Make Your Financial Reports Come to Life with Profit and Loss Statement Templates from Template.net

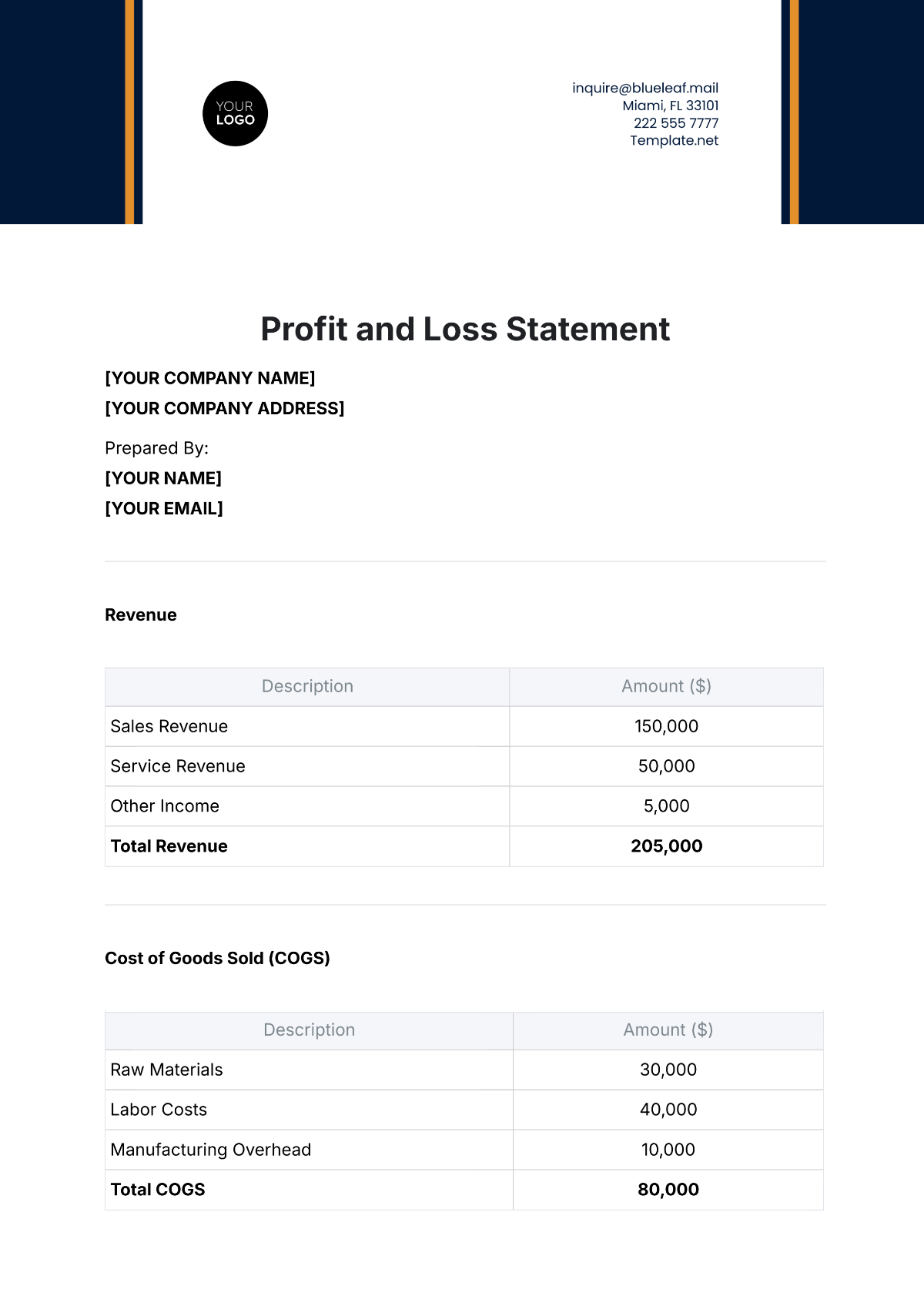

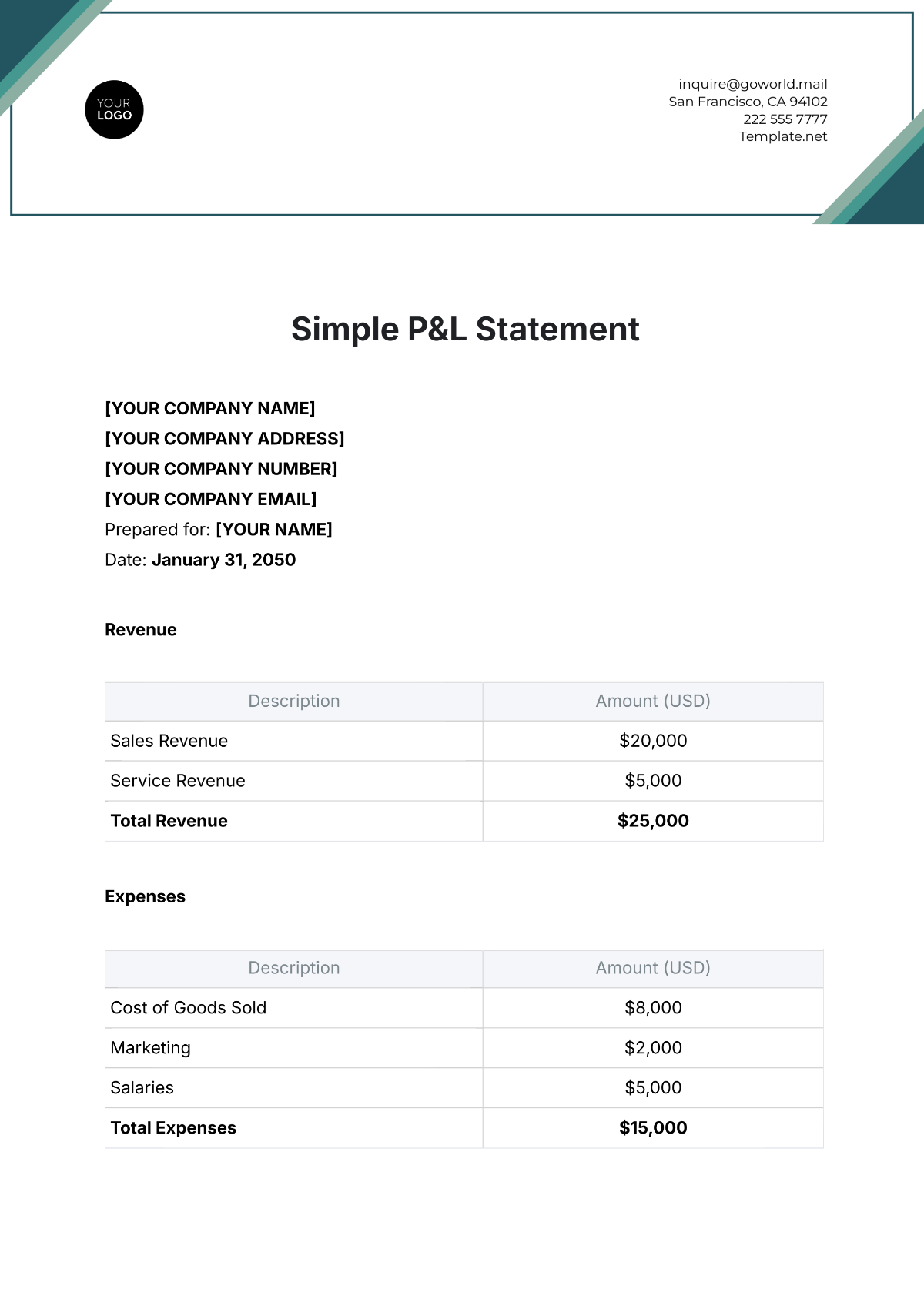

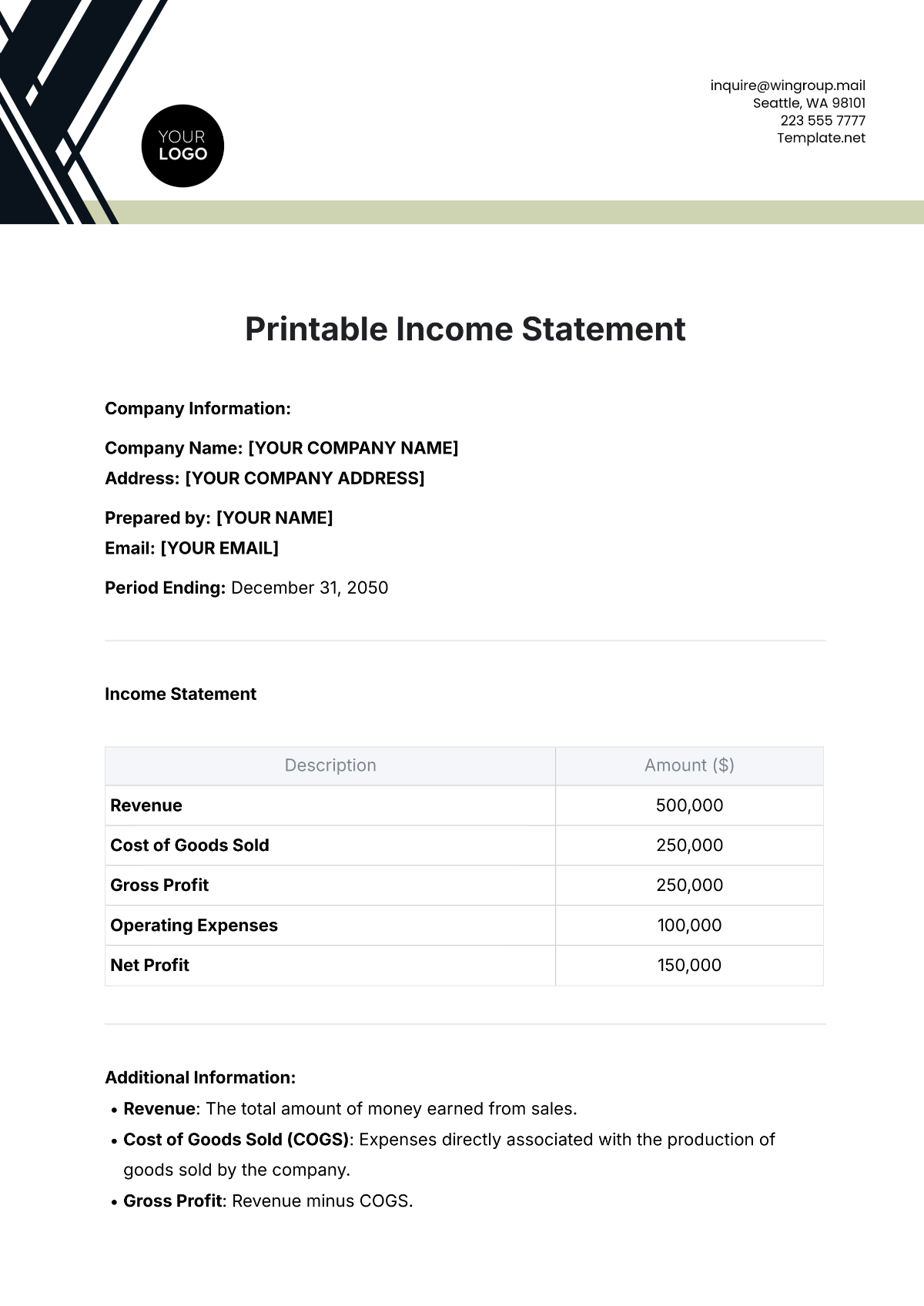

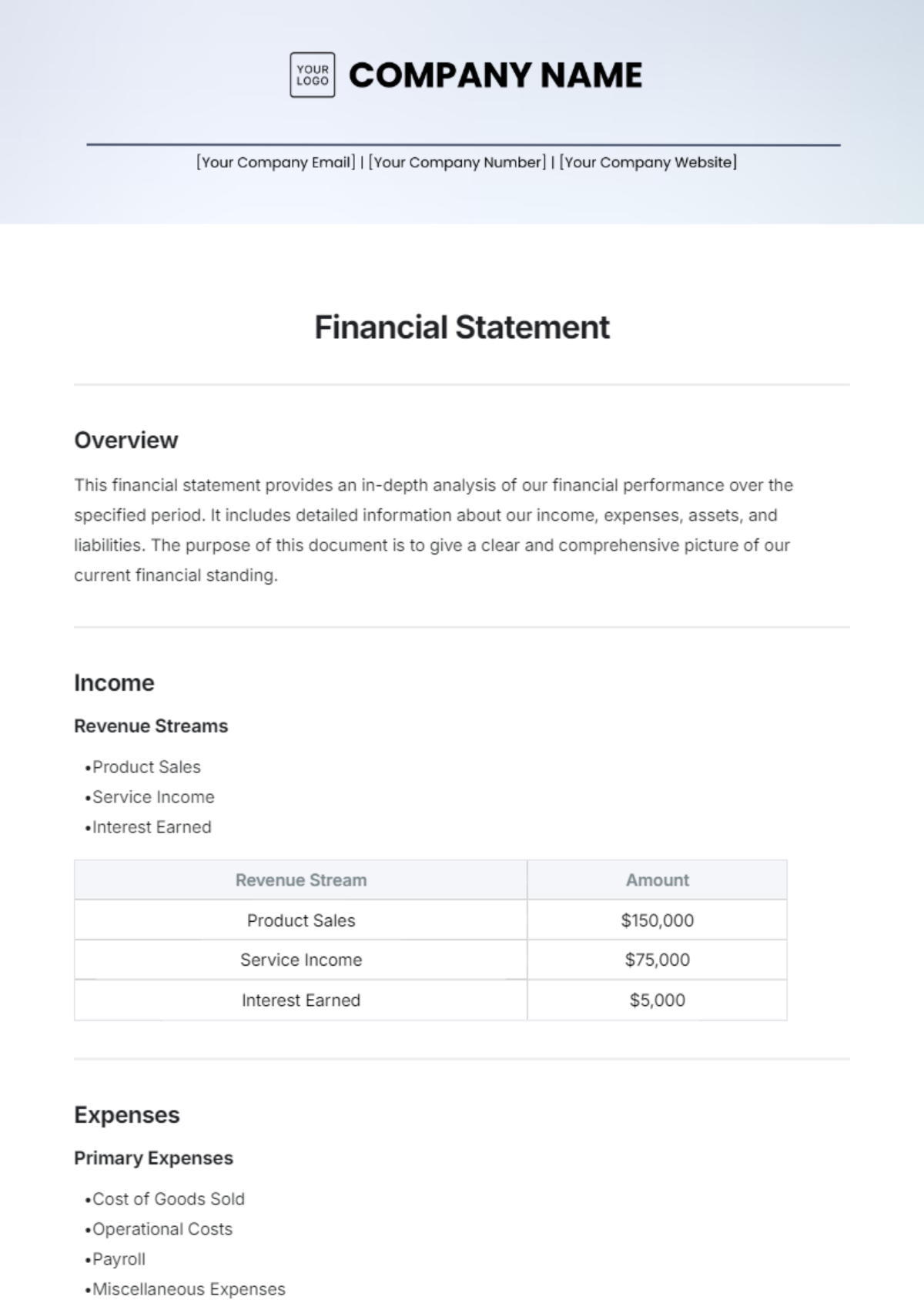

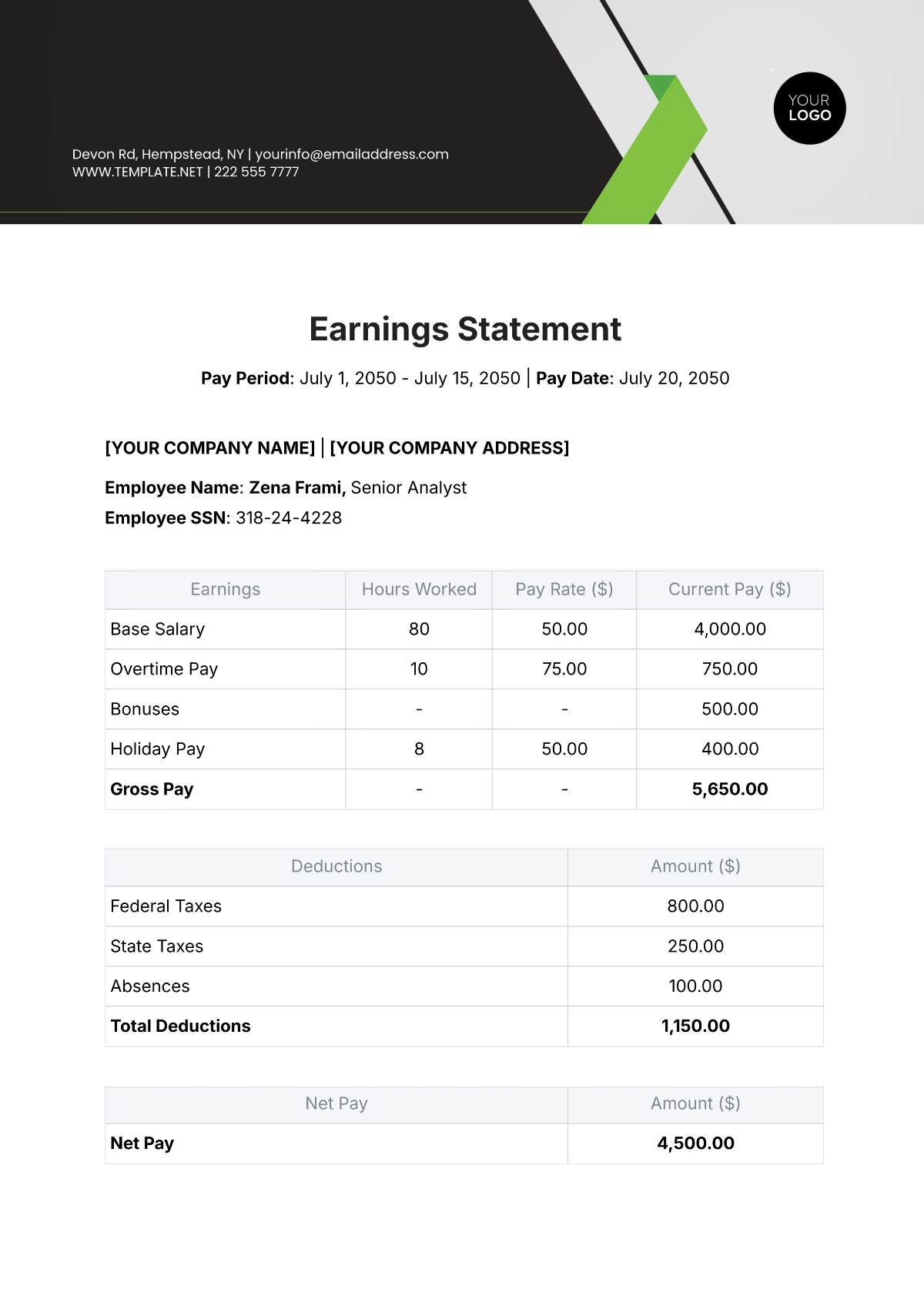

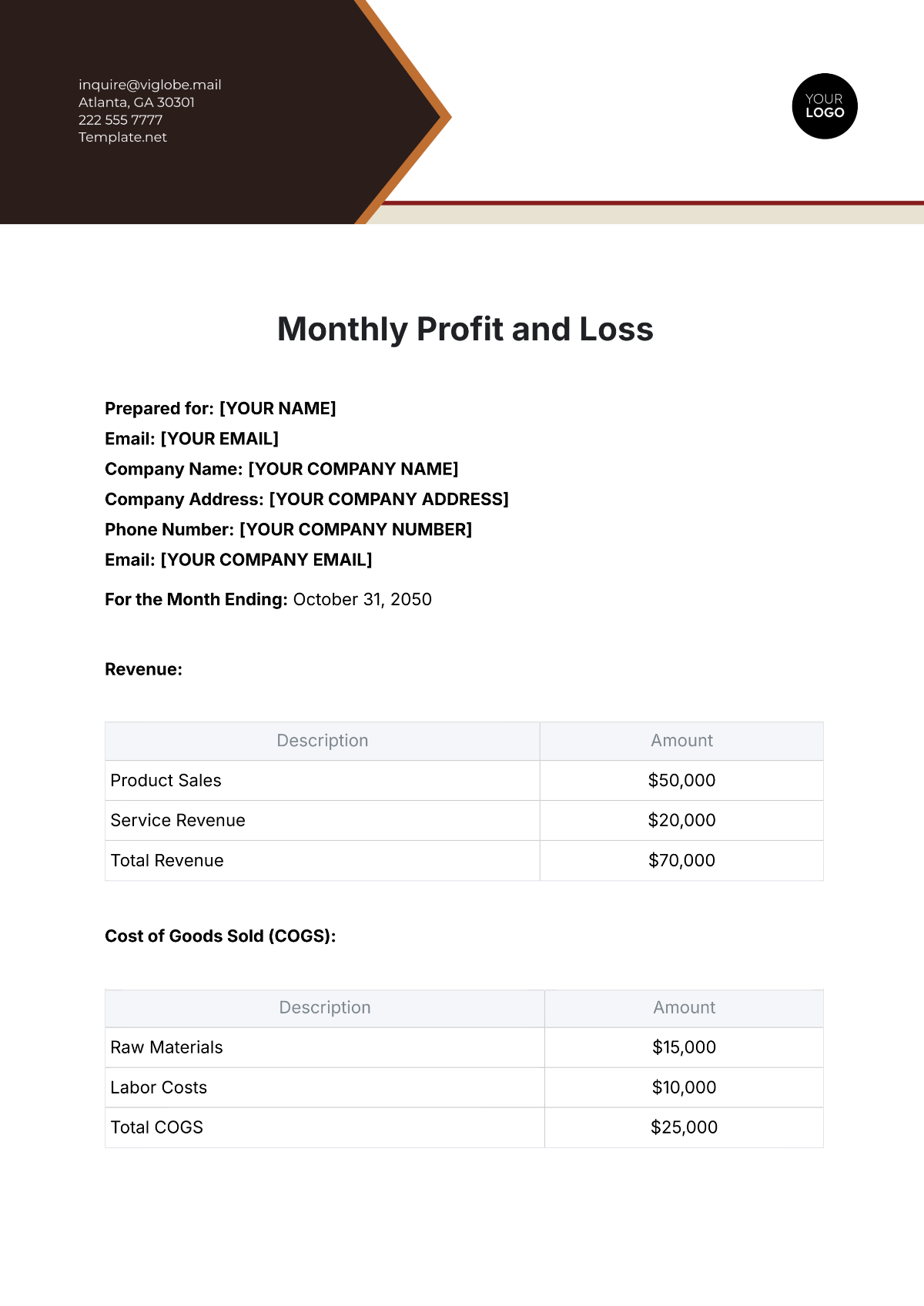

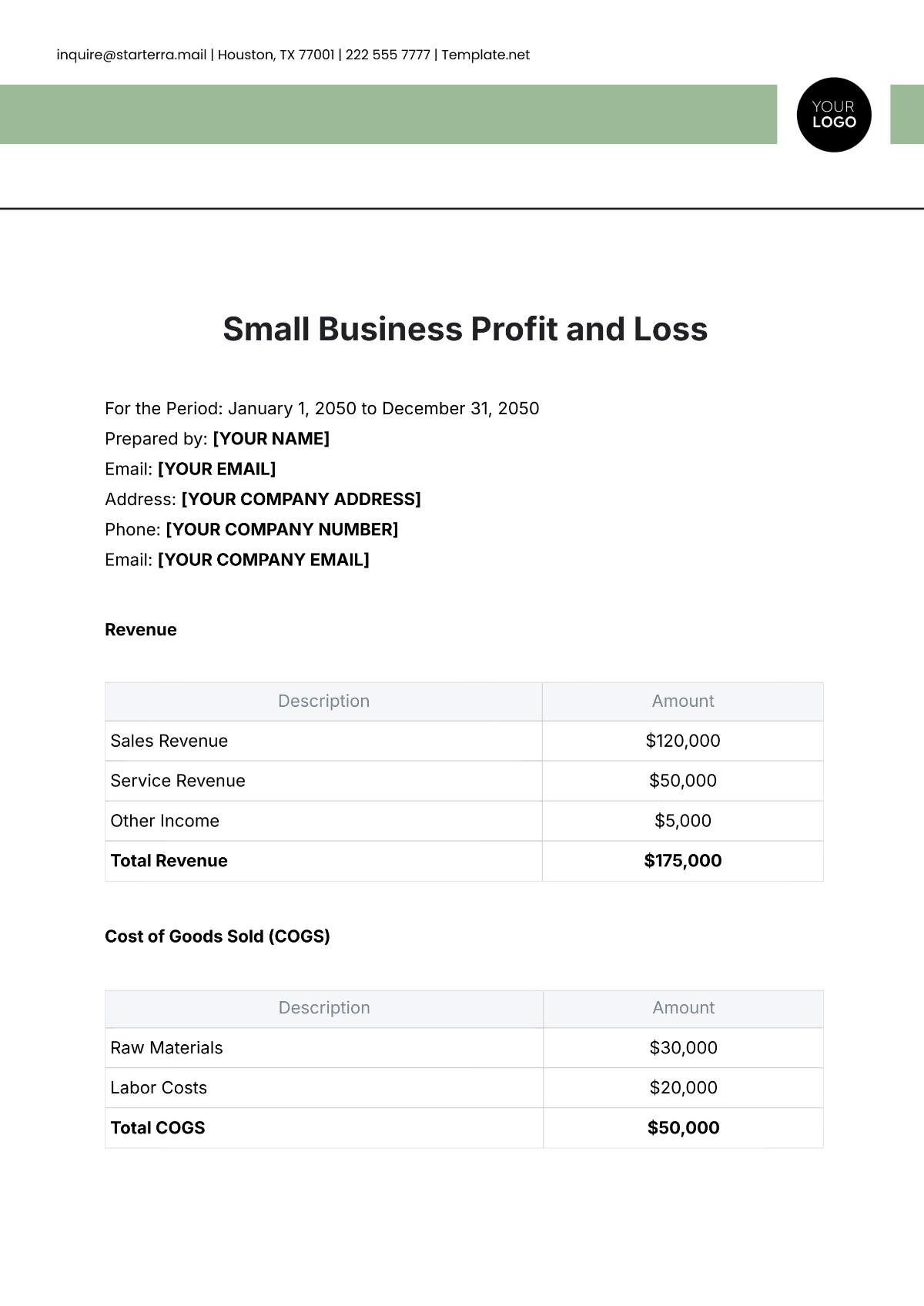

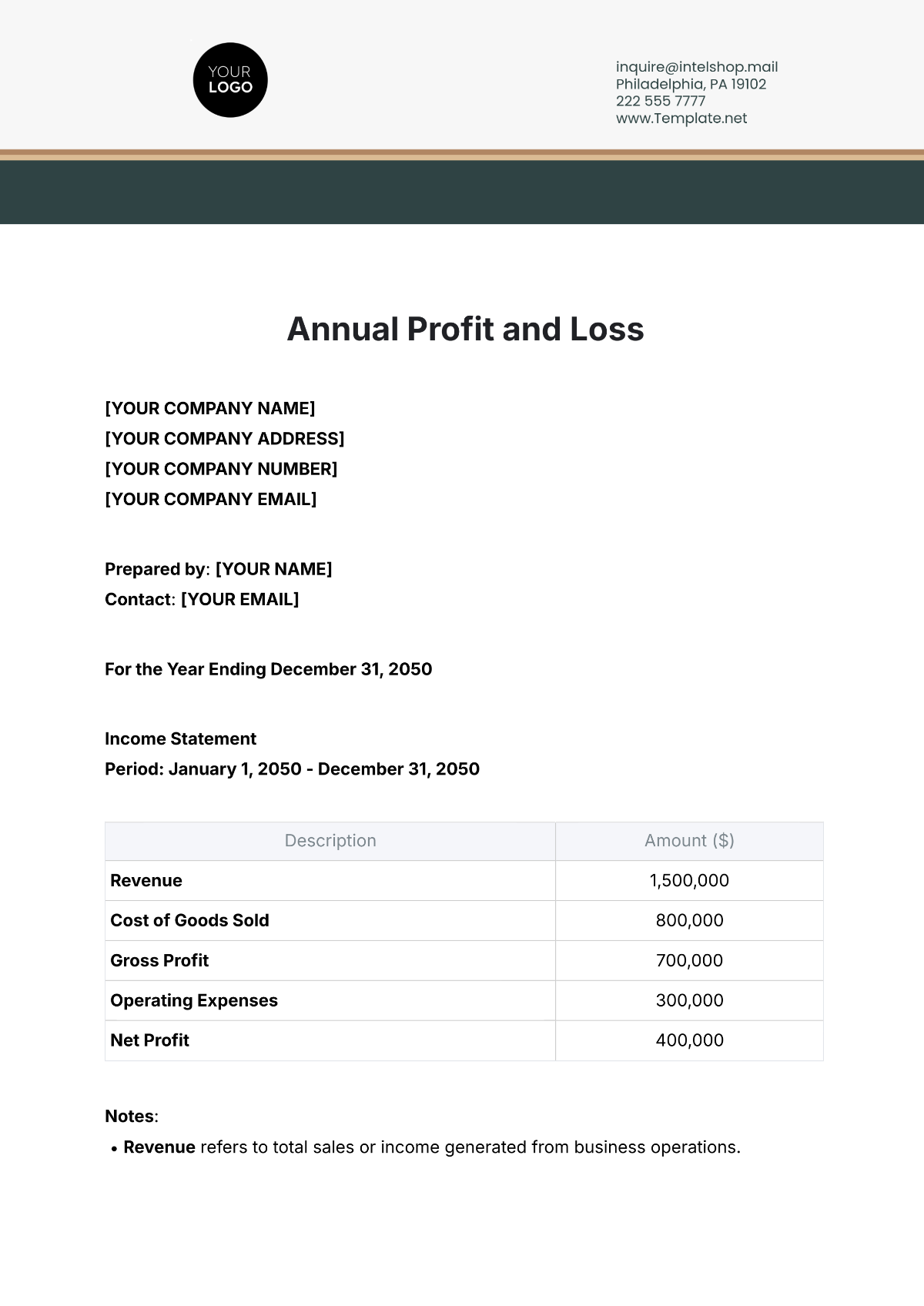

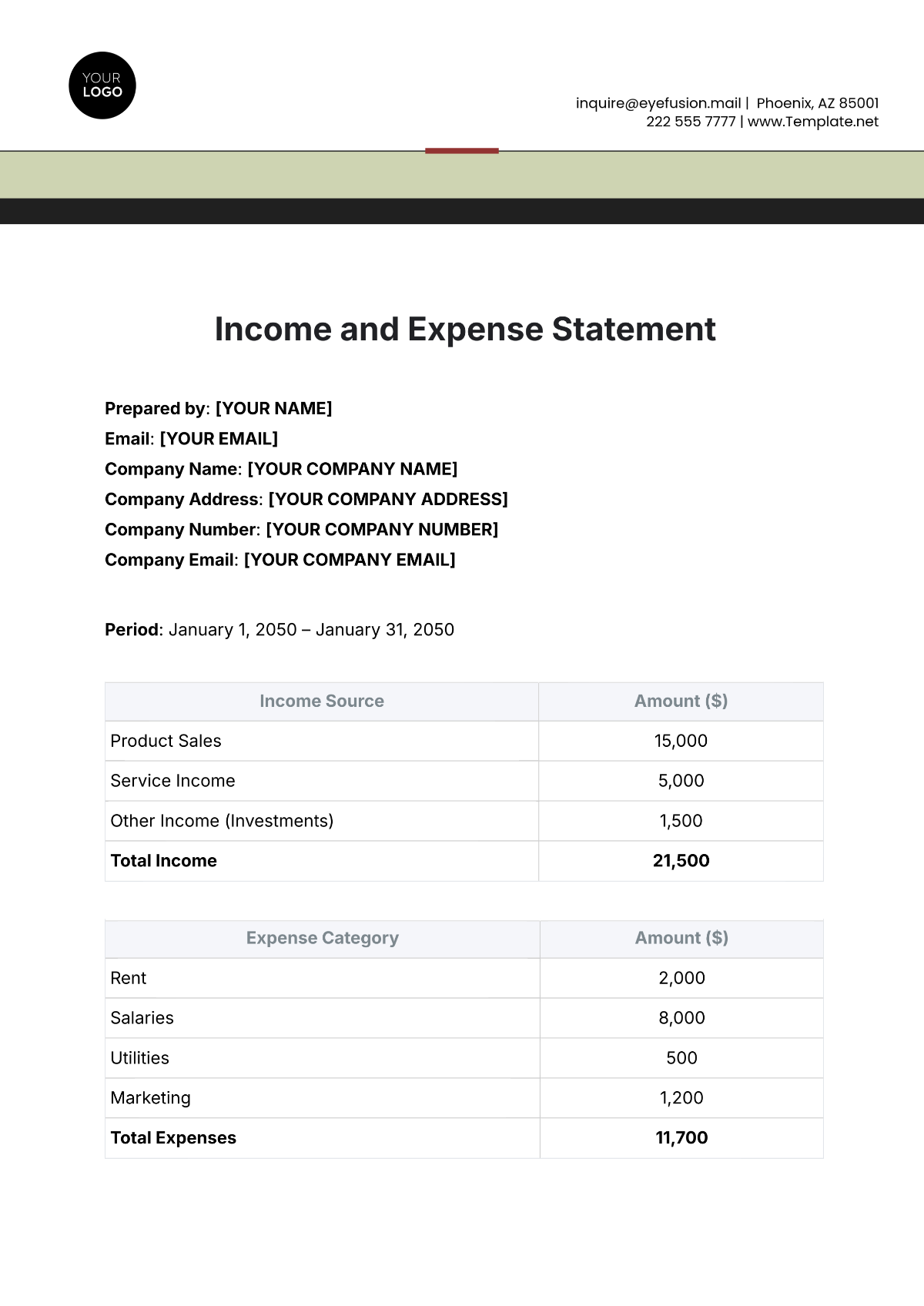

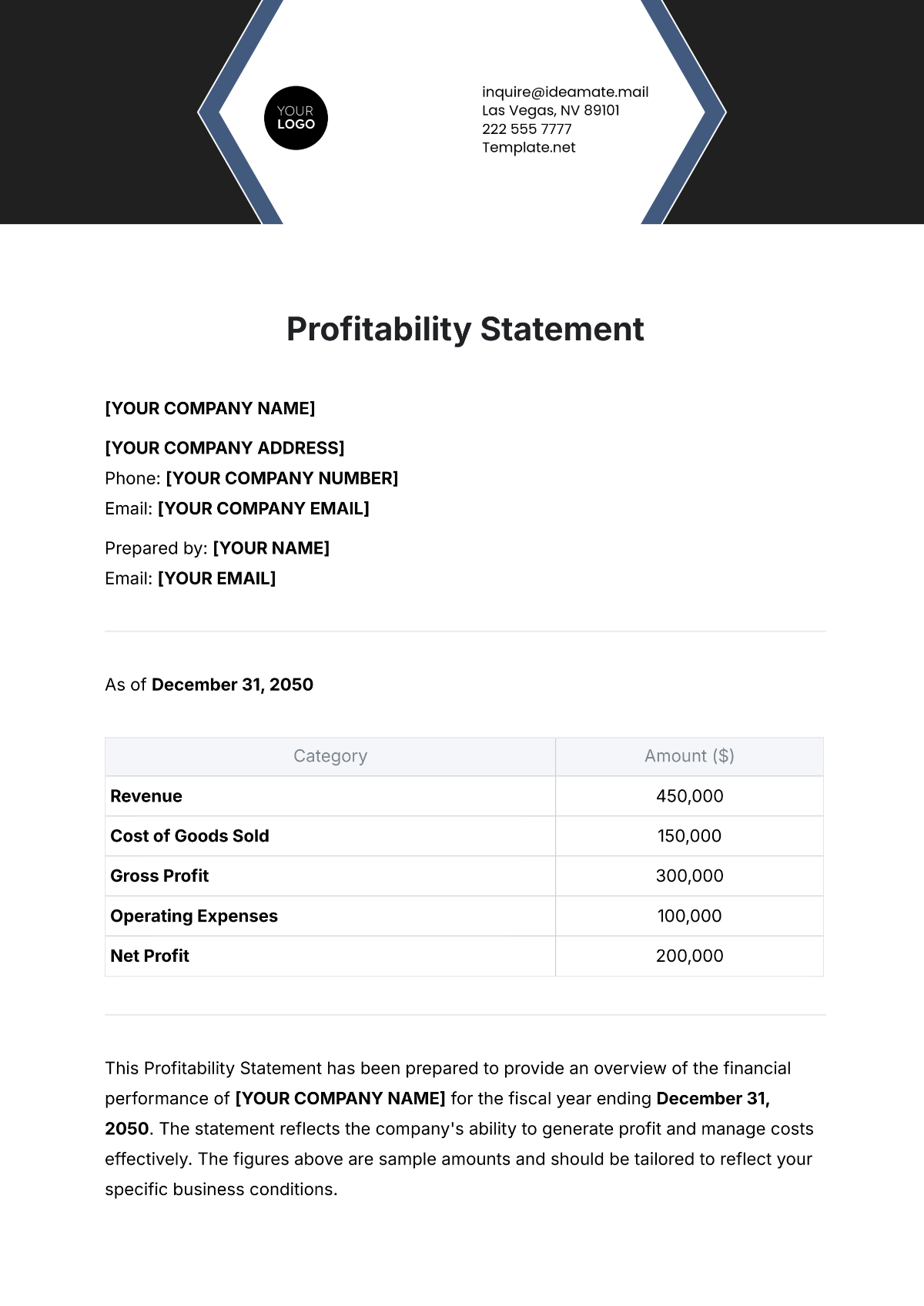

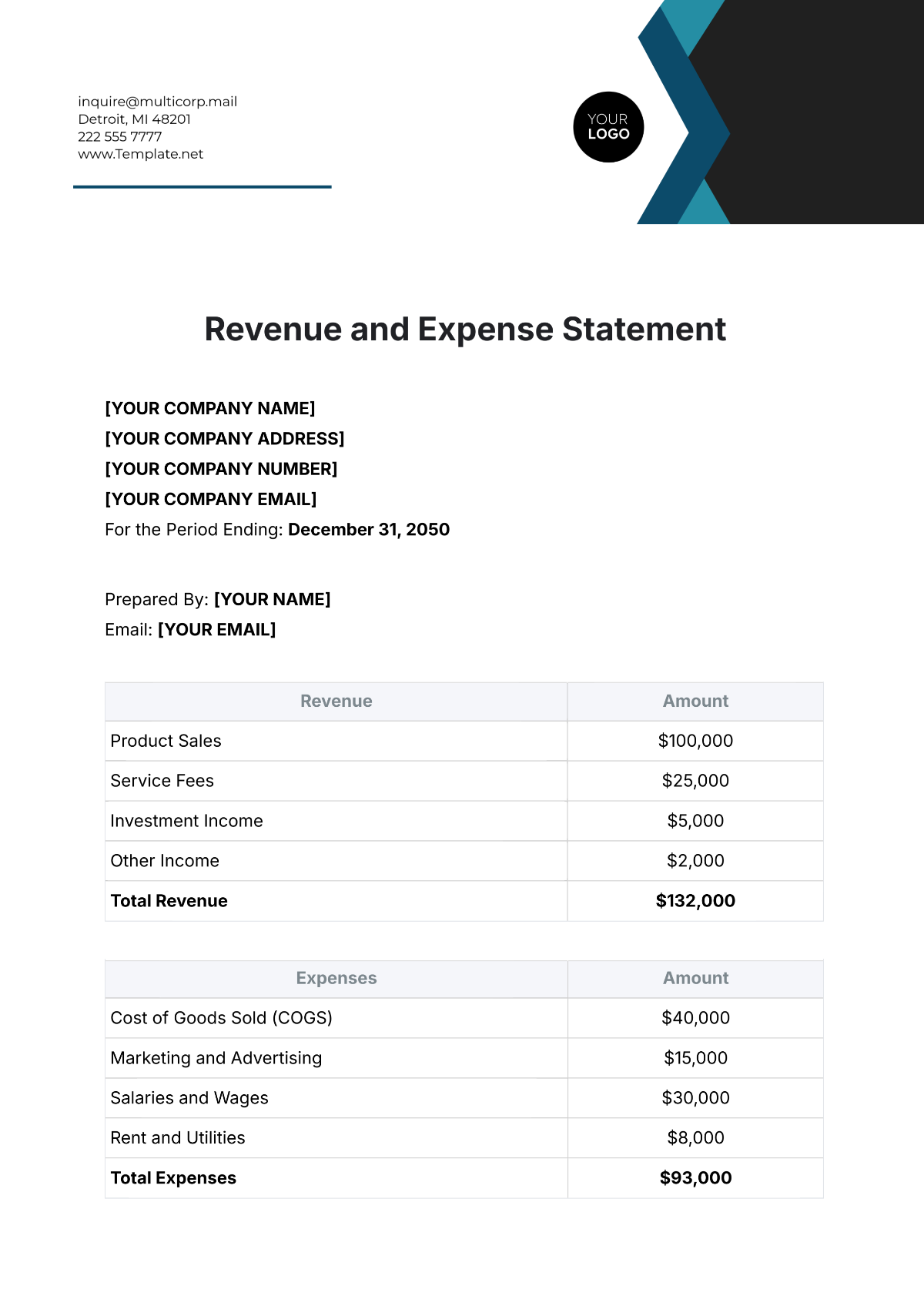

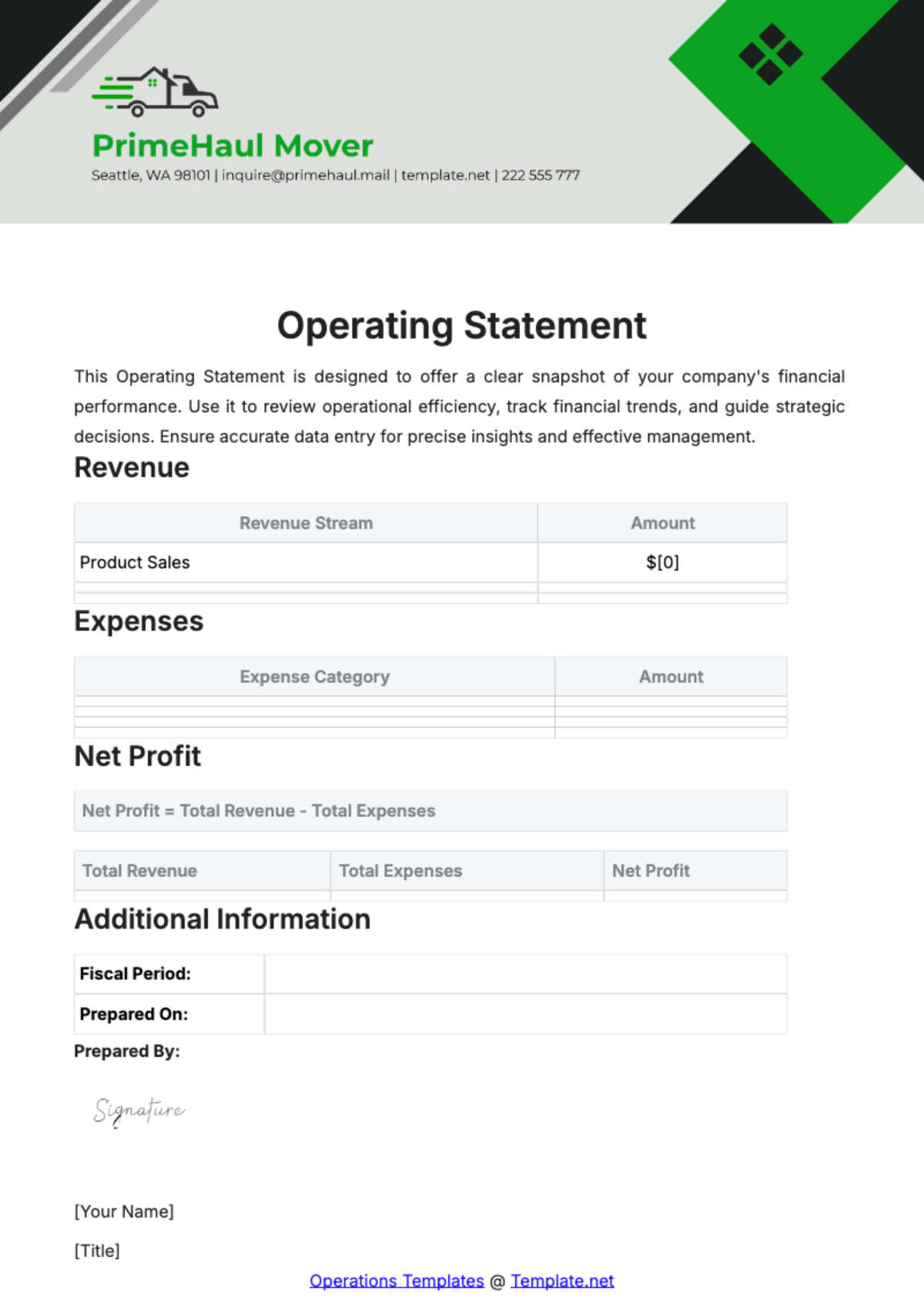

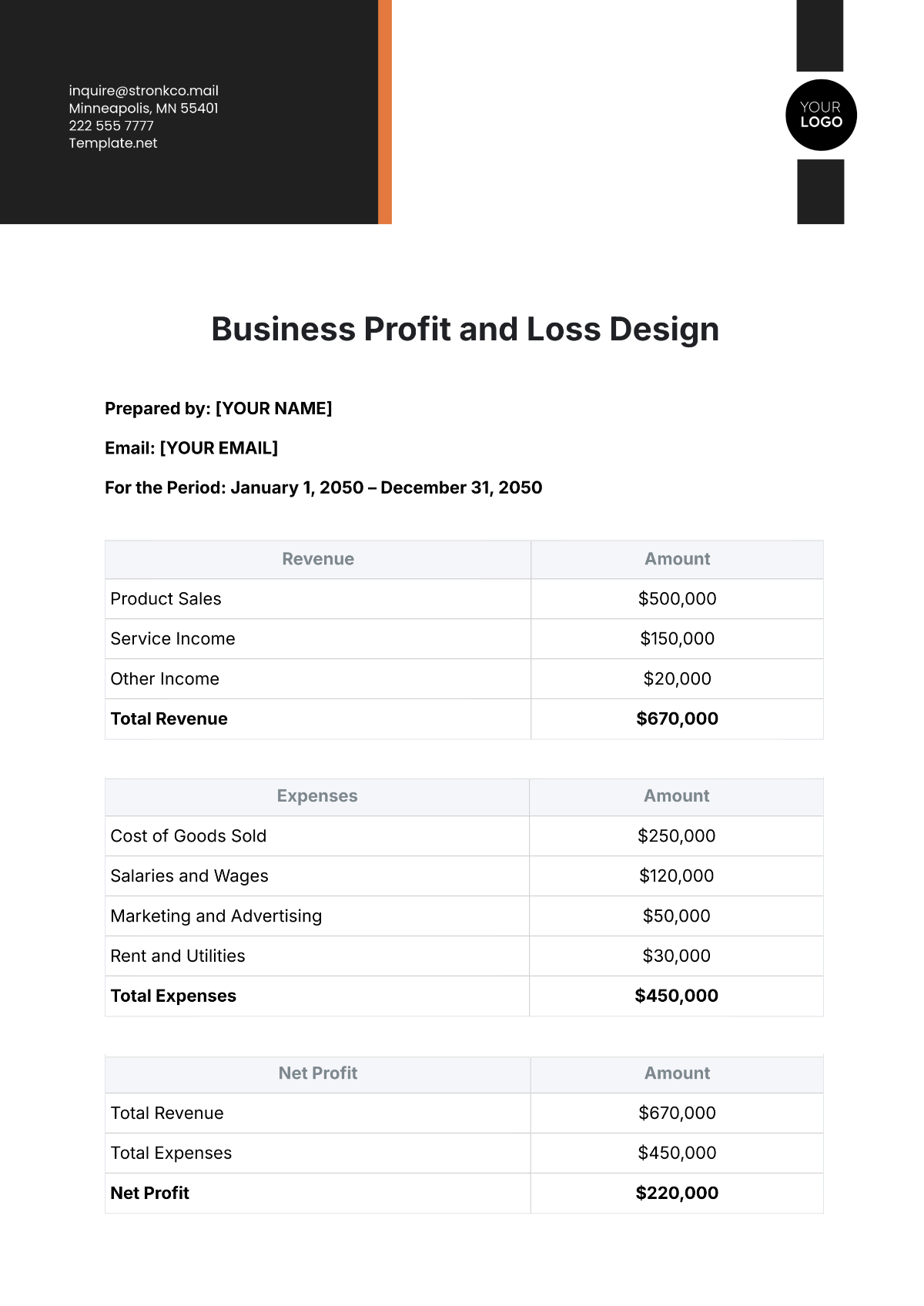

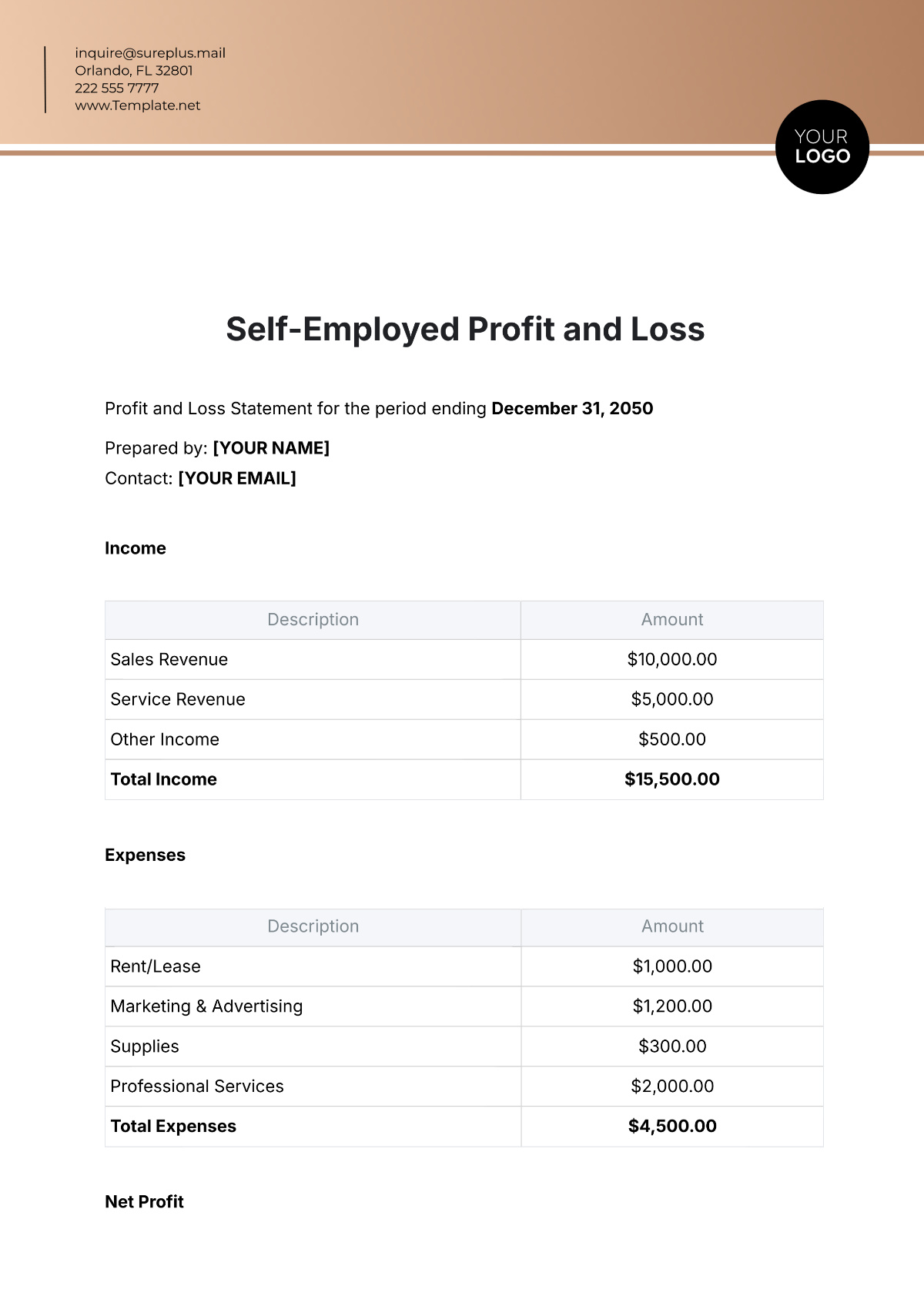

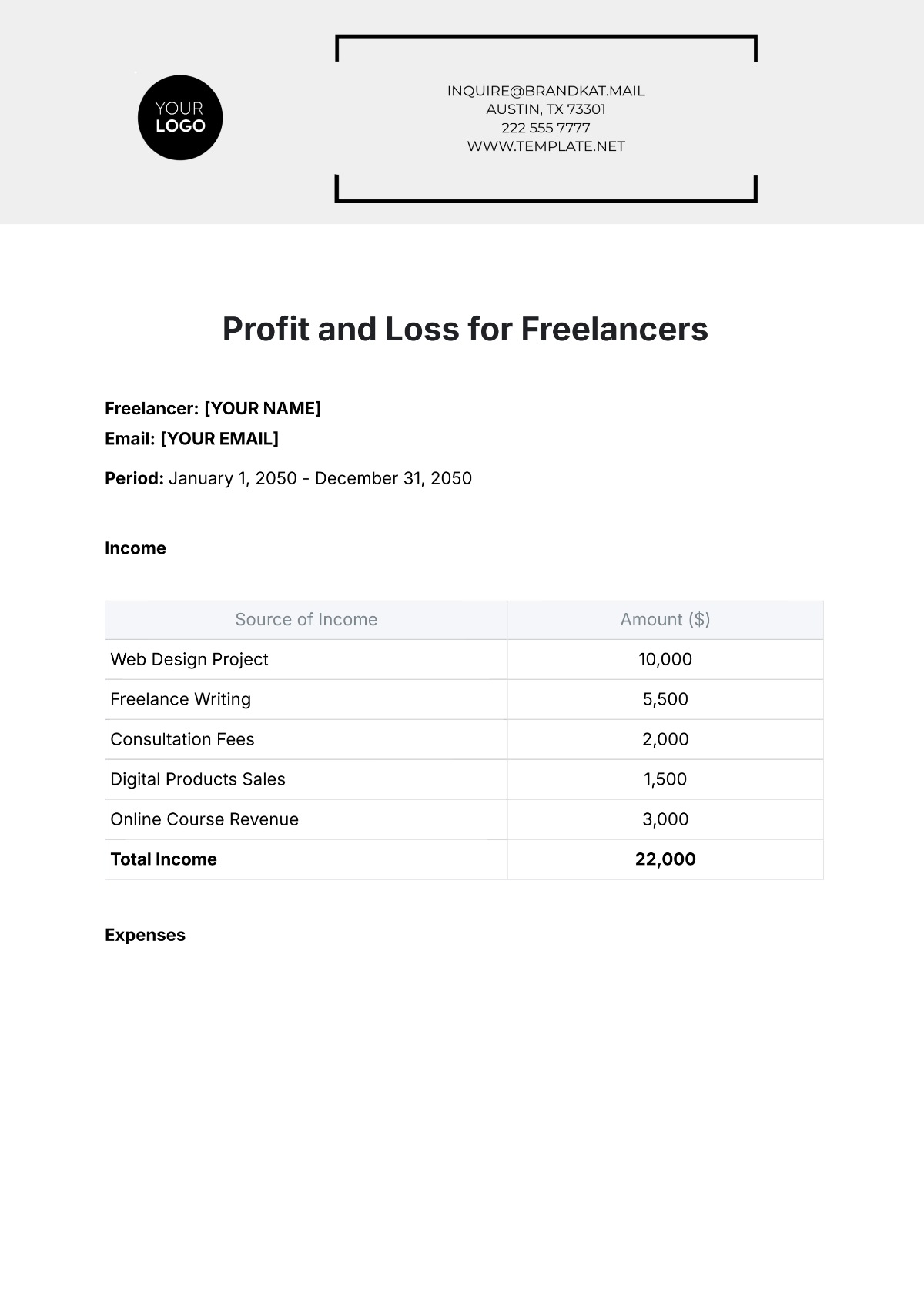

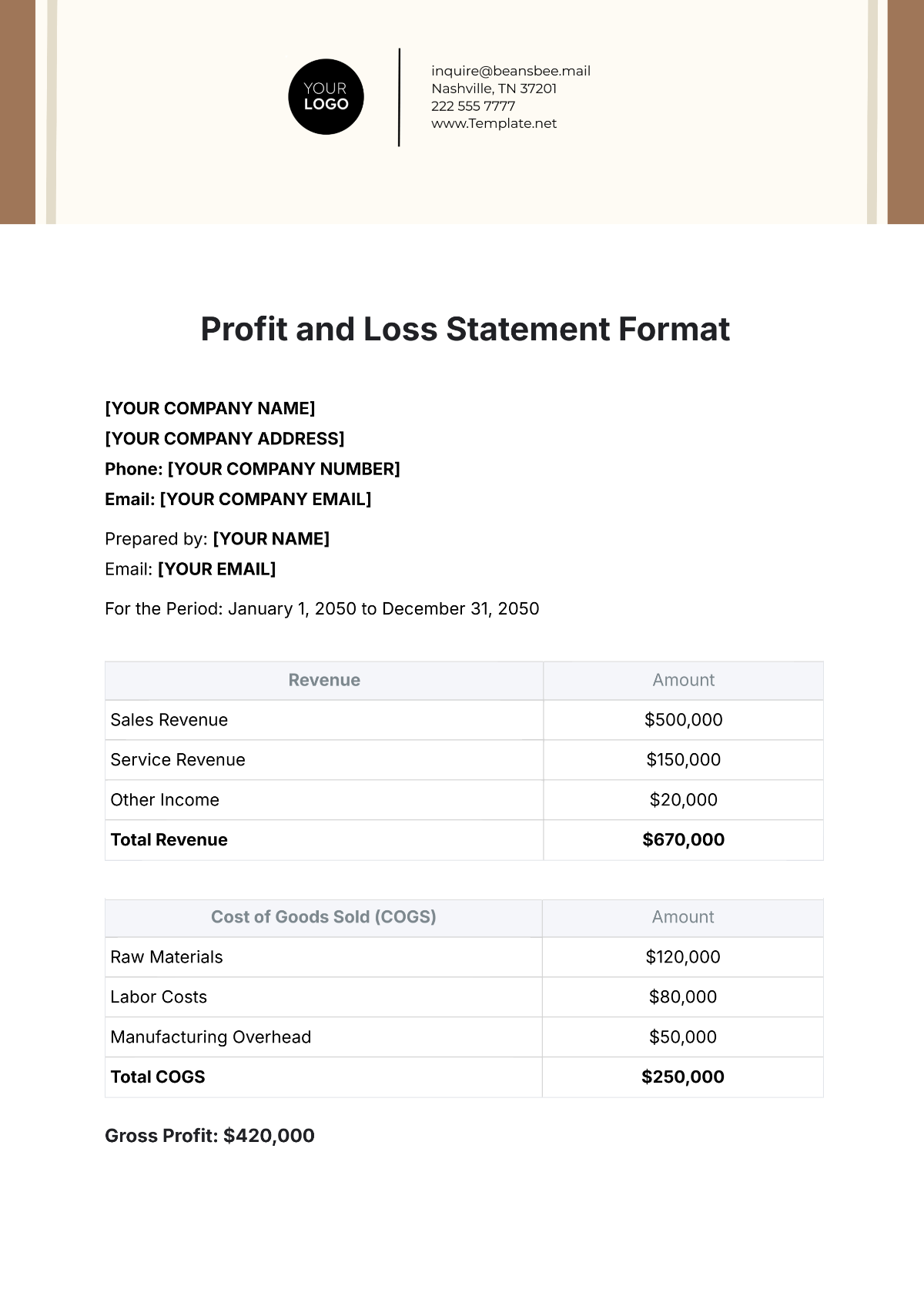

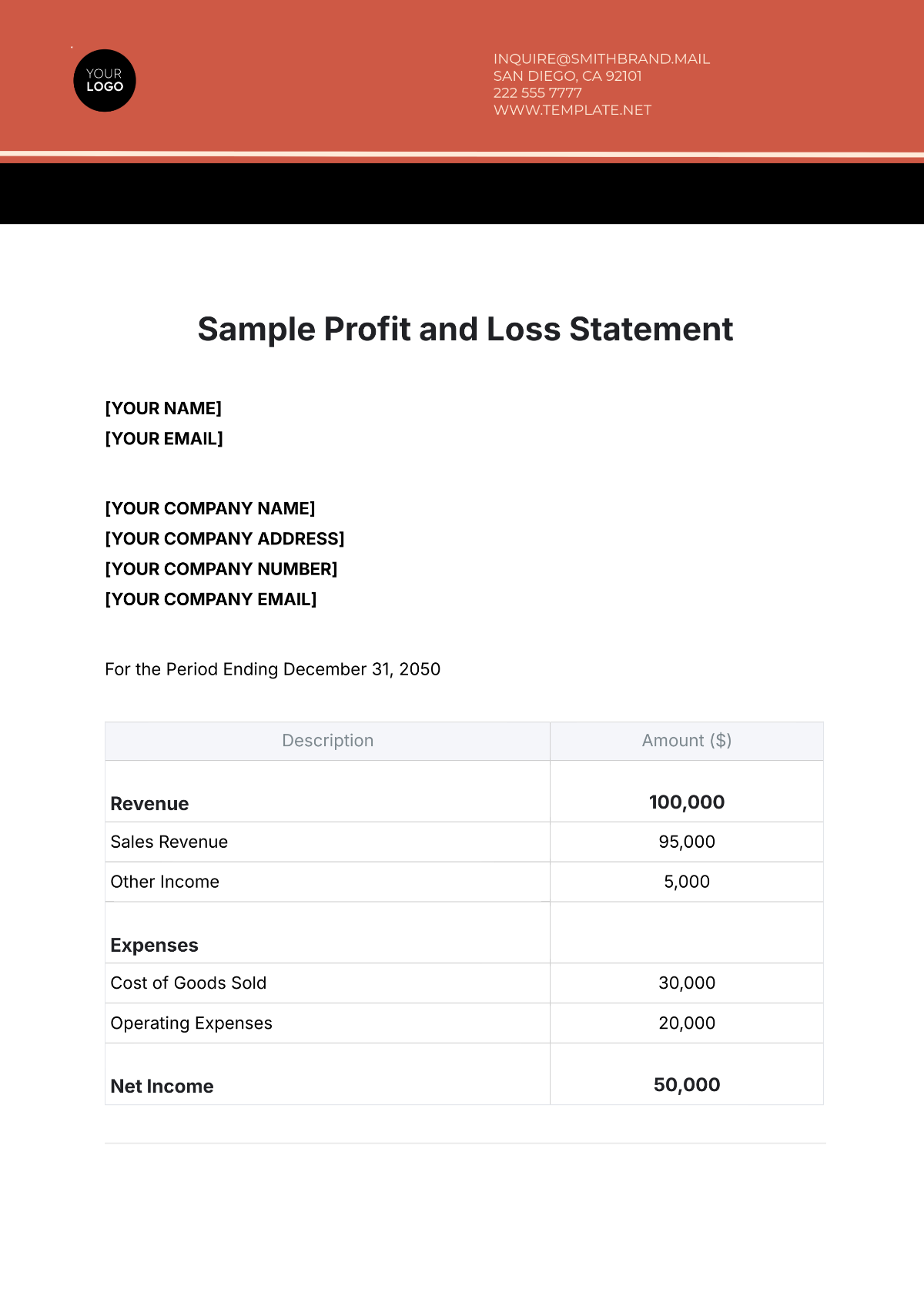

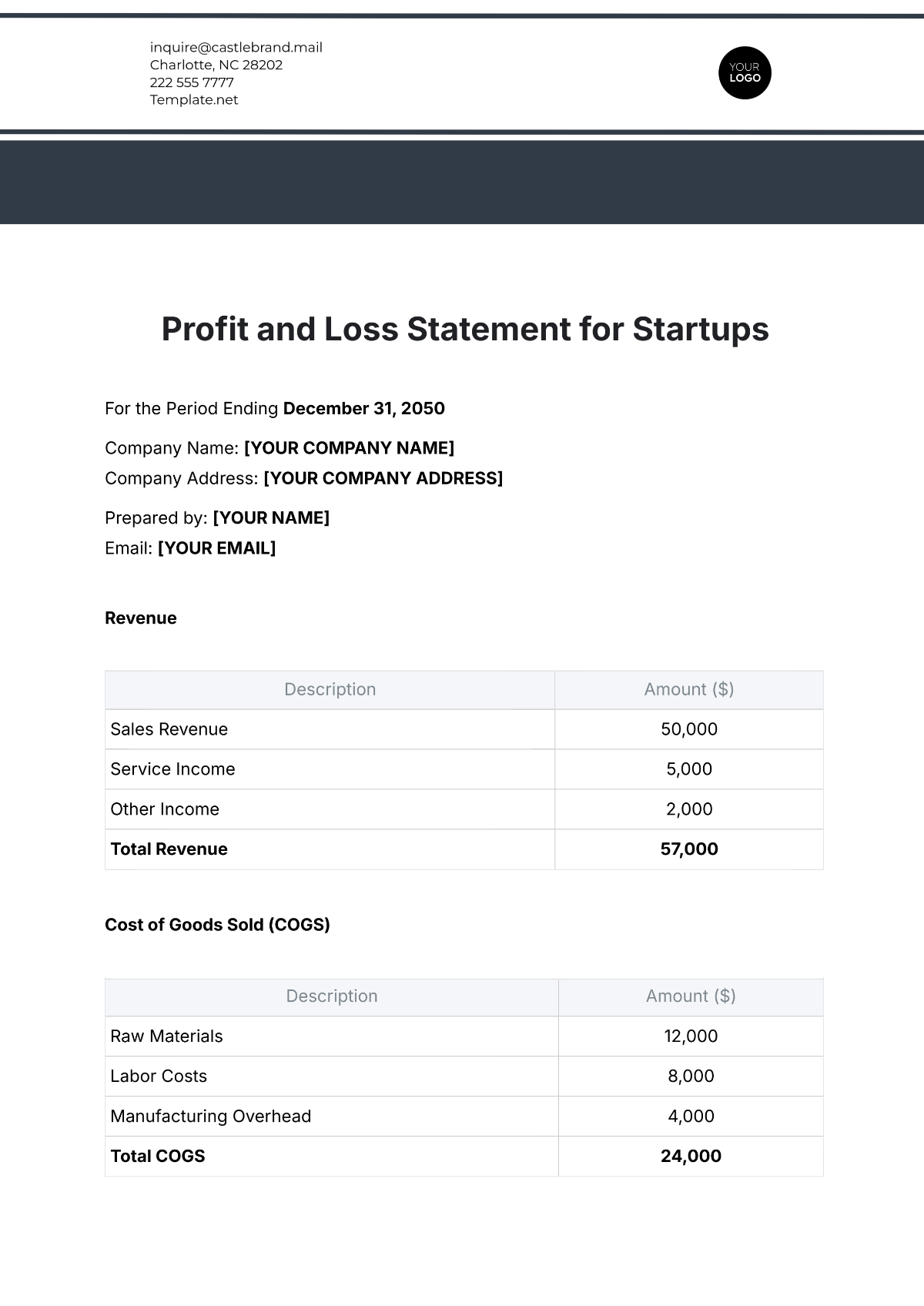

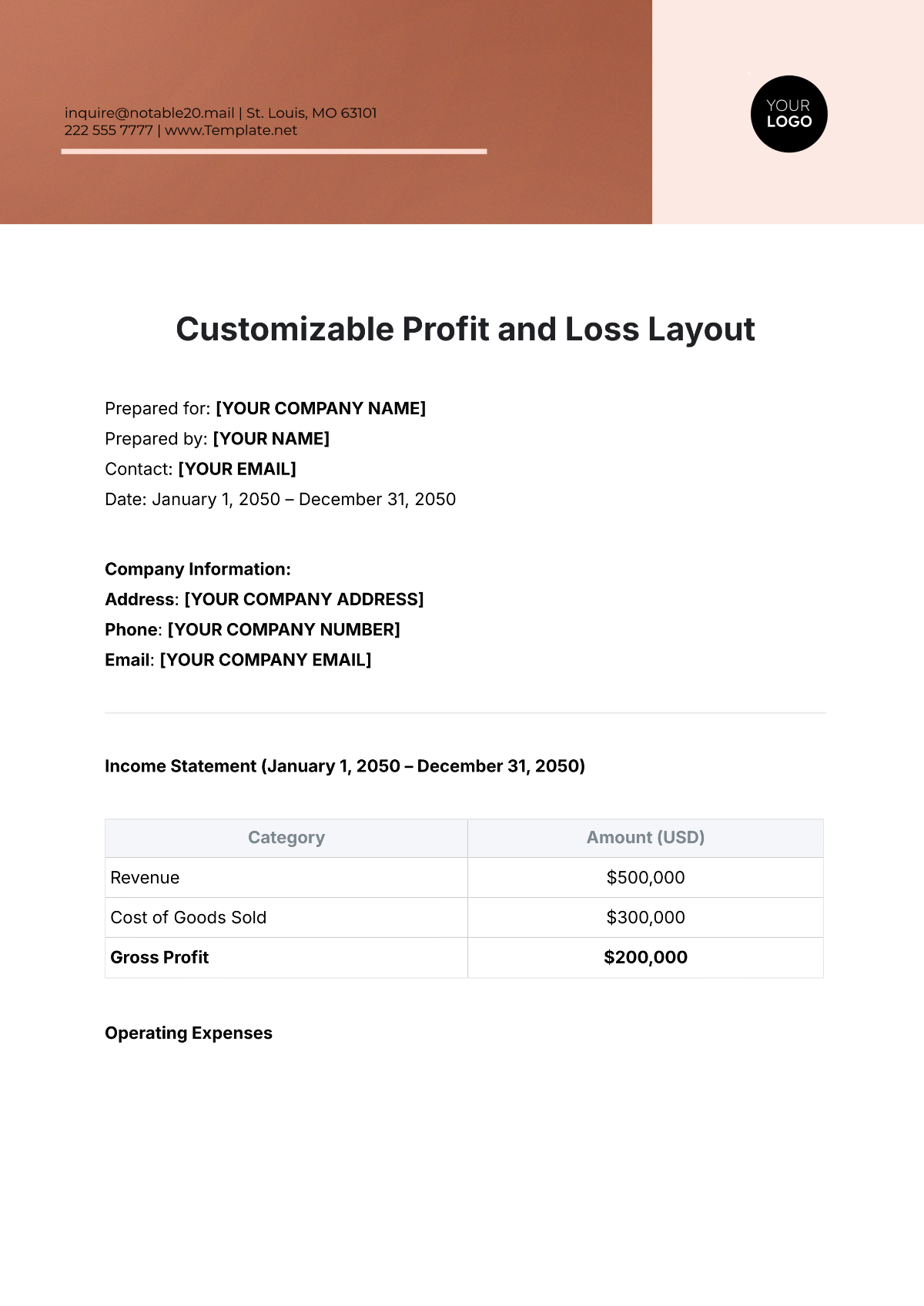

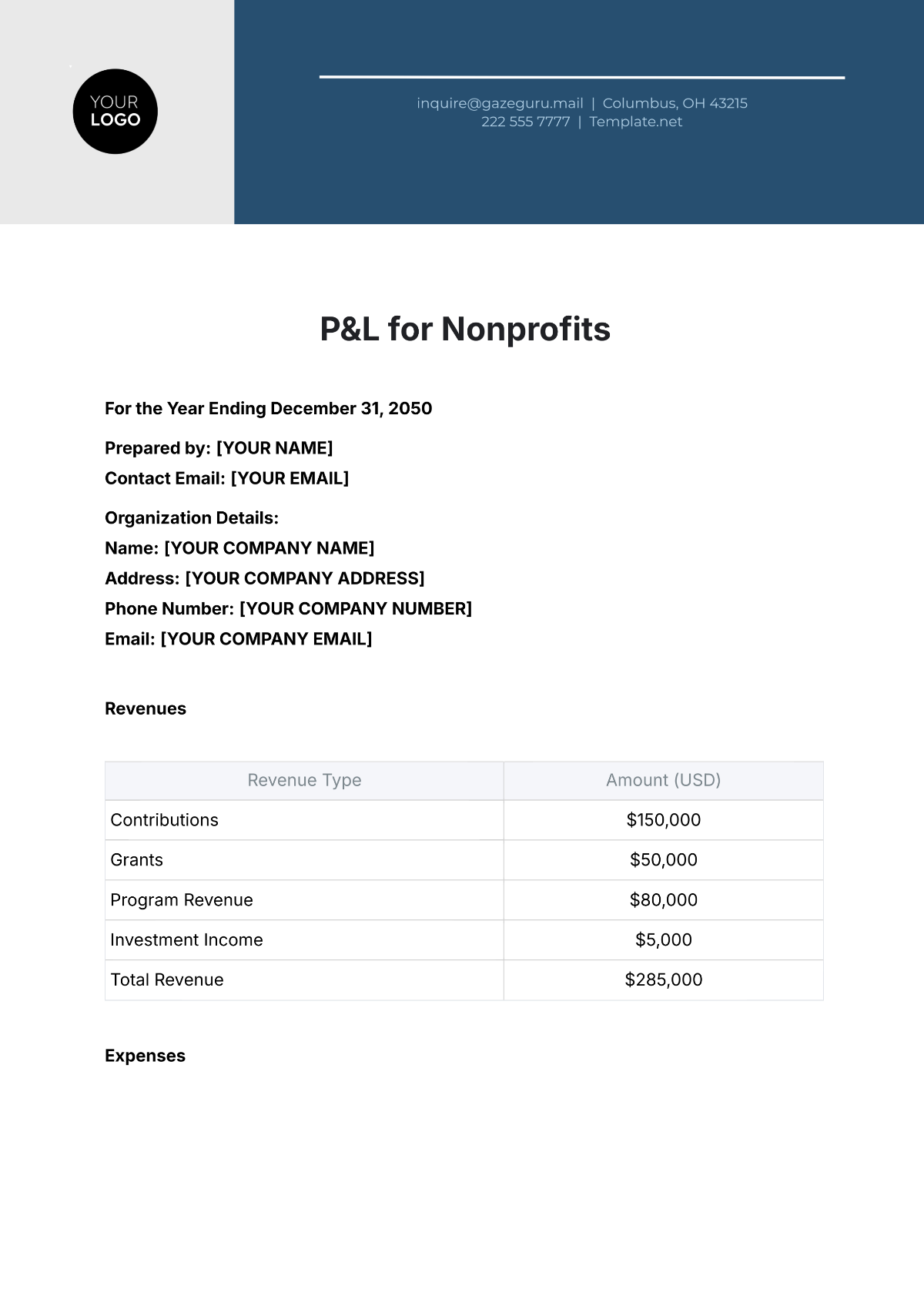

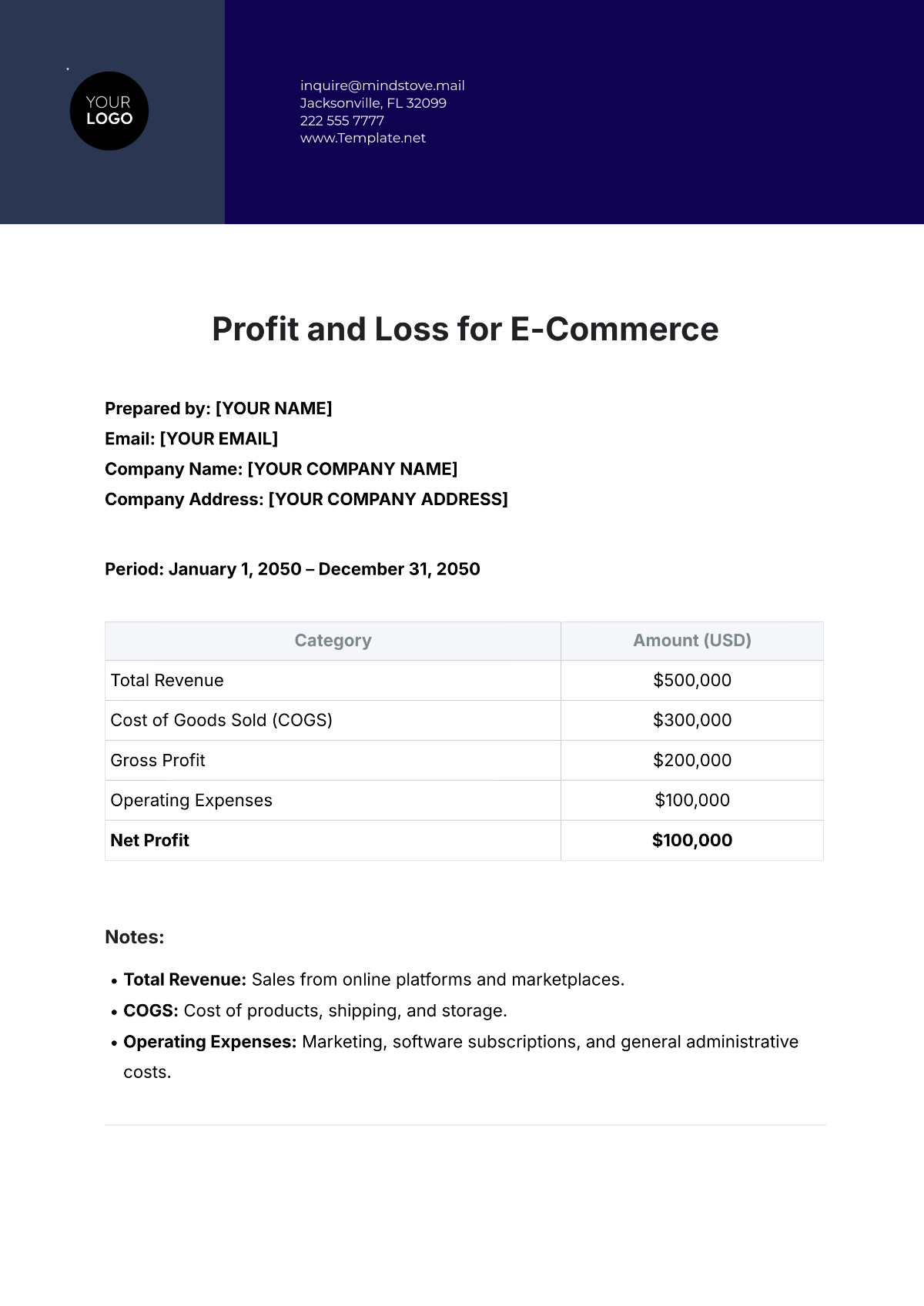

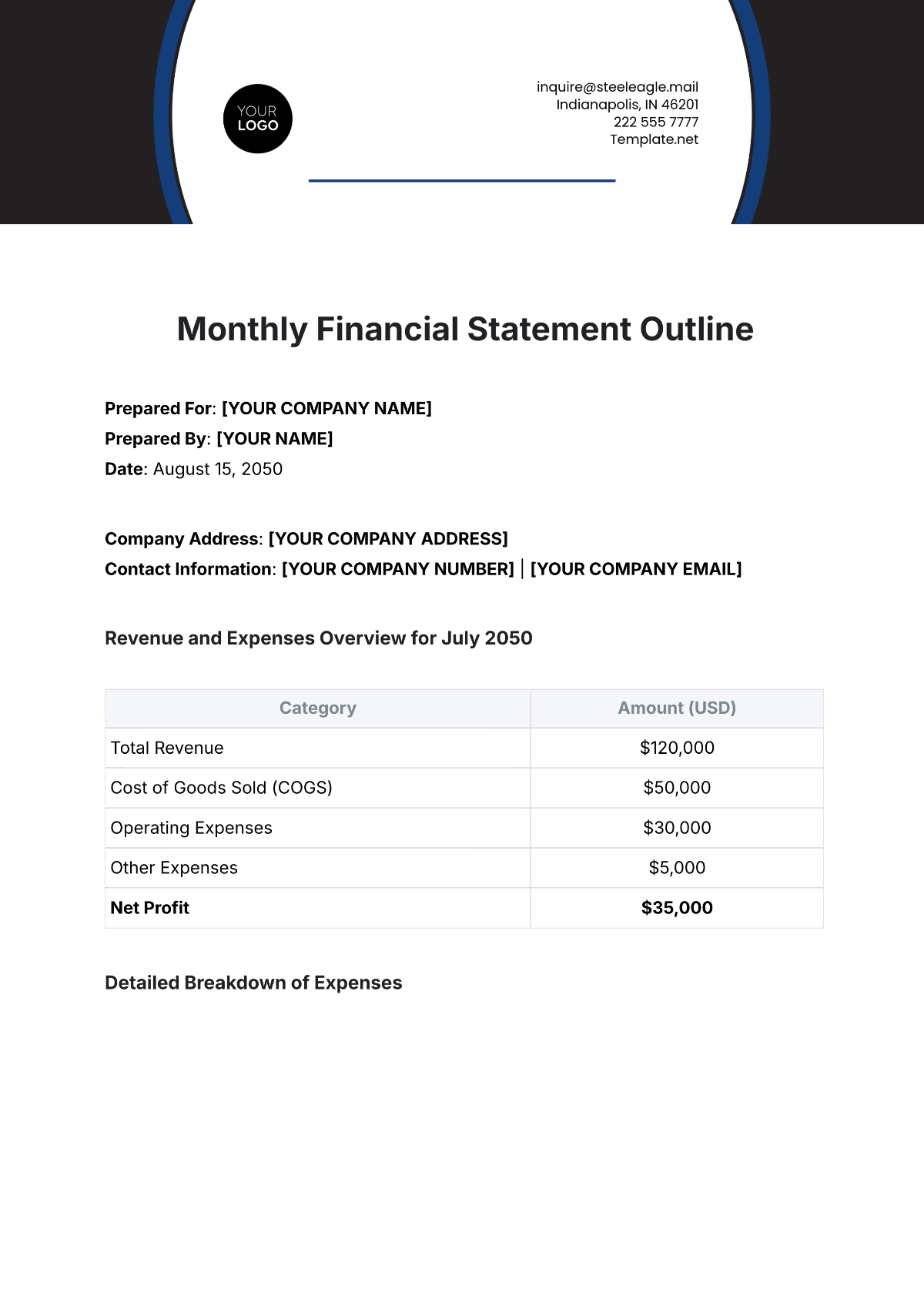

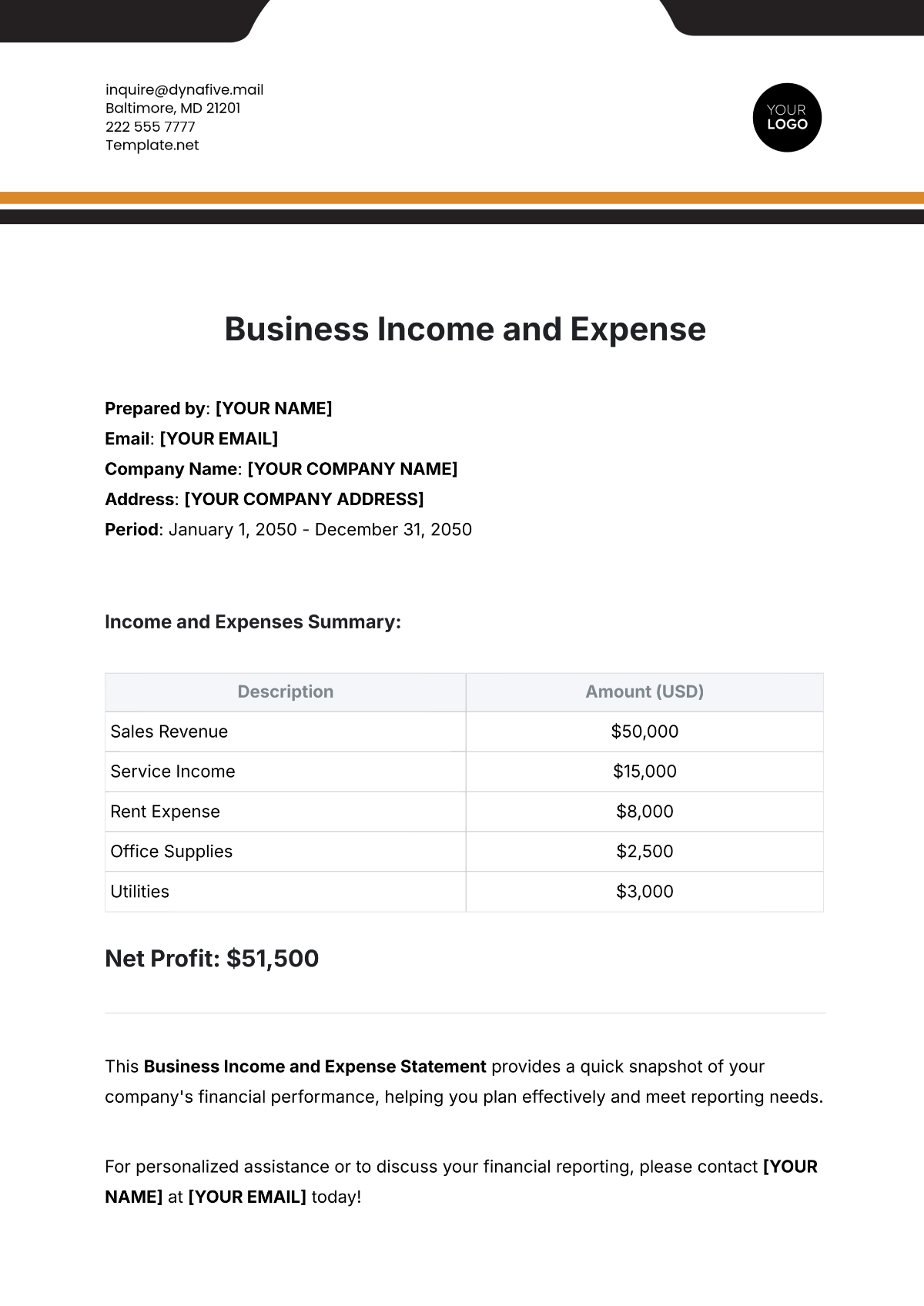

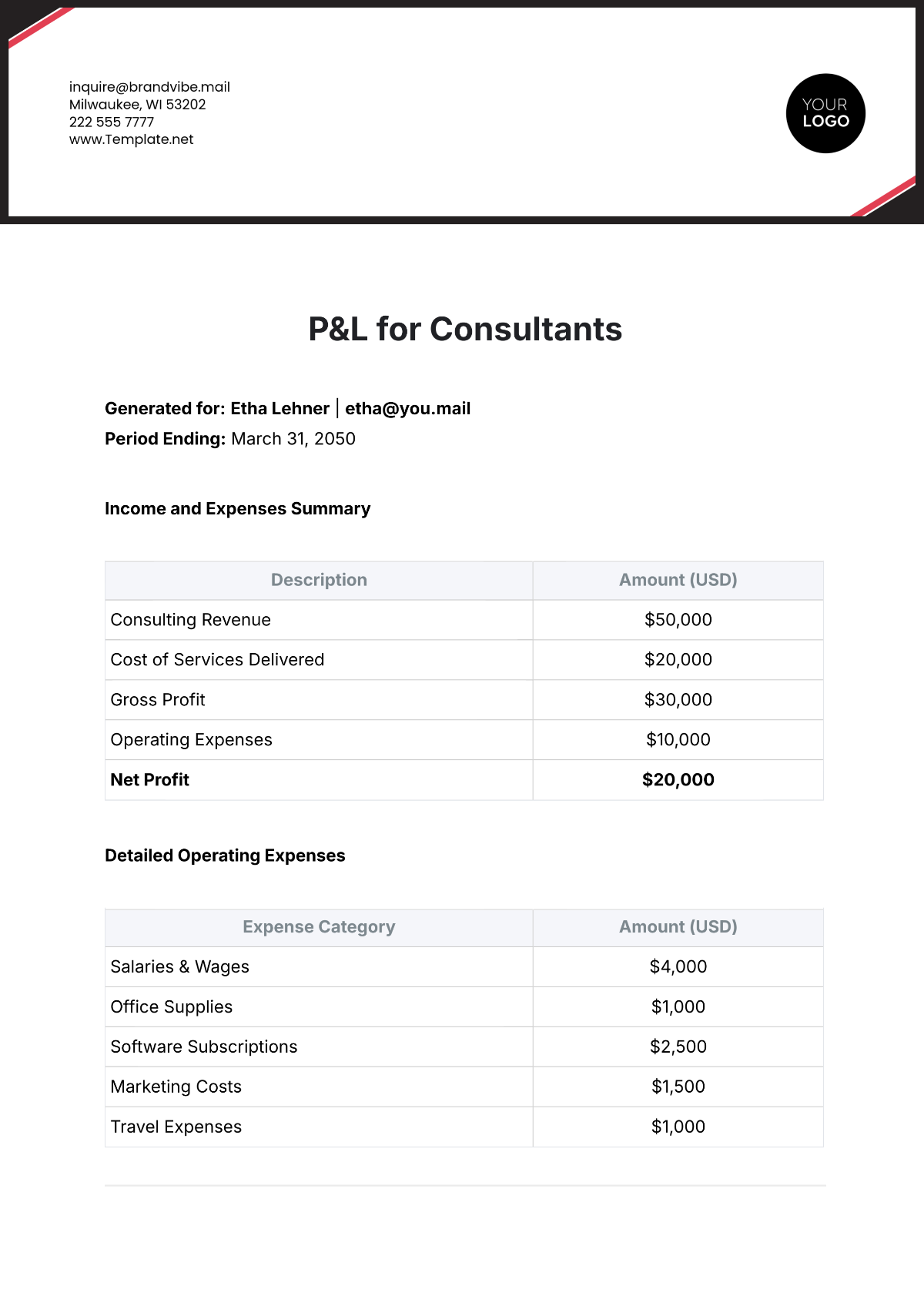

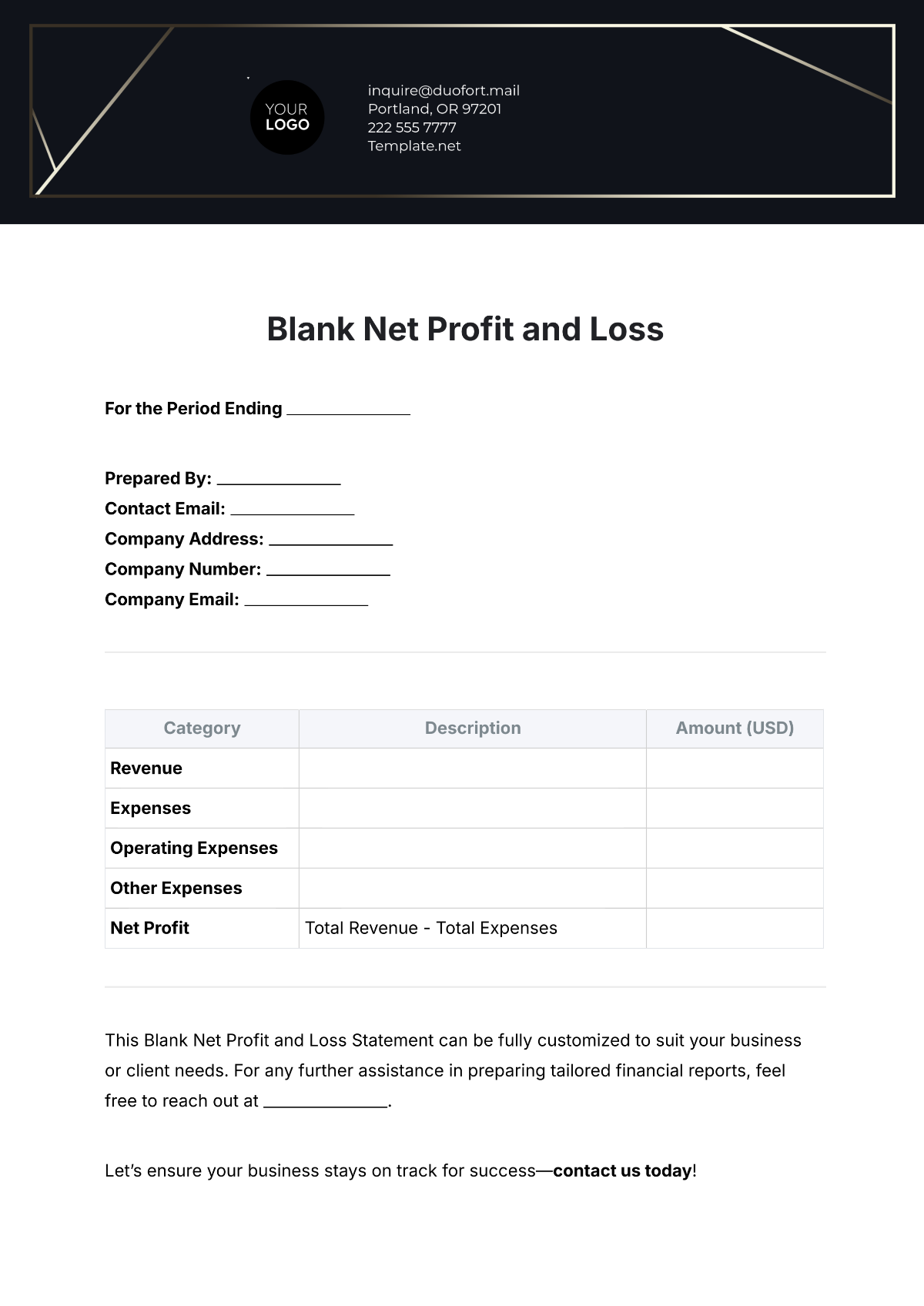

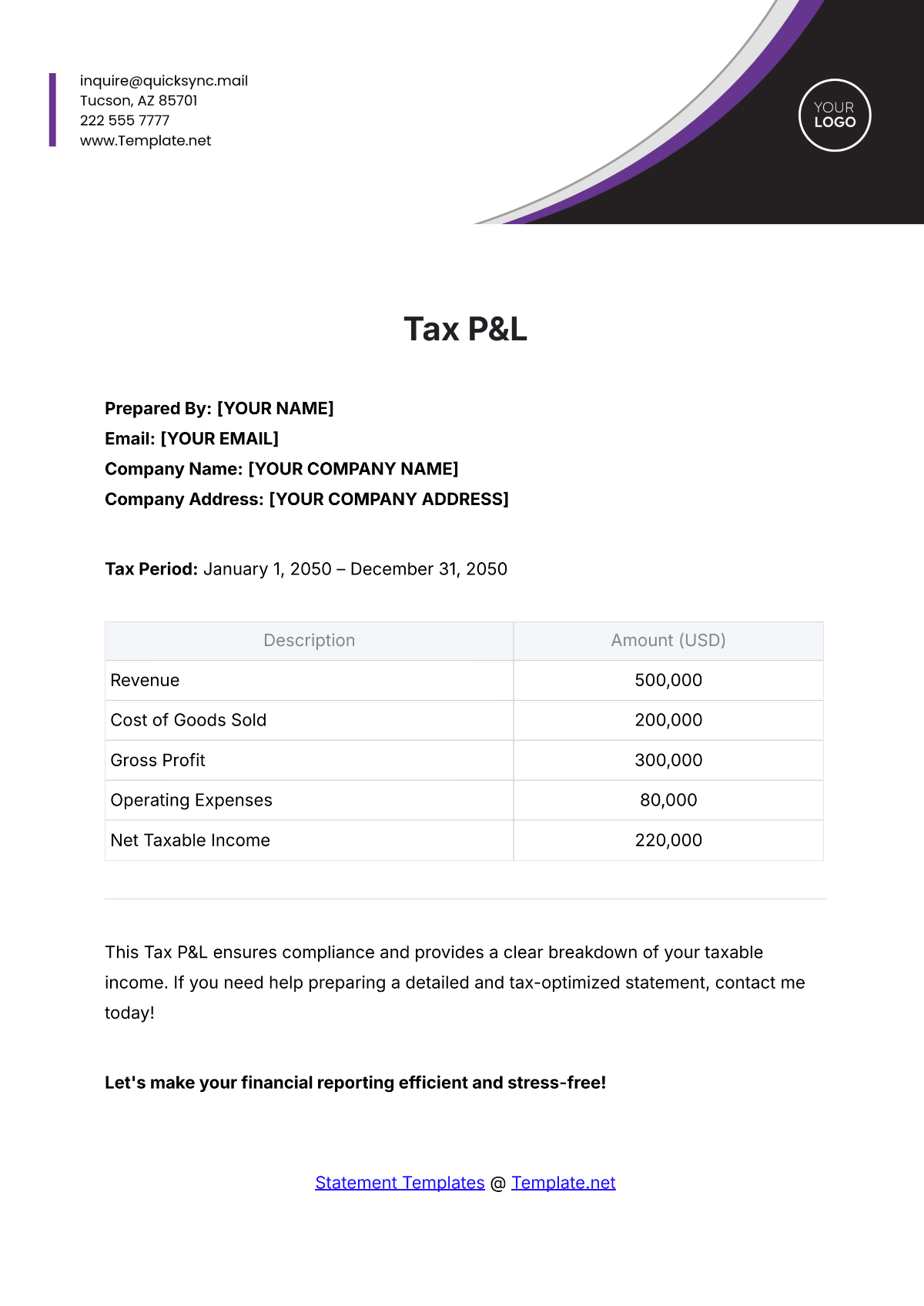

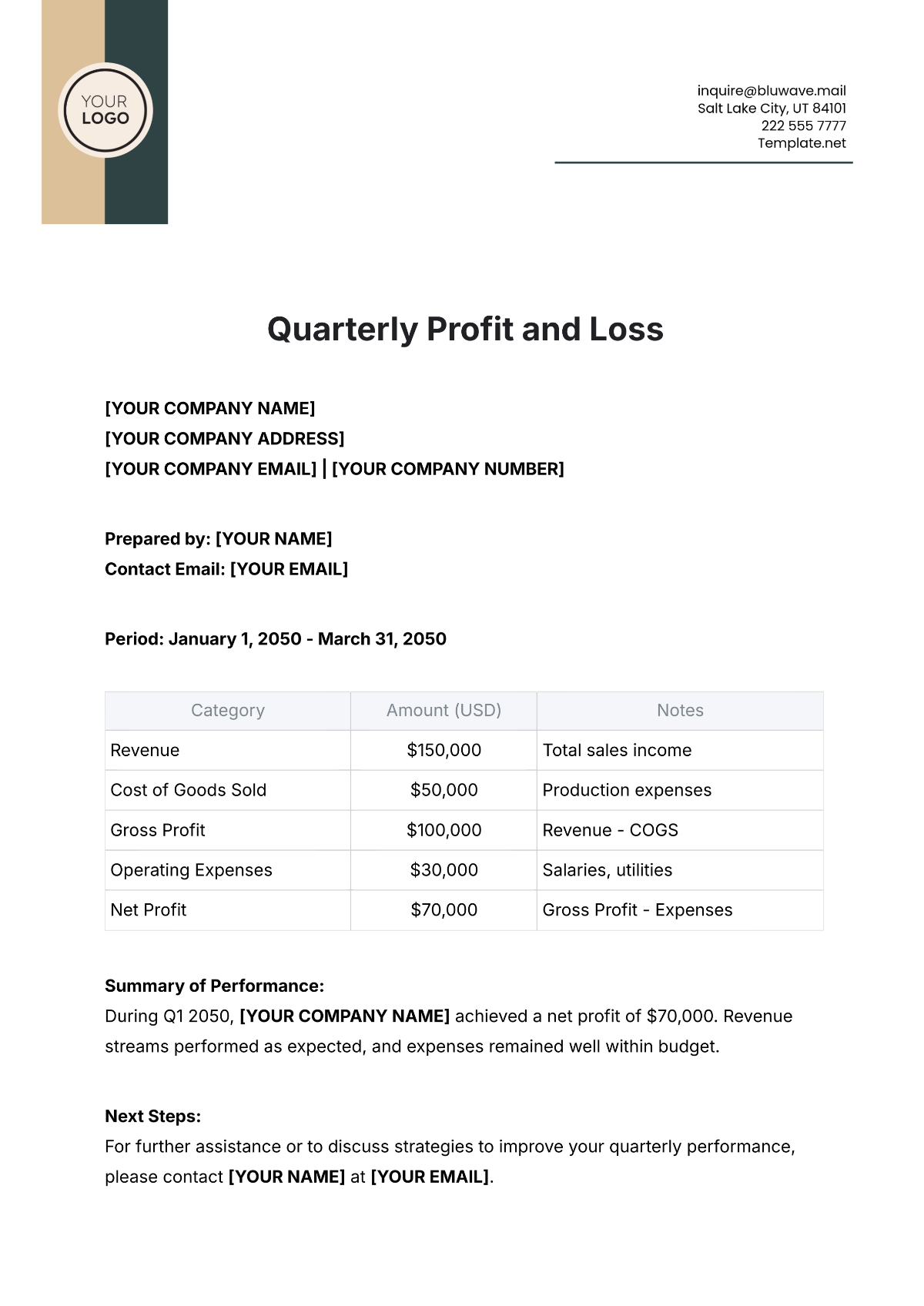

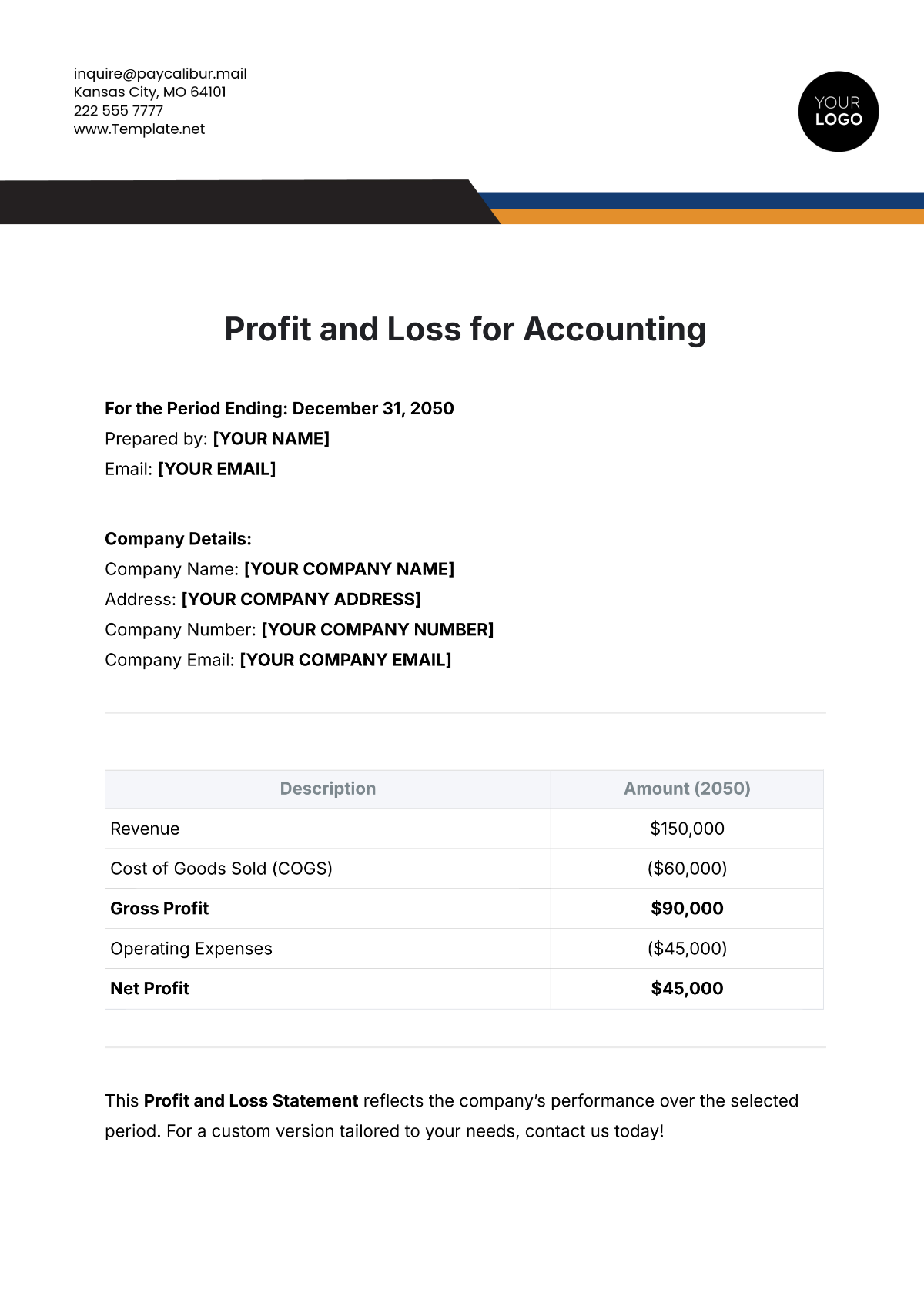

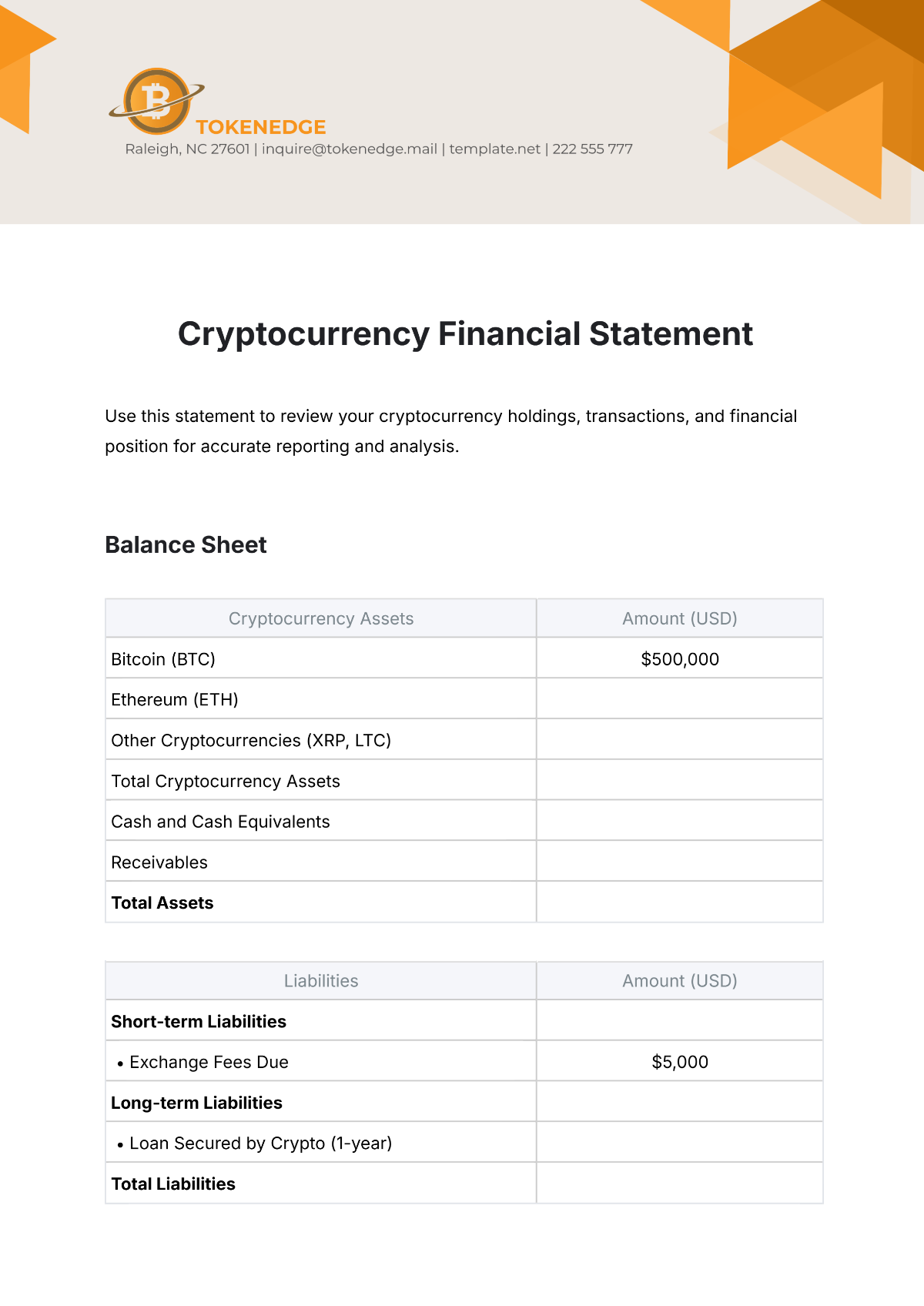

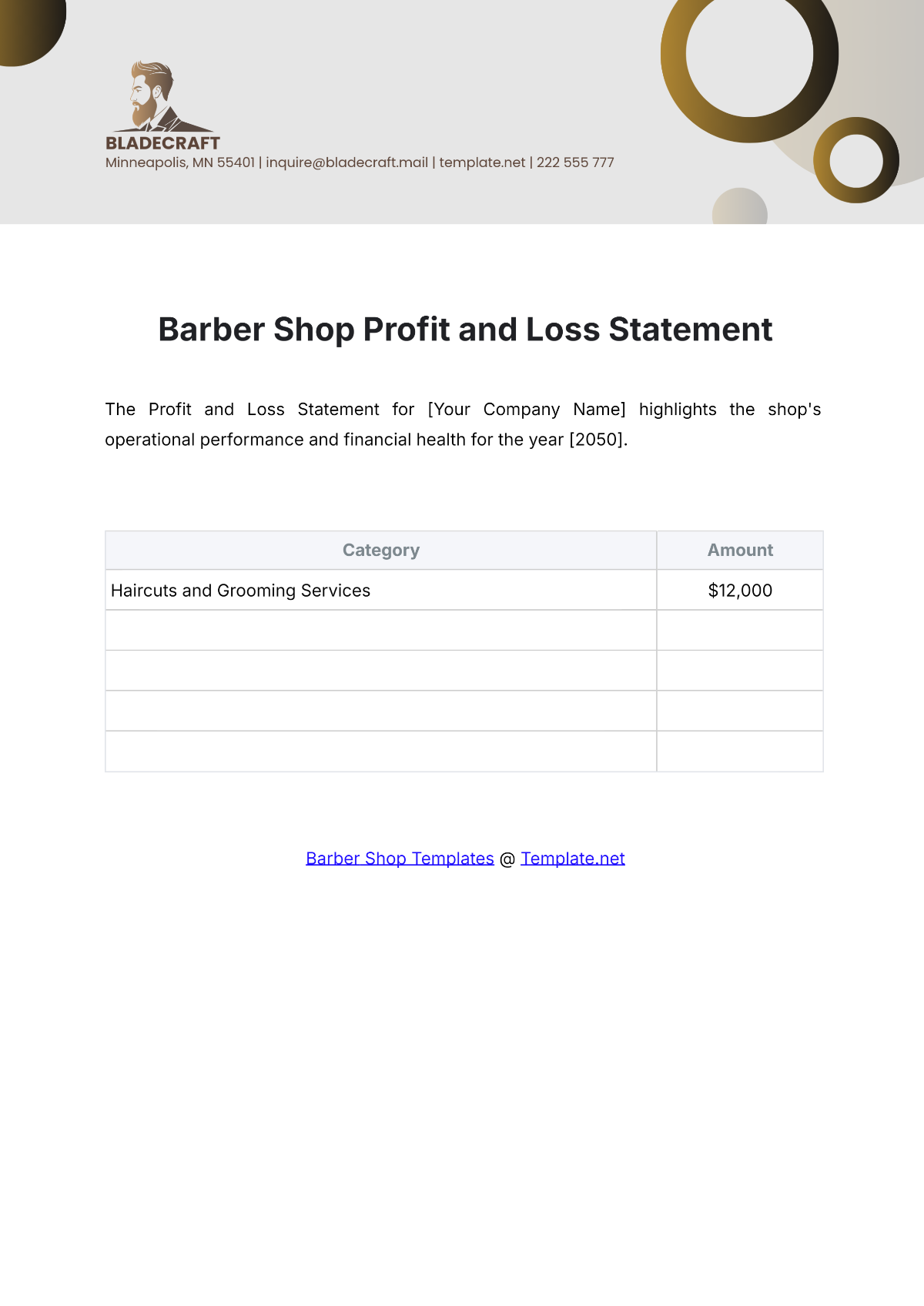

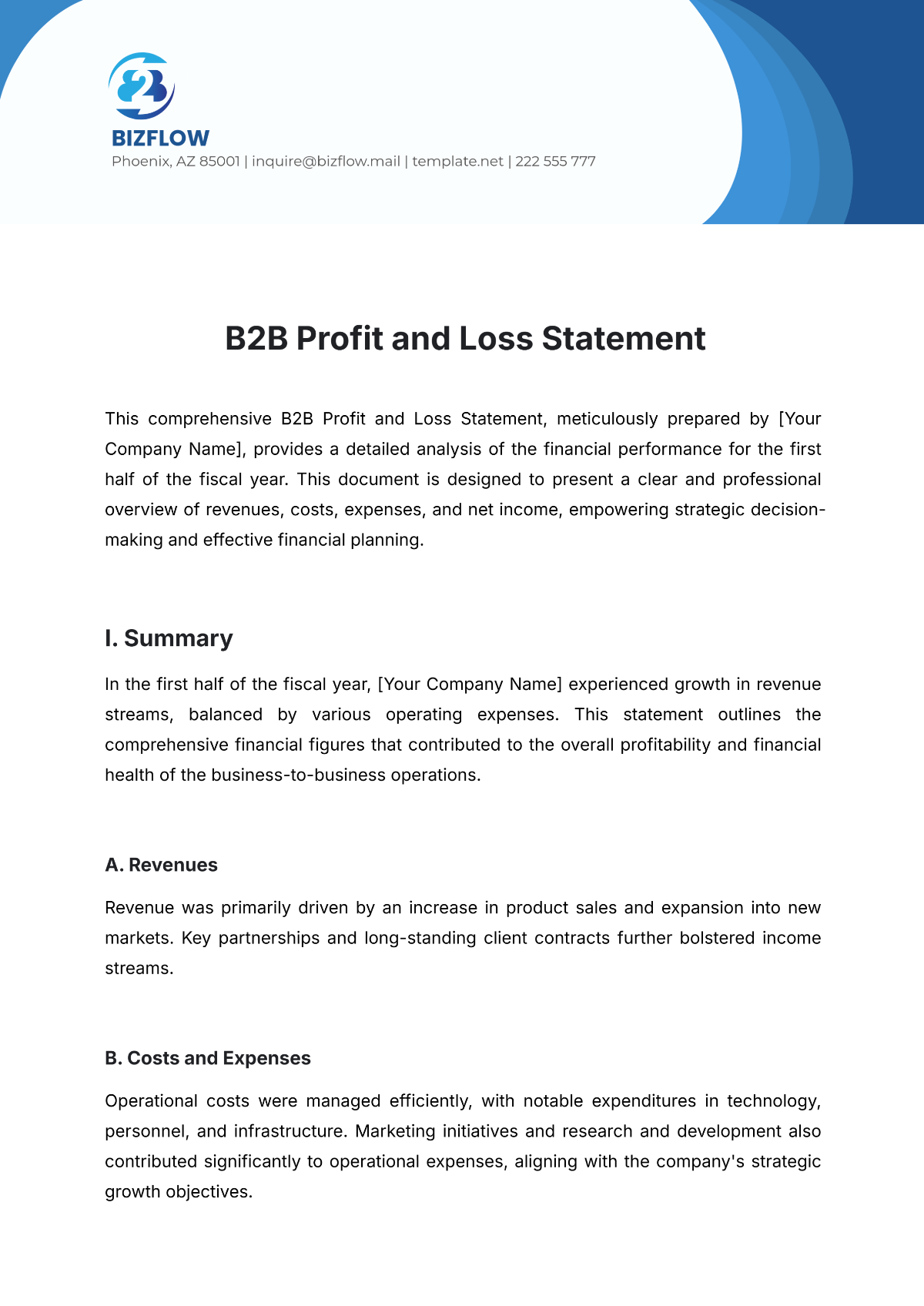

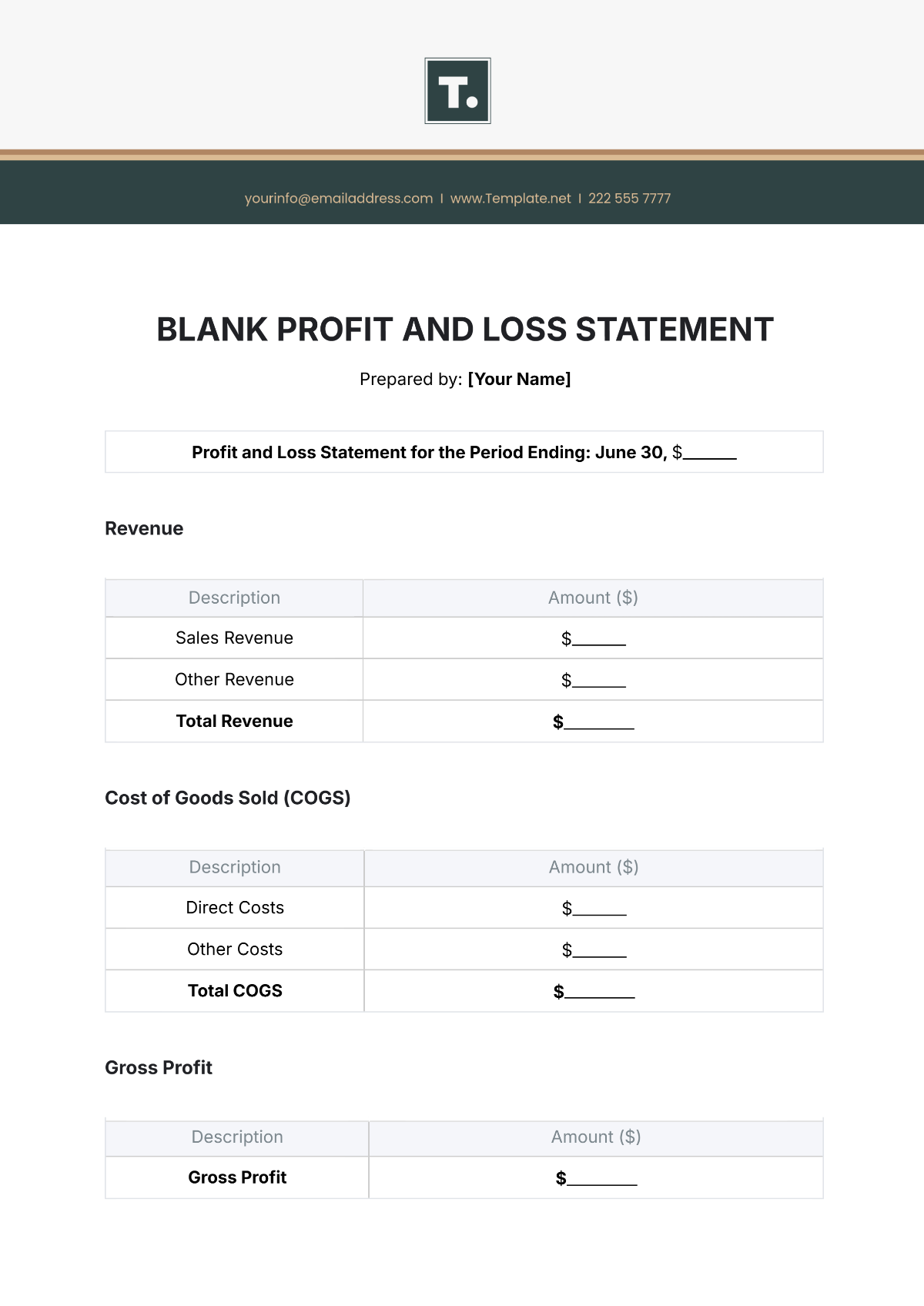

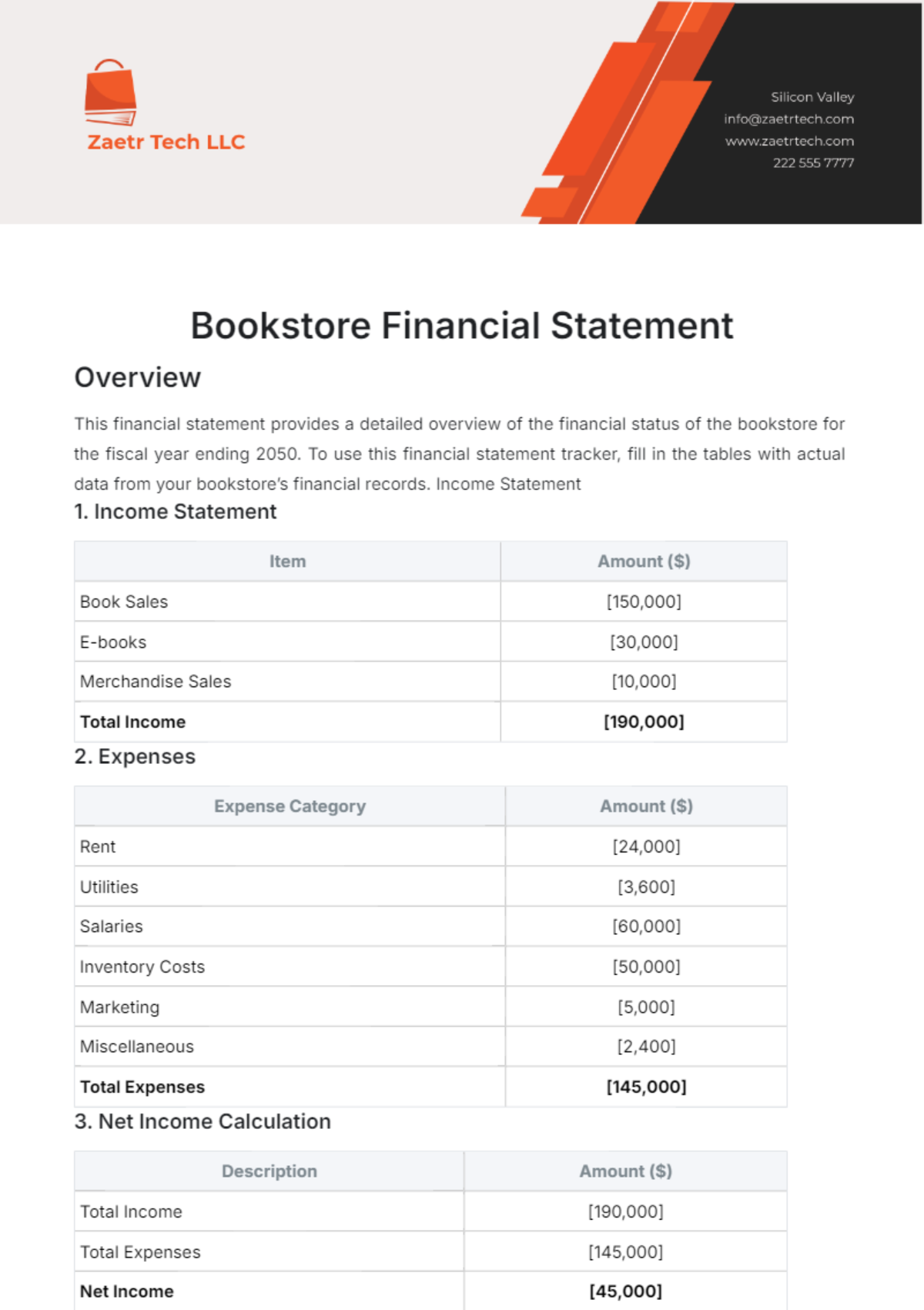

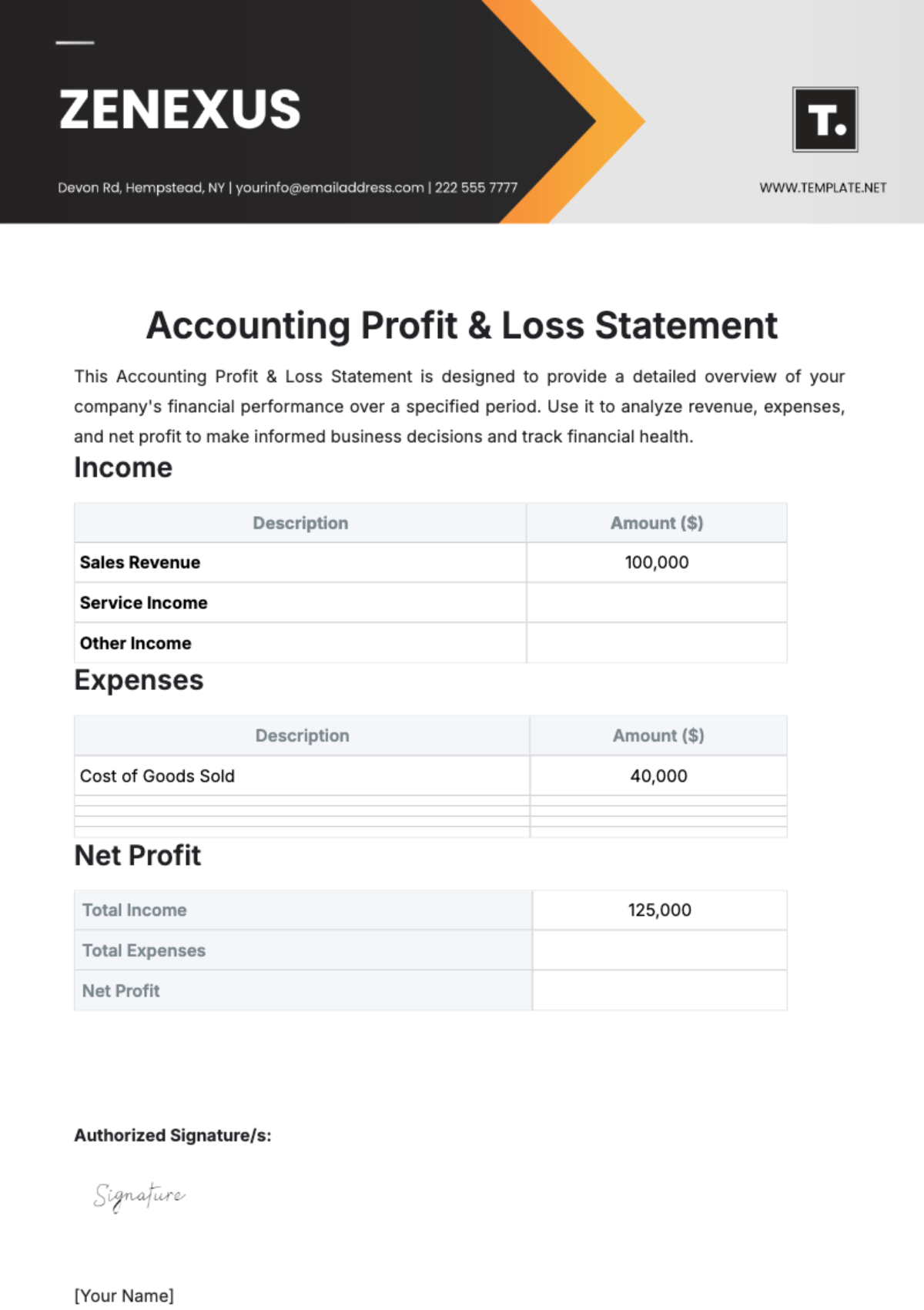

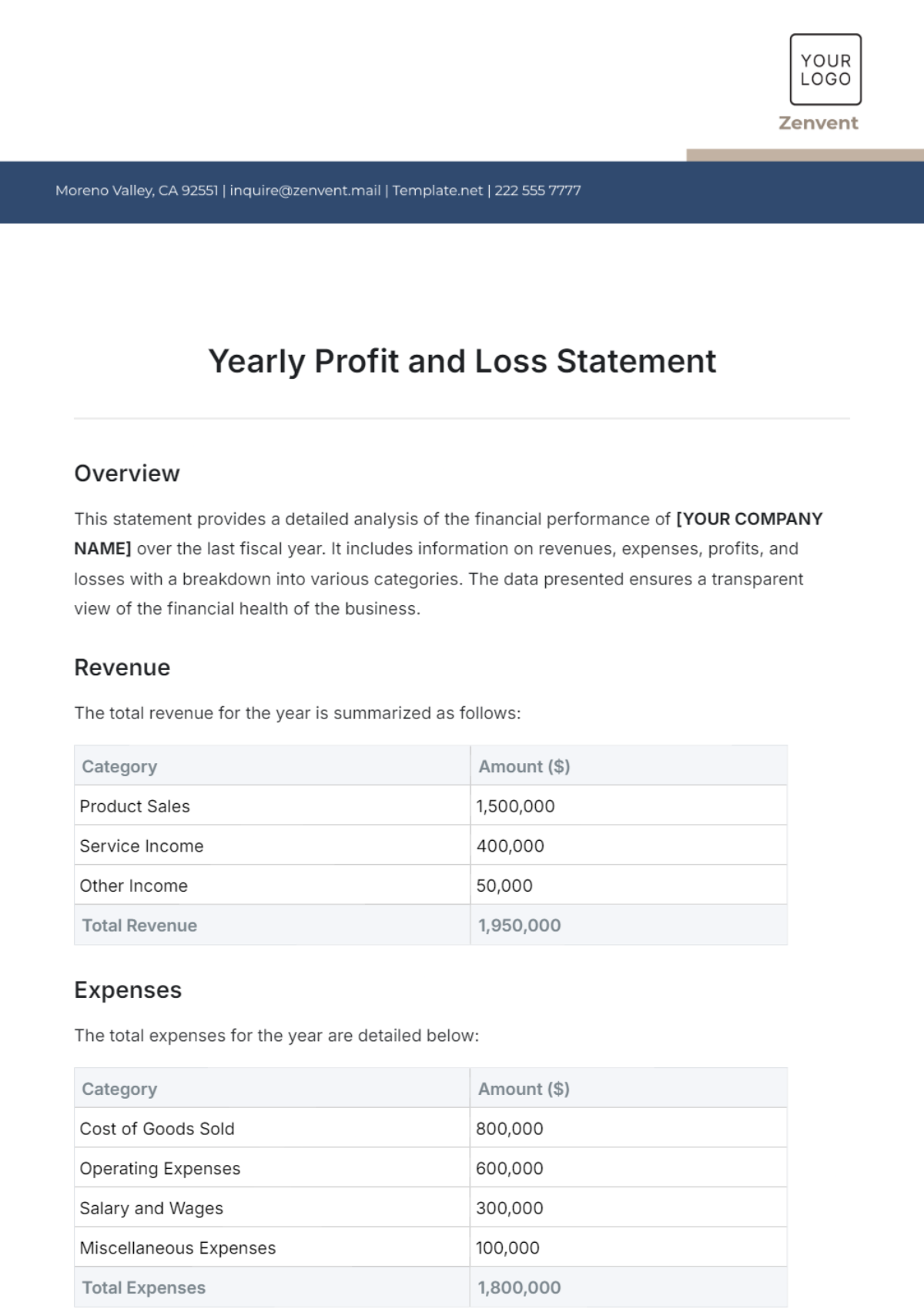

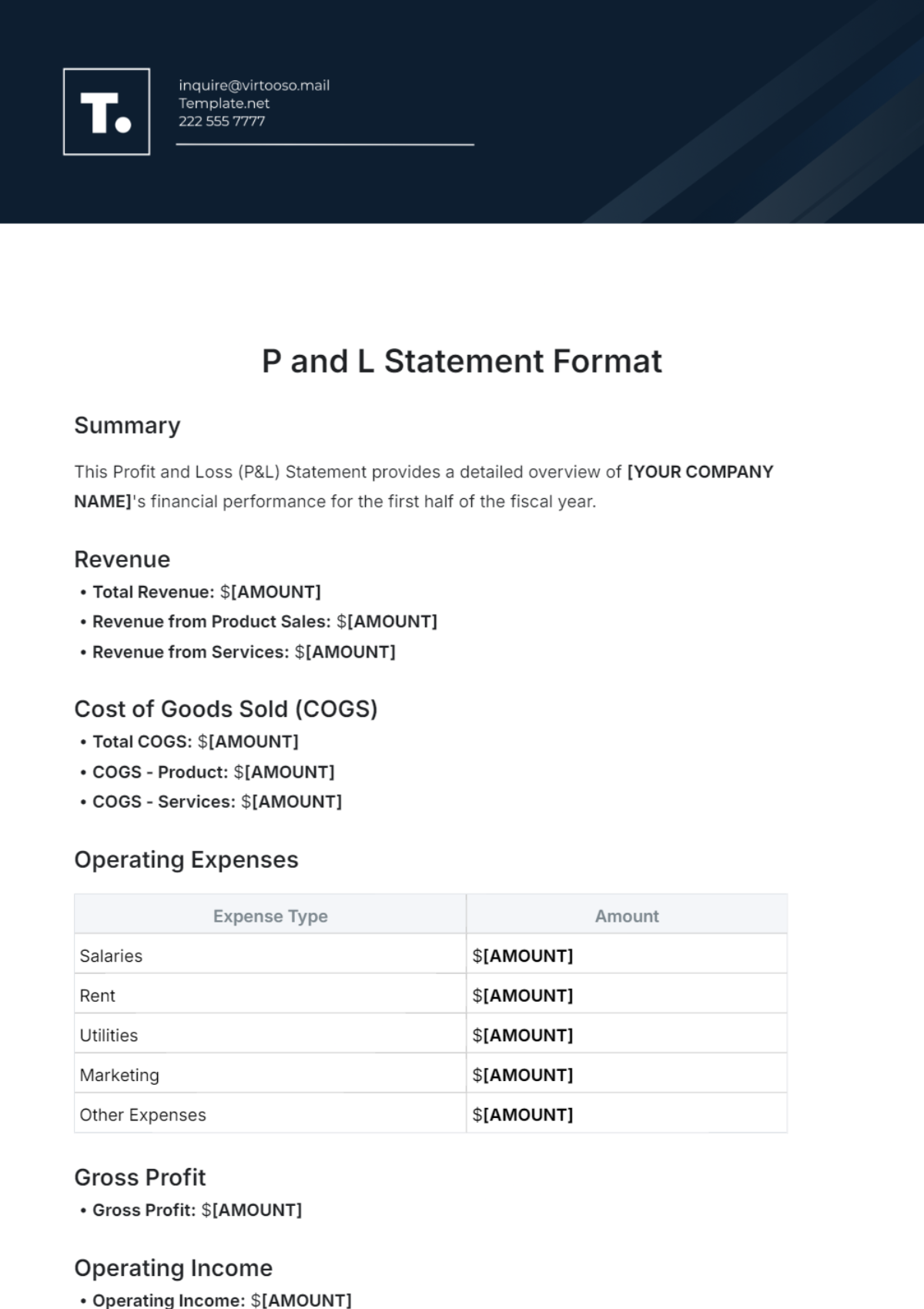

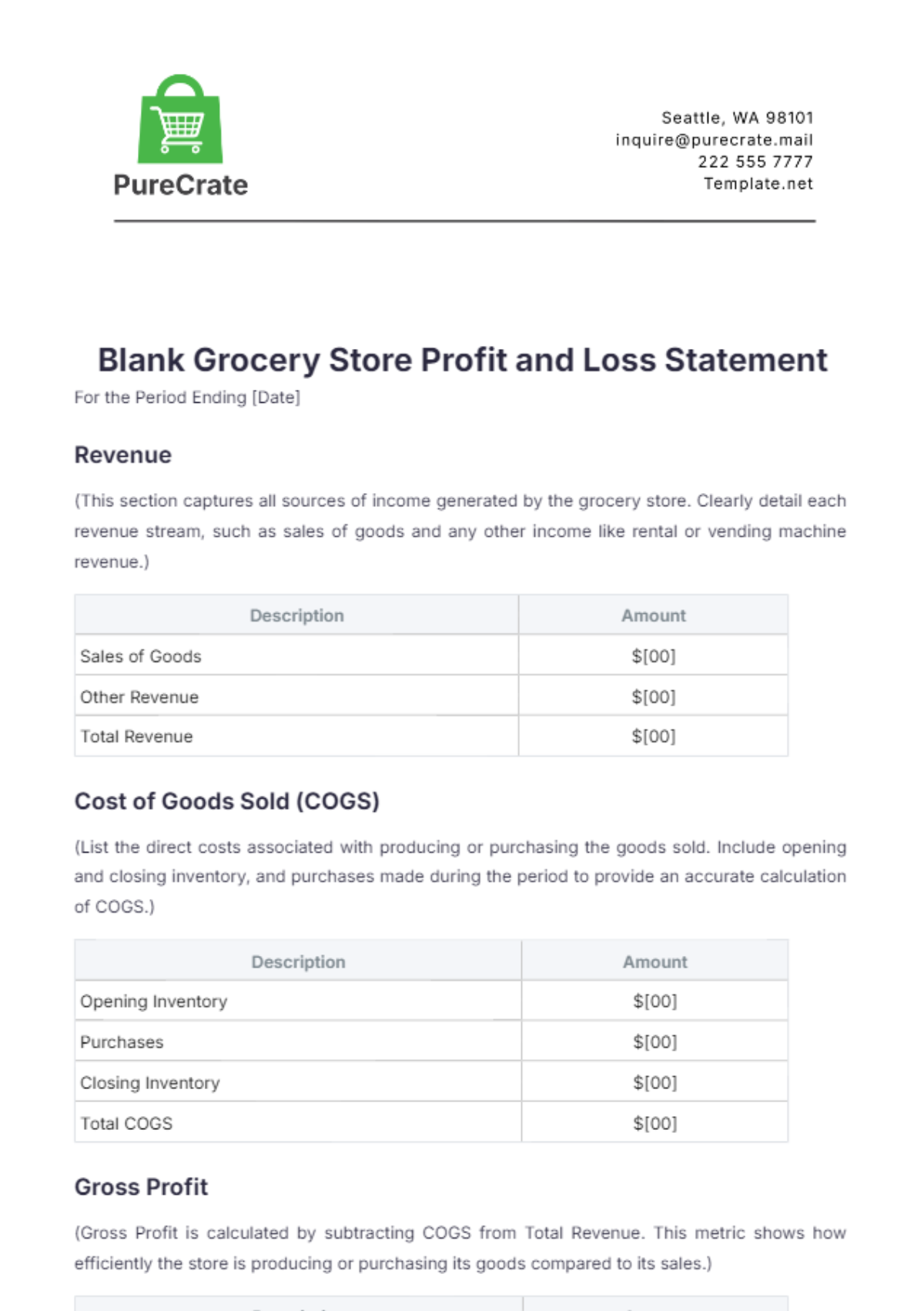

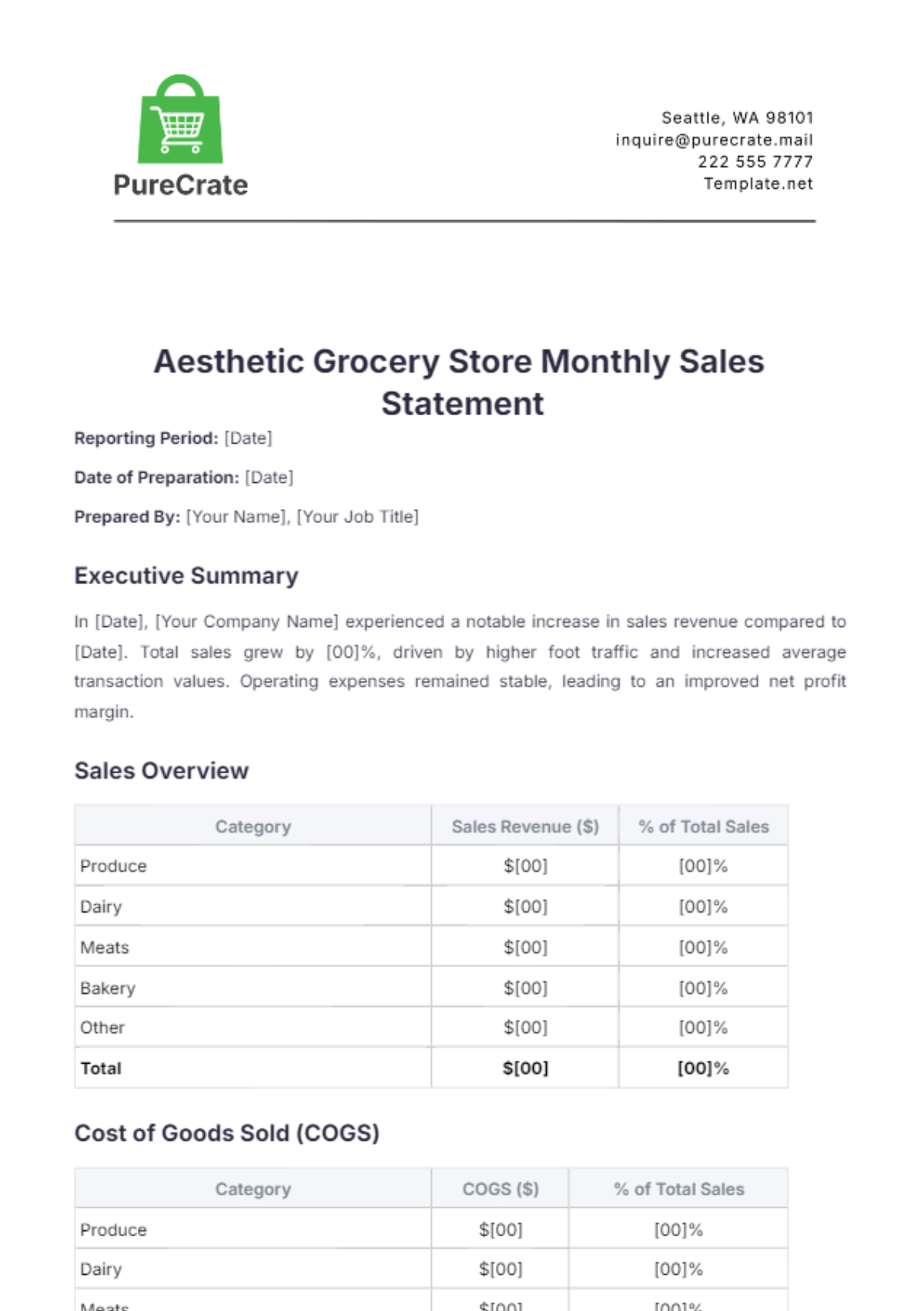

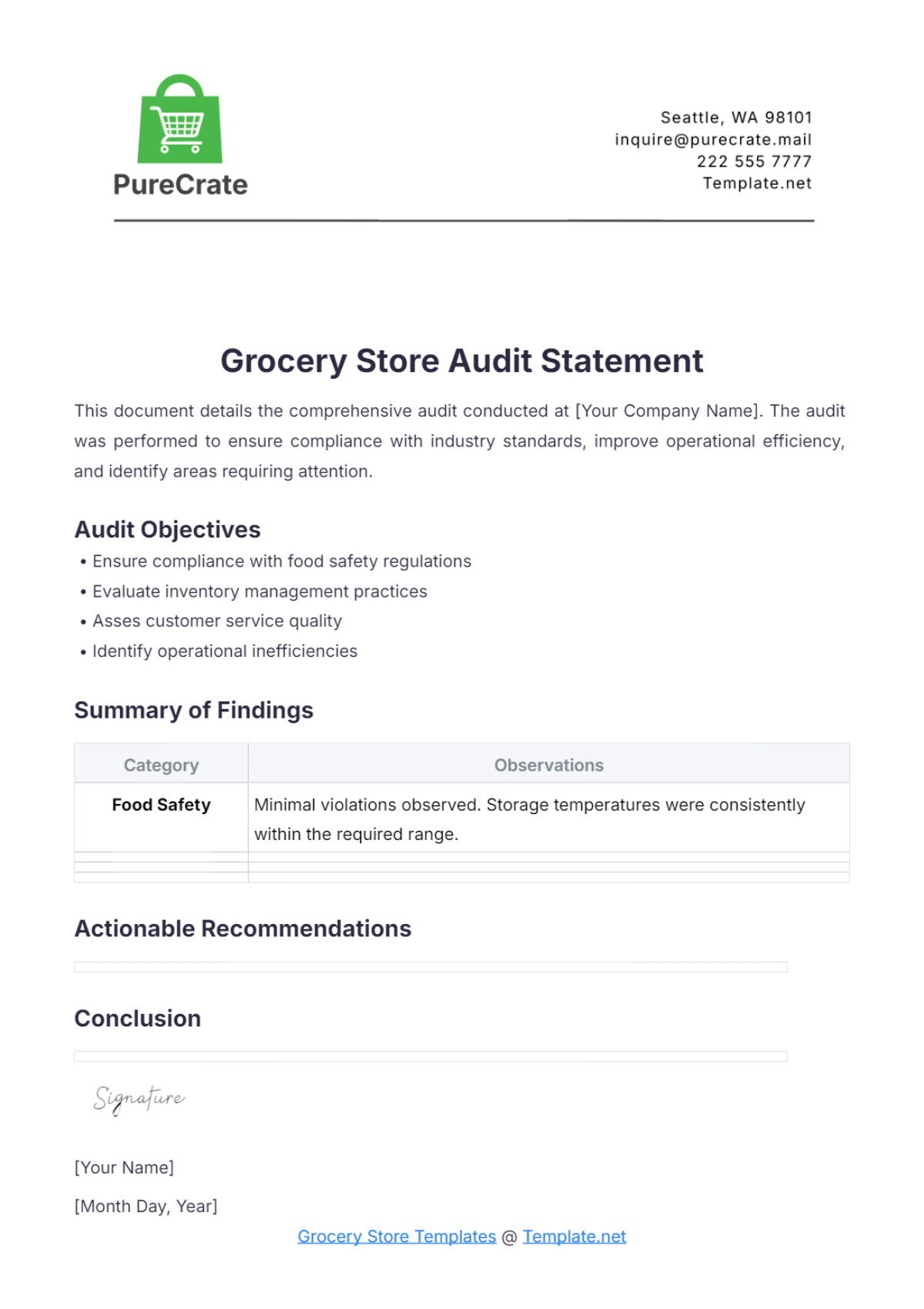

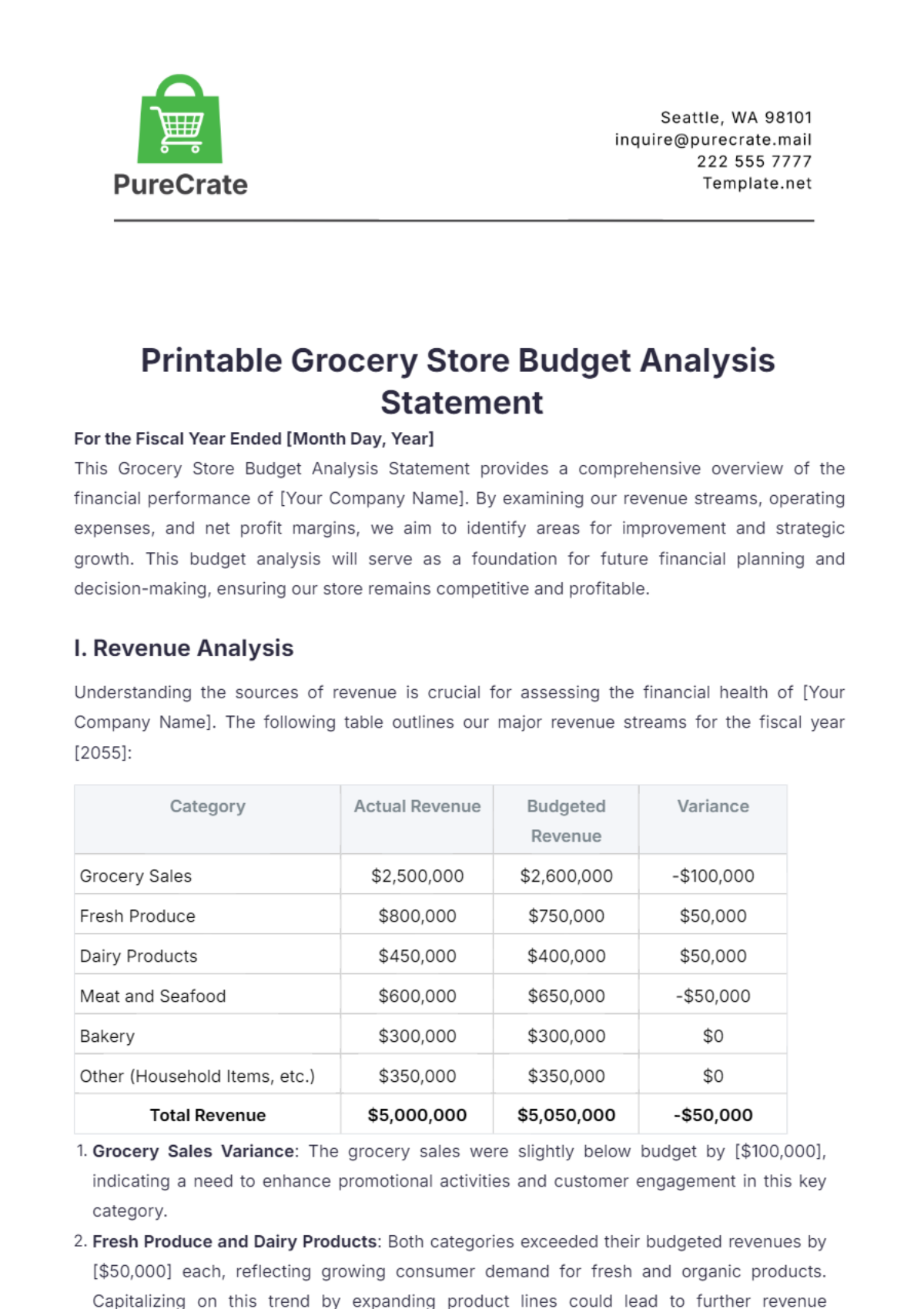

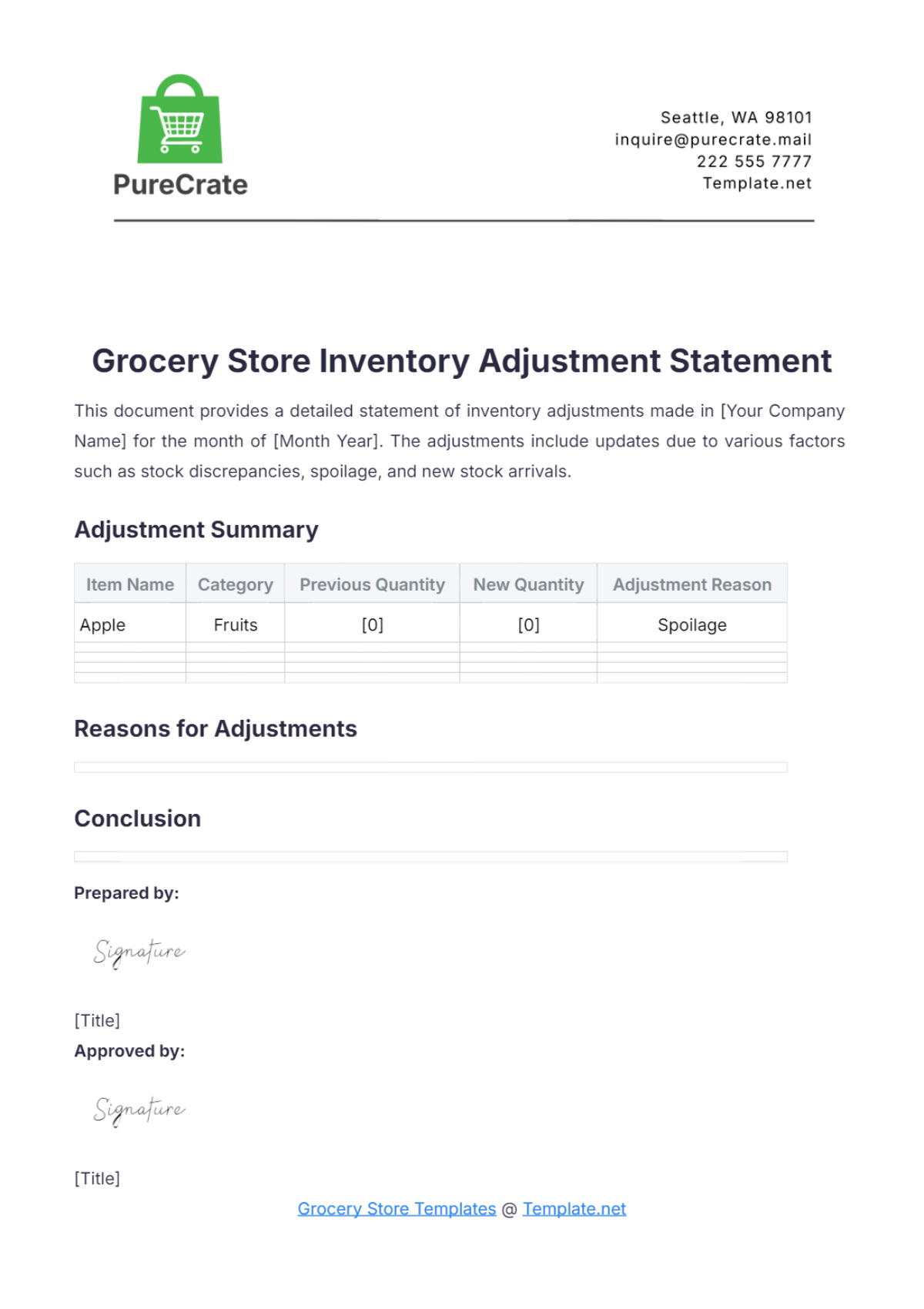

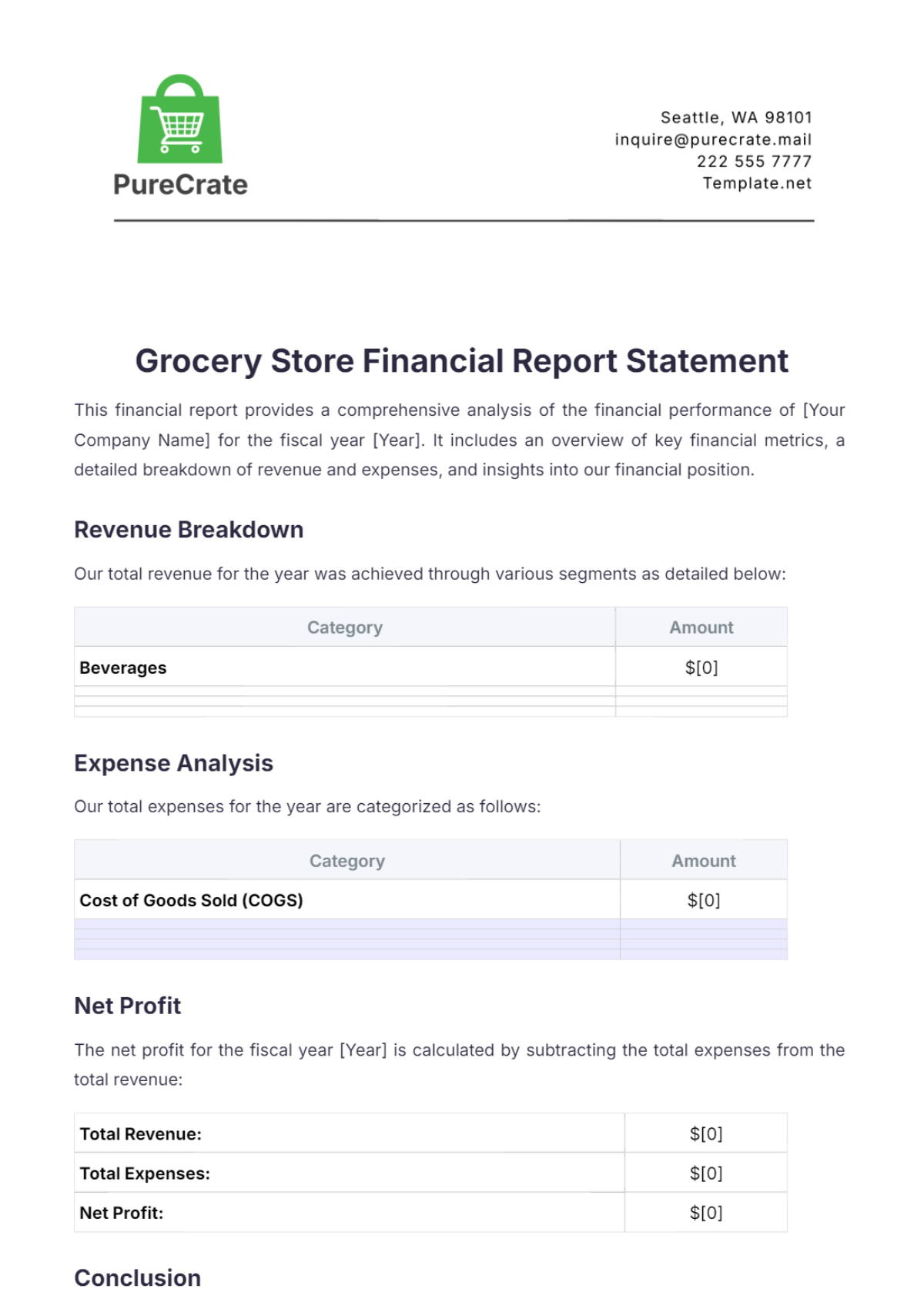

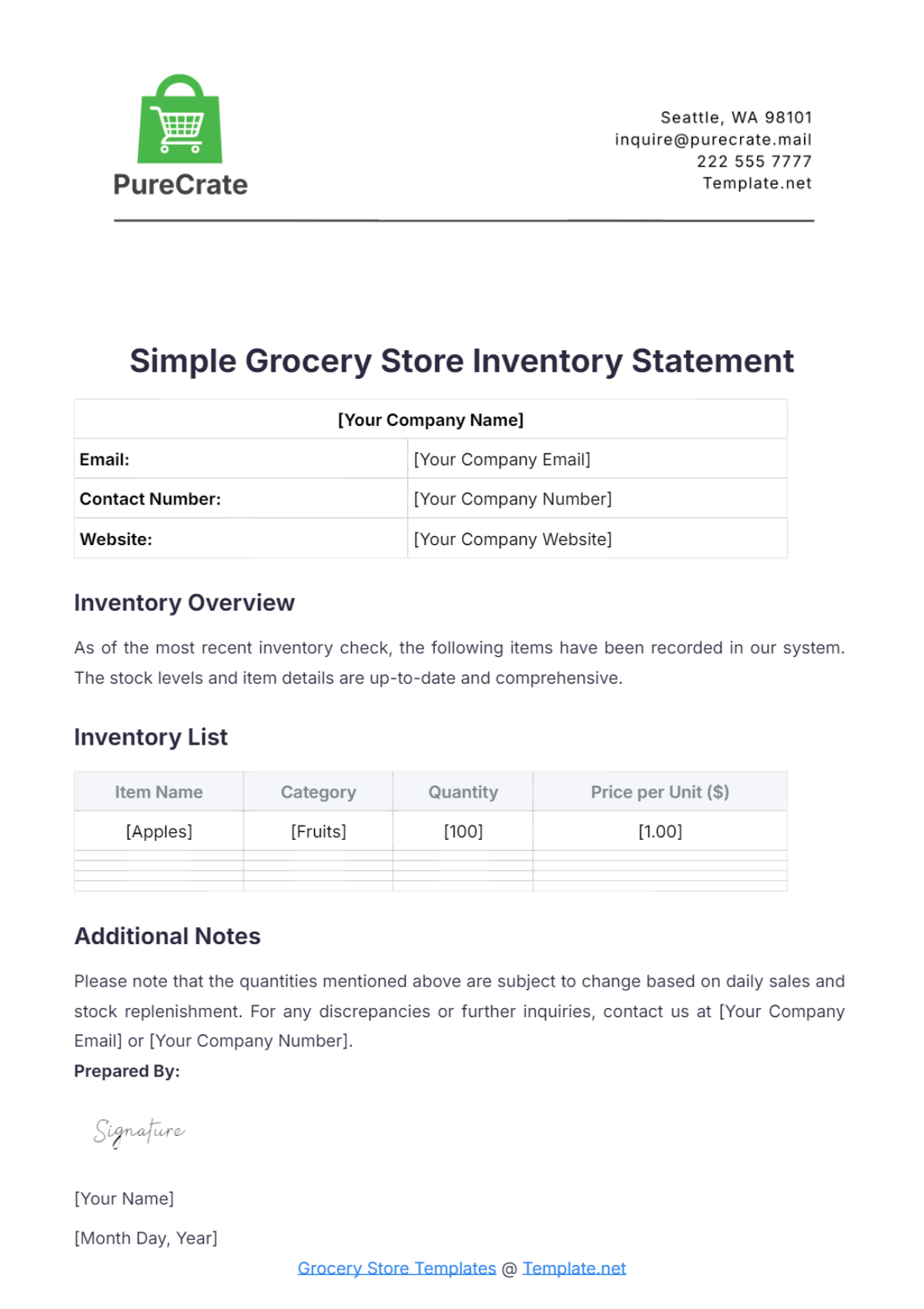

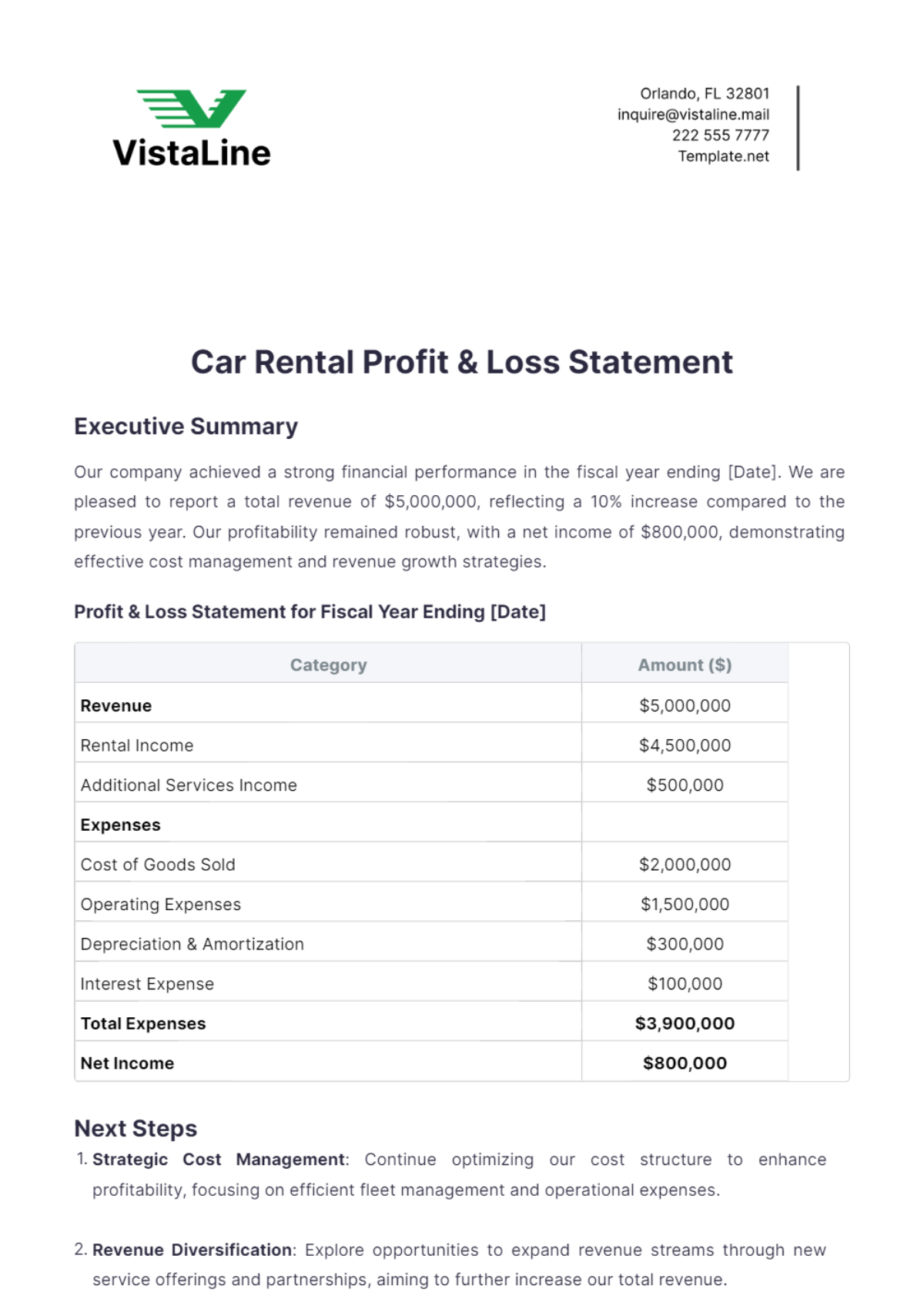

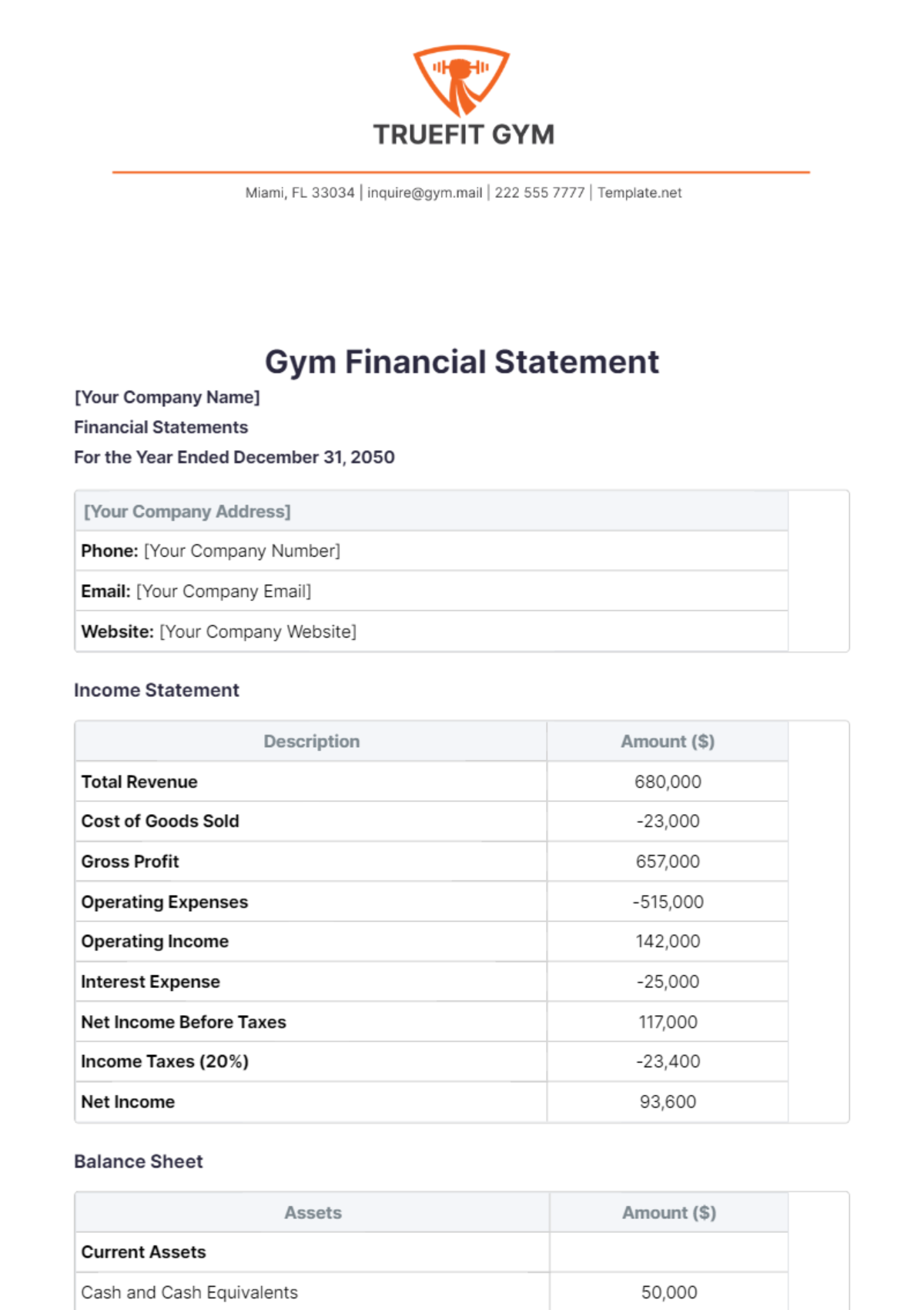

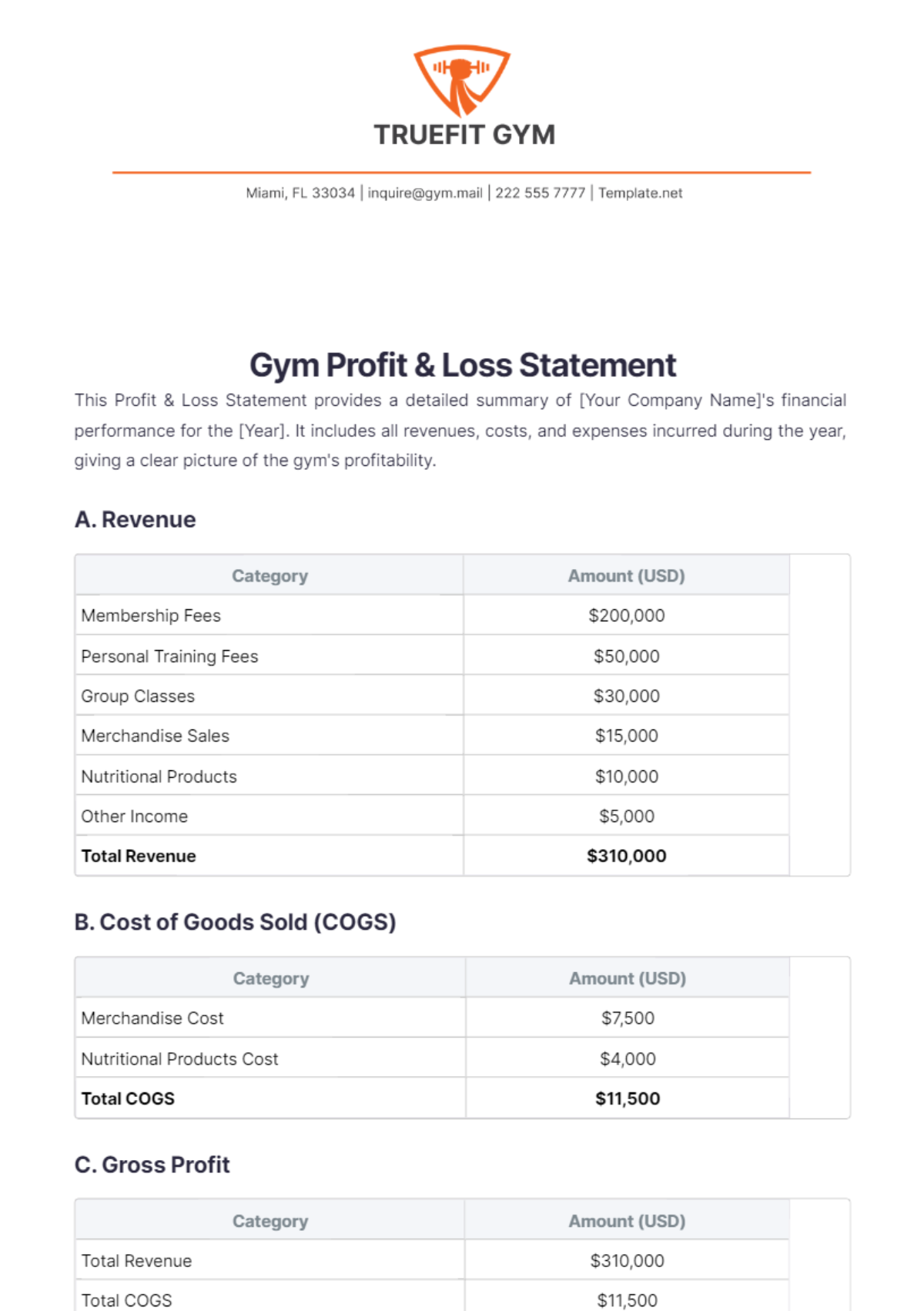

Bring your financial clarity to the forefront with Profit and Loss Statement Templates from Template.net. Perfect for small business owners, accountants, and financial analysts, these templates help you keep your audience engaged, streamline your reporting process, and boost your financial presentations effortlessly. Whether it's summarizing your quarterly revenue or detailing annual expenses for a crucial business meeting, these templates ensure professionally formatted, easy-to-understand financial statements. Simply enter key details like time periods and monetary data for each line item, avoiding any skill barrier with our user-friendly layouts. Enjoy complete freedom in customizing print-ready designs or digital copies without any additional cost, allowing you to focus solely on your financial insights.

Discover the many Profit and Loss Statement Templates we have on hand to suit every financial need. Choose from a selection of professionally designed templates, swap in your company’s building blocks, and tweak colors and fonts to match your corporate identity. Take advantage of advanced features like drag-and-drop icons or graphics to enhance your statement's visual appeal. The possibilities are endless and skill-free, making sophisticated design accessible to anyone. Our library is regularly updated with fresh templates, ensuring your financial documents always look cutting-edge. When you're finished, download, print, or distribute your statements via email or export for broader dissemination, making them ideal for multiple channels and real-time collaboration.