8+ Restructuring Agreement Templates – PDF, DOC

The Sample loan agreement is one of the most complicated documents which can safeguard both the parties who are involved in the transaction. In general, the lender is the one who can create a loan agreement. The entire responsibility for creating the terms of the agreement is the responsibility of the lending party.

The Employment agreement templates which is used by the borrower along with their lender for restructuring the debts of a borrower is known as restructuring agreement. The Restructuring Agreement is an action which is being taken by an organization for modifying the operational along with the financial aspects of an organization.

Agreement Template Bundle

Preliminary Restructuring Agreement

getlinkgroup.com

getlinkgroup.comNew Financing Restructuring Agreement

pbg-sa.pl

pbg-sa.plRestructuring Support Agreement

thisisnoble.com

thisisnoble.comIn Intercreditor agreement templates, all the changes which are made in the document must be highlighted. One of the most common kind of restructuring agreement includes the debt restructuring agreement in which all the terms and conditions are highlighted so that the borrower can get more deals on the loan along with a lower rate of interest which will eventually help to lower down the principle amount that the borrower will need to repay. The restructuring agreement must contain all the decreased or extended terms and condition of the agreement. The restructuring agreement must consist the entire details of both the parties such as the name, address and the contact details of both the parties.

In a restructuring Franchise agreement template, you will need to0 include the entire details of the parties who are involved in the transaction. It is essential that you fill up the borrower’s section with the entire details of the borrower. The document must consist of the legal name of the borrower. If the borrower is a business and not an individual person than the document must consist the name of the business or the designation of the entity. You will need to have the entire details of the borrower along with the lender and all of it should be included in the restructuring agreement.

Restructured Loan Agreement

files.archive.rbapmabs.org

files.archive.rbapmabs.orgFramework Agreement on Financial Restructuring

tbb.org.tr

tbb.org.trDebt Restructuring Agreement

leychoon.com

leychoon.comTermination Restructuring Agreement

puc.nh.gov

puc.nh.govSettlement Restructuring Agreement

sec.gov

sec.govRestructuring Agreement Example

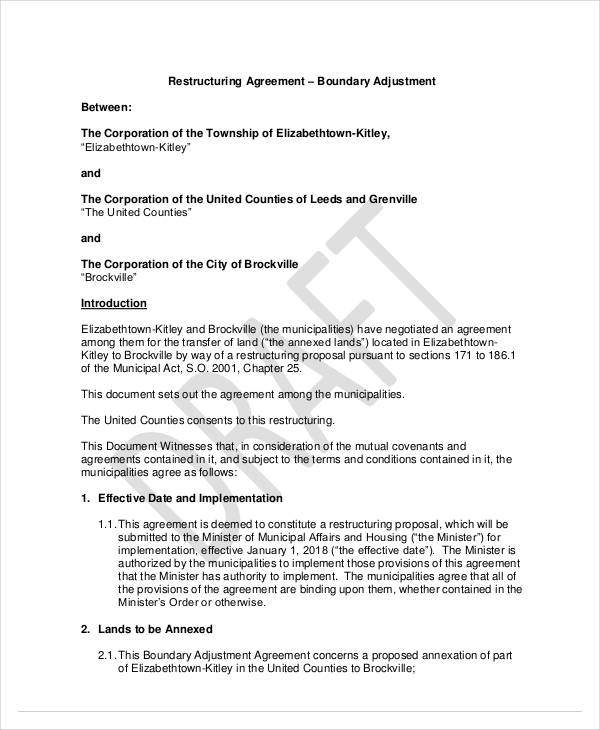

elizabethtownkitley.civicweb.net

elizabethtownkitley.civicweb.netThe companies need to fill up a confidentiality agreement templates if they are facing bankruptcy. There are several loans which are structured in a subordinate along with the other loans. The re always remains a risk of ending up as a default for the existing loan or one can even avail the lower interest rate. Depending on the shareholder agreement, the entity can sell its assets, restructure its entire financial agreements as well as issue equity for reducing the debt and can even file for bankruptcy if the business maintains the operation.

Debt restructuring is one of the best ways of securing financial business agreement templates between two parties. It is one of the best processes that are being used by the companies for avoiding the chances of getting the default. Many companies opt for debt restructuring if they are in the risk of facing bankruptcy. The loans are structured in such a way that some of them are secondary in the priority for other loans. The senior borrowers will be paid before the subordinate lenders if the borrowing company is on the verge of facing bankruptcy.