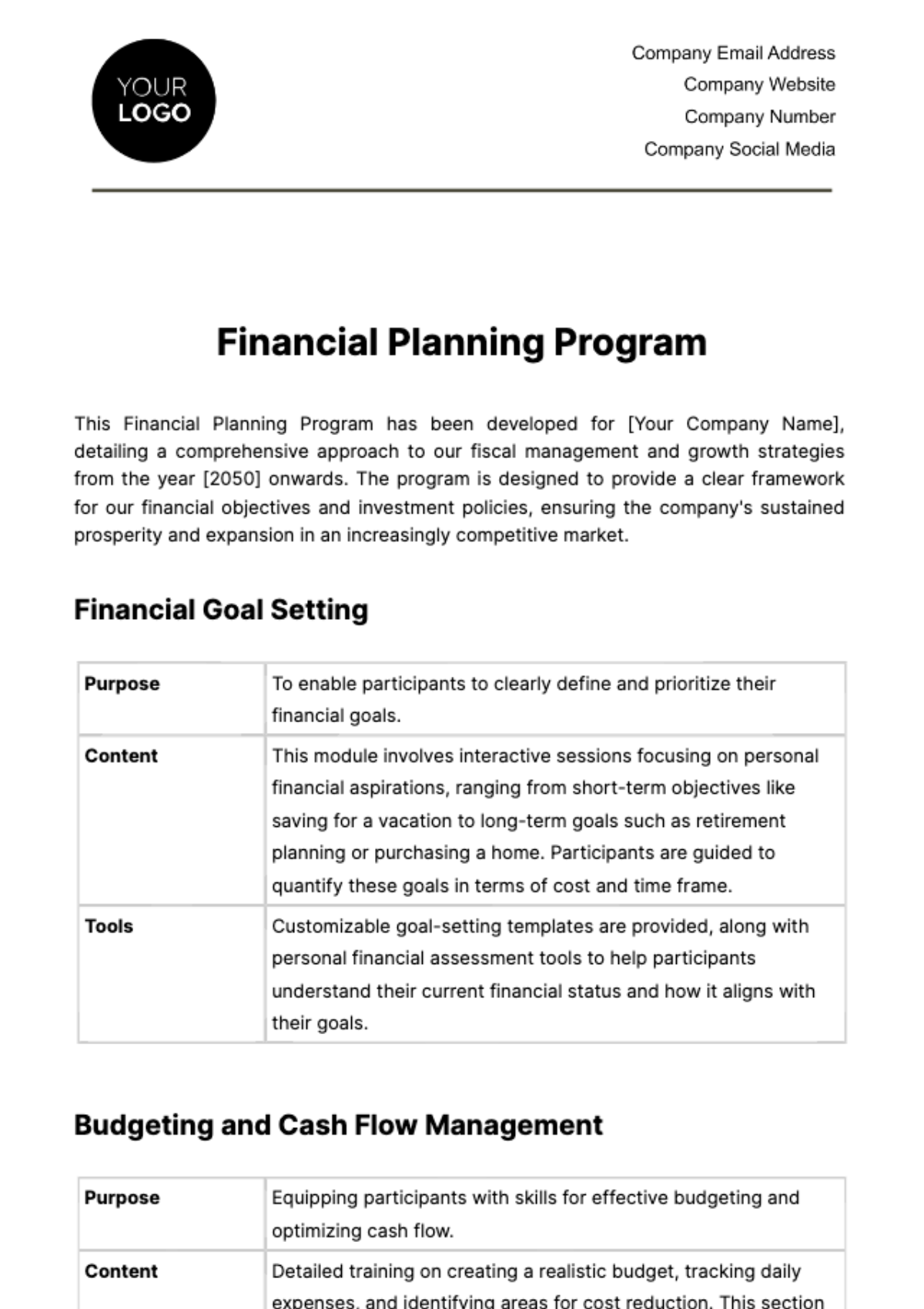

Free Financial Planning Program

This Financial Planning Program has been developed for [Your Company Name], detailing a comprehensive approach to our fiscal management and growth strategies from the year [2050] onwards. The program is designed to provide a clear framework for our financial objectives and investment policies, ensuring the company's sustained prosperity and expansion in an increasingly competitive market.

Financial Goal Setting

Purpose | To enable participants to clearly define and prioritize their financial goals. |

Content | This module involves interactive sessions focusing on personal financial aspirations, ranging from short-term objectives like saving for a vacation to long-term goals such as retirement planning or purchasing a home. Participants are guided to quantify these goals in terms of cost and time frame. |

Tools | Customizable goal-setting templates are provided, along with personal financial assessment tools to help participants understand their current financial status and how it aligns with their goals. |

Budgeting and Cash Flow Management

Purpose | Equipping participants with skills for effective budgeting and optimizing cash flow. |

Content | Detailed training on creating a realistic budget, tracking daily expenses, and identifying areas for cost reduction. This section also covers strategies for increasing income, such as side hustles or investments. |

Tools | Participants gain access to user-friendly budgeting software and cash flow analysis spreadsheets, complete with real-life scenarios and practice exercises. |

Debt Management and Credit Planning

Purpose | To educate on managing and eliminating debt, and understanding the impact of credit on financial health. |

Content | Comprehensive guidance on different types of debt (credit cards, loans, mortgages), debt repayment strategies (snowball vs. avalanche methods), and improving credit score. It also includes sessions on negotiating debt terms and understanding the implications of credit reports. |

Tools | Interactive debt repayment calculators and sample communication templates for negotiating with creditors are provided for practical application. |

Investment Strategies and Risk Management

Purpose | Introducing participants to various investment options and teaching them how to manage investment risks. |

Content | This section covers the basics of investing in stocks, bonds, mutual funds, and real estate. It also focuses on understanding risk tolerance, the importance of asset allocation, and strategies for building a diversified investment portfolio. |

Tools | Investment risk assessment questionnaires, portfolio diversification guides, and case studies on investment strategies under different market conditions are included for hands-on learning. |

Retirement Planning and Estate Management

Purpose | To prepare participants for retirement and to educate them on essential estate planning principles. |

Content | Detailed instructions on retirement saving techniques, understanding various retirement accounts (IRAs, 401(k)s, pensions), and the role of Social Security. The estate planning segment includes creating wills, setting up trusts, and healthcare directives. |

Tools | Retirement savings calculators and an estate planning checklist are provided, along with templates for legal documents related to estate planning. |

Prepared by:

[Your Name]

[Job Title]

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock your financial potential with the Financial Planning Program Template available on Template.net. This editable and customizable program offers a comprehensive framework to manage budgets, set goals, and optimize investments. Utilize the Ai Editor Tool to tailor the program to your specific needs, ensuring a personalized and effective financial strategy.