Table of Contents

- 10+ Accounts Payable Audit Templates in PDF | Word

- 1. Accounts Payable Audit Template

- 2. Accounts Payable Internal Audit Template

- 3. Accounts Payable Audit Report

- 4. Accounts Payable Performance Audit

- 5. Accounts Payable Internal Audit Summary

- 6. Accounts Payable Audit Example

- 7. Accounts Payable Audit in PDF

- 8. Audit of Accounts Payable Template

- 9. Board Accounts Payable Audit Report

- 10. Accounts Payable Audit Program

- 11. Accounts Payable Audit Release Checklist

- How to Conduct the Accounts Payable Audit?

- Why do You Need Accounts, Payable Auditor?

- What is the Importance of an Accounts Payable Audit?

- What are the Ways to Audit an Accounts Payable File?

10+ Accounts Payable Audit Templates in PDF | MS Word

Accounts payable audit is the systematic auditing of an organization’s accounts payable records. This is a type of evaluation system of the records of the transactions. The process is to ensure whether the records are properly maintained and if they are correct from the point of view of the business. The audit is done to check whether the rules are being followed as well as to check whether the business is run efficiently.

10+ Accounts Payable Audit Templates in PDF | Word

1. Accounts Payable Audit Template

utsystem.edu

utsystem.edu2. Accounts Payable Internal Audit Template

springfieldmo.gov

springfieldmo.gov3. Accounts Payable Audit Report

azregents.edu

azregents.edu4. Accounts Payable Performance Audit

durhamnc.gov

durhamnc.gov5. Accounts Payable Internal Audit Summary

bernco.gov

bernco.gov6. Accounts Payable Audit Example

cityofberkeley.info

cityofberkeley.info7. Accounts Payable Audit in PDF

bernco.gov

bernco.gov8. Audit of Accounts Payable Template

documents.ottawa.ca

documents.ottawa.ca9. Board Accounts Payable Audit Report

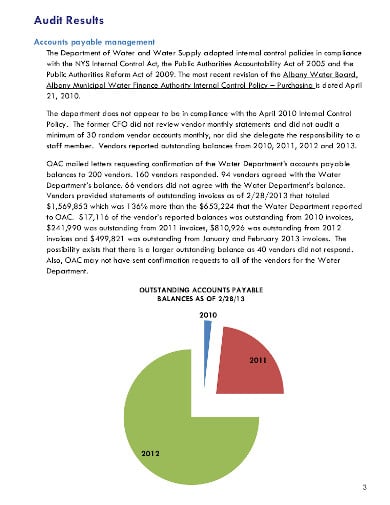

albanyny.gov

albanyny.gov10. Accounts Payable Audit Program

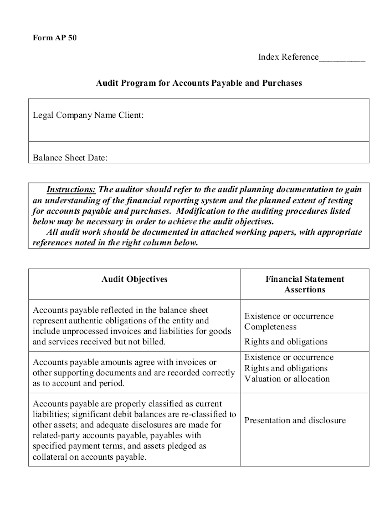

monicpa.mn

monicpa.mn11. Accounts Payable Audit Release Checklist

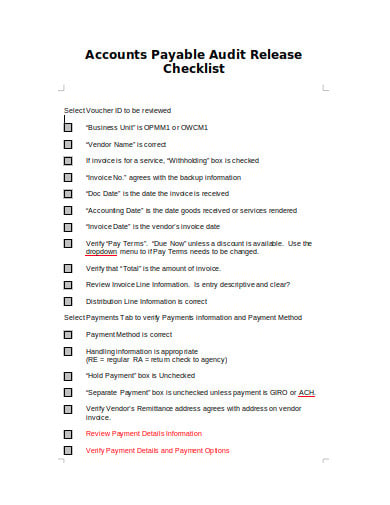

ct.gov

ct.govHow to Conduct the Accounts Payable Audit?

Step 1: The Examination of Standard Operating Procedures

The SOPs or the Standard Operating Procedures are an important part of a well-functioning Accounts Payable department. In some companies do not have formal written SOPs and some companies have not created any formal SOPs.

In case the company has, the audit team reviews all the details. If the accounts payable team has not created SOPs or if the existing SOPs do not reflect the actions of the accounts payable department then the audit team will stop the fieldwork. The auditing will be resumed once the accounts payable department has prepared or issued a formal SOPs.

Step 2: The Analysis of the Paper Trails

In the case of analysis of paper trails, the auditor needs to check the original source of the documents such as:

1. Purchase orders

2. Vendor invoices

3. Bank Records

4. Journal Entries for AP and inventory.

Step 3: Confirmation

Auditors can ask the company’s vendors to provide the confirmation on the balance the is owed. They can also ask for confirmation based on the amount due based on the company’s records. In case the amount that is confirmed by the vendor does not match to the one mentioned in the AP ledger, the auditor will take a note of that and will investigate it further.

Step 4: Verification of the Final Statement

The Accounts Payable Auditor compares the amount that is mentioned in the company’s financial statement with that of the Accounts Payable ledger. They also review the process of the identification and recording of the transactions. They also make a search on the cash payments made to vendors and the unrecorded liabilities that include goods and services that have been received but the payment has not been made.

Why do You Need Accounts, Payable Auditor?

The job role of the accounts payable auditor is to check the efficiency, functioning, and authentication of the accounts payable department. Many organizations have noticed that having a recurring audit of the accounts payable department helps in maintaining the efficiency of the department and also avoid any types of errors in the payment procedures.

An accounts payable auditor performs the proper functioning of the audit process and contributes to the formulation of better and authentic results. The auditor works efficiently to find any loopholes or problems in the process or the system and then investigate it to get to the conclusion. That, in turn, will help in the proper accounts payable management.

What is the Importance of an Accounts Payable Audit?

Auditing the Accounts payable department is the protection against inaccuracy and fraud. Auditing is a systematic and independent method of looking into the records if the accounts payable department to ensure proper documentation of the transactions. Therefore the auditing ensures that the records of the department are authentic, and there is no discrepancy in the transaction procedure or the payment made.

What are the Ways to Audit an Accounts Payable File?

1. Audit For Completeness

This process completes and fulfills the objectives of the whole auditing process. The reconciliation, cut off tests and the audit trails are the main method that the auditor uses to audit the AP documents to check whether the calculations and recordings are properly made.

2. Audit for Validity

This is the method that is used to check the legitimacy of the AP transactions. The common method that the auditor uses is transaction confirmation from the vendors and suppliers.

3. Audit of Compliance

This is the method that is used to determine whether the accounting procedures are at par or is compliant with the principles of accounting. The auditors usually work backward verifying the end-of-year financial statements, balance sheet, income statement, cash flow statement, etc.

4. Audit of Disclosure

This method is used to ensure that the accounts payable balance are properly disclosed on the end-of-year financial statement. The ways that the auditor uses is verifying and inspecting the end-of-year financial statement.