If your company does not have any credit and collection, now is the time to get started. As a credit and collection manager, to ensure the consistency of your credit and collection, you must have an active managing account receivable. Do you want to know the secret of this success? Well and thoroughly planned credit and collections. To partake knowledge about it here are tips that you can follow in making your company's credit and collection.

1. Develop your Mission Statement

In the real business industry, a thorough outline is necessary to achieve credit and collection. Either you are a credit and collections manager or credit and collections director, your sample statement should be focused on the long-range mission, and the credit department should need to define its purpose. You can also include philosophies under the credit process approach, providing a general guideline in dealing with risk and collections. Whether it would be liberal, moderate, or conservative, it should mirror the direction of the overall company.

2. Define Goals

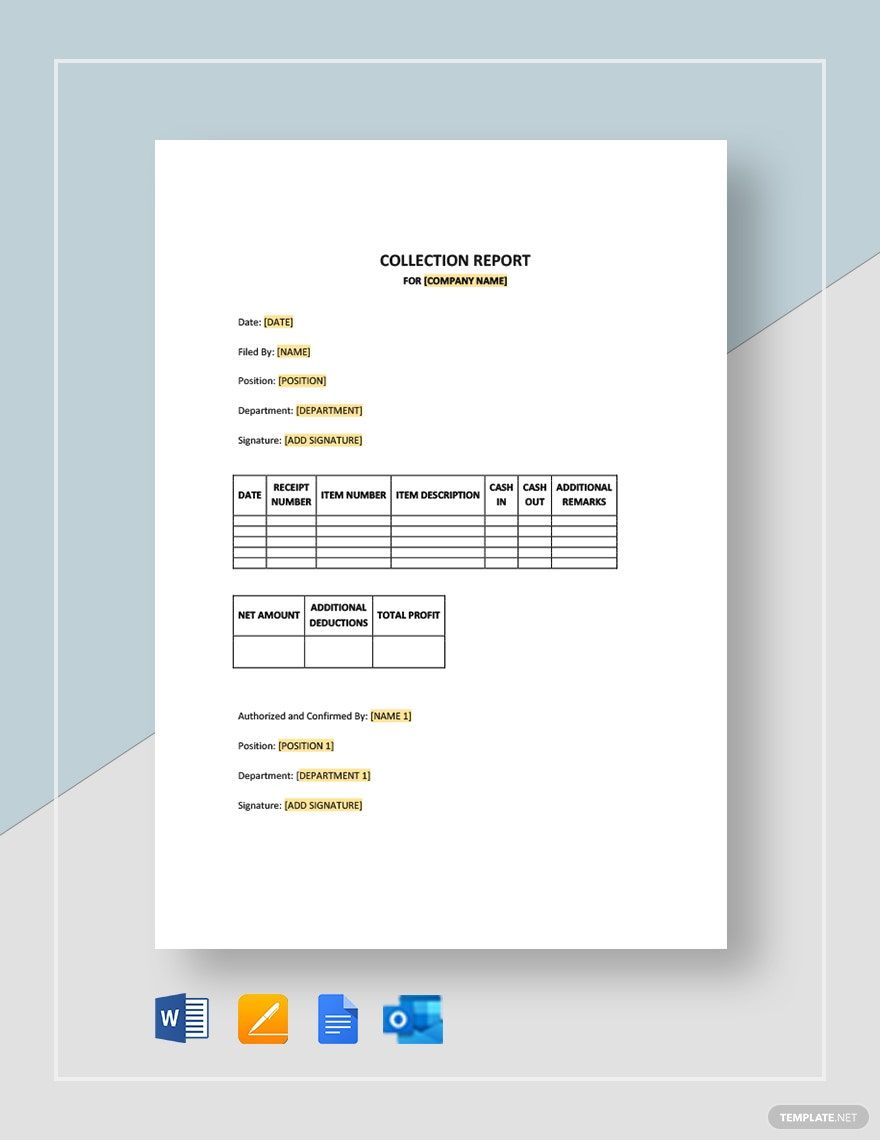

The credit and financial department should include their goals. The goals should be parallel with the current market status and the strategic direction of your company. Many companies use factors to follow their established goals — Days Sales Outstanding (DSO), percent current, aging bucket performance, Collection Effectiveness Index (CEI), Strengths, Weaknesses, Opportunities, Threats (SWOT analysis), bad debt write-off percentage, etc. Also, they should be reviewed, revised, and updated annually.

3. Include Measure to Manage

If a company has goals, it must be measured to foresee the progress. Use this 5C's of Credit to measure yours:

- Character - Will to Pay

- Capacity - Will they keep it

- Capital - Are they capable of it

- Collateral - Contingency plan

- Conditions - Status of the current economy

Remember that goals and goals performance should communicate regularly basis on the entire credit organization.

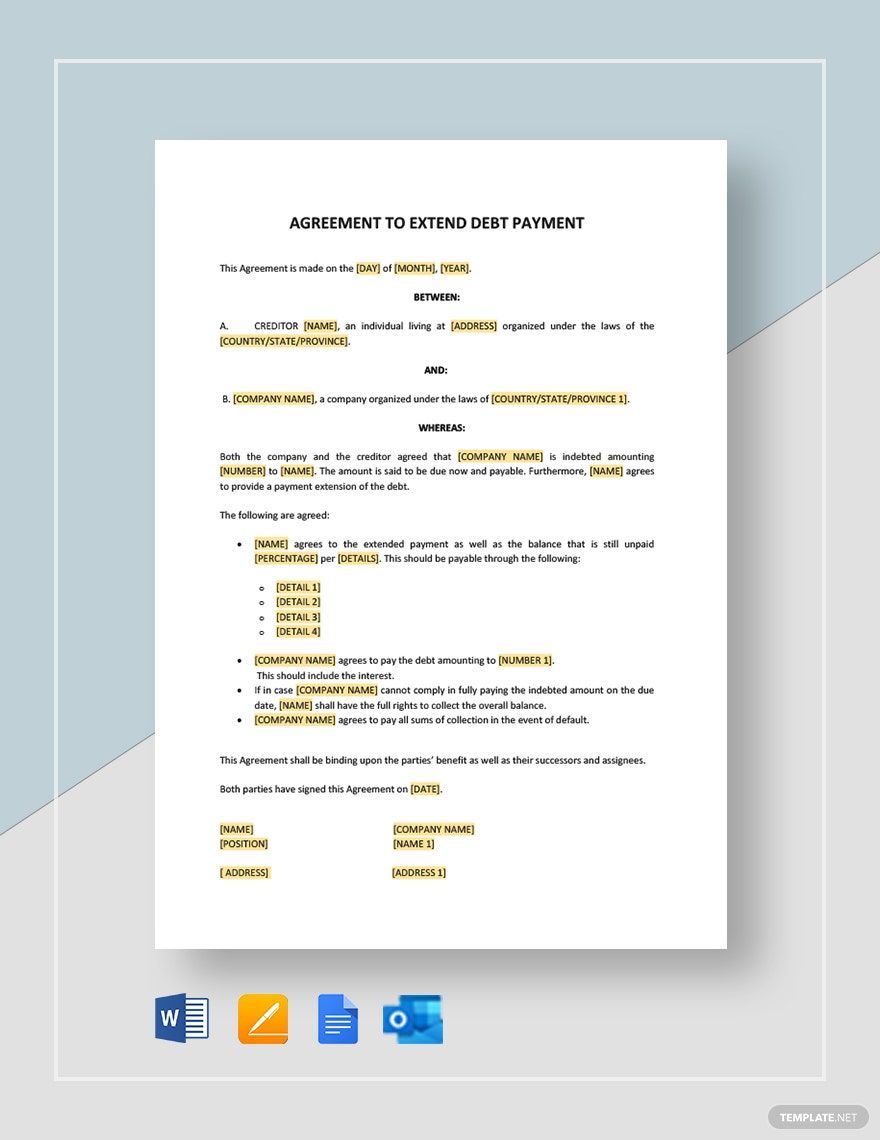

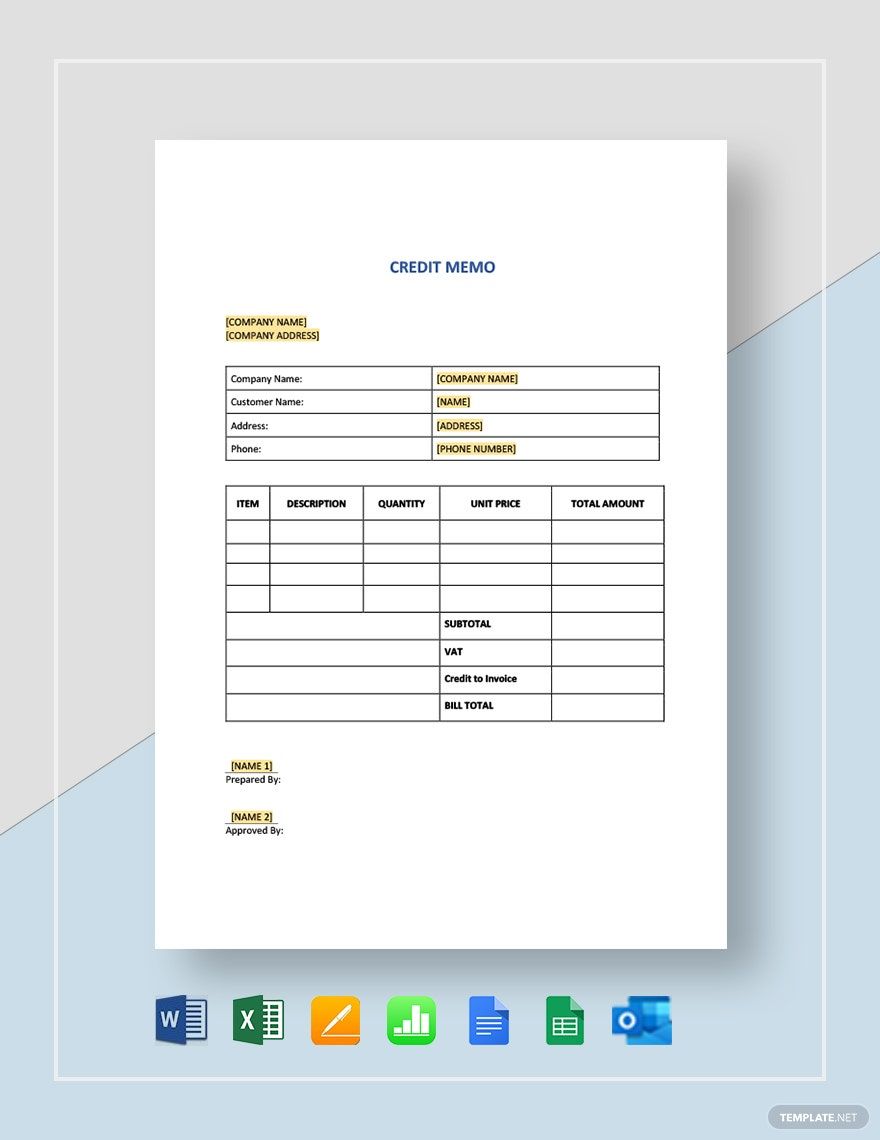

4. Clarify the Departmental Responsibilities

The relationship between the credit collection staff and the debtor must be specified. It would help streamline operations, prevent redundancy, and improve productivity. Each position must be listed, and each corresponds to a job description. Usually, the credit and collection department is composed of corporate credit manager, regional credit manager, collection specialist, credit and collections analyst, credit investigator, and clerk.

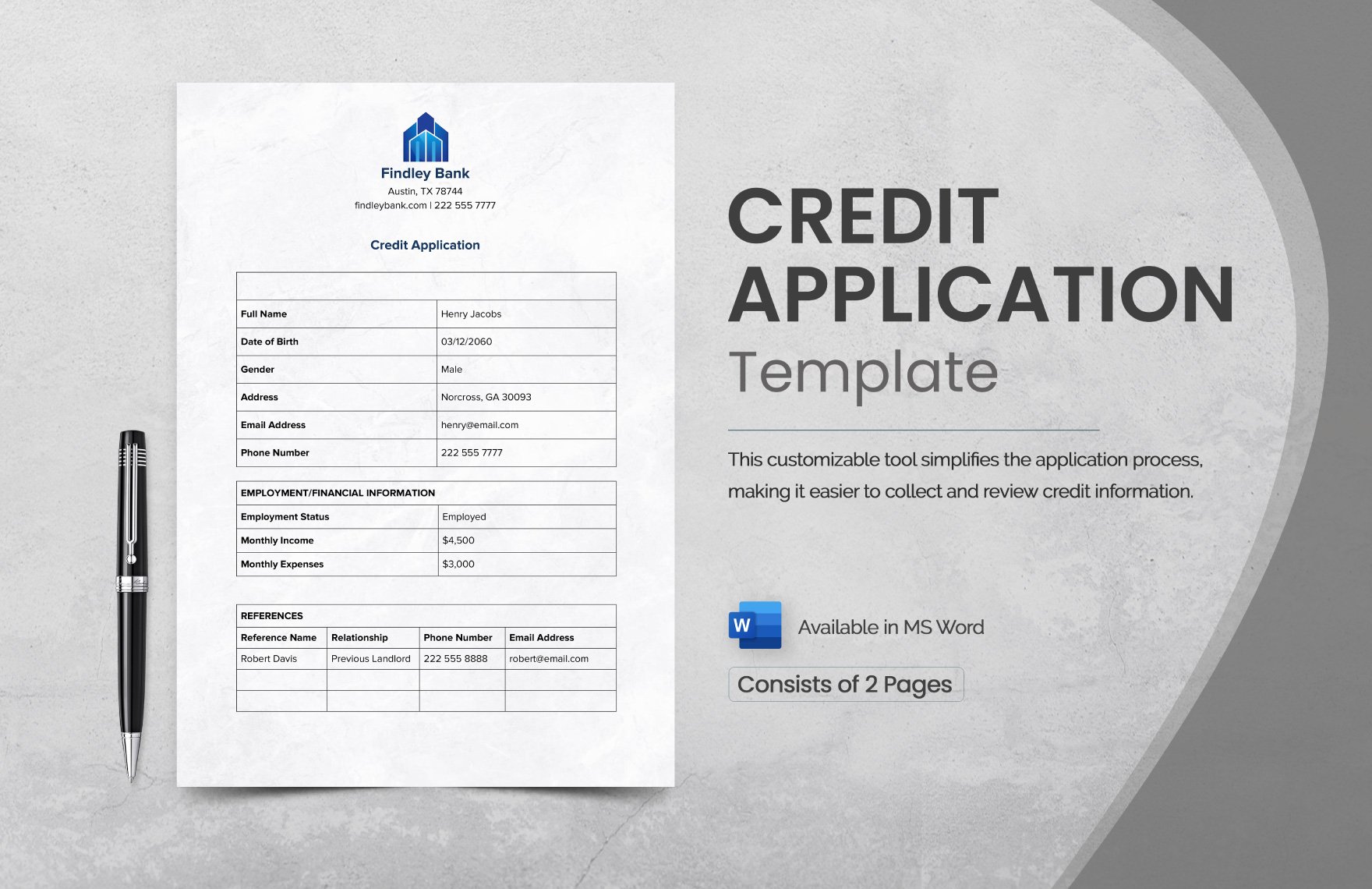

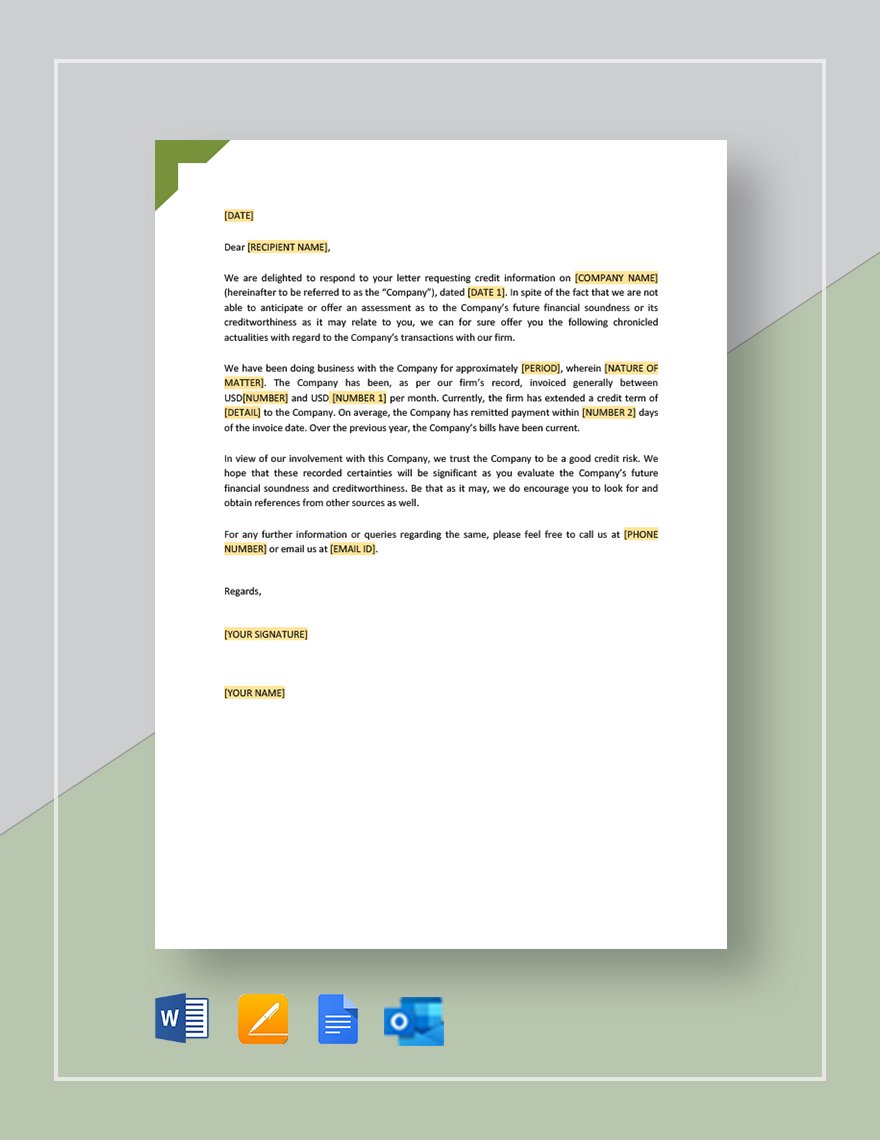

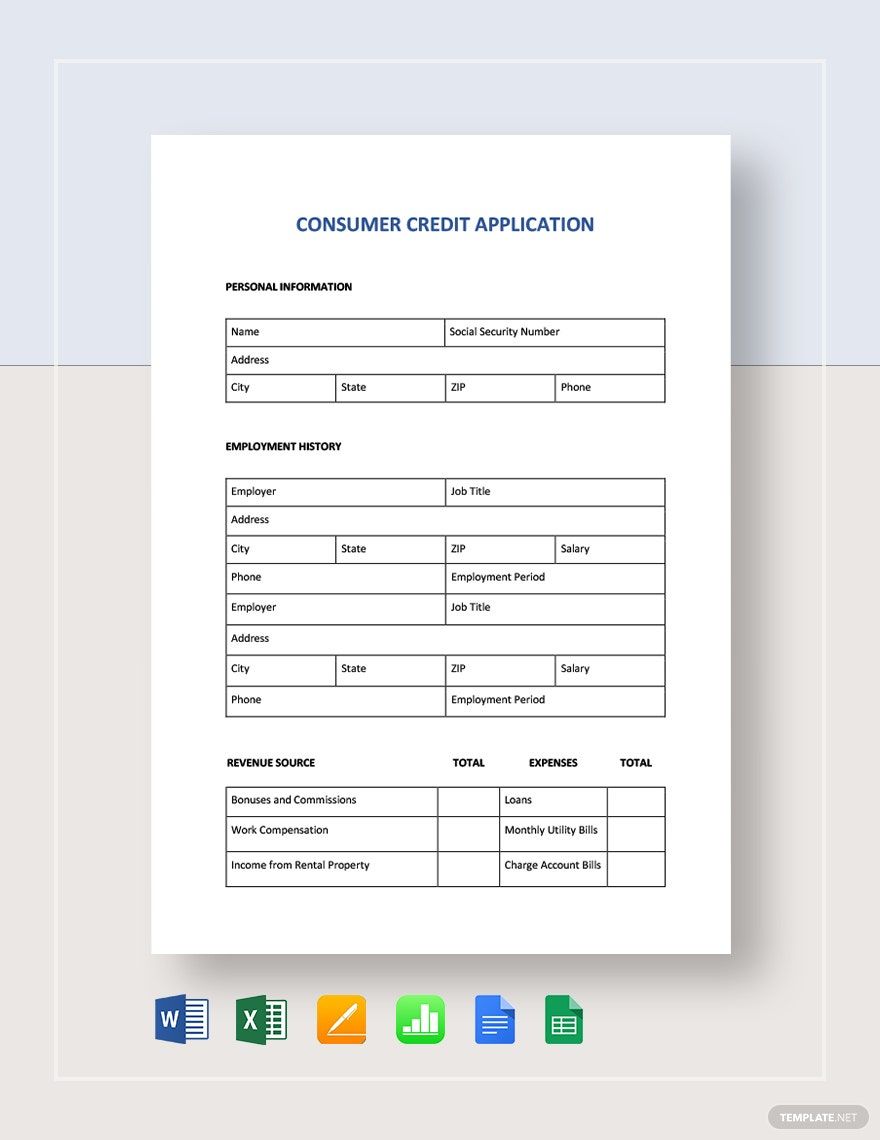

5. Establish Credit Evaluation Process

Be sure that the process of assessing credit would not be critical and must detail the credit and collections. Indeed, the sum of the company's credit risk is the total of assigned credit limits. There are three fundamental ratios for credit evaluation — quick ratio, degree of a leverage ratio, and profitability ratio.