Bring Your Professional Communication to Life with Credit Letter Templates from Template.net

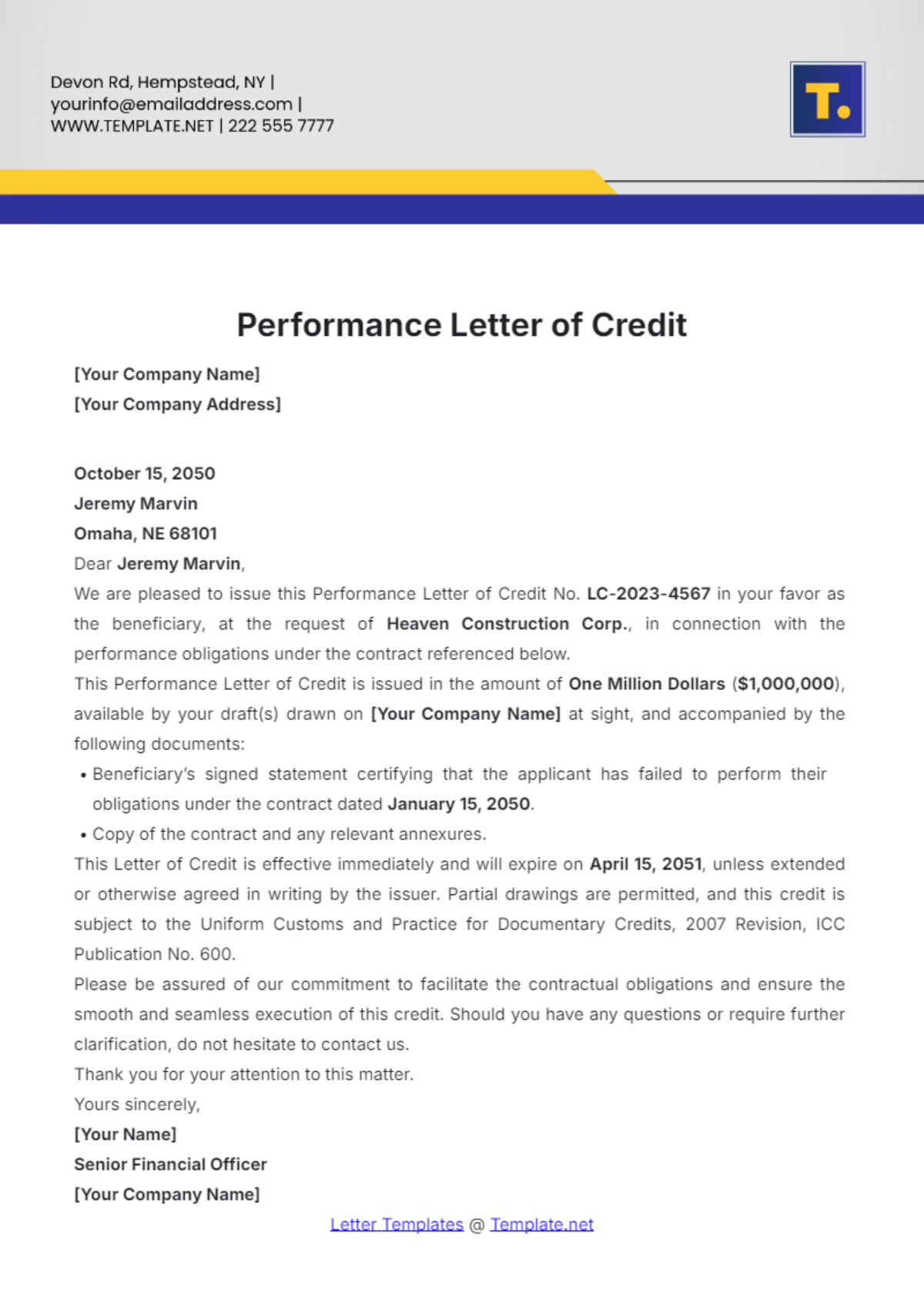

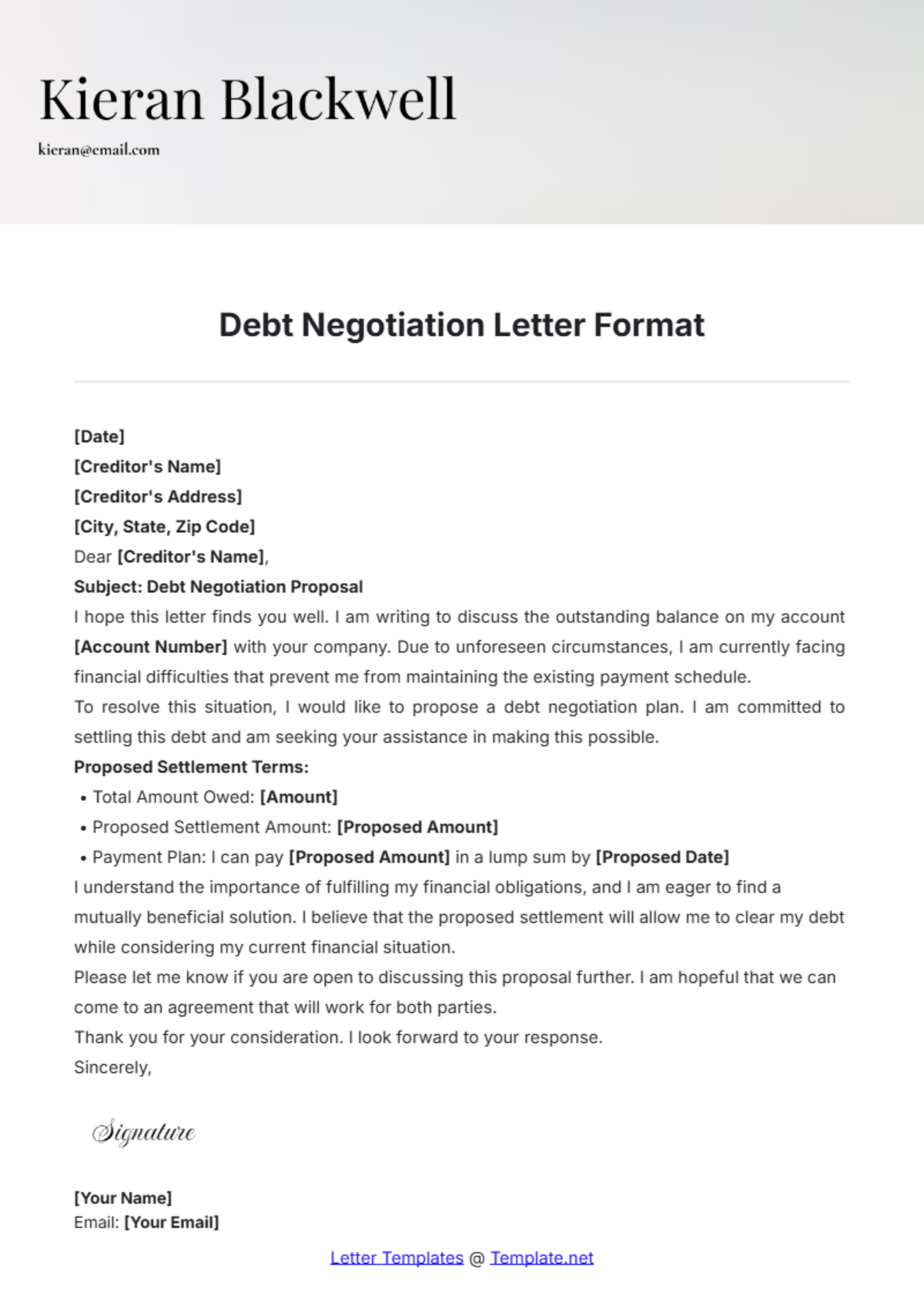

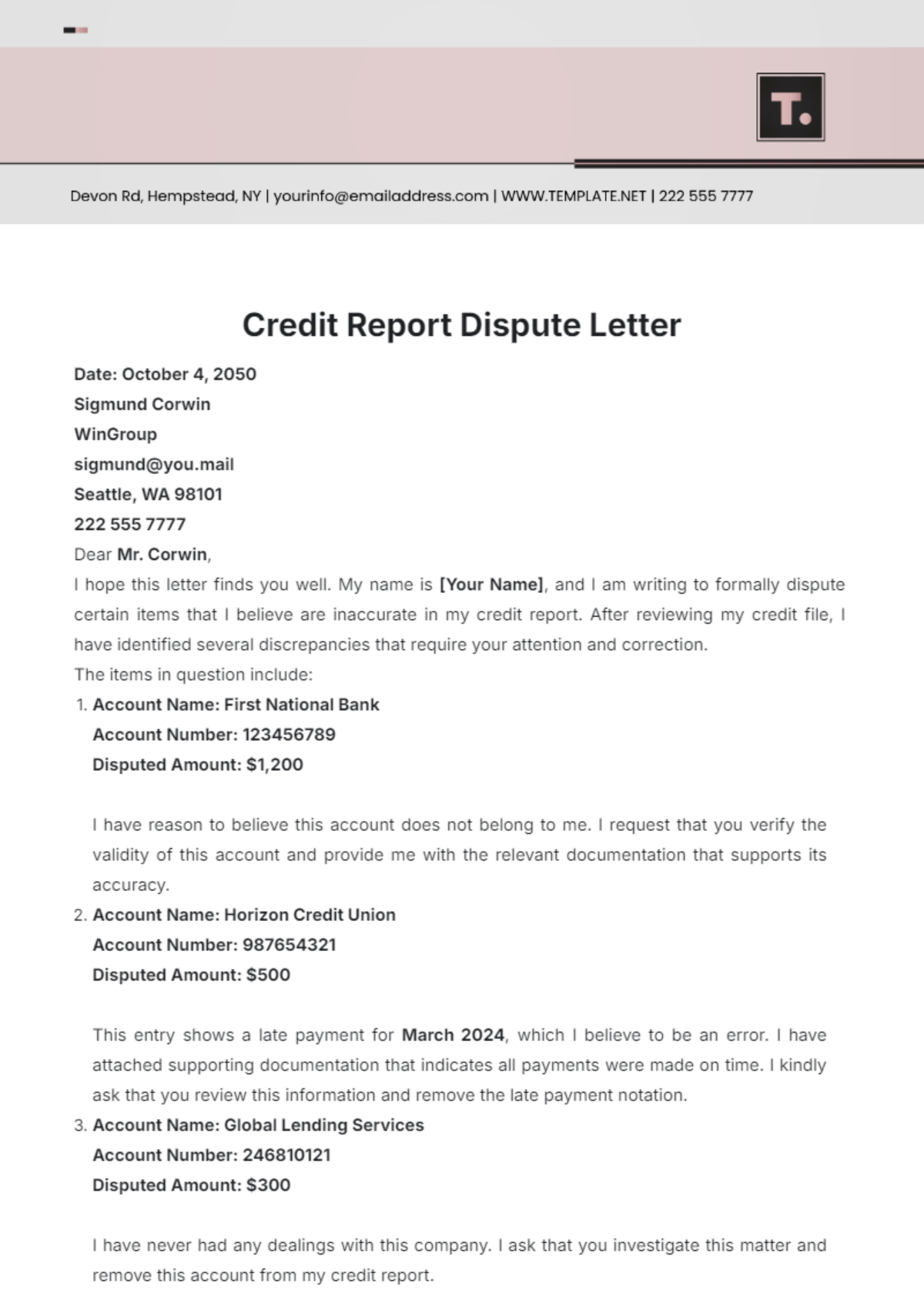

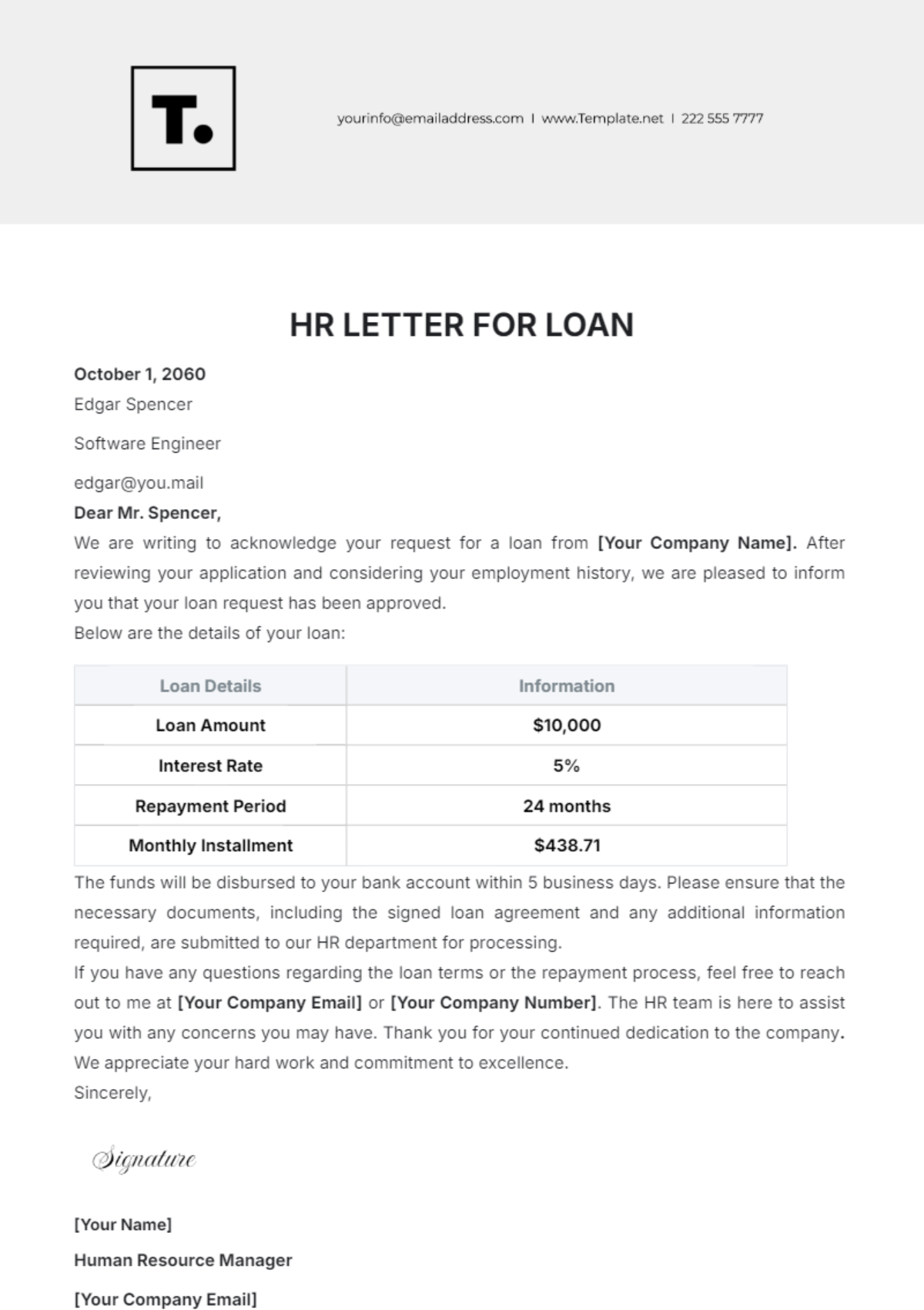

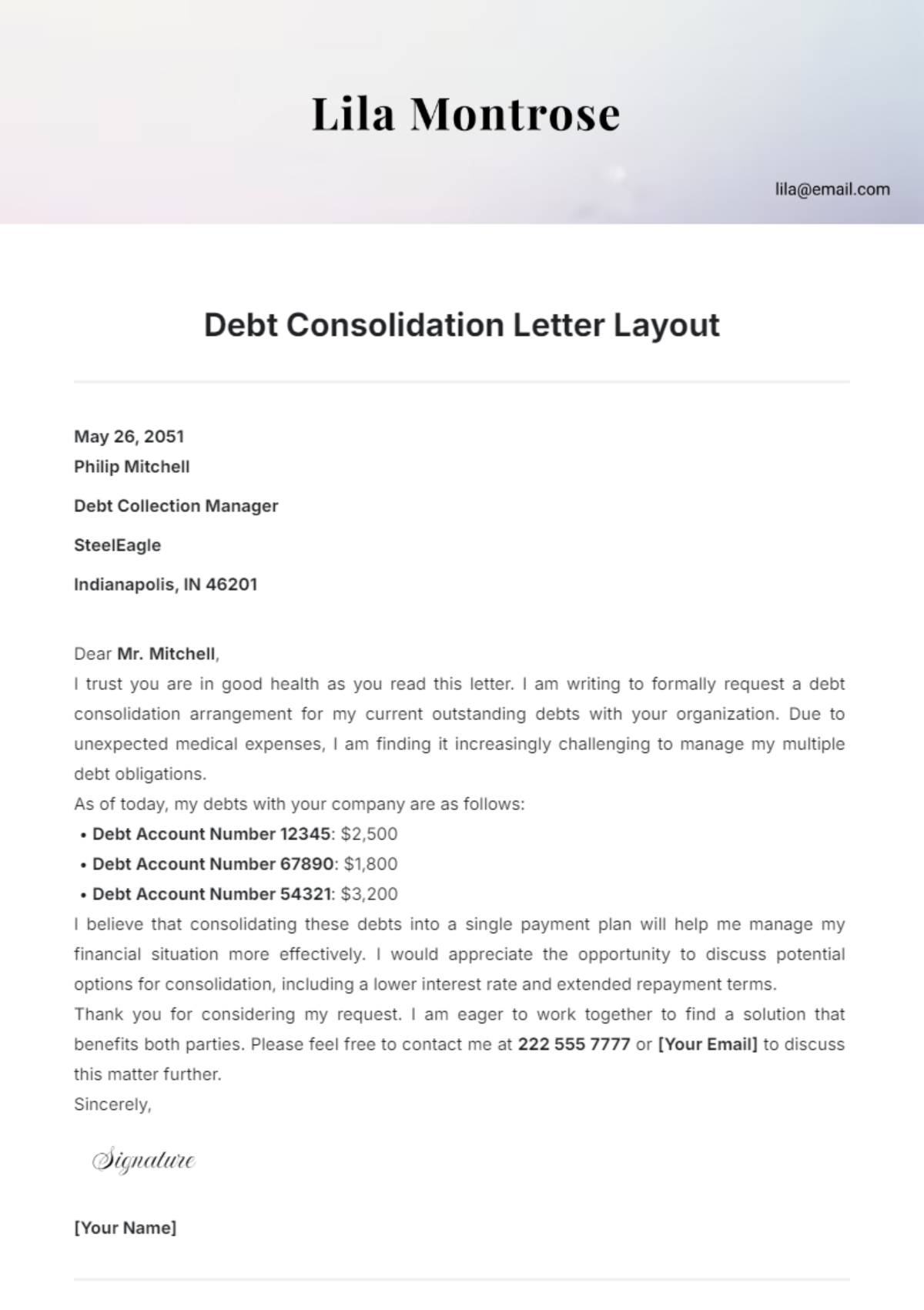

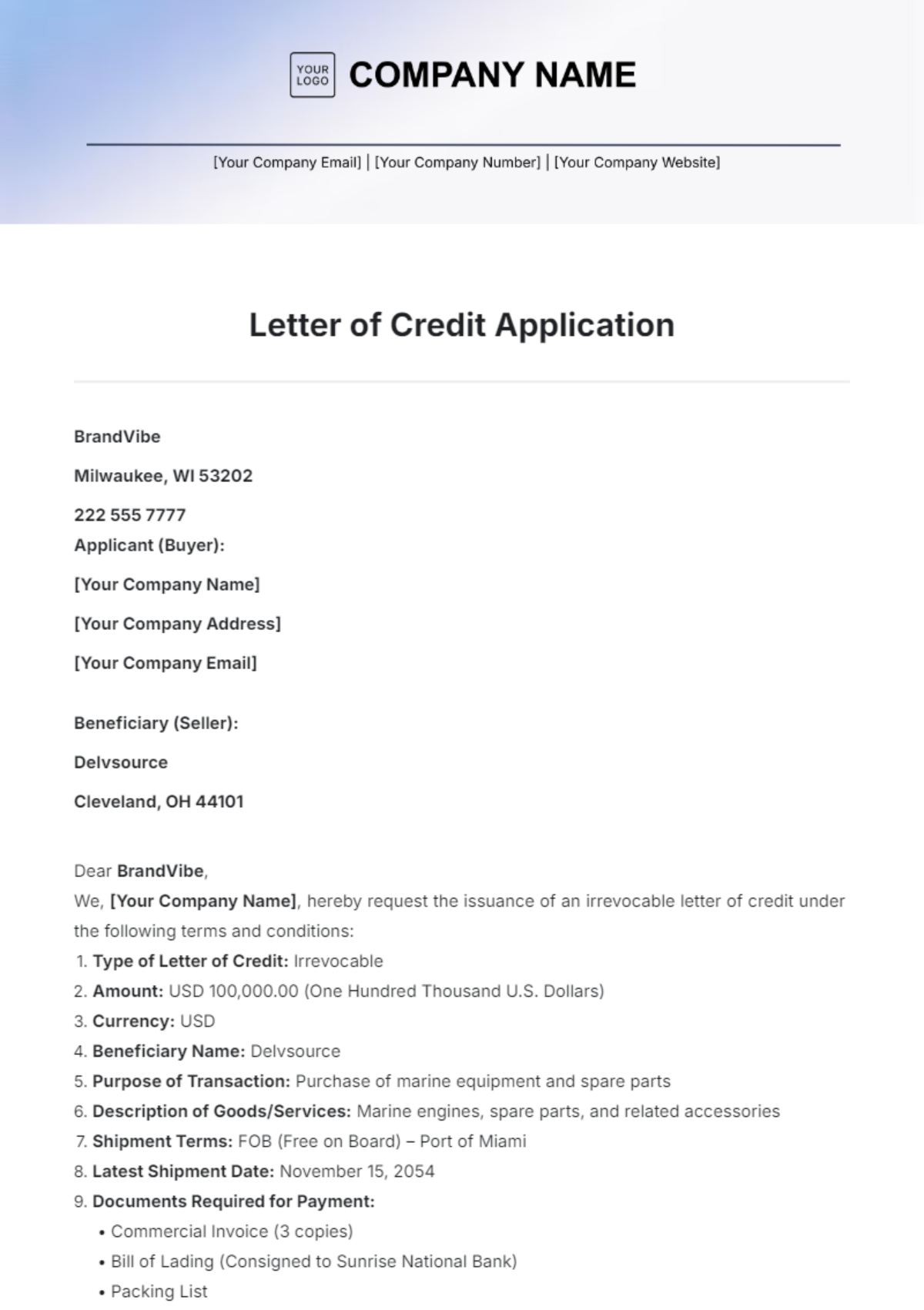

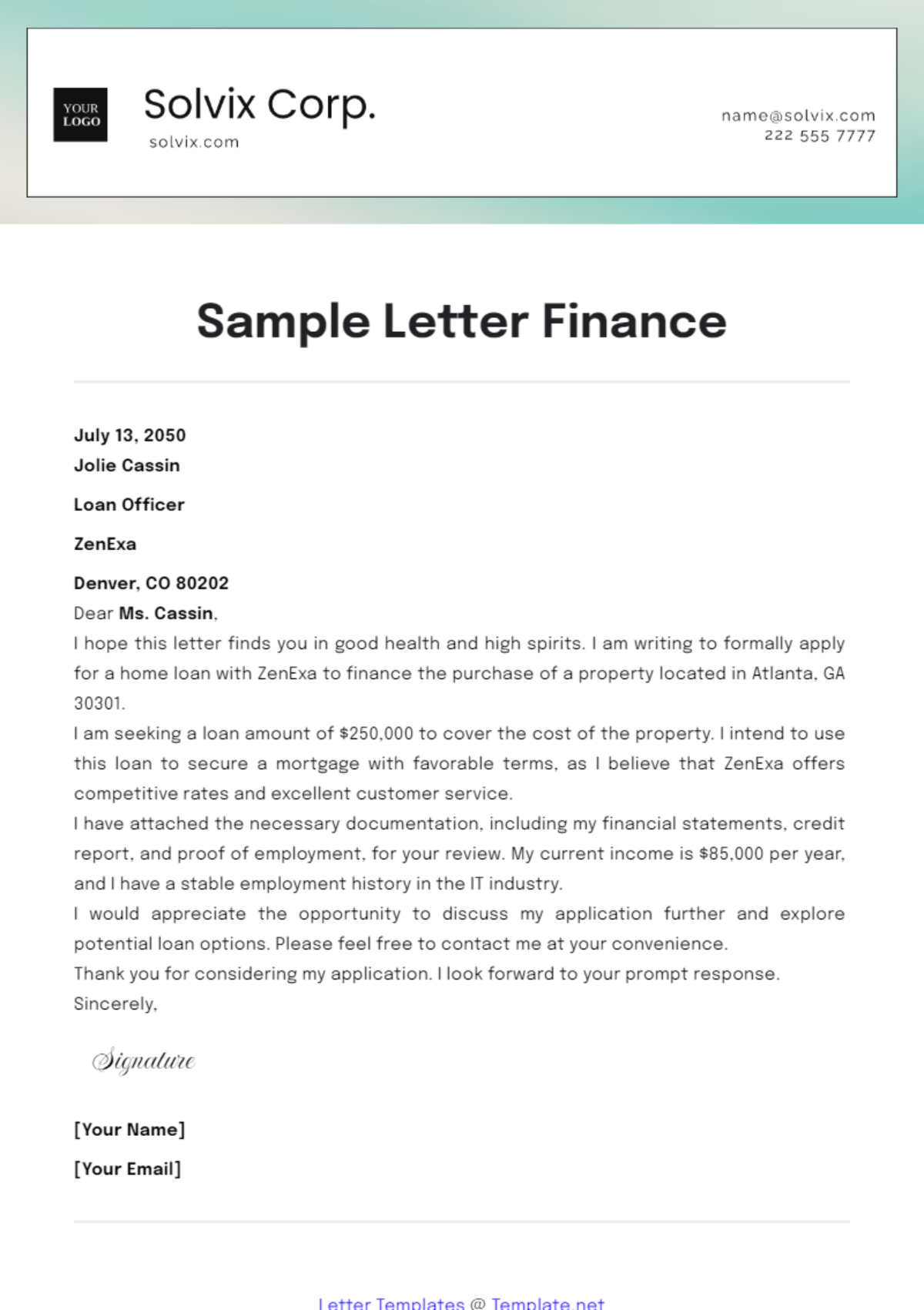

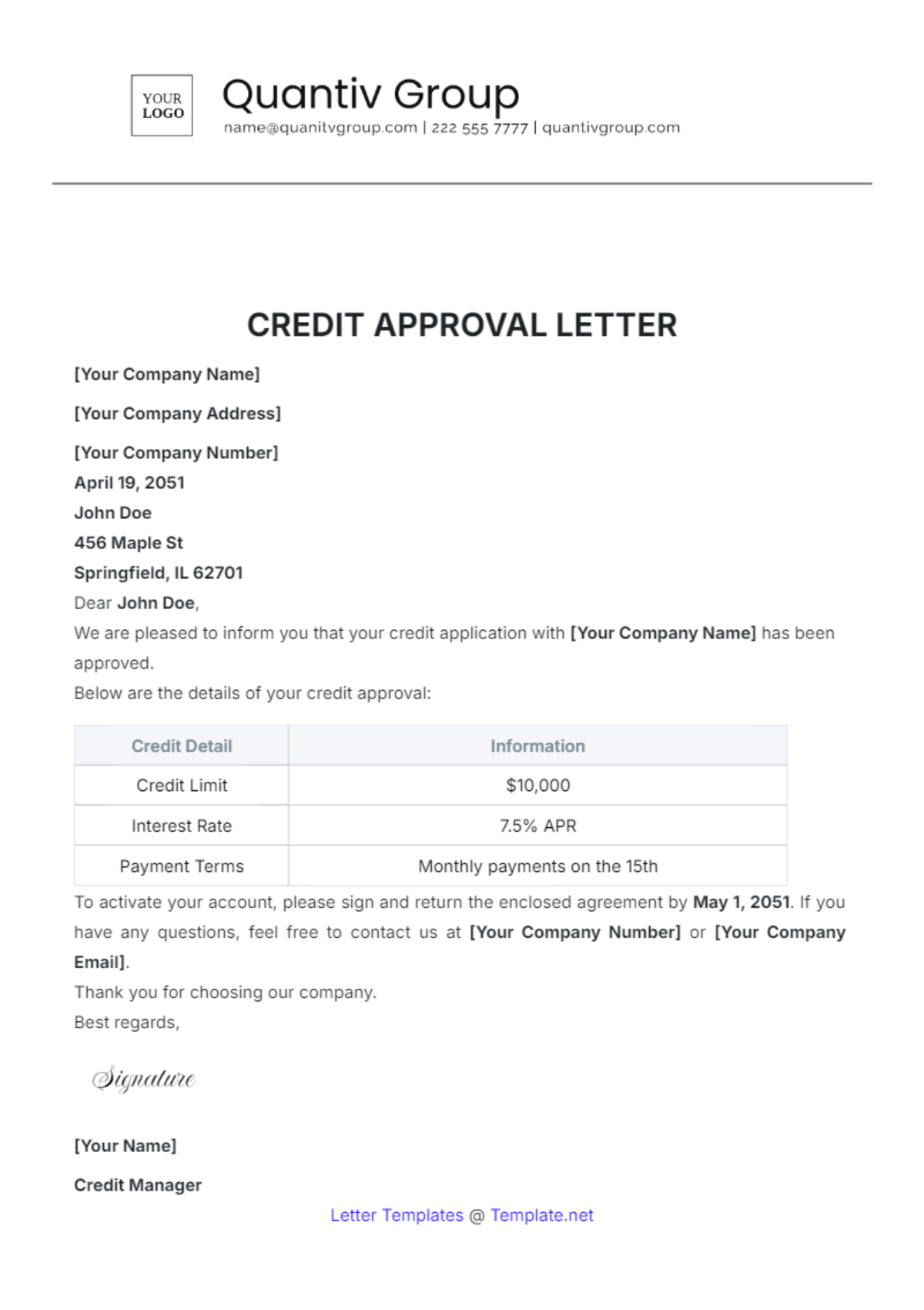

Keep your business interactions effective and professional with credit letter templates by Template.net. Designed for entrepreneurs, small business owners, and financial managers, these templates help you streamline communications, ensure accurate documentation, and foster trust among your partners and clients. Use these templates to promote a new line of credit offerings, send a meticulous credit approval notification, or maintain clear communication during financial assessments. Included within the package are comprehensive sections for detailed financial information and contact details, so you don't have to worry about missing out on any critical data. There's no need for advanced design skills; our templates provide professional-grade layouts, and are available at no charge, ensuring a smooth, hassle-free experience whether you're planning to print or distribute digitally.

Discover the many credit letter template options we have on hand, ready to meet your specific requirements. Choose a template, easily swap in your company's logo, and tweak colors and fonts to reflect your branding effortlessly. Take it a step further by dragging and dropping graphics, and adding animated effects with user-friendly tools. The possibilities are endless and require no special skills, making it both a fun and efficient way to enhance your business communication efforts. Plus, with regularly updated templates and fresh designs added weekly, you can keep your letters dynamic and up-to-date. When you're finished, download your polished communication or share it via email, print, or export, making it suitable for multiple channels and ensuring seamless collaboration in real-time.