Any business needs accurate financial statements to run their business correctly. Did your boss assign you to present a financial statement but don't have enough time? Worry no more, for we offer you a variety of our ready-made Finance Statement Templates! Constructing your financial statements can be tedious and time-consuming, but say goodbye to your problems and say hello to these professionally-written templates that can save you from the hassle of creating one from scratch. 100% customizable, printable, and highly editable in various formats, these templates will quickly help you file reports and creates amazingly accurate presentations for meetings and other client presentations. Finances need not be a burden. Make meetings on sales and budget issues exciting and download our best templates today.

What is a Financial Statement?

Financial statements are written records that states your business' economic activities and financial performances at a given period. Its primary purpose is to evaluate your company's standing in terms of its revenue and expenses.

How to Make Financial Statements?

Accountants are the ones who commonly prepare your financial statements. It is essential that you create your financial statements with clear financial transparency of your records. Be sure that you evaluate your tax liability and migrate errors to build trust within your company. Once you do, you can improve more with your payment cycle and create better decision making, planning, and forecasting for your company.

1. Gather All Your Financial Data for Specific Period

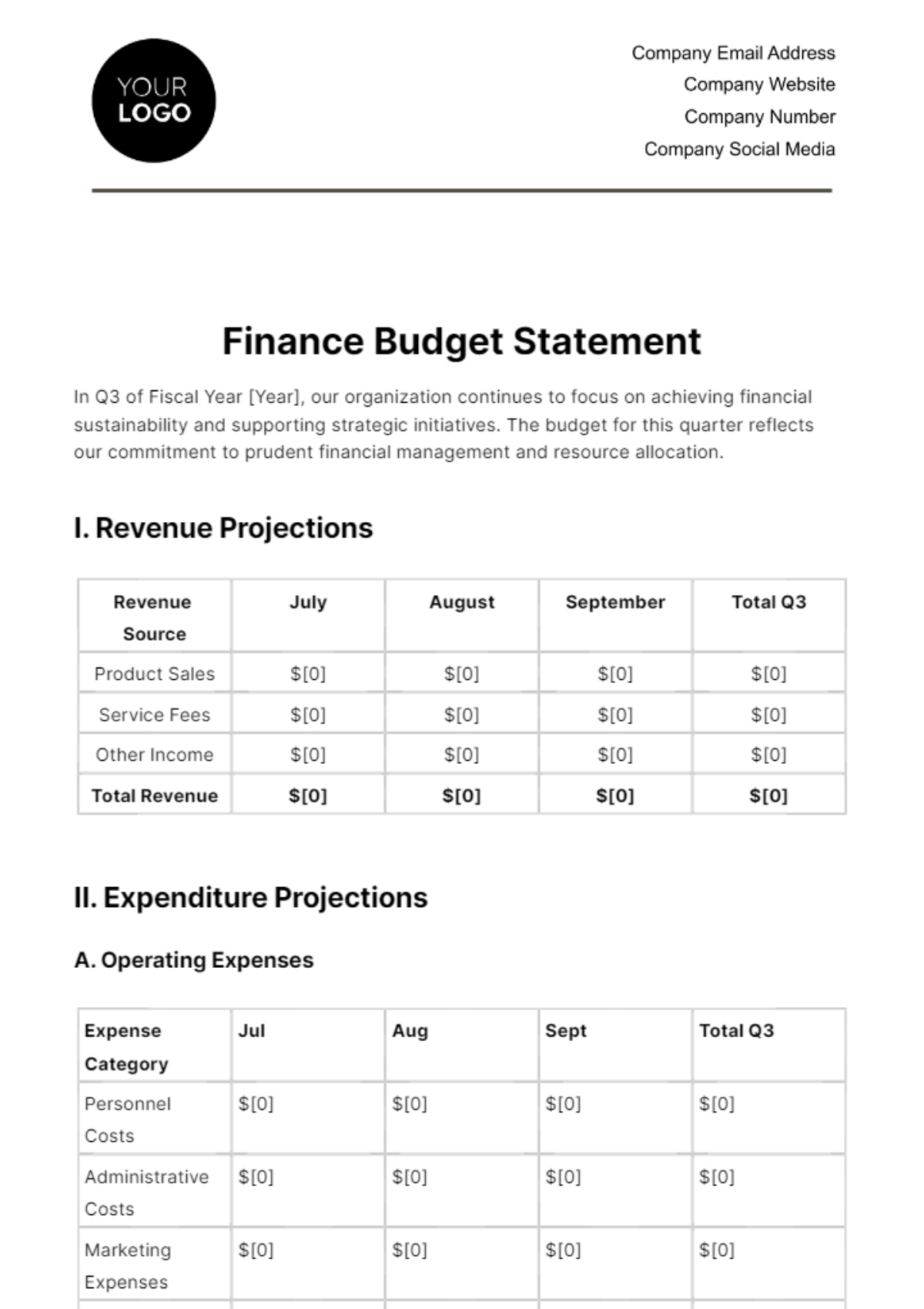

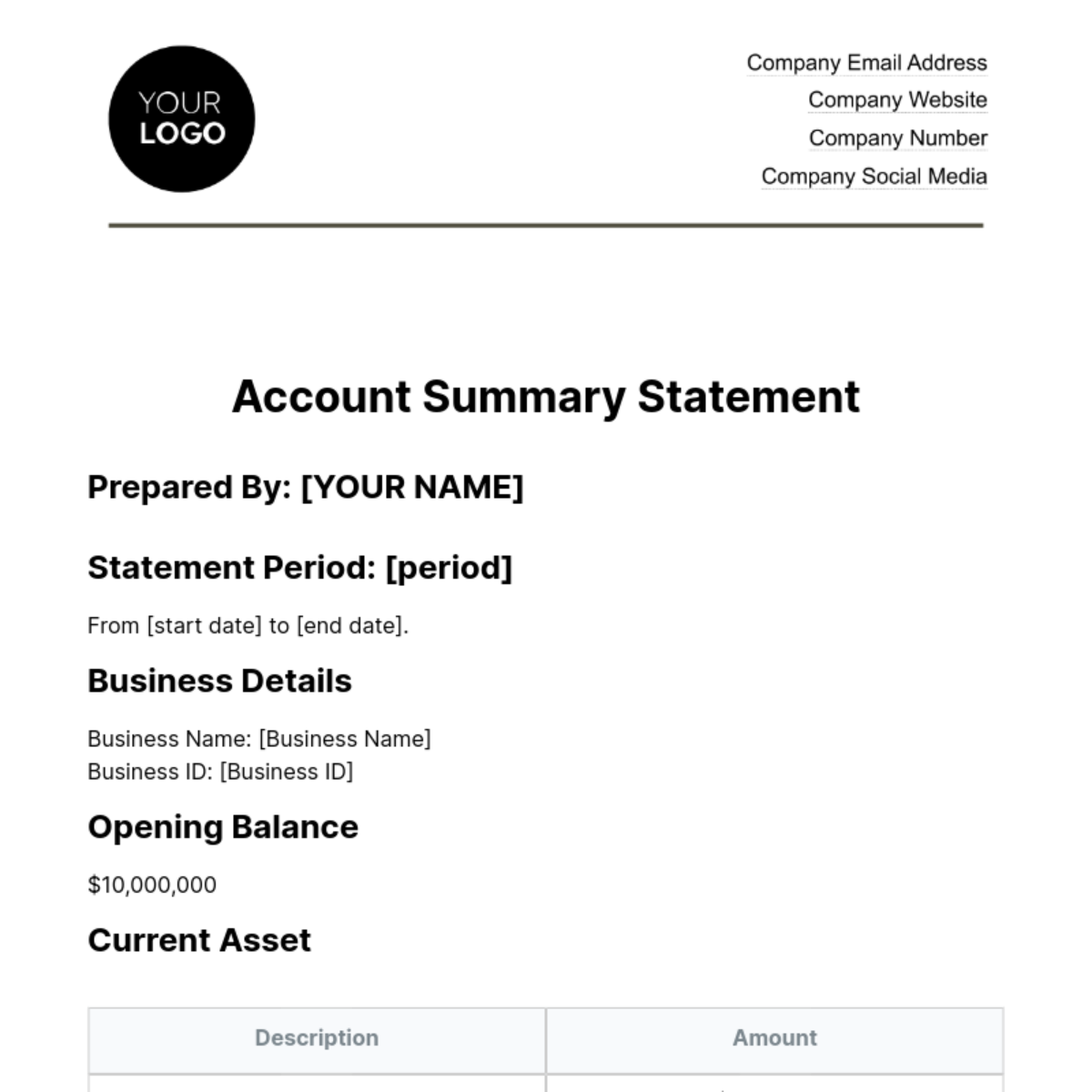

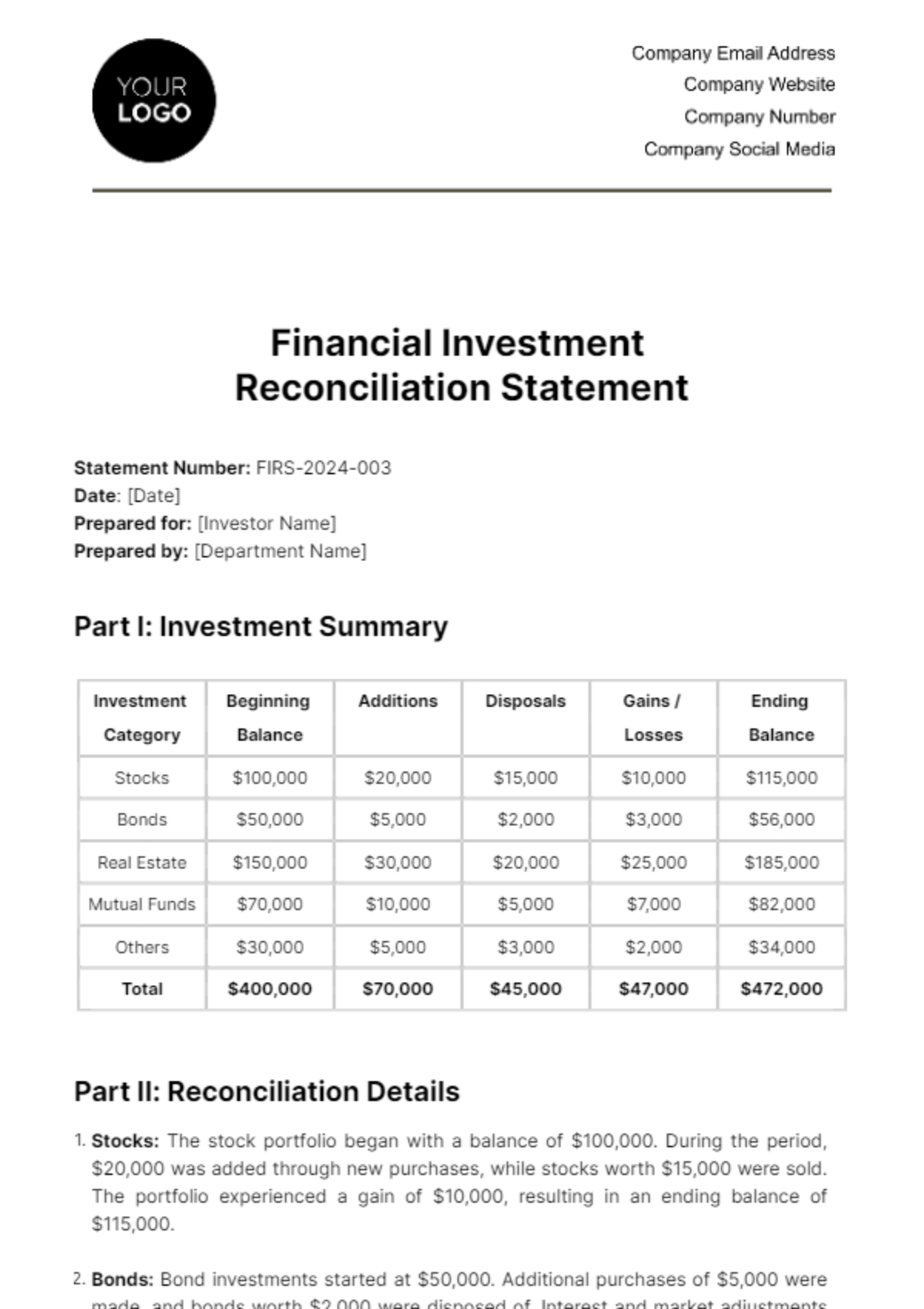

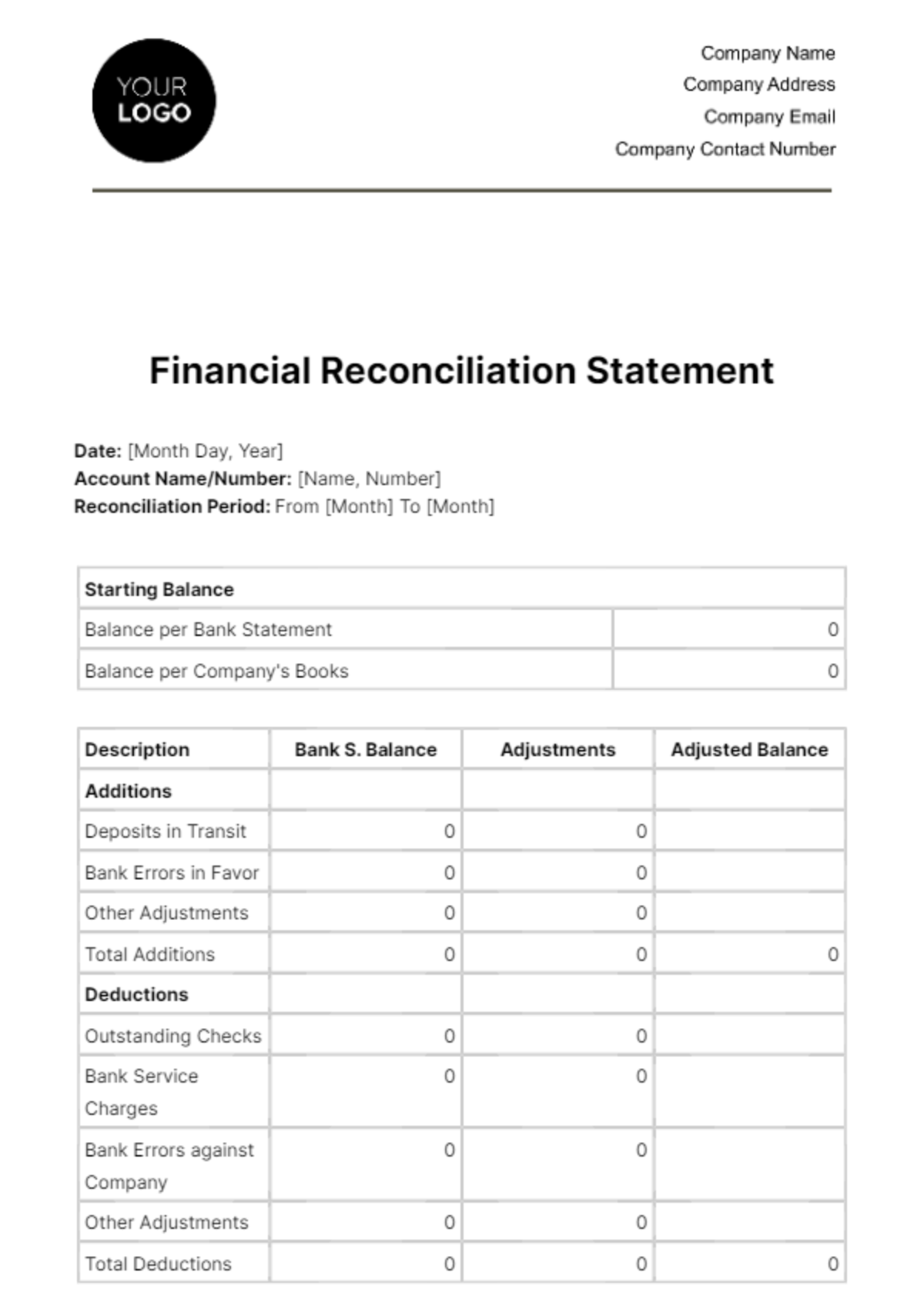

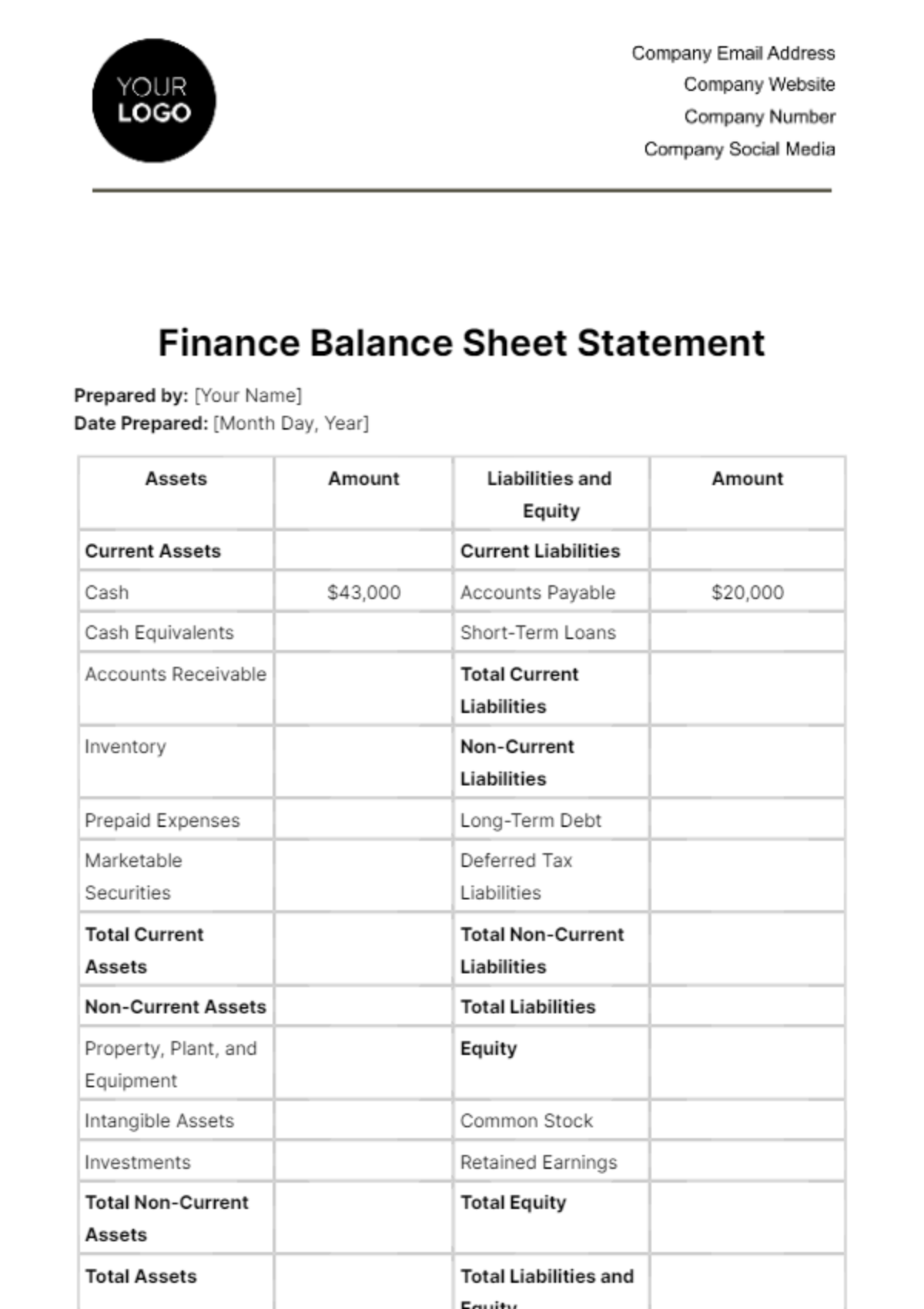

It requires the right amount of data for it to construct a financial statement. First, specify the period of your financial statement's scope. Do you plan to make a financial statement that shows your monthly activities or yearly activities? Audit every department you have and create an analysis of where your budget goes. Then, prepare your balance sheet, income statement, and your cash flow reports as evidence and basis of your financial account.

2. Start With Your Balance Sheet

Describe your company's financial performance with balance sheets and indicate the exact amount your business owns and owes. List down all your assets and liabilities, along with your shareholder's equity (capital) and compare the three of them. Get your capital by deducting the number of your liabilities from your assets. Are you profiting more or losing more than what you've expected? Calculate your profit margin by determining your bet income and divide it with your revenue.

3. Create Your Income Statement

Summarize your company's revenue and expenses, as well as your resulting profit and loss with your income statement. Calculate your gross profit and indicate your company's operating expenses and non-operating expenses, then get your income and income tax. Once you do, acquire your net income and layout your income statement.

4. List Down Your Cash Flow

Record your money's in and out with the help of cash flows and pay your suppliers and employees properly while meeting your short term and long term obligations. Check your net income and calculate your cash flow and operating activities. How is your budget doing? Is your company spending lesser or more than what you have expected? Check the cash flow of your other operations and investing activities and look for any budget left for your additional financing then, layout your cash flow statement.

5. Review and Present Your Finance Statement

Now that you have settled all the essential details of your financial statement, it is time to present it to your audiences. However, before you do it, make sure that there are no errors and discrepancies with your work. Present your report by displaying your balance sheet and income statements first, then follow it with your cash flow report. Provide an in-depth discussion of your report and close it with notes about your financial statement.