How to do Bookkeeping for Business

It’s easy to lose track of where our money goes. Sometimes we misplace change inside our pockets, or we forget about hidden wads of cash placed inside cookie jars. While those situations seem normal and benign, overlooking inaccuracies in business can be disastrous and detrimental to companies. Those with plans of starting a business need to take time in learning the ropes of business accounting and bookkeeping. If you’re new to the latter, then don’t fret—we’ve got everything you could possibly want in this complete guide to small business bookkeeping! Details like the definition, significance, and the actual methods to choose from await you.

How to do Bookkeeping for Business

Bookkeeping: The Collection of Records

In its simplest definition, bookkeeping is the process of collecting, organizing, and documenting the financial records of the business. It involves gathering the paper trail of business sales, official receipts, invoices, and anything that proves the legal transactions of the company. There are some who confuse it for accounting, and vice versa. Such a mistake is understandable since both are closely related, but key differences separate them. Bookkeeping requires the interpretation and classification of data that are provided by accounting. As a matter of fact, bookkeeping may be seen as just the first step in the general process that is accounting. They are clearly not interchangeable in any way, and instead, the two work in tandem to provide business crucial information.

The Bookkeeper: Archiving the Business Details

The role of bookkeepers is summarized in two points. First, the assigned bookkeeper compiles documents such as cash flow receipts, tax forms, credit collection reports, invoices, bills and credit statements, and payroll records. Second, he or she arranges the materials in order—by month, year, or category—so that tracking the items will not be hard. The bookkeeper is responsible for recording anything that concerns the finances of the company. If you want to create an assessment on revenues, you can check the bookkeeping file to gather the data.

Why Bookkeeping Matters to Businesses

The profession of bookkeeping can be traced back to thousands of years ago. Before the emergence of electronic gadgets to record transactions, humans who participated in the trade of livestock used tokens to document the deals between merchants and consumers. But when commerce developed and became complex, new bookkeeping systems were invented to ease the situation. An article from the New York Times discussing how scientists unearthed clay tablets containing contracts of trade and records of transactions proves that bookkeeping has been around for a long time. Bookkeeping, being the process of archiving crucial financial information for the business, is essential to companies, and here are the reasons why it matters.

Organizing Crucial Business Information

The company should be aware of its assets and liabilities. Through bookkeeping, the business has valuable information about its current stocks. Moreover, it also organizes the list of finances that the enterprise currently has in its file.

Saving Time and Resources

With bookkeeping, companies can save time and energy. Instead of rummaging through thousands of documents to find the item they need, businesses can quickly run through the database to find relevant records. Having a bookkeeper is also practical for developing firms. The management can either choose an employee to be a bookkeeper or hire a professional to do the job.

Reducing Financial Mistakes

A bookkeeper focuses on completing one task—that is, documenting and organizing financial transactions for the company. The bookkeeper(s) pays attention to all the details of financial dealings, thus minimizing the possibility of errors. From the data, the planning team is careful with the processes in the business.

Provides a Clear Image and Direction of the Investment

Through bookkeeping, the business owner gets a clear view of where the investment is going. After all, the numbers in financial reports are tangible evidence that supports the direction of the company. Looking at data helps in knowing how to grow your business in other areas.

Profitability and Growth

As mentioned before, the basis for the improvement of a company is through numerical data. With the assistance of the information accumulated by bookkeepers and the analysis of accountants, the company can figure out ways to increase productivity in the workplace. You can have a business checklist to write down notes about plans for the company.

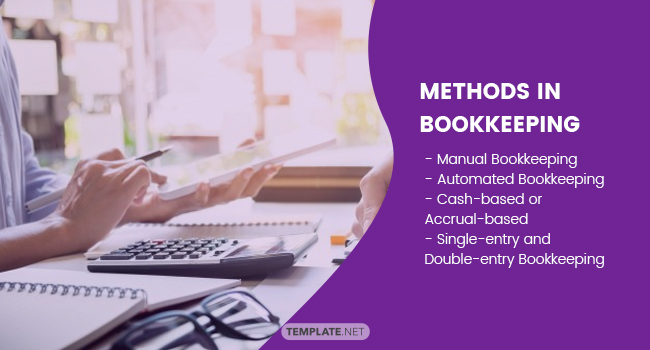

Methods in Bookkeeping

The bookkeeping services industry employs around 1.17 million people. On average, the salary of these professionals reaches roughly $39,000. The workload can be challenging, especially if the company is exponentially larger. With that, different software and tools are available to assist the professionals with their tasks. Although bookkeepers do not perform analysis, accessible software applications offer that mechanism for their counterparts. Going back, here are the methods in bookkeeping that you have to know.

Manual Bookkeeping

As the “traditional” way of bookkeeping, this method includes the use of pen and paper to record the financial statements of the business. Sometimes it uses offline applications like Microsoft Excel and LibreOffice to compile service payments and receipts. Despite its usefulness to the company, the process is time-consuming for bookkeepers.

Automated Bookkeeping

Contrary to manual bookkeeping, automated bookkeeping makes use of artificial intelligence applications and software to perform some tasks. Instead of making bookkeepers do the calculations, the system does it for them. It can also categorize the various variable inputs for the convenience of the bookkeepers.

Cash-based or Accrual-based

The cash-based system centers on the actual inflow and outflow of money in the business. Whenever cash arrives and leaves the company, it is recorded by the bookkeeper. On the other hand, accrual-based accounts incoming and outgoing cash even when the company does not yet receive it. Either way, you can use any of these to measure the receivables and expenses of your enterprise.

Single-entry and Double-entry Bookkeeping

Understanding these two things is easy. Single-entry bookkeeping focuses on a straightforward approach in recording the business transactions of the company. The bookkeeper places only one entry into the system. In contrast, double-entry takes a different approach and utilizes two accounts for the business. The entry is labeled as credit or debit. Do note that cash-based works best with single-entry bookkeeping and accrual-based is for double-entry bookkeeping.

Excellent Tips for Effortless Bookkeeping

Unlike what most people assume, bookkeeping is not an easy task. The job requires a whole lot of patience and energy. Imagine compiling hundreds of notes and expense sheets every day at work. Not only that, bookkeepers have to keep track of all these documents and make sure that each one is recorded in journals or applications. And if one item goes missing, it can delay the accounting procedures of the company. With that said, we provide you with top-notch tips to make bookkeeping more comfortable and easier.

Choosing the Right Software

Besides selecting worksheet forms and estimate sheets, you have to choose a software that matches the needs of your company. After all, the ones who will use the software are your business. Various tools are available in the market and you can pick one for your firm.

Separate Business Expenses from Personal Costs

As a lot of business owners would say, don’t mingle the personal and professional sides of your life—keep them separated. Like that, you have to avoid mixing your private funds with the earnings of your company. If you have to take out some funds from the profit, it should be accounted for by bookkeepers. Expense tracking is essential in your business, and when you combine your money with the revenues, tracing it would be hard for bookkeepers.

Plan Your Major Expenses

When there are upcoming plans and projects, you have to plan for the budget of these activities. So create a to-do list and write down the schedule of significant affairs that your company will undertake for a specific timeline. Thinking about future events that will be costly for the business will help in the budget planning of the company planners.

Store the Records Securely

And lastly, you have to choose a method that keeps the records secure from intruders and hackers. Often, business owners have their own security system to avoid unwanted viewers from seeing crucial business information. You can hire specialists to create a system for your business. Or you can buy legitimate software in the market.

It’s certainly safe to say that bookkeeping is crucial and must be practiced to achieve the required level of proficiency. Avoiding miscalculations requires a level of skill that companies greatly benefit from, but if you can’t pull that off, then another option is available to you. There’s always the choice of hiring the right bookkeeping professionals, although that’s a different topic for a different article. Those who choose to do the work themselves can be assured that the knowledge gained here will be able to guide you through what you need to do for your business. Remember that every last amount matters to your business, as does the accuracy of its reporting.