Bring your Financial Planning to Life with Monthly Budget Templates from Template.net

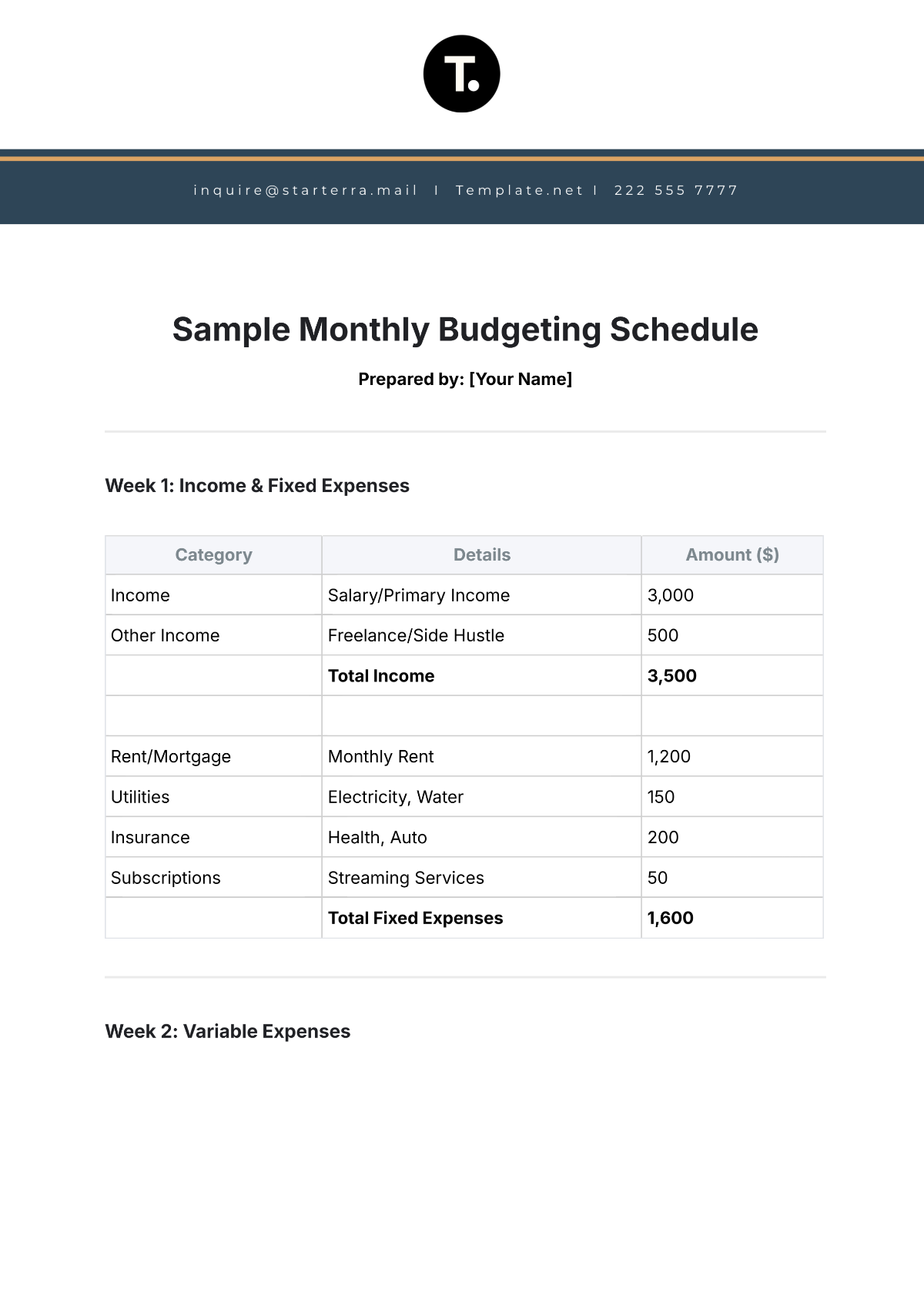

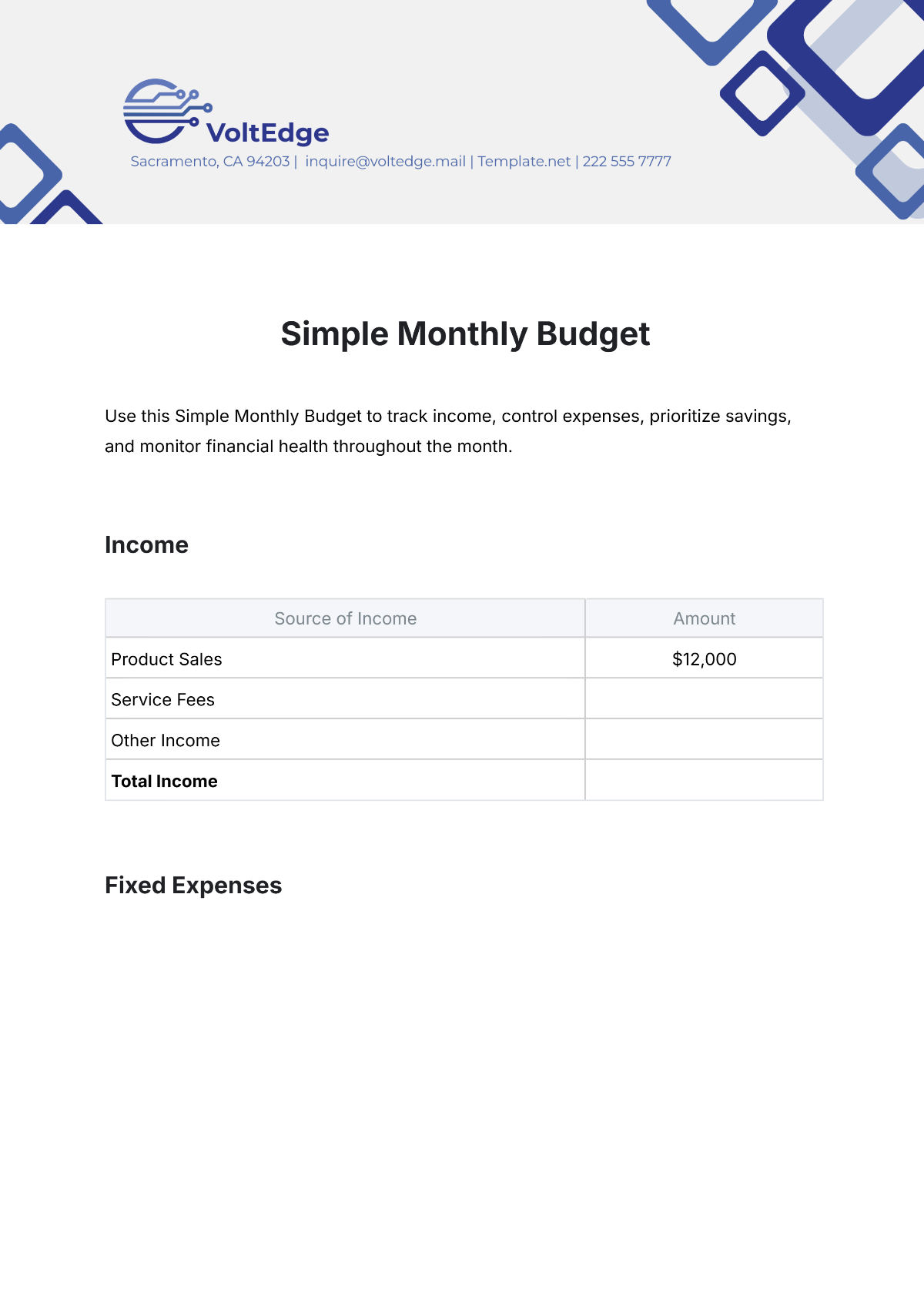

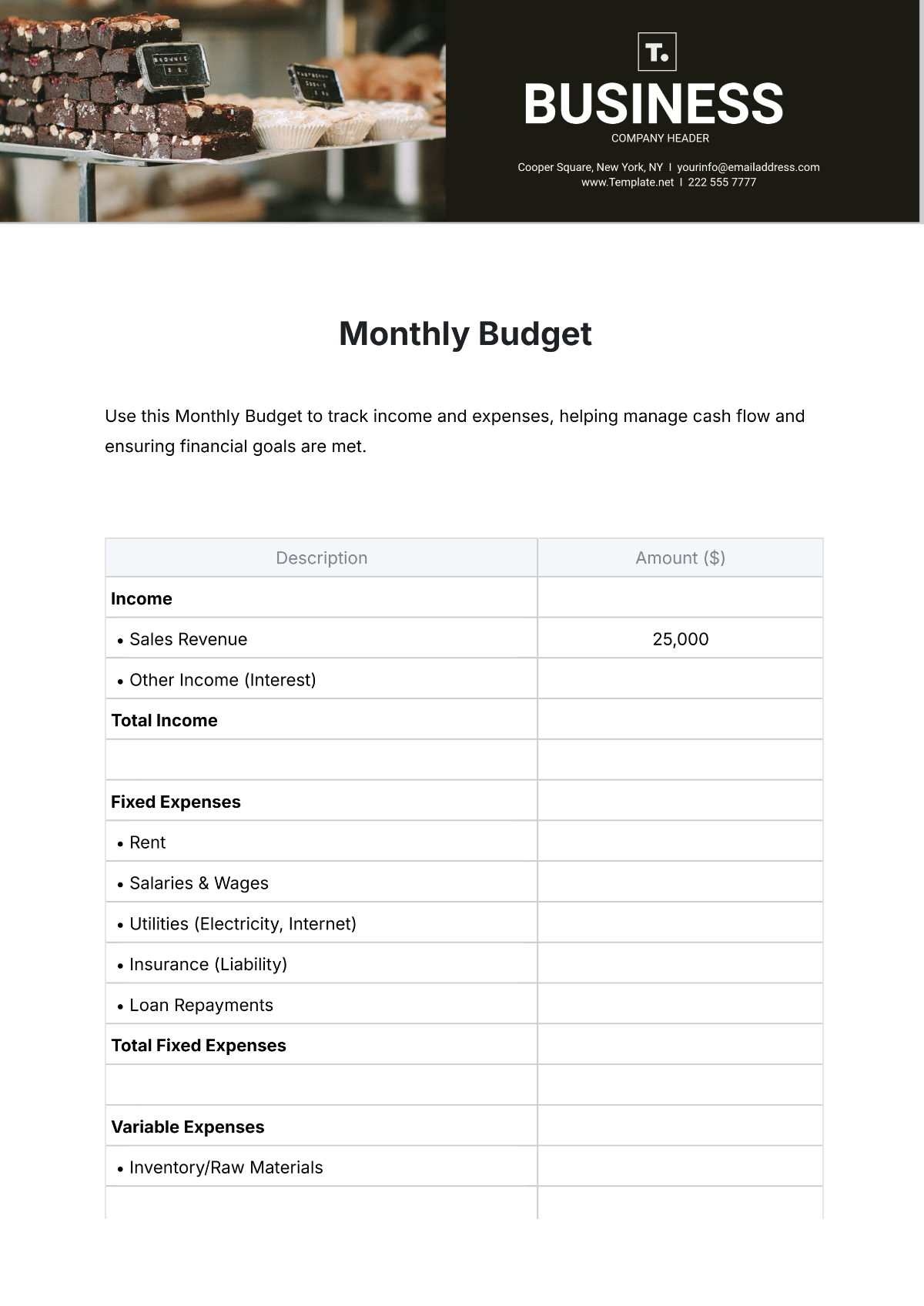

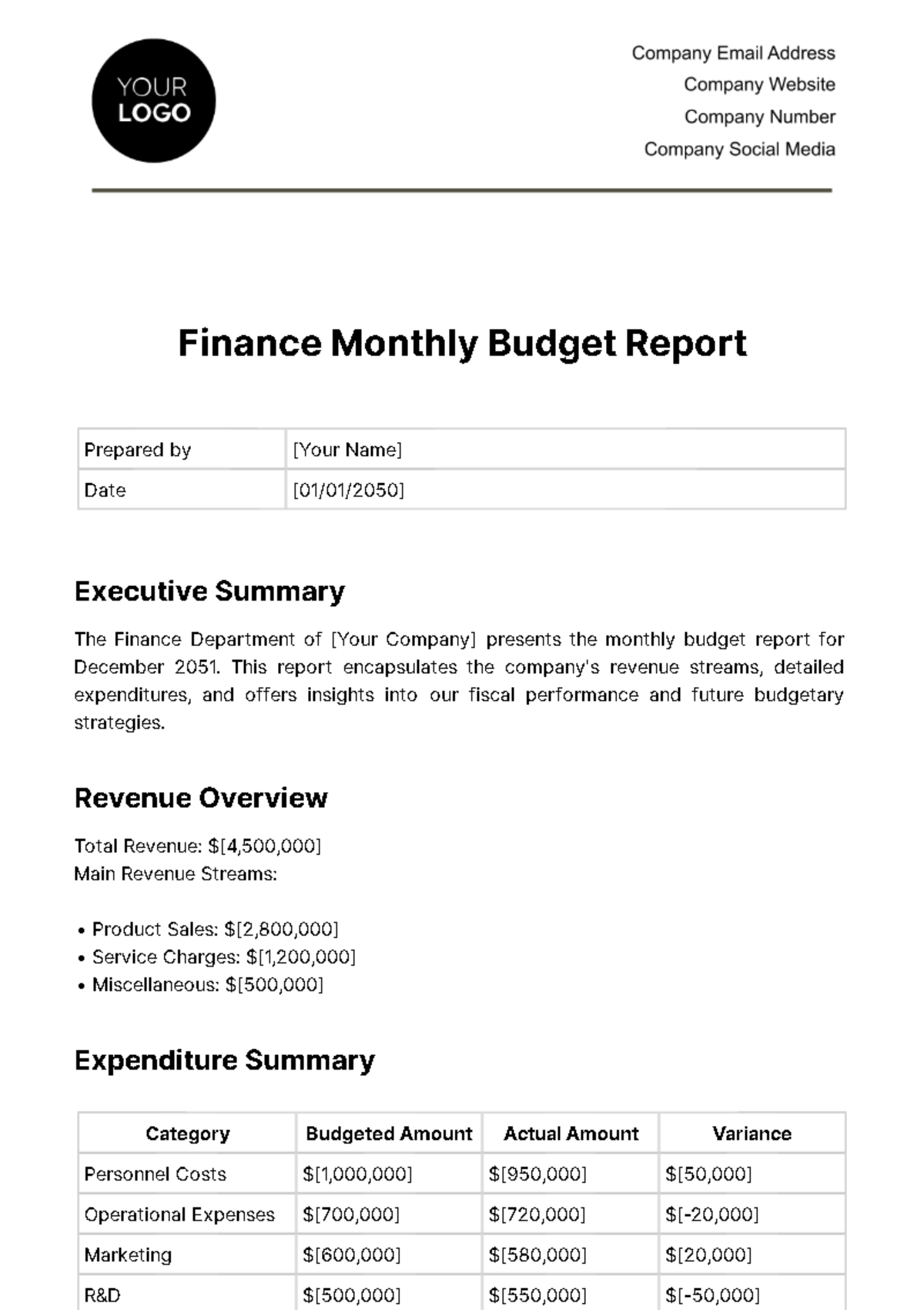

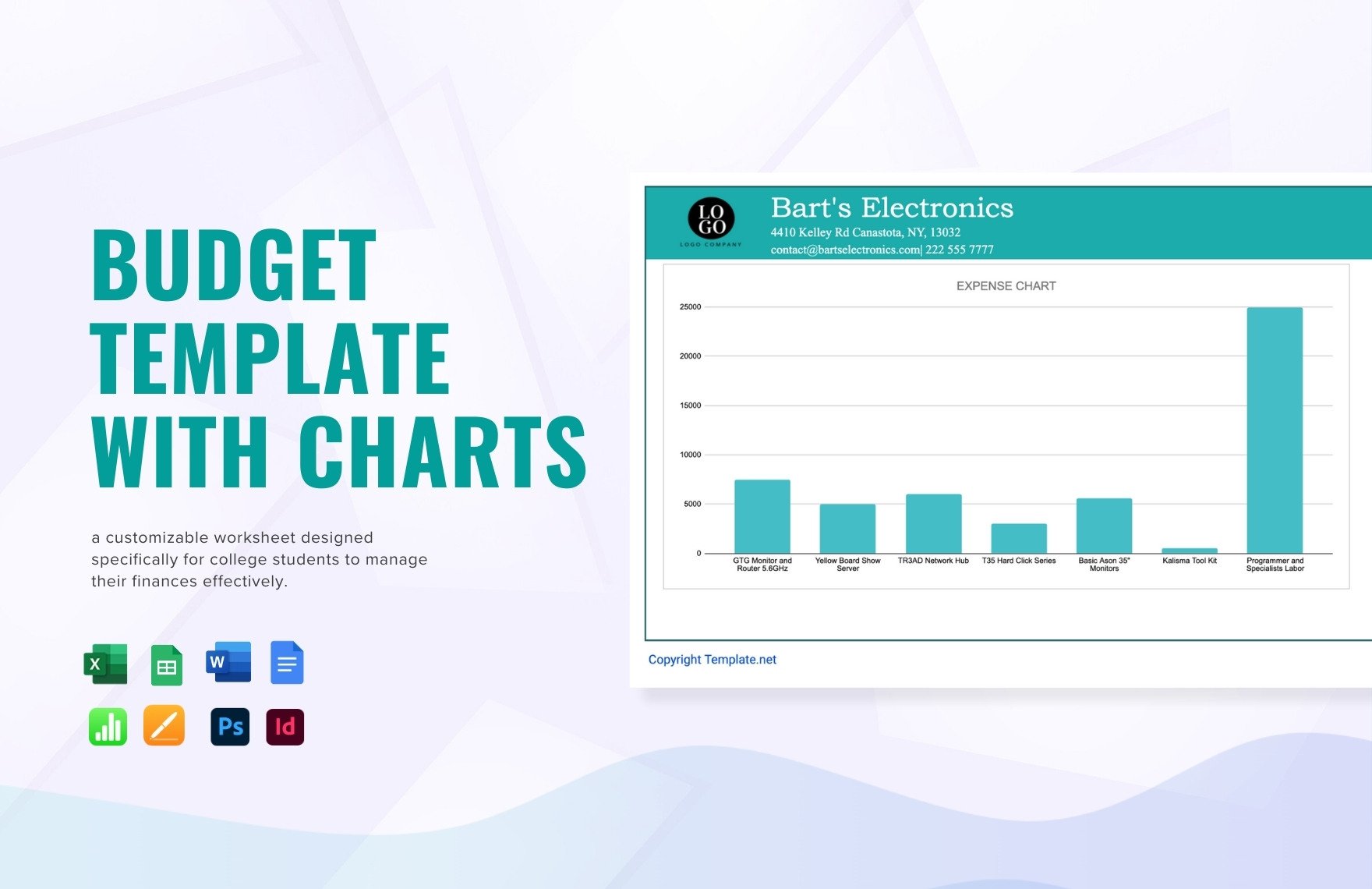

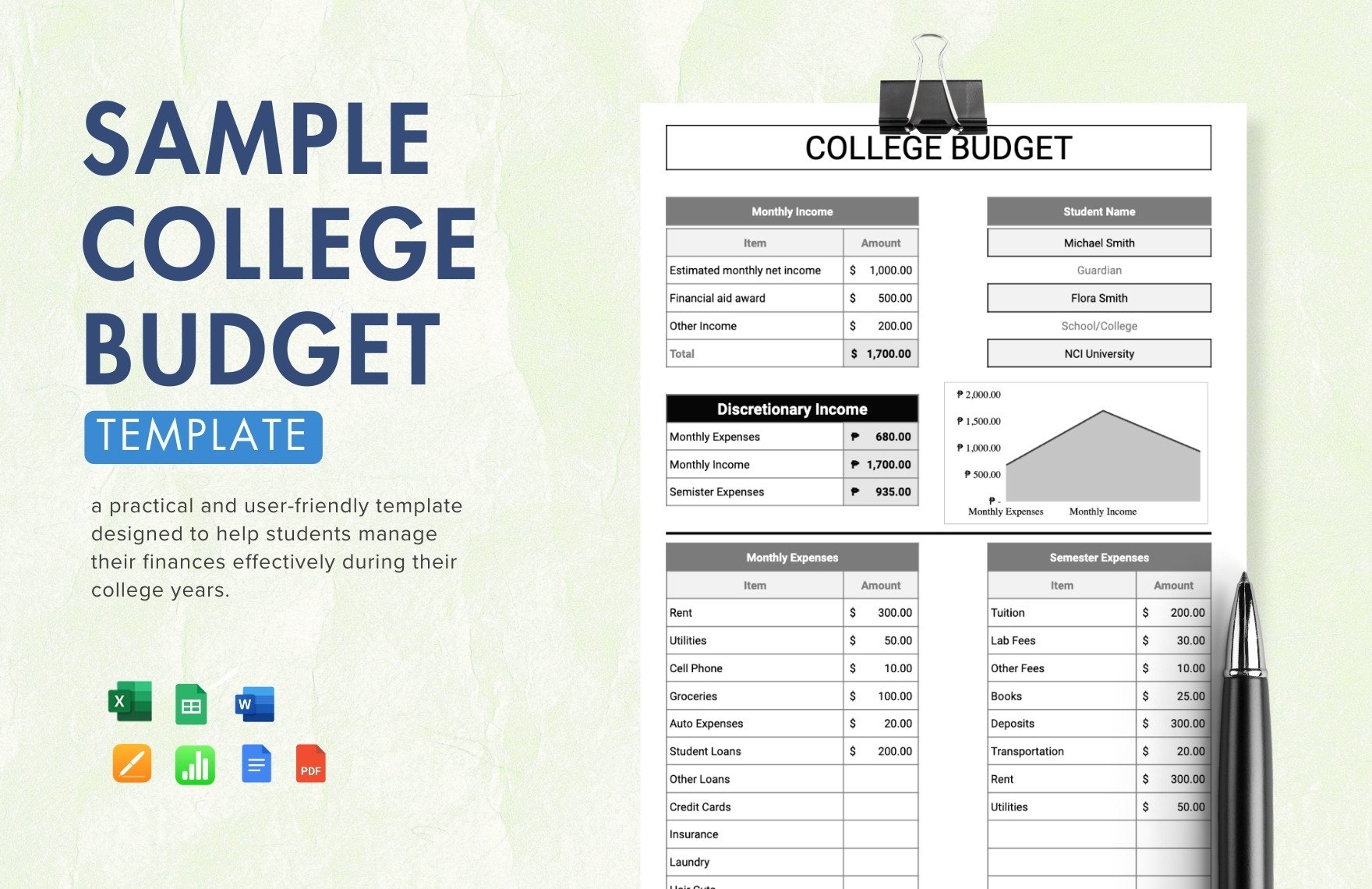

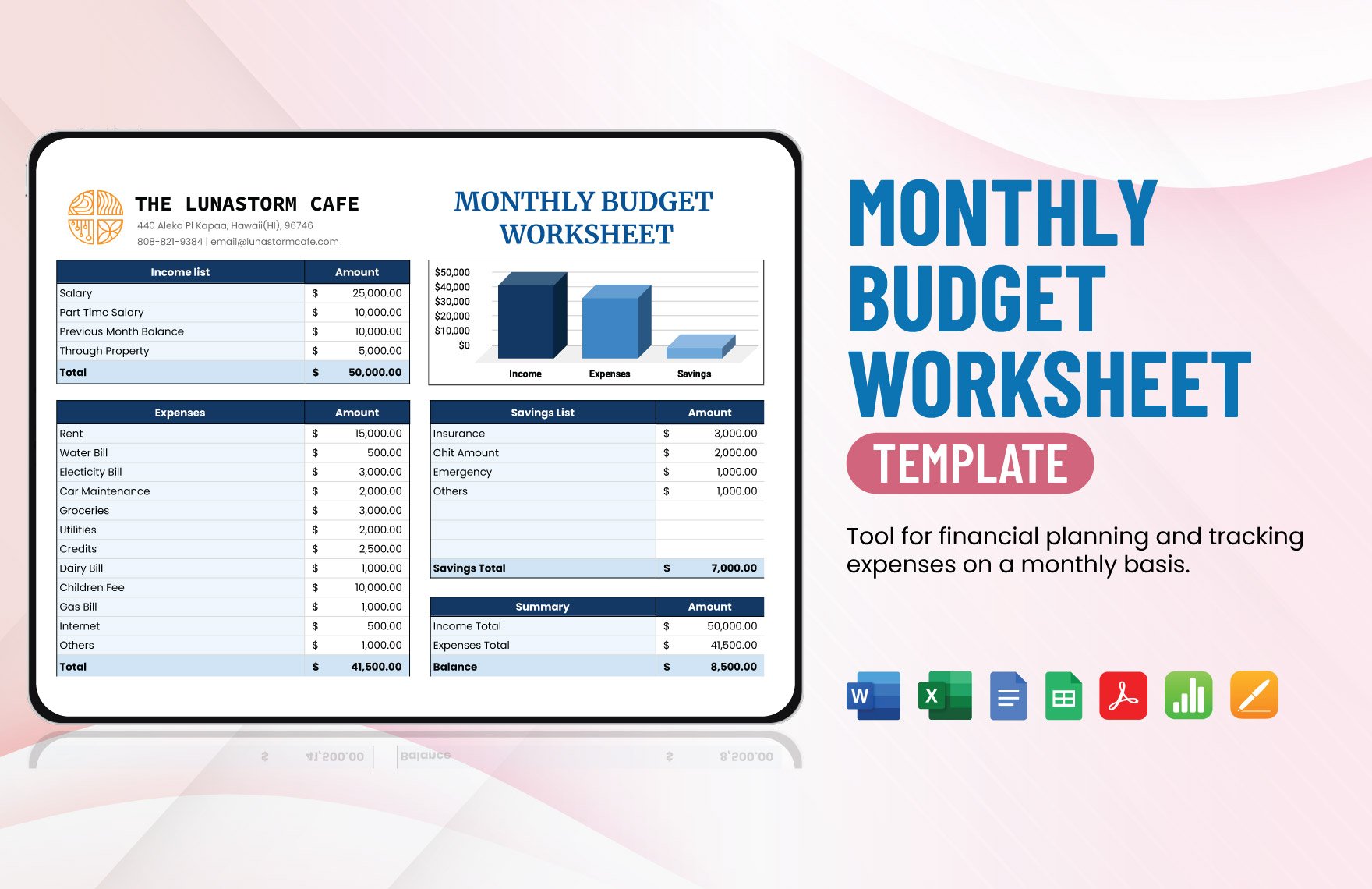

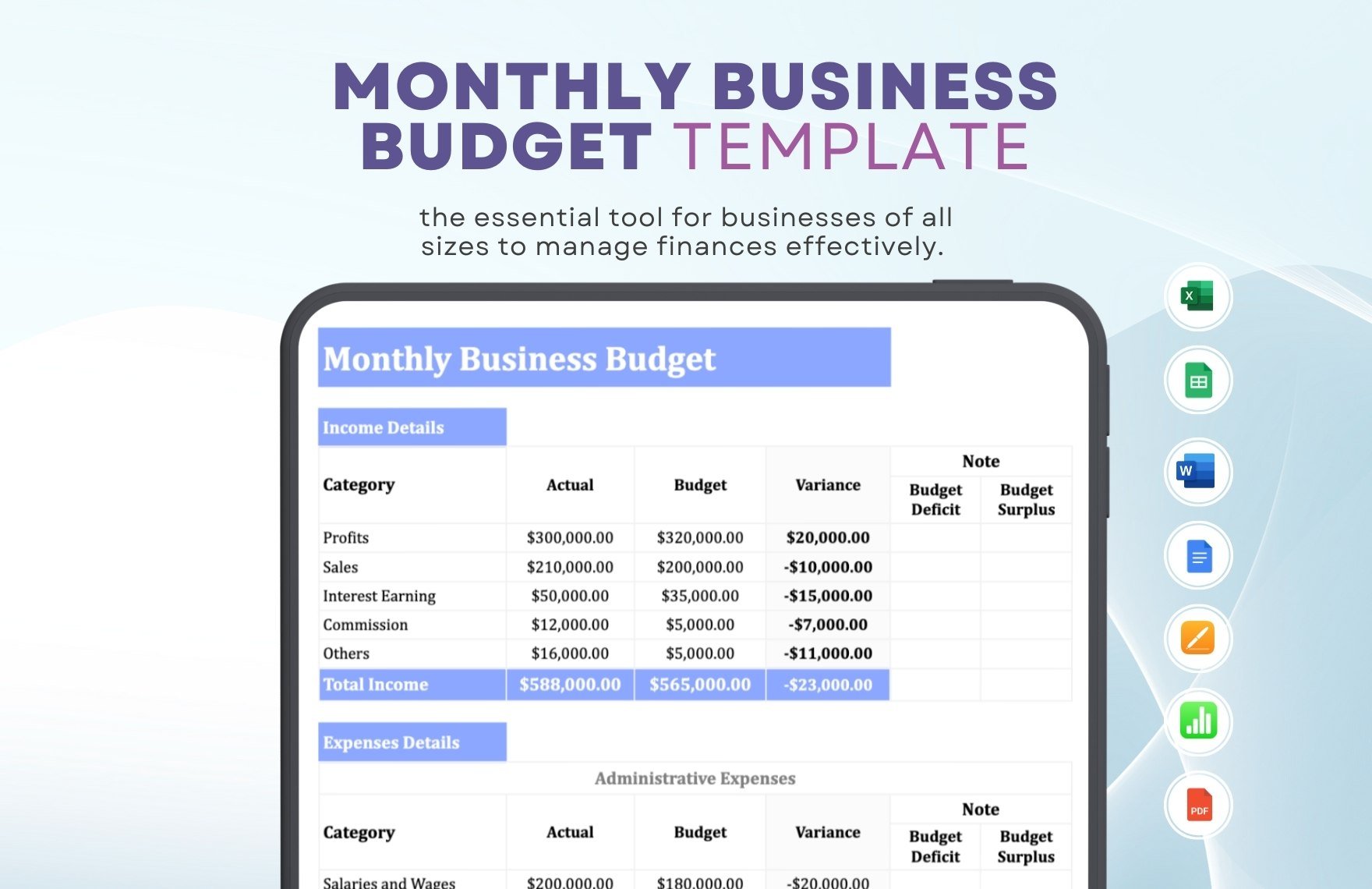

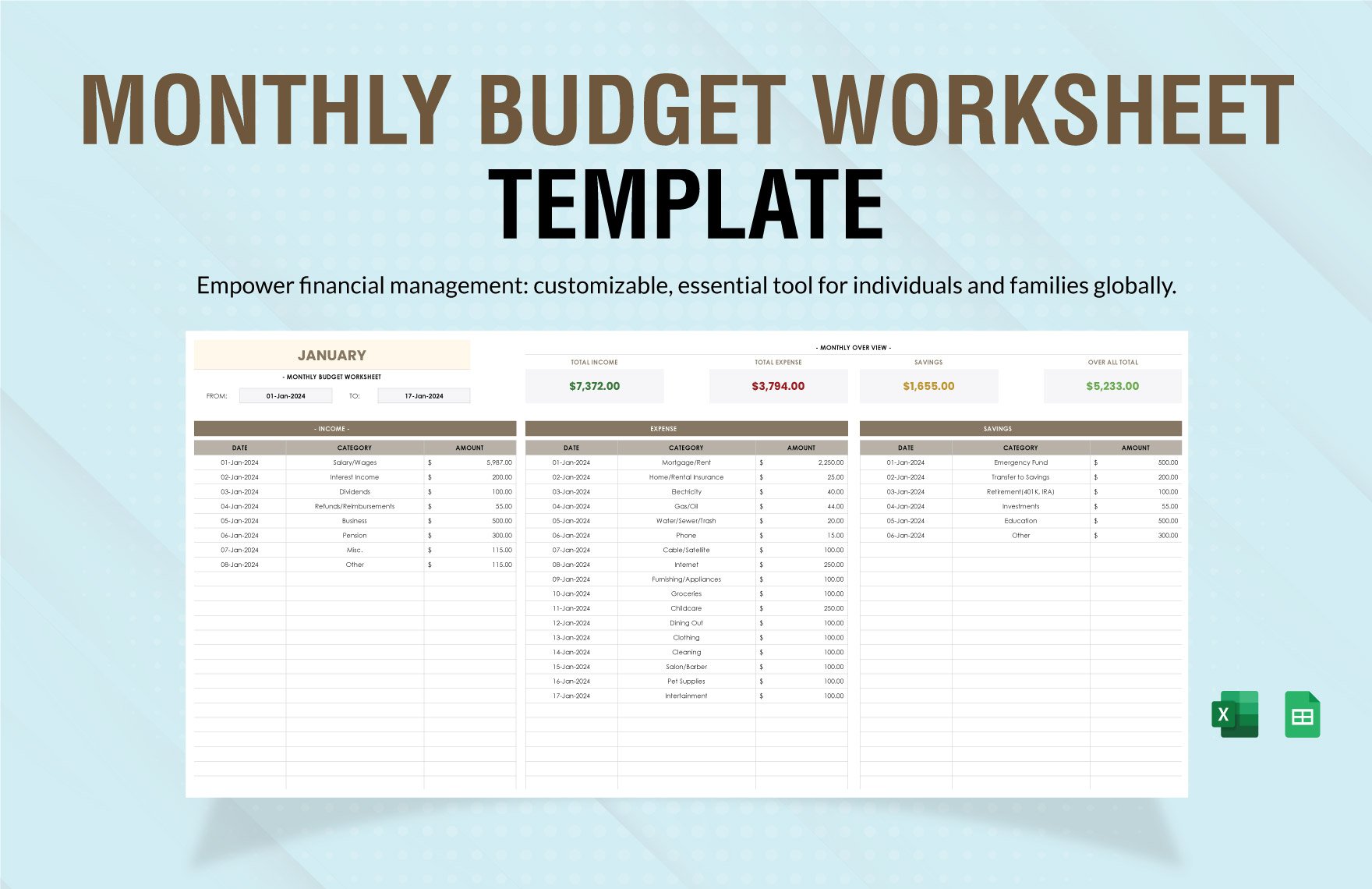

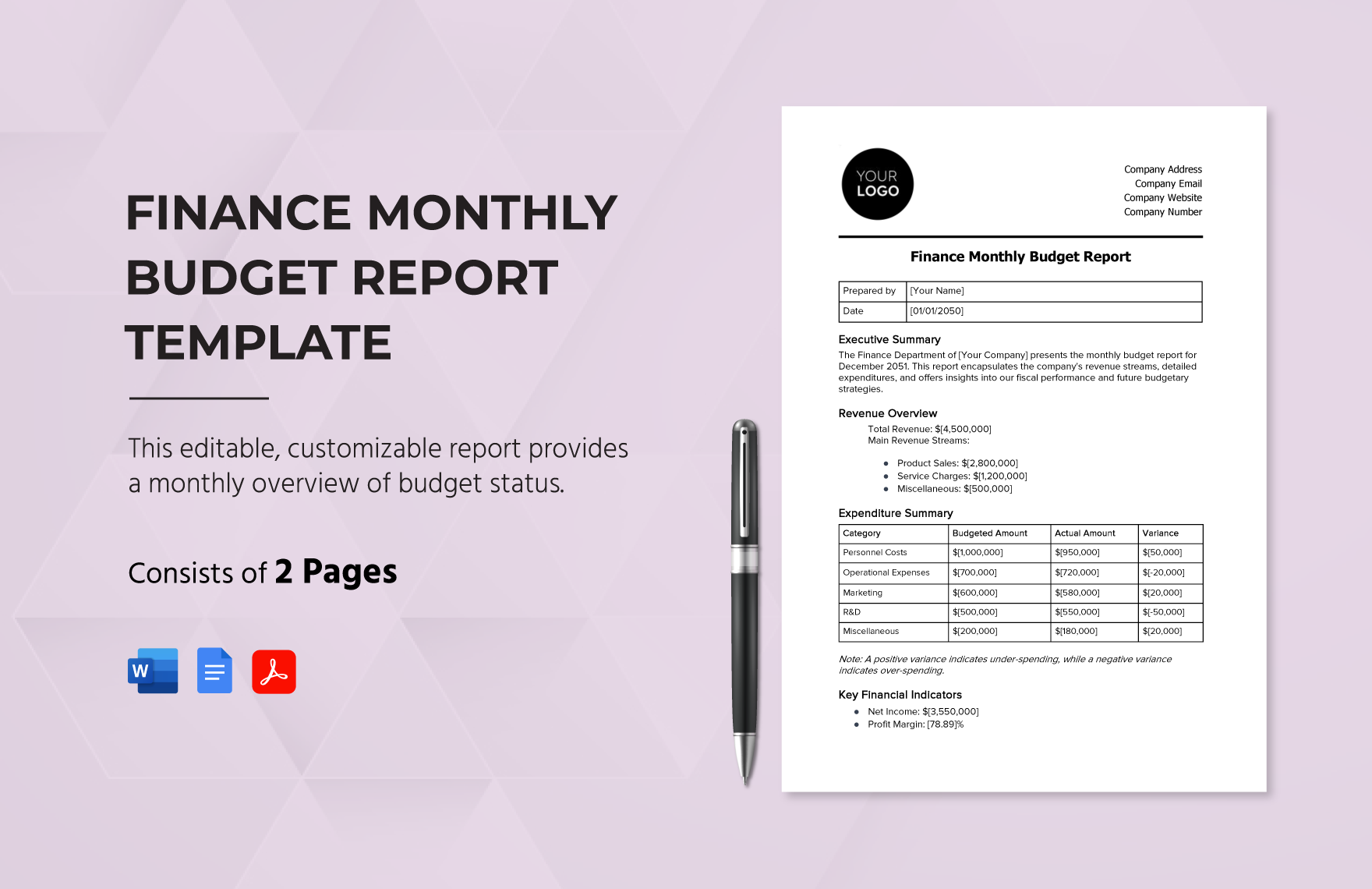

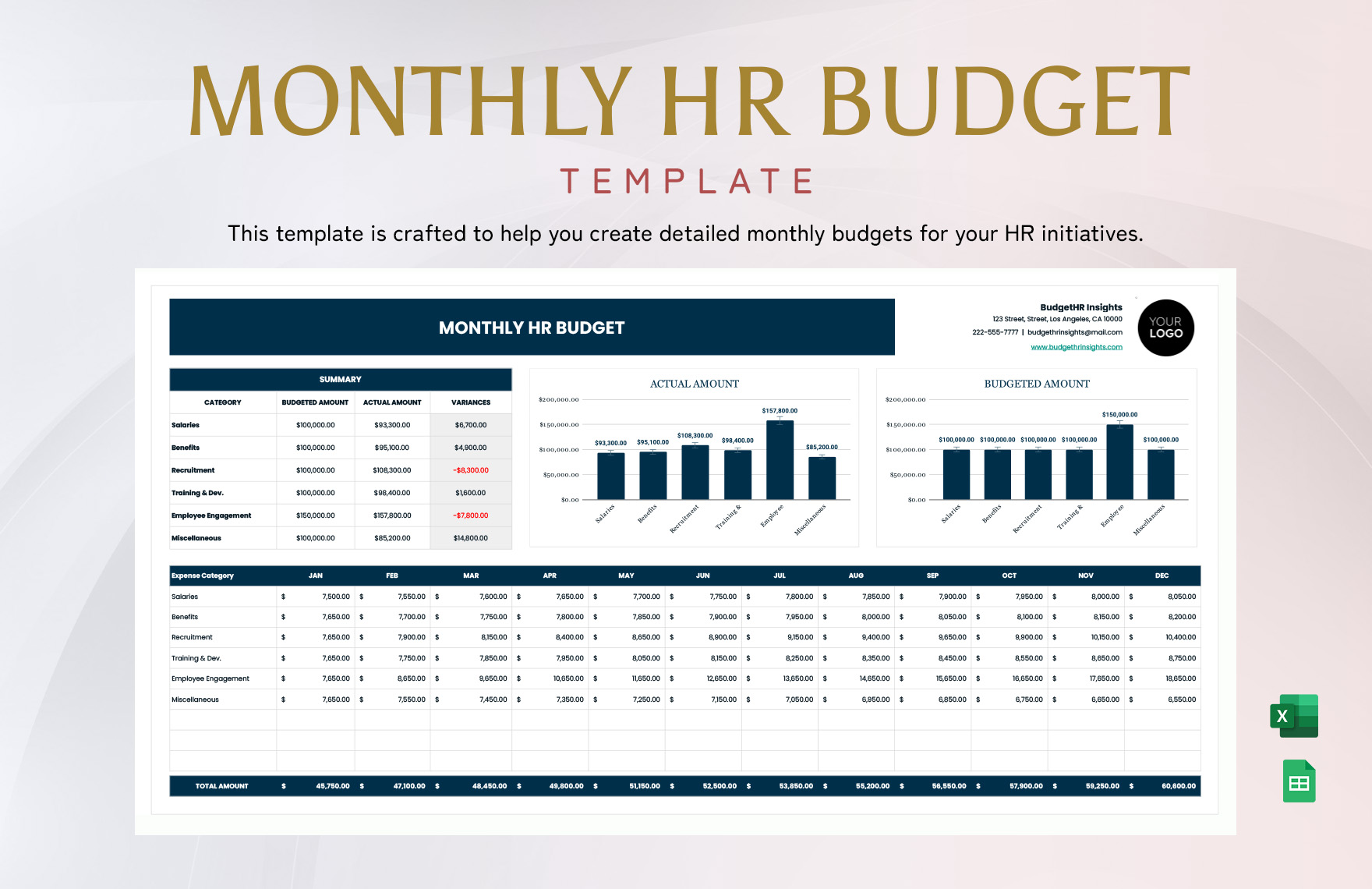

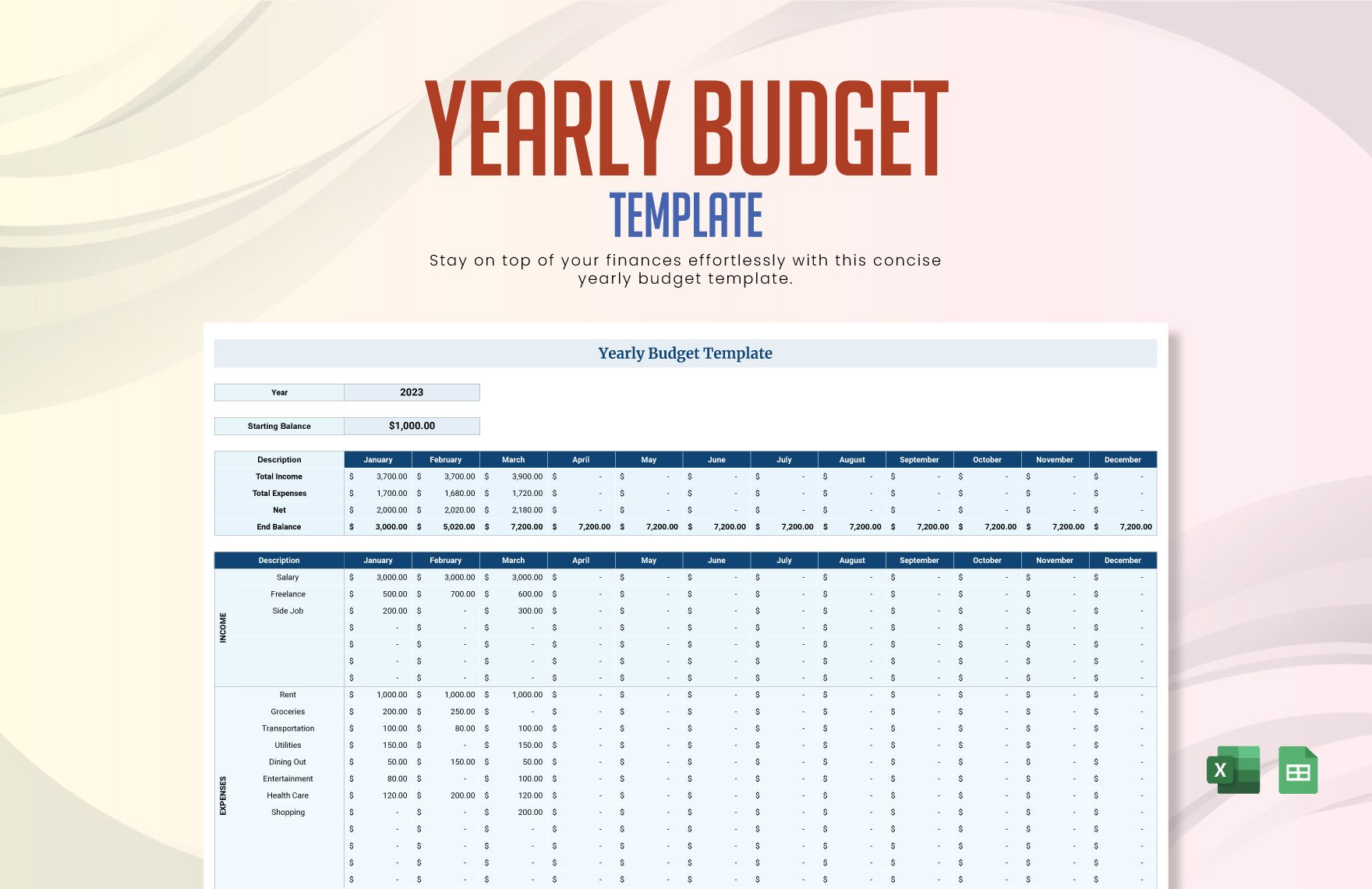

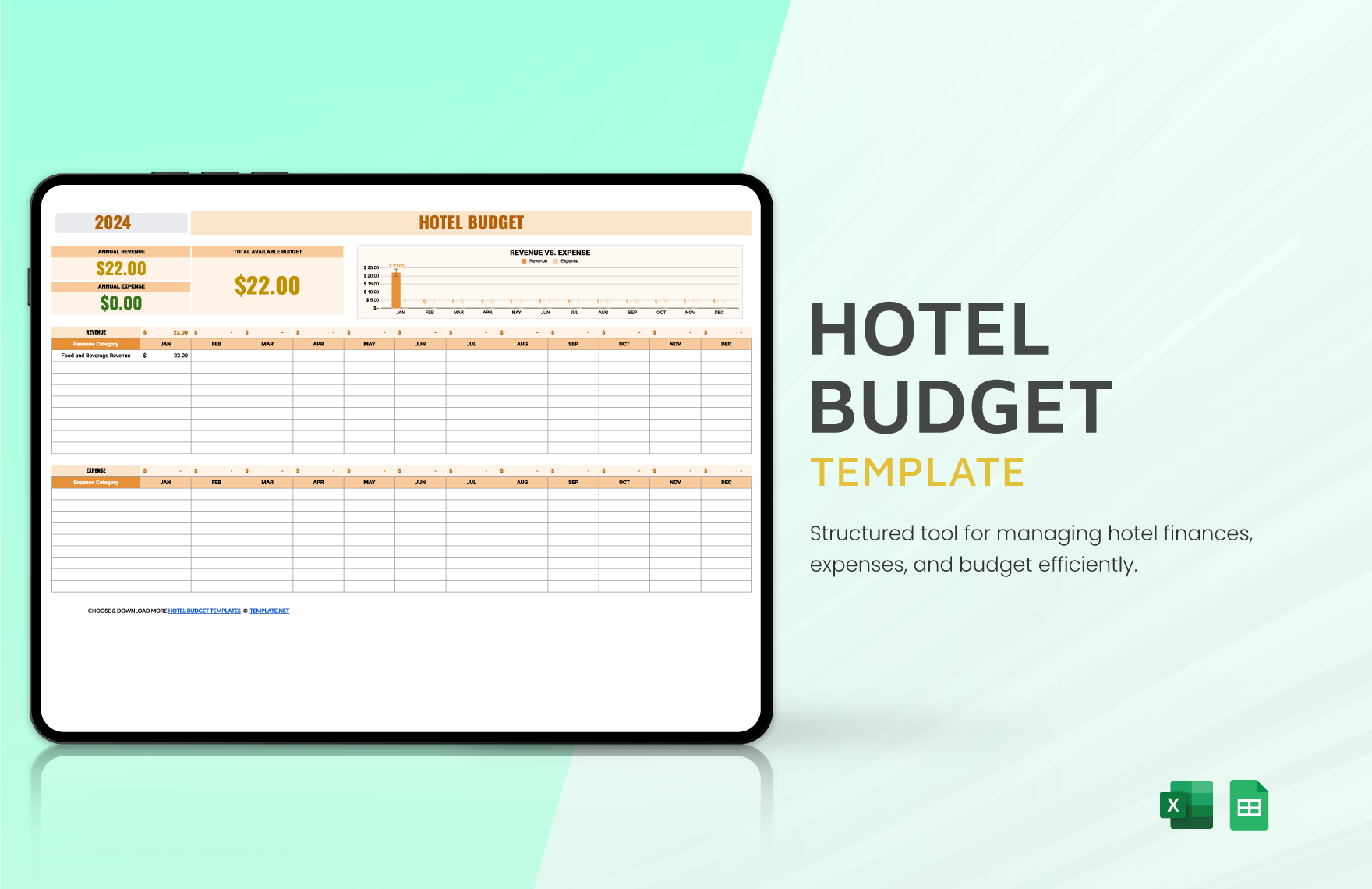

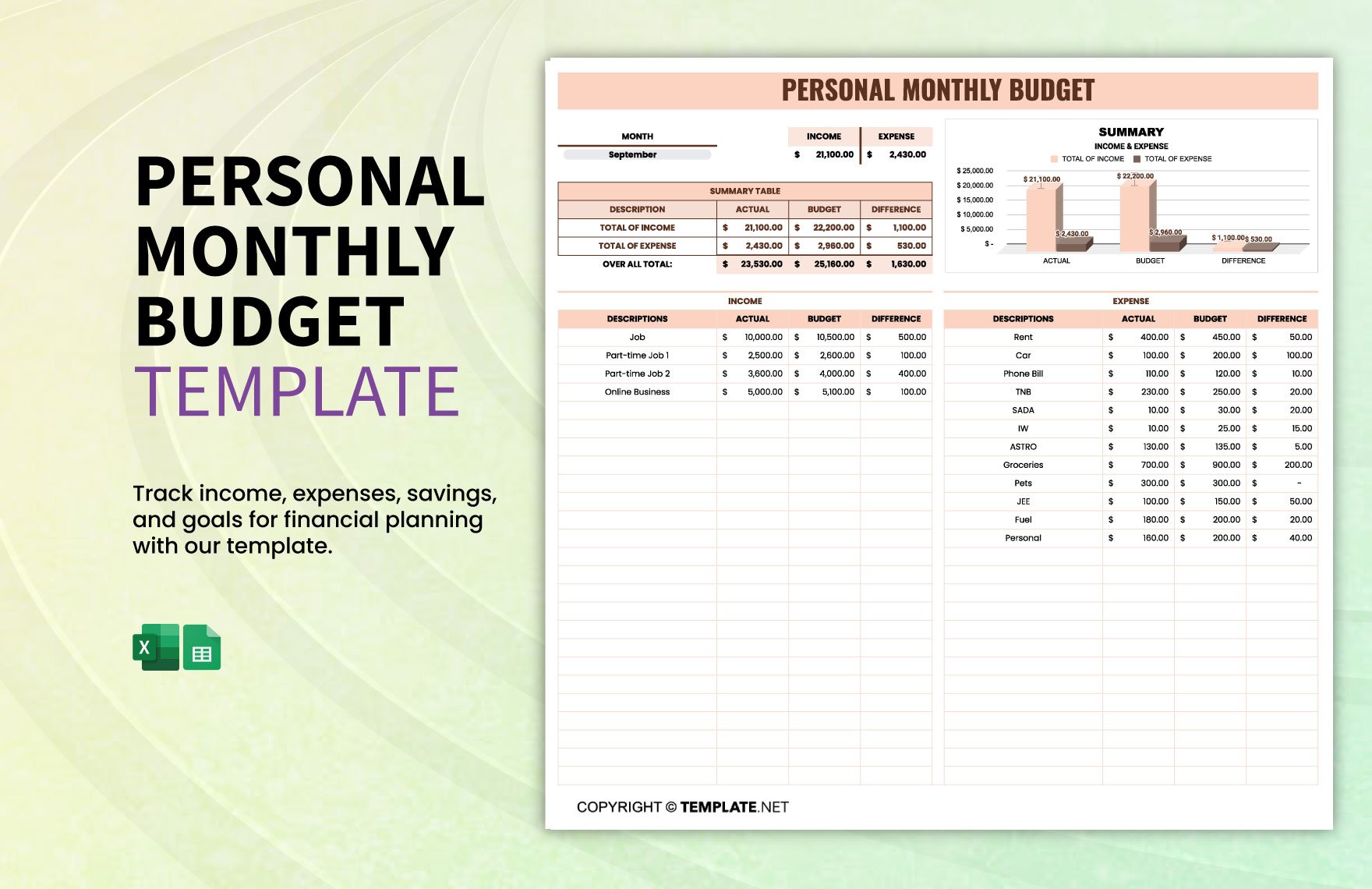

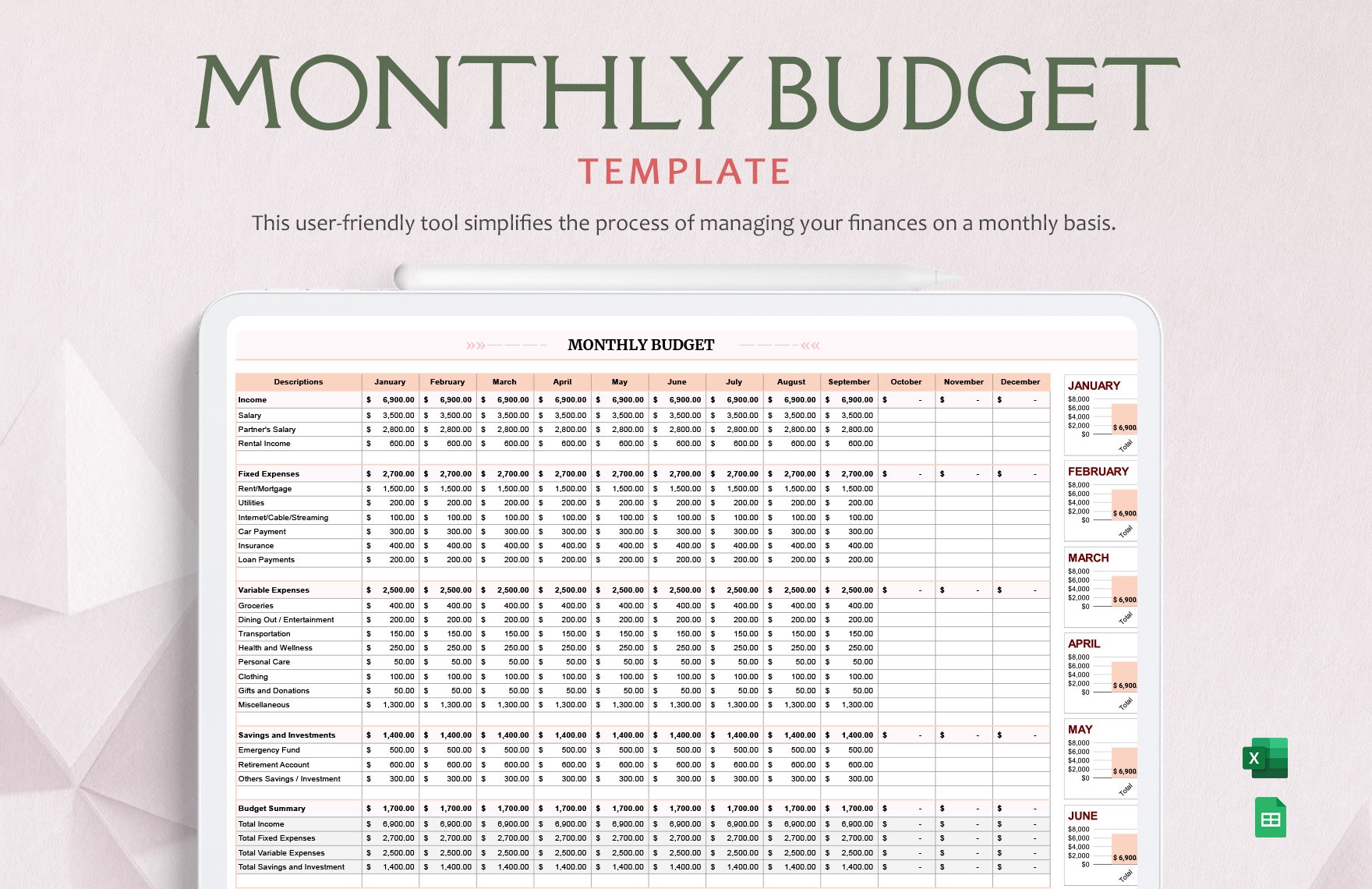

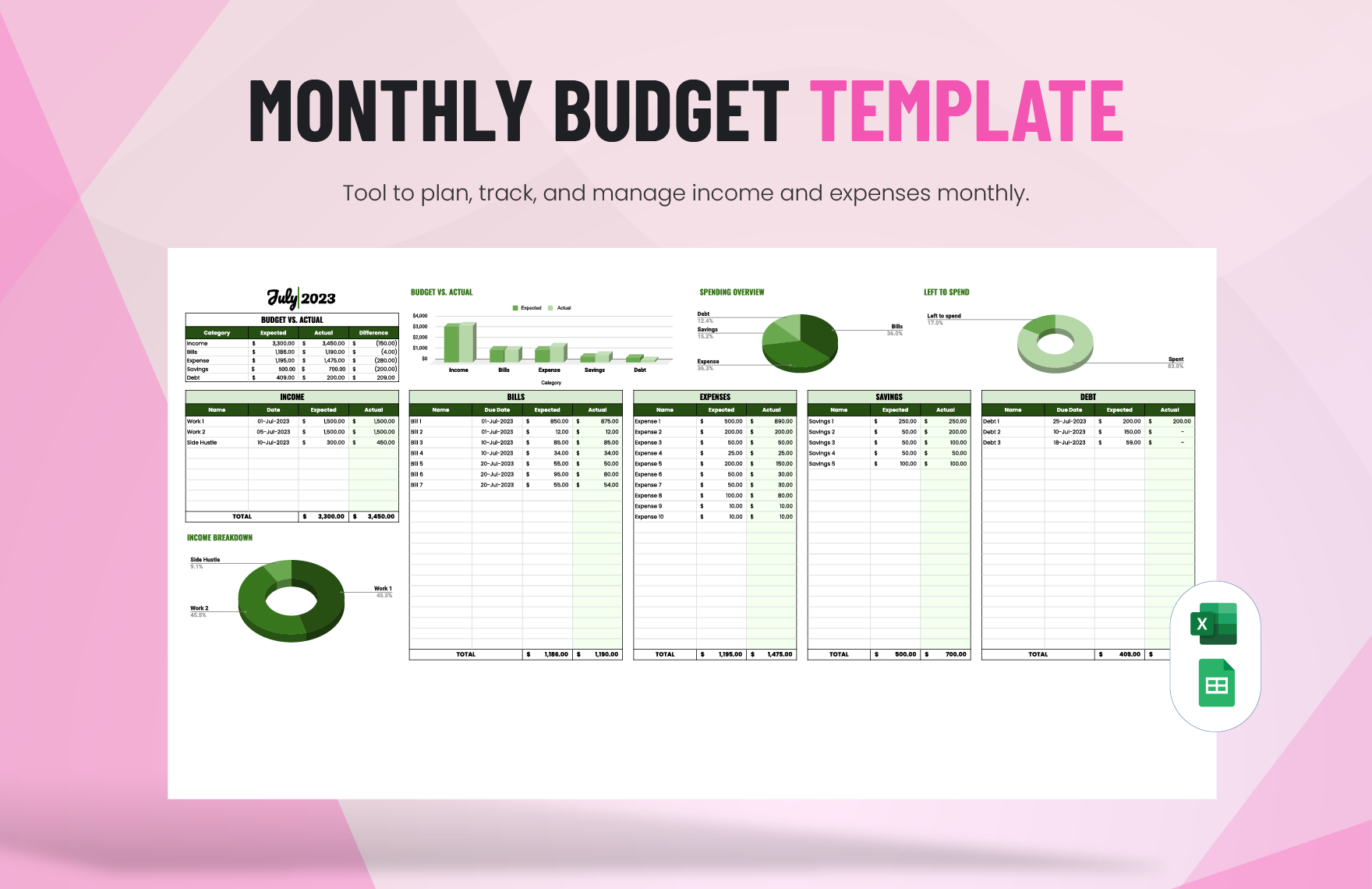

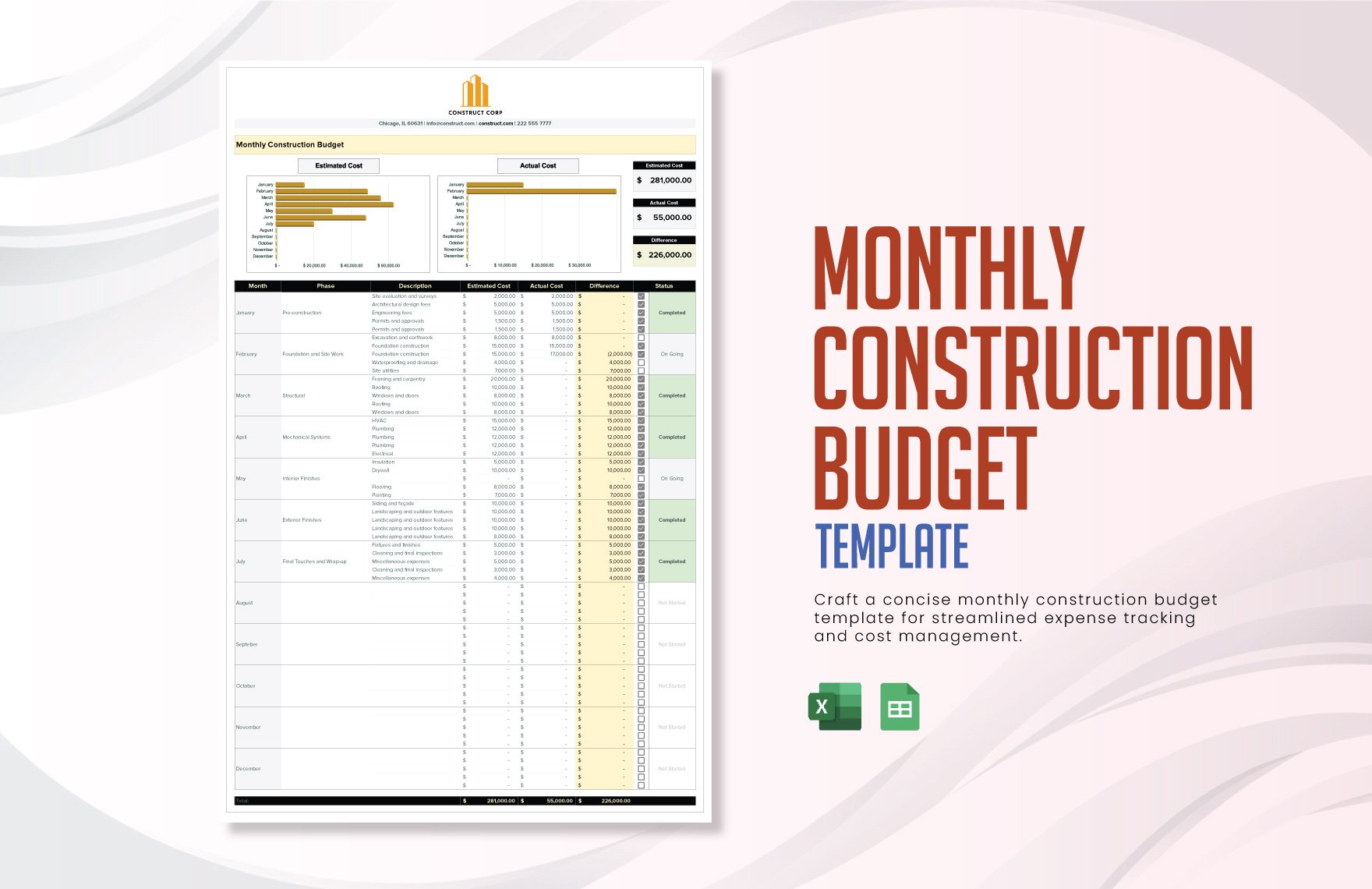

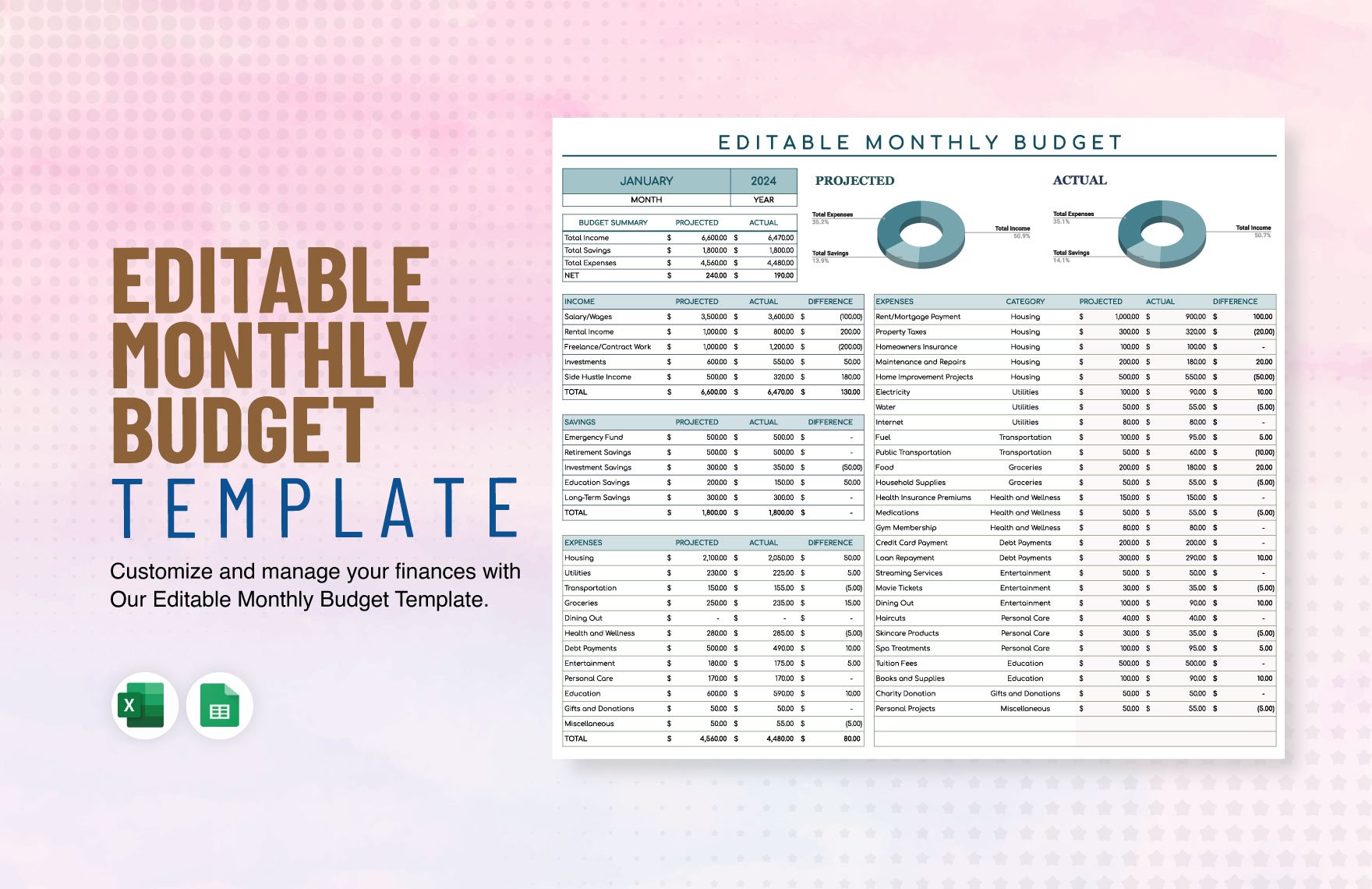

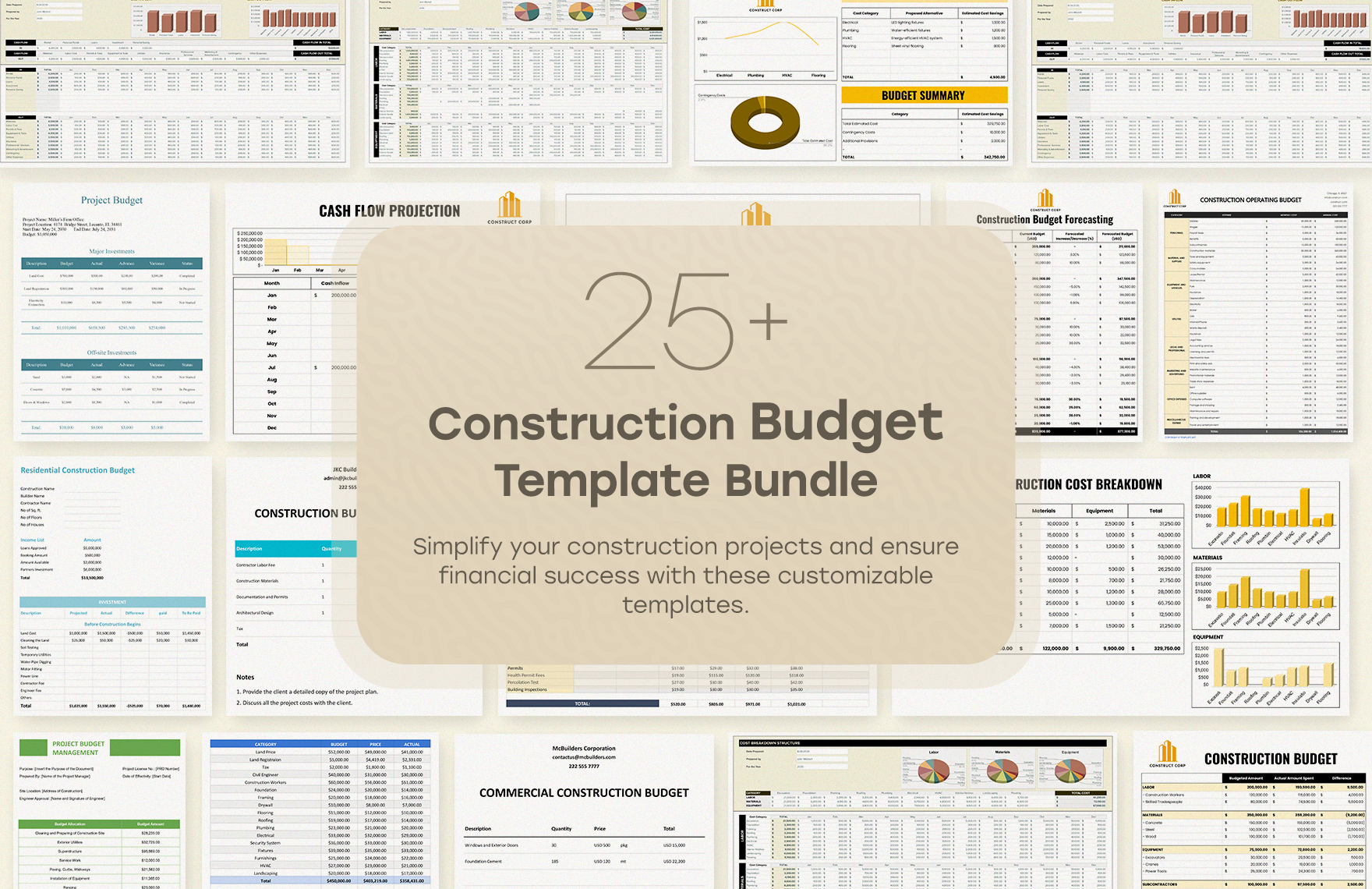

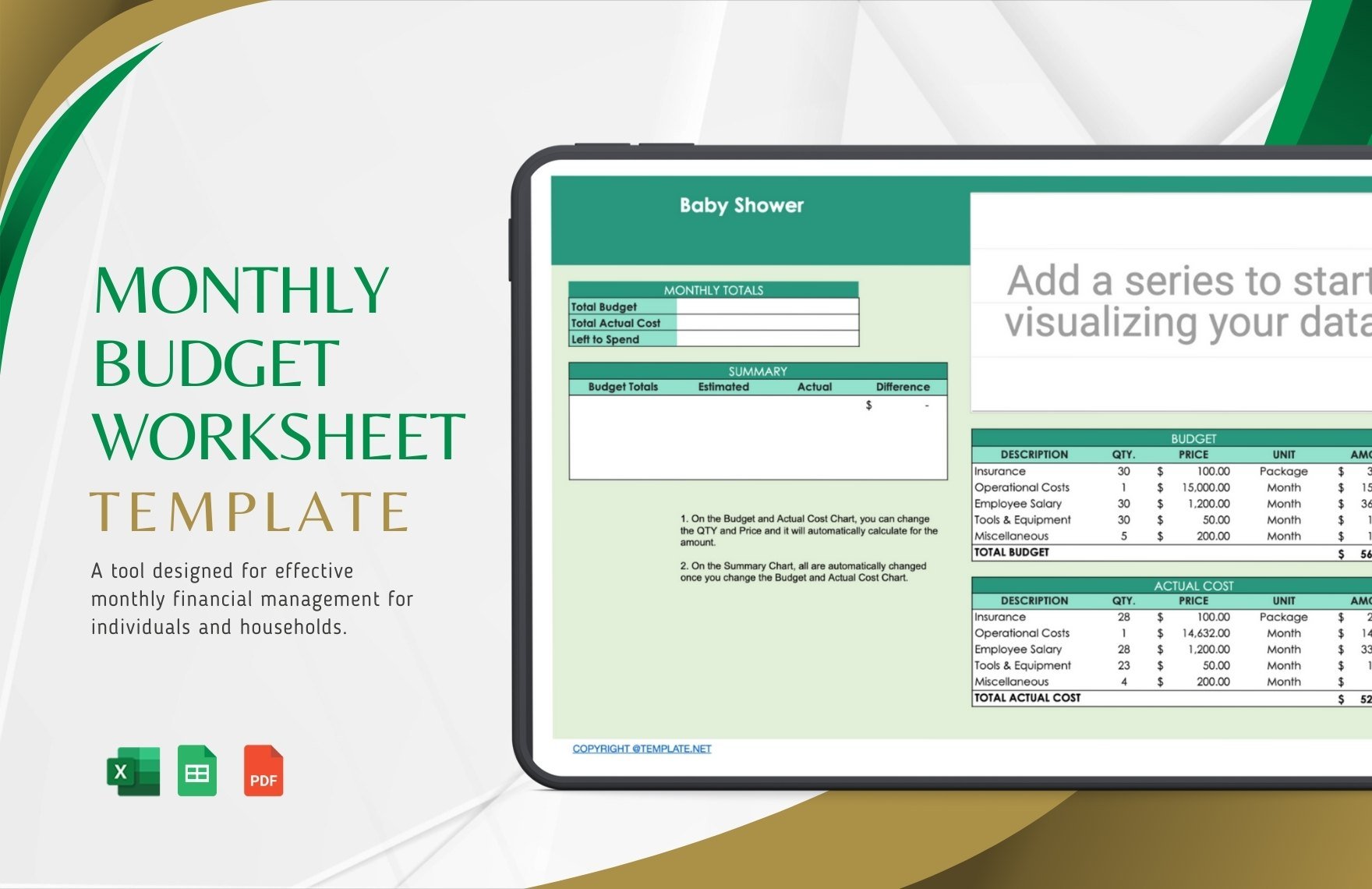

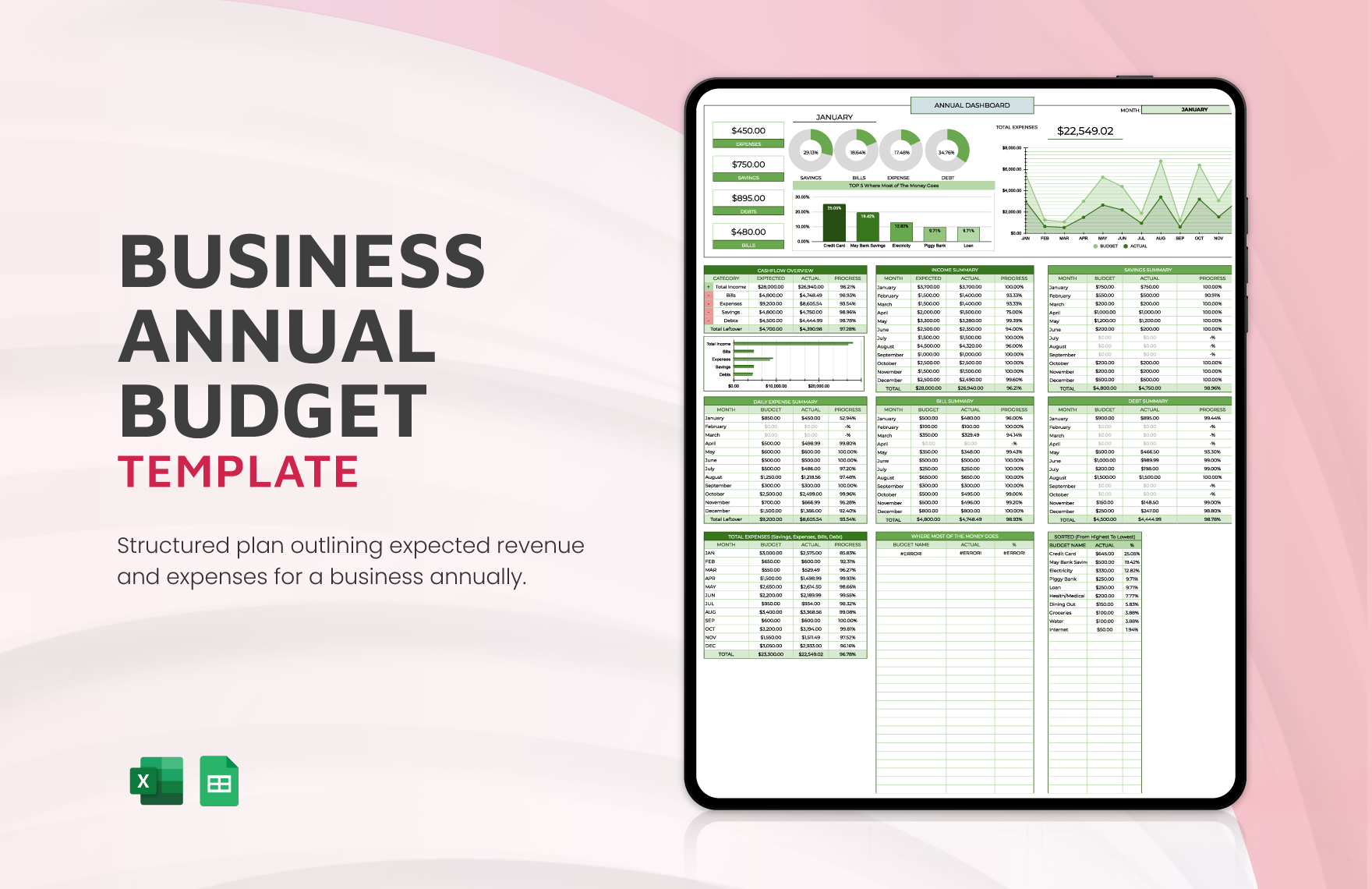

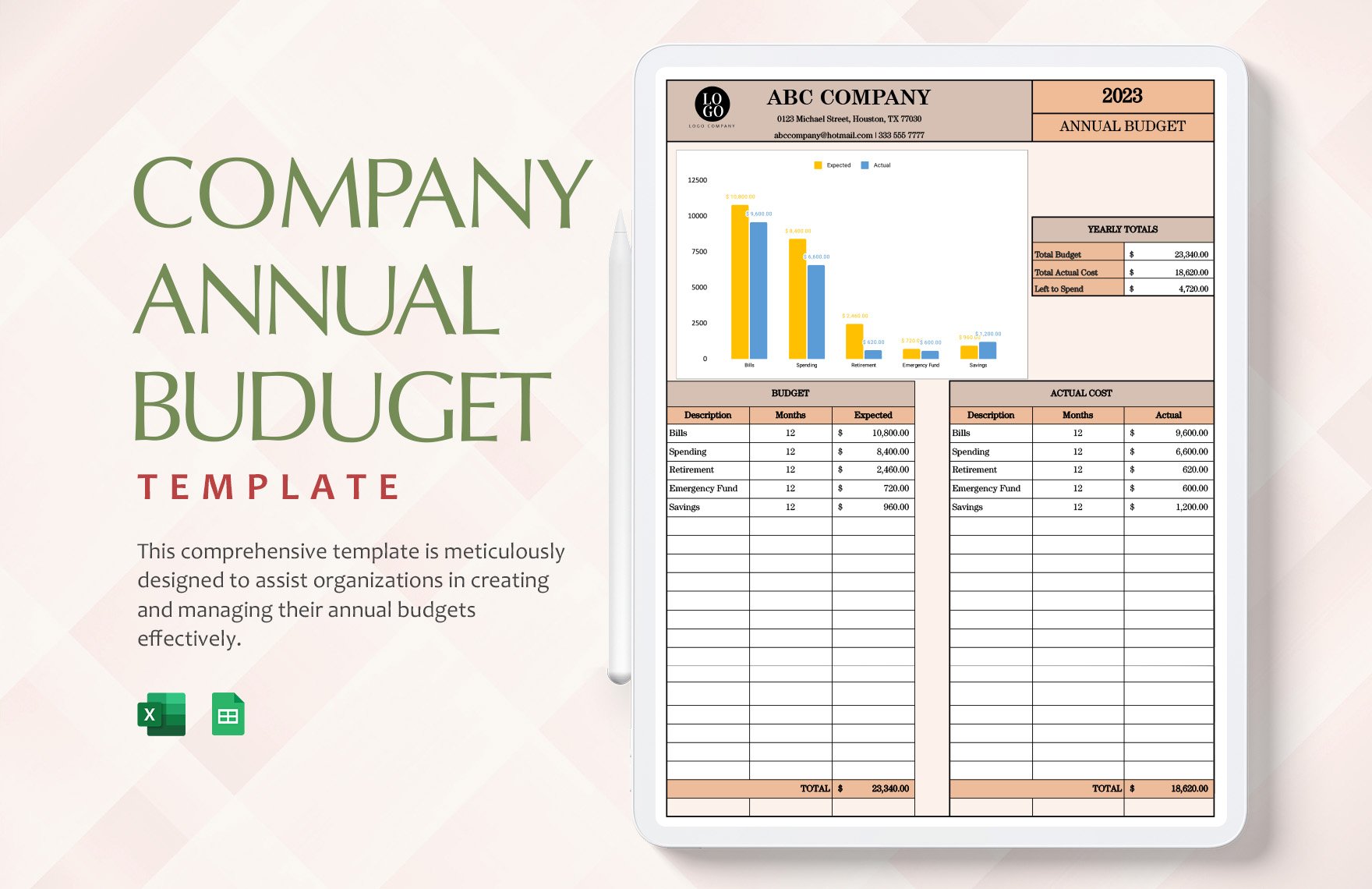

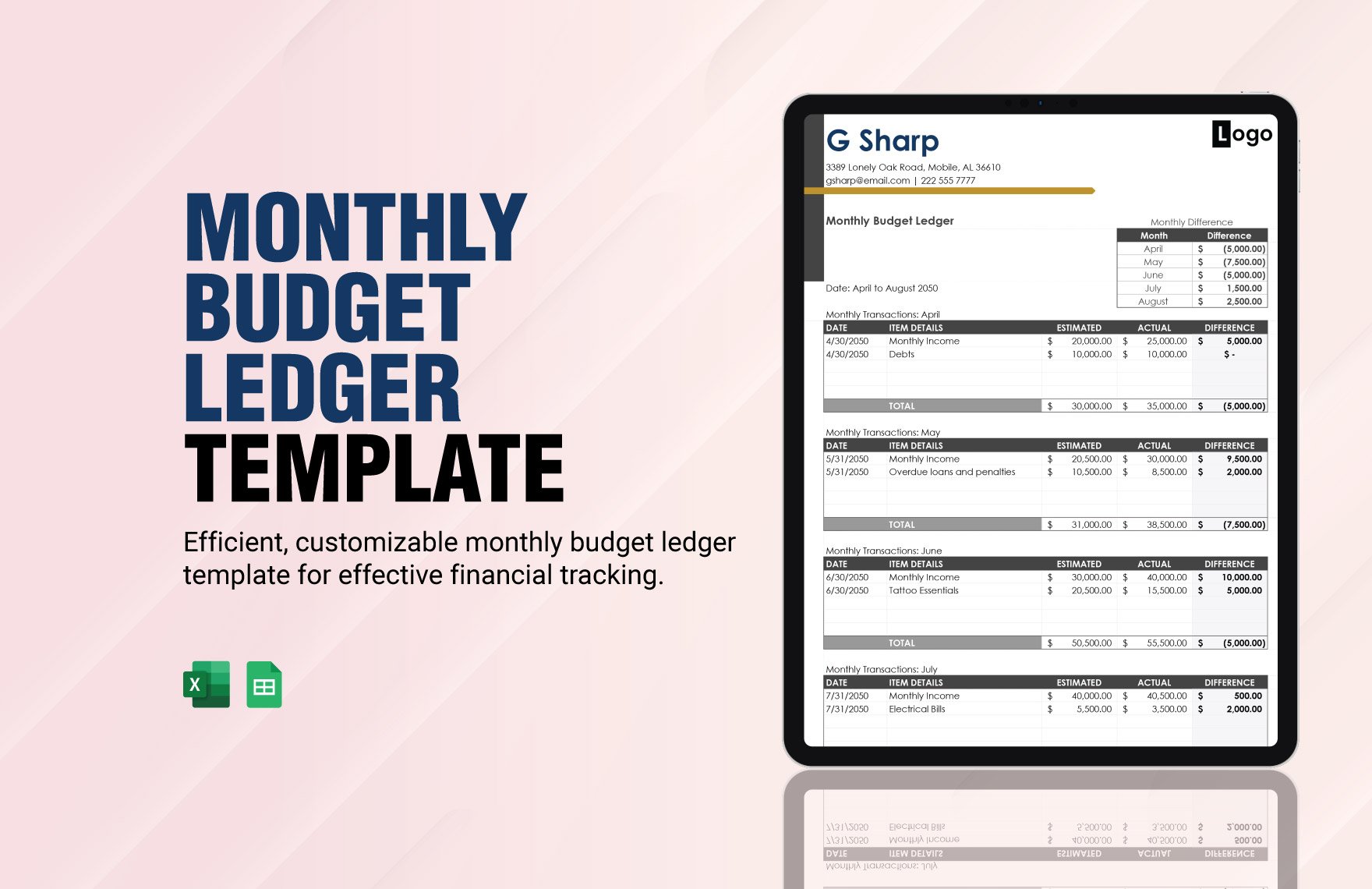

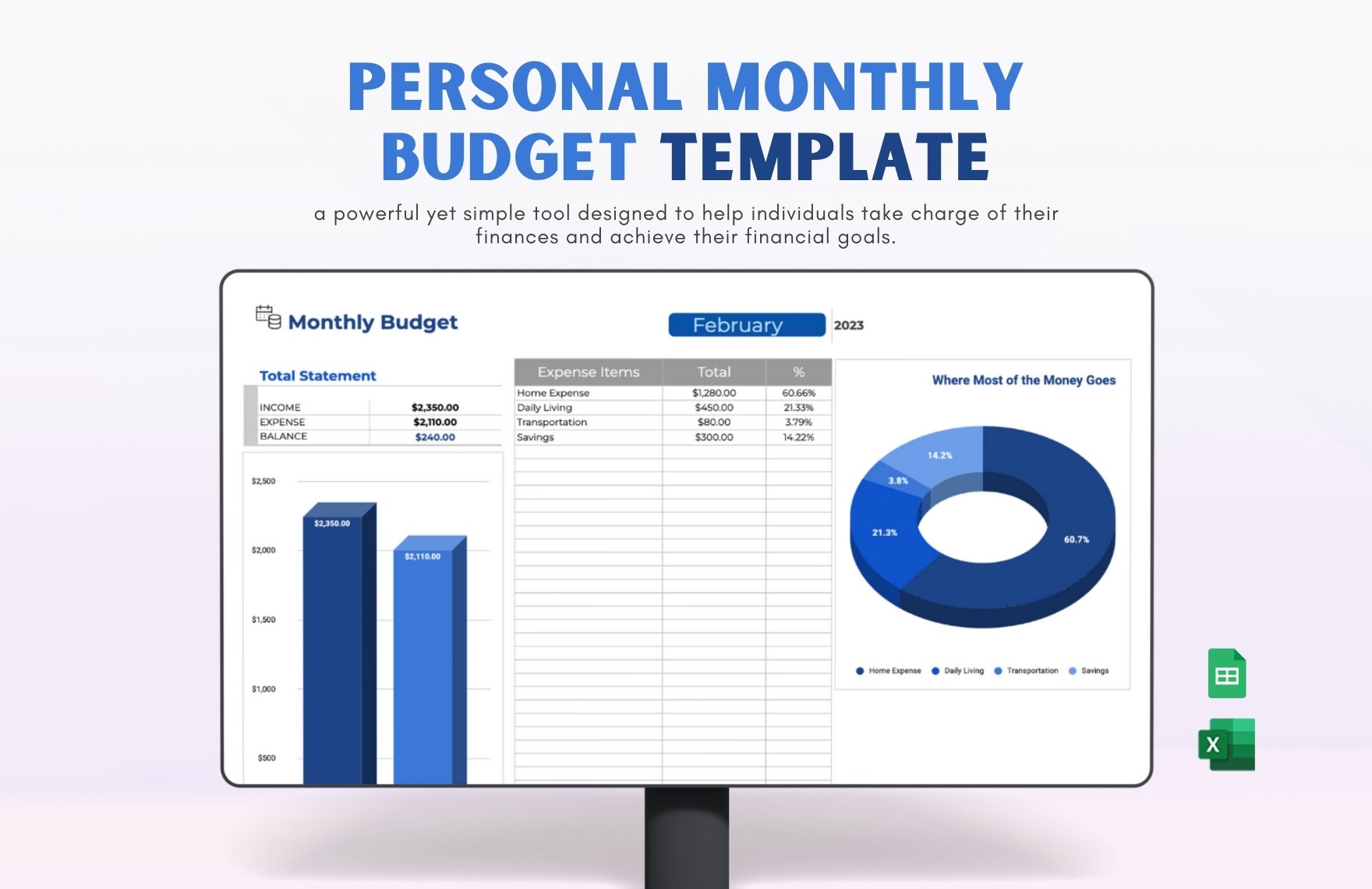

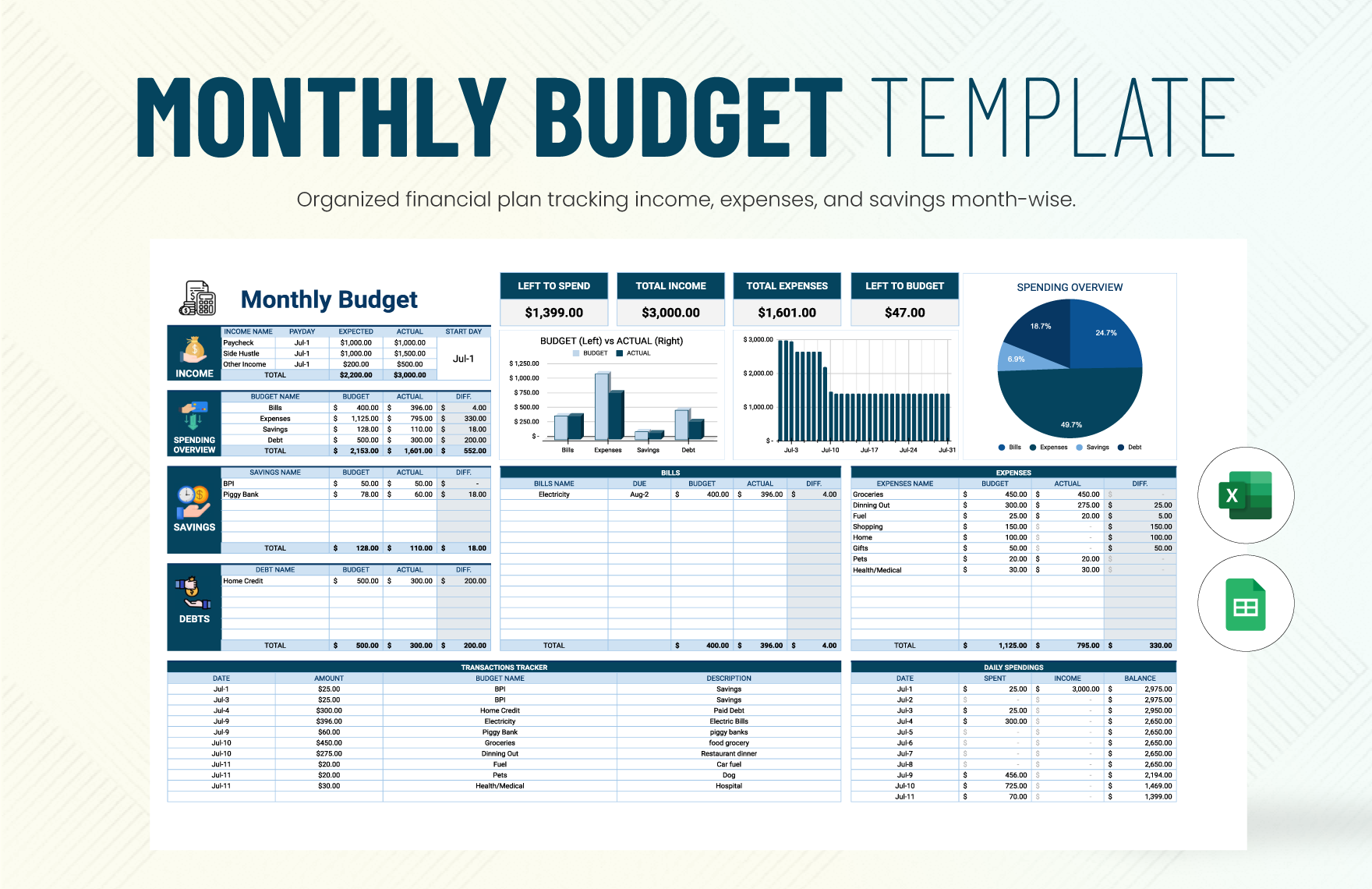

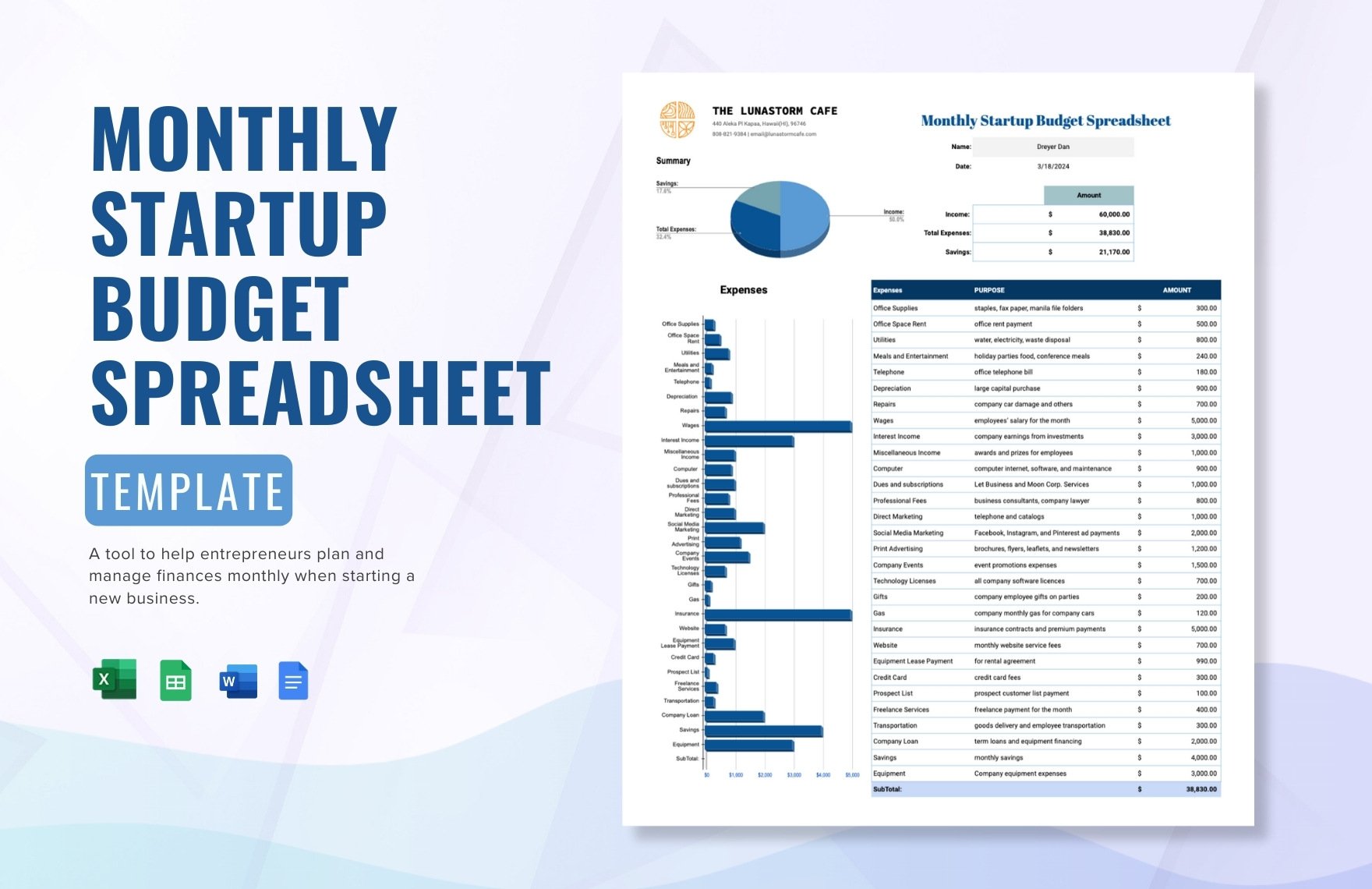

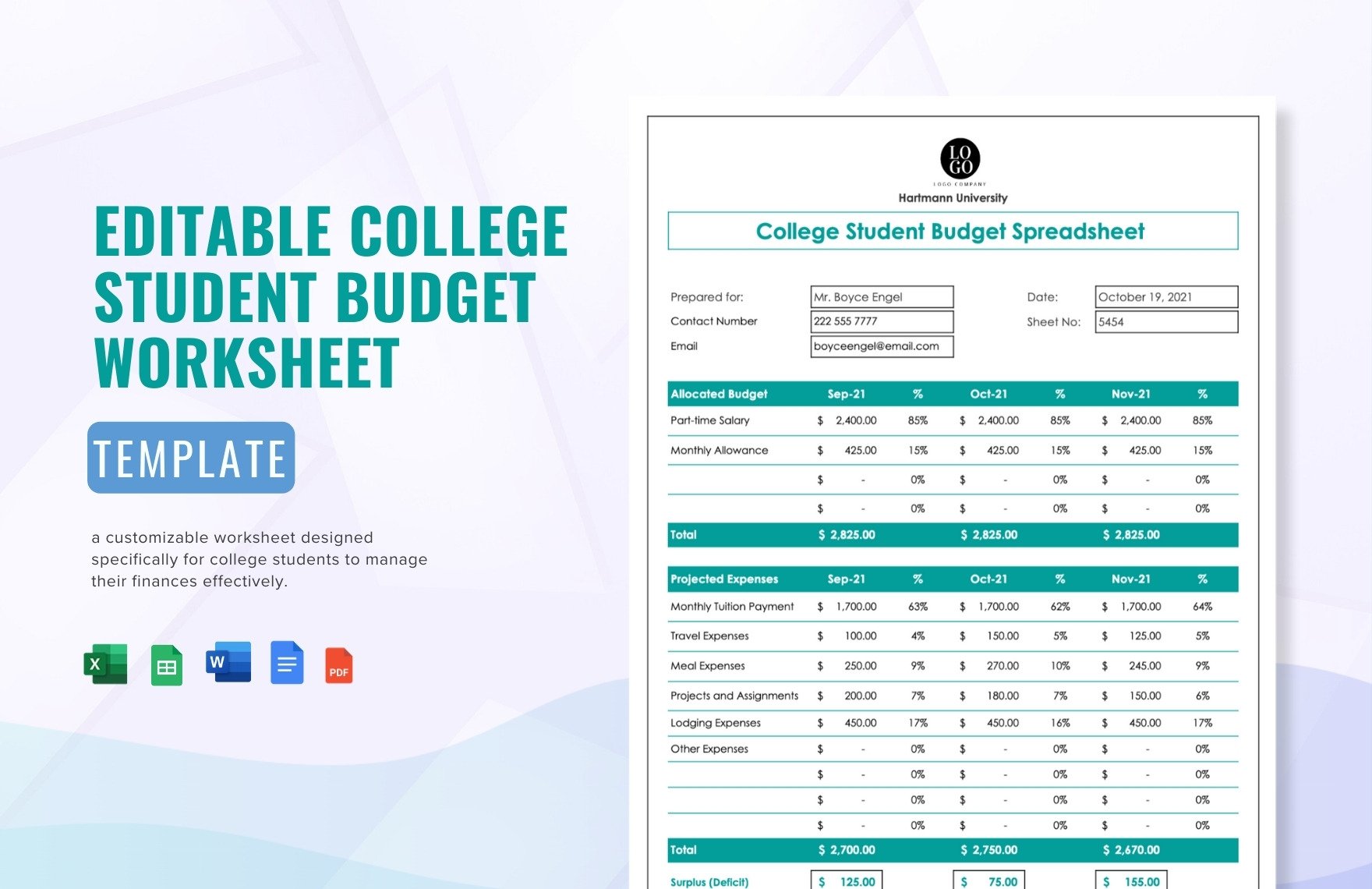

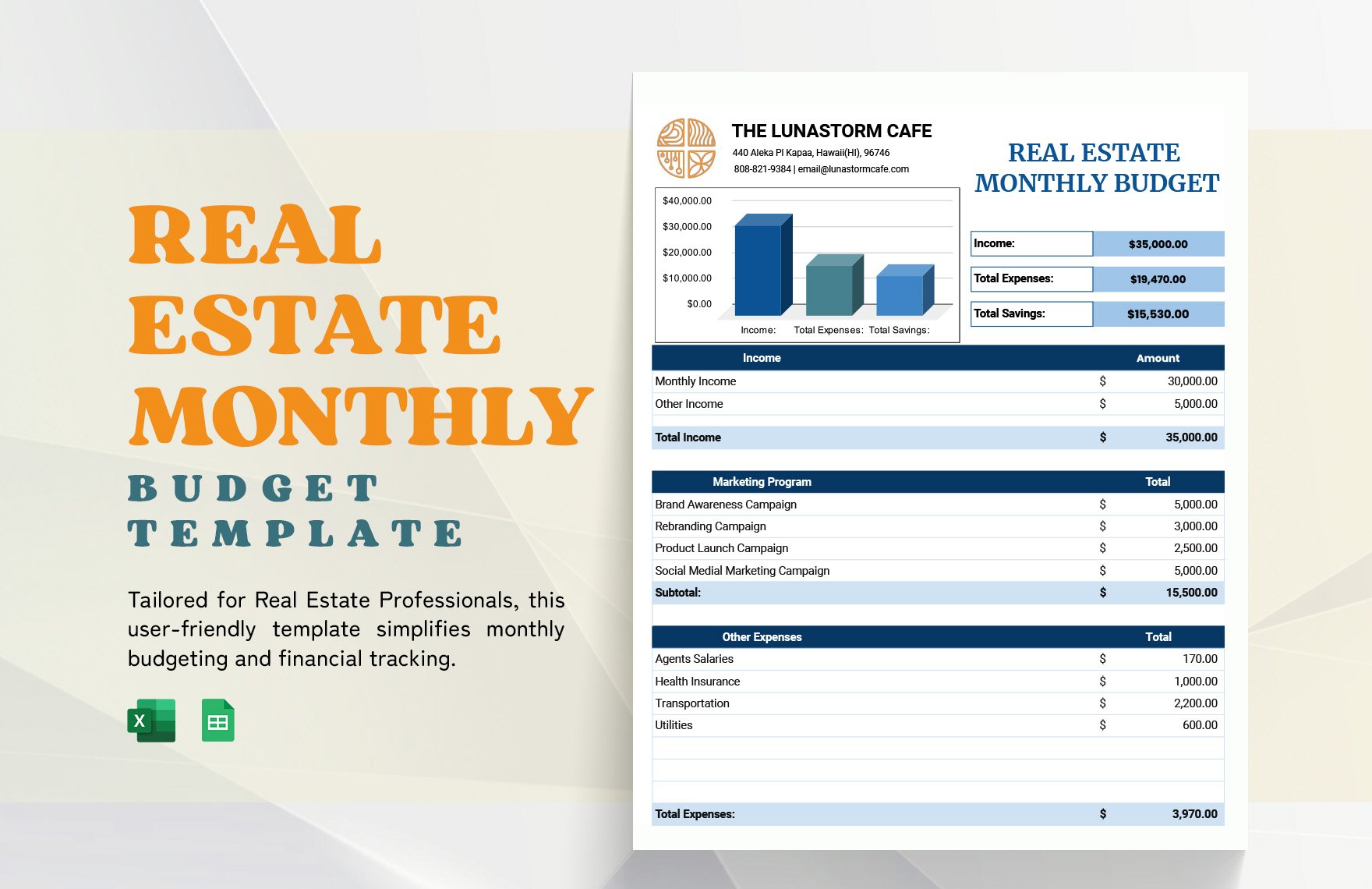

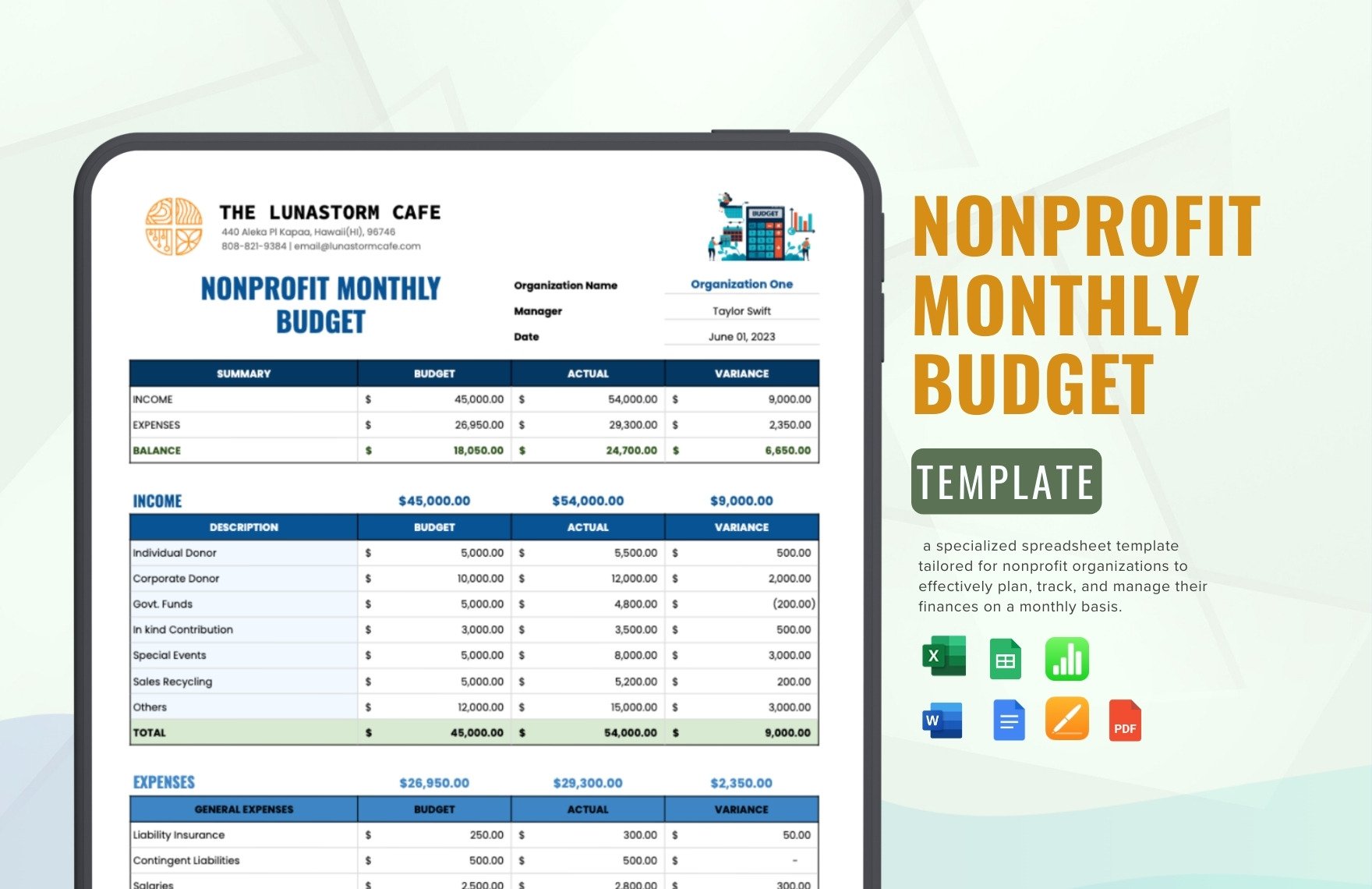

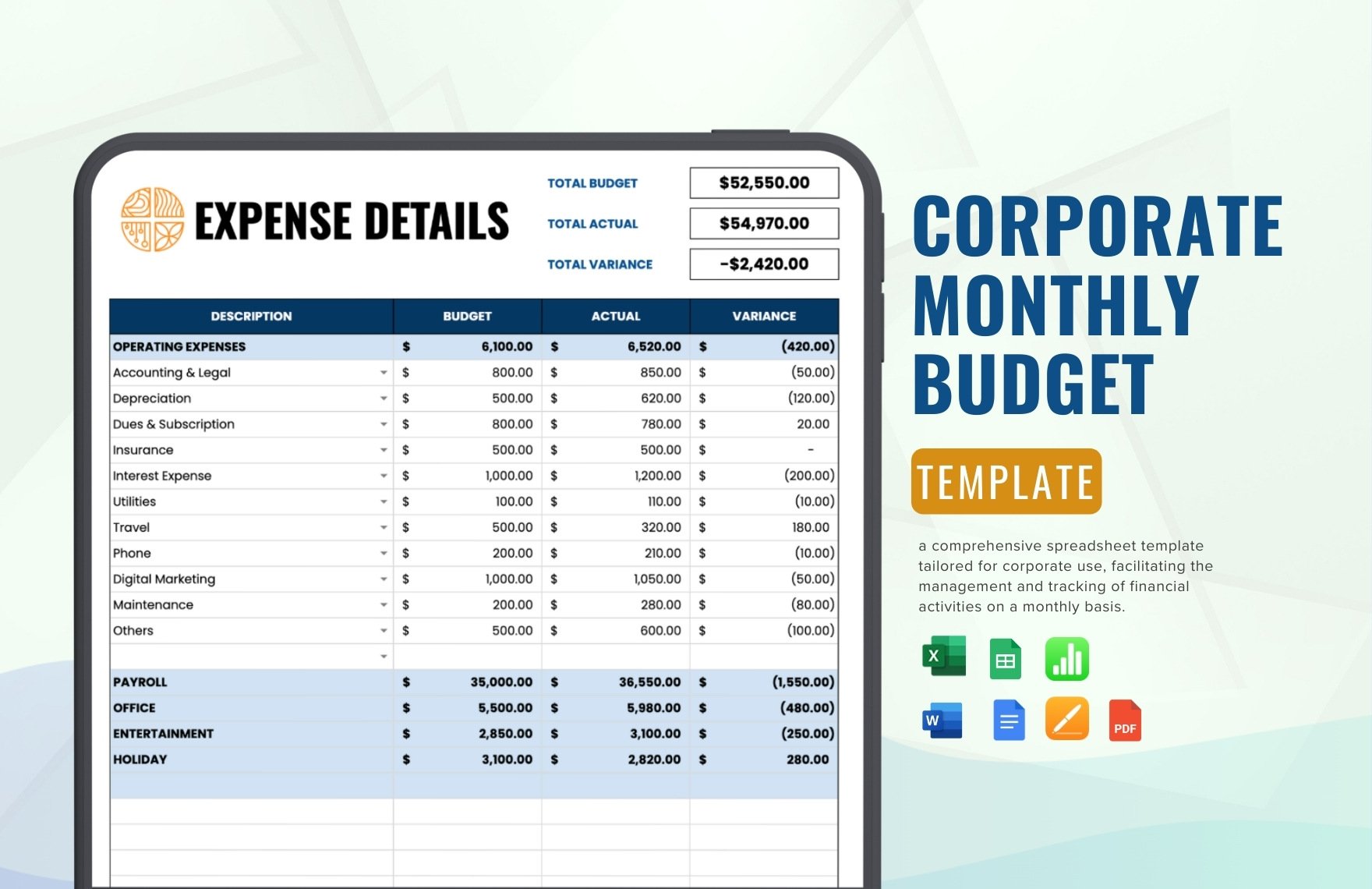

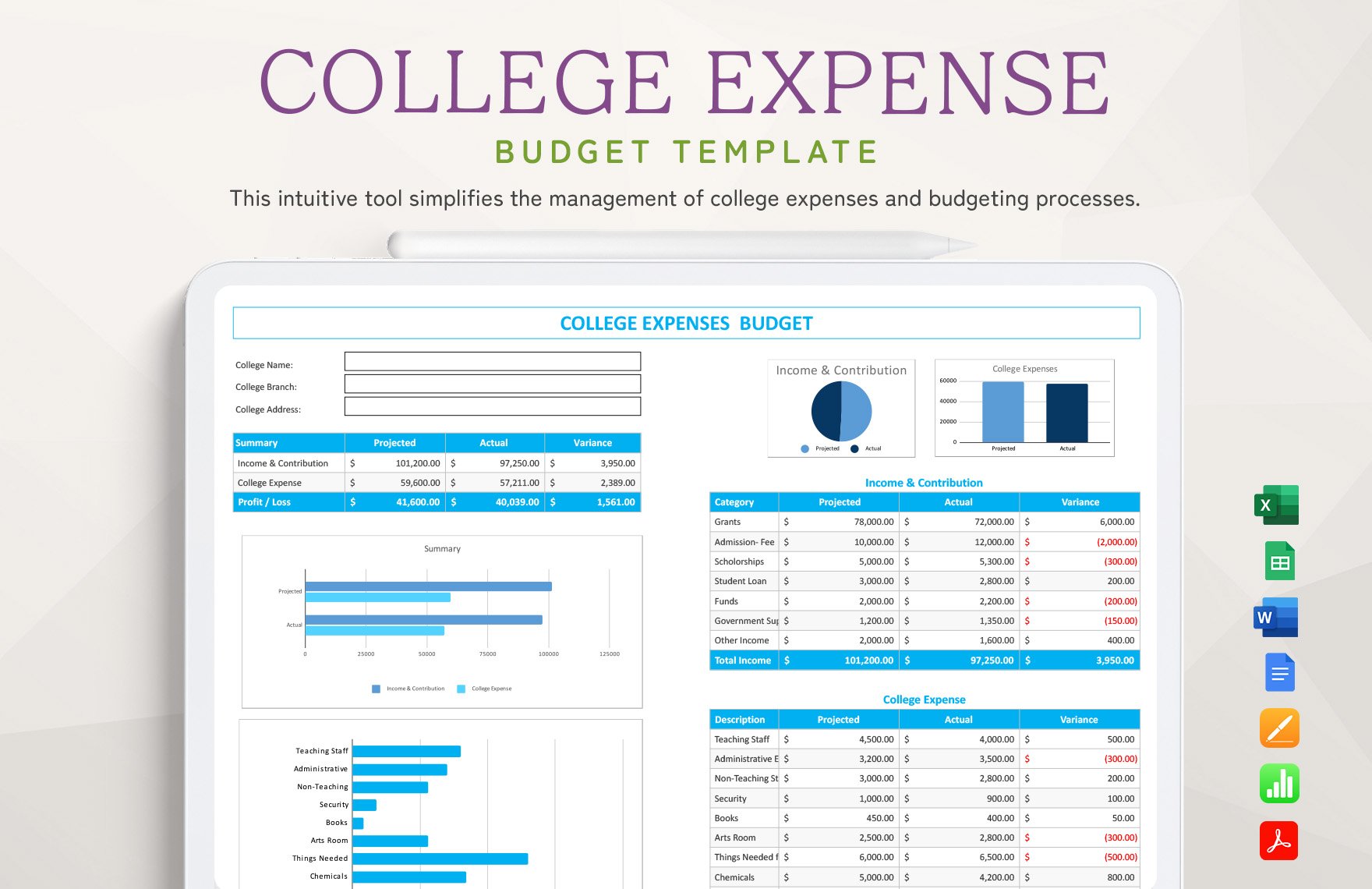

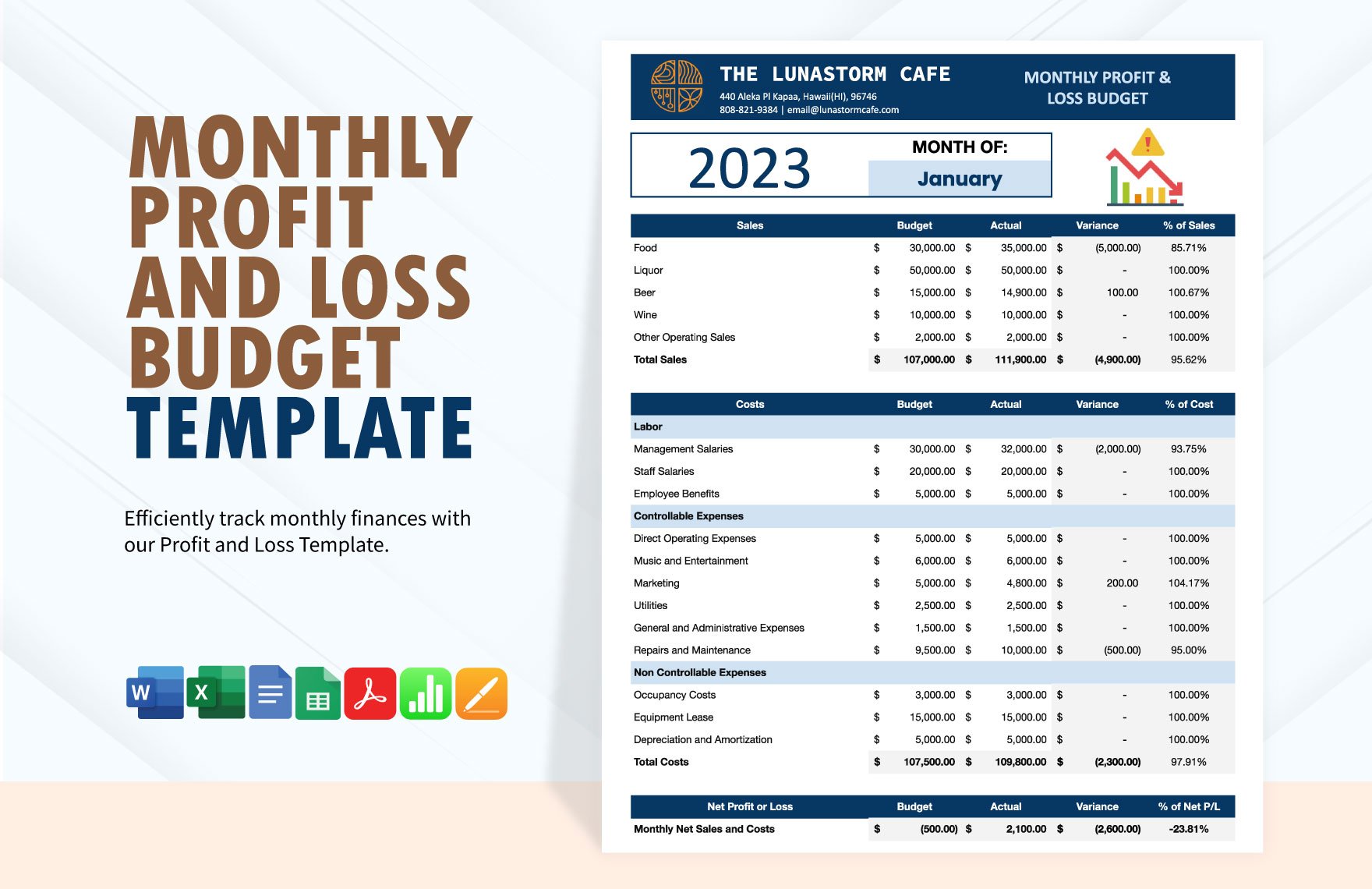

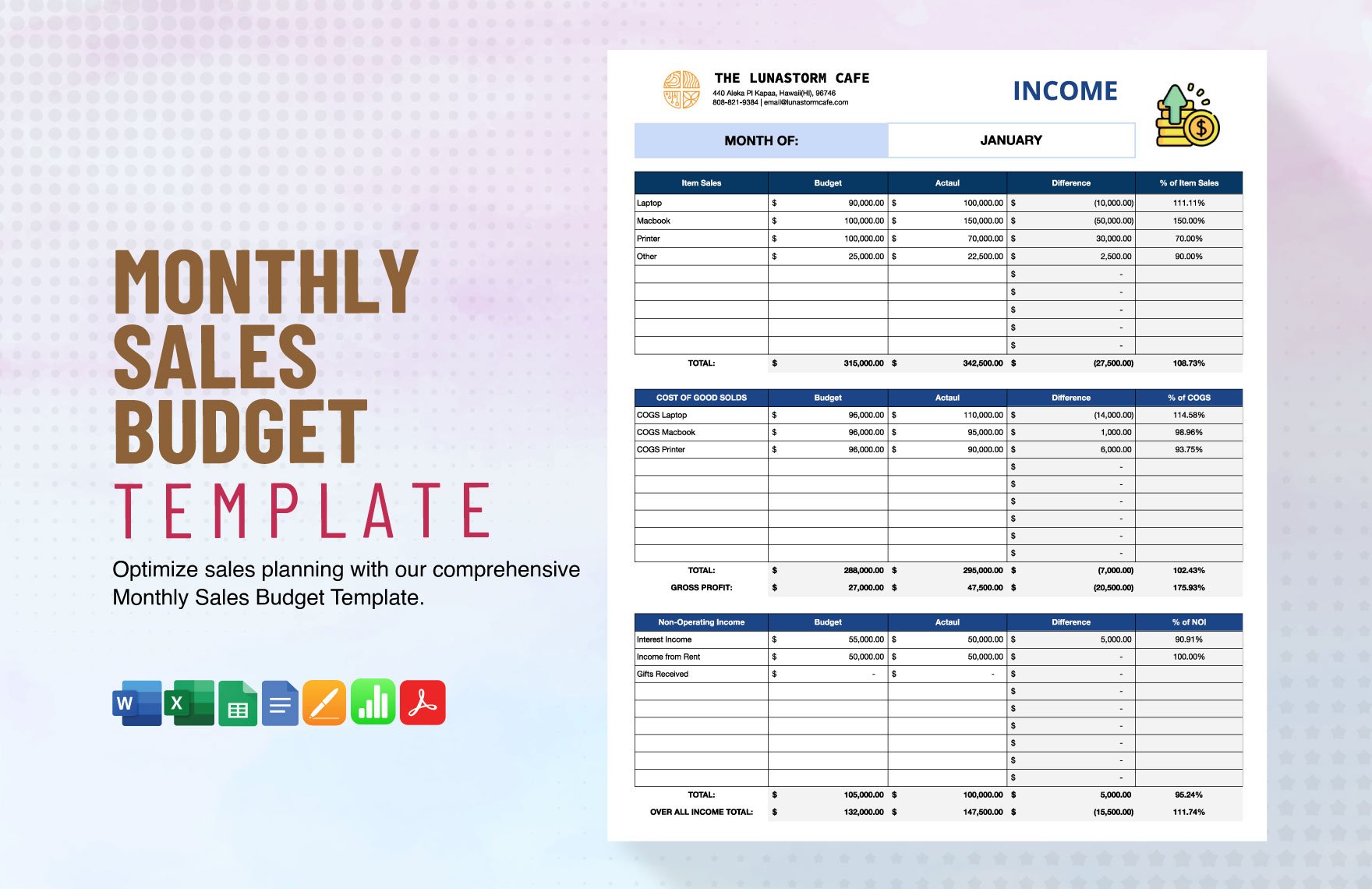

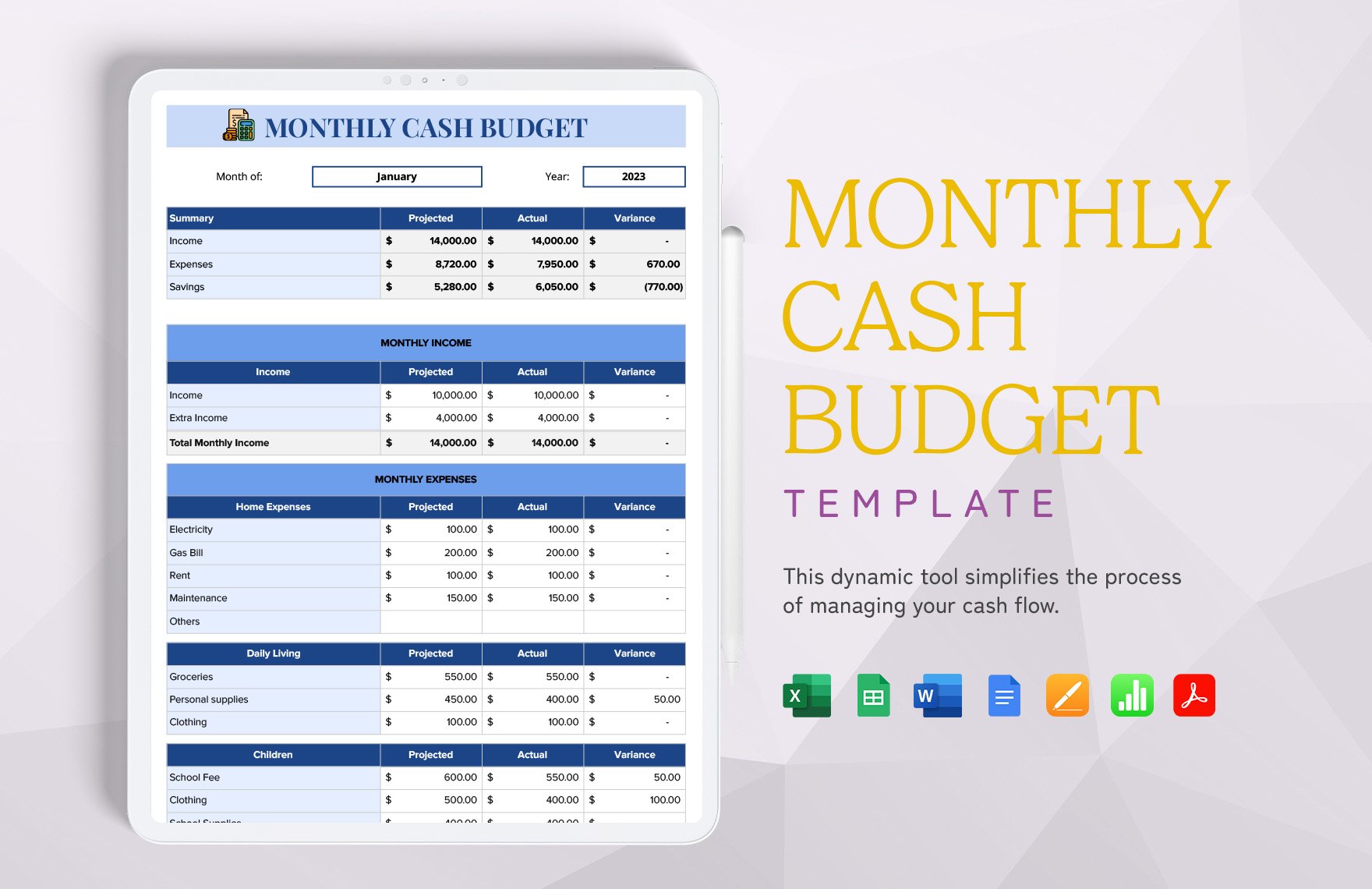

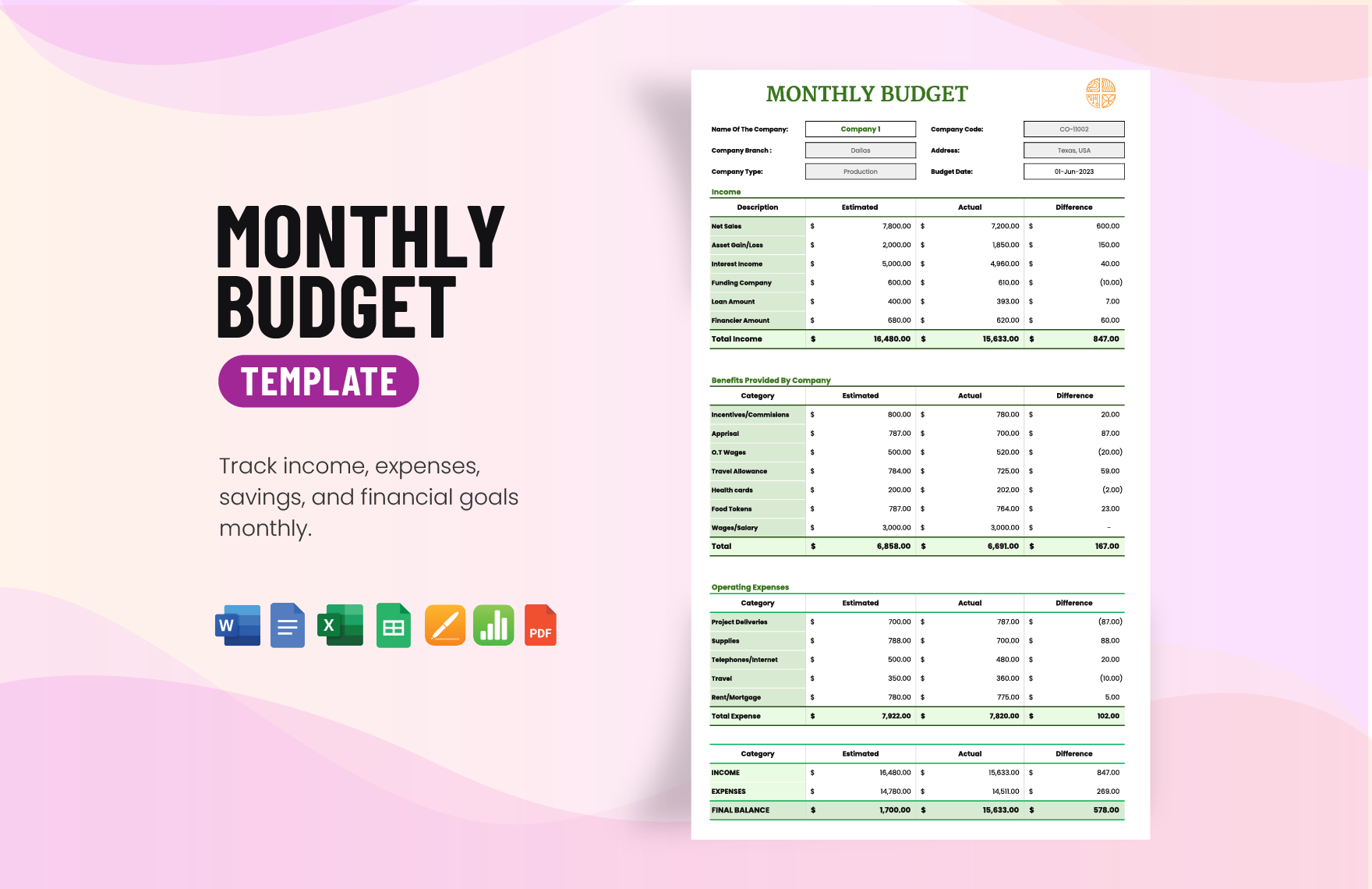

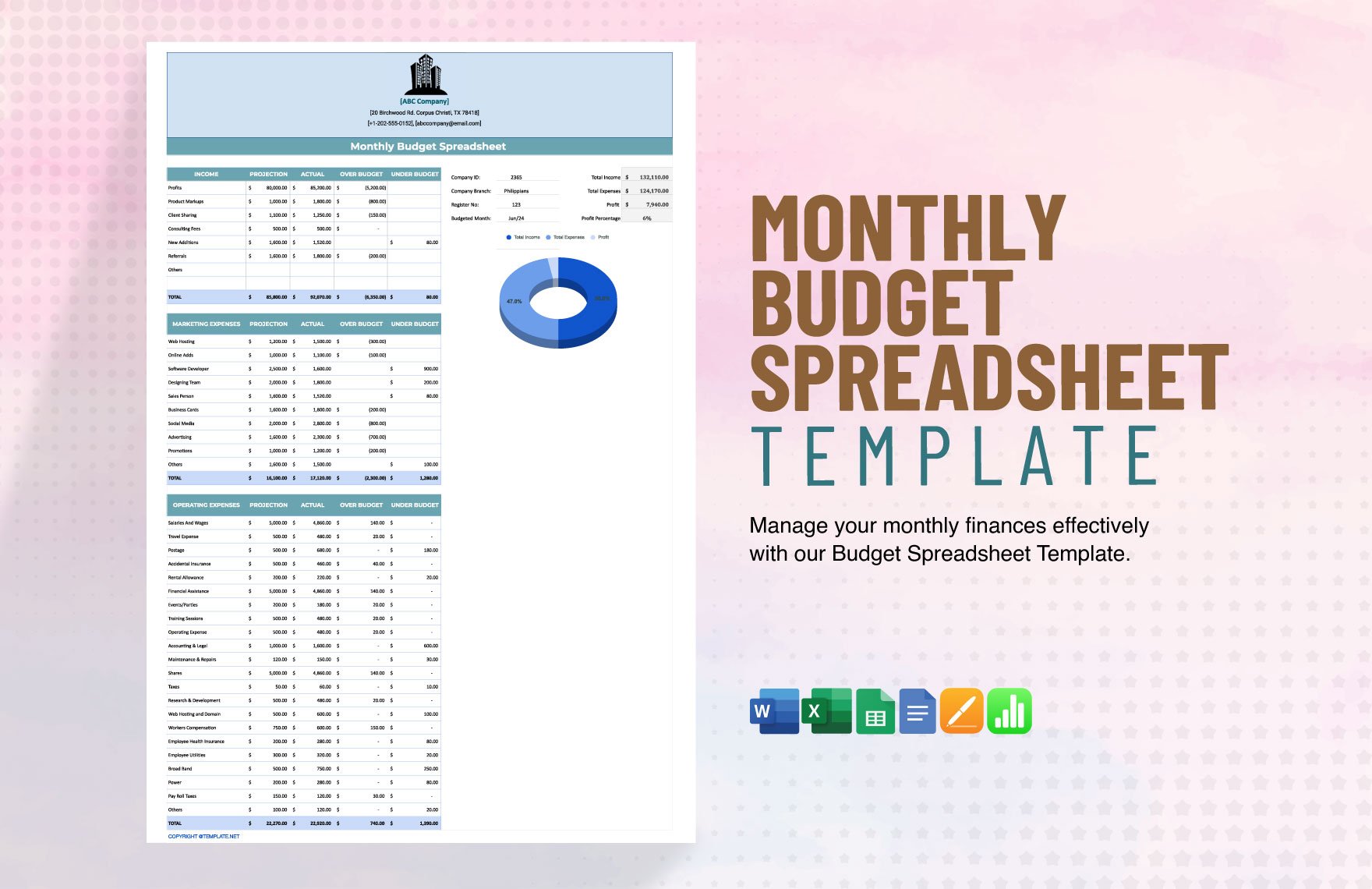

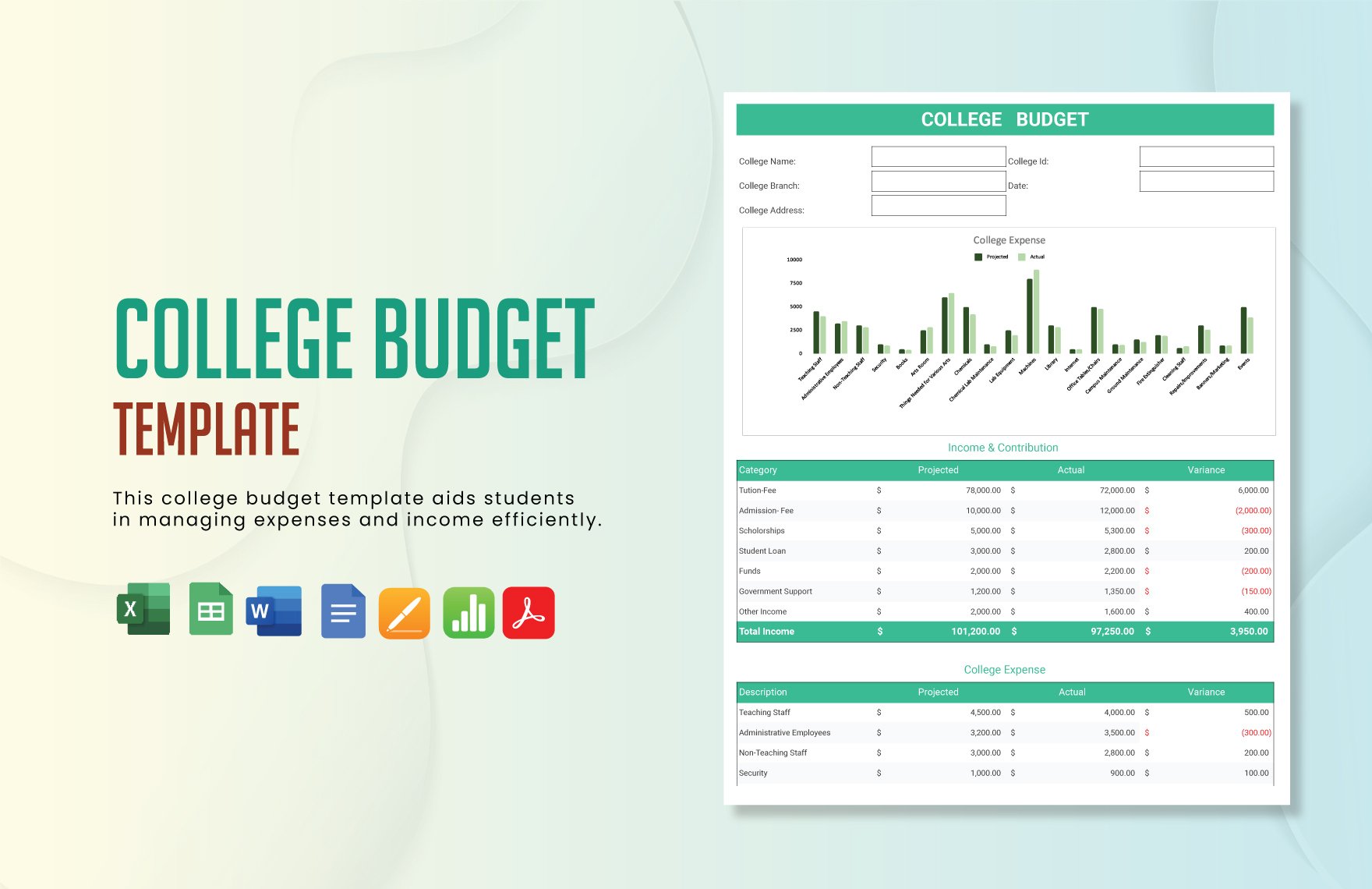

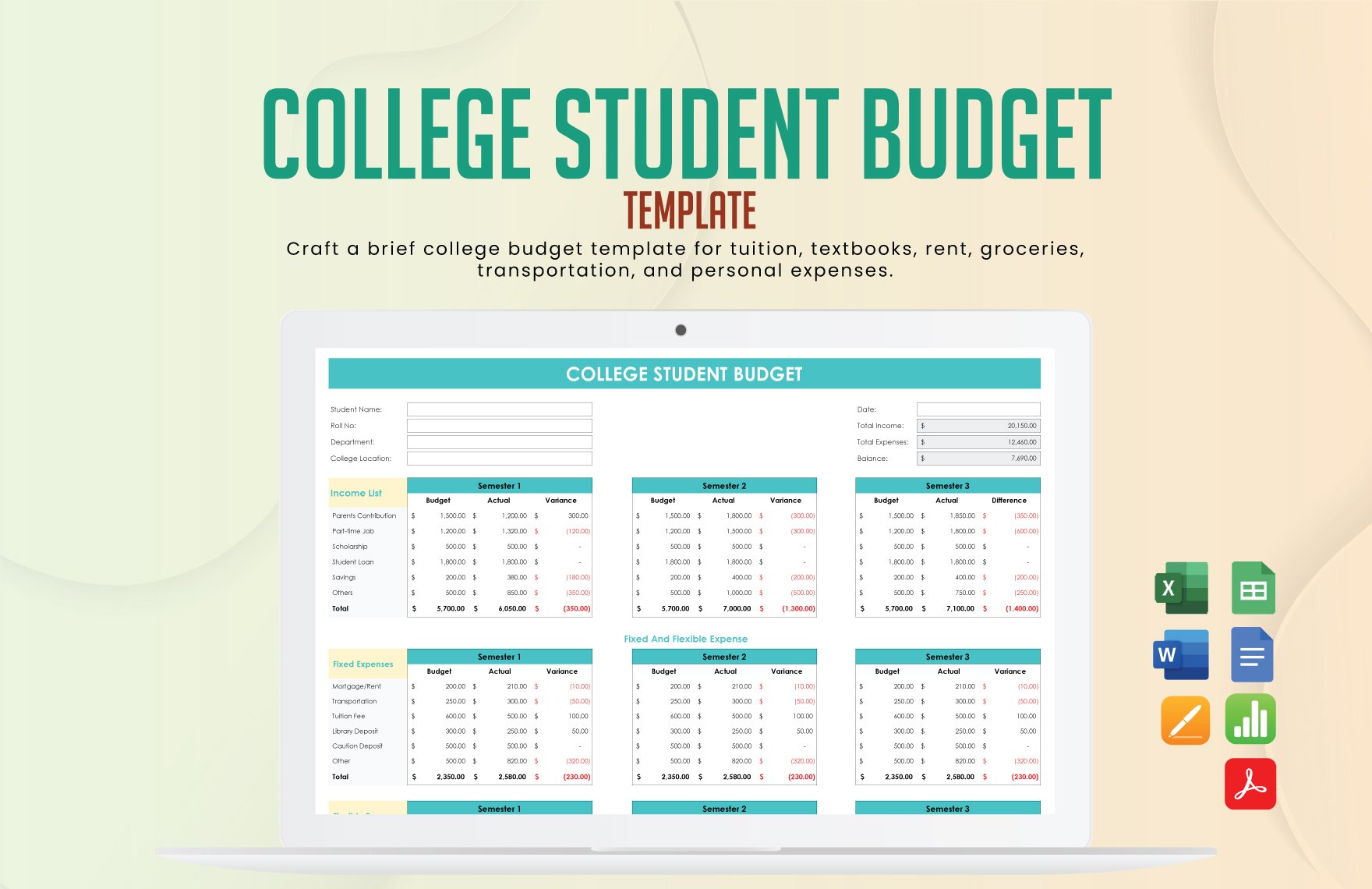

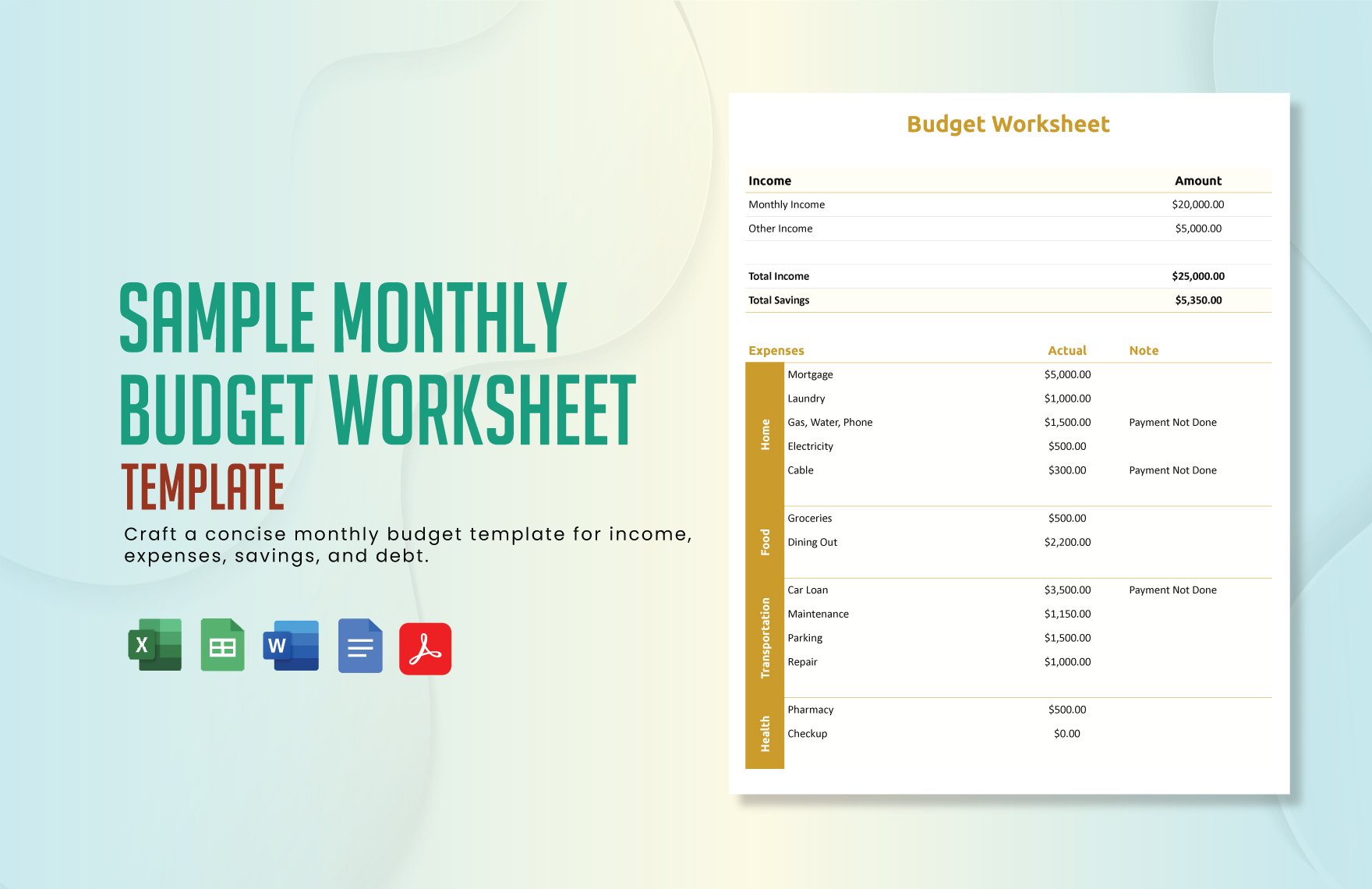

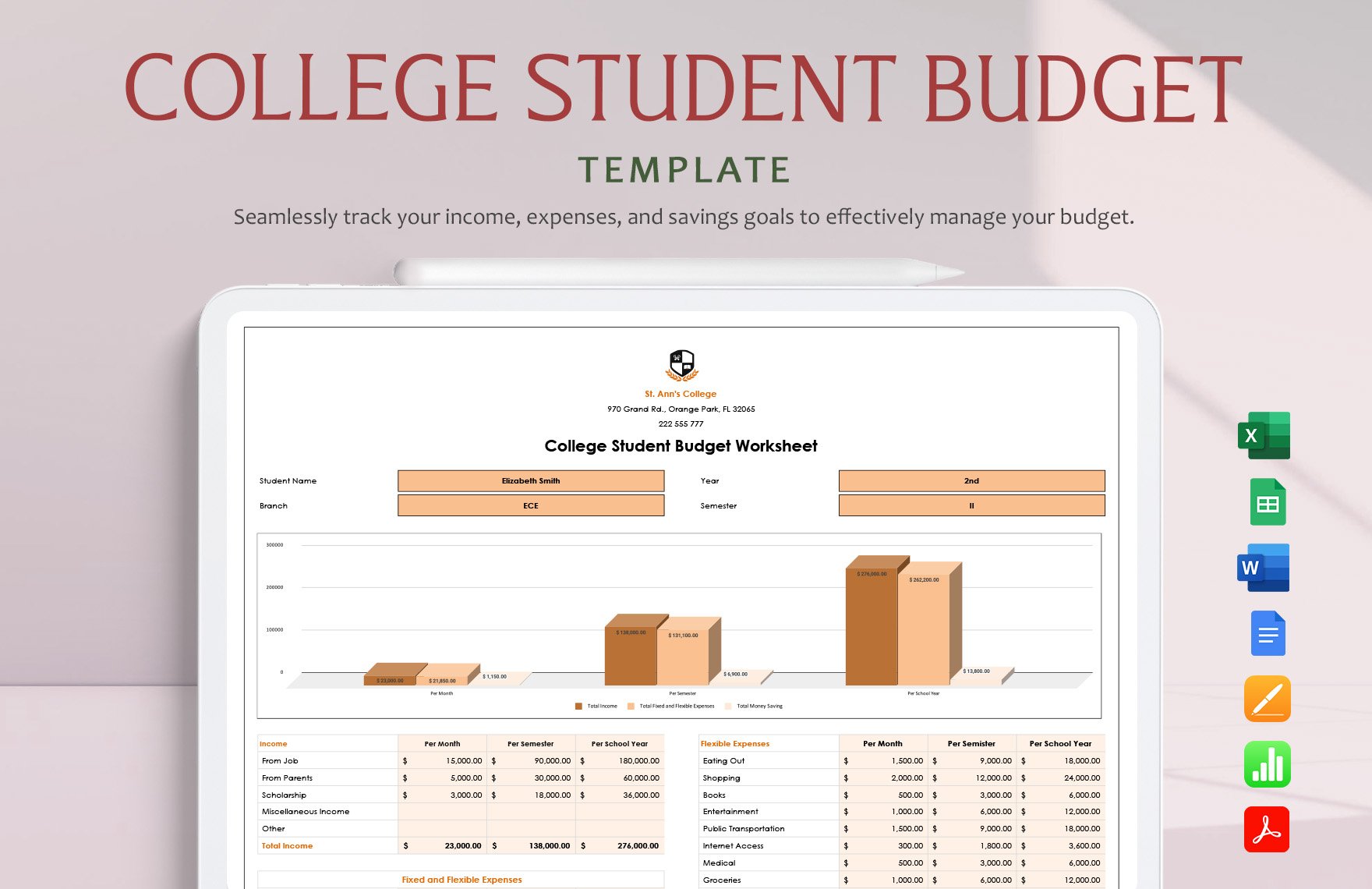

Keep your financial goals on track, stay organized, and easily manage your expenses with the Monthly Budget Templates from Template.net. Designed for individuals, families, and businesses alike, these templates offer a streamlined approach to budgeting that saves you time and helps you achieve financial clarity. Whether you're preparing for a family vacation or managing monthly business expenses, these templates are perfect for guiding your financial planning. They include essential components such as date, category, expected vs. actual cost, and even notes sections for detailed tracking. No advanced accounting skills are required, and with free, professional-grade designs available, anyone can step up their financial planning game effortlessly. Customizable layouts ensure each template can be tailored for print or digital distribution, making them versatile for any user’s needs.

Discover the many budget templates we have on hand to suit your every financial planning need. Begin by selecting from a variety of pre-made templates, then effortlessly swap in your details, tweak colors, and adjust fonts for a personal touch. Enhance your budget with advanced features like drag-and-drop icons and graphics, or add animated effects to make data more engaging. Possibilities are endless, and thanks to our user-friendly design, there's no need for graphic design skills. Our library is regularly updated with new designs, ensuring fresh templates for ever-evolving budgeting requirements. Once you’ve tailored your perfect budget, download or share it instantly via print, email, or export, making it ideal for multiple channels and effortless collaboration in real-time.