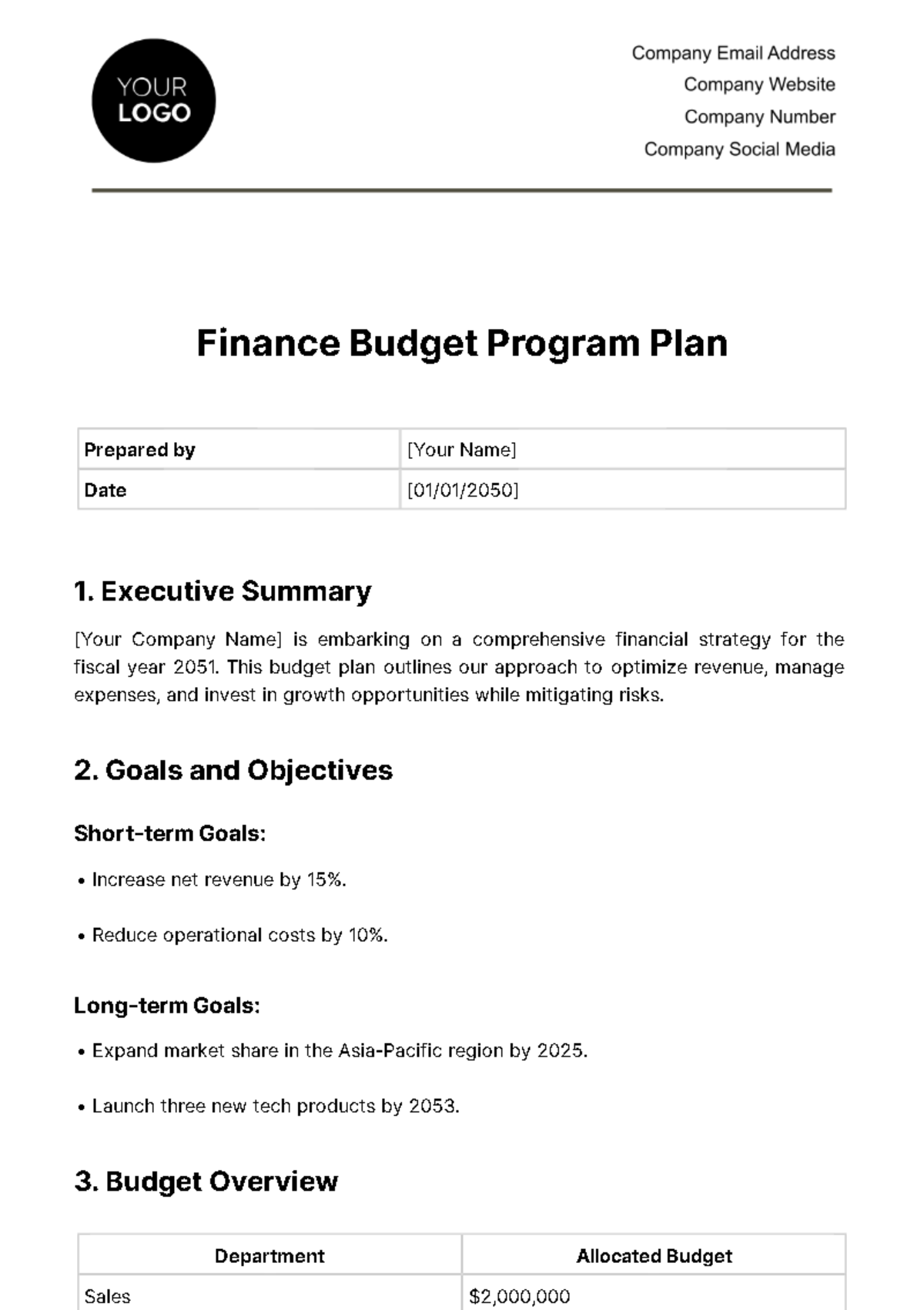

Free Finance Budget Program Plan

Prepared by | [Your Name] |

Date | [01/01/2050] |

1. Executive Summary

[Your Company Name] is embarking on a comprehensive financial strategy for the fiscal year 2051. This budget plan outlines our approach to optimize revenue, manage expenses, and invest in growth opportunities while mitigating risks.

2. Goals and Objectives

Short-term Goals:

Increase net revenue by 15%.

Reduce operational costs by 10%.

Long-term Goals:

Expand market share in the Asia-Pacific region by 2025.

Launch three new tech products by 2053.

3. Budget Overview

Department | Allocated Budget |

Sales | $2,000,000 |

Marketing | $1,500,000 |

R&D | $2,500,000 |

Operations | $1,000,000 |

HR | $500,000 |

Total Budget: $7,500,000

4. Revenue Forecast

Projected revenues for 2051 are estimated at $10 million, an increase of 20% from the previous year. This growth is attributed to the introduction of new product lines and expansion into new markets.

5. Expense Plan

a. Personnel Costs: $3 million

To enhance our competitive edge, we are dedicating $3 million to talent acquisition and development. This investment is critical for attracting and retaining top-tier talent. A significant portion of this budget will be directed towards advanced recruitment strategies, targeting highly skilled professionals for key roles. We will also focus on comprehensive training programs that encompass leadership development, technical skills upgrade, and soft skills enhancement. Moreover, a substantial allocation towards employee engagement and wellness programs will aim to boost productivity and reduce turnover, creating a more dynamic and committed workforce.

b.Operational Costs: $1.5 million

Our operational strategy involves a $1.5 million investment to streamline processes and enhance efficiency. We plan to implement process optimization initiatives, utilizing lean management techniques and automation tools. This will be complemented by investments in facility upgrades to modernize equipment and increase operational capacity. Additionally, we will integrate sustainability initiatives focused on eco-friendly practices to reduce our environmental impact while cutting down long-term operational costs.

c. Marketing and Sales: $2 million

A total of $2 million will be allocated to bolster our marketing and sales efforts, particularly focusing on new product launches. This includes a robust marketing campaign utilizing digital platforms and influencer partnerships, aiming to maximize our reach and market penetration. Furthermore, we plan to expand our sales team to explore new markets and customer segments. An essential part of this strategy is enhancing the customer experience to ensure customer loyalty and repeat business.

d. Research and Development: $1 million

Our R&D strategy, with a $1 million budget, focuses on driving innovation and maintaining a competitive edge. This involves investing in the development of new technologies and improving existing products. Conducting extensive market research will be crucial to identifying emerging trends and customer needs. We also plan to allocate funds for collaborations and partnerships with universities and research institutions, fostering an environment of innovation and cutting-edge research.

6. Investment Strategy

a. Diversifying the Investment Portfolio

Our investment objective is to diversify our portfolio, balancing risk and return. We plan to allocate 50% of our investments in technology stocks, particularly in high-growth areas like AI, cybersecurity, and cloud computing. 30% of our investments will go into government and corporate bonds with strong ratings for stable returns. The remaining 20% will be invested in new ventures, focusing on startups and innovative projects with high growth potential.

b. Risk Management

Our risk management approach includes regular portfolio reviews and adjustments in response to market conditions. We will conduct these reviews bi-annually, assessing performance and making necessary rebalances. Continuous monitoring of market trends and economic indicators will inform our investment decisions, ensuring that our portfolio remains robust and diversified across different sectors and geographic regions.

7. Risk Management

Market Risk: Diversification of product lines and geographical expansion.

Operational Risk: Implementation of advanced cybersecurity measures.

Financial Risk: Regular audits and compliance checks.

8. Monitoring and Reporting

Review Schedule: Quarterly financial reviews.

KPIs: Revenue growth, cost savings, ROI on marketing campaigns.

Reporting: Monthly reports to the Board of Directors.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Budget Program Plan Template. Fully editable and customizable using our Ai Editor Tool, this template empowers you to create comprehensive budget plans tailored to your organization's needs. Streamline financial management and optimize resource allocation with ease, ensuring efficiency and accuracy every step of the way.