Bring Your Business Efficiency to Life with Invoice Templates from Template.net

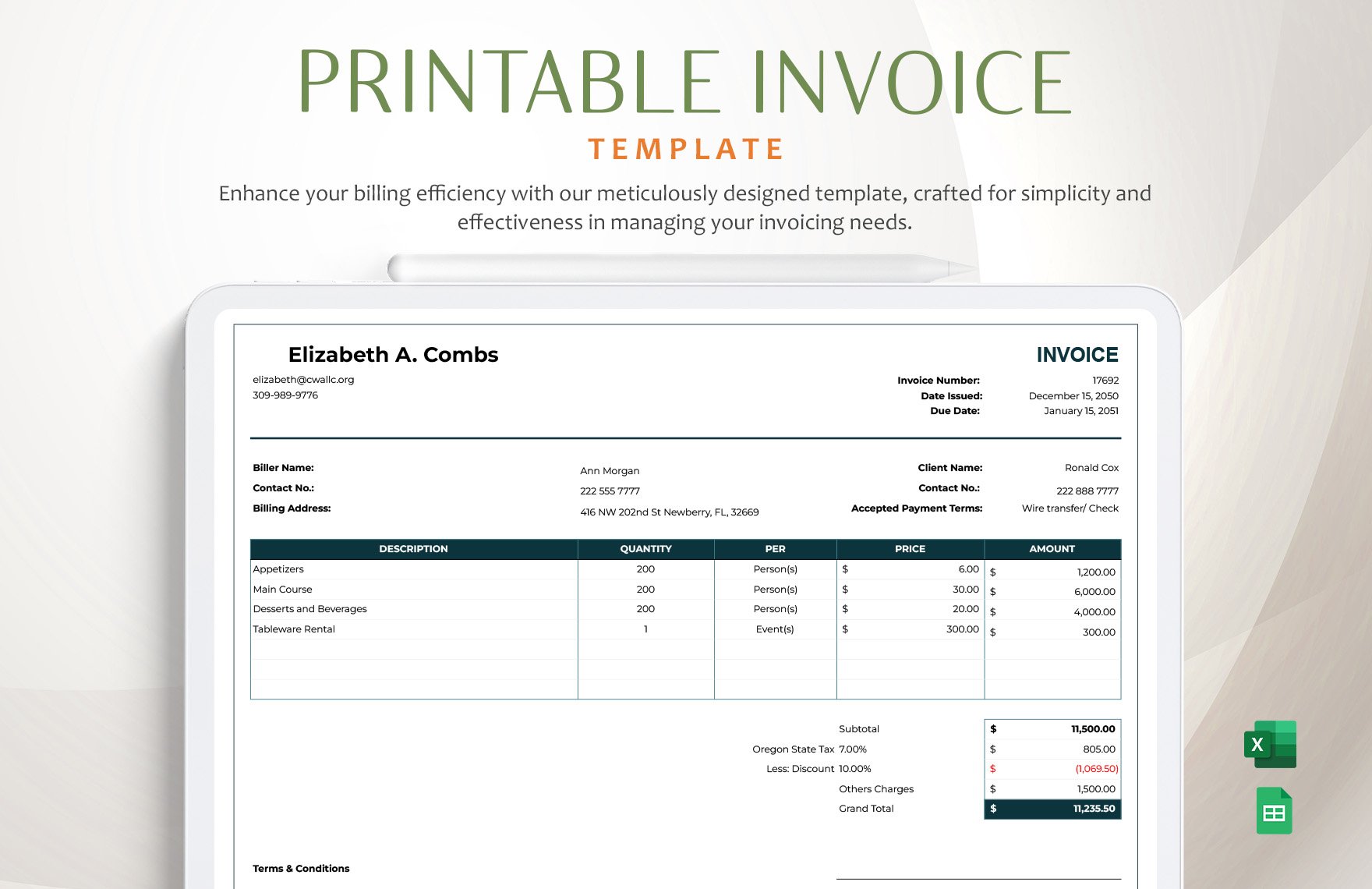

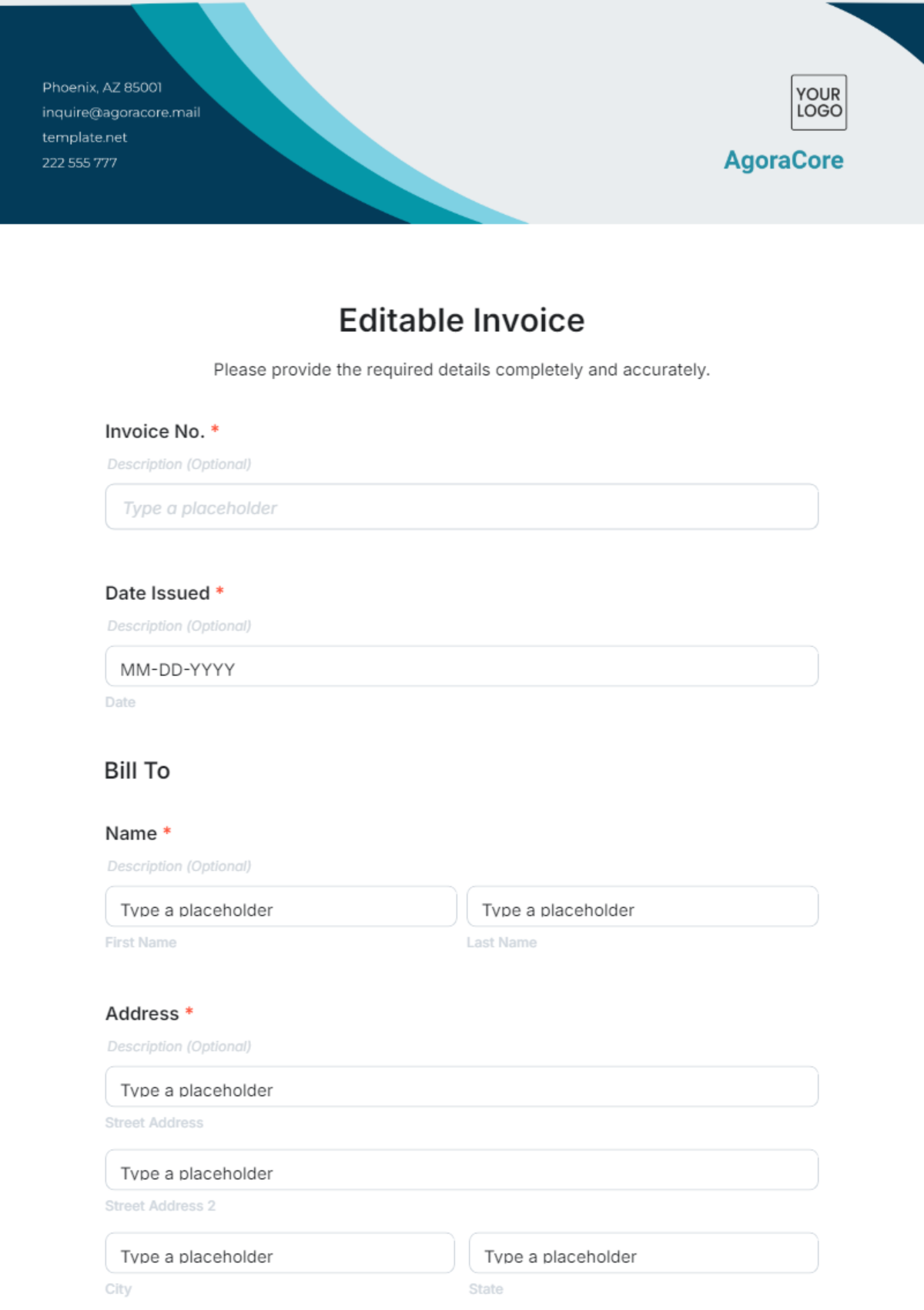

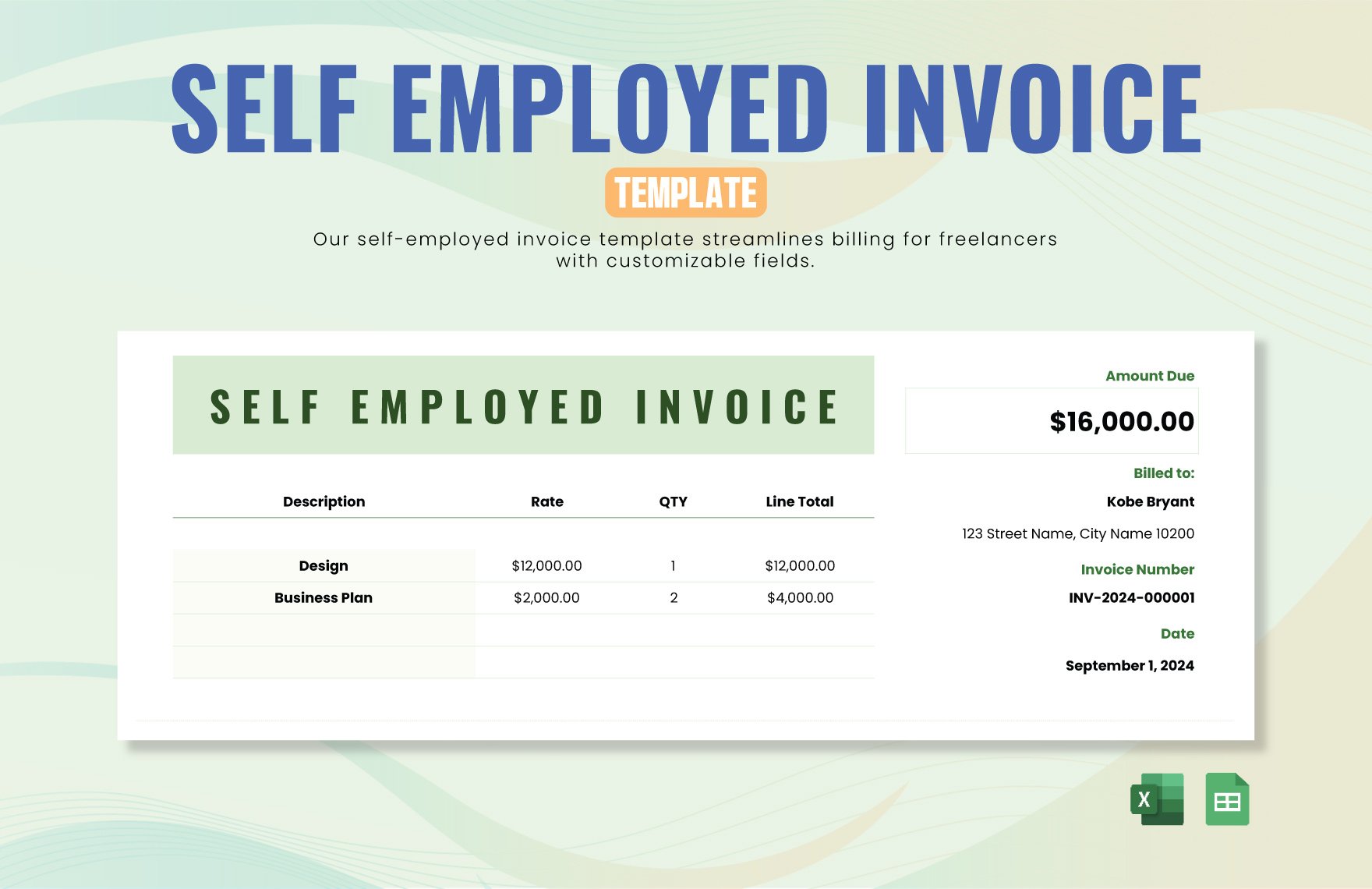

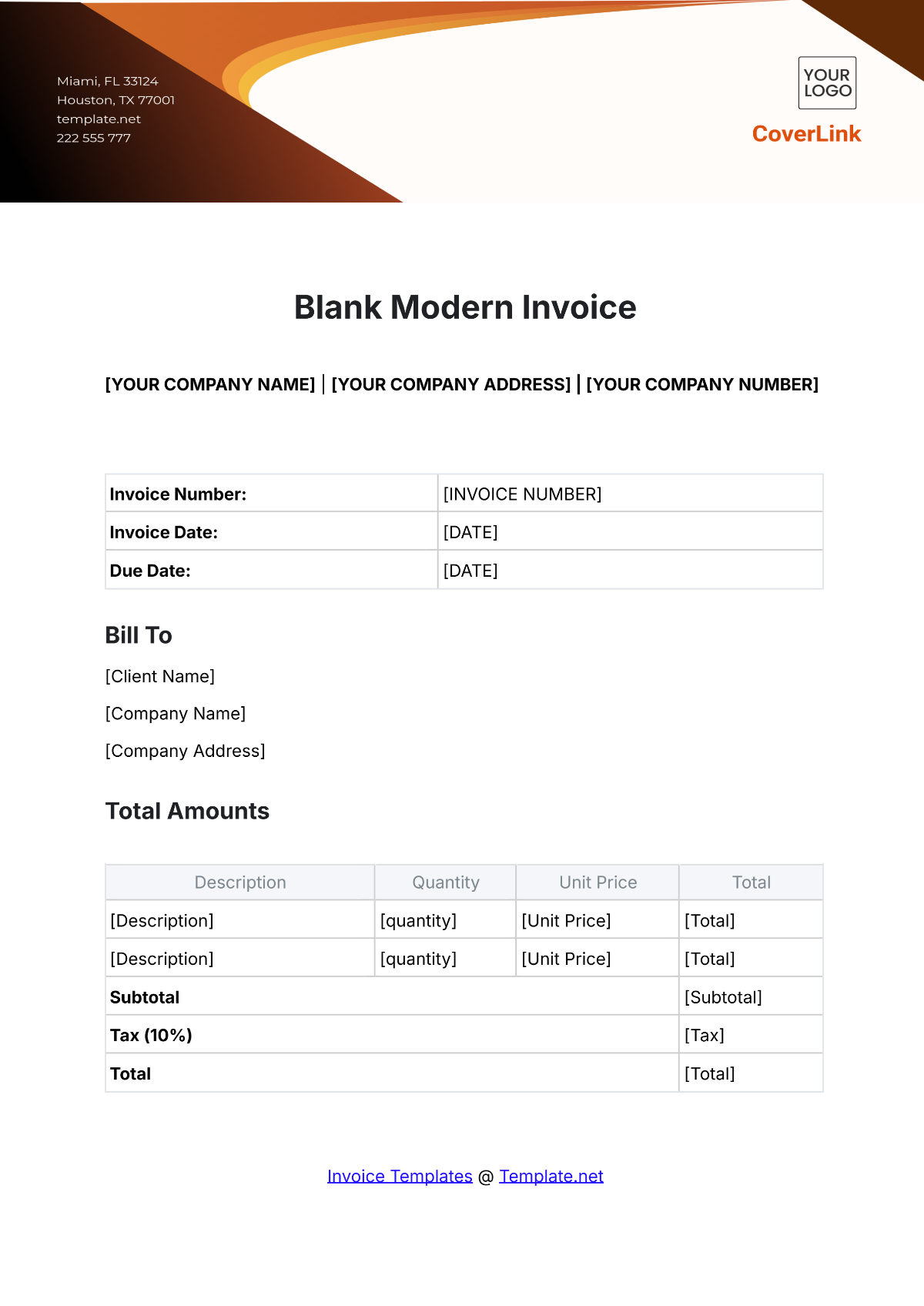

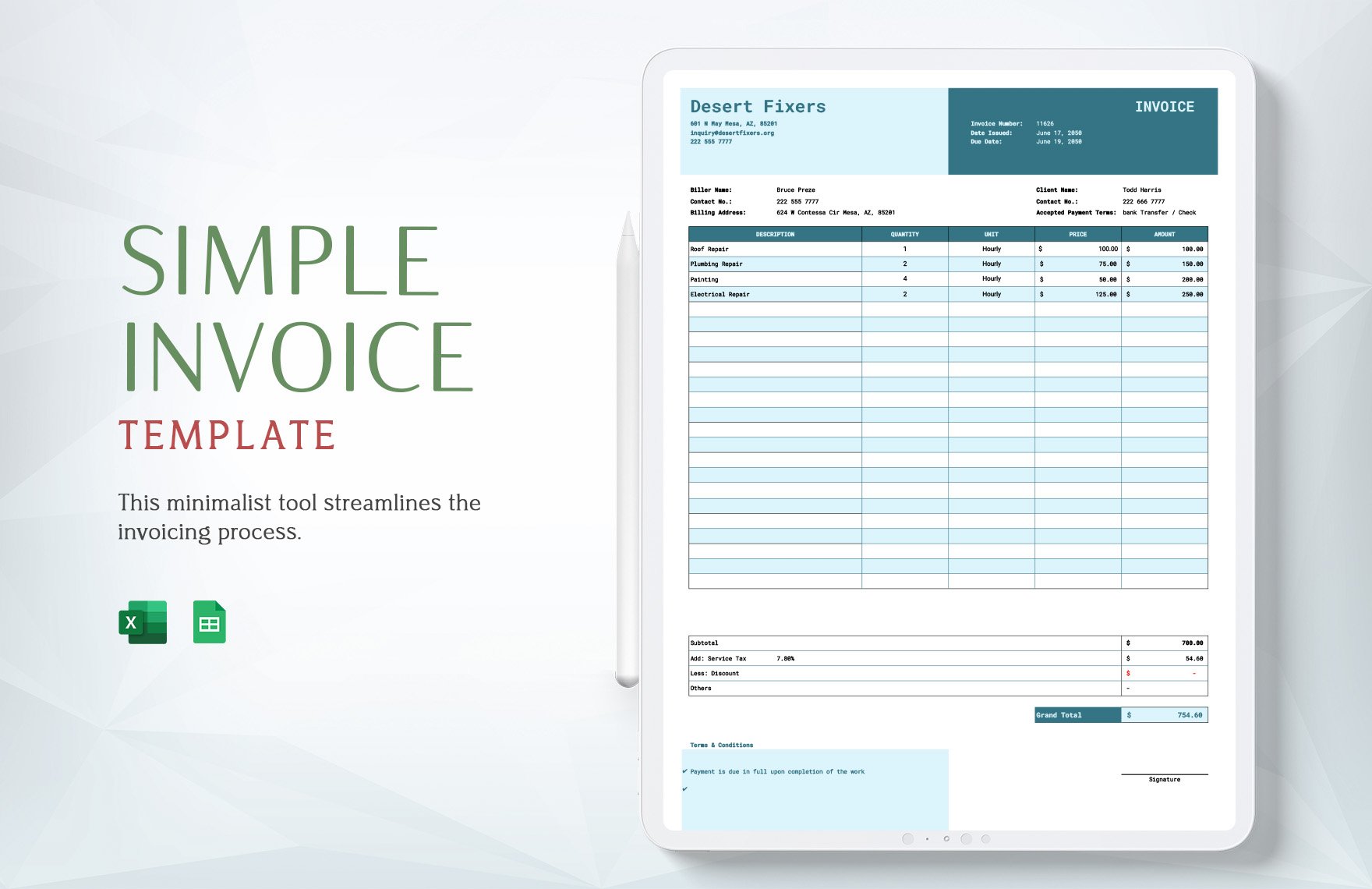

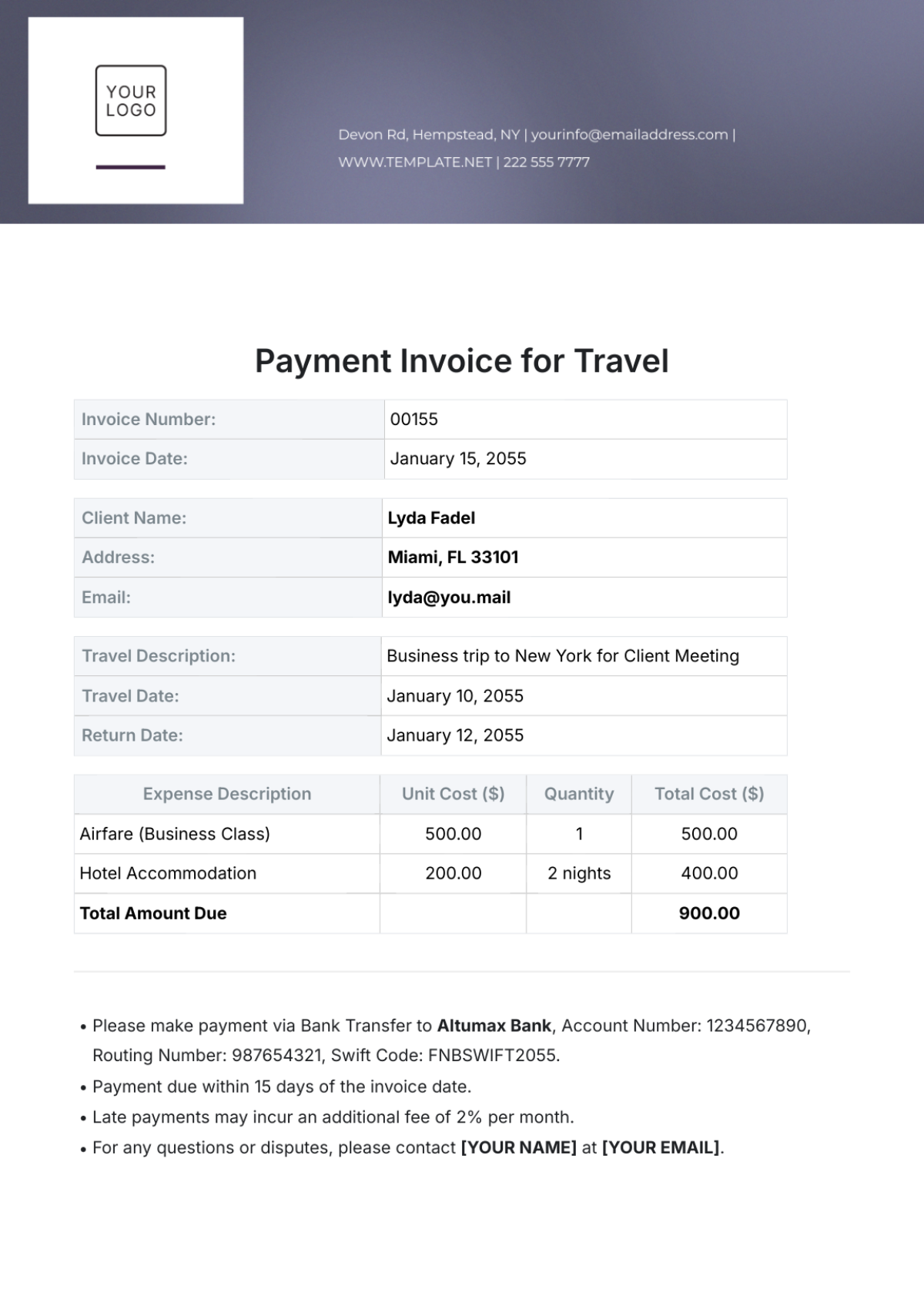

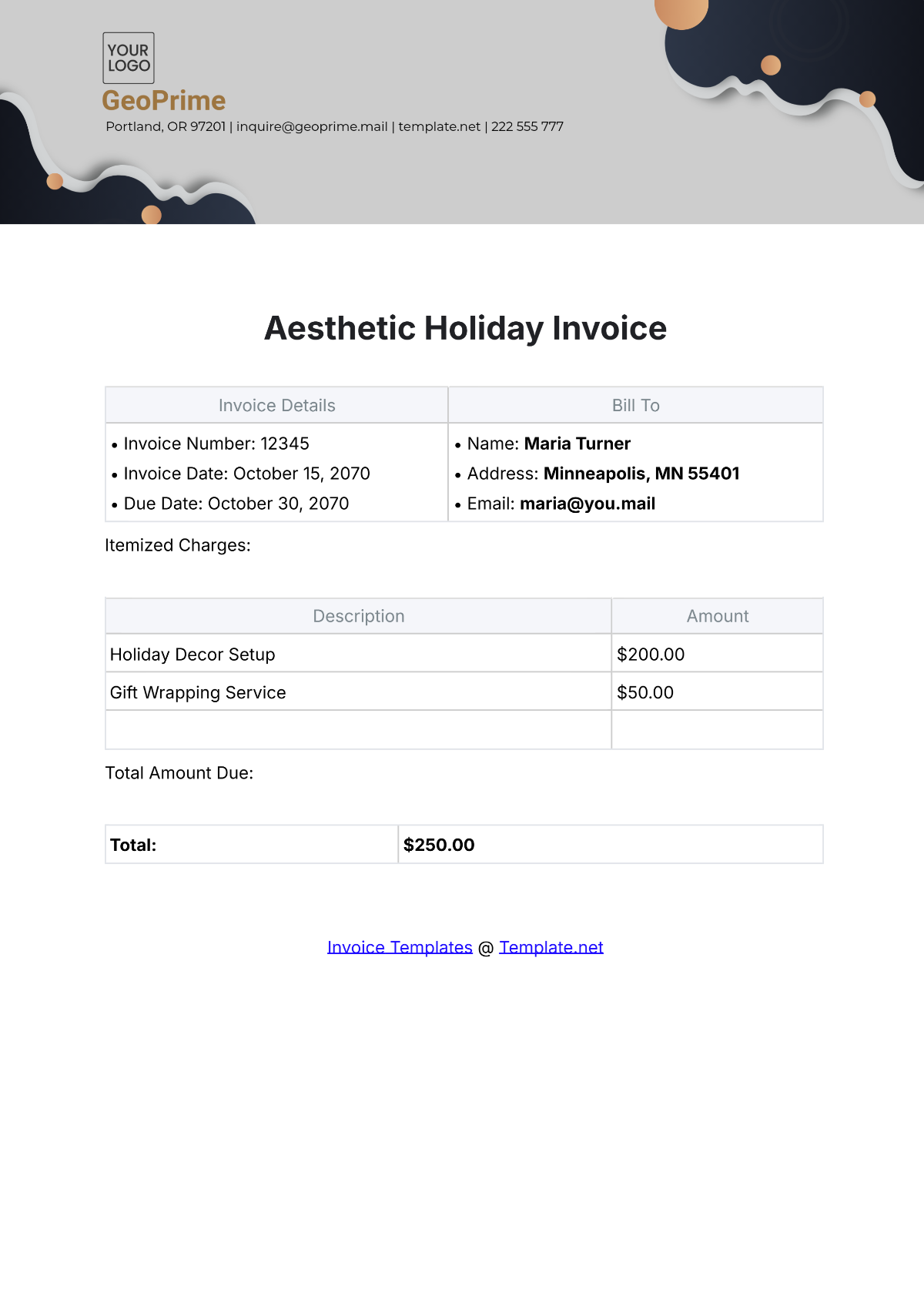

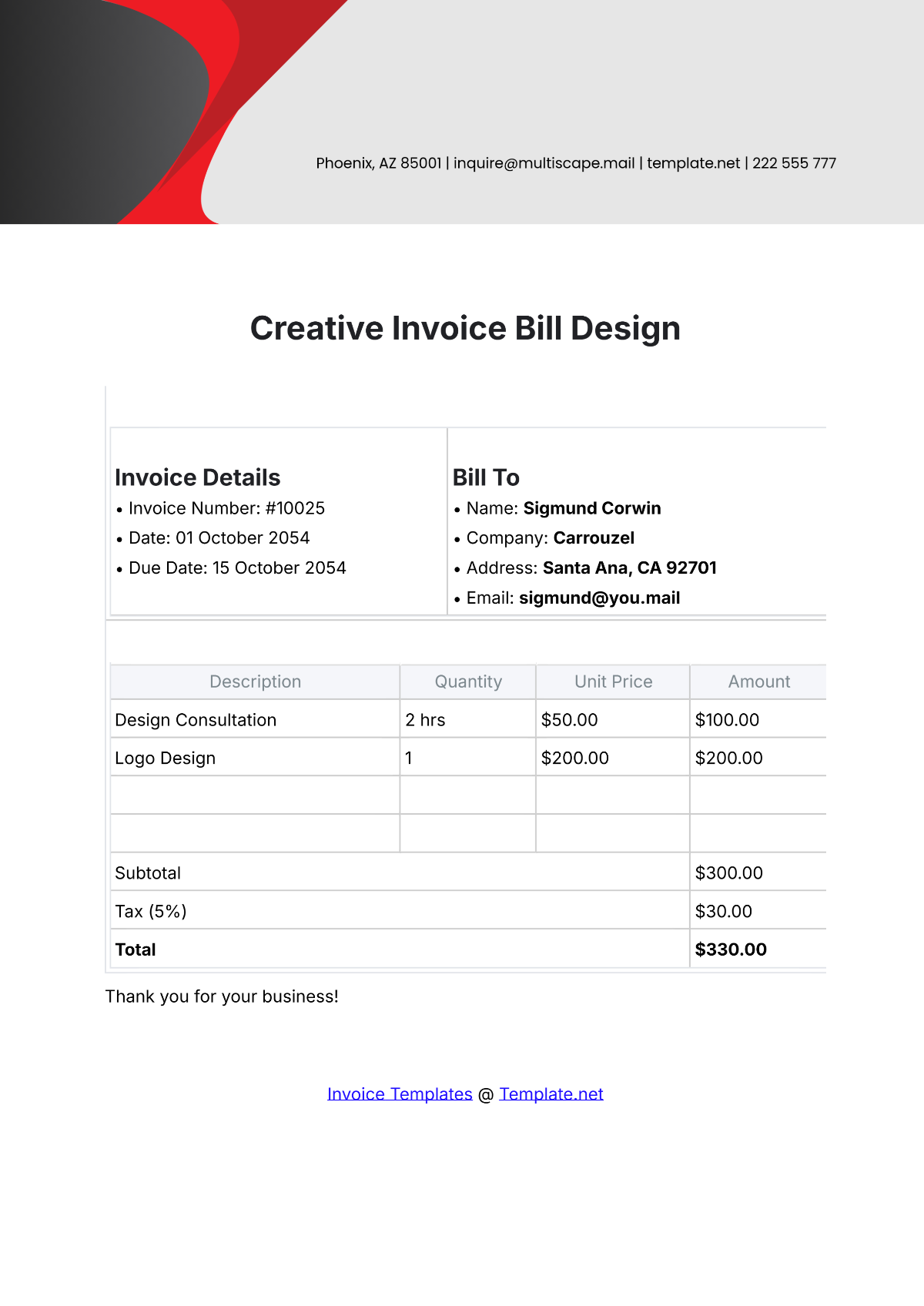

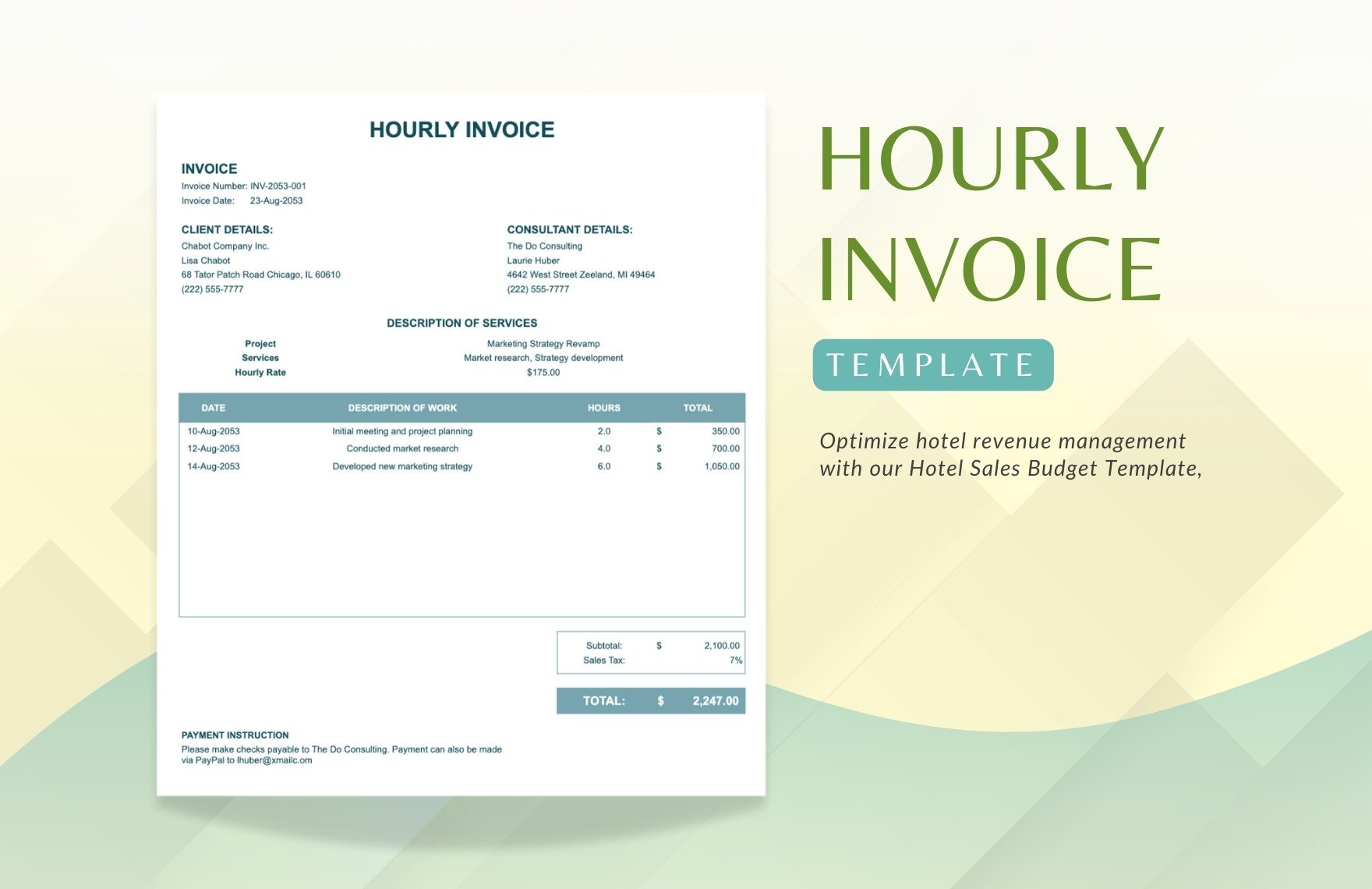

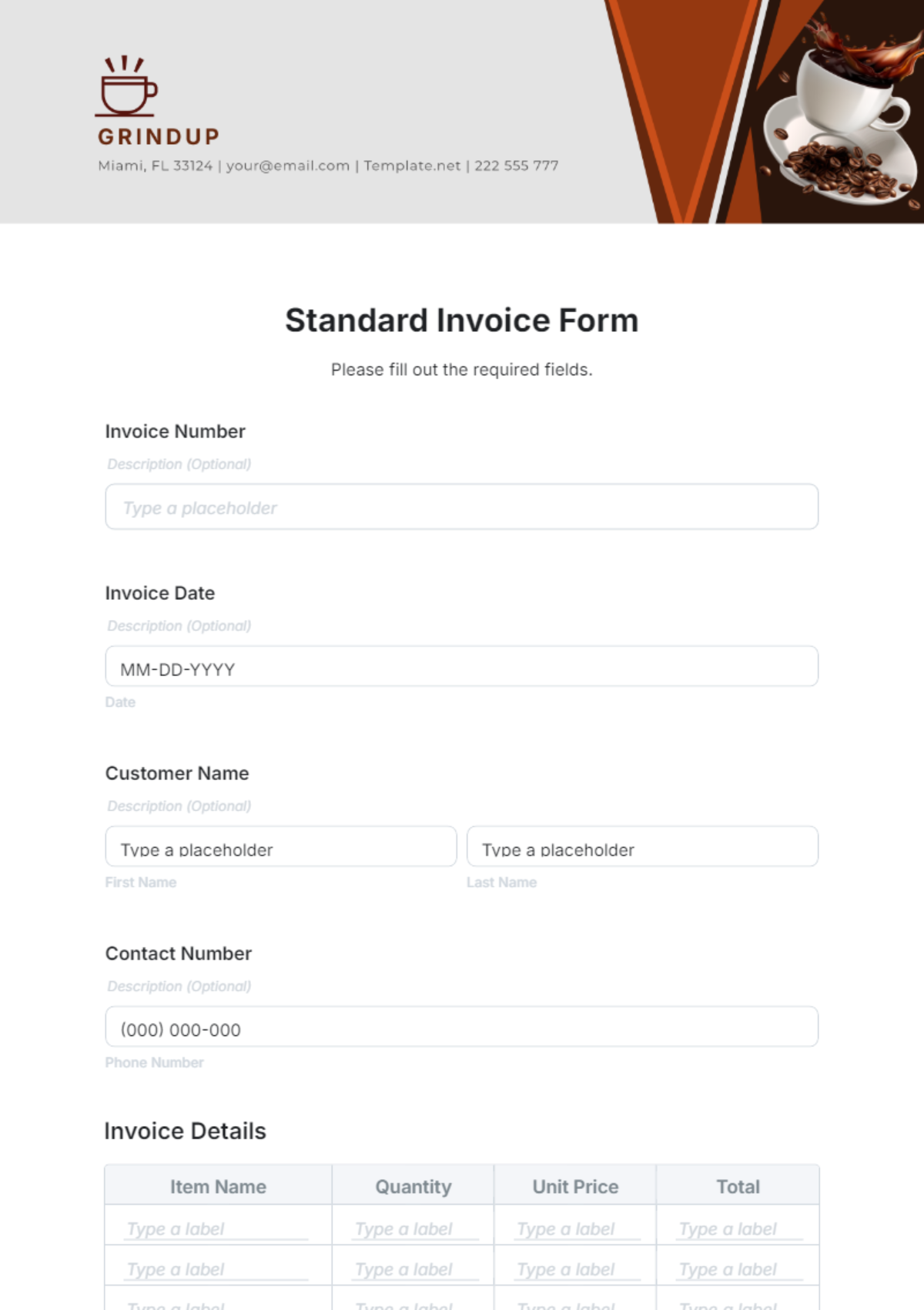

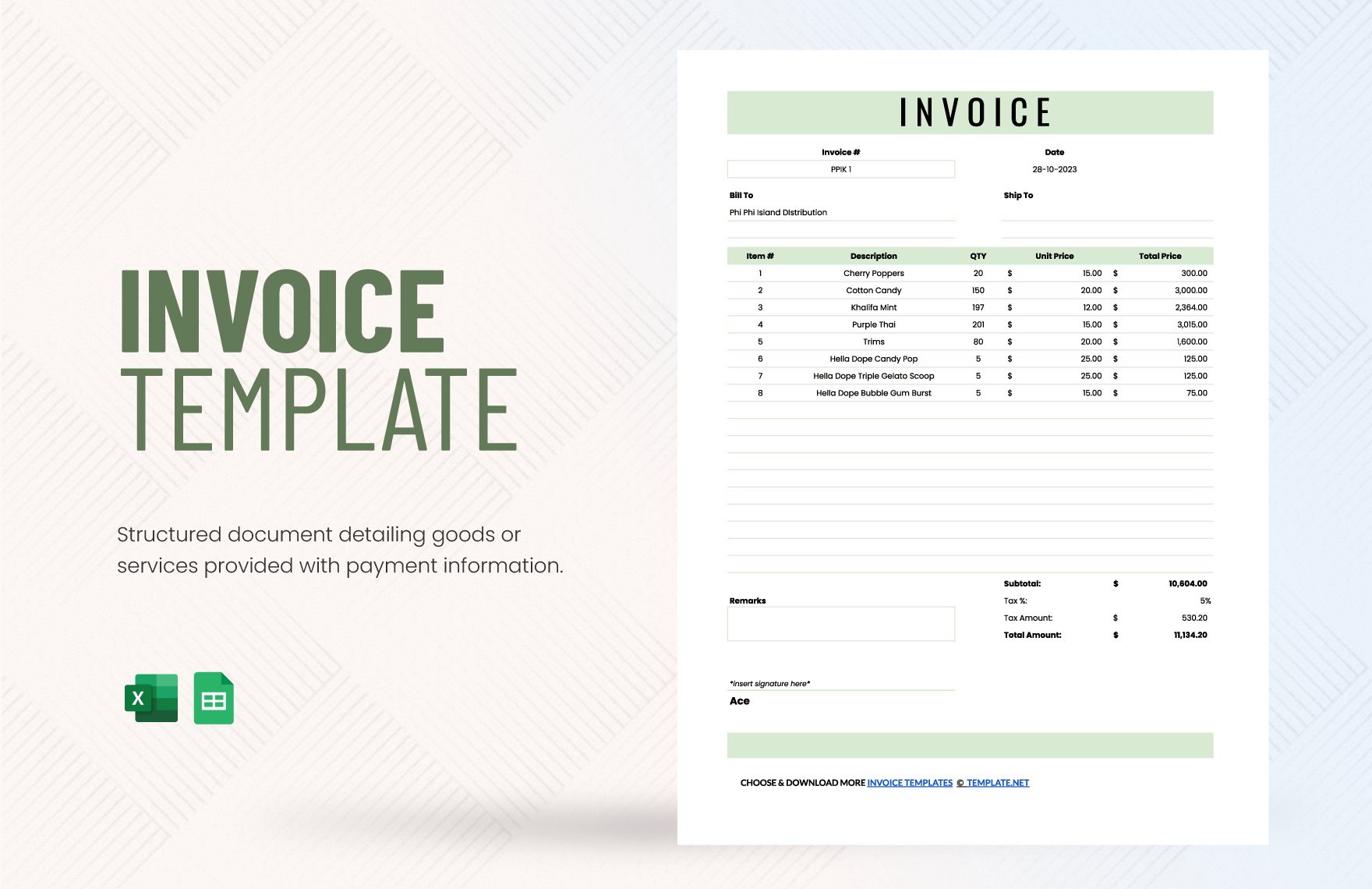

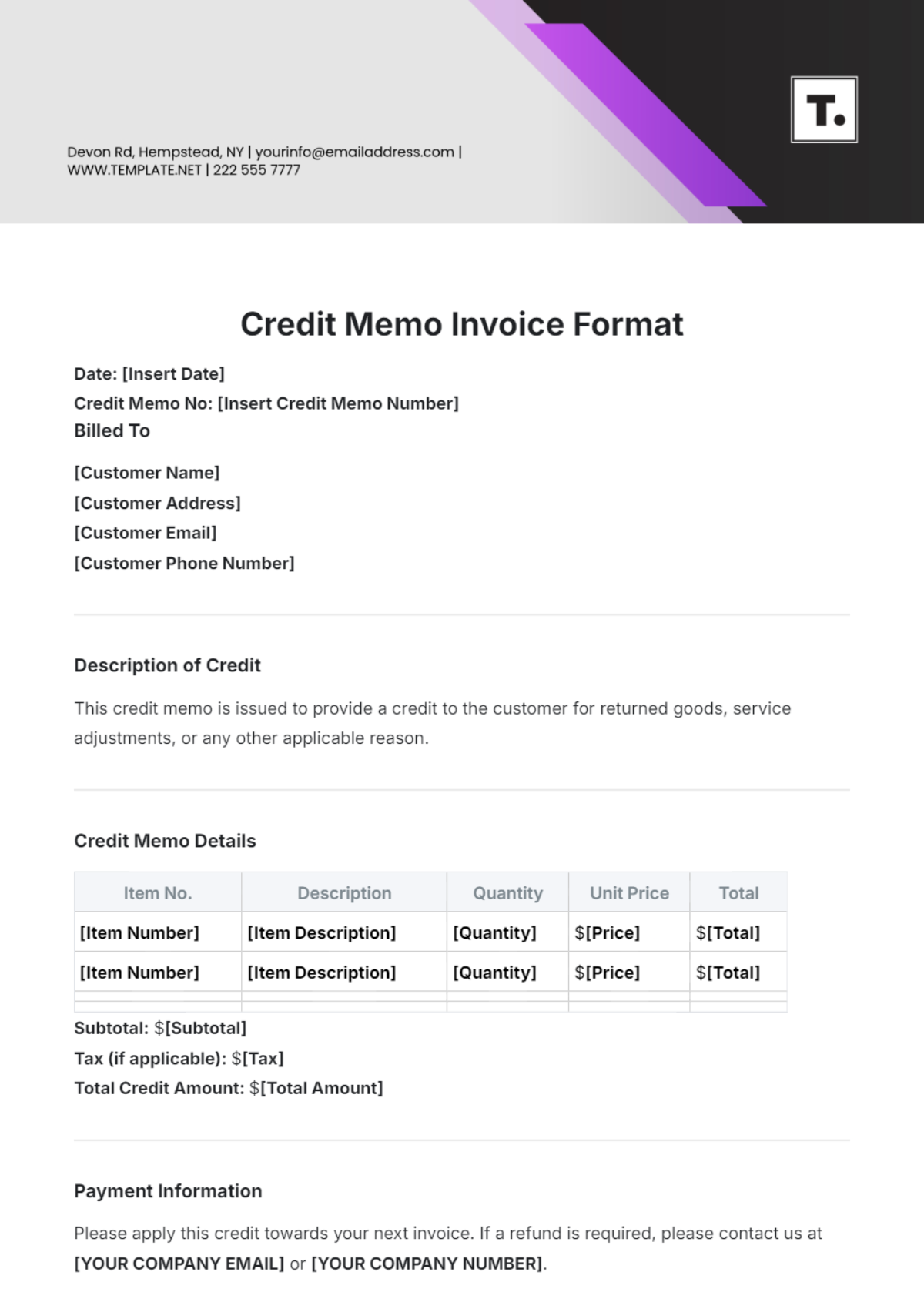

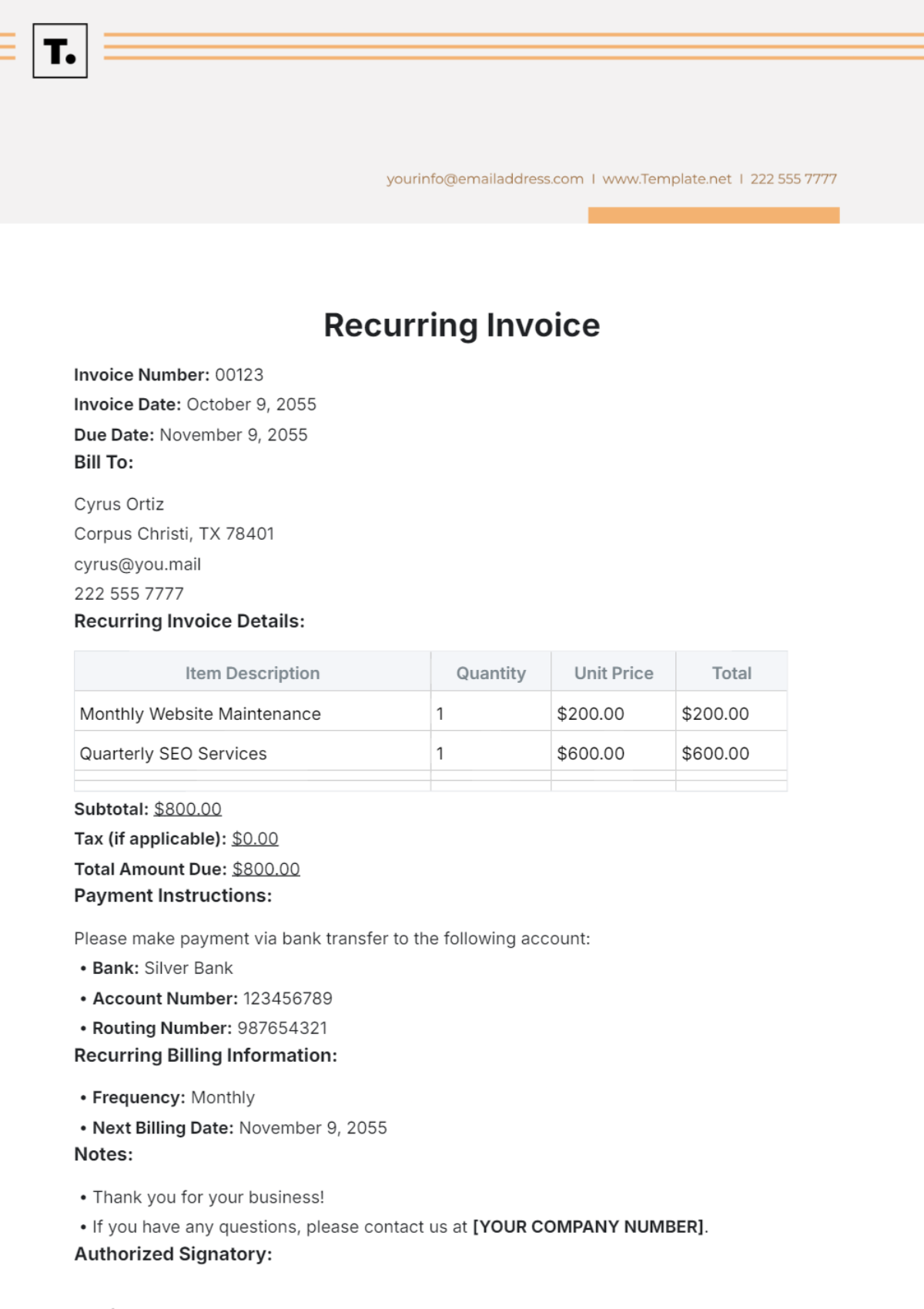

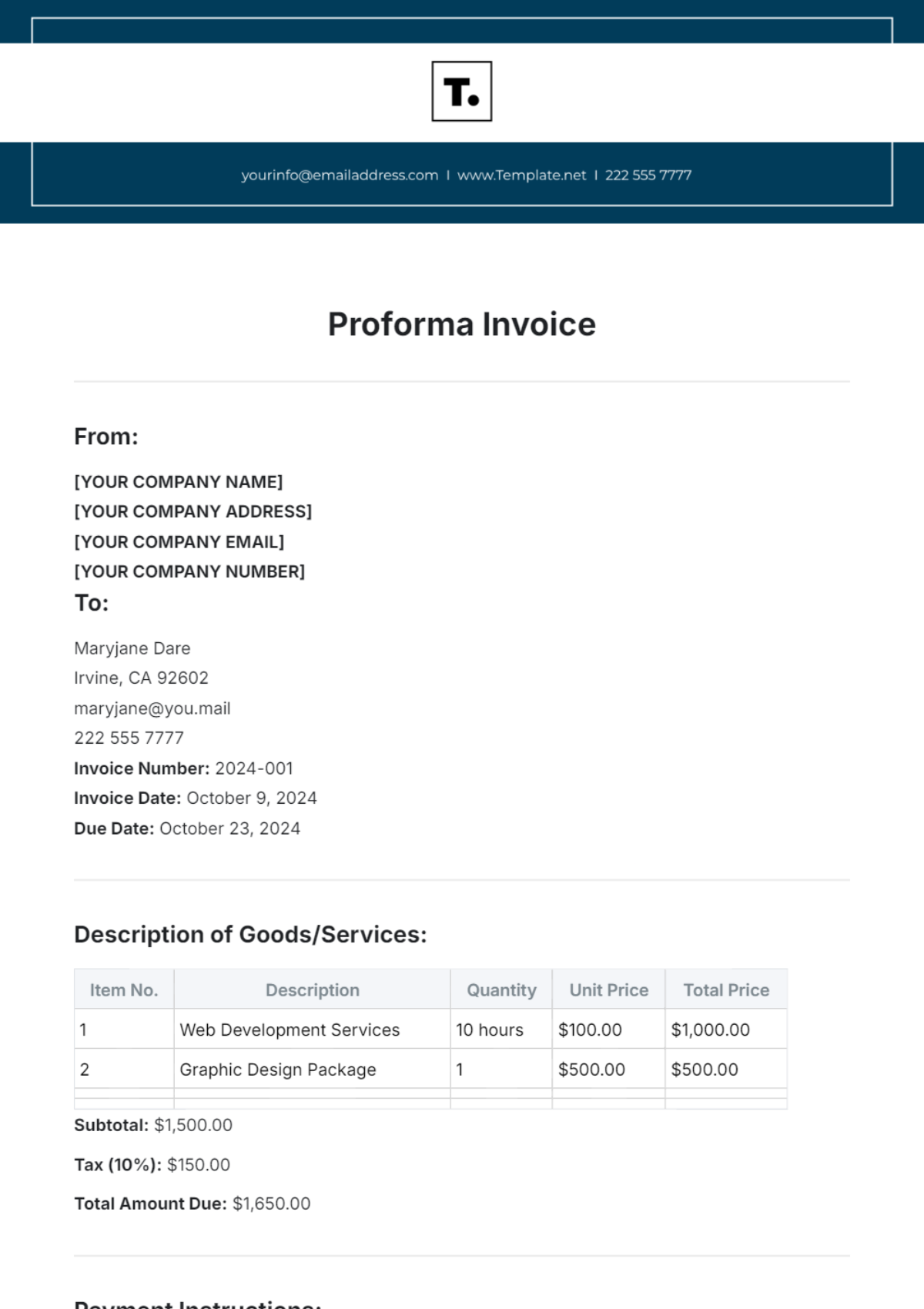

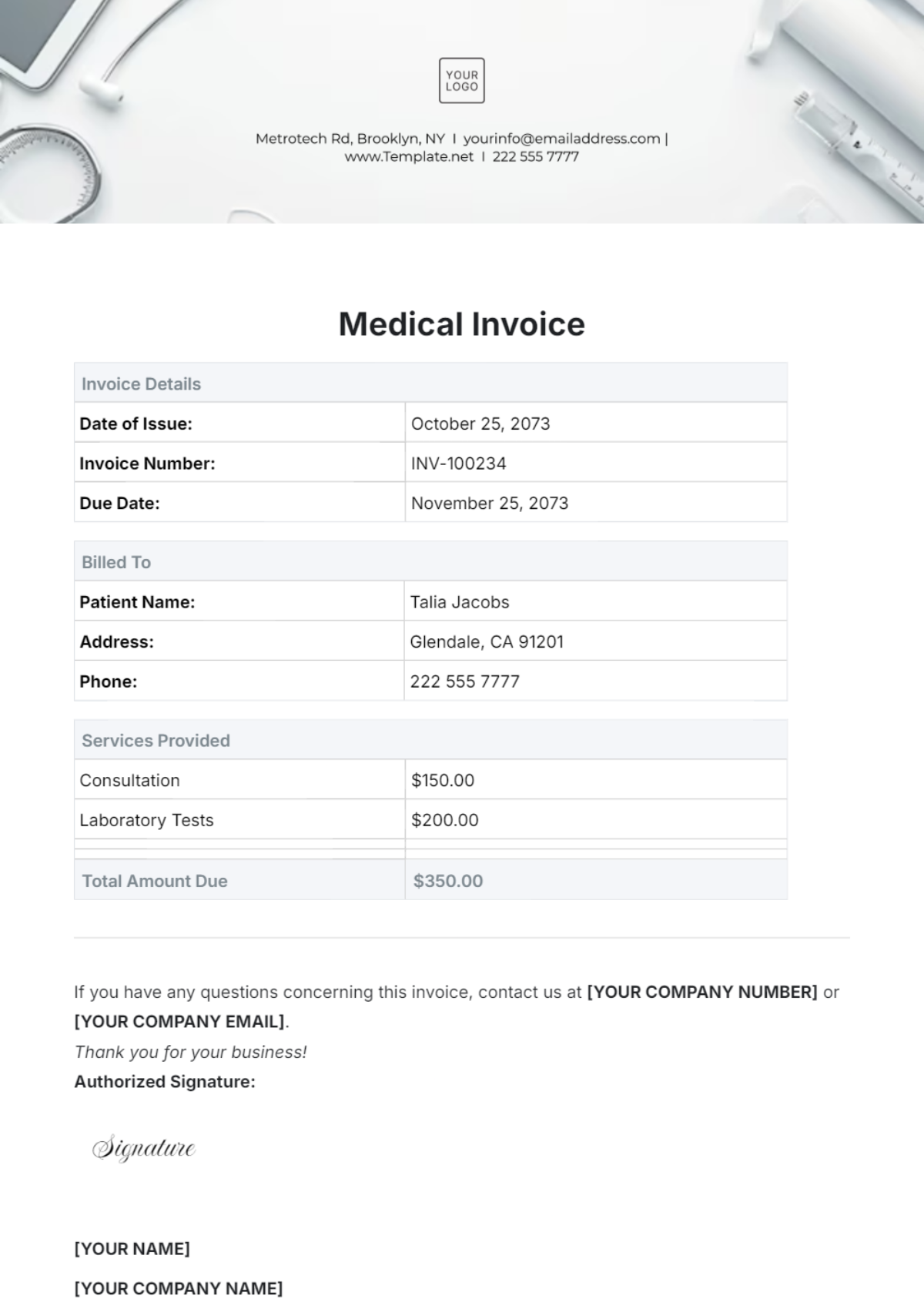

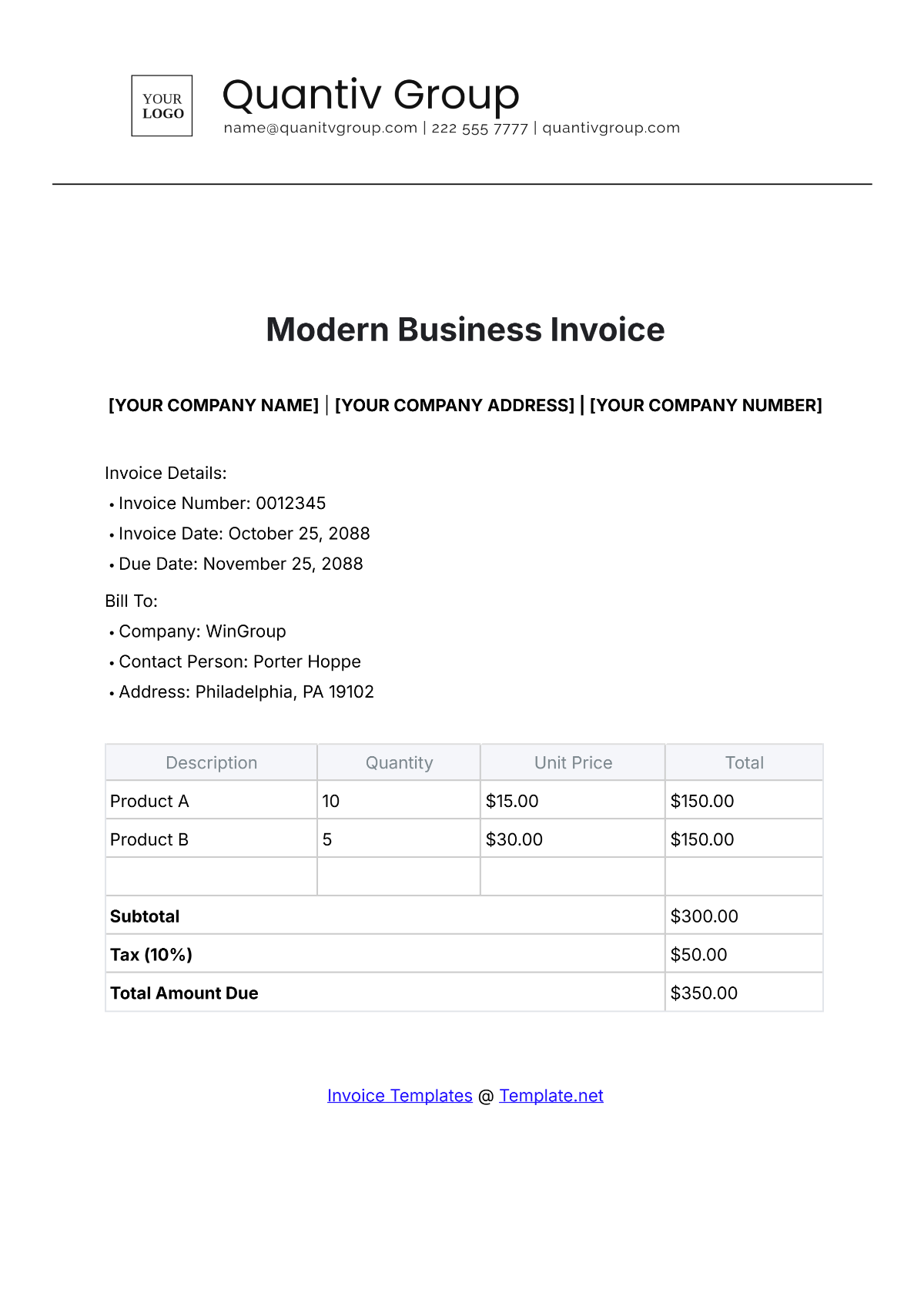

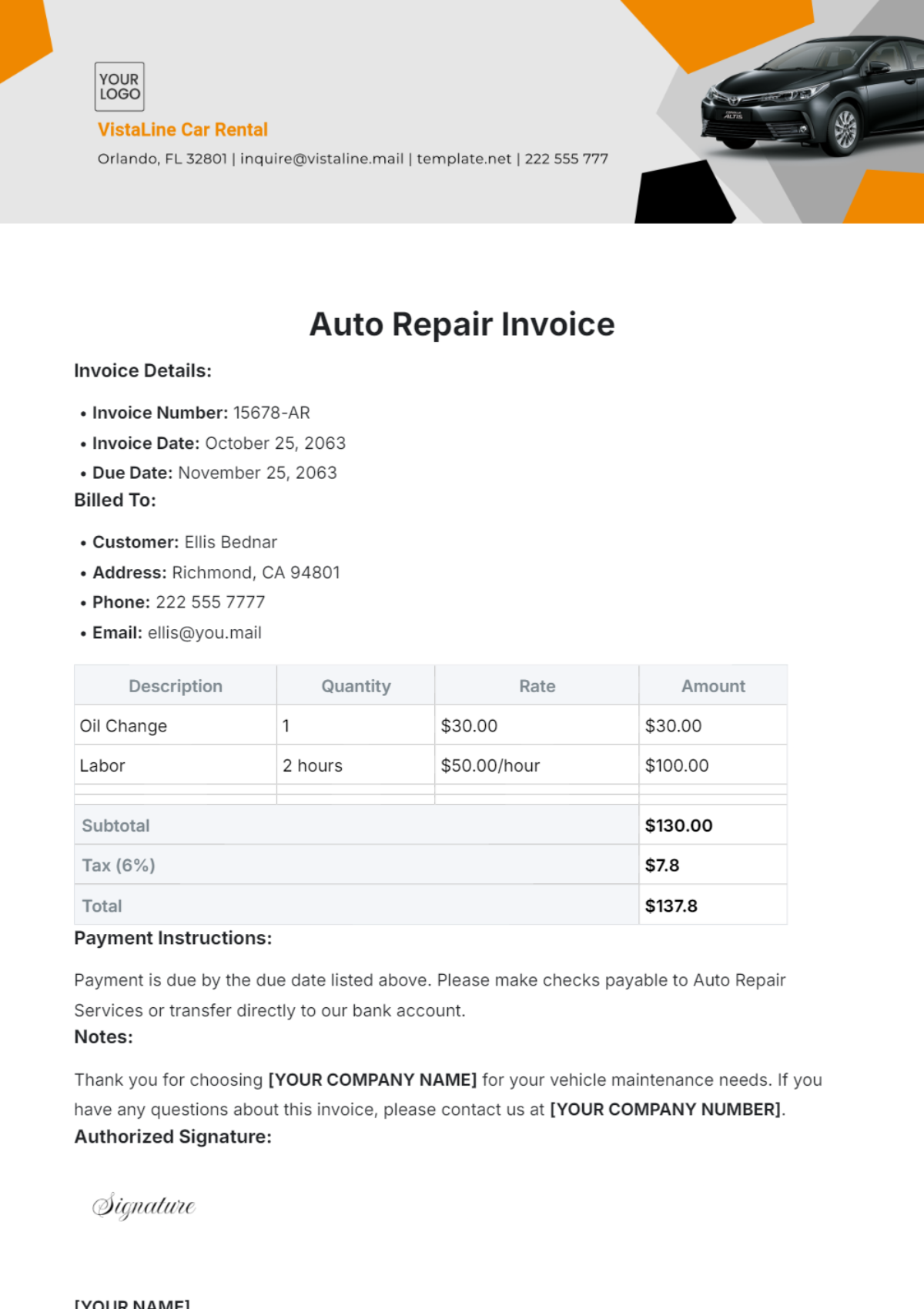

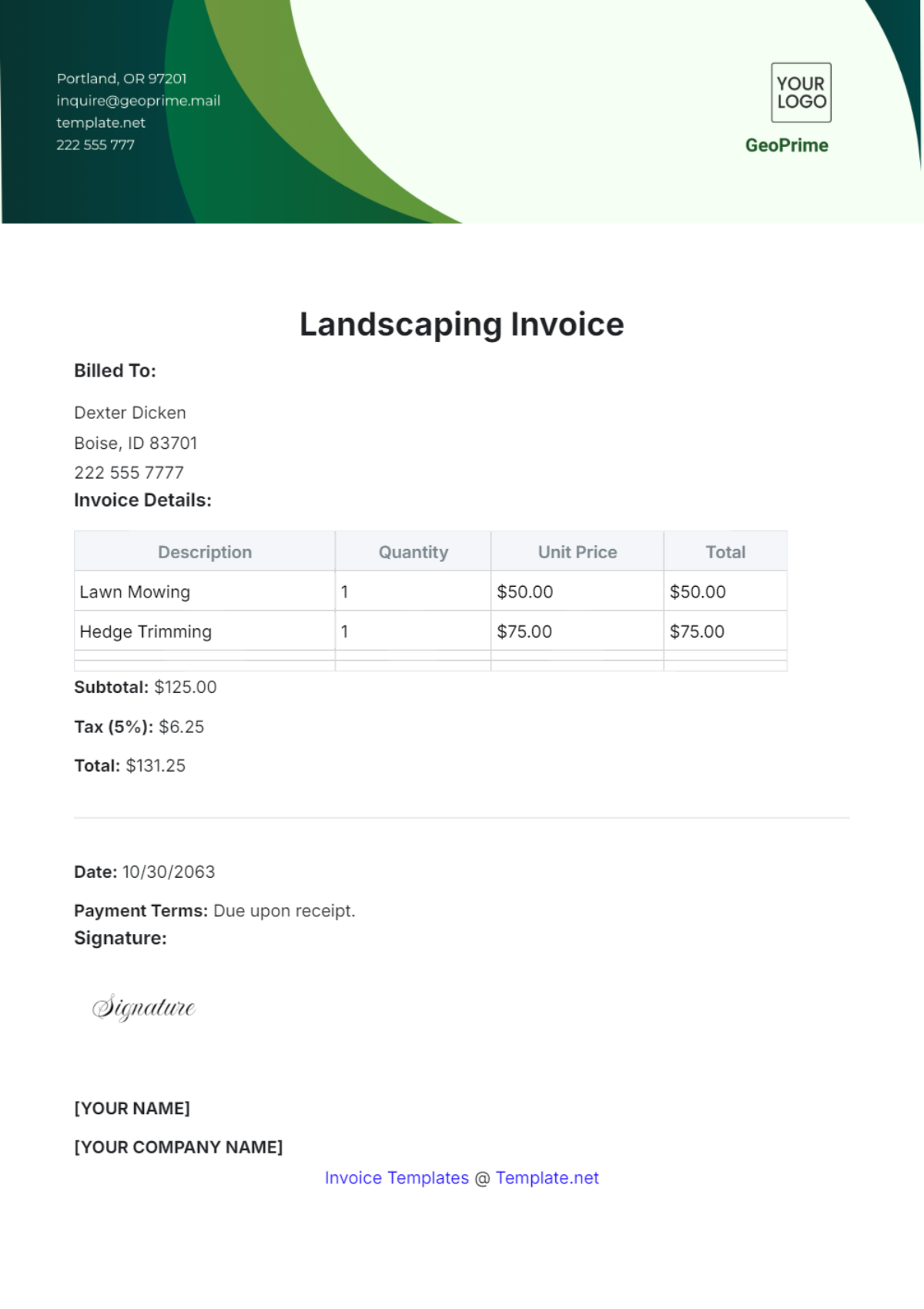

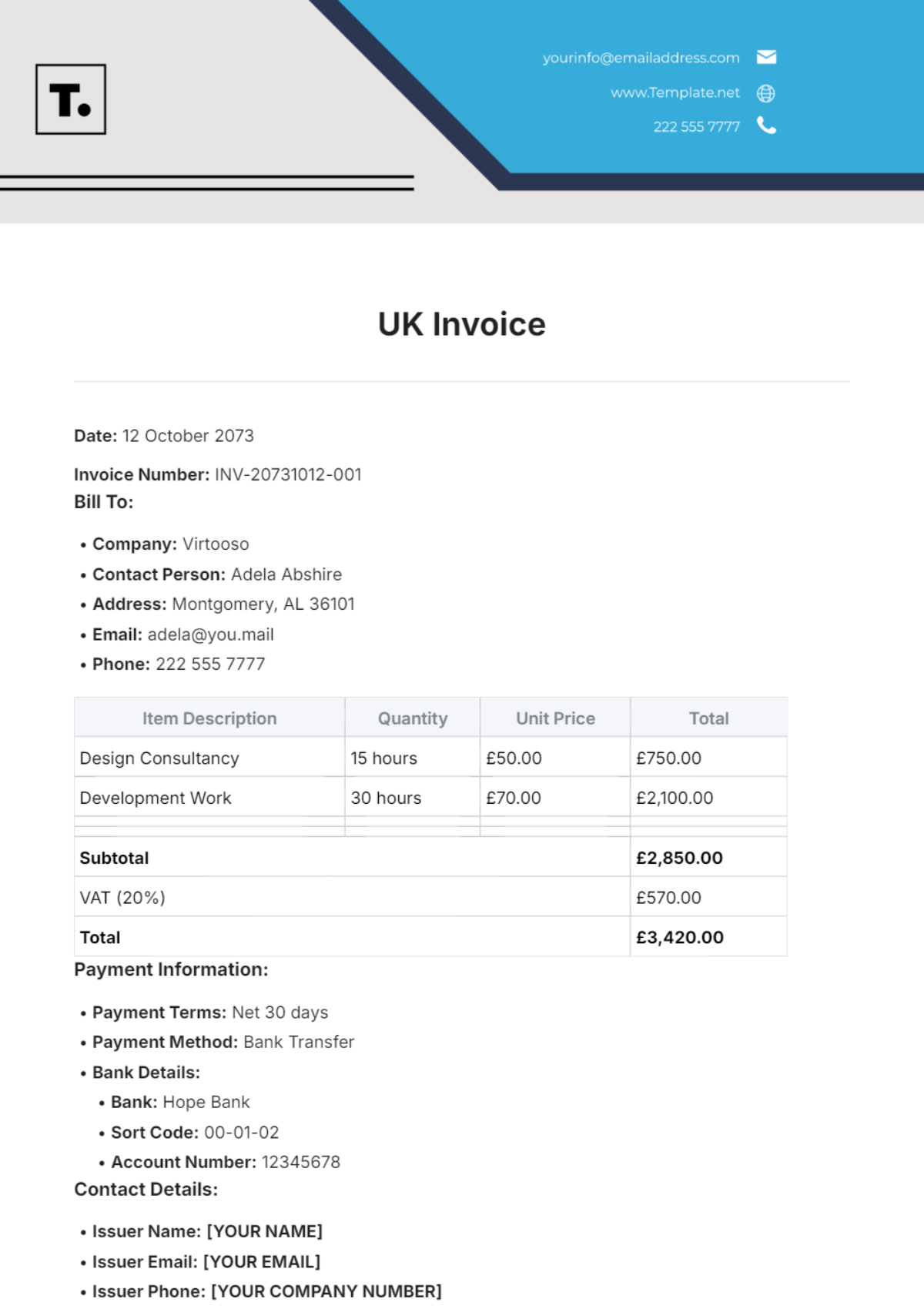

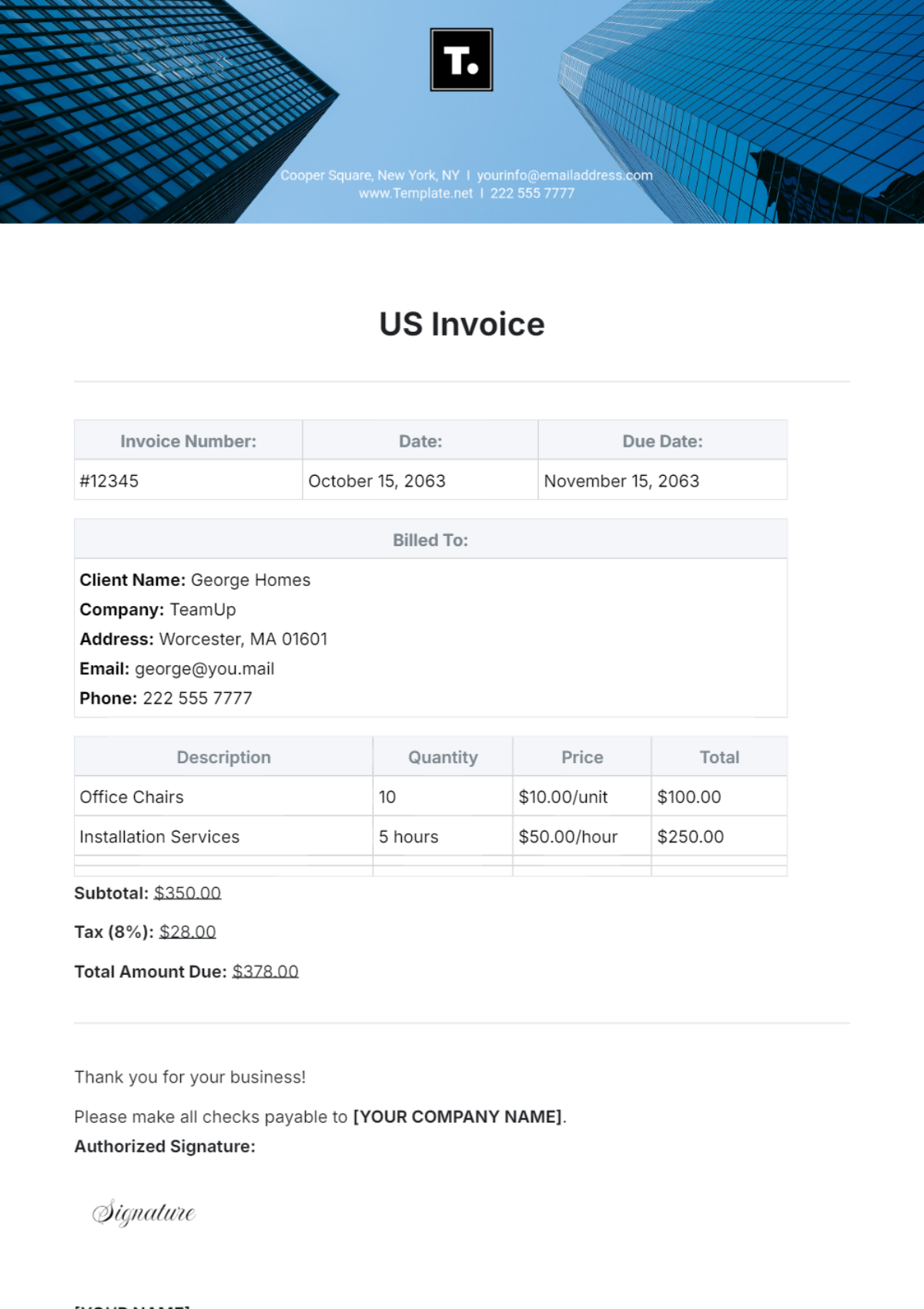

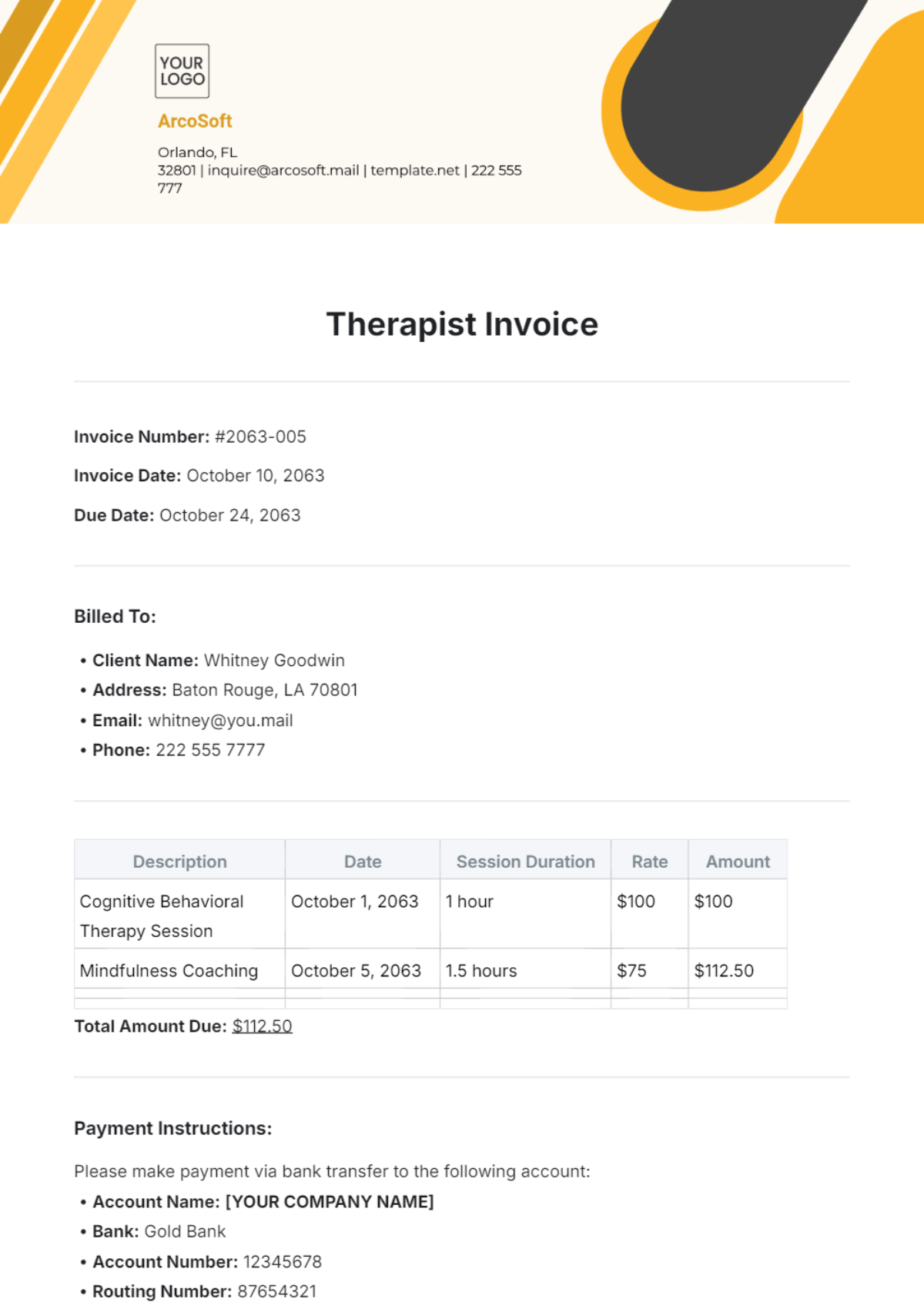

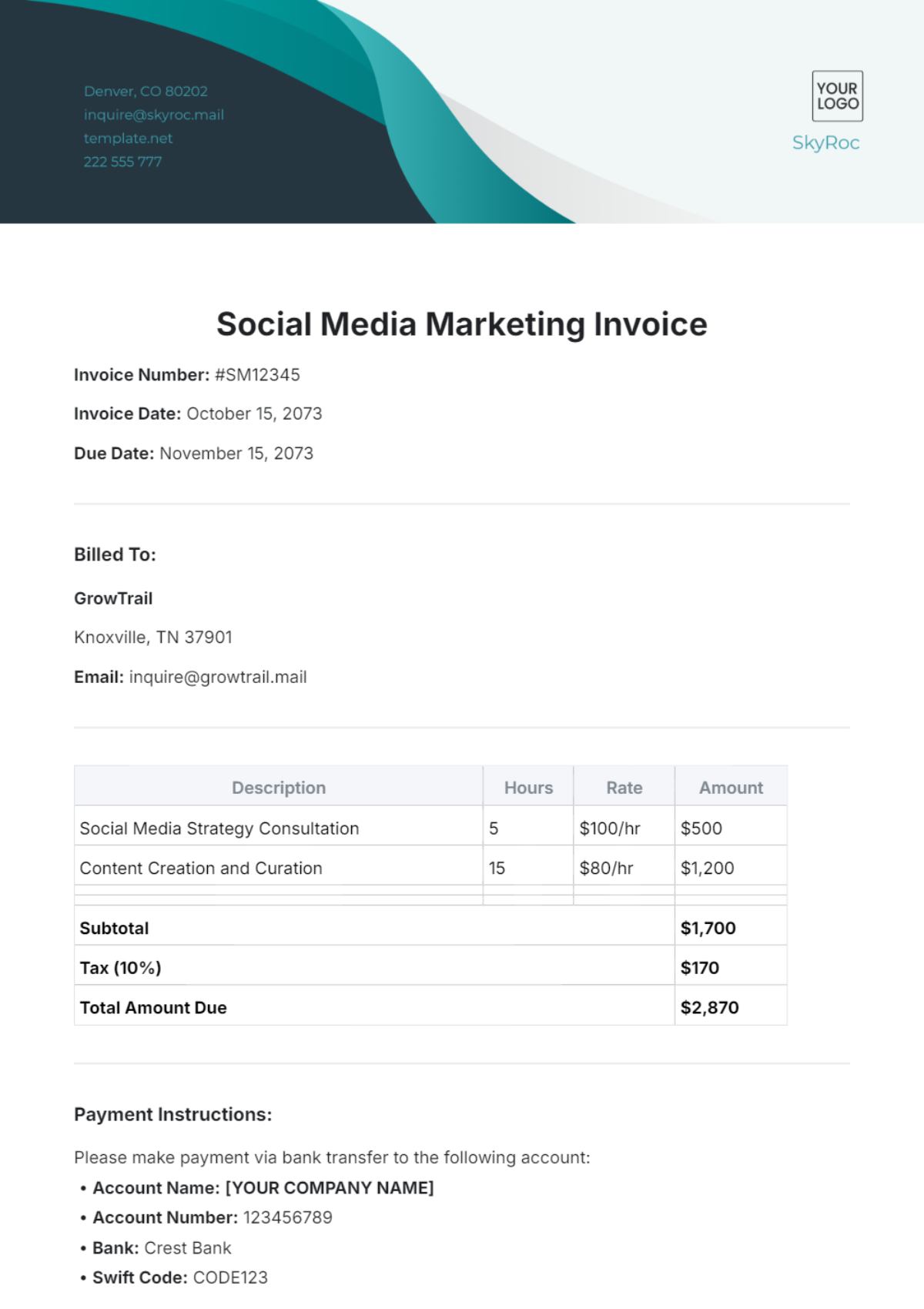

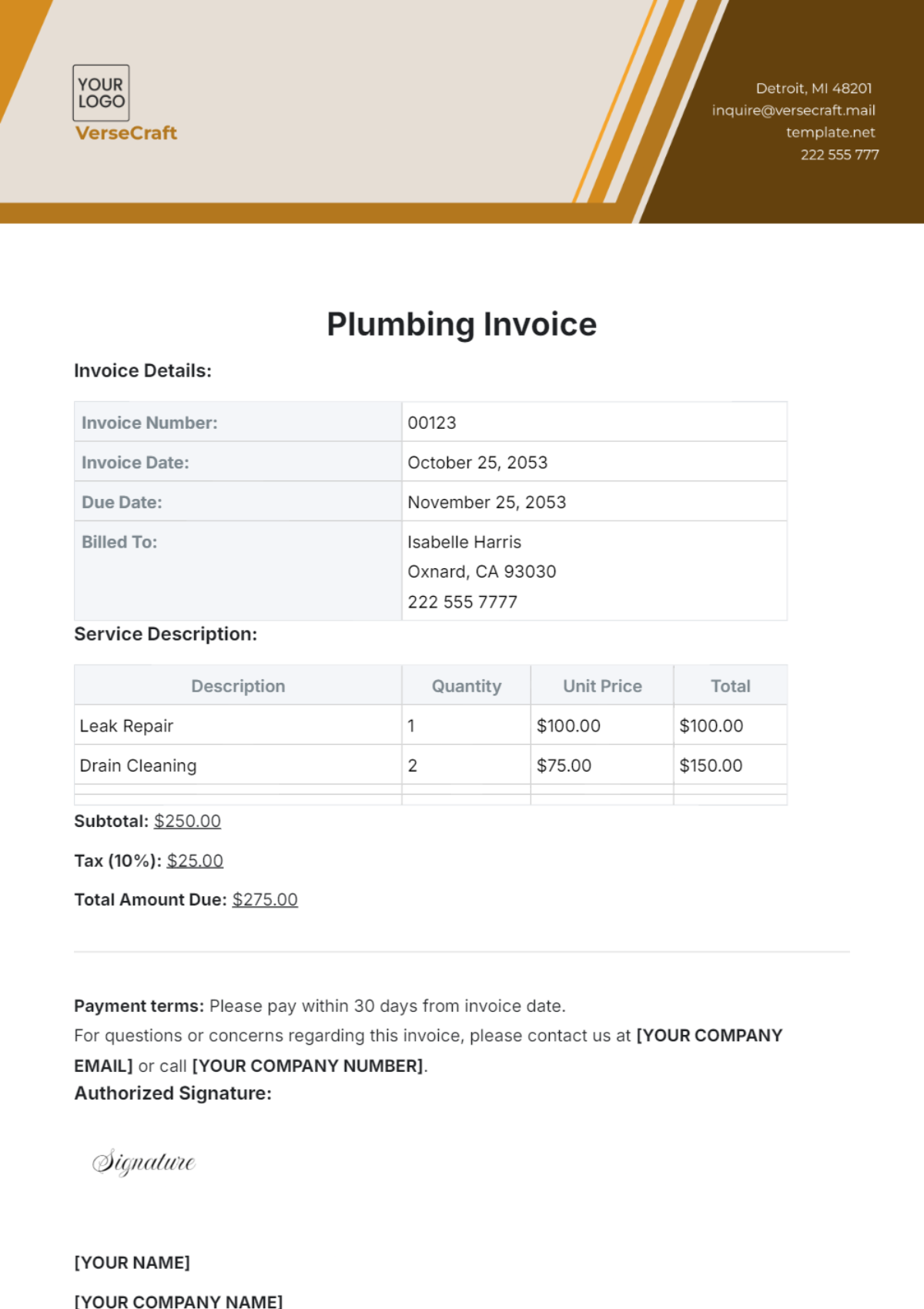

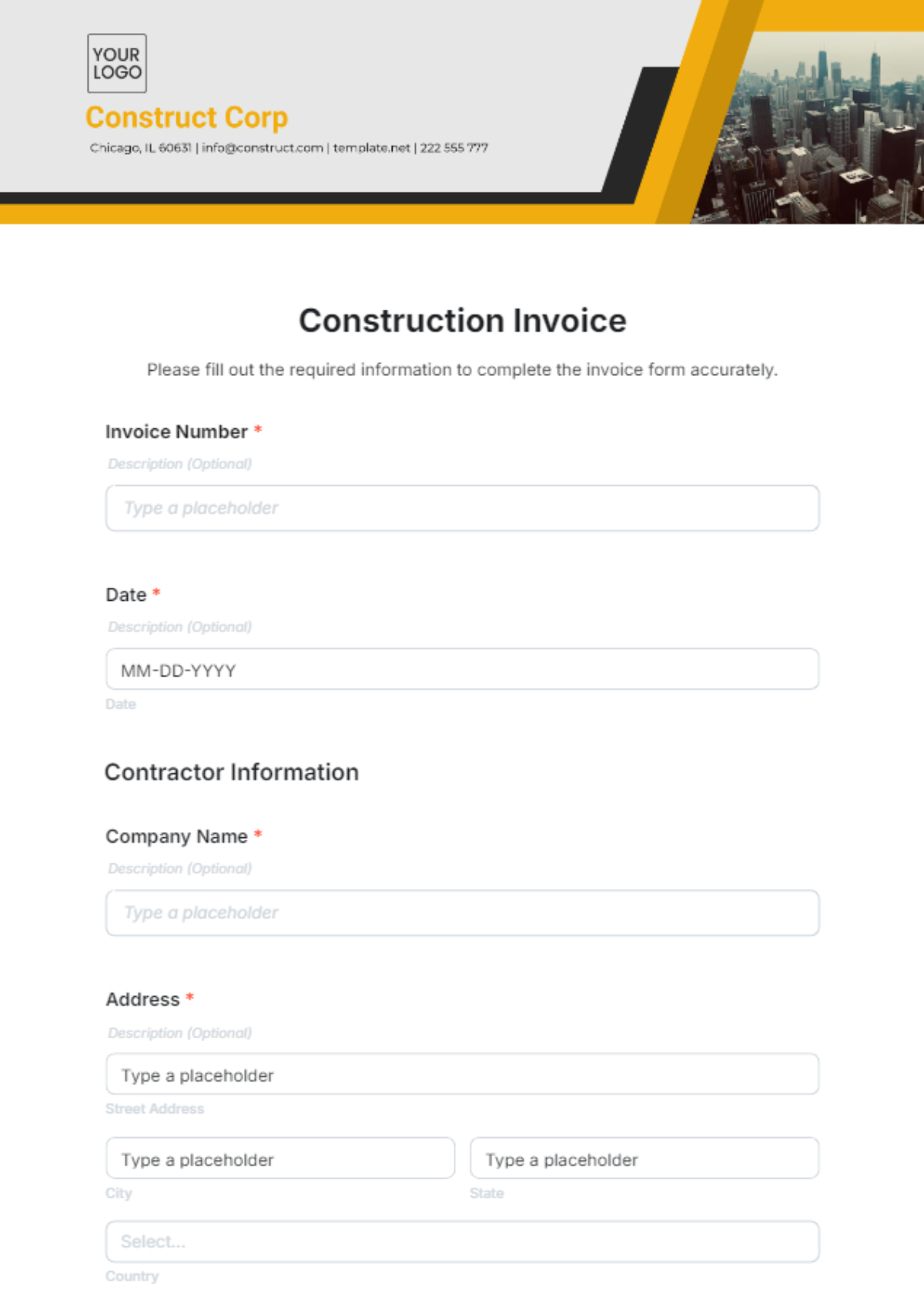

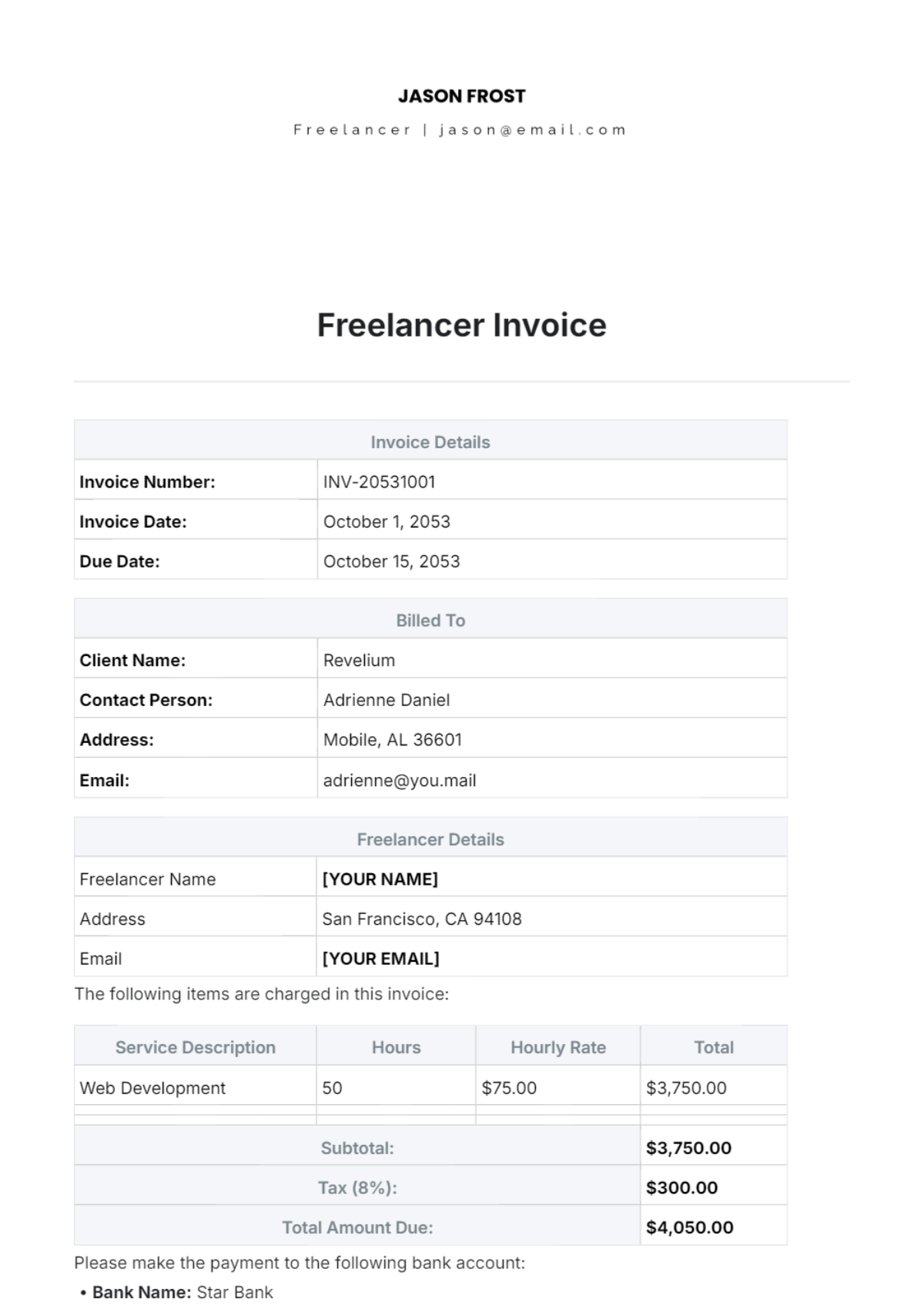

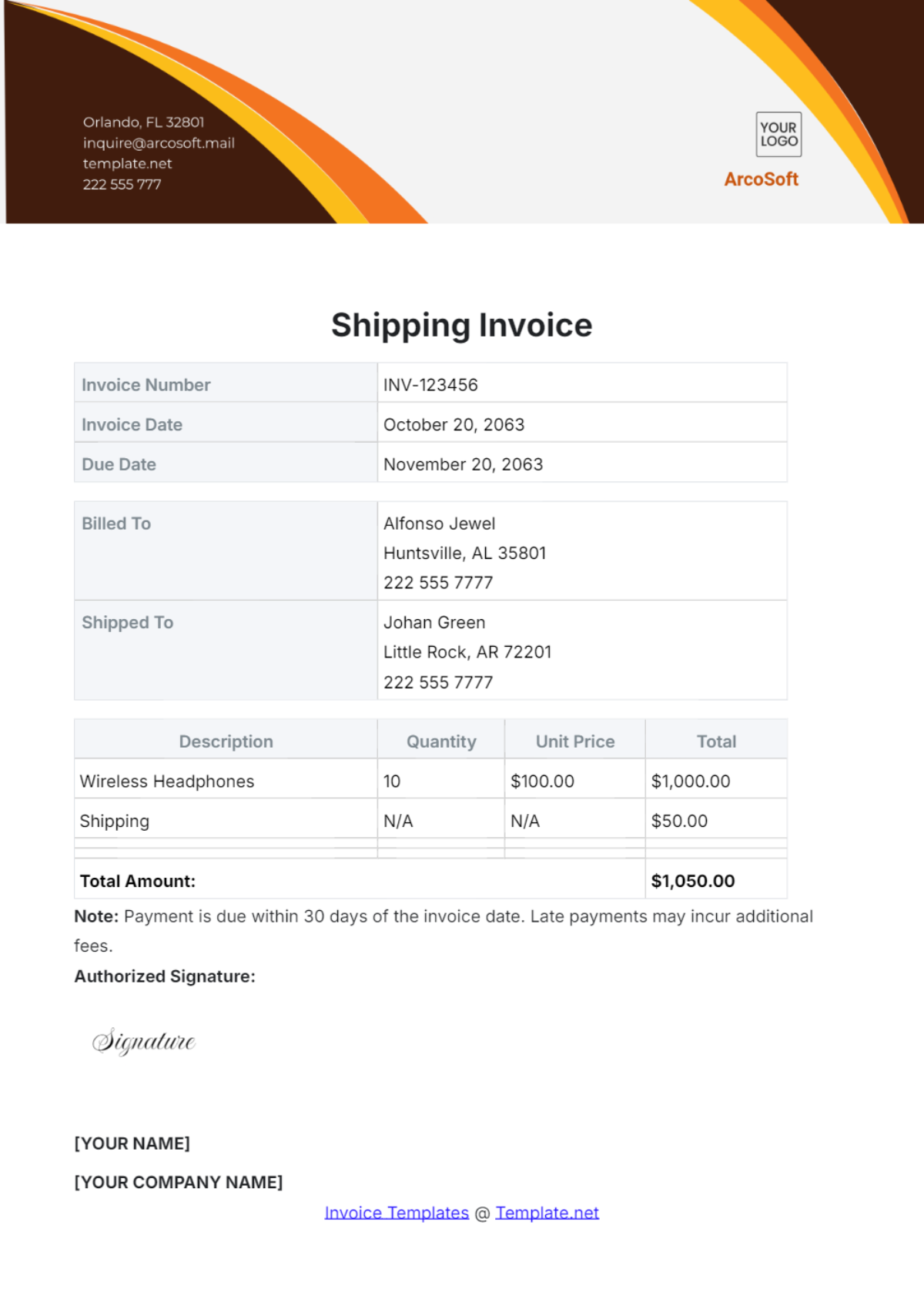

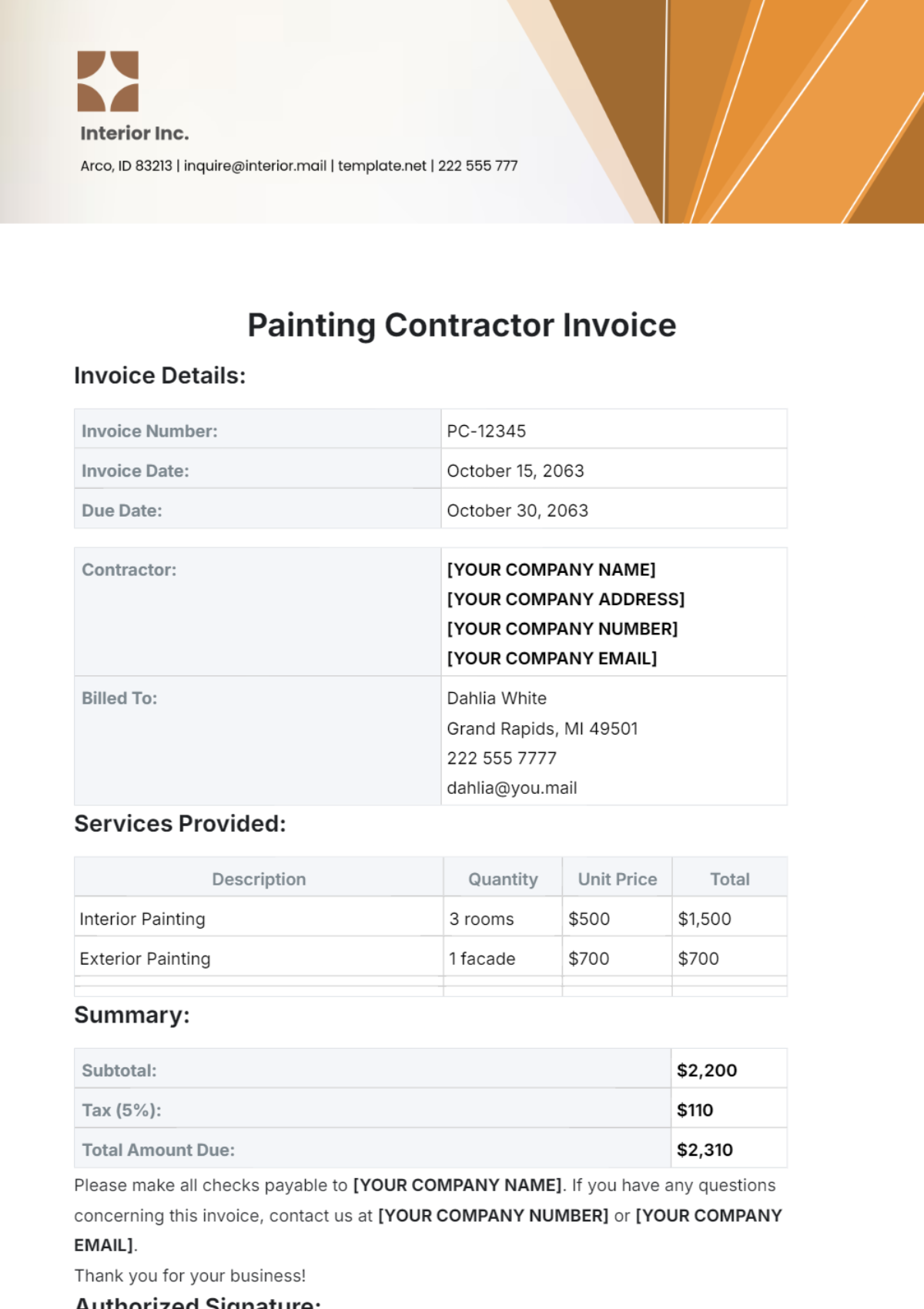

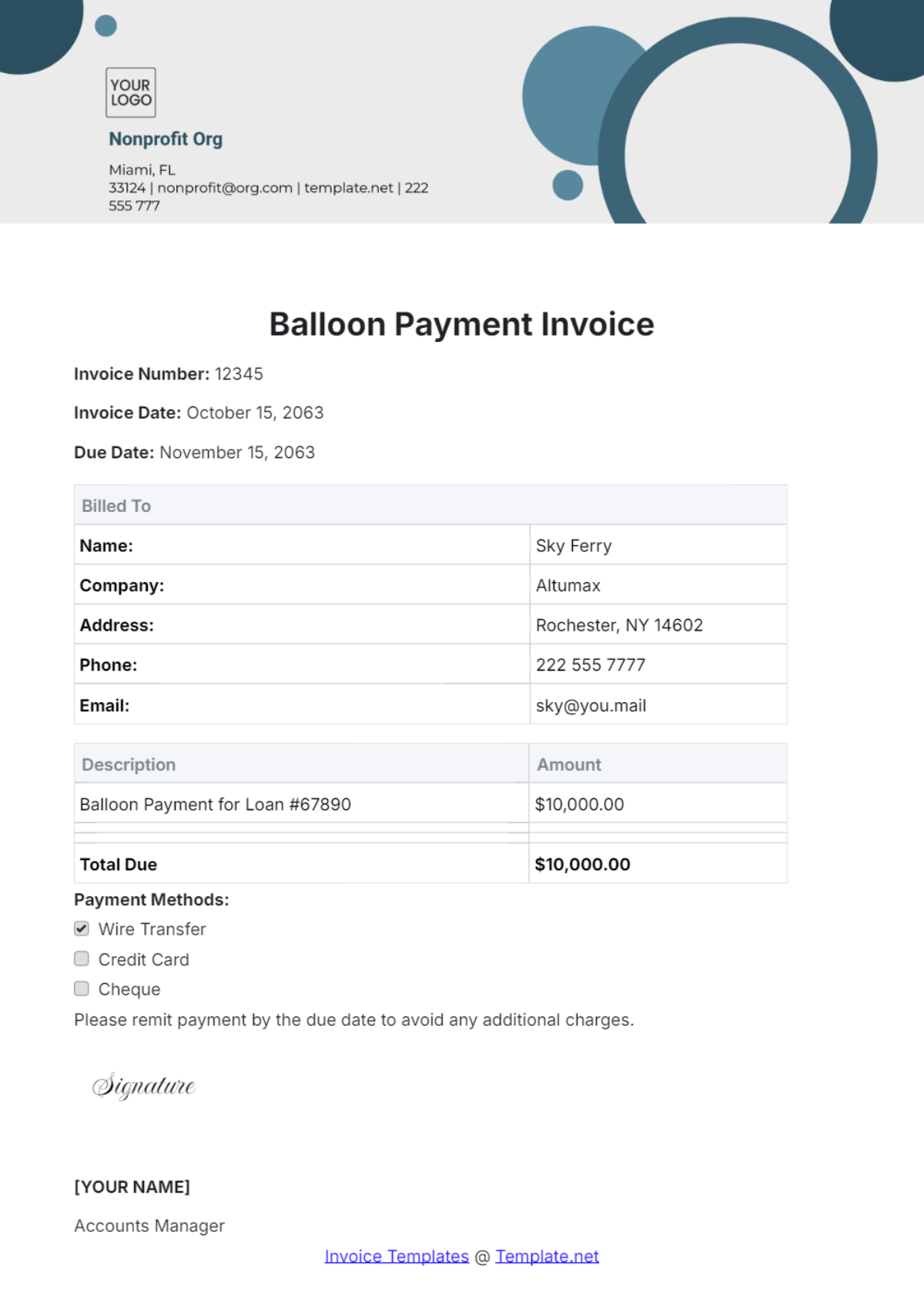

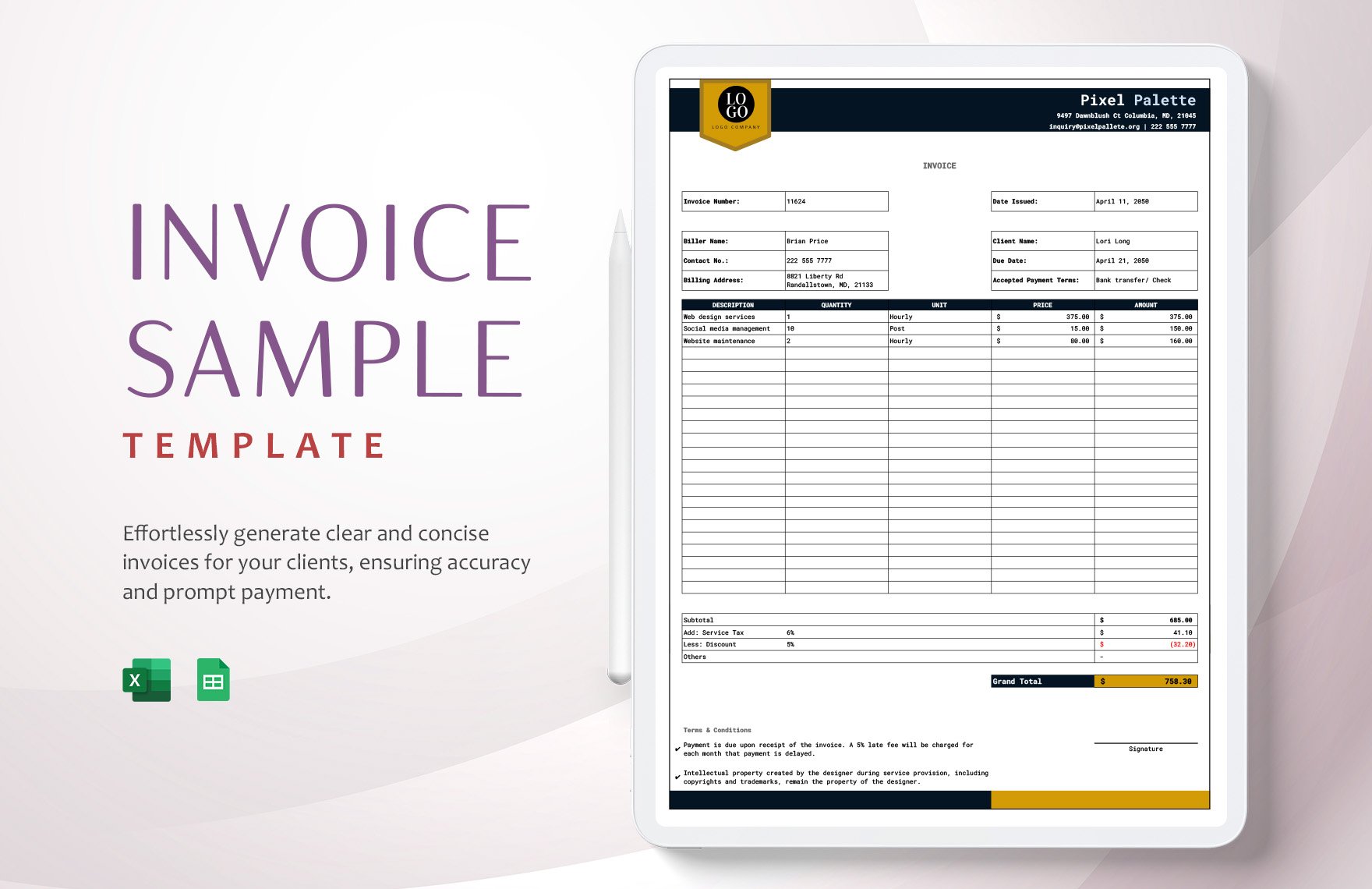

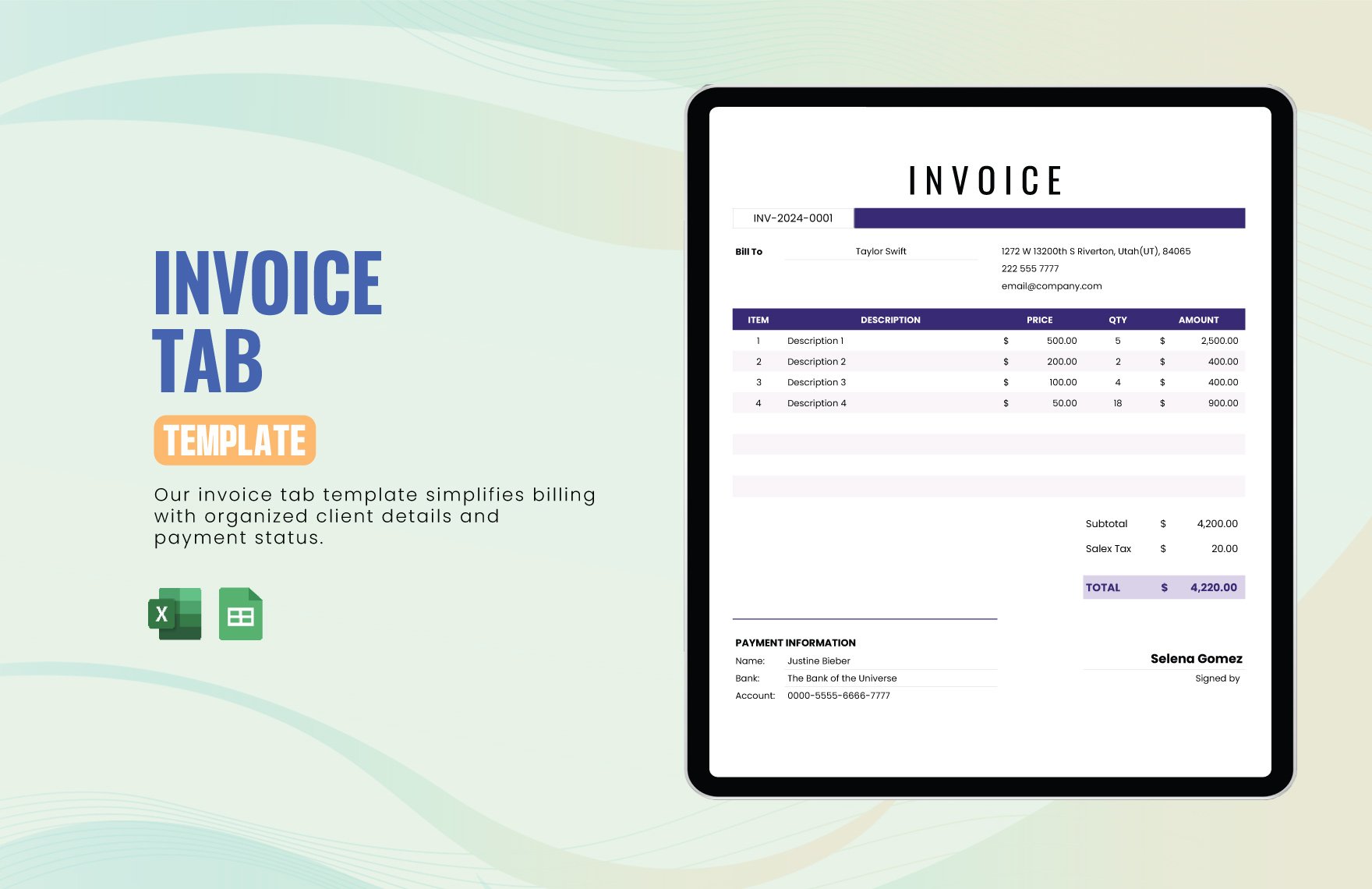

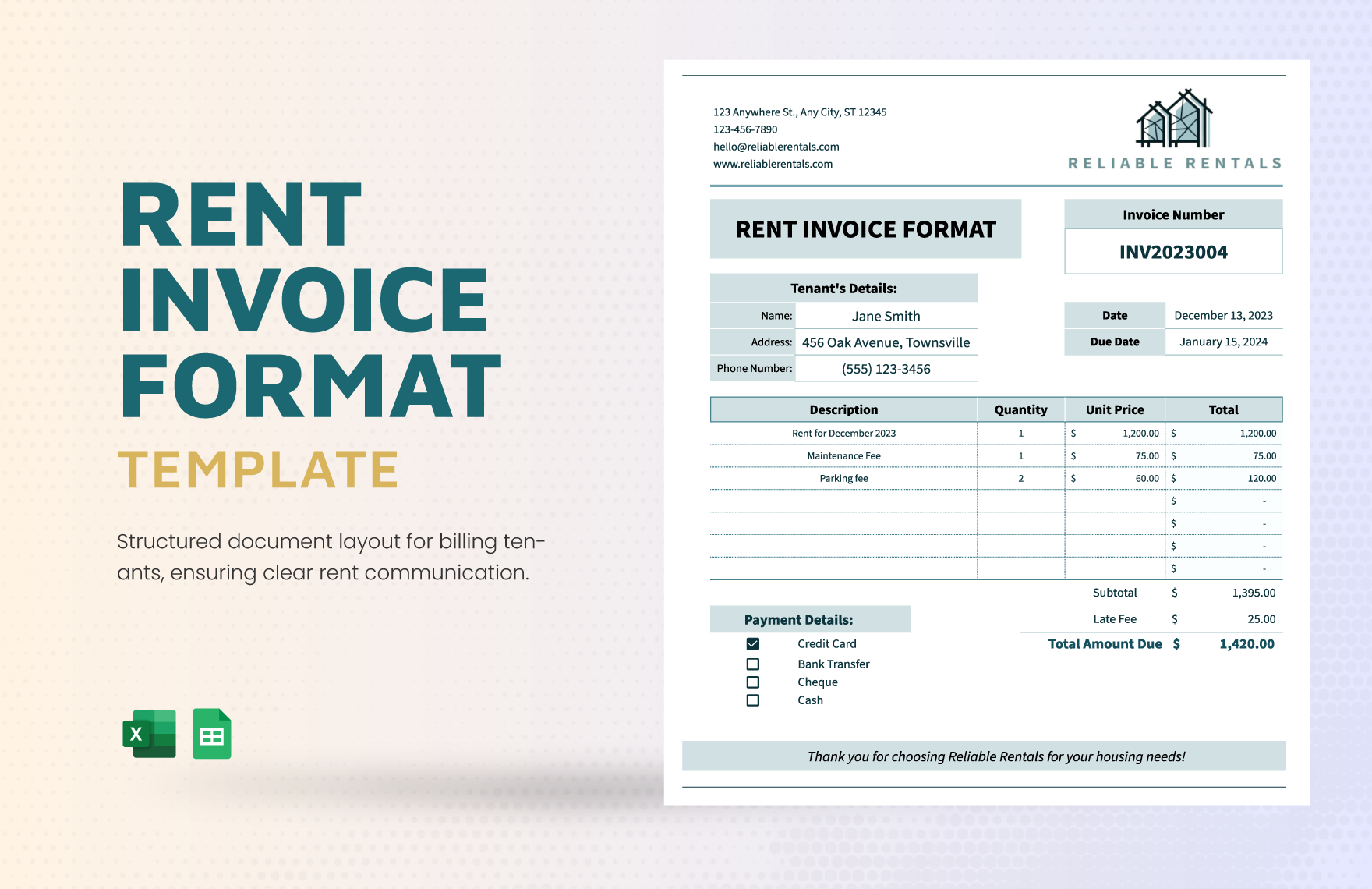

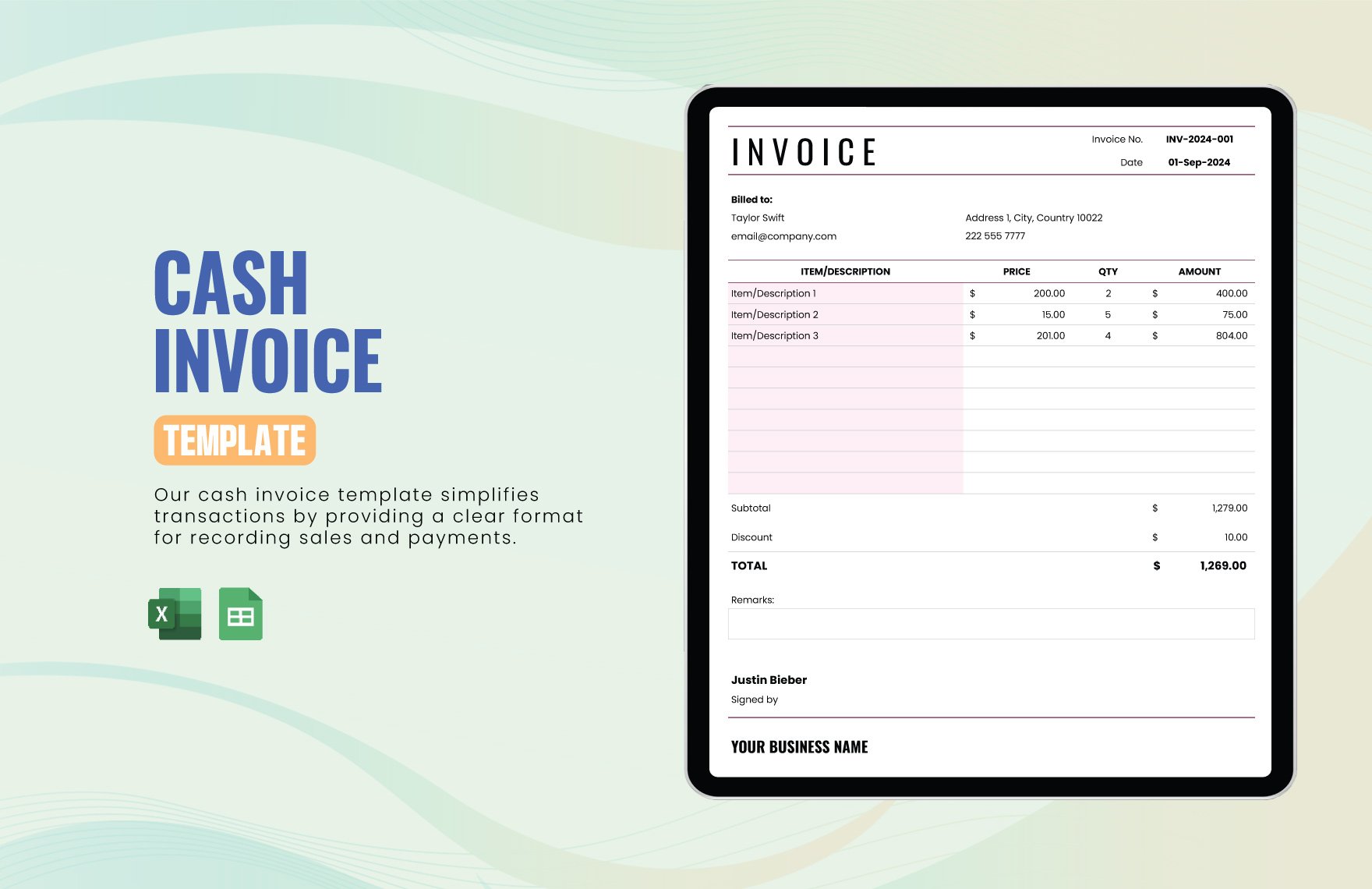

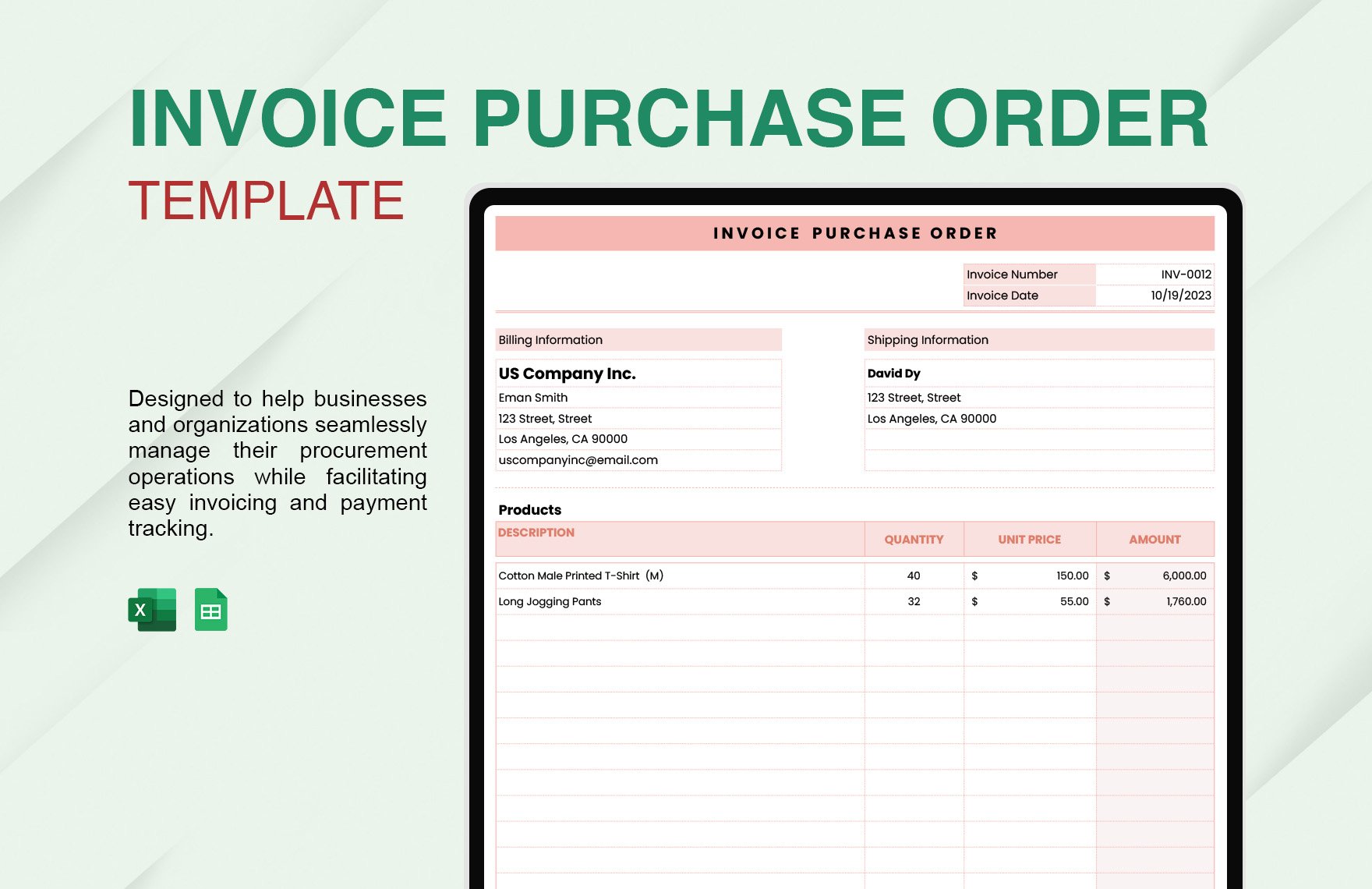

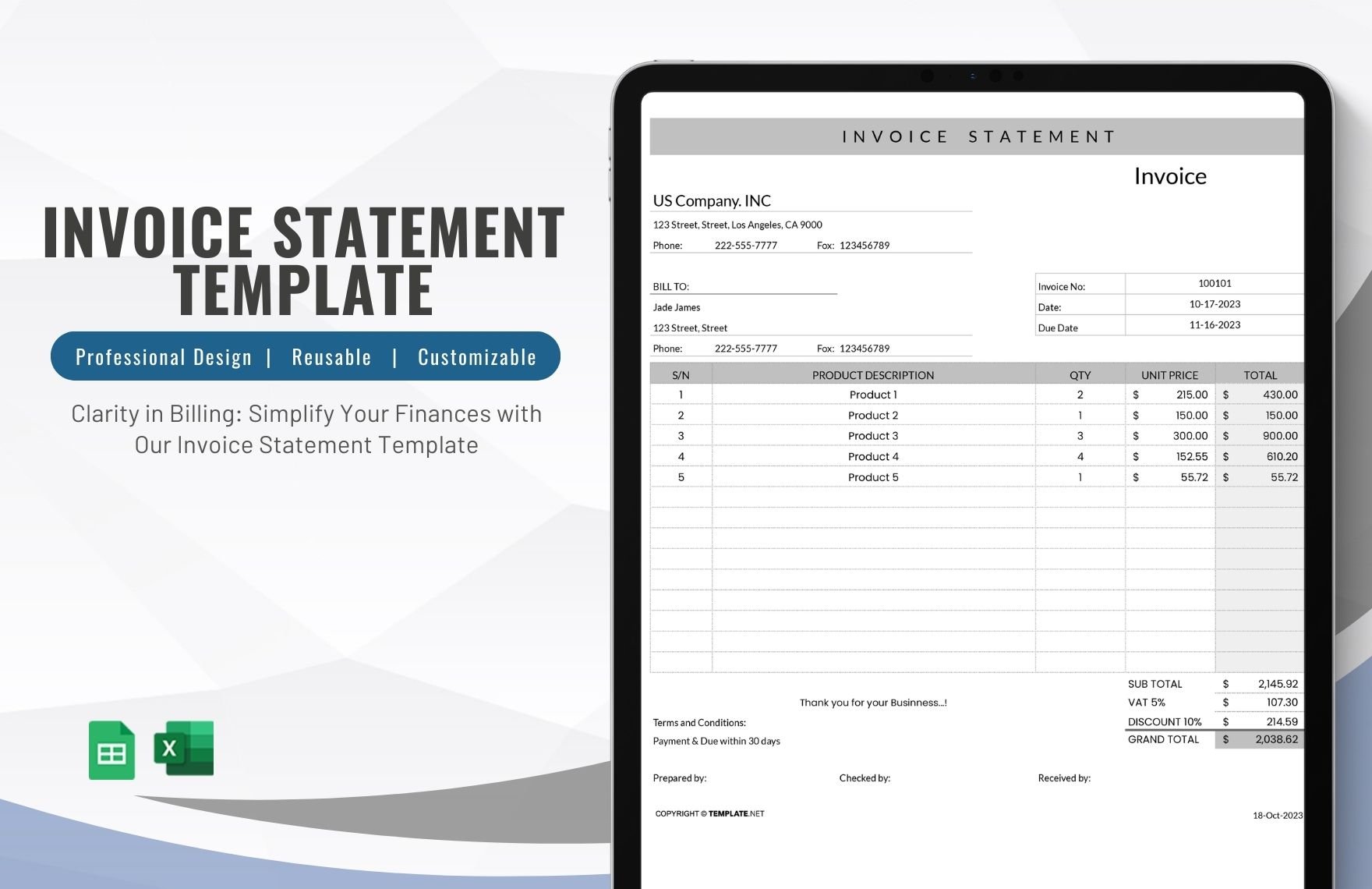

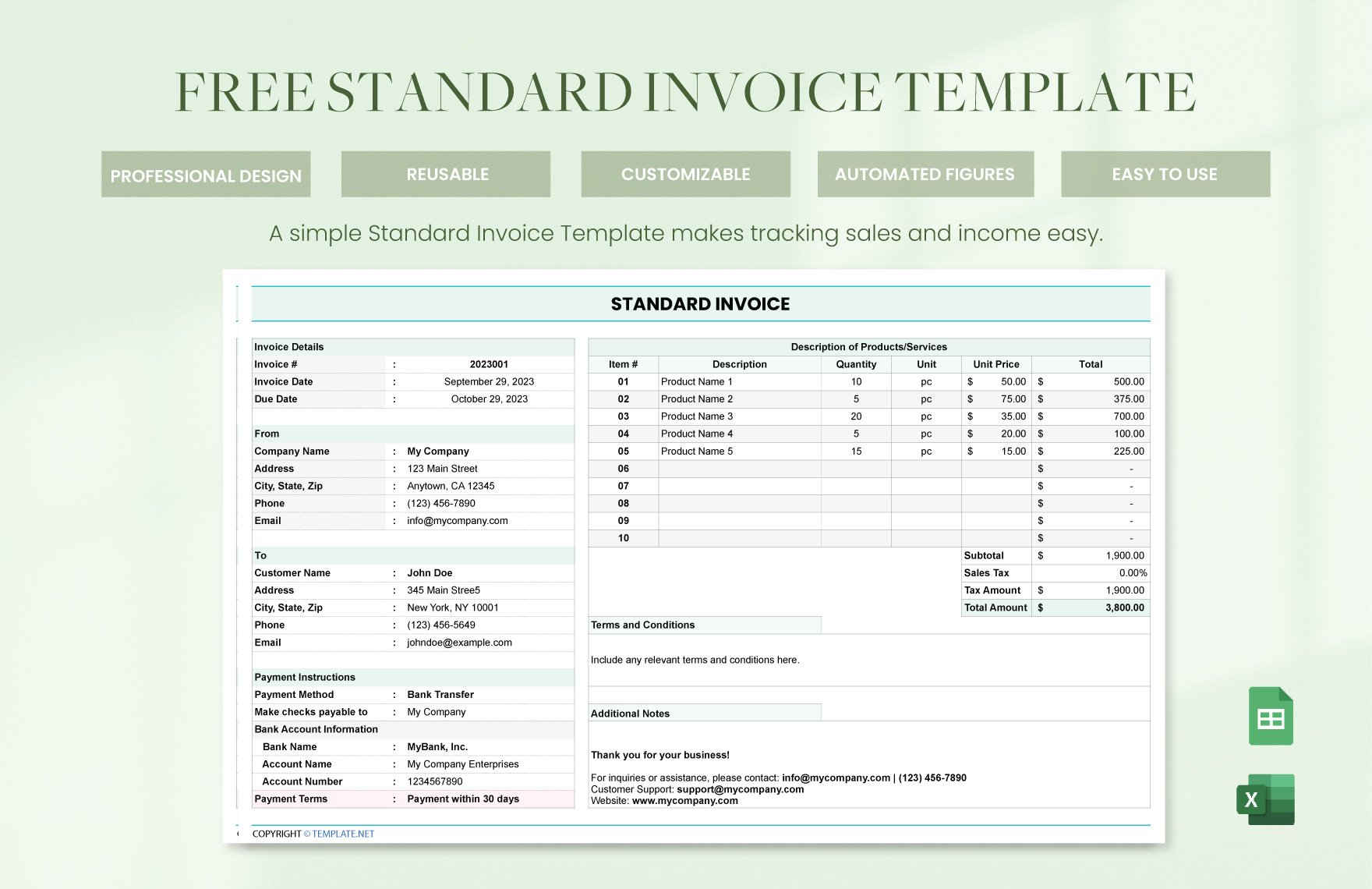

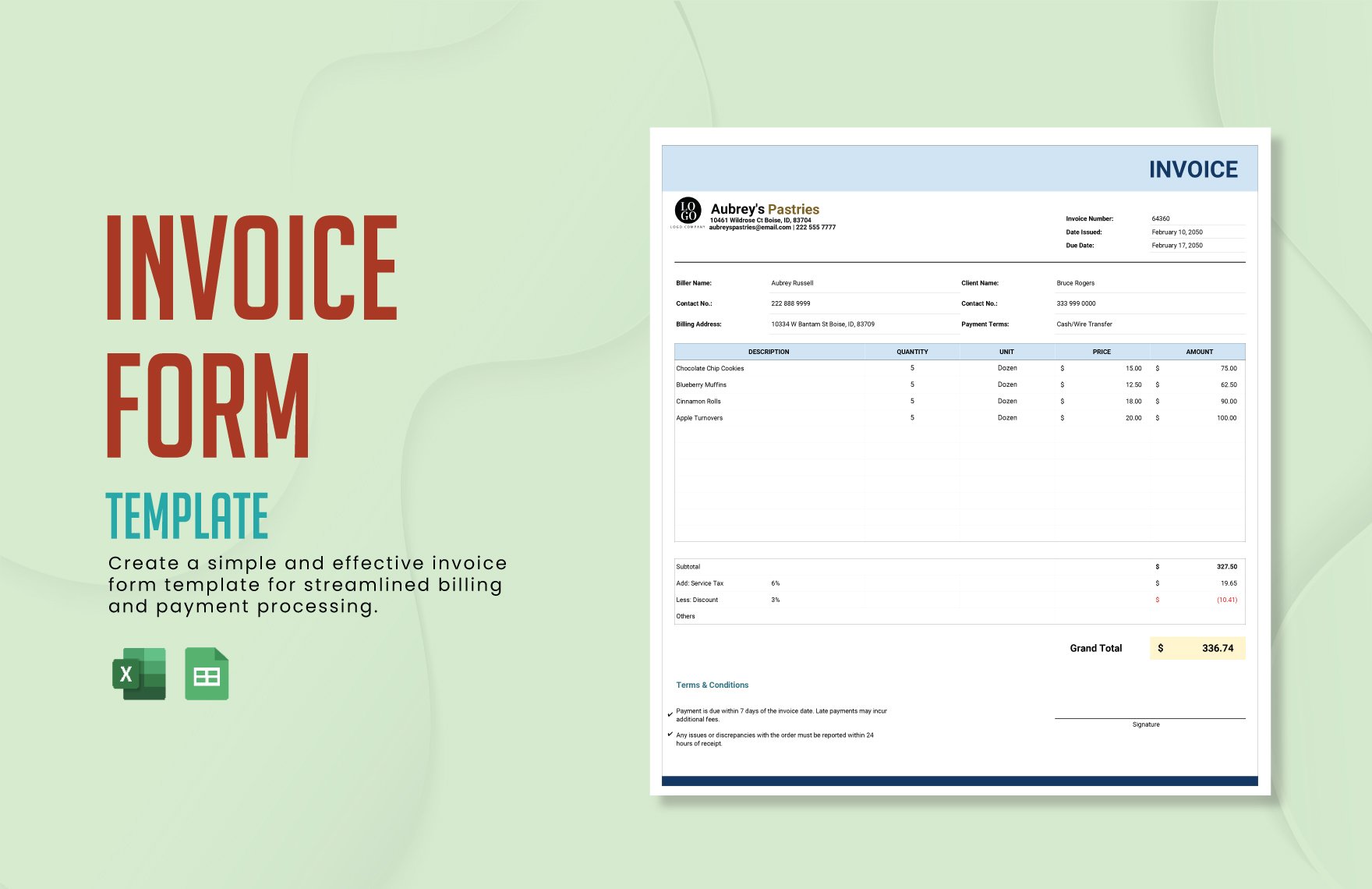

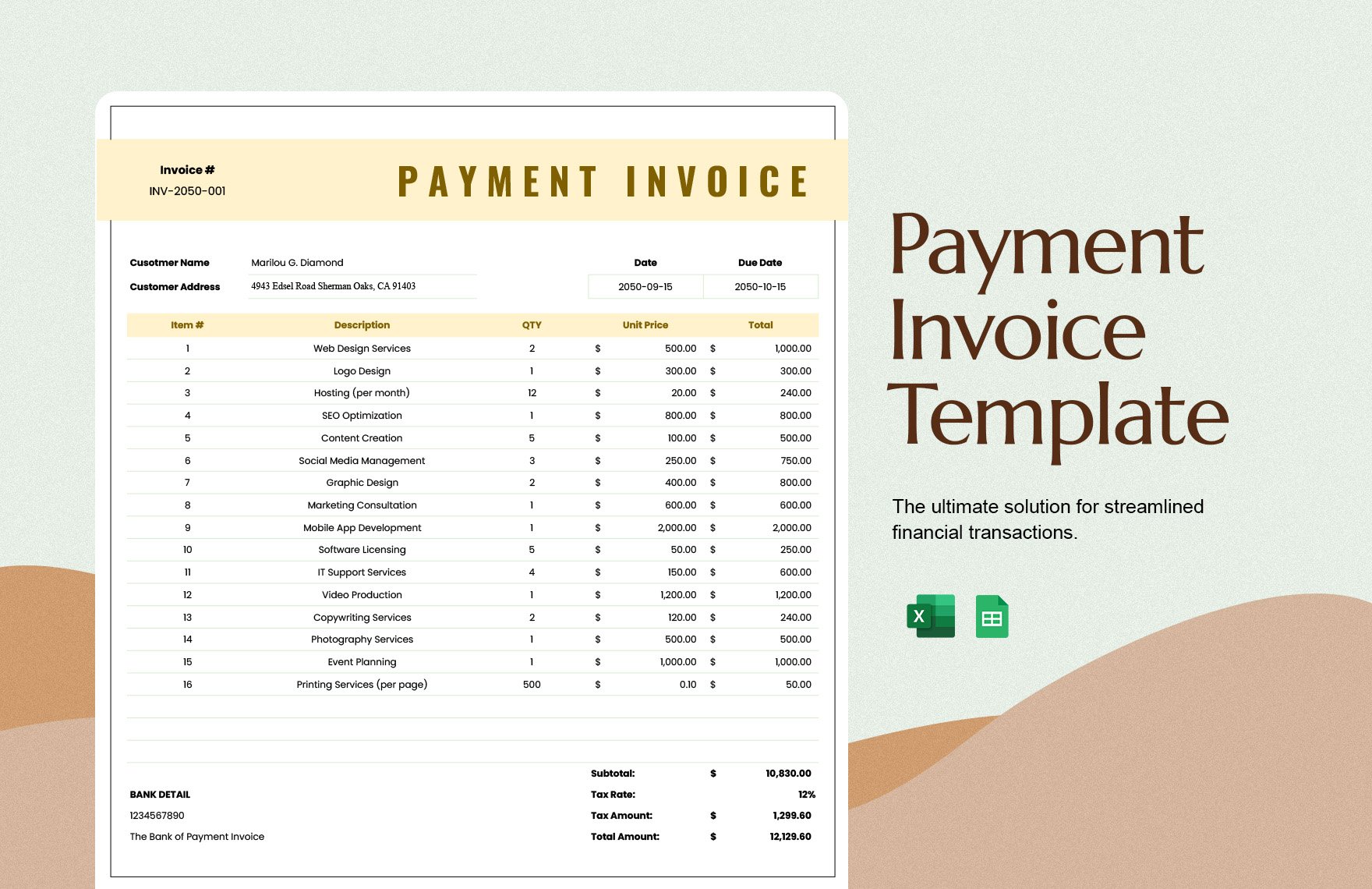

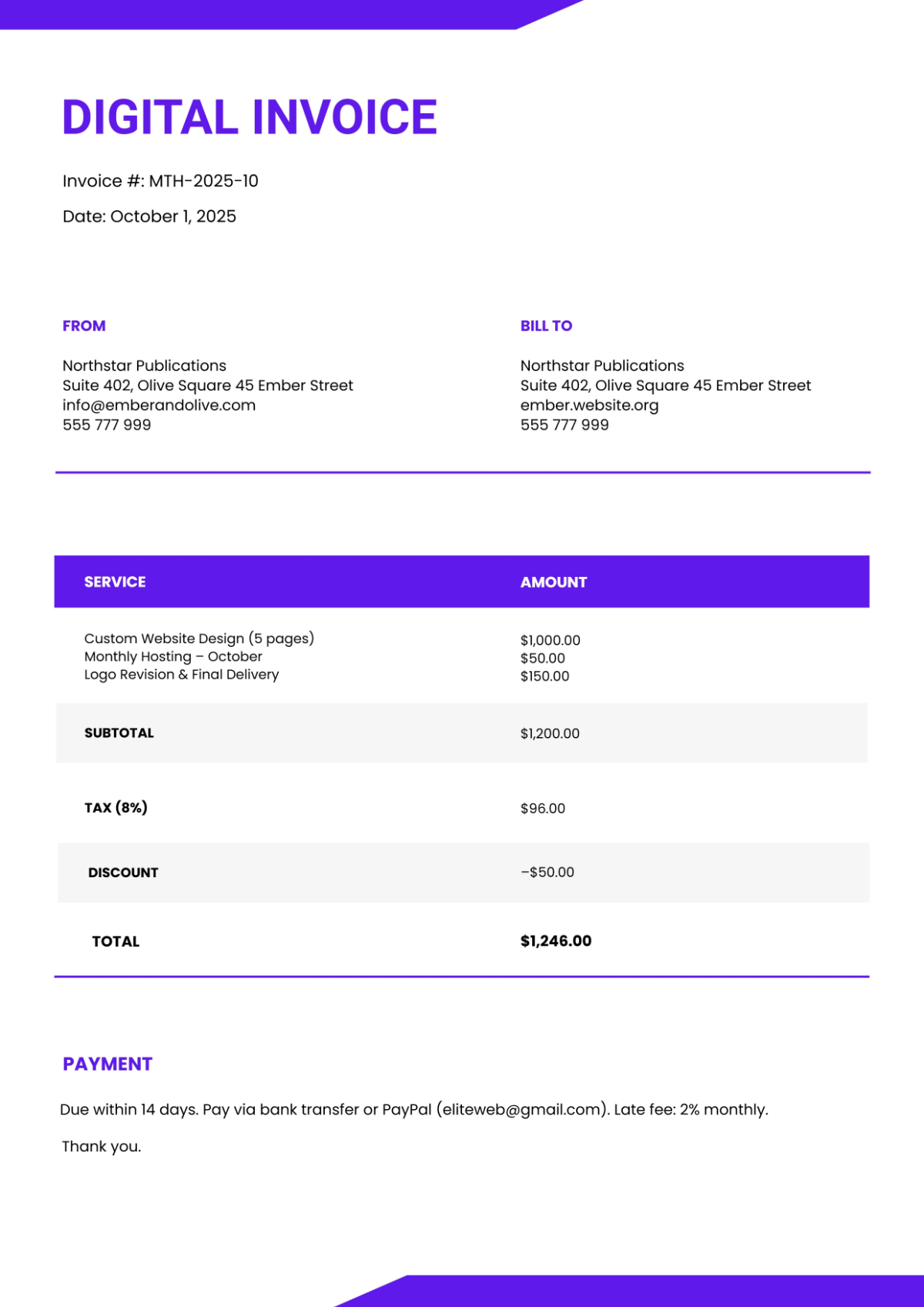

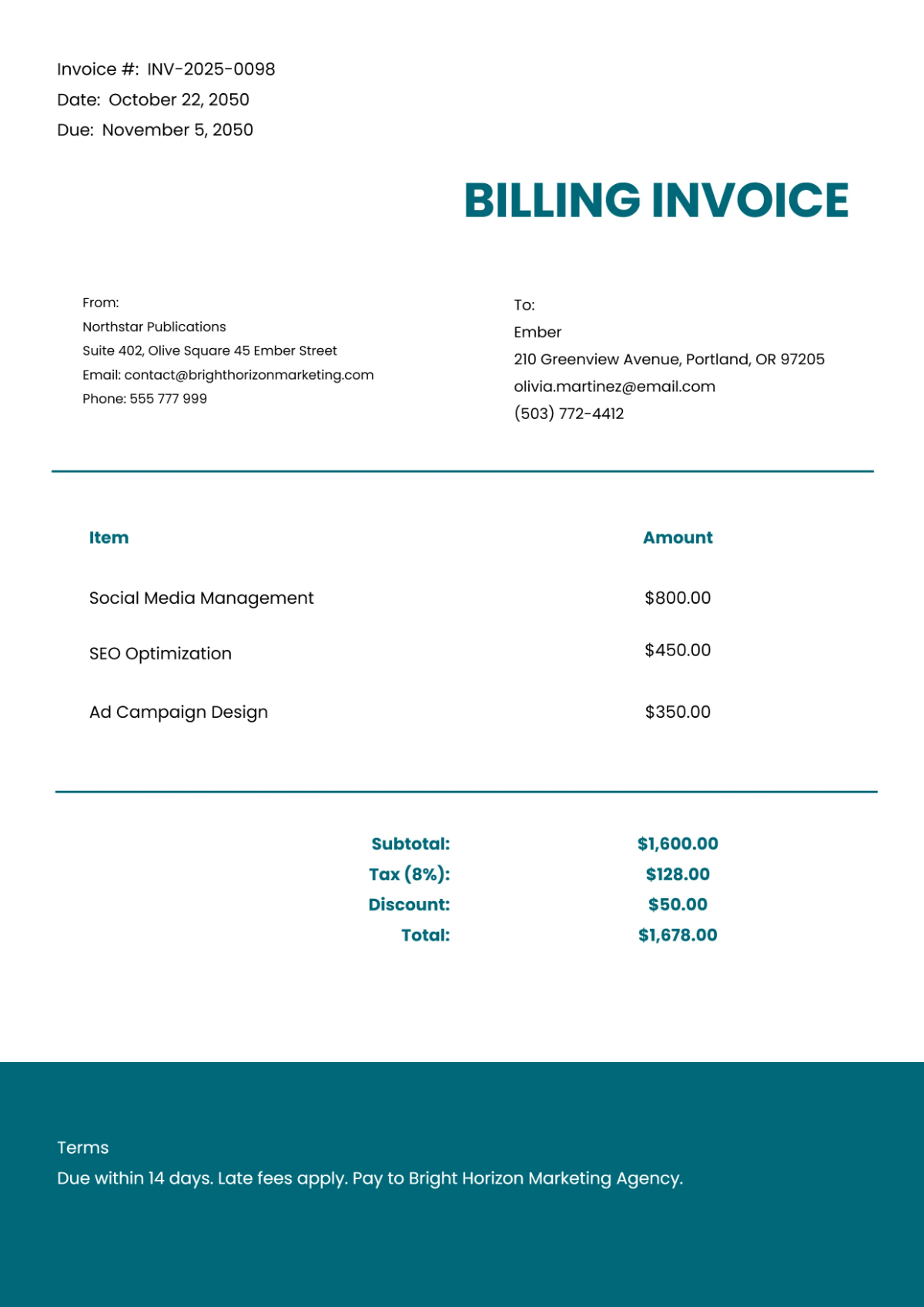

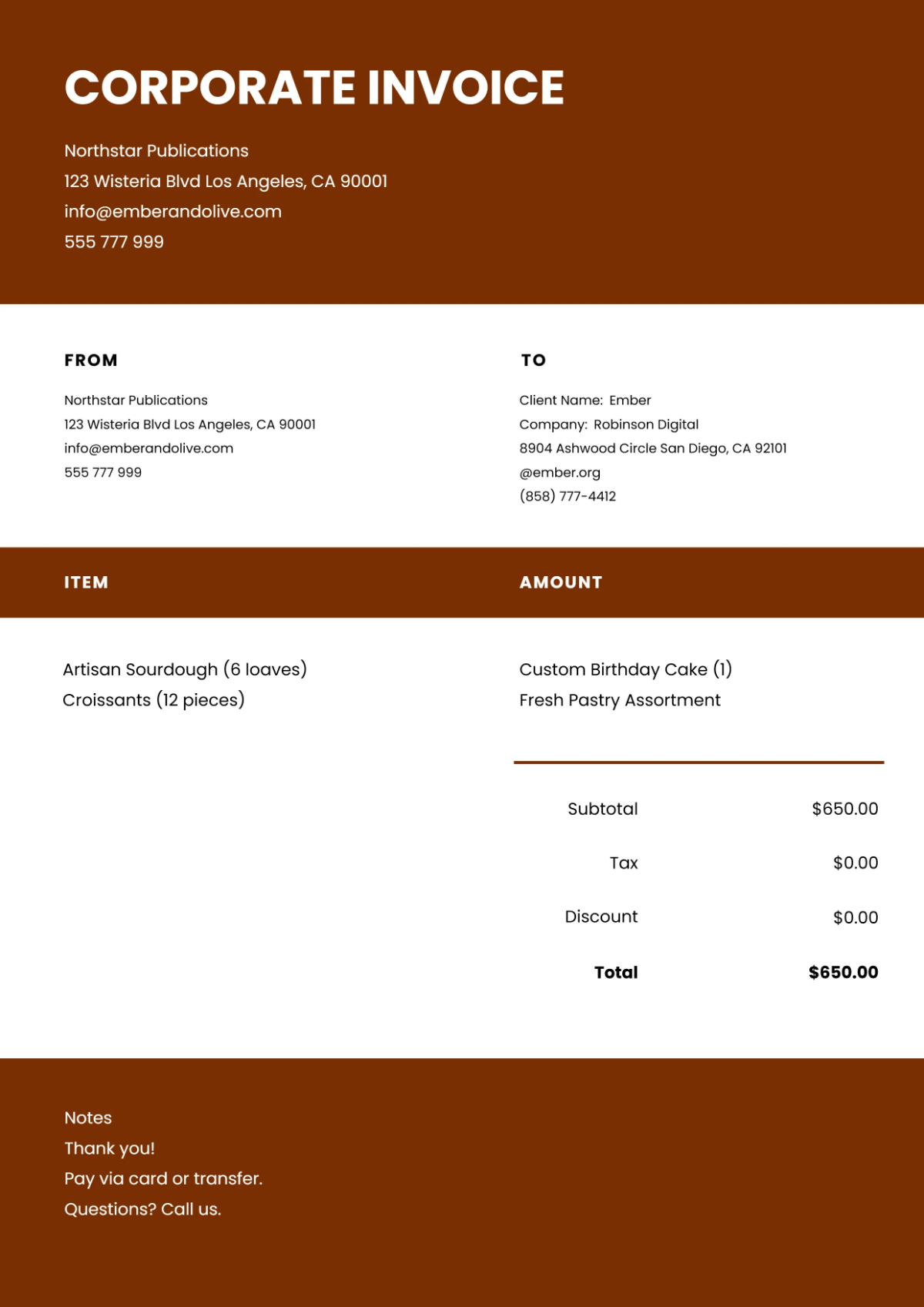

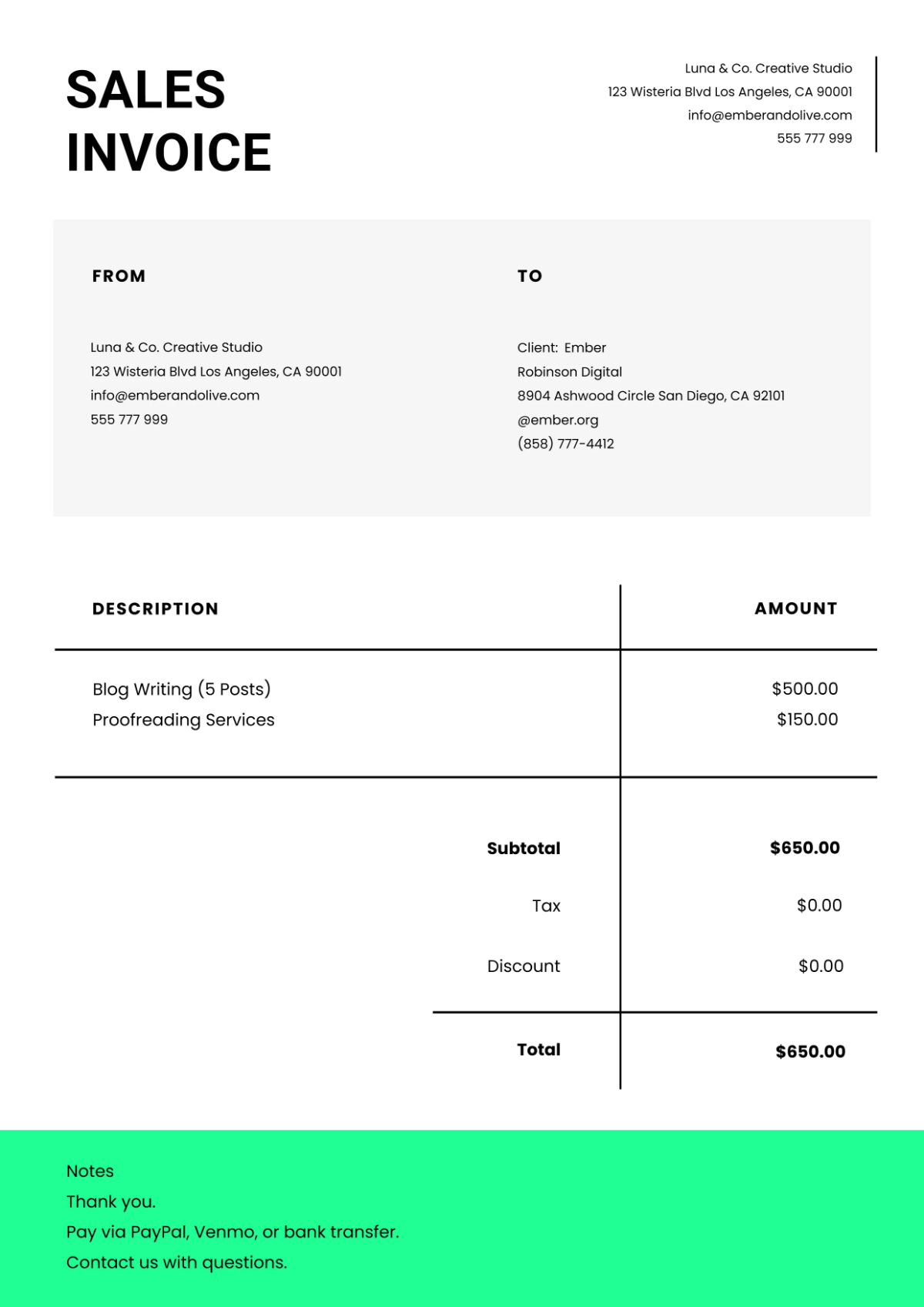

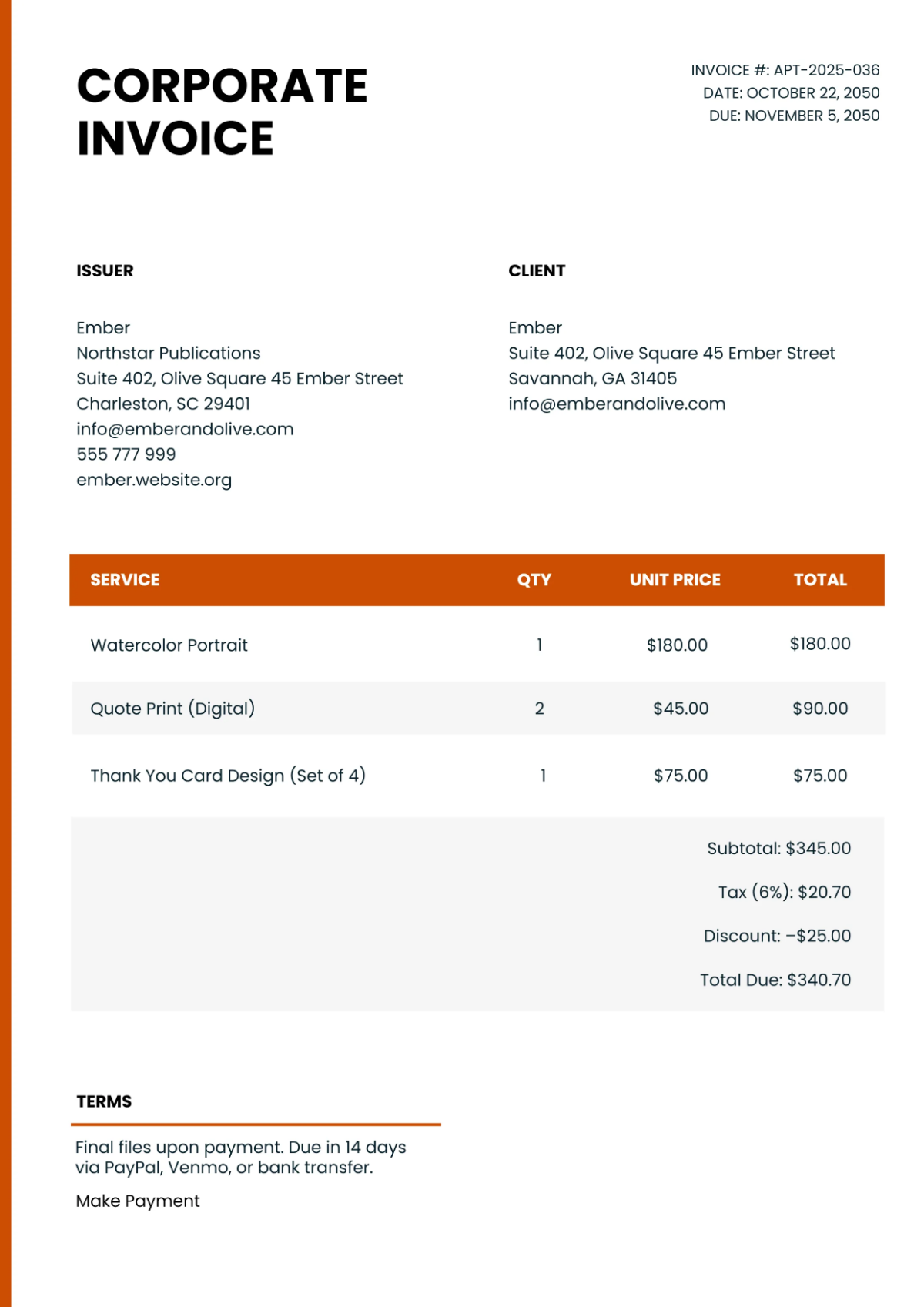

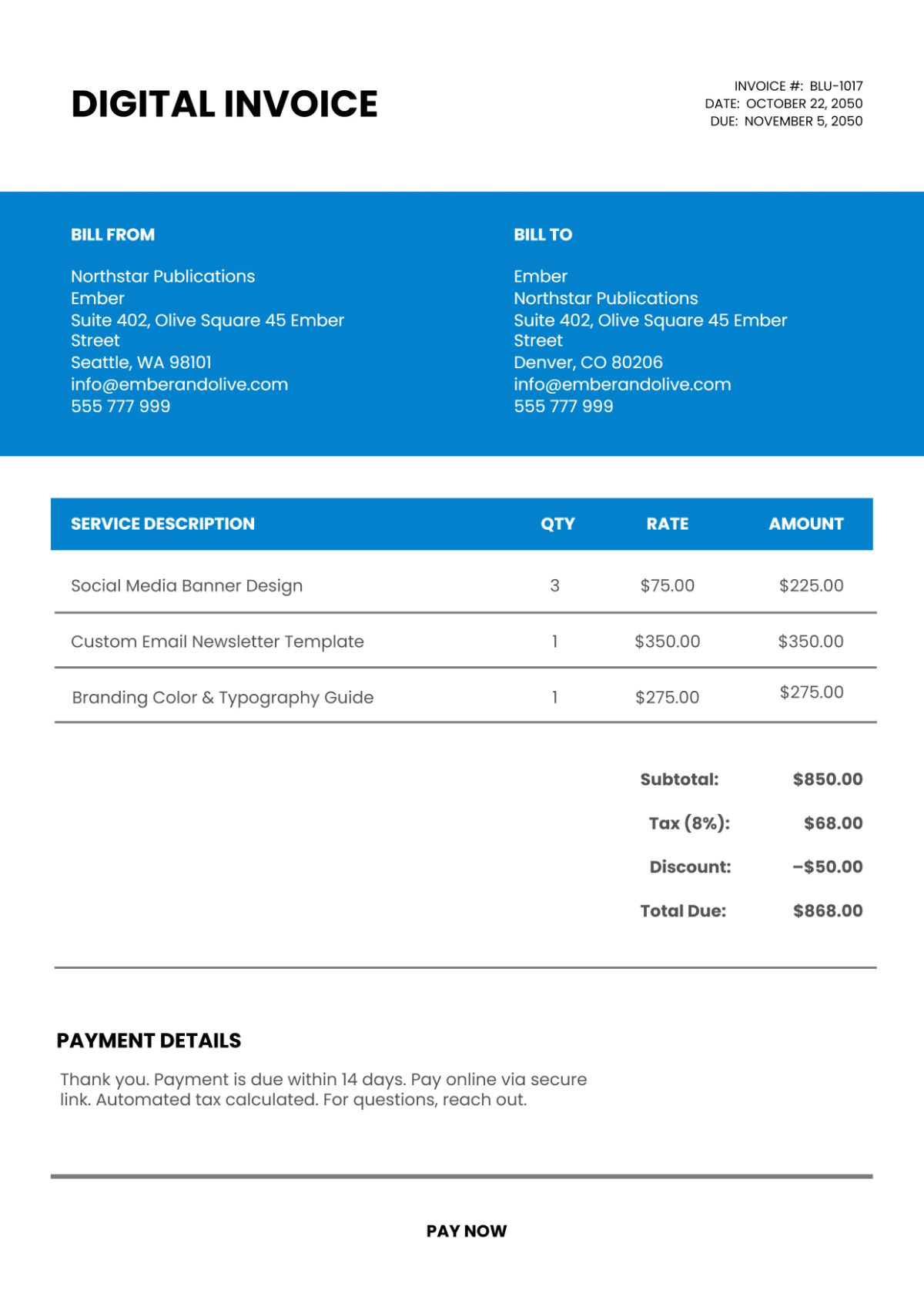

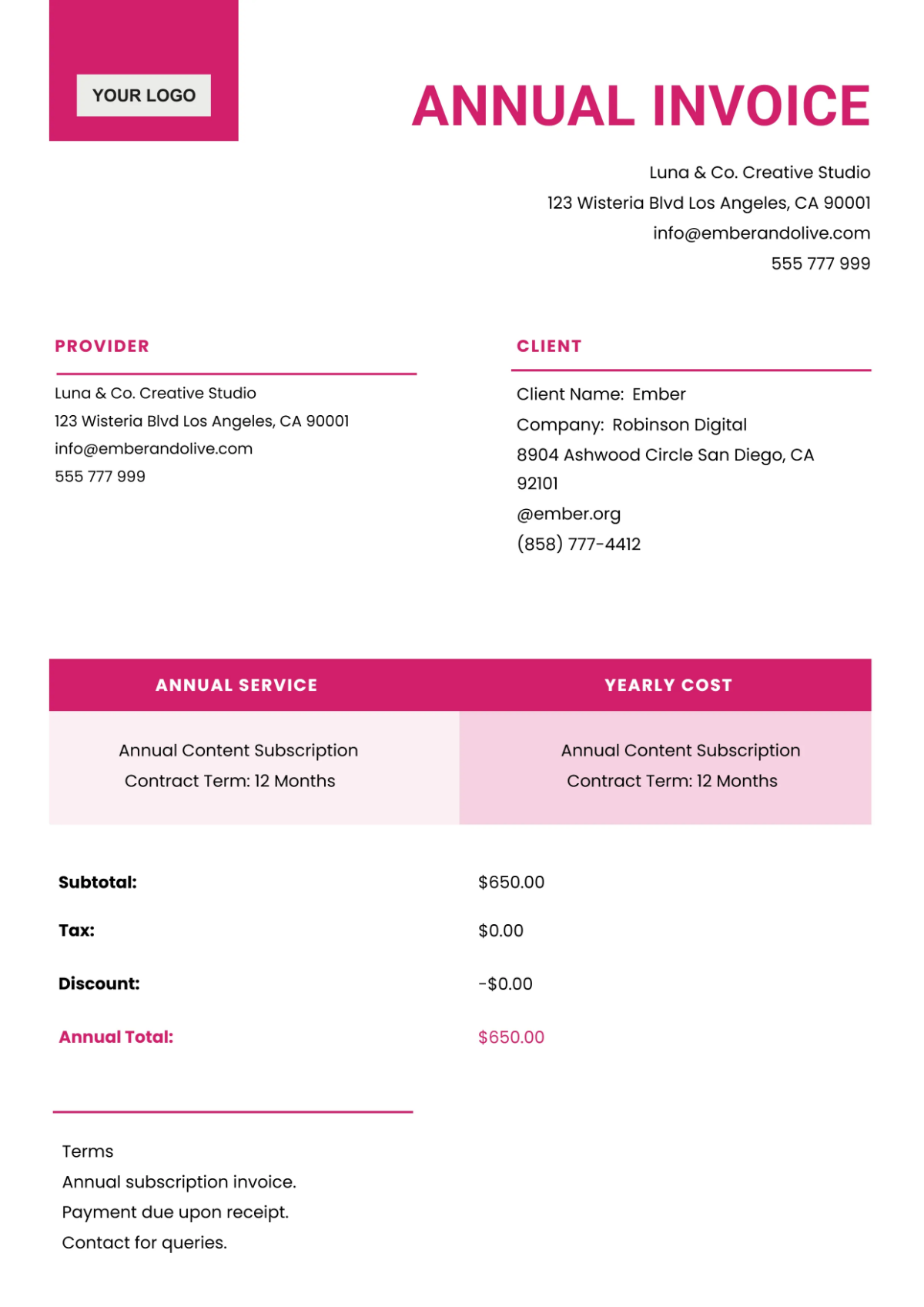

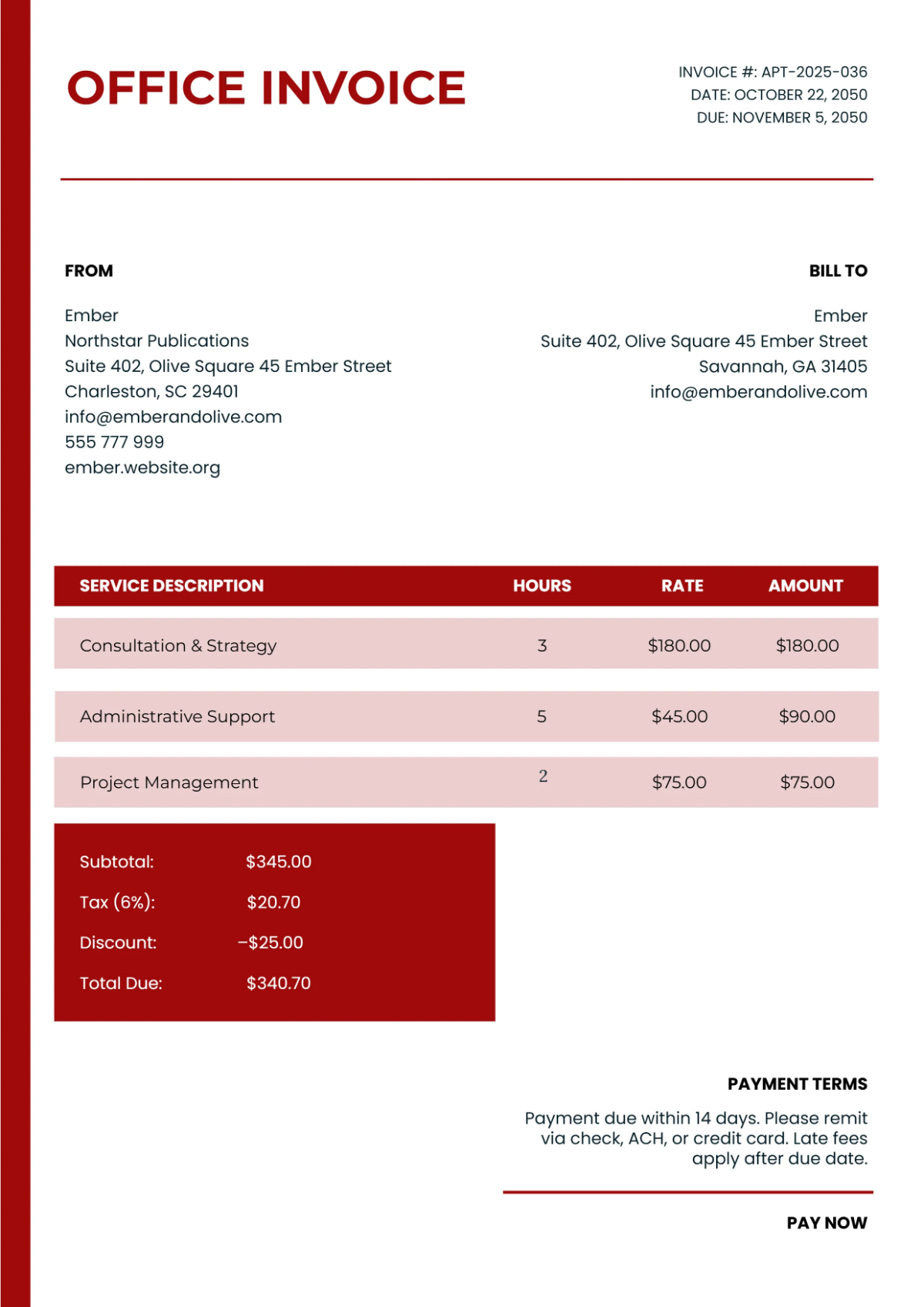

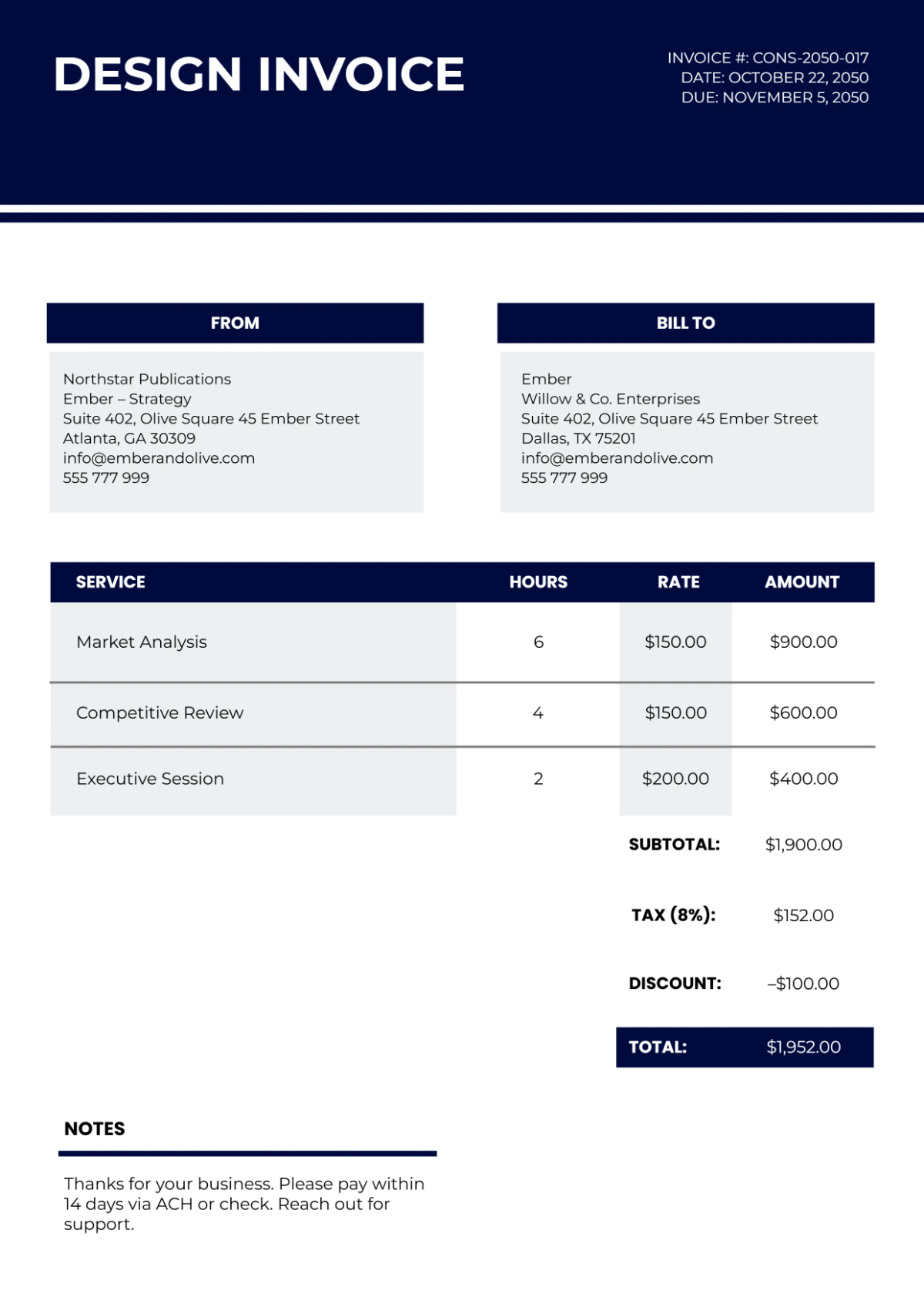

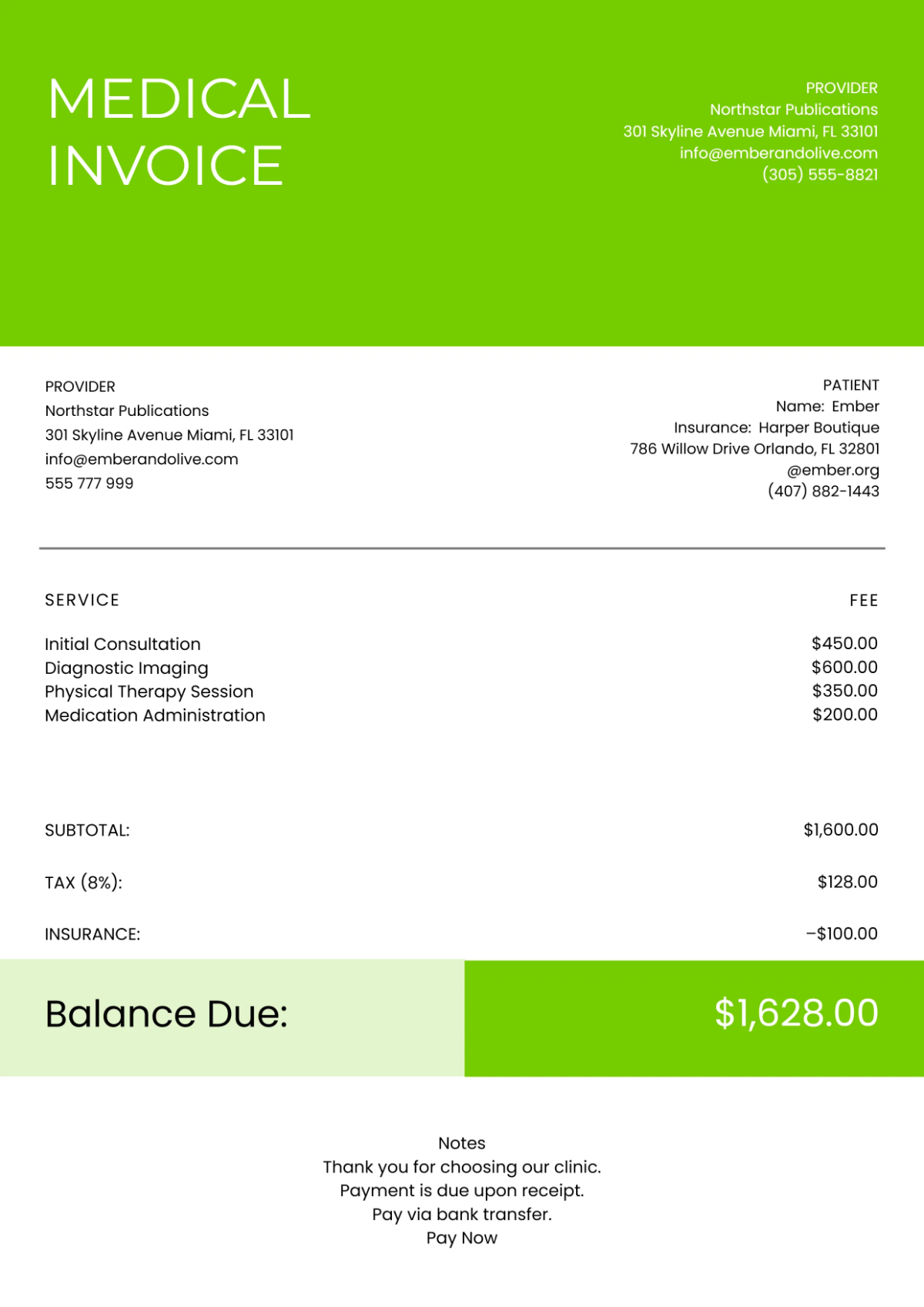

Get organized and professional with Invoice Maker using Invoice Templates from Template.net. Designed for business owners and freelancers alike, these templates help keep your finances in check, streamline your paperwork, and add a touch of professionalism to your billing process. Whether you're looking to promote a sale with special discounts or invite clients to an exclusive event, these templates offer the versatility you need. Customize them to include essential details like dates, client information, and promotional codes effortlessly. No design skills are required—just choose from our professionally crafted options, including both free and premium designs, that are perfect for print or digital distribution.

Discover the many Invoice Templates we have on hand to meet all your billing needs. Select a template that suits your brand, swap in your own company logo and assets, and tweak colors and fonts to match your style effortlessly. With drag-and-drop functionality, you can add icons or annotated graphics, and even incorporate animated effects or AI-powered text suggestions for that extra flair. The possibilities are endless and require no prior skill, making billing not just a task but an enjoyable activity. Dive into our regularly updated templates or check back for new designs added weekly. When you're finished, download or share via print, email, or export your invoice directly to social media, ensuring you reach your audience across multiple channels seamlessly.