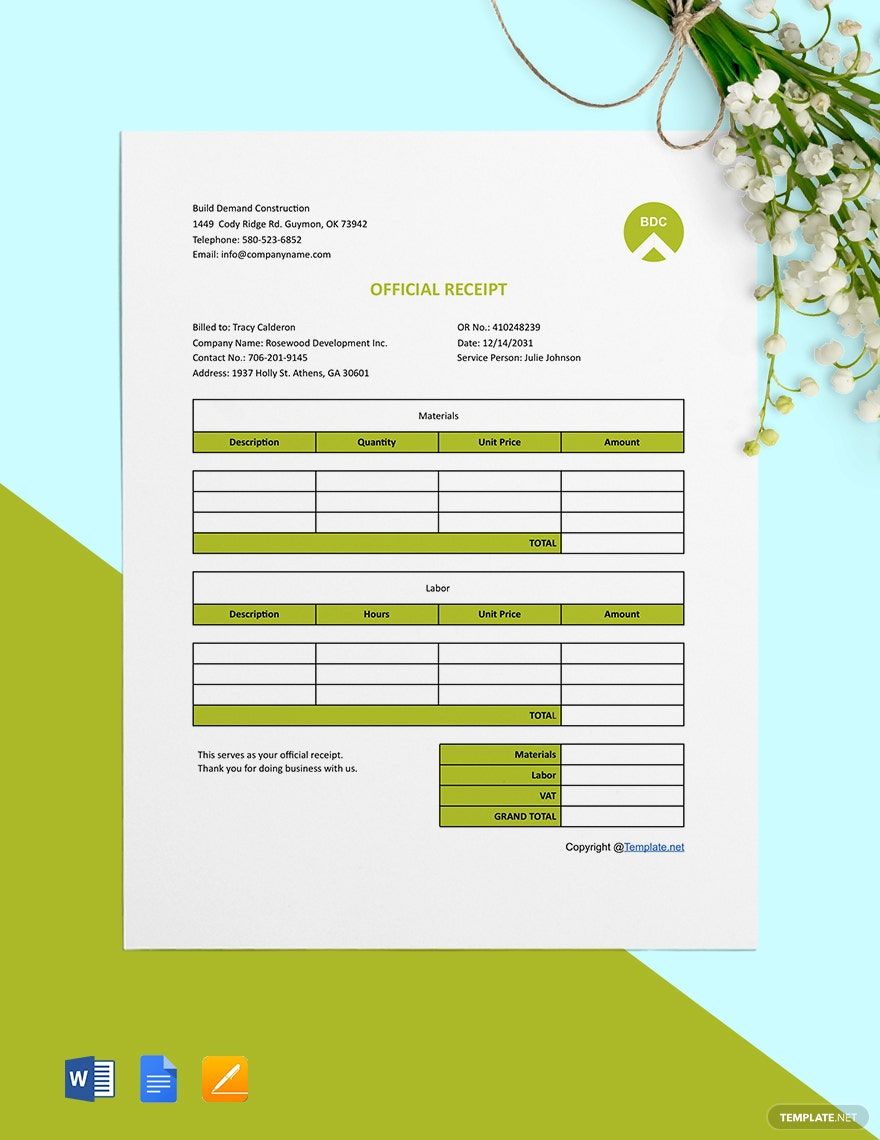

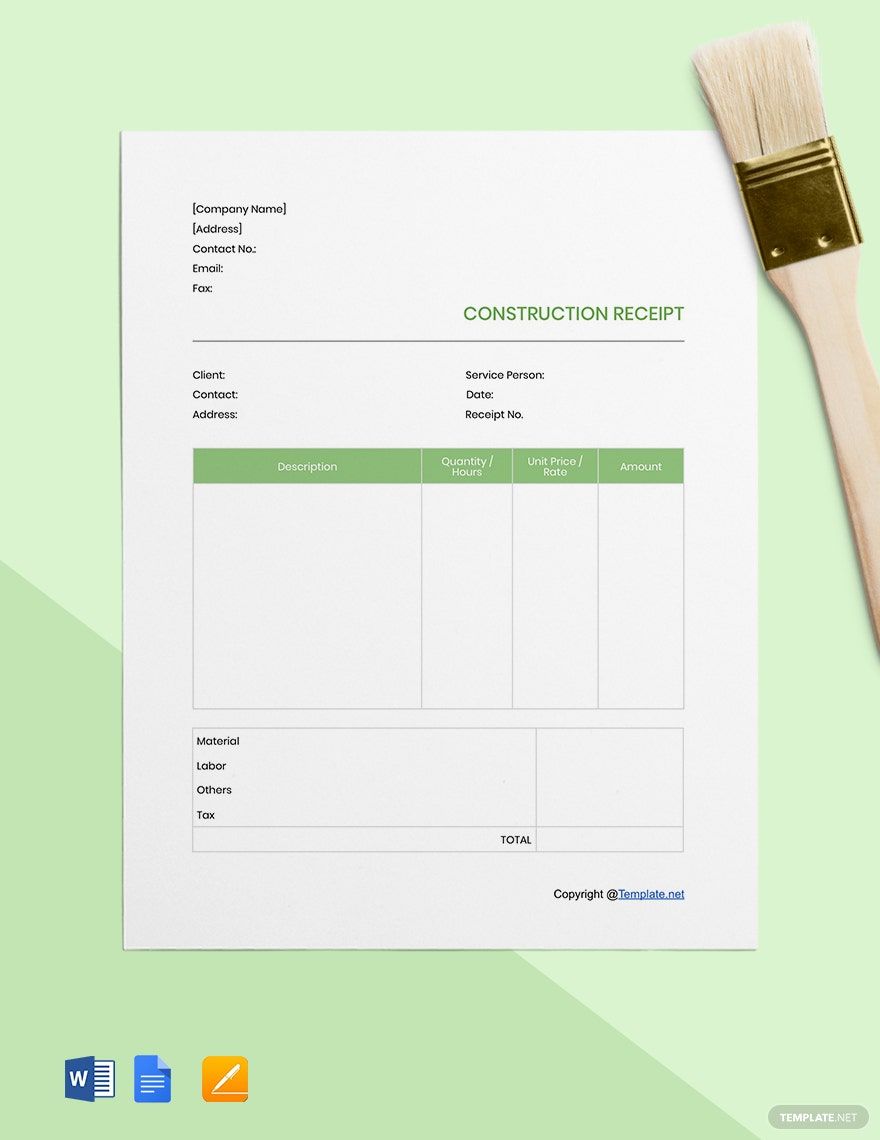

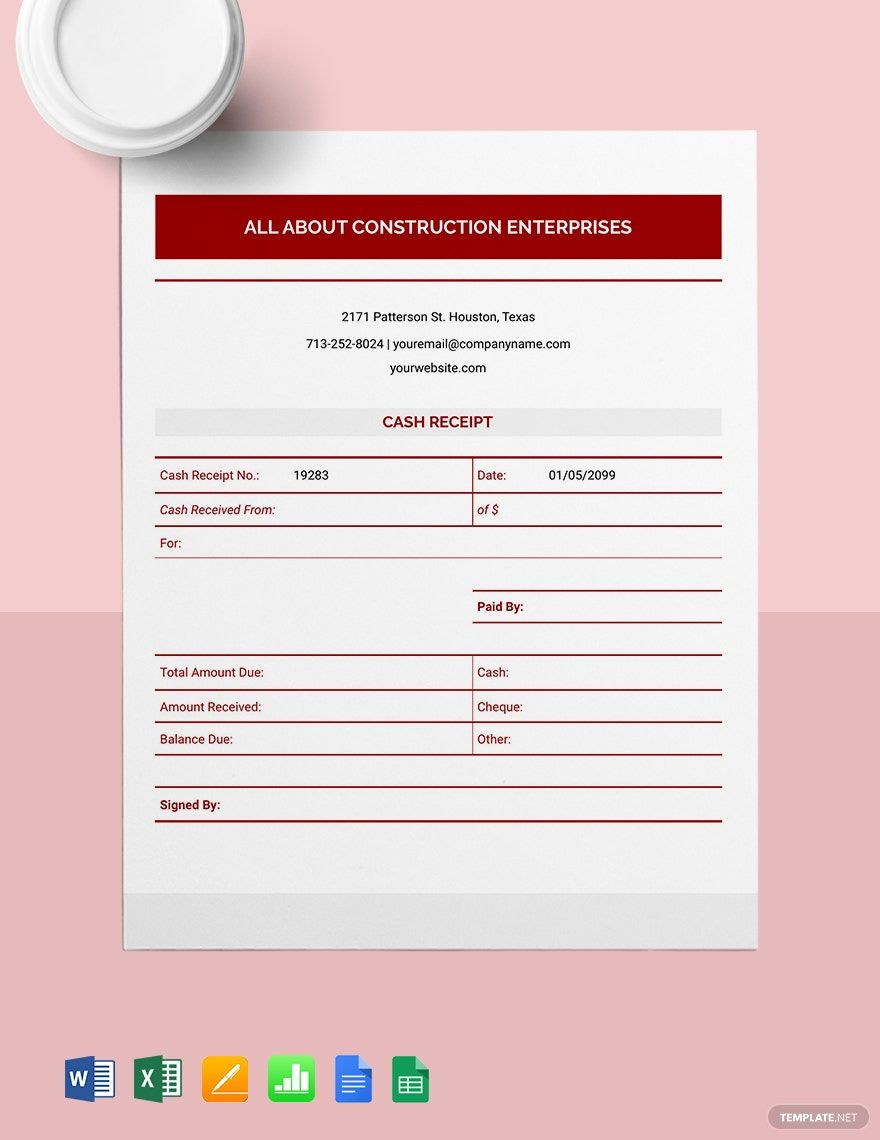

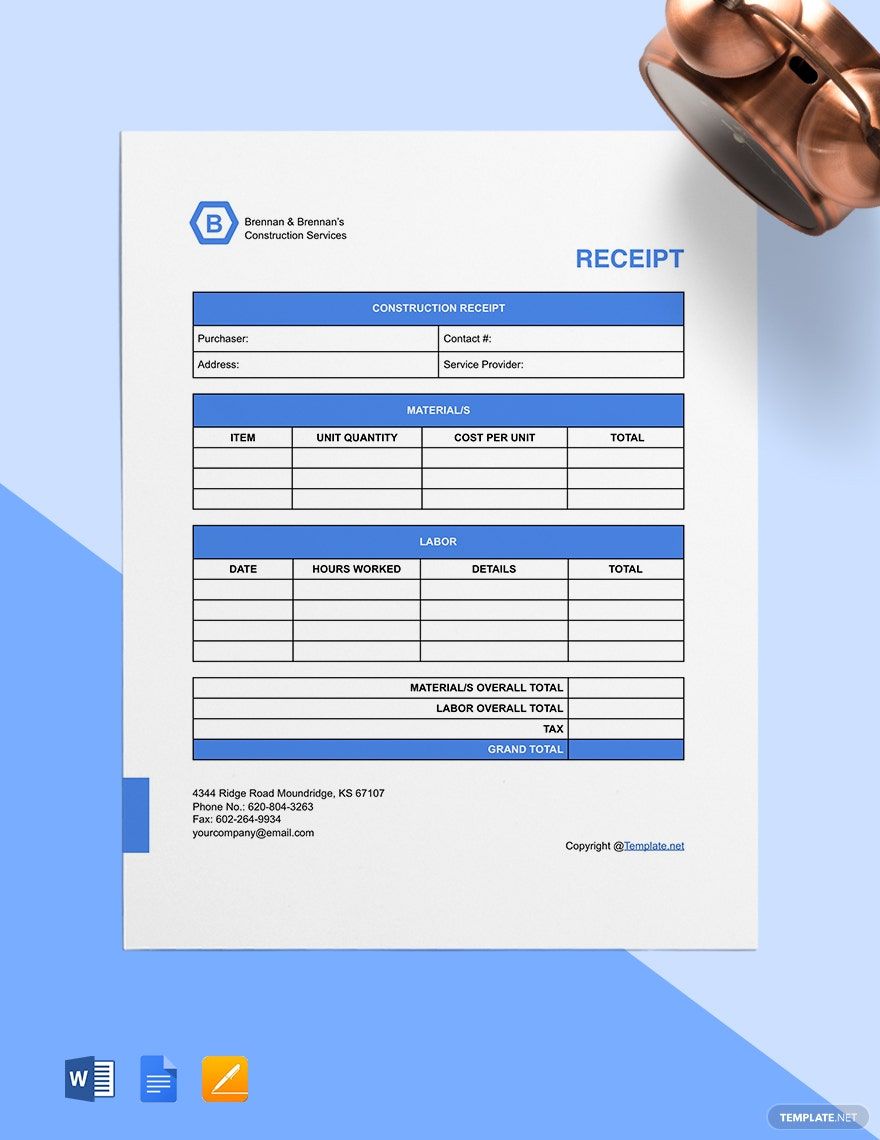

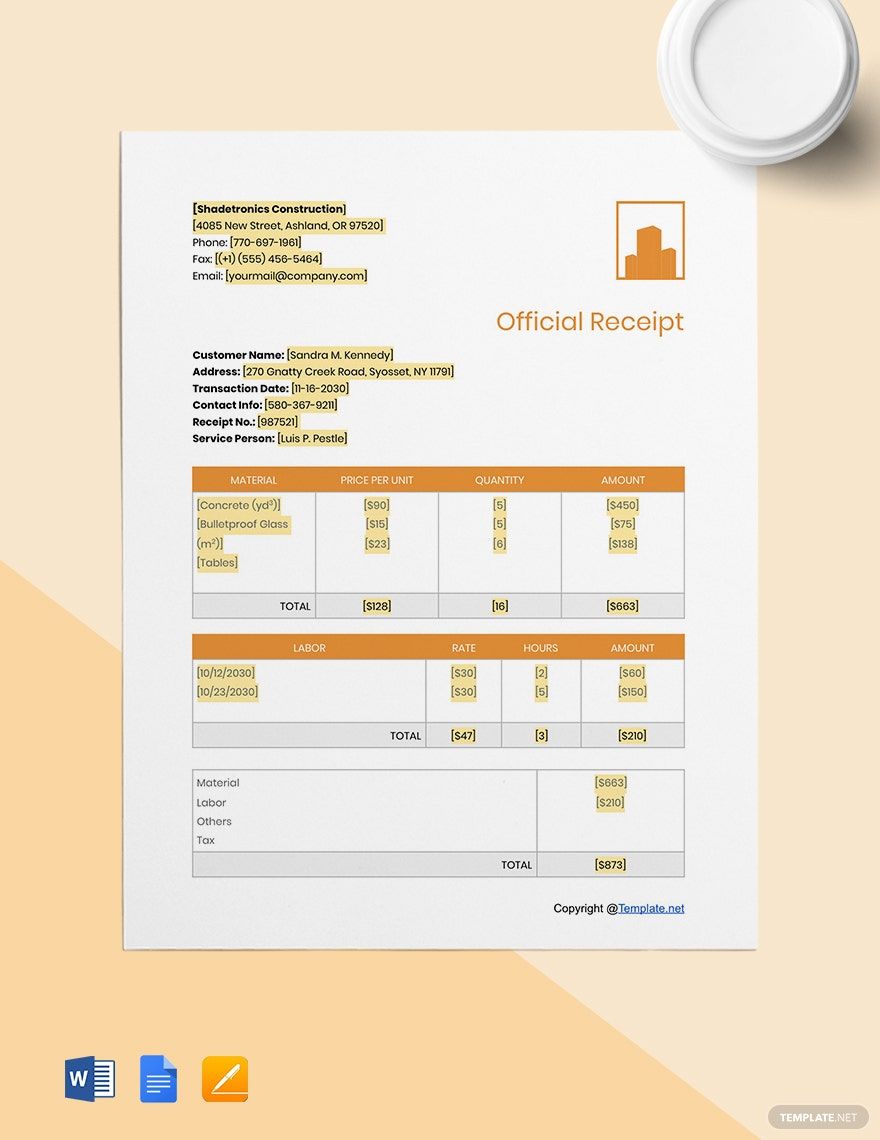

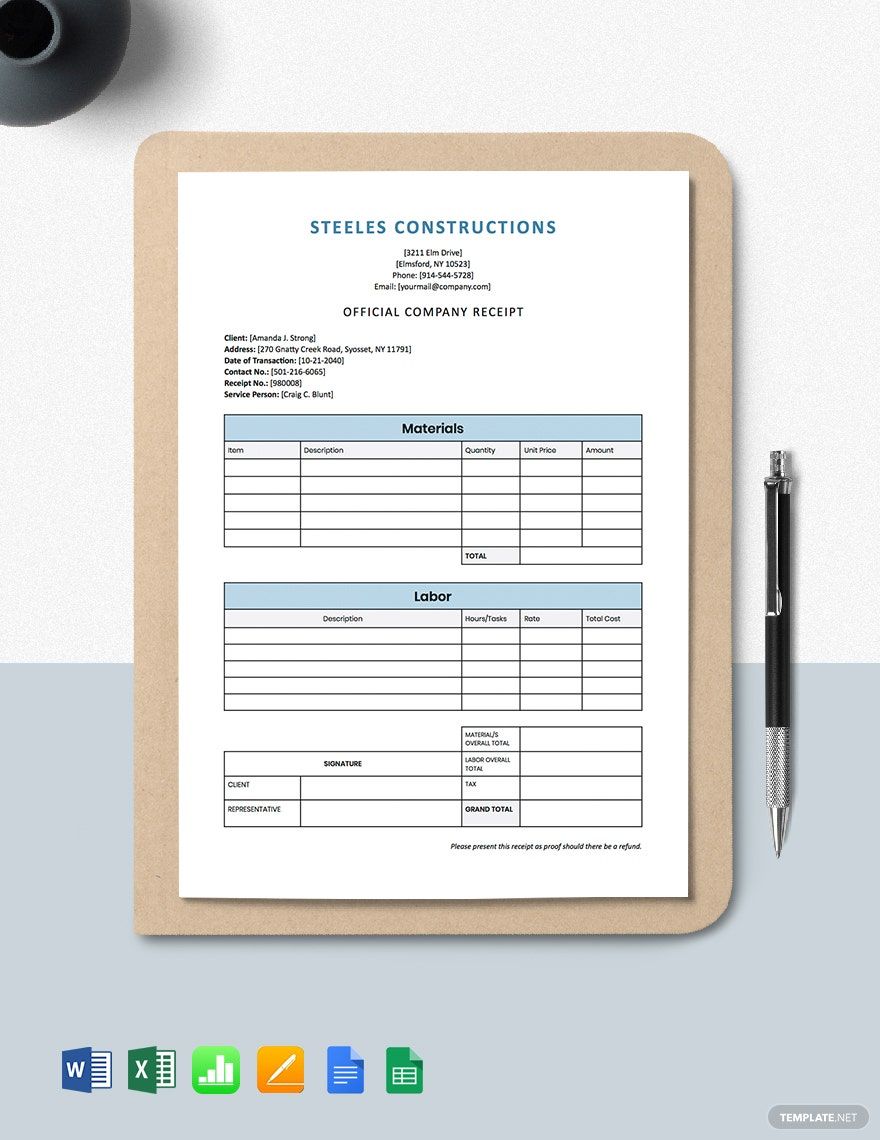

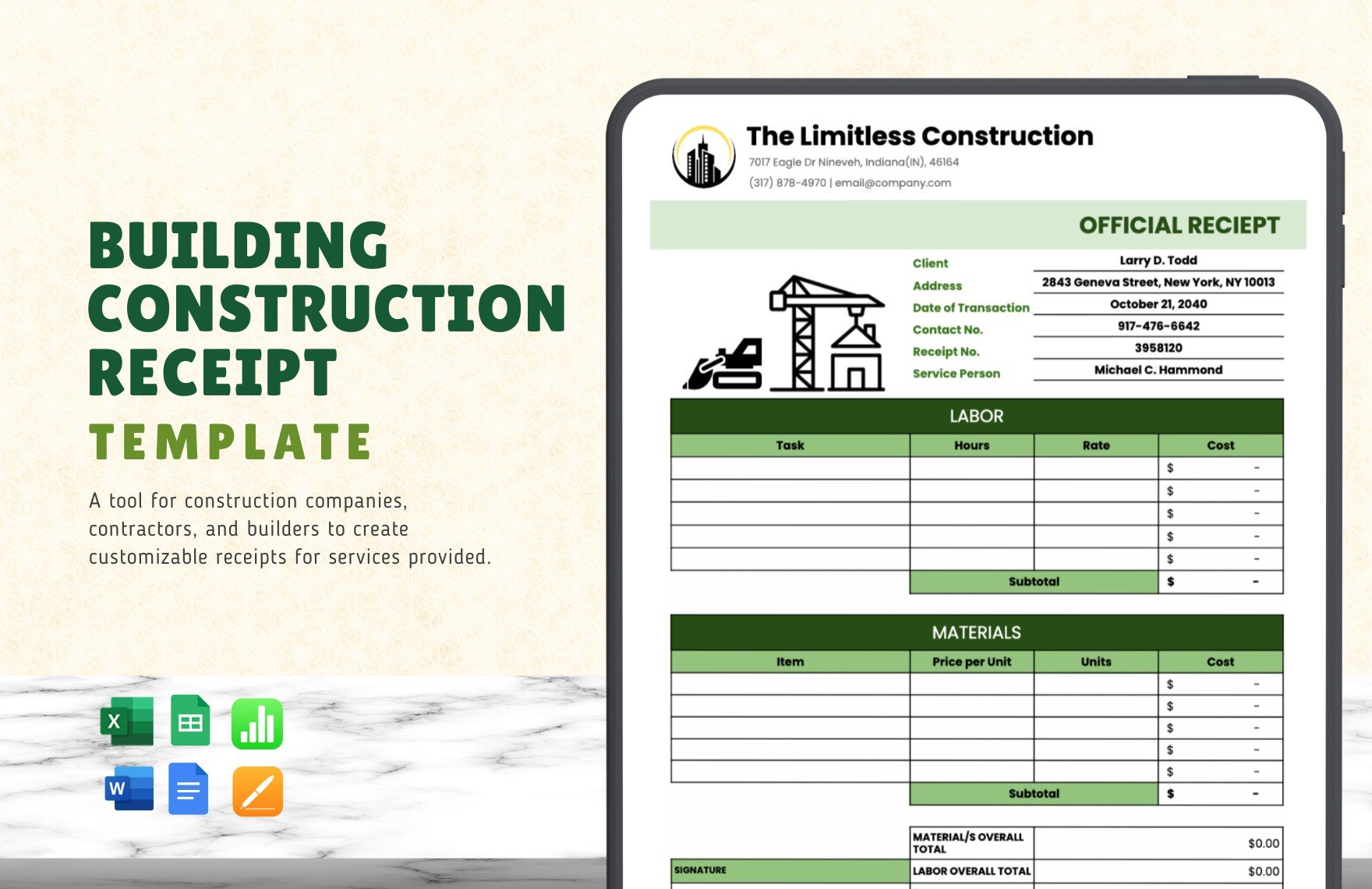

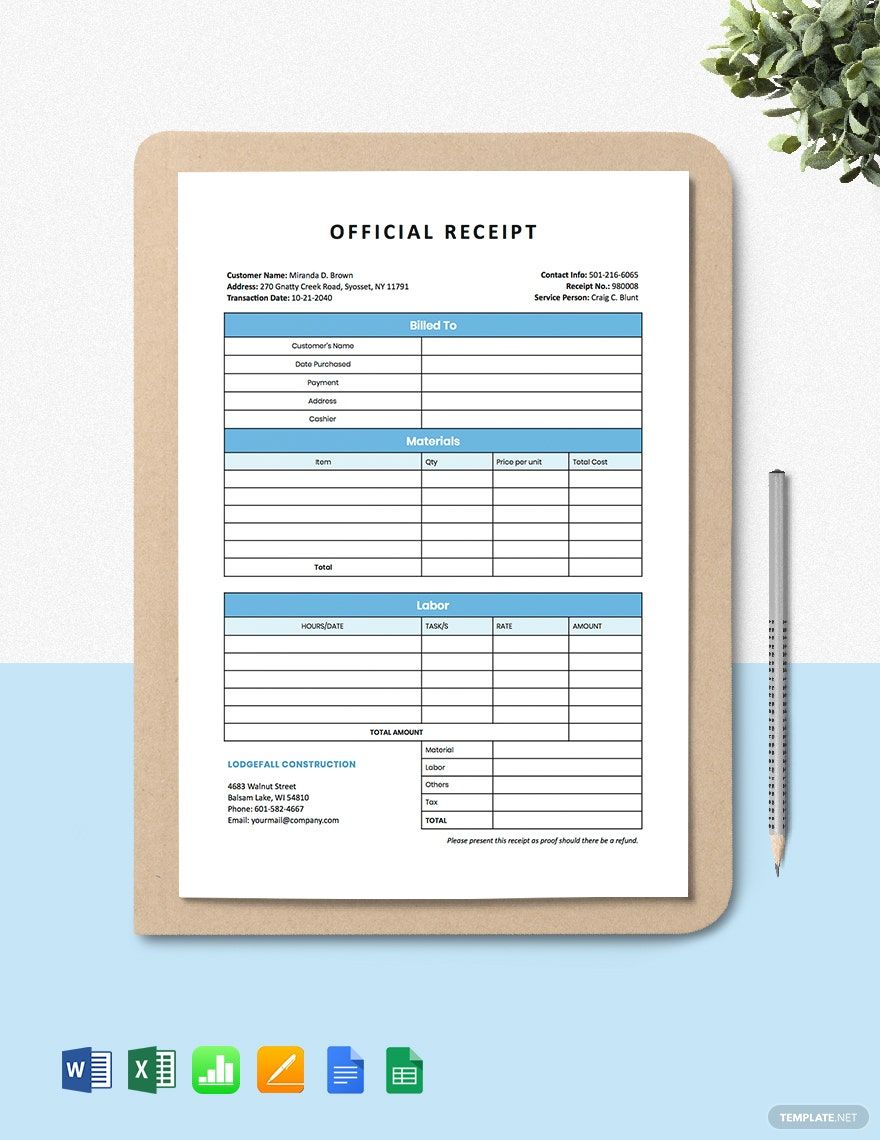

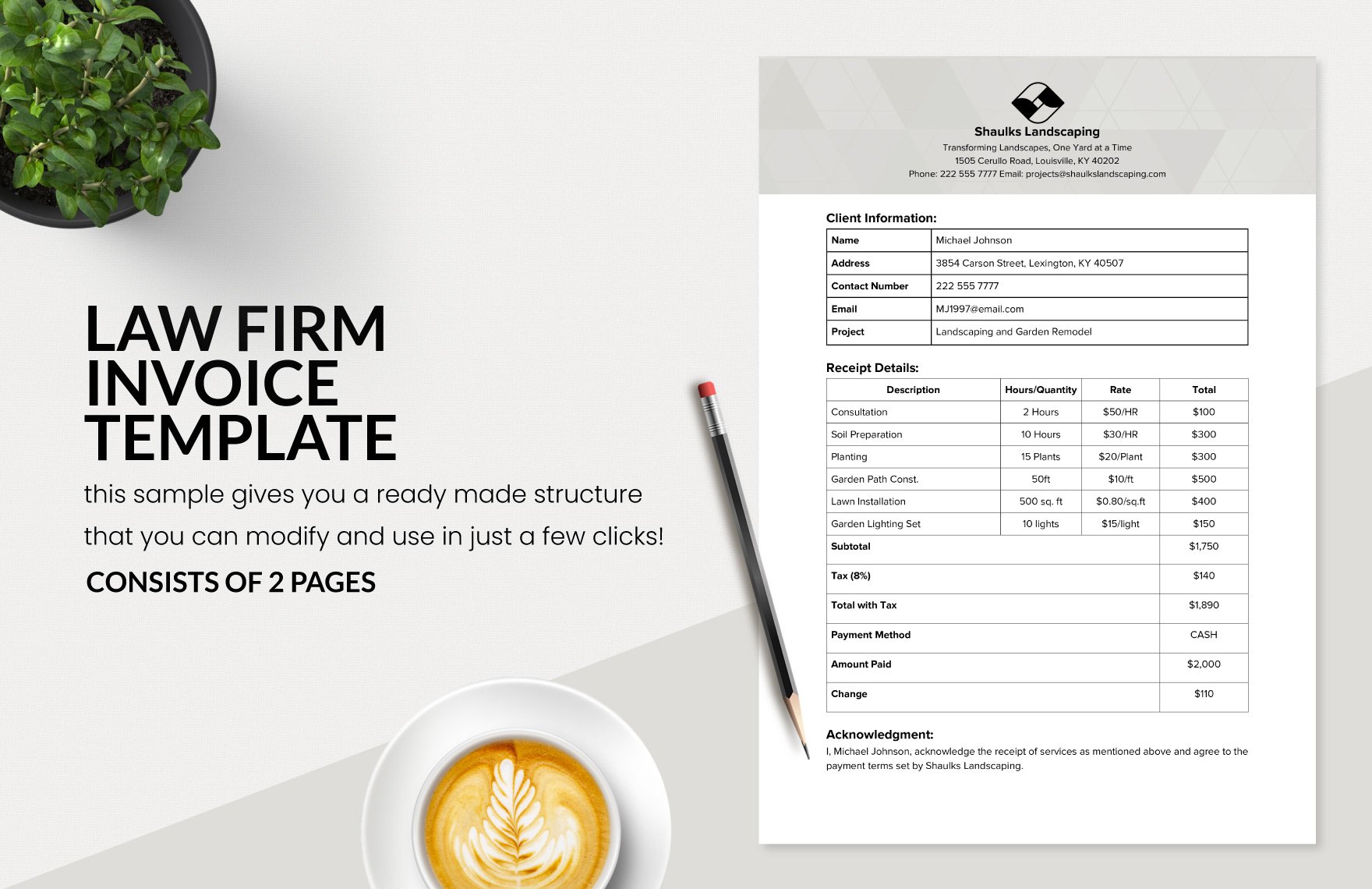

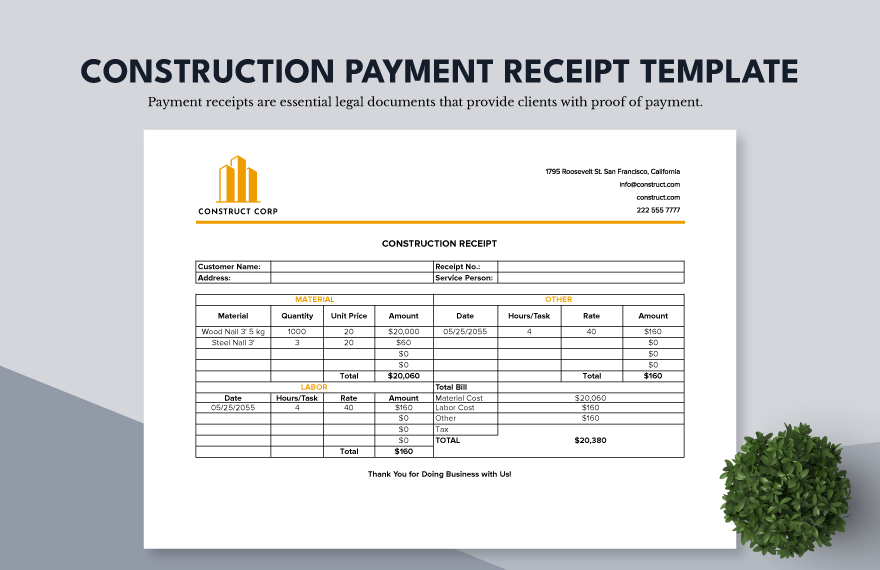

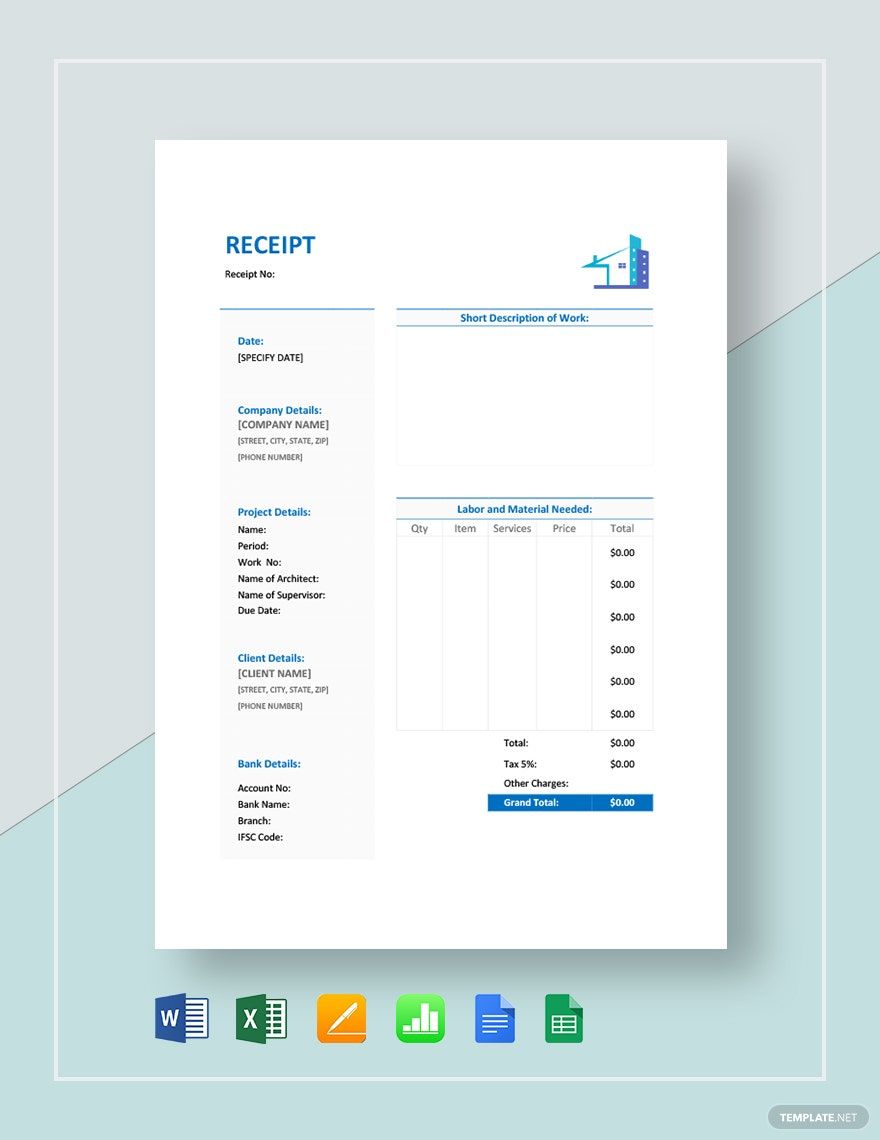

Keep your construction business running smoothly with Construction Receipt Templates from Template.net, designed for contractors, site managers, and accounting professionals. Keep your records organized, streamline your invoicing process, and ensure accuracy with these comprehensive templates. Whether you're looking to promote a seamless billing cycle or provide transparent documentation during audits, our templates are here to help. Each receipt includes essential details such as company information, service descriptions, and itemized billing, ensuring clarity and professionalism with every transaction. No accounting degree required—our professional-grade design ensures simplicity and efficiency, making it a breeze for anyone to use. Additionally, customize layouts for print or digital distribution, adapting them to meet specific client requirements.

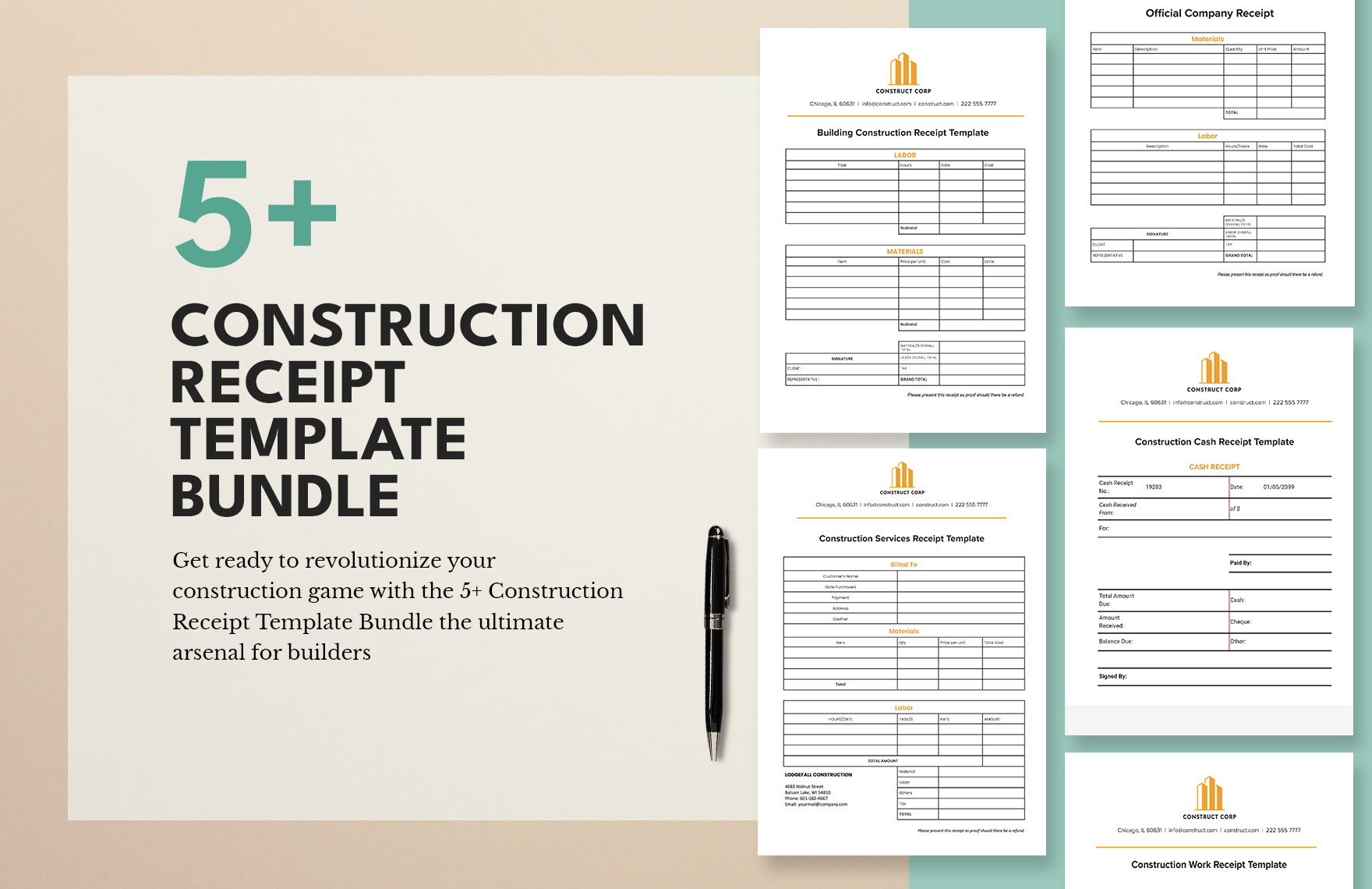

Discover the many customized Construction Receipt Templates we have on hand that cater to various needs, from small-scale projects to large construction undertakings. Begin by choosing a template that suits your project style, then easily swap in your company logo, project details, or specific service information. Tweak colors and fonts to align with your brand, or add advanced touches like industry-specific icons and graphics. Our AI-powered text tools provide suggestions for content, ensuring your documents are both precise and polished. Indulge in the fun of creating tailored receipts with endless possibilities, all while requiring no advanced design skills. With regularly updated templates, you’ll always have fresh options to choose from. When you’re finished, download or share your document via email, link, or print, providing flexibility for multiple distribution channels and ensuring efficiency in your business operations.