Table of Contents

- 11+ Investment Disclaimer Templates in PDF | DOC

- 1. Standard Investment Disclaimer

- 2. Investment Recommendation Disclaimer

- 3. Investment Disclaimer and Risk Warning

- 4. Investment General Disclaimer

- 5. Securities Investment Disclaimer

- 6. Investment Account Advice Disclaimer

- 7. Investment Platform Disclaimer

- 8. Financial Management Investment Disclaimer

- 9. No Investment Advice Disclaimer

- 10. Investment Company Disclaimer

- 11. Liability Investment Disclaimer

- 12. Investment Club Network Disclaimer

- Why is An Investment Disclaimer Written?

- Where Do These Warnings Appear and Why?

- Criteria for Giving an Investment Disclaimer

- What are Annuity Contracts Used for in an Investment Disclaimer?

- What is an Annuity Agreement?

11+ Investment Disclaimer Templates in PDF | DOC

An investment disclaimer is a key to the venture procedure, however, the idea that is especially known by most ordinary financial specialists. Thus, disclaimer alerts – those dubiously worded, fine print disclaimers at the base of budgetary archives and sites – are critical for the two purchasers and vendors.

11+ Investment Disclaimer Templates in PDF | DOC

1. Standard Investment Disclaimer

citibank.co.in

citibank.co.in2. Investment Recommendation Disclaimer

nordea.se

nordea.se3. Investment Disclaimer and Risk Warning

royallondon.com

royallondon.com4. Investment General Disclaimer

racap.com

racap.com5. Securities Investment Disclaimer

investing.com

investing.com6. Investment Account Advice Disclaimer

ashburtoninvestments.com

ashburtoninvestments.com7. Investment Platform Disclaimer

ebp.com

ebp.com8. Financial Management Investment Disclaimer

capecove.ca

capecove.ca9. No Investment Advice Disclaimer

online.com

online.com10. Investment Company Disclaimer

floir.com

floir.com11. Liability Investment Disclaimer

globusmaritime.gr

globusmaritime.gr

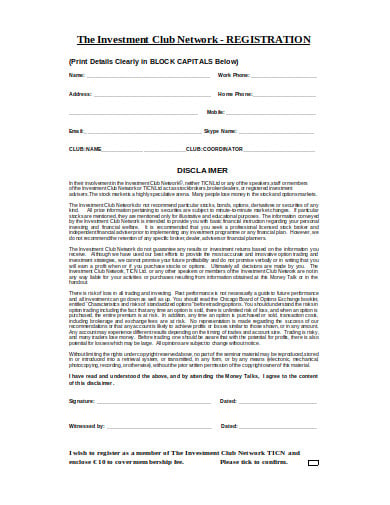

12. Investment Club Network Disclaimer

ticn.com

ticn.comWhy is An Investment Disclaimer Written?

Lamentably, even though there are numerous alerts out there, they regularly stay new or are not adequately unequivocal. A speculator needs a considerable degree of experience and modernity to realize what they truly mean, or a counselor needs to set aside the effort to disclose it to the financial specialist cautiously. However, very frequently, these conditions don’t win. Here and there, merchants like to keep individuals in obscurity to make a deal.

Where Do These Warnings Appear and Why?

- Fundamentally for lawful reasons, venture firms and money related organizations, by and large, distribute an admonition in their pamphlets and on web locales. The goal isn’t just to disclose to the financial specialist the idea of the dangers engaged with the specific sort of speculation being offered, yet in addition to guaranteeing that there can be no claims if things go severely. The alerts are either in a different web interface or imprinted in extra pages – shifting from a fairly little commentary to a quite express and huge sort clarification of what can turn out badly. The length will in general shift from one sentence to a few pages.

- This cautions individuals to be cautious, yet what the number of speculators truly comprehend what is implied by “appropriateness” or would try to twofold check? Also, if the financial specialist confides in the dealer, they will imagine that they are being cautious. The chances of a speculator setting off to a consultant are low.

Criteria for Giving an Investment Disclaimer

There are a few criteria that an admonition ought to satisfy on the off chance that it is to get the correct message over:

Measurement

Even though this isn’t constantly potential, speculators ought to have some thought with regards to the extent of their cash that they could lose.

- Alerts ought to be anything but difficult to follow. Any disclaimer or risk cautioning ought to be straightforward. On the off chance that you don’t comprehend what the risk cautioning is letting you know, don’t accept that the venture is directly for you since you confide in the merchant. An unpracticed financial specialist could without much of a stretch be encouraged to purchase anything, running from a fundamental stock reserve to an exceptionally unpredictable organized item.

- Marking is significant for the two gatherings. On the off chance that a speculator needs to sign the notice, this shows its significance to the person in question and gives great security to the firm. In any case, never sign anything you don’t comprehend.

Web Admonitions

On the web, it is very simple to click away from an admonition and continue with the arrangement. Ideally, the connection and section would be clear and the financial specialist provoked to pay attention to the notice. This is certifiably not an ideal world, in any case, and it’s dependent upon financial specialists to ensure they read the disclaimer before proceeding.

Individual Clarifications

This is the main way numerous financial specialists will truly comprehend the dangers of given speculation. On the off chance that the print cautioning doesn’t meet your criteria, look for individual guidance. The clarification ought to be clear and give adequate detail so you realize what you could lose, and how, and what different items may be pretty much appropriate and engaging. The dealer ought to likewise make a note of how the notice was displayed and, if conceivable, get the financial specialist to sign this as well.

Ask Until You Are Sure

As a private financial specialist, you have to demand verbal and additionally composed data and clarifications until you are certain you comprehend the admonitions. Try not to stop until you are completely mindful, in quantitative terms, of what you remain to pick up and lose, and what other potential speculations there are with various risk/reward proportions.

The Bottom Line

Fundamentally, speculation chance admonitions are clear and adequate not exclusively to give lawful assurance, yet in addition to guaranteeing that the message returns home. Firms and guides should just sell items with a notice that passes on the genuine degree of risk. Lamentably, what ought to be done and what is the normal practice are two distinct things. As a financial specialist, it’s pivotal to know the amount of your cash you could lose and what conditions could make this happen. On the off chance that you are awkward with the dangers of the venture, recall there are consistently lower-chance other options.

What are Annuity Contracts Used for in an Investment Disclaimer?

An annuity contract is a composed understanding between an insurance agency and a client sketching out each gathering’s commitments. In an investment disclaimer, it incorporates subtleties, for example, the structure of the annuity, regardless of whether variable or fixed, any punishments for early withdrawal, spousal and recipient arrangements, for example, a survivor statement and pace of spousal inclusion, and the sky is the limit from there.

What is an Annuity Agreement?

An annuity agreement may have up to four counterparties: the guarantor, normally an insurance agency; the proprietor of the annuity; the annuitant; and the recipient. The proprietor is the agreement holder. The annuitant is the person whose life is utilized as the measuring stick for deciding when benefits installments will begin and stop. By and large, the proprietor and annuitant are similar individuals.

The recipient is the individual assigned by the annuity proprietor to get any passing advantage when the annuitant bites the dust. An annuity contract is useful to the individual financial specialist in that it lawfully ties the insurance agency to give an ensured intermittent installment to the annuitant once the annuitant arrives at retirement and solicitations beginning of installments. It ensures a risk-free retirement salary.