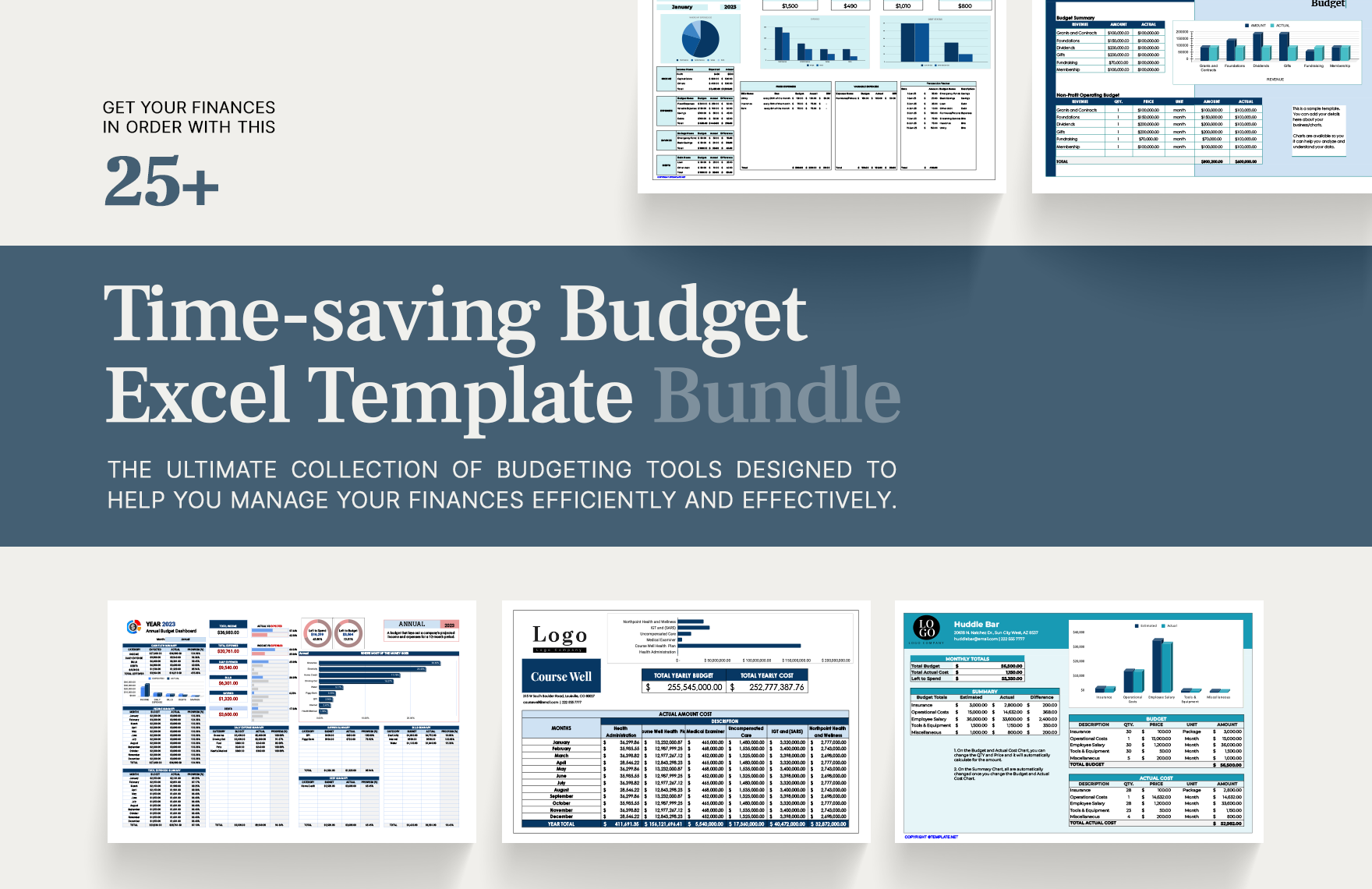

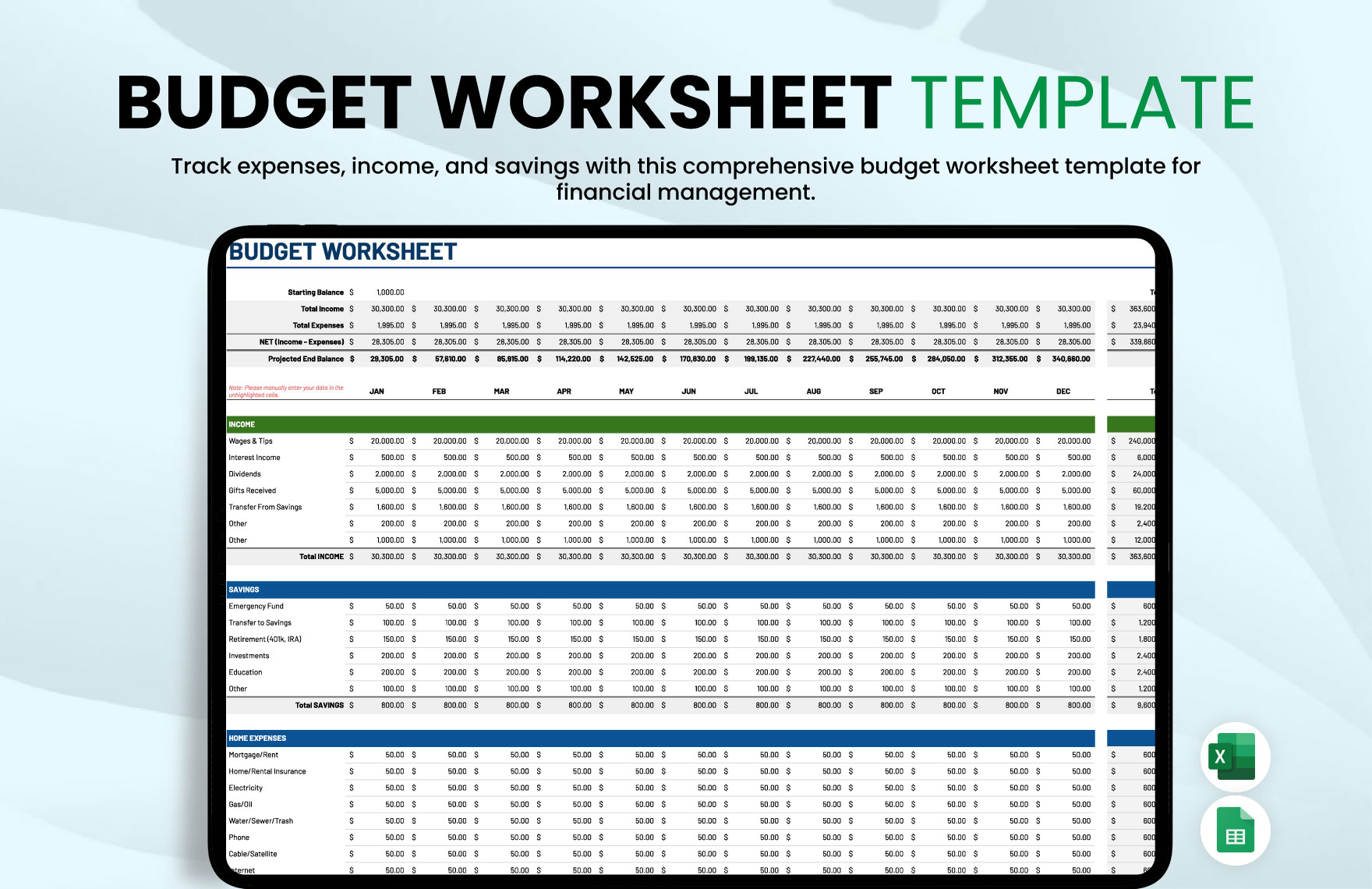

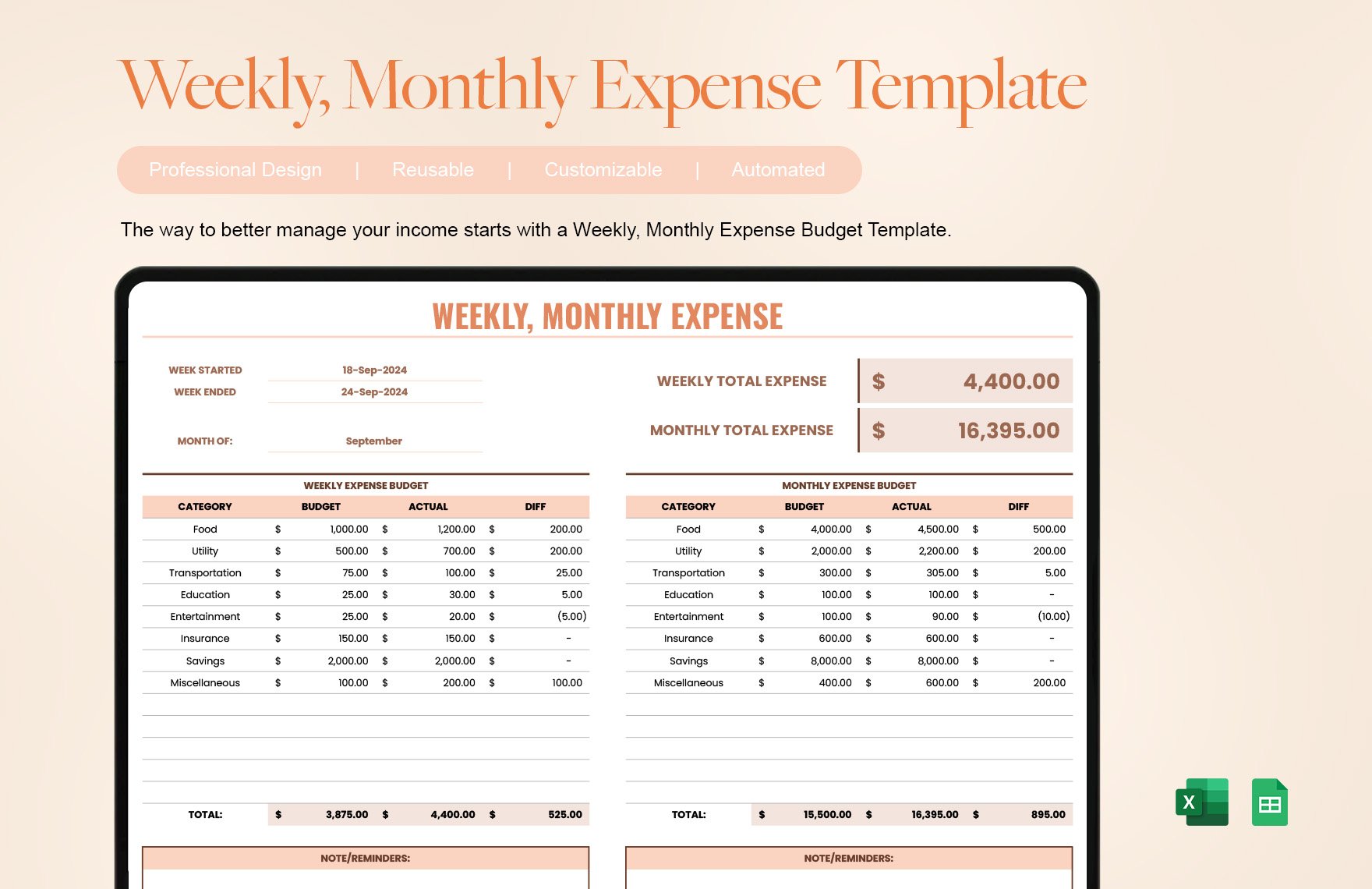

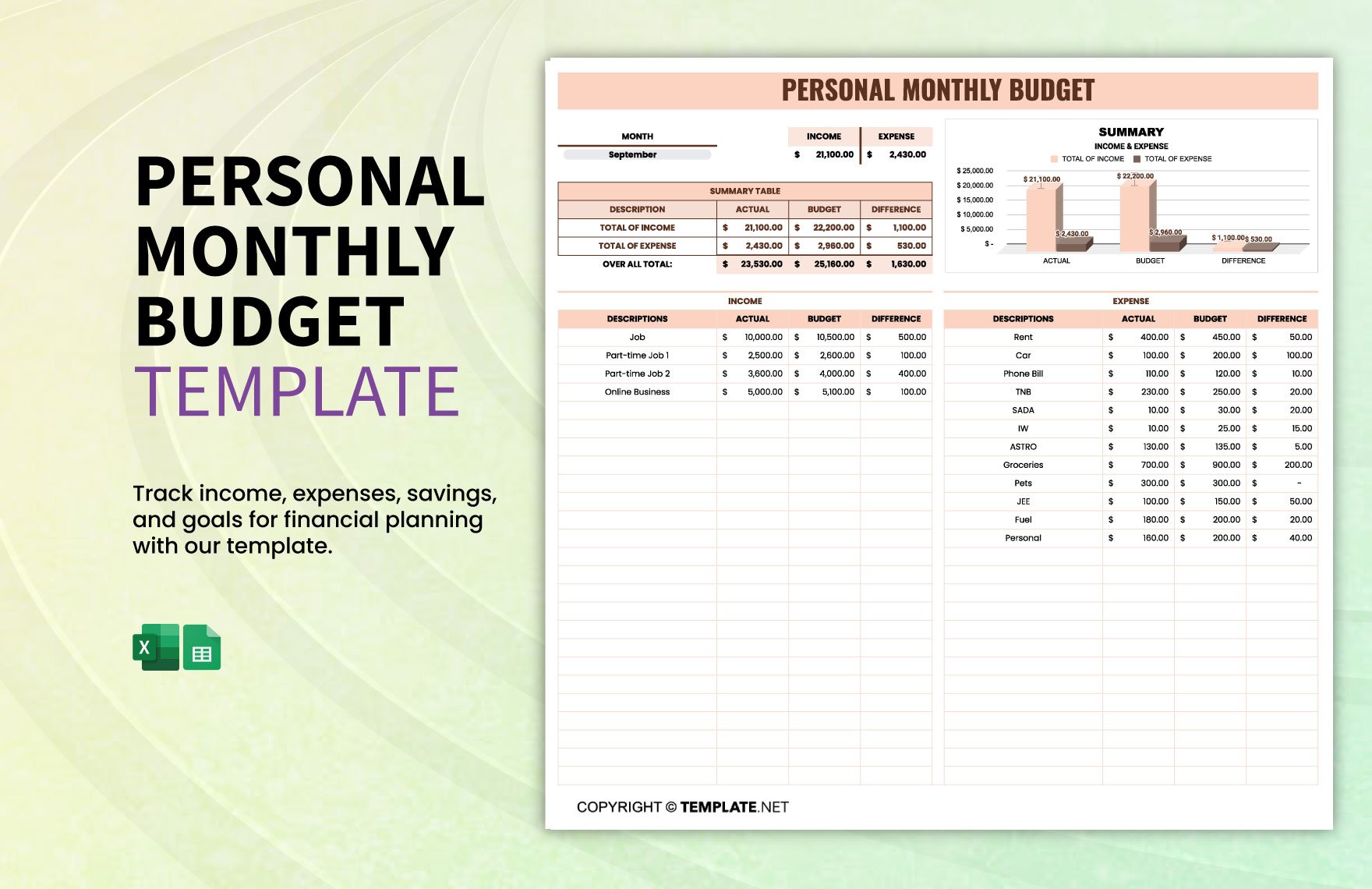

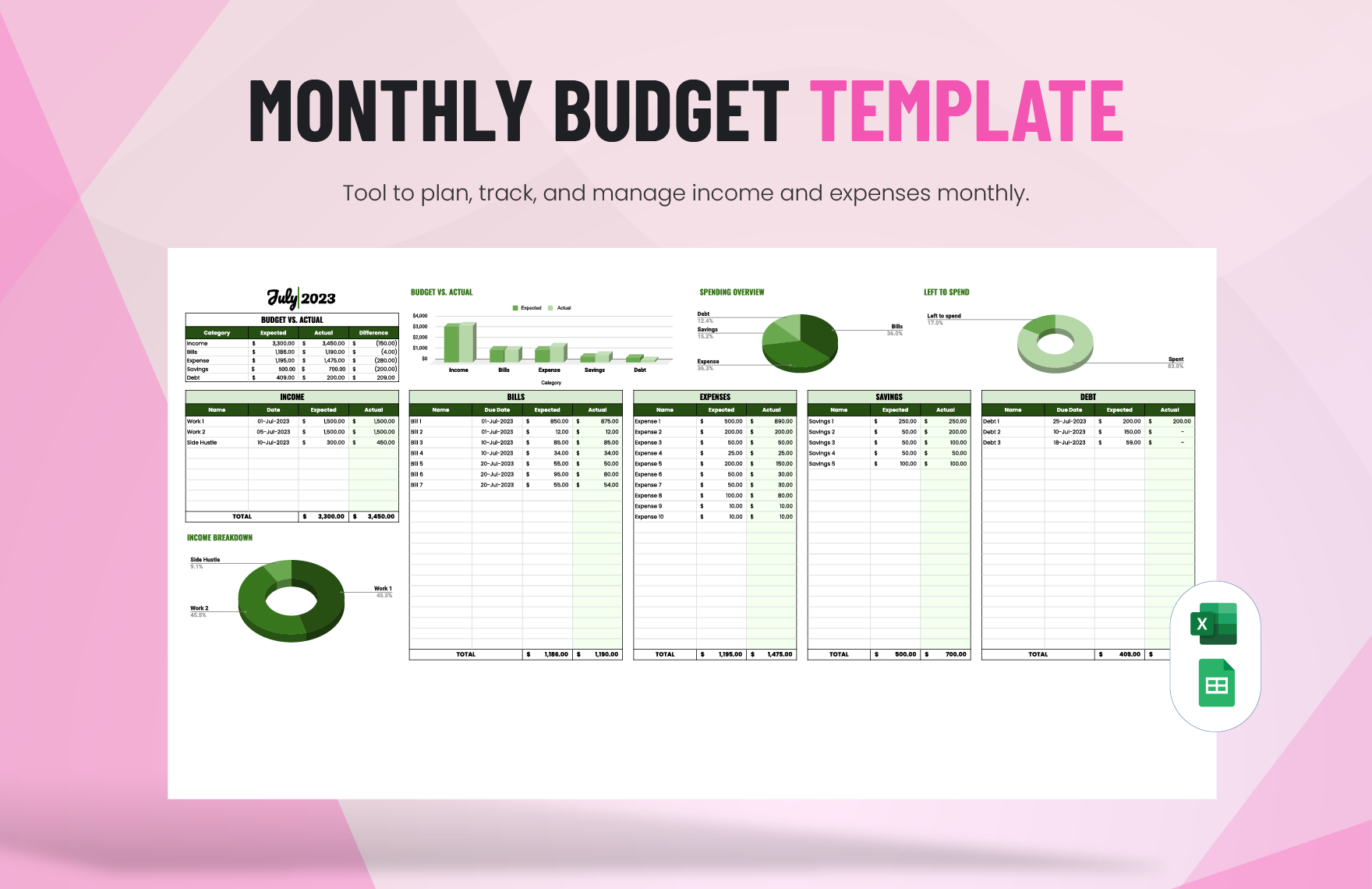

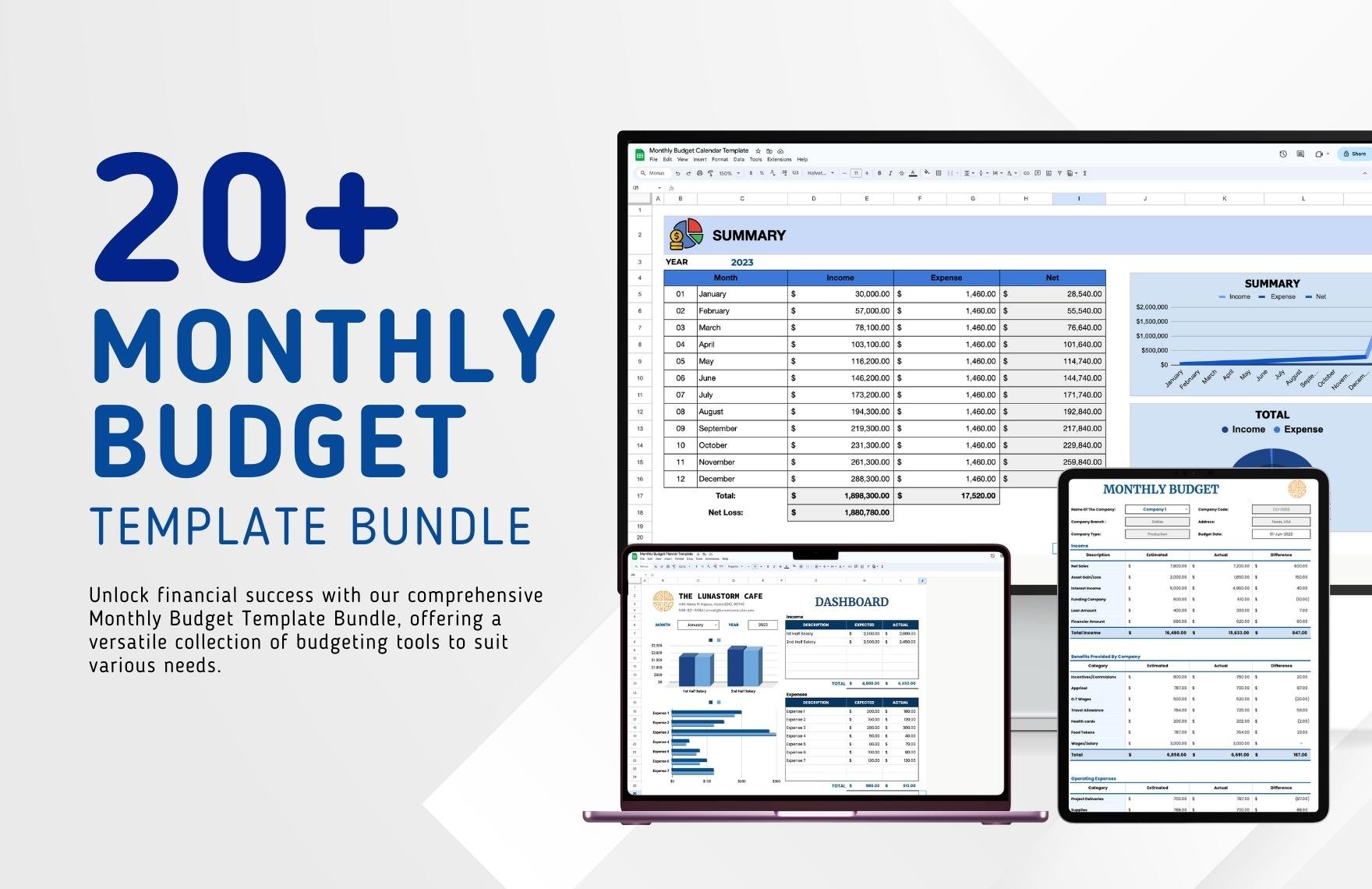

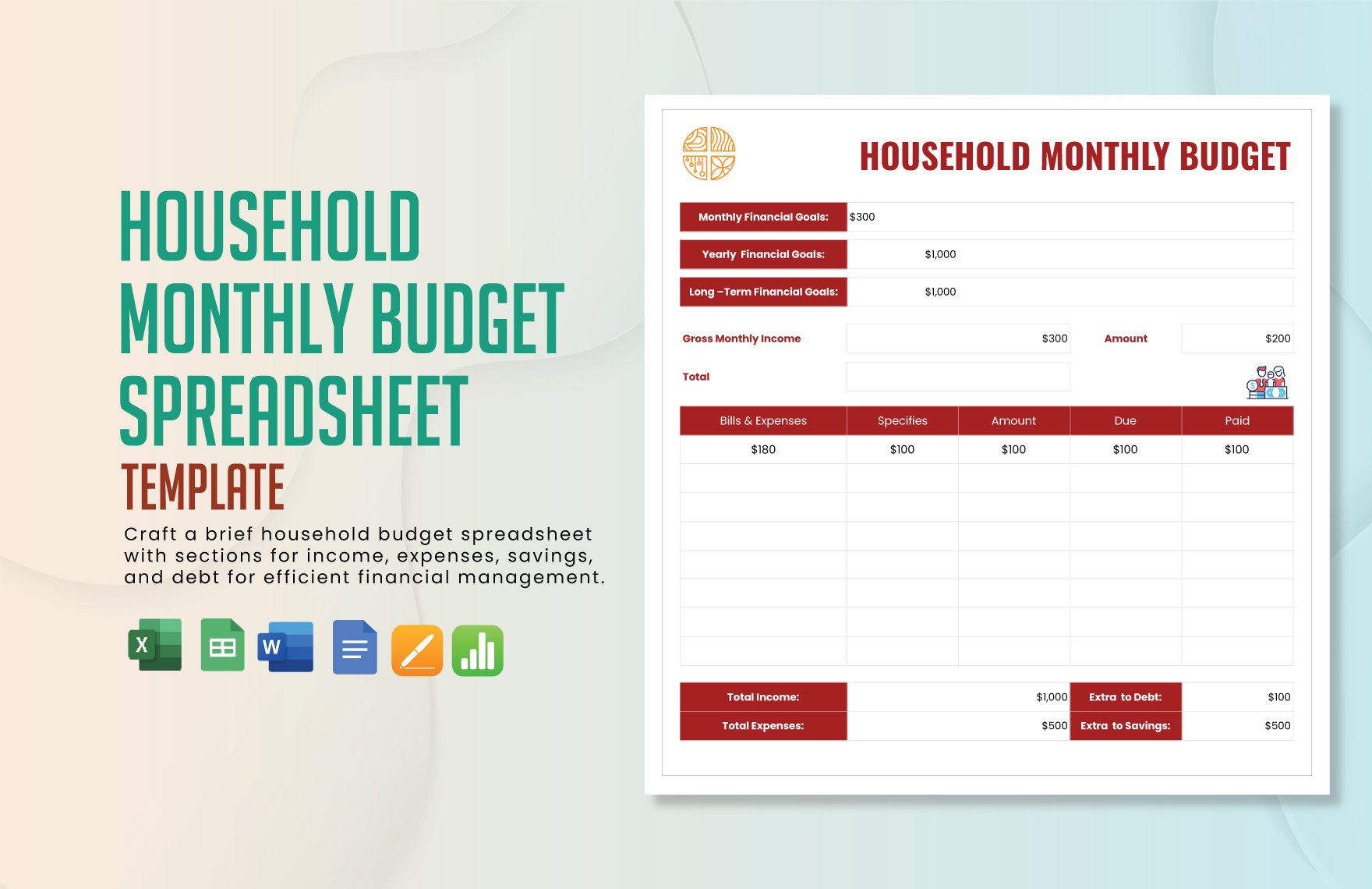

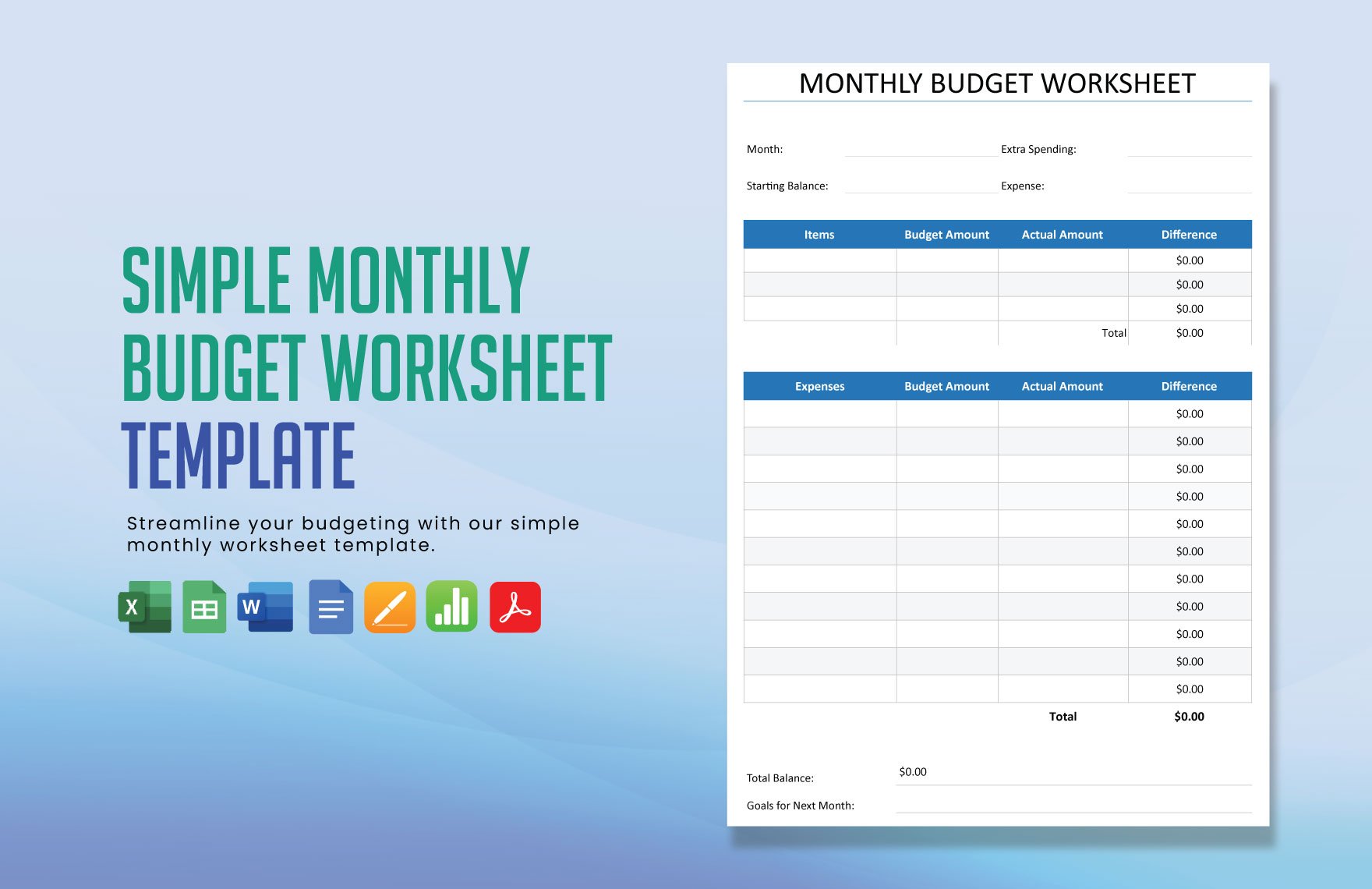

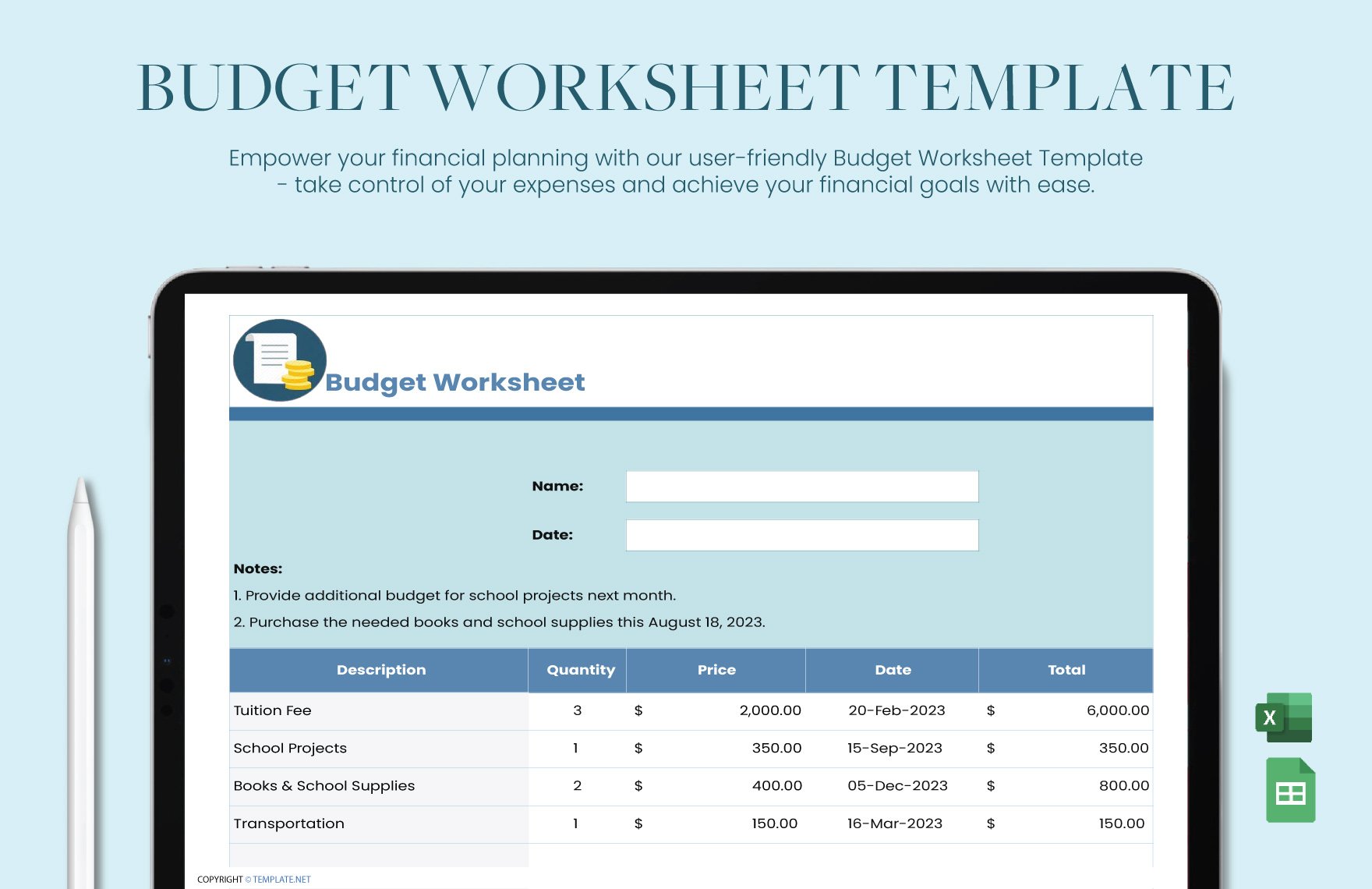

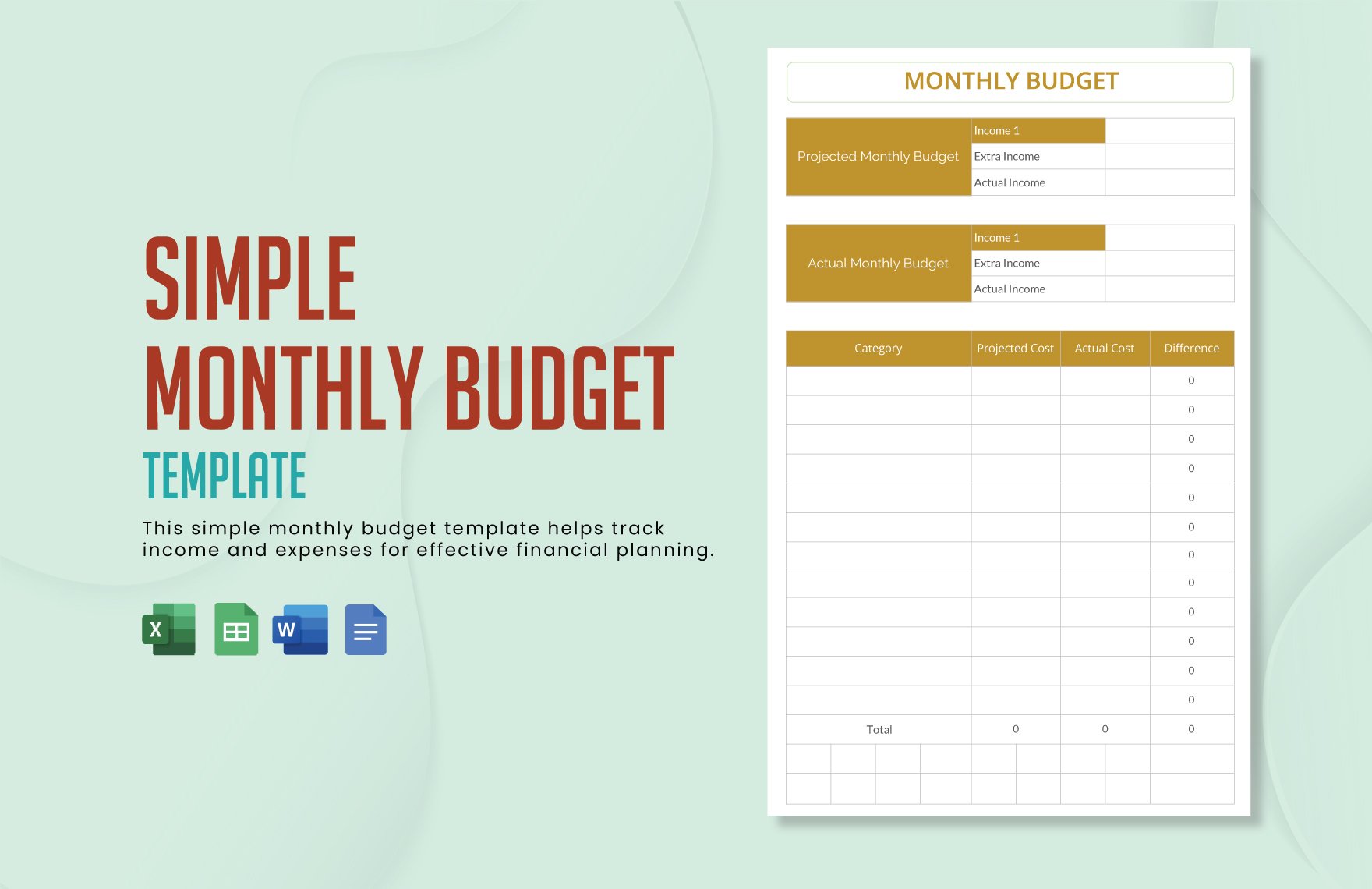

Trying to keep track of your expenses yet don't know how to make a budget planner? Free your worries, we are here to help you out. You don't have to start from scratch because we offer high-quality, 100% customizable, and editable budget worksheets that are made available in A4 and US letter sizes. These professional budget sheets are also made available in Google Docs, Google Sheets, MS Word, MS Excel, Numbers, and Apple Pages formats. You can access these worksheet templates anytime, anywhere. So don't let this rare opportunity slip through your hands. Download and subscribe now!

What Is a Monthly Budget Worksheet?

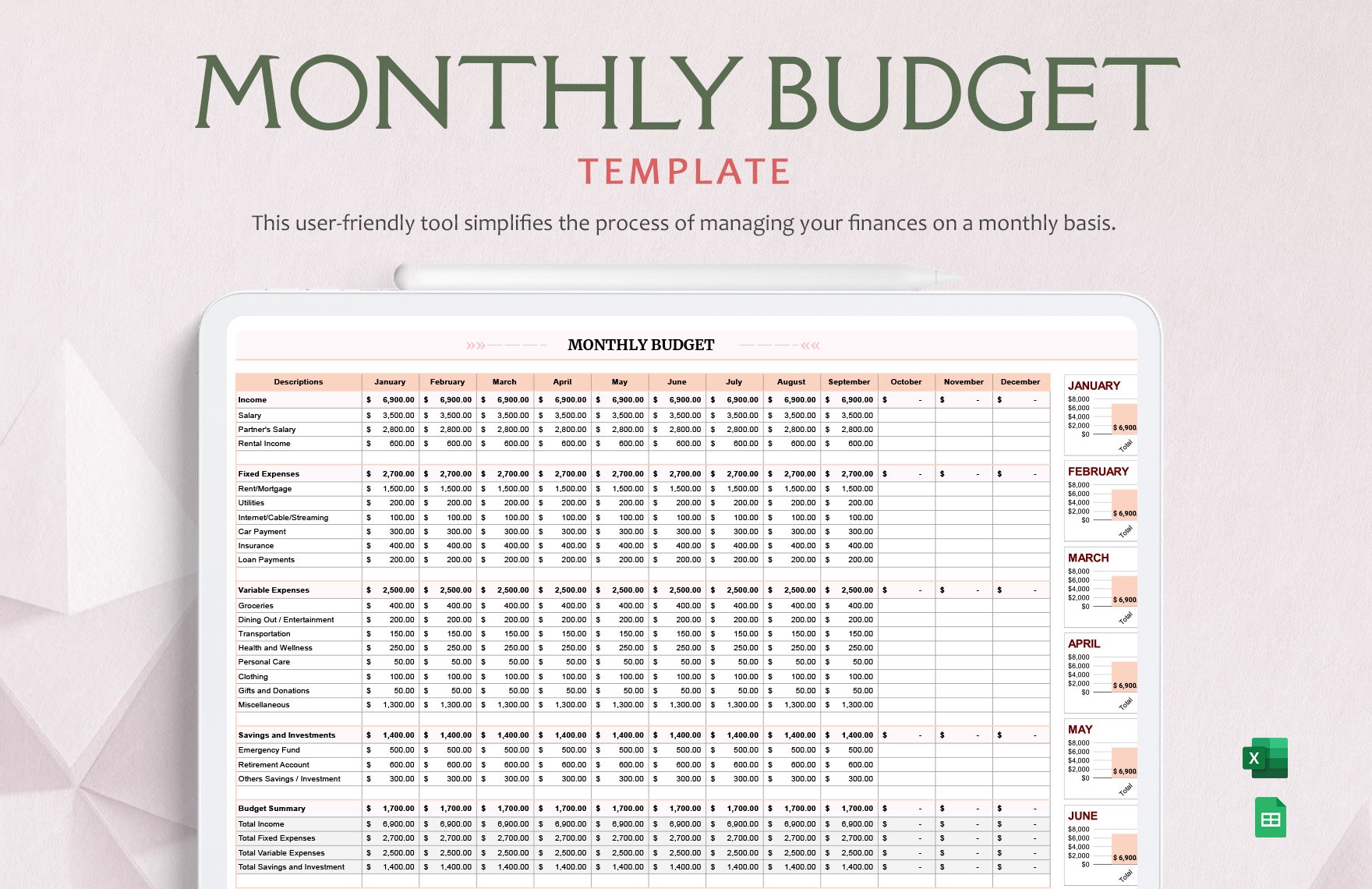

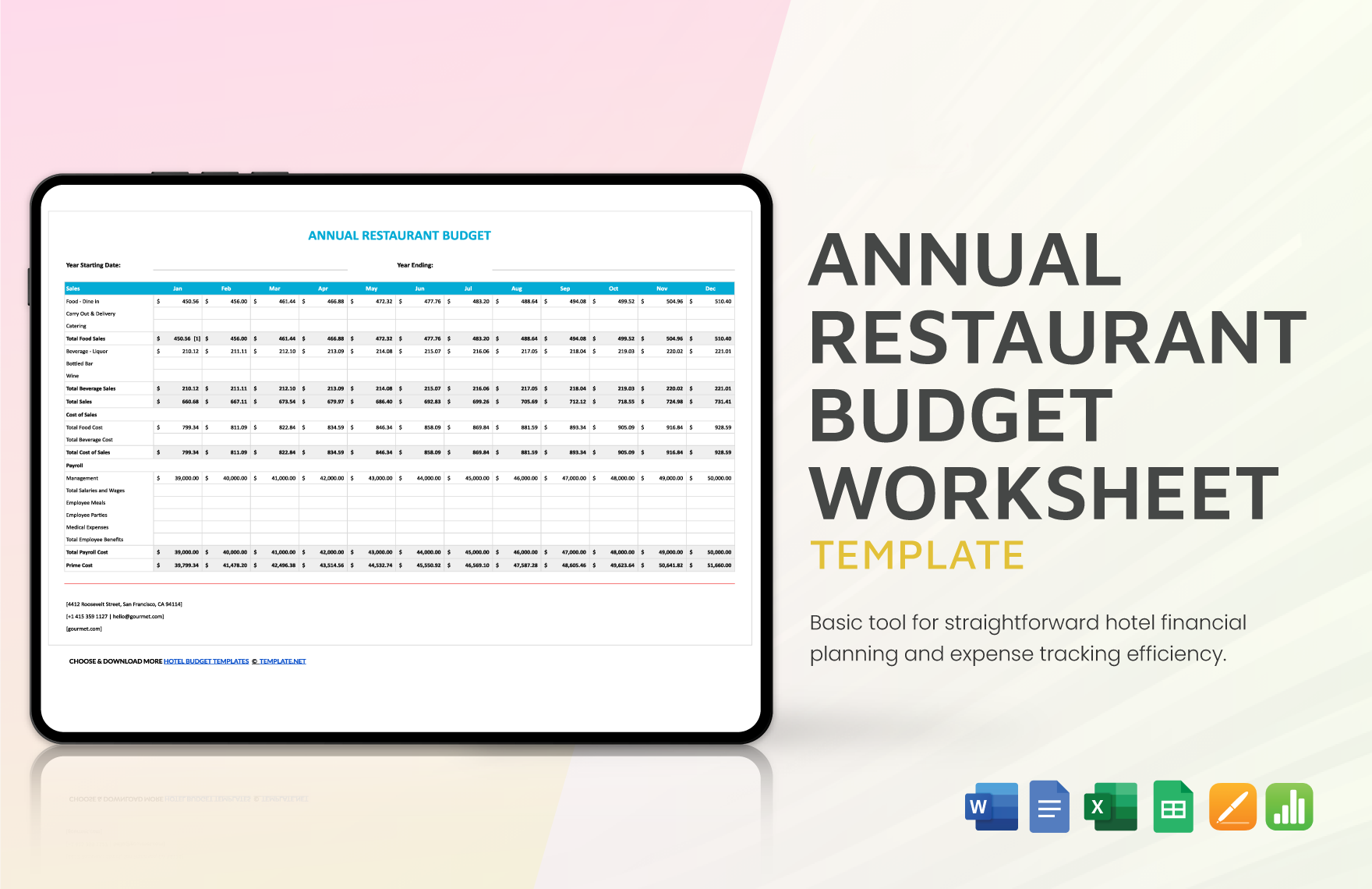

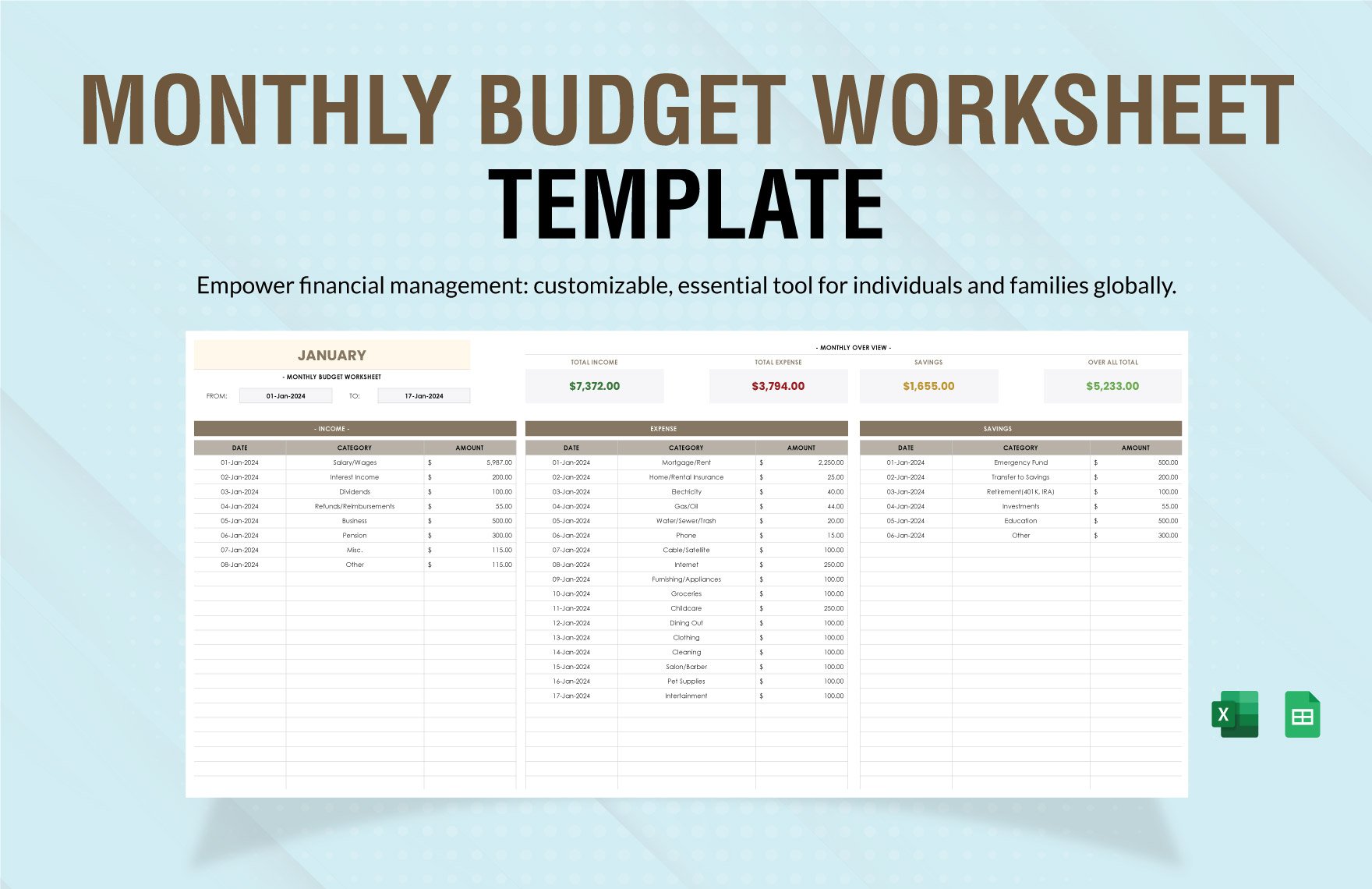

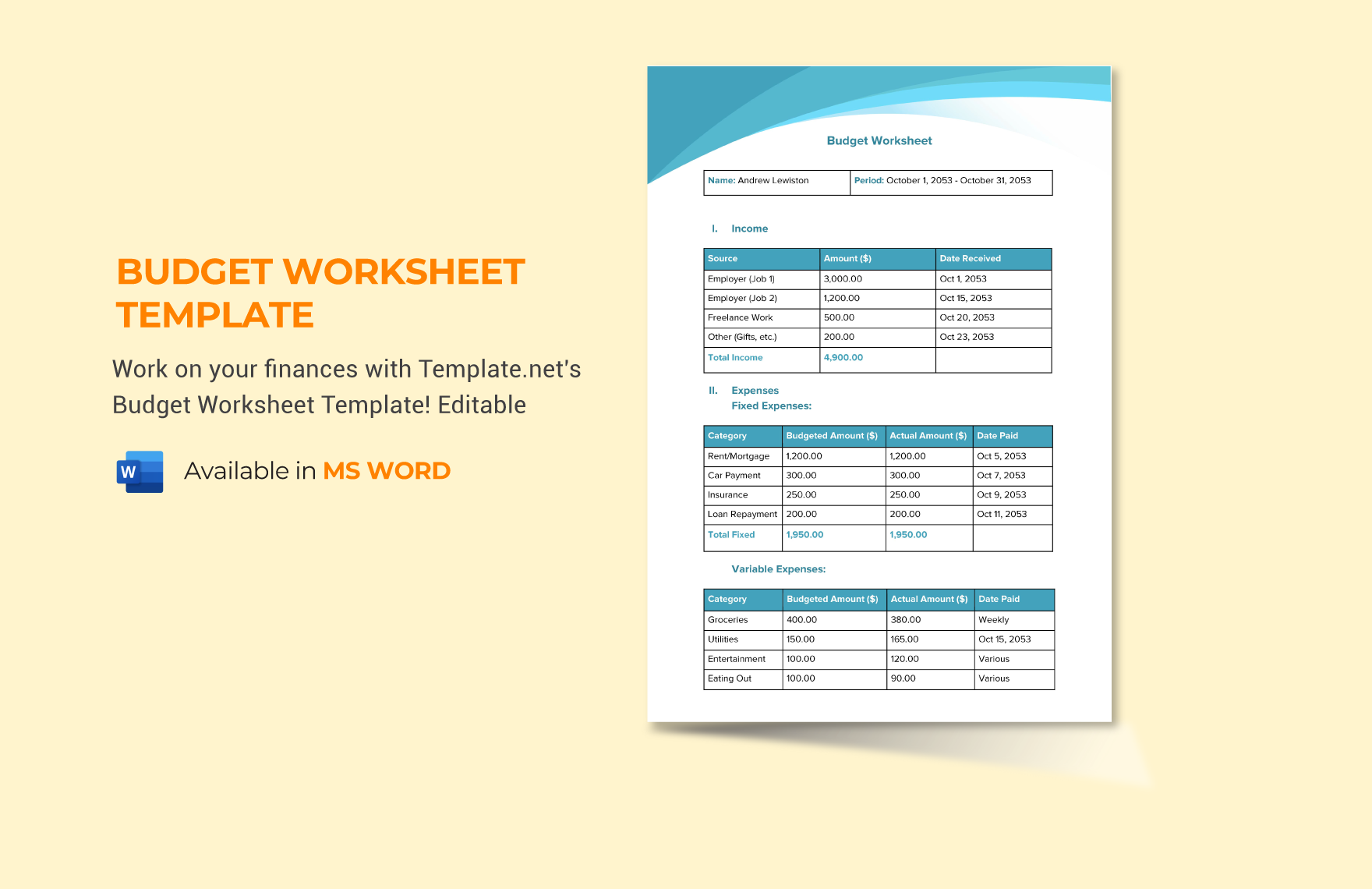

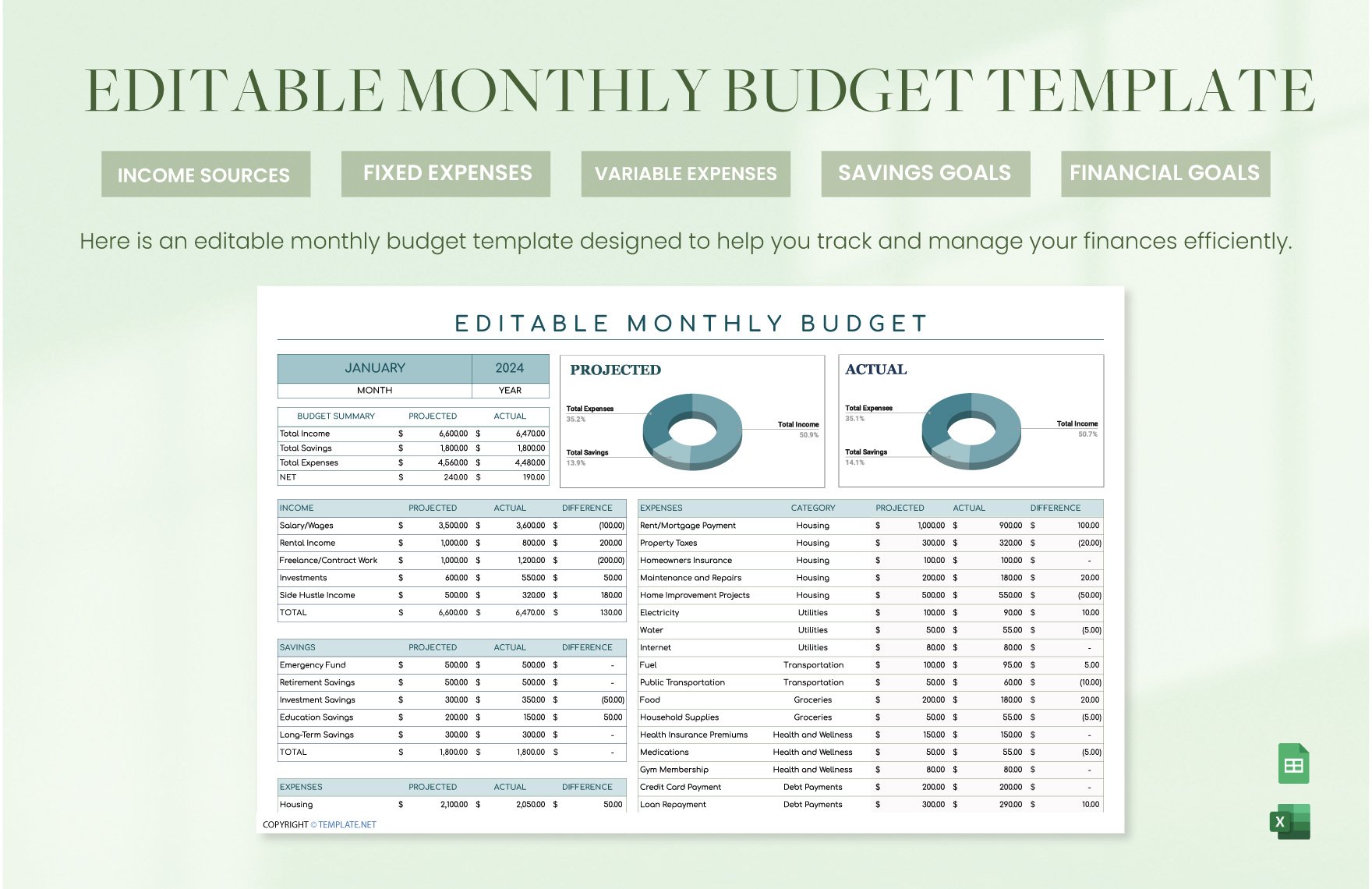

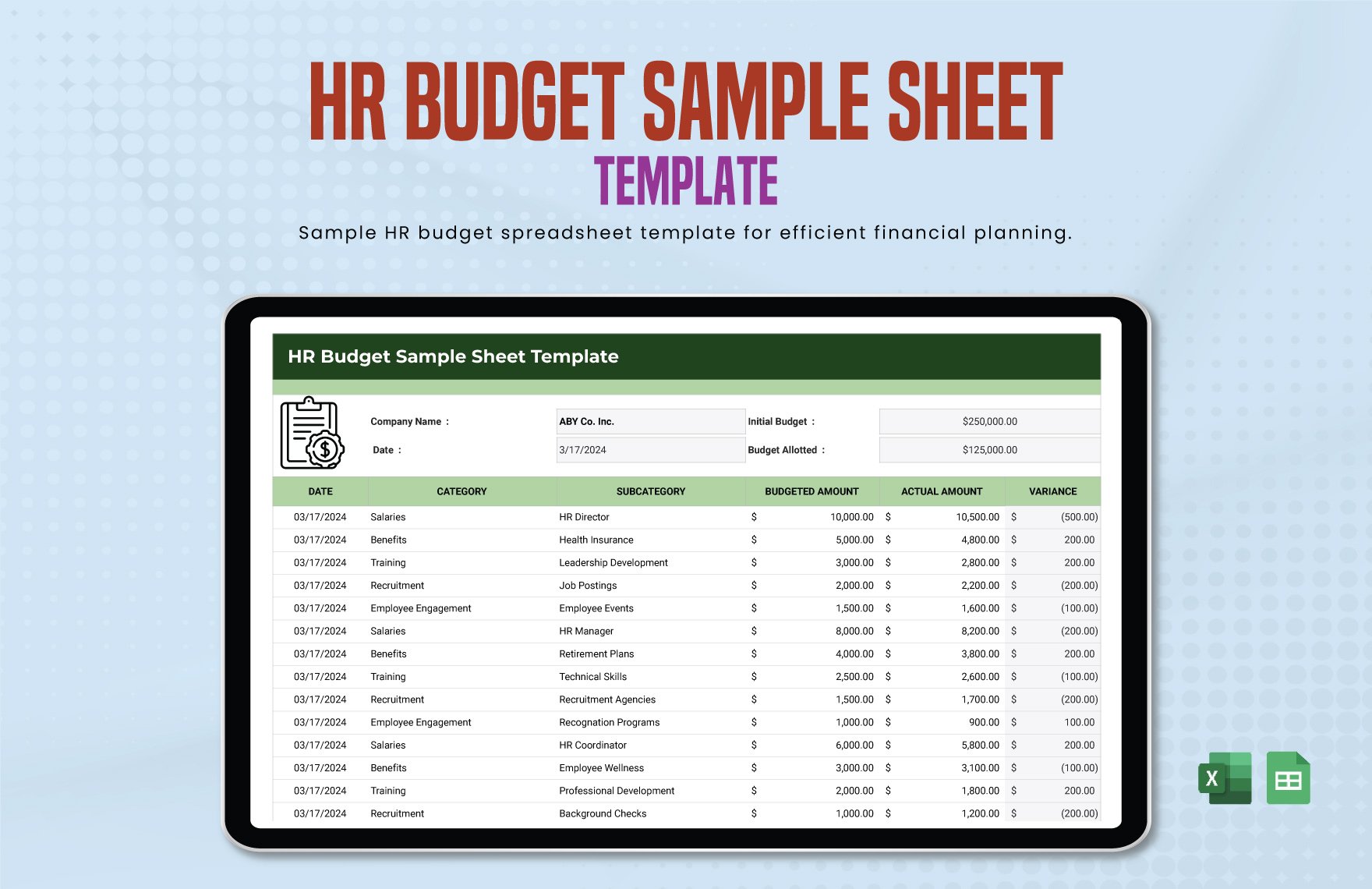

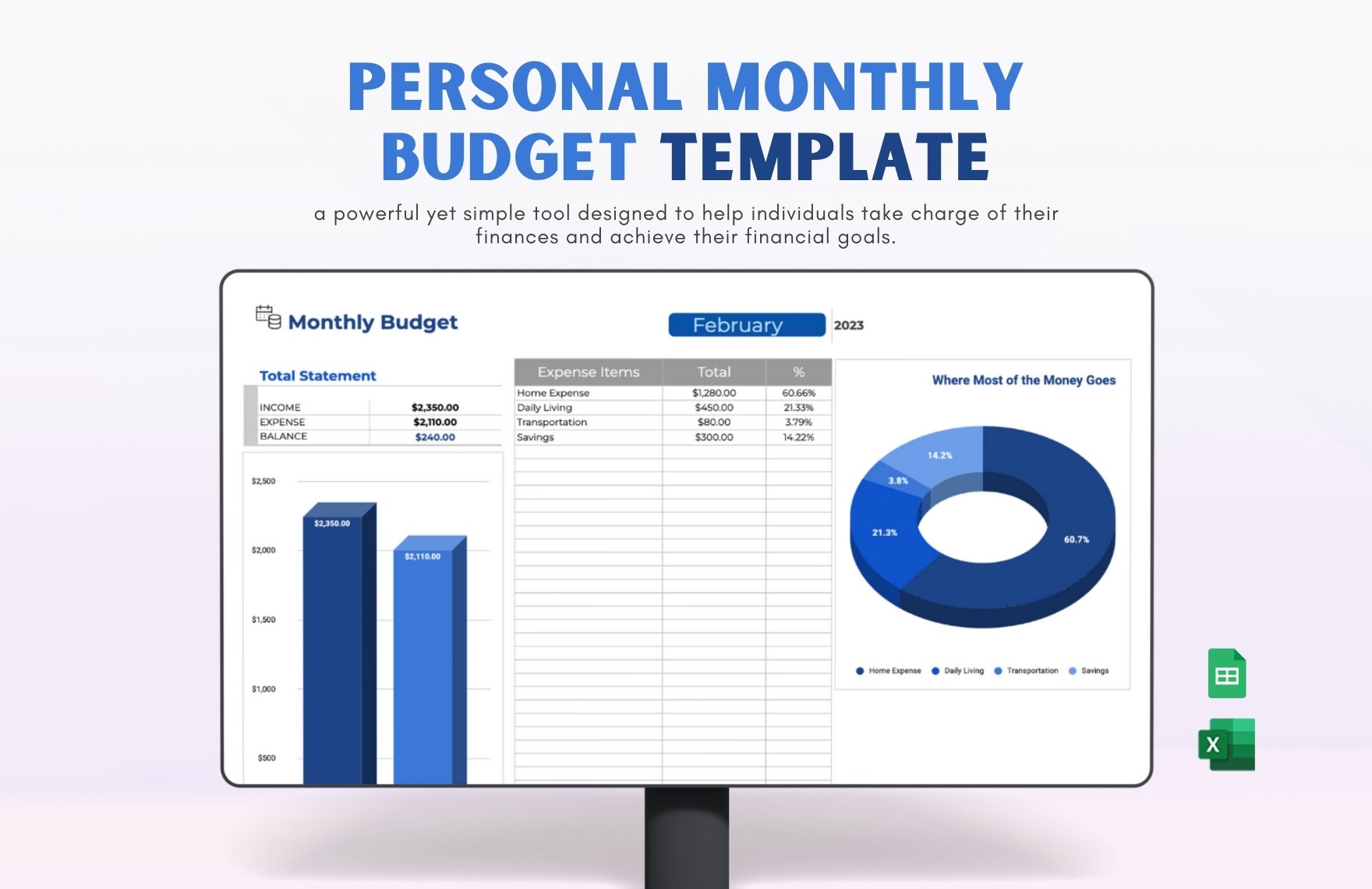

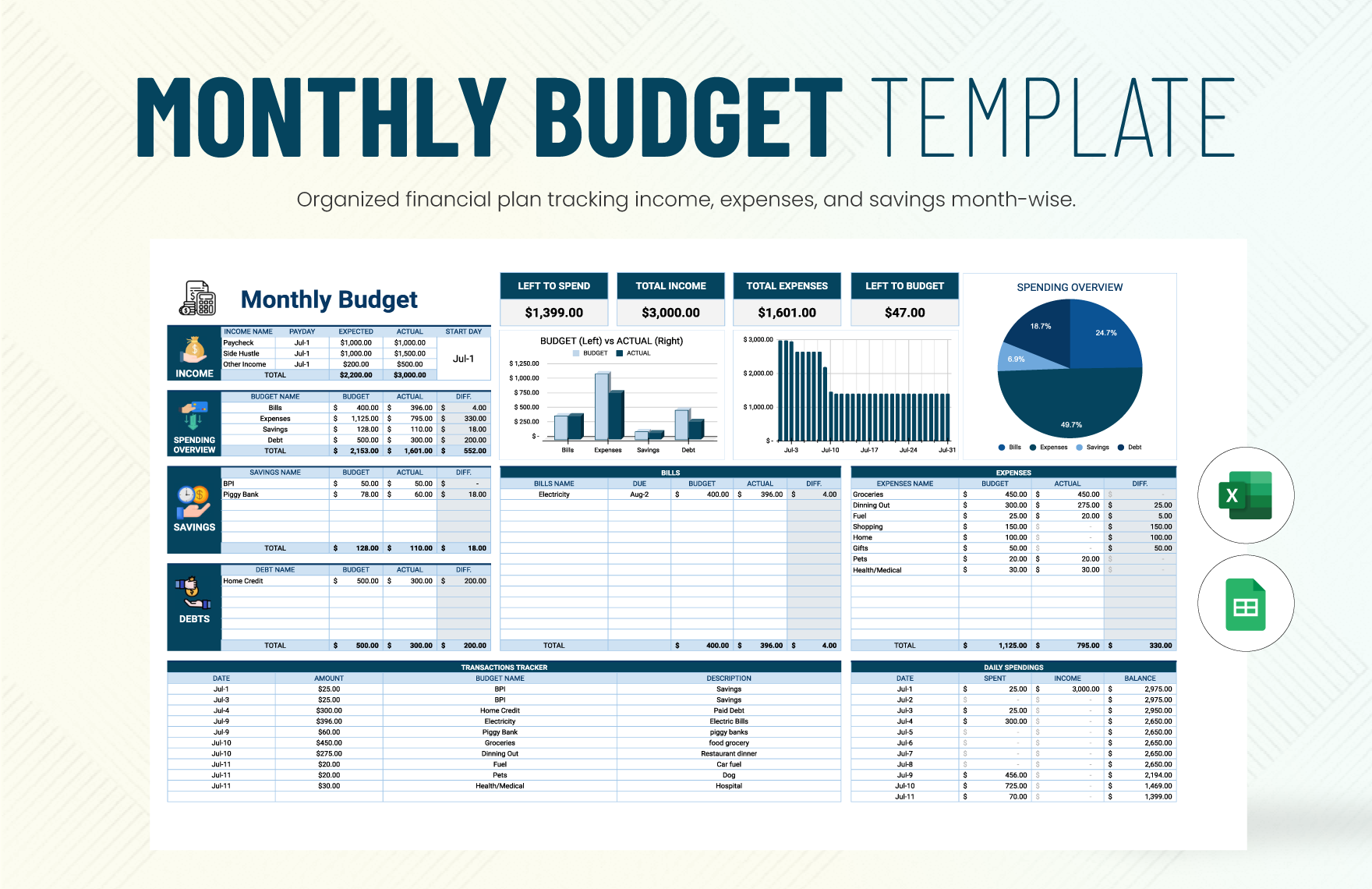

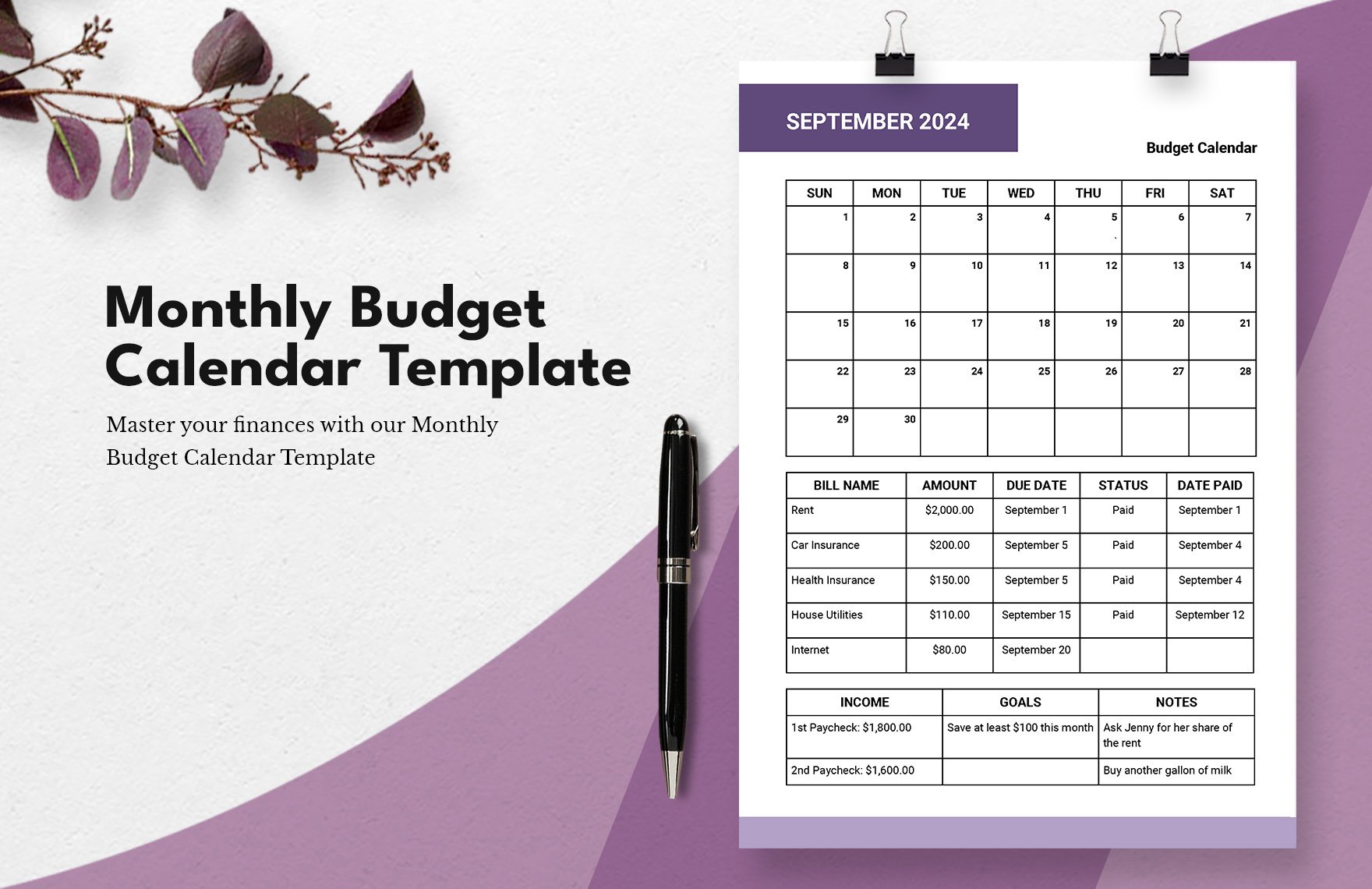

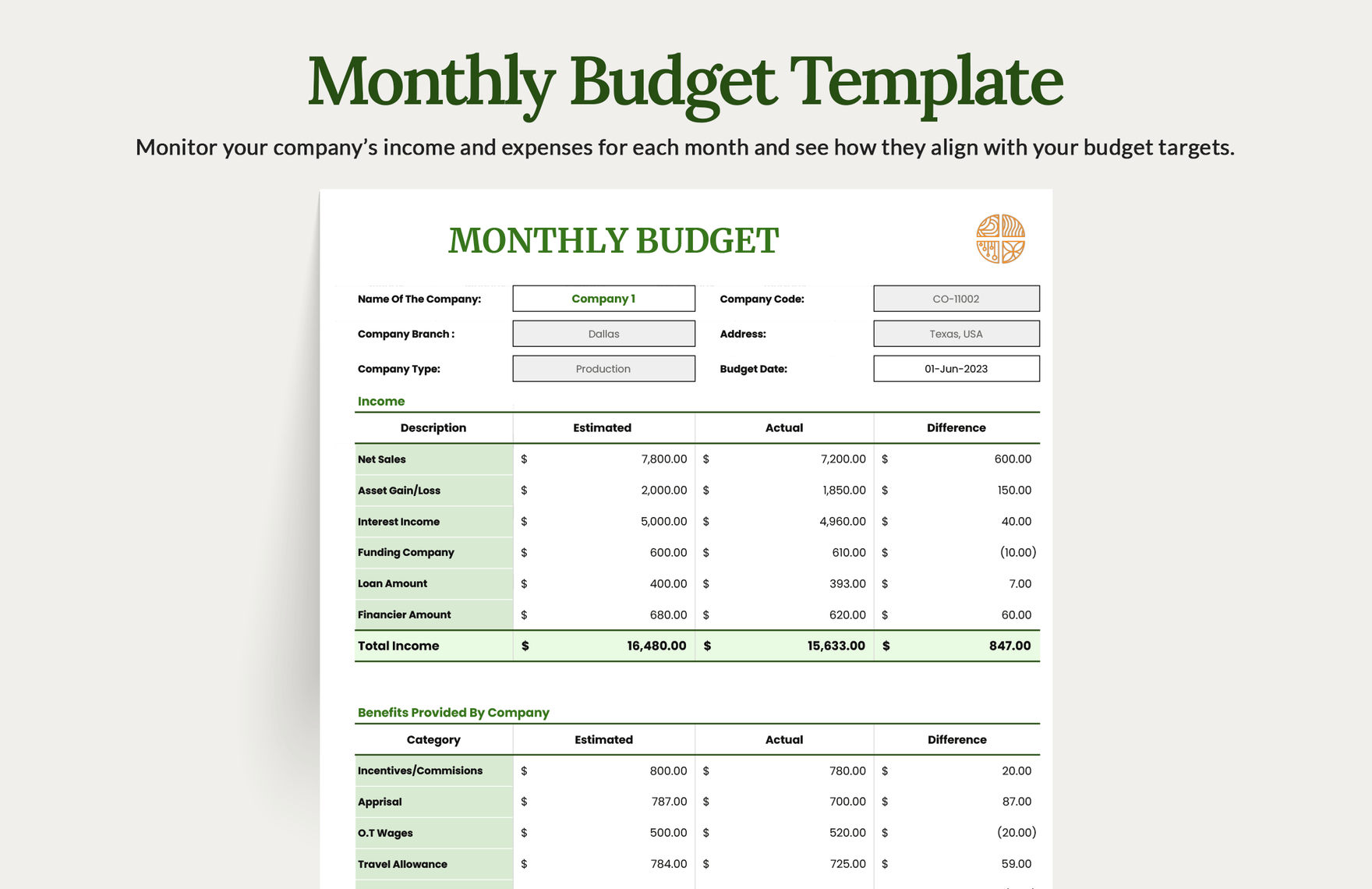

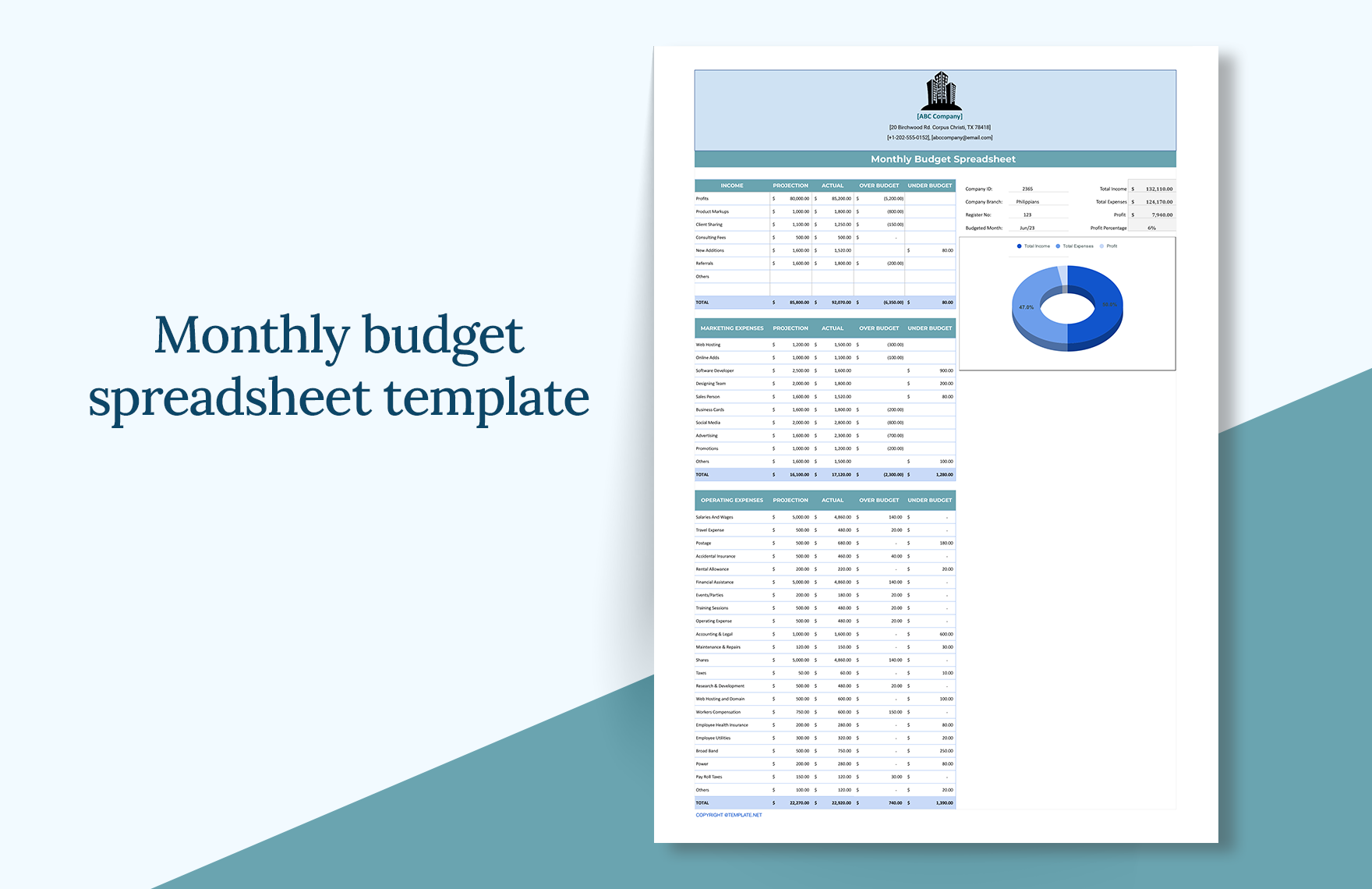

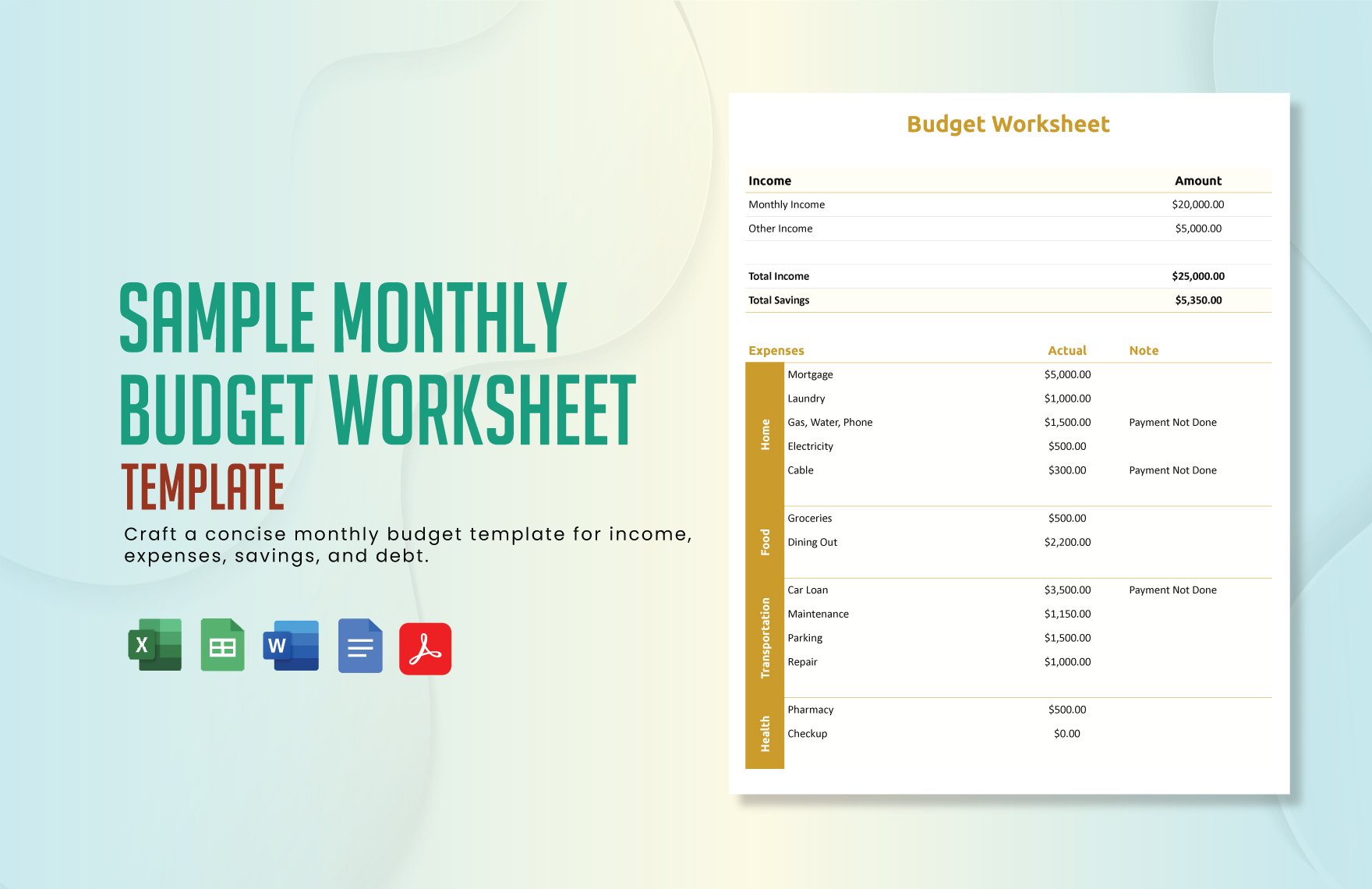

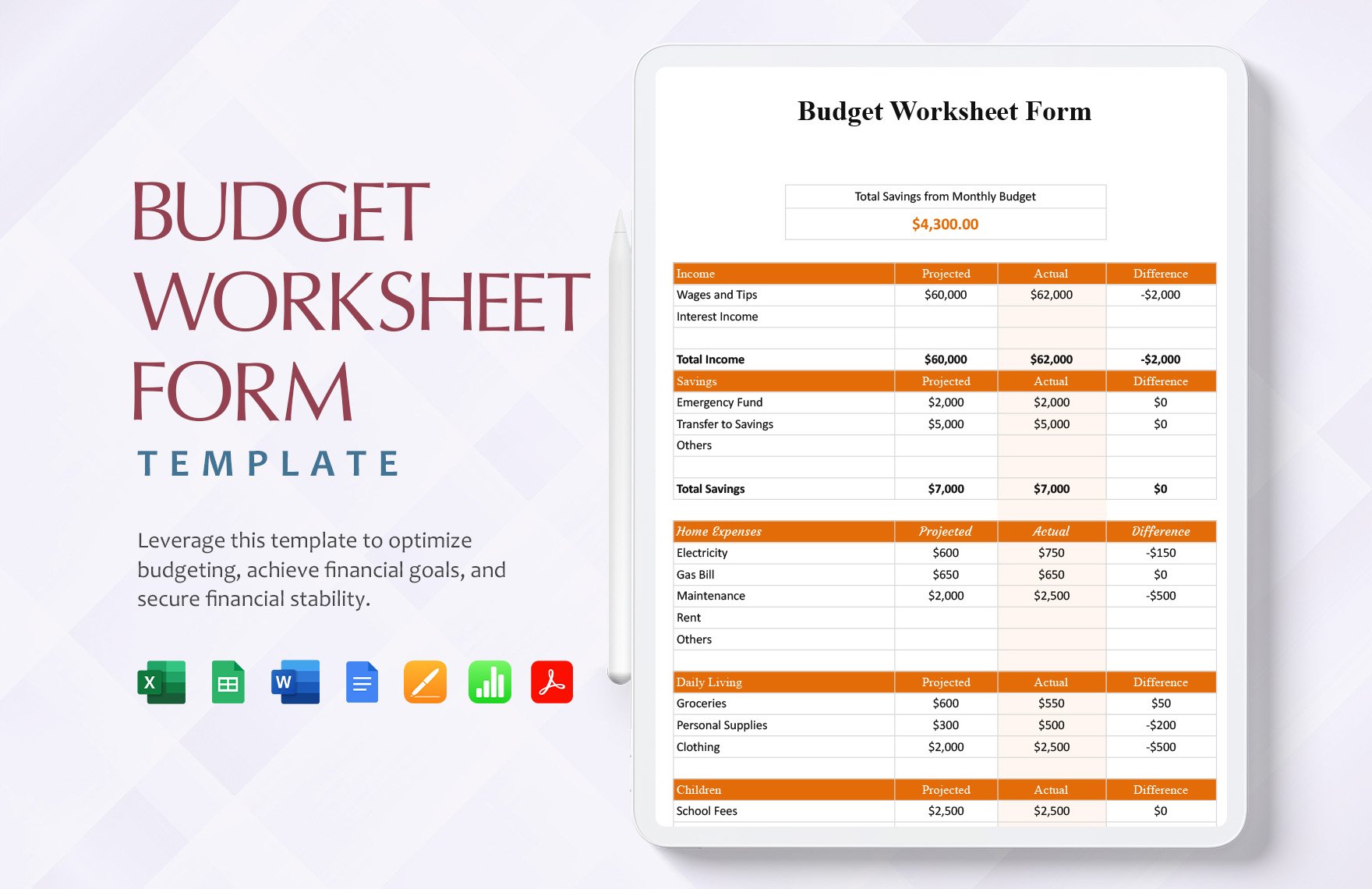

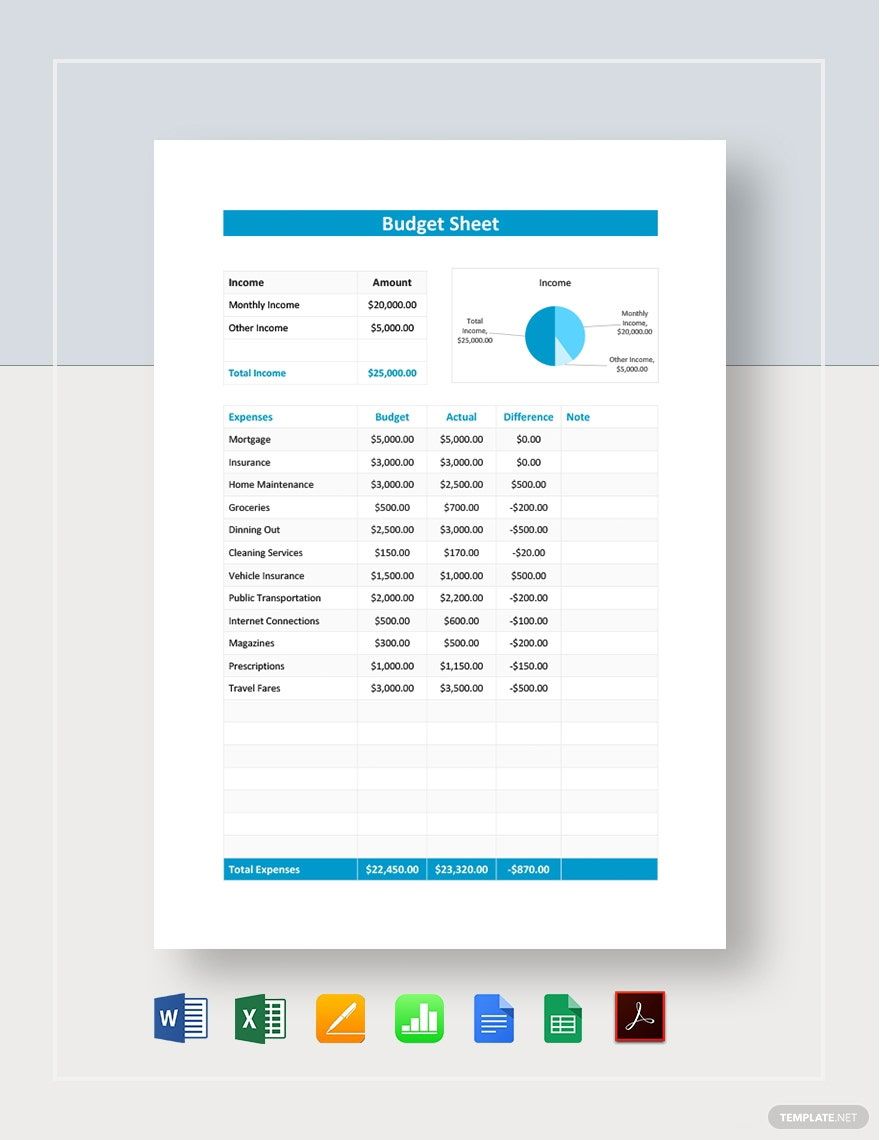

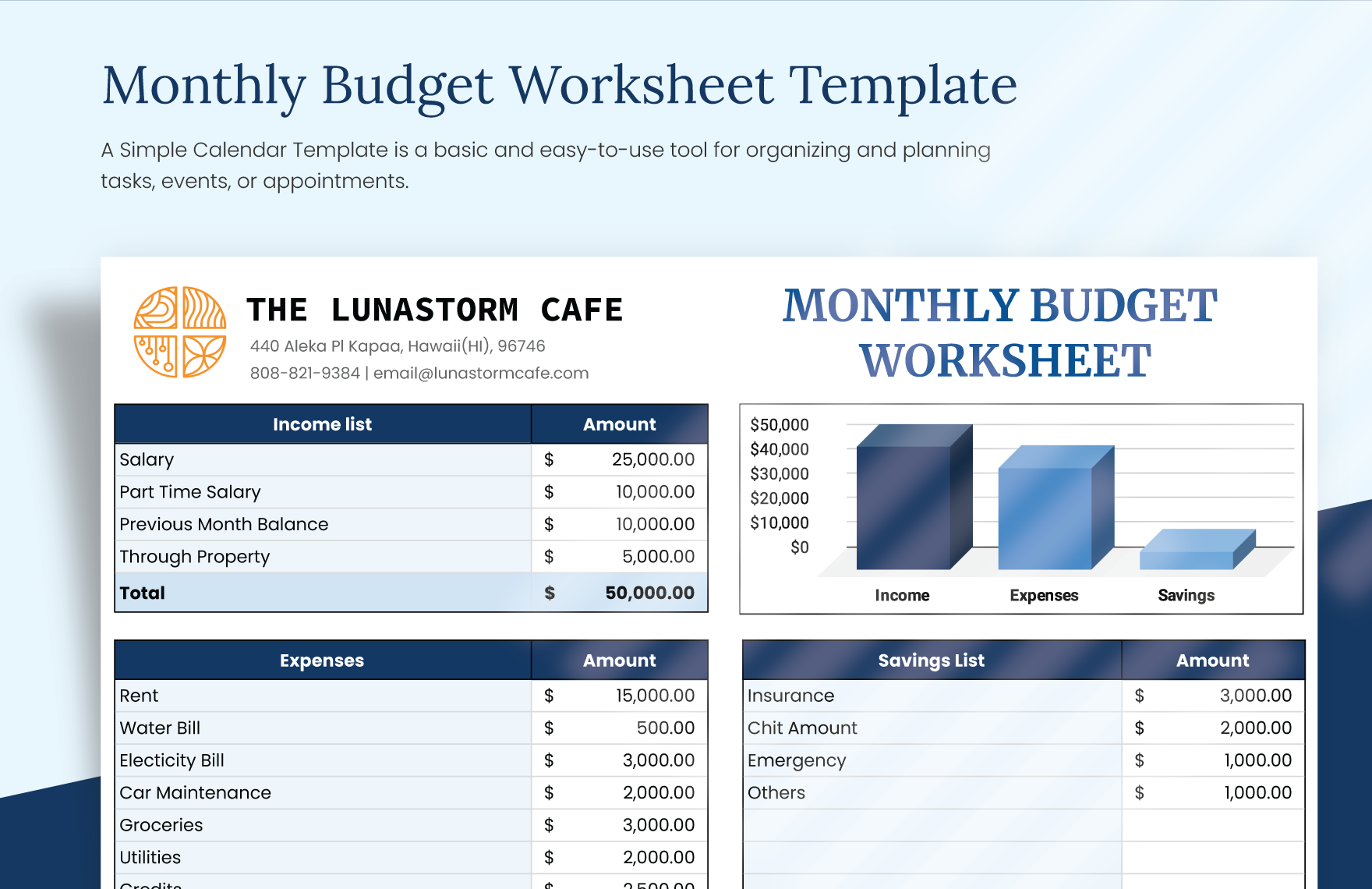

A monthly budget worksheet is a detailed document that lists all expected incomes and expenses within a month. The purpose of this budget template is to predict whether you have gained a profit or not; it is also used for monitoring the performance of the business, and it is also used as a tool for decision-making.

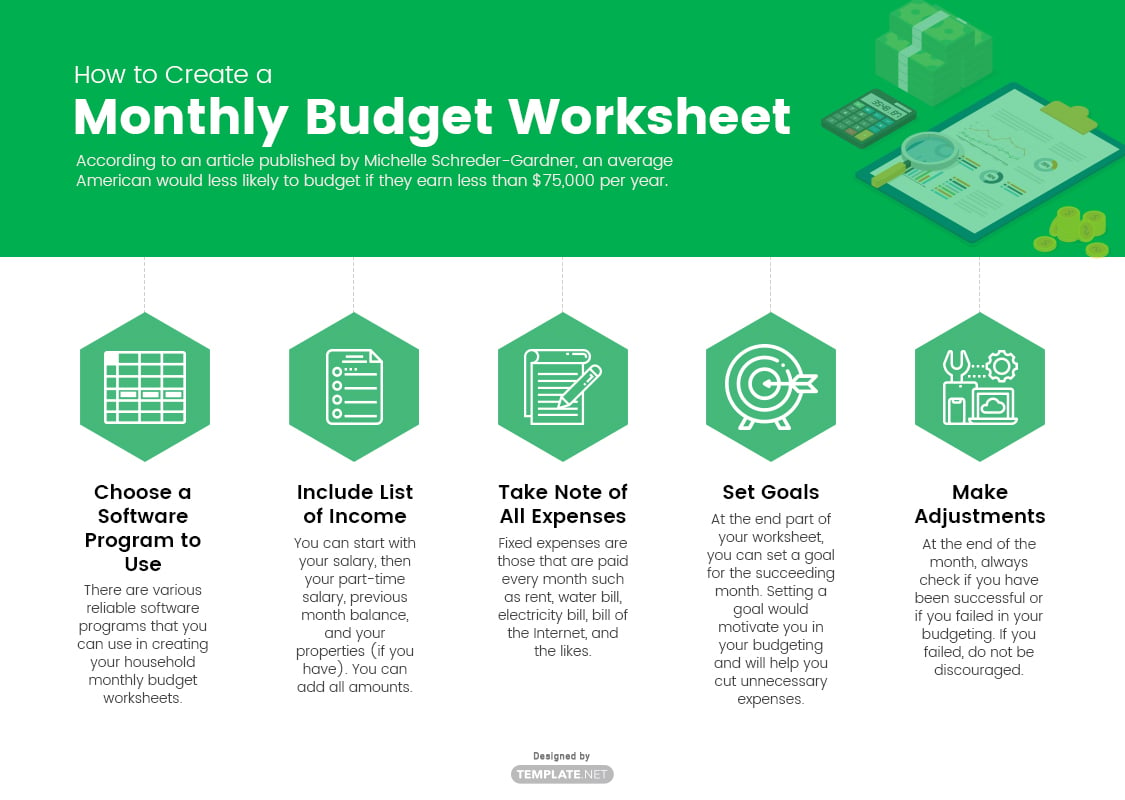

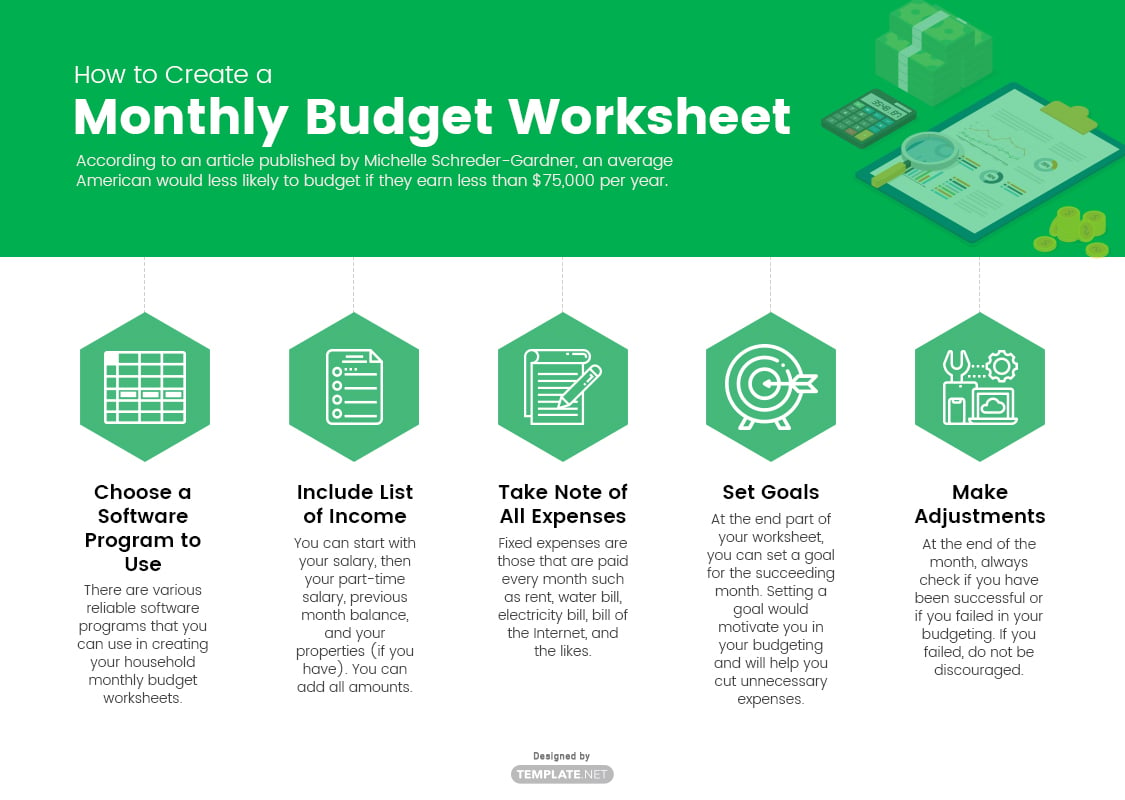

How to Create a Monthly Budget Worksheet?

According to an article published by Michelle Schreder-Gardner, an average American would less likely to budget if they earn less than $75,000 per year. Budgeting is extremely important no matter where you are financially or where you belong in society—rich, middle class, or poor. Having a personal monthly budget worksheet would reduce the chances of debt and will increase your savings. Here are some guidelines that can help you in creating your own monthly budget planner worksheet.

1. Choose a Software Program to Use

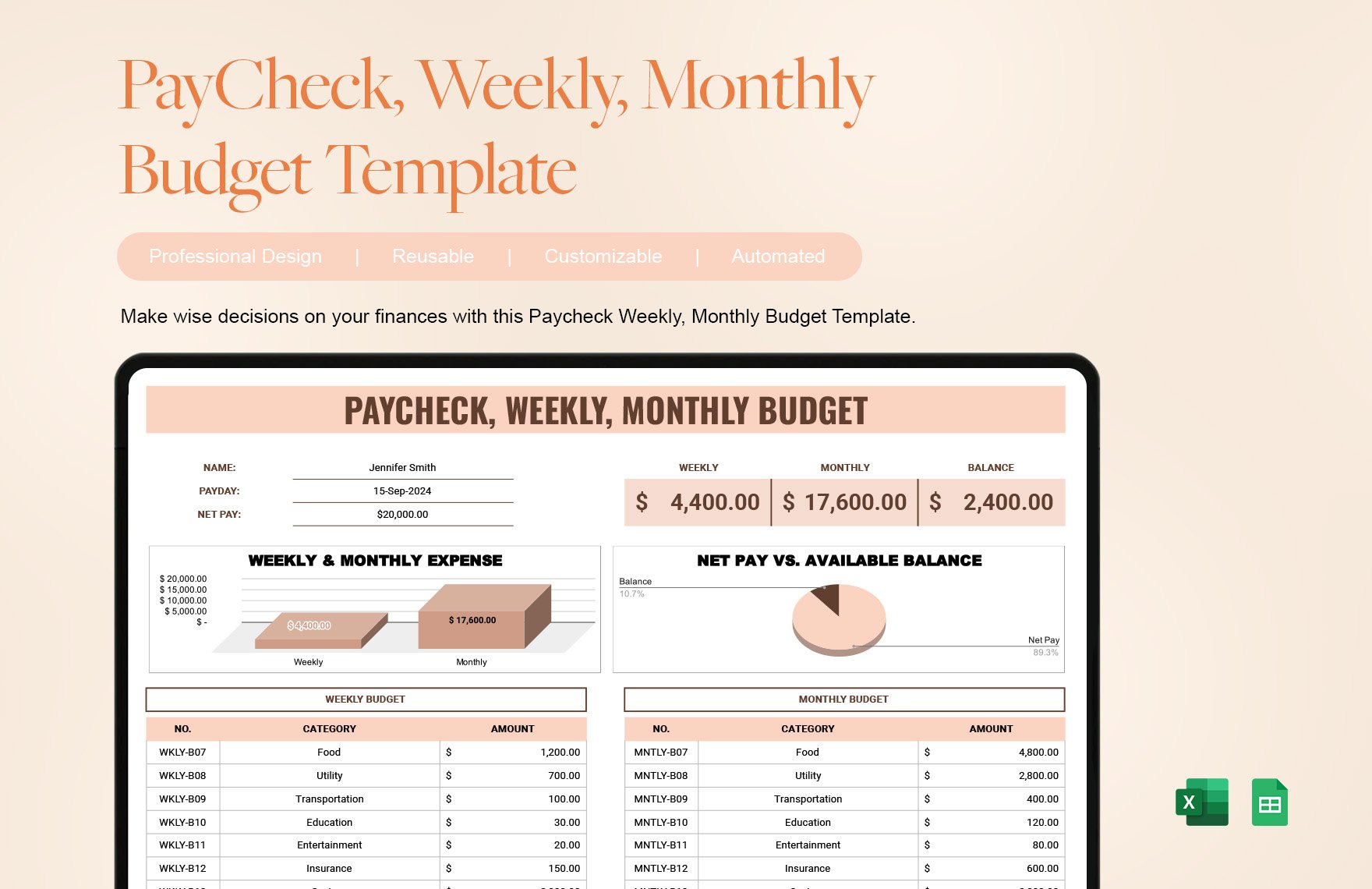

There are various reliable software programs that you can use in creating your household monthly budget worksheets such as Google Docs, Google Sheets, MS Word, MS Excel, and Apple Numbers. However, if you don't want to encounter problems in making your worksheet, then you better choose the program that you are already familiar with. Right after you have chosen a program, you have to decide on the format. You can start your budget worksheet with specifying the month, the starting balance, extra spending, and expense.

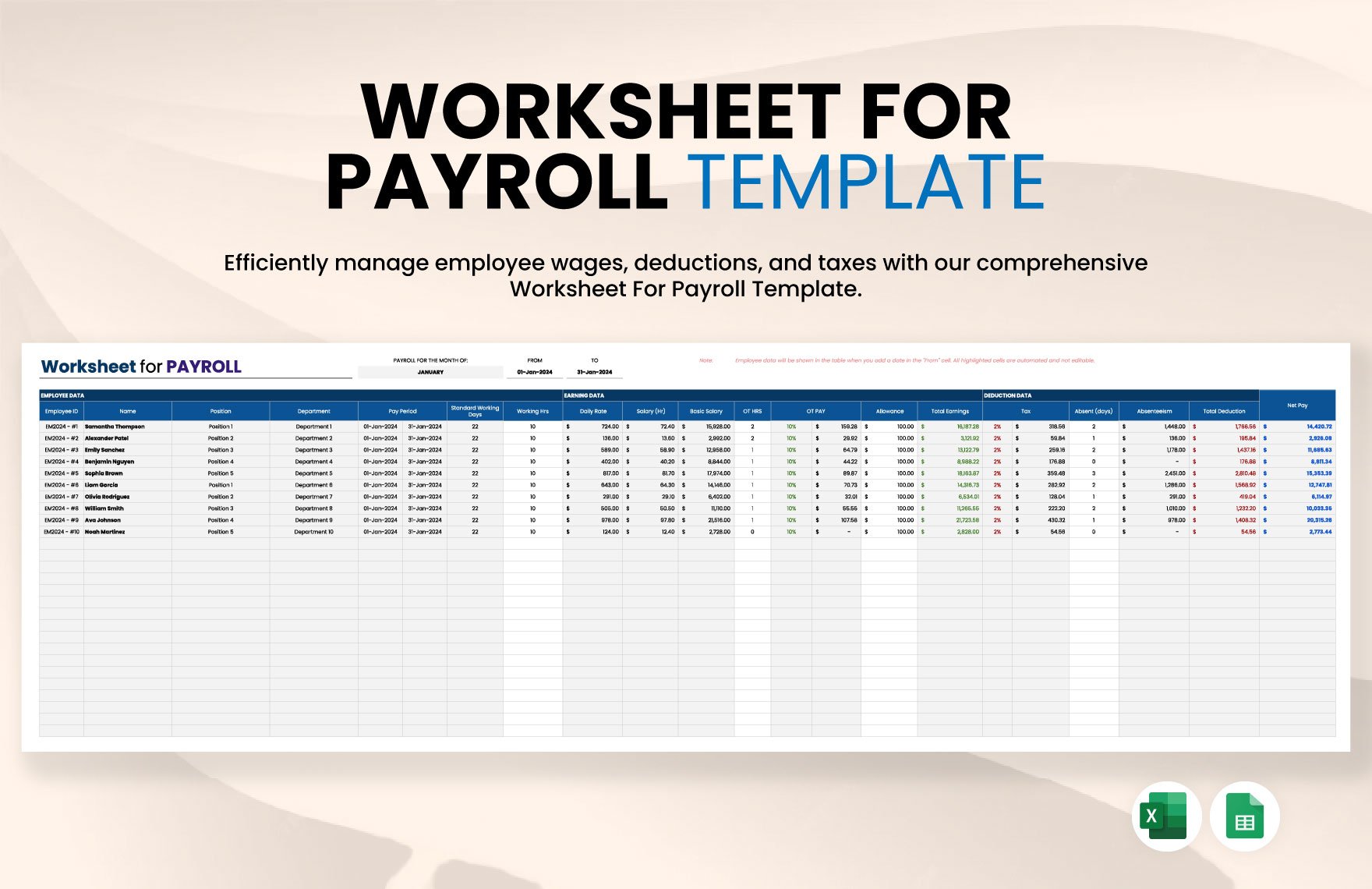

2. Include List of Income

Include all income and its sources so you can track all the money that you accumulated within the month. You can start with your salary, then your part-time salary, previous month balance, and your properties (if you have). You can add all amounts of the aforementioned sources, then you'll have your total net income for the month.

3. Take Note of All Expenses

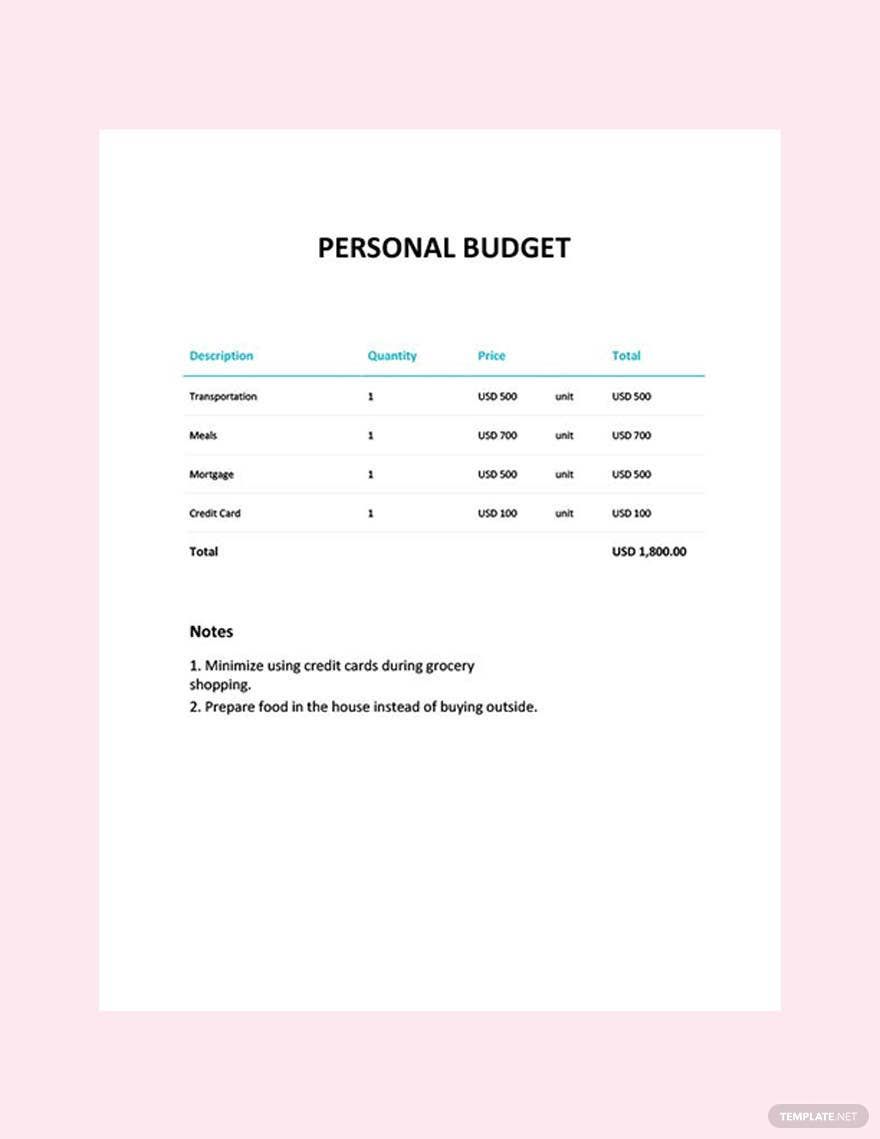

If you want to be successful in your monthly budget, then you must list all the expenses that you have, fixed or variable. Fixed expenses are those that are paid every month such as rent, water bill, electricity bill, bill of the Internet, and the likes. On the other hand, variable expenses are those that can be changed from month to month such as groceries, utilities, and children's fees.

4. Set Goals

At the end part of your worksheet, you can set a goal for the succeeding month. Setting a goal would motivate you in your budgeting and will help you cut unnecessary expenses. Think of what you want to achieve and clearly list it all, either long-term or short-term. Do not be discouraged if you will not achieve it directly; success is always counted sweetest when you have worked hard for it.

5. Make Adjustments

At the end of the month, always check if you have been successful or if you failed in your budgeting. If you failed, do not be discouraged. Use your failure to motivate you. Check which part you failed and try to think of a solution. If you overspent, then you might as well make an adjustment to your habits in your next monthly family budget sheet. It's always hard during the first few months of budgeting, but eventually, you can master it someday.