Streamline Your Financial Tasks with Ready-to-Use Accounting Templates in Microsoft Excel by Template.net

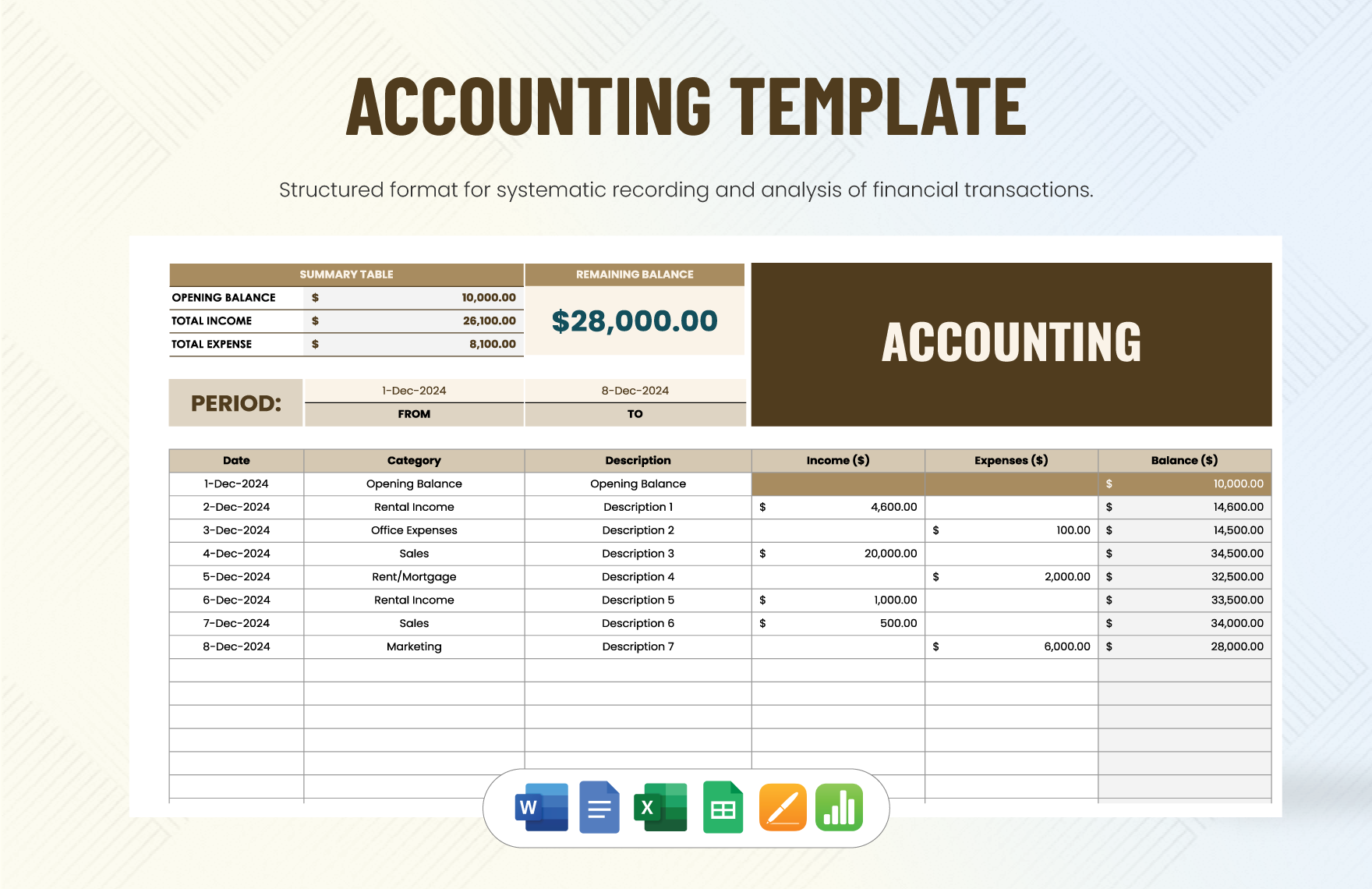

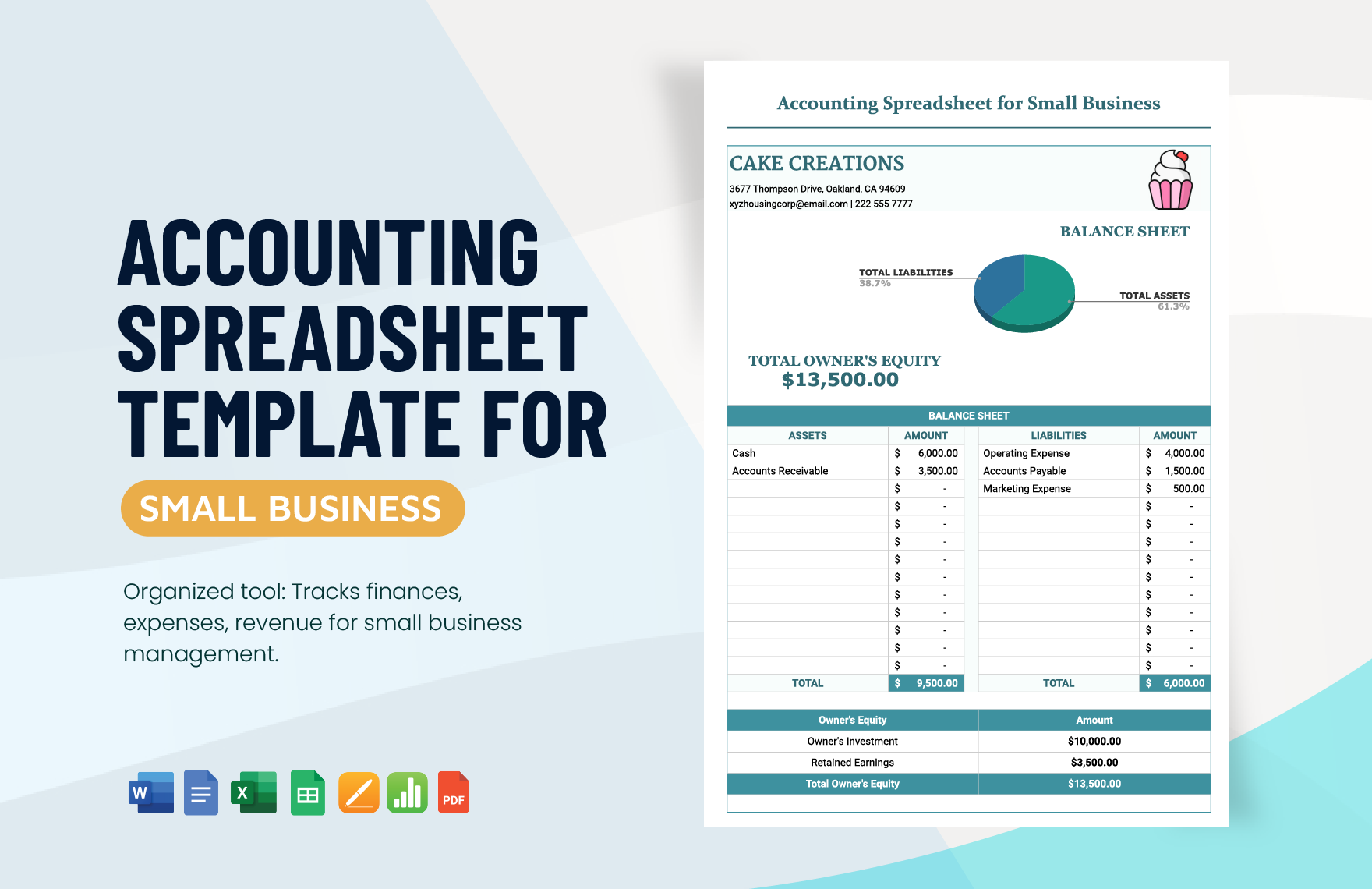

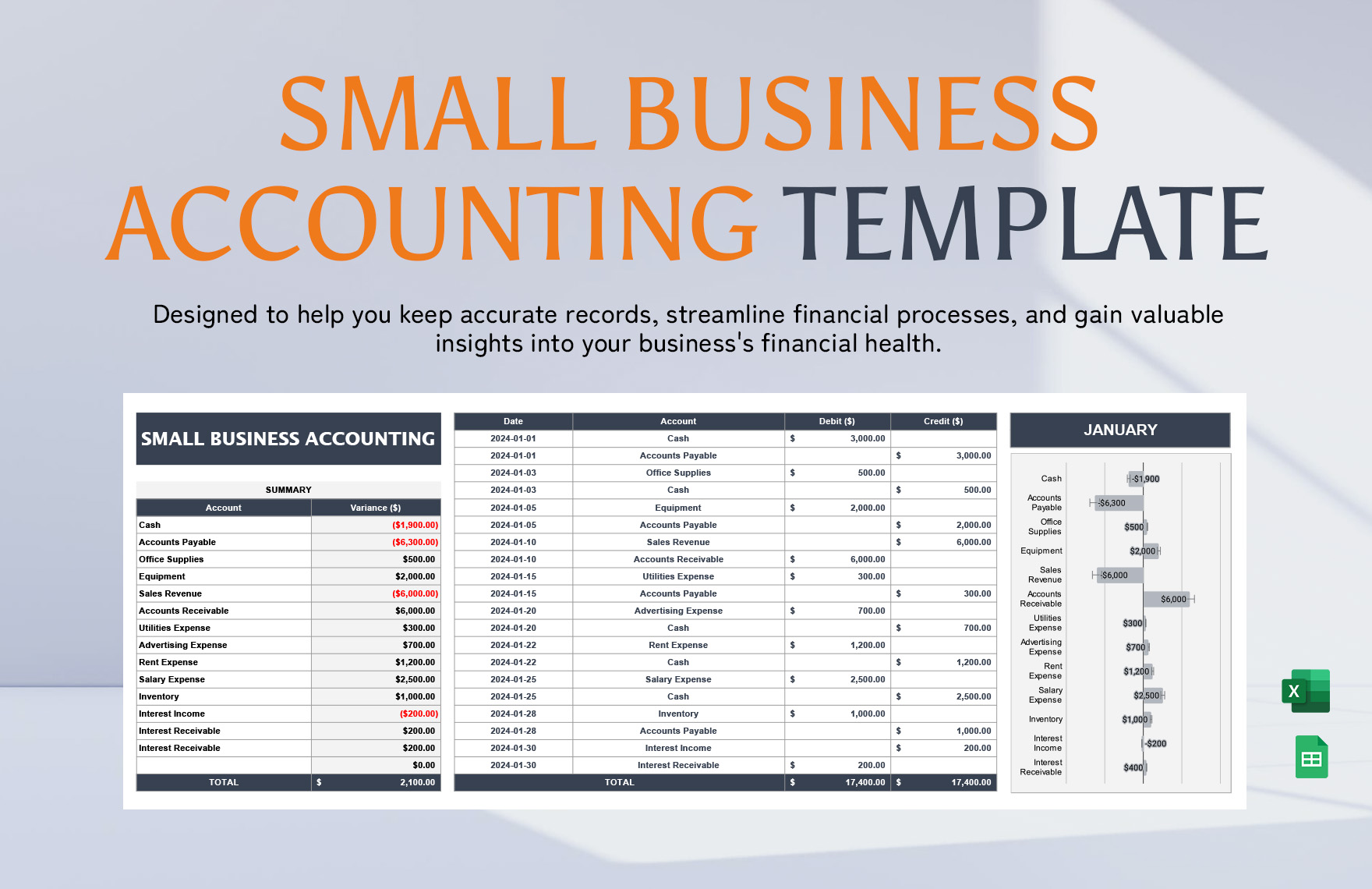

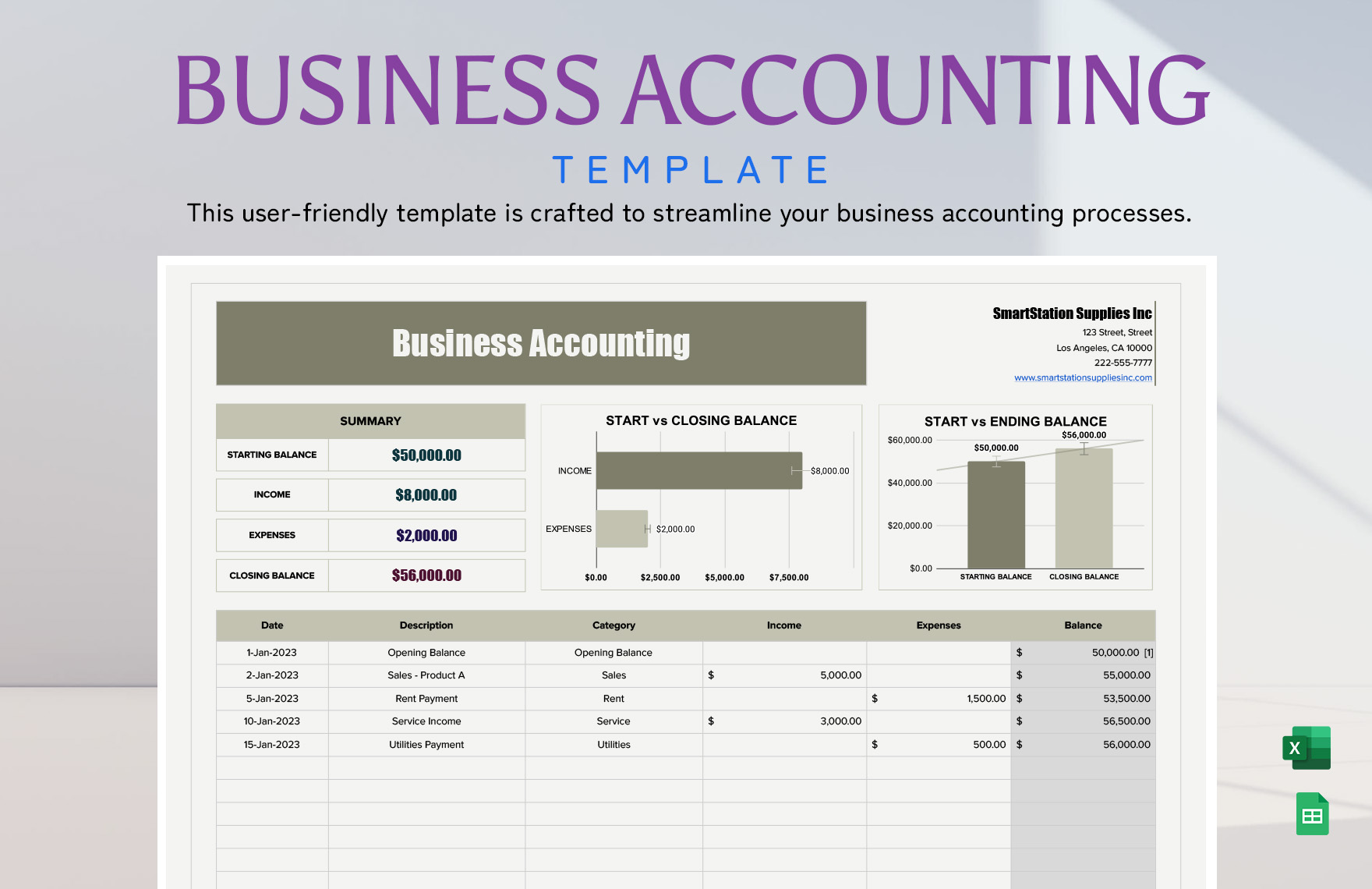

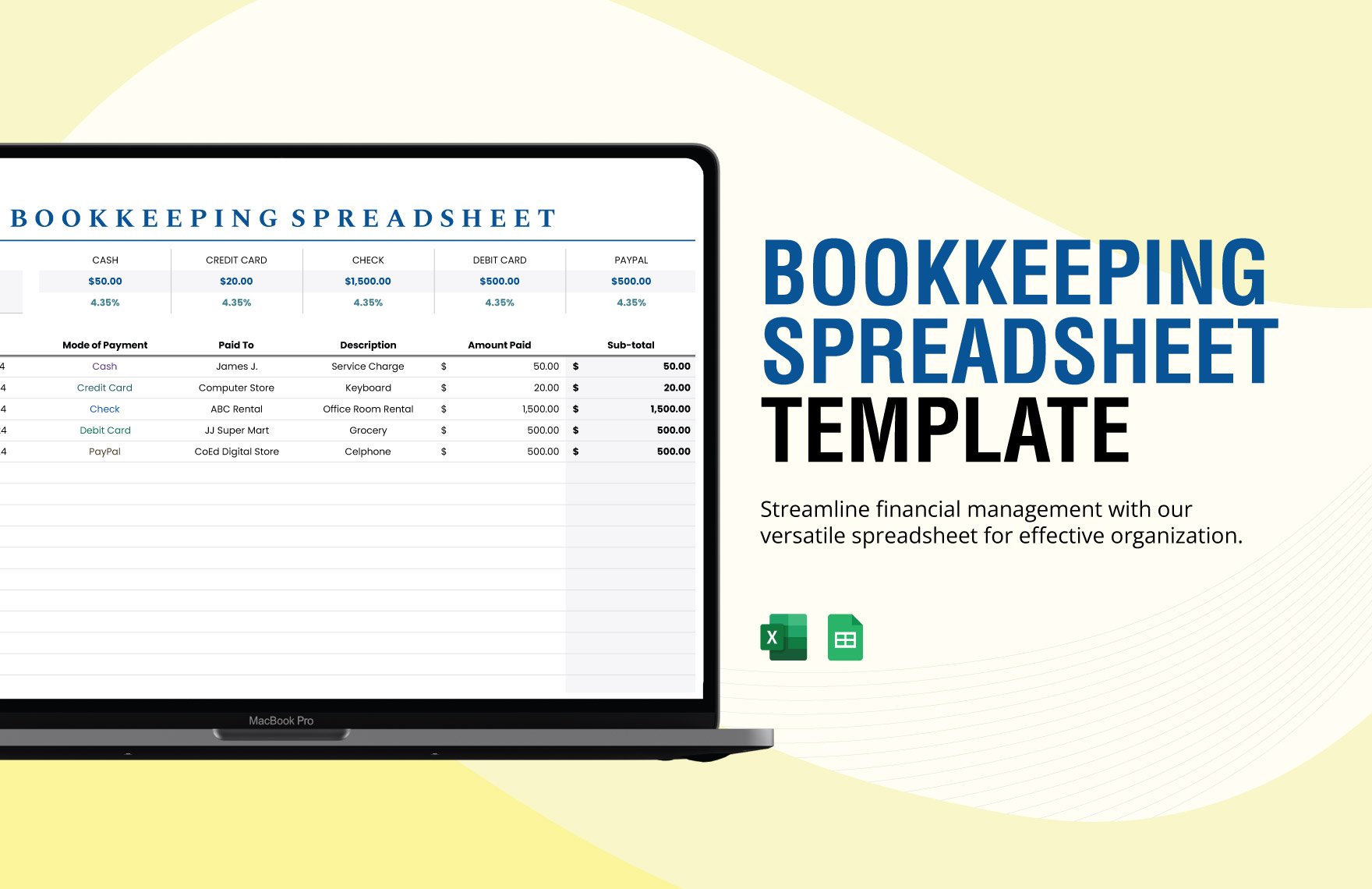

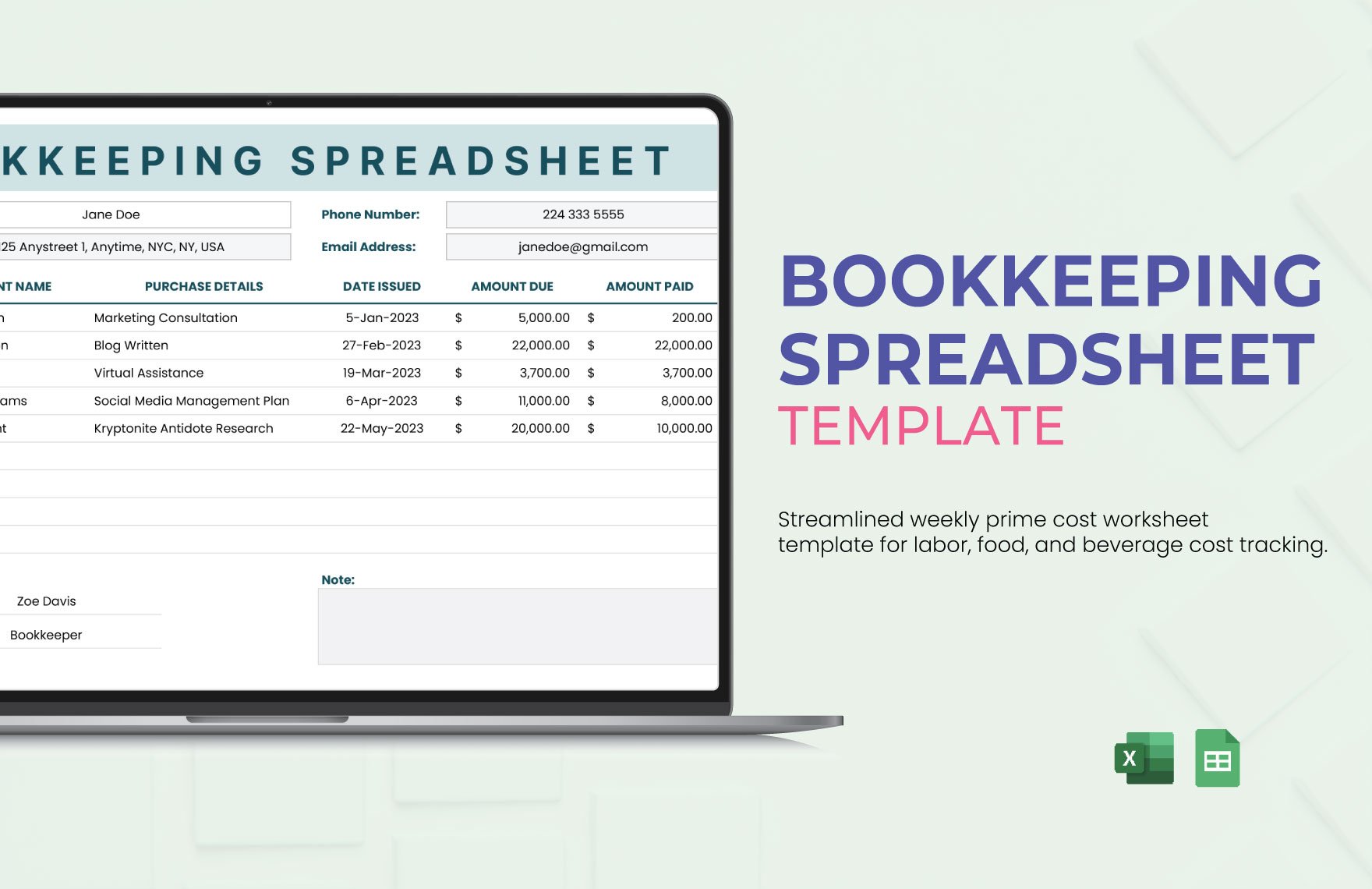

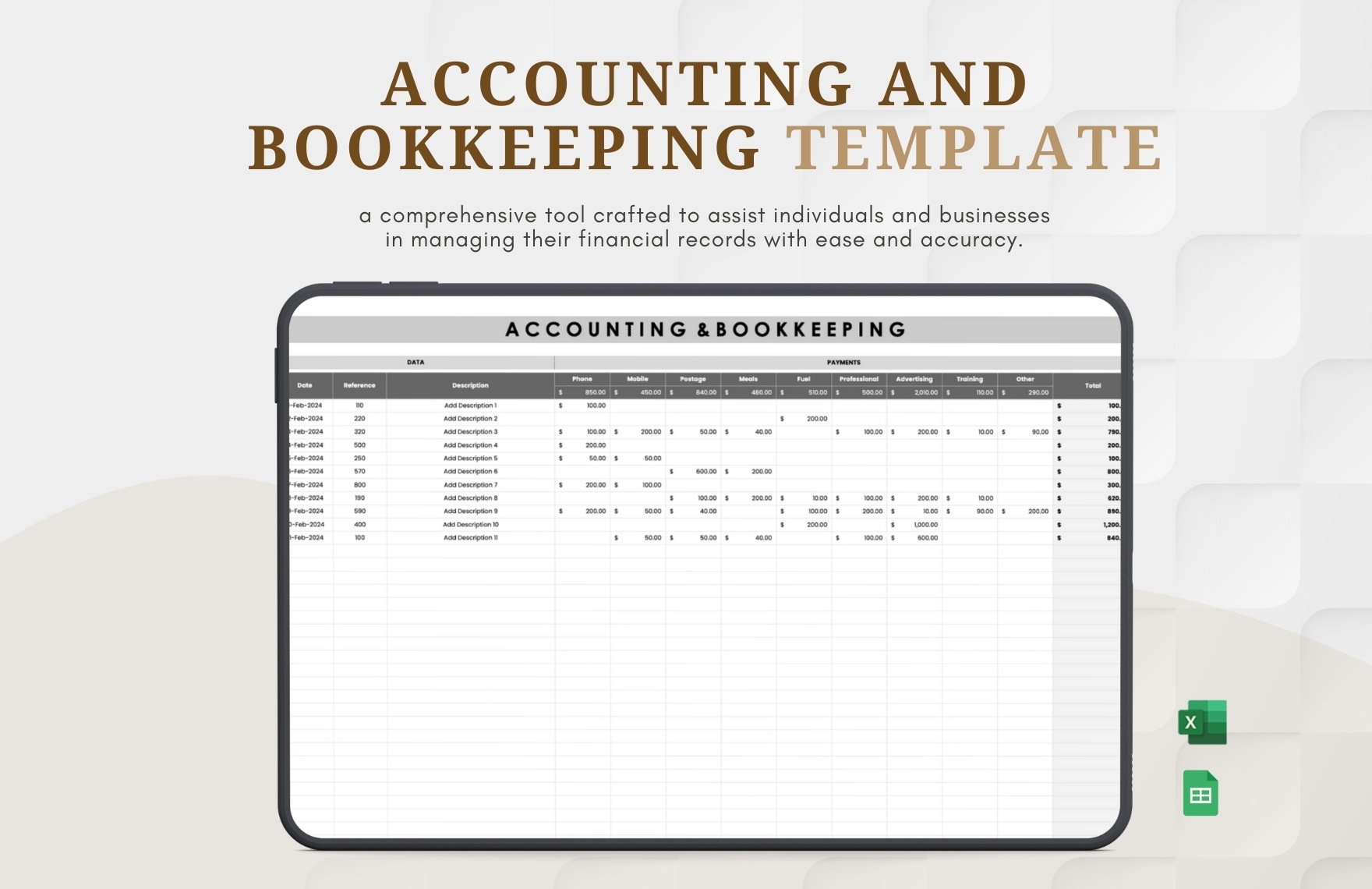

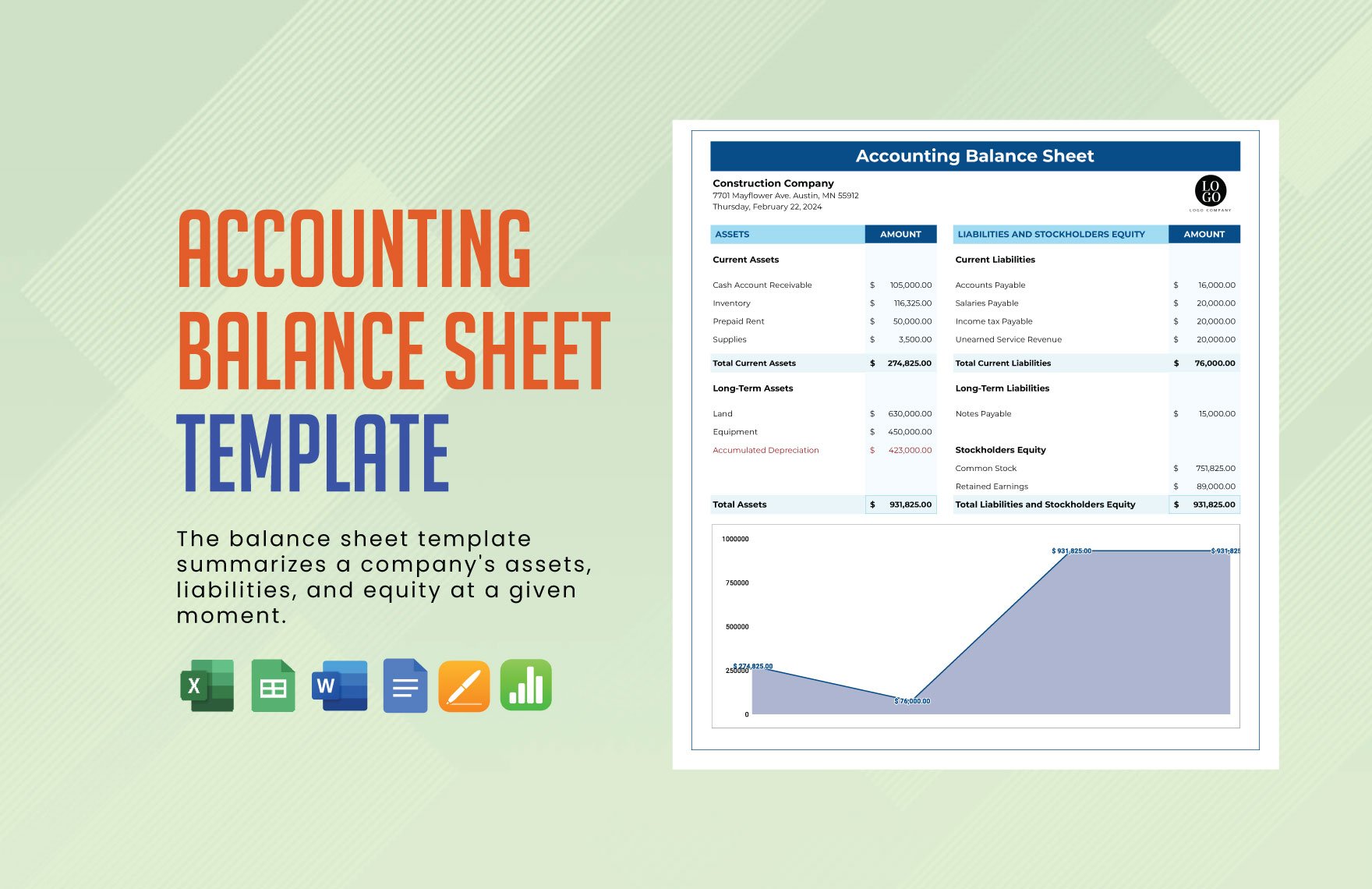

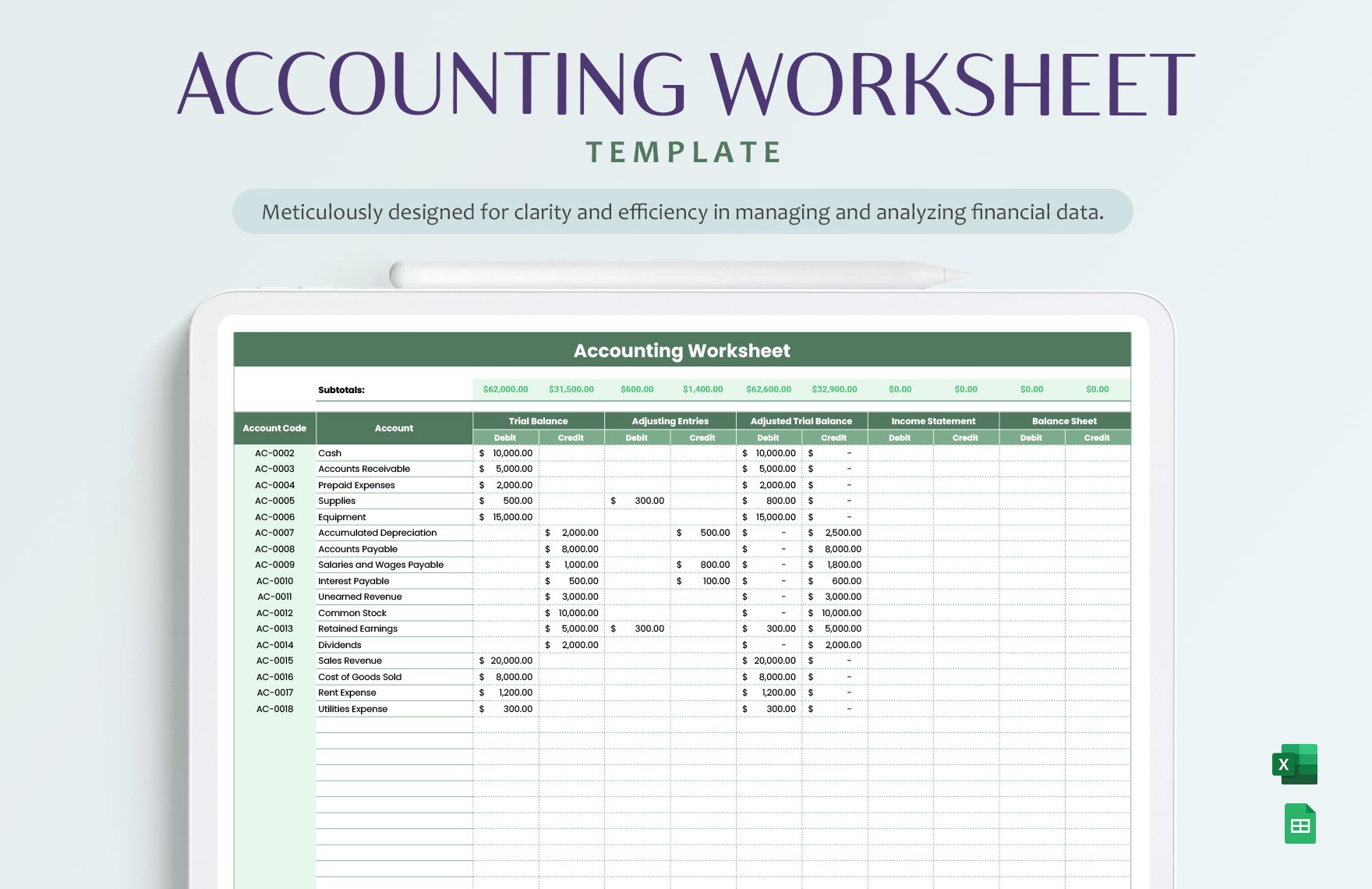

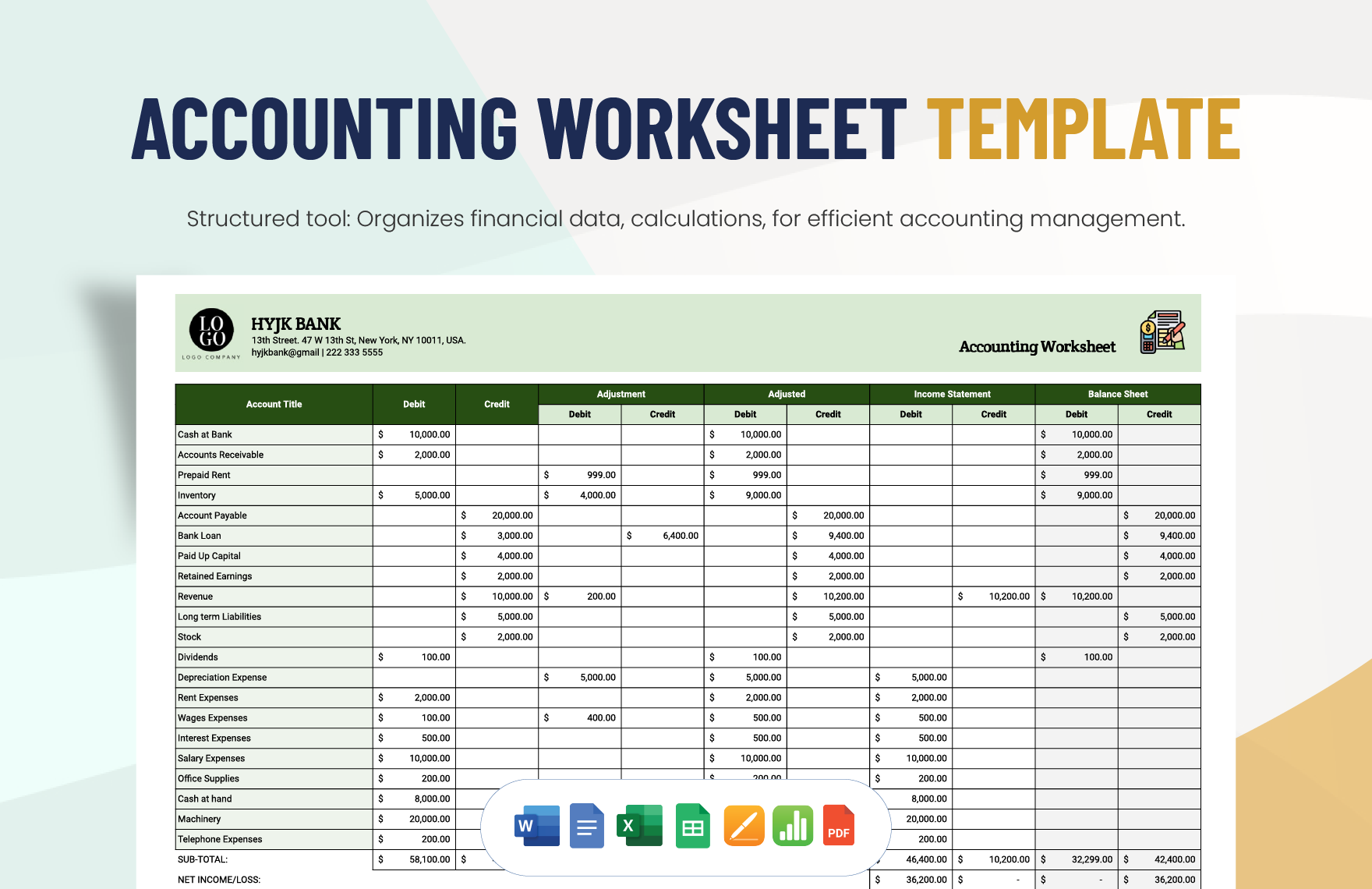

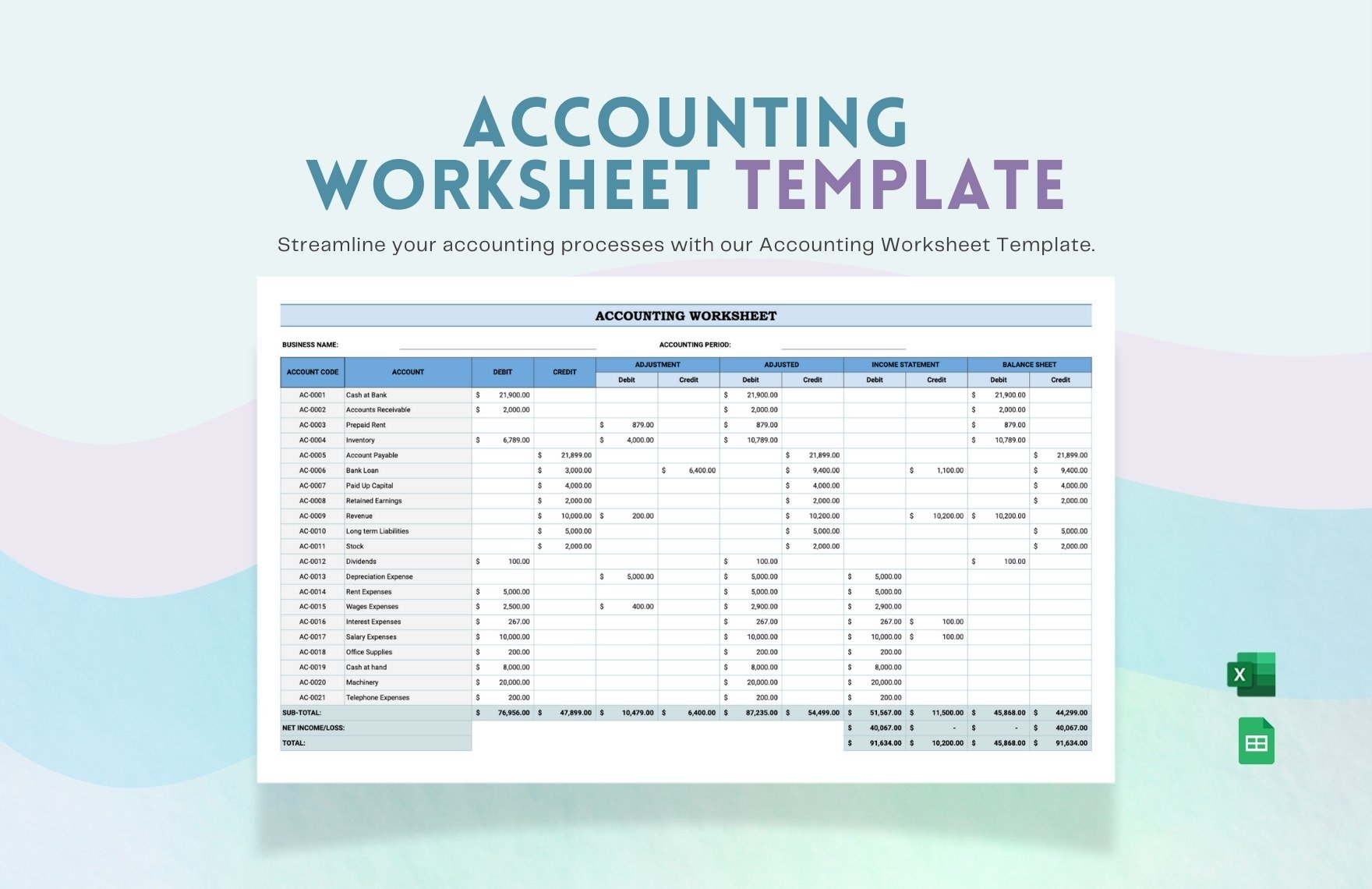

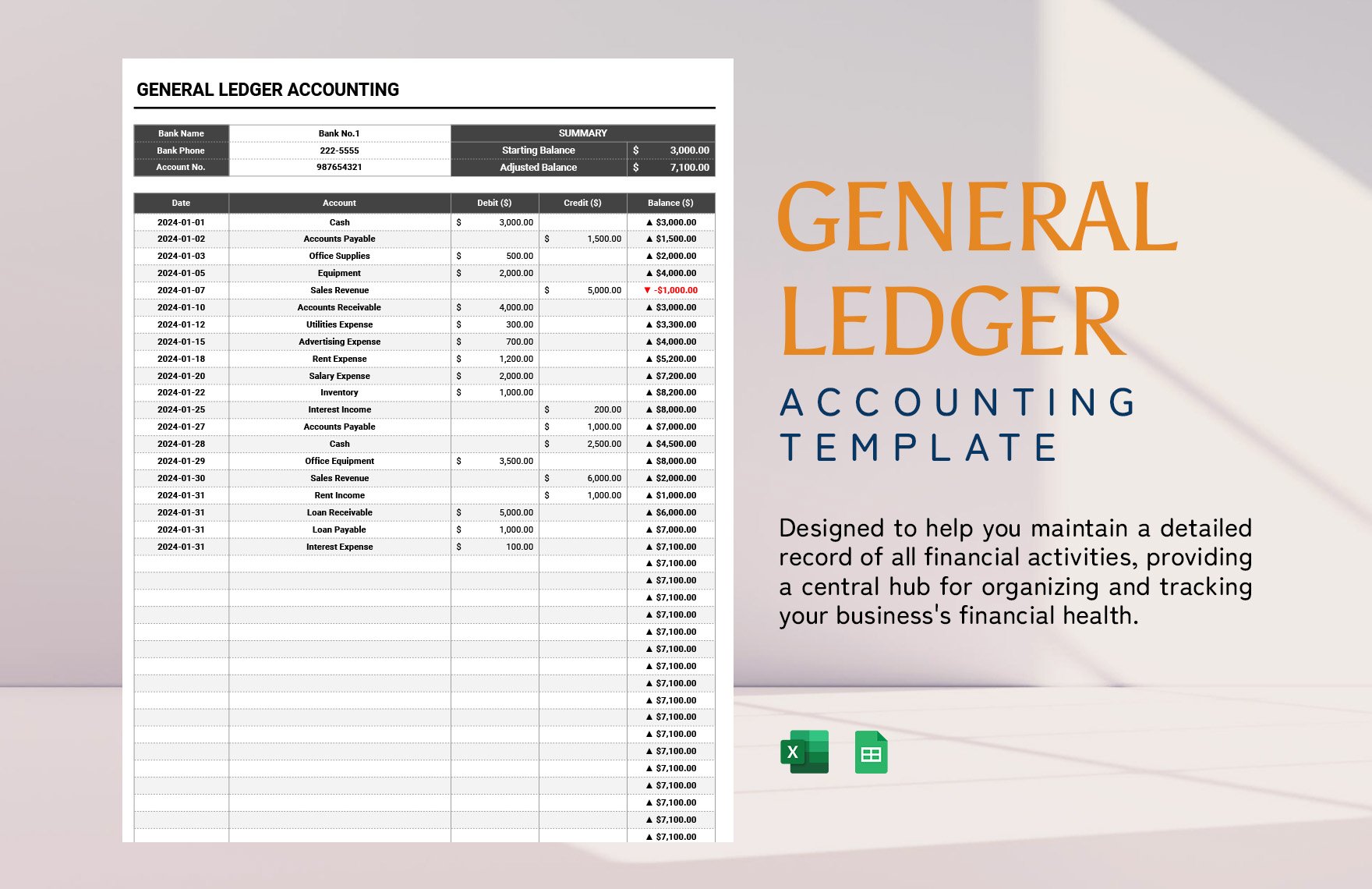

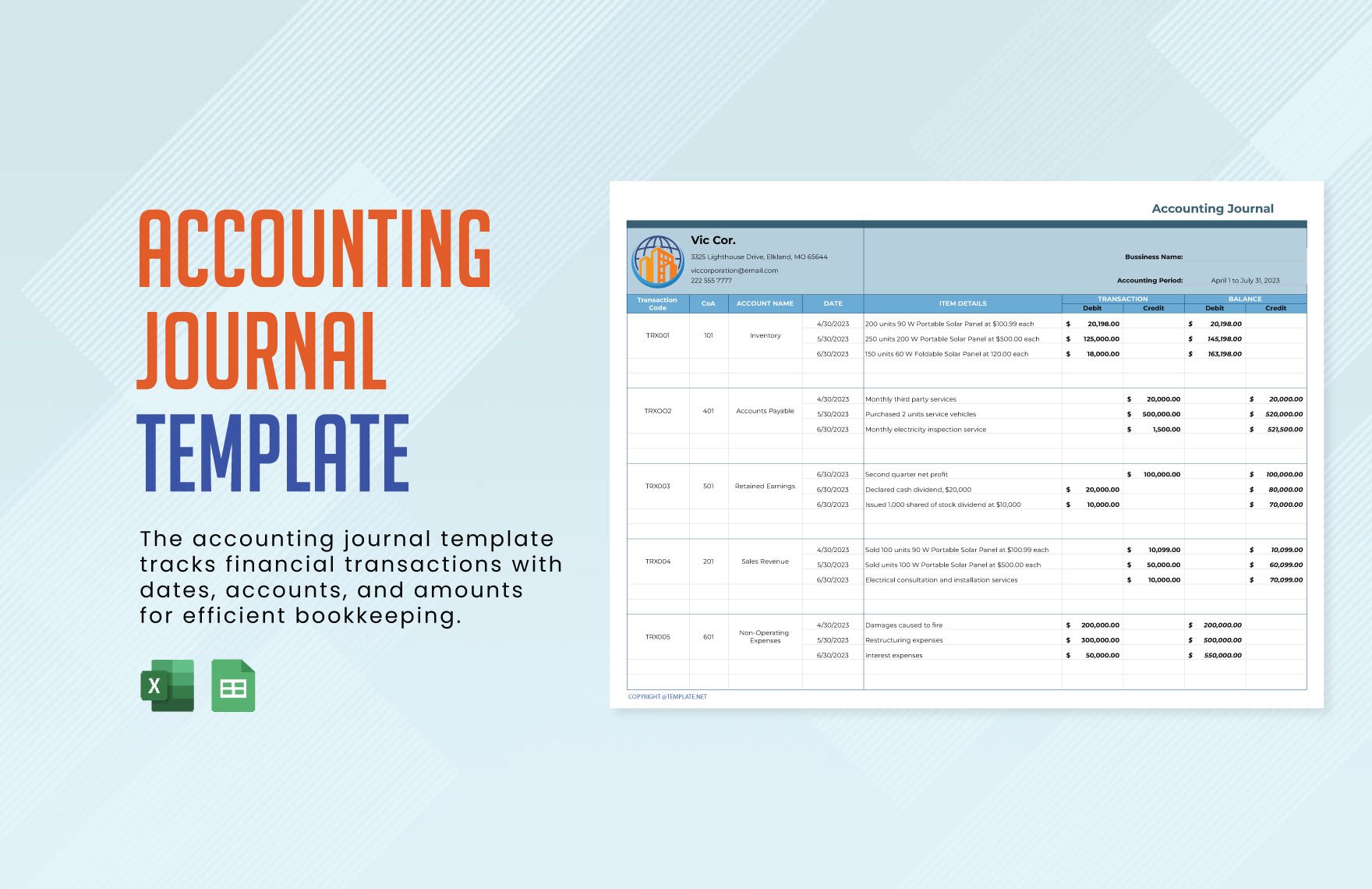

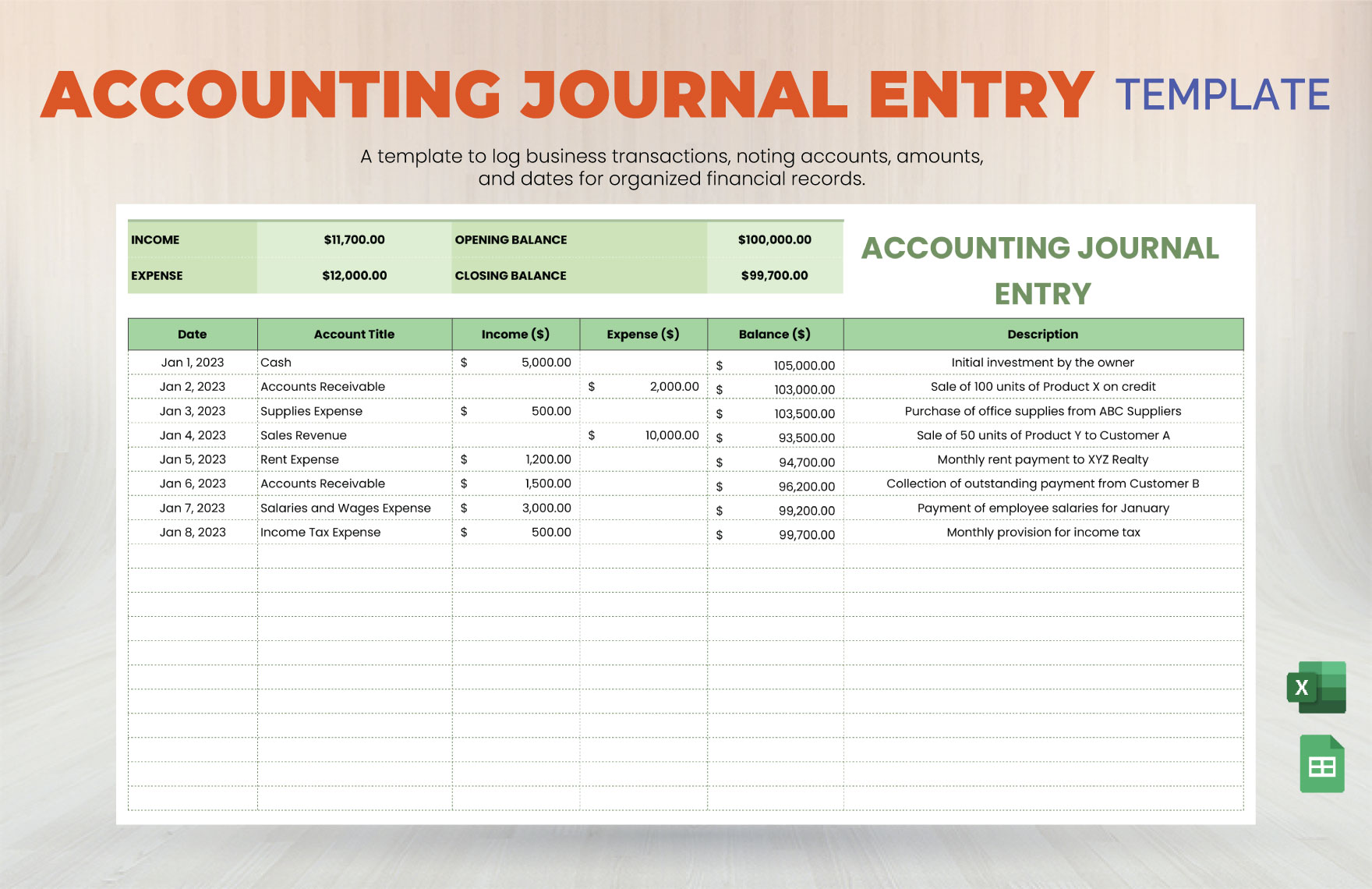

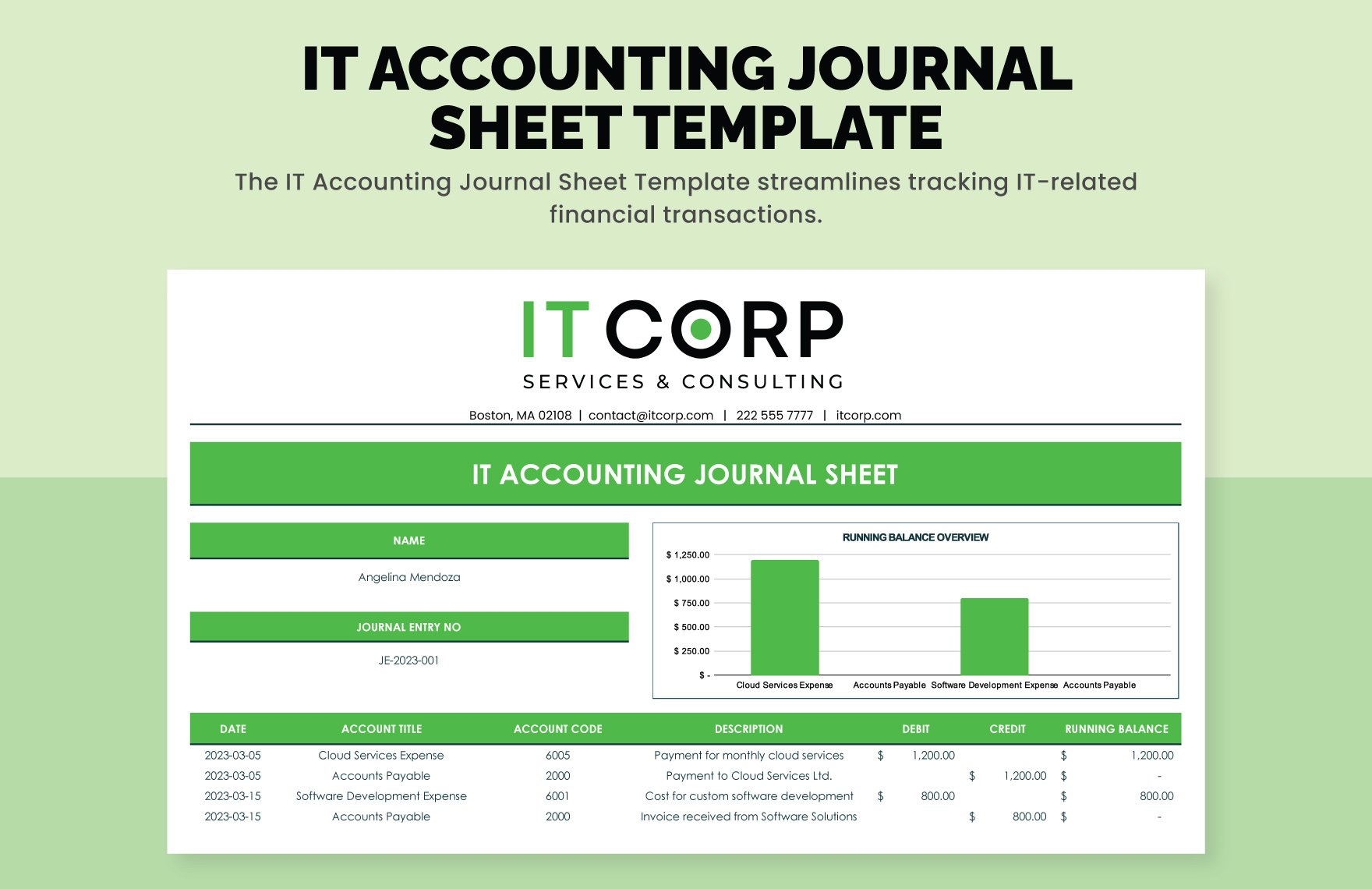

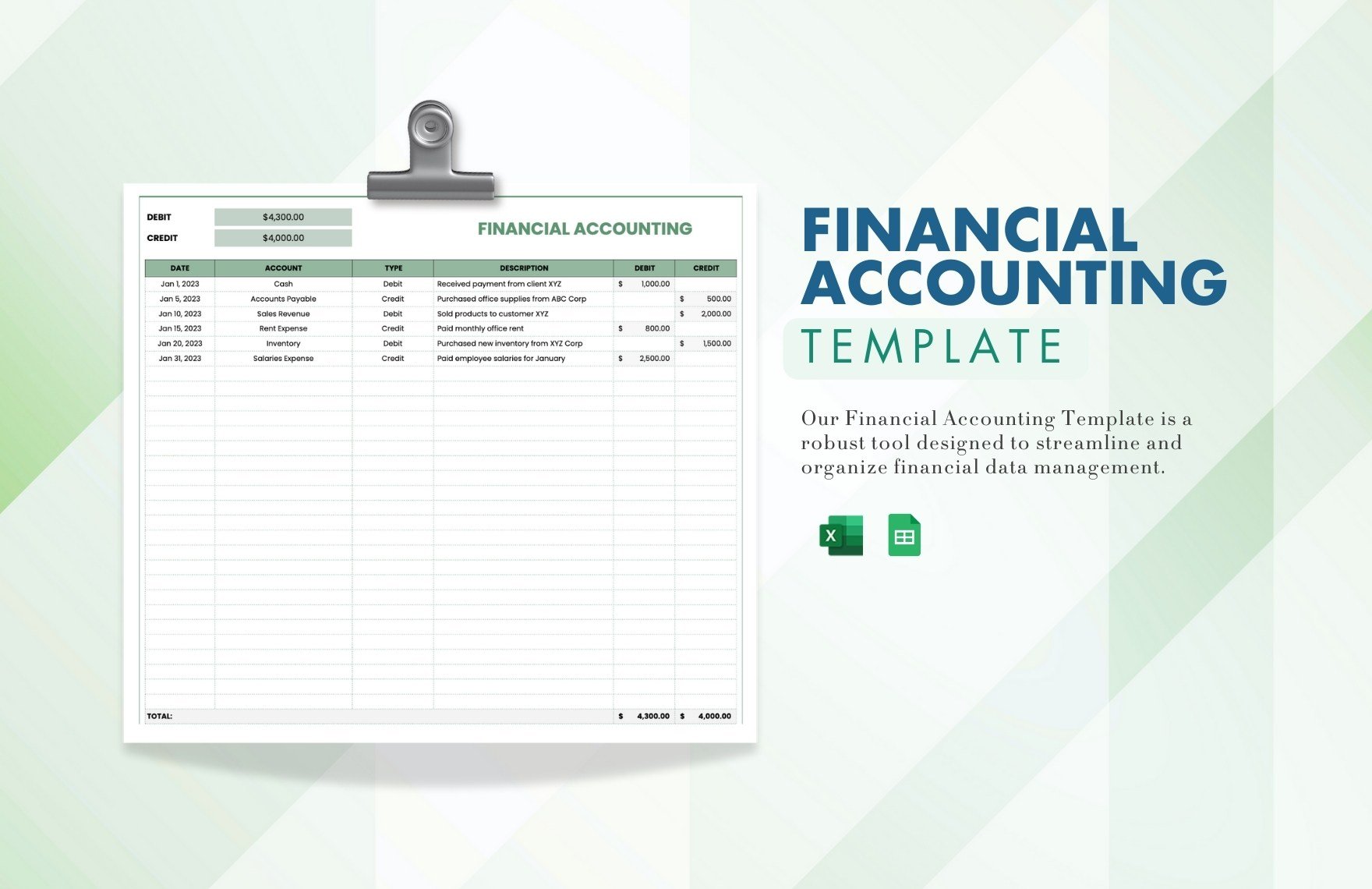

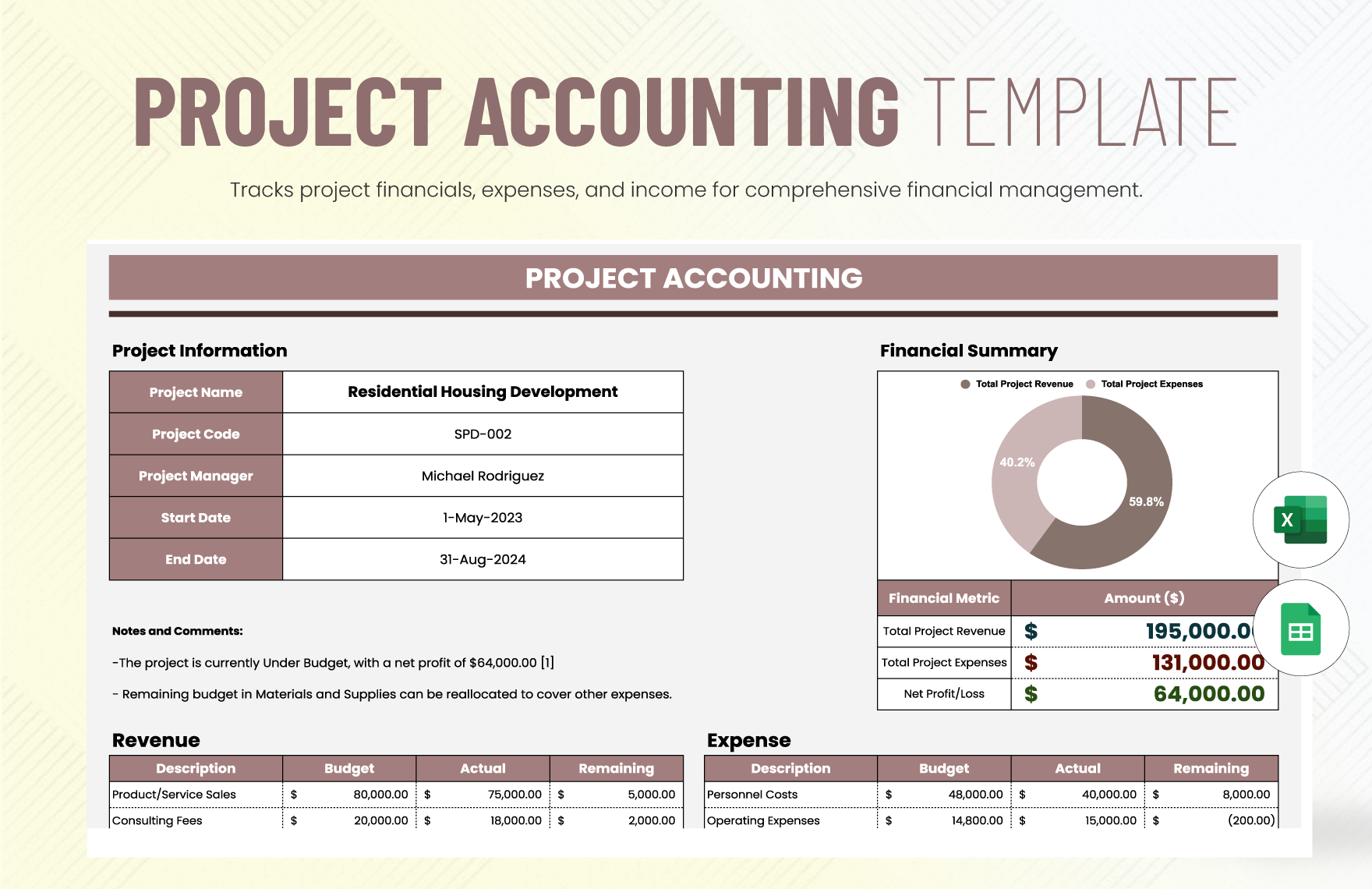

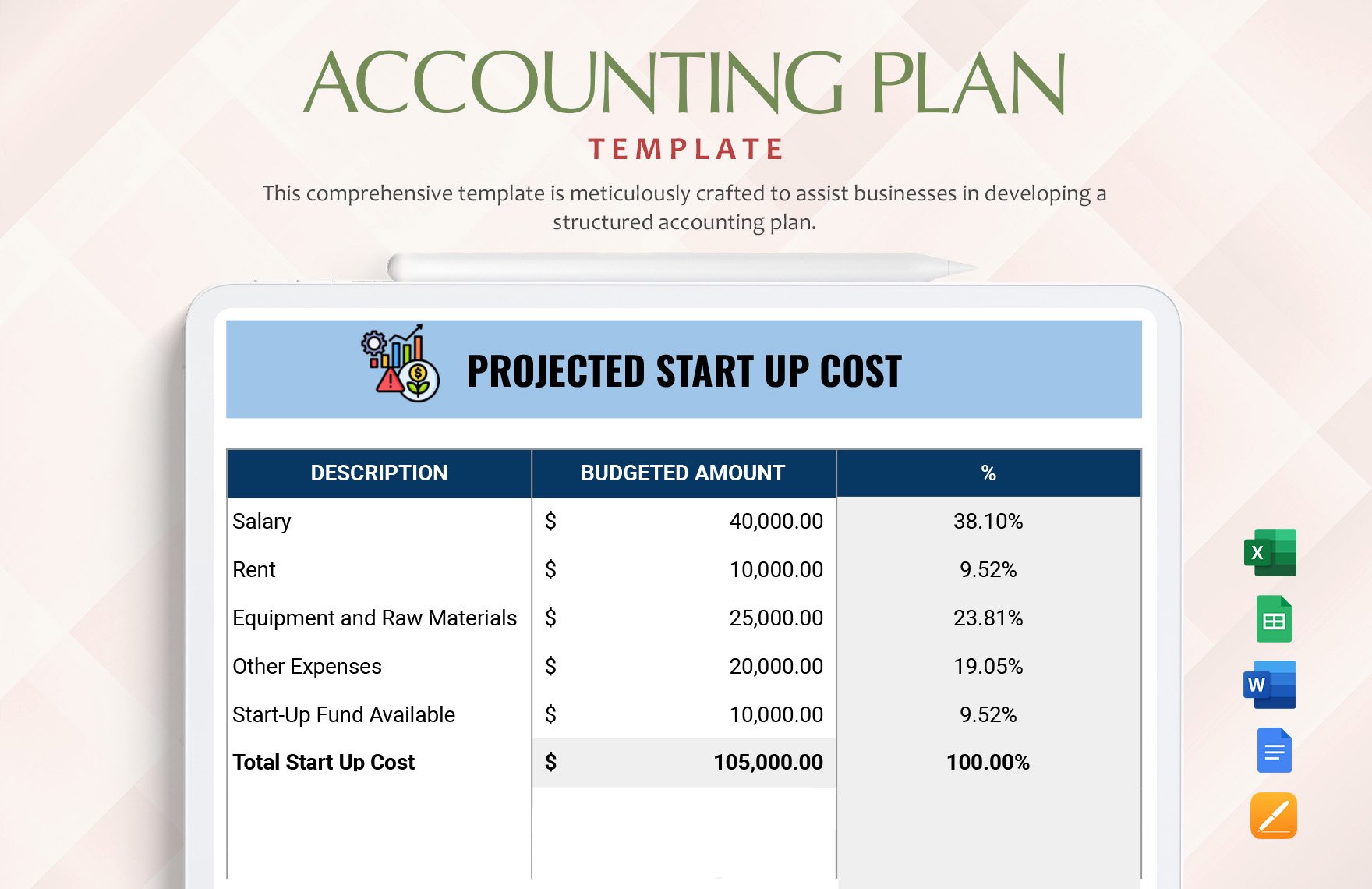

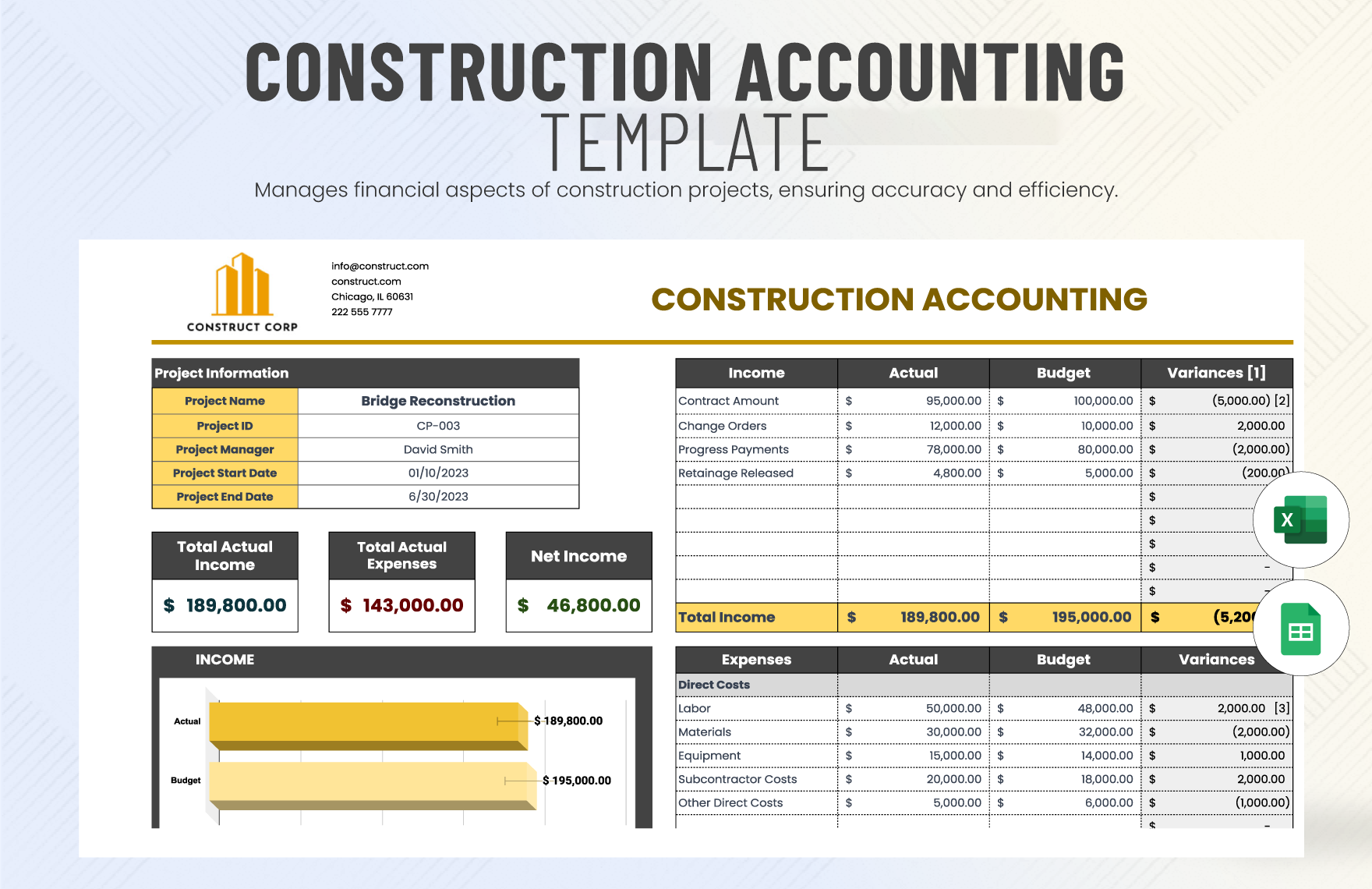

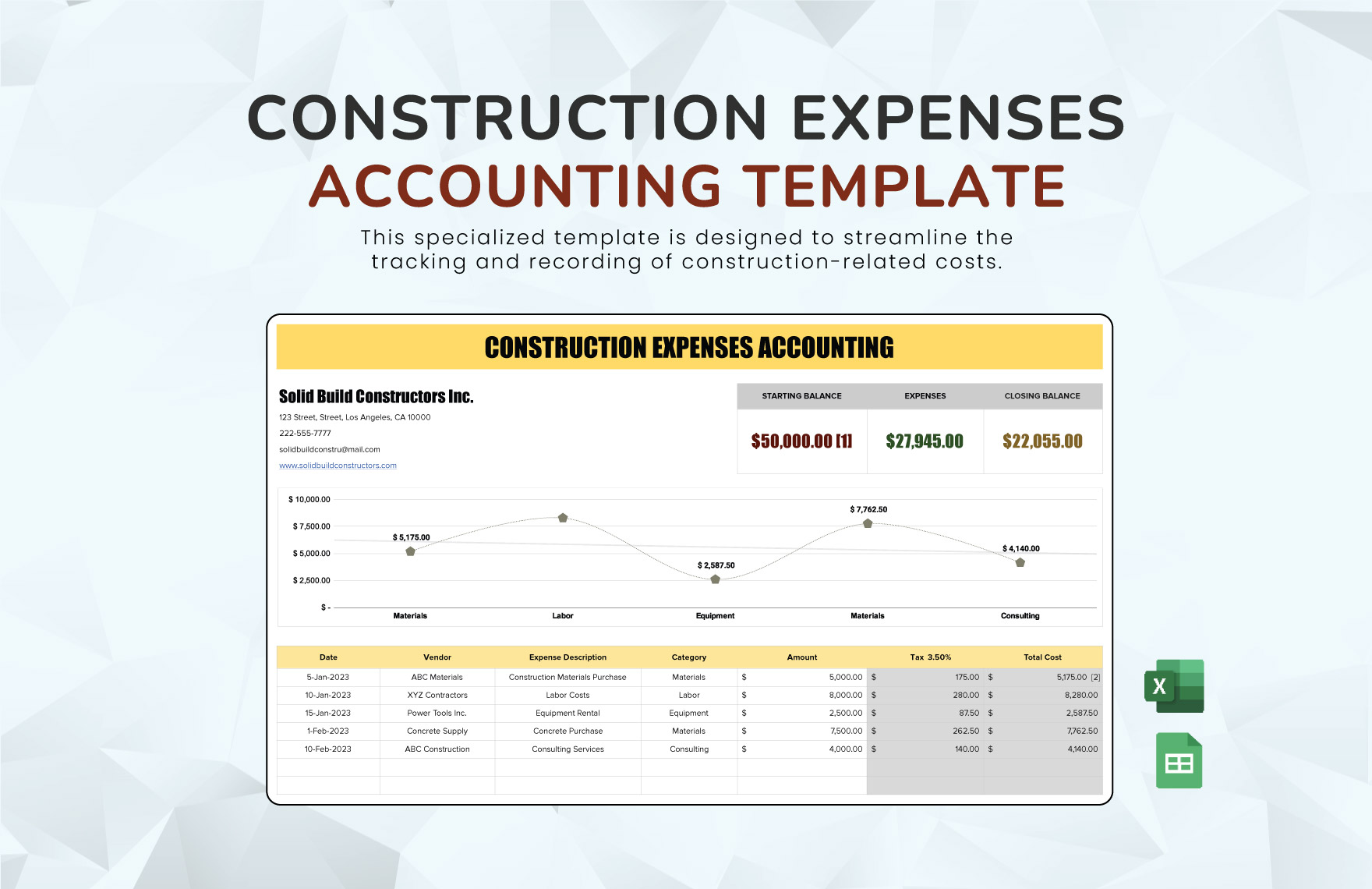

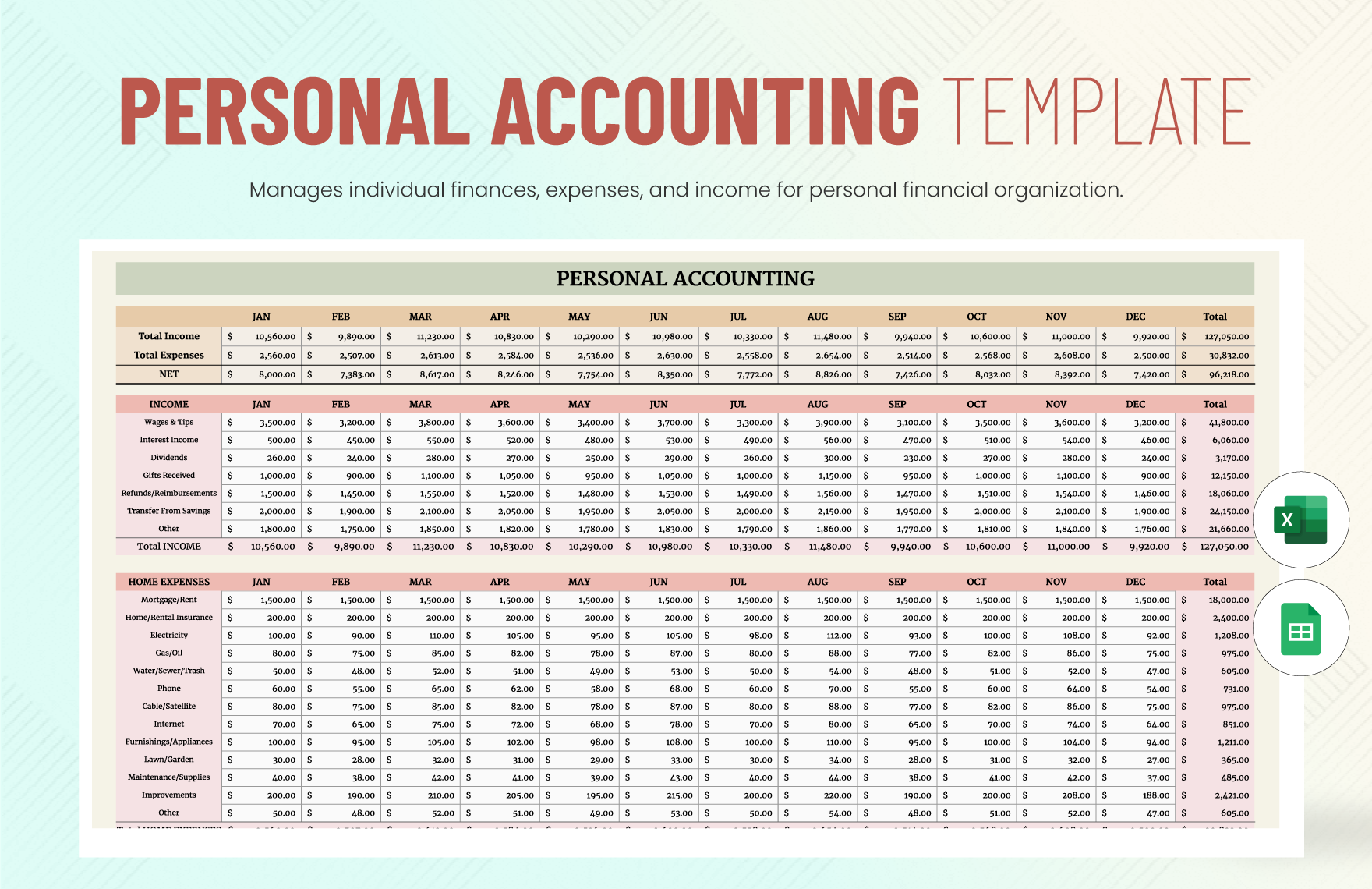

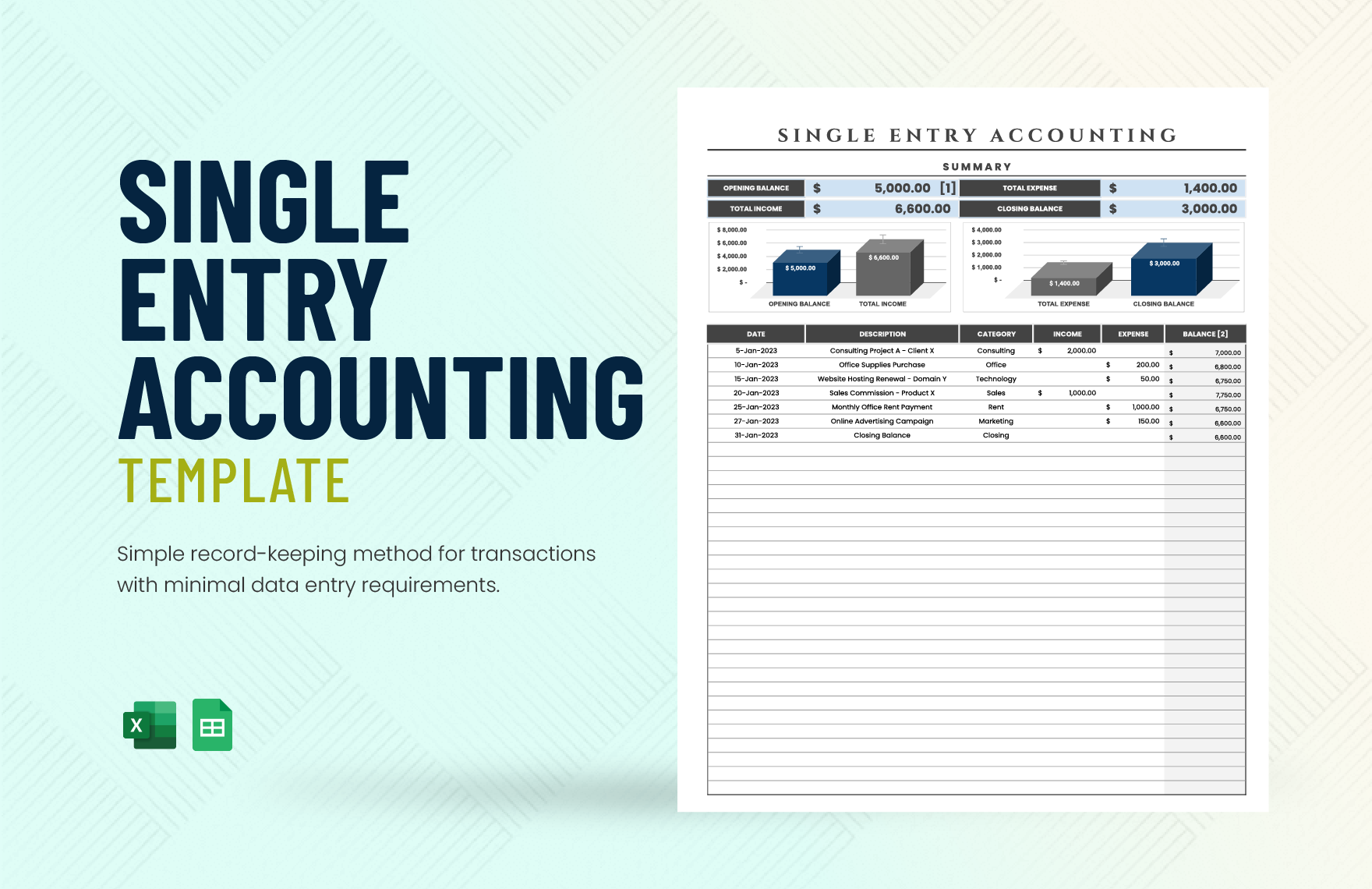

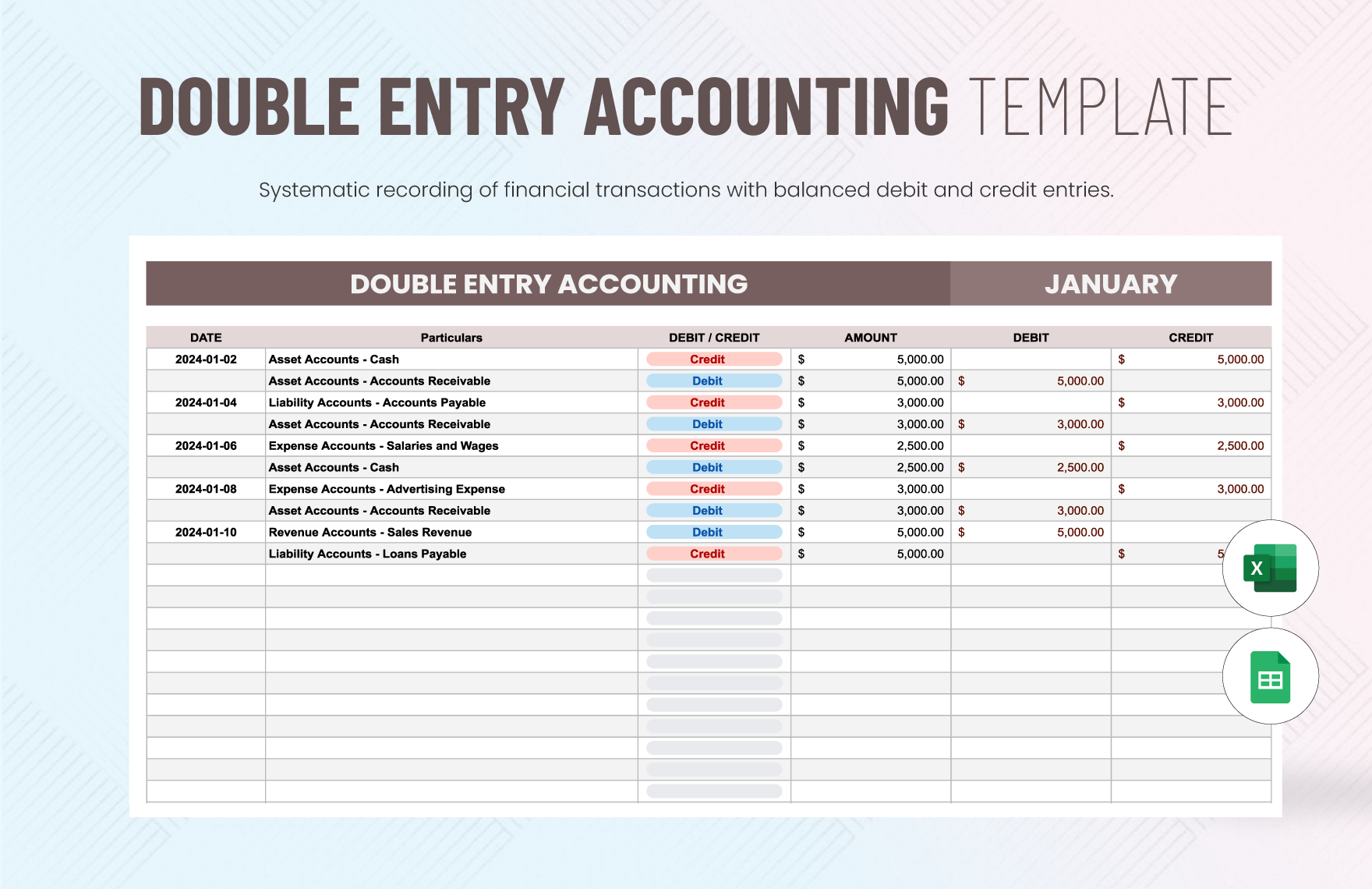

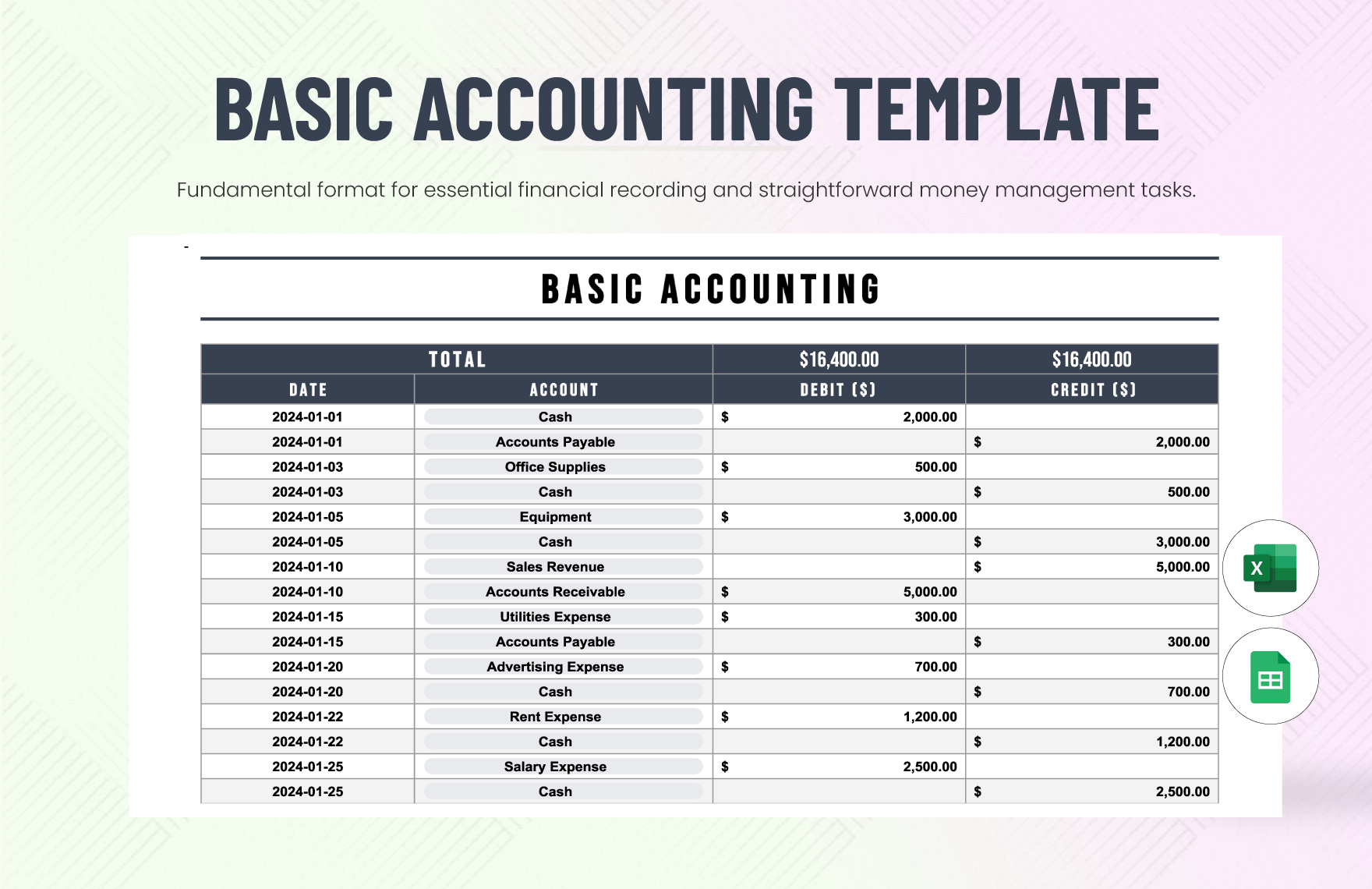

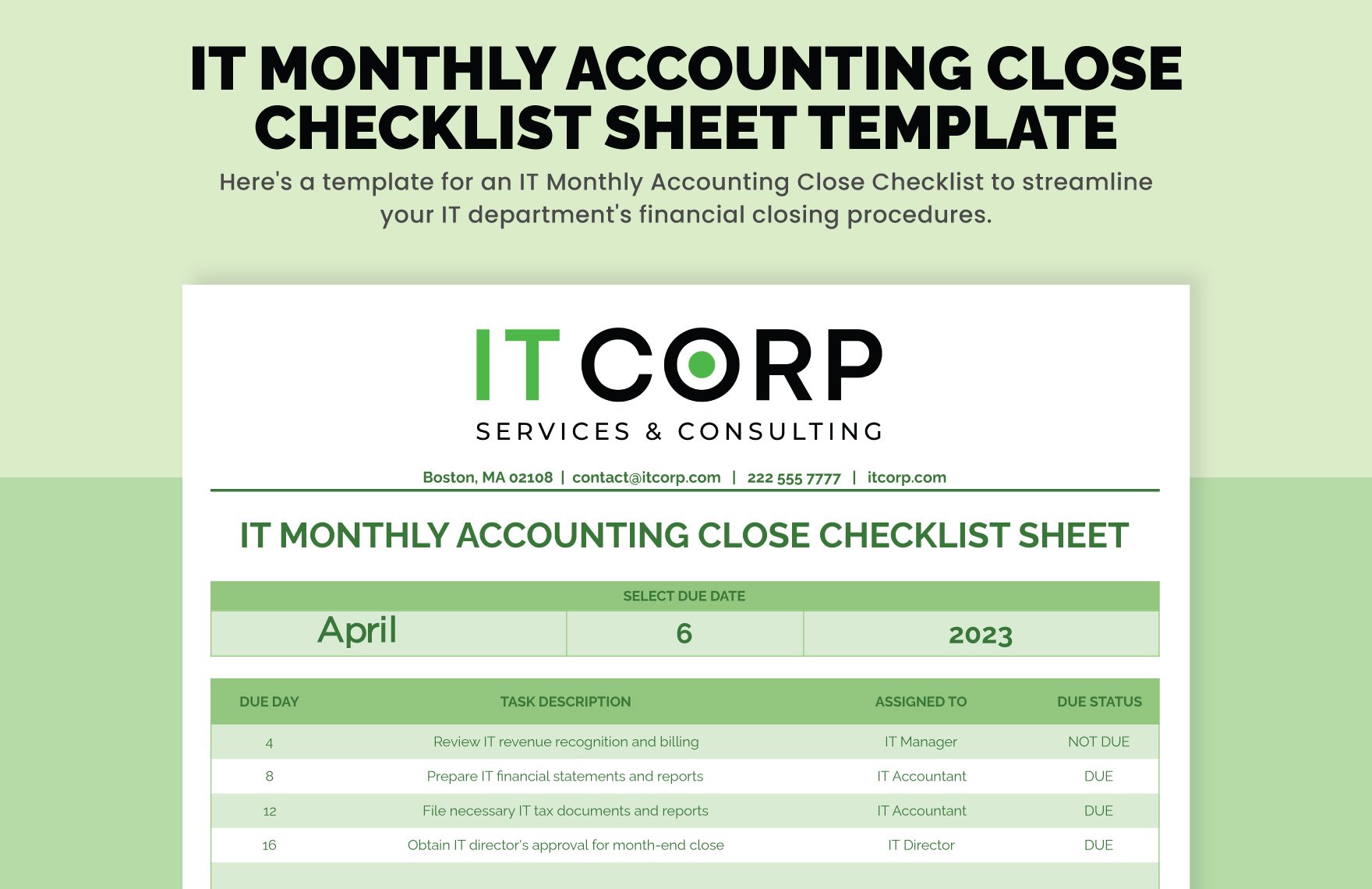

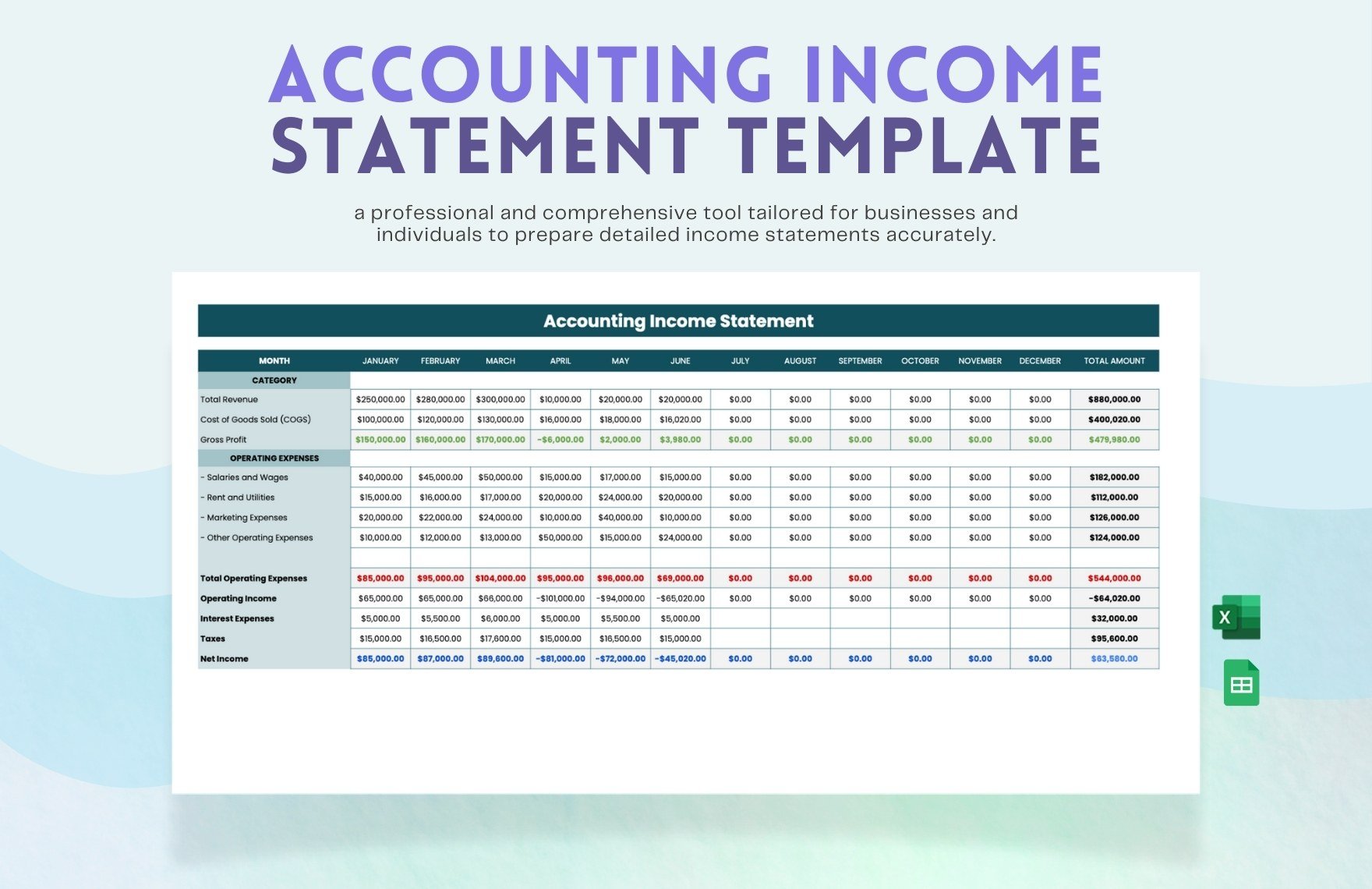

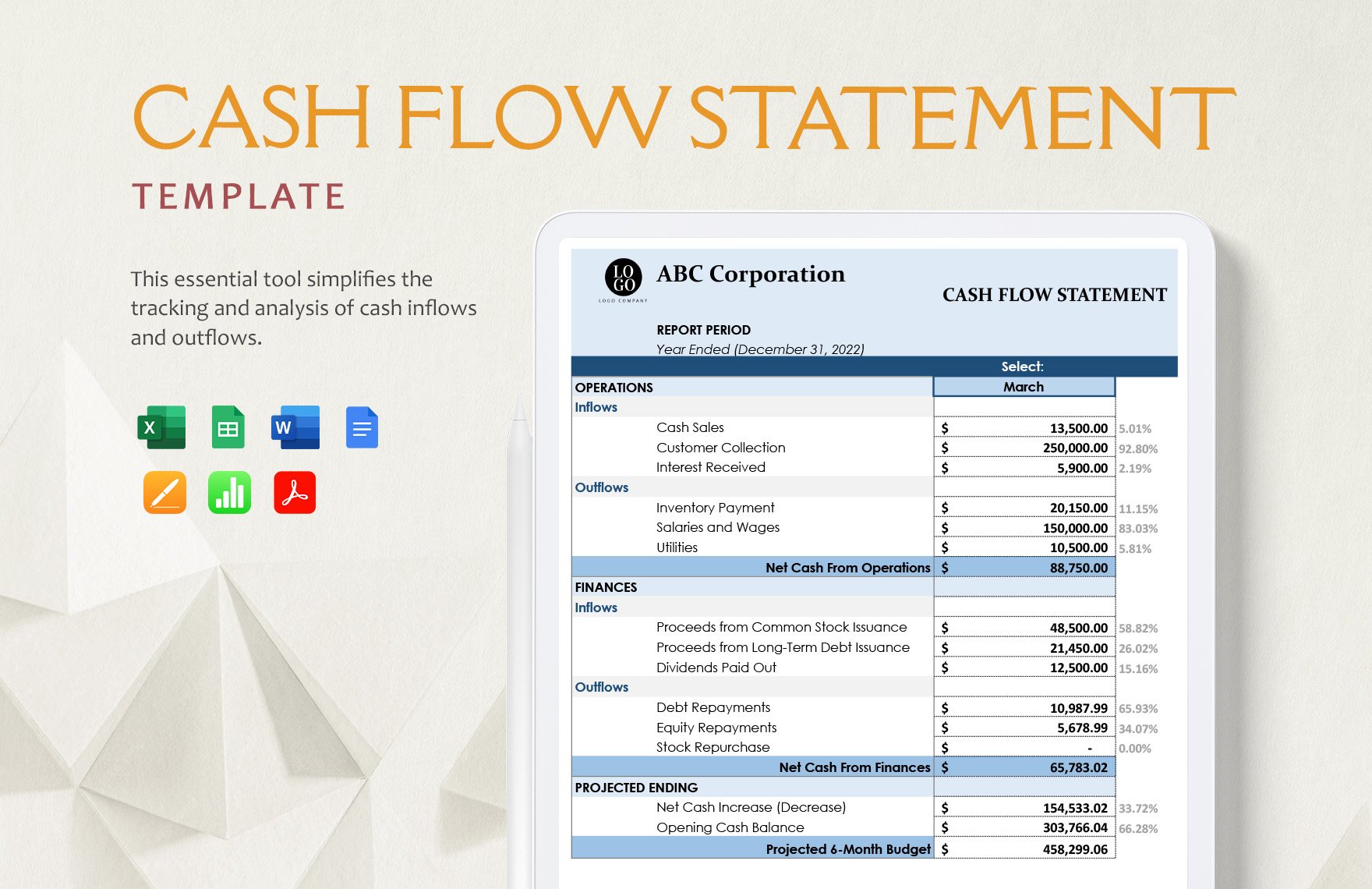

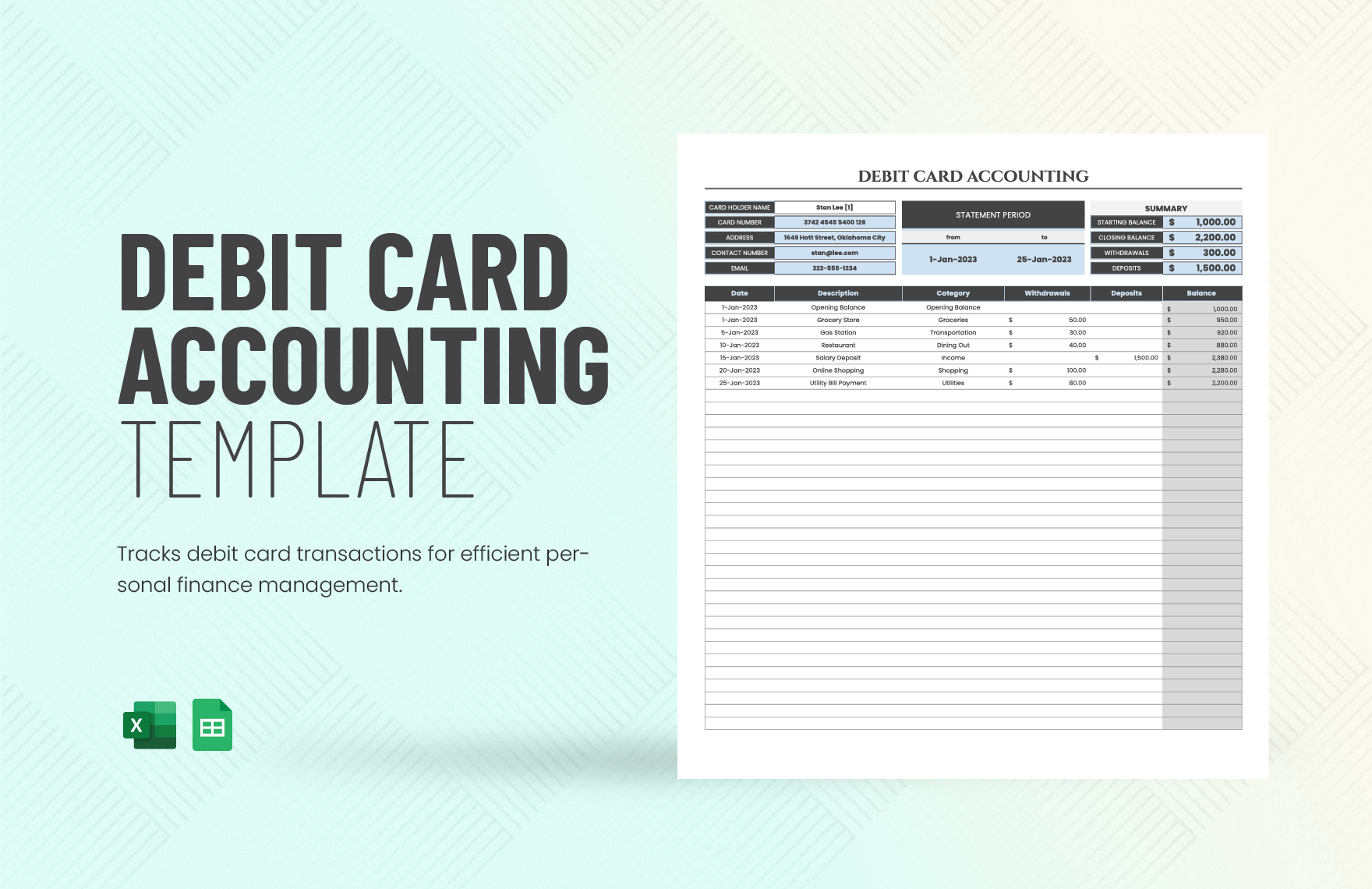

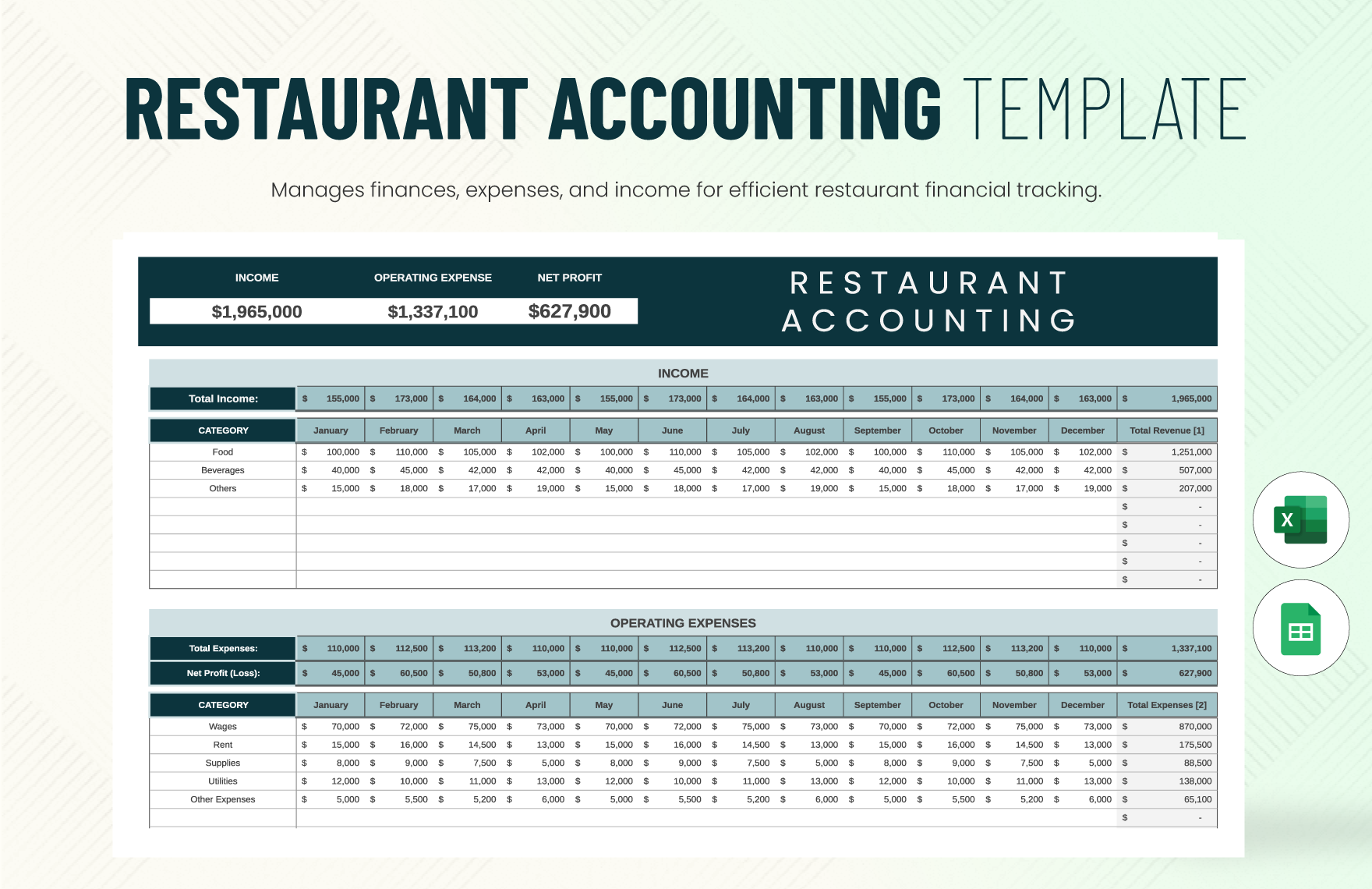

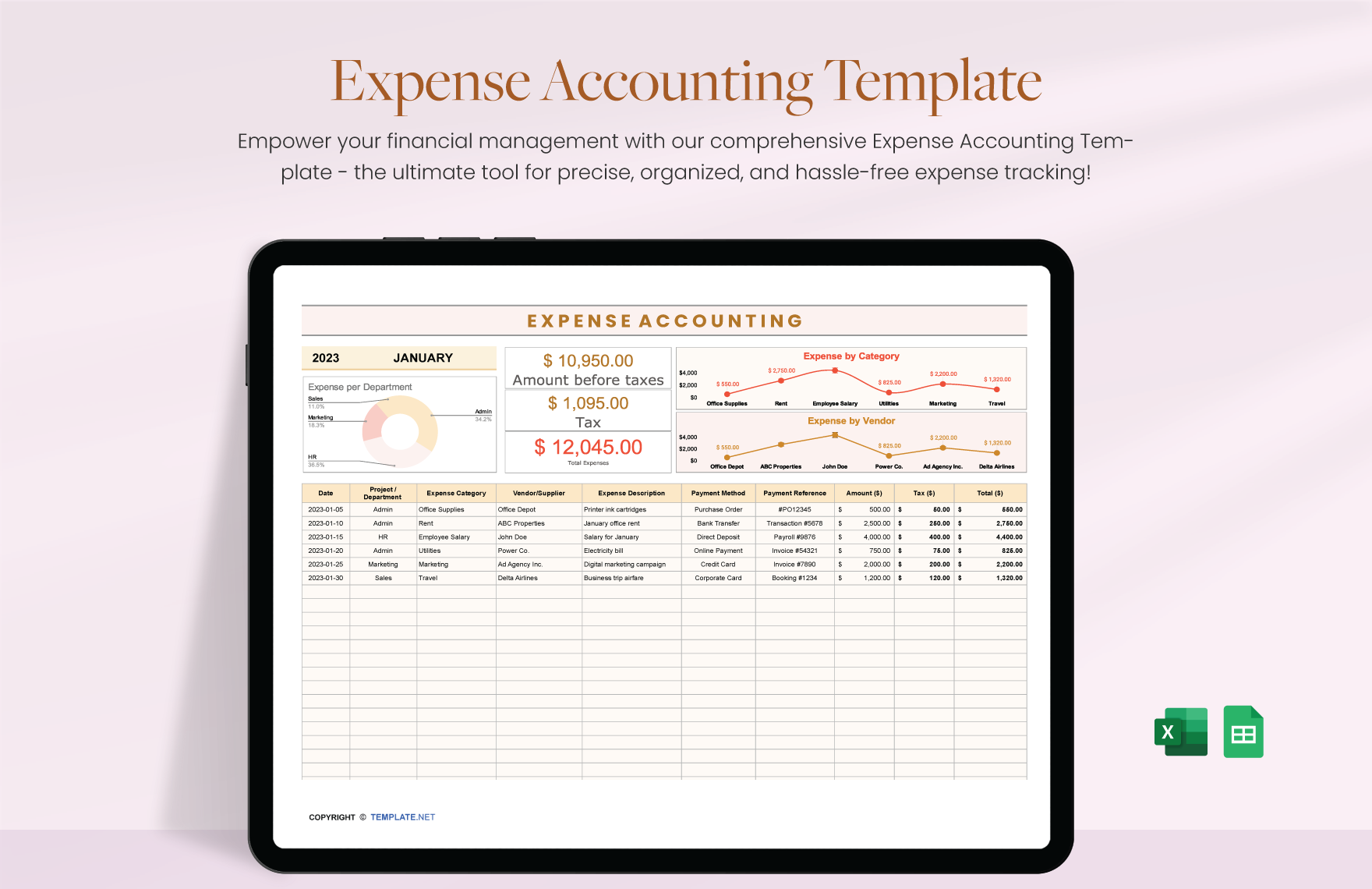

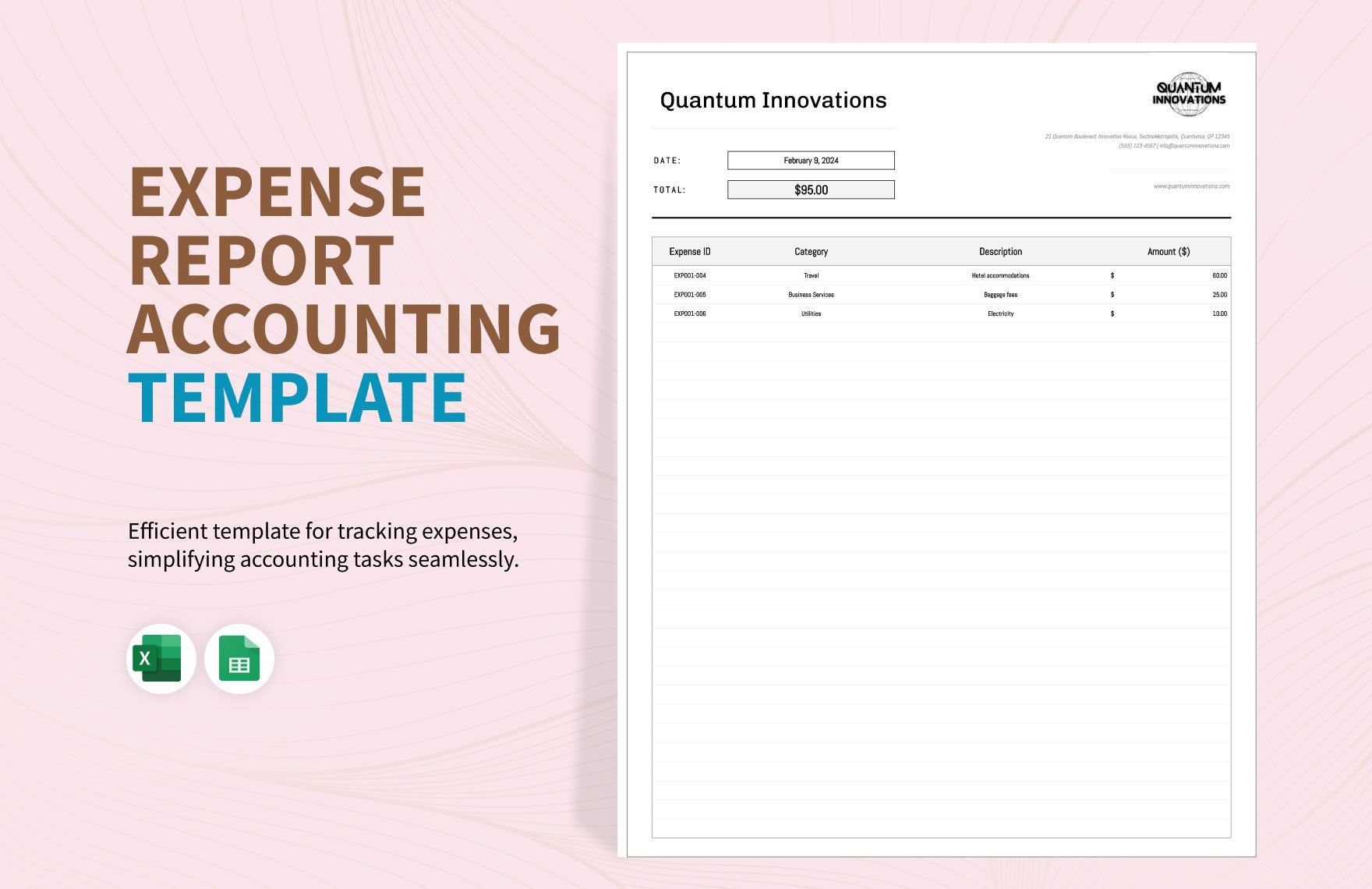

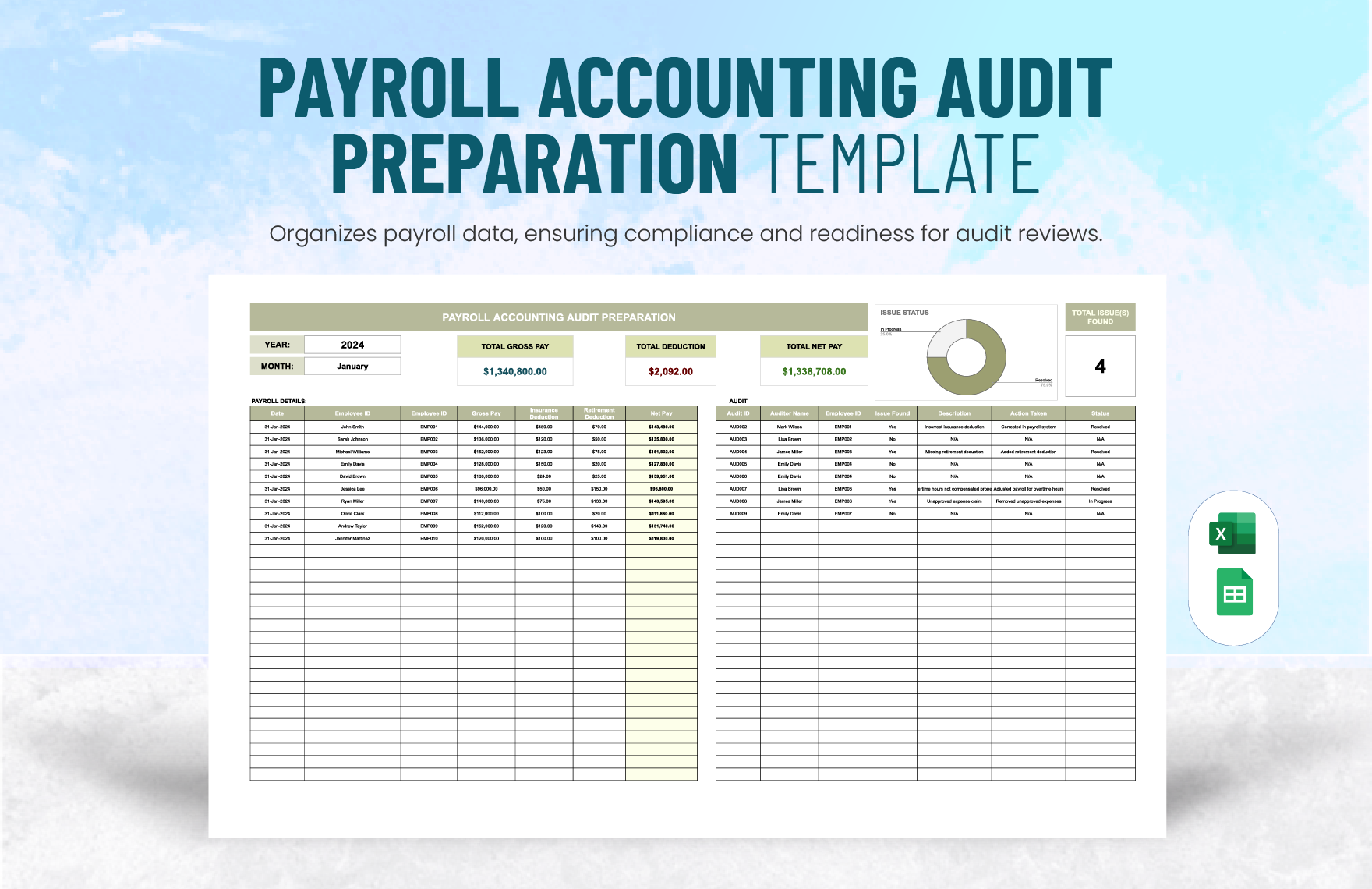

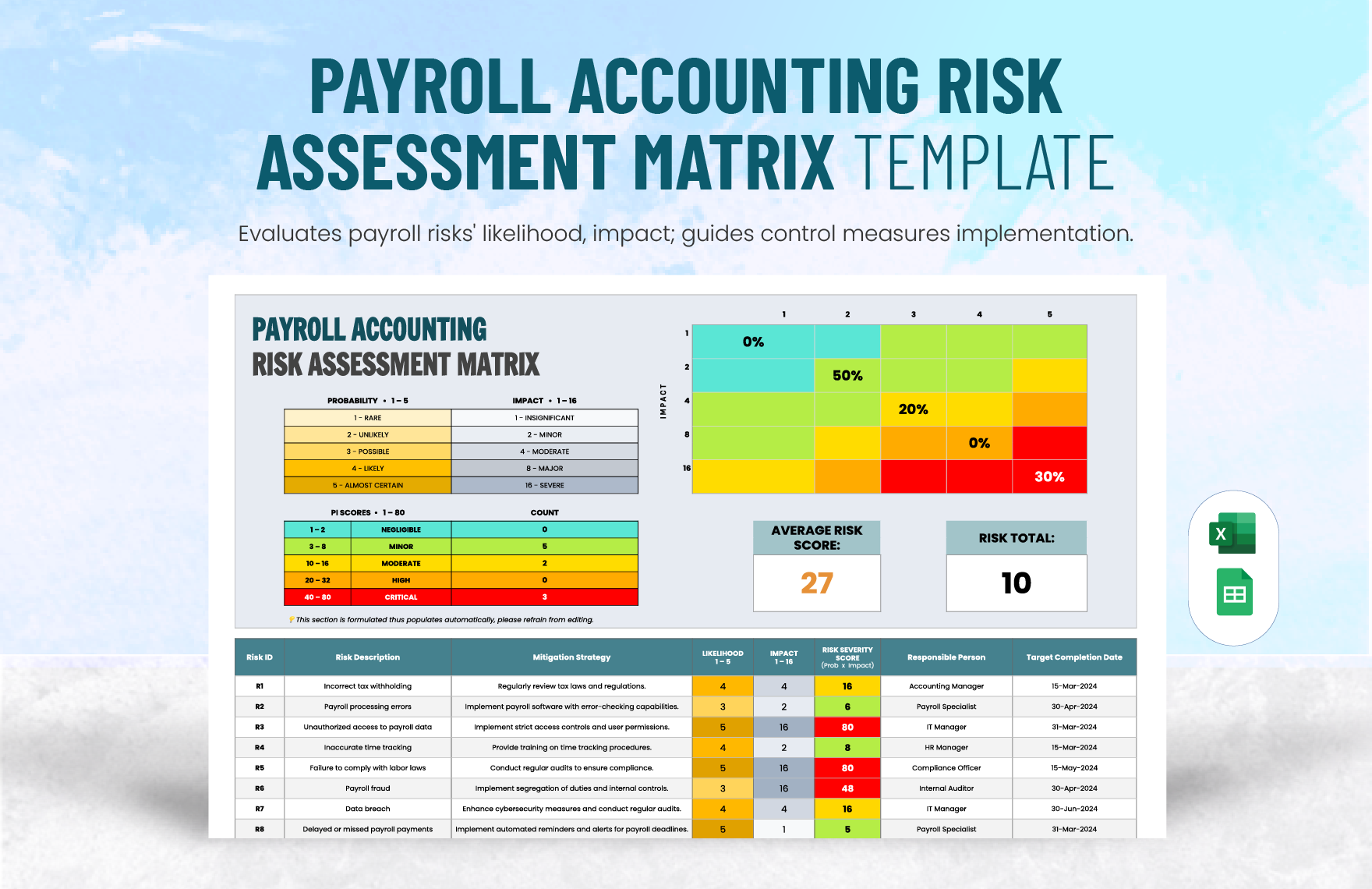

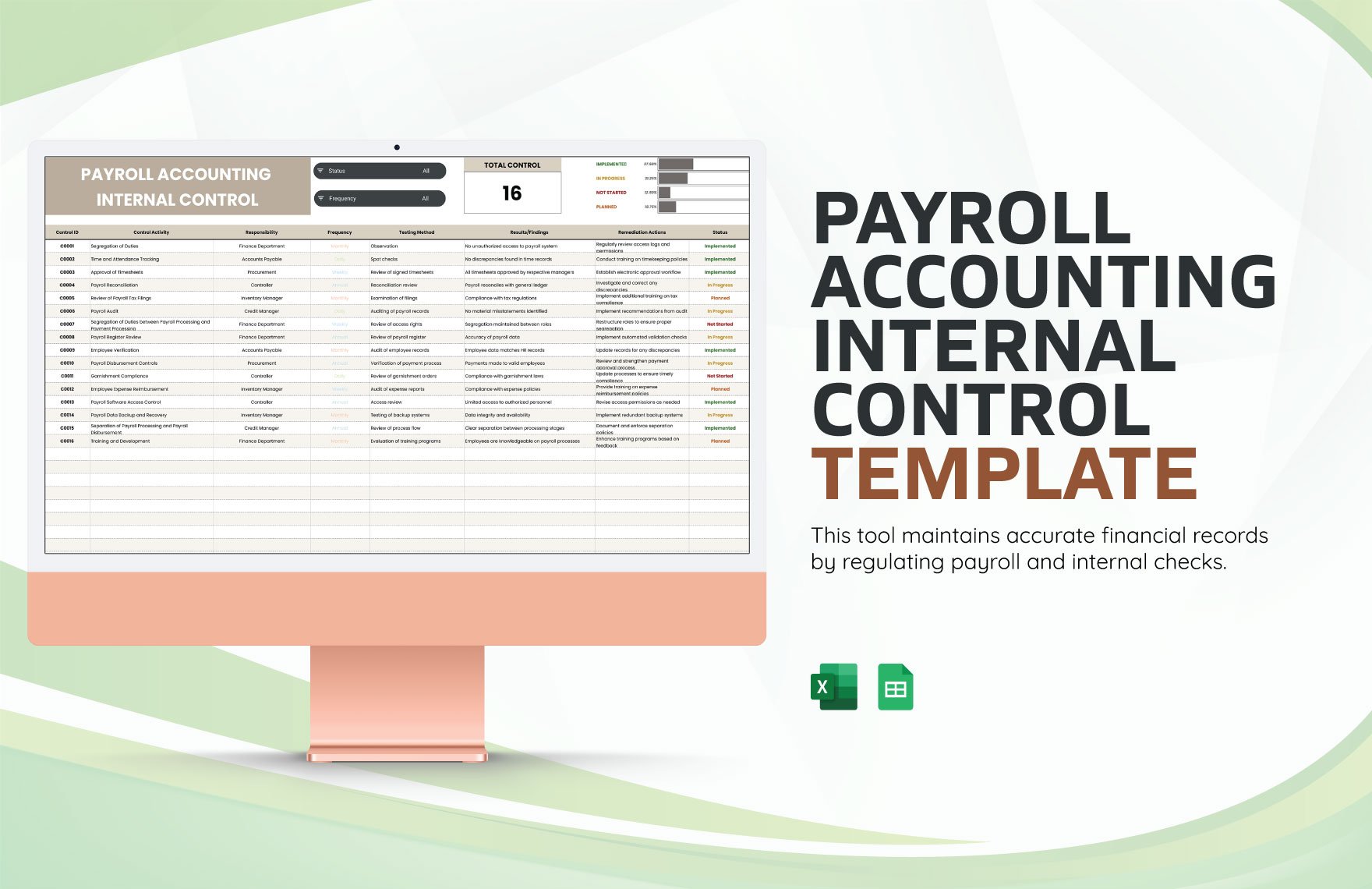

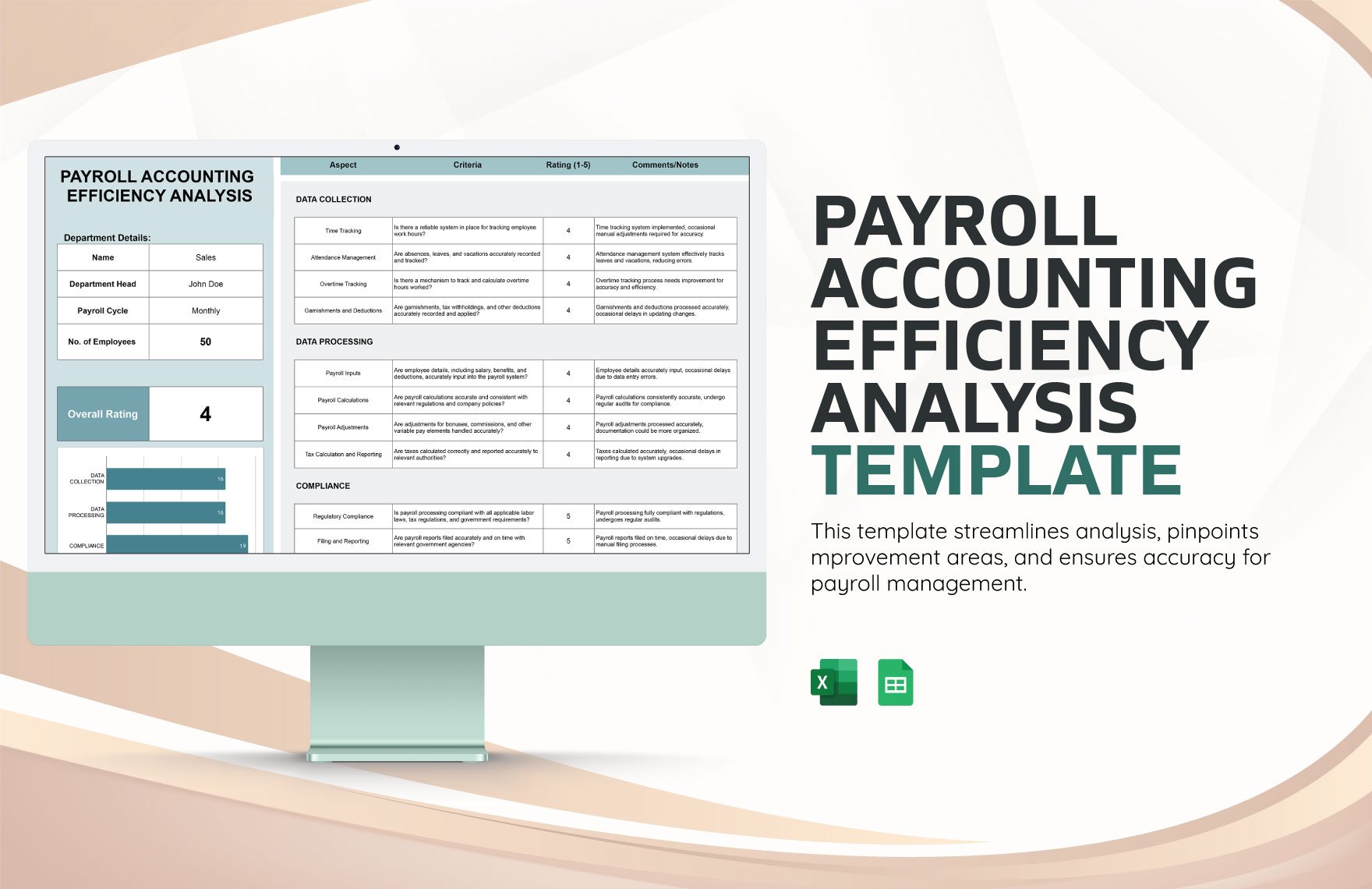

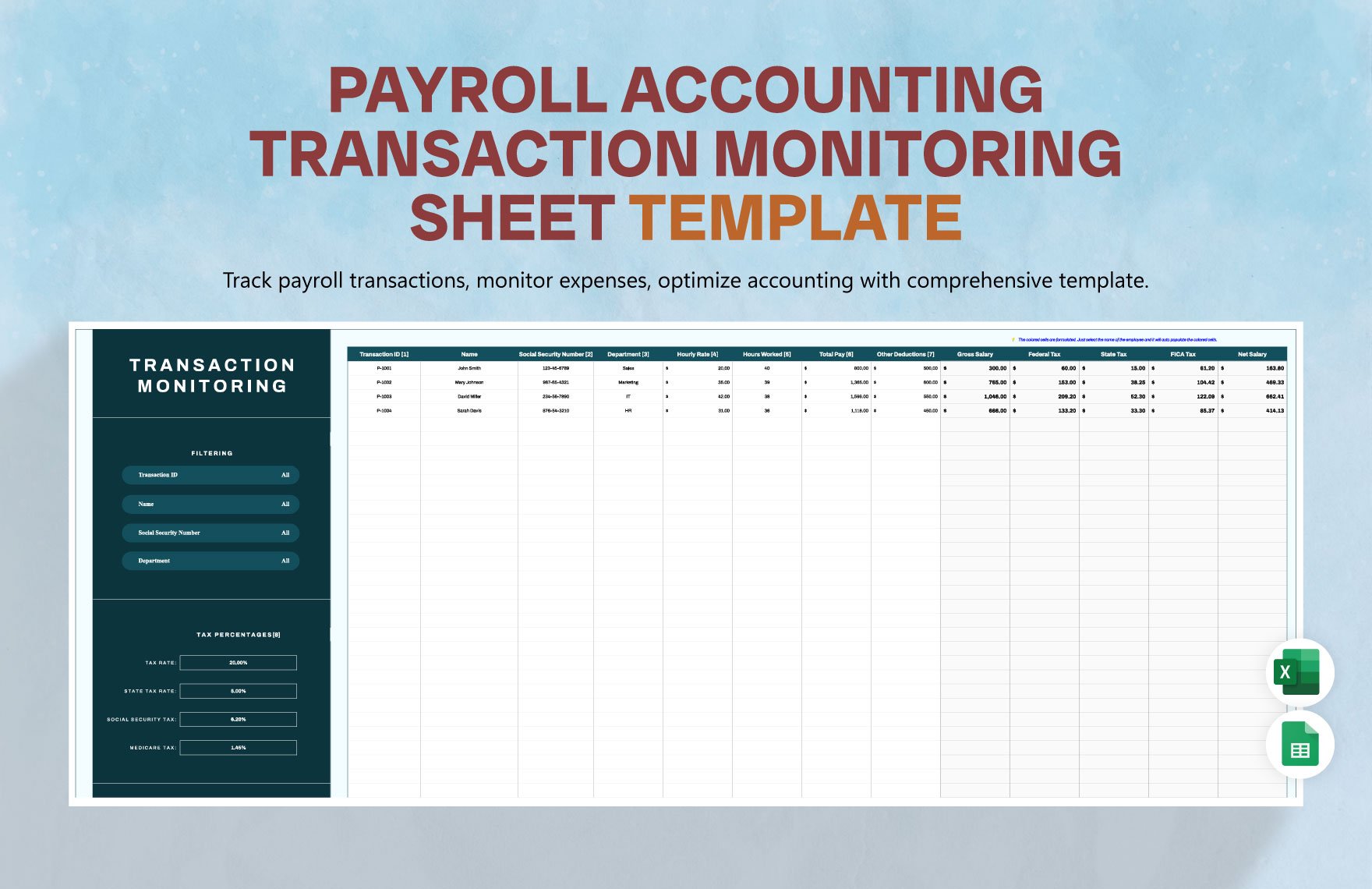

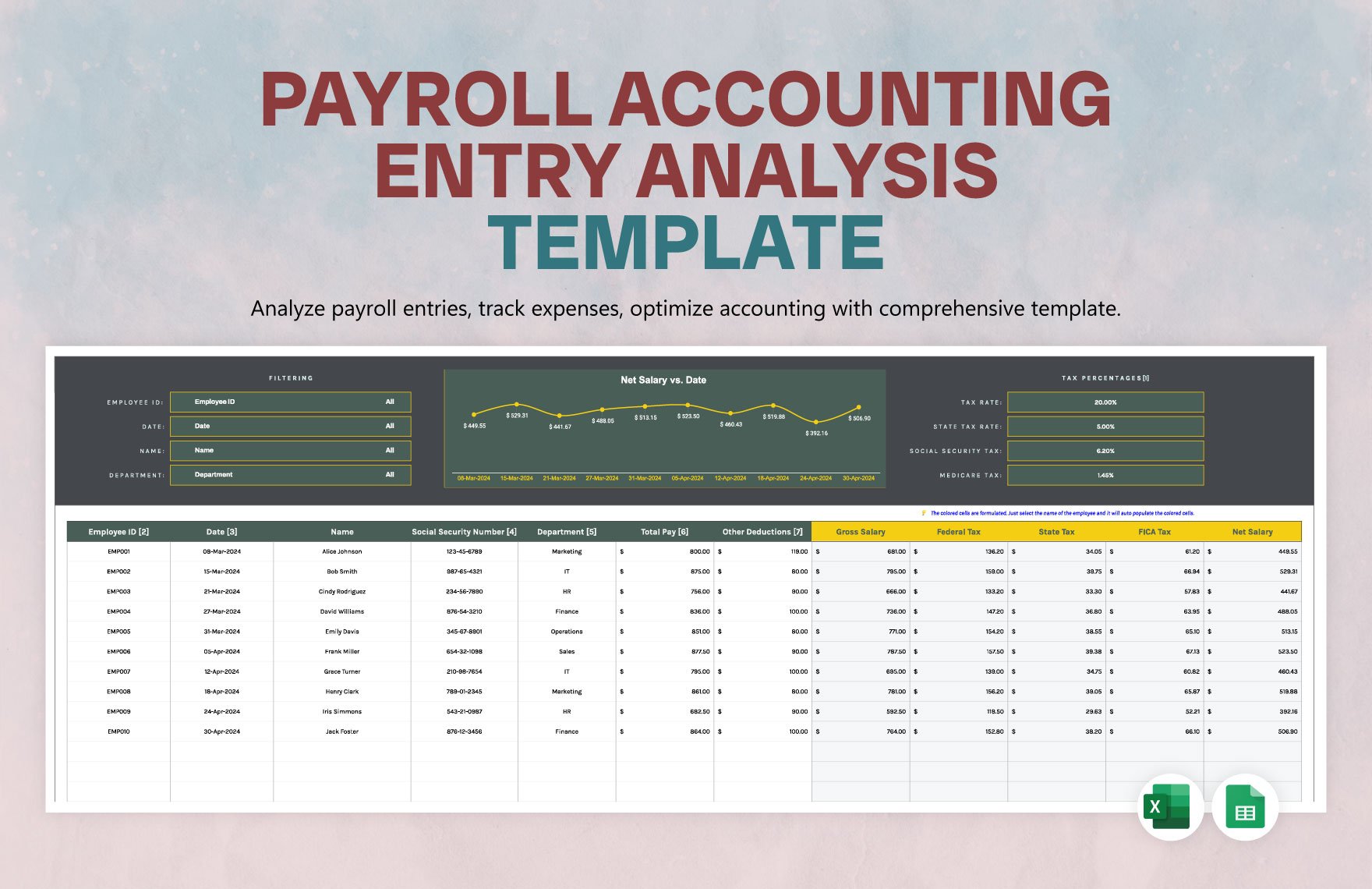

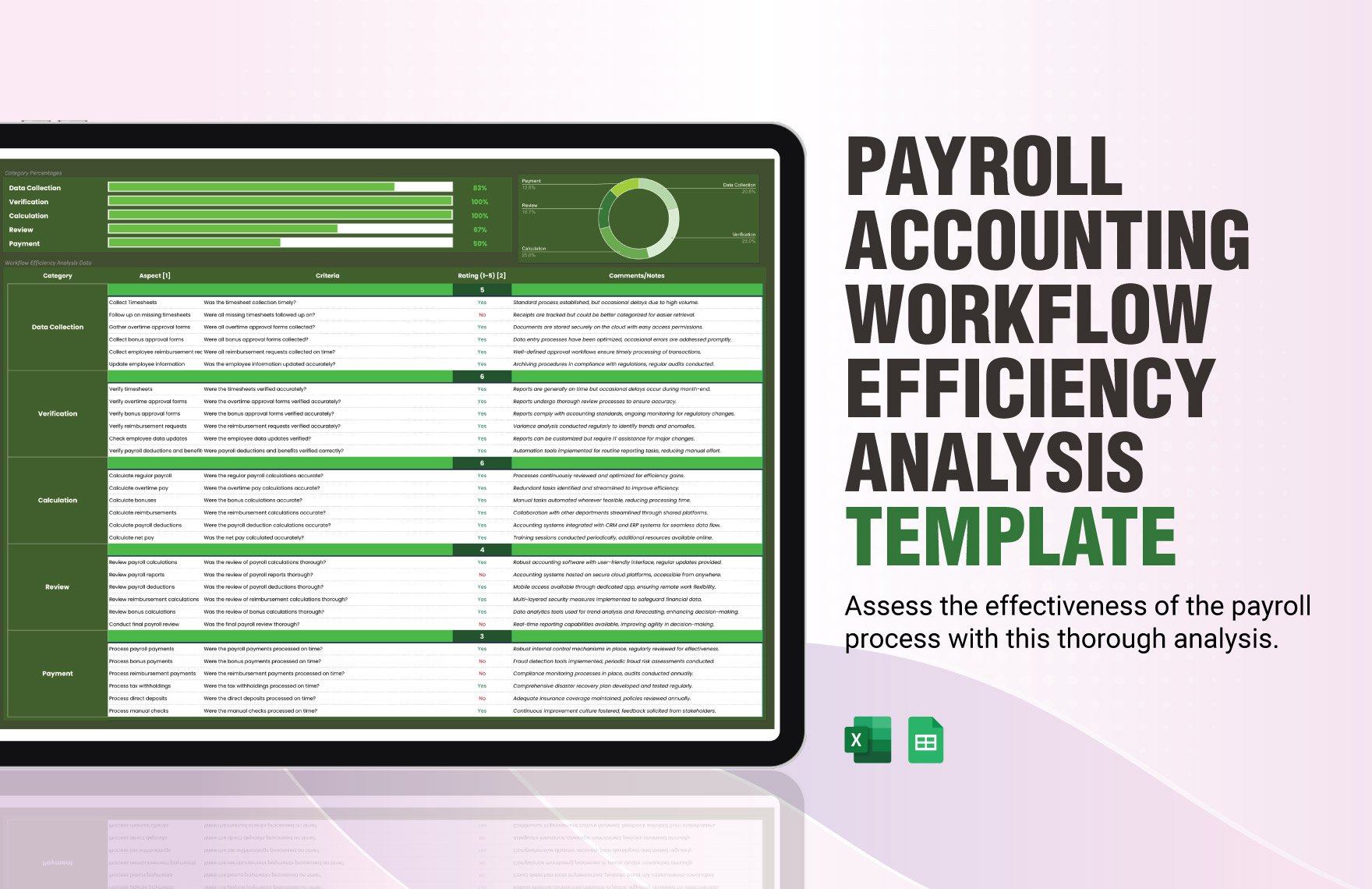

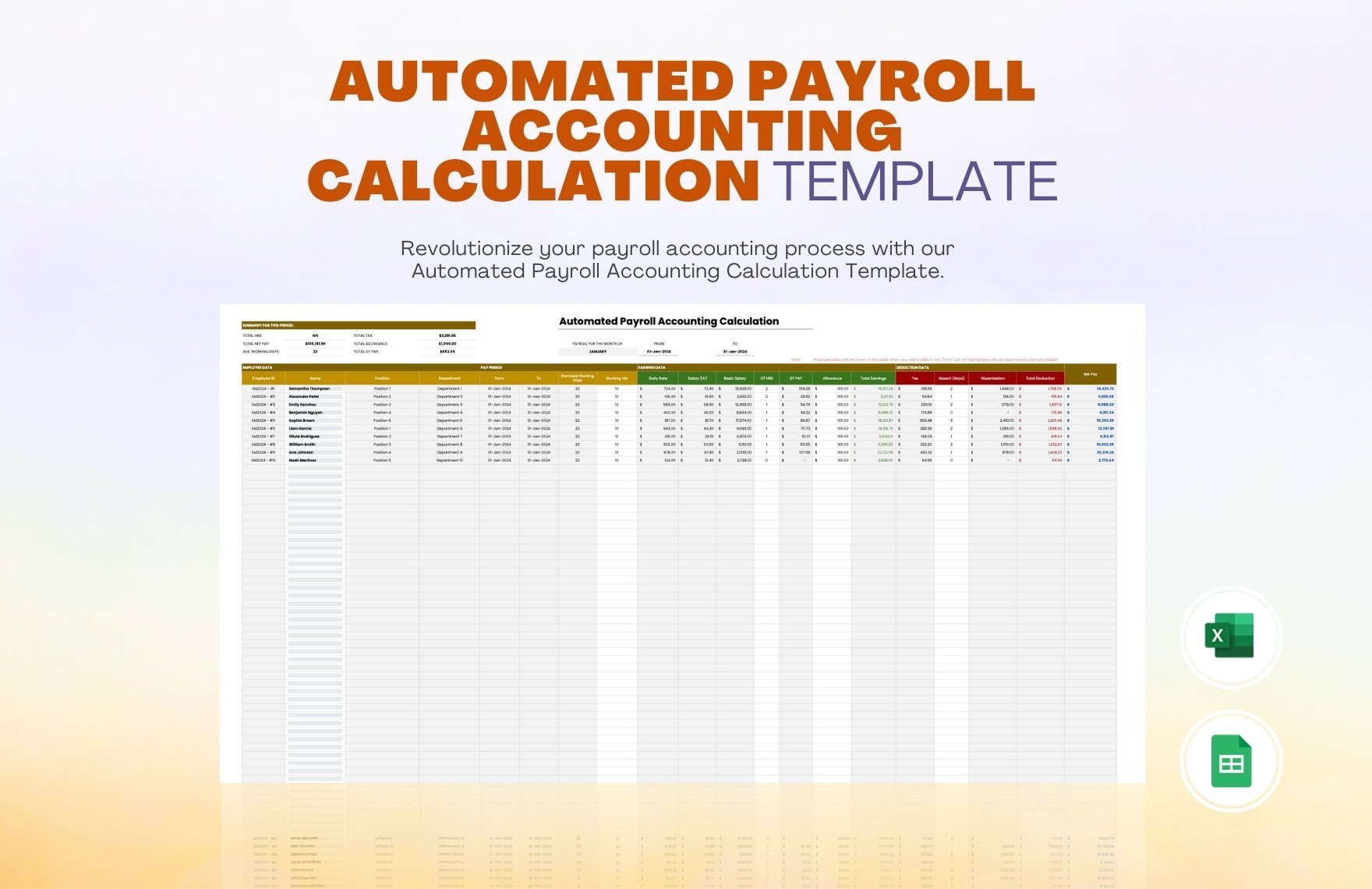

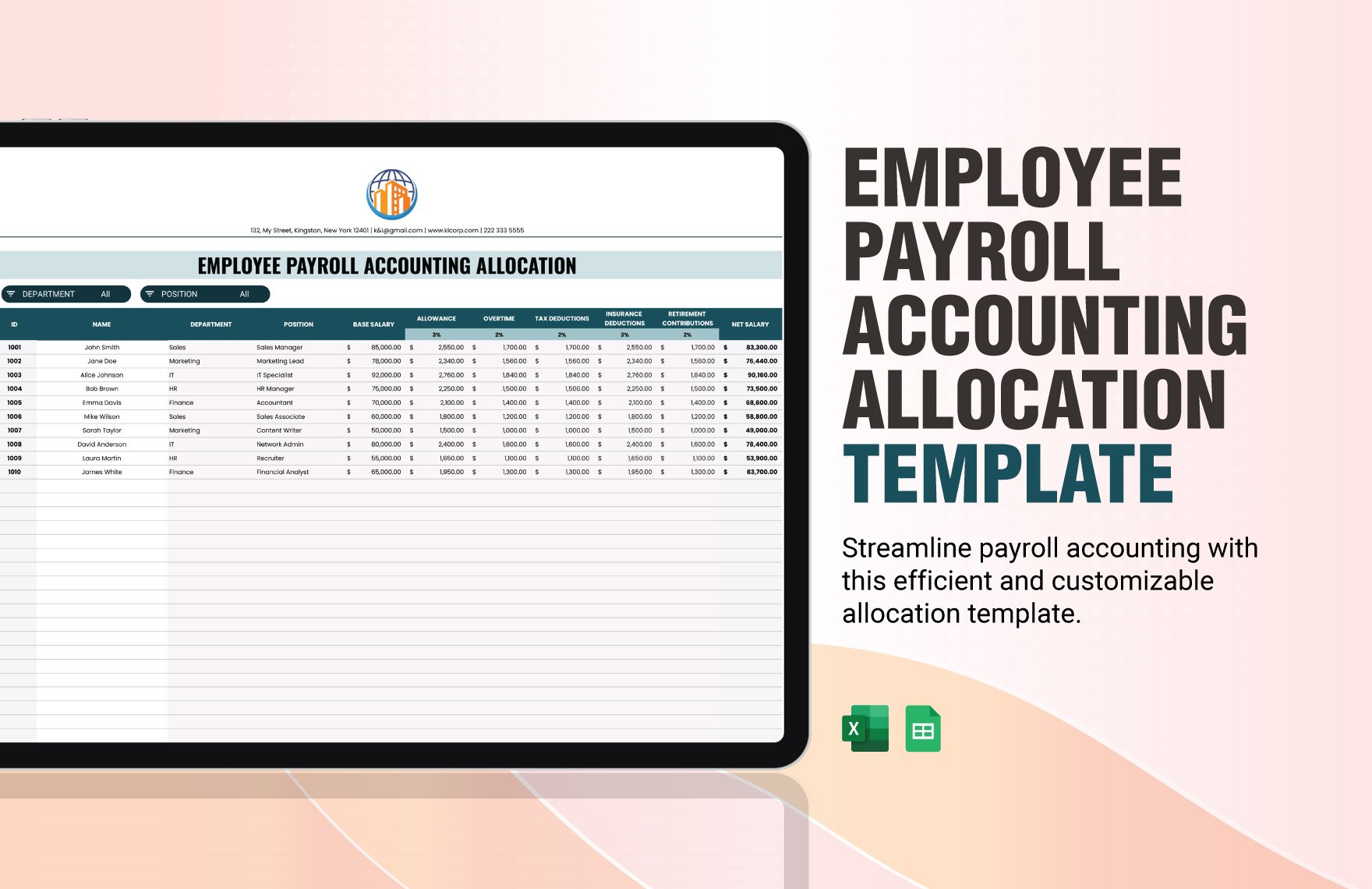

Take control of your financial management with pre-designed Accounting Templates available in Microsoft Excel by Template.net. These templates are crafted for small business owners, accountants, and anyone seeking to maintain a professional-grade financial record without the hassle of starting from scratch. Whether you need to track expenses or balance the books, discover templates that help promote an efficient accounting process. Take advantage of our free pre-designed templates, all of which come in easily downloadable and printable formats in Microsoft Excel. Skip the learning curve with our intuitive designs—no spreadsheet skills needed. For those looking to adapt to both print and digital distributions or need customizable layouts for social media presentations, our templates provide the necessary versatility.

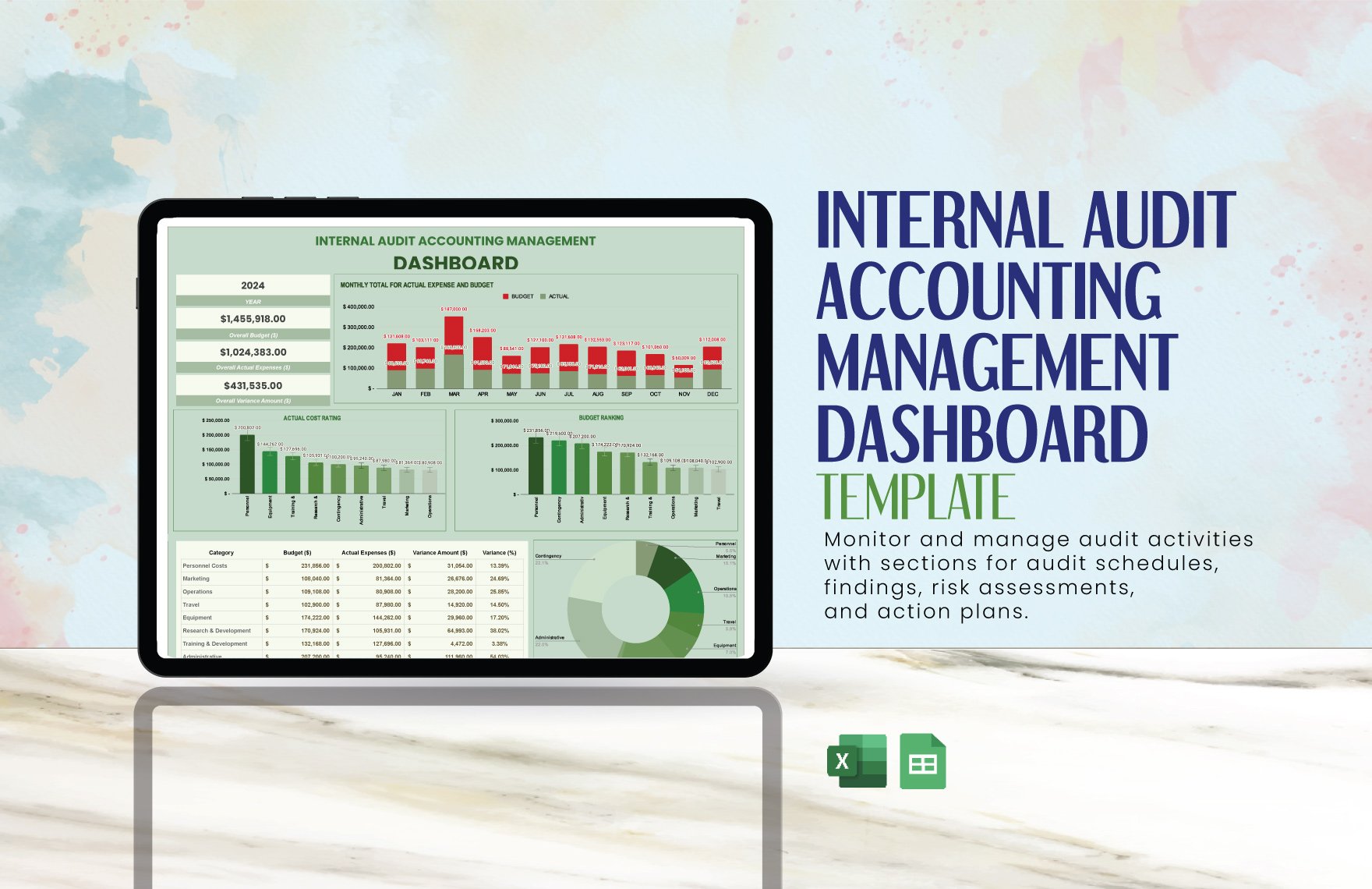

Discover a comprehensive variety of pre-designed Accounting Templates that cater to various financial needs and sectors. Explore more beautiful premium templates in Microsoft Excel that are regularly updated with the latest design trends and accounting standards, ensuring your documents are always up-to-date. You can easily download or share these templates via links, email, or export them for broader reach and impact. To maximize flexibility and convenience, we encourage users to leverage both free and premium designs, providing endless possibilities for professional, customized financial documentation.