One of the sole reasons why businesses operate is to gain profit. With that, the cash flow must be constant and continuous. But, according to statistics, 6 out of 10 Americans are anxious about bills and half of them are paid late. To continue generating revenues, you need to generate sales invoices for your clients. Make one now by having our comprehensive, professionally written, and industry compliant Sales Invoice Template in PDF format. This file lets you save time, money, and effort with its original content. Apart from that, this template is editable, customizable, and printable in various sizes. Download now!

Sales Invoice Templates in PDF

Explore professionally designed editable sales invoice templates in PDF to download. Free, customizable, and perfect for professional quality. Download now.

Bring your business transactions to life with pre-designed Sales Invoice Templates in Adobe PDF by Template.net

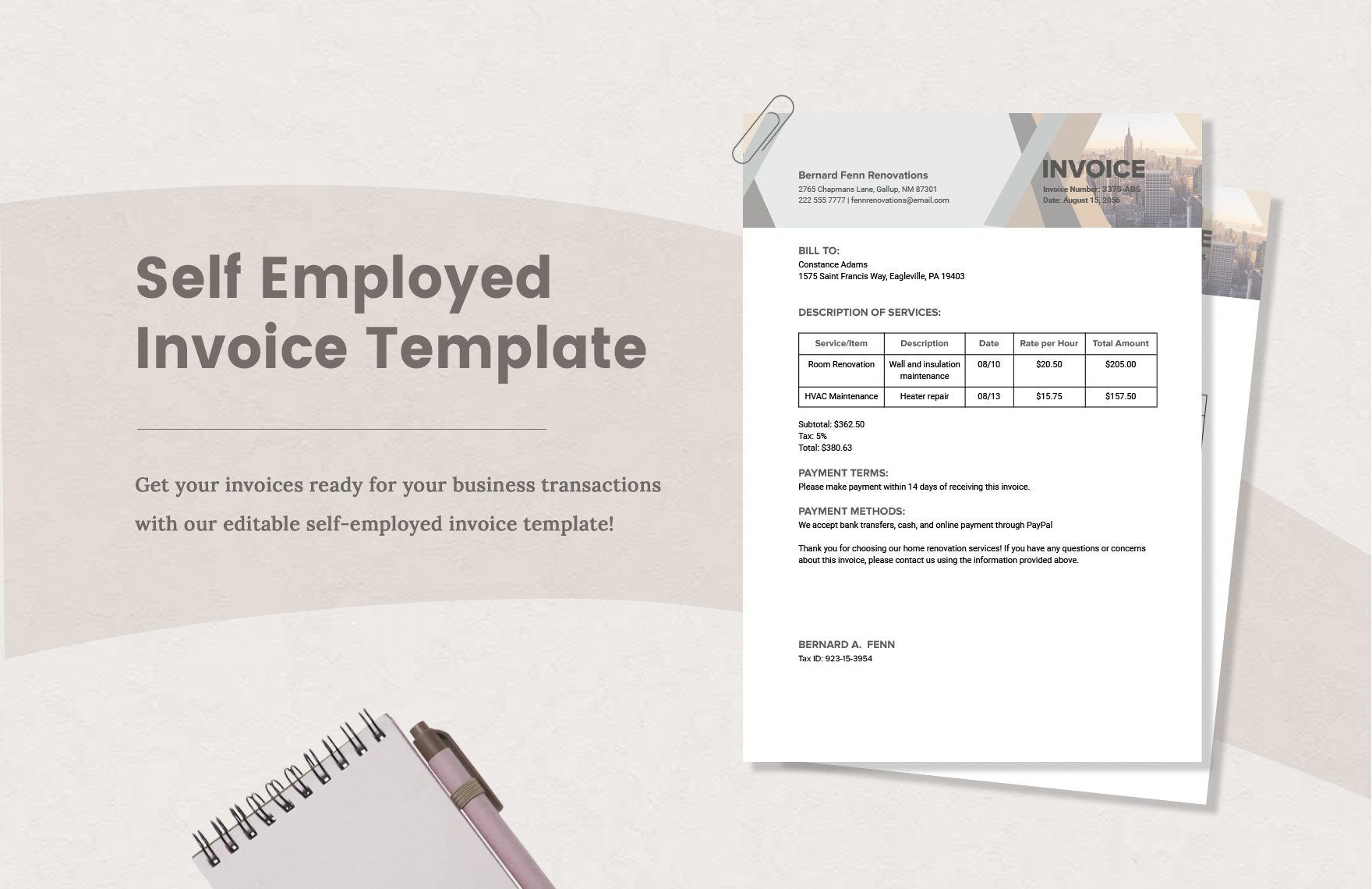

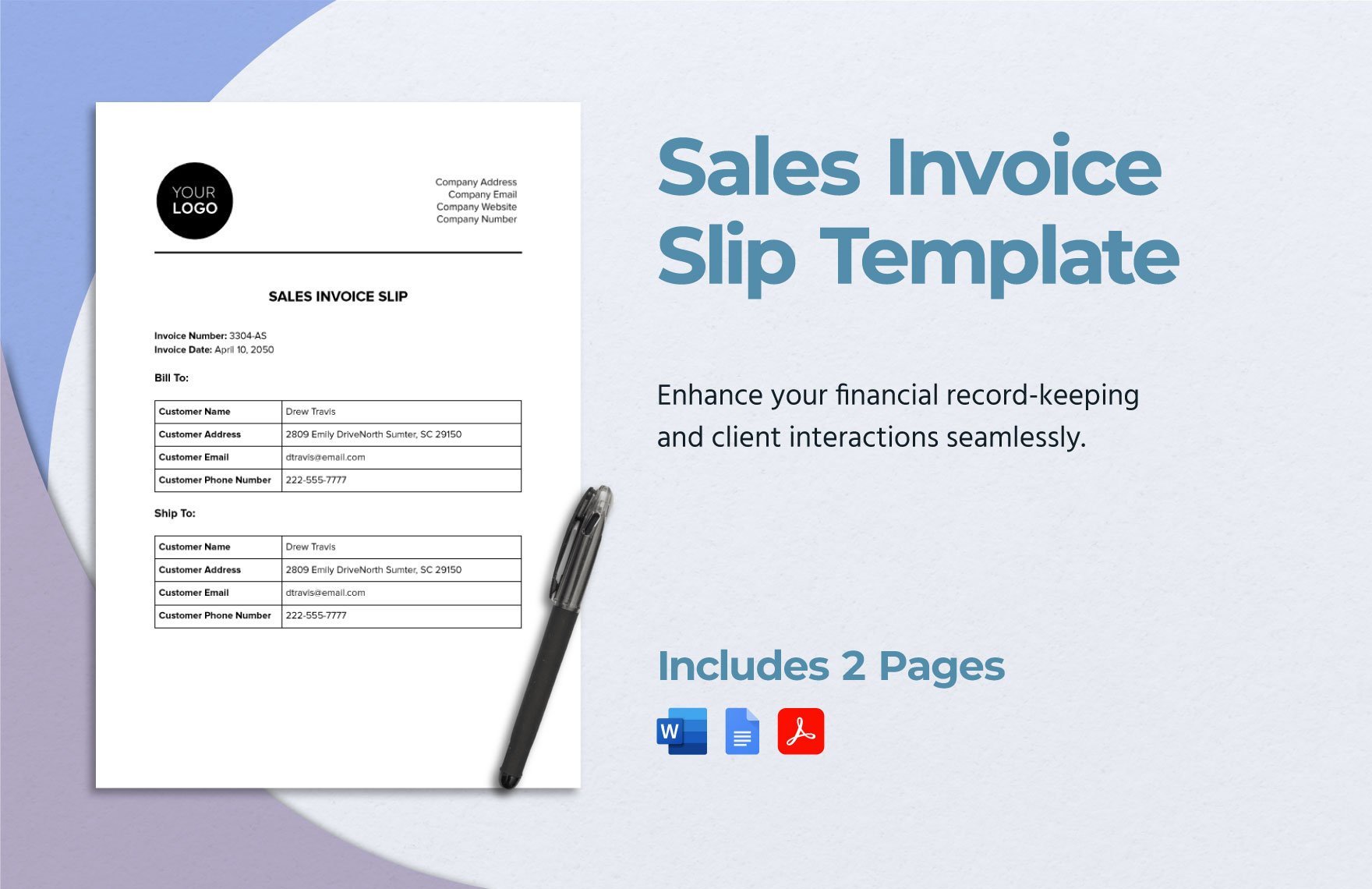

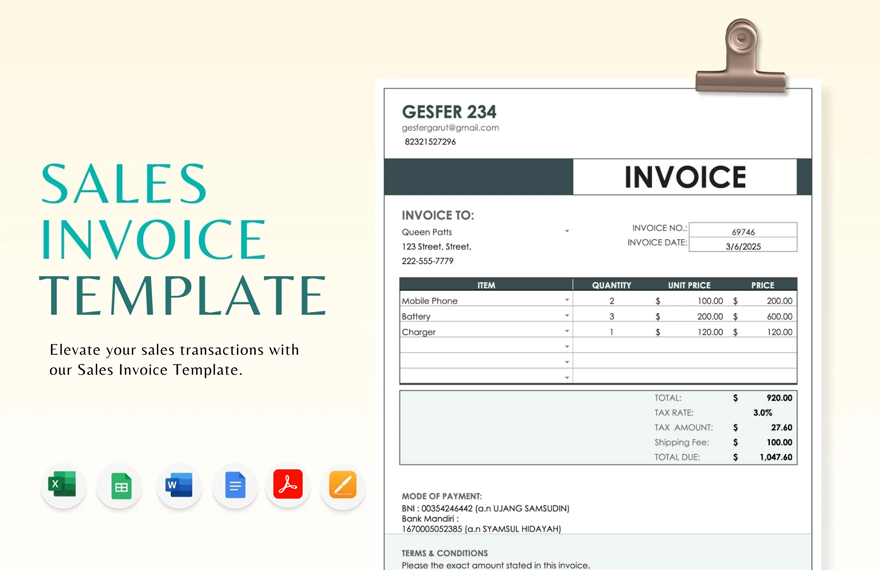

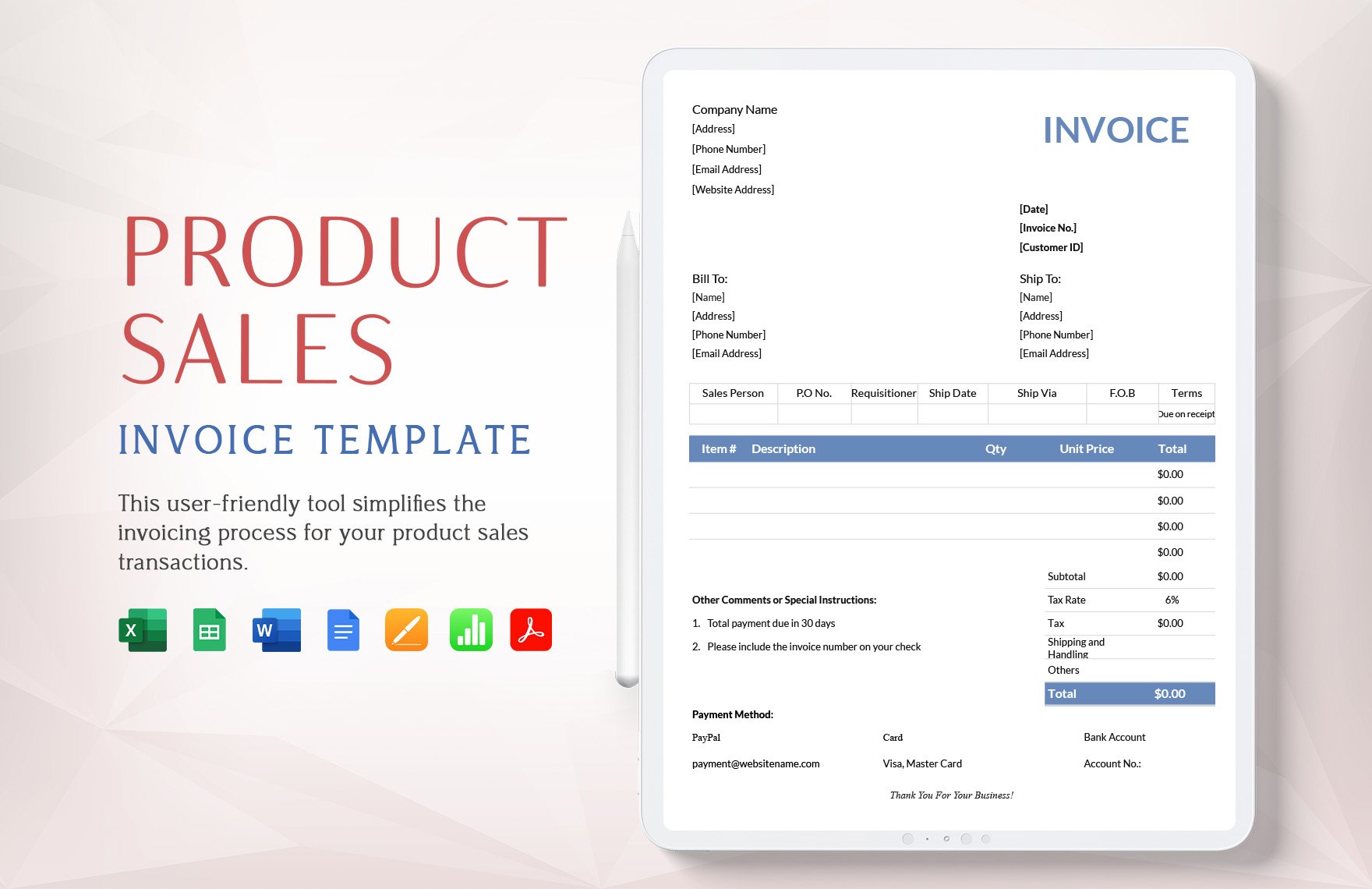

Free pre-designed Sales Invoice Templates by Template.net offer a dynamic solution for businesses looking to elevate their invoicing process. Perfect for entrepreneurs, freelancers, and small business owners, these templates allow you to create professional-grade invoices swiftly and effortlessly without any design experience. Whether you're looking to bill a client or maintain a record of your sales transactions, these templates are tailored to meet your needs. With a diverse range of downloadable and printable files available in Adobe PDF, you'll find it easy to customize each template to fit your brand. Save time and resources with these straightforward, beautiful pre-designed layouts, available in both print and digital formats, ensuring no design skills are needed for effective invoicing.

Discover an extensive array of pre-designed and customizable Sales Invoice Templates with Template.net. Explore more beautiful premium pre-designed templates in Adobe PDF, with regular updates adding fresh designs to keep your invoices captivating and professional. Share your completed invoices effortlessly, with options to download or share via link, print, email, or export, boosting your reach and efficiency. By leveraging both free and premium templates, you gain maximum flexibility, ensuring your invoices stand out in any scenario. Dive into this rich library today and take the pain out of invoicing with high-quality, customizable designs that cater specifically to your business needs.

Frequently Asked Questions

What are other types of invoices?

Aside from sales invoices, the following are the invoices that you can issue:

1. Standard invoices

2. Commercial invoices

3. Progress invoices

4. Utility invoices

5. Recurring invoices

6. Pre-Forma invoices

7. Timesheet

8. Debit Memo

What is the opposite of an invoice?

The opposite document of an invoice is a credit note.

What is the difference between billing and invoicing?

Billing is an act where the amount of money owed for the products or services rendered by the producer or seller is paid. Invoicing is an act where you would issue a document narrating every goods or services rendered to the consumer or buyer.

How can you differentiate sales invoice from sales order?

The main difference between the two is their point of origin. A sales order is made by the customers or clients who wanted to make a purchase. A sales invoice is issued by a seller or producer to inform a particular client about the purchase that they made.