Table of Contents

- 41+ Free Pay Stub Templates

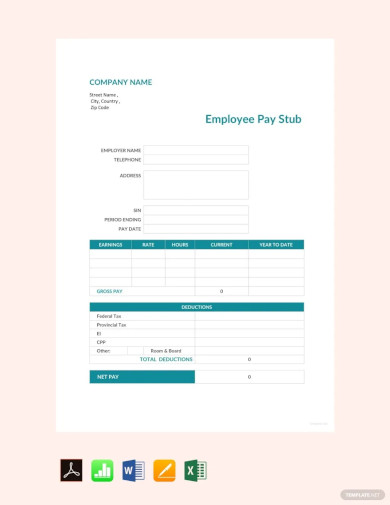

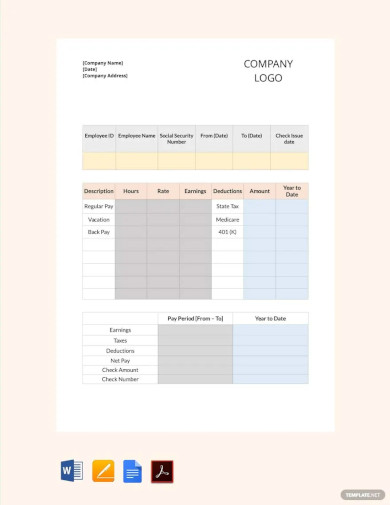

- Employee Pay Stub Template

- Free Sample Pay Stub Template

- Free Basic Pay Stub Template

- Sample Employee Pay Stub Template

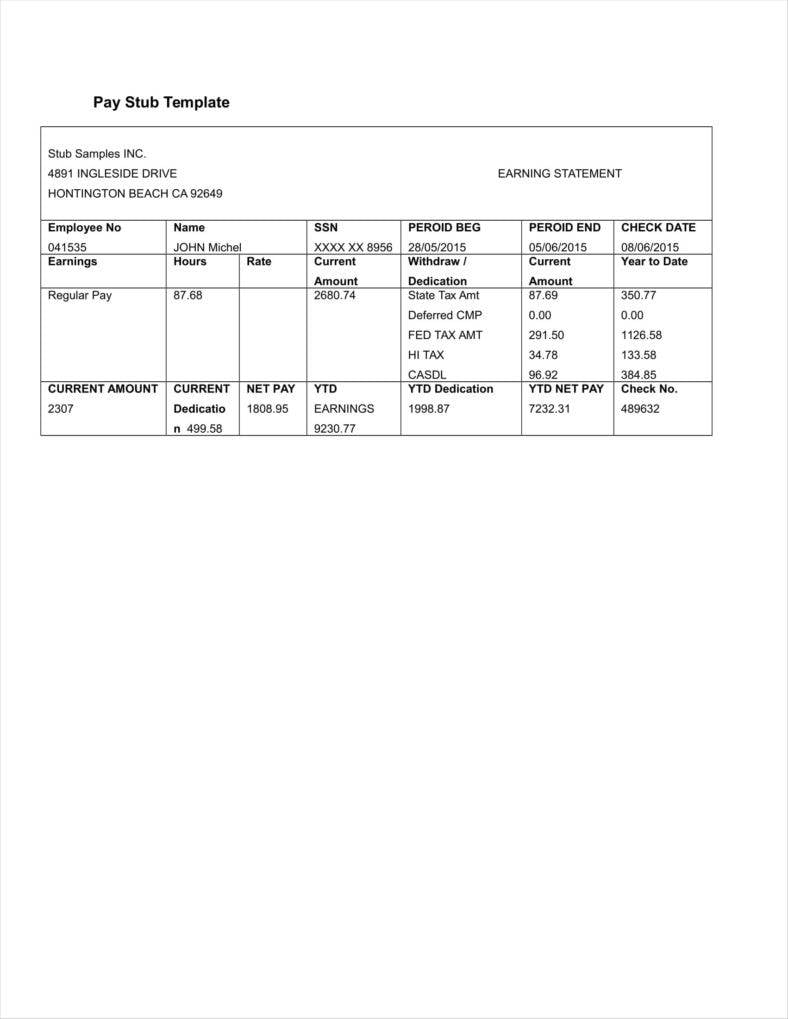

- Sample Pay Stub Template

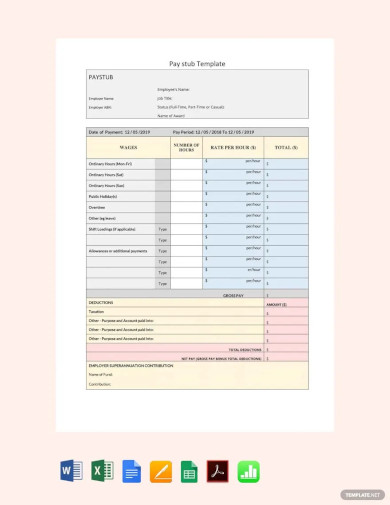

- Canadian Check Pay Stub Template

- Basic Pay Stub Template

- Employee Pay Stub Template

- Company Salary Pay Stub Template

- Company Salary Pay Stub Template

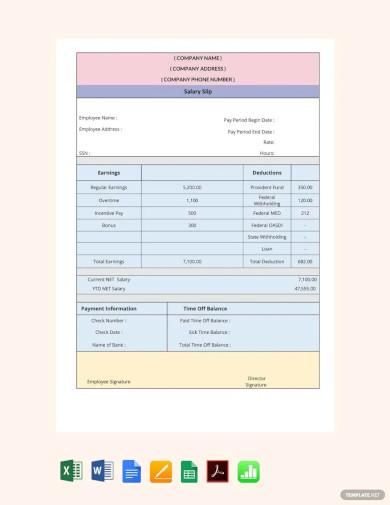

- Printable Salary Slip Pay Stub Template

- Fillable Pay Check Pay Stub Template

- Simple Corporate Business Pay Stub Template

- Organisation Pay Stub Template

- Bonus Pay Stub Template

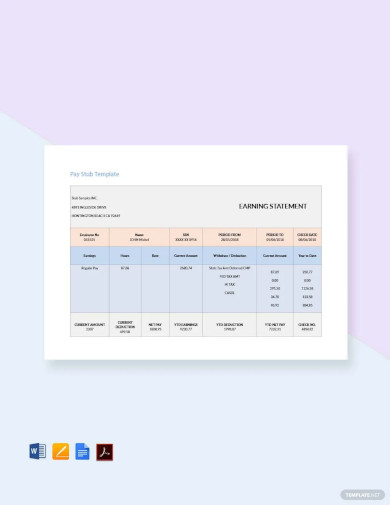

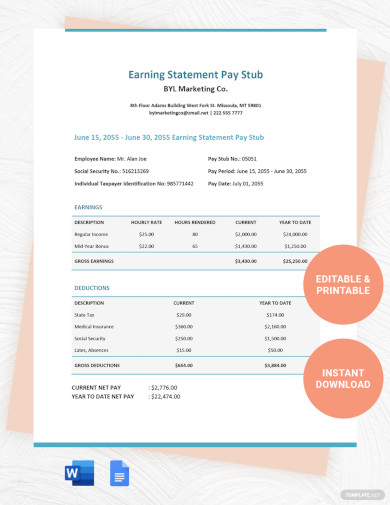

- Earning Statement Pay Stub Template

- ePay Stub Template

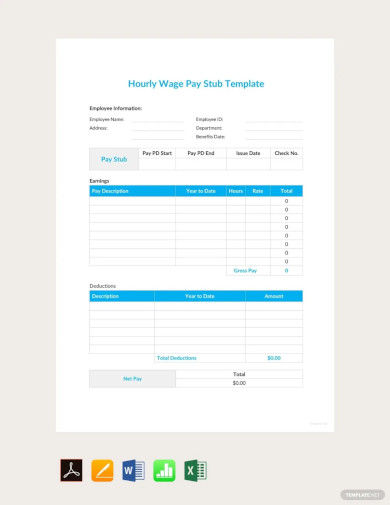

- Free Hourly Wage Pay Stub Template

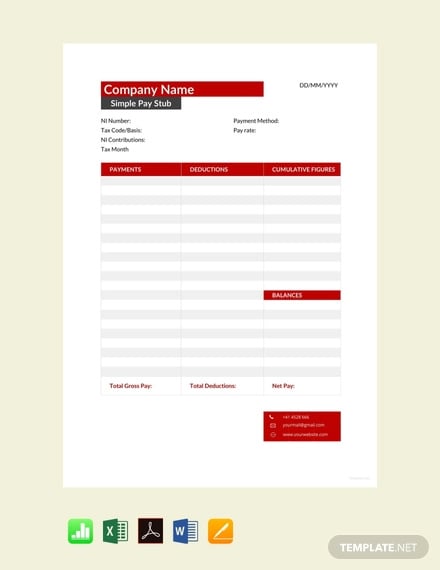

- Free Simple Pay Stub Template

- Free Incentives Pay Stub Template

- Free Editable Company Payroll Invoice in PDF

- Free Bank Payroll Check Template PDF

- Pay Stub for a Monthly Paid Employee with Deductions

- Free Pay Roll Pay Check Stub Template

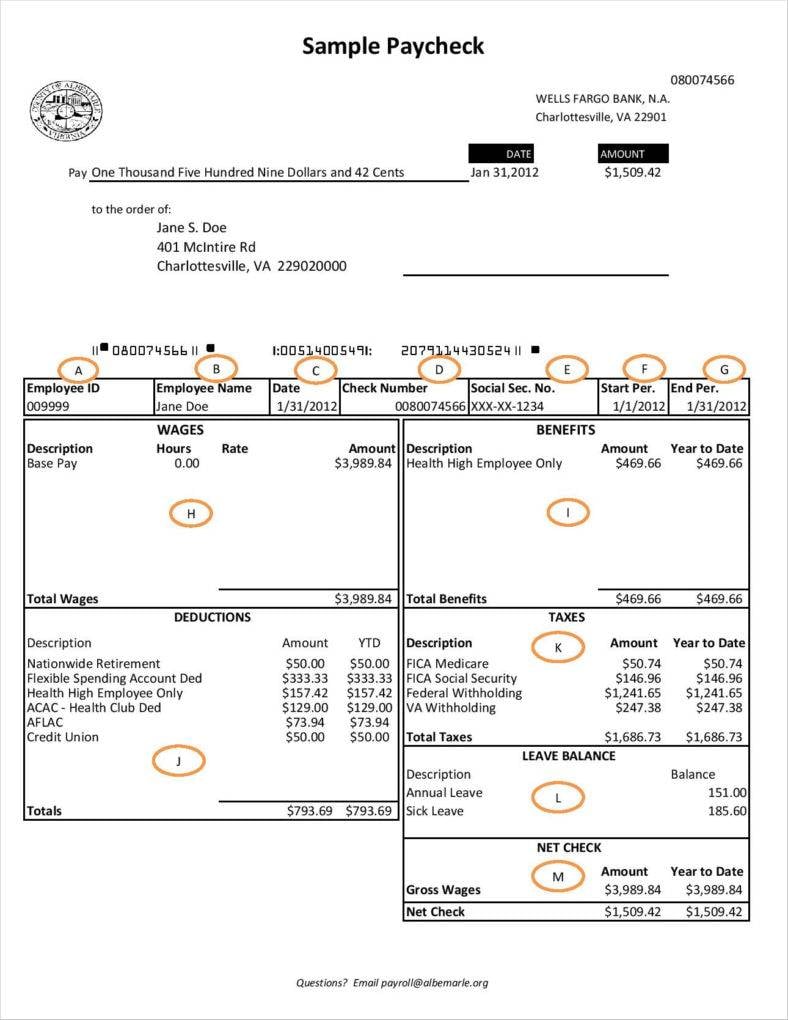

- Free Sample Construction of Paycheck Stub Template

- Free Small Business Paycheck Stub Template

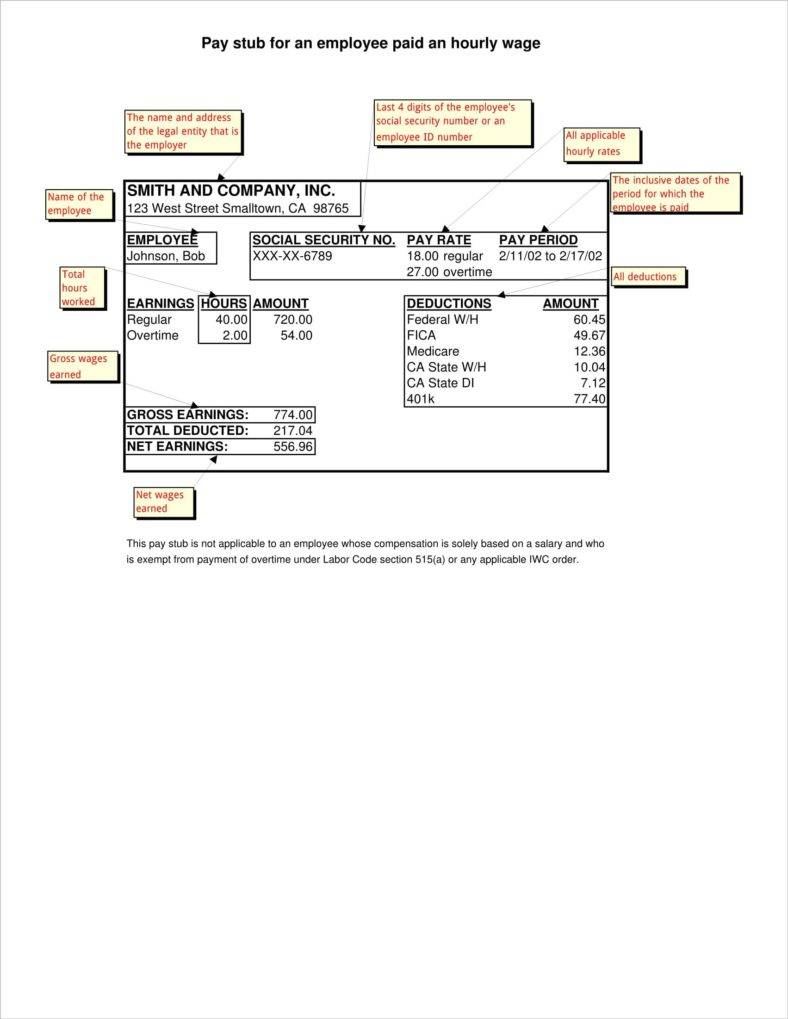

- Free Pay Stub for Hourly Wage Employee

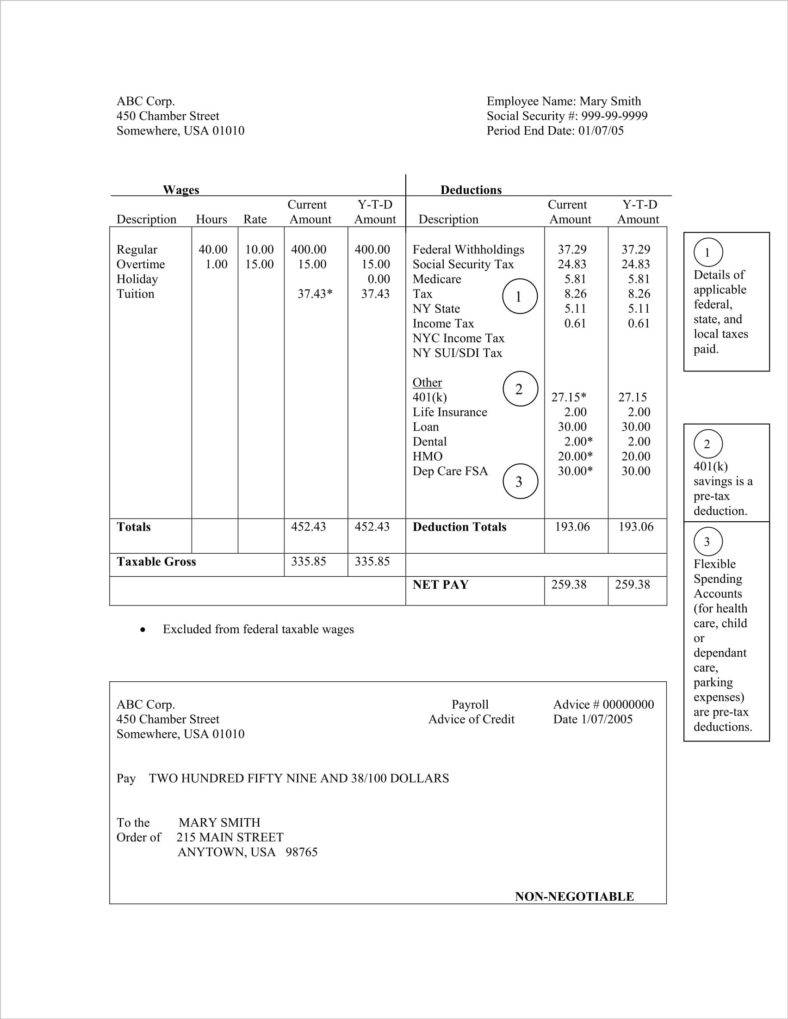

- Free Pay Stub Example

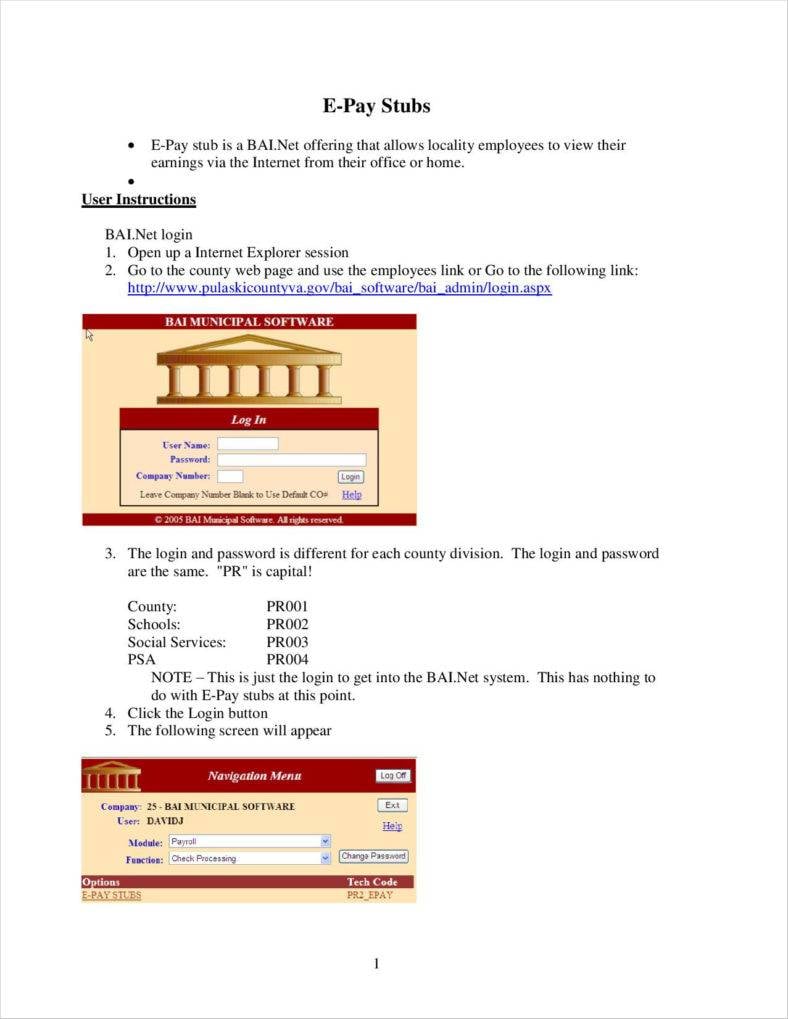

- Free E-Pay Stub Template

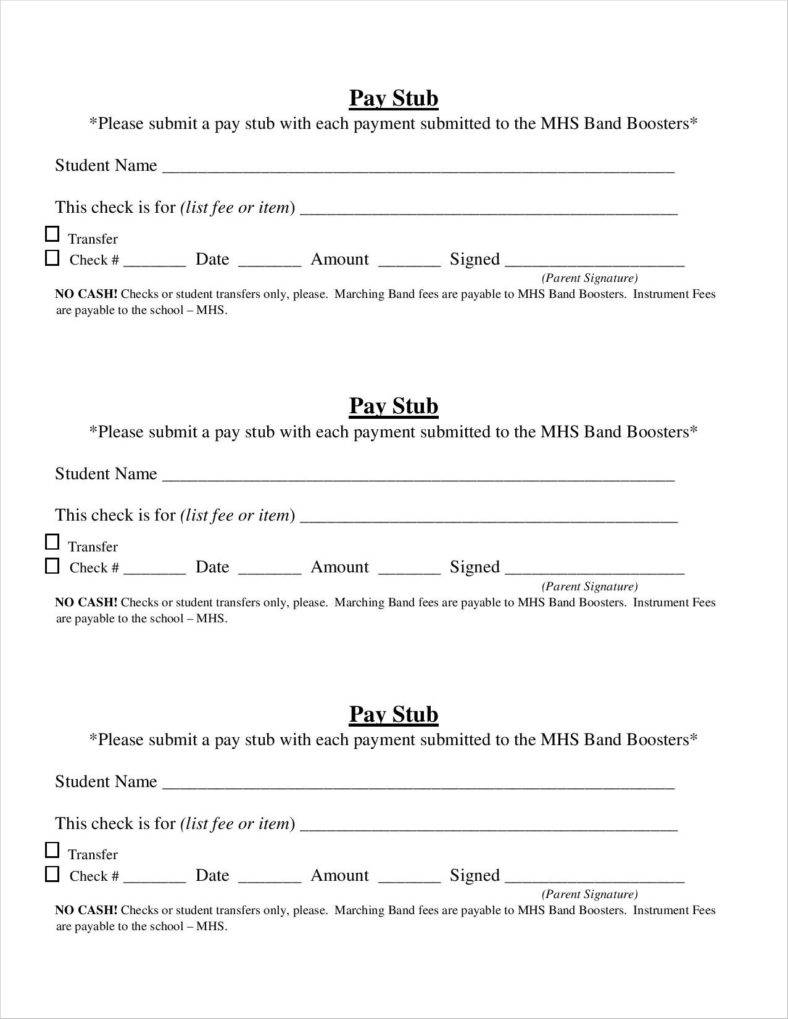

- Simple Independent Contractor Pay Stub Template

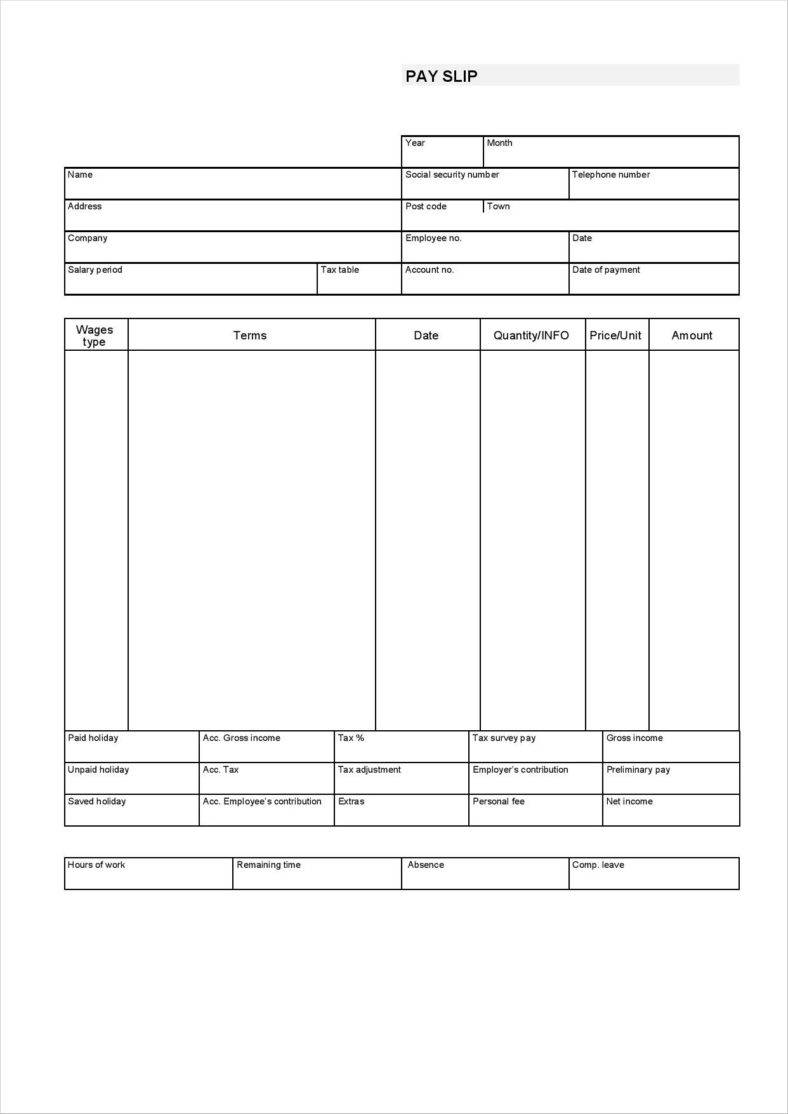

- Free Blank Pay Stub Printable Template

- Free Company Pay Stub Statement Template

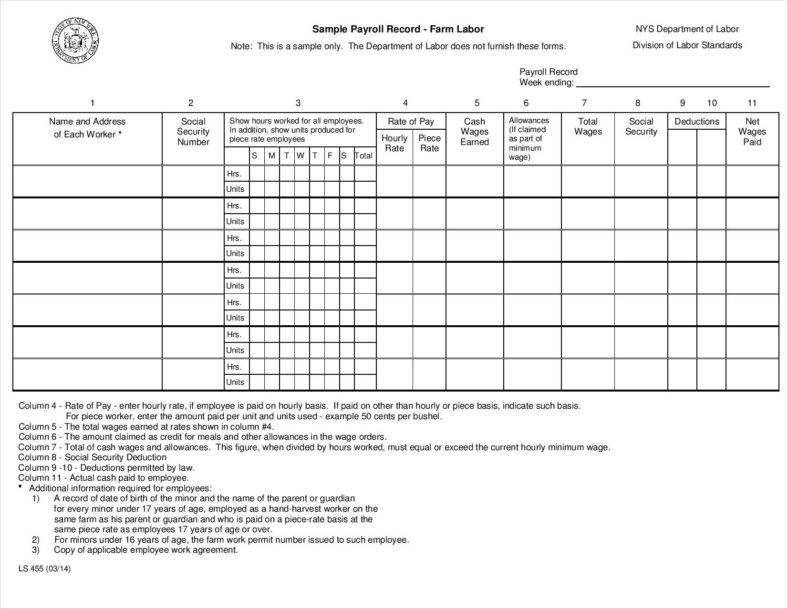

- Free Employee Payroll Record Template

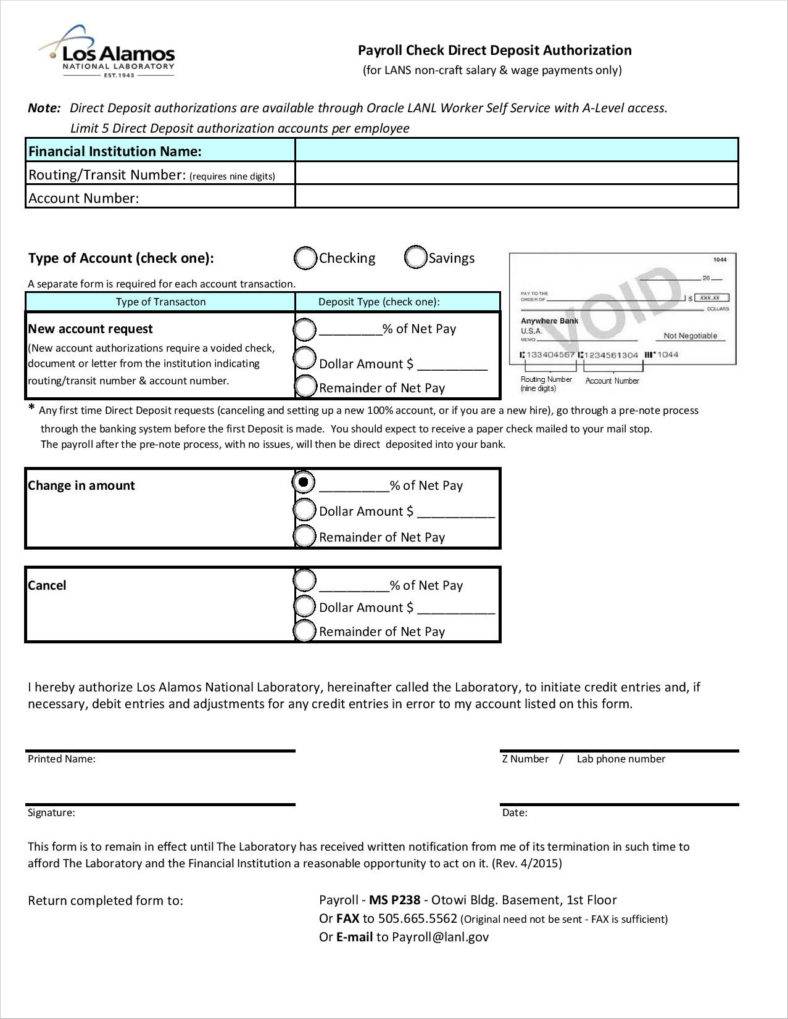

- Free Blank Payroll Check Template

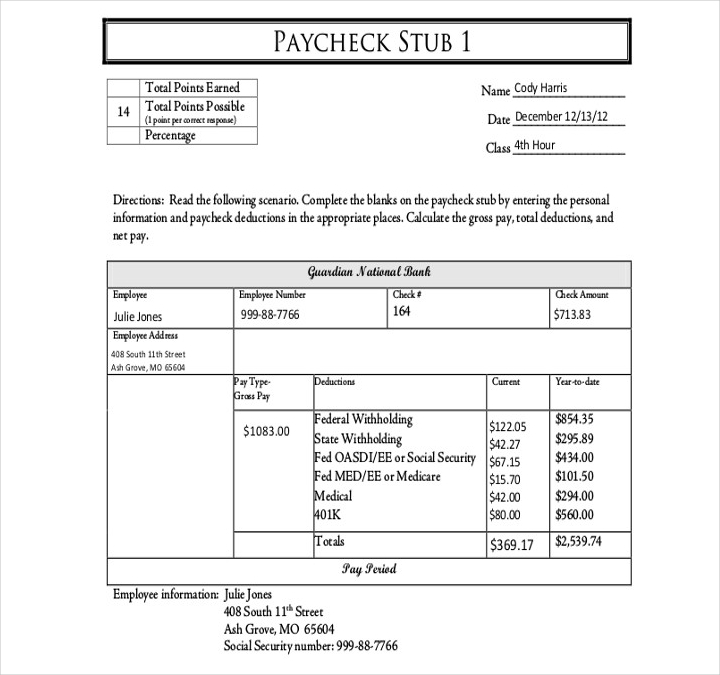

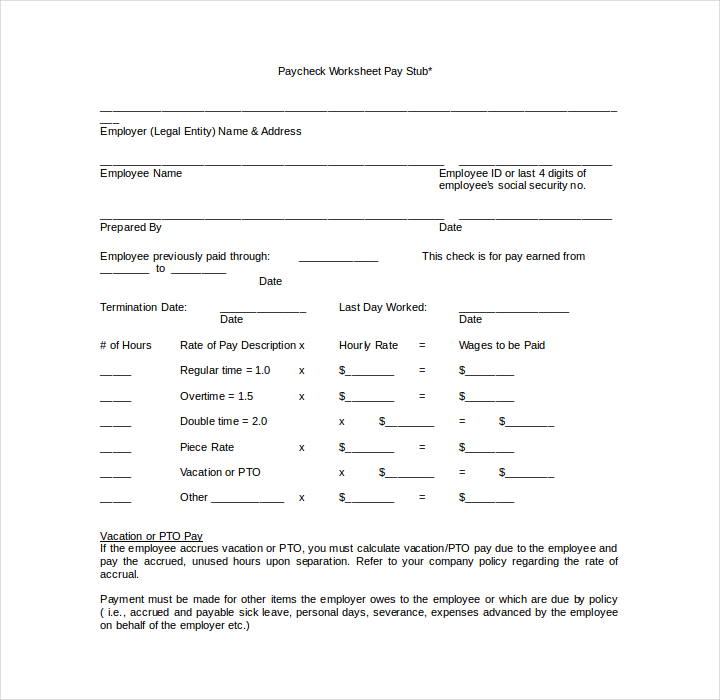

- Free Paycheck Worksheet Pay Stub Template

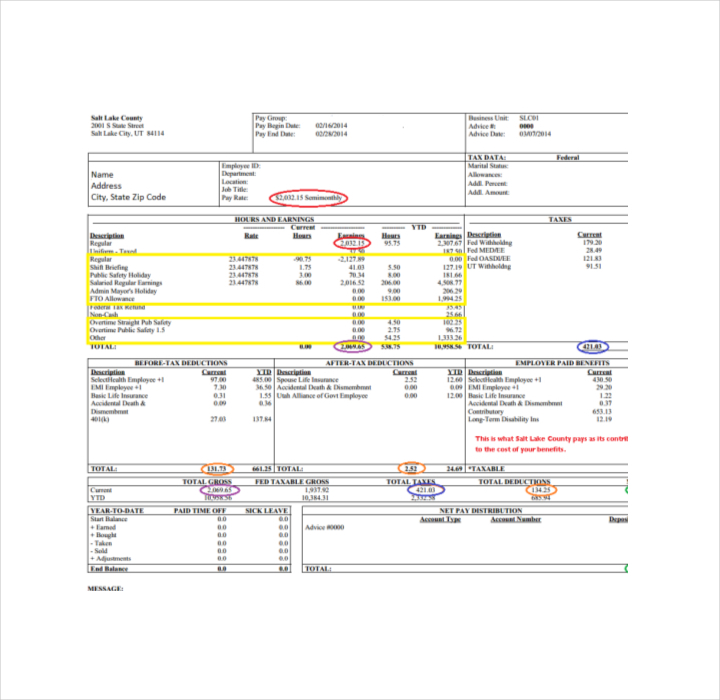

- Free Employed Salary Pay Stub Template

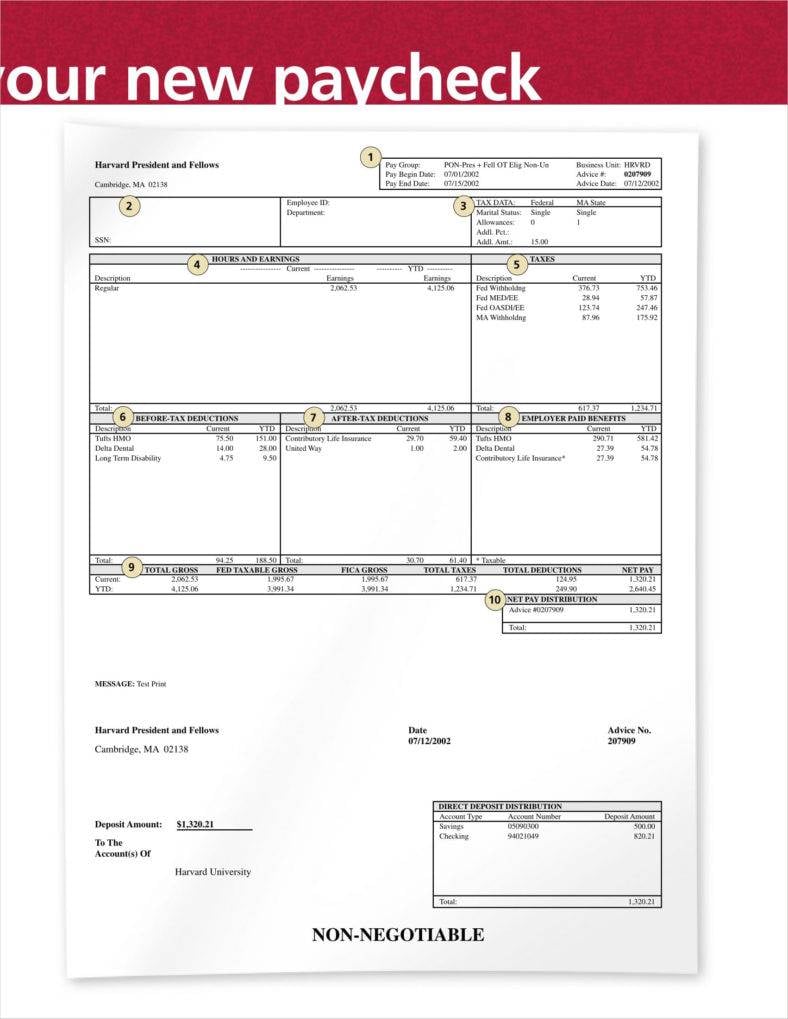

- Basic Blank Weekly Pay Stub Sample

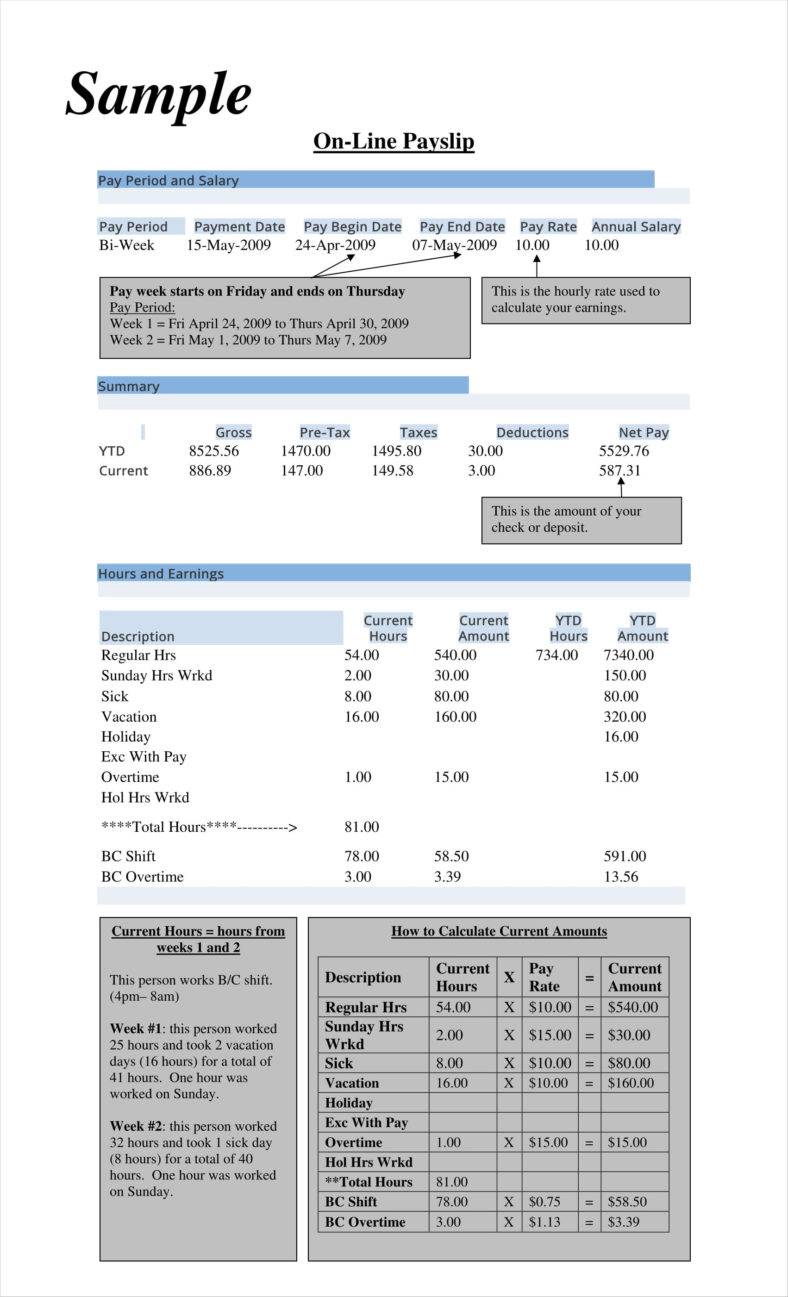

- Free Sample Blank Online Cash Pay Stub

- Free Blank Pay Stub Template

- Free Blank Calculated Pay Stub Guide Template

- Free Simple Pay Stub Portal Sheet Template

- The Purpose of Pay Stubs

- How to Make Pay Stubs for Employees

- Reasons to Make a Pay Stub

- The Information Included in a Pay Stub

- Gross Wages

- Taxes, Deductions, and Contributions

- Net Pay

- How to Read a Pay Stub’s Earnings and Deductions

- Understanding your Earnings

- When Learning What Taxes and Withholdings Were Taken

- General FAQs

- 1. What Is a Pay Stub?

- 2. What Information Does a Pay Stub Contain?

- 3. Why Do Banks Ask for Pay Stubs?

- 4. Why Is a Pay Stub Important?

- 5. How Does an Employee Receive a Pay Stub?

41+ Free Pay Stub Templates in Google Docs | Google Sheets | MS Excel | MS Word | Numbers | Pages | PDF

Are you working as an accountant or in HR? Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs. Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during the payroll check. The employee template offers a convenient format that quickly shows salary computation like a calculator and is compatible with any portal sheet.

41+ Free Pay Stub Templates

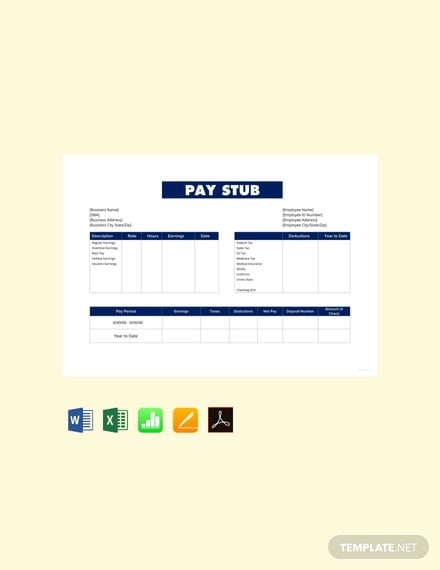

Employee Pay Stub Template

Free Sample Pay Stub Template

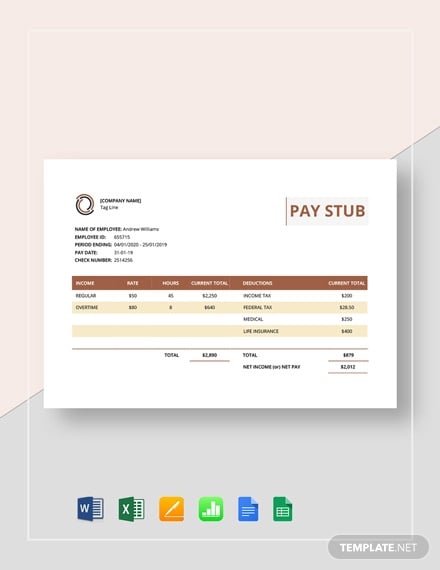

Free Basic Pay Stub Template

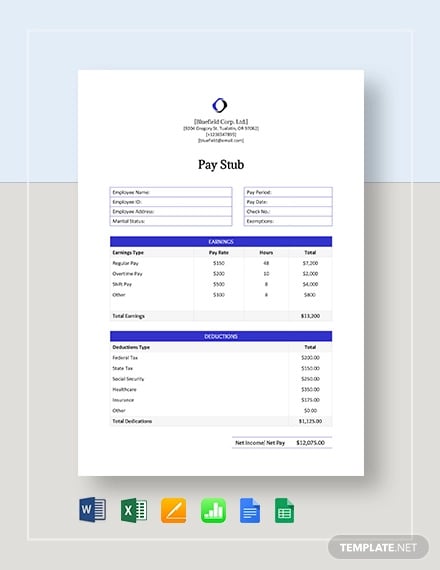

Sample Employee Pay Stub Template

Sample Pay Stub Template

Canadian Check Pay Stub Template

Basic Pay Stub Template

Employee Pay Stub Template

Pay stubs will give employees all the details they need to know regarding their salary. Plus, it’s a very helpful Word document if the employee has any problems concerning his or her paycheck. You can also see more on Pay Stub Sheets in Word.

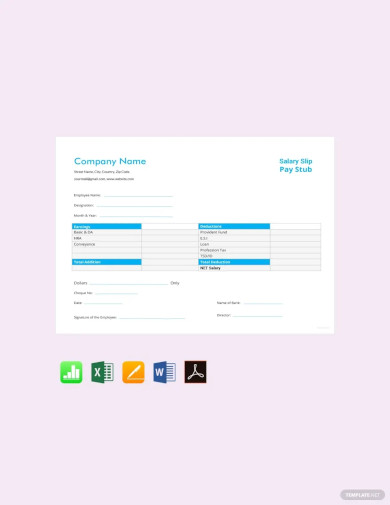

Company Salary Pay Stub Template

Company Salary Pay Stub Template

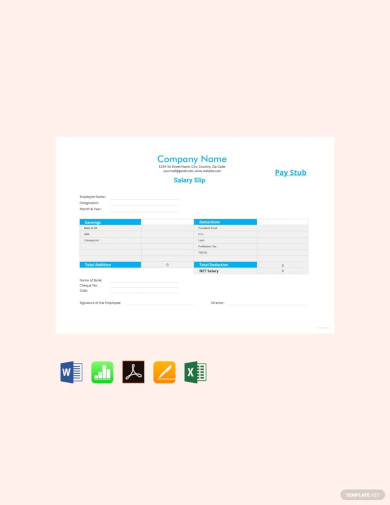

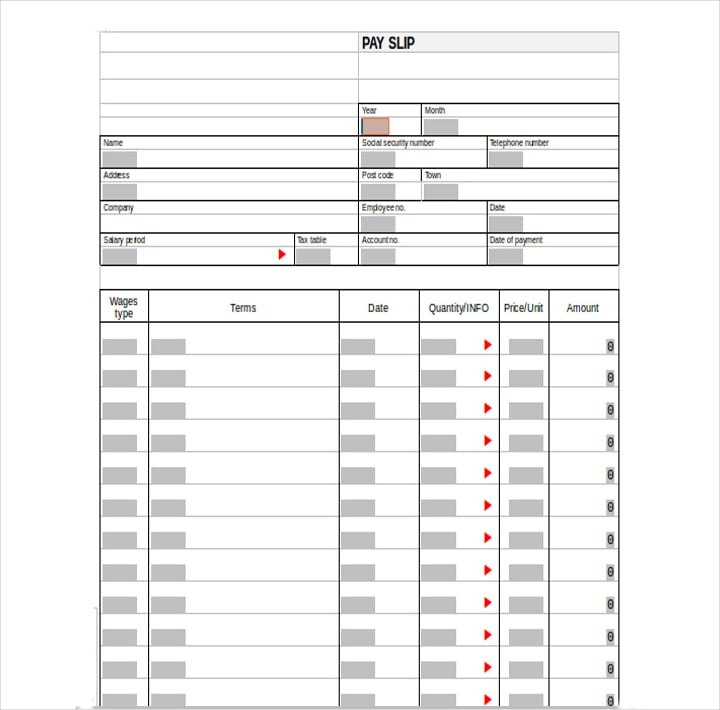

Printable Salary Slip Pay Stub Template

Fillable Pay Check Pay Stub Template

Simple Corporate Business Pay Stub Template

Organisation Pay Stub Template

Bonus Pay Stub Template

Earning Statement Pay Stub Template

ePay Stub Template

Free Hourly Wage Pay Stub Template

Free Simple Pay Stub Template

Free Incentives Pay Stub Template

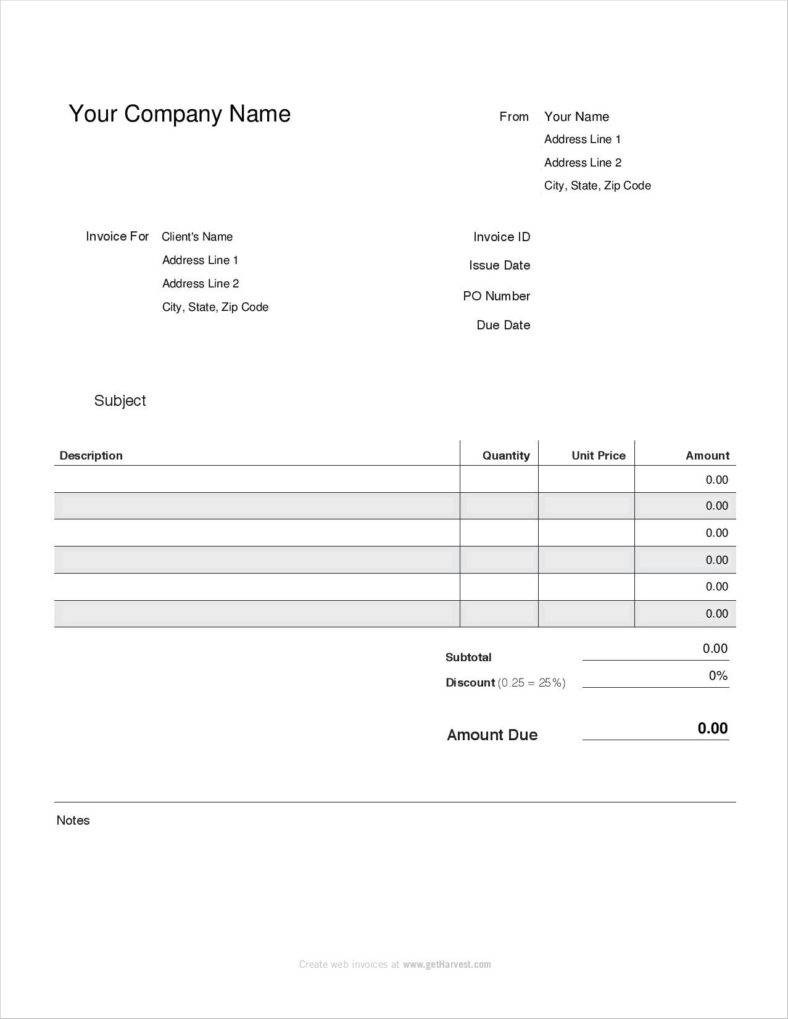

Free Editable Company Payroll Invoice in PDF

harvestpublic.s3.amazonaws.com

Free Bank Payroll Check Template PDF

albemarle.org

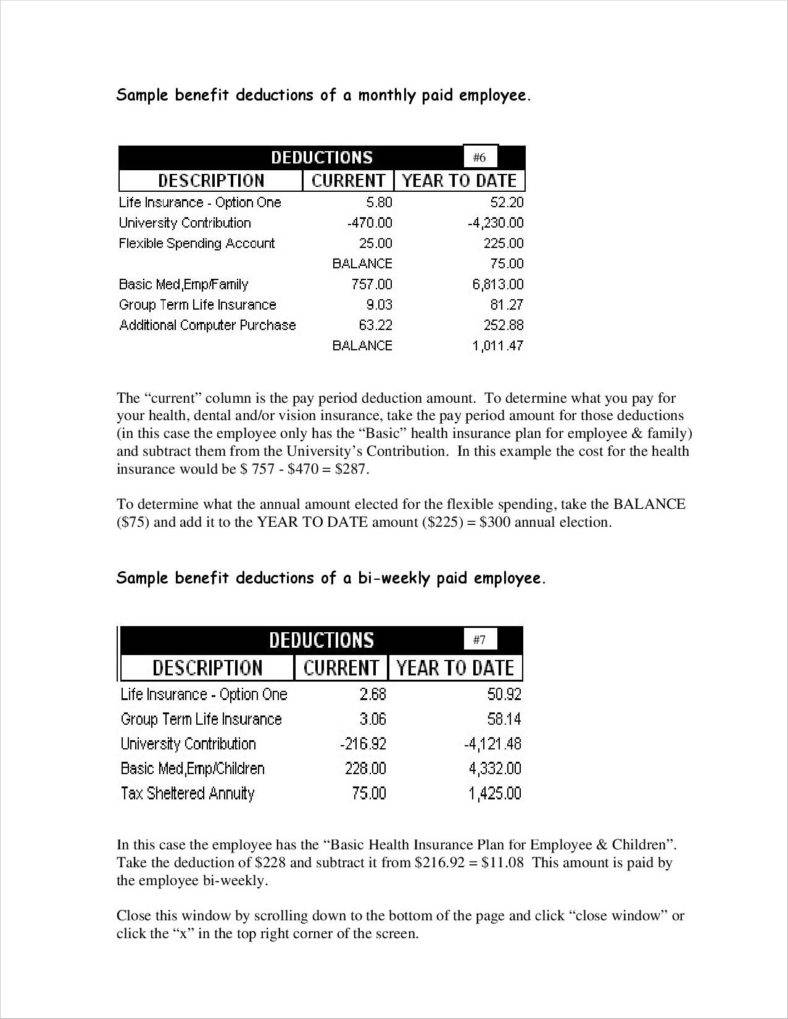

Pay Stub for a Monthly Paid Employee with Deductions

southwestern.edu

Free Pay Roll Pay Check Stub Template

templates.openoffice.org

Free Sample Construction of Paycheck Stub Template

wikidownload.com

Free Small Business Paycheck Stub Template

d3aencwbm6zmht.cloudfront.net

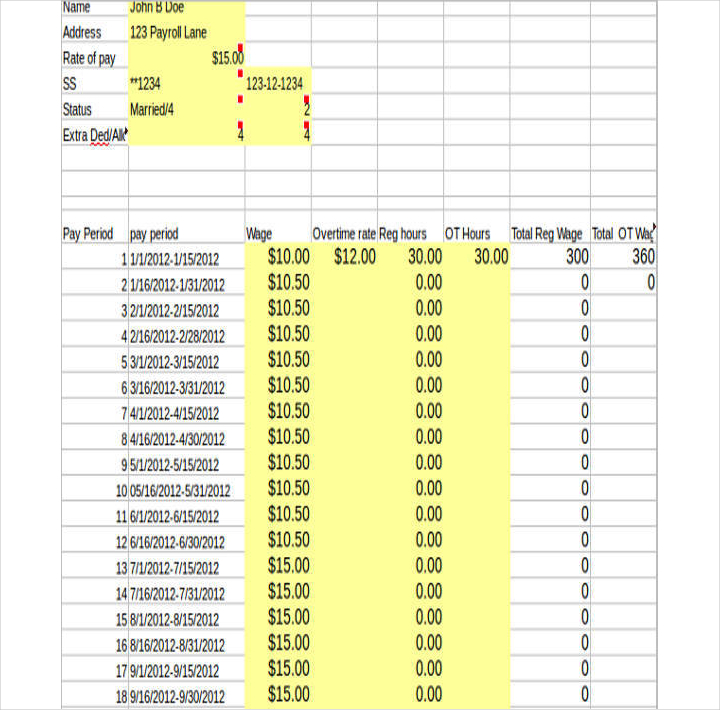

Free Pay Stub for Hourly Wage Employee

dir.ca.gov

Free Pay Stub Example

thirteen.org

Free E-Pay Stub Template

pulaskicounty.org

Simple Independent Contractor Pay Stub Template

middletownband.com

Free Blank Pay Stub Printable Template

wikidownload.com

Free Company Pay Stub Statement Template

docspile.com

Free Employee Payroll Record Template

labor.ny.gov

Free Blank Payroll Check Template

lanl.gov

Free Paycheck Worksheet Pay Stub Template

silvershr.com

Free Employed Salary Pay Stub Template

slco.org

Basic Blank Weekly Pay Stub Sample

hls.harvard.edu

Free Sample Blank Online Cash Pay Stub

rit.edu

Free Blank Pay Stub Template

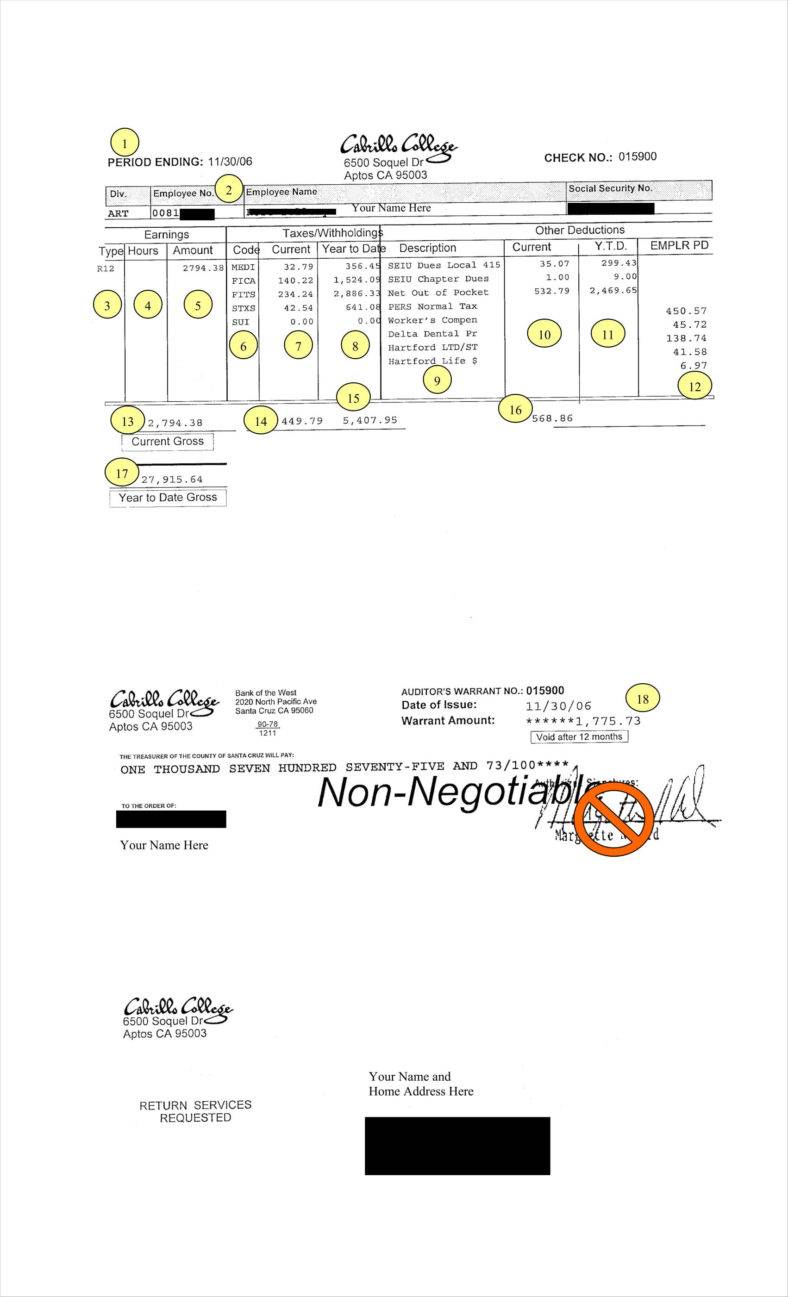

cabrillo.edu

Free Blank Calculated Pay Stub Guide Template

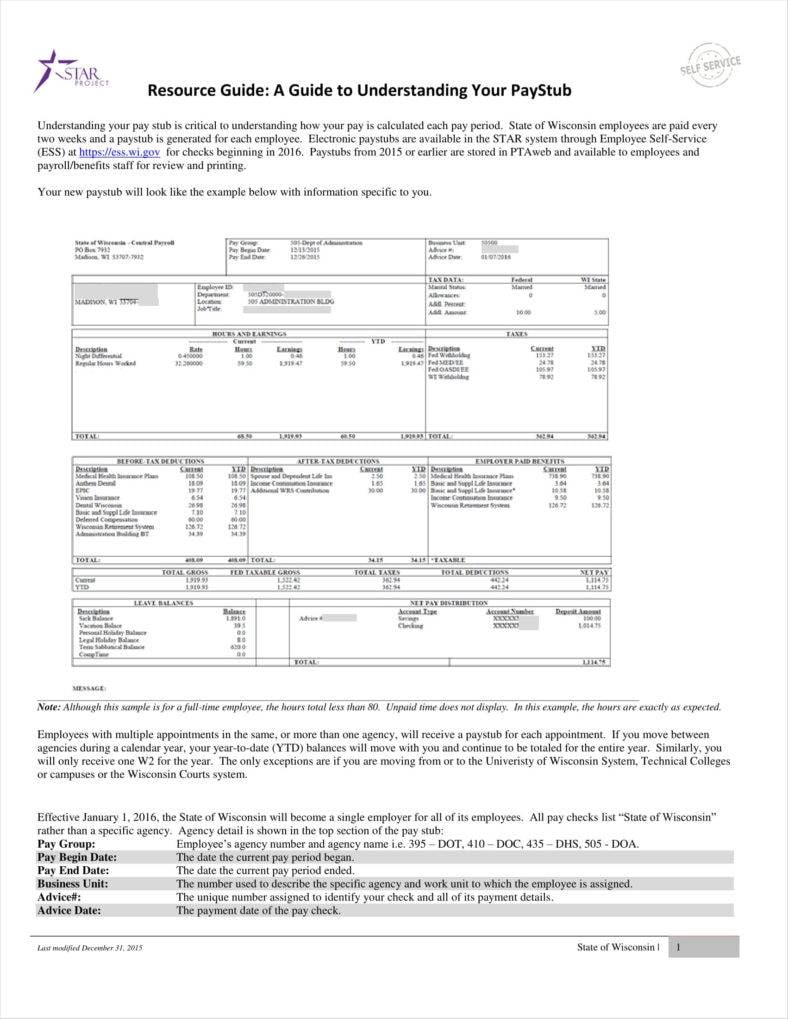

dma.wi.gov

Free Simple Pay Stub Portal Sheet Template

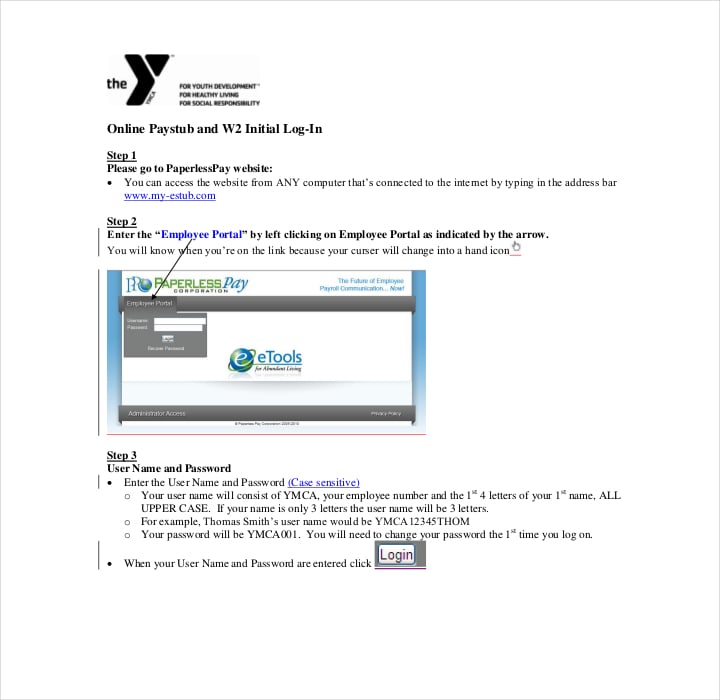

ymcaboston.org

The Purpose of Pay Stubs

A paycheck in itself does not provide employees with all the important details that they need to keep track of when it comes to their finances. It won’t help them know what taxes were taken out of their paycheck stub template, the amount of taxes they have to pay, and the number of hours they’ve worked. Besides, employees are going to need these simple pay stubs if they’re going to apply for a loan, refinance their house, or if they have to fill out their child’s college financial aid sample forms. But probably the most important reason as to why employees need their pay stubs would be because it will help them out with their financial plan management. If they know just how much they are earning and what they’re going to be taking home with them at the end of every pay period, then they can allocate their budget accordingly to ensure that they’re living a well-managed lifestyle.

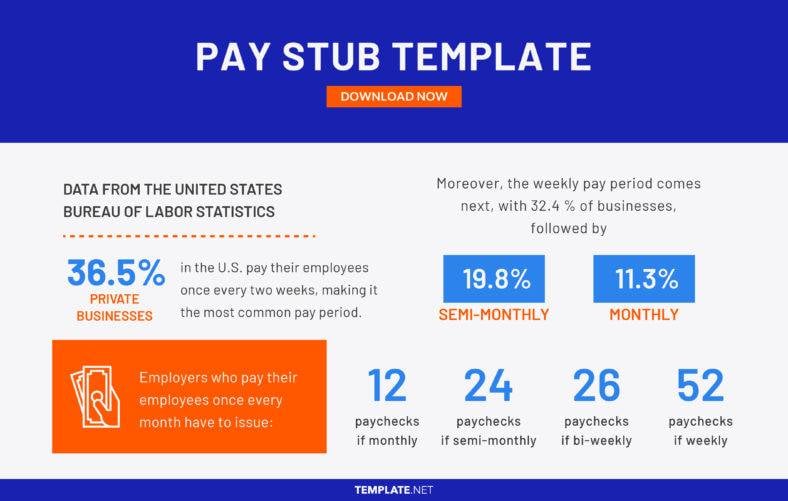

Data from the United States Bureau of Labor Statistics showed that 36.5% of private businesses in the U.S. pay their employees once every two weeks, making it the most common pay period.

Moreover, the weekly pay period comes next, with 32.4 % of businesses, followed by semi-monthly and monthly with 19.8% and 11.3%, respectively.

Employers who pay their employees once every month have to issue 12 paychecks in a year, 24 paychecks if semi-monthly, 26 if bi-weekly, and 52 if weekly.

How to Make Pay Stubs for Employees

Employers have to make sure that the employees get the information they need regarding their salary. Employees who know where their money is going and who know exactly just how much they’re earning will be able to make the important financial decisions needed to maintain a good lifestyle. So if you’re going to make pay stubs, then the first thing you’re going to need is a blank spreadsheet application that can help you. Once that’s done, here are the following steps that can help you make proper and professional pay stubs:

- The first thing that you are going to have to do is to download a pay stub template. These can be found online and they’re relatively low-priced; some of them can even be downloaded and used for free. Once you’ve done that, the next thing you’re going to have to do is to paste it into your blank spreadsheet sample program.

- Next would be for you to open up your computer’s spreadsheet application, such as Microsoft Excel, and create your pay stub if you do not wish to use a template. You’ll have to give your spreadsheet a header that should contain the name and the address of your company.

- Place the employer’s full name and social security number on the left-hand side of the pay stub. And right across this information, you’ll have to create a list for the pay period and the date that the paycheck was written.

- The next step would be for you to list the name of the employee and above it would be the employee’s rate of pay, which also includes the rate of overtime. Follow that up with the number of regular hours and overtime hours that the employee has worked on the next line.

- Go to the next line and Simple list down all of the deductions that have to be taken out of the employee’s wages. These deductions may include federal taxes, state taxes, social security, health insurance, Medicare, and more.

- Lastly, finish the pay stub by listing down all of the year-to-date sheet information. Then you may print out and distribute the pay stubs to the employees along with their paycheck. Or you can also have the option to send the pay subs via email.

Reasons to Make a Pay Stub

If you’re an employer, then you know that there are several situations wherein a pay stub can be of great use. Whether you’re running a small business or a big corporation, you’re going to have to learn about pay stubs and how to make them as they can help quite a bit in making payroll management run as efficiently as possible. Plus, your employees will appreciate knowing where their money is going. So here are a couple of reasons why one should make a pay stub:

- Managing your finances. As mentioned before, one of the foremost reasons to make a pay stub is to manage one’s finances. While accounting systems can track the money that goes in and out of the business well enough, pay stubs are useful as a secondary sheet record that can come in handy when you wish to assess the success of your business. They’re even more important if they’re audited so try to make sure that they are in sample order.

- Keep track of all of your employees. Another good reason why you would want to generate pay stubs is that they’re recorded to review whenever you would like to know more about an employee’s pay history. Plus, it’s also a good way for you to know if your employees are happy or not. All you have to do is take a look at their payslips and make any of the necessary monetary adjustments that will allow you to address plan employee satisfaction. So if an employee comes up to you with a problem with his or her paycheck, then all you have to do is find the problem, fix it, then you might just see your employee smiling with the way that you’re able to handle things.

- Ensuring the growth of your firm. If you’re an independent contractor or if you’re self-employed, then you might be confused when trying to monitor the success of your own business. This is especially true if you have just started working with your agency staff or sub-contractors. In this case, you should consider making pay stubs to help you out. Creating free pay stubs will help you go in the right direction when it comes to taking your startup plan business to the next level of success. You can also see more on Pay Stub Sheets in Pdf.

- Evidence of employment. Through the use of pay stubs, employers can provide all of the information that’s in their employee-related workplace records. Pay stubs are the employee’s record sheet from each pay period and it also shows that the employer is taking care of the payments in a professional and business-like manner. So basically, a pay stub can be used by the employee to show that he or she is working for the company. You can also see more on Employment Forms.

- Easier payroll access. If you’re making use of online pay stubs, then you’ll find that it has a lot of flexibility when it comes to managing the payroll process. And it’s also because it allows you to process the payroll at any time, any place, and through any device. Although you have to remember that you have to pay your employees as per the local, state, and federal regulations. If you grow your business to the point where you can smooth out the payroll process, then you and your employees can expect that the schedule payroll will be processed on time and ensure that the process remains consistent throughout the business’s lifespan. You can also see more on Pay Stub Sheets in Google sheets.

- No document storage. Making use of paperless electronic pay stub templates will make it easier for you to access all of the employee payroll data considering that it’s all in one place. Since your pay stubs are in an online system, they can be retrieved anytime that you wish and they can be made instantly available if any one of your employees would like to view their pay stub. You can also see more on Pay Stub Sheets in Google docs.

- A good eco-friendly solution. Electronic pay stubs aren’t just beneficial to your own business. They can benefit the environment as well. If you’re making physical copies of the pay stubs, then you’re just adding more paper and waste to the environment. So go with electronic pay stubs if you want to promote your IT company as one that cares about the environment. You can also see more on Pay Stub Sheets in Numbers.

- Increased convenience. Your business can benefit a lot from making use of electronic pay stubs. It can help reduce business analysis costs since you won’t be needing toner, print, cartridges, etc. Electronic pay stubs also help employees out as they can just access them anytime they wish by opening up their e-mails. Additionally, it’s a great way for you to free up space in the office as you won’t be needing that file cabinet to keep records of your employees. You can also see more on Pay Stub Sheets in Excel.

- Employee benefits. As said earlier, your employees will appreciate being able to access their pay stubs 24/7 by simply logging into their accounts and checking their email memos. And with options like direct deposit, employees no longer have to go through payroll management whenever they want to get their paycheck.

- Automatic tax compliance. With the help of blank pay stubs, you and your employees won’t be burdened by state and federal taxes. The reason for this is that payroll IT software solutions can automate these tax payments to ensure that you’re all compliant. So employees who are worried about not having their taxes paid can just check their pay stubs to make sure that they have done so.

The Information Included in a Pay Stub

There are a lot of details that are included in a pay stub or paycheck stub that allow you and your employer to keep track of all payments and deductions. Generally, the items on the pay stub can be broken down to (1) gross wages; (2) taxes, deductions, and contributions; and (3) net pay. If you would like to know more about the three different parts, then take a look at each of the categories below.

Gross Wages

Gross wages are the starting point of an employee’s pay. This is the money that the company owes you before any deductions are taken out of it. The gross pay is calculated differently depending on whether the employee is paid hourly or by salary in Google Docs. If you’re being paid by the hour, then your gross pay will be based on the multiplication of your hourly rate with the number of hours that you have worked. If you’re a salaried worker and you want to find your gross pay, then all you have to do is divide the annual salary by the number of pay periods within the year.

The employee’s gross pay can be found in the pay stub and the information is broken down into two separate columns. The first column would show the current gross pay or the information for the pay period. The other column would be providing the year-to-date total. The following are covered in an employee’s pay stub:

- The number of hours worked. For those workers that are paid by the hour, then this information has to be within the pay stub. Salary workers can also have the number of hours worked placed in their pay stubs. Non-exempt employees can work different hours than when compared to regular employees. They’re able to work either regular, overtime, or even double-time. When you’re making a pay stub, you have to be sure that you put each kind of hour worked in its line. You must also separate the hours worked into current and year-to-date columns. Just remember to do all of this as this is the kind of payment contract information that hourly paid employees will look into to see if there’s a problem with their pay or if everything is alright.

- Pay rate. This is something that will tell the employees just how much payment they are due. For hourly workers, it’s best to take a sample note of each employee’s hourly pay rate and place it on the pay stub. In a salary worker’s case, you can show the amount of the pay they are due for the pay period that they worked. Also, if some of your employees pulled in overtime or even double-time shifts schedules, then you’re going to have to record this within the pay stub.

- Gross pay. The pay stub should have this to show the employee the total wages that he or she earned before any of the necessary deductions. Besides an employee’s regular wage, there are also chances that an employee might earn additional statement income. This can come in the simple form of overtime pay, holiday pay, personal time, payroll advances, or bonuses. So once you’re making the pay stub, make sure to printable list each form of income in a separate line. Remember that gross pay lists each of the printable forms of income into two separate columns: the current and year-to-date payroll.

Taxes, Deductions, and Contributions

This is what will be deducted from the employee’s gross pay. With things like taxes and other deductions, an employee’s earnings will be reduced. The pay stub has to itemize these deductions so that the employees will be able to see just how much from their gross pay was taken out and where the money is going.

Much like gross pay, taxes and deductions are separated into two different categories. One category would show the employee the current deductions, and the other category would show the year-to-date amount. The following information is the common deductions that employees can find on their pay stubs:

- Employee tax deductions. It’s usually the government memo such as the IRS that taxes an employee’s pay. The common taxes that are deducted from an employee’s pay are federal income taxes, state taxes, and even local income taxes. When you’re placing these on the pay stub, make sure to use a separate line for each tax type and show the current amount that has been deducted from the pay period and the year-to-date.

- Benefits and other deductions. Other payroll deductions will depend on the kind of benefits that your business provides to its employees. A good example would be an employee contributing to retirement sample plans. Deductions could also include loan payments, charitable contributions, and any other type of voluntary deductions. Be sure to list each deduction on its line, and show the current and year-to-date totals.

- Employer contributions. There are some items in the employee’s pay stub that do not deduct anything from the employee’s pay. These amounts reflect an employer’s contribution to the employee. A good example would be the employer paying FUTA tax, SUTA tax, and the employer portion of the FICA tax. An employer could also contribute to employee benefits. These benefits include plan insurance premiums and small business plans. Each of these contributions has to be listed on their line.

Net Pay

This would be the amount of money that’s leftover after all of the necessary deductions have been made from the employee’s gross pay. It’s the amount of money that the employee gets to take home. The net pay is the amount that you write into the employee’s paycheck or what should be directly deposited into the employee’s bank account. You can find the net pay for the current pay period as well as the one for the year-to-date. You can also see more on Deposit Slips.

Since the pay stub itemizes both the earnings and the deductions, then it should make things easier if an employee wishes to check its accuracy. So if there’s a problem with the employee payroll templates regarding a particular employee’s salary, then all you have to do is explain everything that’s in the stub. You can also see more on Deposit Slip in Google docs.

How to Read a Pay Stub’s Earnings and Deductions

Once you get familiar with the layout and terminology of a basic pay stub template, then you can accurately track just how much money you’re earning, how much you get to take home with you, and how much of your money went into taxes withholdings. So to help you here are information that should help you read your pay stub. You can also see more on. You can also see more on Blank Order Forms.

Understanding your Earnings

When you’re going through the top of your pay stub, you’ll be able to find your basic information. This would include the complete name of your employer, his or her address, and the date that the paycheck was issued. You may also find information regarding the parts of the company that processes your payroll. You will likely find the check number at the top of the pay stub. This information is very useful when you would like to enter it into your financial records to help you keep better track of your income sources and amounts. And if there’s anything wrong with the information in the pay stub, all you have to do is check with the human resources department so they can help you fix the problem.

- Find the area in your pay stub that’s labeled as “Gross Pay”. The gross pay will always be around a certain period; this would be the pay period. The pay period will vary in length, which means that it all depends on your employer. These pay periods may cover weekly, bi-weekly, or even monthly periods. While other periods are possible, they are not as common.

- Locate your net pay by going over the free pay stub template and finding the item that’s labeled as “Net Pay”. As mentioned before, this is the amount of money you get to take home with you after your gross pay has been deducted from any taxes and withholdings. You can see some more templates on Feedback Forms.

When Learning What Taxes and Withholdings Were Taken

- Look for the “Federal Tax Amount” to know just how much of your salary is going to federal taxes. The amount will depend on the number of exemptions that you have claimed on your W-4 form. If you would like to change these exceptions, then you will have to fill out a new W-4 form. You can contact human resources if you want to know how to best make changes to it.

- Find the item labeled as “State Tax” if you would like to know how much is going to that state that you live in. Remember that state tax will depend on the state that you live in, and you have to remember that not all states collect taxes.

- Locate the item that’s labeled as “Social Security” to see how much money is going to your social security account. Paying this will help finance your retirement in the future. Both you and your employer will contribute 6.2% of whatever income either of you receives to social security payments.

- Find the area on your pay stub that’s listed as “Medicare”. This is the simple program that handles your medical payments and billing statement when you’re eligible for social security. Medical payments are usually set at 1.45% of both your and your employer’s paycheck stub.

If you would like to know more about pay stubs, then you may go through our other available articles on pay stub examples and templates that will give you more tips on how to create pay stubs.

General FAQs

1. What Is a Pay Stub?

A pay stub is a PDF document that sample outlines the details of an employee’s pay. It is a part of the paycheck and shows the taxes and other deductions that are taken out of an employee’s income.

2. What Information Does a Pay Stub Contain?

A pay stub includes the following information:

- The employee’s information

- The employer’s information

- Gross Earnings

- Net Pay

- Tax and other deductions

- Employee Pay Rate

3. Why Do Banks Ask for Pay Stubs?

Those who are looking to apply for a loan will have to submit their pay stubs to the bank. This pay stub acts as a proof of income sheet and helps banks to verify if the candidate applying for a loan is a part of that particular large organization or not.

4. Why Is a Pay Stub Important?

Pay stubs are important as they serve as proof of income for employees. They contain financial information that will keep the employee informed about their earnings and deductions. It is also needed when one has to pay taxes.

5. How Does an Employee Receive a Pay Stub?

When an employee gets his/her paycheck in the form of a paper PSD document, the pay stub will be attached to it. But if employees are paid by direct deposit to their respective bank accounts, the pay stub will be sent digitally.