Best AI Content Writing Tools

Introduction Creating content today is faster, smarter, and more competitive than ever. Whether you are a blogger, marketer, business owner,…

Sep 01, 2023

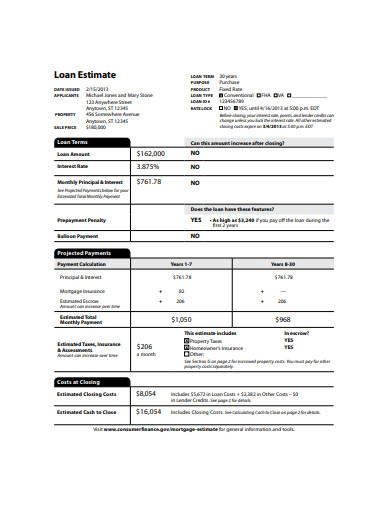

When signing on a loan, both parties need to make an estimate of the important and required components. Approximate calculations need to be done regarding the money being provided by the party giving the loan and the money being received by the receiving party. Preparing an estimate helps in proper and smooth execution. These loan estimate templates are made for this purpose.

The first and foremost thing to decide while making a loan estimate is to decide the loan amount. Here, the party requesting the loan needs to specify how much money is needed. The party providing the loan then either agrees to provide the whole amount or tries to negotiate. The interest rate of the loan also needs to be determined by the party giving the loan.

First, you need to have a good sense of what you can afford easily on a monthly basis, then you can glance at your savings to find out how much you can possibly afford for the down payment. Both parties also need to define the monthly payments that will be made for the loan.

The loan which is being provided by one party and received by the other can be of three types: conventional, FHA, or special programs. The majority of loans fall under conventional loans and they cost lesser than FHA loans. FHA loans have a low down payment and can be acquired by those with low credit scores. Special programs include VA, USDA and local. The type of loan is decided by the party requesting the loan.

The loan term refers to the time period the party requesting the loan has to repay the loaned amount. This period is usually decided by the party providing the loan. Although, in some cases, the other party has the option of negotiating. The term of the loan has an impact on the monthly principal, interest rate, and interest payment.

The interest rate and type are usually decided by the party providing the loan. The type of rate can be fixed-rate or adjustable-rate. A fixed rate is in which the interest rate during the loan’s set price duration does not fluctuate. An adjustable rate is a loan form in which the interest rate given to the outstanding balance differs throughout the loan’s lifetime.

After determining the essentials required for drafting the loan estimate, both parties need to provide their details. This includes their names, ages, addresses, ID proofs, and contact information. An important thing to include here is the loan receiving party’s social security number.

After the end of the estimate, provide spaces for putting the signature and date of both parties. This step is very important as without it there is no way to prove that both parties acknowledge and comply with the loan agreement.

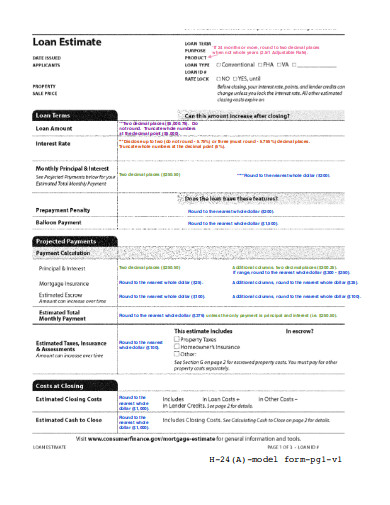

files.consumerfinance.gov

files.consumerfinance.govThe Loan Estimate is the most significant paper that you will see when applying for a mortgage. It helps to define all the essential elements of the loan for both the loan providing as well as the receiving party. Make the loan estimate suited to your needs with the help of this simple loan estimate template. The provided content allows for the option of being edited.

files.consumerfinance.gov

files.consumerfinance.govMaking a loan estimate is a serious task but everyone is adept at this task. We understand this which is why we are here with this loan estimate template. This file provides you with an example of a general loan estimate that you can use to make one for your needs. Just download this file in PDF format and you’re good to go.

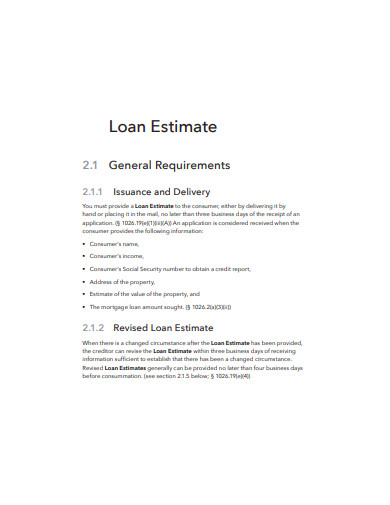

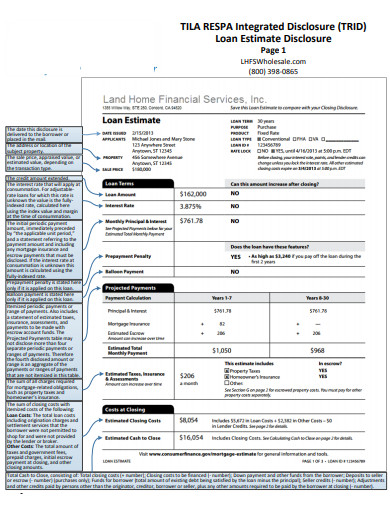

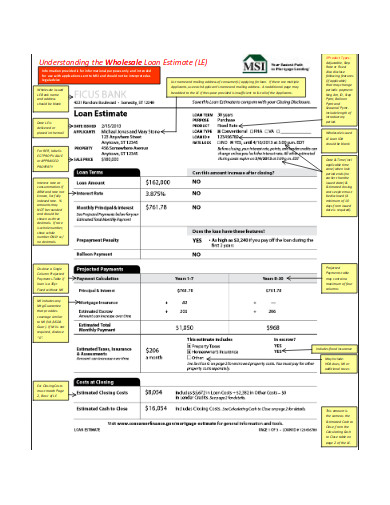

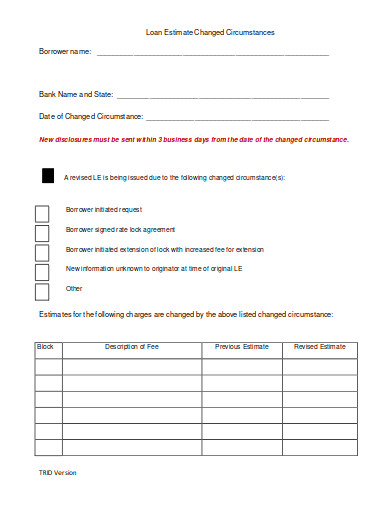

wholesale.lhfs.com

wholesale.lhfs.comThe loan estimate describes your loan’s main conditions, from interest rates to cost closure. It is a very important document for the loan providing and the loan receiving parties. Draft the appropriate loan estimate with the help of this loan estimate disclosure file. To use the file, all you need to do is click on the download icon beside the file.

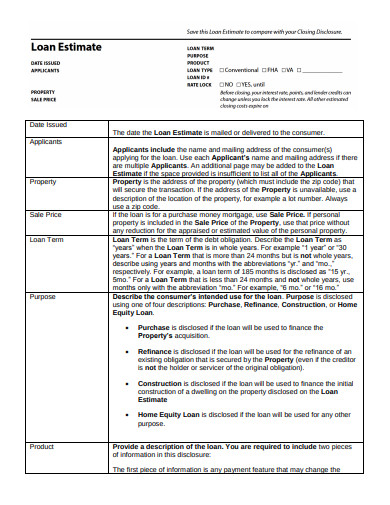

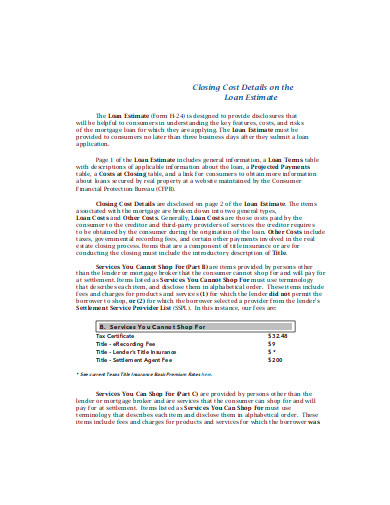

stewart.com

stewart.comWith this loan estimate file, you can also make the perfect estimate for the loan you are providing. By downloading this file you can access to sample loan estimate sheet in PDF with suggestive headings such as applicants, property, safe price loan term, and other similar ones. Grab this opportunity now and click on the download icon!

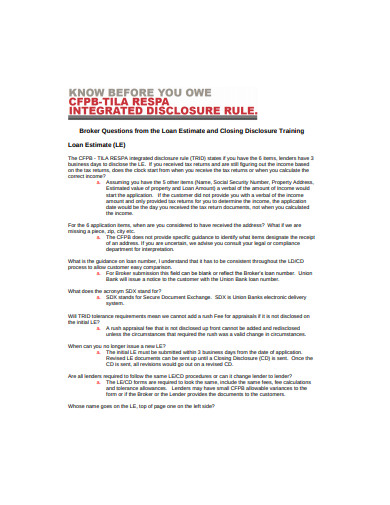

unionbank.com

unionbank.comThis loan estimate file offers you with a sample of a document explaining the rules of making a loan estimate. The file provides original suggestive headings and content written by professional writers. You can easily download this estimate sheet sample in PDF format on the go. The provided content can be used a guide to making a loan estimate customized for you.

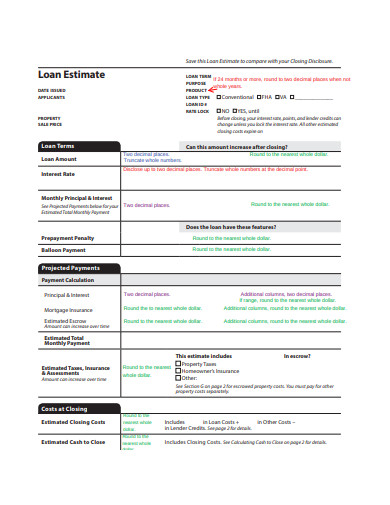

invtitle.com

invtitle.comThere is a typical format to be followed while drafting a loan estimate. Are you worried that you are not aware of this format? Don’t fret because we are here with this Loan Estimate Format in PDF. With this file, you can easily draft the loan estimate sheet according to your needs. All you need to do is download the file and you’re good to go.

calbankers.com

calbankers.comThis basic loan estimate sheet template offers you with a pre-made estimate sheet. All you have to do is download the file in PDF format and you will be ready to make your own. The file is customizable so you can also edit the provided suggestive headings and content according to your needs. Click on the download button now to avail of this loan estimate sheet sample template!

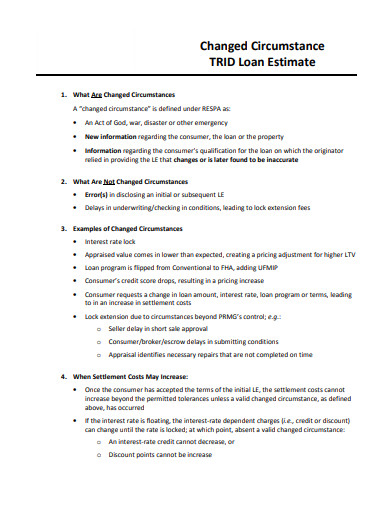

eprmg.net

eprmg.netThis Professional Loan Estimate Example is specifically designed to help you make the proper loan estimate for your project. The file contains the format that you can follow to make the estimate. It is available in PDF file format in the form of an article. To use the estimate sheet file just click on the download icon.

cu-mont.org

cu-mont.orgA Loan Estimate is a three-page form you collect following a mortgage application. It is usually drafted by the party providing the loan and both parties are required to sign it and be aware of the clauses in it. Make the apt loan estimate for your needs with the help of this sample estimate template. The file can easily be downloaded on any OS platform and can also be printed.

sentryabstract.com

sentryabstract.comThe loan estimate provides you with significant information on the credit that you have requested for and the interest rate and principal payment decided by the loan-providing party. If you want to make a proper loan estimate, then you definitely need to download this estimate file. The file can be downloaded in PDF format.

bankerscompliance.com

bankerscompliance.comLoan estimates are a necessary component of any kind of loan request and agreement. However, making those estimates can prove to be an exhausting task. That’s why you need this free blank estimate of loan form. This file will lessen your burden and help make the estimate of the loan quickly and efficiently. The file is fully editable and printable.

centraltexastitle.com

centraltexastitle.comWondering why you need to make a loan estimate? The loan estimate provides you with data on the estimated tax and insurance expenses and how the interest rate and fees may alter in the future. Use this Loan Estimate Example to make the proper loan estimate suited to your needs. The file can be downloaded in PDF and can also be edited if required.

msiloans.biz

msiloans.bizThis free estimate template offers you a file that is designed to explain to you the nitty grities of how to create an estimate for your credit needs. You can use this template to help you draft a document suited to your and client’s loan requirements. Just click on the download button and you’re good to go.

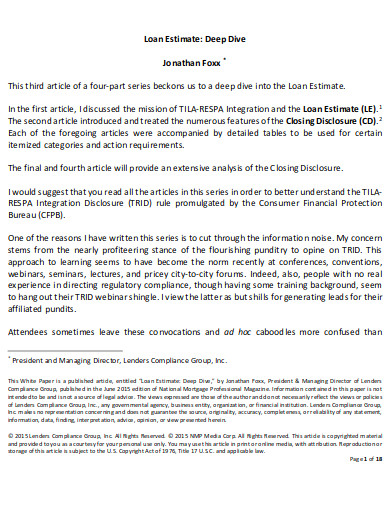

lenderscompliancegroup.com

lenderscompliancegroup.comWith the promotion incoming, you want to shift with your family to a new place. But you need a loan first. Facing a similar situation? Then you need to download this General Loan Estimate in PDF. The file is very simple and easy to use. You can even make changes in the provided content according to your convenience. The file can also be used to make a construction estimate.

bankersonline.com

bankersonline.comIt is not easy estimating a loan; you cannot make it overnight. You need to understand the amount requested for, the down payment, the interest rates, and all other related elements. If you don’t want to go through the hassle of making a proper estimate for your credit needs, you need to download this blank estimate template in PDF.

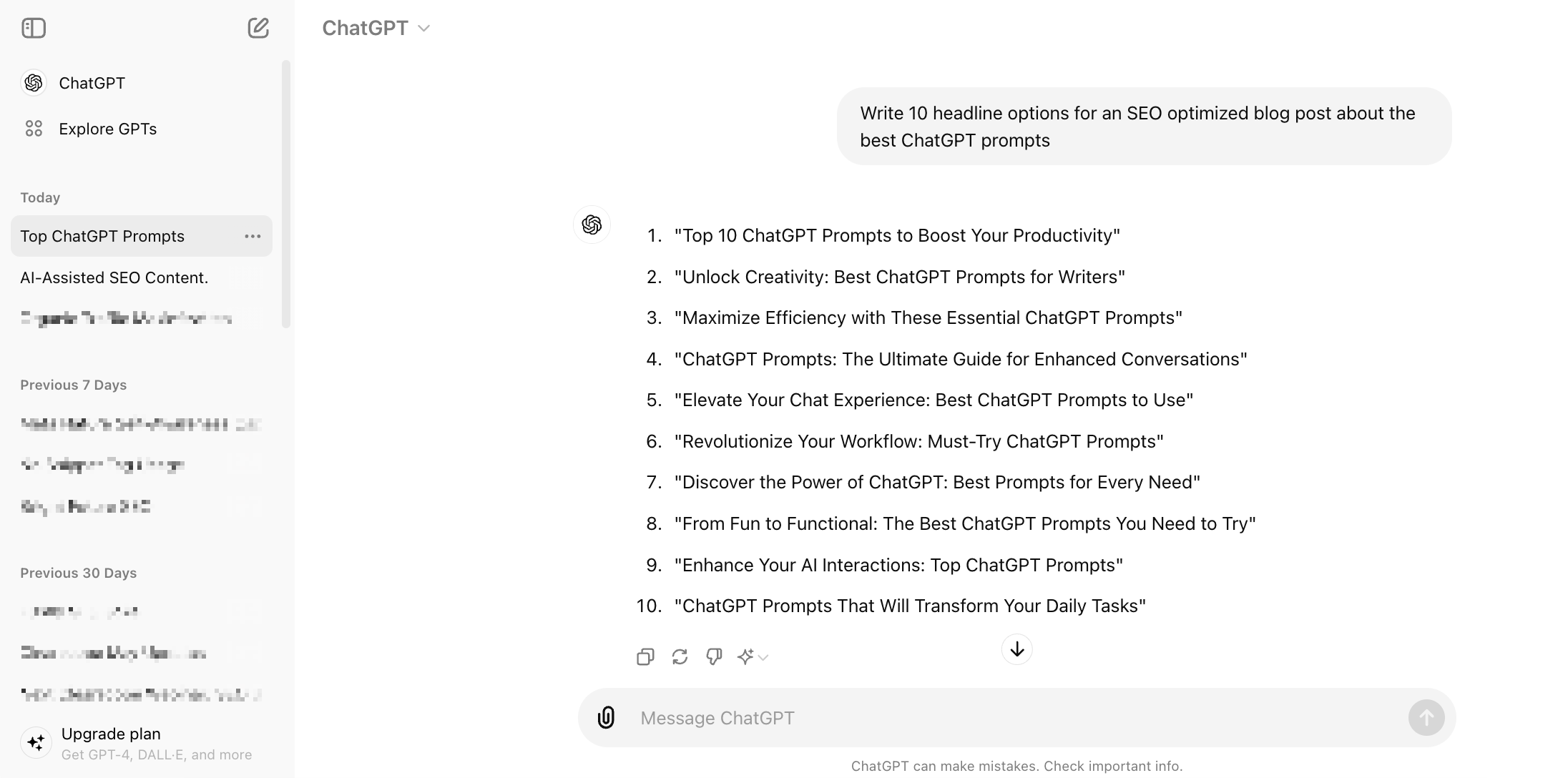

Introduction Creating content today is faster, smarter, and more competitive than ever. Whether you are a blogger, marketer, business owner,…

1. Introduction: The Real State of AI Image Generation in 2026 AI image generation in 2026 is no longer a…

Introduction: The State of AI Customer Service in 2026 Customer service has undergone a fundamental shift. By 2026, AI chatbots…

Introduction: AI Video Generation Is No Longer Experimental What began as short, unstable demo clips has evolved into production-grade systems…

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

Hospitality Induction Templates are structured guides created specifically for the hospitality industry to facilitate the onboarding process for new employees.…

Whether you are a business or an organization, it is important for you to keep track of your business bank…

A Company Description provides meaningful and useful information about itself. The high-level review covers various elements of your small business…

A smartly designed restaurant menu can be a massive leverage to any food business.