Table of Contents

- Checklist Template Bundle

- 8+ Annuity Checklist Templates in DOC | PDF

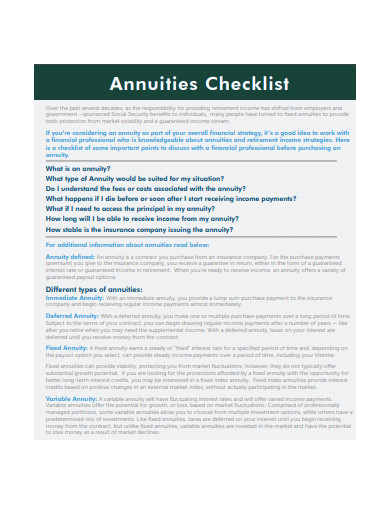

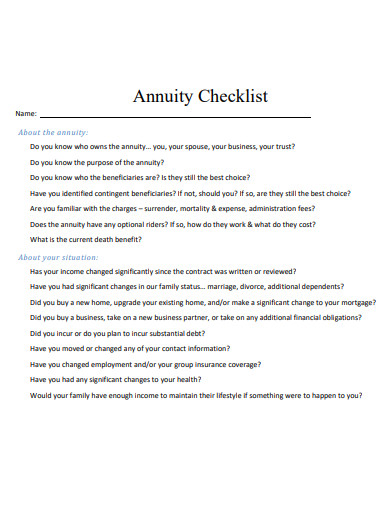

- 1. Annuity Checklist Template

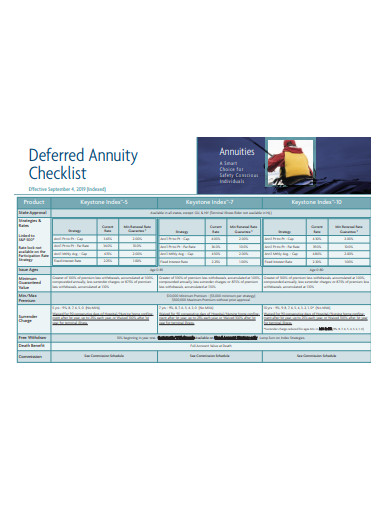

- 2. Deferred Annuity Checklist Example

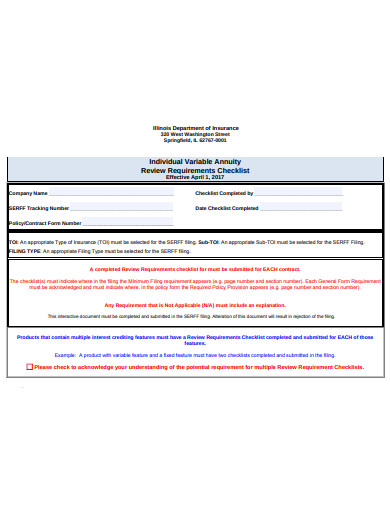

- 3. Individual Variable Annuity Checklist

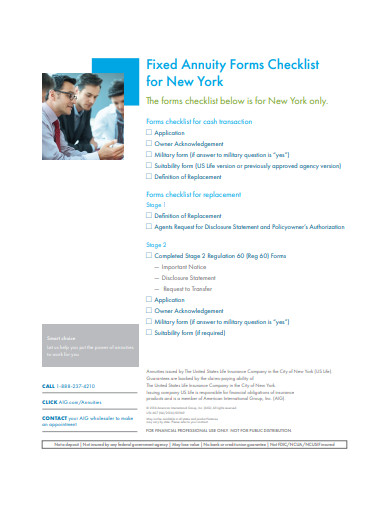

- 4. Fixed Annuity Forms Checklist Template

- 5. Sample Annuity Checklist Template

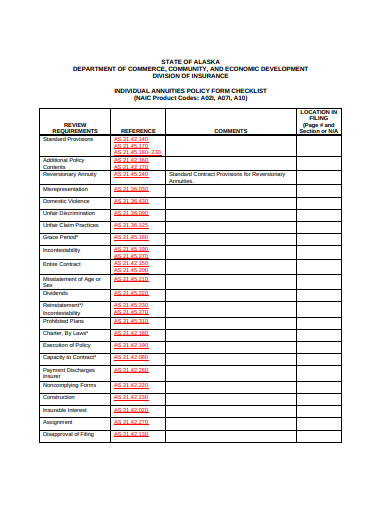

- 6. Individual Annuity Policy Form Checklist Example

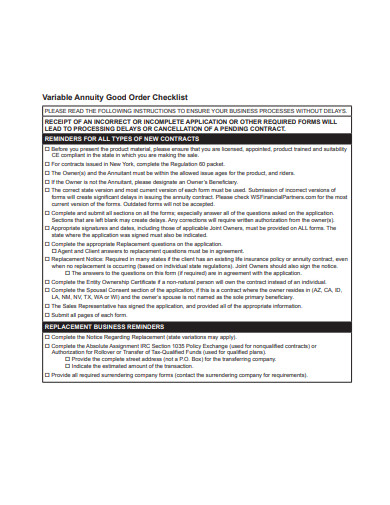

- 7. Variable Annuity Good Order Checklist

- 8. Request for Annuity Checklist Template

- 9. Annuity Checklist in DOC

- What Is an Annuity Checklist?

- How to Create an Annuity Checklist

- FAQs

- How expansive is the annuity market?

- Is an individual retirement account (IRA) the same as an annuity?

- How much money is required to purchase an annuity?

8+ Annuity Checklist Templates in MS Word | PDF

When most employees reach a certain age, especially those who reach 60 and above, they become retirees. Some of them even retire earlier than usual due to health problems or simply because they’ve already achieved financial stability. That said, your life insurance company will definetly find prospects by offering annuities. If you’re already selling annuity contracts, do it even more so starting today. If you haven’t yet, go for it soon. Regardless of whether you’ve offered annuities before or not, we’re going to introduce you to annuity checklists and show nine samples of them here.

Checklist Template Bundle

8+ Annuity Checklist Templates in DOC | PDF

1. Annuity Checklist Template

iqwealthmanagement.com

iqwealthmanagement.com2. Deferred Annuity Checklist Example

annuityadvisors.com

annuityadvisors.com3. Individual Variable Annuity Checklist

insurance.illinois.gov

insurance.illinois.gov4. Fixed Annuity Forms Checklist Template

1000.aig.com

1000.aig.com5. Sample Annuity Checklist Template

wealthlegacygroup.com

wealthlegacygroup.com6. Individual Annuity Policy Form Checklist Example

commerce.alaska.gov

commerce.alaska.gov7. Variable Annuity Good Order Checklist

wsfinancialpartners.com

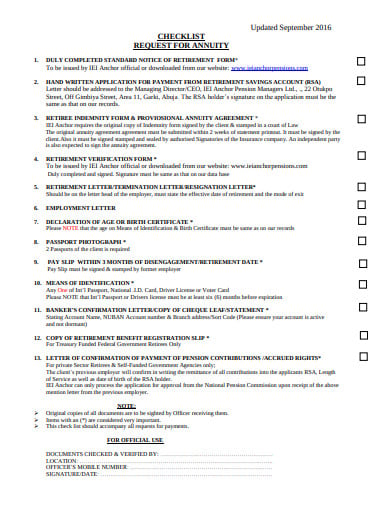

wsfinancialpartners.com8. Request for Annuity Checklist Template

ieianchorpensions.com

ieianchorpensions.com9. Annuity Checklist in DOC

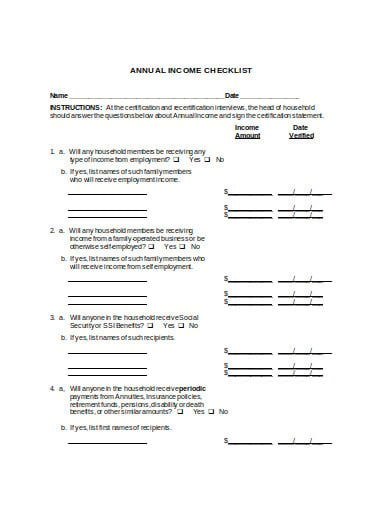

txtha.org

txtha.orgWhat Is an Annuity Checklist?

An annuity checklist is a document that breaks down the details and variables of an annuitant’s pension. An annuitant is what you call a person who receives an annuity. An annuity checklist serves as a written guide or record of the annuitant’s annuity scheme, such as how often he or she should put investment. It may also provide details about an annuitant’s income or salary rate. Why? Well, that’s because his or her regular earnings are an important factor in calculating his or her payment. The components of annuity checklists usually vary from different insurance companies. That’s due to the distinctive inclusions of their annuity offers.

How to Create an Annuity Checklist

Annuity checklists come in various shapes and sizes, as evidenced by the nine samples we presented to you. Like, we said just earlier, each annuity package of every insurance company has distinctive inclusions. In that case, the annuity checklist of company A will look drastically different from that of company B’s. Although there’s no strict format or flow of how annuity checklists should look like, there are basic steps you need to follow in creating one. We’ll be discussing those steps below.

Step 1: Display Your Insurance Company’s Name and Logo

In every document that your company produces, it should have its name and logo. An annuity checklist is not an exception from that rule. The presence of your company and logo on the checklist will certify that it’s an official document. Putting those two on the checklist is a way of showing that a prospective annuitant can trust your firm. Plus, it’s also a method to showcase and establish the branding of your insurance company on the document. Place the name and logo at the top or beginning of the annuity checklist.

Step 2: Indicate the Annuity Category

Annuities have seven categories. These categories are:

- Variable annuity

- Fixed annuity

- Indexed annuity

- Immediate annuity

- Deferred annuity

- Equity indexed annuity

- Perpetuity annuity

These annuity categories are distinct from each other to a certain degree. For that reason, you need to indicate the category of each annuity checklist you’ll be creating. You can indicate it just below the company name and logo, or anywhere at the top portion of the document. This step is important so that you can sort and archive all annuity checklists orderly and easily. Furthermore, it clarifies what each annuity checklist is all about.

Step 3: Emphasize the Terms and Conditions

Every annuity package has certain terms and conditions. Both sides of the party, which is your company and the annuitants, must abide by them to avoid future disputes and discrepancies. With that in mind, you have to emphasize the terms and conditions on the annuity checklist itself. That includes nonforfeiture clauses, late payment sanctions, cash flow rules, and many more. Stating the terms and conditions is essential so that both parties can reach a clear agreement concerning the annuity.

Step 4: Provide Explanations of How the Annuity Works

Last but not least, make sure to provide informative explanations of an annuity’s process. It’s likely that prospective annuitants only have minimal knowledge about the annuity they’re about to invest in. It’s your insurance company’s obligation to enlighten them about it. Keep in mind that an annuity lasts a lifetime. That said, an annuitant must have in-depth knowledge about the ins and outs of his or her chosen annuity.

FAQs

How expansive is the annuity market?

According to the Insured Retirement Institute, the estimated total sales of the annuity industry is $55.9 billion. With that amount, we can all assume that the annuity market is indeed expansive. It could grow further if more people buy annuities from insurance companies.

Is an individual retirement account (IRA) the same as an annuity?

The answer is no. Although both an IRA and an annuity provide financial stability to a person during retirement, they differ in some ways. Annuities are insurance products, and they’re more expensive and don’t have investment limits. Whereas, an IRA is simply an ordinary account that contains a person’s retirement investments. There’s no telling which of the two is better, though. It depends on an individual’s preference concerning his or her financial future.

How much money is required to purchase an annuity?

According to CPASiteSolutions.com, the minimum staring investment ranges between $5,000 to $10,000. However, the price range depends on what kind of annuity you’ll be purchasing. Moreover, the payment schemes of each type of annuity are different from each other. But, if one plans to purchase an annuity, he or she should at least prepare $5,000 to $10,000 worth of money.

Sooner or later, annuities could become your company’s most profitable insurance product. That’s if you promote it vigorously in the market. There’s strong potential for profitability in selling annuities. They are very beneficial for a person’s long term finances. With that fact, you can certainly find countless prospective annuitants out there.