10+ Biweekly Budget Templates

It also helps you track how much you have spent and what particular dates you have spent most. It is important to take note of your earning pattern so as not to overspend and get nothing to set aside. If you earn weekly budget, you could make use of biweekly budget template that you can work on with liquidating your expenses.

Budget Excel Template Bundle

Construction Budget Template Bundle

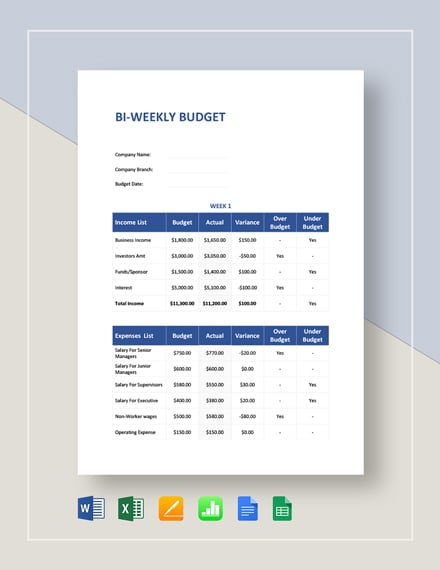

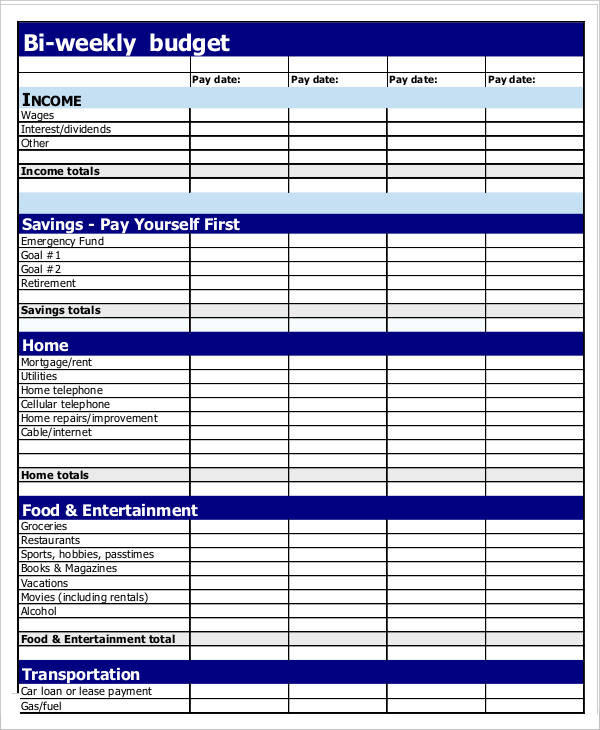

Sample Bi-Weekly Budget Template

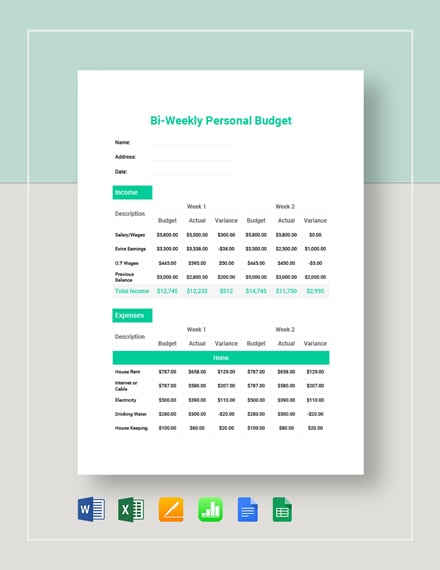

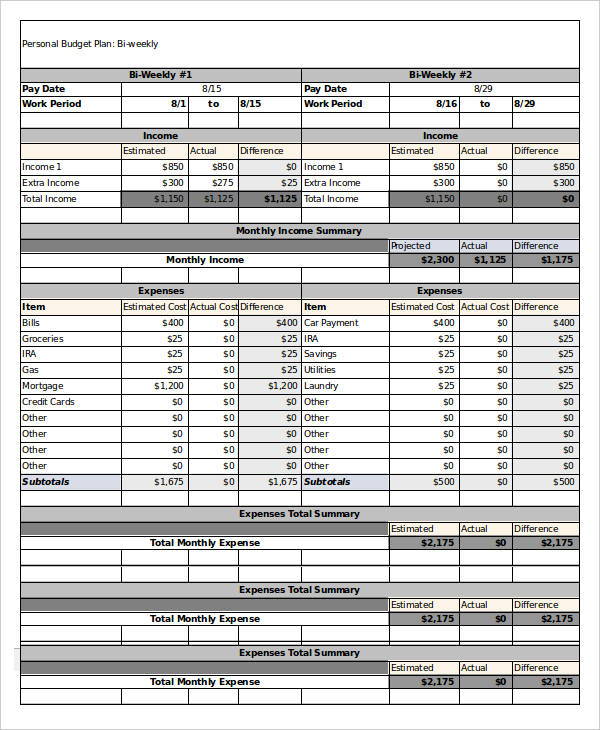

Simple Bi-Weekly Personal Budget Template

Budgeting your finances is an initial step toward responsible living. You could apply budgeting to almost everything. Whether you are living alone, with your family, or with your spouses, even in school and organizations, budgeting finances saves a lot of time and effort in avoiding unnecessary spending. You can also see more on Business Budget Templates.

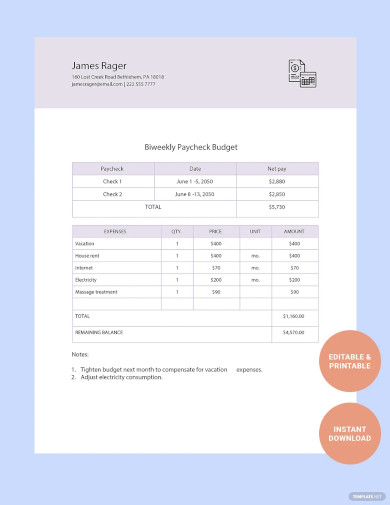

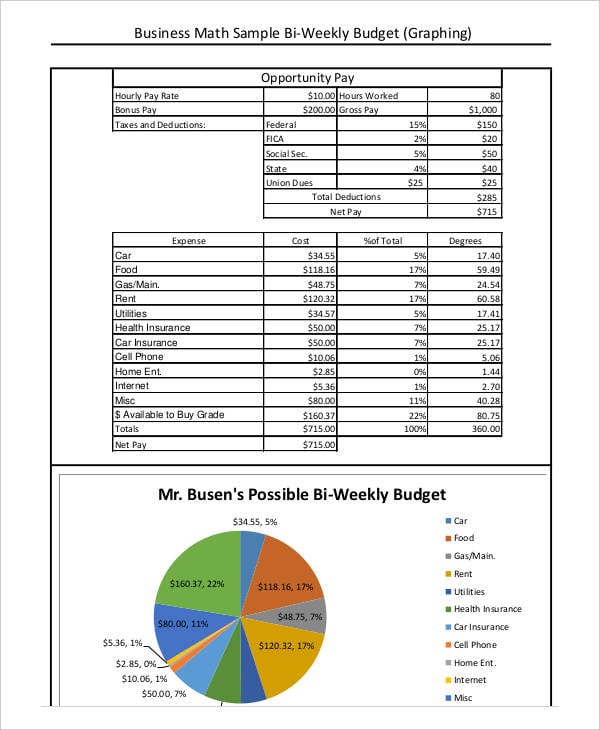

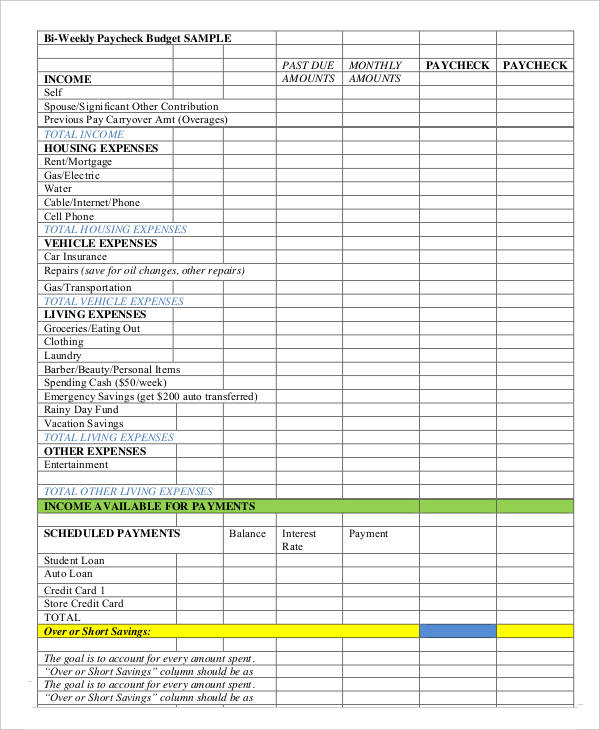

Basic Bi Weekly Paycheck Budget Template

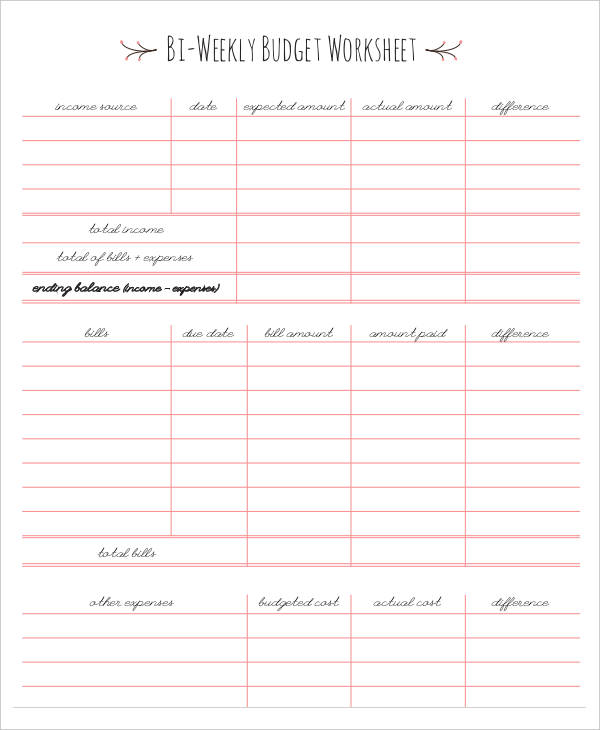

Free Blank Bi-Weekly Budget Template

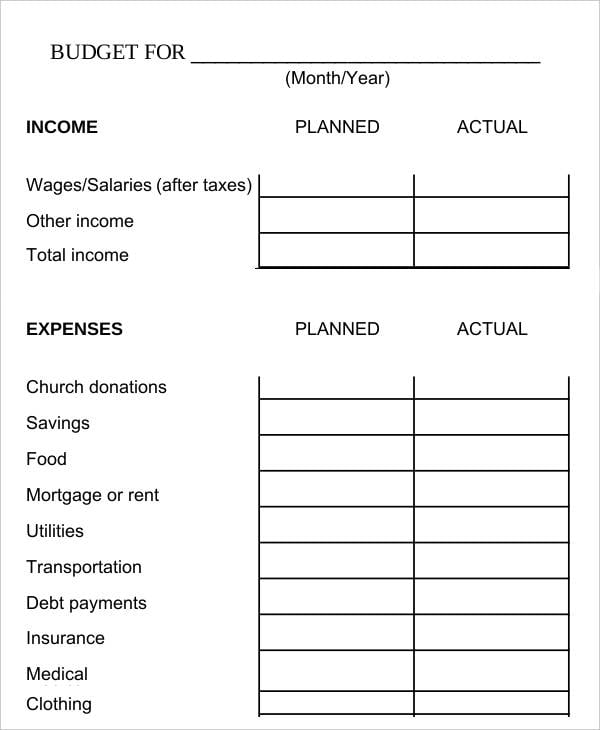

Free Bi-Weekly Pay Budget Template

highschool.csredhawks.org/

highschool.csredhawks.org/Free Bi-Weekly Budget Worksheet Template

fabnfree.com

fabnfree.comFree Bi-Weekly Paycheck Budget Template

arborfamilycounseling.com

arborfamilycounseling.comFree Bi-Weekly Personal Budget Template

thrivent.com

thrivent.comFree Bi-Weekly Family Budget Worksheet Template

lds.org

lds.orgFree Bi-Weekly Home Budget Template

mpoweredcolorado.org

mpoweredcolorado.orgThink of Budgeting

You can always track your everyday expenses in ways you may like, but for purposes of accuracy of all your inputs, you could always track down your Yearly Budget as well as your Weekly Budget to see if your expenses have been coinciding all throughout your liquidation. One must know how to budget his or her finances through this list:

- Prioritize your needs. You have to list down all that you need within the span of week(s) until you get your paycheck. This is basically everything that you spend on every day like food and transportation. Starting small with this pattern, you could always put up a minimal budget for how much you would spend on your meals as your transportation expenses could be a fixed amount every day.

- Household bills. As soon as you get your pay, always set aside your payment for your household bills. It would actually help you clear your mind on your expenses if you gradually get your bills covered as soon as you have the money to pay for it. You can also see more on Budget Sheets.

- Unnecessary spending. If you spend too much on unnecessary things, you might be left with nothing to save. All these unnecessary spending boils down to all of your wants. Spending on your wants could possibly ruin your simple budget scheme.

Keeping Your Budget

In terms of your Personal Budget, there are also a lot of ways to improve on budgeting your expenses as well as on avoiding to spend too much:

- Always keep track of your expenses by keeping a receipt of your purchase or listing your expenses at the very least. This way, you are reminded of how you are spending and you get to assess your finances.

- Put in mind that when you leave your credit cards at home, you are getting away with the temptation of spending too much. It is important to set aside savings to do away with overspending.

- Start with having a daily budget. If you are able to stick to your daily layout of budget without spending more, create a weekly budget and convince yourself to stick to it.

When you keep track of your expenses, you are reminded of how more or less you need to spend. You are reminded of slowing down on spending and cutting down some of your unnecessary expenses for you to save more. You can also see more templates on Template.Net Site!