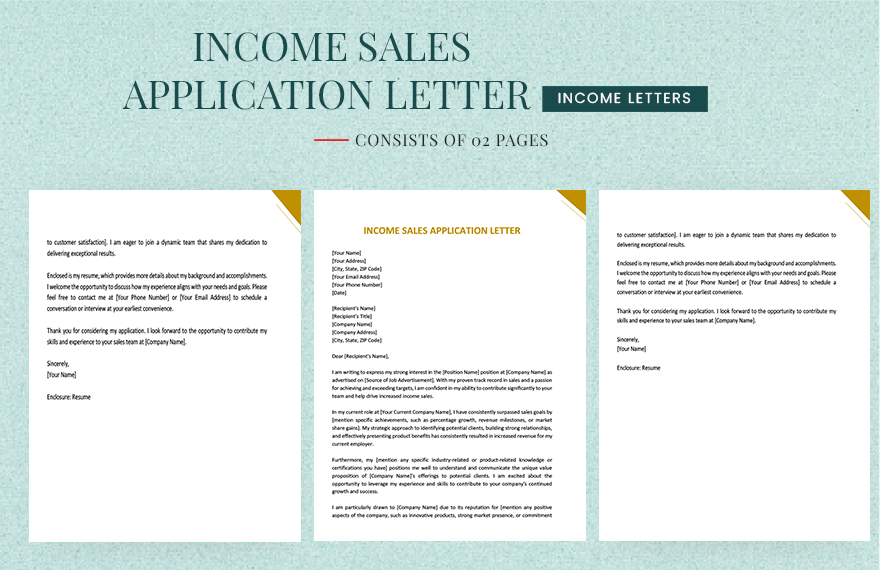

If a person applies for a mortgage or loan, he or she needs to provide proof of income to the lenders. An income letter is a useful proof that a person is earning and can pay debt or lease. So, whether you're an employee, self-employed, or an employer who needs a letter, you've come to the right place. Convey your message quickly with our collection of ready-made Income Letter Templates! These are 100% editable and printable. The content of each template is professionally written, too. What are you waiting for? Download one now!

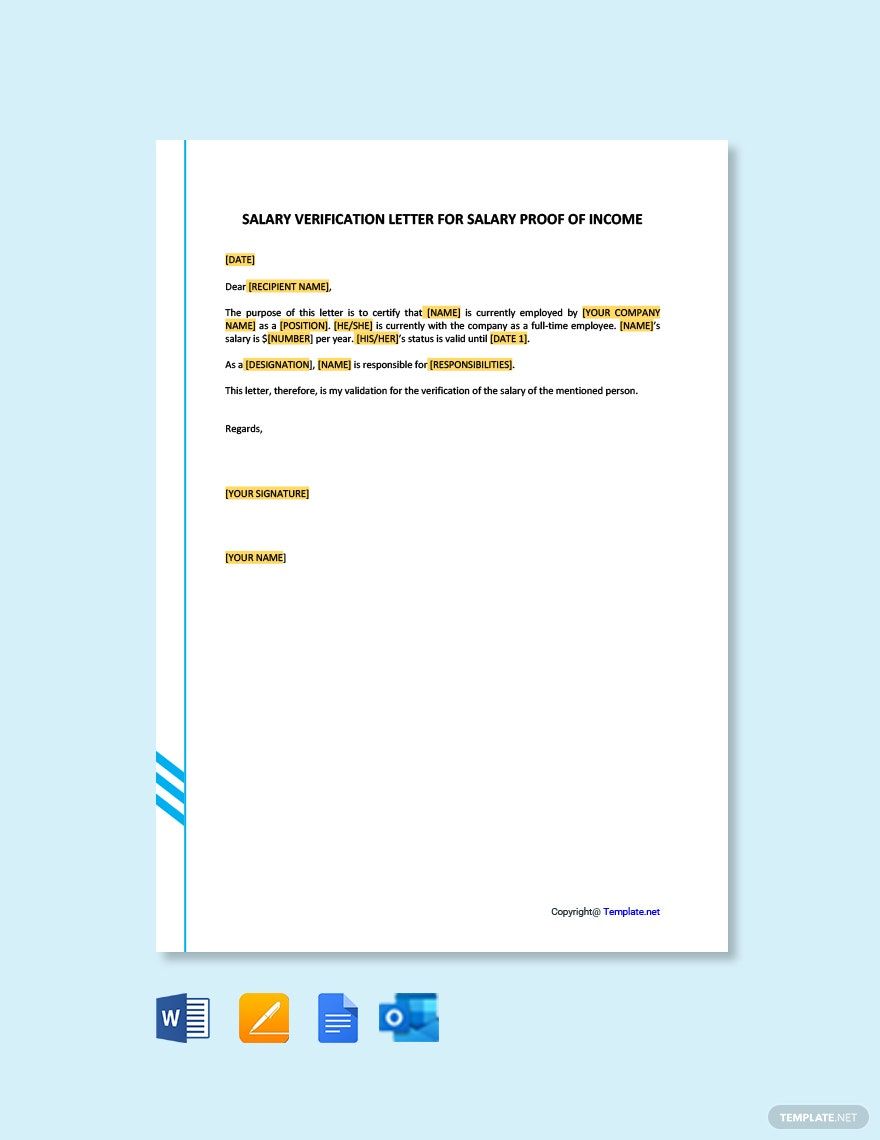

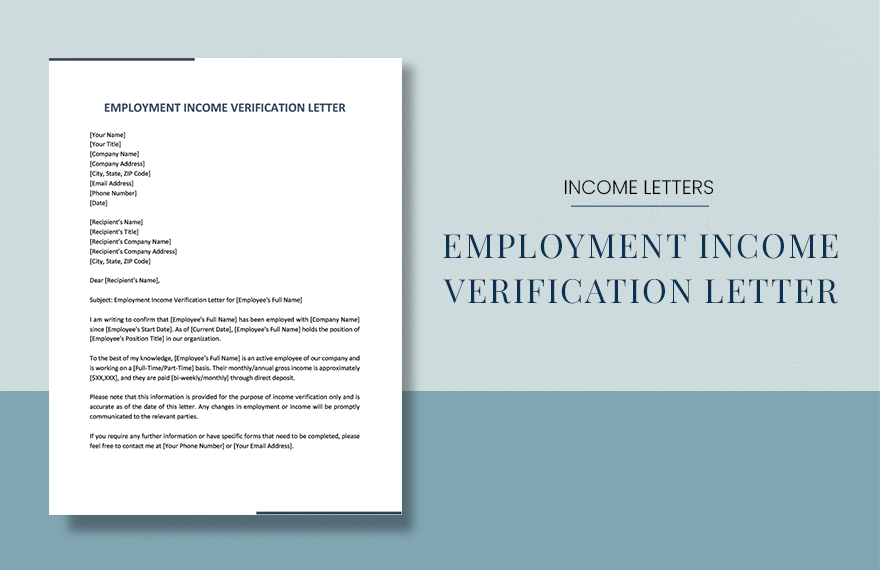

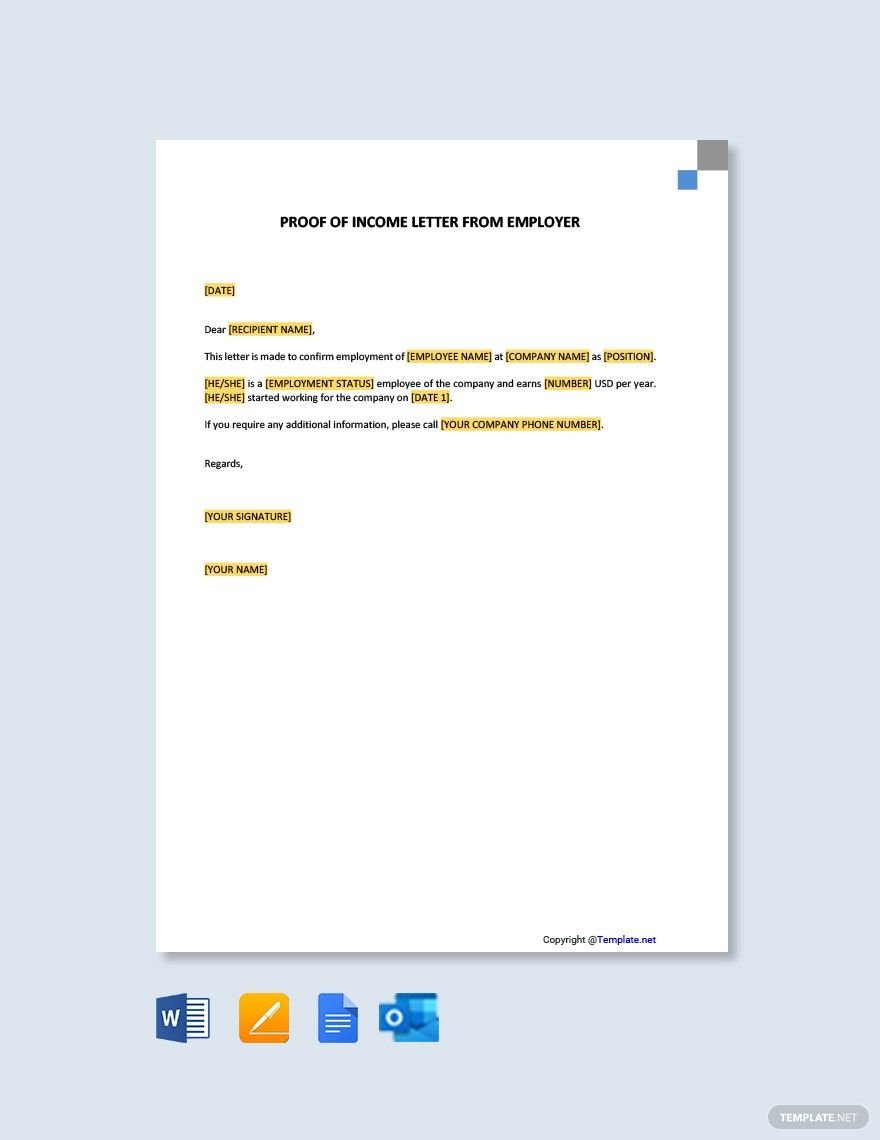

What Is an Income Letter?

An income letter is a document that contains a proof of an employee's employment and income. According to the Bureau of Labor and Statistics, an American worker usually earned $957 a week during the first quarter of 2020.

How to Create an Income Letter

Use the tips below in writing an effective printable letter about income.

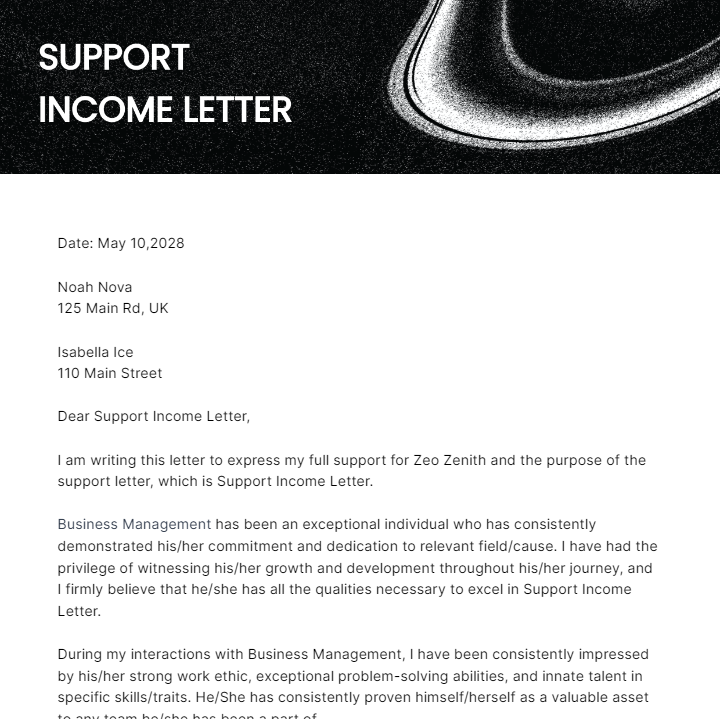

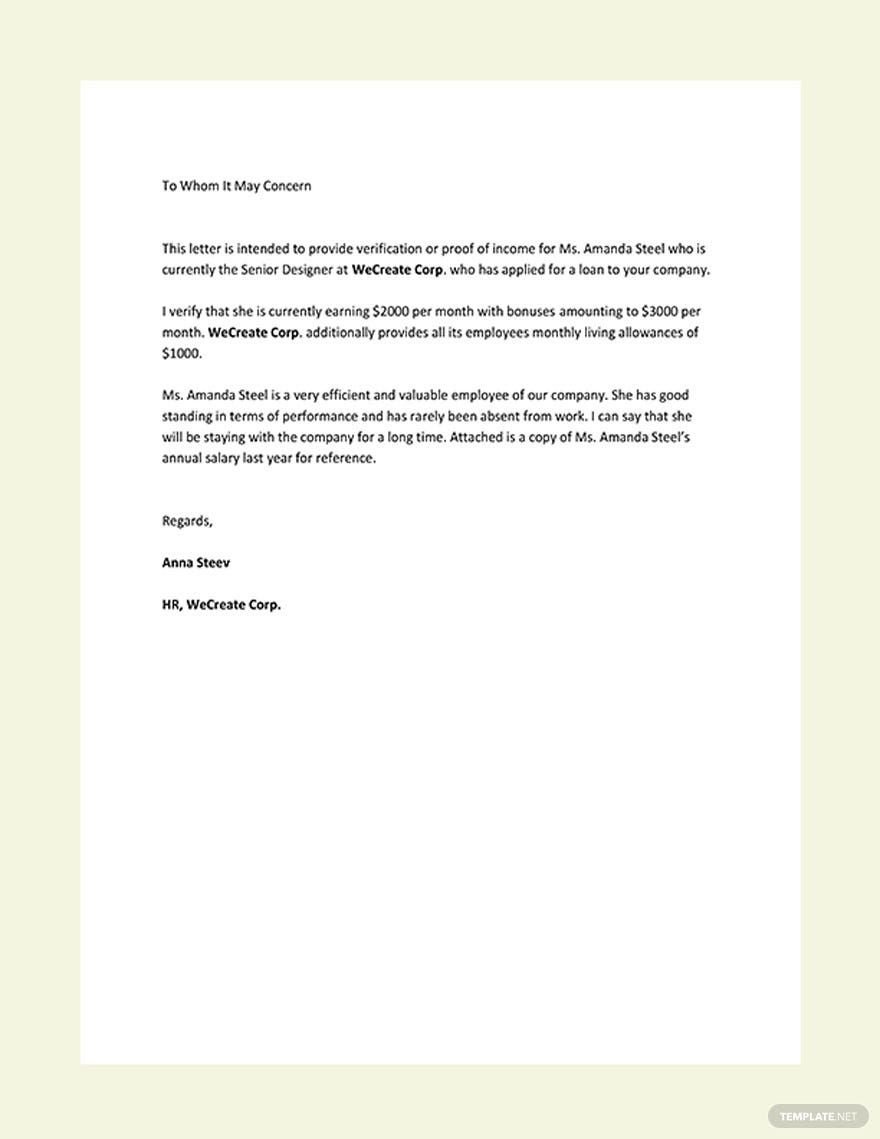

1. State Your Purpose

Be direct with your purpose and write it in the letter. Avoid writing long and unnecessary information but go straight to the point. Tell why you're writing the sample letter. Is it for loan application or verification that an employee is working in your company?

2. Sound Professional

Every business letter has to sound professional, and that includes an income letter. A letter with a professional tone shows politeness, respect, and unbiased language. Your tone usage reflects you as the writer and affects how you convey your message.

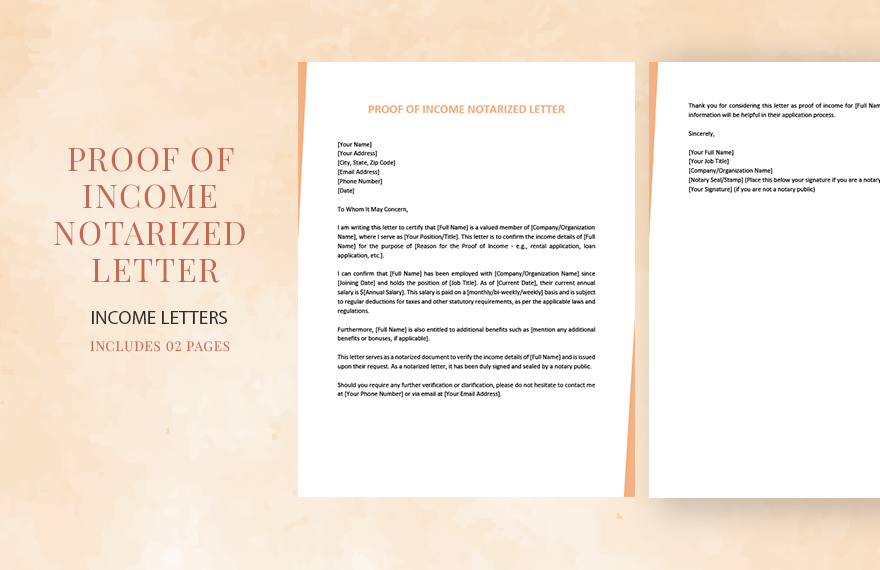

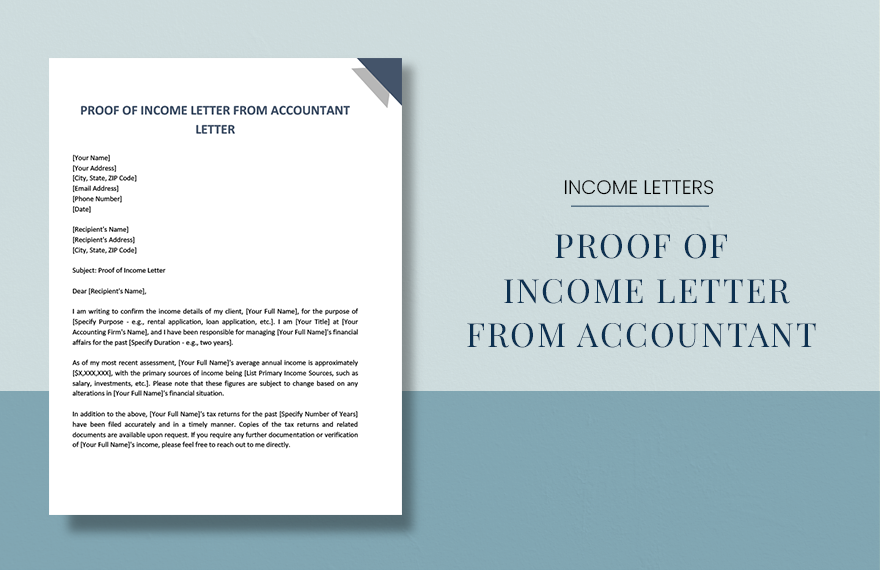

3. Write the Income Amount

Since an income letter focuses on a person's income, remember to specify it. Never lie in your salary letter, otherwise you're going to put yourself on the bad light.

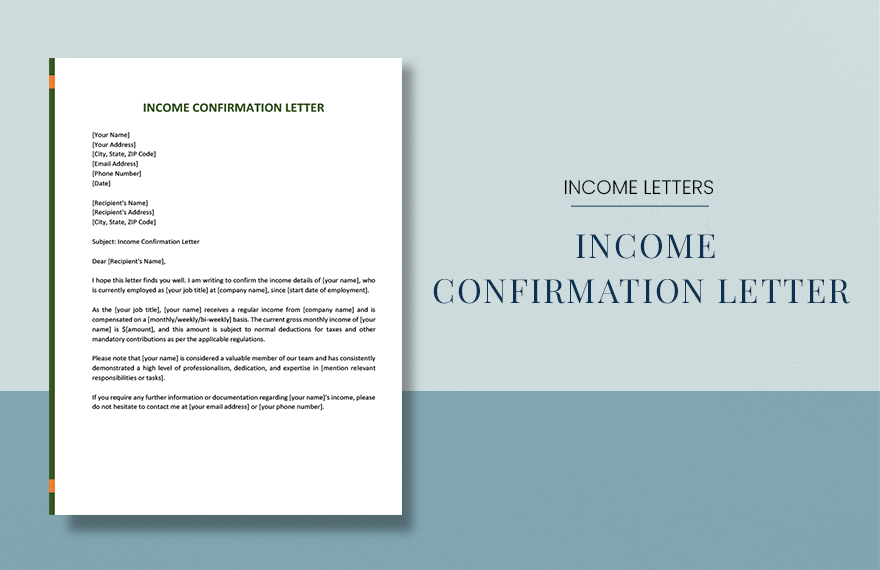

4. Share Your Job Responsibilities

Although it's a salary letter, it doesn't mean you can't write details about your job. You can share a glimpse of your job, too, like sharing what you do in your workplace in the formal letter. It can make the recipient get to know you a little better.

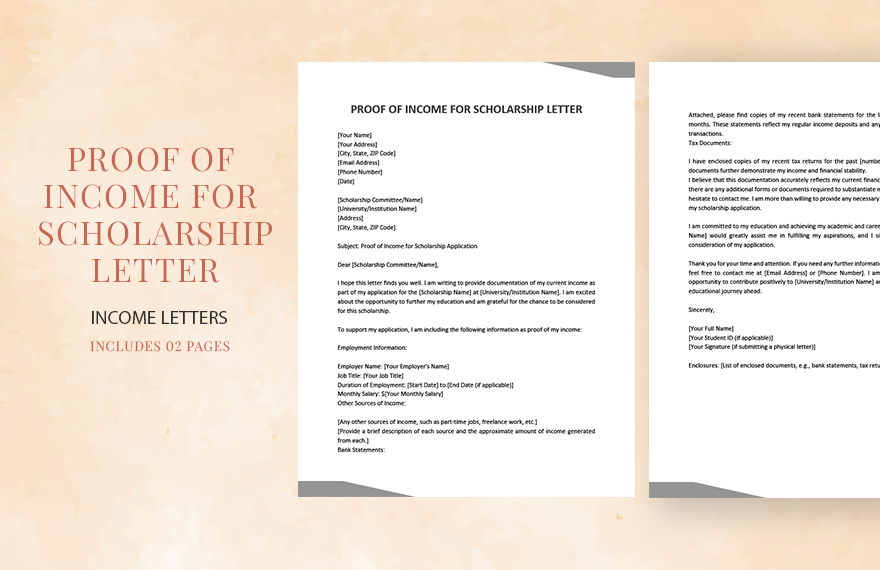

5. Add Additional Income Sources

If you're writing a simple letter to apply for loans, you can add some of your other personal income sources to the letter. The recipient may grant your request since he or she's sure that you can pay for the account. You can add if you have a pension or other income sources.