Organize Your Finances with Pre-Designed Monthly Budget Templates in Microsoft Word by Template.net

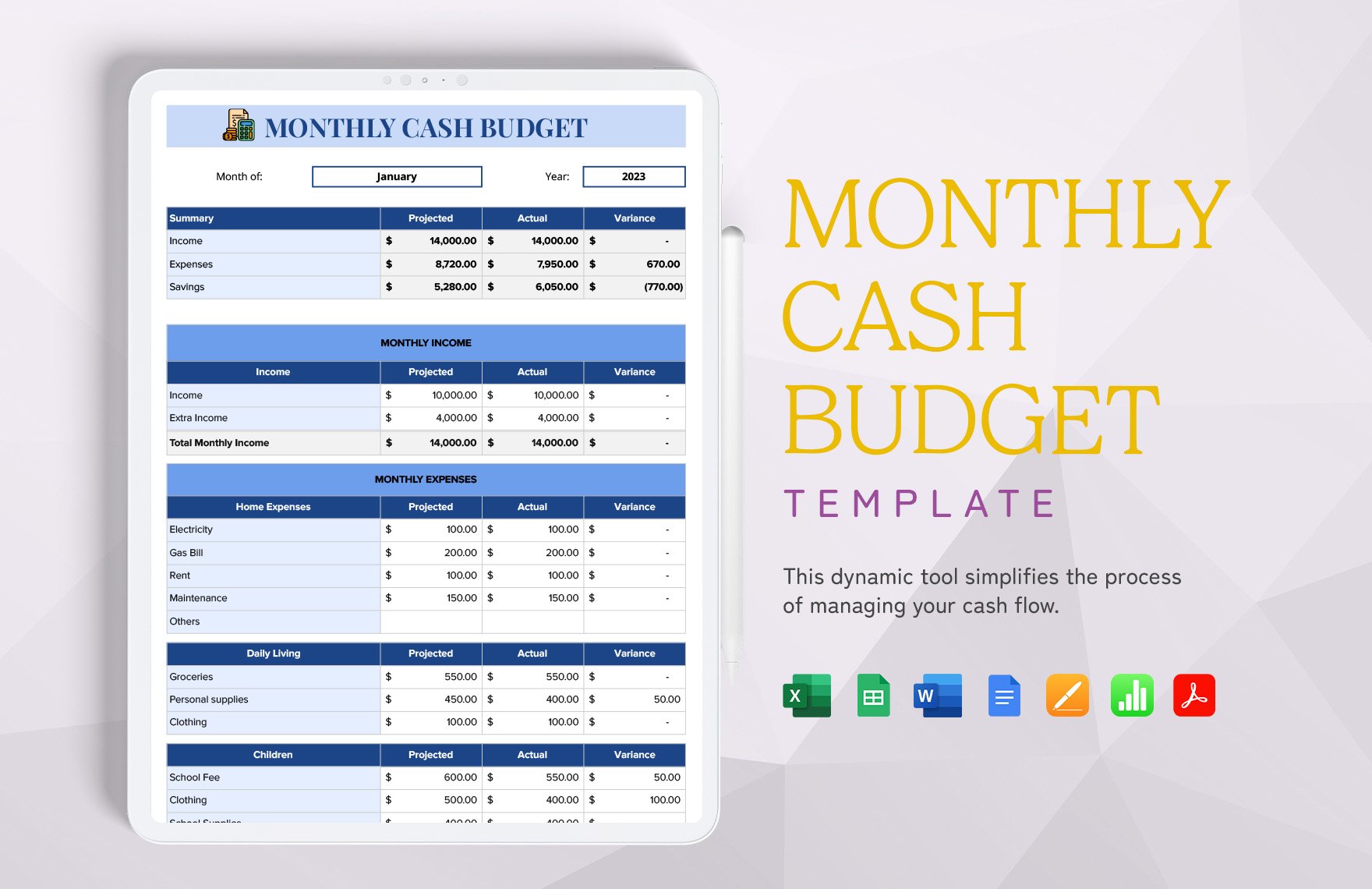

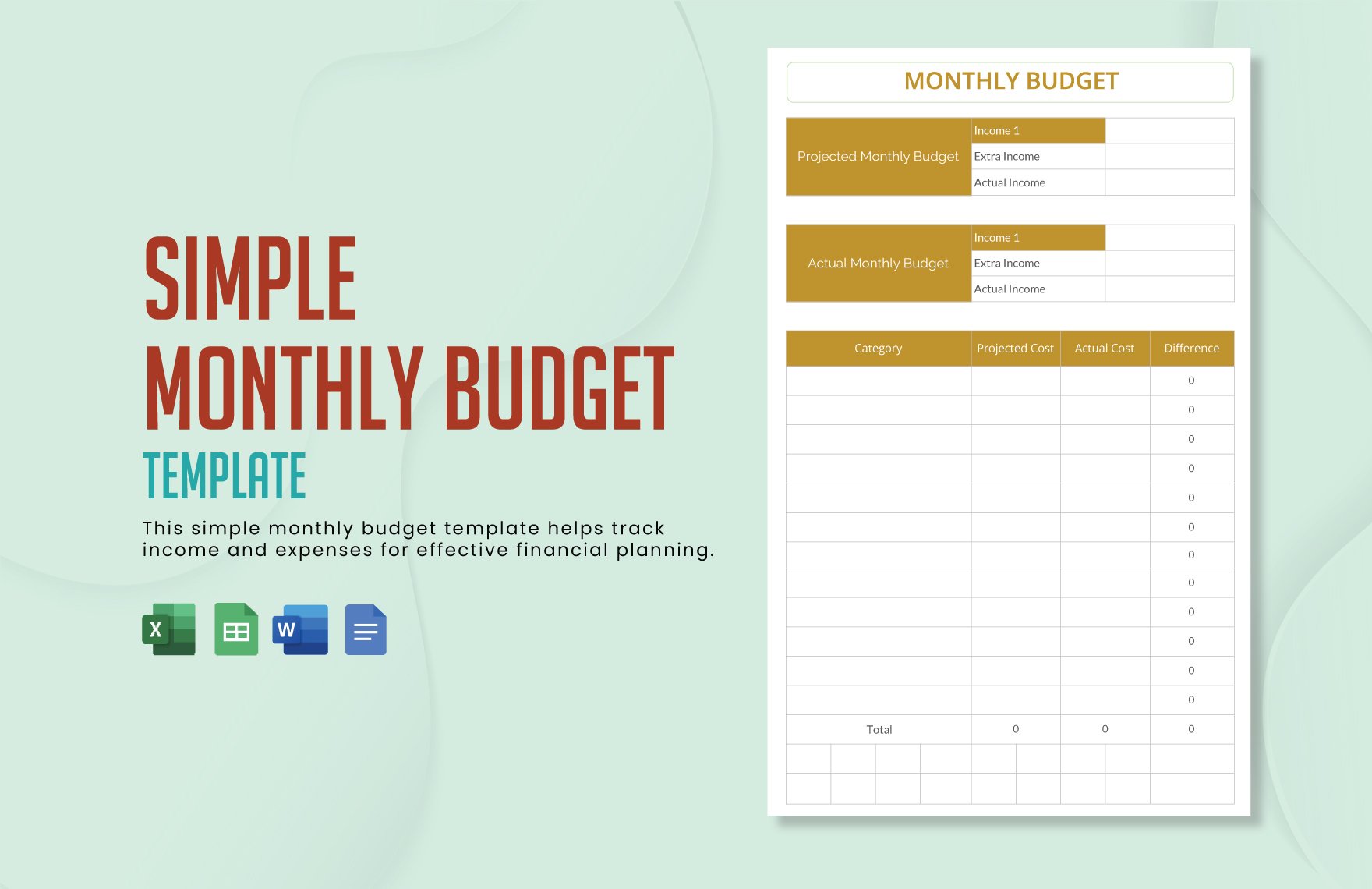

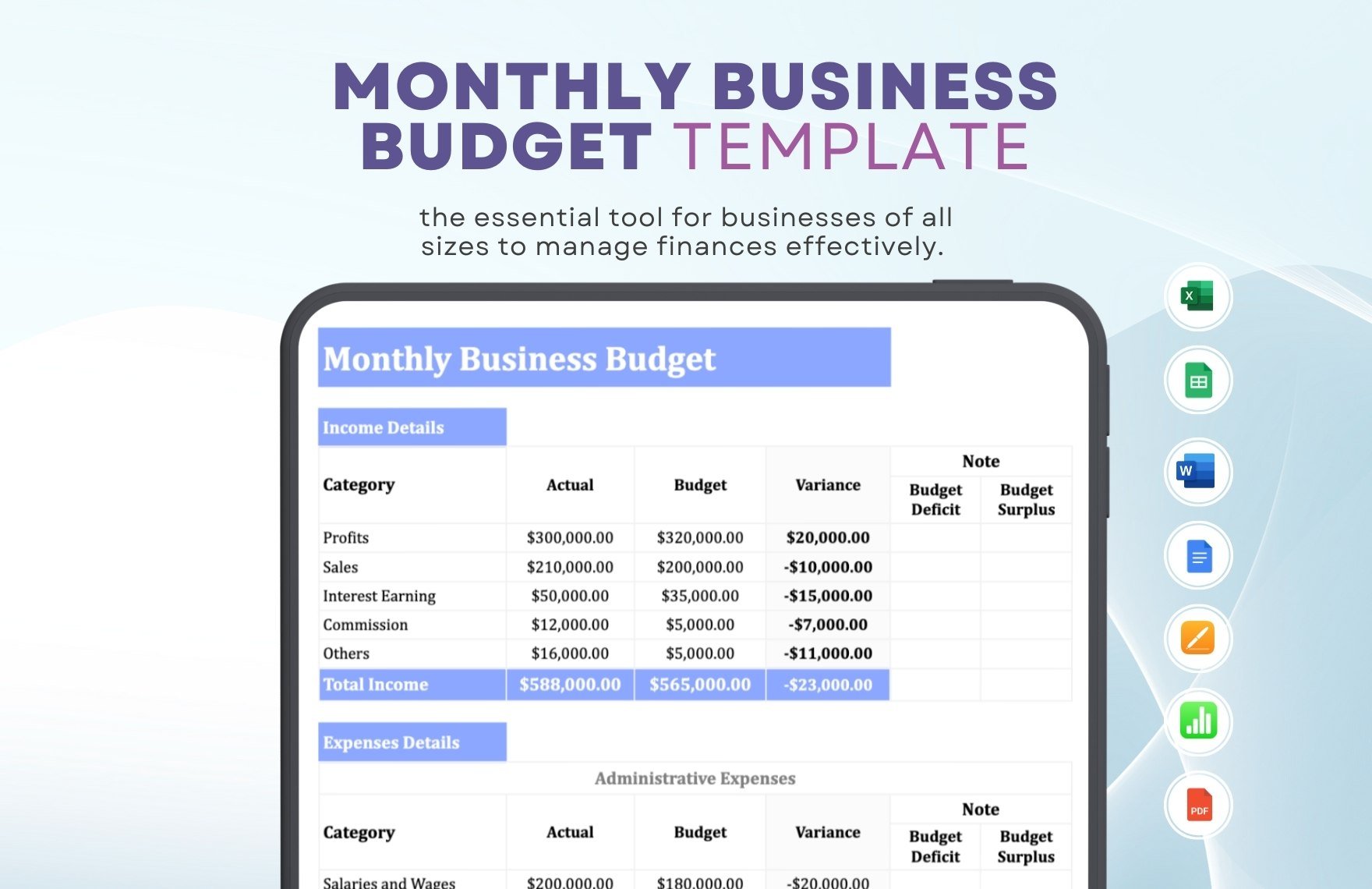

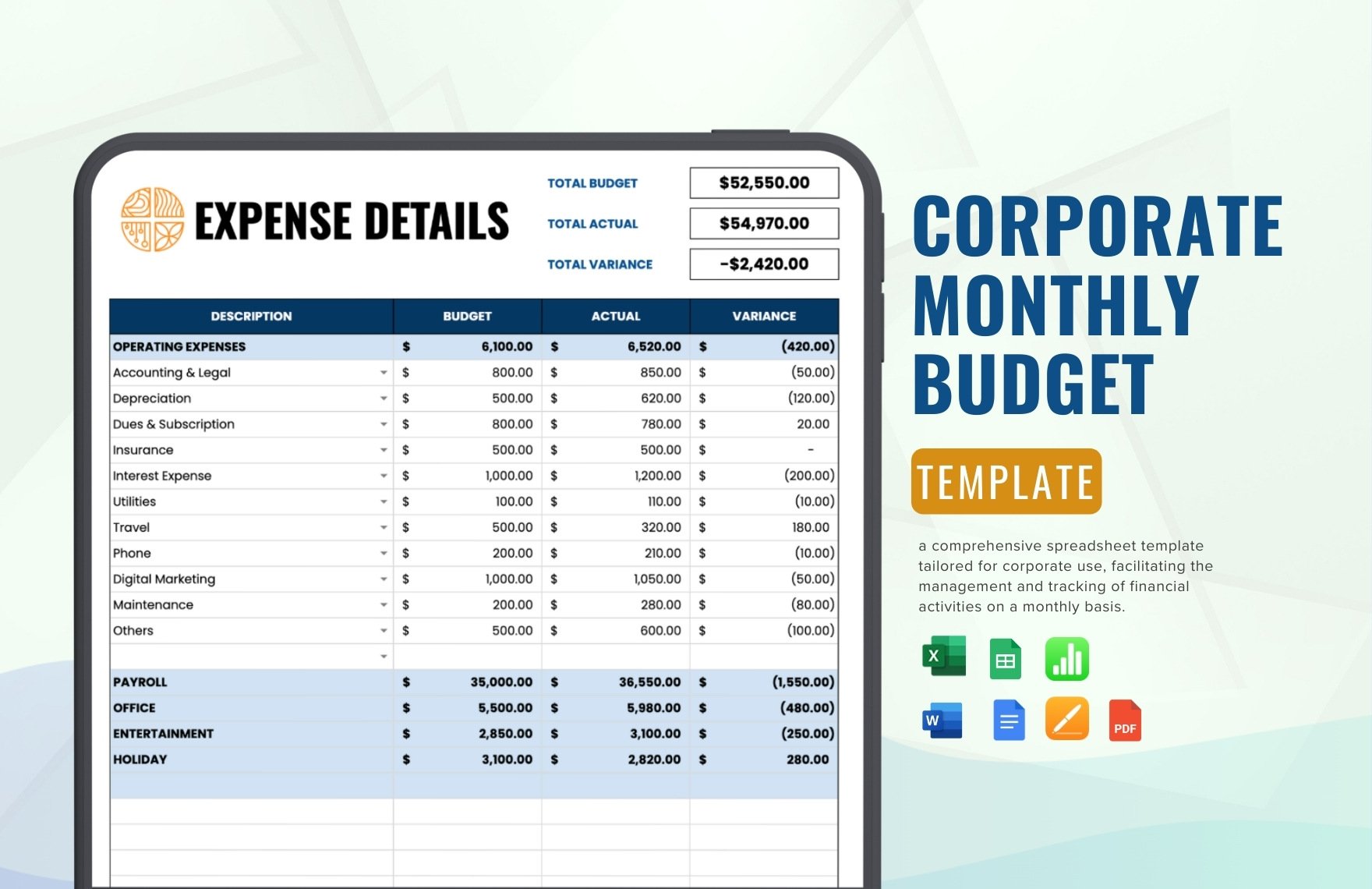

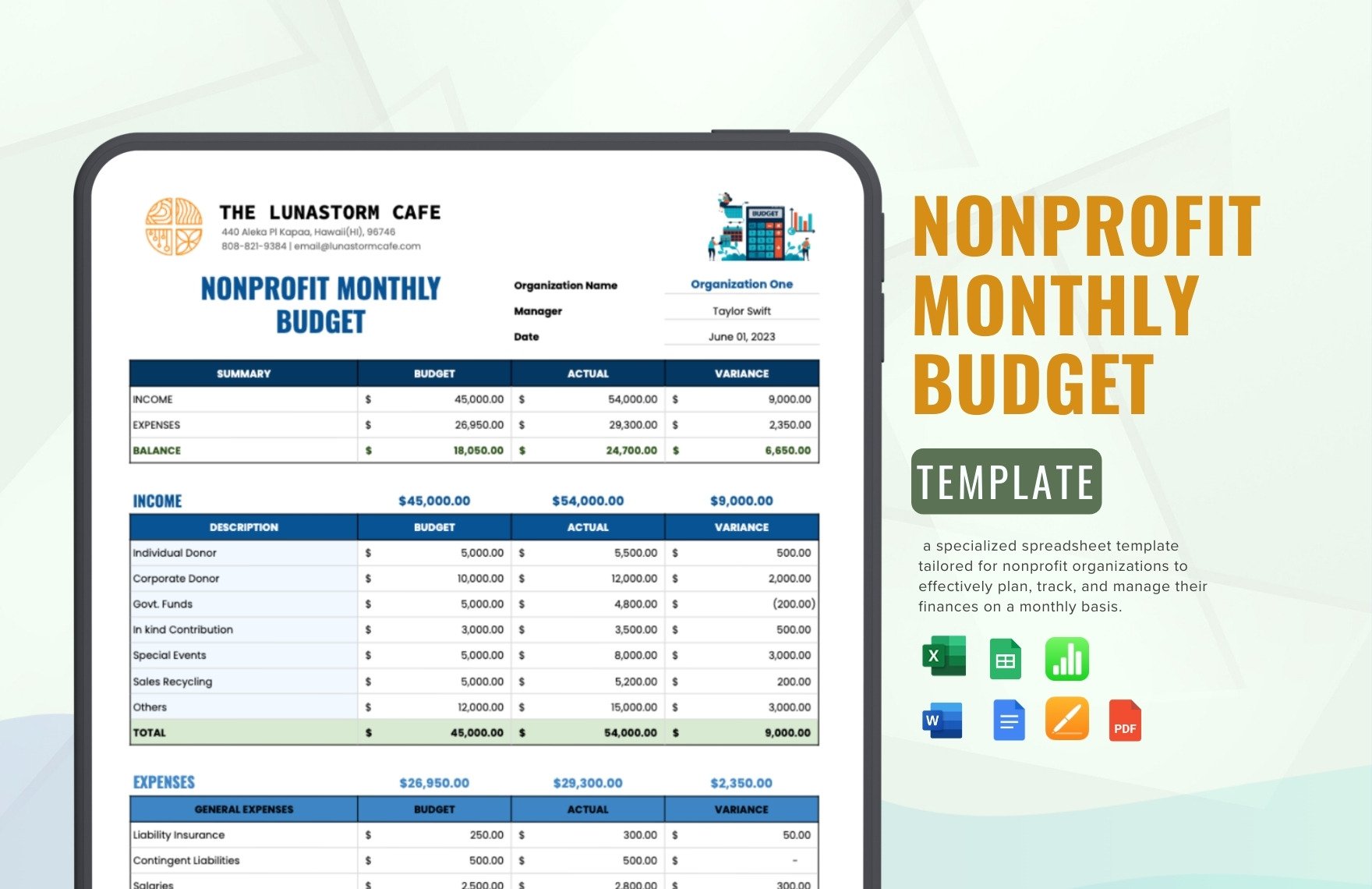

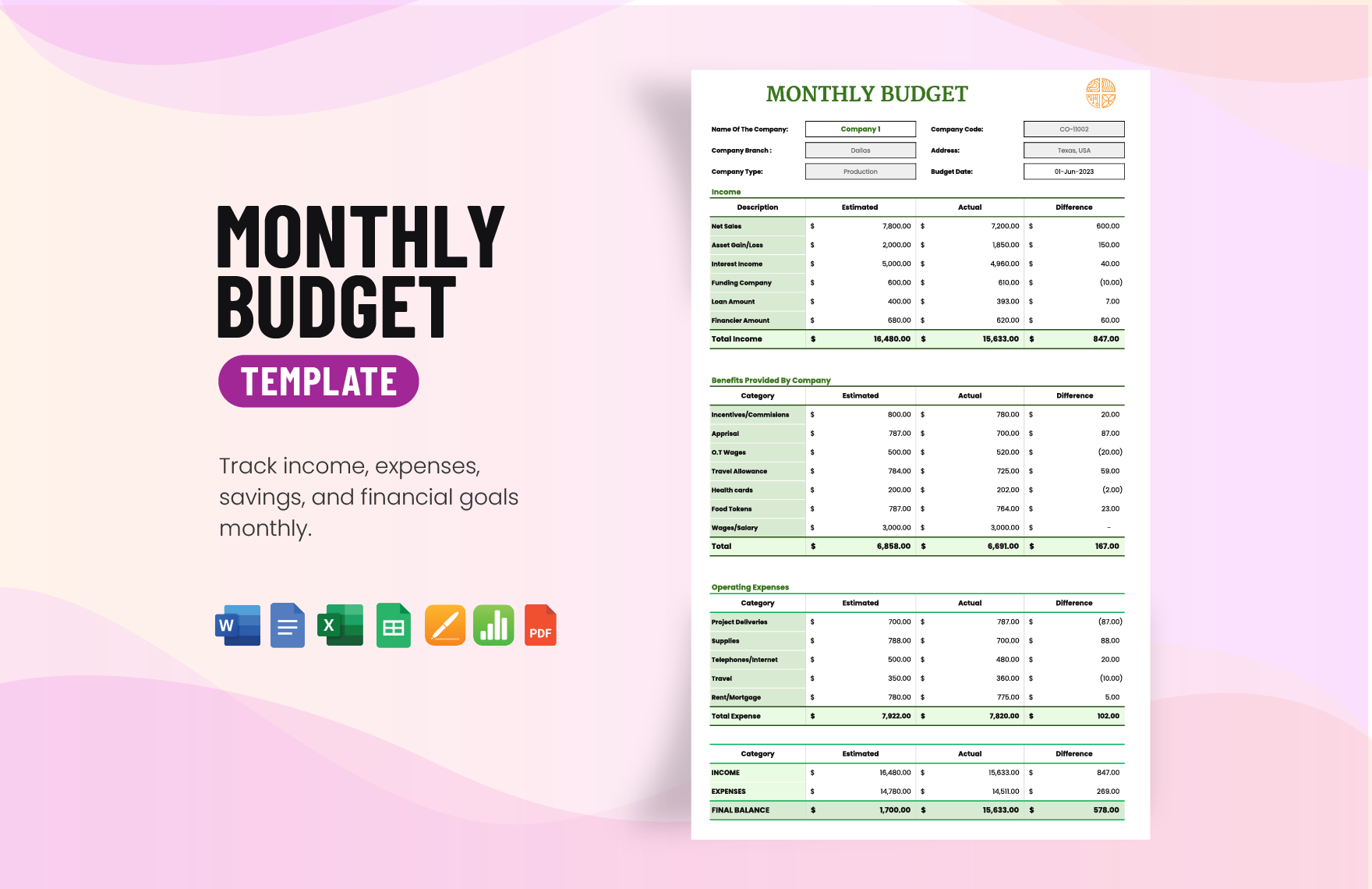

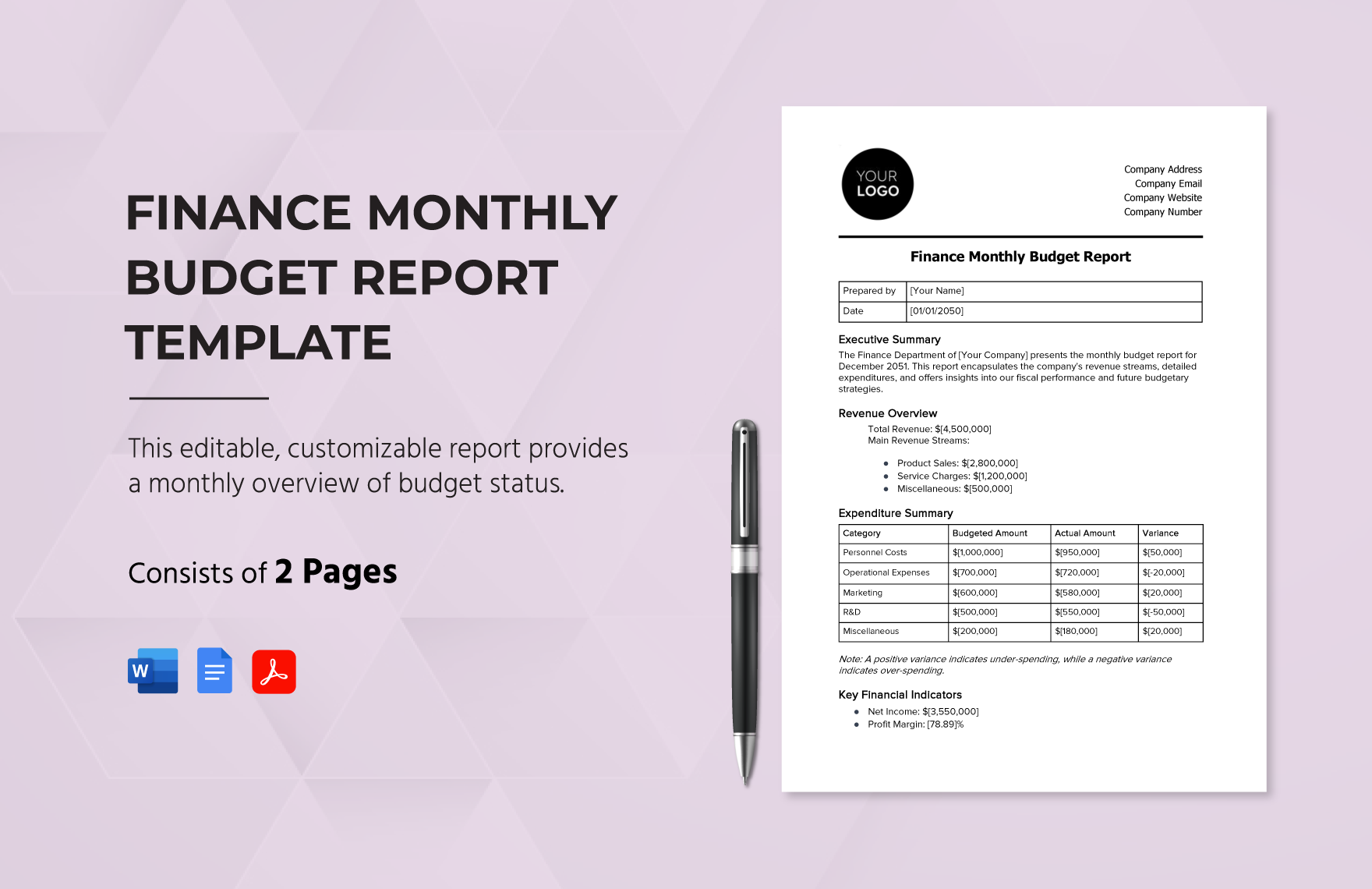

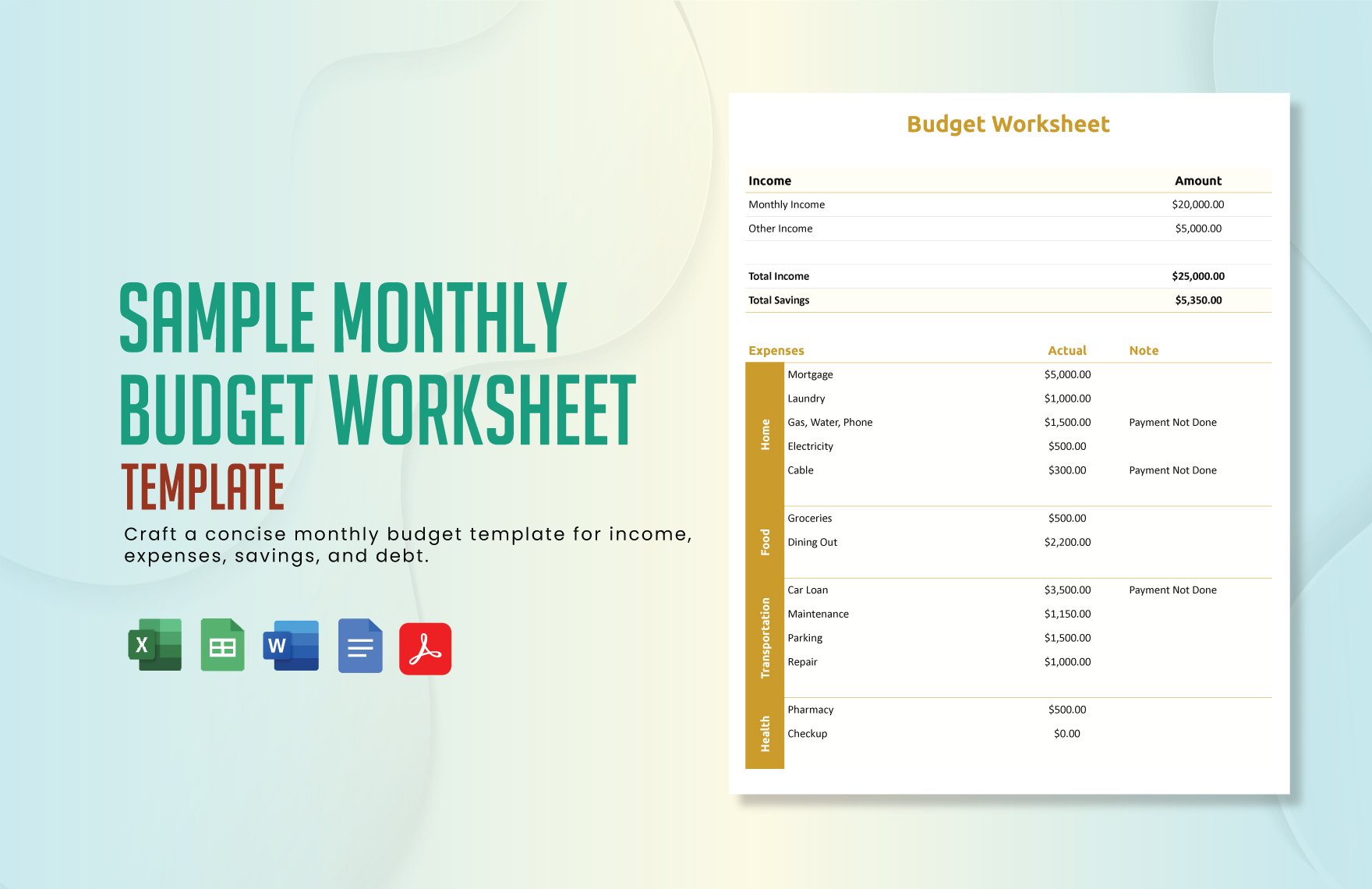

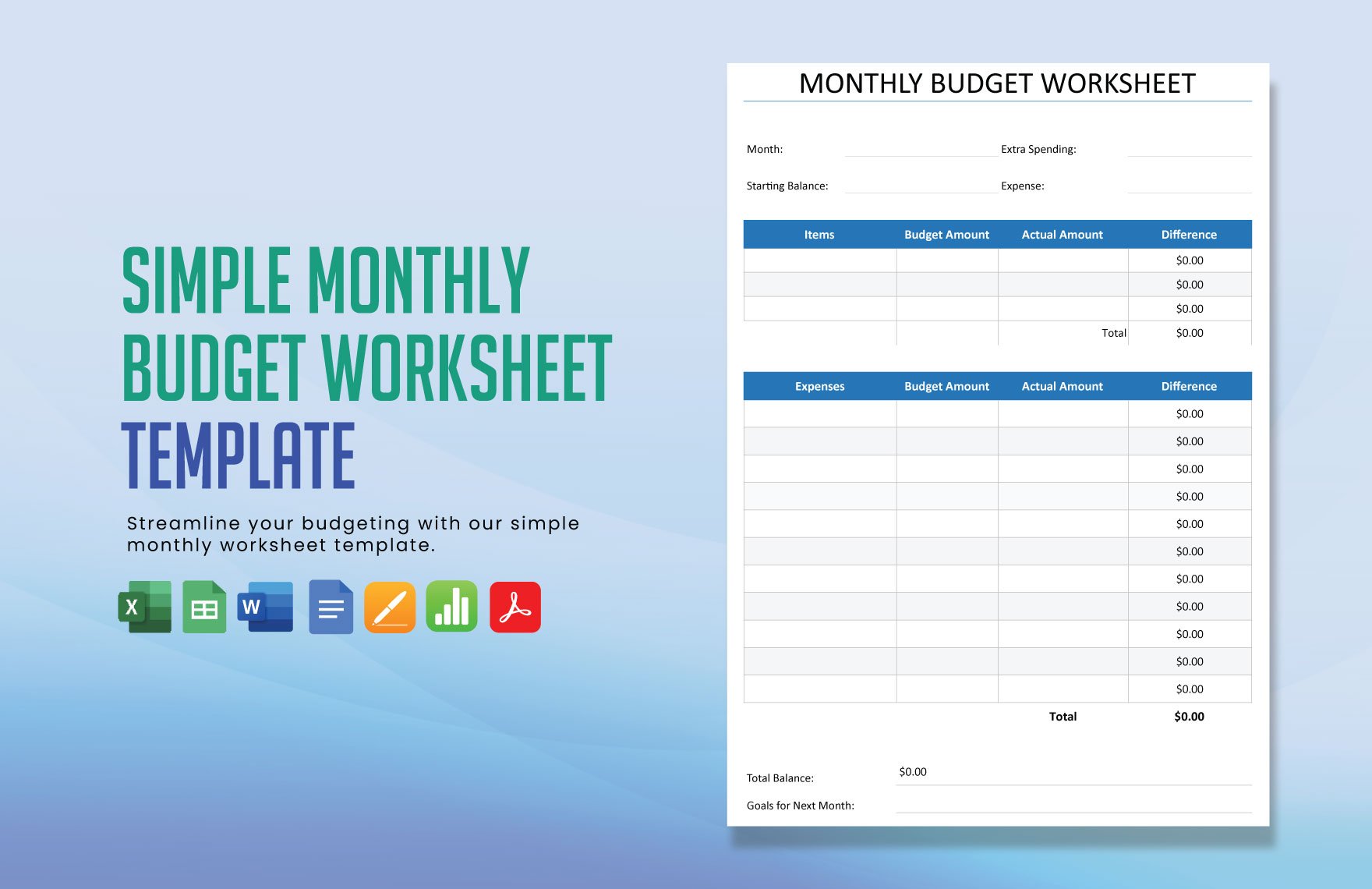

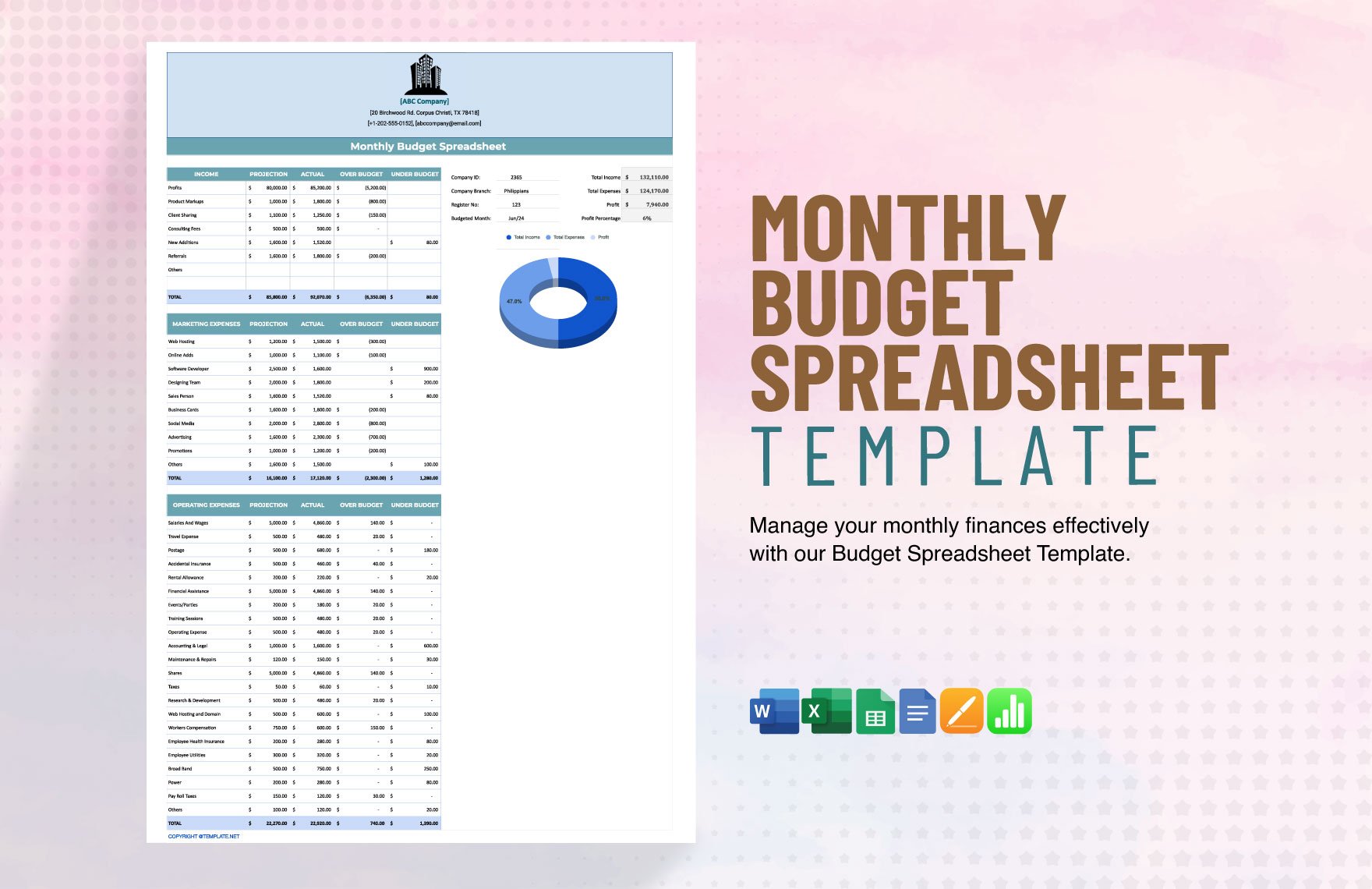

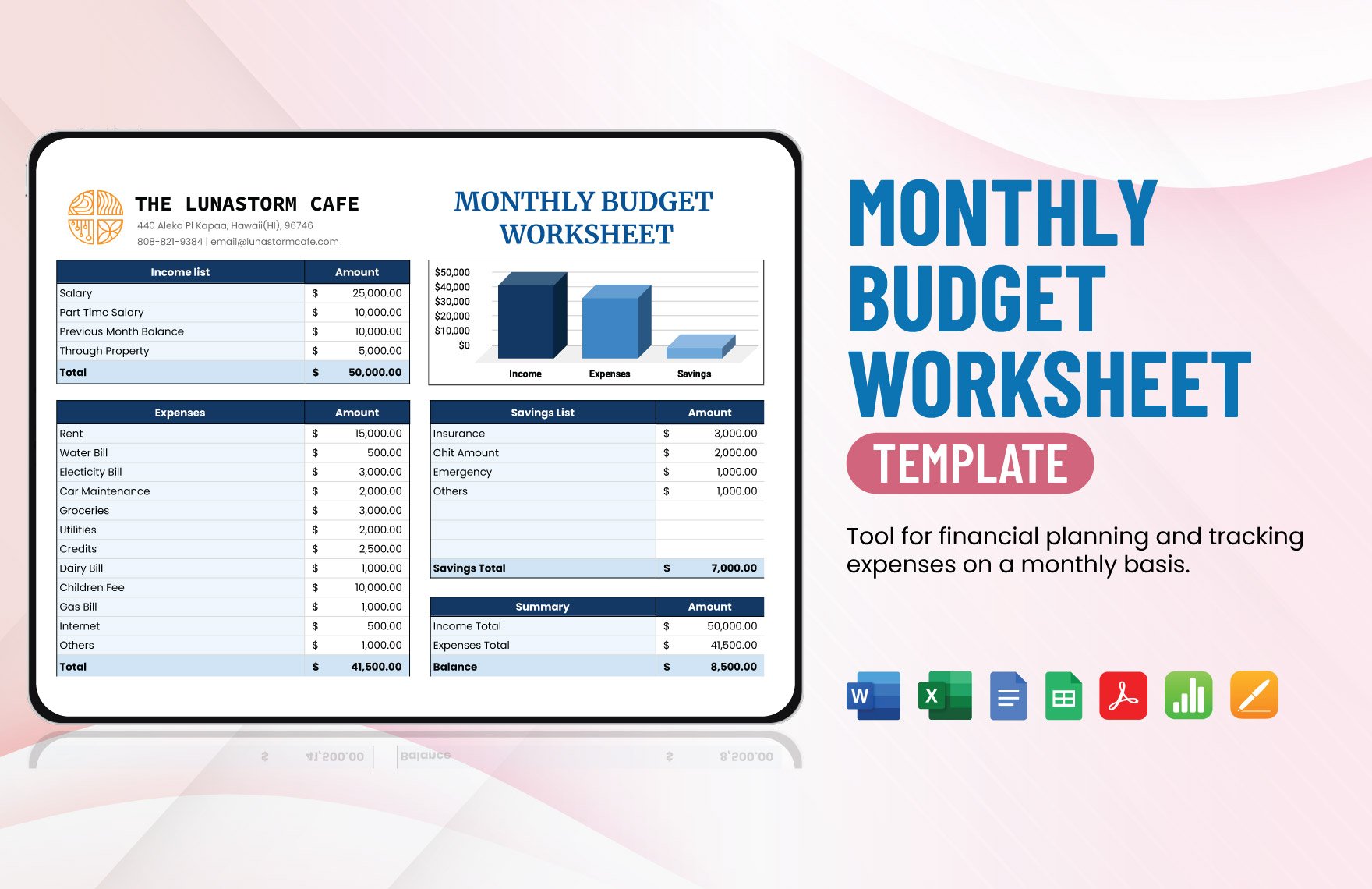

Take control of your financial planning with our pre-designed Monthly Budget Templates in Microsoft Word by Template.net. Designed for everyone from seasoned budgeters to those just beginning, you can now effortlessly plan and manage your finances with no complicated calculations. Whether you're looking to plan for an upcoming family vacation or monitor monthly spending on groceries, our templates have you covered. With our Free pre-designed templates, you have access to beautiful, customizable layouts that are both downloadable and printable in Microsoft Word. Say goodbye to design worries and hello to financial freedom with our intuitive, easy-to-use template library.

Explore a world of financial ease with a diverse collection of Monthly Budget Templates available in both free and Premium formats. Regularly updated with new designs, our library ensures you always have the latest tools at your fingertips. Each template can be seamlessly downloaded or shared via email, exporting options that guarantee increased reach and flexibility. Take advantage of our library of varied options, leveraging both Free and Premium templates to suit your unique financial needs. Start structuring your finances with templates that promise both versatility and convenience.