Defining Payroll – How it Works and Why it Matters

What do startups and larger enterprises have in common? Both are in dire need of effective payroll systems. Having that in place ensures a proper hold on not only your company’s financial management but also its legal compliance. It’s worth remembering that payroll is not just something pragmatically useful, but it is also tied to any business’ financial status and image. Anybody who improperly manages faces poor employee retention and a myriad of fiscal uncertainties. Who would ever want to find themselves in such a bleak situation? Buckle up and let’s see what we can do to help define payroll for you, how it works, and why it matters to your operations.

Defining Payroll – How it Works and Why it Matters

What is Payroll?

To help us define payroll, we must first acknowledge what it isn’t. Some people have difficulties differentiating between payroll and payslip. The former is to keep, while the latter is meant for release. A payslip is what employees receive as proof of correct compensation. Payroll is something kept within your company to help you manage your finances better. In the event of legal concerns regarding employee pay, then payrolls can be used either as the employees’ proof of company mismanagement, or the company’s evidence against an employee’s claim similar to issues about the Clark County School District (CCSD) pay glitch as posted in News Las Vegas.

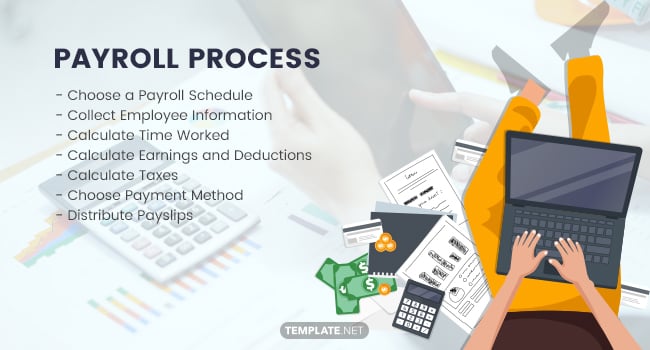

Payroll Process

Regardless of whether you do it manually or with the use of a payroll software program, what’s important is that the calculations follow the requirements of the Fair Labor Standards Act. Among the factors that guarantee accuracy would be the listing of how many hours each employee rendered over a specific time period, the agreed-upon salary rate, any additional pay, and the necessary deductions. For a much clearer picture, take a look at the following:

Choose a Payroll Schedule

Know your financial status before you fix your payroll schedule. Weekly, bi-weekly, monthly, or bi-monthly, are the schedule options that you base your payroll calculations. Each payroll schedule mentioned has specific pros and cons that have a substantial say on your business’ budget management. Check out both its advantages and disadvantages below.

A weekly payroll schedule is easy to calculate since there is only a short interval to consider. However, it can be costly to prepare and release a copy every week. A bi-weekly has the same pro with weekly, but it is more inconvenient for the accountant to calculate the amount since this comes in distinguished dates. A semi-monthly payroll schedule enables the accountant to carefully calculate the amount from the worksheet and timesheet, which makes it more conducive. The monthly payroll schedule is not costly to run at all, but the concern is with the budgeting since this has a longer period to take account.

Collect Employee Information

Confidentiality is the utmost concern when it comes to gathering and keeping employee information for running payroll. This typically contains general information, including the employee’s full name, birth date, occupation, address, and his/her government information. Next are the time and days rendered. You may also refer to this data from the timesheet and work schedule of the employee. Make sure to follow the policy and procedures of accessing your employee’s information.

Calculate Time Worked

Your calculations will only depend on your salary rate considering each employee differential. For employees, each minute counts. That is why planning on how to compute existing minutes shall end precisely. For instance, your employee was 15 minutes late and had only spent 7 hours and 45 minutes. If it’s hourly based, you may calculate the existing 45 minutes into a decimal by dividing it by 60. Regardless of the product, you now multiply it by your hourly or daily salary rate. Make sure that all your calculations are correct to avoid inconsistencies in your end.

Calculate Earnings and Deductions

Right after you calculated the time worked, you may now calculate your employee’s earning for the entire payroll period or the gross pay. Then, you deduct mandatory deductions such as late, absences, penalties, and others that are unmentioned.

Calculate Taxes

Government-mandated payroll taxes are additional amounts that are included in the payroll calculations. Failure to withhold such amount, due to administrative glitch, is left to the business’ responsibility.

Choose Payment Method

Numerous payment methods are free for business owners to consider. Paycheck, direct deposit, payroll cards, and cash are the primary and common payment options. If you evaluate which from which, you also give weight on the time and cost of each option.

Distribute Payslips

It’s typical nowadays that payrolls are relayed via email. Sending days before payday is advisable in case of payment adjustments. The owner must assure that the crediting of payment should take place before or exactly payday. Late distribution of payslips will negatively affect you and your business.

Importance of Payroll in Business

As mentioned earlier, payroll covers the majority of the company overhead. For sure, its impact on business operations is no joke. Payroll can either help your business outgrow or end to lose. Being aware of the payroll essentials, a company might flourish into a progressive one.

Payroll Structures Company Morale

Payroll reflects the financial stability and ability of a company among competing businesses. This advantage does not only impact as a whole but also with employee profile and morale. Employees tend to question a company’s capacity to function once payroll issues and discrepancies happen along with the payroll calculation release. Late salary credit once happened affects the employee’s competitiveness in performing tasks. When this happens, like a boat without balance, your business sinks, your company reputation is affected.

Sustain Employer-Employee Rapport

When morale flourishes, rapport enters. Employees are one of the resources that a company should take good care of. Connection, communication, and transparency are a few of the factors that employees seek for assurance. Issuance of well-calculated and presented salary payslip on time is the best that a payroll professional can do. Payroll contains records and reports of employee’s net worth inclusive with benefits, increments, and other considerations. Having met these responsibilities, the company’s workforce will opt to trust the payroll process and the business in the long run.

Enables Company to Determine Areas of Improvement

When you produce payrolls accordingly, then analyze it, the higher the chances of releasing accurate forecasts. The gathered payroll data influence your business decisions. With this, you tend to check the cost and its impact in either small or big businesses. Not only that, payroll guides you in business decisions but also with the planning advancement of your company onward. Payroll does not limit you to where your business views reach you. Instead, it expands your concerns into areas in need of improvements. Payroll reflects your financial stability, which is crucial in any business to operate thoroughly.

Incorporate Business Strategies

The payroll analysis lets you incorporate useful business strategies within the operational cost. In instances where there are mishaps in the entire payroll, a professional may come up with a strategy to overcome it. Strategies do not limit you to only new but also improved ones. This tends to help you weigh the necessity of operation expansion. Regularly checking payroll status in business helps you manage your strategies and activities according to a plan. Also, the strategy you incorporate should meet your needs, not less nor pretentious.

Payroll Keeps you Systematic

In any business, being methodically dependent is essential. The process, operations, and management should deal firmly with each other to make the task easier to handle. Payroll, in addition, helps a company trace the financial flows and the workforce updates. When managing a business, there should be a plan and, at the same time, a flow that serves as a guide of the entrepreneurial objectives that structured the company.

Methods to Do Payroll

Started from the manual calculation, today’s payroll calculation relies on technology, or others use datasheets for data analysis before proceeding to computation. Regardless of what method to use, it should leave with an accurate result.

Manual

Generally, HR for business sectors does responsibilities in finance and accounting. That is if there is no specific person or accountant who does that in your company. Manual processing of payrolls depends on the frequency or the time spent of the employee in a day and the corresponding wage. This process requires intensive work and effort from you since this has time constraints. Additionally, this requires consulting for accuracy check.

Software

Nowadays, various kinds of software offer you technical support by providing a structure that users will only input data. This enables you to address concerns on complex computation. This payroll software program will help you (owner of a small business) or your payroll specialist (for large companies) assure that whatever load of payroll you need to finish, will settle at the set time.

Service

For large businesses, availing of services to run extensive payroll processes is advisable. Not only that, this helps in payroll calculation but also in keeping HR responsibilities on hand. This enables integrative relationships among the company workforce.

Payroll Deductions and Reimbursements

Any company has to repay their employees on accountable business-related expenses that they spent using their personal money. This additional amount shall appear to any salaries given that there is proof of cash release. Employee exemptions on tax requirements are applicable in processing reimbursements. No one can deduct tax on the reimbursed amounts included in gross pay calculations.

If there’s one thing to take away from all of this, it’s the fact that payroll matters. Your business venture will fall apart without it. Meticulous execution and a keen eye for anything out of order are required for your company’s payroll preparation. With enough mistakes, the chances of once-avoidable difficulties will pile up and play out like a form of the ripple effect. Now that you are better educated on the topic, you can take what you’ve learned and applied it in a way that will help not only in keeping your business afloat but will also make it thrive.