Free Summary of Article on Capital Budgeting

Summarized By: [YOUR NAME]

Introduction:

In this section, the [AUTHOR'S NAME] introduces the concept of capital budgeting and its significance in financial decision-making for [YOUR COMPANY NAME]. Capital budgeting involves evaluating long-term investment opportunities and deciding which projects to pursue based on their potential to generate returns. The [AUTHOR'S NAME] highlights the importance of strategic allocation of resources and how effective capital budgeting can drive growth and profitability for [YOUR COMPANY NAME].

Methods of Capital Budgeting:

A. Payback Period:

The payback period method assesses how long it takes for an investment to generate cash flows equal to its initial cost. This approach is straightforward and easy to understand. However, it overlooks the time value of money and does not consider cash flows beyond the payback period. For [YOUR COMPANY NAME], the payback period can be a useful initial screening tool for evaluating investment proposals, particularly for projects with short-term returns.

B. Net Present Value (NPV):

NPV calculates the present value of all cash inflows and outflows associated with an investment, discounted at the company's cost of capital. A positive NPV indicates that the project is expected to generate value for [YOUR COMPANY NAME], while a negative NPV suggests that the project may destroy value. NPV takes into account the time value of money and provides a more comprehensive assessment of investment profitability. [AUTHOR'S NAME] emphasizes the importance of using NPV as a primary decision criterion for capital budgeting at [YOUR COMPANY NAME].

Risk Analysis:

Capital budgeting decisions involve uncertainty, and it's crucial to assess the risk associated with investment projects. [AUTHOR'S NAME] discusses various techniques for risk analysis, including sensitivity analysis, scenario analysis, and Monte Carlo simulation. These methods help [YOUR COMPANY NAME] to evaluate the impact of different scenarios on investment outcomes and make informed decisions considering risk factors.

A. Sensitivity Analysis:

Sensitivity analysis involves examining how changes in one or more variables affect the outcome of an investment project. [AUTHOR'S NAME] explains that by adjusting key parameters such as revenue forecasts, cost estimates, or discount rates, [YOUR COMPANY NAME] can assess the project's sensitivity to various factors. This analysis provides insights into which variables have the most significant impact on the project's profitability and helps [YOUR COMPANY NAME] to identify potential risks and opportunities.

B. Scenario Analysis:

Scenario analysis involves constructing different scenarios or sets of assumptions about future events and assessing their potential impact on the investment project. [AUTHOR'S NAME] emphasizes that scenario analysis allows [YOUR COMPANY NAME] to consider a range of possible outcomes and evaluate how sensitive the project is to changes in market conditions, regulatory environment, or other external factors. By exploring multiple scenarios, [YOUR COMPANY NAME] can better understand the potential risks and uncertainties associated with the investment and develop contingency plans accordingly.

Strategic Resource Allocation:

Strategic resource allocation is a key component of capital budgeting, as emphasized by [AUTHOR'S NAME]. [YOUR COMPANY NAME] must carefully allocate its financial resources to projects that align with its overall strategic objectives. By prioritizing investments that support growth initiatives, innovation, and competitive advantage, [YOUR COMPANY NAME] can enhance its market position and drive sustainable long-term value creation. Moreover, strategic resource allocation ensures that limited resources are allocated efficiently, maximizing the return on investment for [YOUR COMPANY NAME].

Capital Rationing:

Capital rationing refers to the practice of limiting the amount of capital available for investment projects, either due to budget constraints or strategic reasons. [AUTHOR'S NAME] discusses how [YOUR COMPANY NAME] may implement capital rationing to prioritize projects with the highest potential for value creation. By setting investment criteria and allocating resources based on strategic priorities, [YOUR COMPANY NAME] can ensure that capital is allocated to projects that align with its overall business strategy and financial objectives.

Long-Term Planning:

Capital budgeting extends beyond short-term investment decisions and involves long-term planning for [YOUR COMPANY NAME]. [AUTHOR'S NAME] underscores the importance of considering the long-term implications of investment decisions and their impact on the company's financial health and sustainability. By incorporating long-term strategic goals into capital budgeting processes, [YOUR COMPANY NAME] can make investment decisions that support its vision for the future and drive sustainable growth over time.

Method | Description |

|---|---|

[Investment Method 1] | [Description of Method 1] |

[Investment Method 2] | [Description of Method 2] |

[Investment Method 3] | [Description of Method 3] |

[Investment Method 4] | [Description of Method 4] |

[Investment Method 5] | [Description of Method 5] |

Conclusion:

In conclusion, effective capital budgeting is essential for [YOUR COMPANY NAME] to allocate resources efficiently and maximize shareholder value. By employing rigorous evaluation techniques such as NPV and risk analysis, [YOUR COMPANY NAME] can make informed investment decisions that align with its strategic objectives and drive long-term growth. Capital budgeting serves as a critical tool for financial management, enabling [YOUR COMPANY NAME] to prioritize investment opportunities and allocate capital to projects with the highest potential for value creation.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Summary of Article on Capital Budgeting Template. This meticulously crafted resource is editable and customizable, ensuring seamless adaptation to your specific needs. Editable in our Ai Editor Tool, it simplifies complex capital budgeting concepts, empowering you to make informed financial decisions with confidence.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

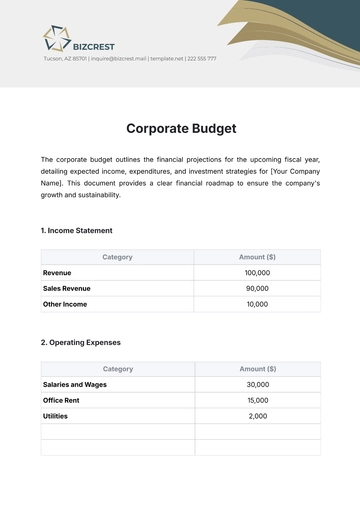

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising