Free SMART Goals for Personal Finance

Objective/Goal Description:

Individuals use this template to set specific budgeting goals, such as reducing discretionary spending, increasing savings rates, or paying off debt.

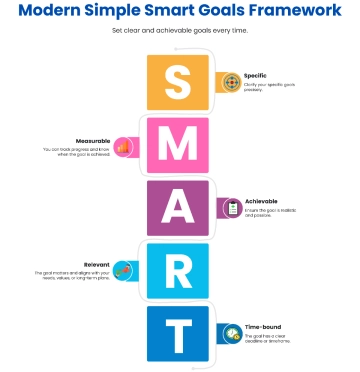

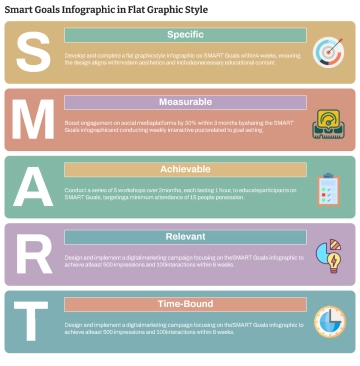

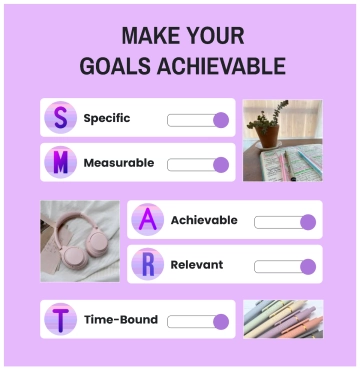

SMART Goal

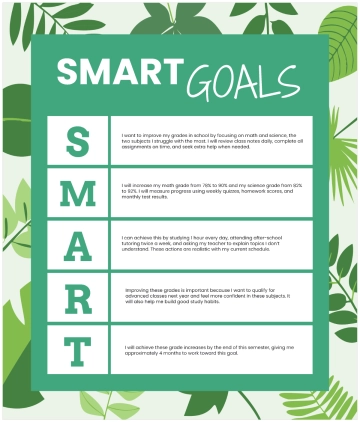

Initial | Initial Meaning | Component |

|---|---|---|

S | Specific | The goal should be clearly defined and specific. For example, "Reduce discretionary spending by [SPECIFIC AMOUNT] per month." |

M | Measurable | The goal should be quantifiable so progress can be tracked. For instance, "Track monthly expenses and aim to reduce discretionary spending by [AMOUNT]." |

A | Achievable | The goal should be realistic and attainable within the individual's financial capabilities. Consider factors such as income, expenses, and lifestyle preferences. |

R | Relevant | The goal should align with the individual's overall financial objectives and contribute to improving their financial health. It should address areas of concern or priority in their budget. |

T | Time-bound | The goal should have a specific deadline or timeframe for completion. Set a deadline for achieving the reduction in discretionary spending, such as "Within the next [TIME FRAME]." |

Action Plan

Steps to Achieve the Goal:

Review current spending habits and identify areas of discretionary spending that can be reduced, such as [EXAMPLES].

Set a specific budget for each category of discretionary spending based on financial priorities and goals.

Track all expenses diligently using a budgeting app, spreadsheet, or pen and paper method.

Implement cost-saving measures, such as [STRATEGIES].

Regularly review progress toward the goal and adjust spending habits as needed to stay on track.

Accountability |

|

Notes |

|

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for mastering your financial goals with Template.net's SMART Goals Template for Personal Finance. This editable and customizable template, available in our Ai Editor Tool, empowers you to tailor your financial objectives with precision and clarity. Take control of your finances today and pave the path to success!