From households to businesses, every investment or expenditure needs perfect planning for sound economic status. Outlining the financial activities might not be simple at times, especially when you deal with vast numbers. To simplify your task, we have made several financial service templates focusing on several professional and personal needs. Our templates contain high-quality graphics and unique content. Thus save your time and effort by choosing the best document for your requirement. You will also get them in various format options like MS Word, Pages, Google Docs, PSD, Illustrator, InDesign, Publisher, and PDF. Thus, wait for no further and get your pocket-friendly subscription plan now!

What are the Financial Services Offered By banks?

Finance services are economic supports provided by banks and other financial institutions. The finance industry is a huge market of consumer-finance companies,credit-card companies, credit unions, banks, investment funds, insurance companies, stock brokerages, accountancy companies, government-sponsored enterprises, and individual managers. Financial companies provide funds to other businesses to derive profit by imposing some interest rates on the lent amount. There are different financial services offered by banks, like

- Advancing of Loans.

- Collection and Payment Of Credit Instruments.

- Foreign Currency Exchange.

- Discounting of Bills of Exchange.

- Check/Cheque Payment.

- Home banking.

- Bank Guarantee.

- ATMs Services.

- Consultancy.

- Private banking.

- Priority banking.

- Credit cards.

- Remittance of Funds.

- Mobile Banking.

- Accepting Deposit.

- Debit cards.

- Online banking.

What are the Most Useful Financial Service Templates?

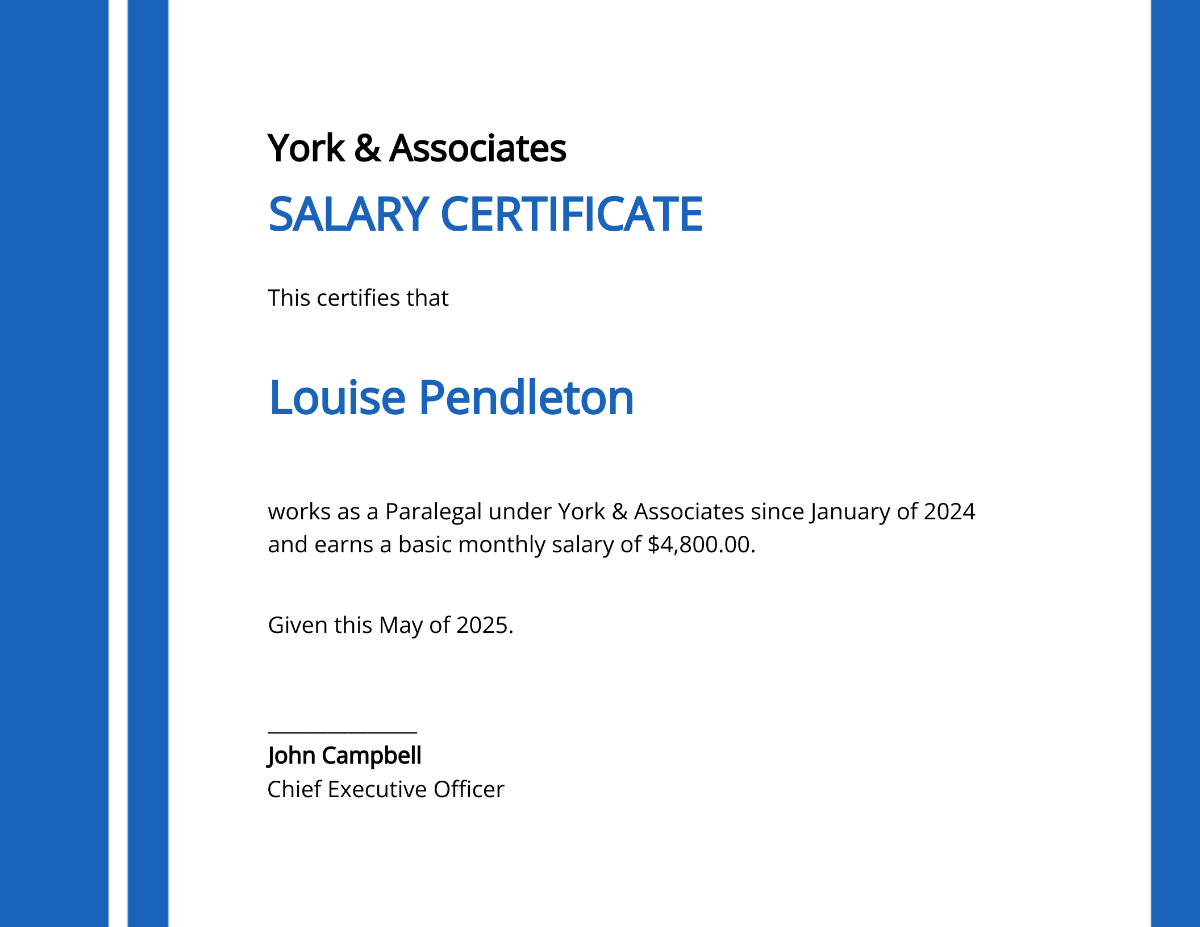

Financial services are provided with detailed documentation and legal paperwork. Apart from the regulatory proceedings, the paperwork takes much time and effort. This effort and time can be saved using some pre-structured financial service templates. We have specified the most important ones in the following points.

- Capital is the most important asset and documenting every monetary expense and investment is crucial. Thus, you can use read-made Financial report templates, Budget planner templates, Financial planner templates, etc.

- To prepare a detailed financial study, use Financial service report templates, Financial analysis templates, financial statement templates, Finance accounting flowchart templates, etc.

- To advertise your finance business, use Finance company poster templates, Financing banner templates, etc.