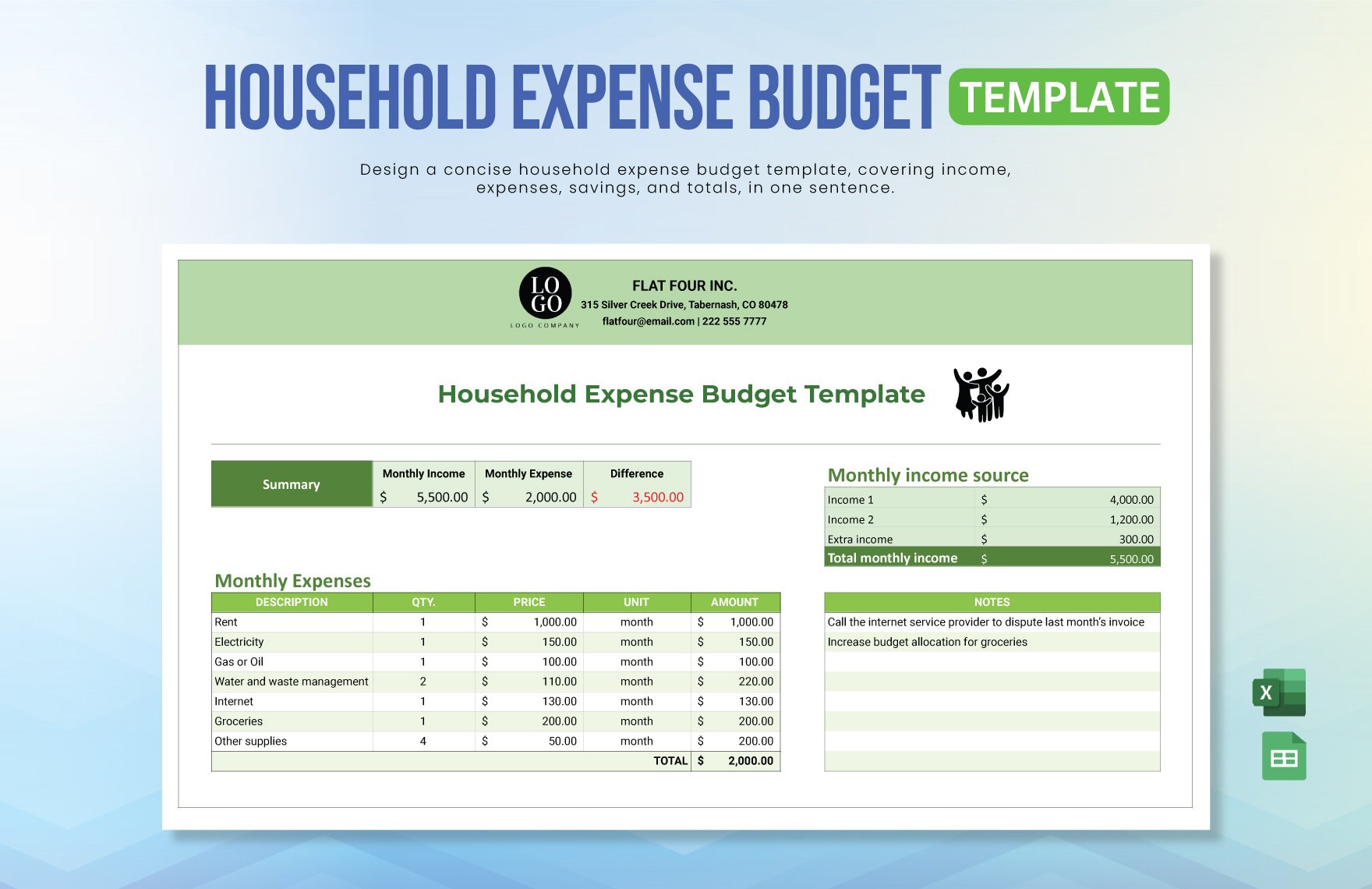

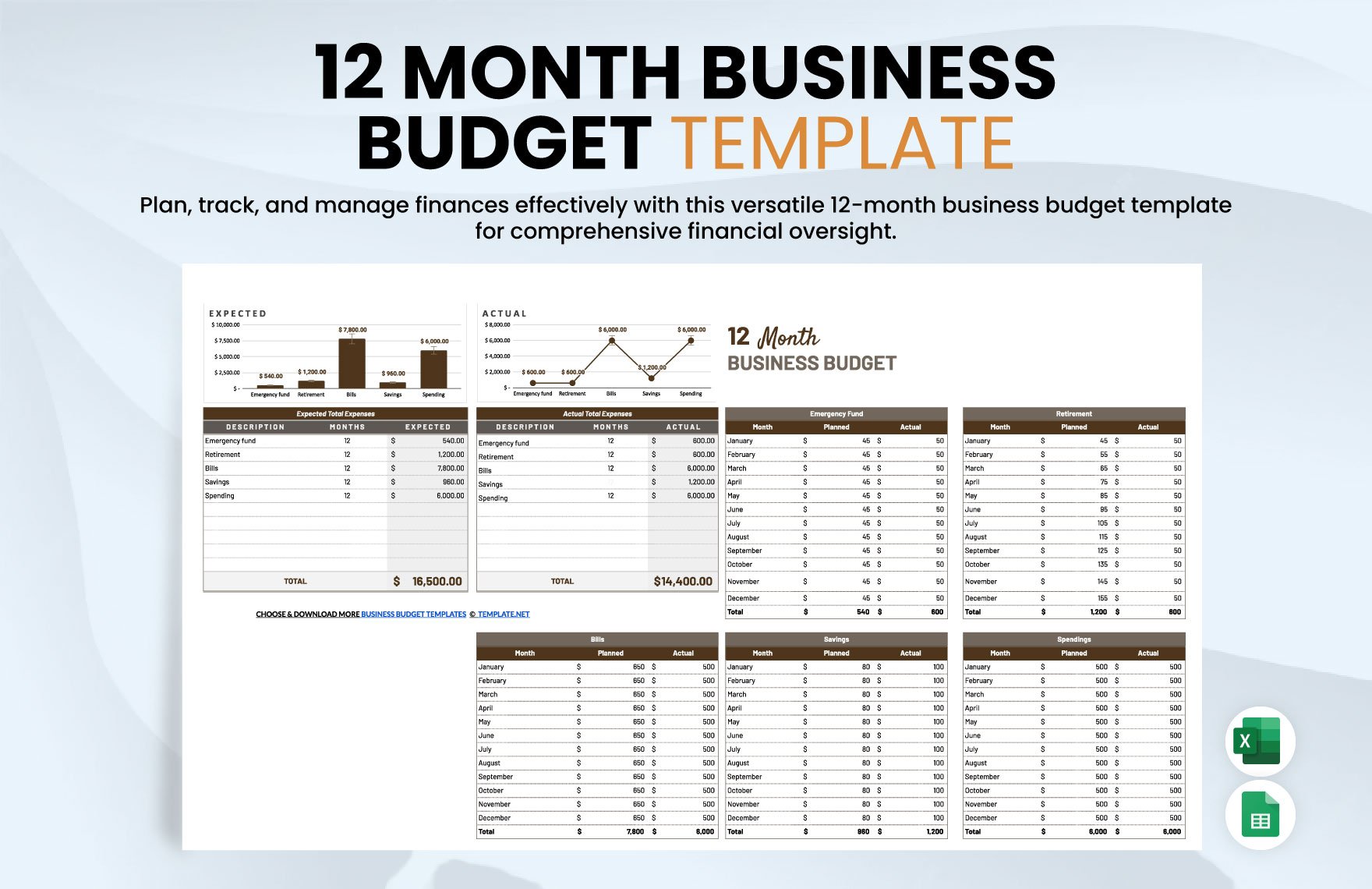

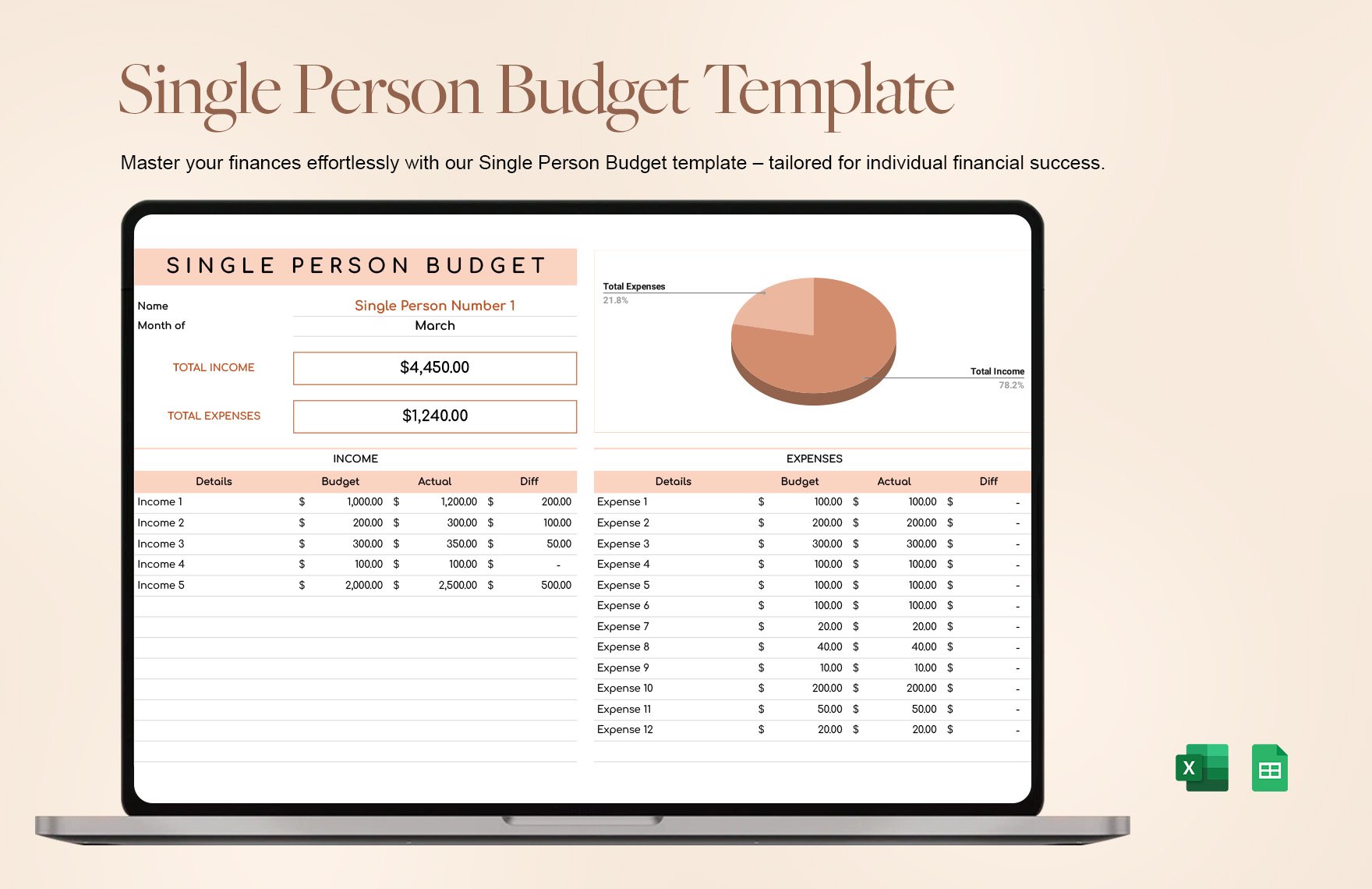

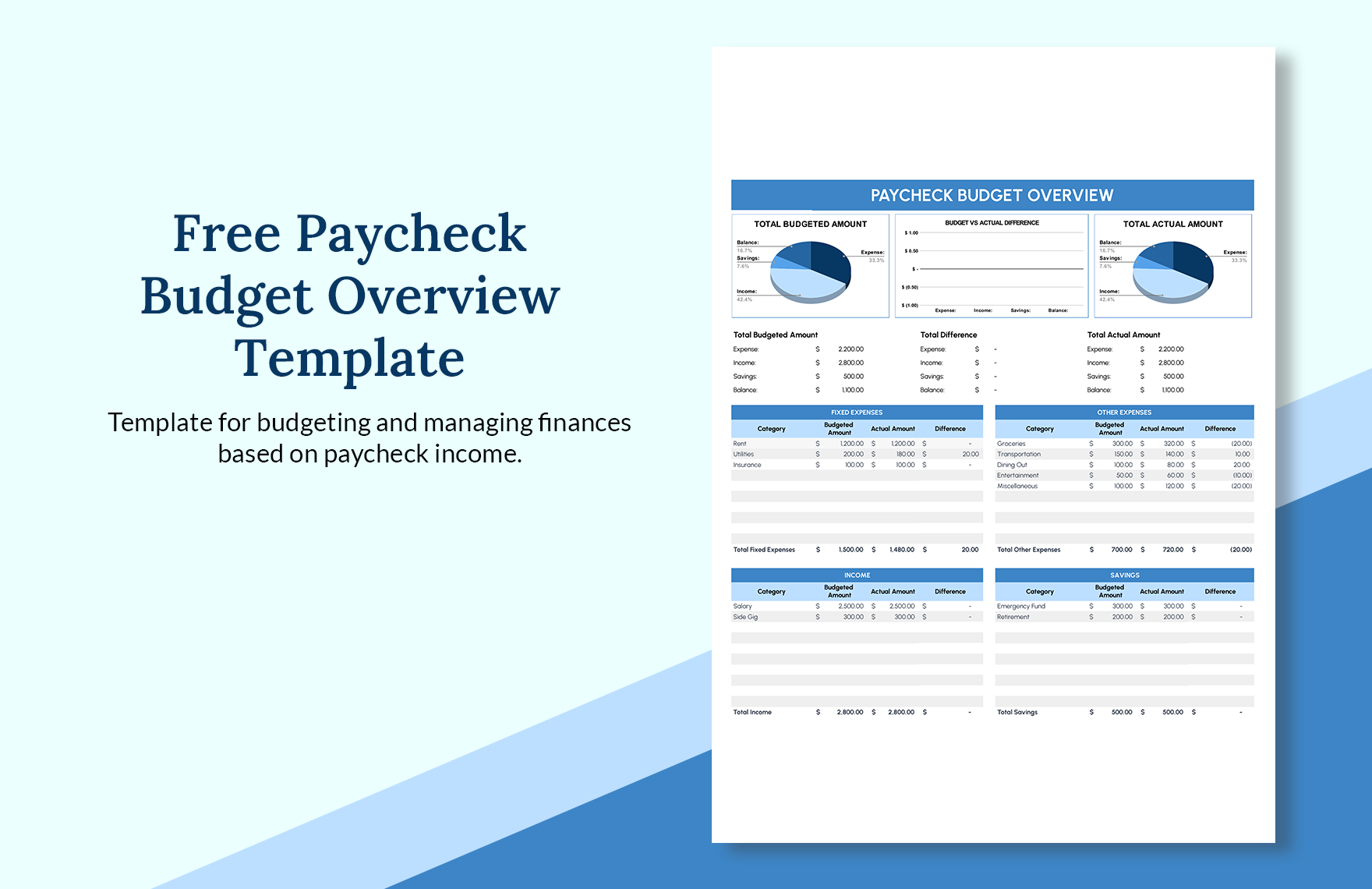

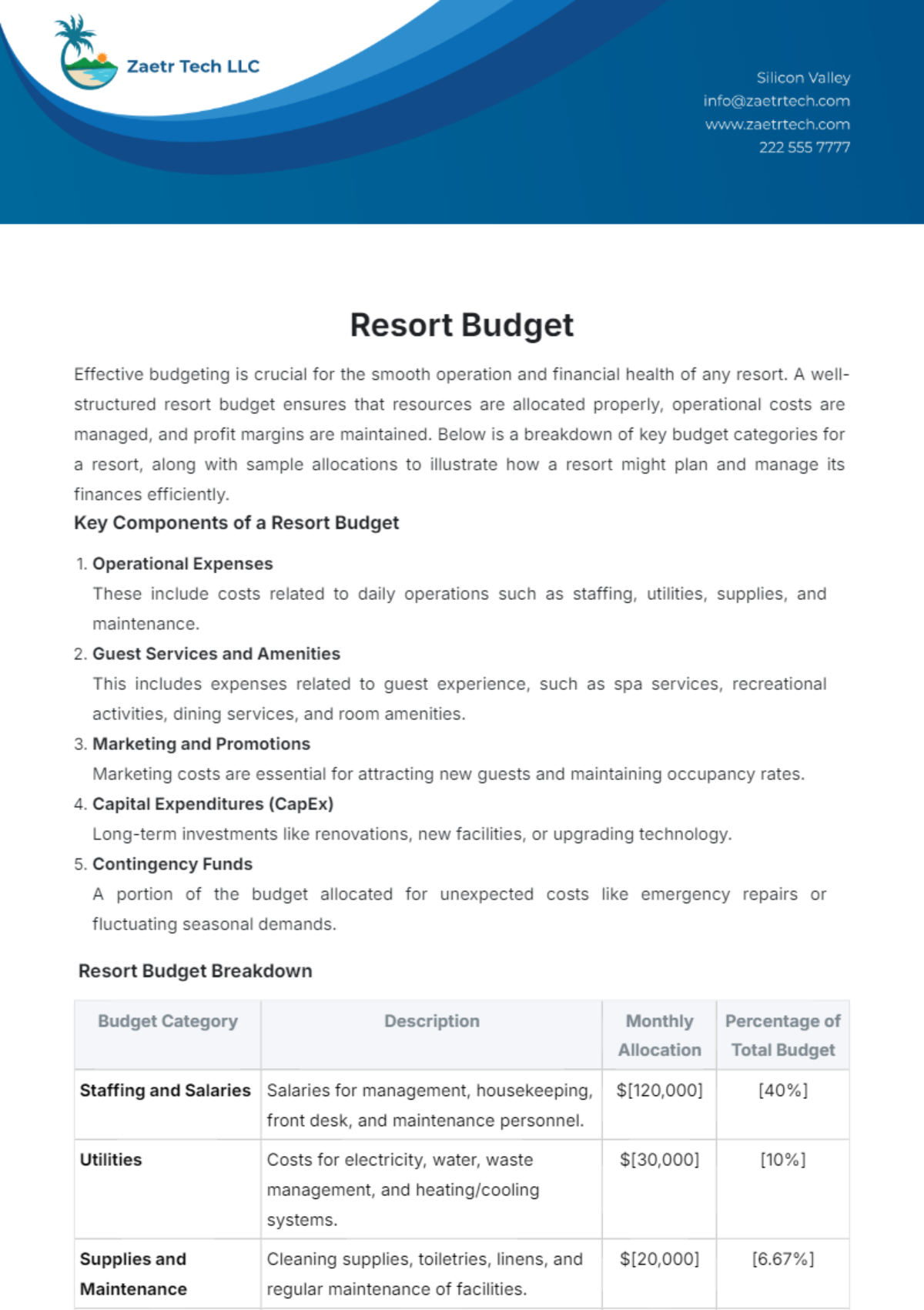

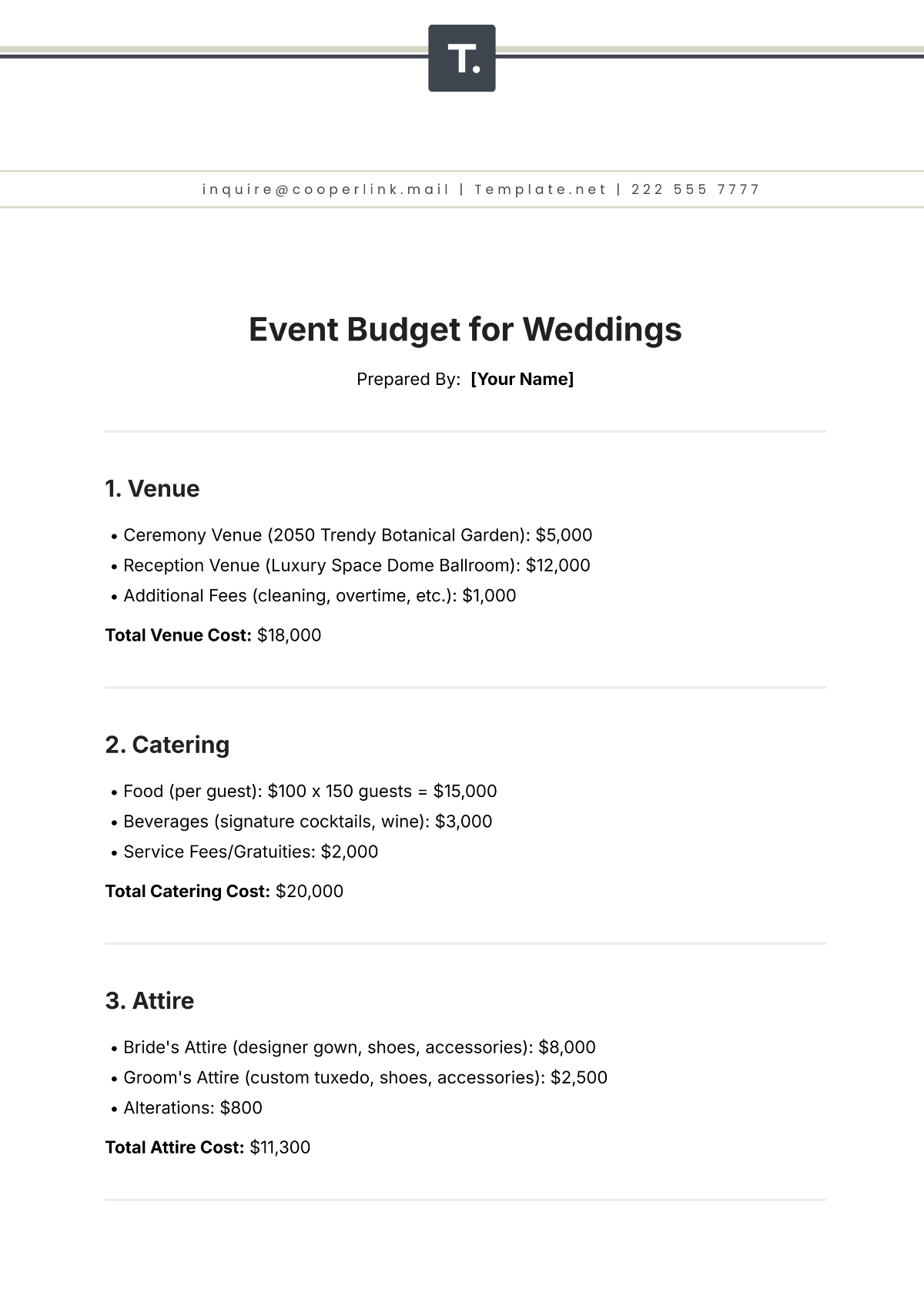

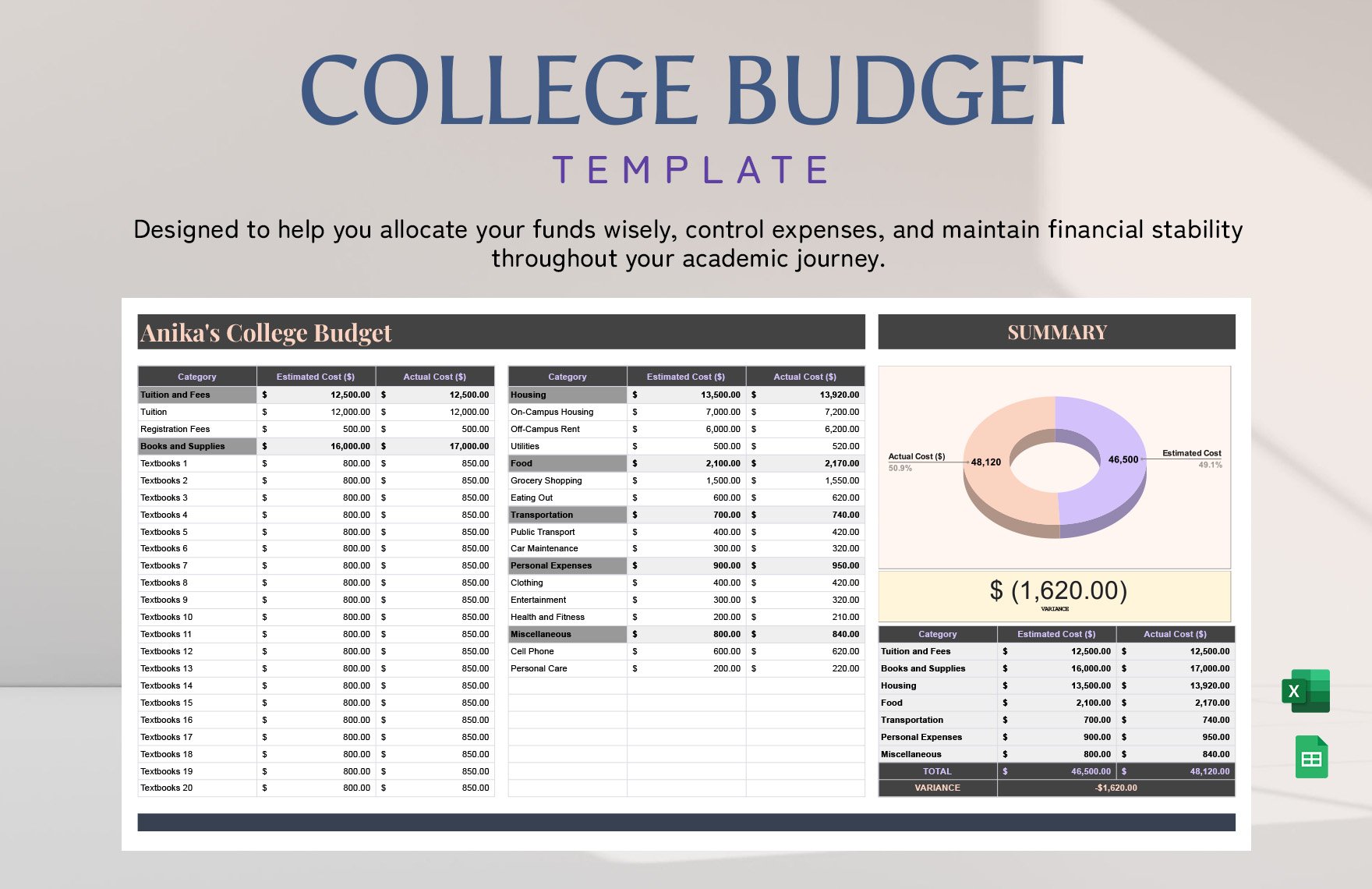

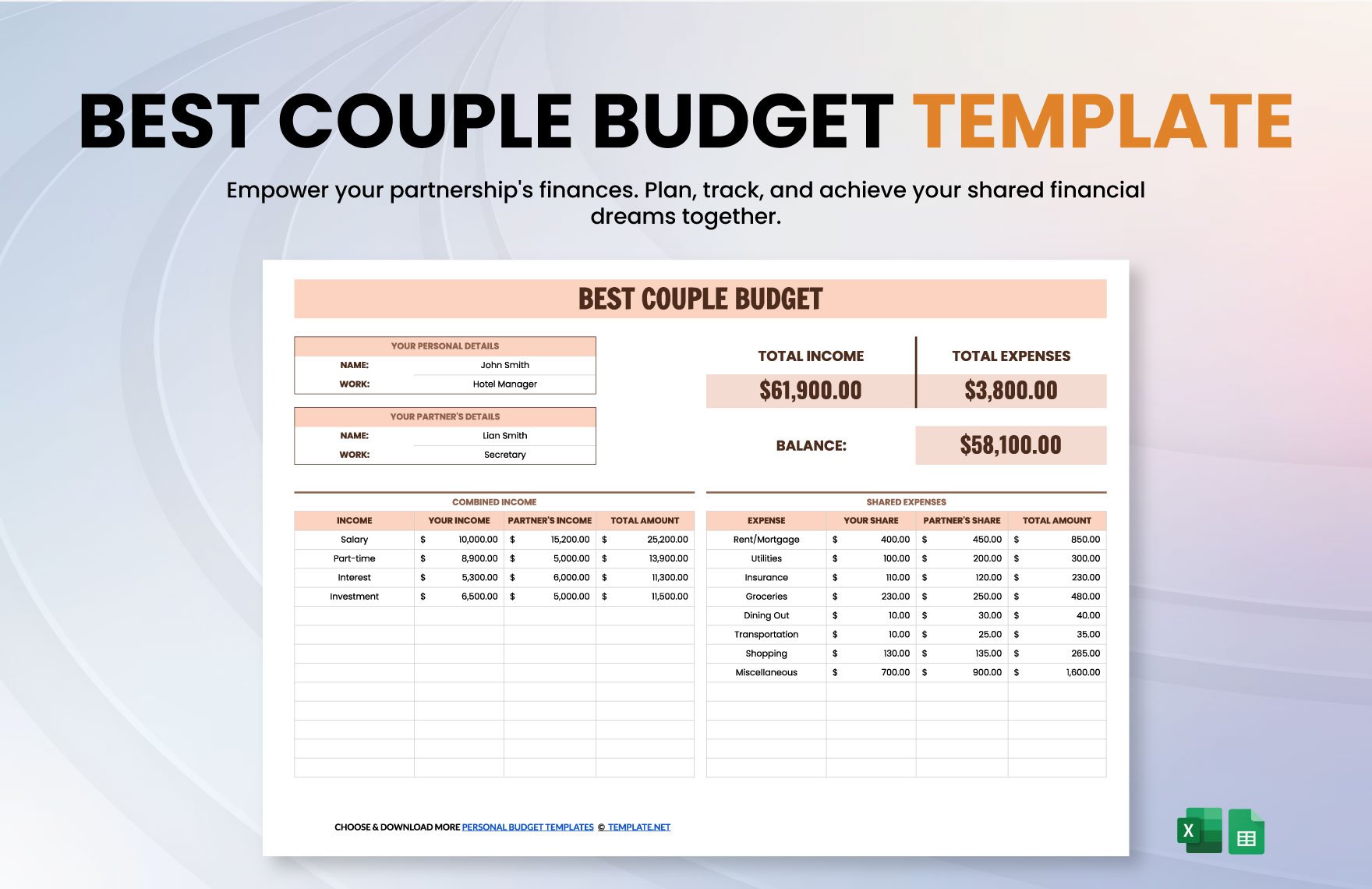

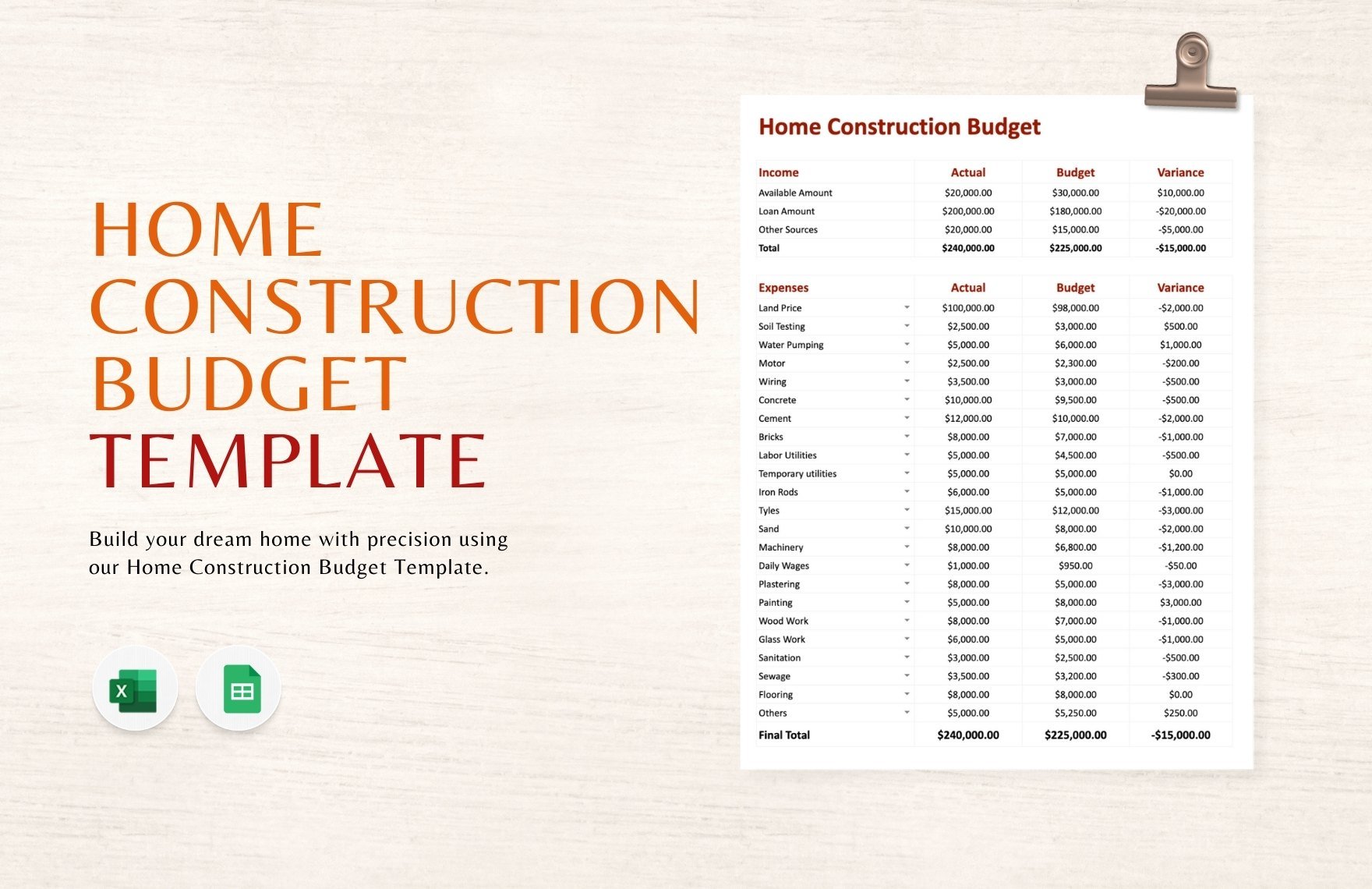

Bring your Financial Planning to Life with Budget Templates from Template.net

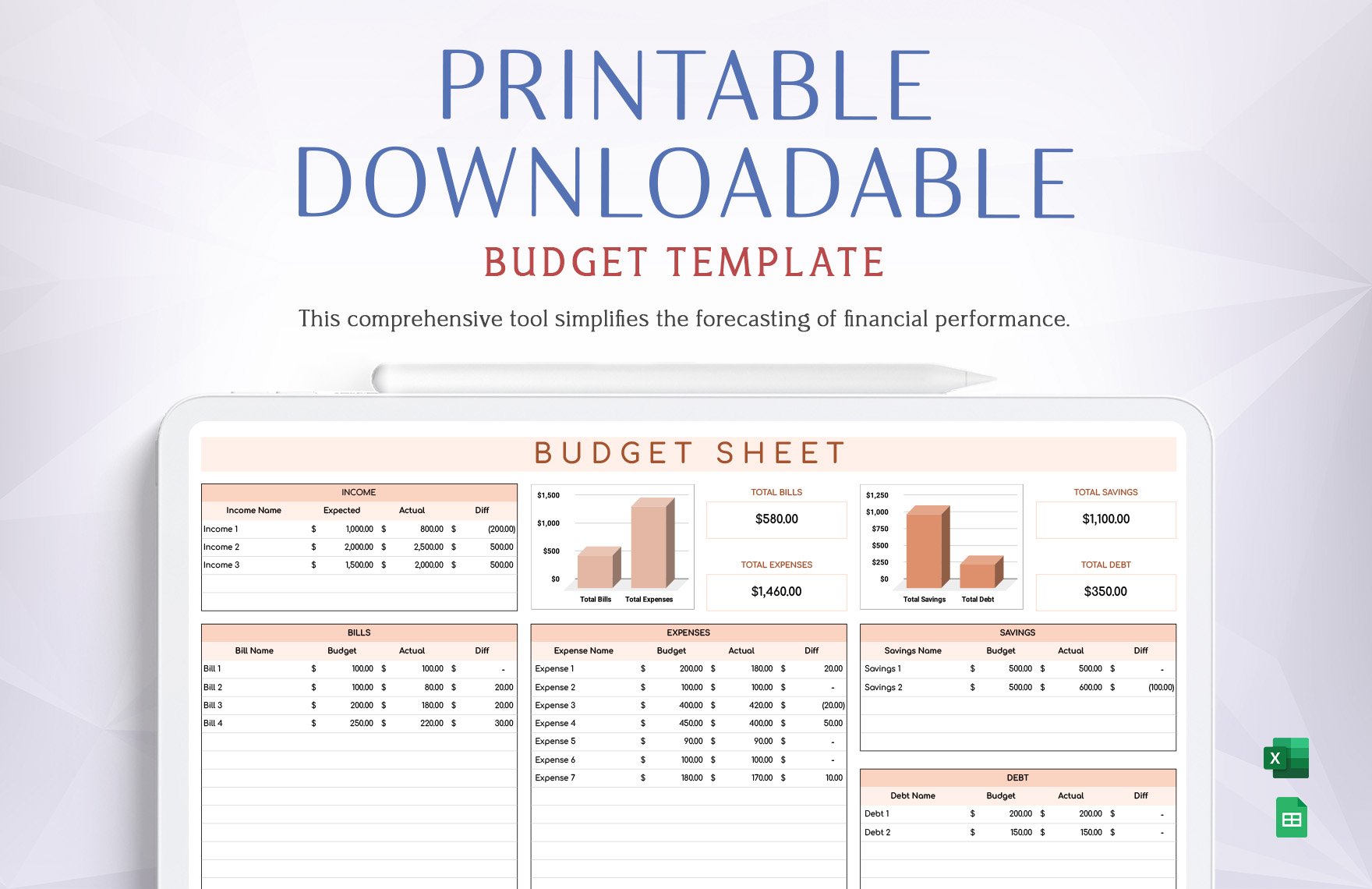

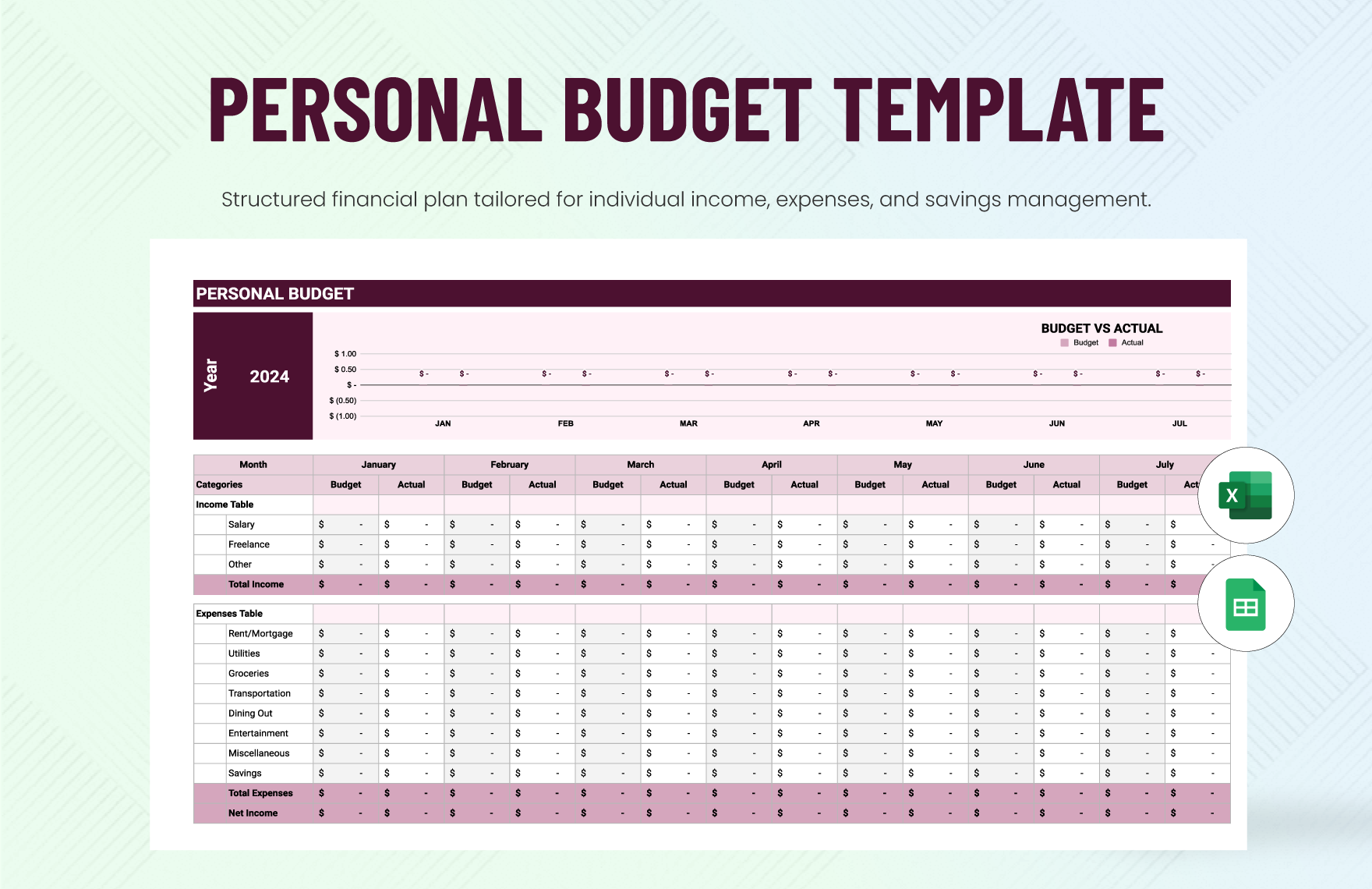

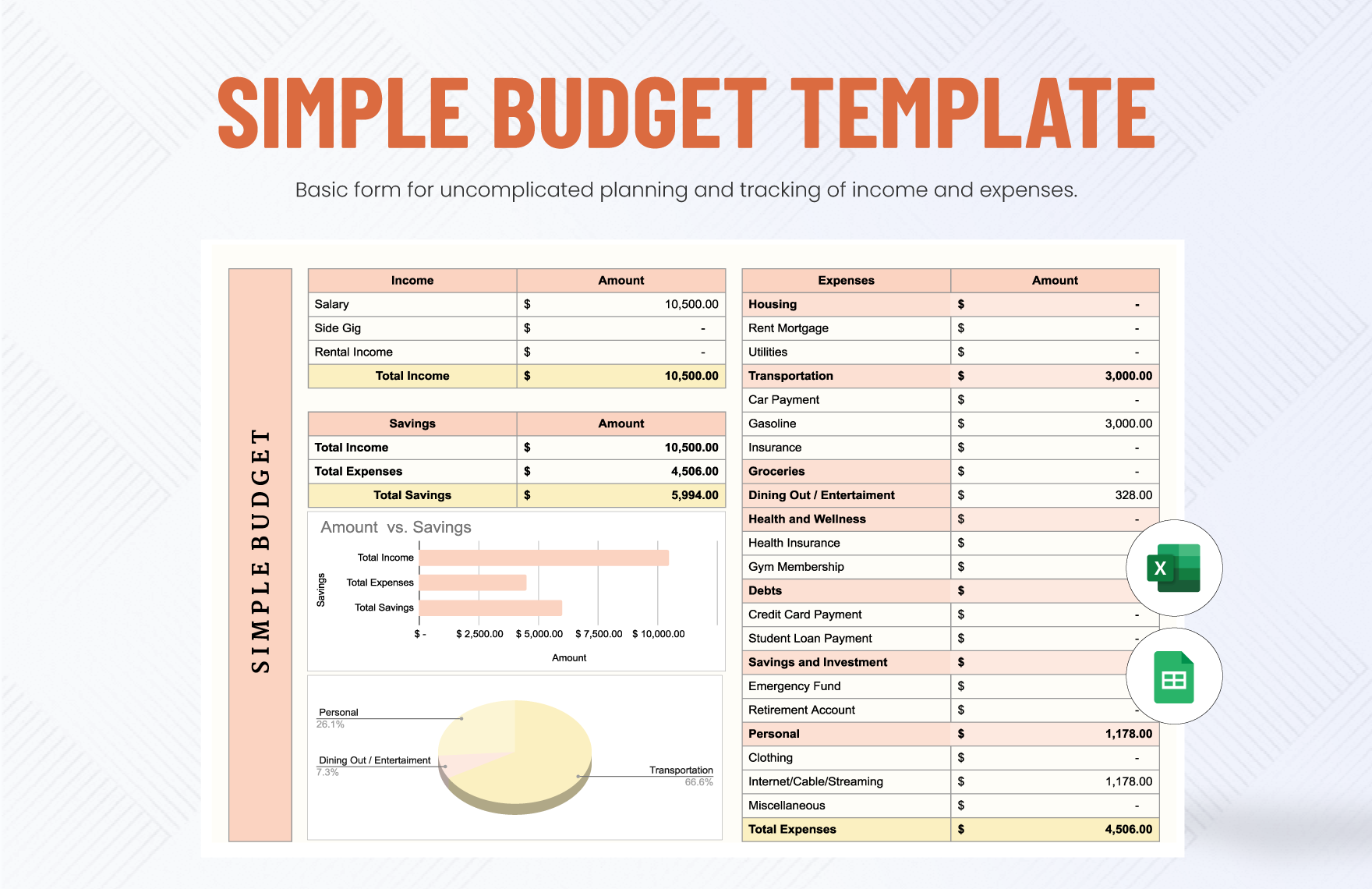

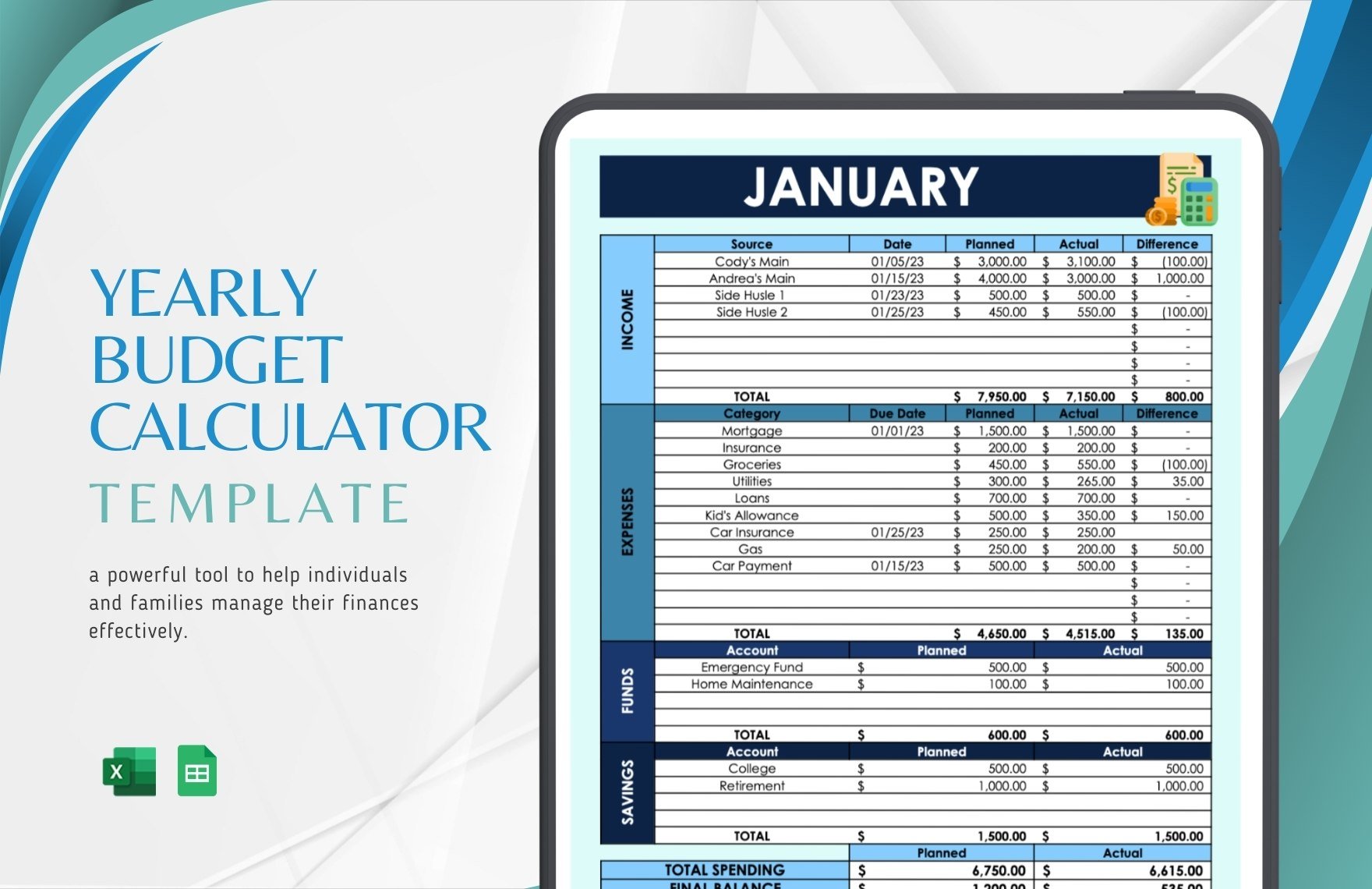

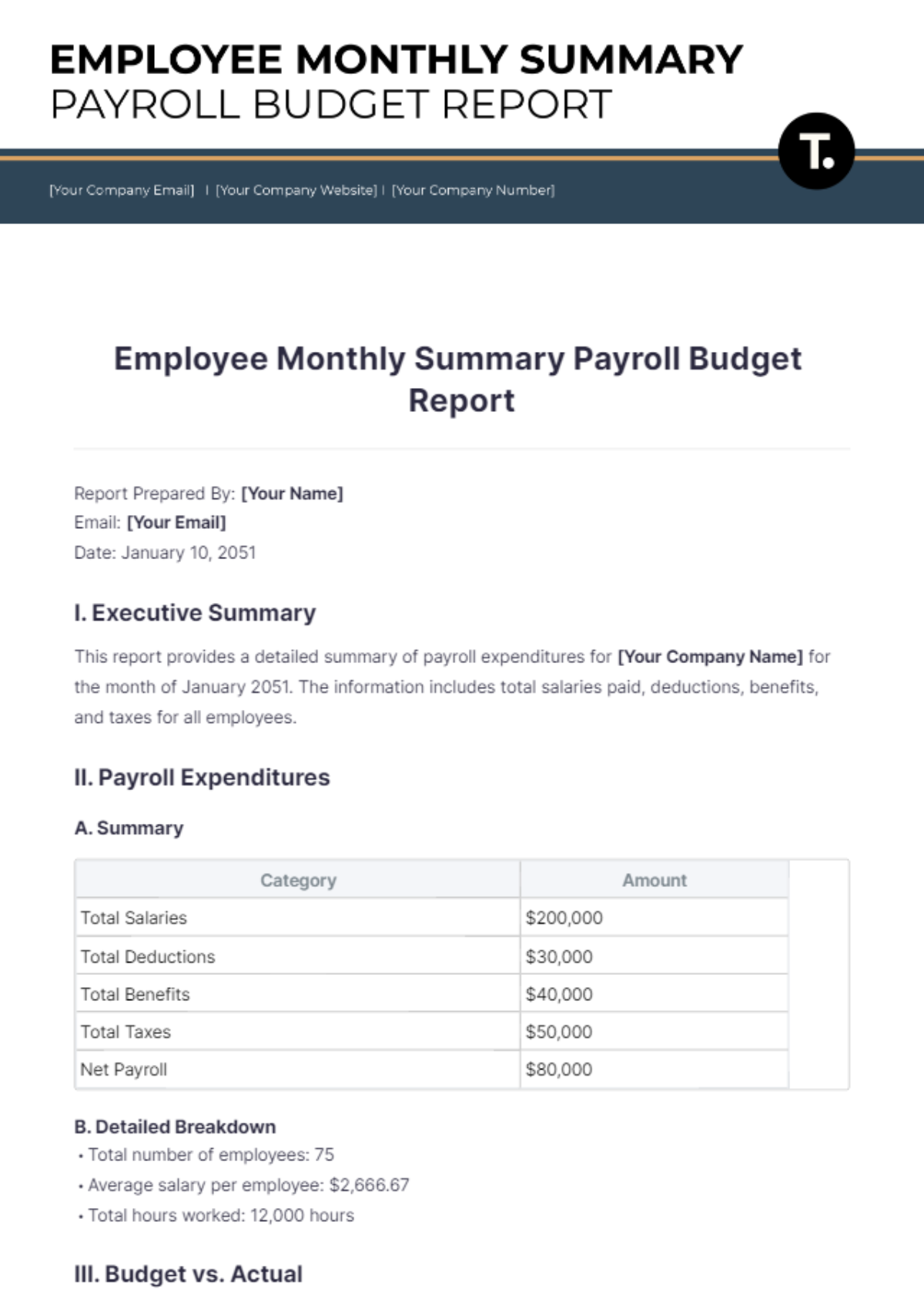

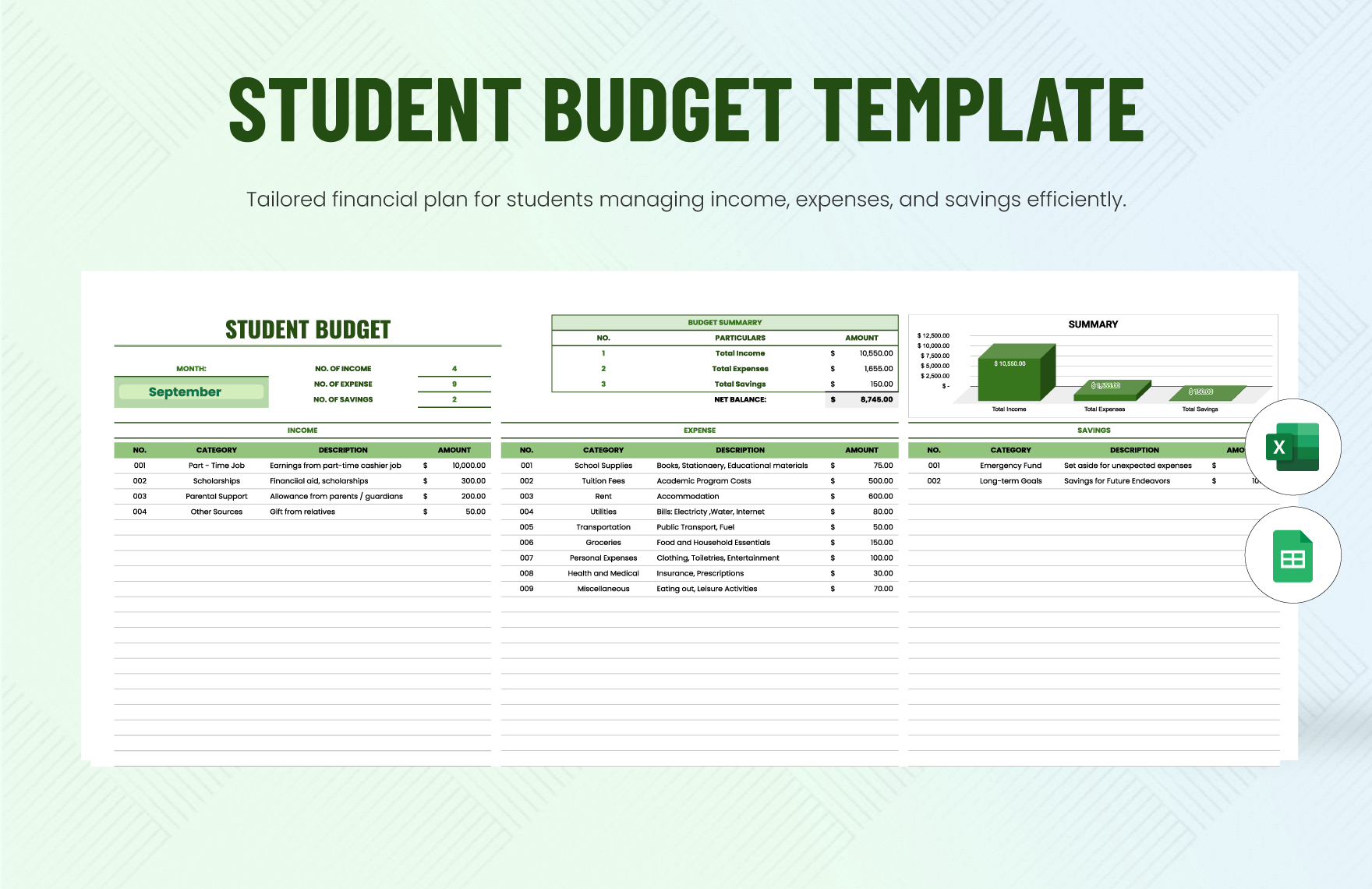

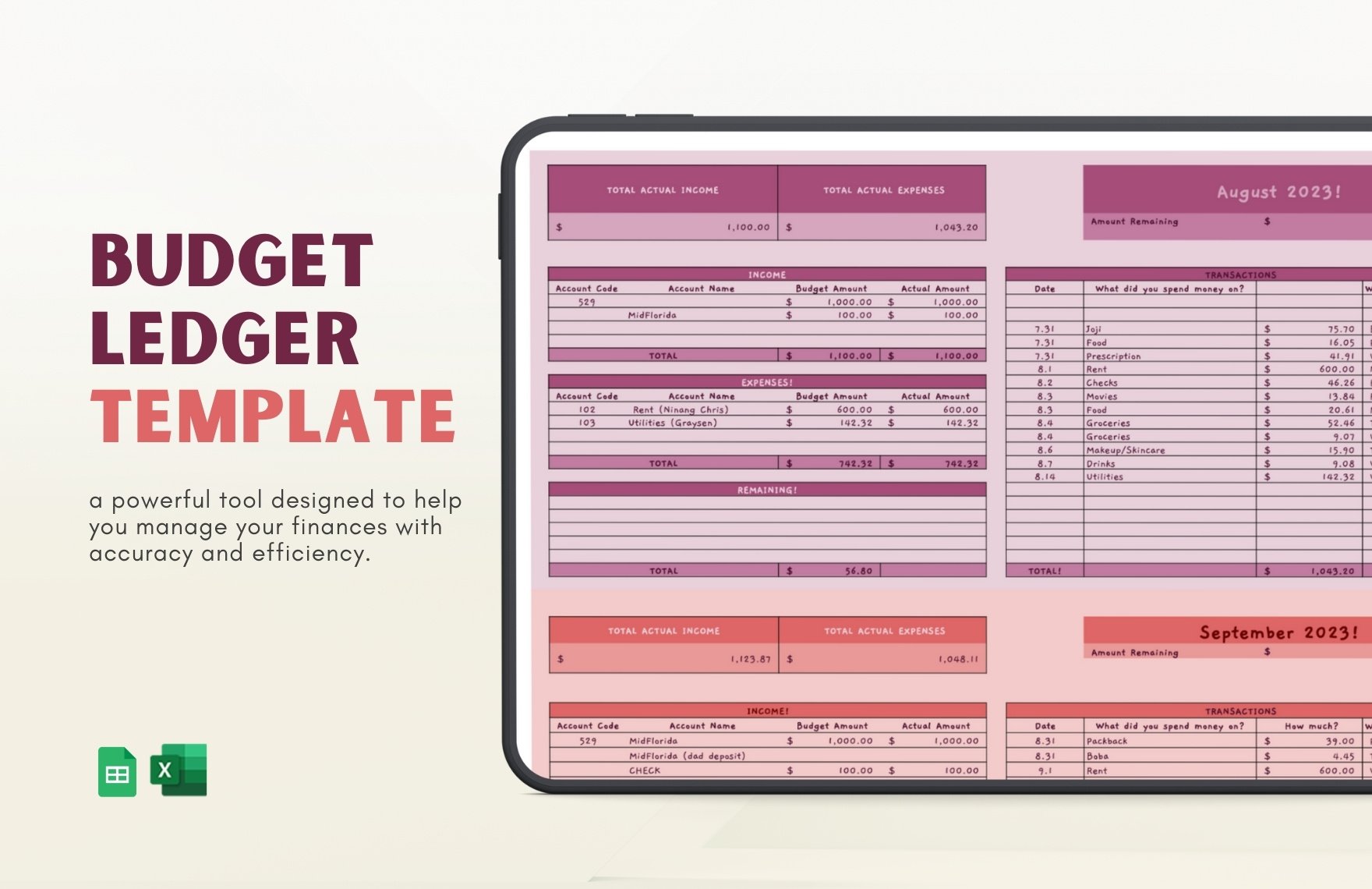

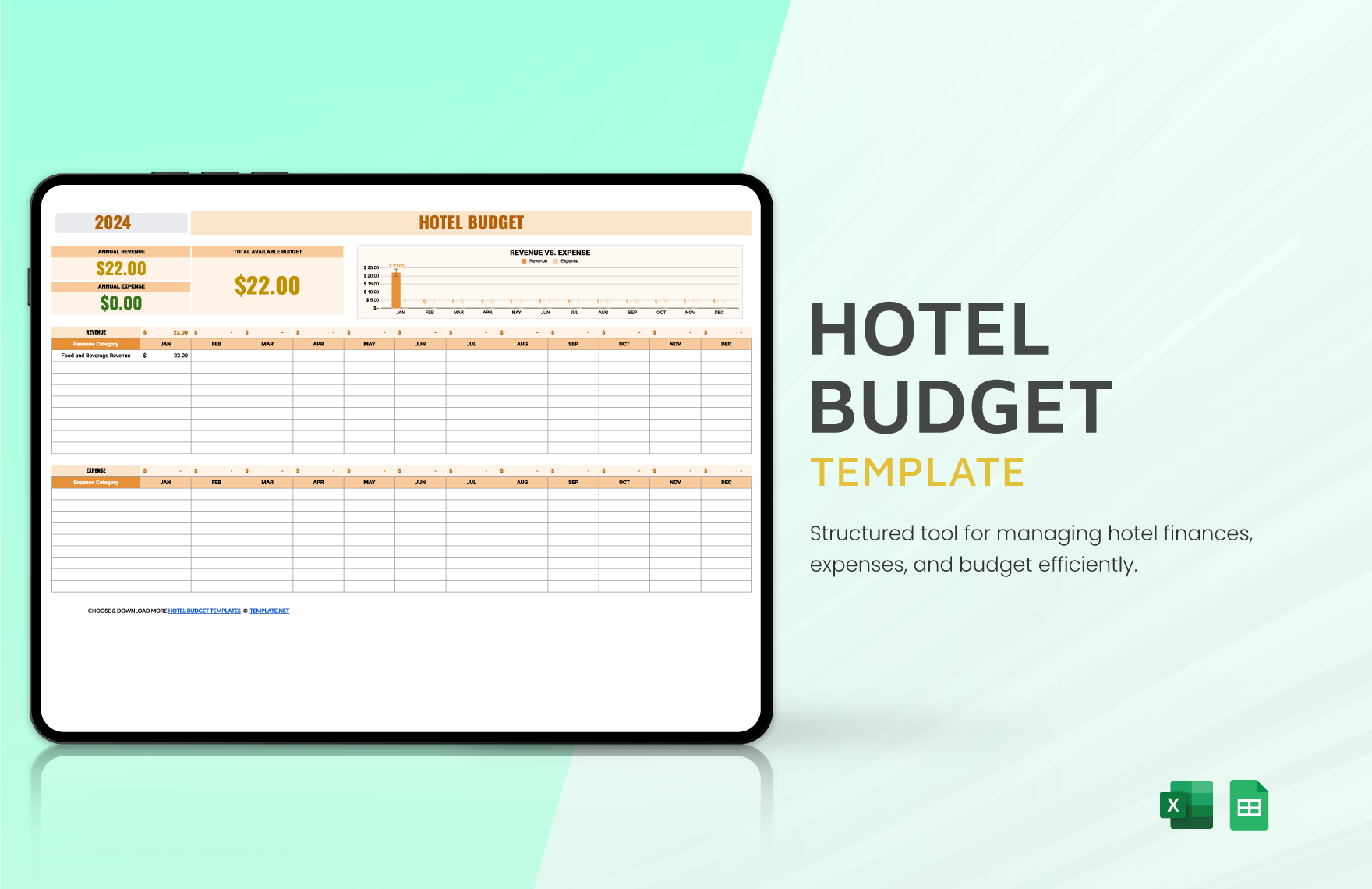

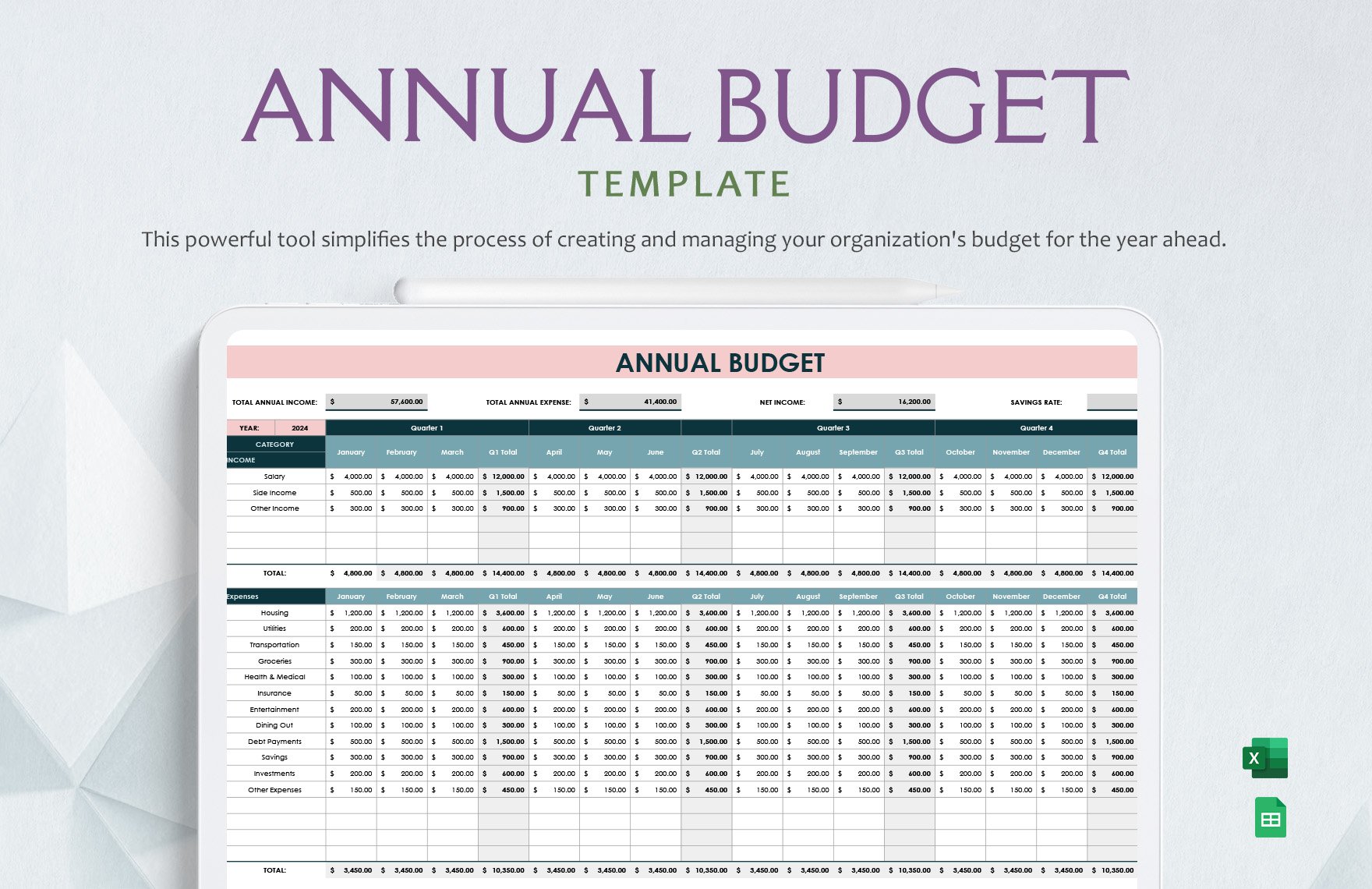

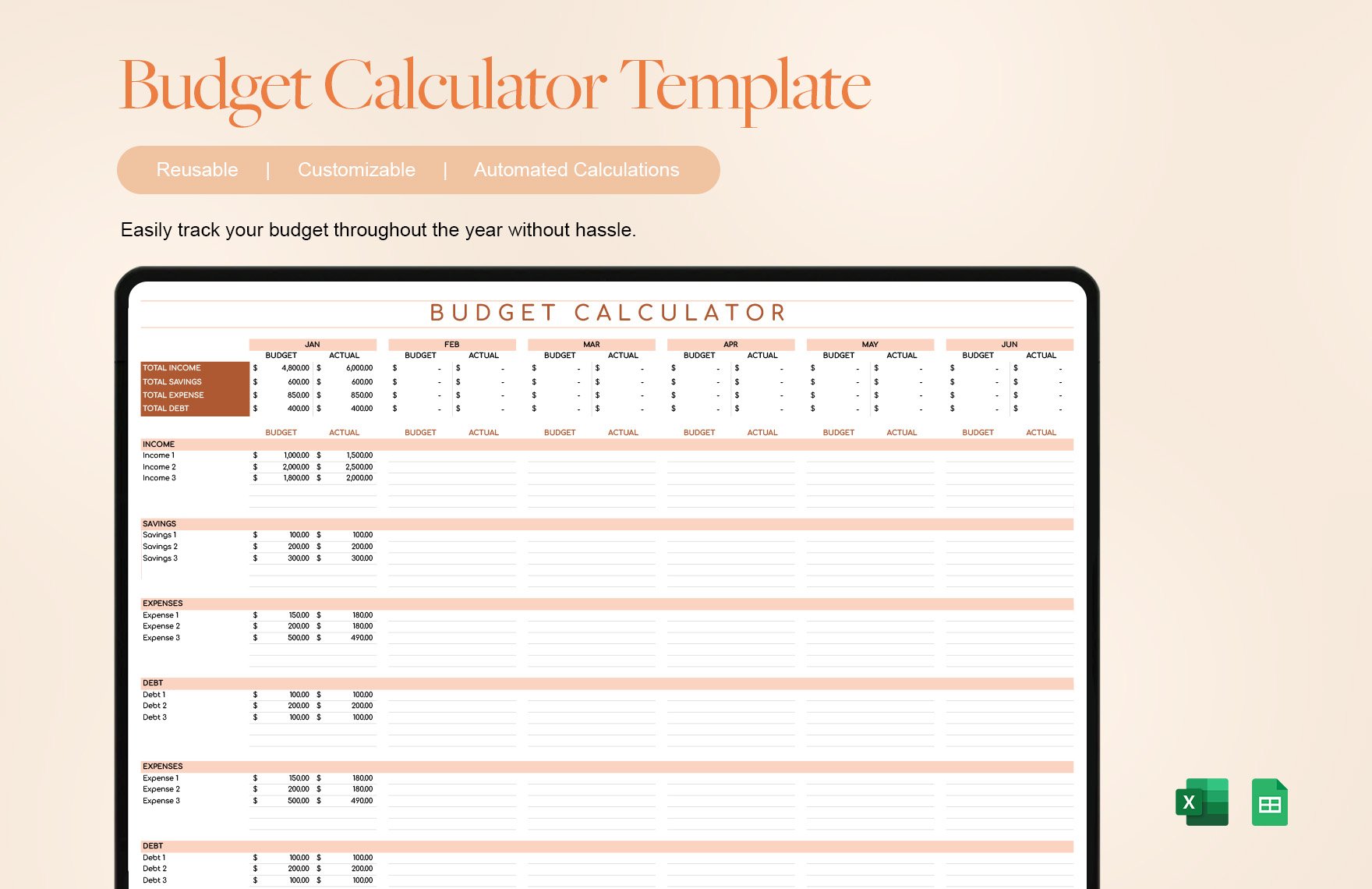

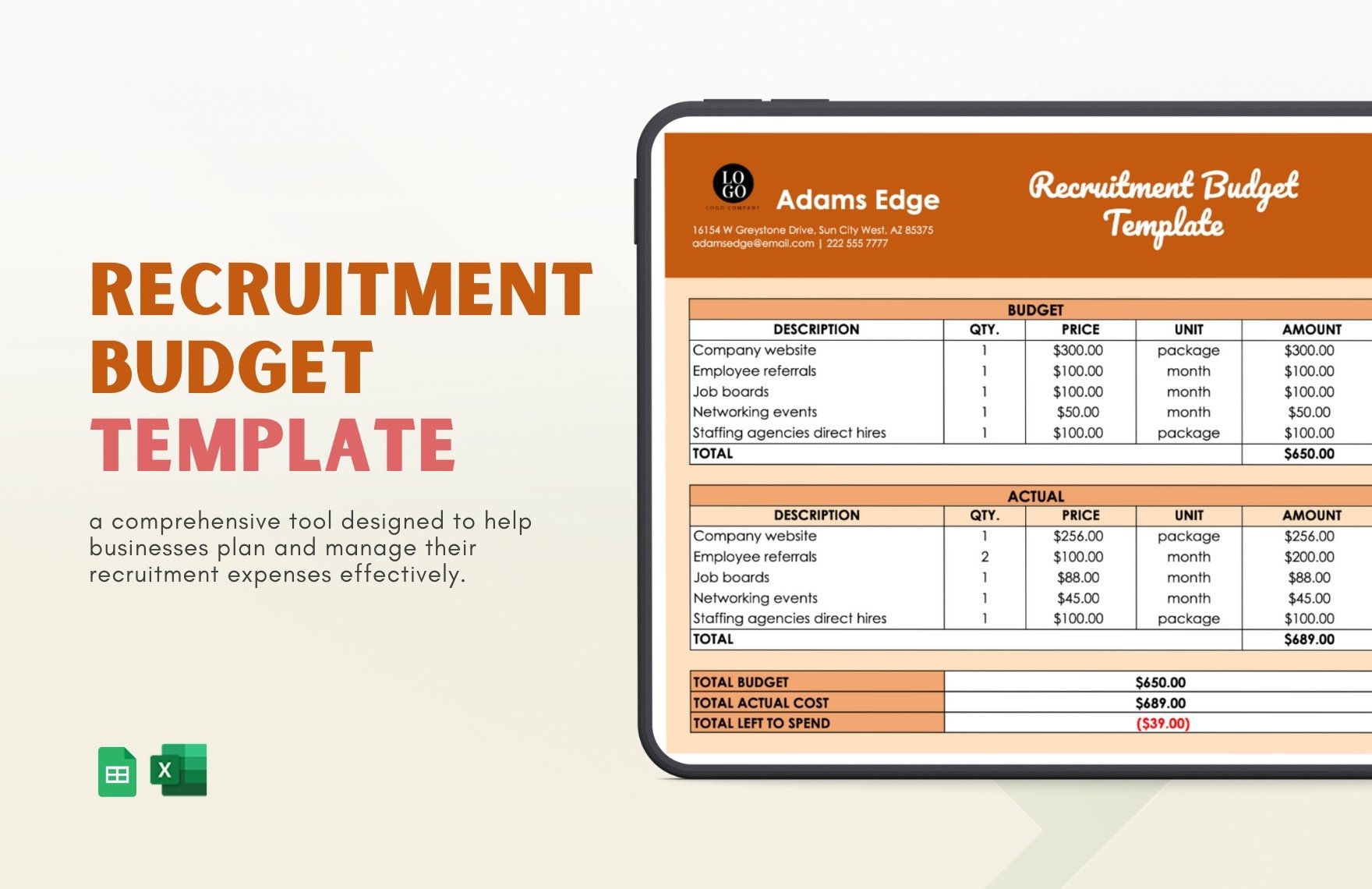

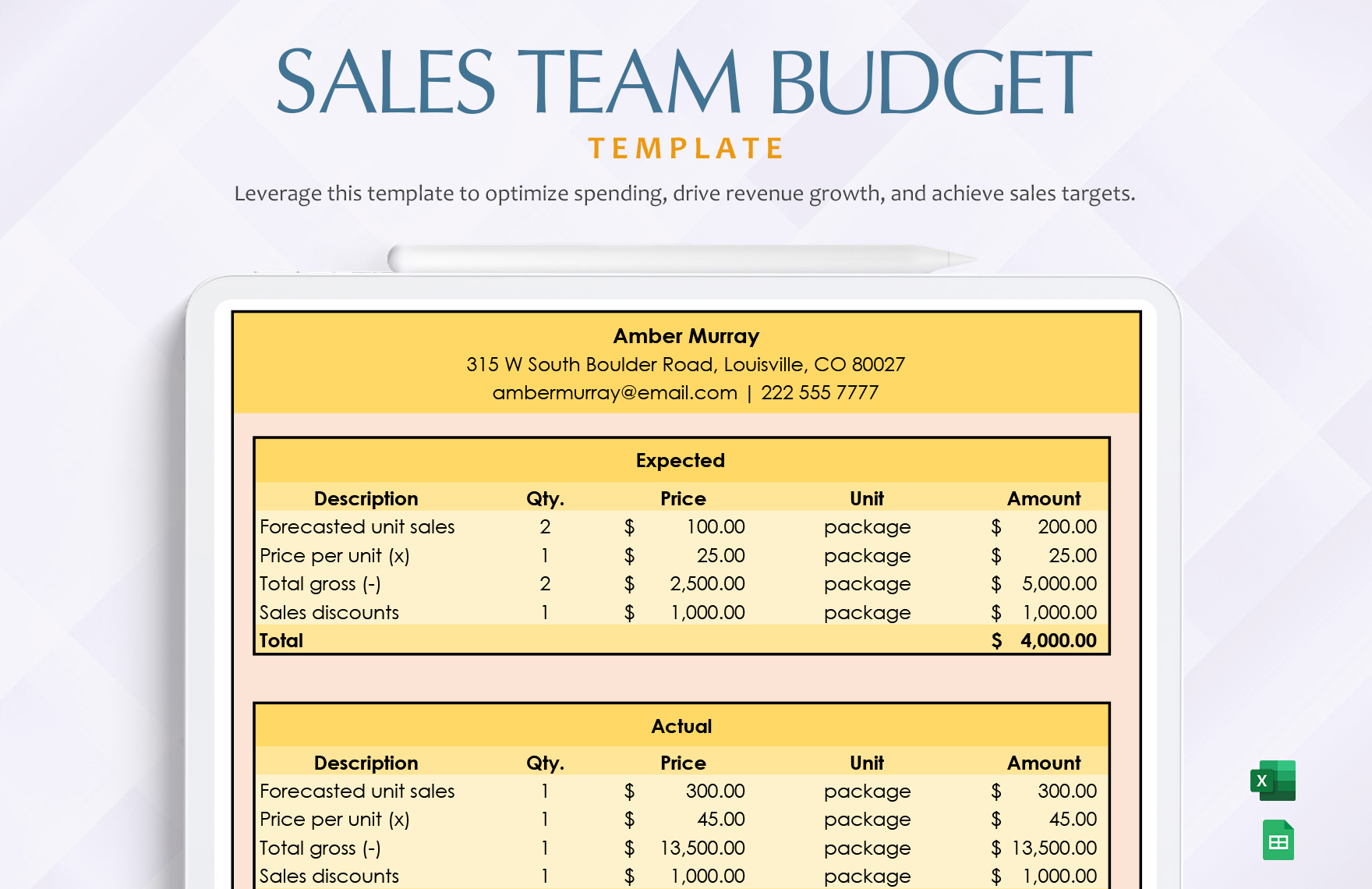

Keep your financial management streamlined and efficient by utilizing Budget Templates from Template.net. Whether you're an individual, a small business owner, or a financial advisor, you can effortlessly create professional-grade budgets that meet your unique needs. Budget Maker, and elevate your financial literacy by engaging stakeholders with clear presentations and projections. Use these templates to promote internal budgeting workshops or invite partners to quarterly financial reviews. Each Budget Template comes with customizable sections, such as time periods, categories, and expense tracking. No advanced skills are required, thanks to our user-friendly interface. Professional designs are downloadable at no cost, ideal for both print or digital distribution through social media channels.

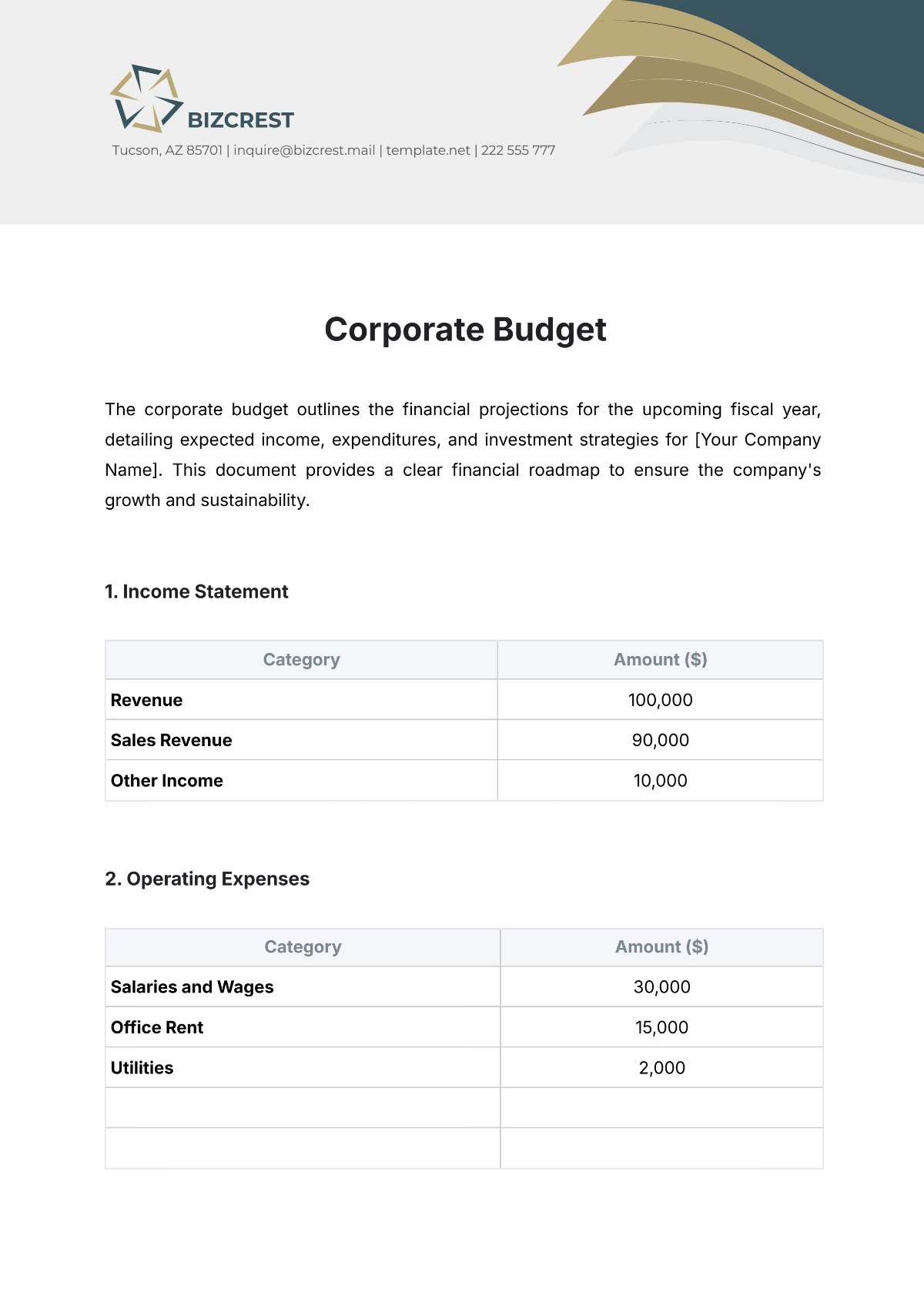

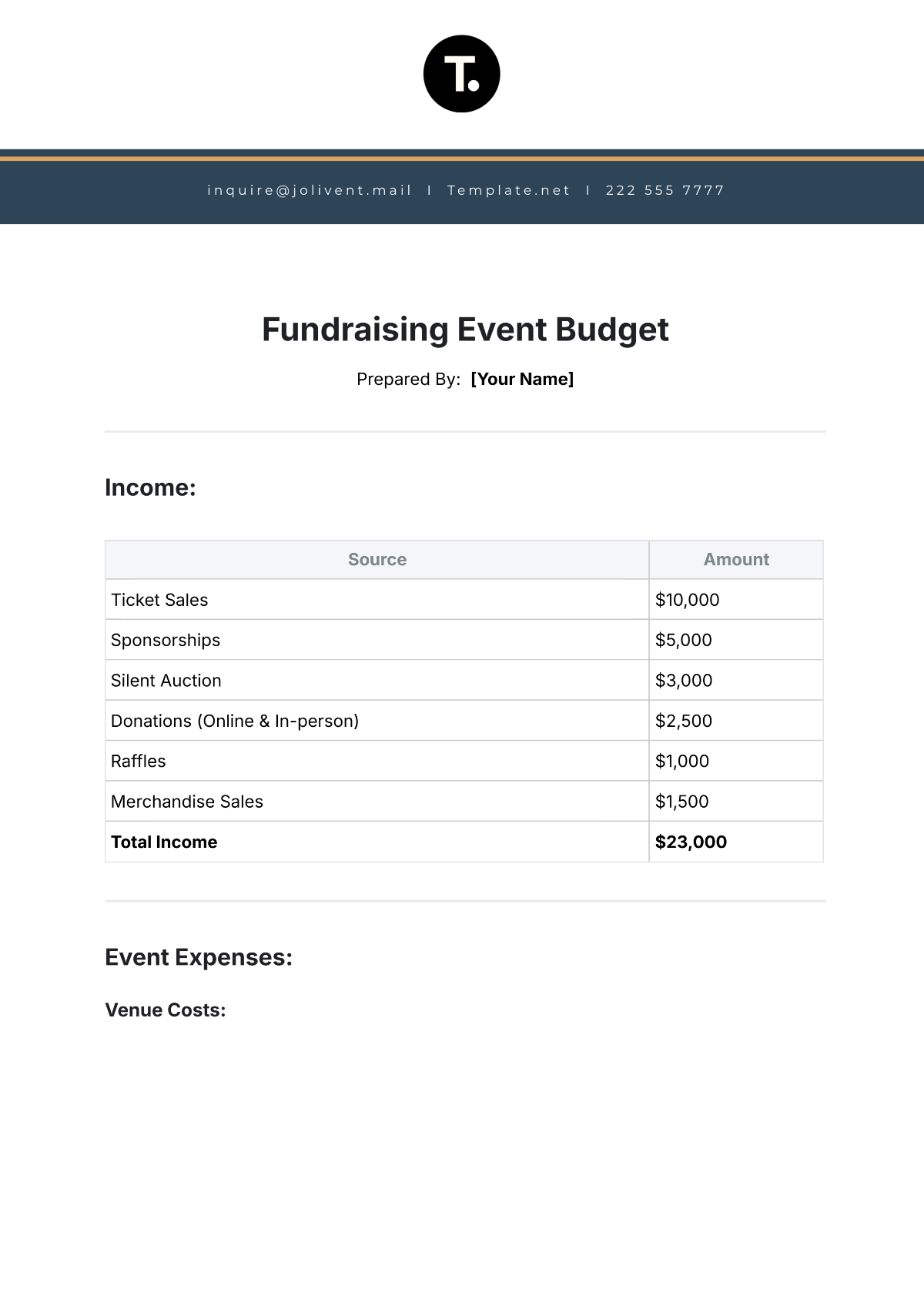

Discover the many Budget Templates we have on hand that cater to various financial scenarios and objectives. Start by selecting a template that best fits your goals, swap in your company logo or personal assets, and easily tweak colors and fonts to align with your branding. Add advanced touches by dragging and dropping icons or graphics, applying animated effects, and utilizing AI-powered text tools for intelligent content suggestions. The possibilities are endless, ensuring a fun and skill-free process. Our library is regularly updated with fresh templates, so there's always something new to explore. When you’re finished, download or share your budget effortlessly via print, email, or export it to publish directly on social media, making it ideal for dissemination across multiple platforms.