11+ Business Audit Templates in PDF | DOC

A documented evaluation of whether or not an organization’s financial statements are objectively accurate along with the standards, proof, and hypotheses used to manage the audit is referred to as a business audit. An auditor states whether or not the financial statements are free of material error. Have a look at the business audit templates provided down below and choose the one that best fits your purpose.

11+ Business Audit Templates in PDF | DOC

1. Audit Insights Small Businesses

icaew.com

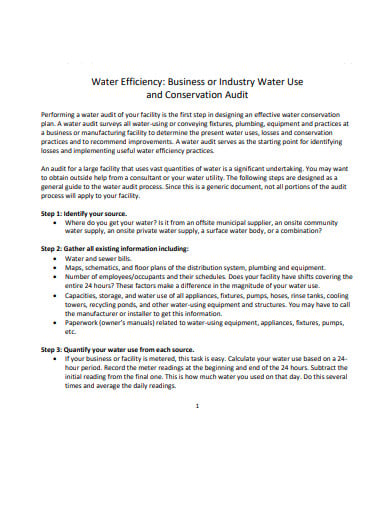

icaew.com2. Audit Business Conversation

des.nh.gov

des.nh.gov3. Business Risk Audit Process

pdfs.semanticscholar.org

pdfs.semanticscholar.org4. Small Sized Business Audit

pitcher.com.au

pitcher.com.au5. Audit Risk Business Risk

ftms.edu.my

ftms.edu.my canso.org

canso.org7. Business Audit Report

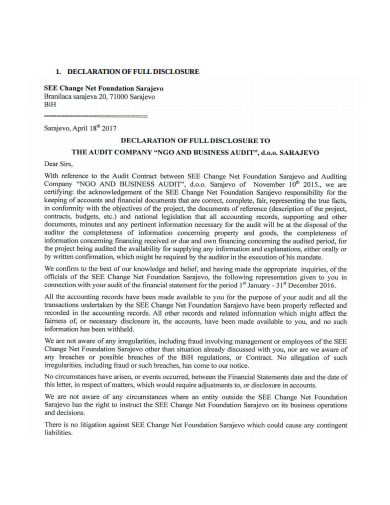

seechangenetwork.org

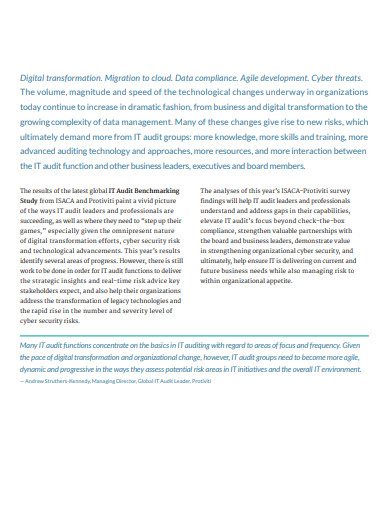

seechangenetwork.org8. Business and Digital Audit

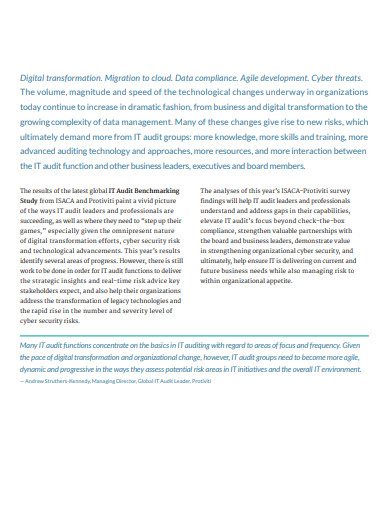

protiviti.com

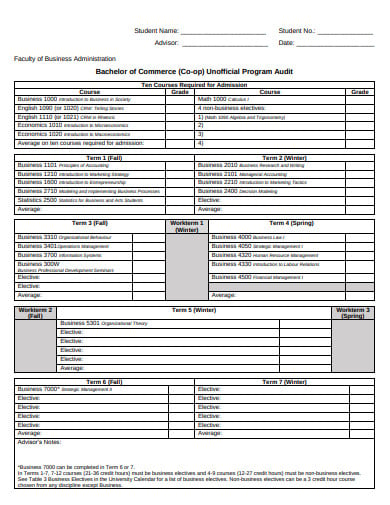

protiviti.com9. Business Administration Audit Process

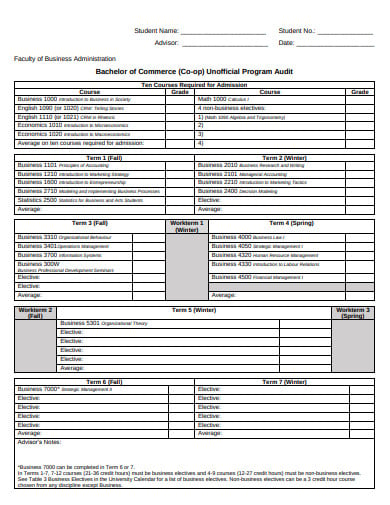

business.mun.ca

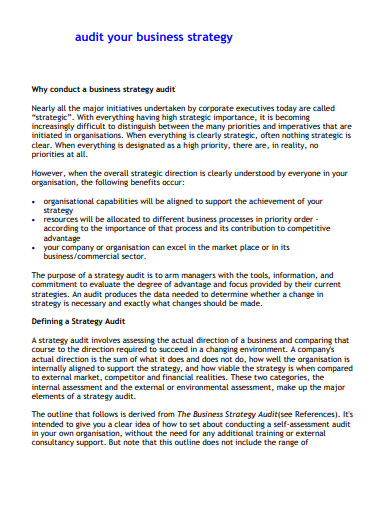

business.mun.ca10. Business Audit Strategy

triarchypress.net

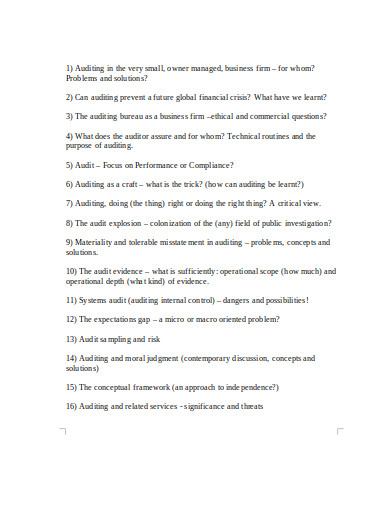

triarchypress.net11. Audit Prevents Business Firm

kau.se

kau.se12. Business Audit Evolution

accounting.rutgers.edu

accounting.rutgers.edu

What is the Step by Step Audit Procedure?

Following are the six definite steps in the audit procedure that must be followed to assure a successful audit:

- Requesting Financial Documents.

- Developing an Audit Plan.

- Registering an Open Meeting.

- Directing Onsite Fieldwork.

- Composing a Report.

- Commencing Up a Closing Meeting.

What is the Scope of an Audit?

The scope of an audit is to give an accurate autonomous examination of the financial statements, which enhances the significance and reliability of the financial statements generated by management, therefore improve user confidence in the financial statement, decrease investor risk and consequently decrease the cost of capital and so on.

How Frequently do Small Businesses get Audited?

Maximum audits are started within two years of the date of filing your tax return, but the IRS can go back six years if they recognize a substantial mistake. The most popular type of small business audit is a correspondence audit, where the IRS informs you in noting down of a potential error or problem with your tax return.

What is the Audit Method?

An audit is an accurate review and analysis of some phases of an organization’s operations to strengthen the degree to which the organization is in agreement with normal standards. In most instances, an audit consists of various steps or stages that are created to guarantee the most precise, accurate and positive results.

What are the Benefits of an Independent Audit?

The benefit of an independent audit is that it assists to stop business management and employees from potential fraud. It also allows reaching low-cost financing with autonomously audited financial statements. In an organization with independent external audits, the complete advantages of all shareholders are completely preserved.

What is the Audit Planning Process?

Performing the audit indicates the method of gathering evidence. The audit planning stage consists of the methods such as attaining an understanding of the customer and its business, making risk and materiality assessments, preparing an audit strategy.

What is the Audit Scope?

The quantity of time and documents which are required in an audit is known as audit scope which is an essential part of all auditing. The audit scope, conclusively, ascertains how intensely an audit is performed. It can change from simple to complete, including all organization documents.

What Do You Mean by an Audit Report?

A written view of an auditor concerning an entity’s financial statements is referred to as an audit report. A clean estimation, if the financial statements are a balanced representation of an entity’s financial position, being independent of material misstatements.

What is the Internal Audit Plan?

Internal audit is the annual audit planning method. The annual audit plan is a report of planned audits by method or location. The objective of the plan is to determine the audit work that will be performed each financial year, and it is a systematic procedure that permits reviewers to concentrate on critical ranges under review.

What is Audit Criteria?

An audit criterion represents the beneficial situation that is used to measure up the exact situation. There are numerous criteria in one audit. The criteria need to follow the logic of the audit questions and assist the audit purpose. The criteria also need to be calculable, as they form the base of evaluation.

What is an Audit Risk Model?

A device used by auditors to know the relationship between multiple risks emerging from an audit engagement allowing them to maintain the overall audit risk. The audit risk model implies that the overall audit risk of engagement is the outcome of the three-component risks.

More in Audit Templates

icaew.com

icaew.com des.nh.gov

des.nh.gov pdfs.semanticscholar.org

pdfs.semanticscholar.org pitcher.com.au

pitcher.com.au ftms.edu.my

ftms.edu.my canso.org

canso.org seechangenetwork.org

seechangenetwork.org protiviti.com

protiviti.com business.mun.ca

business.mun.ca triarchypress.net

triarchypress.net kau.se

kau.se accounting.rutgers.edu

accounting.rutgers.edu