Table of Contents

- 11+ Internal Audit Budget Templates in PDF | DOC

- 1. Internal Audit Budget Function

- 2. Internal Audit Report Budget Monitoring

- 3. Internal Manual Audit in Budget

- 4. Internal Audit on Budget Management

- 5. Office Internal Audit Budget

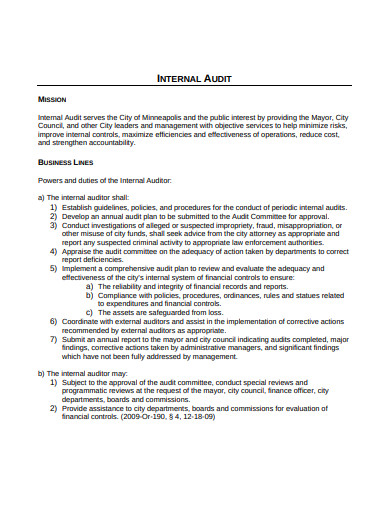

- 6. Internal Audit General Fund Budget

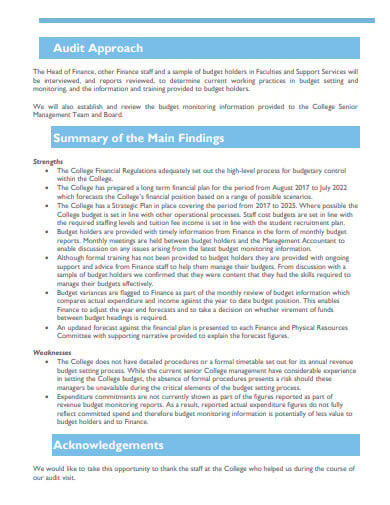

- 7. Internal Audit Report Budget Control

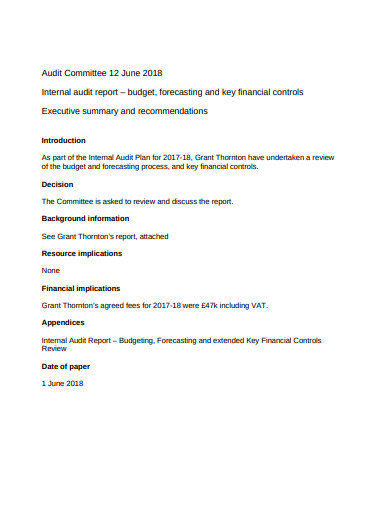

- 8. Internal Audit Budget Forecasting

- 9. Internal Audit Integrated Budget

- 10. Final Internal Audit Budget Control

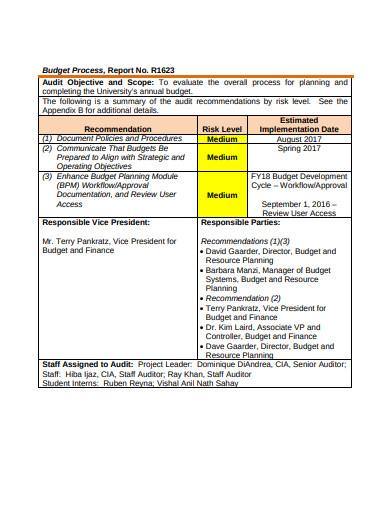

- 11. Internal Audit Budget Office Process

- 12. Internal Audit Budget Program

- 6 Steps to Conduct an Internal Audit Budget

- What do internal auditors do?

- what is budget evaluation?

11+ Internal Audit Budget Templates in PDF | DOC

An internal audit budget determines if the budgeting process is working efficiently. This is an assessment of the budgeting effort. The budget audit looks at strategies, processes, encouragement, and efficiency of the budget. Dynamic budgeting should be effective. An analysis of the budget identifies issues in the budgeting process. An independent party not a member of the budget team should perform it every two or three years. The internal budget auditor will report to the upper management, who can act accordingly.

11+ Internal Audit Budget Templates in PDF | DOC

1. Internal Audit Budget Function

dl.theiia.org

dl.theiia.org2. Internal Audit Report Budget Monitoring

committees.aberdeencity.gov.uk

committees.aberdeencity.gov.uk3. Internal Manual Audit in Budget

finance.gov.mk

finance.gov.mk4. Internal Audit on Budget Management

icommercecentral.com

icommercecentral.com5. Office Internal Audit Budget

utsystem.edu

utsystem.edu6. Internal Audit General Fund Budget

minneapolismn.gov

minneapolismn.gov7. Internal Audit Report Budget Control

cityofglasgowcollege.ac.uk

cityofglasgowcollege.ac.uk8. Internal Audit Budget Forecasting

hcpc-uk.org

hcpc-uk.org9. Internal Audit Integrated Budget

mycouncil.surreycc.gov.uk

mycouncil.surreycc.gov.uk10. Final Internal Audit Budget Control

london.gov.uk

london.gov.uk11. Internal Audit Budget Office Process

bernco.gov

bernco.gov12. Internal Audit Budget Program

wipo.int

wipo.int6 Steps to Conduct an Internal Audit Budget

Internal audits are considered to be a key activity of management control which ensures clear internal business business processes. It also allows the client to identify challenges as well as opportunities for improvement in business processes. An internal audit is a component of the process of auditing that takes place within the company to determine the compliance of internal processes and systems. An internal audit’s main objective is to check and guarantee that the policies and procedures of a company are implemented, and also notify the top management about the policy enforcement discrepancy.

Step 1: Know When and What to Audit

You will determine which processes are to be audited before performing the internal audit. Understanding the audit process’s scope and objectives will help you create an audit schedule. As mentioned earlier, the internal audit should be carried out on the basis of the process risks. The greater the risk in a particular area of the company the more often you would like to audit that area of business. It is also essential to understand the complexity of the business process that you are planning to audit to help you to determine the right time for system auditing.

Step #2: Create an audit schedule

Creating an audit schedule provides the departments with advanced notice of the upcoming audit. The program will help them have the necessary documentation and records available for review and audit. The internal schedule will also the business of planning for resources required to conduct the internal audit. A surprise audit is not recommended as it may create a disengaged situation and stakeholders will feel threatened by the auditor. It is recommended you share the audit schedule and obtain approval and confirmation.

Step #3: Pre-Planning the scheduled Audit

Being prepared before a scheduled audit is essential as it will simplify and make the whole audit process effective. During the pre-planning phase, auditors need to send an audit plan to the department providing information about the audit scope, objective, criteria and possible documentation evidence needed for the audit.

The auditor must be prepared before the audit with a clear understanding of the policies and procedures that will be reviewed. For example; Before auditing a purchasing process, the auditor needs to understand the policies and procedures related to purchasing and also know what kind of evidence that he/she may review. This will significantly improve the efficiency of the audit process will also reduce the downtime

Step #4: Conducting the audit

Internal audits can be conducted by different methods such as documentation review, interviewing and observation. Based on the scope and objective of the auditor, the audit shall choose any methodology or combination of all to carry the internal audit. The internal auditor shall sight and examine sufficient hard-copy or electronic records to verify; evidence of compliance with the management system procedures; and effective implementation of process and internal control. You need to ensure the audit is conducted in a fair and unbiased manner.

Step #5: Record the findings

Recording the findings is vital in the audit process, and the auditor needs to list all evidence sighted by record numbers or record data. The aim of documenting audit findings is to identify gaps in compliance and look at opportunities to fix the deficit and improve the process. Records may also include observation and notes from the interview process. It is recommended that the auditor provide a quick snapshot of the findings quickly at the end of the internal audit to ensure the auditee is aware and also has a chance to clear any questions.

Step #6: Report findings

All findings should be reported in an easy to read audit report. Audit reports serve evidence that an internal audit was conducted. These reports should be reviewed and approved by the department manager / top management. The report can also include an improvement / corrective action plan that should need to develop and implemented in the areas where gaps were identified. ISO recommends you use PDCA (Plan, Do, Check, Act) Management tool to facilitate and carry the improvement process within the business.

To be successful, it is crucial that businesses meet the needs of their customer and can deliver products and services accurately without any error. All internal controls established by the organization needs to be maintained and effectively followed to support quality products and services. An internal audit is a management tool that organizations use to ensure that the process meets requirements.

Internal auditing is an independent, objective assurance and consulting activity designed to add value to and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.[1] Internal auditing achieves this by providing insight and recommendations based on analyses and assessments of data and business processes.[2] With a commitment to integrity and accountability, internal auditing provides value to governing bodies and senior management as an objective source of independent advice. Professionals called internal auditors are employed by organizations to perform internal auditing activity.

The scope of internal auditing within an organization is broad and may involve topics such as an organization’s governance, risk management, and management controls over: efficiency/effectiveness of operations (including safeguarding of assets), the reliability of financial and management reporting,[3][4] and compliance with laws and regulations. Internal auditing may also involve conducting proactive fraud audits to identify potentially fraudulent acts; participating in fraud investigations under the direction of fraud investigation professionals, and conducting post investigation fraud audits to identify control breakdowns and establish financial loss.

Internal auditors are not responsible for the execution of company activities; they advise management and the Board of Directors (or similar oversight body) regarding how to better execute their responsibilities. As a result of their broad scope of involvement, internal auditors may have a variety of higher educational and professional backgrounds.

What do internal auditors do?

We have a professional duty to provide an unbiased and objective view. We must be independent of the operations we evaluate and report to the highest level in an organization: senior managers and governors. Typically this is the board of directors or the board of trustees, the accounting officer or the audit committee.

To be effective, the internal audit activity must have qualified, skilled and experienced people who can work following the Code of Ethics and the International Standards.

The nature of internal auditing, its role within the organization and the requirements for professional practice are contained within the International Professional Practices Framework (IPPF). The components and the detailed content of the IPPF are available in the Global professional guidance area of the website.

what is budget evaluation?

Budget evaluation refers to the final stage of the budget cycle when there is an assessment of whether public resources have been used appropriately and effectively. For this stage to support good governance and the effective and efficient use of public resources, assessments of the budget implementation and its impact must include assessments by bodies that are independent of the government and that have sufficient capacity and resources to perform their task.