Table of Contents

- Statement Template Bundle

- 10+ Annuity Statement Templates in PDF | DOC

- 1. Annuity Statement Template

- 2. Annuity Claimant Statement

- 3. Annuity Disclosure Statement Template

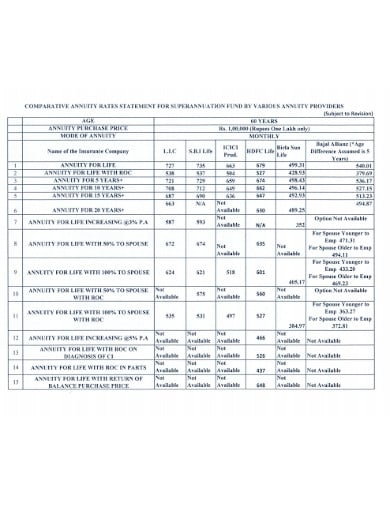

- 4. Annuity Rates Statement in PDF

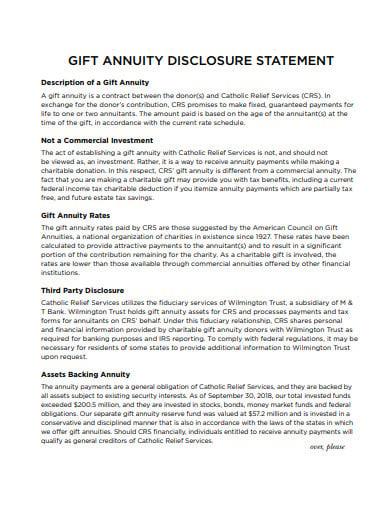

- 5. Gift Annuity Disclosure Statement

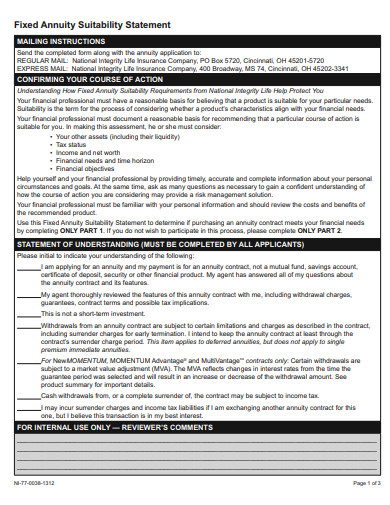

- 6. Fixed Annuity Suitability Statement Template

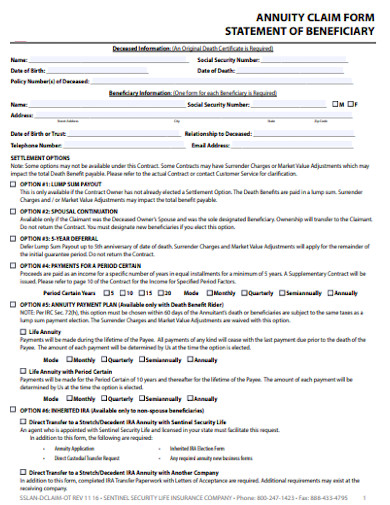

- 7. Annuity Claim Form Statement Template

- 8. Statement of Annuity & Pension

- 9. Understanding New Annuity Statement

- 10. Annuity Statement Template in Doc

- 11. College Gift Annuity Statement

- Elements of An Annuity Statement

- Types of Annuities

10+ Annuity Statement Templates in PDF | DOC

An annuity statement is an annual or monthly report of your deferred annuity’s cash value and investment results. Deductible annuities complement the pension income, enabling you to put limitless after-tax dollars in tax deferred arrangements. Income taxes are due after payment, not before. It refers to an annual or quarterly update of your deferred annuity’s cash value and investment efficiency.

Statement Template Bundle

10+ Annuity Statement Templates in PDF | DOC

1. Annuity Statement Template

tiaa.org

tiaa.org2. Annuity Claimant Statement

reliancestandard.com

reliancestandard.com3. Annuity Disclosure Statement Template

annuities.thehartford.com

annuities.thehartford.com4. Annuity Rates Statement in PDF

fci.gov.in

fci.gov.in5. Gift Annuity Disclosure Statement

crs.org

crs.org6. Fixed Annuity Suitability Statement Template

wsfinancialpartners.com

wsfinancialpartners.com7. Annuity Claim Form Statement Template

sslco.com

sslco.com8. Statement of Annuity & Pension

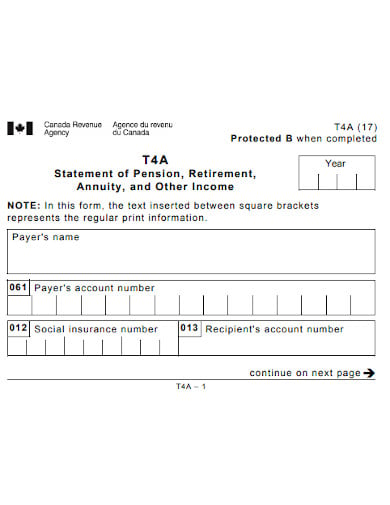

canada.ca

canada.ca9. Understanding New Annuity Statement

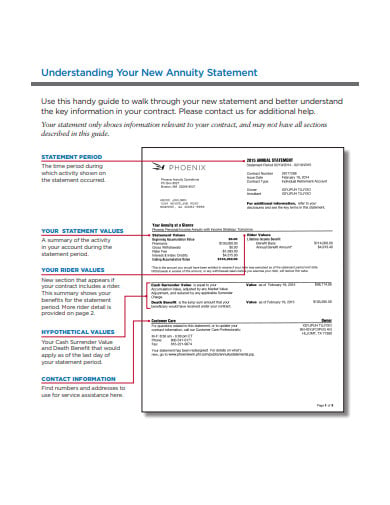

phoenixwm.phl.com

phoenixwm.phl.com10. Annuity Statement Template in Doc

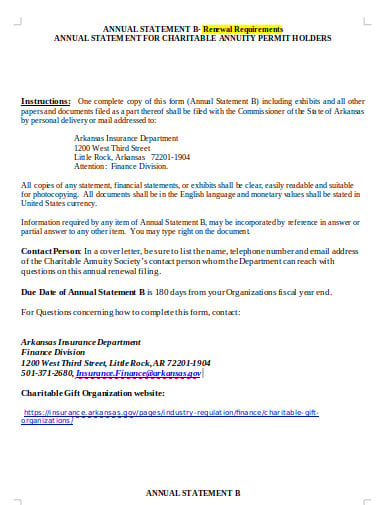

insurance.arkansas.gov

insurance.arkansas.gov11. College Gift Annuity Statement

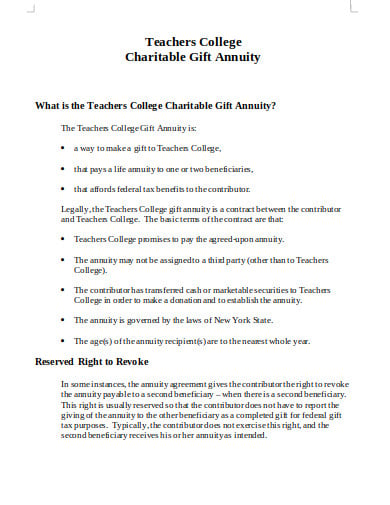

tc.columbia.edu

tc.columbia.eduElements of An Annuity Statement

Annuity Identification Information

The basic information contained on the annuity statement gives details describing the annuity plan. This includes your name, address and account number are the identifying details. The letter is sent by the contract holding insurance company and generally includes direct contact details for customer service at the insurance company and for the sales representative for the annuity.

Contract Overview

The annuity statement also contains an overview of the terms of the contract including the owner’s name and the annuitant. Annuities are long-term arrangements and regularly checking the terms helps to ensure that you manage your economic future and assets properly. The annuitant is the individual who gets the benefits of the contract and is paid according to events of life. If the annuitant dies, then the beneficiaries must receive death benefits. The owner and the annuitant may also be the same person.

Investments and Performance

Deferred annuities offer varying options for investment. Specified rates of return give fixed annuities with low-interest rates. Tariffs renew on the date of anniversary and are assured for the next 12 months. Variable annuities use mutual funds to create a portfolio for investors. The Statement should explain your specific annuity performance. Set annuity statements mention the revenue earned, the actual cash value and the rate of interest. Dynamic annuity statements describe the output of the mutual funds for that duration and state the current cash value in each fund.

Statement Frequency

Depending on the type of annuity, annuity companies usually submit statements once a year or every three months. Specified annuities only change prices once a year and thereby reduce investor expenditures by creating an annual statement only. Dynamic annuities vary significantly in value and require greater management; statements are therefore produced every three months. Many annuity companies can submit statements more frequently.

Types of Annuities

An annuity is a private contract with an insurer that trades an initial payout for future payments (usually withdrawals). The retirees then have a guaranteed income that is not subject to swings in the stock market.

Annuities are of four types:

1: Immediate annuities

The immediate annuity is the simplest type of annuity to recognize because it has very simple guarantees in its most frequent form. A traditional fixed unconditional annuity involves making upfront a lump-sum payment to an insurance company in exchange for allowing to accept funds from the insurer starting immediately regularly. You may framework an immediate annuity to pay for the remainder of your life, for a specified period. This can also apply for as long as you and the individual you selected as a beneficiary are still alive.

2: Deferred income annuities

Unlike instant annuities, deferred revenue annuities do not immediately start making payments. But they closely resemble immediate annuities in most other respects. You pay a certain upfront amount with a deferred income annuity, and in return, the insurance company agrees to pay you some sum when you reach the age indicated in the contract. Most people use deferred income annuities to hedge against the possibility of death, with payouts coming in at 80 or 85 years of age which can provide additional income when you need it most.

3: Fixed annuities

A fixed annuity refers to an annuity the value of which increases within the annuity contract based on specified returns. Usually, fixed annuities do not start immediately and are therefore deferred annuities, but unlike a deferred annuity, you have the option to choose when and when to start receiving compensation under the plan from the insurance company.

4: Variable annuities

Besides a fixed annuity, the returns of a variable annuity are tied to a given market. Variable annuities can provide you with access to a wide range of assets along with the benefits that annuities generally provide, regardless of whether it’s the stock market, the bond market, a mix of the two or a more specific investment niche. Variable annuities are tax-delayed like fixed annuities, but the benefit of having a wider range of potential assets relates to many, and so do the assurances. Payments can be costly, with both cashing-out caps on surrender payments and recurring annual fees for warranties and longevity costs cutting into your total profit.